SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

Commission File Number: 000-19182

For the month of: March 2005

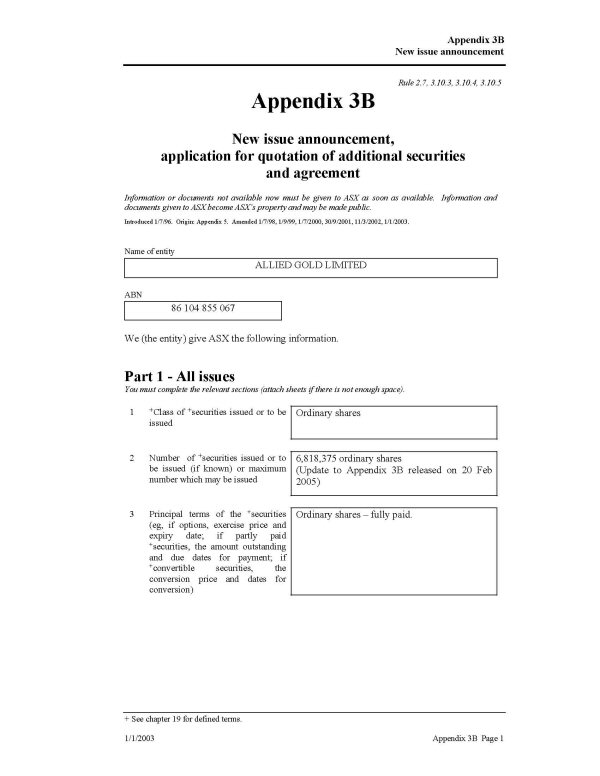

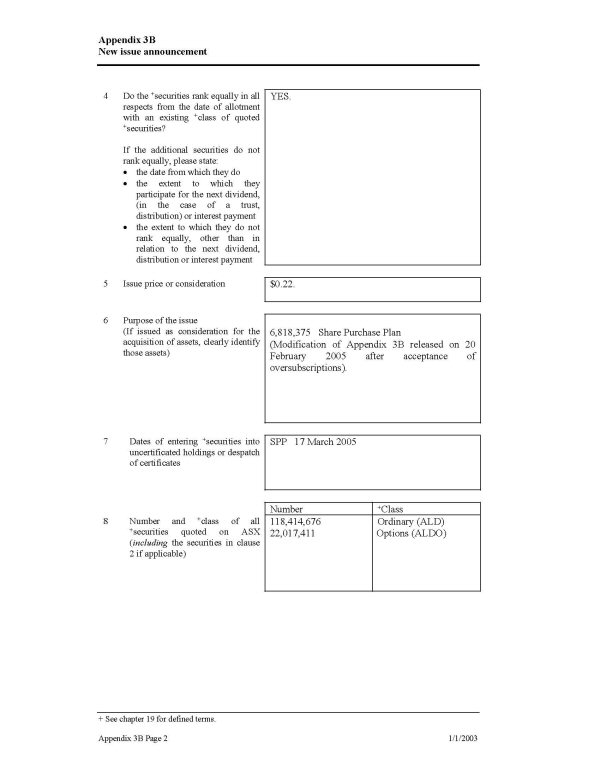

| ALLIED GOLD LIMITED |

| (Translation of registrant’s name into English) |

| Unit 15, Level 1, 51-53 Kewdale Road, Welshpool, W.A. 6106 Australia |

| (Address of principal executive offices) |

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to rule 12g3-2(b) under the Securities Exchange Act of 1934.

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b) 82 —

-1-

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | ALLIED GOLD LIMITED

(Registrant) |

| Date: May 12, 2005 | By: /s/ David Lymburn

David Lymburn

Corporate Secretary |

EXHIBIT INDEX

-2-

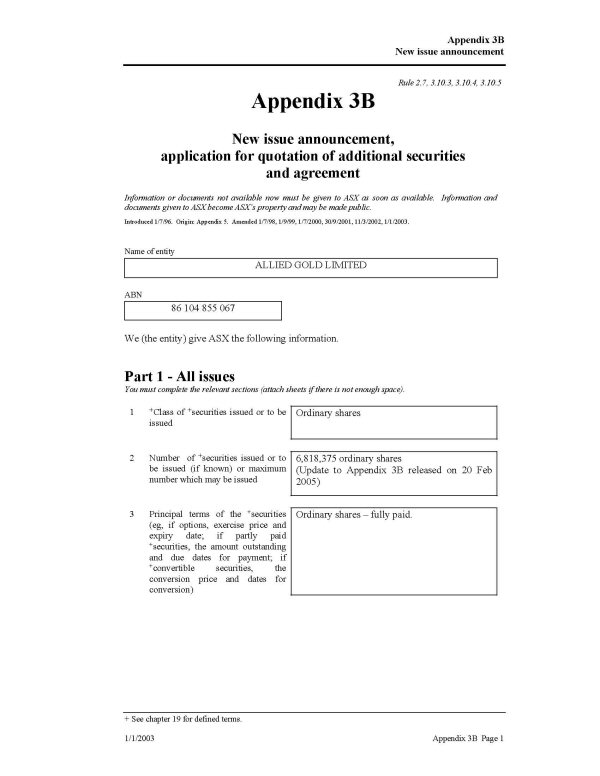

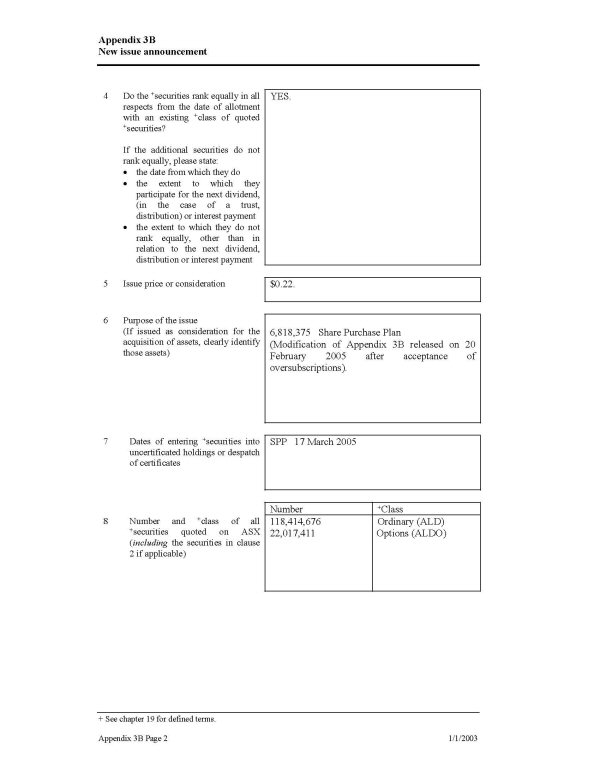

EXHIBIT 1

| ALLIED GOLD LTD

ACN 104 855 067

ABN 86 104 855 067 | Unit 15, Level 1, 51-53 Kewdale Road

Welshpool, Western Australia 6106

PO Box 235, Welshpool DC 6986

Telephone: 61 8 9353 3638

Facsimile: 61 8 9353 4894

Email: info@alliedgold.com.au

Web: www.alliedgold.com.au |

11 March 2005

Australian Stock Exchange

Company Announcements

“This press release is not for dissemination in the United States and shall not be disseminated to United States news services.”

