INVESTOR PRESENTATION�October 2022 MYBRB.BANK ©2022 Blue Ridge Bank, N.A. All Rights Reserved. Exhibit 99.1

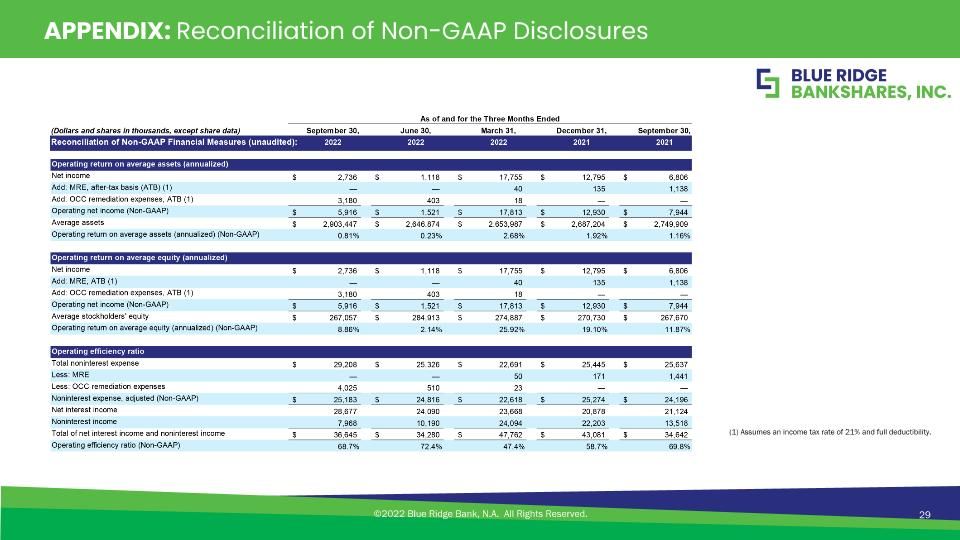

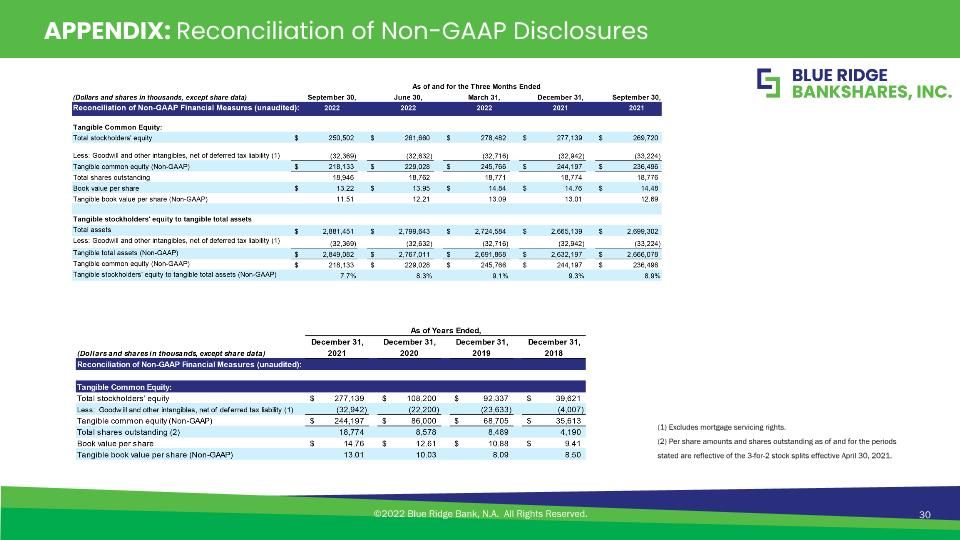

DISCLOSURE ©2022 Blue Ridge Bank, N.A. All Rights Reserved. 2 Forward-Looking Statements This presentation of Blue Ridge Bankshares, Inc. (the “Company”) contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements represent plans, estimates, objectives, goals, guidelines, expectations, intentions, projections, and statements of the Company’s beliefs concerning future events, business plans, objectives, expected operating results and the assumptions upon which those statements are based. Forward-looking statements include, without limitation, any statement that may predict, forecast, indicate, or imply future results, performance or achievements, and are typically identified with words such as “may,” “could,” “should,” “will,” “would,” “believe,” “anticipate,” “estimate,” “expect,” “aim,” “intend,” “plan,” or words or phases of similar meaning. The Company cautions that the forward-looking statements are based largely on its expectations and are subject to a number of known and unknown risks and uncertainties that are subject to change based on factors which are, in many instances, beyond the Company’s control. Actual results, performance or achievements could differ materially from those contemplated, expressed or implied by the forward-looking statements. The following factors, among others, could cause the Company’s financial performance to differ materially from that expressed in such forward-looking statements: (i) the strength of the United States economy in general and the strength of the local economies in which the Company conducts operations; (ii) geopolitical conditions, including acts or threats of terrorism and/or military conflicts, or actions taken by the United States or other governments in response to acts or threats of terrorism and/or military conflicts, which could impact business and economic conditions in the United States and abroad; (iii) the effects of the COVID-19 pandemic, including the adverse impact on the Company’s business and operations and on the Company’s customers which may result, among other things, in increased delinquencies, defaults, foreclosures and losses on loans; (iv) the occurrence of significant natural disasters, including severe weather conditions, floods, health related issues, and other catastrophic events; (v) the Company’s management of risks inherent in its real estate loan portfolio, and the risk of a prolonged downturn in the real estate market, which could impair the value of the Company’s collateral and its ability to sell collateral upon any foreclosure; (vi) changes in consumer spending and savings habits; (vii) technological and social media changes; (viii) the effects of, and changes in, trade, monetary and fiscal policies and laws, including interest rate policies of the Board of Governors of the Federal Reserve System, inflation, interest rate, market and monetary fluctuations; (ix) changing bank regulatory conditions, policies or programs, whether arising as new legislation or regulatory initiatives, that could lead to restrictions on activities of banks generally, or the Company’s subsidiary bank in particular, more restrictive regulatory capital requirements, increased costs, including deposit insurance premiums, regulation or prohibition of certain income producing activities or changes in the secondary market for loans and other products; (x) the impact of changes in financial services policies, laws and regulations, including laws, regulations and policies concerning taxes, banking, securities and insurance, and the application thereof by regulatory bodies; (xi) the impact of, and the ability to comply with, the terms of the formal written agreement between the Bank and the OCC; (xii) the impact of changes in laws, regulations and policies affecting the real estate industry; (xiii) the effect of changes in accounting policies and practices, as may be adopted from time to time by bank regulatory agencies, the Securities and Exchange Commission (the “SEC”), the Public Company Accounting Oversight Board, the Financial Accounting Standards Board or other accounting standards setting bodies; (xiv) the timely development of competitive new products and services and the acceptance of these products and services by new and existing customers; (xv) the willingness of users to substitute competitors’ products and services for the Company’s products and services; (xvi) the outcome of any legal proceedings that may be instituted against the Company; (xvii) reputational risk and potential adverse reactions of the Company’s customers, suppliers, employees or other business partners; (xviii) the effects of acquisitions the Company may make, including, without limitation, the failure to achieve the expected revenue growth and/or expense savings from such transactions; (xix) changes in the level of the Company’s nonperforming assets and charge-offs; (xx) the Company’s involvement, from time to time, in legal proceedings and examination and remedial actions by regulators; (xxi) potential exposure to fraud, negligence, computer theft and cyber-crime; (xxii) the Company’s ability to pay dividends; and (xxiii) the Company’s involvement as a participating lender in the PPP as administered through the U.S. Small Business Administration. The foregoing factors should not be considered exhaustive and should be read together with other cautionary statements that are included elsewhere in documents the Company files from time to time with the SEC including those discussed in sections entitled “Risk Factors.” If one or more of the factors affecting forward-looing information and statements proves incorrect, then actual results, performance or achievements could differ materially from those expressed in, or implied by, forward-looking information and statements contained in this presentation. Therefore, the Company cautions not to place undue reliance on its forward-looking information and statements. The Company will not update the forward-looking statements to reflect actual results or changes in factors affecting the forward-looking statements. New risks and uncertainties may emerge from time to time, and it is not possible for the Company to predict their occurrence or how these risks and uncertainties will affect it. Non-GAAP Financial Measures The accounting and reporting policies of the Company conform to U.S. generally accepted accounting principles (“GAAP”) and prevailing practices in the banking industry. However, management uses certain non-GAAP measures to supplement the evaluation of the Company’s performance. Management believes presentations of these non-GAAP financial measures provide useful supplemental information that is essential to a proper understanding of the operating results of the Company’s core businesses. These non-GAAP disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. Reconciliations of GAAP to non-GAAP measures are included at the end of this presentation.

Top 10 USDA B&I Lender in 2021 Named to Piper Sandler �Small-All Stars Class of 2021 "Best Small Bank in Virginia" in Newsweek's ranking of America's Best Banks 2022. 1st Mid-Atlantic bank to join the UN-convened Net-Zero Banking Alliance, helping to lead the financial industry in protecting our planet. Gives back to our communities ABOUT BLUE RIDGE BANK ©2022 Blue Ridge Bank, N.A. All Rights Reserved. 3

Since 1893 Community banking with a national reach. Redefining community and serving the businesses and individuals in our region. MYBRB.BANK ABOUT BLUE RIDGE BANK ©2022 Blue Ridge Bank, N.A. All Rights Reserved. 4

PURPOSE Our MISSION is to create financial value and opportunity for our shareholders, customers, employees, and communities by providing evolving, flexible, and customized solutions for the needs of our clients….and to have fun while doing it. We act with integrity and PURPOSE while serving others, commit to success, celebrate achievement, and enjoy every day. We create economic VALUE for our clients, communities, and shareholders through our commitment to providing financial products and services with a client-centric focus. WHY WE EXIST MISSION VALUES ©2022 Blue Ridge Bank, N.A. All Rights Reserved. 5

