SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

Commission File Number: 000-19182

For the month of: April 2005

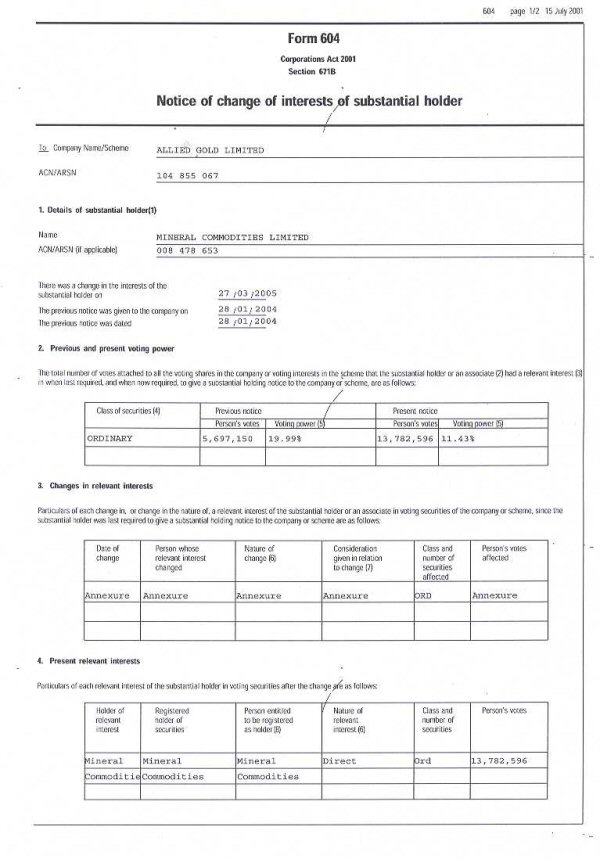

| ALLIED GOLD LIMITED |

| (Translation of registrant’s name into English) |

| Unit 15, Level 1, 51-53 Kewdale Road, Welshpool, W.A. 6106 Australia |

| (Address of principal executive offices) |

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to rule 12g3-2(b) under the Securities Exchange Act of 1934.

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b) 82 —

-1-

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | ALLIED GOLD LIMITED

(Registrant) |

| Date: May 12, 2005 | By: /s/ David Lymburn

David Lymburn

Corporate Secretary |

EXHIBIT INDEX

-2-

EXHIBIT 1

| ALLIED GOLD LTD

ACN 104 855 067

ABN 86 104 855 067 | Unit 15, Level 1, 51-53 Kewdale Road

Welshpool, Western Australia 6106

PO Box 235, Welshpool DC 6986

Telephone: 61 8 9353 3638

Facsimile: 61 8 9353 4894

Email: info@alliedgold.com.au

Web: www.alliedgold.com.au |

6 April 2005

Australian Stock Exchange

Company Announcements Office

“This press release is not for dissemination in the United States and shall not be disseminated to United States news services.”

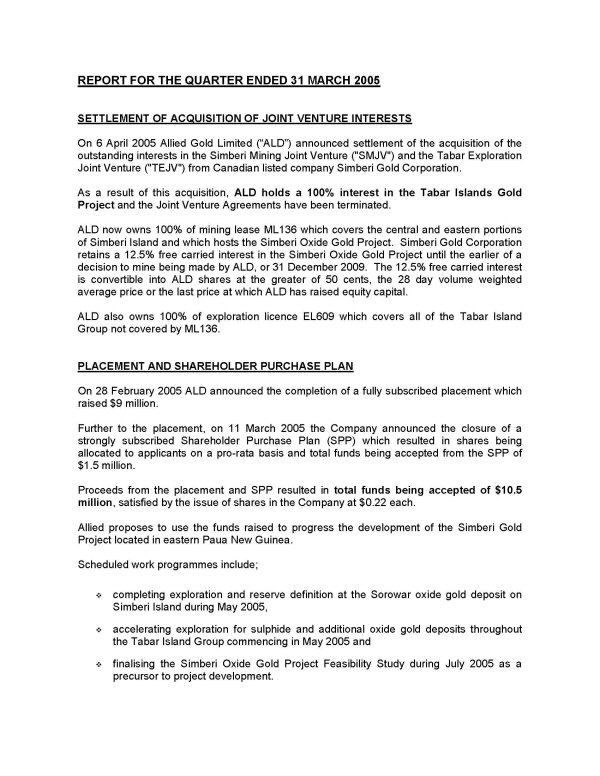

SETTLEMENT OF ACQUISITION OF JOINT VENTURE INTERESTS

Allied Gold Limited (“ALD”) announces that it has settled the acquisition of the outstanding interests in the Simberi Mining Joint Venture (“SMJV”) and the Tabar Exploration Joint Venture (“TEJV”) from Canadian listed company Simberi Gold Corporation.