CAPITAL RAISING UPDATE

TOTAL FUNDS ACCEPTED FROM THE PLACEMENT AND SPP OF $10.5

MILLION

Allied Gold Limited (ASX:ALD) announces that it has closed a Shareholder Purchase Plan (SPP).

As detailed in the Letter to Shareholders dated 21 February 2005 the Offer of Shares under the Plan was limited to 4,545,454 shares at a purchase price of $0.22 per share ($1 million). The Company is pleased to report that the offer was strongly oversubscribed with a total of $2.54 million being received during the Offer period. The Directors have elected to accept oversubscriptions of $0.5 million which will result in Shares being allocated to applicants on a pro-rata basis with total funds being accepted from the SPP of $1.5 million.

The Directors thank Allied’s shareholders for their strong endorsement of support via the SPP.

Further to the SPP, on 28 February Allied announced the completion of a fully subscribed placement which raised $9 million, resulting intotal funds received from the placement and SPP of $10.5 million.

Allied proposes to use these funds to progress the development of the Simberi Gold Project located in eastern Papua New Guinea.

This will include:

| | • | | settling the purchase of outstanding joint venture interests in the Simberi Mining Joint Venture (SMJV) and Tabar Exploration Joint Venture (TEJV) from Simberi Gold Corporation, a Canadian listed company; |

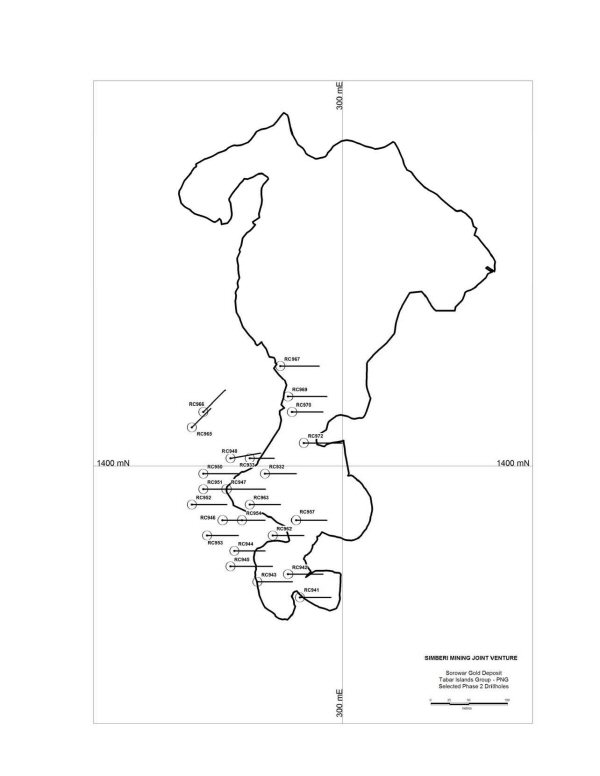

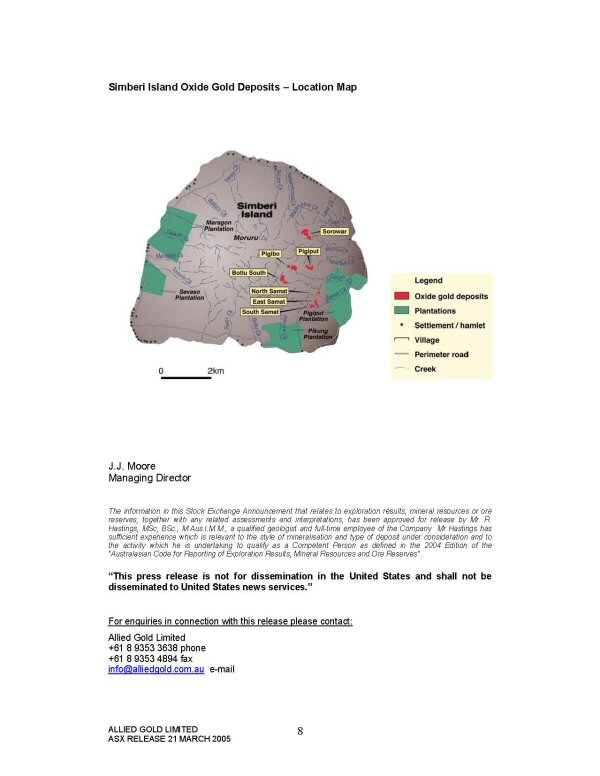

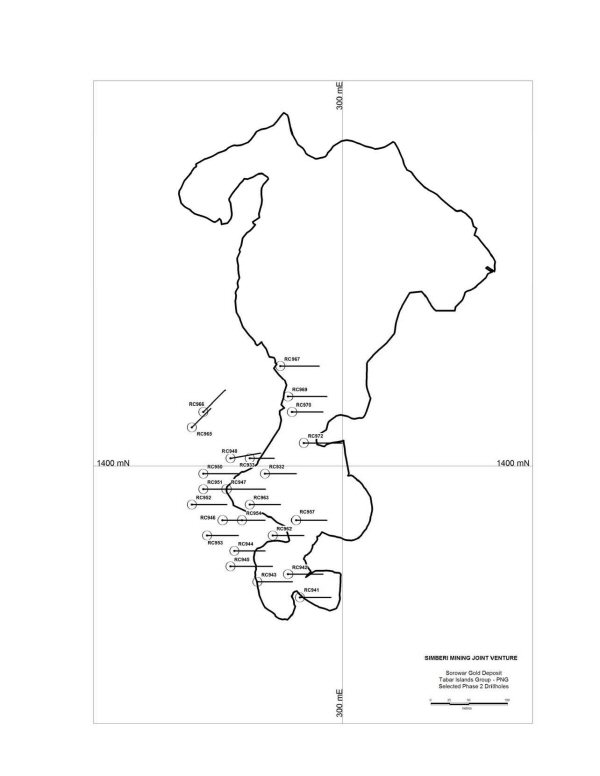

| | • | | completing exploration and reserve definition at the Sorowar oxide gold deposit on Simberi Island; |

| | • | | accelerating exploration for sulphide and additional oxide gold deposits throughout the Tabar Island Group; and |

| | • | | finalising the Simberi Oxide Gold Project Feasibility Study to enable project development. |

Funds will also be available for working capital.