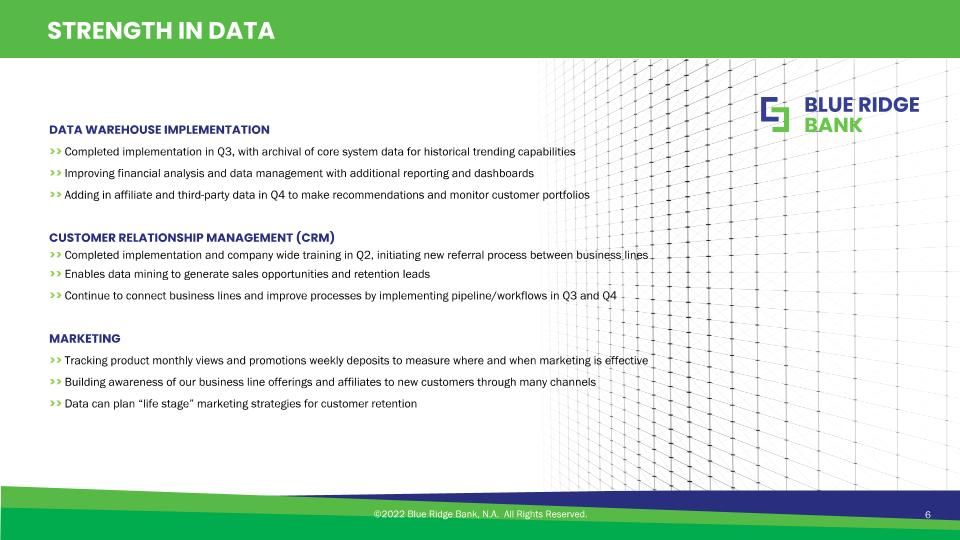

©2022 Blue Ridge Bank, N.A. All Rights Reserved. 6 STRENGTH IN DATA DATA WAREHOUSE IMPLEMENTATION >> Completed implementation in Q3, with archival of core system data for historical trending capabilities >> Improving financial analysis and data management with additional reporting and dashboards >> Adding in affiliate and third-party data in Q4 to make recommendations and monitor customer portfolios CUSTOMER RELATIONSHIP MANAGEMENT (CRM) >> Completed implementation and company wide training in Q2, initiating new referral process between business lines >> Enables data mining to generate sales opportunities and retention leads >> Continue to connect business lines and improve processes by implementing pipeline/workflows in Q3 and Q4 MARKETING >> Tracking product monthly views and promotions weekly deposits to measure where and when marketing is effective >> Building awareness of our business line offerings and affiliates to new customers through many channels >> Data can plan “life stage” marketing strategies for customer retention

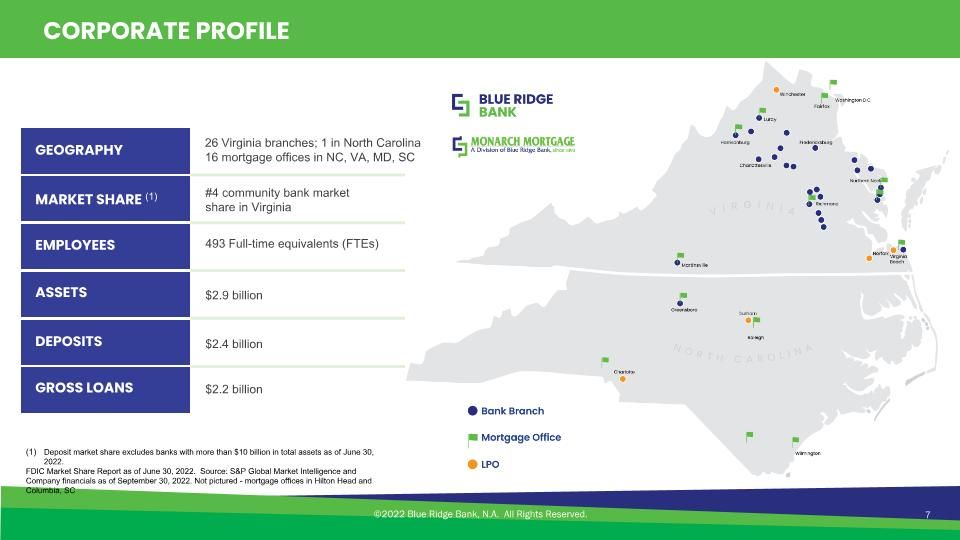

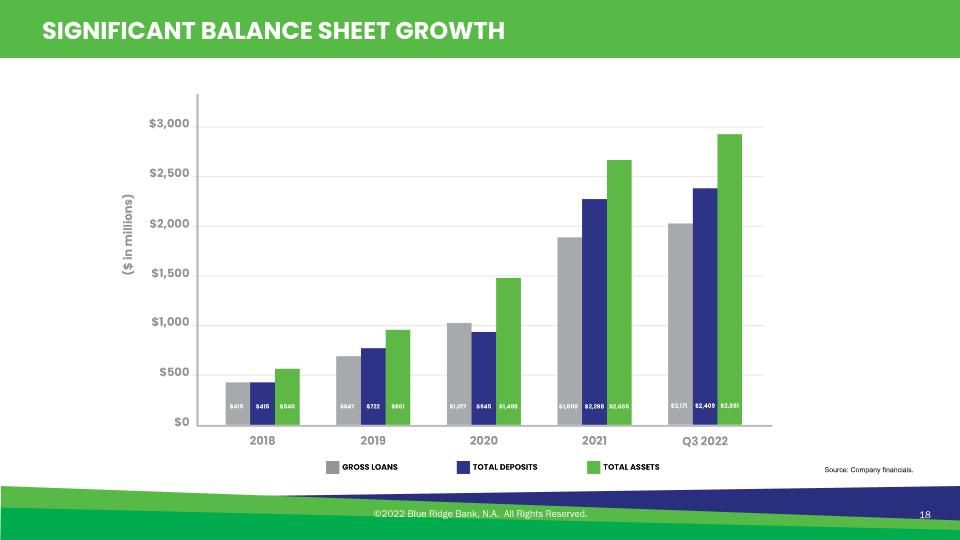

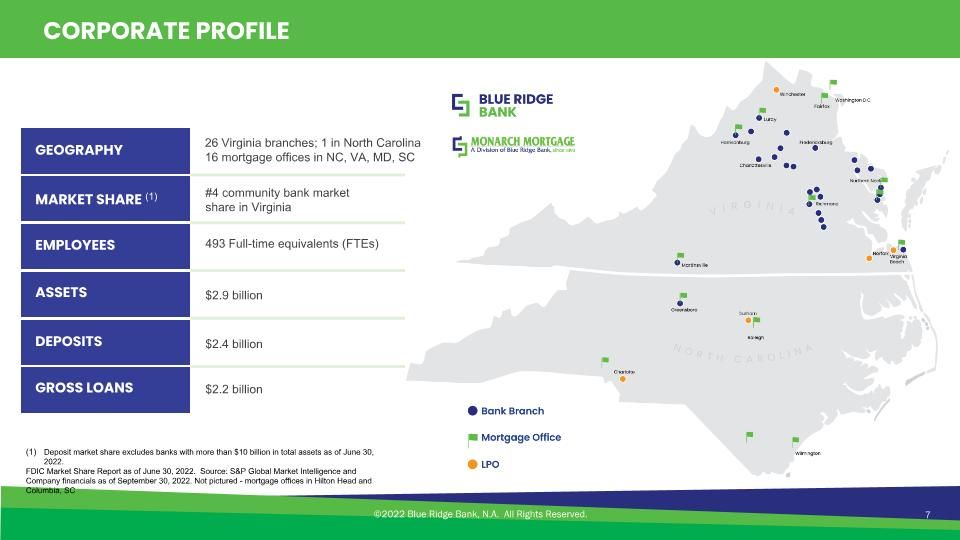

CORPORATE PROFILE Deposit market share excludes banks with more than $10 billion in total assets as of June 30, 2022. FDIC Market Share Report as of June 30, 2022. Source: S&P Global Market Intelligence and Company financials as of September 30, 2022. Not pictured - mortgage offices in Hilton Head and Columbia, SC ASSETS DEPOSITS GROSS LOANS EMPLOYEES 493 Full-time equivalents (FTEs) MARKET SHARE (1) #4 community bank market share in Virginia $2.9 billion $2.4 billion $2.2 billion GEOGRAPHY 26 Virginia branches; 1 in North Carolina 16 mortgage offices in NC, VA, MD, SC ©2022 Blue Ridge Bank, N.A. All Rights Reserved. 7

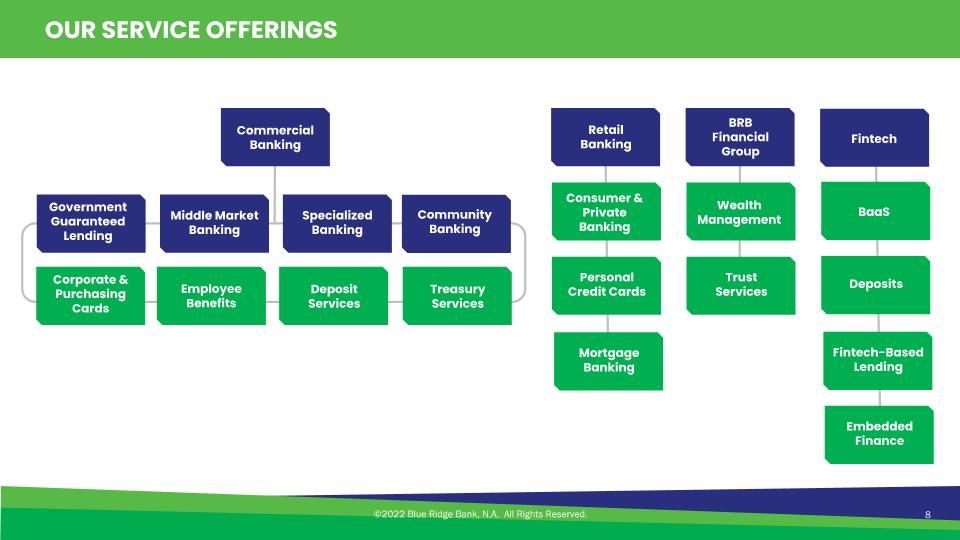

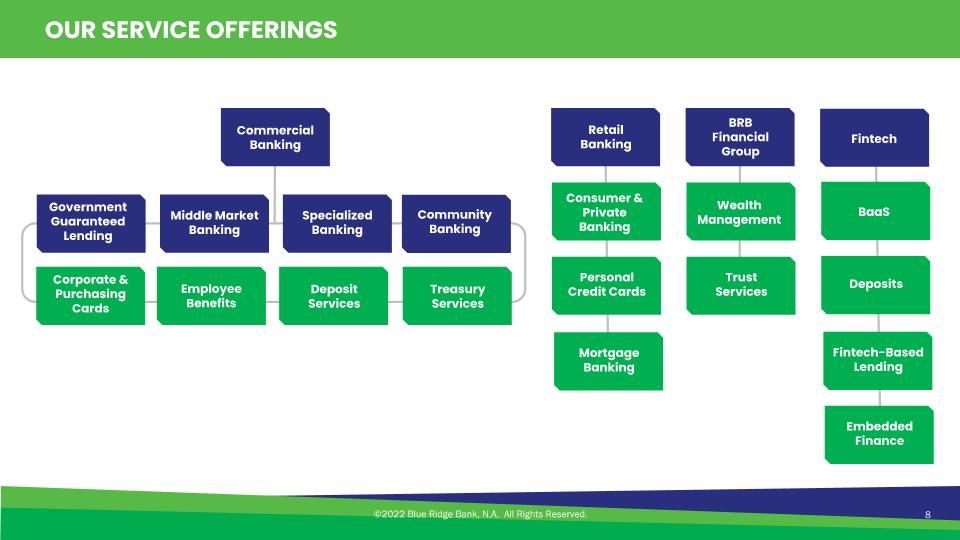

©2022 Blue Ridge Bank, N.A. All Rights Reserved. 8 OUR SERVICE OFFERINGS Commercial �Banking Retail Banking Middle Market Banking Government Guaranteed Lending Corporate & Purchasing Cards Employee Benefits Fintech Deposit Services Consumer & Private Banking Personal Credit Cards BRB Financial Group Wealth Management Trust Services Community Banking Treasury Services Mortgage Banking BaaS Deposits Fintech-Based Lending Specialized Banking Embedded Finance

