(f) Conversion of Series B Preferred Stock. In the event that all (but not less than all) outstanding shares of Series B Preferred Stock (other than with respect to any Holder that are prohibited from conversion as a result of the Ownership Limit (as defined below)) are converted, automatically or by action of the holders thereof, into Common Stock pursuant to the provisions of the Company’s Articles of Incorporation as then in effect, then from and after the date on which such outstanding shares of Series B Preferred Stock have been so converted, this Warrant shall be exercisable, subject to Section 11, for such number of shares of Common Stock into which the Warrant Shares would have been converted had the Warrant Shares been outstanding on the date of such conversion as provided in the Company’s Articles of Amendment as then in effect, and the Exercise Price shall equal the Exercise Price in effect as of immediately prior to such conversion divided by the number of shares of Common Stock into which one Warrant Share would have been converted on such date, all subject to further adjustment thereafter from time to time in accordance with the provisions of this Warrant. Within a reasonable period thereafter, the Company shall furnish to the Holder a like Warrant reflecting the foregoing and corresponding adjustments in substitution for this Warrant, but only upon receipt of this original Warrant or, if this Warrant is mutilated, lost, stolen, or destroyed, a customary and reasonable indemnity and surety bond, if requested by the Company.

(g) Calculations. All calculations under this Section 9 shall be made to the nearest cent or the nearest share, as applicable.

(h) Notice of Adjustments. Upon the occurrence of each adjustment pursuant to this Section 9, the Company at its expense will, at the written request of the Holder, promptly compute such adjustment, in good faith, in accordance with the terms of this Warrant and prepare a certificate setting forth such adjustment, including a statement of the adjusted Exercise Price and adjusted number or type of Warrant Shares or other securities issuable upon exercise of this Warrant (as applicable), describing the transactions giving rise to such adjustments and showing in detail the facts upon which such adjustment is based. Upon written request, the Company will promptly deliver a copy of each such certificate to the Holder and to the Company’s transfer agent.

(i) Notice of Corporate Events. If, while this Warrant is outstanding, the Company (i) declares a dividend or any other distribution of cash, securities or other property in respect of its Series B Preferred Stock, including, without limitation, any granting of rights or warrants to subscribe for or purchase any capital stock of the Company or any subsidiary, (ii) authorizes or approves, enters into any agreement contemplating or solicits stockholder approval for any Fundamental Transaction or (iii) authorizes the voluntary dissolution, liquidation or winding up of the affairs of the Company, then, except if such notice and the contents thereof shall be deemed to constitute material non-public information, the Company shall deliver to the Holder a notice of such transaction at least ten (10) Trading Days prior to the applicable record or effective date on which a Person would need to hold Series B Preferred Stock in order to participate in or vote with respect to such transaction; provided, that no notice shall be required if information is disseminated in a press release or document furnished or filed with the Commission; and provided, further, that the failure to deliver such notice or any defect therein shall not affect the validity of the corporate action required to be described in such notice. To the extent that any notice provided hereunder constitutes, or contains, material, non-public information regarding the Company or any of its subsidiaries, the Company shall simultaneously file such notice with the Commission (as defined in the Purchase Agreement) pursuant to a Current Report on Form 8-K.

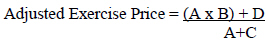

10. Payment of Exercise Price. The Holder shall pay the Exercise Price in immediately available funds; provided, however, that if, on any Exercise Date there is not an effective Registration Statement registering, or no current prospectus available for, the resale of the Warrant Shares by the Holder, then the Holder may, in its sole discretion, satisfy its obligation to pay the Exercise Price through a “cashless exercise”, in which event the Company shall issue to the Holder the number of Warrant Shares determined as follows:

10