Blue Ridge Bankshares, Inc. Investor Presentation February 2021 Exhibit 99.1

Forward-Looking Statements This presentation of Blue Ridge Bankshares, Inc. (the “Company”) contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements represent plans, estimates, objectives, goals, guidelines, expectations, intentions, projections and statements of the Company’s beliefs concerning future events, business plans, objectives, expected operating results and the assumptions upon which those statements are based. Forward-looking statements include without limitation, any statement that may predict, forecast, indicate or imply future results, performance or achievements, and are typically identified with words such as “may,” “could,” “should,” “will,” “would,” “believe,” “anticipate,” “estimate,” “expect,” “aim,” “intend,” “plan,” or words or phases of similar meaning. The Company cautions that the forward-looking statements are based largely on its expectations and are subject to a number of known and unknown risks and uncertainties that are subject to change based on factors which are, in many instances, beyond the Company’s control. Actual results, performance or achievements could differ materially from those contemplated, expressed or implied by the forward-looking statements. The following factors, among others, could cause the Company’s financial performance to differ materially from that expressed in such forward-looking statements: (i) the strength of the United States economy in general and the strength of the local economies in which the Company conducts operations; (ii) geopolitical conditions, including acts or threats of terrorism, or actions taken by the United States or other governments in response to acts or threats of terrorism and/or military conflicts, which could impact business and economic conditions in the United States and abroad; (iii) the effects of the COVID-19 pandemic, including the adverse impact on the Company’s business and operations and on the Company’s customers which may result, among other things, in increased delinquencies, defaults, foreclosures and losses on loans; (iv) the occurrence of significant natural disasters, including severe weather conditions, floods, health related issues, and other catastrophic events; (v) the Company’s management of risks inherent in its real estate loan portfolio, and the risk of a prolonged downturn in the real estate market, which could impair the value of the Company’s collateral and its ability to sell collateral upon any foreclosure; (vi) changes in consumer spending and savings habits; (vii) technological and social media changes; (viii) the effects of, and changes in, trade, monetary and fiscal policies and laws, including interest rate policies of the Board of Governors of the Federal Reserve System, inflation, interest rate, market and monetary fluctuations; (ix) changing bank regulatory conditions, policies or programs, whether arising as new legislation or regulatory initiatives, that could lead to restrictions on activities of banks generally, or the Company’s subsidiary bank in particular, more restrictive regulatory capital requirements, increased costs, including deposit insurance premiums, regulation or prohibition of certain income producing activities or changes in the secondary market for loans and other products; (x) the impact of changes in financial services policies, laws and regulations, including laws, regulations and policies concerning taxes, banking, securities and insurance, and the application thereof by regulatory bodies; (xi) the impact of changes in laws, regulations and policies affecting the real estate industry; (xii) the effect of changes in accounting policies and practices, as may be adopted from time to time by bank regulatory agencies, the Securities and Exchange Commission (the “SEC”), the Public Company Accounting Oversight Board, the Financial Accounting Standards Board or other accounting standards setting bodies; (xiii) the timely development of competitive new products and services and the acceptance of these products and services by new and existing customers; (xiv) the willingness of users to substitute competitors’ products and services for the Company’s products and services; (xv) the effects of the Company’s recent mergers with Bay Banks of Virginia, Inc. and Virginia Community Bankshares, Inc. or other acquisitions the Company may make, including that integration of the businesses of such banks may take longer, be more difficult, time-consuming or costly to accomplish than expected, the expected growth opportunities or cost savings from such mergers may not be fully realized or may take longer to realize than expected, and the Company could experience deposit attrition, costumer losses or business disruptions following such mergers; (xvi) changes in the level of the Company’s nonperforming assets and charge-offs; (xvii) the Company’s involvement, from time to time, in legal proceedings and examination and remedial actions by regulators; (xviii) potential exposure to fraud, negligence, computer theft and cyber-crime; (xix) the Company’s ability to pay dividends; (xx) the Company’s involvement as a participating lender in the Paycheck Protection Program (“PPP”) as administered through the U.S. Small Business Administration (“SBA”), and (xxi) other risks and factors identified in the “Risk Factors” sections and elsewhere in documents the Company files from time to time with the SEC. The Company undertakes no obligation to publicly update or revise any forward-looking statements or to update the reasons why actual results could differ from those contained in such statements, whether as a result of new information, future events or otherwise. In light of these risks, uncertainties and assumptions, the forward-looking statements discussed might not occur, and you should not put undue reliance on any forward-looking statements. Non-GAAP Financial Measures This presentation contains financial information determined by methods other than in accordance with accounting principles generally accepted in the United States of America (“GAAP”). The Company’s management uses these non-GAAP financial measures in its analysis of the Company’s performance. These measures typically adjust GAAP performance measures to exclude the effects of the amortization of intangibles and include the tax benefit associated with revenue items that are tax-exempt, as well as adjust income available to common shareholders for certain significant activities or transactions that are infrequent in nature. Management believes presentations of these non-GAAP financial measures provide useful supplemental information that is essential to a proper understanding of the operating results of the Company’s core businesses. These non-GAAP disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. Disclosure

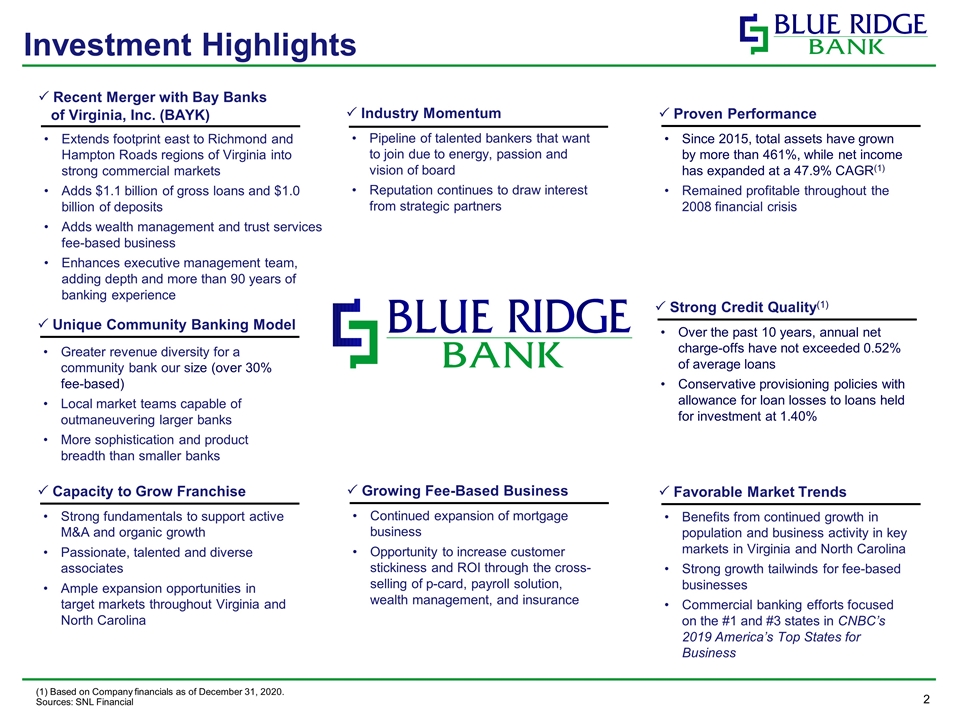

P Recent Merger with Bay Banks . fof Virginia, Inc. (BAYK) Extends footprint east to Richmond and Hampton Roads regions of Virginia into strong commercial markets Adds $1.1 billion of gross loans and $1.0 billion of deposits Adds wealth management and trust services fee-based business Enhances executive management team, adding depth and more than 90 years of banking experience Investment Highlights P Industry Momentum Pipeline of talented bankers that want to join due to energy, passion and vision of board Reputation continues to draw interest from strategic partners P Proven Performance Since 2015, total assets have grown by more than 461%, while net income has expanded at a 47.9% CAGR(1) Remained profitable throughout the 2008 financial crisis (1) Based on Company financials as of December 31, 2020. Sources: SNL Financial P Unique Community Banking Model Greater revenue diversity for a community bank our size (over 30% fee-based) Local market teams capable of outmaneuvering larger banks More sophistication and product breadth than smaller banks P Strong Credit Quality(1) Over the past 10 years, annual net charge-offs have not exceeded 0.52% of average loans Conservative provisioning policies with allowance for loan losses to loans held for investment at 1.40% P Capacity to Grow Franchise Strong fundamentals to support active M&A and organic growth Passionate, talented and diverse associates Ample expansion opportunities in target markets throughout Virginia and North Carolina P Growing Fee-Based Business Continued expansion of mortgage business Opportunity to increase customer stickiness and ROI through the cross-selling of p-card, payroll solution, wealth management, and insurance P Favorable Market Trends Benefits from continued growth in population and business activity in key markets in Virginia and North Carolina Strong growth tailwinds for fee-based businesses Commercial banking efforts focused on the #1 and #3 states in CNBC’s 2019 America’s Top States for Business