As a result of this acquisition,ALD holds a 100% interest in the Tabar Islands Gold Project and the Joint Venture Agreements have been terminated.

ALD now owns 100% of mining lease ML136 which covers the central and eastern portions of Simberi Island and which hosts the Simberi Oxide Gold Project. Simberi Gold Corporation retains a 12.5% free carried interest in the Simberi Oxide Gold Project until the earlier of a decision to mine being made by ALD, or 31 December 2009. The 12.5% free carried interest is convertible into ALD shares at the greater of 50 cents, the 28 day volume weighted average price or the last price at which ALD has raised equity capital.

ALD also owns 100% of exploration licence EL609 which covers all of the Tabar Island Group not covered by ML136.

With the settlement now complete ALD’s immediate objectives are to;

| | • | | complete exploration and reserve definition at the Sorowar oxide gold deposit on Simberi Island, |

| | • | | finalise the Simberi Oxide Gold Project Feasibility Study to enable project development, |

| | • | | accelerate exploration for sulphide and additional oxide gold deposits throughout the Tabar Island Group and to |

| | • | | select and mandate a bank to provide the debt funded portion of the Simberi Oxide Project financing. |

Finalisation of the Simberi Oxide Gold Project Feasibility Study is expected by mid-2005.

Yours faithfully

J. J. Moore

Managing Director

“This press release is not for dissemination in the United States and shall not be disseminated to United States news services.”

For enquiries in connection with this release please contact:

Allied Gold Limited

+61 8 9353 3638 phone

+61 8 9353 4894 fax

info@alliedgold.com.au e-mail

Forward-Looking Statements.

This press release contains forward-looking statements concerning the projects owned by Allied. Statements concerning mineral reserves and resources may also be deemed to be forward-looking statements in that they involve estimates, based on certain assumptions, of the mineralisation that will be found if and when a deposit is developed and mined. Forward-looking statements are not statements of historical fact, and actual events or results may differ materially from those described in the forward-looking statements, as the result of a variety of risks, uncertainties and other factors, involved in the mining industry generally and the particular properties in which Allied has an interest, such as fluctuation in gold prices; uncertainties involved in interpreting drilling results and other tests; the uncertainty of financial projections and cost estimates; the possibility of cost overruns, accidents, strikes, delays and other problems in development projects, the uncertain availability of financing and uncertainties as to terms of any financings completed; uncertainties relating to environmental risks and government approvals, and possible political instability or changes in government policy in jurisdictions in which properties are located.

Forward-looking statements are based on management’s beliefs, opinions and estimates as of the date they are made, and no obligation is assumed to update forward-looking statements if these beliefs, opinions or estimates should change or to reflect other future developments.

Not an offer of securities or solicitation of a proxy.

This communication is not a solicitation of a proxy from any security holder of Allied, nor is this communication an offer to purchase nor a solicitation to sell securities. Any offer will be made only through an information circular or proxy statement or similar document. Investors and security holders are strongly advised to read such document regarding the proposed business combination referred to in this communication, if and when such document is filed and becomes available, because it will contain important information. Any such document would be filed by Allied with the Australian Securities and Investments Commission, the Australian Stock Exchange and with the U.S. Securities and Exchange Commission (SEC).

EXHIBIT 2

| ALLIED GOLD LTD

ACN 104 855 067

ABN 86 104 855 067 | Unit 15, Level 1, 51-53 Kewdale Road

Welshpool, Western Australia 6106

PO Box 235, Welshpool DC 6986

Telephone: 61 8 9353 3638

Facsimile: 61 8 9353 4894

Email: info@alliedgold.com.au

Web: www.alliedgold.com.au |

8 April 2005

Australian Stock Exchange

Company Announcements Office

“This press release is not for dissemination in the United States and shall not be disseminated to United States news services.”

