SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

Commission File Number: 000-19182

For the month of: October 2005

| ALLIED GOLD LIMITED |

| (Translation of registrant’s name into English) |

| Unit 15, Level 1, 51-53 Kewdale Road, Welshpool, W.A. 6106 Australia |

| (Address of principal executive offices) |

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to rule 12g3-2(b) under the Securities Exchange Act of 1934.

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b) 82 —

-1-

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | ALLIED GOLD LIMITED

(Registrant) |

| Date: November 15, 2005 | By: /s/ David Lymburn

David Lymburn

Corporate Secretary |

EXHIBIT INDEX

-2-

EXHIBIT 1

11 October 2005

Company Announcements Office

Australian Stock Exchange Ltd

ASX Release

“This press release is not for dissemination in the United States and shall not be disseminated to United States news services”

Dear Sir/Madam

HIGH GRADE GOLD INTERCEPTS (incl 3m at 139 g/t gold)

RETURNED FROM IP TARGETS OUTSIDE OF PIGIPUT

SULPHIDE DEPOSIT

HIGHLIGHTS

Significant sulphide gold results have been returned from drilling recently completed near the Pigiput sulphide gold project on Simberi Island, viz;

| • | | 6m at 5.36g/t gold from surface and 3m at 139.4g/t gold from 226m in RC1153. |

| • | | 4m at 4.56g/t goldfrom 77m,11m at 2.04g/t goldfrom 175m and32m at 1.60g/t goldfrom 195m in RC1151 |

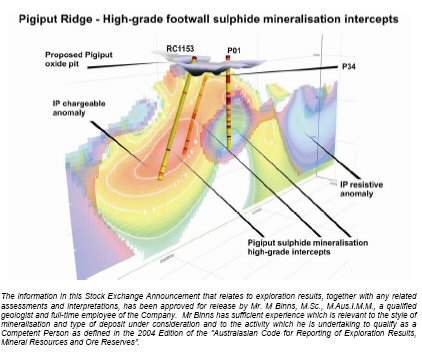

These results are very encouraging. The presence of high grade mineralisation within the Pigiput deposit footwall indicates significant potential for extensions to the known high-grade hangingwall sulphide gold deposit.

Interpretation of Results

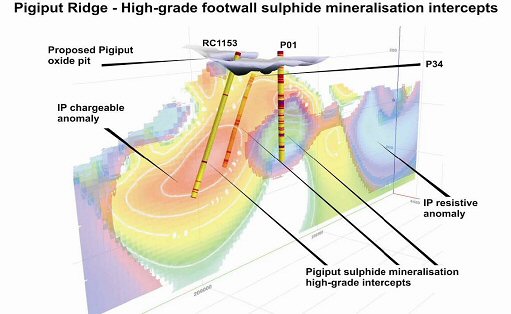

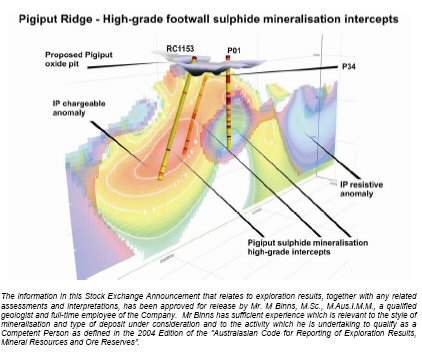

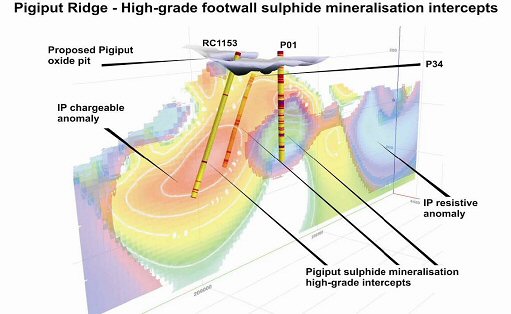

RC1153 drilled a previously untested chargeable IP anomaly in the footwall of the known Pigiput sulphide gold deposit.

The resulting “bonanza” grade intercept of1m at 409g/t Aufrom 227m represents the third extremely high-grade gold intercept recorded in the footwall region of the Pigiput deposit. Two previous drillholes, P01 and P34, also intercepted spectacular gold grades(see attached plan).

The most significant intercepts from P01 and P34 are;

P01

• | |

5m at 146.4g/t goldfrom 191m (including1m at 156g/t goldfrom 192m and1m at 534g/t goldfrom 194m). |

P34

• | |

14m at 42.1g/t goldfrom 119m (including1m at 490g/t goldfrom 130m and1m at 111g/t goldfrom 132m). |

These results together with RC1153 demonstrate that there is potential for significant high-grade footwall gold mineralisation over a large, mostly untested area beneath Pigiput Ridge(see attached sections).

The recent drilling data confirm that gold mineralisation within the Pigiput area is associated with chargeable IP anomalies. Each IP target drillhole intersected gold mineralisation. Further work will follow to better define the extent and tenor of sulphide-hosted gold mineralisation in the Pigiput area.