Following settlement of the acquisition of the outstanding joint venture interests, which is scheduled to occur on or before 1 April 2005, Allied will own 87.5% of the SMJV and 100% of the TEJV. Allied has the right to proceed to 100% ownership by the issue of Allied shares at a minimum price of $0.50 to Simberi Gold Corporation at the earlier of a decision to mine (by Allied) or 31 December 2009.

The funds received from the capital raising and SPP results in Allied being fully funded to finalise the upgraded Simberi Oxide Gold Project Feasibility Study by mid2005 as a precursor to project development and commissioning. The Company is also now strongly positioned to proceed with substantial geophysical exploration and drilling programmes to identify further oxide and sulphide gold deposits on Simberi and Tatau Islands and gold/copper deposits on Tatau and Tabar Islands.

Low-level, detailed helicopter-borne geophysical surveys were completed in February and ground preparation and survey line clearing has been completed to enable induced polarization (“IP”) geophysical surveys to be carried out on Simberi and Tatau Islands to test for the sub-surface signatures indicative of sulphide-hosted gold and gold/copper type deposits.

On 4 March 2005, 40,909,091 ordinary shares at 22 cents each were allotted pursuant to the placement and a further 6,818,182 shares, also at 22 cents, will be issued and allotted pursuant to the SPP on 17 March 2005.

RED DAM OPTION

On 27 July 2004, Allied entered into an Option Agreement with Siberia Mining Corporation Limited (“SMC”) for the sale of the Red Dam Gold Project. On 8 March 2005 SMC paid a fee of $100,000 to Allied for an extension to the Option whereby SMC have the right to exercise the Option at any time prior to 27 July 2005 by payment of $850,000.

Yours faithfully

J. J. Moore

Managing Director

The information in this Stock Exchange Announcement that relates to exploration results, mineral resources or ore reserves, together with any related assessments and interpretations, has been approved for release by Mr. R. Hastings, MSc, BSc., M.Aus.I.M.M., a qualified geologist and full-time employee of the Company Mr Hastings has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined in the 2004 Edition of the “Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves”.

“This press release is not for dissemination in the United States and shall not be disseminated to United States news services.”

For enquiries in connection with this release please contact:

Allied Gold Limited

+61 8 9353 3638 phone

+61 8 9353 4894 fax

info@alliedgold.com.au e-mail

Forward-Looking Statements.

This press release contains forward-looking statements concerning the projects owned by Allied. Statements concerning mineral reserves and resources may also be deemed to be forward-looking statements in that they involve estimates, based on certain assumptions, of the mineralisation that will be found if and when a deposit is developed and mined. Forward-looking statements are not statements of historical fact, and actual events or results may differ materially from those described in the forward-looking statements, as the result of a variety of risks, uncertainties and other factors, involved in the mining industry generally and the particular properties in which Allied has an interest, such as fluctuation in gold prices; uncertainties involved in interpreting drilling results and other tests; the uncertainty of financial projections and cost estimates; the possibility of cost overruns, accidents, strikes, delays and other problems in development projects, the uncertain availability of financing and uncertainties as to terms of any financings completed; uncertainties relating to environmental risks and government approvals, and possible political instability or changes in government policy in jurisdictions in which properties are located.

Forward-looking statements are based on management’s beliefs, opinions and estimates as of the date they are made, and no obligation is assumed to update forward-looking statements if these beliefs, opinions or estimates should change or to reflect other future developments.

Not an offer of securities or solicitation of a proxy.

This communication is not a solicitation of a proxy from any security holder of Allied, nor is this communication an offer to purchase nor a solicitation to sell securities. Any offer will be made only through an information circular or proxy statement or similar document. Investors and security holders are strongly advised to read such document regarding the proposed business combination referred to in this communication, if and when such document is filed and becomes available, because it will contain important information. Any such document would be filed by Allied with the Australian Securities and Investments Commission, the Australian Stock Exchange and with the U.S. Securities and Exchange Commission (SEC).

EXHIBIT 2

EXHIBIT 3

EXHIBIT 4

ALLIED GOLD LTD

ABN 86 104 855 067

HALF-YEAR FINANCIAL REPORT

31 DECEMBER 2004

ALLIED GOLD LTD

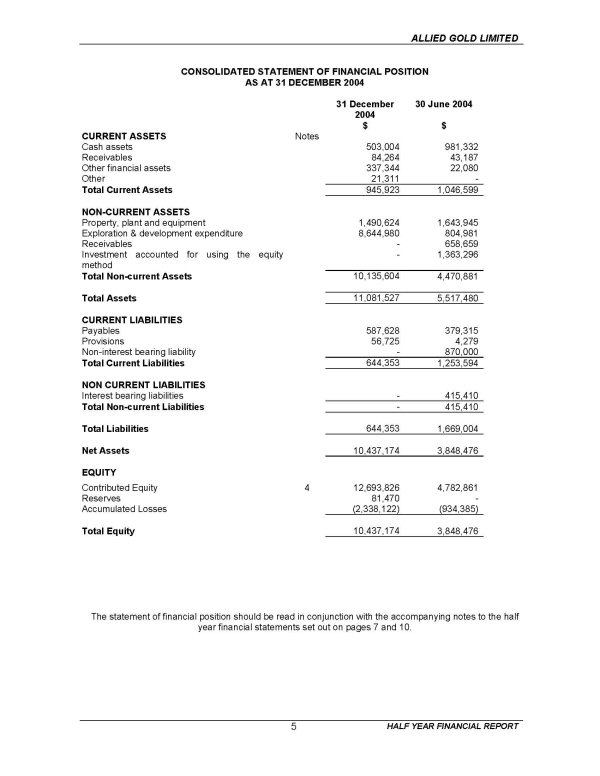

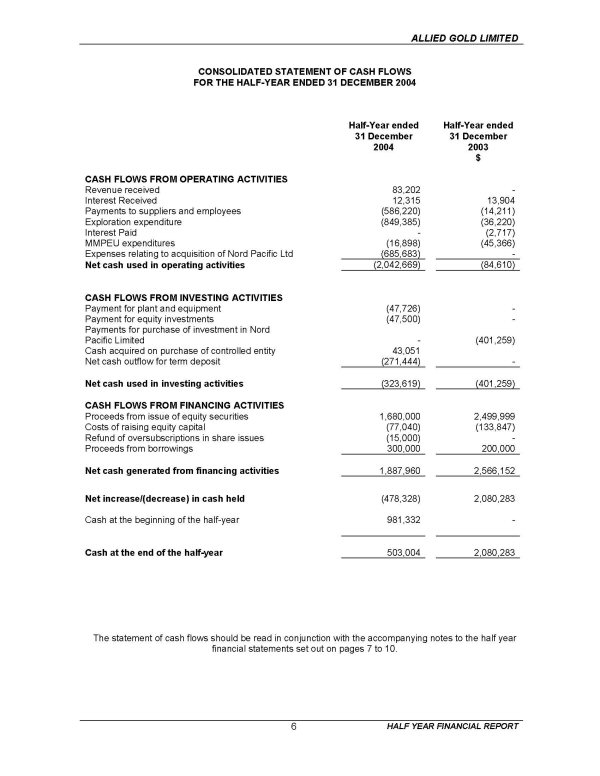

DIRECTORS’ REPORT

The Directors present their report on the Consolidated Entity, consisting of Allied Gold Ltd (the “Company”) and the entities it controlled at the end of or during the half-year ended 31 December 2004.

