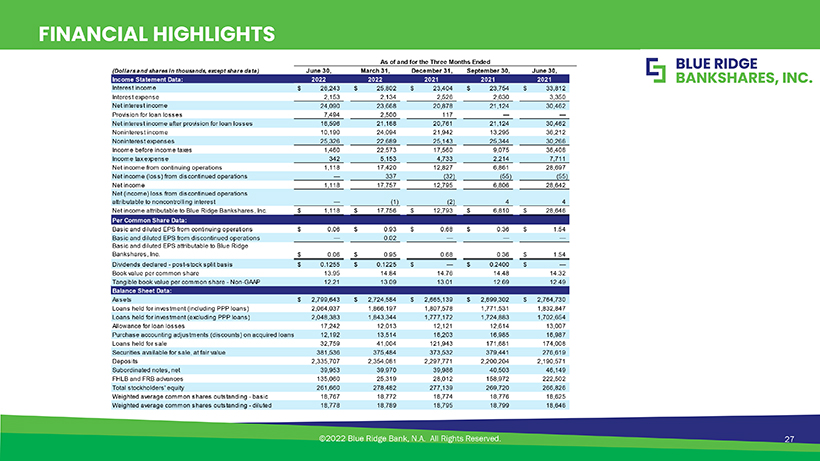

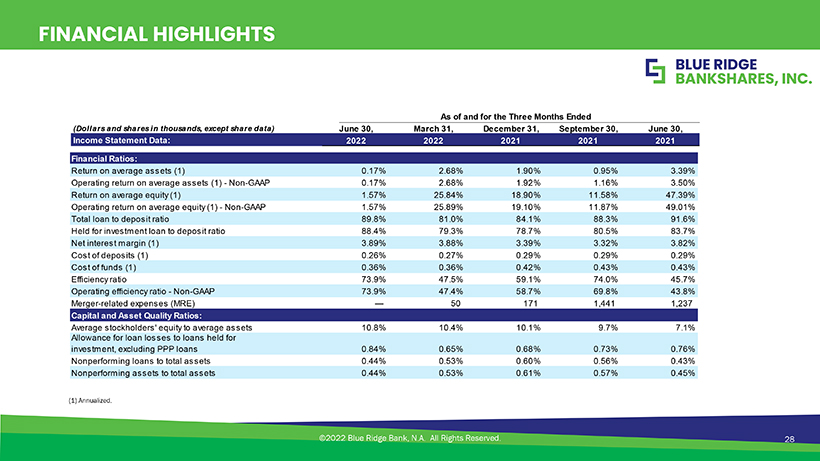

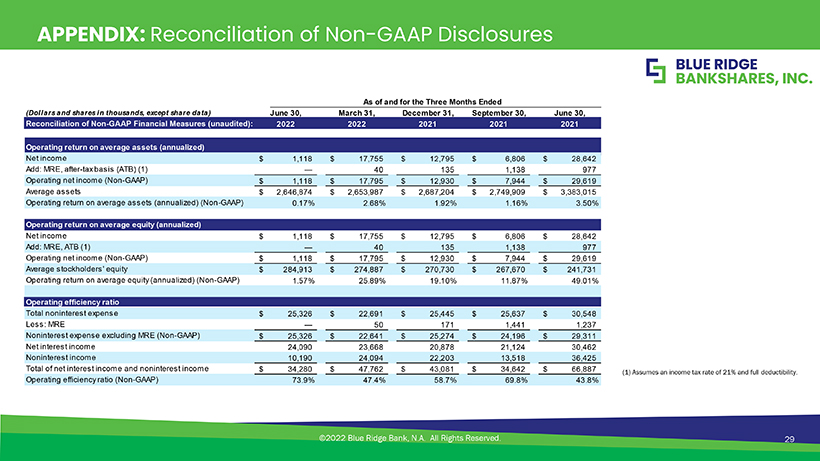

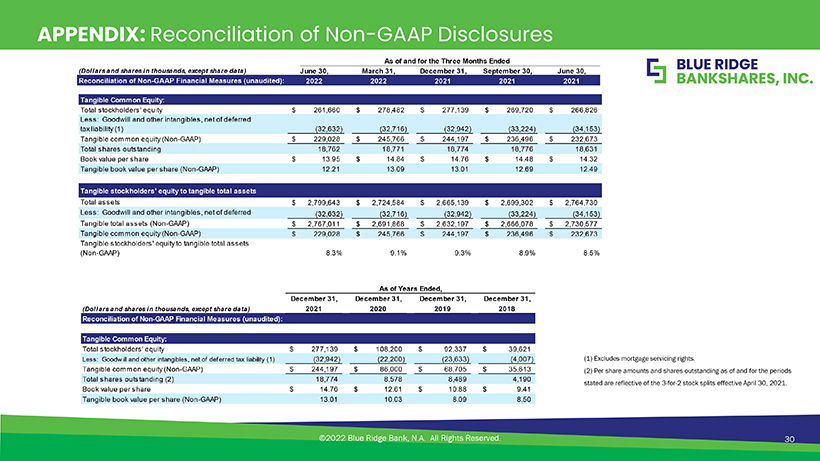

DISCLOSURE Forward-Looking Statements This presentation of Blue Ridge Bankshares, Inc. (the “Company”) contains forward-looking statements within the substitute competitors’ products and services for the Company’s products and services; the Company’s inability to meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements represent successfully manage growth or implement its growth strategy; the effect of acquisitions the Company may make, plans, estimates, objectives, goals, guidelines, expectations, intentions, projections, and statements of including, without limitation, disruption of employee or customer relationships, and the failure to achieve the management’s beliefs concerning future events, business plans, objectives, expected operating results, and the expected revenue growth and/or expense savings from such acquisitions; the Company’s participation in the PPP assumptions upon which those statements are based. Forward-looking statements include without limitation, any statement that may predict, forecast, indicate, or imply future results, performance or achievements, and are established by the U.S. government and its administration of the loans and processing fees earned under the typically identified with words such as “may,” “could,” “should,” “will,” “would,” “believe,” “anticipate,” “estimate,” program; the Company’s involvement, from time to time, in legal proceedings, and examination and remedial “expect,” “aim,” “intend,” “plan,” or words or phases of similar meaning. The Company cautions that the forward- actions by regulators; the Company’s potential exposure to fraud, negligence, computer theft, and cyber-crime; the looking statements are based largely on management’s expectations and are subject to a number of known and Bank’s ability to pay dividends; and the Bank’s ability to effectively manage its fintech partnerships, and the unknown risks and uncertainties that are subject to change based on factors which are, in many instances, abilities of those fintech companies to perform as expected. beyond its control. Actual results, performance, or achievements could differ materially from those contemplated, expressed, or implied by the forward-looking statements. The foregoing factors should not be considered exhaustive and should be read together with other cautionary statements that are included elsewhere in documents the Company files from time to time with the SEC including The following factors, among others, could cause the Company’s financial performance to differ materially from those discussed in the section entitled “Risk Factors.” If one or more of the factors affecting forward-looking that expressed in such forward-looking statements: the strength of the United States economy in general and the information and statements proves incorrect, then actual results, performance or achievements could differ strength of the local economies in which it conducts operations; changes in the level of the Company’s materially from those expressed in, or implied by, forward-looking information and statements contained in this nonperforming assets and charge-offs; management of risks inherent in the Company’s real estate loan portfolio, and the risk of a prolonged downturn in the real estate market, which could impair the value of collateral and the presentation. Therefore, the Company cautions not to place undue reliance on its forward-looking information and ability to sell collateral upon any foreclosure; the effects of, and changes