Filed Pursuant to Rule 424(b)(3)

Registration No. 333-114877

TRANSACTION PROPOSED—YOUR VOTE IS VERY IMPORTANT

Dear Lyondell and Millennium shareholders:

As we previously announced, our boards of directors have approved a transaction that will combine our two companies to create the third largest, independent publicly traded U.S. chemical company and consolidate ownership of our Equistar Chemicals, LP joint venture.

In the proposed transaction, holders of Millennium common stock will receive between 0.95 and 1.05 shares of Lyondell common stock for each share of Millennium common stock held, depending on the average of the volume-weighted daily average sale prices of Lyondell common stock for the 20 trading days ending on the third trading day before closing. Existing Lyondell shares will remain outstanding. Shareholders are urged to obtain current market quotations for Lyondell common stock (NYSE symbol “LYO”) and Millennium common stock (NYSE symbol “MCH”).

The combined company will be named Lyondell Chemical Company and have headquarters in Houston, Texas. Lyondell shareholders will own approximately 74% of the combined company and Millennium shareholders will own approximately 26%, based on the number of Lyondell’s and Millennium’s outstanding shares on October 14, 2004 and the closing price of Lyondell common stock on October 13, 2004. Dan F. Smith, Lyondell’s President and Chief Executive Officer, will be the President and Chief Executive Officer of the combined company. At closing, two independent members of Millennium’s current board of directors will join Lyondell’s board.

In connection with the proposed transaction, Lyondell is asking its shareholders to approve (1) the issuance of shares of Lyondell common stock to Millennium shareholders and (2) an amended and restated certificate of incorporation increasing the number of authorized Lyondell shares. Lyondell is also seeking approval of the amendment and restatement of its 1999 incentive plan. Lyondell’s board of directors unanimously recommends that the Lyondell shareholders approve these proposals. In connection with the proposed transaction, Millennium is asking its shareholders to adopt the Agreement and Plan of Merger dated March 28, 2004, which governs the proposedtransaction. Millennium’s board of directors unanimously recommends that the Millennium shareholders adopt the agreement and plan of merger and thereby approve the transactions contemplated in the agreement and plan of merger.

In considering the recommendation of your company’s board of directors, you should be aware that directors and officers of Lyondell and Millennium have interests in the proposed transaction that are different from, or are in addition to, the interests of Lyondell and Millennium shareholders generally, and that these directors and officers will directly benefit if the proposed transaction is completed. These interests and benefits are described in the attached joint proxy statement/prospectus.

We have scheduled separate meetings to be held on November 30, 2004 for our respective shareholders to vote on these proposals. The times and places of the meetings are set forth in the attached notices.

This document provides you with detailed information about the proposed transaction, the proposals and the shareholder meetings. You can also obtain financial and other information about Lyondell and Millennium from documents they have filed with the Securities and Exchange Commission. We encourage you to carefully read this entire document and the documents attached hereto and incorporated herein by reference before voting, particularly the section entitled “Risk Factors” beginning on page 24.

Dan F. Smith

President and Chief Executive Officer

Lyondell Chemical Company

Robert E. Lee

President and Chief Executive Officer

Millennium Chemicals Inc.

Neither the Securities and Exchange Commission nor any state securities regulator has approved or disapproved the shares of Lyondell common stock to be issued in the proposed transaction or determined if this joint proxy statement/prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This joint proxy statement/prospectus dated October 15, 2004 and the related forms of proxy are intended to be sent to the shareholders of Lyondell and Millennium on or about October 25, 2004.

LYONDELL CHEMICAL COMPANY

1221 McKinney Street, Suite 700

Houston, Texas 77010

(713) 652-7200

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

November 30, 2004

To our shareholders:

We will hold a special meeting of the shareholders of Lyondell Chemical Company in Lyondell’s General Assembly Room, 42nd Floor, One Houston Center, 1221 McKinney Street, in Houston, Texas, at 9:00 a.m. Texas time on Tuesday, November 30, 2004, for the following purposes, as more fully described in the attached joint proxy statement/prospectus:

| | (1) | To consider and approve a proposal to issue Lyondell common stock to the shareholders of Millennium Chemicals Inc. in connection with the transaction contemplated by the Agreement and Plan of Merger, dated March 28, 2004, among Lyondell, Millennium Chemicals Inc. and Millennium Subsidiary LLC, a wholly owned subsidiary of Millennium. |

| | (2) | To consider and approve a proposal to amend and restate Lyondell’s certificate of incorporation to increase the authorized Lyondell shares (excluding preferred stock) from 420 million shares to 500 million shares. |

Note: Approval of both Proposals (1) and (2) is a condition to closing the proposed transaction.

| | (3) | To consider and approve a proposal to amend and restate Lyondell’s 1999 incentive plan. |

| | (4) | To transact any other business as may properly come before the meeting or any adjournment or postponement thereof. |

Lyondell’s board of directors has carefully reviewed and considered the terms of the proposed transaction, the proposed amended and restated certificate of incorporation and the proposed amended and restated 1999 incentive plan. Lyondell’s board of directors unanimously recommends that Lyondell shareholders vote “FOR” (1) the issuance of Lyondell common stock to Millennium shareholders in the proposed transaction, (2) the proposed amended and restated certificate of incorporation of Lyondell and (3) the proposed amended and restated 1999 incentive plan of Lyondell. In considering the recommendation of Lyondell’s board of directors, you should be aware that directors and officers of Lyondell have interests in the proposed transaction that are different from, or in addition to, the interests of Lyondell shareholders generally, and that these directors and officers will directly benefit if the proposed transaction is completed. Please see “Proposals to Approve the Proposed Transaction—Interests of Certain Persons in the Proposed Transaction” beginning on page 93. Lyondell’s board of directors was aware of these interests and considered them in approving the agreement and plan of merger and the amendment and restatement of Lyondell’s certificate of incorporation.

Lyondell shareholders of record at the close of business on October 14, 2004 will be entitled to notice of and to vote at the special meeting and any adjournment or postponement thereof.

Attendance at the meeting is limited to Lyondell shareholders. Admission will be on a first-come, first-serve basis. Registration will begin at 8:30 a.m. and the meeting will begin at 9:00 a.m. Texas time. Each shareholder holding shares in brokerage accounts will need to bring a copy of a brokerage statement reflecting stock ownership as of the record date. Please note that you may be asked to present valid picture identification, such as a driver’s license or passport.

Your vote is very important. Please read the attached joint proxy statement/prospectus. Then, please submit a proxy as soon as possible so that your shares can be voted at the meeting in accordance with your instructions. You may submit your proxy (1) over the Internet, (2) by telephone or (3) by mail. For specific instructions regarding submitting a proxy, please see the instructions on the enclosed proxy card. You may revoke your proxy at any time before it is voted at the special meeting.

BY ORDER OF THE BOARD OF DIRECTORS,

| | |

| Kerry A. Galvin | | Houston, Texas |

| Secretary | | October 15, 2004 |

MILLENNIUM CHEMICALS INC.

20 Wight Avenue, Suite 100

Hunt Valley, Maryland 21030

(410) 229-4400

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

November 30, 2004

To our shareholders:

We will hold a special meeting of the shareholders of Millennium Chemicals Inc. at Millennium’s offices, 20 Wight Avenue, Hunt Valley, Maryland 21030, at 10:00 a.m. Maryland time on Tuesday, November 30, 2004, for the following purposes, as more fully described in the attached joint proxy statement/prospectus:

| | (1) | To consider and approve a proposal to adopt the Agreement and Plan of Merger, dated March 28, 2004, among Lyondell Chemical Company, Millennium and Millennium Subsidiary LLC, a wholly owned subsidiary of Millennium, pursuant to which Millennium Subsidiary will merge with and into Millennium, and Millennium will become a wholly owned subsidiary of Lyondell. |

| | (2) | To transact any other business as may properly come before the meeting or any adjournment or postponement thereof. |

Millennium’s board of directors has carefully reviewed and considered the terms of the proposed transaction and unanimously recommends that Millennium shareholders vote “FOR” the adoption of the agreement and plan of merger. In considering the recommendation of Millennium’s board of directors, you should be aware that directors and officers of Millennium have interests in the proposed transaction that are different from, or in addition to, the interests of Millennium shareholders generally, and that these directors and officers will directly benefit if the proposed transaction is completed. Please see “Proposals to Approve the Proposed Transaction—Interests of Certain Persons in the Proposed Transaction” beginning on page 93. Millennium’s board of directors was aware of these interests and considered them in approving the agreement and plan of merger.