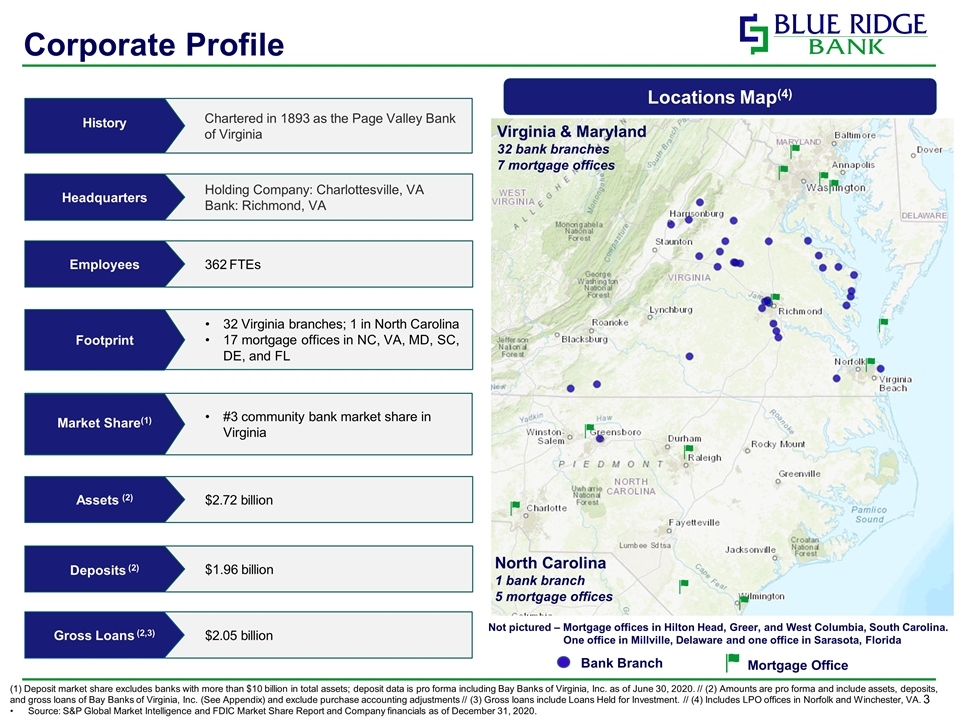

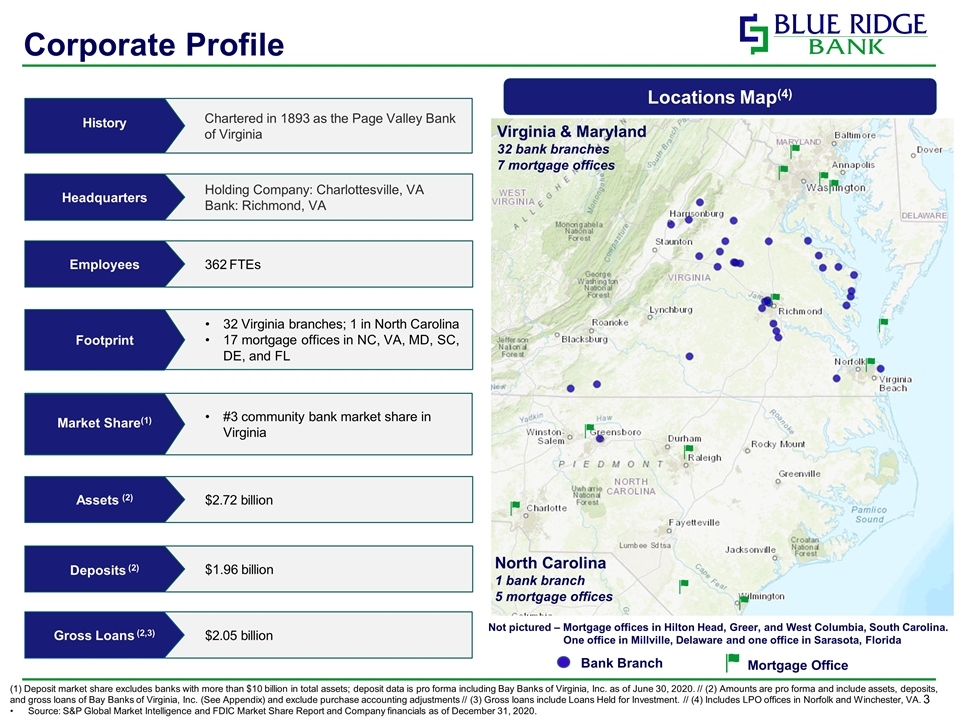

Corporate Profile Locations Map(4) #3 community bank market share in Virginia 32 Virginia branches; 1 in North Carolina 17 mortgage offices in NC, VA, MD, SC, DE, and FL $1.96 billion $2.72 billion Holding Company: Charlottesville, VA Bank: Richmond, VA 362 FTEs $2.05 billion Chartered in 1893 as the Page Valley Bank of Virginia History Footprint Deposits (2) Market Share(1) Assets (2) Headquarters Employees Gross Loans (2,3) Virginia & Maryland 32 bank branches 7 mortgage offices North Carolina 1 bank branch 5 mortgage offices Bank Branch Mortgage Office (1) Deposit market share excludes banks with more than $10 billion in total assets; deposit data is pro forma including Bay Banks of Virginia, Inc. as of June 30, 2020. // (2) Amounts are pro forma and include assets, deposits, and gross loans of Bay Banks of Virginia, Inc. (See Appendix) and exclude purchase accounting adjustments // (3) Gross loans include Loans Held for Investment. // (4) Includes LPO offices in Norfolk and Winchester, VA. Source: S&P Global Market Intelligence and FDIC Market Share Report and Company financials as of December 31, 2020. Not pictured – Mortgage offices in Hilton Head, Greer, and West Columbia, South Carolina. One office in Millville, Delaware and one office in Sarasota, Florida

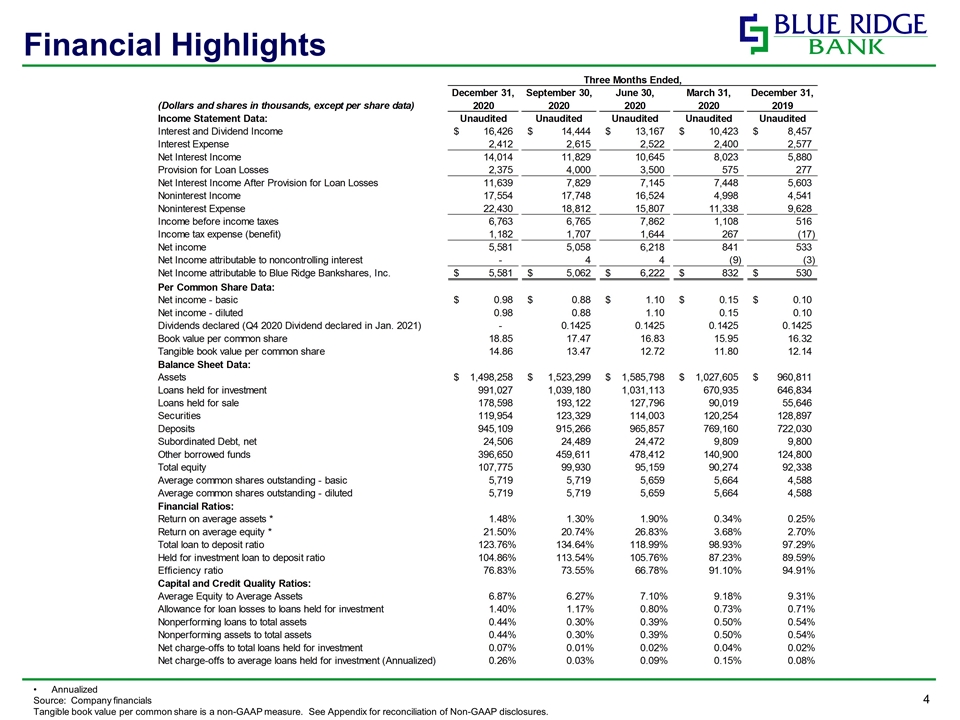

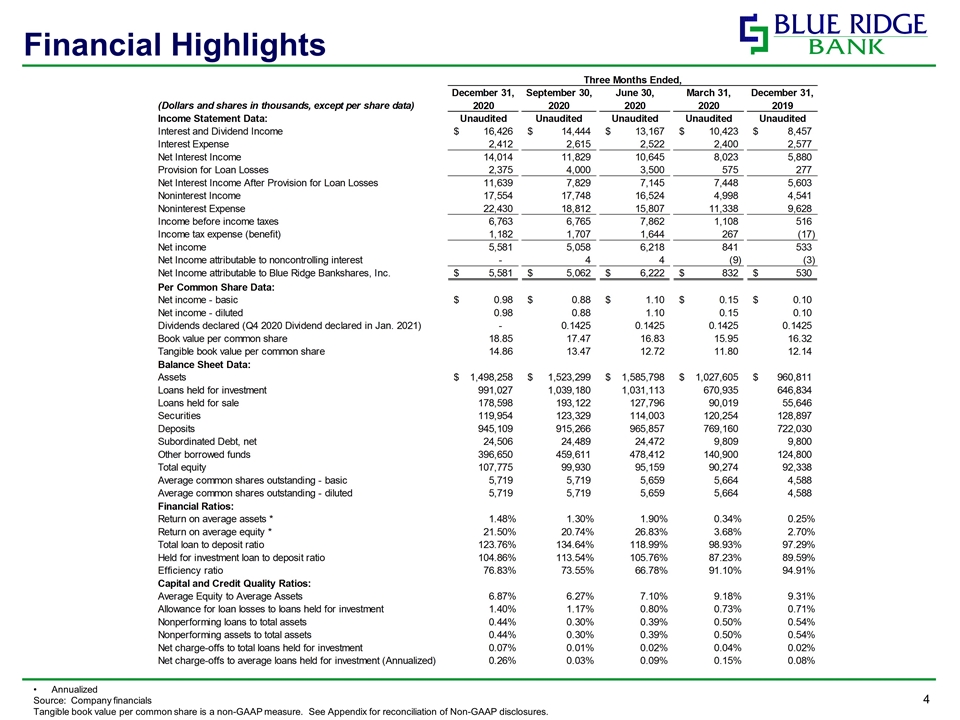

Financial Highlights Annualized Source: Company financials Tangible book value per common share is a non-GAAP measure. See Appendix for reconciliation of Non-GAAP disclosures.

Brian K. Plum Chief Executive Officer Randal R. “Randy” Greene President and Chief Operating Officer Judy C. Gavant, CPA Chief Financial Officer Management Team Chief Executive Officer of Blue Ridge Bankshares, Inc. since December 2014 Previously served as CFO and Chief Administrative Officer of Blue Ridge Bankshares, Inc. from 2007-2014 Holds a BS in Accounting and Economics from Eastern Mennonite University, a MS in Accounting from James Madison University, and a MBA from the Darden School of Business at the University of Virginia More than 15 years experience in the commercial banking industry, and 19 years working with mortgage banking President and Chief Operating Officer of Blue Ridge Bankshares, Inc. and Chief Executive Officer of Blue Ridge Bank Previously served as President and CEO of Bay Banks of Virginia, Inc. Holds a BBA from East Tennessee State University More than 35 years of experience in the banking industry Chief Financial Officer Previously served as CFO of Bay Banks of Virginia, Inc. from 2018 - Jan. 2021 Served as Chief Accounting Officer of Xenith Bankshares, Inc. from 2010 - 2018 Holds a BS in Accounting from Louisiana State University and a MS in Taxation from Virginia Commonwealth University More than 37 years experience in accounting, taxation, finance, and M&A

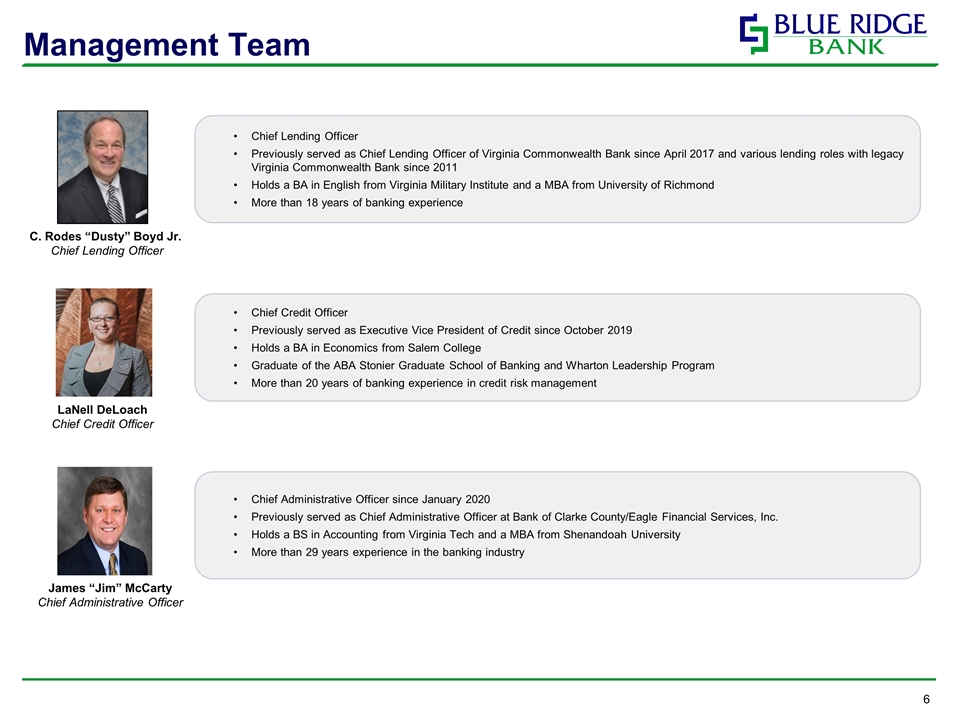

James “Jim” McCarty Chief Administrative Officer Management Team Chief Administrative Officer since January 2020 Previously served as Chief Administrative Officer at Bank of Clarke County/Eagle Financial Services, Inc. Holds a BS in Accounting from Virginia Tech and a MBA from Shenandoah University More than 29 years experience in the banking industry LaNell DeLoach Chief Credit Officer C. Rodes “Dusty” Boyd Jr. Chief Lending Officer Chief Credit Officer Previously served as Executive Vice President of Credit since October 2019 Holds a BA in Economics from Salem College Graduate of the ABA Stonier Graduate School of Banking and Wharton Leadership Program More than 20 years of banking experience in credit risk management Chief Lending Officer Previously served as Chief Lending Officer of Virginia Commonwealth Bank since April 2017 and various lending roles with legacy Virginia Commonwealth Bank since 2011 Holds a BA in English from Virginia Military Institute and a MBA from University of Richmond More than 18 years of banking experience