The IP data fit into the general geological framework of an epithermal system in which intrusions at depth cause alteration and drive emplacement of mineralisation at more shallow levels. Coincident high chargeability and high resistivity anomalies are interpreted to be intrusions carrying sulphides and gold mineralisation.

Discussion of Results

Phase 4 drilling — Pigiput Area

Diamond drilling in the Pigiput area was designed to;

| • | | Test induced polarisation (“IP”) geophysical targets, |

| • | | Test target extensions to known high-grade mineralisation and, |

| • | | Test for further high-grade footwall mineralisation. |

In summary, the results of this recent drilling will extend the zone of known sulphide mineralisation at Pigiput and provide high priority areas for further sulphide drilling.

The three most recent drillholes (RC1151, RC1152 and RC1153) are tabulated below;

| | | | | | | | |

|---|

| IP ANOMALY DRILLING - PIGIPUT REGION |

| Drillhole | Northing

(mN)

Simb grid | Easting

(mN)

Simb grid | Dip/Azimuth

(°)

Simb grid | From

(m) | To

(m) | Interval

(m) | Grade

(g/t

Au) | Mineralisation

Type |

| RC1151 | 9,075 | 9,360 | -90°/000°

incl.

incl.

incl.

incl.

incl.

incl.

incl.

incl.

incl.

incl.

incl.

incl.

| 0

25

77

111

117

142

146

163

175

189

195

230

248 | 250

26

81

112

131

143

153

171

186

191

227

231

249 | 250

1

4

1

14

1

7

8

11

2

32

1

1 | 0.83

1.00

4.56

1.16

1.32

2.24

1.15

1.15

2.04

1.16

1.60

1.31

1.00 | Ox, Su

Ox

Su

Su

Su

Su

Su

Su

Su

Su

Su

Su

Su

|

| | | | | | | | |

|---|

| IP ANOMALY DRILLING - PIGIPUT REGION |

| Drillhole | Northing

(mN)

Simb grid | Easting

(mN)

Simb grid | Dip/Azimuth

(°)

Simb grid | From

(m) | To

(m) | Interval

(m) | Grade

(g/t

Au) | Mineralisation

Type |

| RC1152 | 9,180 | 9,300 | -90°/000°

incl.

incl.

incl.

incl.

incl.

incl.

| 0

62

72

83

90

96

204

| 235

66

73

85

91

97

205

| 235

4

1

2

1

1

1

| 0.32

1.50

2.71

1.78

1.79

1.80

1.85

| Su

Su

Su

Su

Su

Su

Su

|

| RC1153 | 8,756 | 9,400 | -65°/180°

incl.

with.

incl.

incl.

incl.

with

incl.

incl.

incl.

incl.

| 0

0

3

17

88

226

227

267

283

288

299 | 300

6

4

18

90

229

228

268

285

289

300 | 300

6

1

1

2

3

1

1

2

1

1 | 1.65

5.36

18.8

1.01

2.85

139.4

409

1.57

1.30

3.38

1.13 | Ox, Tr, Su

Ox

Ox

Ox

Ox

Su

Su

Su

Su

Su

Su

|

Note:

Assaying for gold by fire assay (50gm) with AAS finish (ALS Chemex Laboratories – Townsville)

Simberi mineralisation types are:

| | Ox = oxide material – extremely weathered (cyanide leach recovery >90%) |

| | Tr = transitional material – distinctly weathered (cyanide leach recovery 50-90%) |

| | Su = sulphide material – slightly weathered to fresh (Cyanide recovery <50%) |

Complete hole assay — no cutoff; “incl.” intervals — 1.0g/t Au cutoff; “with” intervals — 10.0g/t Au cutoff.

Phase 4 Drilling — Sorowar Area

Diamond drilling is currently underway in the vicinity of the Sorowar deposit to test targets generated from recent IP geophysical surveys. Sulphide mineralisation which underlies the oxidised gold caps is virtually untested at Sorowar and six high priority chargeable anomalies (with varying associated resistive anomalies) have been identified for testing under the Phase 4 drill programme. Two of the six planned holes at Sorowar have been completed and assays are pending.

Yours faithfully

ALLIED GOLD LIMITED

J.J. Moore

Managing Director

The information in this Stock Exchange Announcement that relates to exploration results, together with any related assessments and interpretations, has been approved for release by Mr. M Binns, M.Sc., M.Aus.I.M.M., a qualified geologist and full-time employee of the Company. Mr Binns has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined in the 2004 Edition of the “Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves”.

“This press release is not for dissemination in the United States and shall not be disseminated to United States news services.”

For enquiries in connection with this release please contact:

Allied Gold Limited

+61 8 9353 3638 phone

+61 8 9353 4894 fax

info@alliedgold.com.au e-mail

Forward-Looking Statements.