DIRECTORS

The Directors of the Company in office during or since the end of the half year are:

| |

|---|

| Mark V Caruso | | Chairman | |

| Jeffrey J Moore | | Managing Director | |

| David A Lymburn | | Non Executive | |

RESULTS

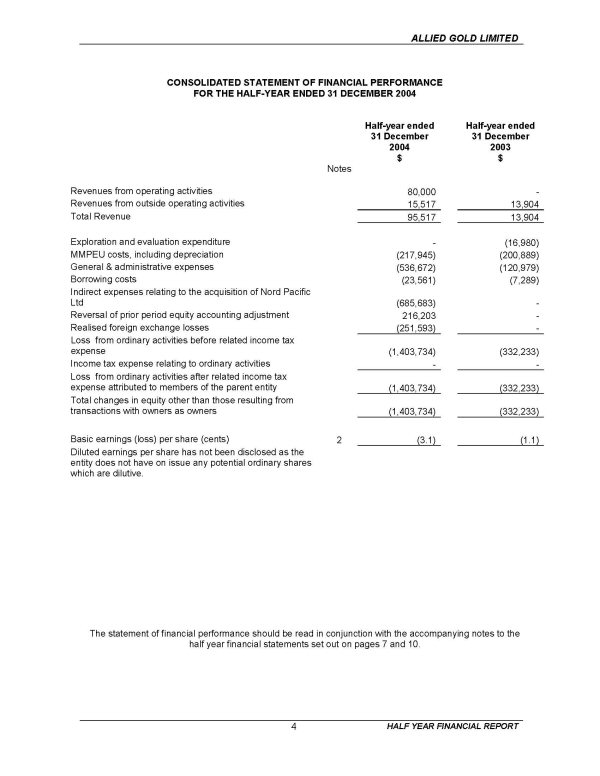

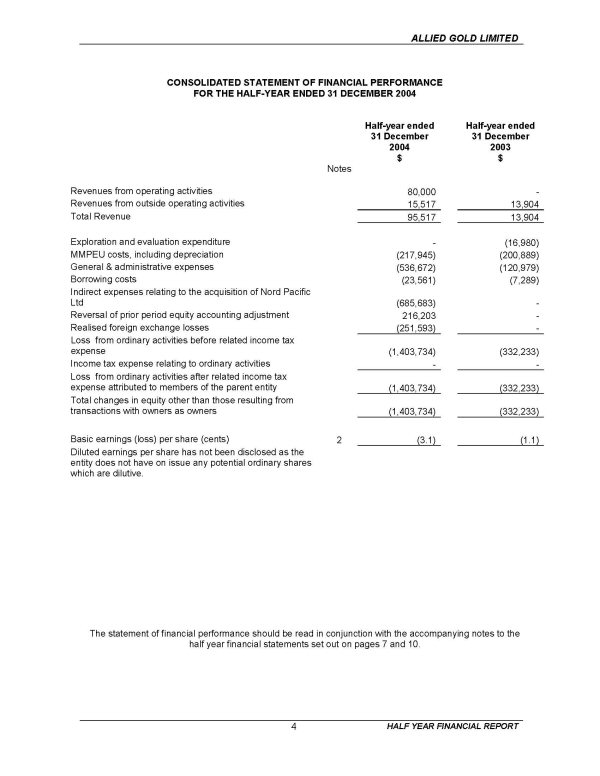

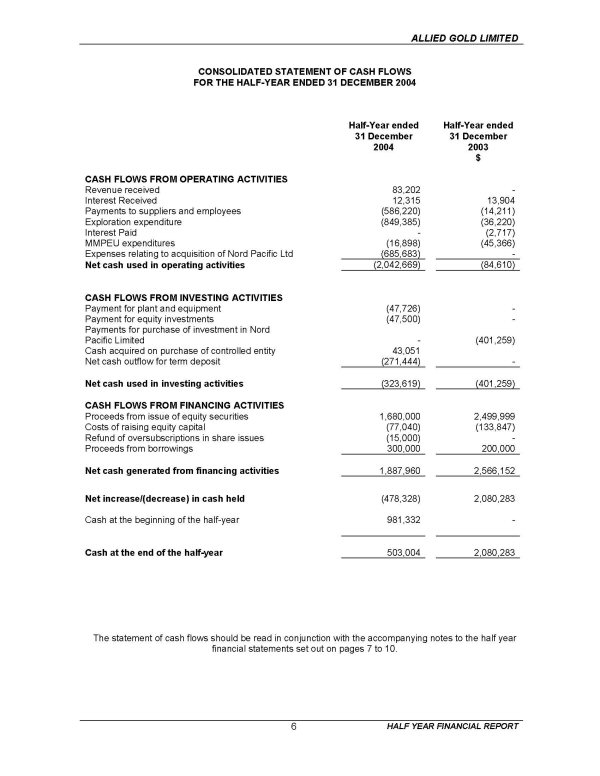

The loss of the consolidated entity after income tax attributable to members of the parent entity was $1,403,734 (2003, $332,233). This includes indirect expenses relating to the acquisition of Nord Pacific Limited of $685,683.

REVIEW OF OPERATIONS

Highlights of the Company’s operations for the period under review are as follows.