in, trade, monetary, and fiscal policies statements. The Company will not update the forward-looking statements to reflect actual results or changes in the and laws, including interest rate policies of the Federal Reserve, inflation, interest rate, market, and monetary factors affecting the forward-looking statements. New risks and uncertainties may emerge from time to time, and it fluctuations; changes in consumer spending and savings habits; the Company’s ability to identify, attract, and is not possible for the Company to predict their occurrence or how these risks and uncertainties will affect it. retain experienced management, relationship managers, and support personnel, particularly in a competitive labor environment; technological and social media changes impacting the Company, the Bank, and the financial Non-GAAP Financial Measures services industry, in general; changing bank regulatory conditions, laws, regulations, policies, or programs, whether arising as new legislation or regulatory initiatives, that could lead to restrictions on activities of banks This presentation contains financial information determined by methods other than in accordance with accounting generally, or the Bank in particular, more restrictive regulatory capital requirements, increased costs, including principles generally accepted in the United States of America (“GAAP”). The accounting and reporting policies of the deposit insurance premiums, increased regulations, prohibition of certain income producing activities, or changes Company conform to GAAP and prevailing practices in the banking industry. However, management uses certain in the secondary market for loans and other products; the impact of changes in laws, regulations, and policies non-GAAP measures to supplement the evaluation of the Company’s performance. These non-GAAP measures affecting the real estate industry; the effect of changes in accounting policies and practices, as may be adopted include operating return on average assets, operating return on average equity, operating efficiency ratio, tangible from time to time by bank regulatory agencies, the SEC, the Public Company Accounting Oversight Board, the common equity, tangible total assets, tangible book value per common share, etc. Management believes FASB, or other accounting standards setting bodies; the impact of the COVID-19 pandemic on the Company’s presentations of these non-GAAP financial measures provide useful supplemental information that is essential to a customers and employees, and the associated efforts by the Company and others to limit the spread of the virus; proper understanding of the operating results of the Company’s core businesses. These non-GAAP disclosures the occurrence of significant natural disasters, including severe weather conditions, floods, health related issues, should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they and other catastrophic events; geopolitical conditions, including acts or threats of terrorism and/or military conflicts, including the military conflict between Russia and Ukraine, or actions taken by the U.S. or other necessarily comparable to non-GAAP performance measures that may be presented by other companies. governments in response to acts or threats of terrorism and/or military conflicts, which could impact business and Reconciliations of GAAP to non-GAAP measures are included at the end of this presentation. economic conditions in the U.S. and abroad; the timely development of competitive new products and services and the acceptance of these products and services by new and existing customers; the willingness of users to ©2022 Blue Ridge Bank, N.A. All Rights Reserved. 2