Millennium shareholders of record at the close of business on October 14, 2004 will be entitled to notice of and to vote at the special meeting and any adjournment or postponement thereof.

Attendance at the meeting is limited to Millennium shareholders. Admission will be on a first-come, first-serve basis. Registration will begin at 9:30 a.m. and the meeting will begin at 10:00 a.m. Maryland time. Each shareholder holding shares in brokerage accounts will need to bring a copy of a brokerage statement reflecting stock ownership as of the record date. Please note that you may be asked to present valid picture identification, such as a driver’s license or passport.

Your vote is very important. Please read the attached joint proxy statement/prospectus. Then, please submit a proxy as soon as possible so that your shares can be voted at the meeting in accordance with your instructions. You may submit your proxy (1) over the Internet, (2) by telephone or (3) by mail. For specific instructions regarding submitting a proxy, please see the instructions on the enclosed proxy card. You may revoke your proxy at any time before it is voted at the special meeting.

BY ORDER OF THE BOARD OF DIRECTORS,

| | |

| C. William Carmean | | Hunt Valley, Maryland |

| Secretary | | October 15, 2004 |

HOW TO OBTAIN ADDITIONAL INFORMATION

This joint proxy statement/prospectus incorporates important business and financial information about Lyondell and Millennium from other documents that are not included in or delivered with this joint proxy statement/prospectus. See “Where You Can Find More Information” beginning on page 178 for a listing of documents incorporated by reference. This information is available to you without charge upon your written or oral request. You also can obtain the documents incorporated by reference in this joint proxy statement/prospectus through the Securities and Exchange Commission website atwww.sec.gov.

Lyondell documents are available to any person, including any beneficial owner of Lyondell common stock, upon request directed to Lyondell’s Investor Relations department, Lyondell Chemical Company, 1221 McKinney Street, Suite 700, Houston, Texas 77010, telephone (713) 309-4590.

Millennium documents are available to any person, including any beneficial owner of Millennium common stock, upon request directed to Millennium’s Investor Relations department, Millennium Chemicals Inc., 20 Wight Avenue, Suite 100, Hunt Valley, Maryland 21030, telephone (410) 229-8113.

To ensure timely delivery of these documents, any request by Lyondell shareholders or Millennium shareholders should be made by November 19, 2004. The exhibits to these documents will generally not be made available unless they are specifically incorporated by reference in this joint proxy statement/prospectus.

TABLE OF CONTENTS

i

| | |

Market Price and Dividend Information | | 18 |

Listing of Lyondell Common Stock | | 19 |

SUMMARY HISTORICAL CONSOLIDATED FINANCIAL DATA OF LYONDELL | | 20 |

SUMMARY HISTORICAL CONSOLIDATED FINANCIAL DATA OF MILLENNIUM | | 21 |

UNAUDITED PRO FORMA COMBINED SUMMARY FINANCIAL DATA | | 22 |

UNAUDITED COMPARATIVE HISTORICAL PER SHARE DATA AND UNAUDITED PRO FORMA PER SHARE DATA | | 23 |

RISK FACTORS | | 24 |

Risks Relating to the Proposed Transaction | | 24 |

Lyondell and Millennium may not achieve the expected benefits of the proposed transaction | | 24 |

The combined company may face difficulties in integrating the operations of Lyondell and Millennium | | 24 |

The market price of the shares of Lyondell common stock to be received in the proposed transaction will fluctuate and you may not know the precise exchange ratio at the time you vote on the proposals | | 24 |

The increase in trading activity resulting from the increase in shares of Lyondell common stock outstanding after the proposed transaction could cause volatility in the market price of Lyondell common stock, and sales of large amounts of Lyondell common stock following the proposed transaction could result in a decline in the market price of Lyondell common stock | | 25 |

The interests of directors and executive officers of Lyondell and Millennium may differ from, or be in addition to, those of the Lyondell shareholders and Millennium shareholders, respectively | | 25 |

The combined company will incur significant costs as a result of the proposed transaction | | 26 |

Millennium has restated its financial statements and has a material weakness in its internal controls that requires remediation, and Millennium may conclude, pursuant to Section 404 of the Sarbanes-Oxley Act, that its internal controls over financial reporting at December 31, 2004 are not effective | | 26 |

Lyondell’s management may make different estimates or judgments with respect to Millennium’s financial statements after completion of the proposed transaction, which could affect the value of your investment in the combined company | | 27 |

Risks Relating to Debt of the Combined Company Following the Proposed Transaction | | 27 |

The combined company’s consolidated balance sheet will be highly leveraged and it will have risks resulting from significant amounts of debt | | 27 |

After the proposed transaction, Lyondell, Millennium and their joint ventures will each continue to require a significant amount of cash to service their indebtedness, and the ability of each of them to generate cash will depend on many factors beyond their control | | 28 |

Debt and other agreements will restrict the ability of Lyondell, Millennium and Equistar to take certain actions and will require Lyondell and Millennium to maintain certain financial ratios. Failure to comply with these requirements could result in acceleration of debt | | 29 |

Debt covenants will limit transfer of cash between Lyondell, Millennium, Equistar and LCR | | 30 |

If Lyondell’s operations do not generate the additional cash needed to pay the additional dividends payable as a result of the issuance of shares in the proposed transaction and any shares of Lyondell common stock issued in the future, and Lyondell is unable to or does not obtain such cash from its joint ventures or Millennium, then Lyondell will have to either fund the additional dividends using available cash or the proceeds of external financing, if available, or reduce its per share dividend | | 31 |

Millennium may not have sufficient funds to repurchase a substantial amount of its 9.25% notes if tendered pursuant to a change in control provision in the indenture governing those notes that will be triggered by the proposed transaction | | 32 |

Risks Relating to the Businesses of the Combined Company | | 32 |

The cyclicality of the chemical and refining industries may cause significant fluctuation in the combined company’s operating results | | 32 |

Costs of raw materials and energy may result in increased operating expenses and reduced results of operations | | 33 |

Millennium has a limited number of suppliers for some of its raw materials, and if one of these suppliers were unable to meet its obligations, Millennium could incur supply shortages or price increases for its raw materials | | 33 |

Lyondell, Millennium and Equistar will continue to sell commodity products in highly competitive markets and face significant price pressure | | 33 |

ii

| | |

External factors beyond the control of Lyondell, Millennium and their respective joint ventures can cause fluctuations in demand for their products and in their prices and margins, which may result in lower operating results | | 34 |

Operating problems in the businesses of Lyondell, its subsidiaries (including Millennium after the closing) or joint ventures may result in lower operating results | | 34 |

The combined company’s international operations will be subject to exchange rate fluctuations, exchange controls, political risks and other risks relating to non-U.S. operations | | 35 |

LCR’s crude oil supply agreement with PDVSA Petroléo, S.A. (PDVSA Oil) is important to LCR’s operations because it reduces the volatility of earnings and cash flow. The agreement is currently subject to litigation and subject to the risk of enforcing judgments against non-U.S. affiliates of a sovereign nation and force majeure risks | | 36 |

After the proposed transaction, Lyondell and its subsidiaries (including Millennium) and Equistar will continue to pursue acquisitions, dispositions and joint ventures | | 37 |

Lyondell’s and Millennium’s and their subsidiaries’ and joint ventures’ operations and assets are, and, after the proposed transaction, will remain, subject to extensive environmental, health and safety and other laws and regulations | | 38 |

Pending or future legislative initiatives may reduce Lyondell’s MTBE sales | | 40 |

Proceedings relating to the alleged exposure to lead-based paints and lead pigments could require Millennium to expend material amounts in litigation and settlement costs and judgments | | 41 |

Risks Relating to Failure to Complete the Proposed Transaction | | 41 |

If the proposed transaction does not occur, neither company will benefit from the expenses it has incurred in pursuit of the proposed transaction and either company may be subject to a termination fee | | 41 |