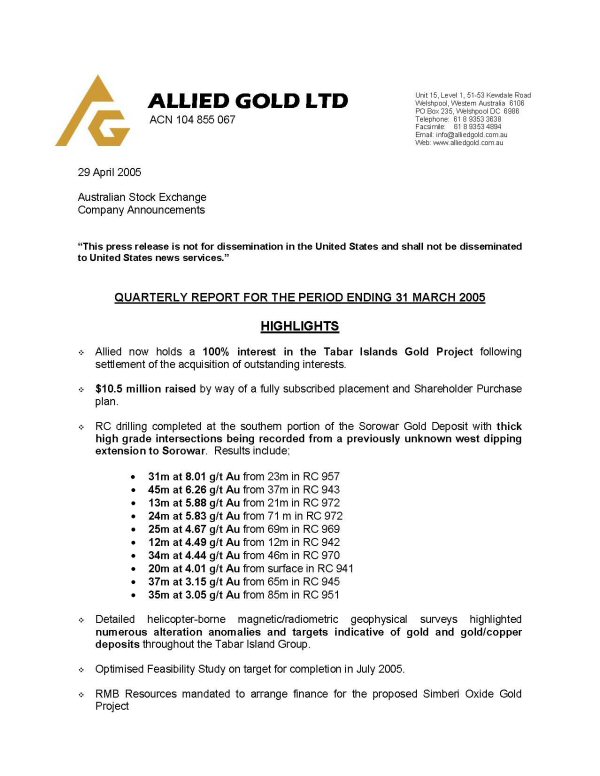

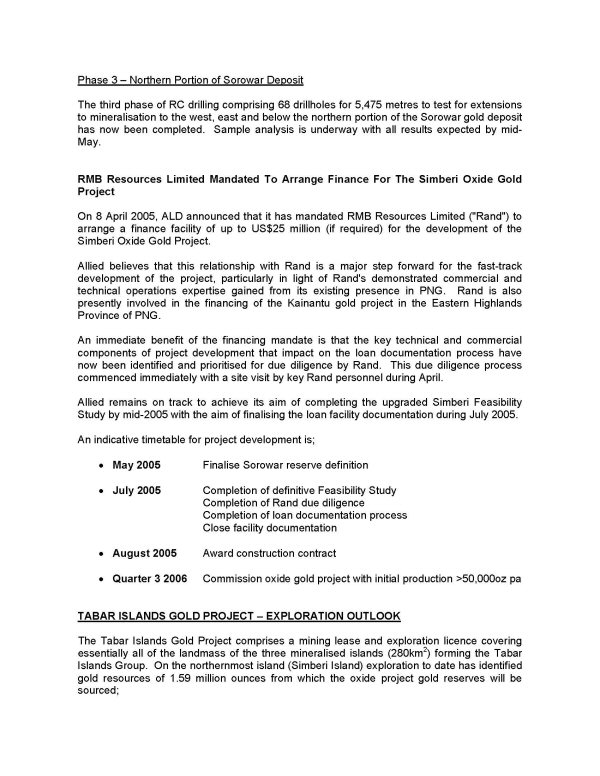

RMB RESOURCES LIMITED MANDATED TO ARRANGE FINANCE FOR THE SIMBERI

OXIDE GOLD PROJECT

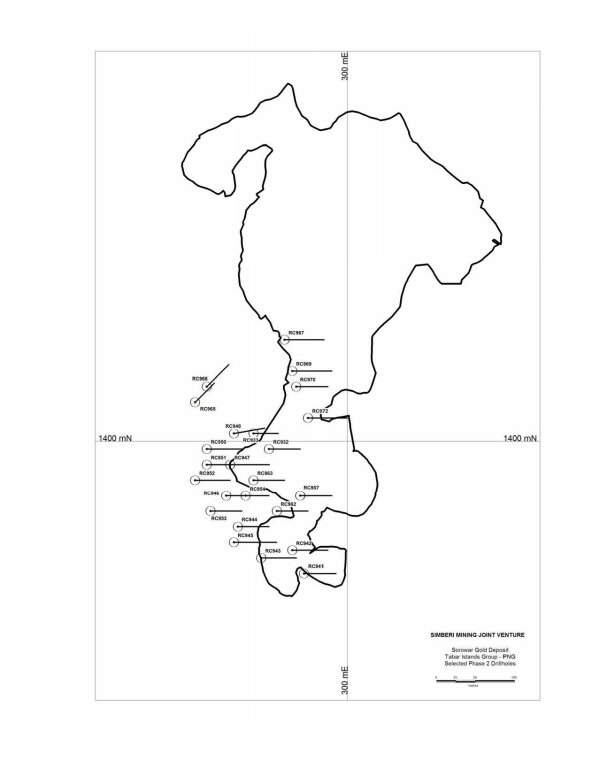

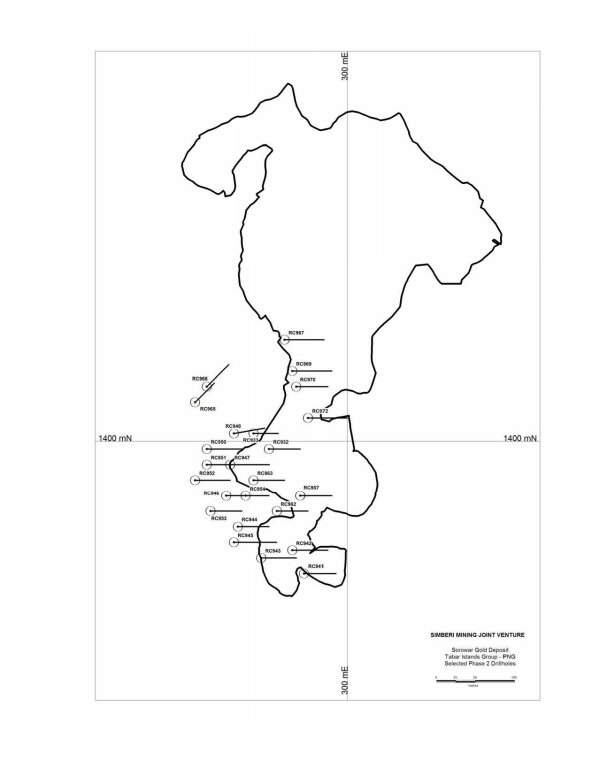

Allied Gold Limited (ASX:ALD) is pleased to announce that it has mandated RMB Resources Limited (“Rand”) to arrange a finance facility of up to US$25 million (if required) for the development of the Simberi Oxide Gold Project in the New Ireland Archipelago of eastern PNG (see map attached).

Allied believes that this relationship with Rand is a major step forward for the fast-track development of the project, particularly in light of Rand’s demonstrated commercial and technical operations expertise gained from its existing presence in PNG. Rand is also presently involved in the financing of the Kainantu gold project in the Eastern Highlands Province of PNG.