This press release contains forward-looking statements concerning the projects owned by Allied. Statements concerning mineral reserves and resources may also be deemed to be forward-looking statements in that they involve estimates, based on certain assumptions, of the mineralisation that will be found if and when a deposit is developed and mined. Forward-looking statements are not statements of historical fact, and actual events or results may differ materially from those described in the forward-looking statements, as the result of a variety of risks, uncertainties and other factors, involved in the mining industry generally and the particular properties in which Allied has an interest, such as fluctuation in gold prices; uncertainties involved in interpreting drilling results and other tests; the uncertainty of financial projections and cost estimates; the possibility of cost overruns, accidents, strikes, delays and other problems in development projects, the uncertain availability of financing and uncertainties as to terms of any financings completed; uncertainties relating to environmental risks and government approvals, and possible political instability or changes in government policy in jurisdictions in which properties are located.

Forward-looking statements are based on management’s beliefs, opinions and estimates as of the date they are made, and no obligation is assumed to update forward-looking statements if these beliefs, opinions or estimates should change or to reflect other future developments.

Not an offer of securities or solicitation of a proxy.

This communication is not a solicitation of a proxy from any security holder of Allied, nor is this communication an offer to purchase nor a solicitation to sell securities. Any offer will be made only through an information circular or proxy statement or similar document. Investors and security holders are strongly advised to read such document regarding the proposed business combination referred to in this communication, if and when such document is filed and becomes available, because it will contain important information. Any such document would be filed by Allied with the Australian Securities and Investments Commission, the Australian Stock Exchange and with the U.S. Securities and Exchange Commission (SEC).

EXHIBIT 2

13 October 2005

Company Announcements Office

Australian Stock Exchange Ltd

ASX Release

“This press release is not for dissemination in the United States and shall not be disseminated to United States news services.”