Failure to complete the proposed transaction could cause Lyondell’s or Millennium’s stock price to decline | | 42 |

DISCLOSURE REGARDING FORWARD LOOKING STATEMENTS | | 43 |

INDUSTRY AND OTHER INFORMATION | | 45 |

Lyondell | | 45 |

Millennium | | 45 |

THE SPECIAL MEETINGS | | 46 |

Date, Time and Place of the Special Meetings | | 46 |

Purpose of the Special Meetings and Required Vote | | 46 |

Record Date, Shares Entitled to Vote and Quorum | | 47 |

Effect of Abstentions and Broker Non-Votes | | 48 |

Proxies | | 49 |

PROPOSALS TO APPROVE THE PROPOSED TRANSACTION | | 51 |

Structure of the Proposed Transaction | | 51 |

Recommendation of Lyondell’s Board of Directors | | 51 |

Recommendation of Millennium’s Board of Directors | | 52 |

Background of the Proposed Transaction | | 52 |

Lyondell’s Reasons for the Proposed Transaction | | 60 |

Millennium’s Reasons for the Proposed Transaction | | 63 |

Certain Financial Forecasts | | 65 |

Opinion of Citigroup Global Markets Inc., Lyondell’s Financial Advisor | | 67 |

Opinion of J.P. Morgan Securities Inc., one of Millennium’s Financial Advisors | | 76 |

Opinion of UBS Securities LLC, one of Millennium’s Financial Advisors | | 86 |

Interests of Certain Persons in the Proposed Transaction | | 93 |

Exchange of Millennium Common Stock Certificates for Lyondell Common Stock Certificates | | 100 |

No Appraisal Rights | | 101 |

Regulatory Approvals | | 101 |

Bank Facility Amendments | | 101 |

Change in Control Provision in Millennium’s Senior Notes | | 101 |

Stock Exchange Listings | | 101 |

Material U.S. Federal Income Tax Consequences of the Proposed Transaction | | 102 |

iii

iv

| | |

ANNEXES: | | |

| |

Annex A | | Agreement and Plan of Merger |

Annex B | | Opinion of Citigroup Global Markets Inc. |

Annex C | | Opinion of J.P. Morgan Securities Inc. |

Annex D | | Opinion of UBS Securities LLC |

Annex E | | Amended and Restated Certificate of Incorporation of Lyondell Chemical Company |

Annex F | | Lyondell Chemical Company Amended and Restated 1999 Incentive Plan |

v

LYONDELL SHARES

Lyondell has two series of common stock outstanding: original common stock, par value $1.00 per share, which trades on the New York Stock Exchange, and Series B common stock, par value $1.00 per share, which is not publicly traded. In this joint proxy statement/prospectus:

| | • | The term “Lyondell common stock” refers only to shares of Lyondell original common stock. |

| | • | The term “Lyondell Series B common stock” refers only to shares of Lyondell Series B common stock. |

| | • | The term “Lyondell shares” refers to shares of Lyondell’s original common stock and Lyondell’s Series B common stock as a single class. |

Holders of Lyondell common stock and Lyondell Series B common stock vote together as one class. For more information about the relative rights of the two series, see “Description of Lyondell Capital Stock” beginning on page 138.

In the proposed transaction, holders of Millennium common stock will receive shares of Lyondell common stock.

vi

QUESTIONS AND ANSWERS ABOUT THE PROPOSED TRANSACTION

This question-and-answer section highlights selected information included in this joint proxy statement/ prospectus but does not contain all of the information that is important to you as a Lyondell or Millennium shareholder. You should carefully read this entire joint proxy statement/prospectus, including the Annexes, and the other documents Lyondell and Millennium refer you to for a more complete understanding of the matters being considered at the special meetings. In addition, Lyondell and Millennium incorporate by reference important business and financial information about Lyondell and Millennium into this joint proxy statement/prospectus. You may obtain the information incorporated by reference into this joint proxy statement/prospectus without charge by following the instructions in the section entitled “Where You Can Find More Information” beginning on page 178.

Q: What is the proposed transaction?

A: On March 28, 2004, Lyondell, Millennium, and Millennium Subsidiary LLC, a wholly owned subsidiary of Millennium, entered into an agreement and plan of merger providing for a stock-for-stock business combination. The agreement provides that Millennium Subsidiary will merge into Millennium, subject to the conditions in the agreement. In the merger, Millennium’s common stock will be converted into the right to receive Lyondell common stock, and one share of Millennium preferred stock (valued at approximately $1,000) to be issued to Lyondell immediately before the merger will be converted into common stock of Millennium. As a result, Millennium will become a wholly owned subsidiary of Lyondell.

Q: Why are Lyondell and Millennium proposing the transaction?

A: Completing the proposed transaction will create the third largest, independent publicly traded U.S. chemical company, with leading positions in propylene oxide and derivatives, ethylene, propylene, polyethylene, titanium dioxide (TiO2) and acetyls, and will consolidate Lyondell’s and Millennium’s ownership of their Equistar Chemicals joint venture. Well positioned globally, the combined company will have significant leverage to the petrochemical cycle, allowing the shareholders to take better advantage of a recovery in the petrochemical cycle. Lyondell and Millennium believe that the synergies captured through the integration of the operations of the two companies, and the size, breadth and depth of the larger combined company, will allow for greater future cash generation than either company could achieve on a stand-alone basis. Accordingly, the respective boards of directors of Lyondell andMillennium believe that the proposed transaction will benefit the shareholders of both companies, and Lyondell and Millennium ask for your support in voting for the proposals at their respective special meetings.

Q: How will the number of shares to be issued to Millennium shareholders be determined?

A: As described in “Summary of the Agreement and Plan of Merger—The Exchange Ratio” beginning on page 112, Millennium shareholders will receive between 0.95 and 1.05 shares of Lyondell common stock for each share of Millennium common stock, depending on the average of the volume-weighted average sale prices of Lyondell common stock for the 20 trading days ending on the third trading day before the closing of the proposed transaction. Millennium shareholders will receive 0.95 of a share of Lyondell common stock for each share of Millennium common stock if that average price is $20.50 or greater and 1.05 shares of Lyondell common stock if that average price is $16.50 or less. Between these two average prices, the exchange ratio will be proportionately adjusted between 0.95 and 1.05. Millennium shareholders will receive cash for fractional shares of Lyondell common stock, net of expenses.

If the average of the volume-weighted average sale prices of Lyondell common stock for the 20 trading days ending on the third trading day before the closing of the proposed transaction is $16.50 or less, Lyondell will issue to Millennium shareholders approximately 69 million shares of Lyondell common stock, based on the number of Millennium shares outstanding as of October 14, 2004. If the average is $20.50 or higher, Lyondell will issue approximately 63 million shares of Lyondell

1

common stock to Millennium shareholders, based on the number of Millennium shares outstanding as of October 14, 2004. If the closing had occurred on October 14, 2004, the exchange ratio would have been 0.95 shares of Lyondell common stock for each share of Millennium common stock outstanding, and, based on the number of Millennium shares outstanding as of October 14, 2004, Lyondell would have issued approximately 63 million shares of Lyondell common stock to Millennium shareholders. For purposes of this joint proxy statement/prospectus, the number of Millennium shares outstanding includes 418,217 shares held in certain Millennium employee benefit plan trusts at October 14, 2004 for distribution to current and former employees, which are not eligible to be voted.

The actual exchange ratio and the number of shares of Lyondell common stock to be issued at closing may differ from this example because the actual exchange ratio will not be determinable until the third trading day before the closing of the proposed transaction. In addition, the number of shares issued would be increased by 1.4 to 1.5 million (depending on the exchange ratio) if all of Millennium’s outstanding stock options (including approximately 0.1 million of options with an exercise price in excess of the October 14, 2004 market price) are exercised for shares before closing and by an additional 10.5 to 11.6 million (depending on the exchange ratio) if Millennium’s convertible debentures are converted before closing. In the fourth quarter 2004, the debentures are convertible at a conversion price of $13.63 per Millennium share.

Q: What matters will be considered at the special meetings?