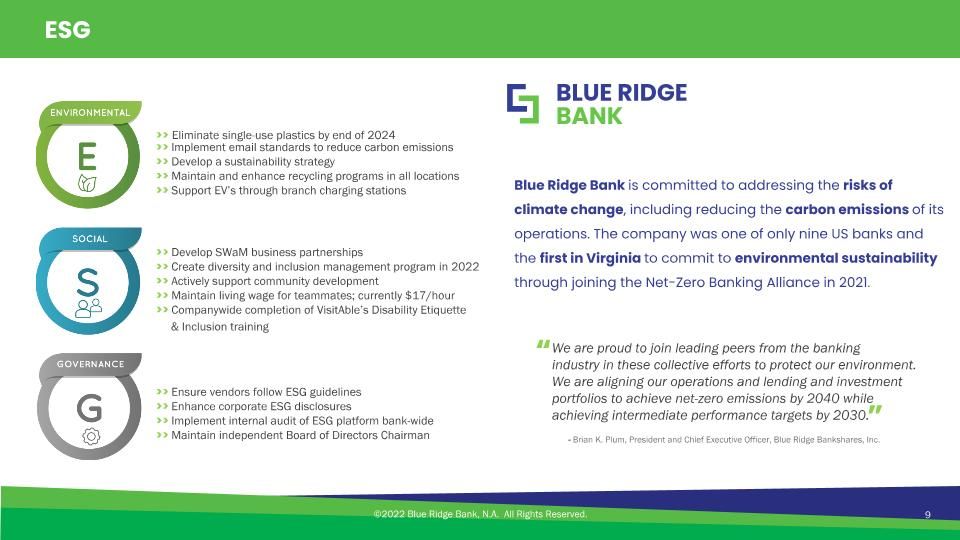

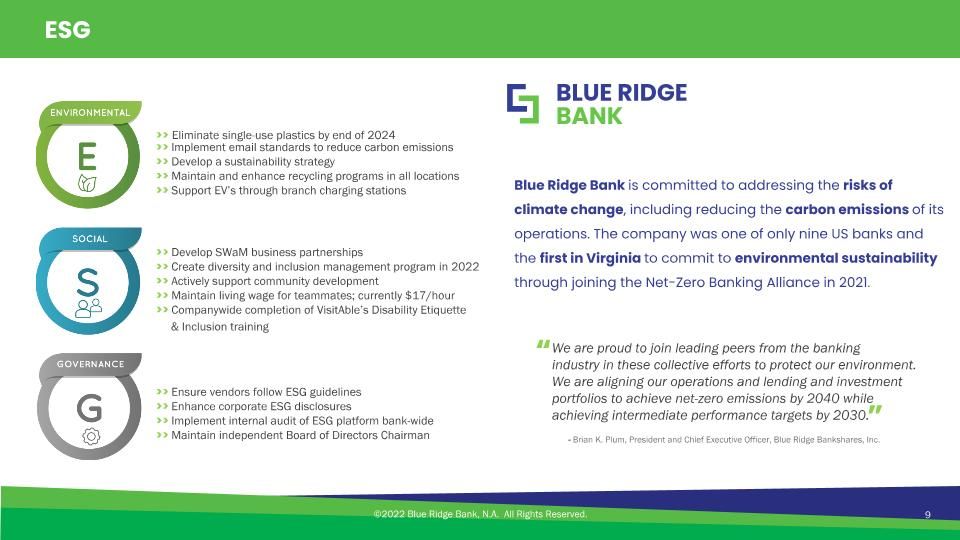

ESG ©2022 Blue Ridge Bank, N.A. All Rights Reserved. 9 >> Eliminate single-use plastics by end of 2024 >> Implement email standards to reduce carbon emissions >> Develop a sustainability strategy >> Maintain and enhance recycling programs in all locations >> Support EV’s through branch charging stations >> Ensure vendors follow ESG guidelines >> Enhance corporate ESG disclosures >> Implement internal audit of ESG platform bank-wide >> Maintain independent Board of Directors Chairman >> Develop SWaM business partnerships >> Create diversity and inclusion management program in 2022 >> Actively support community development >> Maintain living wage for teammates; currently $17/hour >> Companywide completion of VisitAble’s Disability Etiquette & Inclusion training Blue Ridge Bank is committed to addressing the risks of climate change, including reducing the carbon emissions of its operations. The company was one of only nine US banks and the first in Virginia to commit to environmental sustainability through joining the Net-Zero Banking Alliance in 2021. Brian K. Plum, President and Chief Executive Officer, Blue Ridge Bankshares, Inc. We are proud to join leading peers from the banking industry in these collective efforts to protect our environment. We are aligning our operations and lending and investment portfolios to achieve net-zero emissions by 2040 while achieving intermediate performance targets by 2030. ” “

FINTECH PARTNERSHIPS ©2022 Blue Ridge Bank, N.A. All Rights Reserved. 10

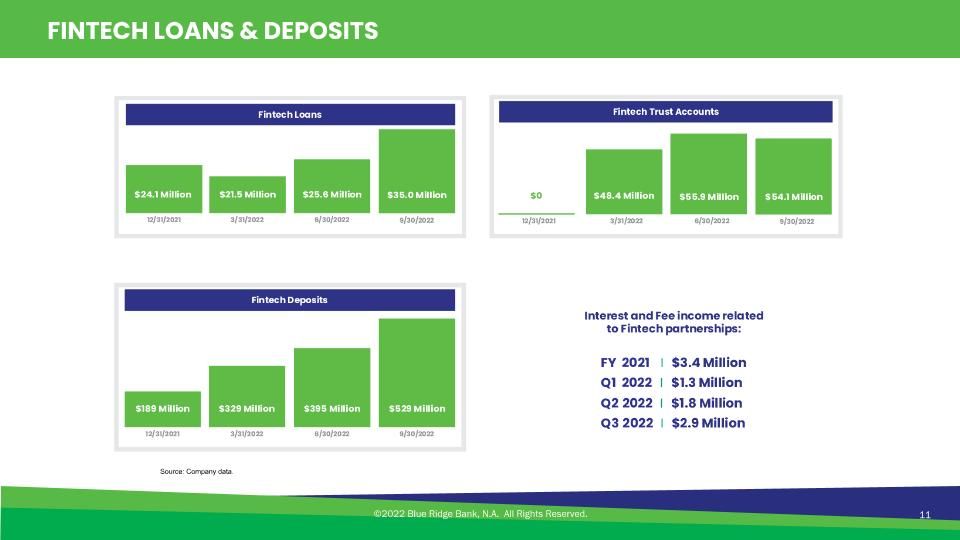

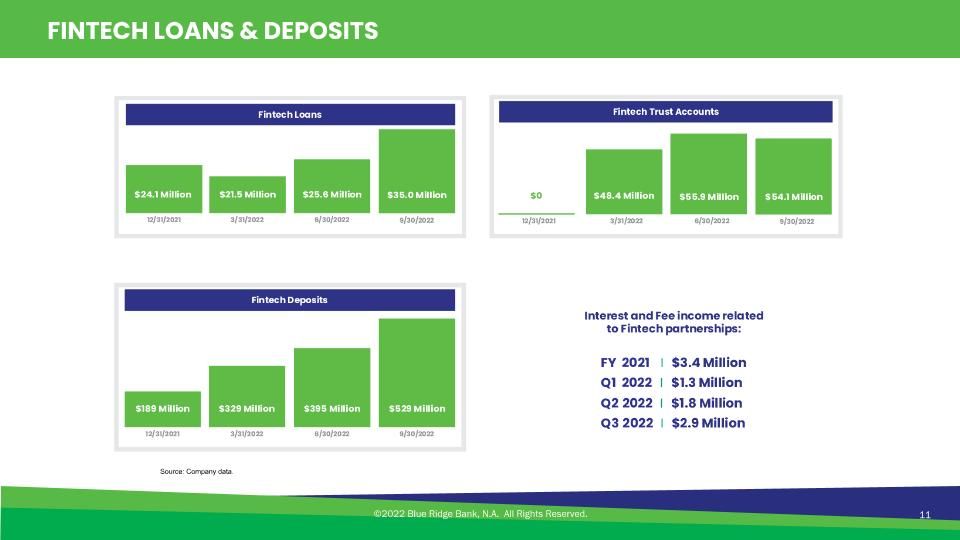

Source: Company data. FINTECH LOANS & DEPOSITS ©2022 Blue Ridge Bank, N.A. All Rights Reserved. 11

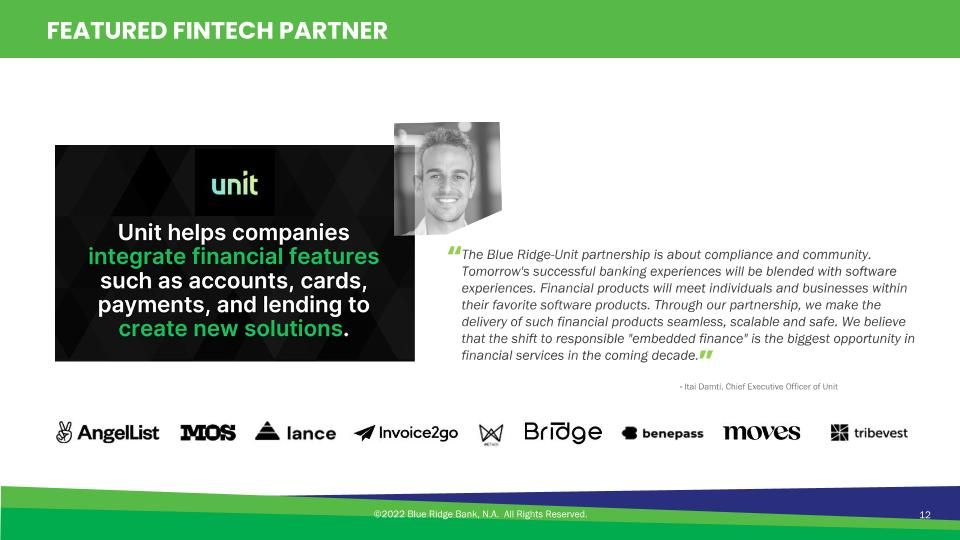

FEATURED FINTECH PARTNER ©2022 Blue Ridge Bank, N.A. All Rights Reserved. 12 The Blue Ridge-Unit partnership is about compliance and community. Tomorrow's successful banking experiences will be blended with software experiences. Financial products will meet individuals and businesses within their favorite software products. Through our partnership, we make the delivery of such financial products seamless, scalable and safe. We believe that the shift to responsible "embedded finance" is the biggest opportunity in financial services in the coming decade. Itai Damti, Chief Executive Officer of Unit ” “