BRBS Mission Statement and Core Values 128 Years of Customer Service Mission Statement Our mission is to create financial value and opportunity for our shareholders, customers, employees, and communities by providing evolving, flexible, and customized solutions for the needs of our clients ….and to have fun while doing it. Act with integrity Value those around you Serve others Commit to success Create solutions Celebrate achievement Enjoy every day Core Values

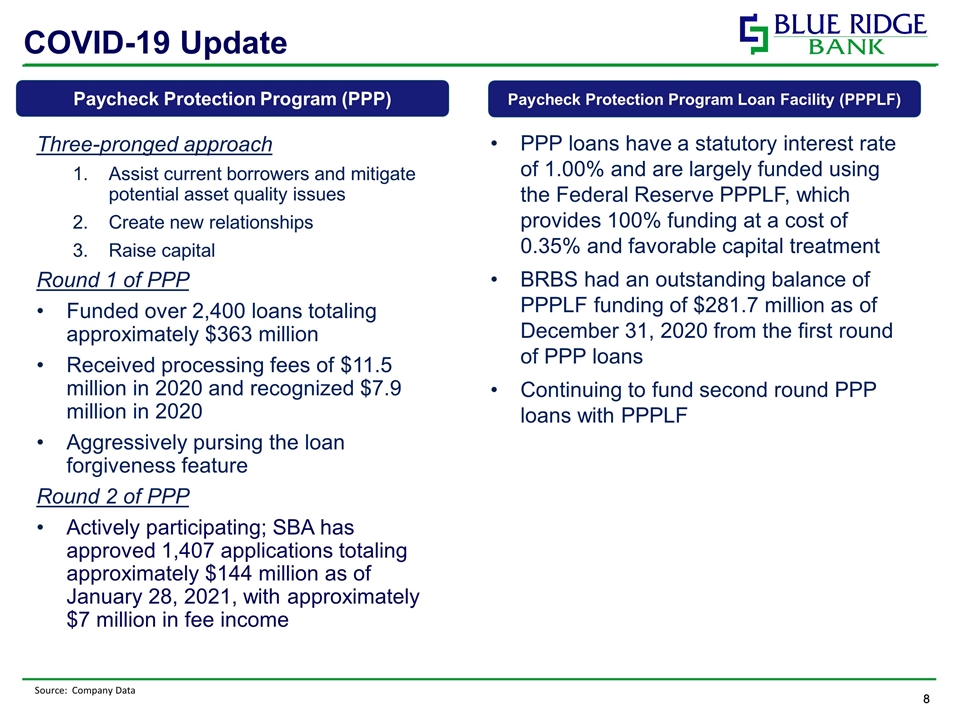

Three-pronged approach Assist current borrowers and mitigate potential asset quality issues Create new relationships Raise capital Round 1 of PPP Funded over 2,400 loans totaling approximately $363 million Received processing fees of $11.5 million in 2020 and recognized $7.9 million in 2020 Aggressively pursing the loan forgiveness feature Round 2 of PPP Actively participating; SBA has approved 1,407 applications totaling approximately $144 million as of January 28, 2021, with approximately $7 million in fee income COVID-19 Update Source: Company Data PPP loans have a statutory interest rate of 1.00% and are largely funded using the Federal Reserve PPPLF, which provides 100% funding at a cost of 0.35% and favorable capital treatment BRBS had an outstanding balance of PPPLF funding of $281.7 million as of December 31, 2020 from the first round of PPP loans Continuing to fund second round PPP loans with PPPLF Paycheck Protection Program (PPP) Paycheck Protection Program Loan Facility (PPPLF) 8

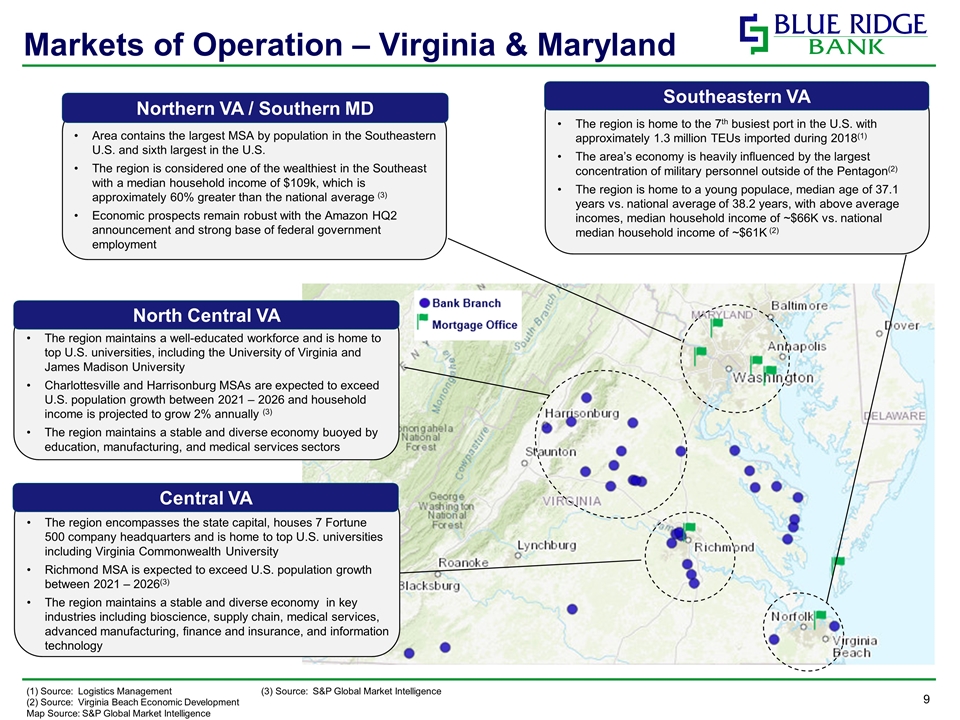

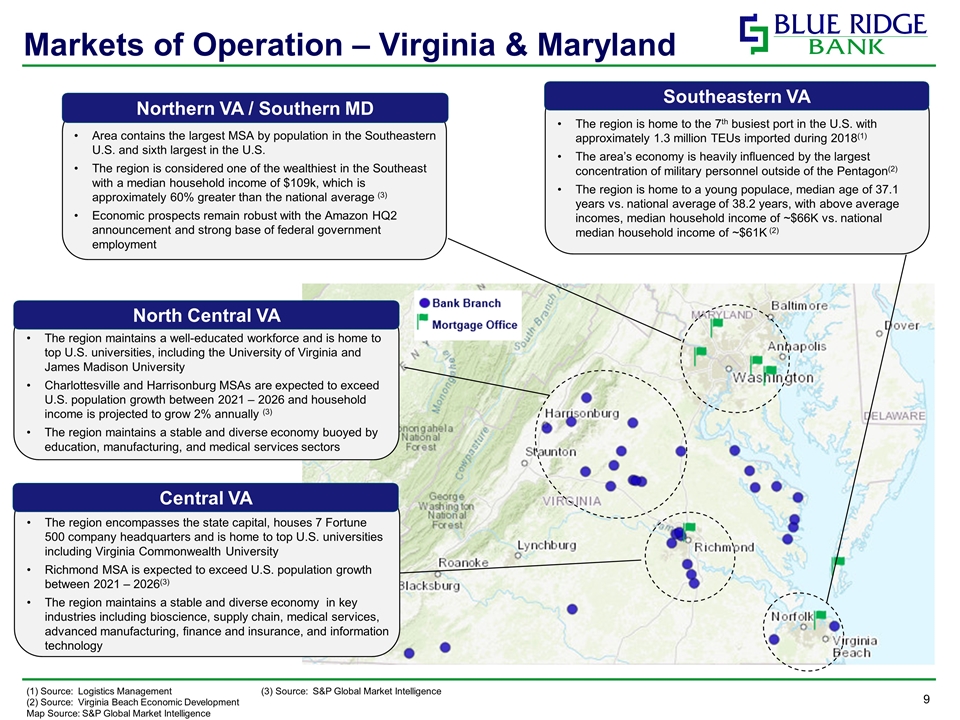

The region is home to the 7th busiest port in the U.S. with approximately 1.3 million TEUs imported during 2018(1) The area’s economy is heavily influenced by the largest concentration of military personnel outside of the Pentagon(2) The region is home to a young populace, median age of 37.1 years vs. national average of 38.2 years, with above average incomes, median household income of ~$66K vs. national median household income of ~$61K (2) Area contains the largest MSA by population in the Southeastern U.S. and sixth largest in the U.S. The region is considered one of the wealthiest in the Southeast with a median household income of $109k, which is approximately 60% greater than the national average (3) Economic prospects remain robust with the Amazon HQ2 announcement and strong base of federal government employment Markets of Operation – Virginia & Maryland The region maintains a well-educated workforce and is home to top U.S. universities, including the University of Virginia and James Madison University Charlottesville and Harrisonburg MSAs are expected to exceed U.S. population growth between 2021 – 2026 and household income is projected to grow 2% annually (3) The region maintains a stable and diverse economy buoyed by education, manufacturing, and medical services sectors North Central VA Northern VA / Southern MD Southeastern VA (1) Source: Logistics Management (3) Source: S&P Global Market Intelligence (2) Source: Virginia Beach Economic Development Map Source: S&P Global Market Intelligence The region encompasses the state capital, houses 7 Fortune 500 company headquarters and is home to top U.S. universities including Virginia Commonwealth University Richmond MSA is expected to exceed U.S. population growth between 2021 – 2026(3) The region maintains a stable and diverse economy in key industries including bioscience, supply chain, medical services, advanced manufacturing, finance and insurance, and information technology Central VA

