Blue Ridge Bankshares, Inc. Investor Presentation September 30, 2019 Exhibit 99.1

Safe Harbor Regarding Forward-Looking Statements This presentation may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 regarding Blue Ridge Bankshares, Inc. (the “Company”). Forward-looking statements often include the words “believes,” “expects,” “anticipates,” “estimates,” “forecasts,” “intends,” “plans,” “targets,” “potentially,” “probably,” “projects,” “outlook” or similar expressions or future or conditional verbs such as “may,” “will,” “should,” “would” and “could.” These forward-looking statements are subject to known and unknown risks, uncertainties and other factors that could cause the actual results to differ materially from the forward-looking statements, including, without limitation, the following: the strength of the United States economy in general and the strength of the local economies in which the Company conducts operations; fluctuations in interest rates and in real estate values; monetary and fiscal policies of the Board of Governors of the Federal Reserve System and the U.S. Government and other governmental initiatives affecting the financial services industry; the risks of lending and investing activities, including changes in the level and direction of loan delinquencies and write-offs and changes in estimates of the adequacy of the allowance for loan losses; the Company’s ability to access cost-effective funding; the timely development of and acceptance of Blue Ridge Bank’s new products and services and the perceived overall value of these products and services by customers, including the features, pricing and quality compared to competitors’ products and services; expected cost savings, synergies and other benefits from the Company’s merger and acquisition activities might not be realized within the anticipated time frames or at all, and costs or difficulties relating to integration matters, including but not limited to customer and employee retention, might be greater than expected; fluctuations in real estate values and both residential and commercial real estate market conditions; demand for loans and deposits in the Company’s market areas; legislative or regulatory changes that adversely affect the Company’s business; results of examinations of the Company and its subsidiaries by their regulators, including the possibility that such regulators may, among other things, take regulatory enforcement action or require the Company’s bank subsidiary to increase its reserves for loan losses or to write-down assets; the impact of technological changes; and the Company’s success at managing the risks involved in the foregoing. Any forward-looking statements are based upon management’s beliefs and assumptions at the time they are made. The Company undertakes no obligation to publicly update or revise any forward-looking statements or to update the reasons why actual results could differ from those contained in such statements, whether as a result of new information, future events or otherwise. In light of these risks, uncertainties and assumptions, the forward-looking statements discussed might not occur, and you should not put undue reliance on any forward-looking statements. Disclosure

In connection with the proposed merger, Blue Ridge has filed with the Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 to register the shares of Blue Ridge common stock to be issued to the shareholders of Virginia Community Bankshares, Inc. (“VCB”). The registration statement includes a joint proxy statement/prospectus that will be mailed to the shareholders of Blue Ridge and VCB. SECURITY HOLDERS OF BLUE RIDGE AND VCB ARE ADVISED TO READ THE REGISTRATION STATEMENT ON FORM S-4 AND THE JOINT PROXY STATEMENT/PROSPECTUS INCLUDED WITHIN THE REGISTRATION STATEMENT AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED MERGER, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT BLUE RIDGE, VCB AND THE PROPOSED TRANSACTION. Security holders may obtain free copies of these documents, once they are filed, and other documents filed with the SEC on the SEC’s website at www.sec.gov. Security holders will also be able to obtain these documents, once they are filed, free of charge, by requesting them in writing from Brian K. Plum, Blue Ridge Bankshares, Inc., 17 West Main Street, Luray, Virginia 22835, or by telephone at (540) 743-6521, or from A. Preston Moore, Jr., Virginia Community Bankshares, Inc., 408 East Main Street, Louisa, Virginia 23093, or by telephone at (540) 967-2111. Blue Ridge, VCB and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of Blue Ridge and VCB in connection with the proposed merger. Information about the directors and executive officers of Blue Ridge and VCB will be included in the joint proxy statement/prospectus when it becomes available. Additional information regarding the interests of those persons and other persons who may be deemed participants in the transaction may be obtained by reading the joint proxy statement/prospectus regarding the proposed merger when it becomes available. You may obtain free copies of each document as described in the preceding paragraph. This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or proxy in favor of the merger, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction. Additional Information About the Merger and Where to Find It

P Experienced Management Team Prior senior leadership roles at significantly larger institutions In total, management has more than 110 years of banking industry experience Investment Highlights P Industry Momentum Attracted three former CEO’s in less than two years Pipeline of talented bankers that want to join due to energy, passion, and vision of board Reputation continues to draw interest from strategic partners P Proven Performance Since 2014, total assets have grown by more than 200% while net income has expanded at a 21.8% CAGR(1) Remained profitable throughout the 2008 financial crisis (1) Based on annualized YTD 2019 net income through Q3 2019. Sources: SNL Financial P Unique Community Banking Model Greater revenue diversity for a community bank our size (over 40% fee-based) Local market teams capable of outmaneuvering larger banks More sophistication and product breadth than smaller banks P Strong Credit Quality Over the past 10 years, annual net charge-offs have not exceeded 0.52% of average loans Conservative provisioning policies with YTD loan loss provisions exceeding net charge-offs by over 200% P Capacity to Grow Our Franchise Strong fundamentals to support active M&A and organic growth Passionate, talented, and diverse associates Ample expansion opportunities in target markets throughout Virginia and North Carolina P Growing Fee-Based Business Continued expansion of our mortgage business Opportunity to increase customer stickiness and ROI through the cross-selling of our p-card and payroll solution capabilities P Favorable Market Trends Benefits from continued growth in population and business activity in key markets in Virginia and North Carolina Strong growth tailwinds for our fee-based businesses Commercial banking efforts focused on the #1 and #3 states in CNBC’s 2019 America’s Top States for Business

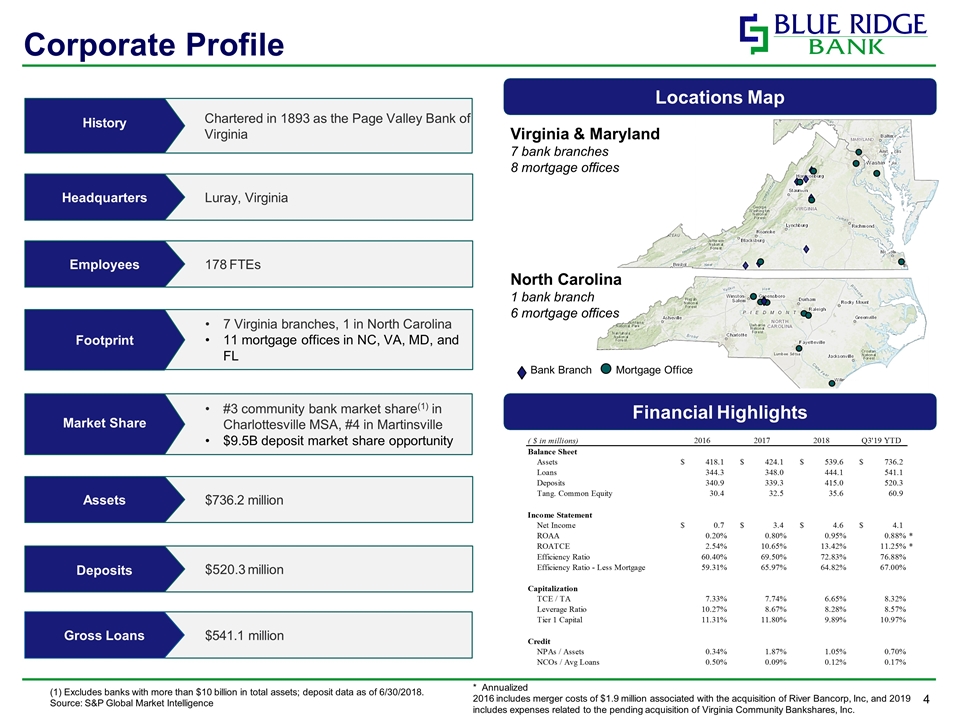

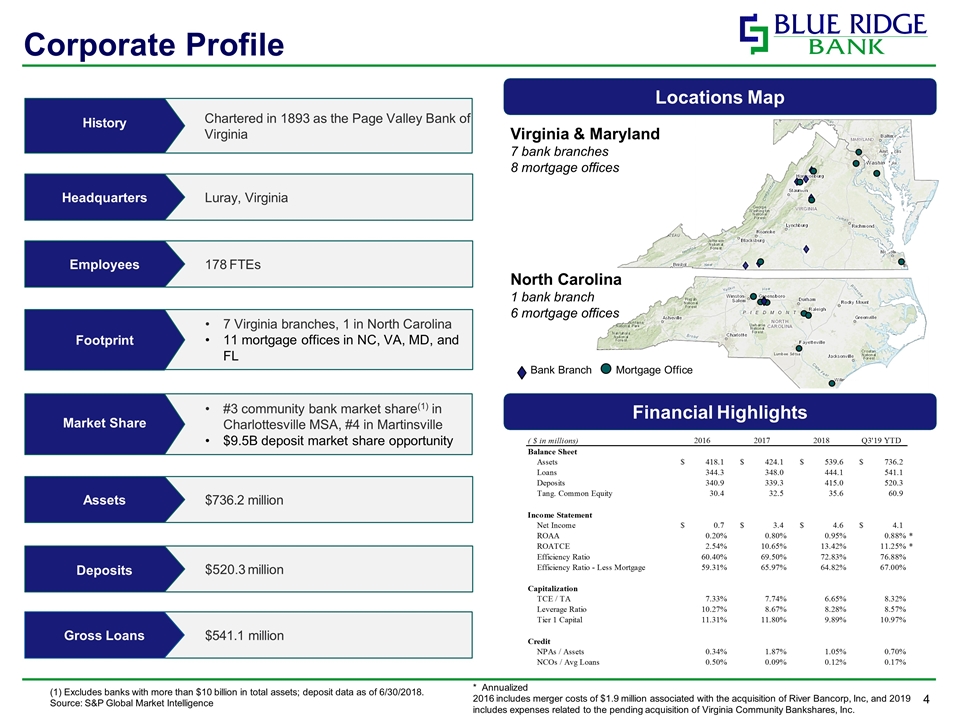

Corporate Profile Financial Highlights Locations Map #3 community bank market share(1) in Charlottesville MSA, #4 in Martinsville $9.5B deposit market share opportunity 7 Virginia branches, 1 in North Carolina 11 mortgage offices in NC, VA, MD, and FL $520.3 million $736.2 million Luray, Virginia 178 FTEs $541.1 million Chartered in 1893 as the Page Valley Bank of Virginia History Footprint Deposits Market Share Assets Headquarters Employees Gross Loans Virginia & Maryland 7 bank branches 8 mortgage offices North Carolina 1 bank branch 6 mortgage offices Bank Branch Mortgage Office (1) Excludes banks with more than $10 billion in total assets; deposit data as of 6/30/2018. Source: S&P Global Market Intelligence * Annualized 2016 includes merger costs of $1.9 million associated with the acquisition of River Bancorp, Inc, and 2019 includes expenses related to the pending acquisition of Virginia Community Bankshares, Inc.