An immediate benefit of the financing mandate is that the key technical and commercial components of project development that impact on the loan documentation process have now been identified and prioritised for due diligence by Rand. This due diligence process will commence immediately with a site visit by key Rand personnel.

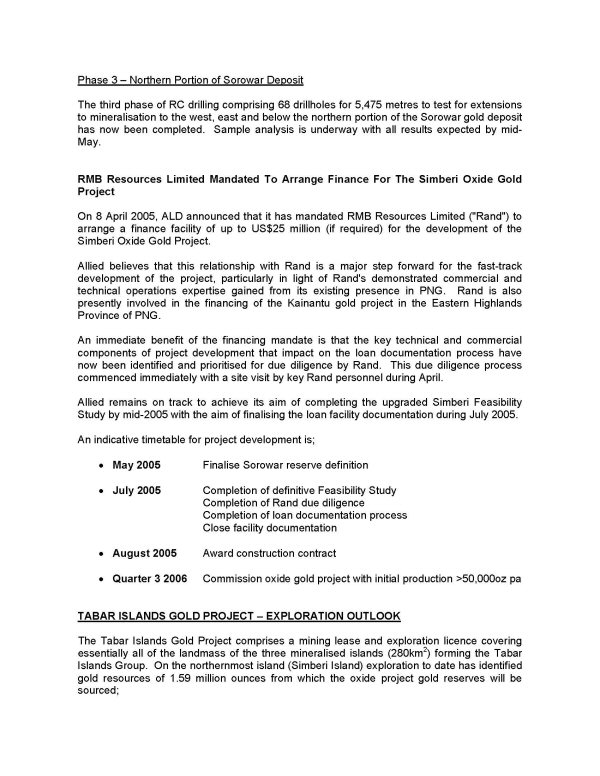

Allied remains on track to achieve its aim of completing the upgraded Simberi Feasibility Study by mid-2005 with the aim of finalising the loan facility documentation during July 2005. An indicative timetable for project development is;

| • | May 2005 | finalise Sorowar reserve definition

finalise mining and processing flowsheet and capital cost estimation |

| • | June 2005 | Completion of definitive Feasibility Study

Completion of Rand due diligence |

| • | July 2005 | Completion of loan documentation process

Close facility documentation |

| • | August 2005 | Award construction contract |

| • | Quarter 3 2006 | Commission oxide gold project with initial production >50,000 oz pa |