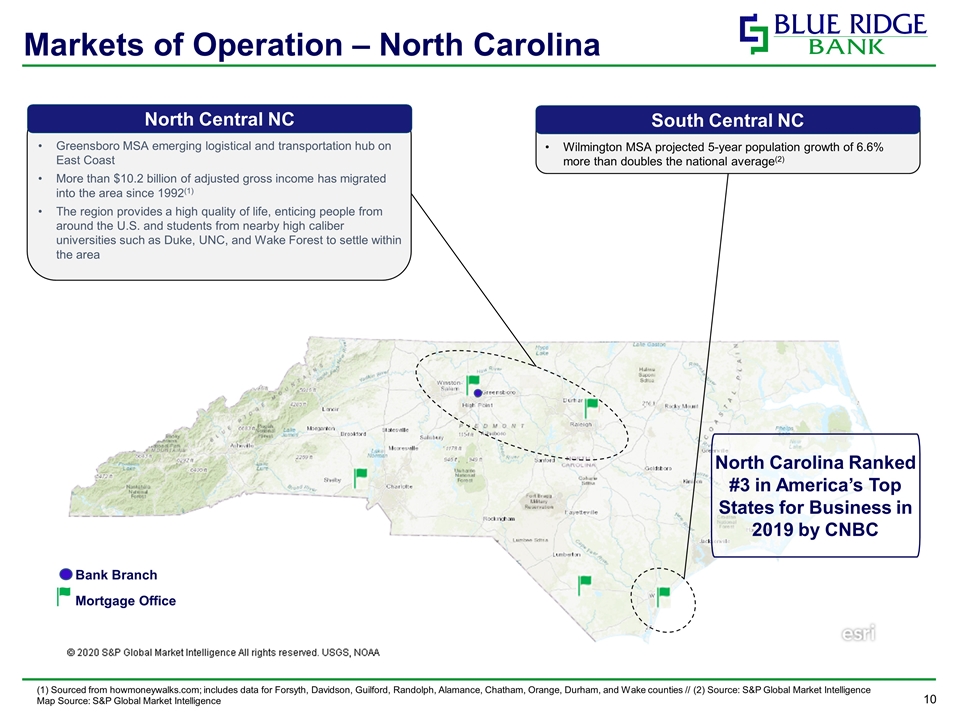

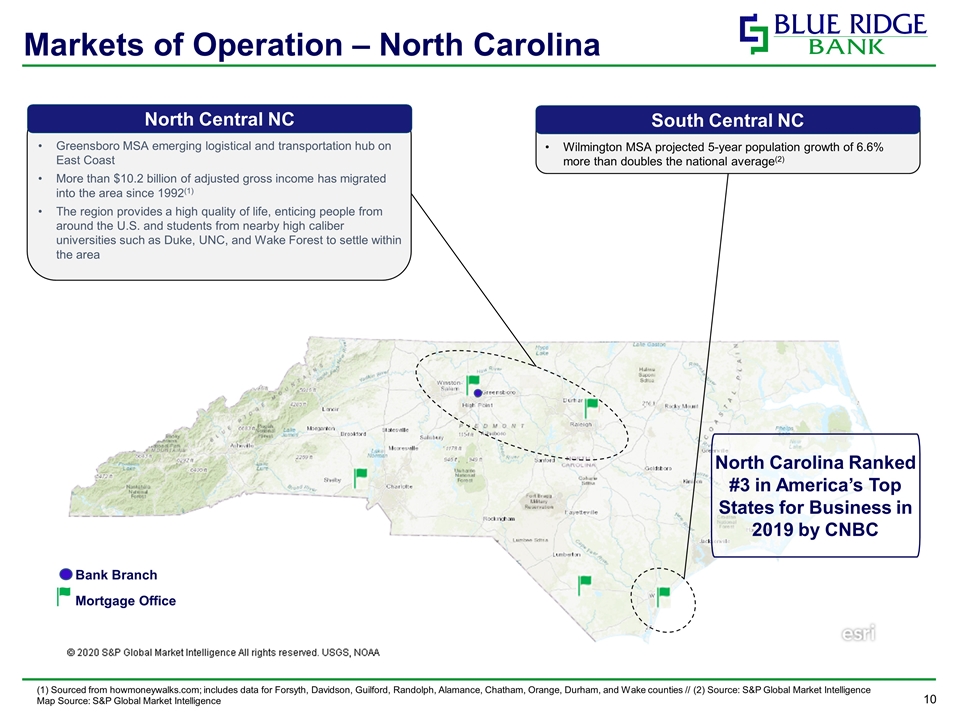

Greensboro MSA emerging logistical and transportation hub on East Coast More than $10.2 billion of adjusted gross income has migrated into the area since 1992(1) The region provides a high quality of life, enticing people from around the U.S. and students from nearby high caliber universities such as Duke, UNC, and Wake Forest to settle within the area Markets of Operation – North Carolina Wilmington MSA projected 5-year population growth of 6.6% more than doubles the national average(2) (1) Sourced from howmoneywalks.com; includes data for Forsyth, Davidson, Guilford, Randolph, Alamance, Chatham, Orange, Durham, and Wake counties // (2) Source: S&P Global Market Intelligence Map Source: S&P Global Market Intelligence North Central NC South Central NC North Carolina Ranked #3 in America’s Top States for Business in 2019 by CNBC Bank Branch Mortgage Office

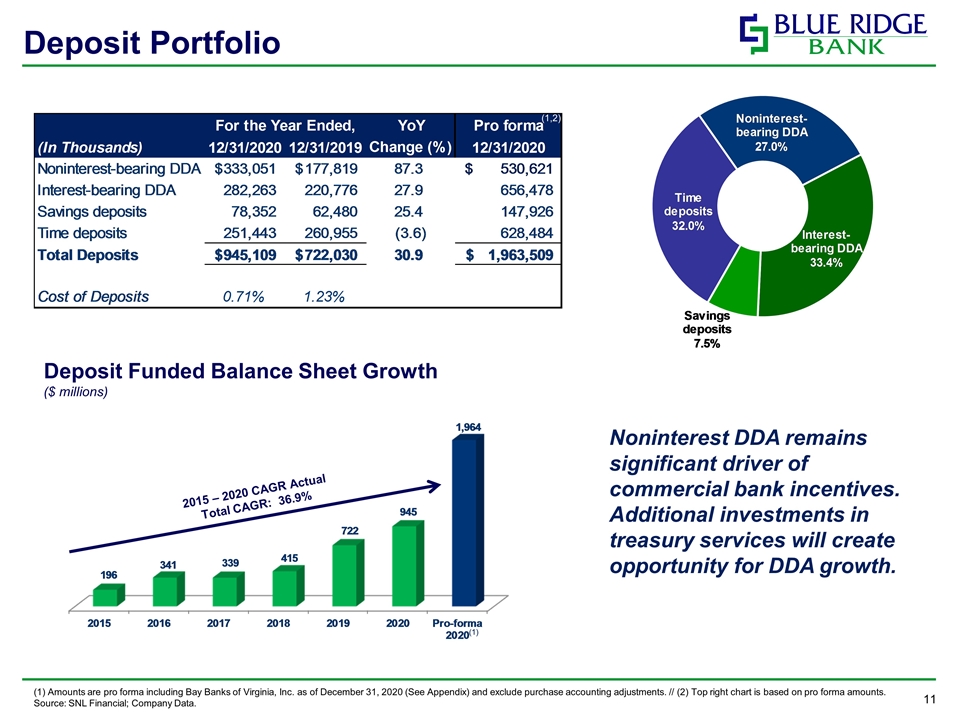

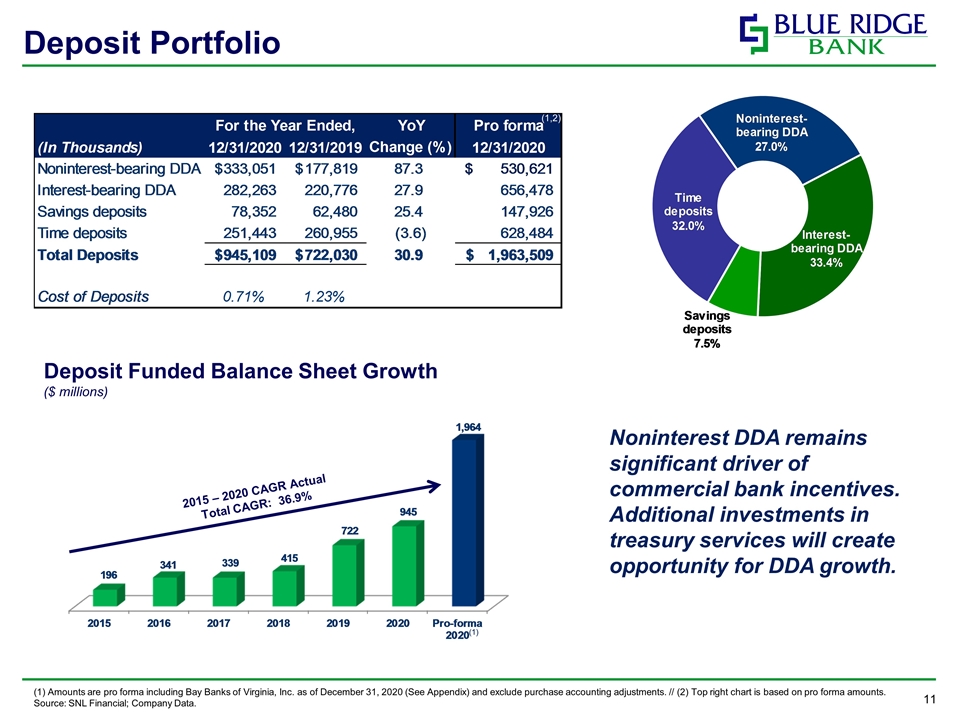

Deposit Portfolio (1) Amounts are pro forma including Bay Banks of Virginia, Inc. as of December 31, 2020 (See Appendix) and exclude purchase accounting adjustments. // (2) Top right chart is based on pro forma amounts. Source: SNL Financial; Company Data. Deposit Funded Balance Sheet Growth ($ millions) 2015 – 2020 CAGR Actual Total CAGR: 36.9% Noninterest DDA remains significant driver of commercial bank incentives. Additional investments in treasury services will create opportunity for DDA growth. (1) (1,2)

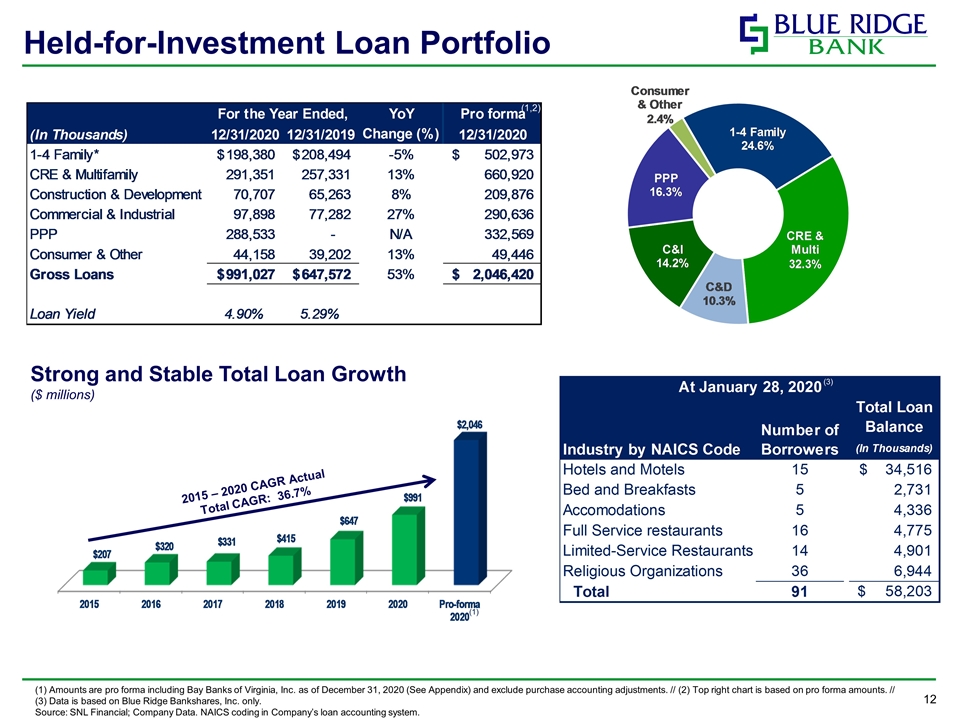

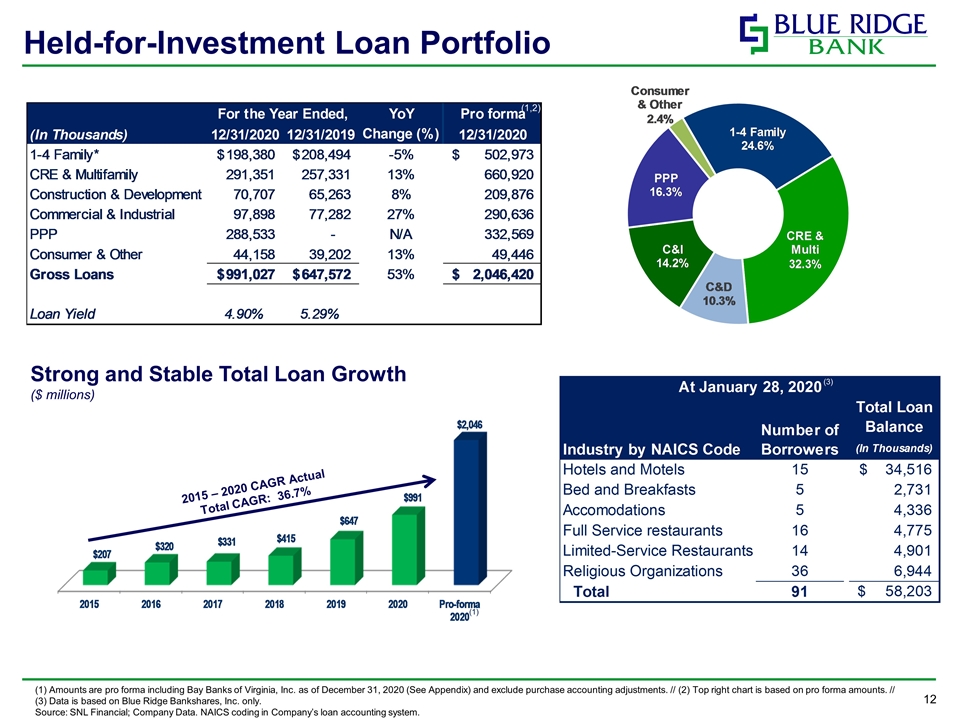

Held-for-Investment Loan Portfolio (1) Amounts are pro forma including Bay Banks of Virginia, Inc. as of December 31, 2020 (See Appendix) and exclude purchase accounting adjustments. // (2) Top right chart is based on pro forma amounts. // (3) Data is based on Blue Ridge Bankshares, Inc. only. Source: SNL Financial; Company Data. NAICS coding in Company’s loan accounting system. Strong and Stable Total Loan Growth ($ millions) 2015 – 2020 CAGR Actual Total CAGR: 36.7% (1) (1,2) (3)