A: Lyondell Shareholders: At the Lyondell special meeting, Lyondell shareholders will be asked to vote “FOR” (1) the issuance of Lyondell common stock to Millennium shareholders in the proposed transaction, (2) the amended and restated certificate of incorporation of Lyondell increasing the authorized Lyondell shares (excluding preferred stock) from 420 million to 500 million shares, and (3) the amended and restated 1999 incentive plan of Lyondell. Approval of Proposals (1) and (2) is a condition to closing theproposed transaction. Approval of Proposal (3) is not a condition to the proposed transaction.

Millennium Shareholders: At the Millennium special meeting, Millennium shareholders will be asked to adopt the agreement and plan of merger. Approval of this proposal is a condition to closing the proposed transaction.

Q: Why does Lyondell want to increase the number of authorized Lyondell shares?

A: Lyondell currently is authorized to issue 340 million shares of Lyondell common stock and 80 million shares of Lyondell Series B common stock. As of October 14, 2004, approximately 141 million shares of Lyondell common stock were issued and outstanding and approximately 43 million shares were reserved for issuance upon conversion of outstanding shares of Lyondell Series B common stock to shares of Lyondell common stock and in connection with outstanding warrants. We anticipate reserving approximately 78 million to 88 million shares of Lyondell common stock to be issued in connection with the proposed transaction (including shares to be reserved for issuance in connection with Millennium’s stock options and convertible debentures). Accordingly, after the increase in authorized shares and completion of the proposed transaction, the number of authorized but unissued and unreserved shares of Lyondell common stock will not be significantly different from what it is today. For more detail, please see “Proposal to Approve the Amended and Restated Certificate of Incorporation of Lyondell” beginning on page 108.

Q: Why is Lyondell shareholder approval necessary to issue Lyondell common stock to Millennium’s shareholders?

A: Lyondell’s listing agreement with the New York Stock Exchange requires shareholder approval for the issuance of shares of common stock equal to 20% or more of the issued and outstanding Lyondell shares. Lyondell will issue a number of shares of Lyondell common stock exceeding that amount to Millennium shareholders in the proposed transaction.

2

Q: What vote is required to approve the proposals?

A: Lyondell Shareholders: In order to approve Lyondell Proposal (1) to issue Lyondell common stock to Millennium shareholders in connection with the proposed transaction and Lyondell Proposal (3) to amend and restate Lyondell’s 1999 incentive plan, the affirmative vote of at least a majority of the votes cast thereon at the special meeting is required, provided the total votes cast represent at least 50% of the outstanding Lyondell shares. In order to approve Lyondell Proposal (2) to amend and restate Lyondell’s certificate of incorporation to increase the number of authorized Lyondell shares, the affirmative vote of at least a majority of the outstanding Lyondell shares is required. In each case, all outstanding Lyondell shares, including shares of Lyondell Series B common stock, will vote as a single class.

Millennium Shareholders: In order to approve the Millennium proposal to adopt the agreement and plan of merger, the affirmative vote of at least a majority of the outstanding shares of Millennium common stock is required.

Q: When will the closing occur?

A: The closing will occur shortly after the shareholder meetings, assuming that the necessary shareholder approvals are obtained and all other conditions have been satisfied or waived.

Q: What do I need to do now?

A: Both companies’ special meetings will take place on Tuesday, November 30, 2004. After carefully reading and considering the information contained in this joint proxy statement/prospectus and the documents incorporated by reference herein, please mail your signed proxy card in the enclosed postage-paid envelope or submit your proxy by telephone or over the Internet, as soon as possible, so that your shares may be represented at your company’s special meeting. In order to ensure that your proxy is received, please submit your proxy as instructed on your proxy card even if you currently plan to attend your company’s special meeting in person.

Q: What vote does my board of directors recommend?

A: Lyondell’s board of directors unanimously recommends that Lyondell’s shareholders vote in favor of all three proposals to be presented at its special meeting. In considering the recommendation of Lyondell’s board of directors, you should be aware that officers and directors of Lyondell have interests in the proposed transaction that are different from, or in addition to, the interests of Lyondell shareholders generally, and that (1) these officers will directly benefit if the proposed transaction is completed and (2) these directors will directly benefit if the proposed transaction is completed because they will remain directors of the combined company and approximately 11,669 stock options held by some of Lyondell’s non-employee directors will vest approximately two months earlier than they would otherwise have vested. These interests and benefits are described in the joint proxy statement/prospectus under “Proposals to Approve the Proposed Transactions—Interests of Certain Persons in the Proposed Transaction” beginning on page 93.

Millennium’s board of directors unanimously recommends that Millennium’s shareholders vote in favor of the proposal to be presented at its special meeting. In considering the recommendation of Millennium’s board of directors, you should be aware that directors and officers of Millennium have interests in the proposed transaction that are different from, or in addition to, the interests of Millennium shareholders generally, and that Millennium’s directors and officers will directly benefit if the proposed transaction is completed. These interests and benefits, including cash payments of approximately $46.7 million in the aggregate and the accelerated vesting of stock options and other share awards, are described in this joint proxy statement/prospectus under “Proposals to Approve the Proposed Transaction—Interests of Certain Persons in the Proposed Transaction” beginning on page 93.

Q: What should I do if I want to change my vote?

A: You can change your vote at any time before your proxy is voted at your company’s special meeting. You can do this in one of three ways:

| | • | you can send the Corporate Secretary of your company a written notice at the address |

3

| | under “Summary—The Companies” on page 7 stating that you would like to revoke your proxy; |

| | • | you can complete and submit a later-dated proxy by mail, by telephone or over the Internet; or |

| | • | you can attend your company’s special meeting and vote in person. |

If you have instructed a broker to vote your shares, you must follow the procedures provided by your broker to change those instructions.

Q: What if I plan to attend the special meeting in person?

A: To ensure that your vote is counted, we recommend that you submit your proxy anyway. You may still attend the special meeting and vote in person.

Q: If my shares are held in “street name” by my broker, will my broker vote my shares for me?

A: If you do not provide your broker with instructions on how to vote your “street name” shares, your broker will not be permitted to vote your shares on the proposals. You should therefore be sure to provide your broker with instructions on how to vote your shares. Please contact your broker for directions on how to instruct your broker to vote your shares.

Q: What happens if I do not vote?

A: Lyondell Shareholders: With respect to Lyondell Proposal (1) to approve the issuance of Lyondell common stock to Millennium shareholders in connection with the proposed transaction and Lyondell Proposal (3) to amend and restate Lyondell’s 1999 incentive plan, your failure to vote your Lyondell shares, including abstentions, will count against satisfaction of the requirement that the votes cast represent at least 50% of the outstanding Lyondell shares and, therefore, abstentions may have the effect of a vote against these proposals. With respect to Lyondell Proposal (2) to amend and restate Lyondell’s certificate of incorporation to increase the number of authorized Lyondell shares, your failure to vote your Lyondell shares, including abstentions, willhave the effect of a vote against this proposal. Because of the nature of the matters to be voted on, and because there are no other matters to be voted on, there will be no broker non-votes. If your shares are held in the Lyondell, Equistar, LCR or Millennium 401(k) plan, please see “The Special Meetings—Effect of Abstentions and Broker Non-Votes” beginning on page 48 for an explanation of the effect of your failure to instruct the trustee of that plan how to vote your shares.

Millennium Shareholders: Your failure to vote your Millennium shares, including an abstention, will have the same effect as a vote against the Millennium proposal to adopt the agreement and plan of merger. Because of the nature of the matters to be voted on, and because there are no other matters to be voted on, there will be no broker non-votes.If your shares are held in the Lyondell, Equistar, LCR or Millennium 401(k) plan, please see “The Special Meetings— Effect of Abstentions and Broker Non-Votes” beginning on page 48 for an explanation of the effect of your failure to instruct the trustee of that plan how to vote your shares.

Q: Should I send in my Millennium stock certificates now?

A: No. If the proposed transaction is completed, written instructions for exchanging share certificates representing shares of Millennium common stock will be sent to Millennium shareholders. Lyondell shareholders will keep their existing share certificates.

Q: Will Millennium shareholders be taxed on the Lyondell common stock that they receive?