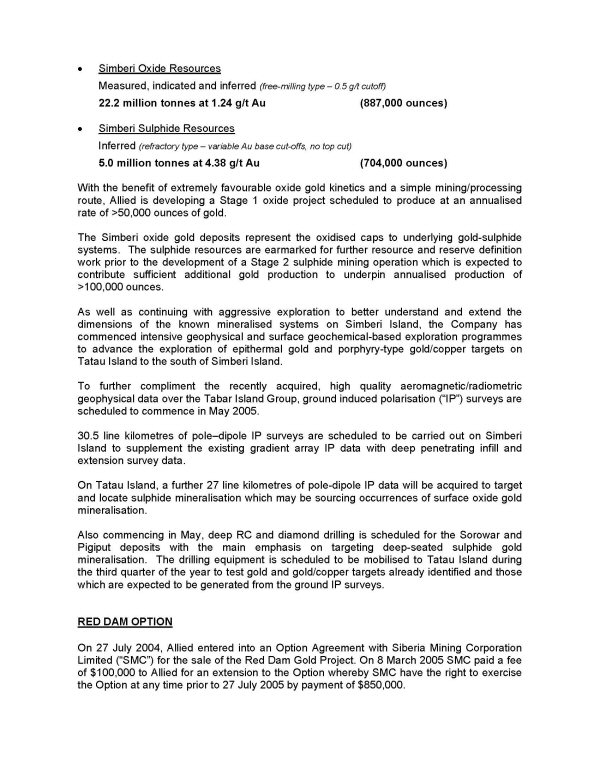

Tabar Islands Gold Project Outlook

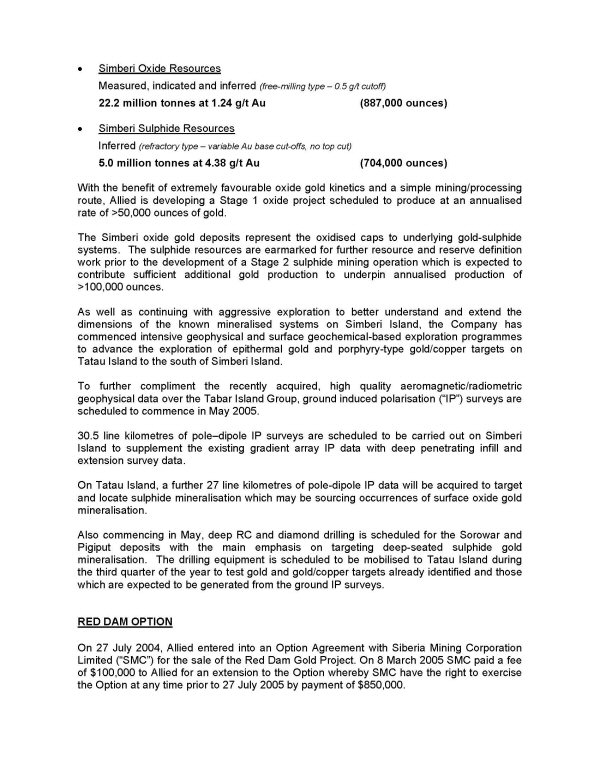

The Tabar Islands Gold Project comprises a mining lease and exploration licence covering essentially all of the landmass of the three mineralised islands (280km2) forming the Tabar Islands Group. On the northernmost island (Simberi Island) exploration to date has identified gold resources of 1.59 million ounces from which the oxide project gold reserves will be sourced;

| • | | Simberi Oxide Resources |

| | Measured, indicated and inferred(free-milling type – 0.5 g/t cutoff)

22.2 million tonnes at 1.24 g/t Au (887,000 ounces) |

| • | | Simberi Sulphide Resources |

| | Inferred(refractory type – variable Au base cut-offs, no top cut)

5.0 million tonnes at 4.38 g/t Au (704,000 ounces) |

With the benefit of extremely favourable oxide gold kinetics and a simple mining/processing route, Allied is developing a Stage 1 oxide project scheduled to produce at an annualised rate of >50,000 ounces of gold.

The Simberi oxide gold deposits represent the oxidised caps to underlying gold-sulphide systems. The sulphide resources are earmarked for further resource and reserve definition work prior to the subsequent development of a Stage 2 sulphide mining operation which is expected to contribute sufficient additional gold production to underpin annualised production of >100,000 ounces.

As well as continuing with aggressive exploration to better understand and extend the dimensions of the known mineralised systems on Simberi Island, the Company has commenced intensive geophysical and surface geochemical-based exploration programmes to advance the exploration of epithermal gold and porphyry-type gold/copper targets on Tatau Island to the south of Simberi Island.

This preparatory work is expected to further add targets to those already earmarked for drilling during the third quarter of 2005.