Dear Sir/Madam,

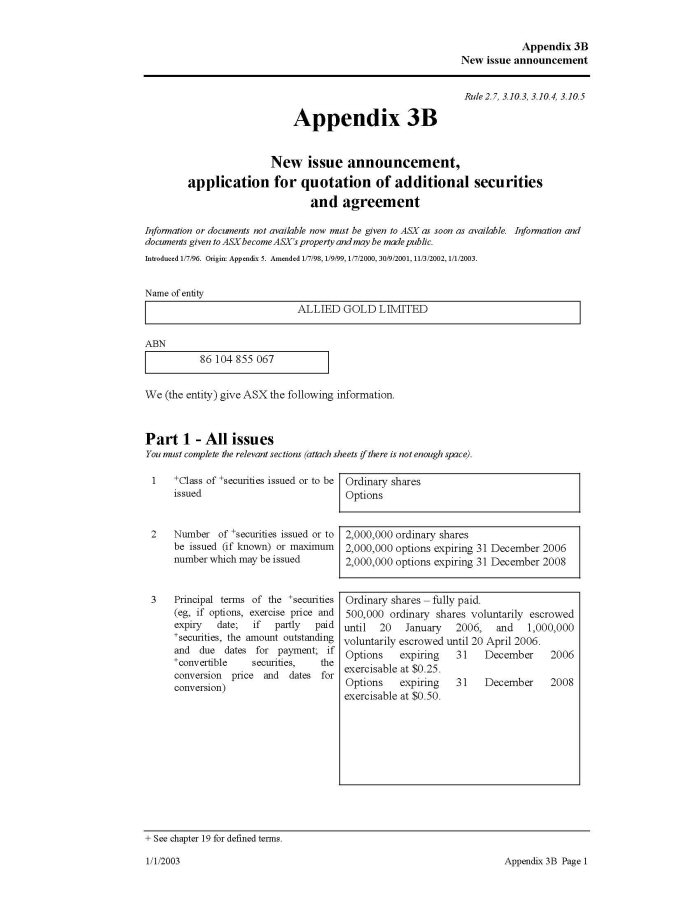

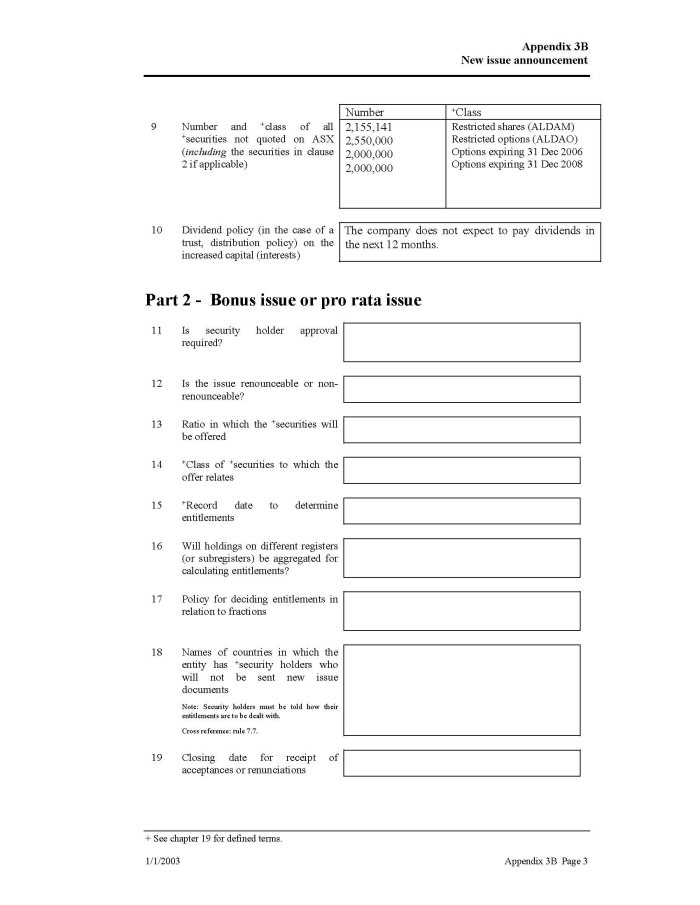

AGREEMENT TO PURCHASE FREE CARRIED INTEREST IN

SIMBERI OXIDE GOLD PROJECT

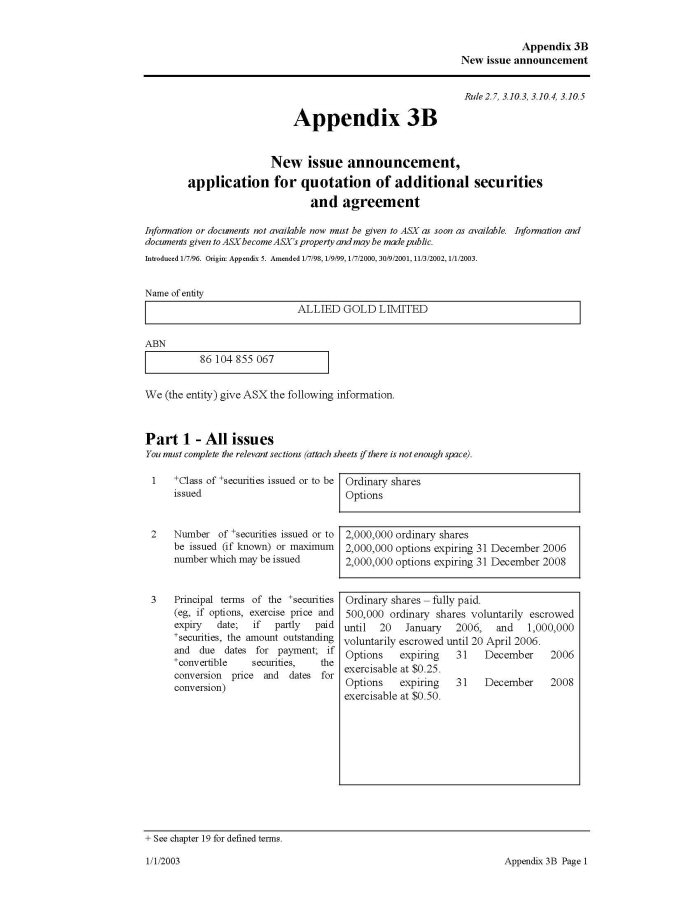

Agreement has been reached with Canadian-listed Simberi Gold Corporation (“SGC”) for Allied Gold Limited (“ALD”) to purchase the outstanding 12.5% free carried interest (“FCI”) in the Simberi Oxide Gold Project.

The purchase will be satisfied on or before the Settlement Date of 20 October 2005 by;

| | • | | Payment of C$200,000 to SGC or its nominee, |

| | • | | The issue of two million fully paid Shares of ALD to SGC or its nominee, |

| | • | | The issue of two million ALD Options exercisable at 25 cents on or before 31 December 2006 to SGC or its nominee, |

| | • | | The issue of two million ALD Options exercisable at 50 cents on or before 31 December 2008 to SGC or its nominee, |

SGC has agreed to voluntary escrow on a portion of the fully paid Shares issued, viz;

| | • | | 500,000 Shares for a period of 3 months from the Settlement Date, |

| | • | | 1,000,000 Shares for a period of 6 months from the Settlement Date. |

Prior to this Agreement, SGC held a 12.5% FCI in the Simberi Oxide Gold Project with ALD having the right to redeem the FCI by the issue of Shares of ALD on the earlier of a decision to mine being made by ALD, or 31 December 2009.

This final rationalisation of the previous Simberi Mining and Tabar Exploration Joint Ventures now enables ALD to press ahead with the development plans for the Simberi Oxide Gold Project as sole owner and operator.

Yours faithfully

ALLIED GOLD LIMITED

J.J. Moore

Managing Director

“This press release is not for dissemination in the United States and shall not be disseminated to United States news services.”

For enquiries in connection with this release please contact:

Allied Gold Limited

+61 8 9353 3638 phone

+61 8 9353 4894 fax

info@alliedgold.com.au e-mail

Forward-Looking Statements.

This press release contains forward-looking statements concerning the projects owned by Allied. Statements concerning mineral reserves and resources may also be deemed to be forward-looking statements in that they involve estimates, based on certain assumptions, of the mineralisation that will be found if and when a deposit is developed and mined. Forward-looking statements are not statements of historical fact, and actual events or results may differ materially from those described in the forward-looking statements, as the result of a variety of risks, uncertainties and other factors, involved in the mining industry generally and the particular properties in which Allied has an interest, such as fluctuation in gold prices; uncertainties involved in interpreting drilling results and other tests; the uncertainty of financial projections and cost estimates; the possibility of cost overruns, accidents, strikes, delays and other problems in development projects, the uncertain availability of financing and uncertainties as to terms of any financings completed; uncertainties relating to environmental risks and government approvals, and possible political instability or changes in government policy in jurisdictions in which properties are located.