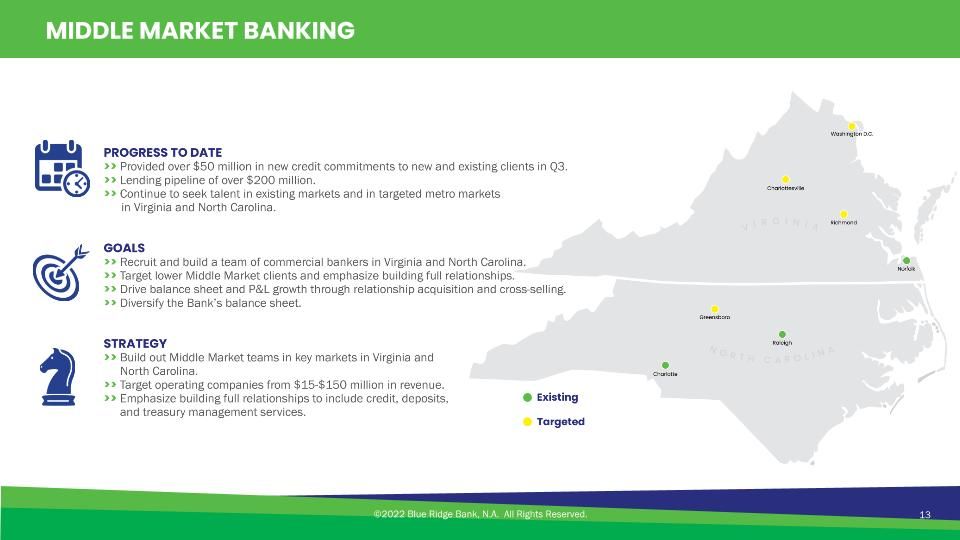

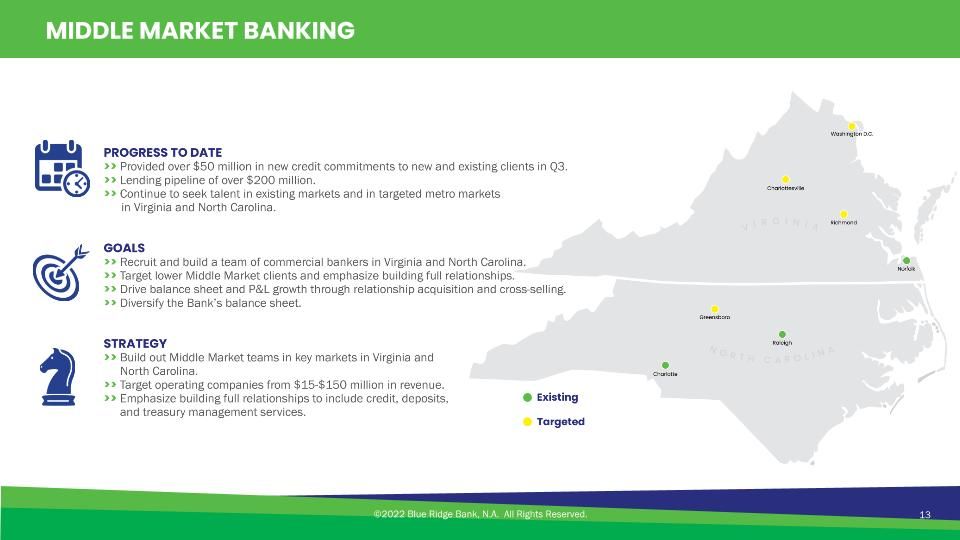

MIDDLE MARKET BANKING ©2022 Blue Ridge Bank, N.A. All Rights Reserved. 13

SPECIALIZED LENDING ©2022 Blue Ridge Bank, N.A. All Rights Reserved. 14 Subscription / Fund Finance Traditional ABL first priority secured inside a Borrowing Base – High Level Monitoring and Cash Dominion Lender Finance and Flow Arrangements PROGRESS THROUGH SEPTEMBER 2022 >> Transactions totaling $138.5 million in commitments with an average utilization rate of 58%. >> Earning average gross yield of over 7.0%. >> Deepened expertise by hiring a dedicated financial analyst and a Quality Assurance Coordinator with over 25+ years of specialized lending and ABL experience. GOALS >> Continue to ensure adequate staffing and attract top-tier talent while maintaining highest level of execution and portfolio monitoring. Ensure highest level of portfolio management ensuring adherence to ABL Policy and ABL Regulatory Guidance. >> Maintain highest degree of selectivity and ensure portfolio diversification. Focus on short-term credit risk duration with highest return on capital. >> Cross sell bank products to compliment revenue stream and income contribution with an emphasis on deposit gathering. STRATEGY >> Continue to scale best-in-class underwriting and frictionless execution by leveraging variable cost model. >> Leverage underwriting with enhanced independent analysis and collateral oversight. >> Enhance capabilities of core unit and point of differentiation through products, services and relationship building. >> Partner with internal lines of business and industry expertise to drive overall bank profitability.

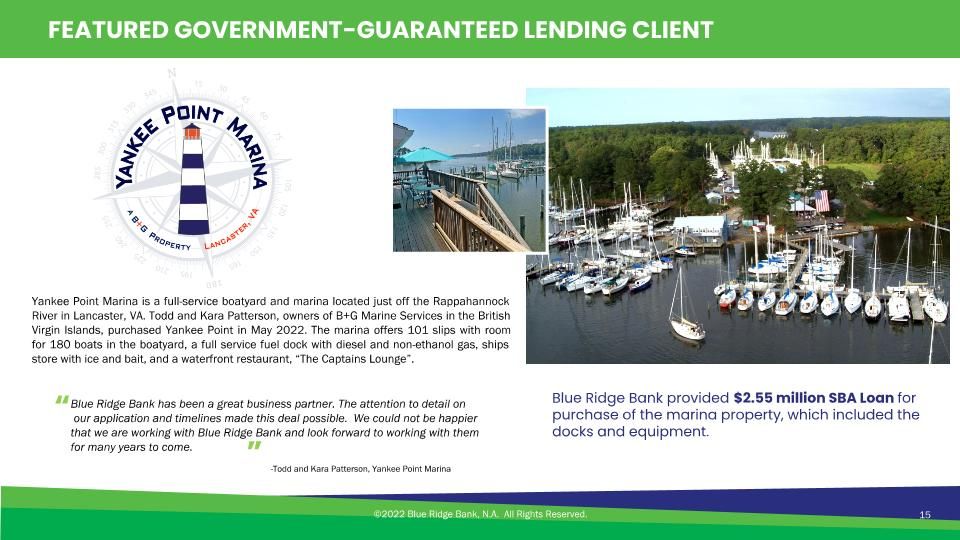

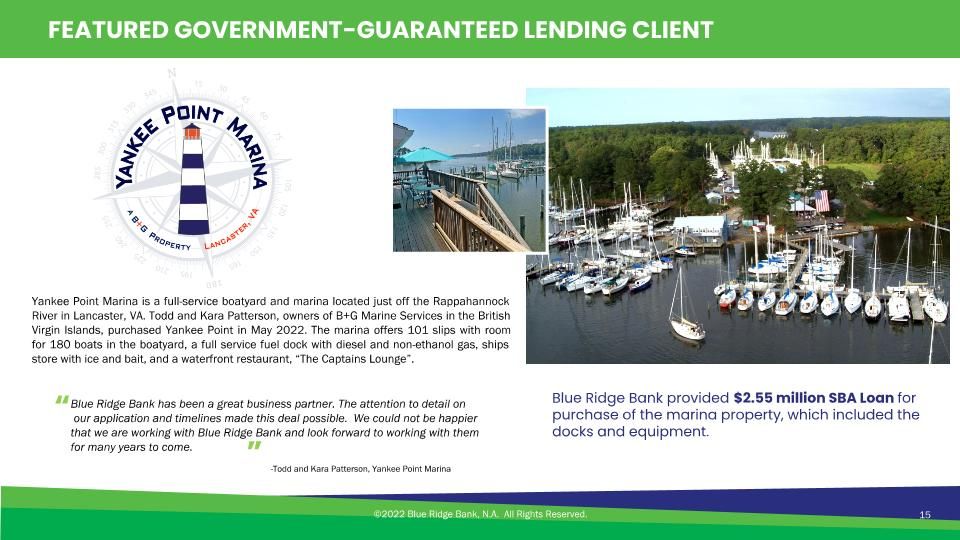

FEATURED GOVERNMENT-GUARANTEED LENDING CLIENT ©2022 Blue Ridge Bank, N.A. All Rights Reserved. 15 Blue Ridge Bank provided $2.55 million SBA Loan for purchase of the marina property, which included the docks and equipment. Yankee Point Marina is a full-service boatyard and marina located just off the Rappahannock River in Lancaster, VA. Todd and Kara Patterson, owners of B+G Marine Services in the British Virgin Islands, purchased Yankee Point in May 2022. The marina offers 101 slips with room for 180 boats in the boatyard, a full service fuel dock with diesel and non-ethanol gas, ships store with ice and bait, and a waterfront restaurant, “The Captains Lounge”. Blue Ridge Bank has been a great business partner. The attention to detail on our application and timelines made this deal possible. We could not be happier that we are working with Blue Ridge Bank and look forward to working with them for many years to come. ” “ -Todd and Kara Patterson, Yankee Point Marina