Yours faithfully

J. J. Moore

Managing Director

For enquiries in connection with this release please contact:

Allied Gold Limited

+61 8 9353 3638 phone

+61 8 9353 4894 fax

info@alliedgold.com.au e-mail

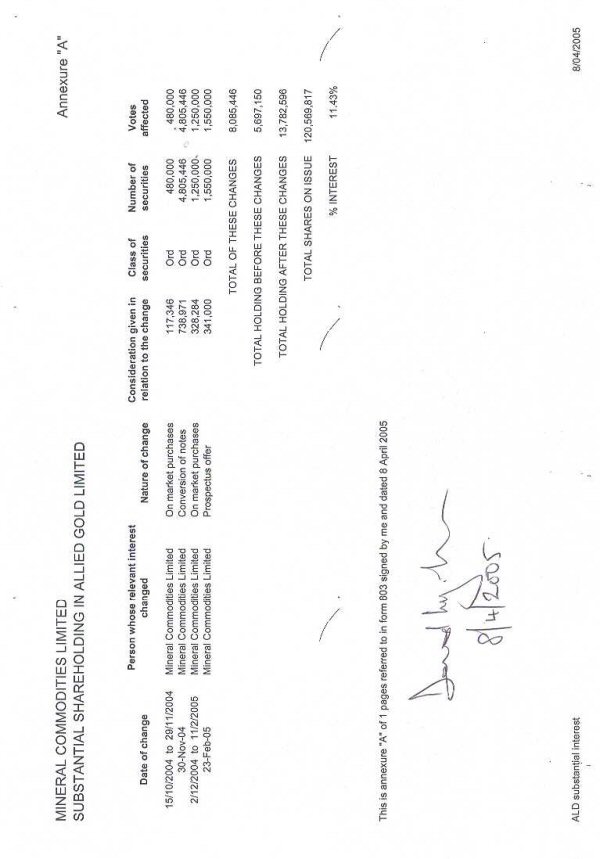

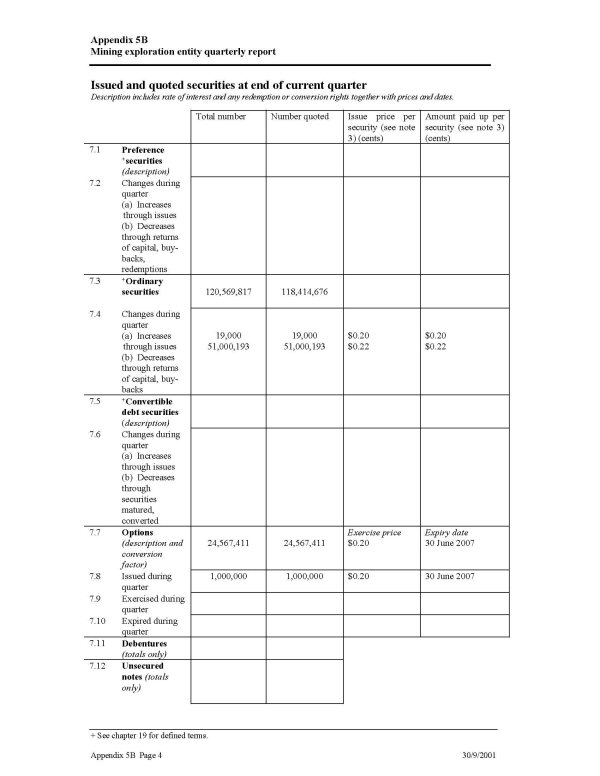

EXHIBIT 3

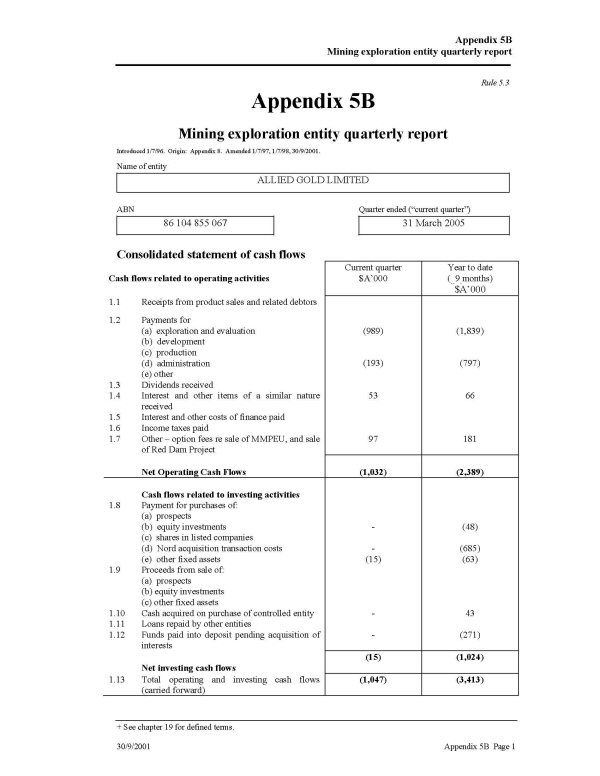

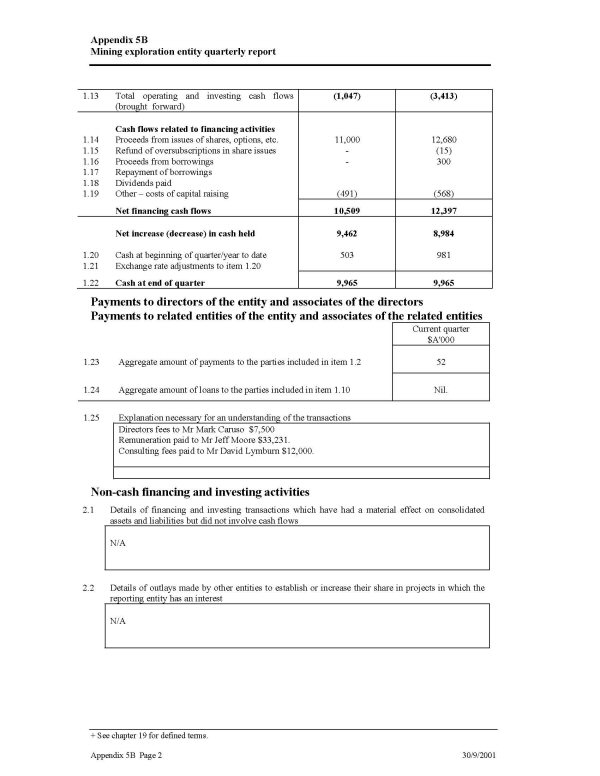