A: Millennium shareholders (other than shareholders subject to special treatment under U.S. federal income tax law) will not recognize gain or loss on the receipt of Lyondell common stock in the proposed transaction. However, gain or loss will be recognized on the receipt of cash for a fractional share. For a further discussion, including the opinions of counsel that Millennium and Lyondell have obtained and will obtain at closing, see “Proposals to Approve the Proposed Transaction—Material U.S. Federal Income Tax Consequences of the Proposed Transaction” beginning on page 102.

4

Q: Does Lyondell intend to continue to pay dividends on Lyondell shares after the proposed transaction?

A: Lyondell expects no change in its dividend policy and expects to continue to pay quarterly dividends on Lyondell shares after the proposed transaction. Dividends on Lyondell shares will only be paid when and to the extent declared by Lyondell’s board of directors. The payment of dividends by Lyondell in the future depends upon Lyondell’s results of operations, financial condition, cash position and requirements, investment opportunities, future prospects, contractual restrictions and other factors deemed relevant by Lyondell’s board of directors.

Giving effect to completion of the proposed transaction and based on Millennium’s outstanding shares on October 14, 2004, Lyondell anticipates paying approximately $56.4 to $62.4 million annually to its shareholders in additional dividends, depending on the number of shares of Lyondell common stock issued in connection with the proposed transaction and assuming continuation of Lyondell’s current dividend rate of $0.90 per share per year. See “Risk Factors—Risks Related to Debt of the Combined Company Following the Proposed Transaction” beginning on page 27. Lyondell’s credit agreement and the indentures for its senior secured and senior subordinated notes contain restrictions that provide that Lyondell may not pay dividends on Lyondell shares at an annual rate exceeding $0.90 per share. In addition, Lyondell is not permitted to pay dividends if it is in default under its credit agreement. See “Comparative Market Prices and Dividends” on page 137.

Although Lyondell will hold all the outstanding equity of Millennium after the consummation of the proposed transaction, debt covenants will limit Lyondell’s ability to transfer cash between Lyondell and Millennium, and cash distributions from Millennium may not be available to help fund Lyondell’s dividend payments. In addition, as described in “Risk Factors—Risks Relating to Debt of the Combined Company Following the Proposed Transaction” beginning on page 27, debt covenants will continue to limit transfers of cash between Lyondell and Equistar and between Millennium andEquistar, even though Equistar will be indirectly wholly owned by Lyondell. Existing debt covenants also will continue to limit transfers of cash between Lyondell and LCR.

For a summary of the dividend payment history of each of Lyondell and Millennium, see “Comparative Market Prices and Dividends” on page 137. On October 7, 2004, Lyondell’s board of directors declared a regular quarterly dividend of $0.225 per Lyondell share payable to Lyondell shareholders of record as of the close of business on November 26, 2004. Millennium shareholders will not be entitled to receive this dividend on the shares of Lyondell common stock they receive in the proposed transaction because the closing of the proposed transaction will occur after the record date for the dividend.

5

WHO CAN HELP ANSWER QUESTIONS

If you are a Lyondell shareholder and have questions, you may contact:

Lyondell Chemical Company

1221 McKinney Street, Suite 700

Houston, Texas 77010

Attn: Investor Relations

Phone number: (713) 309-4590

Lyondell shareholders may also contact Lyondell’s proxy solicitor:

Morrow & Co. Inc.

445 Park Avenue, 5th Floor

New York, New York 10022

Call collect: (212) 754-8000

Banks and brokerage firms, please call toll free: (800) 654-2468

Shareholders, please call toll free: (800) 607-0088

If you are a Millennium shareholder and have questions, you may contact:

Millennium Chemicals Inc.

20 Wight Avenue, Suite 100

Hunt Valley, Maryland 21030

Attn: Investor Relations

Phone number: (410) 229-8113

Millennium shareholders may also contact Millennium’s proxy solicitor:

Georgeson Shareholder Communications Inc.

17 State Street, 10th Floor

New York, New York 10004

Banks and brokerage firms, please call: (212) 440-9800

All others call toll free: (800) 334-8636

6

SUMMARY

This summary section highlights selected information from this joint proxy statement/prospectus regarding the proposals and may not contain all of the information that is important to you as a Lyondell and/or Millennium shareholder. Accordingly, Lyondell and Millennium encourage you to carefully read this entire document, including the Annexes, and the documents which are incorporated by reference. You may obtain a copy of the documents that Lyondell and Millennium have incorporated by reference without charge by following the instructions in the section entitled “Where You Can Find More Information” beginning on page 178. We have included page references in this summary to direct you to more complete descriptions of the topics presented in this summary.

The Companies

Lyondell Chemical Company

1221 McKinney Street, Suite 700

Houston, Texas 77010

(713) 652-7200

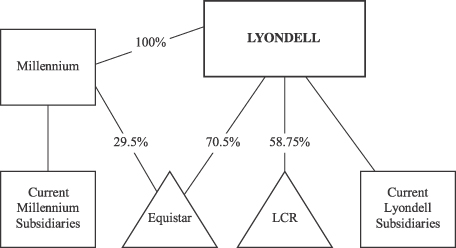

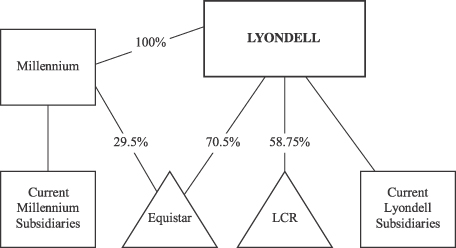

Lyondell is a leading producer of: propylene oxide (PO); PO derivatives including propylene glycol, propylene glycol ethers and butanediol; and styrene monomer and methyl tertiary butyl ether as co-products of PO production. In addition, through its 70.5% interest in Equistar, Lyondell is also one of the largest producers of ethylene, propylene and polyethylene in North America and a leading producer of ethylene oxide, ethylene glycol, high value-added specialty polymers and polymeric powder. Lyondell owns a 58.75% interest in LYONDELL-CITGO Refining LP, referred to in this document as LCR. Lyondell believes, based on its experience in the industry, that LCR is one of the largest refiners in the U.S. processing extra heavy Venezuelan crude oil to produce gasoline, low sulfur diesel and jet fuel. For more information regarding estimates of capacity position and capacity share, see “Industry and Other Information” on page 45.

Millennium Chemicals Inc.

20 Wight Avenue, Suite 100

Hunt Valley, Maryland 21030

(410) 229-4400

Millennium is the second-largest producer of titanium dioxide (TiO2) in the world, the largest merchant seller of titanium tetrachloride and a producer of silica gel and cadmium-based pigments. It also is the second-largest producer of acetic acid and vinyl acetate monomer in North America, and a leading producer of terpene-based fragrance and flavor chemicals. Millennium owns the remaining 29.5% interest in Equistar. For more information regarding estimates of capacity position and capacity share, see “Industry and Other Information” on page 45.

Millennium Subsidiary LLC

20 Wight Avenue, Suite 100

Hunt Valley, Maryland 21030

(410) 229-4400

Millennium Subsidiary LLC is a Delaware limited liability company formed by Millennium on March 25, 2004 for the sole purpose of effecting the proposed transaction. This is the only business of Millennium Subsidiary.

Risk Factors (page 24)

See “Risk Factors” for a discussion of factors you should carefully consider before deciding how to vote at your company’s special meeting.

7

Structure of the Proposed Transaction

On March 28, 2004, Lyondell, Millennium, and Millennium Subsidiary entered into an agreement and plan of merger providing for a stock-for-stock business combination. In the proposed transaction, Millennium Subsidiary will merge into Millennium (the “merger”), with Millennium being the surviving entity. In the merger, Millennium common stock will be converted into the right to receive Lyondell common stock, and the share of Millennium preferred stock (valued at approximately $1,000) to be issued to Lyondell immediately before the merger will be converted into common stock of Millennium. As a result, Millennium will become a wholly owned subsidiary of Lyondell.