Brian K. Plum President & CEO Seth D. Moore President, Carolina State Bank Amanda G. Story Chief Financial Officer E. Neal Crawford, Jr. CEO, Carolina State Bank Management Team Gary R. Shook Chief Operating Officer President and CEO of Blue Ridge Bankshares, Inc. since December 2014 Previously served as CFO and Chief Administrative Officer of Blue Ridge Bankshares, Inc. from 2007-2014 Holds a BS in Accounting and Economics from Eastern Mennonite University, a MS in Accounting from James Madison University, and a MBA from the Darden School of Business at the University of Virginia More than 13 years experience in the commercial banking industry, and 17 years working with mortgage banking Chief Operating Officer of Blue Ridge Bankshares, Inc. and President of Blue Ridge Bank since April 2018 President and CEO of Middleburg Bank, a division of Access National Bank, Chairman and CEO of Middleburg Investment Group, Chairman, Middleburg Trust Company and Director and Executive Committee member of Access National Corporation until March 2018 Holds a BA in History from the University of Virginia More than 37 years experience in the banking industry President of Blue Ridge Bankshares’ North Carolina region since February 2018 Previously held various roles and senior positions with Wachovia/Wells Fargo, RBC, SunTrust, BNC, and Fidelity Bank Holds a BA in Economics from UNC-Chapel Hill and is a graduate from the North Carolina School of Banking More than 15 years experience in the banking industry in the Triad Chief Financial Officer since 2014 Previously at audit and tax advisory firm Brown, Edwards & Company, LLP in Harrisonburg, VA from 2006 to 2014 Holds a BA in Business Administration with a concentration in Accounting from Bridgewater College More than 13 years of bank related accounting experience Chief Executive Officer of the Carolina State Bank division since November 2018 Previously Chief Executive Officer and President of Towne Financial Services from June 2016 – December 2017 Before its sale to TowneBank, spent 10+ years at Chesapeake, VA based Monarch Financial Holdings, rising to President in 2010 Holds a BSBA in Finance from East Carolina University and is a graduate of the Stonier Graduate School of Banking at the University of Pennsylvania More than 34 years experience in the banking industry in both Virginia and North Carolina

BRBS Mission Statement and Core Values 126 Years of Customer Service Mission Statement Our mission is to create financial value and opportunity for our shareholders, customers, employees, and communities by providing evolving, flexible, and customized solutions for the needs of our clients ….and to have fun while doing it. Act with integrity Value those around you Serve others Commit to success Create solutions Celebrate achievement Enjoy every day Core Values

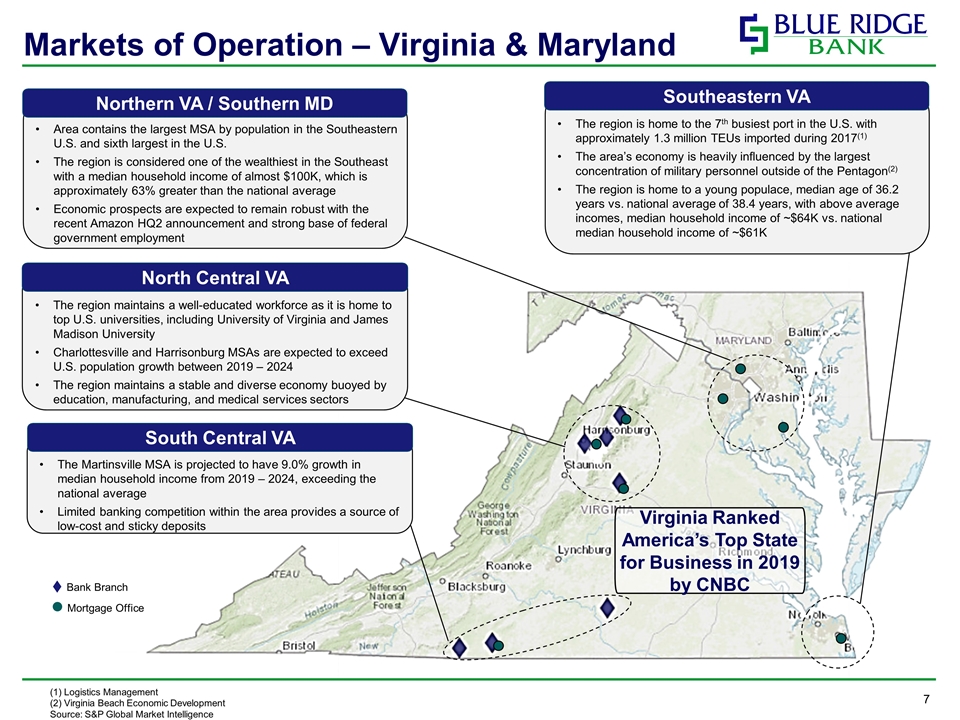

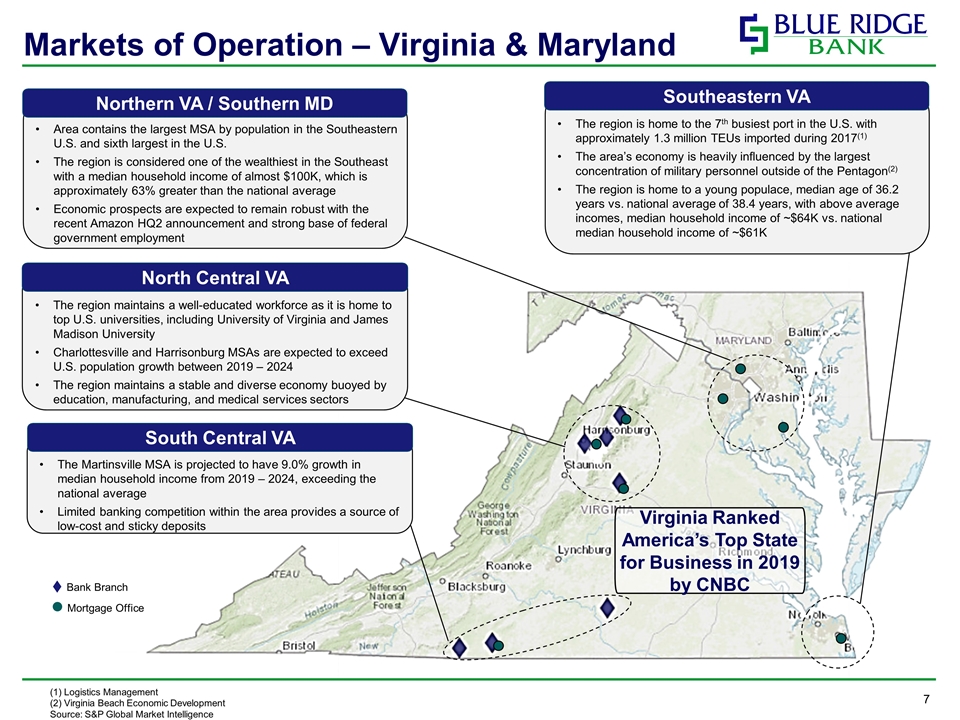

The region is home to the 7th busiest port in the U.S. with approximately 1.3 million TEUs imported during 2017(1) The area’s economy is heavily influenced by the largest concentration of military personnel outside of the Pentagon(2) The region is home to a young populace, median age of 36.2 years vs. national average of 38.4 years, with above average incomes, median household income of ~$64K vs. national median household income of ~$61K Area contains the largest MSA by population in the Southeastern U.S. and sixth largest in the U.S. The region is considered one of the wealthiest in the Southeast with a median household income of almost $100K, which is approximately 63% greater than the national average Economic prospects are expected to remain robust with the recent Amazon HQ2 announcement and strong base of federal government employment Markets of Operation – Virginia & Maryland The region maintains a well-educated workforce as it is home to top U.S. universities, including University of Virginia and James Madison University Charlottesville and Harrisonburg MSAs are expected to exceed U.S. population growth between 2019 – 2024 The region maintains a stable and diverse economy buoyed by education, manufacturing, and medical services sectors The Martinsville MSA is projected to have 9.0% growth in median household income from 2019 – 2024, exceeding the national average Limited banking competition within the area provides a source of low-cost and sticky deposits North Central VA South Central VA Northern VA / Southern MD Southeastern VA Bank Branch Mortgage Office (1) Logistics Management (2) Virginia Beach Economic Development Source: S&P Global Market Intelligence Virginia Ranked America’s Top State for Business in 2019 by CNBC