Consistent Balance Sheet Growth (1) CAGR does not include 2020 pro forma data. // (2) Amounts are pro forma and include assets, deposit, and gross loans of Bay Banks of Virginia, Inc. as of December 31, 2020 (See Appendix) and exclude purchase accounting adjustments. Source: SNL Financial and Company financials ($ in millions) (1) (2)

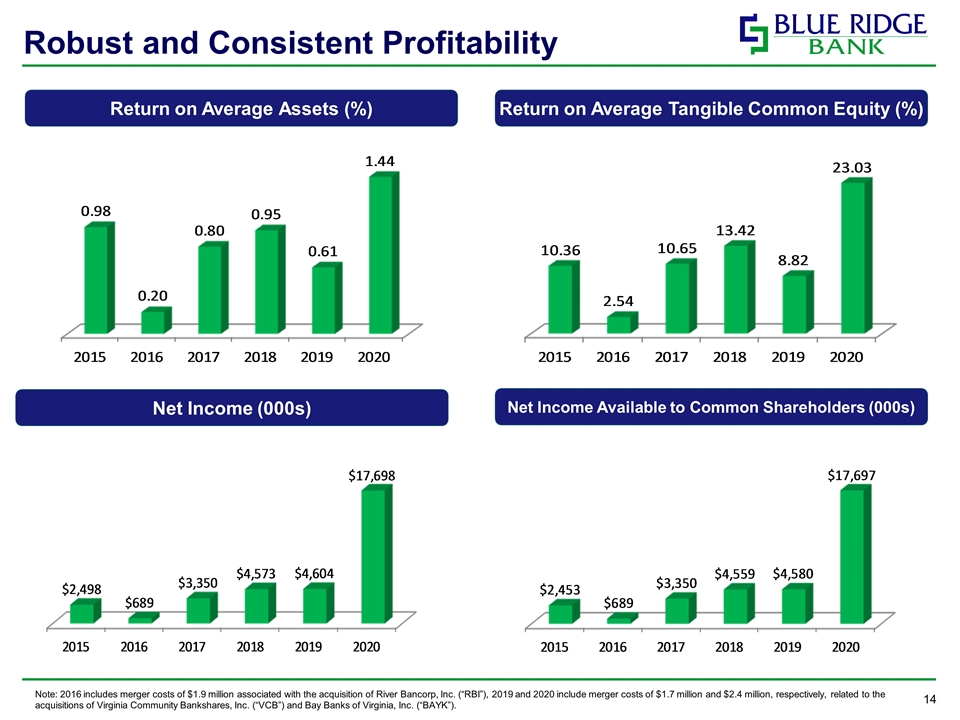

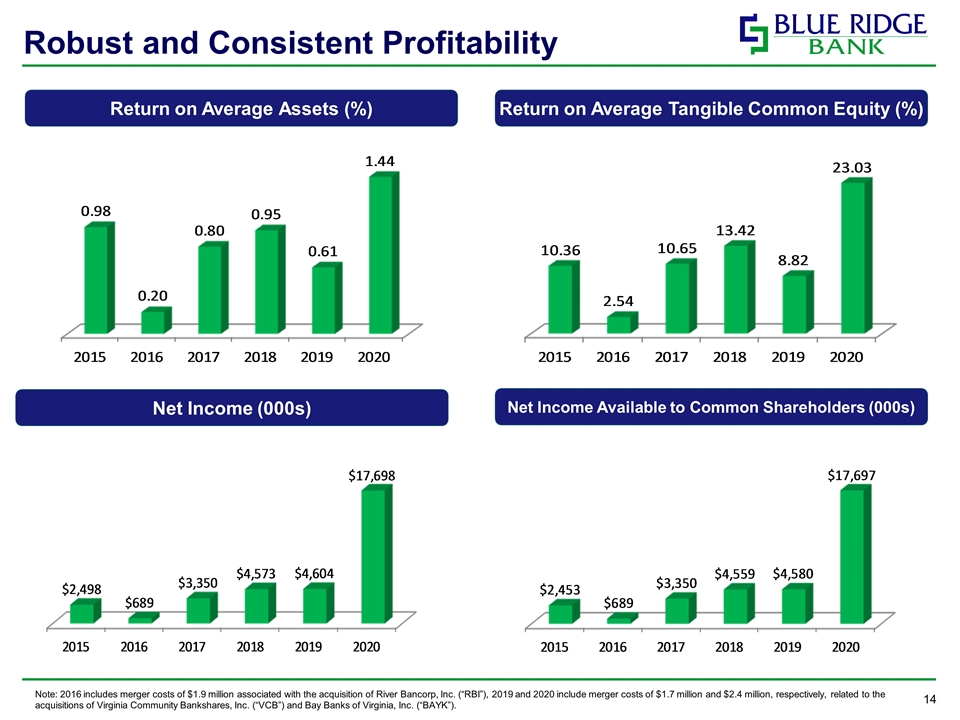

Robust and Consistent Profitability Note: 2016 includes merger costs of $1.9 million associated with the acquisition of River Bancorp, Inc. (“RBI”), 2019 and 2020 include merger costs of $1.7 million and $2.4 million, respectively, related to the acquisitions of Virginia Community Bankshares, Inc. (“VCB”) and Bay Banks of Virginia, Inc. (“BAYK”). Return on Average Assets (%) Return on Average Tangible Common Equity (%) Net Income Available to Common Shareholders (000s) Net Income (000s)

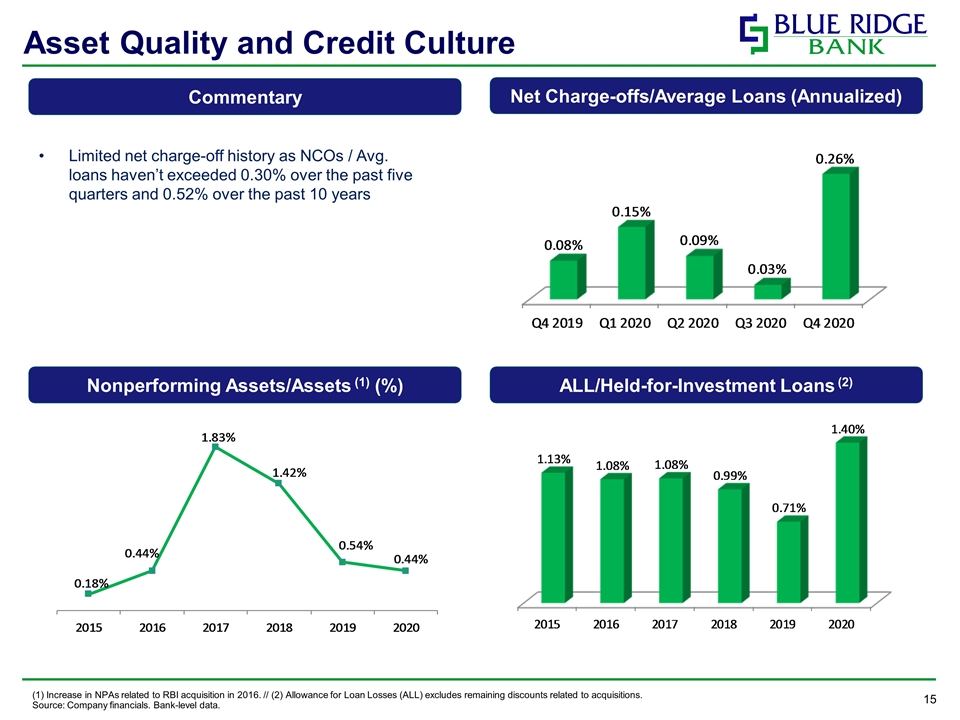

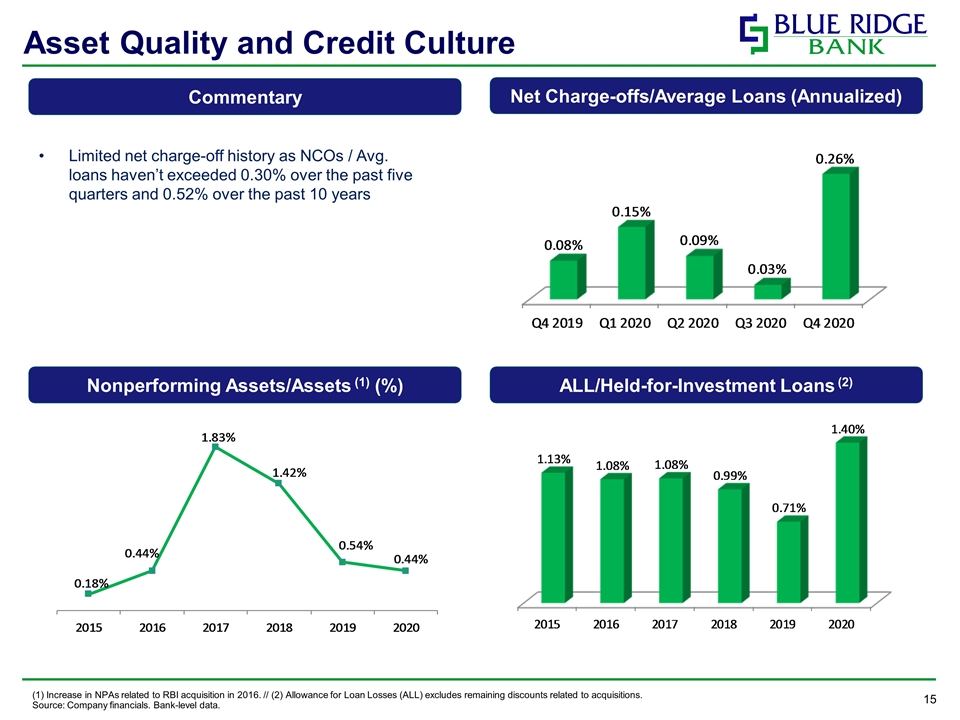

Asset Quality and Credit Culture (1) Increase in NPAs related to RBI acquisition in 2016. // (2) Allowance for Loan Losses (ALL) excludes remaining discounts related to acquisitions. Source: Company financials. Bank-level data. Commentary Net Charge-offs/Average Loans (Annualized) Limited net charge-off history as NCOs / Avg. loans haven’t exceeded 0.30% over the past five quarters and 0.52% over the past 10 years Nonperforming Assets/Assets (1) (%) ALL/Held-for-Investment Loans (2)