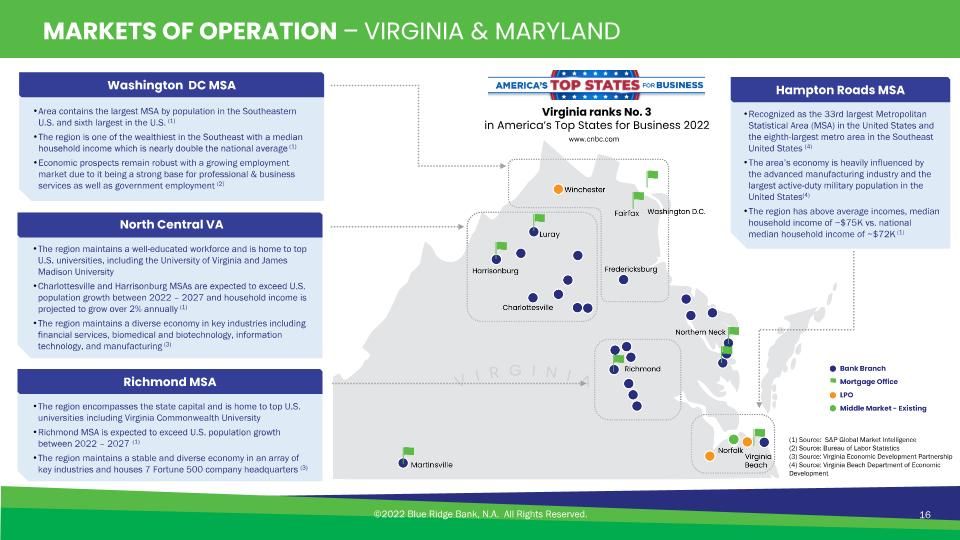

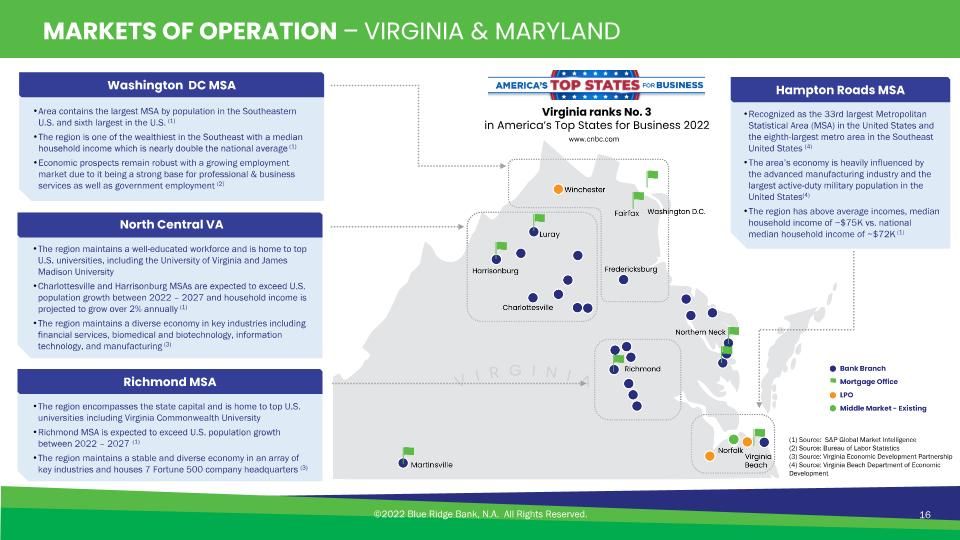

MARKETS OF OPERATION – VIRGINIA & MARYLAND Washington DC MSA Area contains the largest MSA by population in the Southeastern U.S. and sixth largest in the U.S. (1) The region is one of the wealthiest in the Southeast with a median household income which is nearly double the national average (1) Economic prospects remain robust with a growing employment market due to it being a strong base for professional & business services as well as government employment (2) Hampton Roads MSA Recognized as the 33rd largest Metropolitan Statistical Area (MSA) in the United States and the eighth-largest metro area in the Southeast United States (4) The area’s economy is heavily influenced by the advanced manufacturing industry and the largest active-duty military population in the United States(4) The region has above average incomes, median household income of ~$75K vs. national median household income of ~$72K (1) North Central VA The region maintains a well-educated workforce and is home to top U.S. universities, including the University of Virginia and James Madison University Charlottesville and Harrisonburg MSAs are expected to exceed U.S. population growth between 2022 – 2027 and household income is projected to grow over 2% annually (1) The region maintains a diverse economy in key industries including financial services, biomedical and biotechnology, information technology, and manufacturing (3) Richmond MSA The region encompasses the state capital and is home to top U.S. universities including Virginia Commonwealth University Richmond MSA is expected to exceed U.S. population growth between 2022 – 2027 (1) The region maintains a stable and diverse economy in an array of key industries and houses 7 Fortune 500 company headquarters (3) ©2022 Blue Ridge Bank, N.A. All Rights Reserved. 16 (1) Source: S&P Global Market Intelligence (2) Source: Bureau of Labor Statistics (3) Source: Virginia Economic Development Partnership (4) Source: Virginia Beach Department of Economic Development Virginia ranks No. 3 in America’s Top States for Business 2022 www.cnbc.com

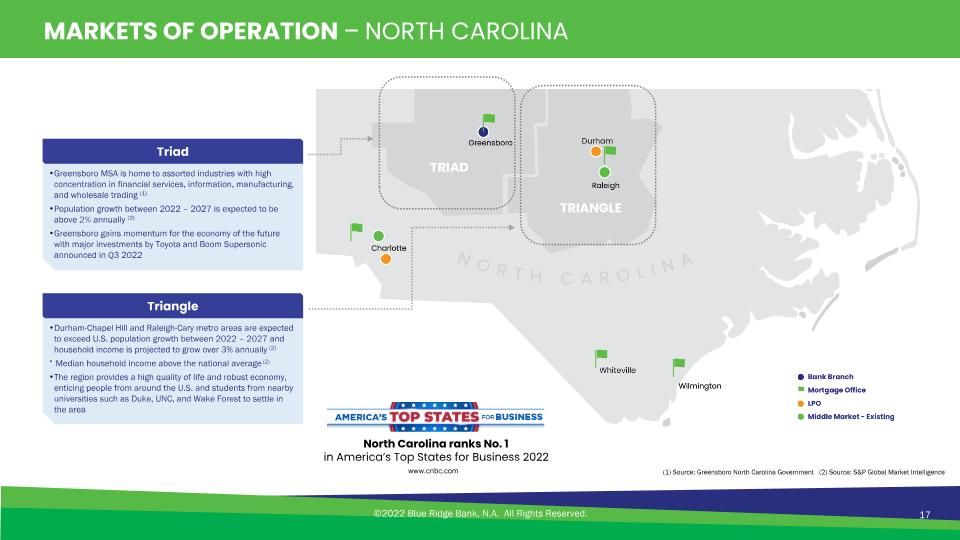

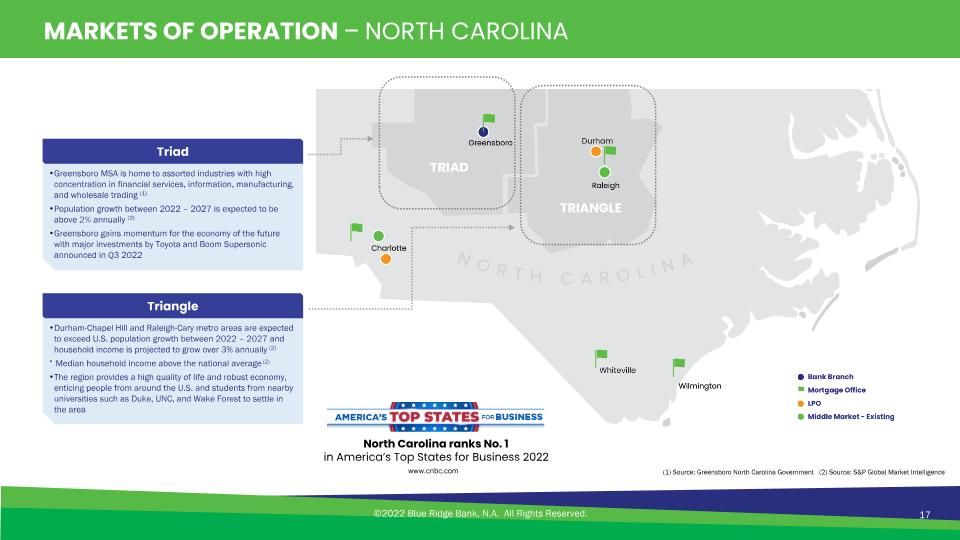

Greensboro MSA is home to assorted industries with high concentration in financial services, information, manufacturing, and wholesale trading (1) Population growth between 2022 – 2027 is expected to be above 2% annually (2) Greensboro gains momentum for the economy of the future with major investments by Toyota and Boom Supersonic announced in Q3 2022 ©2022 Blue Ridge Bank, N.A. All Rights Reserved. MARKETS OF OPERATION – NORTH CAROLINA Triad (1) Source: Greensboro North Carolina Government (2) Source: S&P Global Market Intelligence 17 Triangle Durham-Chapel Hill and Raleigh-Cary metro areas are expected to exceed U.S. population growth between 2022 – 2027 and household income is projected to grow over 3% annually (2) Median household income above the national average (2) The region provides a high quality of life and robust economy, enticing people from around the U.S. and students from nearby universities such as Duke, UNC, and Wake Forest to settle in the area North Carolina ranks No. 1 in America’s Top States for Business 2022 www.cnbc.com

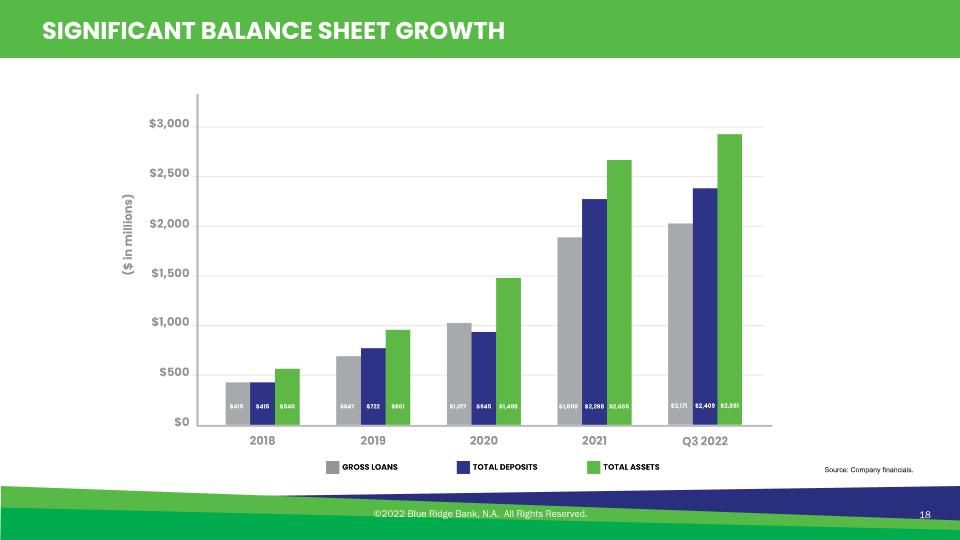

Source: Company financials. SIGNIFICANT BALANCE SHEET GROWTH ©2022 Blue Ridge Bank, N.A. All Rights Reserved. 18