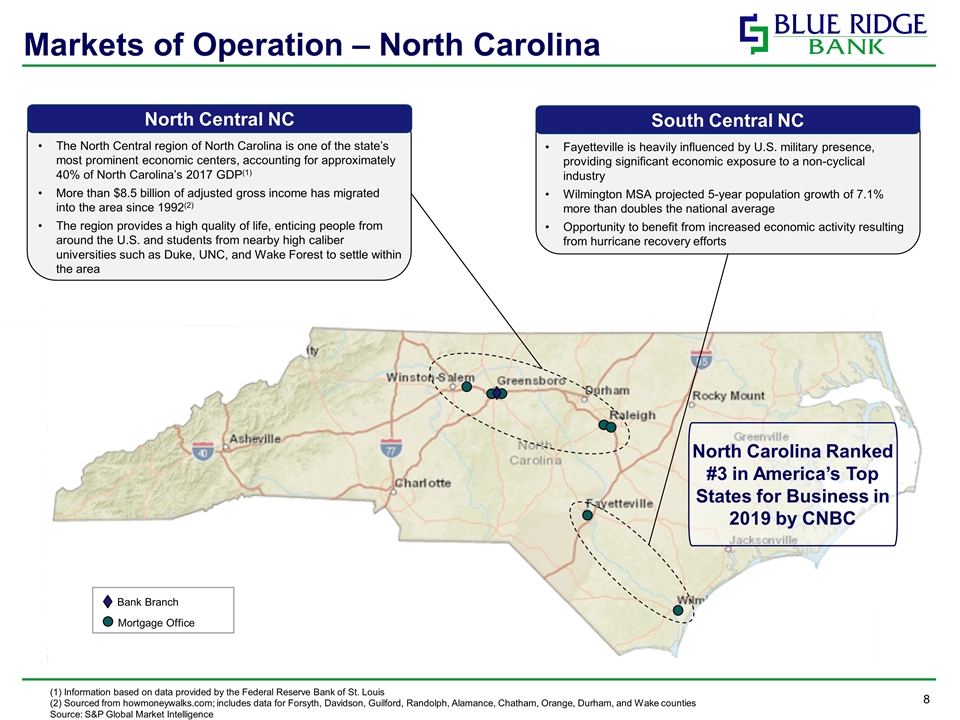

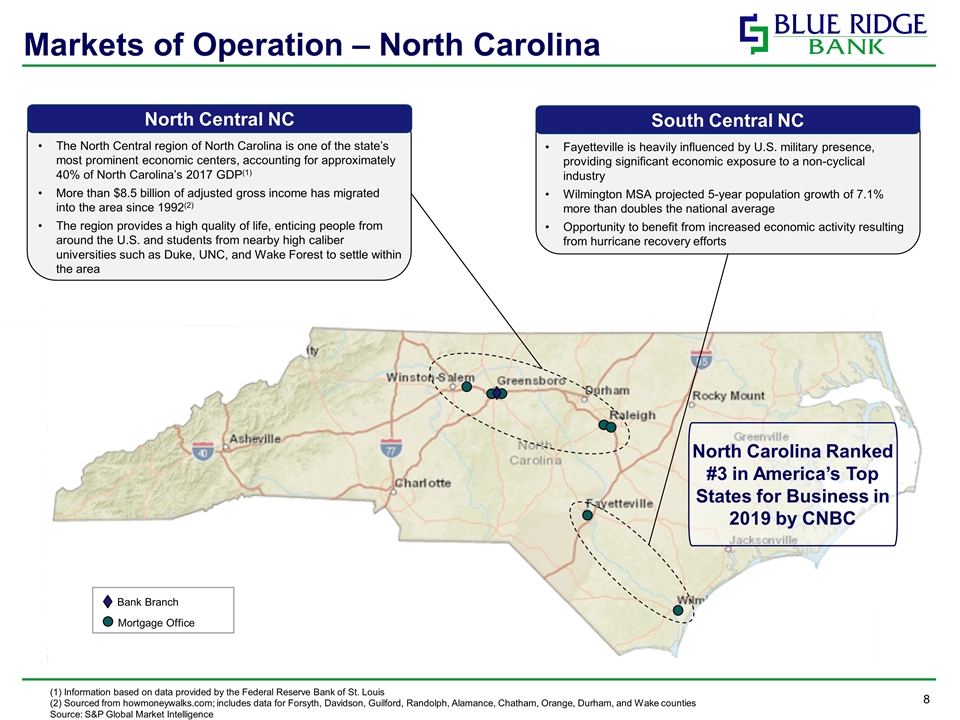

The North Central region of North Carolina is one of the state’s most prominent economic centers, accounting for approximately 40% of North Carolina’s 2017 GDP(1) More than $8.5 billion of adjusted gross income has migrated into the area since 1992(2) The region provides a high quality of life, enticing people from around the U.S. and students from nearby high caliber universities such as Duke, UNC, and Wake Forest to settle within the area Markets of Operation – North Carolina Fayetteville is heavily influenced by U.S. military presence, providing significant economic exposure to a non-cyclical industry Wilmington MSA projected 5-year population growth of 7.1% more than doubles the national average Opportunity to benefit from increased economic activity resulting from hurricane recovery efforts (1) Information based on data provided by the Federal Reserve Bank of St. Louis (2) Sourced from howmoneywalks.com; includes data for Forsyth, Davidson, Guilford, Randolph, Alamance, Chatham, Orange, Durham, and Wake counties Source: S&P Global Market Intelligence North Central NC South Central NC Bank Branch Mortgage Office North Carolina Ranked #3 in America’s Top States for Business in 2019 by CNBC

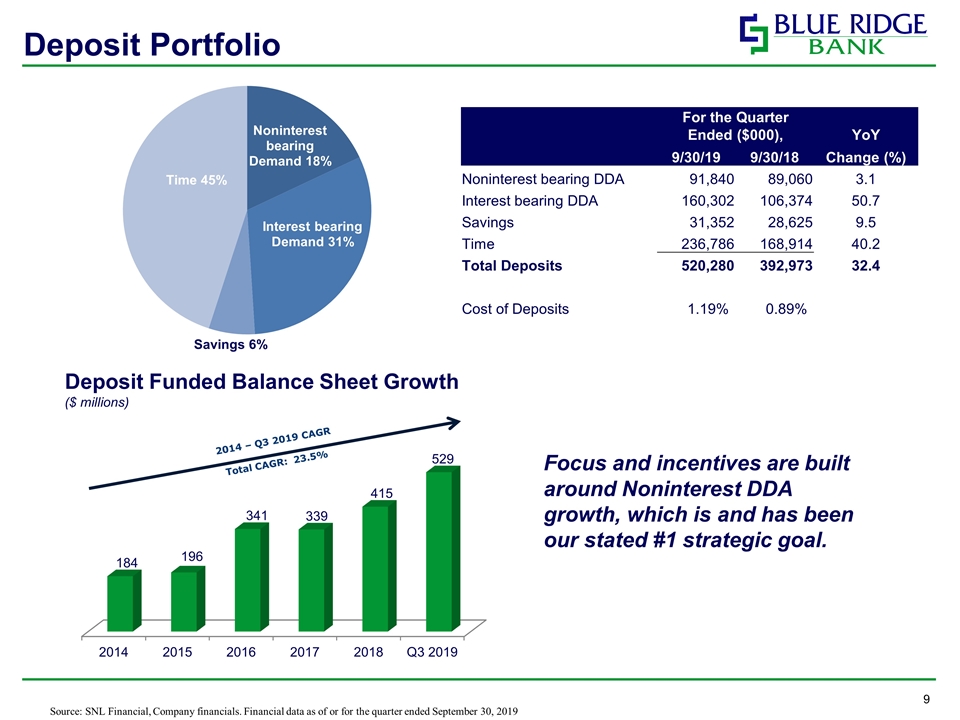

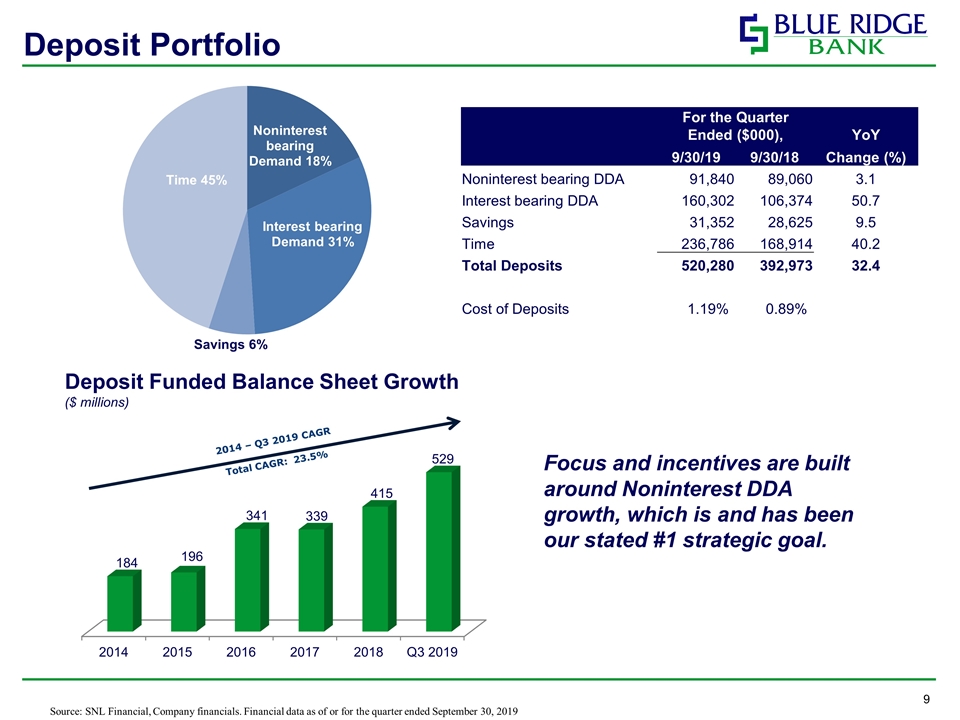

Deposit Portfolio Source: SNL Financial, Company financials. Financial data as of or for the quarter ended September 30, 2019 Deposit Funded Balance Sheet Growth ($ millions) 2014 – Q3 2019 CAGR Total CAGR: 23.5% For the Quarter Ended ($000), YoY 9/30/19 9/30/18 Change (%) Noninterest bearing DDA 91,840 89,060 3.1 Interest bearing DDA 160,302 106,374 50.7 Savings 31,352 28,625 9.5 Time 236,786 168,914 40.2 Total Deposits 520,280 392,973 32.4 Cost of Deposits 1.19% 0.89% Focus and incentives are built around Noninterest DDA growth, which is and has been our stated #1 strategic goal.