Forward-looking statements are based on management’s beliefs, opinions and estimates as of the date they are made, and no obligation is assumed to update forward-looking statements if these beliefs, opinions or estimates should change or to reflect other future developments.

Not an offer of securities or solicitation of a proxy.

This communication is not a solicitation of a proxy from any security holder of Allied, nor is this communication an offer to purchase nor a solicitation to sell securities. Any offer will be made only through an information circular or proxy statement or similar document. Investors and security holders are strongly advised to read such document regarding the proposed business combination referred to in this communication, if and when such document is filed and becomes available, because it will contain important information. Any such document would be filed by Allied with the Australian Securities and Investments Commission, the Australian Stock Exchange and with the U.S. Securities and Exchange Commission (SEC).

EXHIBIT 3

24 October 2005

Company Announcements Office

Australian Stock Exchange Ltd

ASX Release

“This press release is not for dissemination in the United States and shall not be disseminated to United States news services”

Dear Sir/Madam

105% INCREASE IN TOTAL SIMBERI OXIDE RESERVES

176% INCREASE IN SOROWAR RESERVES AND IN PIT

RESOURCES

INCREASED RESERVES EXPECTED TO UNDERPIN POSITIVE

FEASIBILITY STUDY RESULTS – DELIVERY IMMINENT

Highlights

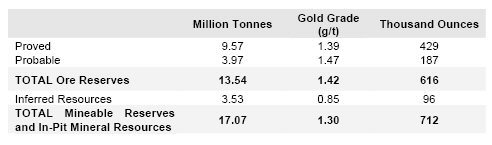

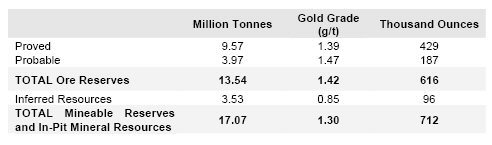

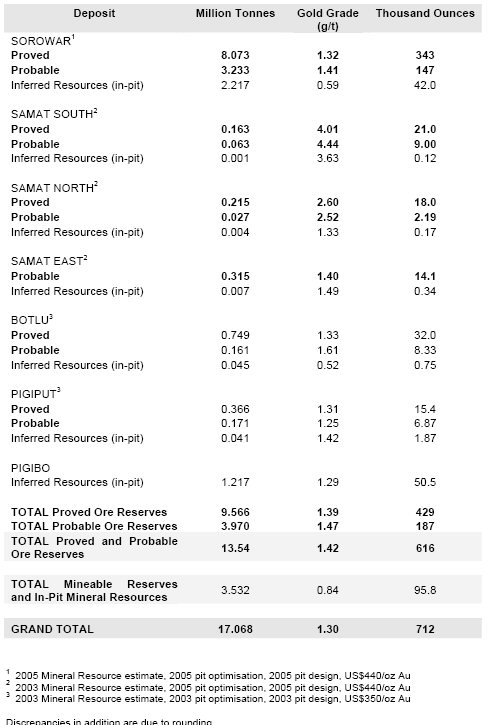

Allied Gold Limited is pleased to announce Simberi Oxide Gold Project Proved and Probable Ore Reserves of;

13.54 million tonnes at 1.42 g/t gold for 616,000 ounces

In addition to the Ore Reserves, Inferred Mineral Resources inside the Sorowar pit and proposed Pigibo pit are expected to contribute to future production.

Total Ore Reserves and Mineral Resources within designed pits are outlined below;

Discussion of Results

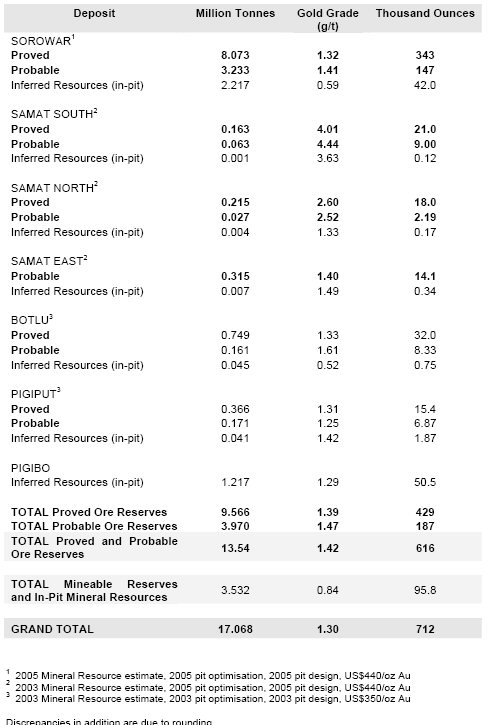

The oxide ore reserves on Simberi Island represent a 105% increase over the reserves reported in the previous (2003) Simberi Oxide Gold Project Feasibility Study.

Furthermore, the Company has a high expectation that future expansion of the oxide mining project will be facilitated by continuing exploration of known and other oxide gold targets throughout the mineralised Tabar Island Group.