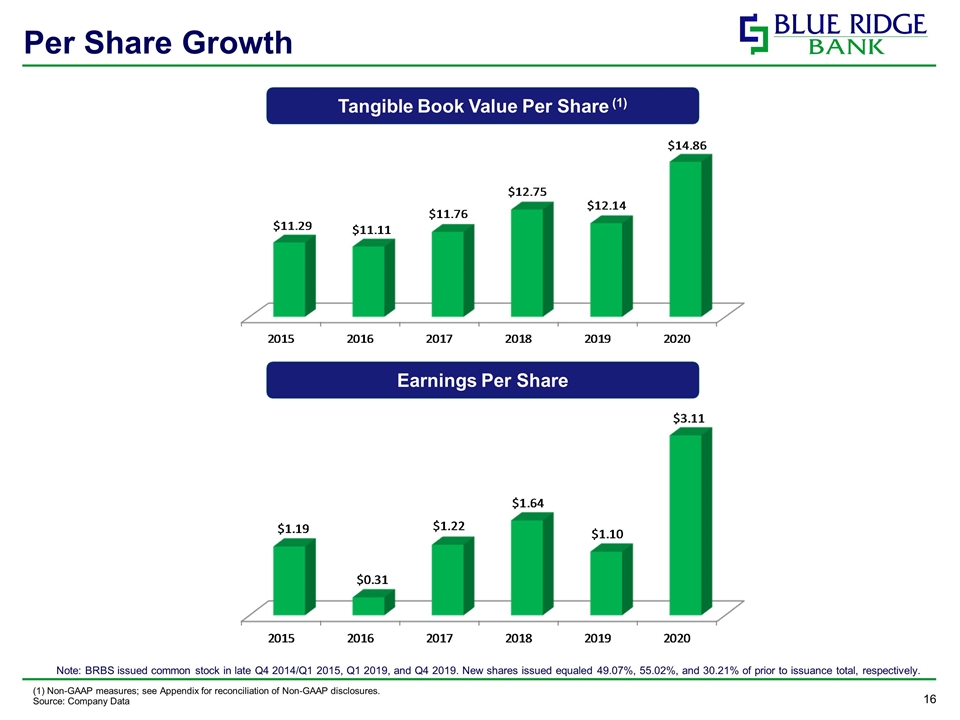

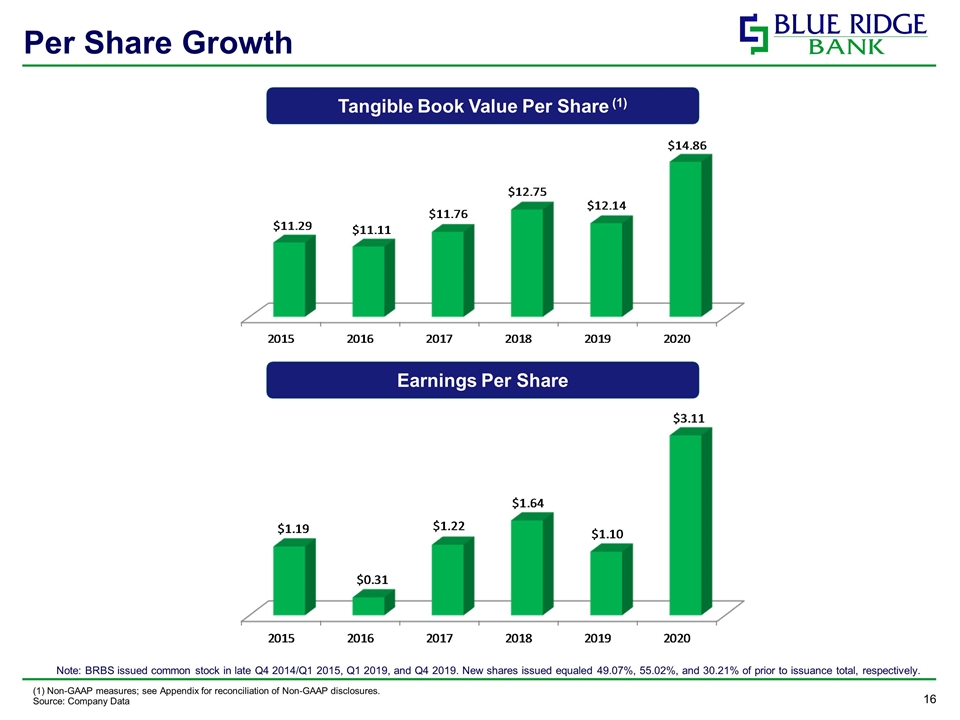

Per Share Growth (1) Non-GAAP measures; see Appendix for reconciliation of Non-GAAP disclosures. Source: Company Data Note: BRBS issued common stock in late Q4 2014/Q1 2015, Q1 2019, and Q4 2019. New shares issued equaled 49.07%, 55.02%, and 30.21% of prior to issuance total, respectively. Tangible Book Value Per Share (1) Earnings Per Share

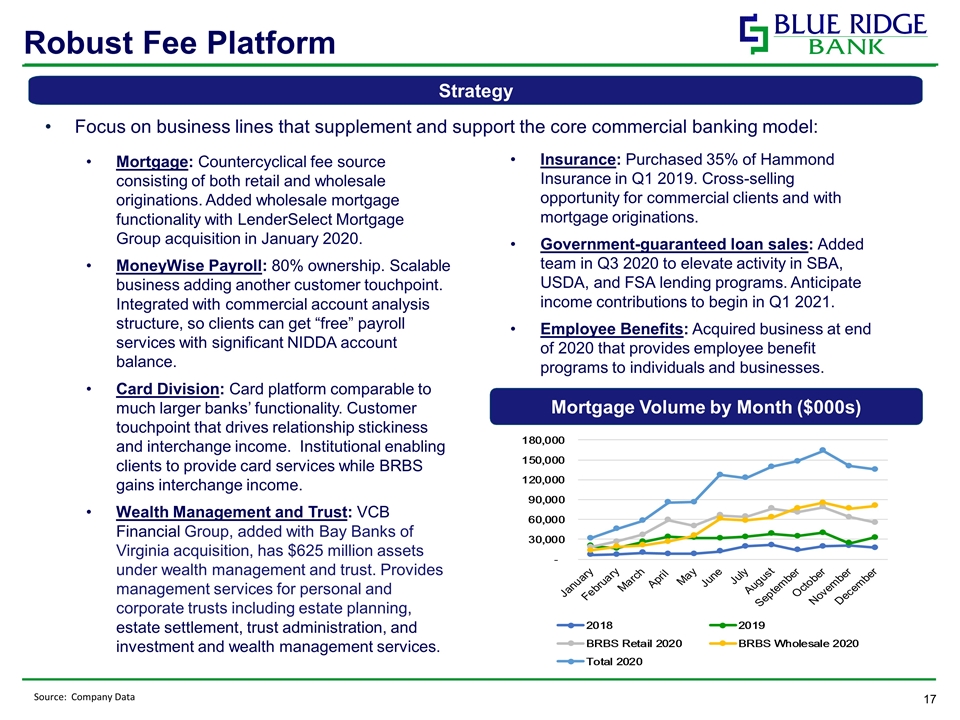

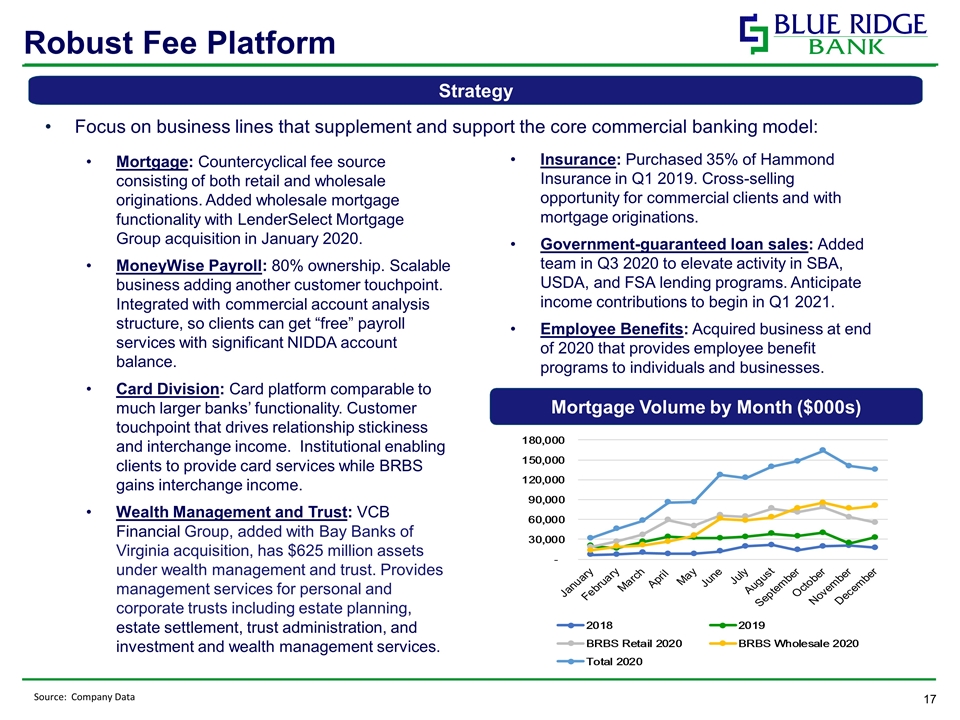

Focus on business lines that supplement and support the core commercial banking model: Robust Fee Platform Strategy Mortgage: Countercyclical fee source consisting of both retail and wholesale originations. Added wholesale mortgage functionality with LenderSelect Mortgage Group acquisition in January 2020. MoneyWise Payroll: 80% ownership. Scalable business adding another customer touchpoint. Integrated with commercial account analysis structure, so clients can get “free” payroll services with significant NIDDA account balance. Card Division: Card platform comparable to much larger banks’ functionality. Customer touchpoint that drives relationship stickiness and interchange income. Institutional enabling clients to provide card services while BRBS gains interchange income. Wealth Management and Trust: VCB Financial Group, added with Bay Banks of Virginia acquisition, has $625 million assets under wealth management and trust. Provides management services for personal and corporate trusts including estate planning, estate settlement, trust administration, and investment and wealth management services. Insurance: Purchased 35% of Hammond Insurance in Q1 2019. Cross-selling opportunity for commercial clients and with mortgage originations. Government-guaranteed loan sales: Added team in Q3 2020 to elevate activity in SBA, USDA, and FSA lending programs. Anticipate income contributions to begin in Q1 2021. Employee Benefits: Acquired business at end of 2020 that provides employee benefit programs to individuals and businesses. Mortgage Volume by Month ($000s) Source: Company Data

Financial Technology (Fintech) Partnerships Actively engaged in Fintech community to create partnerships enabling the Fintech partners and Blue Ridge to capitalize on industry disruption Fintech partnerships generate revenue streams, deposits, and new customers, and drive internal efficiency gains through technology enhancement Fintech partnerships generated approximately $47 million in related deposits as of December 31, 2020

Company News Update Recent Merger with Bay Banks of Virginia, Inc.