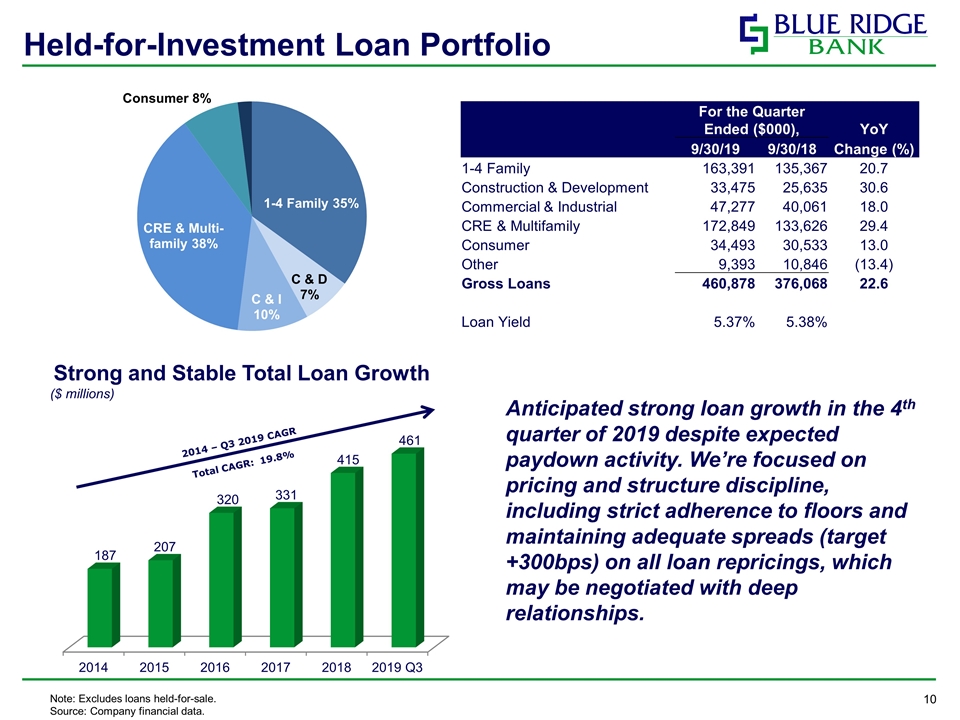

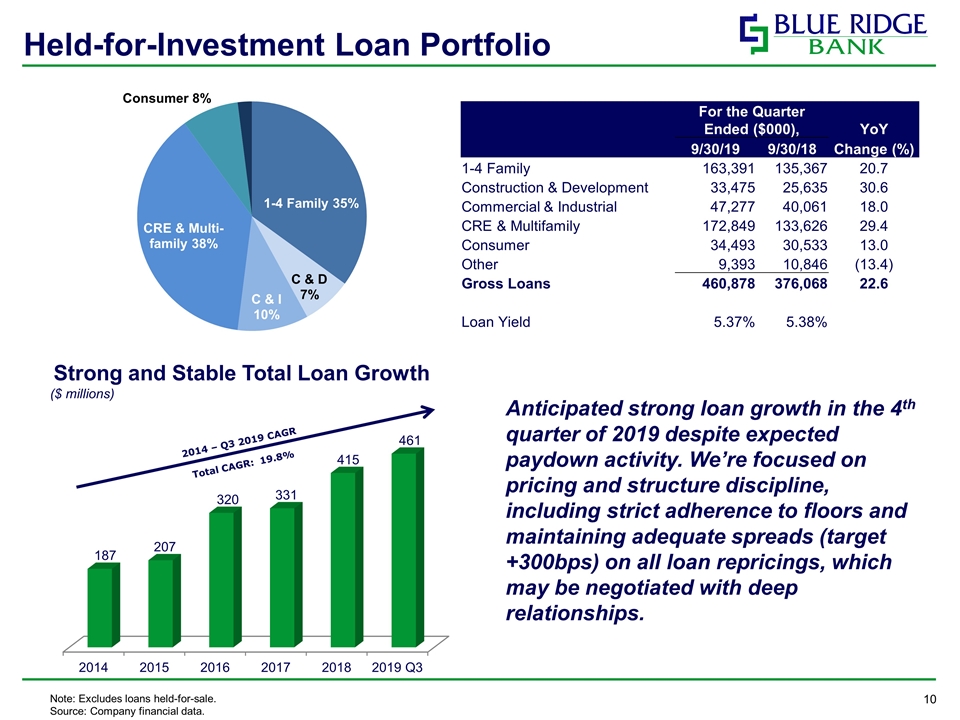

Held-for-Investment Loan Portfolio Note: Excludes loans held-for-sale. Source: Company financial data. Strong and Stable Total Loan Growth ($ millions) 2014 – Q3 2019 CAGR Total CAGR: 19.8% For the Quarter Ended ($000), YoY 9/30/19 9/30/18 Change (%) 1-4 Family 163,391 135,367 20.7 Construction & Development 33,475 25,635 30.6 Commercial & Industrial 47,277 40,061 18.0 CRE & Multifamily 172,849 133,626 29.4 Consumer 34,493 30,533 13.0 Other 9,393 10,846 (13.4) Gross Loans 460,878 376,068 22.6 Loan Yield 5.37% 5.38% Anticipated strong loan growth in the 4th quarter of 2019 despite expected paydown activity. We’re focused on pricing and structure discipline, including strict adherence to floors and maintaining adequate spreads (target +300bps) on all loan repricings, which may be negotiated with deep relationships.