The Simberi Gold Project is located in the New Ireland Province of eastern Papua New Guinea, about 60 kms to the north-west of the Lihir Gold Mine. The Simberi Oxide Gold Project is a Stage 1 mining project which will extract ore from seven deposits which represent the known surface and near-surface oxidised caps to underlying sulphide gold mineralisation on eastern Simberi Island.

With the completion of reserve studies, the final component of the Optimised Feasibility Study is now in place and the Company expects delivery of the final OFS document before the end of October.

Exploration work including ongoing drilling is scheduled to continue throughout the forthcoming year to further test the margins and strike extent of known deposits as well as testing additional high priority oxide gold anomalies on Simberi and Tatau Islands.

At the Sorowar pit, the largest pit scheduled for mining, a further 162 reverse circulation drillholes for 13,596 metres have been drilled since the 2003 Feasibility Study. The additional drilling data facilitated a 176% increase inreserves and resources within the designed pit from 5,187,000 tonnes at 1.15 g/t gold for 192,000 ounces to;

13,523,000 tonnes at 1.22 g/t gold for 530,000 ounces.

This equates to the discovery of 23.2 reserve ounces for every metre drilled since the 2003 Study was completed. The Sorowar deposit is still open along strike and at depth and further expansion of the Sorowar deposit should result in increased gold throughput and oxide project minelife.

In October 2005, Gemcom completed updated pit optimisations and Ore Reserve estimates for Sorowar using the latest 2005 Mineral Resource block model, and for the three Samat deposits using the existing block models reported in the 2003 Feasibility Study.

As Botlu and Pigiput are not scheduled to be mined until year 6, the Ore Reserves estimated and reported in the 2003 Feasibility Study were retained. Mining at Sorowar is proposed to be staged, with an initial bulk mining phase followed by a selective mining cutback and waste disposal within the existing void. The Samat, Botlu and Pigiput pits will be bulk mined.

In addition to the Ore Reserves, Inferred Mineral Resources inside designed pits are expected to contribute to future production. Mineable Reserves and Resources for the project are;

Approximately 90% of the Ore Reserve is oxide material, and the remainder is transition and sulphide pods at Sorowar.

Recent metallurgical testwork on typical Sorowar mineralisation indicates that previous estimates of gold extraction from transitional and sulphide material in other local deposits are not representative of Sorowar ore. Gold recoveries for all Sorowar material types within the pit design are estimated to be 92% for oxide, 72% for transitional and 66% for sulphide materials. Overall recoveries for all of the material within the Ore Reserves and Mineral Resources is 88%.

Additional geotechnical testwork has resulted in rock strength estimates that are lower than expected, with consequent lower associated mining costs.

Yours faithfully

ALLIED GOLD LIMITED

J.J. Moore

Managing Director

The information in this Stock Exchange Announcement that relates to exploration results, together with any related assessments and interpretations, has been approved for release by Mr. M Binns, M.Sc., M.Aus.I.M.M., a qualified geologist and full-time employee of the Company. Mr Binns has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined in the 2004 Edition of the “Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves”.

The information in this Stock Exchange Announcement that relates to ore reserves has been compiled by Mr Mike Apfel of Gemcom Australia who is a Member of the Australasian Institute of Mining and Metallurgy. Mr Apfel has had sufficient experience in Ore Reserve estimation relevant to the style of mineralisation and type of deposit under consideration to qualify as a Competent Person as defined in the 2004 Edition of the “Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves”.

Mr Apfel consents to the inclusion of the information contained in this ASX release in the form and context in which it appears.

“This press release is not for dissemination in the United States and shall not be disseminated to United States news services.”

For enquiries in connection with this release please contact:

Allied Gold Limited

+61 8 9353 3638 phone

+61 8 9353 4894 fax

info@alliedgold.com.au e-mail

Forward-Looking Statements.

This press release contains forward-looking statements concerning the projects owned by Allied. Statements concerning mineral reserves and resources may also be deemed to be forward-looking statements in that they involve estimates, based on certain assumptions, of the mineralisation that will be found if and when a deposit is developed and mined. Forward-looking statements are not statements of historical fact, and actual events or results may differ materially from those described in the forward-looking statements, as the result of a variety of risks, uncertainties and other factors, involved in the mining industry generally and the particular properties in which Allied has an interest, such as fluctuation in gold prices; uncertainties involved in interpreting drilling results and other tests; the uncertainty of financial projections and cost estimates; the possibility of cost overruns, accidents, strikes, delays and other problems in development projects, the uncertain availability of financing and uncertainties as to terms of any financings completed; uncertainties relating to environmental risks and government approvals, and possible political instability or changes in government policy in jurisdictions in which properties are located.

Forward-looking statements are based on management’s beliefs, opinions and estimates as of the date they are made, and no obligation is assumed to update forward-looking statements if these beliefs, opinions or estimates should change or to reflect other future developments.

Not an offer of securities or solicitation of a proxy.