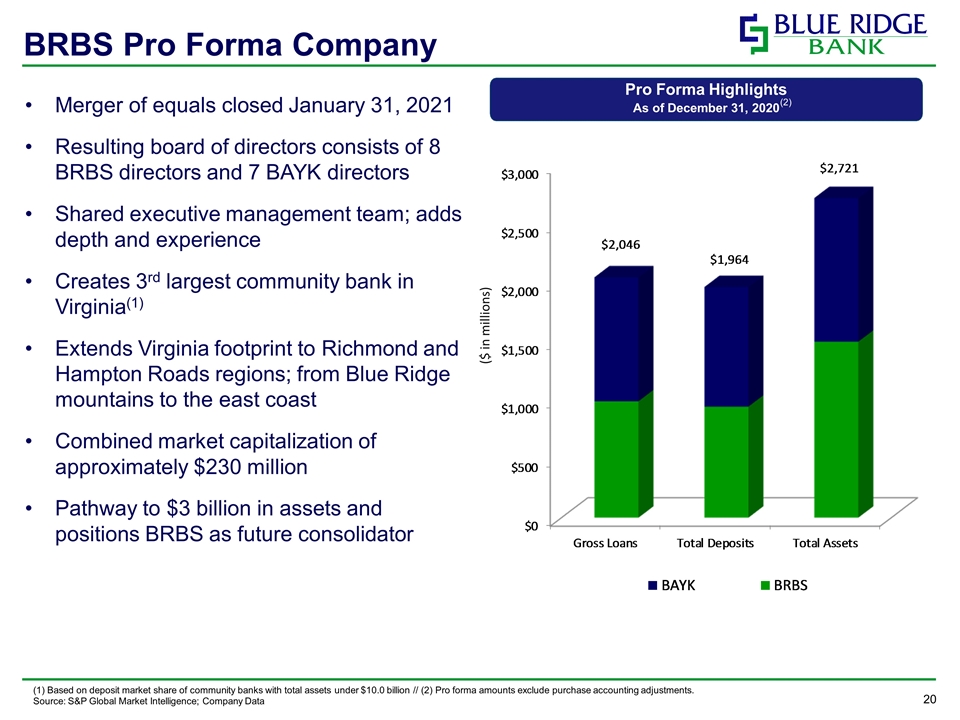

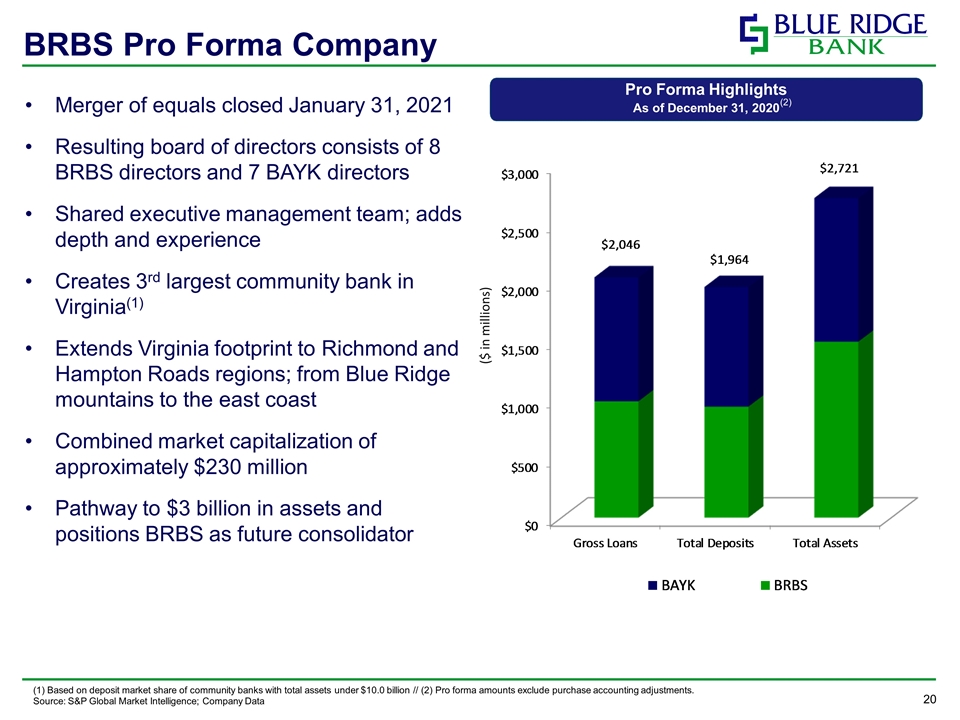

BRBS Pro Forma Company 1, 94, 92 25, 27, 120 2, 152, 52 1, 2, 94 (1) Based on deposit market share of community banks with total assets under $10.0 billion // (2) Pro forma amounts exclude purchase accounting adjustments. Source: S&P Global Market Intelligence; Company Data Merger of equals closed January 31, 2021 Resulting board of directors consists of 8 BRBS directors and 7 BAYK directors Shared executive management team; adds depth and experience Creates 3rd largest community bank in Virginia(1) Extends Virginia footprint to Richmond and Hampton Roads regions; from Blue Ridge mountains to the east coast Combined market capitalization of approximately $230 million Pathway to $3 billion in assets and positions BRBS as future consolidator ($ in millions) Pro Forma Highlights As of December 31, 2020 (2)

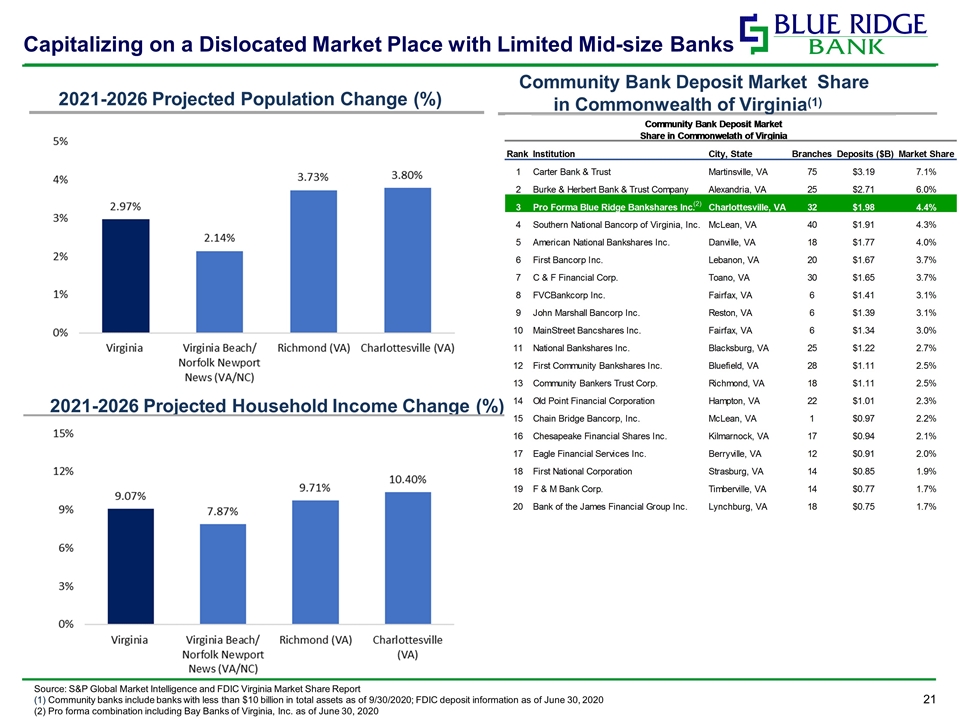

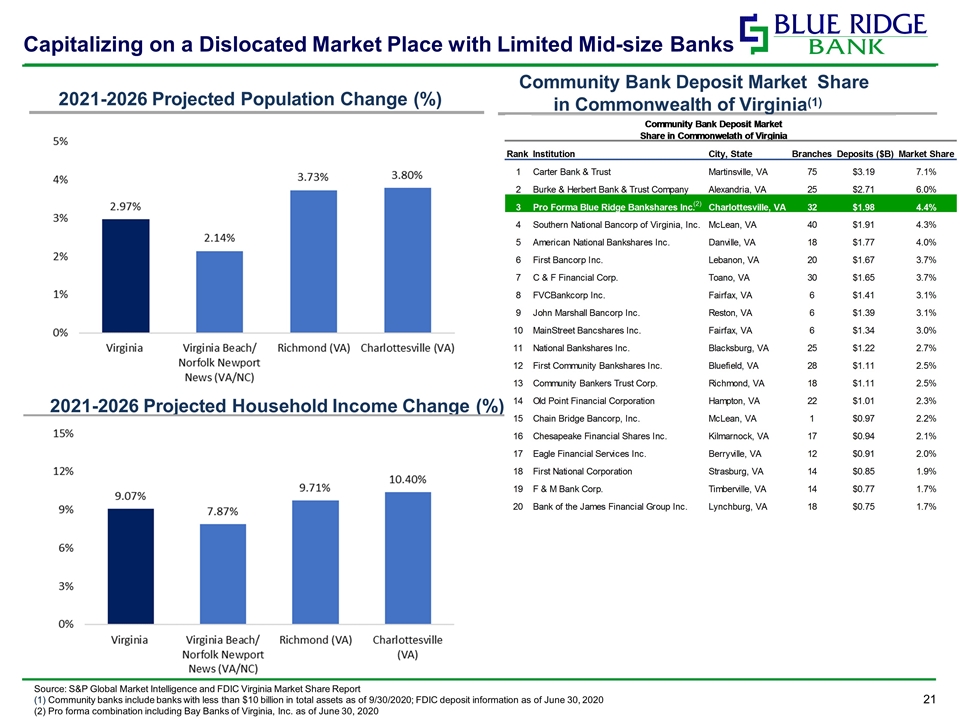

Capitalizing on a Dislocated Market Place with Limited Mid-size Banks Source: S&P Global Market Intelligence and FDIC Virginia Market Share Report (1) Community banks include banks with less than $10 billion in total assets as of 9/30/2020; FDIC deposit information as of June 30, 2020 (2) Pro forma combination including Bay Banks of Virginia, Inc. as of June 30, 2020 2021-2026 Projected Population Change (%) 2021-2026 Projected Household Income Change (%) Community Bank Deposit Market Share in Commonwealth of Virginia(1) (2)