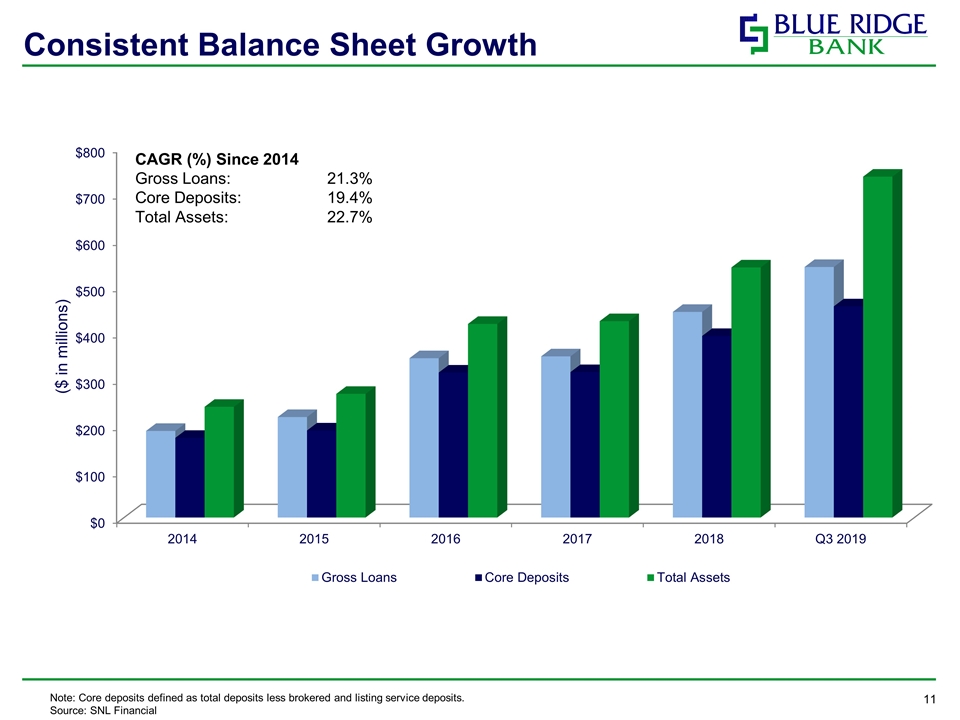

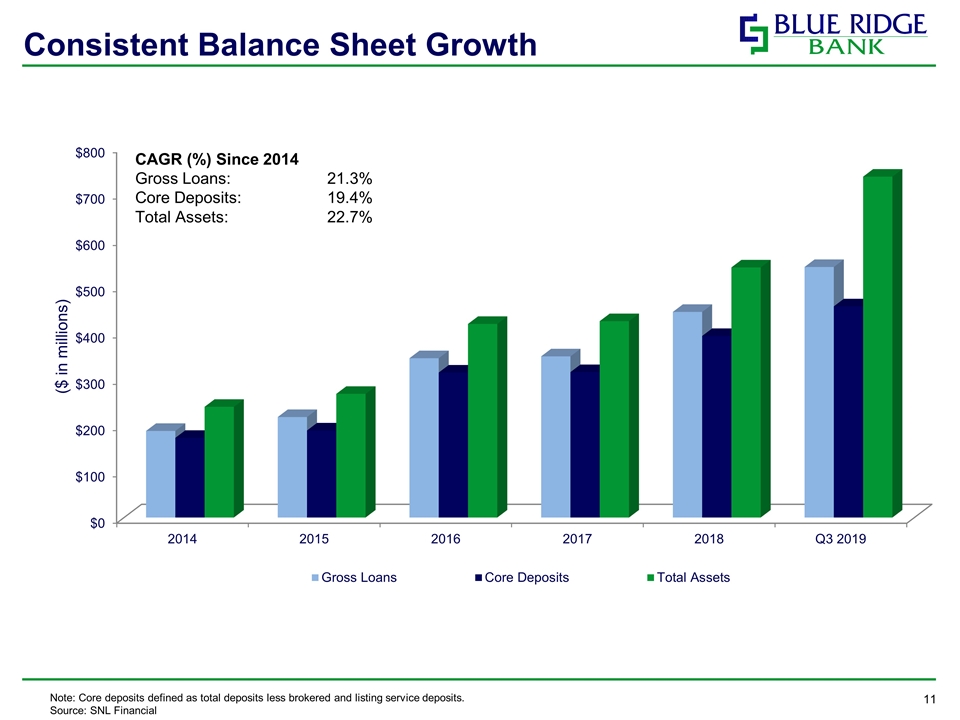

Consistent Balance Sheet Growth Note: Core deposits defined as total deposits less brokered and listing service deposits. Source: SNL Financial ($ in millions)

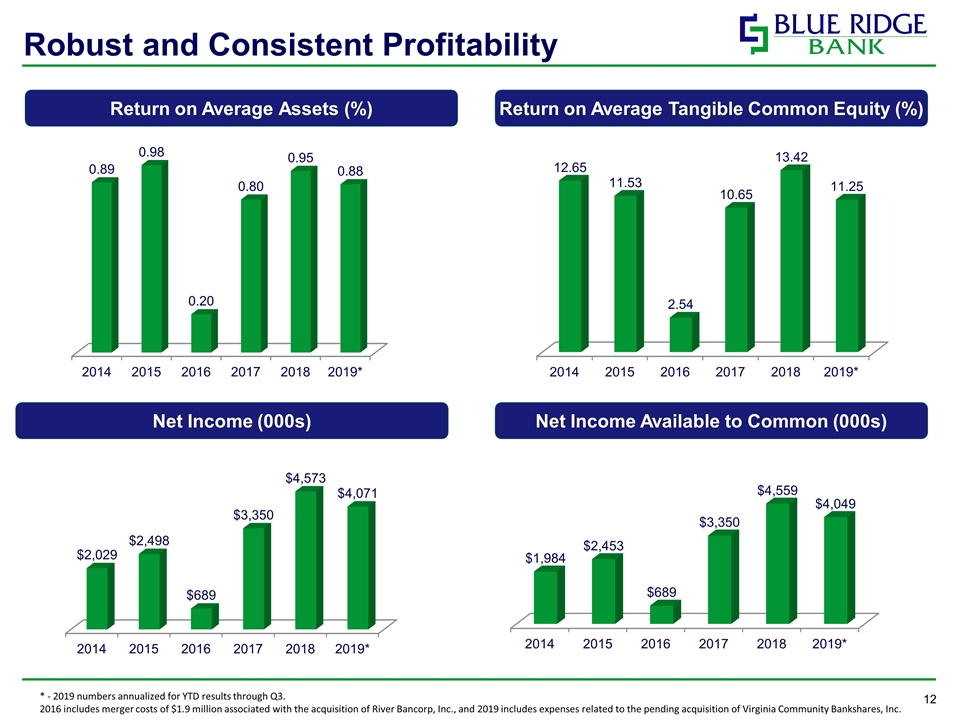

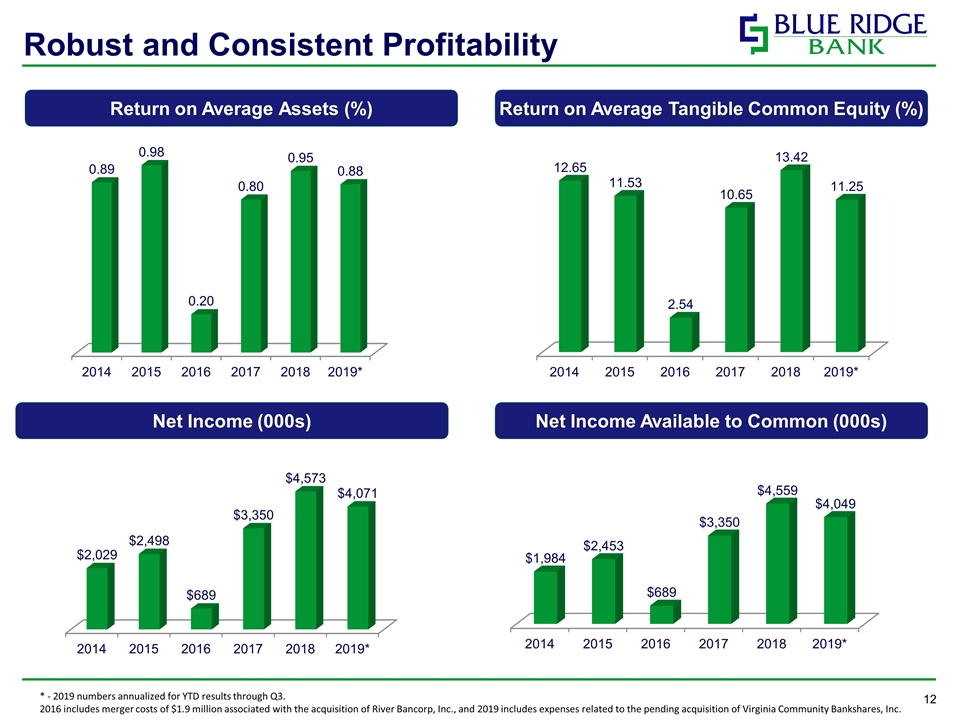

Robust and Consistent Profitability * - 2019 numbers annualized for YTD results through Q3. 2016 includes merger costs of $1.9 million associated with the acquisition of River Bancorp, Inc., and 2019 includes expenses related to the pending acquisition of Virginia Community Bankshares, Inc. Return on Average Assets (%) Return on Average Tangible Common Equity (%) Net Income Available to Common (000s) Net Income (000s)

Asset Quality and Credit Culture Source: SNL Financial and Company financials. Bank-level data. * - Includes credit mark on loans acquired in the acquisition of River Bancorp, Inc. in 2016. Commentary Net Charge-offs/Average Loans (Annualized) Limited net charge-off history as NCOs / Avg. loans haven’t exceeded 0.25% over the past five quarters and 0.52% over the past 10 years Modest uptick in NPAs starting in 2016 was related to two isolated credits where the expected loss is minimal Nonperforming Assets/Assets (%) ALLL/Held-for-Investment Loans*