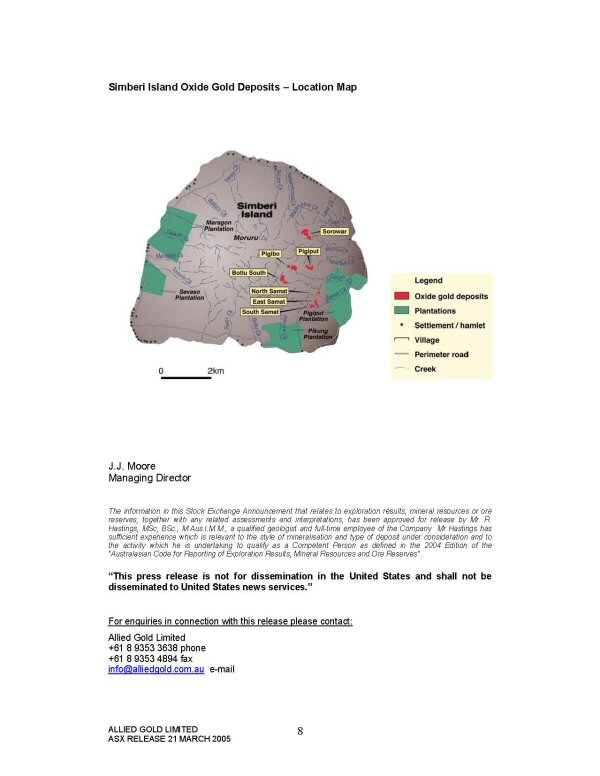

Simberi Gold Project

By an agreement dated 20 December 2003, the Company agreed to acquire 100% of Nord Pacific Ltd (Nord) by way of a Plan of Arrangement (Nord Transaction). Nord is registered in New Brunswick, Canada, and had its head office in Albuquerque, New Mexico.

Nord’s principal asset is the Simberi Gold Project comprising the Simberi Mining Joint Venture (SMJV) and the Tabar Exploration Joint Venture (TEJV). The SMJV and the TEJV respectively hold a mining lease (ML 136) and exploration licence (EL 609) covering essentially all of the land area of the Tabar Islands, located in the New Ireland Archipelago in eastern Papua New Guinea. Under the terms of the SMJV, Nord and Toronto listed company Simberi Gold Corporation (SGC) each hold a 50% interest. Nord holds a 99% interest in the TEJV.

The Plan of Arrangement was approved by Nord shareholders on 11 September 2004. On 17 September 2004, the Company’s shareholders approved the issue of 22,170,176 shares to Nord shareholders in exchange for all the Nord shares on issue not already owned by the Company, and the issue of 1,400,000 shares to Nord Resources Corporation in satisfaction of a debt owed by Nord.

The Plan of Arrangement became unconditional following approval by the Court of the Queens Bench New Brunswick on 20 September 2004. With effect from this date, Nord Pacific Ltd became a 100% subsidiary of the Company.

On 16 November 2004, the Company announced that it had entered into a heads of agreement with SGC to consolidate the ownership interests of the SMJV and the TEJV. The total cash consideration payable is approximately $4.17 million (representing C$4.0 million). A deposit of approximately $271,000 was paid by the Company in December 2004 and approximately $3.9 million is due at settlement on 1 April 2005.

Upon completion, the Company will hold an 87.5% interest in the SMJV and a 100% interest in the TEJV. SGC retains a free carried 12.5% interest in the SMJV until the earlier of a decision to mine or 31 December 2009, at which point the interest is convertible into Allied Gold shares at the greater of, 50 cents, the last price at which Allied Gold Limited has raised equity capital or the volume weighted average price for the preceding 28 days.

Red Dam

The Red Dam gold project is located near Coolgardie, Western Australia and is comprised of P16/1577 and P16/1578, and applications for M16/344 and P16/2078. The tenements cover a contiguous area of approximately 300ha. The project is located in a structural corridor containing current gold resources exceeding 5Moz. Deposits in this zone include Kundana, White Foil, Frogs Leg, the ABC Line, Mungari East and Carbine.

On 27 July 2004 the Company entered into an Option Agreement with Siberia Mining Corporation Ltd for the sale of the Red Dam gold project for a consideration of between $950,000 and $1,000,000. The option expires on 26 July 2005.

ALLIED GOLD LIMITED

MMPEU

This gold treatment plant is a complete modular treatment plant with equipment and circuits for; crushing (2 stage), grinding & classification, gravity metal recovery, leaching, adsorption, elution, carbon reactivation, bullion smelting and reagent mixing. In 2000 the front end of the plant was set up at the RAV 8 nickel deposit near Ravensthorpe, Western Australia for Tectonic Resources NL. The plant was acquired from Fortescue Metals Group Limited in July 2003 for a consideration of $1,900,000 which was satisfied by the issue of 9,500,000 fully paid ordinary shares. During the half year under review the plant has not been in operational use. Maintenance activity has been conducted.

The Company had entered into an Option Agreement with the promoters of Minera Colibri, a Peruvian gold exploration company, for the sale of the plant for a total consideration of $5,000,000. The option was not exercised.

CHANGES IN STATE OF AFFAIRS

During and since the end of the half year period the Company has issued the following securities.

| SHARES | Number of Shares | Contributed Equity

$ |

|---|

| Balance as at 30 June 2004 | | 28,500,001 | | | |

| Placement - 6 July 2004 | | 4,275,000 | | 855,000 | |

| Nord acquisition - September 2004 | | 22,170,178 | | 4,434,035 | |

| Loan repayment - Nord Resources Corporation | | 1,400,000 | | 280,000 | |

| Placement - 30 November 2004 | | 8,400,000 | | 1,680,000 | |

| Conversion of convertible notes - 30 November 2004 | | 4,805,446 | | 738,970 | |

| Placement - 19 January 2005 | | 2,272,727 | | 500,000 | |

| Issue of shares - Simberi project acquisition fee | | 1,000,000 | | 220,000 | |

| 28 January 2005 | |

| Option conversion | | 19,000 | | 3,800 | |

| Placement - 4 March 2005 | | 40,909,091 | | 9,000,000 | |

| Balance at the date of this report | | 113,751,443 | | | |

| OPTIONS | Number of Options |

|---|

Balance as at 30 June 2004 | |

18,500,000 | |

| Placement - 6 July 2004 | | 1,425,000 | |

| Placement - 30 November 2004 | | 2,799,991 | |

| Conversion of convertible notes - 30 November 2004 | | 861,420 | |

| Issue of options - Simberi project acquisition fee - | | 1,000,000 | |

| 28 January 2005 | |

| Option conversion | | (19,000 | ) |

| Balance at the date of this report | | 24,567,411 | |

SUBSEQUENT EVENTS

Other than the matters discussed elsewhere in this half year financial report, there has not arisen in the interval between the end of the financial period and the date of this report any item, transaction or event of a material and unusual nature likely, in the opinion of the Directors of the Company, to affect significantly the operations of the Company, the results of those operations or the state of affairs of the Company in future financial periods.