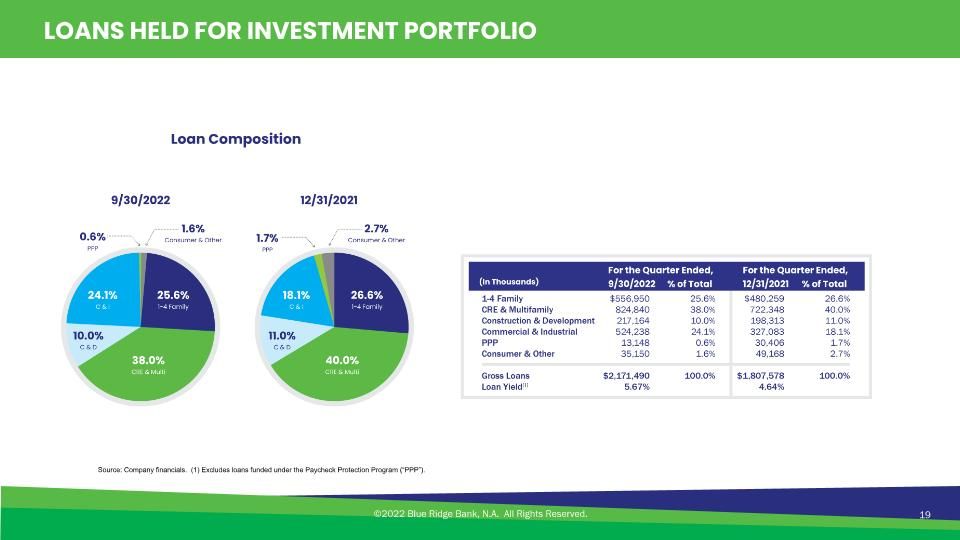

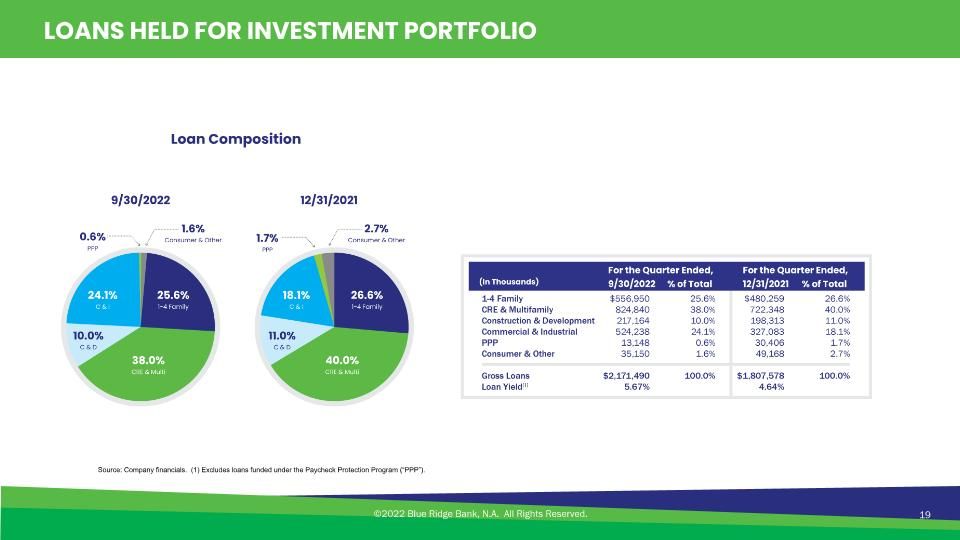

Source: Company financials. (1) Excludes loans funded under the Paycheck Protection Program (“PPP”). LOANS HELD FOR INVESTMENT PORTFOLIO ©2022 Blue Ridge Bank, N.A. All Rights Reserved. 19 Loan Composition

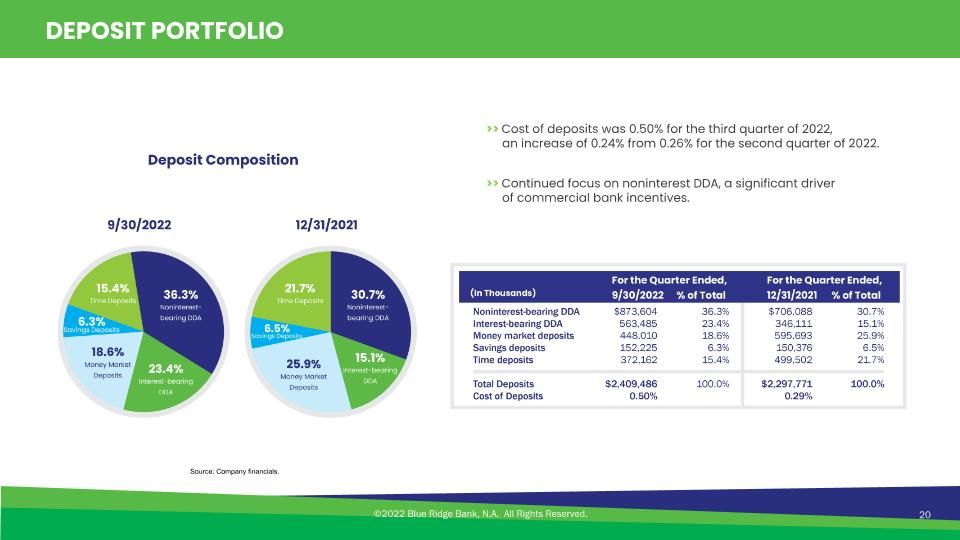

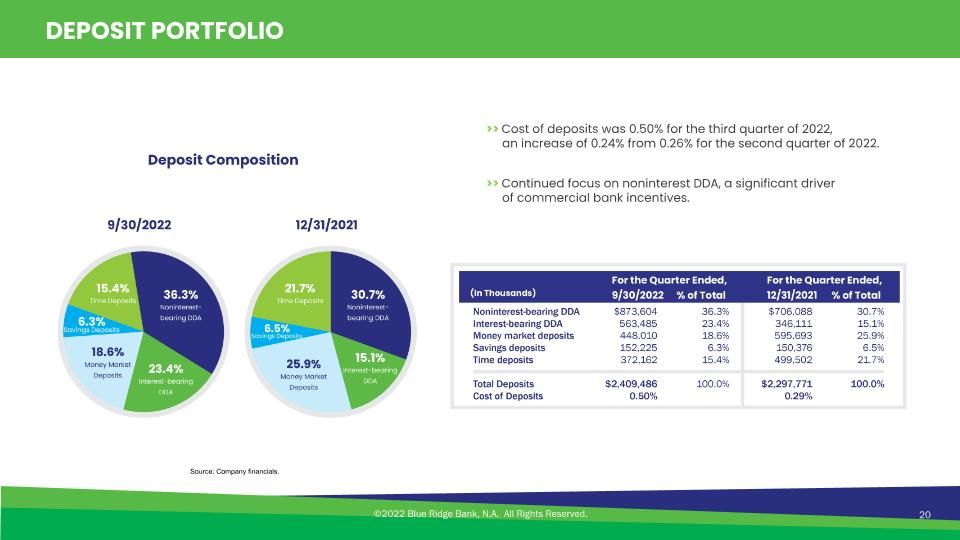

(1) Source: Company financials. DEPOSIT PORTFOLIO >> Cost of deposits was 0.50% for the third quarter of 2022, an increase of 0.24% from 0.26% for the second quarter of 2022. ©2022 Blue Ridge Bank, N.A. All Rights Reserved. 20 >> Continued focus on noninterest DDA, a significant driver of commercial bank incentives. Deposit Composition

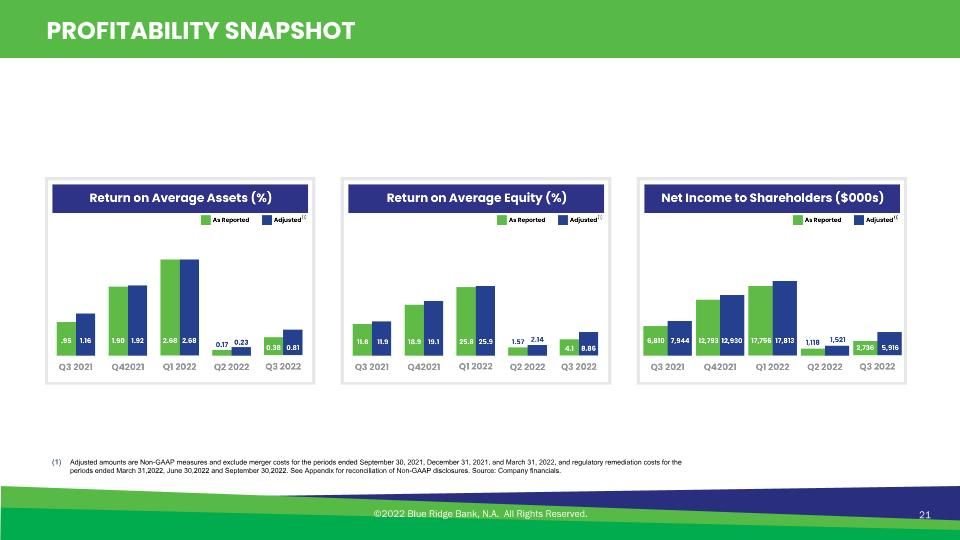

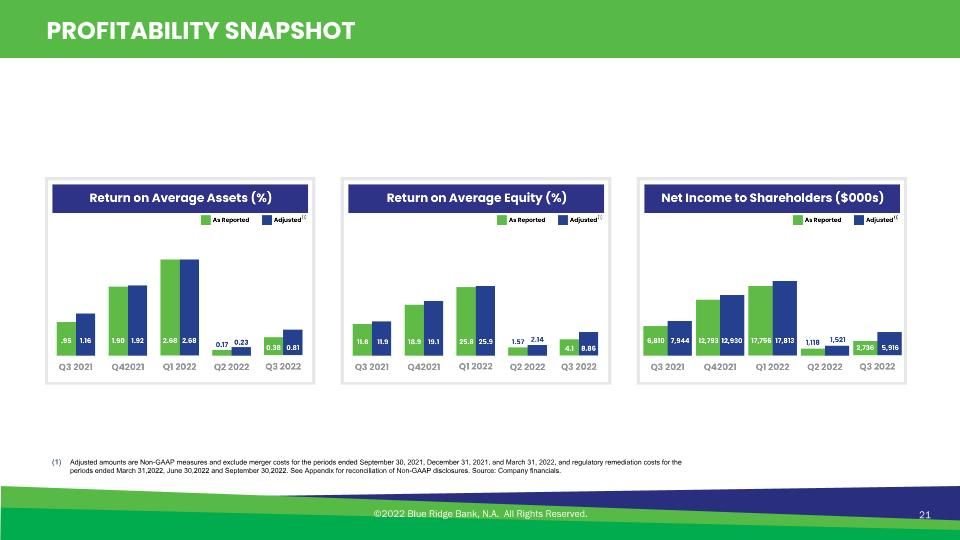

Adjusted amounts are Non-GAAP measures and exclude merger costs for the periods ended September 30, 2021, December 31, 2021, and March 31, 2022, and regulatory remediation costs for the periods ended March 31,2022, June 30,2022 and September 30,2022. See Appendix for reconciliation of Non-GAAP disclosures. Source: Company financials. PROFITABILITY SNAPSHOT ©2022 Blue Ridge Bank, N.A. All Rights Reserved. 21