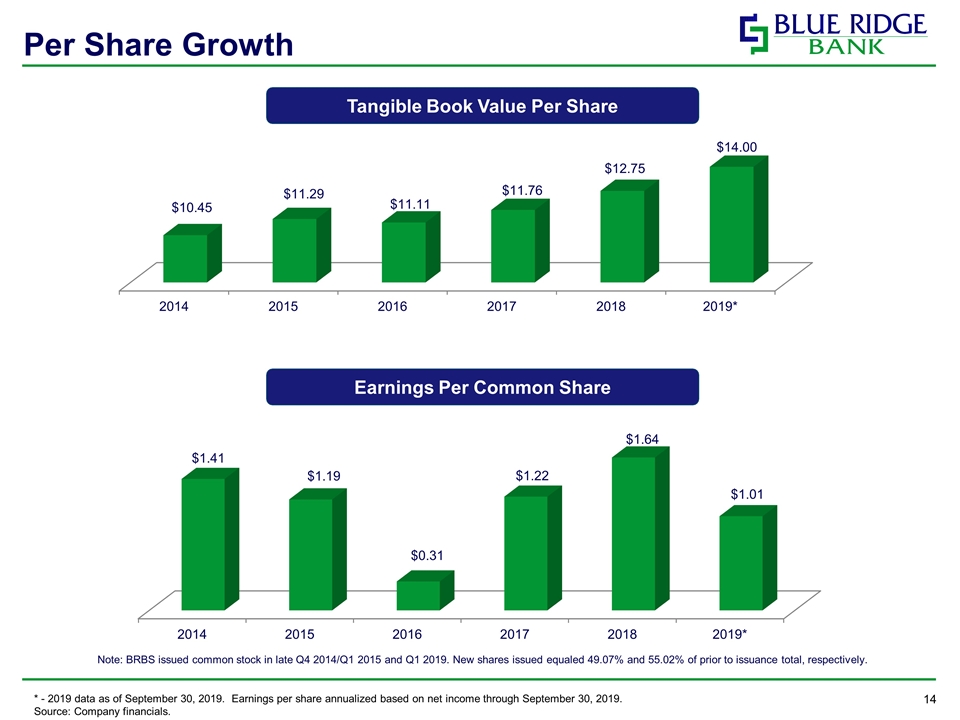

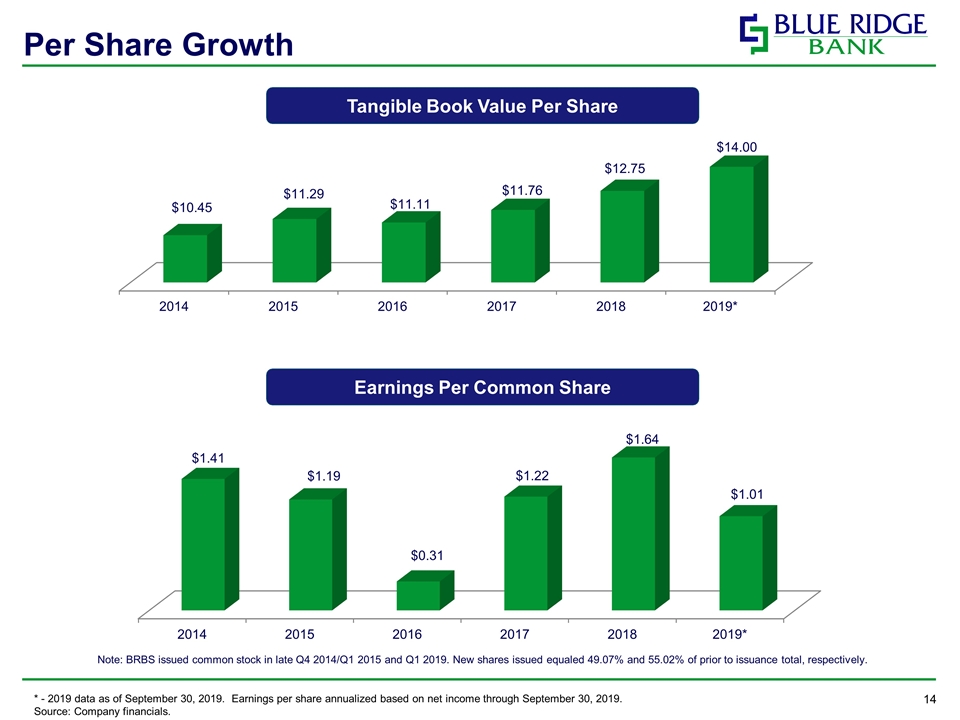

Per Share Growth * - 2019 data as of September 30, 2019. Earnings per share annualized based on net income through September 30, 2019. Source: Company financials. Note: BRBS issued common stock in late Q4 2014/Q1 2015 and Q1 2019. New shares issued equaled 49.07% and 55.02% of prior to issuance total, respectively. Tangible Book Value Per Share Earnings Per Common Share

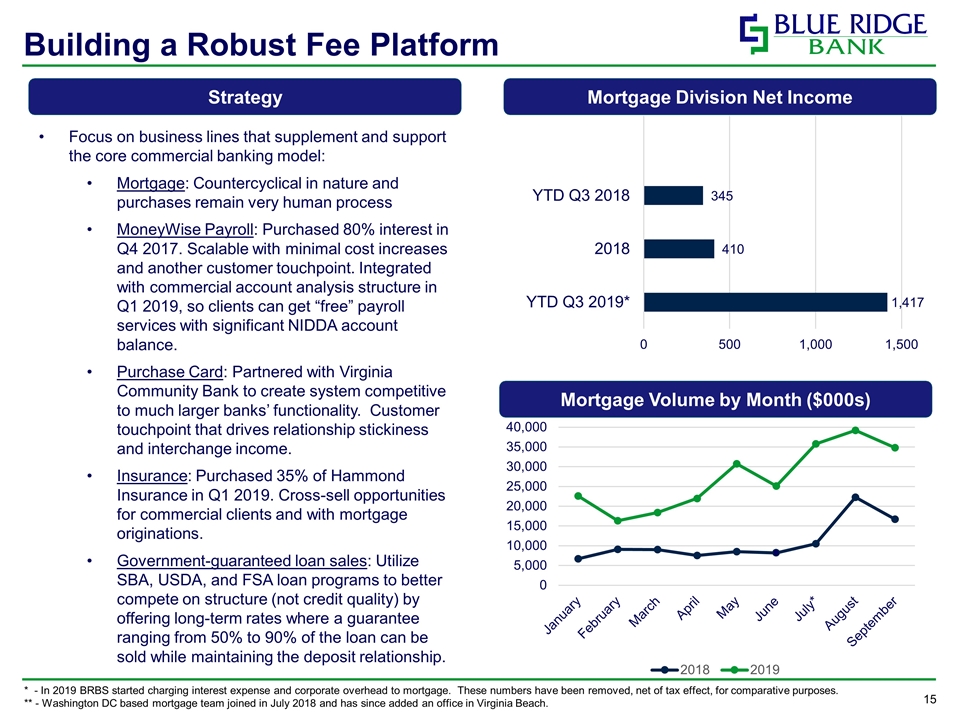

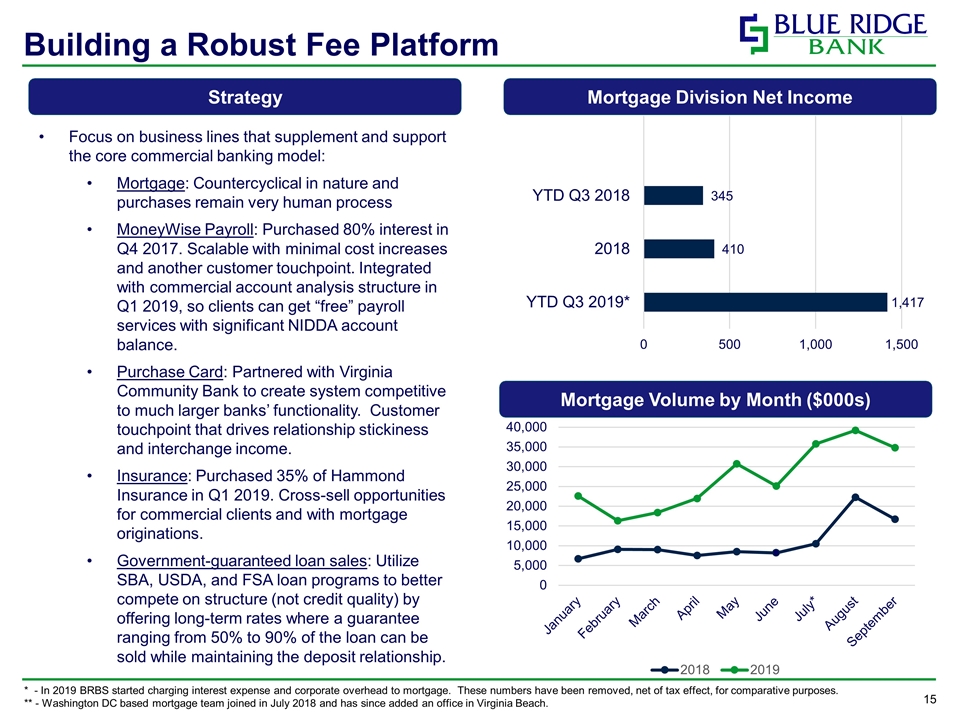

Building a Robust Fee Platform * - In 2019 BRBS started charging interest expense and corporate overhead to mortgage. These numbers have been removed, net of tax effect, for comparative purposes. ** - Washington DC based mortgage team joined in July 2018 and has since added an office in Virginia Beach. Strategy Focus on business lines that supplement and support the core commercial banking model: Mortgage: Countercyclical in nature and purchases remain very human process MoneyWise Payroll: Purchased 80% interest in Q4 2017. Scalable with minimal cost increases and another customer touchpoint. Integrated with commercial account analysis structure in Q1 2019, so clients can get “free” payroll services with significant NIDDA account balance. Purchase Card: Partnered with Virginia Community Bank to create system competitive to much larger banks’ functionality. Customer touchpoint that drives relationship stickiness and interchange income. Insurance: Purchased 35% of Hammond Insurance in Q1 2019. Cross-sell opportunities for commercial clients and with mortgage originations. Government-guaranteed loan sales: Utilize SBA, USDA, and FSA loan programs to better compete on structure (not credit quality) by offering long-term rates where a guarantee ranging from 50% to 90% of the loan can be sold while maintaining the deposit relationship. Mortgage Division Net Income Mortgage Volume by Month ($000s)