| | 2 | HALF YEAR FINANCIAL REPORT |

ALLIED GOLD LIMITED

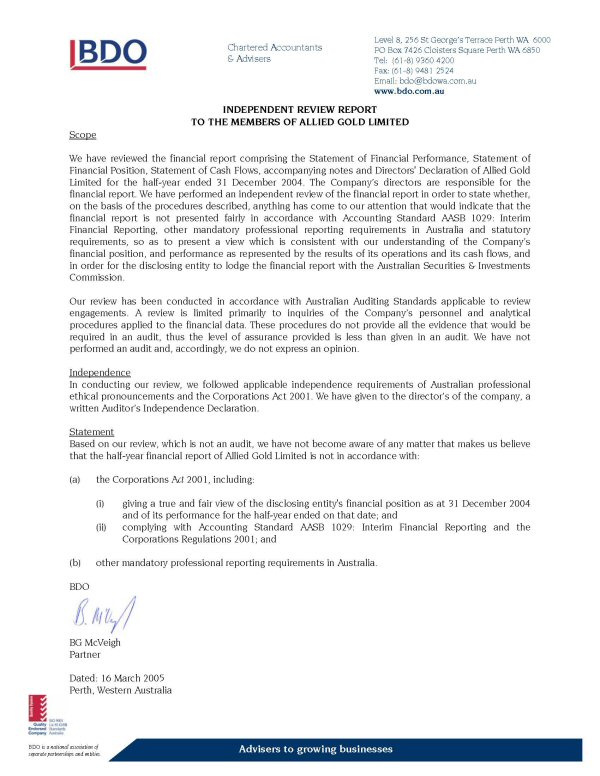

AUDITORS’ INDEPENDENCE DECLARATION

The Auditors’ Independence Declaration on page 12 forms part of the Directors’ Report for the half year ended 31 December 2004. This relates to the audit report, where they state that they have issued an Independent Declaration.

Dated at Perth this 15th day of March 2005.

Signed in accordance with a resolution of the Directors.

/s/ David Lymburn

David Lymburn

Director

| | 3 | HALF YEAR FINANCIAL REPORT |

ALLIED GOLD LIMITED

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE HALF YEAR ENDED 31 DECEMBER 2004

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

1. BASIS OF PREPARATION

The half-year consolidated financial statements are a general purpose financial report prepared in accordance with the requirements of the Corporations Act 2001, Accounting Standard AASB 1029:Interim Financial Reporting, Urgent Issues Group Consensus Views, and other authoritative pronouncements of the Australian Accounting Standards Board.

It is recommended that this financial report be read in conjunction with the annual financial report for the year ended 30 June 2004 and any public announcements made by Allied Gold Ltd and it’s controlled entities during the half-year in accordance with continuous disclosure requirements arising under the Corporations Act 2001.

The accounting policies have been consistently applied by the entities in the economic entity and are consistent with those applied in the 30 June 2004 annual financial report.

The half-year report does not include full disclosures of the type normally included in an annual financial report.

The half year financial report has been prepared on an accruals basis and is based on historical costs and does not take into account changing money values or, except where stated, current valuations of noncurrent assets. Cost is based on the fair values of the consideration given in exchange for assets.

2. EARNINGS PER SHARE (EPS)

| Half-year

ended 31

December 2004

$ | Half-year

ended 31

December 2003

$ |

|---|

Basic earnings/(losses) per share - cents per share | |

(3.1 |

) |

(1.1 |

) |

| | |

| Earnings used in calculation of basic and diluted earnings | |

| per share | | (1,403,734 | ) | (332,233 | ) |

| | |

| Weighted average number of ordinary shares outstanding | |

| during the 6 months used in the calculation of basic and | |

| diluted earnings per share | | 45,236,432 | | 28,500,001 | |

3. DIVIDENDS PAID

No dividends were paid or proposed during the 6 months ended 31 December 2004.

| | 7 | HALF YEAR FINANCIAL REPORT |

ALLIED GOLD LIMITED

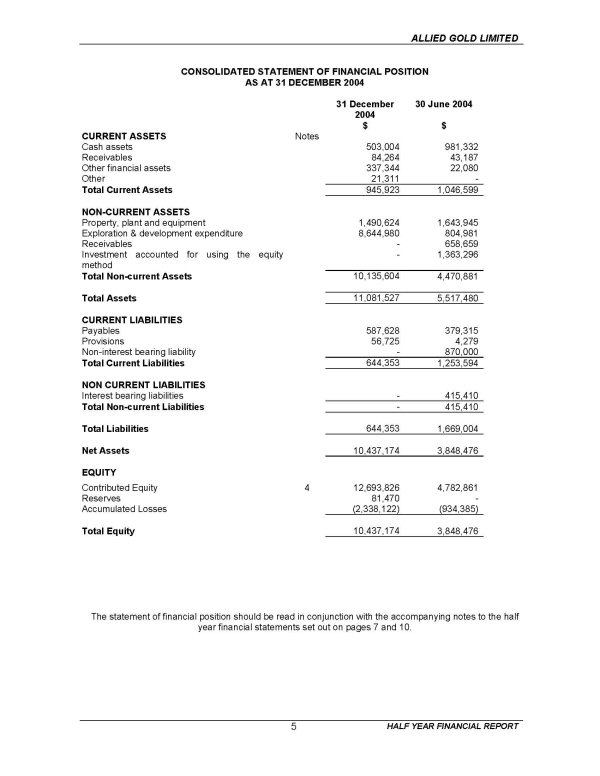

4. CONTRIBUTED EQUITY

| SHARES | 31 December 2004 | 30 June 2004 |

|---|

| Number of

shares | Contributed

equity

$ | Number of

shares | Contributed

equity

$ |

|---|

| Balance at beginning of period | | 28,500,001 | | 4,782,861 | | 28,500,001 | | 4,799,550 | |

| Placement - 6 July 2004 | | 4,275,000 | | 855,000 | | -- | | -- | |

| Nord acquisition - September 2004 | | 22,170,178 | | 4,434,035 | | -- | | -- | |

| Loan repayment - Nord Resources | | 1,400,000 | | 280,000 | | -- | | -- | |

| Corporation | |

| Placement - 30 November 2004 | | 8,400,000 | | 1,680,000 | | -- | | -- | |

| Conversion of convertible notes - | | 4,805,446 | | 738,970 | | -- | | -- | |

| 30 November 2004 | |

| Costs of capital raising for the | | -- | | (77,040 | ) | -- | | (16,689 | ) |

| period | |

| |

|

| Balance at end of period | | 69,550,625 | | 12,693,826 | | 28,500,001 | | 4,782,861 | |

| |

|

5. ACQUISITION OF CONTROLLED ENTITY

At 30 June 2004 the Company owned 44.2% of the issued shares of Nord Pacific Limited. On 24 September 2002 the Company acquired all of the remaining issued shares of Nord Pacific Limited pursuant to a Plan of Arrangement that was approved by the shareholders of Nord Pacific Limited, the shareholders of Allied Gold Limited and the Court of New Brunswick, Canada.

Nord Pacific Limited became a 100% subsidiary of Allied Gold Limited on 24 September 2004.