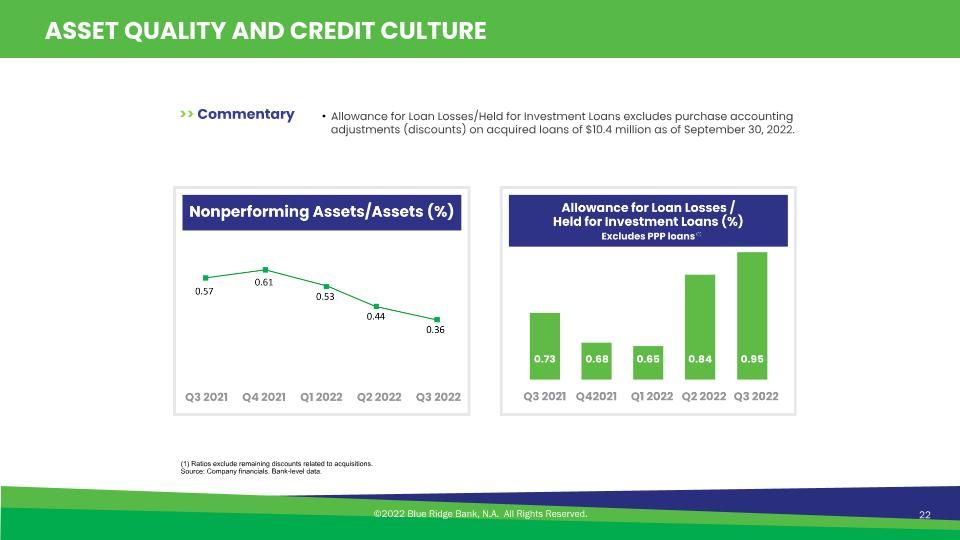

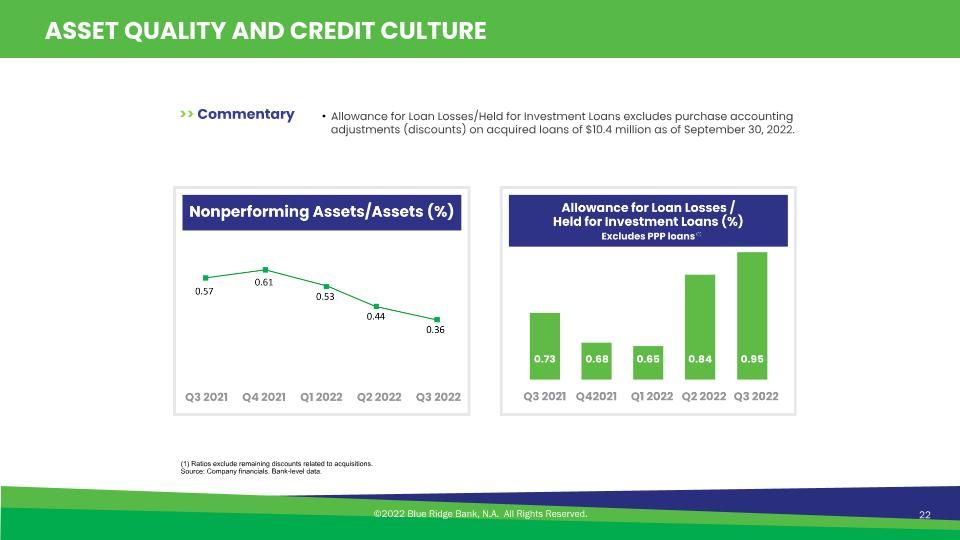

(1) Ratios exclude remaining discounts related to acquisitions. Source: Company financials. Bank-level data. ASSET QUALITY AND CREDIT CULTURE ©2022 Blue Ridge Bank, N.A. All Rights Reserved. 22 >> Commentary Allowance for Loan Losses/Held for Investment Loans excludes purchase accounting adjustments (discounts) on acquired loans of $10.4 million as of September 30, 2022.

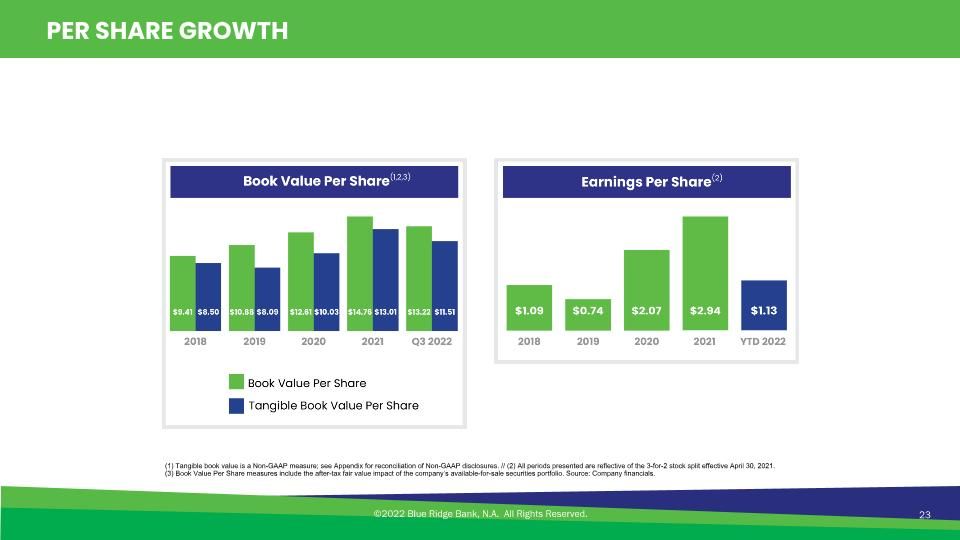

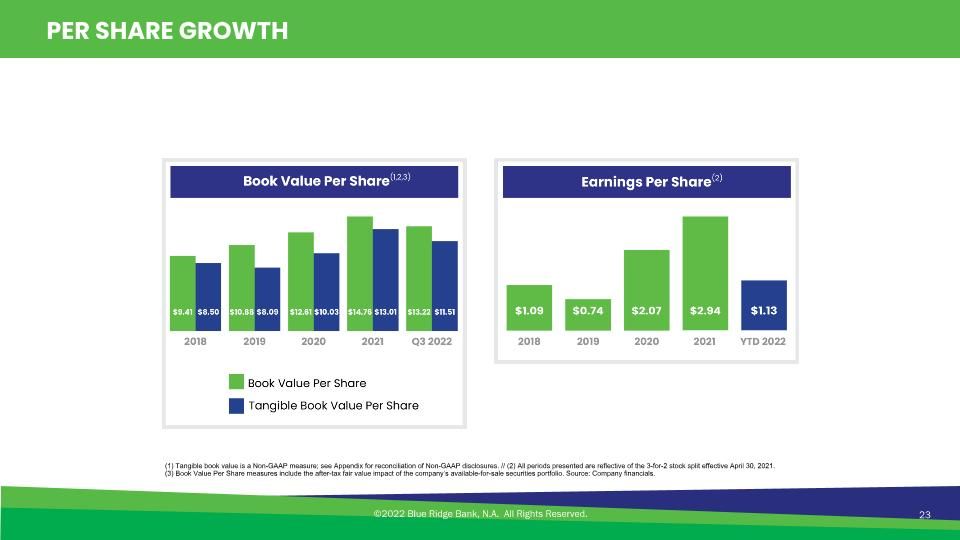

(1) Tangible book value is a Non-GAAP measure; see Appendix for reconciliation of Non-GAAP disclosures. // (2) All periods presented are reflective of the 3-for-2 stock split effective April 30, 2021. (3) Book Value Per Share measures include the after-tax fair value impact of the company’s available-for-sale securities portfolio. Source: Company financials. PER SHARE GROWTH ©2022 Blue Ridge Bank, N.A. All Rights Reserved. 23

FORMAL WRITTEN AGREEMENT On August 29, 2022, Blue Ridge Bank entered into a formal agreement (the “Agreement”) with the Office of the Comptroller of Currency (“OCC”), the Bank’s primary regulator. The Agreement principally concerns the Bank’s fintech line of business and requires the Bank to continue enhancing its controls for assessing and managing the third-party, BSA/AML, and IT risks stemming from its fintech partnerships. A complete copy of the Agreement was furnished in a Form 8-K filed with the Securities and Exchange Commission (“SEC”) on September 1, 2022, and can be accessed on the SEC’s website (www.sec.gov) and the Company’s website (www.blueridgebankshares.com). The Company is actively working to bring the Bank’s fintech policies, procedures, and operations into conformity with OCC directives. Deliverables to date have been submitted on schedule at 10, 30, and 60-day requirements. ©2022 Blue Ridge Bank, N.A. All Rights Reserved. 24 Remediation costs incurred of $4.5M YTD. Expect remediation costs are expected to decline slightly in Q4 and further in 2023.