This communication is not a solicitation of a proxy from any security holder of Allied, nor is this communication an offer to purchase nor a solicitation to sell securities. Any offer will be made only through an information circular or proxy statement or similar document. Investors and security holders are strongly advised to read such document regarding the proposed business combination referred to in this communication, if and when such document is filed and becomes available, because it will contain important information. Any such document would be filed by Allied with the Australian Securities and Investments Commission, the Australian Stock Exchange and with the U.S. Securities and Exchange Commission (SEC).

ALLIED LIFTS SIMBERI OXIDE RESERVES 105% TO

616,000oz AHEAD OF FEASIBILITY COMPLETION

OPTIMISED FEASIBILITY STUDY DUE FOR DELIVERY BY THE END OF OCTOBER 2005

Emerging PNG-focused gold company Allied Gold Ltd (ASX:ALD) today unveiled a105% increase inoxide Ore Reserves for its Simberi Gold Project in eastern Papua New Guinea to616,000oz ahead of the anticipated completion of the final Optimised Feasibility Study (OFS) on the project before the end of this month.

The oxide Ore Reserves underpin the proposed Stage 1 mining project at the 2.27Moz Simberi Project, which will involve the extraction of ore from seven open pit deposits representing the known surface and near-surface oxidized caps to underlying sulphide mineralization on Simberi Island. The project is located in the New Ireland Province of eastern PNG, about 60km north-west of the world-class Lihir Gold Mine

The landmark reserve upgrade follows the recent announcement by Allied that it had reached agreement to purchase the outstanding 12.5% free-carried interest in the Simberi Project from Canadian-listed Simberi Gold Corporation. The completion of this transaction will give it 100% ownership of the project.

Total Proved and Probable oxide Ore Reserves at Simberi now total13.54 million tonnes at1.42g/t for616,000oz of contained gold, with additional Inferred Resources inside the main Sorowar pit and the proposed Pigibo pit of 96,000oz also expected to contribute to future production. Total Mineable Reserves and in-pit Mineral Resources stand at17.07 million tonnes at1.3g/t gold for712,000oz.

Allied’s Managing Director, Mr Jeff More, said the reserve upgrade represented a 105% increase over the original oxide reserves reported in the previous 2003 Simberi Project Gold Project Feasibility Study, and highlighted the very high success rate of its drilling programs over the past 12 months.

“We are very pleased with the outcome, which provides a very solid foundation for completion of the final OFS document, which we expect to be delivered before the end of this month,” Mr Moore said. “Furthermore, we have a very high expectation that ongoing exploration of known and other oxide gold targets throughout the highly mineralized Tabar Island Group will underpin a future expansion of the oxide gold reserves.”

“Exploration work including ongoing drilling is scheduled to continue throughout the forthcoming year to further test the margins and strike extent of known deposits, as well as testing additional high priority oxide gold anomalies on Simberi and Tatau Islands,” he added.

A highlight of the reserve upgrade was a 176% increase in the reserve and in-pit resources estimate for the Sorowar pit, the largest pit scheduled for mining. The additional drilling completed since 2003 resulted in a new reserve and in-pit resources estimate of 13.532 million tonnes at 1.22g/t gold for 530,000oz. The Sorowar deposit is still open along strike and at depth, and further expansion of the deposit is expected to result in increase gold throughput and oxide project mine life.

Earlier this year, Allied mandated RMB Resources to arrange a finance facility of up to US$25 million (if required) for development of the Simberi Oxide Gold Project. RMB has been involved in the financing of the Kainantu gold project in the Eastern Highlands Province of PNG.

The underlying sulphide gold resources on Simberi Island (704,000 ounces) will be developed as part of a longer-term strategy by Allied, in conjunction with regional exploration, as the basis for a Stage 2 sulphide mining operation which is expected to contribute sufficient additional gold production to underpin annualised production in excess of 100,000 ounces.

The information in this Media Release that relates to exploration results, mineral resources or ore reserves, together with any related assessments and interpretations, has been approved for release by Mr. R. Hastings, MSc, BSc., M.Aus.I.M.M., a qualified geologist and full-time employee of the Company. Mr Hastings has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined in the 2004 Edition of the “Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves”.

ENDS

| |

|---|

| Released by: | On behalf of: |

| Jan Hope / Nicholas Read | Mr Jeff Moore |

| Jan Hope & Partners | Managing Director |

| Telephone: (08) 9388 1474 | Allied Gold Ltd |

| | Telephone: (08) 9353 3638 |

| | Mobile: (0400) 927 202 |

| | Email: info@alliedgold.com.au |

| | Web: www.alliedgold.com.au |

EXHIBIT 4

EXHIBIT 5

ALLIED GOLD LIMITED

ABN 86 104 855 067

NOTICE OF ANNUAL GENERAL MEETING

EXPLANATORY STATEMENT

PROXY FORM

| PLACE: | | The Chifley on The Terrace

185 St Georges Terrace

PERTH, WESTERN AUSTRALIA |

This Notice of Annual General Meeting is an important document and requires your immediate attention. Please read it carefully. If you are in doubt as to what you should do, please consult your professional adviser.