Creating Central Virginia’s Preeminent Community Bank

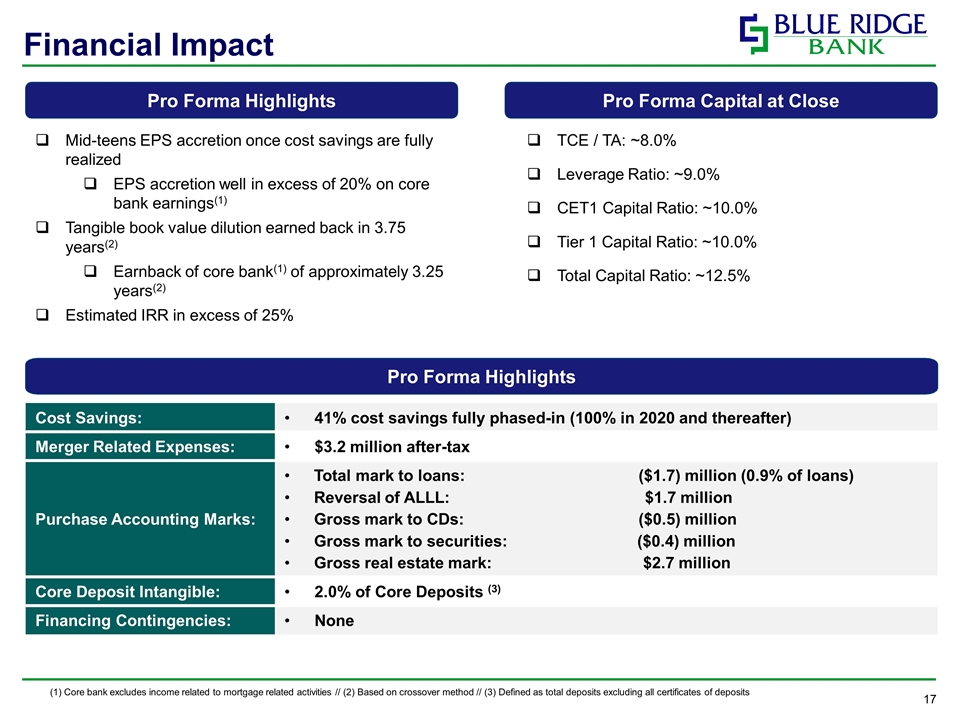

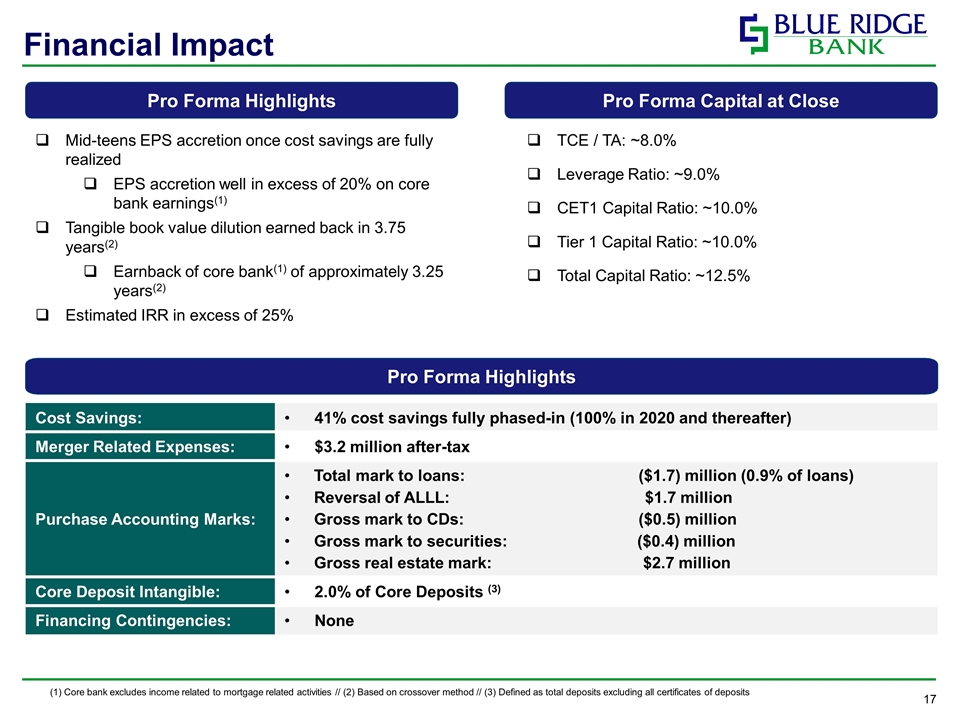

Financial Impact (1) Core bank excludes income related to mortgage related activities // (2) Based on crossover method // (3) Defined as total deposits excluding all certificates of deposits Cost Savings: 41% cost savings fully phased-in (100% in 2020 and thereafter) Merger Related Expenses: $3.2 million after-tax Purchase Accounting Marks: Total mark to loans:($1.7) million (0.9% of loans) Reversal of ALLL:$1.7 million Gross mark to CDs:($0.5) million Gross mark to securities: ($0.4) million Gross real estate mark: $2.7 million Core Deposit Intangible: 2.0% of Core Deposits (3) Financing Contingencies: None Mid-teens EPS accretion once cost savings are fully realized EPS accretion well in excess of 20% on core bank earnings(1) Tangible book value dilution earned back in 3.75 years(2) Earnback of core bank(1) of approximately 3.25 years(2) Estimated IRR in excess of 25% TCE / TA: ~8.0% Leverage Ratio: ~9.0% CET1 Capital Ratio: ~10.0% Tier 1 Capital Ratio: ~10.0% Total Capital Ratio: ~12.5% Pro Forma Highlights Pro Forma Capital at Close Pro Forma Highlights

Provides a low-cost funding base with a complementary enhancement of multiple noninterest income lines of business Transaction Overview Creates the 5th largest community bank headquartered in central Virginia and Shenandoah Valley that benefits from the scale of a $1 billion institution(1) (1) Community banks include banks with less than $10 billion in total assets; central Virginia defined as the area from Fredericksburg to Culpeper in the north to Roanoke Rapids in the south to Martinsville in the West Plan to list on the NYSE which could lead to enhanced liquidity and valuation expansion Complements existing footprint while providing a foothold in the Washington D.C. MSA Financially attractive, providing enhancement to operating metrics Charlottesville becomes headquarters, continuing expansion into high growth markets

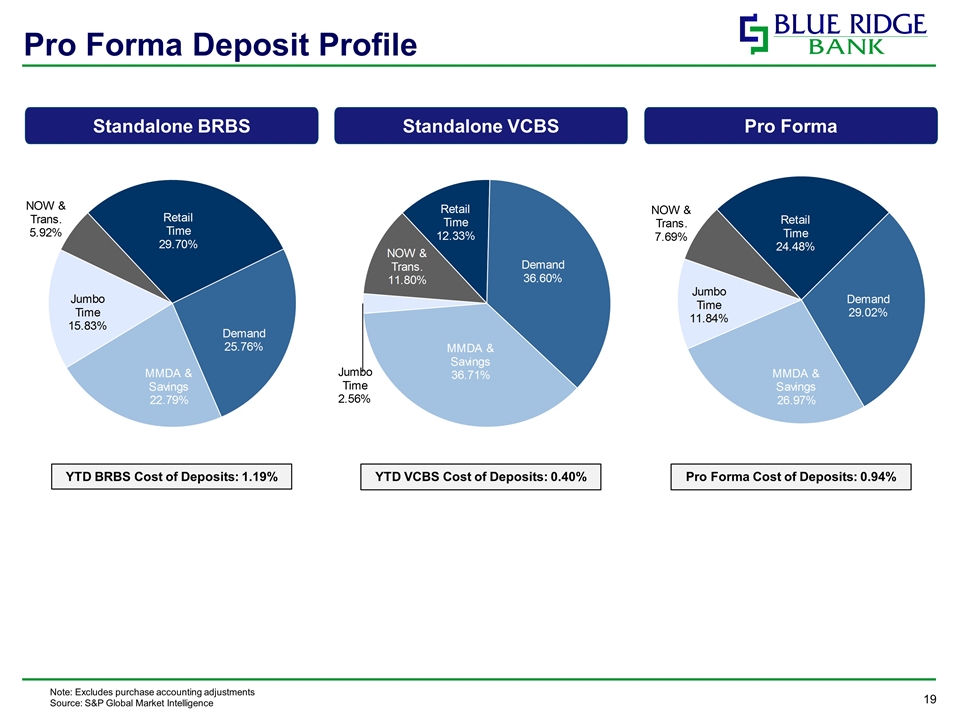

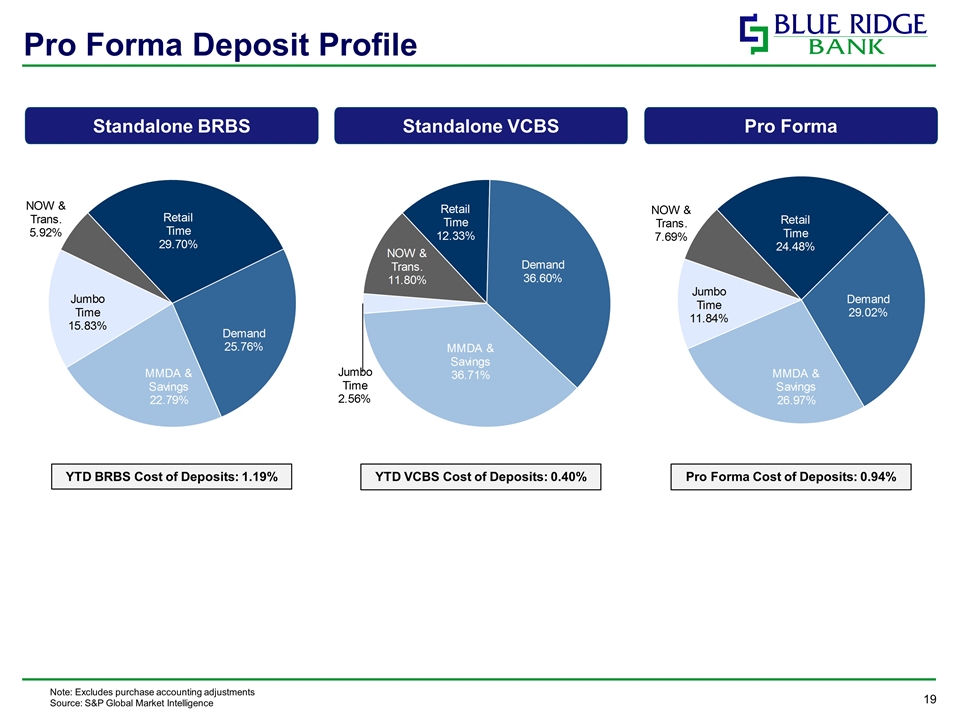

Pro Forma Deposit Profile Standalone BRBS Standalone VCBS Pro Forma Note: Excludes purchase accounting adjustments Source: S&P Global Market Intelligence YTD BRBS Cost of Deposits: 1.19% YTD VCBS Cost of Deposits: 0.40% Pro Forma Cost of Deposits: 0.94%