Details of the purchase consideration and the fair value of the net assets acquired is as follows.

| $ |

|---|

| Purchase consideration | | 5,739,314 | |

| |

|

|---|

| Fair value of net assets acquired | |

| Cash | | 43,051 | |

| Receivables | | 45,229 | |

| Property, plant & equipment | | 46,613 | |

| Exploration and development expenditure - | |

| Simberi and Tabar areas of interest | | 7,586,023 | |

| Payables and other liabilities | | (615,594 | ) |

| Borrowings | | (1,366,008 | ) |

| |

|

|---|

| Total fair value of net assets acquired | | 5,739,314 | |

| |

|

|---|

6. SEGMENT INFORMATION

During the half year the Company had only one significant segment of activity being exploration for minerals in Papua New Guinea.

7. SUBSEQUENT EVENTS

On 16 November 2004, the Company announced that it had entered into a heads of agreement with SGC to consolidate the ownership interests of the SMJV and the TEJV and on 31 January 2005 it signed the formal Agreement for Sale of Joint Venture Interests. The total cash consideration payable is

| | 8 | HALF YEAR FINANCIAL REPORT |

ALLIED GOLD LIMITED

approximately $4.17 million (representing C$4.0 million). A deposit of $271,444 was paid by the Company in December 2004 and approximately $3.9 million is due at settlement on 1 April 2005.

Upon completion, the Company will hold an 87.5% interest in the SMJV and a 100% interest in the TEJV. SGC retains a free carried 12.5% interest in the SMJV until the earlier of a decision to mine or 31 December 2009, at which point the interest is convertible into Allied Gold shares at the greater of, 50 cents, the last price at which Allied Gold Limited has raised equity capital or the volume weighted average price for the preceding 28 days.

Subsequent to the end of the half year the Company has issued the following securities.

| SHARES | Number of shares | Contributed equity

$ |

|---|

Placement - 19 January 2005 | |

2,272,727 | |

500,000 | |

| Issue of shares - Simberi project acquisition | | 1,000,000 | | 220,000 | |

| fee - 28 January 2005 | |

| Option conversion | | 19,000 | | 3,800 | |

| Placement - 4 March 2005 | | 40,909,091 | | 9,000,000 | |

| OPTIONS | Number of options |

|---|

| Issue of options - Simberi project acquisition | | 1,000,000 | |

| fee - 28 January 2005 | |

In addition, the Company announced the closure of a Share Purchase Plan (SPP) which had been offered to all eligible shareholders registered as of 22 February 2005. The SPP closed on 8 March 2005 and shares are expected to be allotted on 17 March 2005. The offer price was 22 cents per share and the Company has resolved to accept $1,500,000 in applications, giving rise to the issue of approximately 6,818,182 shares.

Other than the above, no matters or circumstances have arisen since the end of the half year which significantly affected or may significantly affect the Consolidated Entity’s operations, the results of this operations or the Consolidated Entity’s state of affairs in future financial years.

8. CONTINGENT LIABILITIES

On the Red Dam project there is a 2.5% gross royalty on gold production and 2.5% of net smelter returns on other products. The Directors are not aware of any other contingent liabilities.

9. INTERNATIONAL FINANCIAL REPORTING STANDARDS

For the year ending 30 June 2006, the consolidated entity will comply with International Financial Reporting Standards (“IFRS”) as issued by the Australian Accounting Standards Board.

This financial report has been prepared in accordance with Australian accounting standards and other financial reporting requirements (Australian GAAP). The differences between Australian GAAP and IFRS identified to date as potentially having a significant effect on the consolidated entity’s financial performance and financial position are summarised below. The summary should not be taken as an exhaustive list of all the differences between the Australian GAAP and IFRS which would require identification of all disclosure, presentation or classification differences that would affect the manner in which the transactions or events are presented.

The potential impacts on the consolidated entity’s financial performance and financial position of the adoption of IFRS, including system updates and other implementation costs which may be incurred, have not been fully quantified as at the transition date of 1 July 2004 due to the short timeframe between finalisation of the IFRS standards and the date of preparing this report. The impact in future years will depend on the particular circumstances prevailing in those years.

| | 9 | HALF YEAR FINANCIAL REPORT |

ALLIED GOLD LIMITED

The consolidated entity has established a formal project to achieve transition to IFRS reporting, beginning with the year ended 30 June 2005. The implementation project consists of three phases as described below:

| | • | | Assessment and planning phase – which aims to produce a high level overview of the impacts of conversion to IFRS reporting on existing accounting and reporting policies and procedures, systems and processes, business structures and staff. |

| | • | | Detailed assessment and design phase – which aims to formulate the changes required to existing accounting policies and systems and processes in order to transition to IFRS. This phase also involves reliably estimating the quantitative impacts of conversion to IFRS. The company has commenced its detailed assessment and design phase and it is expected to be completed during the upcoming financial year. |

| | • | | Implementation phase –which will include the implementation of identified changes to accounting and business procedures, processes and systems and operational training for staff. It will enable the consolidated entity to generate the required reporting disclosures as it progresses through its transition to IFRS. |

The key potential implications of the conversion to IFRS on the consolidated entity are as follows:

| | • | | Impairment of assets will be determined on a discounted basis, with strict tests for determining whether goodwill and other assets of cash-generating operations have been impaired. Whilst at this time there have been no indications of an impairment of these assets, if there is impairment in the future, the amount will be recognised in the statement of annual performance. |

| | • | | Income tax will be calculated based on the “balance sheet approach”, replacing the current “income statement approach”. This method recognises deferred tax balances where there is a difference between the carrying value of an asset or a liability, and it tax base. It is expected that this standard may require the consolidated entity to carry higher levels of deferred tax assets and liabilities. |

| | • | | Equity based compensation in the form of shares and options will be recognised as an expense in the period during which the employee provides related services. The consolidated entity does not currently recognise an expense for options issued to employees. On adoption of IFRS the consolidated entity will recognise an expense for options and will amortise the expense over the relevant vesting period. |

| | • | | Currently the group includes gross revenue received on disposal of assets as revenue. Under Australian equivalents to IFRS’s gains and losses on sale of investments will be recognised on a net basis in revenue, resulting in lower revenue being recorded by the group. |

| | • | | AASB 6 “Exploration for Evaluation of Mineral Resources” will require the Company to apply “area of interest” accounting to exploration and evaluation expenditures, effectively grandfathering the treatment currently used by the Company under AASB 1022 “Accounting for Extractive Industries”. Under AASB 6, if facts and circumstances suggest that the carrying amount of any recognised exploration and evaluation assets may be impaired, the Company must perform impairment tests on those assets in accordance with AASB 136 “Impairment of Assets”. Impairment of exploration and evaluation assets is to be assessed at a cash generating unit or group of cash generating units level provided this is no larger than an area of interest. Any impairment loss is to be recognised as an expense in accordance with AASB 136. The adoption of AASB 6 is not expected to lead to a change in the Company’s accounting policy with respect to exploration and evaluation expenditure. |

| | 10 | HALF YEAR FINANCIAL REPORT |

ALLIED GOLD LIMITED

ALLIED GOLD LTD

ABN 86 104 855 067

AND CONTROLLED ENTITIES

DIRECTORS’ DECLARATION

The Directors of the Company declare that:

The attached financial statements and notes, as set out on pages 4 to 10

| (a) | | comply with Accounting Standard AASB 1029: Interim Financial Reporting and the Corporations Regulations; and |

| (b) | | give a true and fair view of the economic entity’s financial position as at 31 December 2004 and of its performance for the half-year ended on that date. |

In the Directors’ opinion, there are reasonable grounds to believe that the Company will be able to pay its debts as and when they become due and payable.