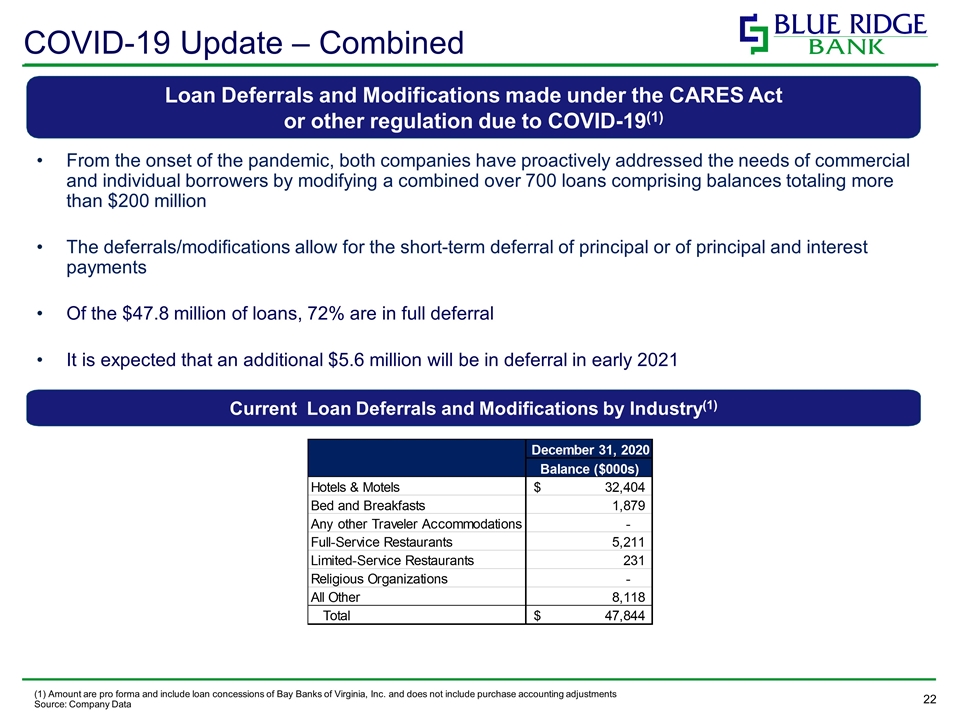

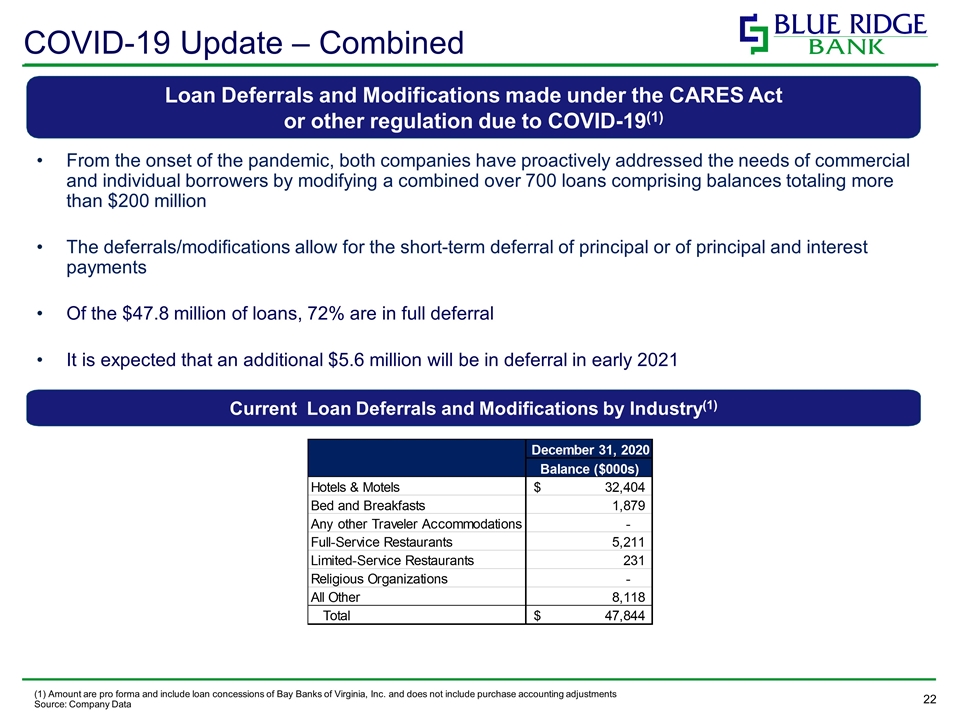

From the onset of the pandemic, both companies have proactively addressed the needs of commercial and individual borrowers by modifying a combined over 700 loans comprising balances totaling more than $200 million The deferrals/modifications allow for the short-term deferral of principal or of principal and interest payments Of the $47.8 million of loans, 72% are in full deferral It is expected that an additional $5.6 million will be in deferral in early 2021 COVID-19 Update – Combined (1) Amount are pro forma and include loan concessions of Bay Banks of Virginia, Inc. and does not include purchase accounting adjustments Source: Company Data Loan Deferrals and Modifications made under the CARES Act or other regulation due to COVID-19(1) Current Loan Deferrals and Modifications by Industry(1)

Minimize COVID-19 asset quality impact as government support wanes Looking Forward Execute BAYK integration Grow efforts to partner with and integrate Fintech providers Drive cross-selling opportunities across business lines Capitalize on current Paycheck Protection Program round and any future targeted programs Leverage footprint and scale to grow quality relationships

Appendix

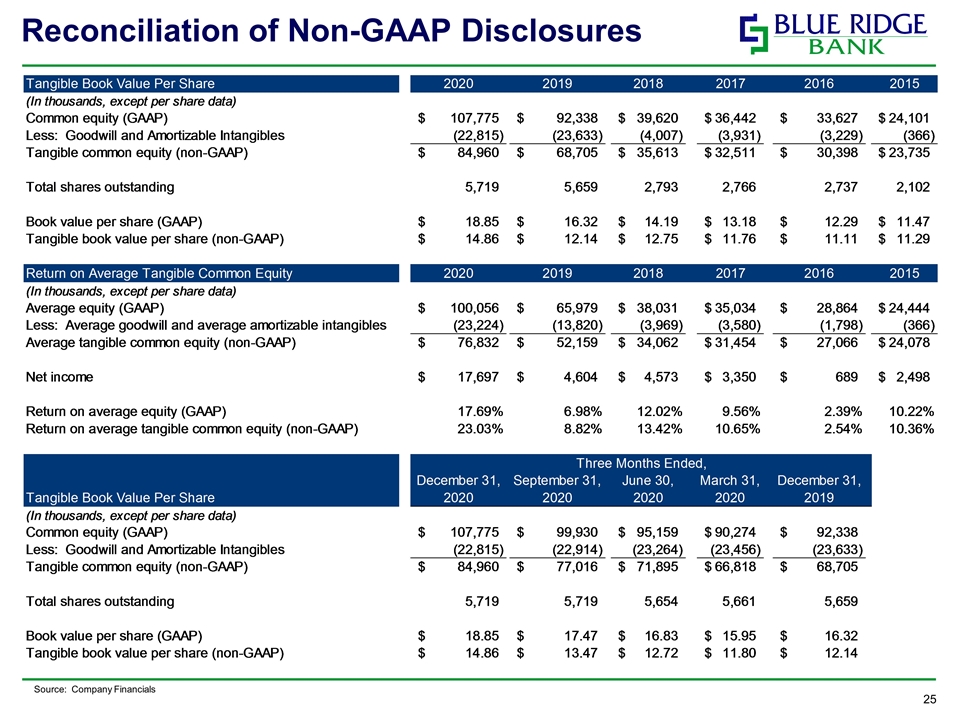

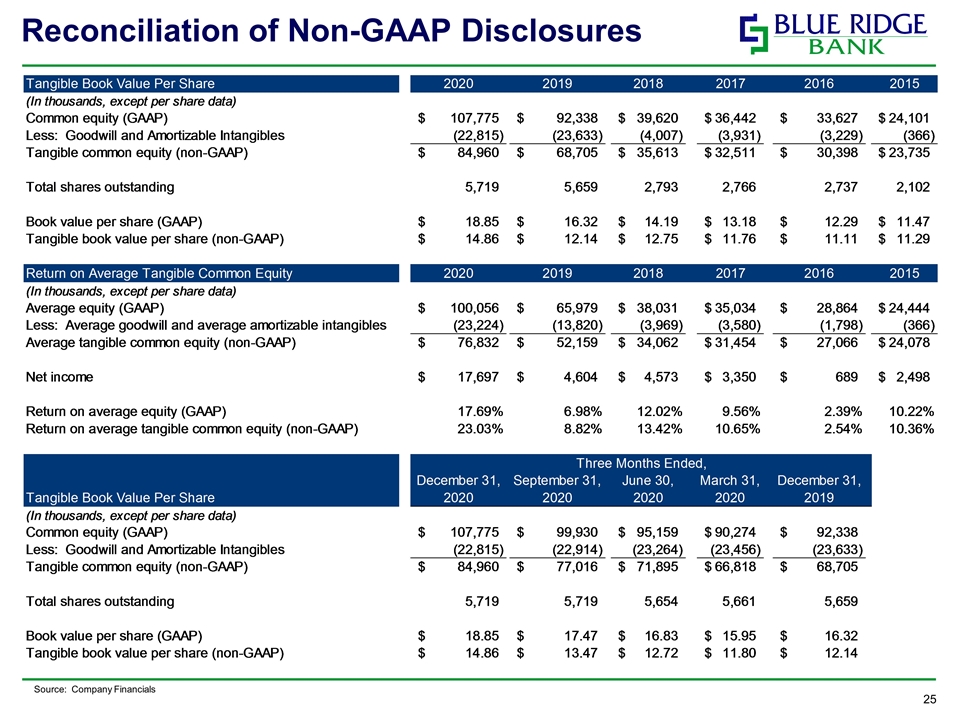

Reconciliation of Non-GAAP Disclosures Source: Company Financials

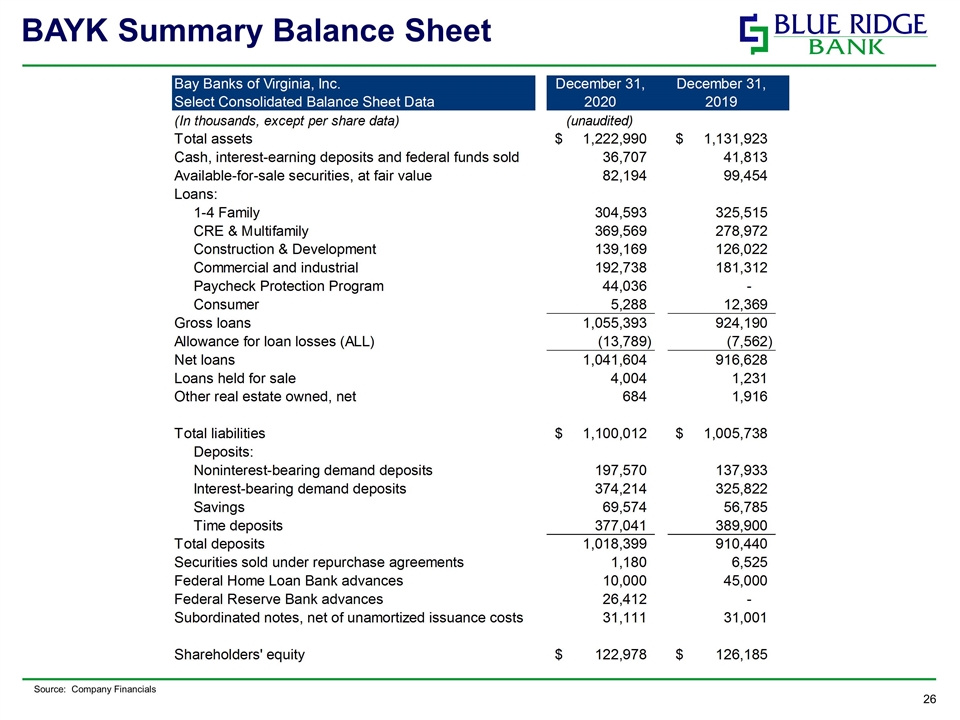

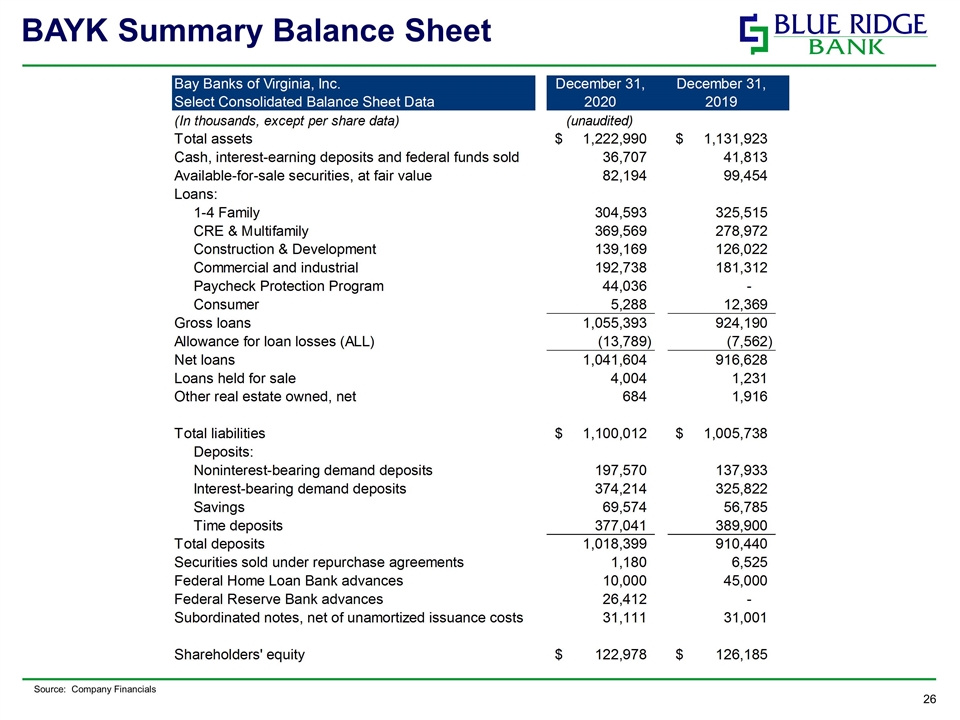

BAYK Summary Balance Sheet Source: Company Financials

Contact Information Brian Plum Chief Executive Officer (540) 843-5207 bplum@mybrb.com Judy Gavant Chief Financial Officer (804) 518-2606 Judy.Gavant@vcb.bank www.mybrb.com