As consideration for the proposed transaction, Millennium shareholders will receive between 0.95 and 1.05 shares of Lyondell common stock for each share of Millennium common stock, depending on the average of the volume-weighted average sales prices on the New York Stock Exchange for Lyondell common stock for the 20 trading days ending on the third trading day before closing. Millennium shareholders will receive 0.95 of a share of Lyondell common stock for each share of Millennium common stock if the average of the volume-weighted average sale prices of Lyondell common stock is $20.50 or greater and 1.05 shares of Lyondell common stock if the average is $16.50 or less. Between these two average prices, the exchange ratio will be proportionately adjusted between 0.95 and 1.05. Set forth below is a table showing a hypothetical range of averages along with the corresponding exchange ratio, implied value of one share of Millennium common stock and the aggregate number of shares of Lyondell common stock to be issued to Millennium shareholders that would result from each such average. This table is for illustrative purposes only, and the actual prices and volumes at which shares of Lyondell common stock may trade between the date hereof and closing may cause the average to fluctuate above or below the hypothetical range of averages set forth below. The exchange ratio and number of shares of Lyondell common stock to be issued at closing may differ from the examples below because the exchange ratio will not be determinable until the third trading day before the closing of the proposed transaction.

| | | | | | |

Hypothetical Range of

Average of Volume-Weighted Average Sale Prices for a 20-Day Period of Lyondell Common Stock

| | Exchange Ratio (Number of shares of

Lyondell common stock Millennium

shareholders will receive for each share

of Millennium common stock)

| | Implied Value of one share of Millennium common stock based on such 20-Day Average(a)

| | Number of shares of Lyondell common stock to be issued to Millennium shareholders(b)(c)

|

| | | | | | | (in millions) |

£$16.50 | | 1.05 | | $17.33 | | 69.3 |

$17.50 | | 1.025 | | $17.94 | | 67.7 |

$18.50 | | 1.00 | | $18.50 | | 66.0 |

$19.50 | | 0.975 | | $19.01 | | 64.4 |

³$20.50 | | 0.95 | | $19.48 | | 62.7 |

$21.46(d) | | 0.95 | | $20.39 | | 62.7 |

| (a) | For purposes of this chart, the “implied value” of a share of Millennium common stock is equal to the volume-weighted average sales price multiplied by the exchange ratio corresponding to such price. However, the “implied value” of a share of Millennium common stock on a particular date would actually be calculated by multiplying the closing price of Lyondell common stock on that date (instead of the average of the volume-weighted average sale prices for a 20-day period ended on the third trading day before that date) by the exchange ratio for such date. For example, at the 0.95 exchange ratio that would have applied had the proposed transaction been completed on October 14, 2004, the implied value of one share of Millennium common stock would have been $20.56, based on the closing price of Lyondell common stock on October 13, 2004 of $21.64. |

| (b) | Based on the number of outstanding shares of Millennium common stock as of October 14, 2004. |

| (c) | The number of shares issued would be increased by 1.4 to 1.5 million (depending on the exchange ratio) if all of Millennium’s outstanding stock options (including approximately 0.1 million of options with an exercise price in excess of the October 14, 2004 market price) are exercised for shares before closing and by an additional 10.5 to 11.6 million (depending on the exchange ratio) if Millennium’s convertible debentures are converted before closing. In the fourth quarter 2004, the debentures are convertible at a conversion price of $13.63 per Millennium share. |

8

| (d) | If the proposed transaction had been completed on October 14, 2004, the average of the volume-weighted average sale prices for the 20 trading days ended on the third trading day before completion would have been $21.46. Accordingly, the exchange ratio would have been 0.95 shares of Lyondell common stock for each outstanding share of Millennium common stock. |

The proposed transaction, including the calculation of exchange ratio, is described in more detail in this document under the heading “Proposals to Approve the Proposed Transaction” beginning on page 51.

Organizational Structure After the Proposed Transaction

The diagram below shows the ownership by Lyondell of Millennium, Equistar and certain other entities after completion of the proposed transaction. Although Lyondell will own all of the equity interest in Millennium and indirectly in Equistar after completion of the proposed transaction, Lyondell, Millennium and Equistar will remain separate legal entities. Each entity will continue to be separately responsible for its respective debt obligations (except that $300 million of Equistar debt is guaranteed by Lyondell) and each entity will continue to be subject to the various restrictive covenants contained in its debt agreements, including restrictions on inter-company activities. See “Risk Factors—Risks Relating to Debt of the Combined Company Following the Proposed Transaction” beginning on page 27.

The Lyondell Special Meeting (page 46)

The Lyondell special meeting will be held in Lyondell’s General Assembly Room, 42nd Floor, One Houston Center, 1221 McKinney Street, in Houston, Texas, at 9:00 a.m. Texas time on Tuesday, November 30, 2004.

Lyondell shareholders of record at the close of business on October 14, 2004 will be entitled to notice of and to vote at the meeting and any adjournment or postponement thereof. On that date, 179,254,841 Lyondell shares were outstanding and entitled to vote at the special meeting. On that date, Lyondell’s directors and executive officers beneficially owned an aggregate of approximately 2.3% of the issued and outstanding Lyondell shares entitled to vote at the special meeting. Two members of Lyondell’s board of directors are executive officers of Occidental Petroleum Corporation, the beneficial owner of approximately 25% of the outstanding Lyondell shares as of the record date.

9

Lyondell Vote Required for Approval of the Issuance of Shares of Lyondell Common Stock to Millennium Shareholders in Connection with the Proposed Transaction (page 106)

Approval of the Lyondell Proposal (1) to issue shares of Lyondell common stock pursuant to the proposed transaction requires the affirmative vote of at least a majority of the votes cast thereon, provided the total votes cast represent at least 50% of the outstanding Lyondell shares. Because the votes cast must represent at least 50% of the outstanding Lyondell shares, your failure to vote, including abstentions, may have the effect of a vote against the proposal to approve the issuance of shares of Lyondell common stock to Millennium shareholders in connection with the proposed transaction. However, if the 50% requirement is satisfied, your failure to vote, including abstentions, will not have an effect on the outcome of this proposal. Because of the nature of this matter there will be no broker non-votes. If your shares are held in the Lyondell, Equistar, LCR or Millennium 401(k) plans, please see “The Special Meetings—Effect of Abstentions and Broker Non-Votes” beginning on page 48 for an explanation of the effect of your failure to instruct the trustee of that plan how to vote your shares.

Approval of this proposal is a condition to closing the proposed transaction.

Lyondell Vote Required for Approval of the Amended and Restated Certificate of Incorporation (page 110)

Approval of the Lyondell Proposal (2) to amend and restate its certificate of incorporation increasing the number of authorized Lyondell shares (excluding preferred stock) from 420 million to 500 million shares requires the affirmative vote of at least a majority of the outstanding Lyondell shares. Because the required vote is based on the affirmative vote of a majority of shares outstanding, your failure to vote, including abstentions, will have the effect of a vote against the proposal to amend and restate Lyondell’s certificate of incorporation to increase the number of authorized Lyondell shares. Because of the nature of this matter there will be no broker non-votes. If your shares are held in the Lyondell, Equistar, LCR or Millennium 401(k) plans, please see “The Special Meetings—Effect of Abstentions and Broker Non-Votes” beginning on page 48 for an explanation of the effect of your failure to instruct the trustee of that plan how to vote your shares.

Approval of this proposal is a condition to closing the proposed transaction.

Lyondell Vote Required for Approval of the Amended and Restated 1999 Incentive Plan (page 171)

Approval of the Lyondell Proposal (3) to amend and restate Lyondell’s 1999 incentive plan to increase the number of shares available for issuance and to revise the award limits under the 1999 incentive plan requires the affirmative vote of at least a majority of the votes cast thereon, provided the total votes cast represent at least 50% of the outstanding Lyondell shares. Because the votes cast must represent at least 50% of the outstanding Lyondell shares, your failure to vote, including abstentions, may have the effect of a vote against the proposal to amend and restate Lyondell’s 1999 incentive plan. However, if the 50% requirement is satisfied, your failure to vote, including abstentions, will not have an effect on the outcome of this proposal. Because of the nature of this matter there will be no broker non-votes. If your shares are held in the Lyondell, Equistar, LCR or Millennium 401(k) plans, please see “The Special Meetings—Effect of Abstentions and Broker Non-Votes” beginning on page 48 for an explanation of the effect of your failure to instruct the trustee of that plan how to vote your shares.

Approval of this proposal is not a condition to closing the proposed transaction.