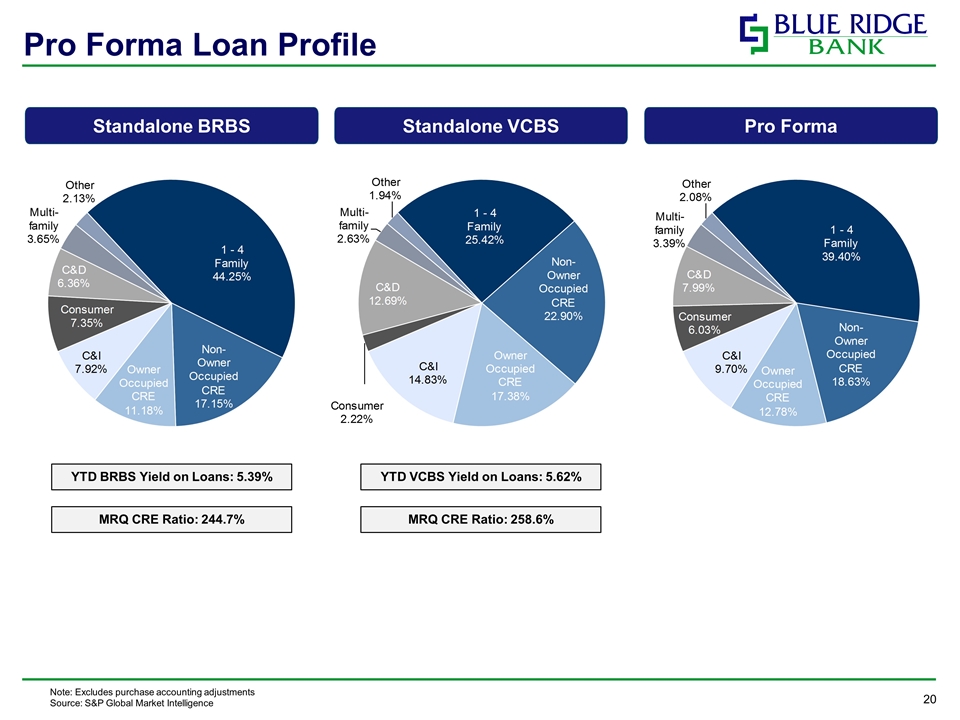

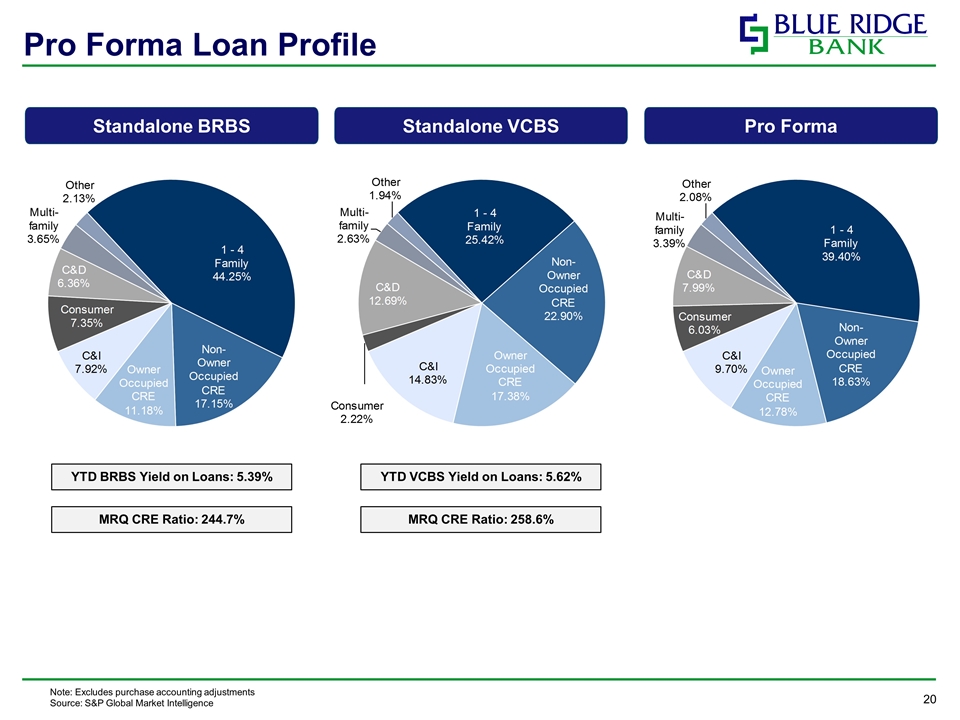

Standalone BRBS YTD BRBS Yield on Loans: 5.39% Pro Forma Loan Profile YTD VCBS Yield on Loans: 5.62% Standalone VCBS Pro Forma Note: Excludes purchase accounting adjustments Source: S&P Global Market Intelligence MRQ CRE Ratio: 244.7% MRQ CRE Ratio: 258.6%

Appendix

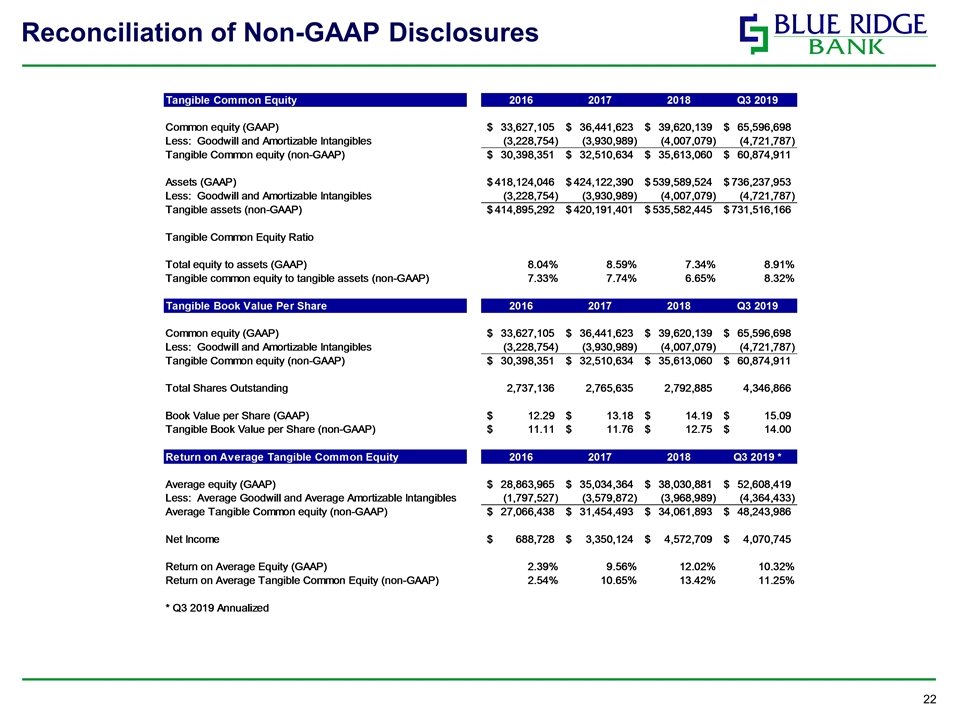

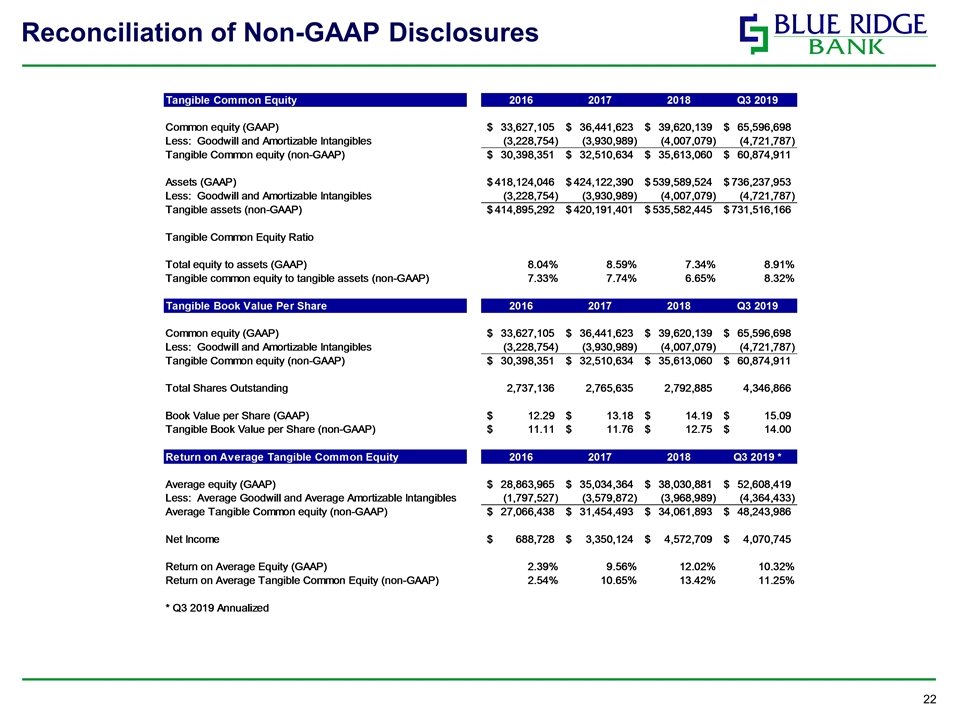

Reconciliation of Non-GAAP Disclosures