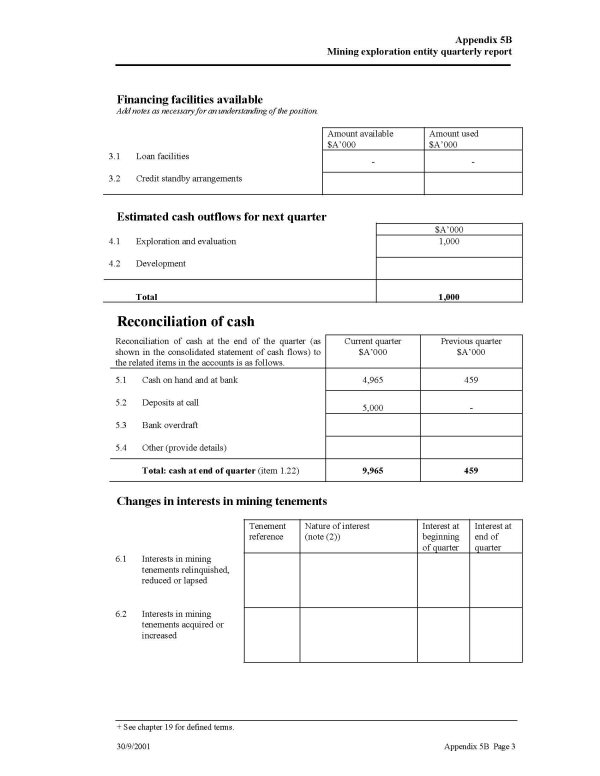

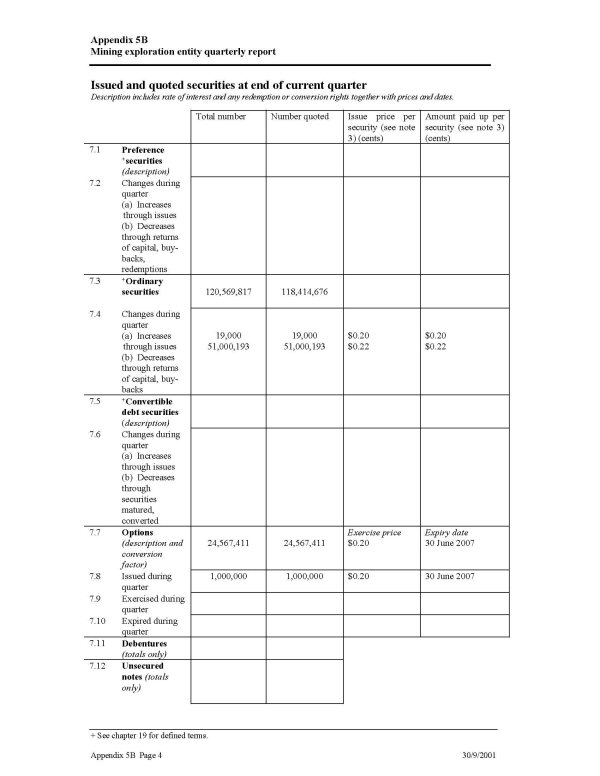

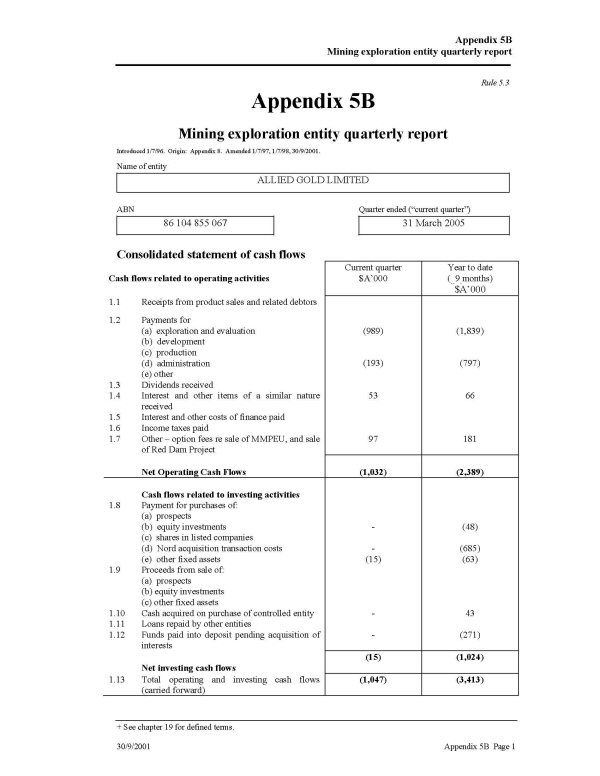

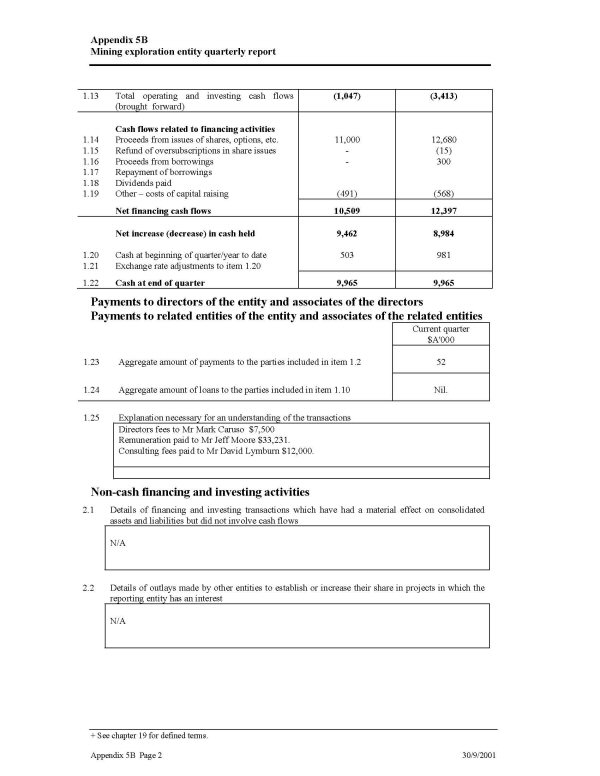

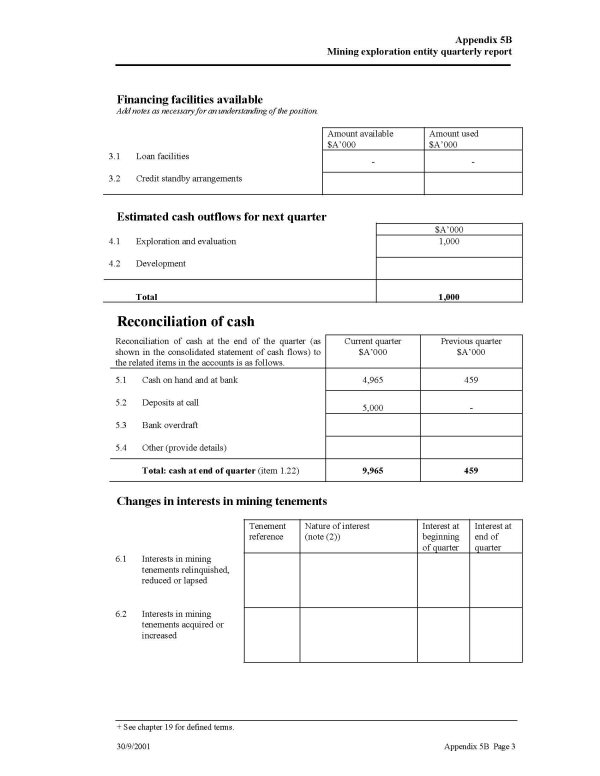

EXHIBIT 4