Recommendation to Lyondell’s Shareholders (pages 106, 110 and 171)

Lyondell’s board of directors believes that (1) the issuance of Lyondell common stock to Millennium shareholders in the proposed transaction, (2) the proposed amended and restated certificate of incorporation increasing the number of authorized Lyondell shares and (3) the proposed amended and

10

restated 1999 incentive plan of Lyondell are advisable and in the best interests of Lyondell’s shareholders and unanimously recommends that Lyondell’s shareholders vote “FOR” each of these proposals.

In considering the recommendation of Lyondell’s board of directors, you should be aware that officers and directors of Lyondell have interests in the proposed transaction that are different from, or in addition to, the interests of Lyondell shareholders generally, and that (1) these officers will directly benefit if the proposed transaction is completed and (2) these directors will directly benefit if the proposed transaction is completed because they will remain directors of the combined company and approximately 11,669 stock options held by some of Lyondell’s non-employee directors will vest approximately two months earlier than they would otherwise have vested. Please see “Proposals to Approve the Proposed Transaction—Interests of Certain Persons in the Proposed Transaction” beginning on page 93. Lyondell’s board of directors was aware of these interests and considered them in approving the agreement and plan of merger and the amendment and restatement of Lyondell’s certificate of incorporation.

The Millennium Special Meeting (page 47)

The Millennium special meeting will be held at Millennium’s offices, 20 Wight Avenue, Hunt Valley, Maryland 21030, at 10:00 a.m. Maryland time on Tuesday, November 30, 2004.

Millennium shareholders of record at the close of business on October 14, 2004 will be entitled to notice of and to vote at the meeting and any adjournment or postponement thereof. On that date, 65,618,654 shares of Millennium common stock were outstanding and entitled to vote at the special meeting. On that date, Millennium’s directors and executive officers beneficially owned an aggregate of approximately 0.7% of the issued and outstanding shares of Millennium’s common stock entitled to vote at the special meeting.

Millennium Vote Required to Adopt the Agreement and Plan of Merger (page 107)

Approval of the Millennium proposal to adopt the agreement and plan of merger requires the affirmative vote of at least a majority of the outstanding shares of Millennium common stock. An affirmative vote for adoption of the agreement and plan of merger is a vote for the merger of Millennium Subsidiary into Millennium and for the other transactions contemplated by the agreement and plan of merger. Because the required vote is based on the affirmative vote of a majority of shares outstanding, your failure to vote, including abstentions, will have the same effect as a vote against the proposal to adopt the agreement and plan of merger. Because of the nature of this matter there will be no broker non-votes. If your shares are held in the Lyondell, Equistar, LCR or Millennium 401(k) plan, please see “The Special Meetings—Effect of Abstentions and Broker Non-Votes” beginning on page 48 for an explanation of the effect of your failure to instruct the trustee of that plan how to vote your shares.

Approval of this proposal is a condition to closing the proposed transaction.

Recommendation to Millennium’s Shareholders (page 107)

Millennium’s board of directors believes that the agreement and plan of merger and the transactions contemplated thereby are advisable and in the best interests of Millennium’s shareholders and unanimously recommends that Millennium’s shareholders vote “FOR” this proposal.

In considering the recommendation of Millennium’s board of directors, you should be aware that directors and officers of Millennium have interests in the proposed transaction that are different from, or in addition to, the interests of Millennium shareholders generally, and that Millennium’s directors and officers will directly benefit if the proposed transaction is completed. Among other things, Mr. Robert E. Lee, Millennium’s president and chief executive officer and a member of Millennium’s board of directors who voted to approve the proposed transaction, will be entitled to receive, as a result of the proposed transaction, an estimated $8.4 million in cash as of September 24, 2004, distribution of shares of Millennium

11

common stock pursuant to Millennium’s executive long term incentive plan (the “ELTIP”), accelerated vesting of his restricted shares and stock options and reimbursement for all excise taxes on such distributions on a fully grossed-up basis. Please see “Proposals to Approve the Proposed Transaction—Interests of Certain Persons in the Proposed Transaction” beginning on page 93. Millennium’s board of directors was aware of these interests and considered them in approving the agreement and plan of merger.

Opinion of Citigroup Global Markets Inc., Lyondell’s Financial Advisor (page 67)

In connection with the proposed transaction, Lyondell’s board of directors received a written opinion from Citigroup Global Markets Inc. as to the fairness, from a financial point of view, to Lyondell of the exchange ratio provided for in the agreement and plan of merger. The full text of Citigroup’s written opinion dated March 28, 2004 is attached to this joint proxy statement/prospectus asAnnex B. We encourage you to read this opinion carefully in its entirety for a description of the assumptions made, procedures followed, matters considered and limitations on the review undertaken.Citigroup’s opinion was provided to Lyondell’s board of directors in connection with its evaluation of the exchange ratio, does not address any other aspect of the proposed transaction or any related transaction and does not constitute a recommendation to any shareholder as to how such shareholder should vote or act on any matters relating to the proposed transaction.

Under the terms of Citigroup’s engagement, Lyondell agreed to pay Citigroup an aggregate fee of $8.5 million for its financial advisory services upon completion of the proposed transaction, of which $7.5 million is contingent on the closing of the proposed transaction. In the event the proposed transaction is not consummated and Lyondell receives a termination fee from Millennium, Lyondell has agreed to pay Citigroup an aggregate fee of up to $7 million. Citigroup and its affiliates in the past have provided investment banking and financial services to Lyondell and Equistar and, from January 1, 2002 through August 31, 2004, have received fees of approximately $15.1 million from Lyondell (including with respect to amendments described under “—Bank Facility Amendments”) and approximately $8.0 million from Equistar for these services. In addition, Citigroup and its affiliates currently are providing services to Lyondell and Equistar in connection with their respective credit facilities for which services Citigroup and its affiliates expect to receive compensation, which has not been quantified at this time. In the ordinary course of business, Citigroup and its affiliates may actively trade or hold the securities of Lyondell, Equistar and Millennium for their own account or for the account of customers and, accordingly, may at any time hold a long or short position in those securities. In addition, Citigroup and its affiliates may maintain relationships with Lyondell, Millennium and their respective affiliates.

Opinion of J.P. Morgan Securities Inc., one of Millennium’s Financial Advisors (page 76)

In connection with the proposed transaction, Millennium’s board of directors received a written opinion from J.P. Morgan Securities Inc. as to the fairness of the exchange ratio, from a financial point of view, to the holders of Millennium’s common stock. The full text of JPMorgan’s written opinion, dated March 28, 2004, is attached to this joint proxy statement/prospectus asAnnex C. We encourage you to read this opinion carefully in its entirety for a description of the assumptions made, procedures followed, matters considered and limitations on the review undertaken.JPMorgan’s opinion was provided to Millennium’s board of directors in connection with its evaluation of the exchange ratio, does not address any other aspect of the proposed transaction or any related transaction and does not constitute a recommendation to any shareholder as to how such shareholder should vote or act on any matters relating to the proposed transaction.

For services rendered in connection with the proposed transaction, including with respect to the amendment of the outstanding credit facilities discussed below, Millennium agreed to pay JPMorgan a fee of $1.25 million upon the public announcement of the proposed transaction and a fee of $7.125 million, plus an incentive fee of $250,000 for each $1.00 per share (pro rated for incremental amounts less than $1.00) over $18.00 per share received by Millennium’s stockholders (valued at the closing price per share of Lyondell common stock on the date the proposed transaction closes) upon completion of the proposed transaction. If Millennium receives any

12

payment from another person following or in connection with the termination, abandonment or failure to occur of the proposed transaction, Millennium will instead pay JPMorgan a fee in an amount equal to 25% of such payment to Millennium, less the $1.25 million fee paid to JPMorgan upon public announcement of the proposed transaction (provided that such amount will not exceed the fee that would have been payable to JPMorgan if the proposed transaction had been completed).