LOOKING FORWARD Leverage Fintech relationships to develop BaaS and lending opportunities Leverage footprint and scale to grow quality relationships Drive cross-selling opportunities across multiple business lines through CRM implementation Grow government-guaranteed lending business Adjust to contraction in mortgage lending activity Continue to integrate Fintech partnerships ©2022 Blue Ridge Bank, N.A. All Rights Reserved. 25 Expand noninterest income through credit card, treasury services, and organic institutional growth

Appendix Financial Highlights and Reconciliation of Non-GAAP Disclosures APPENDIX ©2022 Blue Ridge Bank, N.A. All Rights Reserved. 26

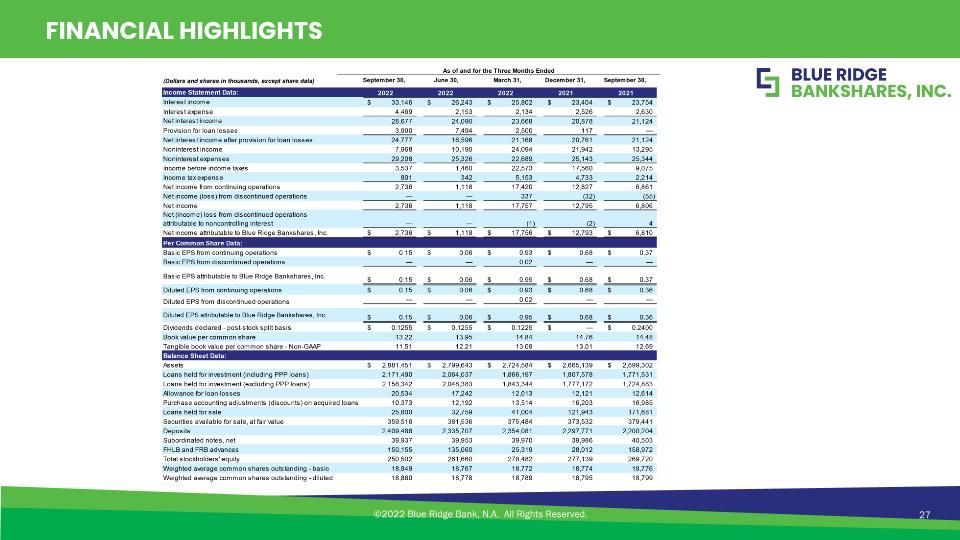

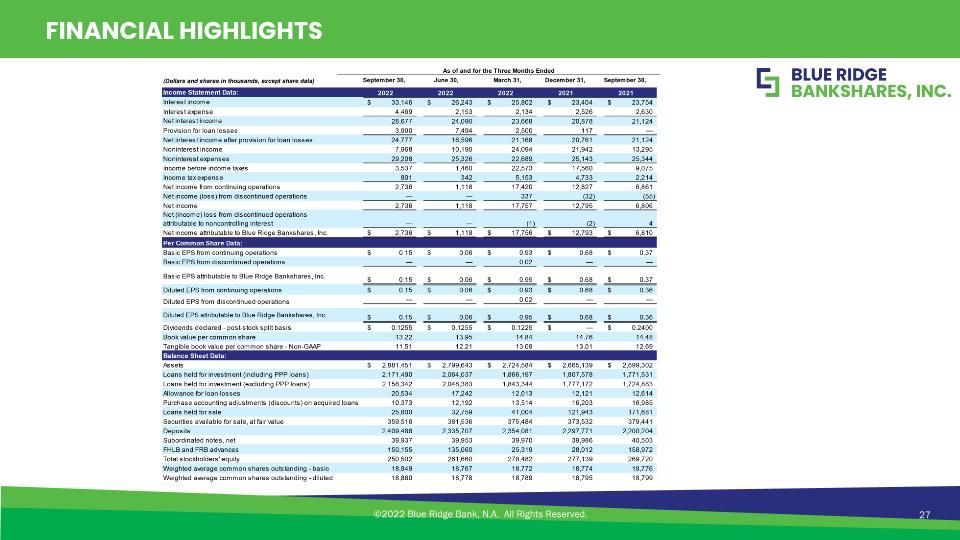

FINANCIAL HIGHLIGHTS ©2022 Blue Ridge Bank, N.A. All Rights Reserved. 27

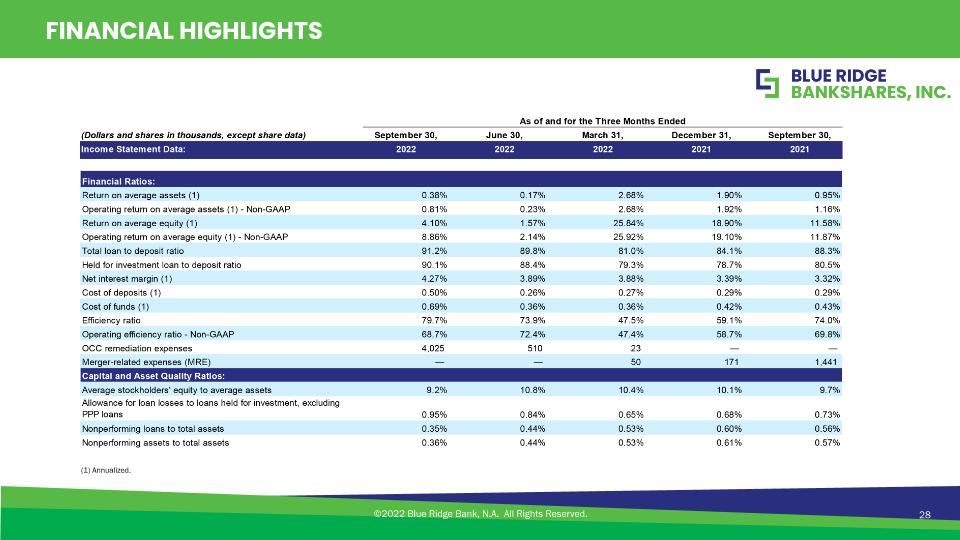

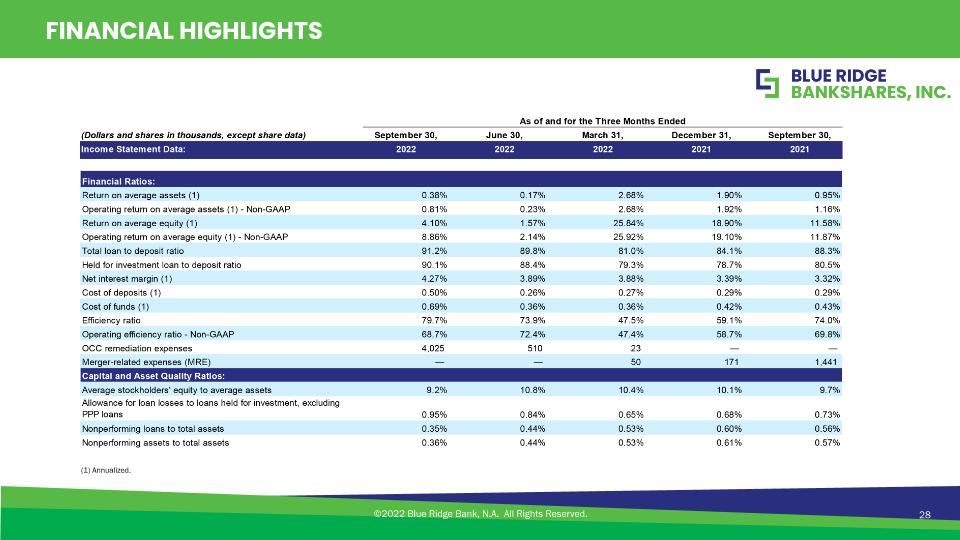

FINANCIAL HIGHLIGHTS ©2022 Blue Ridge Bank, N.A. All Rights Reserved. 28 (1) Annualized.

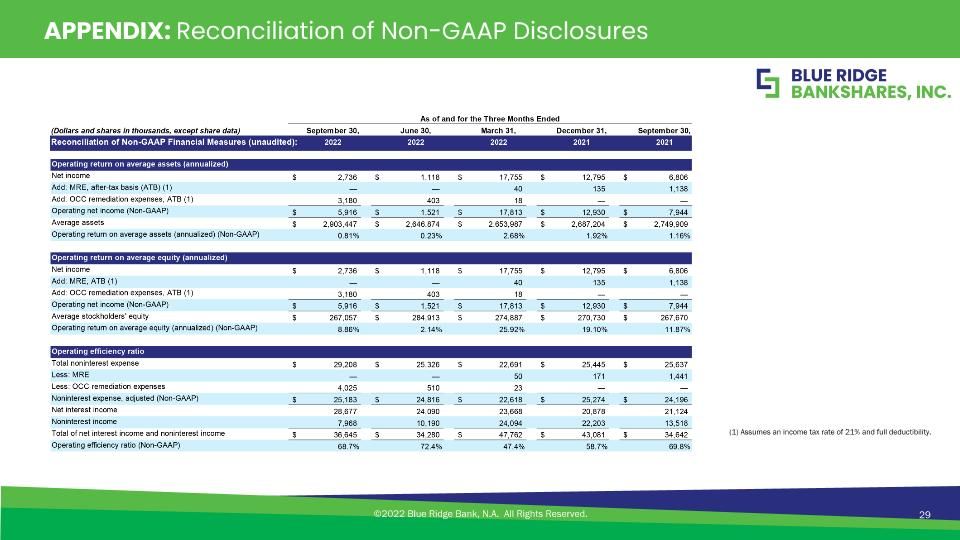

APPENDIX: Reconciliation of Non-GAAP Disclosures ©2022 Blue Ridge Bank, N.A. All Rights Reserved. 29 (1) Assumes an income tax rate of 21% and full deductibility.

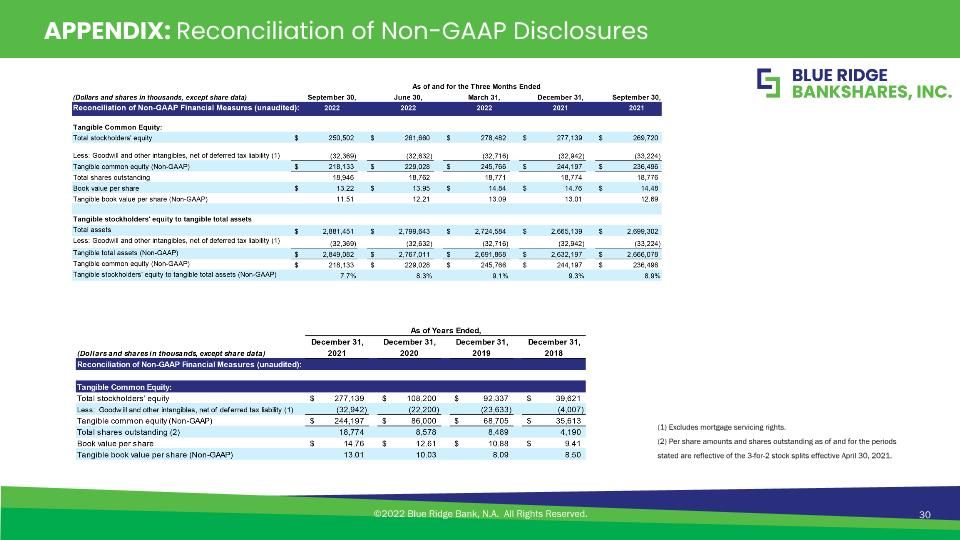

APPENDIX: Reconciliation of Non-GAAP Disclosures ©2022 Blue Ridge Bank, N.A. All Rights Reserved. 30 (1) Excludes mortgage servicing rights. (2) Per share amounts and shares outstanding as of and for the periods stated are reflective of the 3-for-2 stock splits effective April 30, 2021.

MYBRB.BANK ©2022 Blue Ridge Bank, N.A. All Rights Reserved.