This declaration is made in accordance with a resolution of the Board of Directors.

/s/ David Lymburn

David Lymburn

Director

Dated at Perth this 15th day of March 2005

| | 11 | HALF YEAR FINANCIAL REPORT |

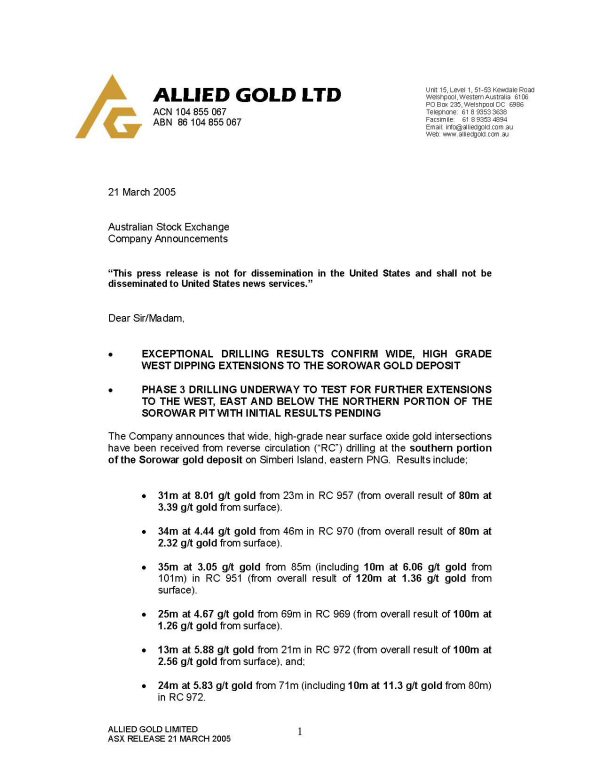

EXHIBIT 5

| ALLIED GOLD LTD

ACN 104 855 067

ABN 86 104 855 067 | Unit 15, Level 1, 51-53 Kewdale Road

Welshpool, Western Australia 6106

PO Box 235, Welshpool DC 6986

Telephone: 61 8 9353 3638

Facsimile: 61 8 9353 4894

Email: info@alliedgold.com.au

Web: www.alliedgold.com.au |

17 March 2005

Australian Stock Exchange

Company Announcements

“This press release is not for dissemination in the United States and shall not be disseminated to United States news services.”

ACQUISITION OF INCREASED INTERESTS IN THE TABAR ISLANDS PROJECT BECOMES UNCONDITIONAL

Allied Gold Limited (ASX:ALD) announces that its acquisition of increased interests in the Simberi Mining Joint Venture (“SMJV”) and Tabar Exploration Joint Venture (“TEJV”), from Canadian listed company Simberi Gold Corporation (SGC), has become unconditional. The transaction received the requisite approval at a shareholders’ meeting of SGC in Toronto on March 16.

Allied is now thebeneficial owner of 87.5% of the SMJV and 100% of the TEJV.

SGC retains a 12.5% free carried interest (“FCI”) in the SMJV through to the earlier of a decision to mine being made by Allied, or 31 December 2009. Upon conversion the FCI will be converted into Allied shares at the greater of A$0.50 per share, the last price at which Allied has raised equity capital or the volume weighted average price for the preceding 28 days. The value of the conversion will be based upon NPV derived from the bankable feasibility study at the time of making the decision to mine.

Settlement of this acquisition is scheduled to occur on 1 April 2005 with the payment of C$4.0 million.

With a total of $10.5 million being successfully raised from a recent placement and Shareholder Purchase Plan, Allied’s immediate objectives are to;

| | • | | complete exploration and reserve definition at the Sorowar oxide gold deposit on Simberi |

| | • | | finalise the Simberi Oxide Gold Project Feasibility Study to enable project development; and to |

| | • | | accelerate exploration for sulphide and additional oxide gold deposits throughout the Tabar Island Group. |

Finalisation of the Simberi Oxide Gold Project Feasibility Study is expected by mid-2005.

Yours faithfully

J. J. Moore

Managing Director

“This press release is not for dissemination in the United States and shall not be disseminated to United States news services.”

For enquiries in connection with this release please contact:

Allied Gold Limited

+61 8 9353 3638 phone

+61 8 9353 4894 fax

info@alliedgold.com.au e-mail

Forward-LookingStatements.

This press release contains forward-looking statements concerning the projects owned by Allied. Statements concerning mineral reserves and resources may also be deemed to be forward-looking statements in that they involve estimates, based on certain assumptions, of the mineralisation that will be found if and when a deposit is developed and mined. Forward-looking statements are not statements of historical fact, and actual events or results may differ materially from those described in the forward-looking statements, as the result of a variety of risks, uncertainties and other factors, involved in the mining industry generally and the particular properties in which Allied has an interest, such as fluctuation in gold prices; uncertainties involved in interpreting drilling results and other tests; the uncertainty of financial projections and cost estimates; the possibility of cost overruns, accidents, strikes, delays and other problems in development projects, the uncertain availability of financing and uncertainties as to terms of any financings completed; uncertainties relating to environmental risks and government approvals, and possible political instability or changes in government policy in jurisdictions in which properties are located.

Forward-looking statements are based on management’s beliefs, opinions and estimates as of the date they are made, and no obligation is assumed to update forward-looking statements if these beliefs, opinions or estimates should change or to reflect other future developments.

Not an offer of securities or solicitation of a proxy.

This communication is not a solicitation of a proxy from any security holder of Allied, nor is this communication an offer to purchase nor a solicitation to sell securities. Any offer will be made only through an information circular or proxy statement or similar document. Investors and security holders are strongly advised to read such document regarding the proposed business combination referred to in this communication, if and when such document is filed and becomes available, because it will contain important information. Any such document would be filed by Allied with the Australian Securities and Investments Commission, the Australian Stock Exchange and with the U.S. Securities and Exchange Commission (SEC).

EXHIBIT 6