JPMorgan and its affiliates have, from time to time, provided financial advisory and financing services to Millennium, Lyondell, Equistar and their affiliates unrelated to the proposed transaction, including acting as lead or joint bookrunner on a number of financings, for which they have received, from January 1, 2002 through August 31, 2004, fees of $5.7 million from Millennium and fees of $8.9 million from Lyondell and $4.8 million from Equistar. One of JPMorgan’s commercial bank affiliates is currently providing services to Millennium and Lyondell in connection with certain outstanding credit facilities for which it and the other lenders on the credit facilities receive customary compensation. The compensation to be paid to JPMorgan for its services in arranging the amendments described under “—Bank Facility Amendments” is included in the transaction fee disclosed in the prior paragraph. JPMorgan or one of its affiliates may also provide other financial advisory and financing services to Millennium, Lyondell, Equistar and/or other affiliates in the future, including acting as agent bank in connection with amendments or replacements of certain credit facilities. JPMorgan writes research on Millennium and Lyondell. In the ordinary course of their businesses, JPMorgan and its affiliates may actively trade the debt or equity securities of Millennium, Equistar or Lyondell for their own accounts or for the accounts of customers and, accordingly, they may at any time hold long or short positions in such securities.

Opinion of UBS Securities LLC, one of Millennium’s Financial Advisors (page 86)

In connection with the proposed transaction, Millennium’s board of directors also received a written opinion from UBS Securities LLC as to the fairness of the exchange ratio, from a financial point of view, to the holders of Millennium’s common stock. The full text of UBS’ written opinion, dated March 28, 2004, is attached to this joint proxy statement/prospectus asAnnex D. We encourage you to read this opinion carefully in its entirety for a description of the assumptions made, procedures followed, matters considered and limitations on the review undertaken.UBS’ opinion was provided to Millennium’s board of directors in connection with its evaluation of the exchange ratio, does not address any other aspect of the proposed transaction or any related transaction and does not constitute a recommendation to any shareholder as to how such shareholder should vote or act on any matters relating to the proposed transaction.

Under the terms of its engagement, Millennium paid UBS a $750,000 fee for the delivery of its opinion to Millennium’s board of directors. Accordingly, none of the fee that was paid to UBS is conditioned upon the closing of the proposed transaction. UBS and its predecessors and affiliates have in the past provided debt and/or equity financing services to Lyondell, Equistar and their affiliates unrelated to the proposed transaction, for which they have received, from January 1, 2002 through August 31, 2004, fees of approximately $2.8 million from Lyondell and approximately $0.5 million from Equistar. In addition, UBS and its affiliates are currently providing services to Equistar and Lyondell in connection with certain outstanding credit facilities, for which they expect to receive customary compensation, which has not been quantified at this time. In the ordinary course of business, UBS and its predecessors and affiliates may trade in the securities of Millennium, Lyondell and Equistar for their own accounts and the accounts of their customers and, accordingly, may at any time hold a long or short position in those securities.

Interests of Certain Persons in the Proposed Transaction (page 93)

In considering the boards’ recommendations, shareholders should be aware that some officers, directors and other key employees of Lyondell and Millennium may have interests in the proposed transaction that may be different from, or in addition to, those of shareholders generally, including the following:

| | • | Certain of Millennium’s officers and other key employees will receive substantial payments in connection with the proposed transaction. If the proposed transaction had been completed as of |

13

| | September 24, 2004 and all 17 of Millennium’s current officers and key employees who are parties to change in control agreements with Millennium had been terminated or terminated their employment under certain circumstances, they would have been entitled to receive an estimated aggregate of $40.7 million in severance and pension benefit payments. In addition, an estimated 147,607 shares of Millennium common stock would have been distributed to them pursuant to the ELTIP (shares distributed pursuant to the ELTIP, the “ELTIP Shares”) and an estimated 101,033 shares of Millennium restricted stock and 303,667 Millennium stock options held by such officers and other key employees would have vested and been converted into, or become exercisable for, Lyondell common stock. They would also have been entitled to receive an aggregate of approximately $6 million in incentive plan payments (including accumulated dividends on the vested shares). Of the foregoing amounts, Mr. Lee (Millennium’s president and chief executive officer and a member of Millennium’s board of directors who voted to approve the proposed transaction) would have been entitled to receive, as a result of the proposed transaction, payment of an estimated $8.4 million of the cash payments, distribution of an estimated 30,067 of the ELTIP Shares and vesting of an estimated 22,830 of the restricted shares and 48,667 of the Millennium stock options. If the transaction is completed, these officers and key employees, including Mr. Lee, will also be reimbursed for all excise taxes on such distributions on a fully grossed-up basis, |

| | • | A total of 42,000 shares of restricted stock held by Millennium’s non-employee directors will vest and automatically be converted into Lyondell common stock upon closing, |

| | • | Millennium’s officers and directors will be indemnified by Lyondell for six years after the proposed transaction, |

| | • | A total of 11,669 stock options held by Lyondell’s non-employee directors, 3,027,783 stock options held by certain of Lyondell’s officers and other key employees and 472,880 phantom stock options held by certain of Lyondell’s key employees will vest and certain of Lyondell’s officers and other key employees will receive other change in control benefits, and |

| | • | Lyondell’s directors and officers will continue to be directors and officers of Lyondell after the proposed transaction and two independent members of Millennium’s current board of directors will be added to Lyondell’s board of directors. |

Summary of the Agreement and Plan of Merger (page 112)

The agreement and plan of merger is attached asAnnex A to this joint proxy statement/prospectus. The agreement and plan of merger is the document that governs the proposed transaction.

Conditions to Completion of the Proposed Transaction (page 113)

Lyondell’s and Millennium’s obligations to complete the proposed transaction are subject to the prior satisfaction or waiver (to the extent permitted by law) of a number of conditions, including:

| | • | adoption by the Millennium shareholders of the agreement and plan of merger; |

| | • | approval by the Lyondell shareholders of (1) the issuance of shares of Lyondell common stock to Millennium shareholders in connection with the proposed transaction and (2) the amended and restated certificate of incorporation increasing the number of authorized Lyondell shares; |

| | • | the expiration or termination of the waiting period applicable to the consummation of the proposed transaction under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, referred to as the HSR Act, the receipt of any clearances required by the European Commission and, except in certain circumstances, the receipt of any material regulatory or governmental approval required, or in the reasonable view of Lyondell, warranted, under national competition, merger control or similar laws of any other relevant jurisdiction or expiration of any relevant waiting period thereunder. The waiting |

14

| | period under the HSR Act expired in May 2004, and clearances required by the European Commission were received in June 2004; |

| | • | the absence of any judgment, injunction, ruling, order or decree of any governmental entity in effect that makes the proposed transaction illegal, restrains or prevents the consummation of the proposed transaction or imposes any condition to, or any requirement as a result of, consummation of the proposed transaction that would, if complied with, constitute or result in a material adverse effect with respect to Lyondell or Millennium; |

| | • | the receipt by each of Lyondell and Millennium of a legal opinion with respect to certain U.S. federal income tax consequences of the proposed transaction; |

| | • | the receipt of the necessary amendments of Lyondell’s and Millennium’s credit agreements and Lyondell’s receivables sales facility (or, in each case, replacements thereof), in form and substance reasonably satisfactory to Lyondell. These amendments have been obtained; and |

| | • | other customary conditions, including the truth and correctness of the representations and warranties of each party and performance of obligations, subject to a materiality standard, and approval of the listing on the New York Stock Exchange of the shares of Lyondell common stock to be issued in the proposed transaction. |

“No Solicitation” Provisions (page 117)

The agreement and plan of merger contains “no solicitation” provisions that prohibit either party from taking any action to solicit an alternative acquisition proposal. The agreement and plan of merger does not, however, prohibit either party or its board of directors from considering, and potentially recommending, an unsolicited written proposal from a third party that contains a superior proposal or is reasonably likely to lead to a superior proposal.

Termination of the Agreement and Plan of Merger (page 121)

The agreement and plan of merger may be terminated at any time prior to closing by mutual written consent. It may also be terminated by either party if:

| | • | the proposed transaction has not been consummated, through no willful or material fault of the terminating party, by December 31, 2004; |

| | • | the Lyondell shareholders fail to approve (1) the issuance of Lyondell common stock to Millennium shareholders in connection with the proposed transaction and (2) an amendment to the certificate of incorporation of Lyondell to effect an increase in the number of authorized Lyondell shares; |

| | • | the Millennium shareholders do not adopt the agreement and plan of merger; |

| | • | there is a breach by the other party of its representations, warranties, covenants or agreements that would cause the failure of the related closing condition, unless the breach is cured within 30 days of notice of the breach; |