CONTENTS PAGE

Notice of Annual General Meeting (setting out the proposed resolutions)

Explanatory Statement (explaining the proposed resolutions)

Glossary

Proxy Form | | 3

6

21

22 |

TIME AND PLACE OF MEETING AND HOW TO VOTE

VENUE

The Annual General Meeting of the Shareholders of Allied Gold Limited which this Notice of Annual General Meeting relates to will be held at 9.00am (WST) on 30 November 2005 at:

The Chifley on The Terrace

185 St Georges Terrace

PERTH, WESTERN AUSTRALIA

VOTING IN PERSON

To vote in person, attend the Annual General Meeting on the date and at the place set out above.

VOTING BY PROXY

To vote by proxy, please complete and sign the proxy form enclosed and either:

| (a) | | deliver the proxy form by hand to the Company’s registered office at Unit 15, Level 1, 51-53 Kewdale Road, Welshpool, Western Australia; or |

| (b) | | send the proxy from by facsimile to the Company on facsimile number (618) 9353 4894. |

so that it is received not later than 9.00 am (WST) on 28 November 2005.

Proxy forms received later than this time will be invalid.

2

NOTICE OF ANNUAL GENERAL MEETING

Notice is given that the Annual General Meeting of Shareholders of Allied Gold Limited will be held at The Chifley on The Terrace, 185 St Georges Terrace, Perth, Western Australia at 9.00am (WST) on 30 November 2005.

The Directors have determined pursuant to Regulation 7.11.37 of the Corporations Regulations 2001 (Cth) that the persons eligible to vote at the Annual General Meeting are those who are registered Shareholders of the Company on 28 November 2005 at 9.00am (WST).

AGENDA

BUSINESS

The Explanatory Statement which accompanies and forms part of this Notice describes the matters to be considered at the Meeting.

ORDINARY BUSINESS

Reports and Accounts

To receive and consider the financial statements of the Company for the year ended 30 June 2005 together with the declaration of the directors, the directors’ report, the remuneration report and the auditor’s report.

| 1. | | RESOLUTION 1 –REMUNERATION REPORT |

| | To consider and if thought fit, to pass, with or without amendment, the following resolution as a non-binding resolution: |

| | “That for the purposes of Section 250R(2) of the Corporations Act, the Company adopt the Remuneration Report.” |

| 2. | | RESOLUTION 2 –RE-ELECTION OF A DIRECTOR – GREG STEEMSON |

| | To consider and if thought fit, to pass, with or without amendment, the following resolution as an ordinary resolution: |

| | “That, Greg Steemson, being a Director of the Company who retires in accordance with clause 13.4 of the Constitution and,being eligible for reelection, is re-elected as a Director of the Company.” |

| 3. | | RESOLUTION 3 –RE-ELECTION OF A DIRECTOR – MARK CARUSO |

| | To consider and if thought fit, to pass, with or without amendment, the following resolution as an ordinary resolution: |

| | “That, Mark Caruso, being a Director of the Company who retires by rotation in accordance with clause 13.2 of theConstitution and, being eligible for reelection, is re-elected as a Director of the Company.” |

| 4. | | RESOLUTION 4 –ISSUE OF DIRECTOR OPTIONS TO MARK CARUSO |

| | To consider and if though fit, to pass, with or without amendment, the following resolution as an ordinary resolution: |

3

| | “That, for the purposes of Section 208 of the Corporations Act, ASX Listing Rule10.11 and for all other purposes, approval is given for the Directors to allot and issue 1,000,000 30c Director Options and1,000,000 40c Director Options to Mark Caruso (or his nominee) on the terms and conditions set out in the ExplanatoryStatement.” |

Voting Exclusion: The Company will disregard any votes cast on this Resolution by Mark Caruso or any person who may participate in the proposed issue and a person who may obtain a benefit, except a benefit solely in the capacity of a security holder, if the Resolution is passed and any associates of those persons.

| 5. | | RESOLUTION 5 –ISSUE OF DIRECTOR OPTIONS TO DAVID LYMBURN |

| | To consider and if though fit, to pass, with or without amendment, the following resolution as an ordinary resolution: |

| | “That, for the purposes of Section 208 of the Corporations Act, ASX Listing Rule 10.11 and for all other purposes, approval is given for the Directors to allot and issue 1,000,000 30c Director Options toDavid Lymburn (or his nominee) on the terms and conditions set out in the Explanatory Statement.” |

Voting Exclusion: The Company will disregard any votes cast on this Resolution by David Lymburn or any person who may participate in the proposed issue and a person who may obtain a benefit, except a benefit solely in the capacity of a security holder, if the Resolution is passed and any associates of those persons.

| 6. | | RESOLUTION 6 –ISSUE OF DIRECTOR OPTIONS TO GREGORY STEEMSON |

| | To consider and if though fit, to pass, with or without amendment, the following resolution as an ordinary resolution: |

| | “That, subject to the passing of Resolution 2, for the purposes of Section 208 of the Corporations Act, ASX Listing Rule10.11 and for all other purposes, approval is given for the Directors to allot and issue 1,000,000 30c Director Options toGregory Steemson (or his nominee) on the terms and conditions set out in the Explanatory Statement.” |

Voting Exclusion: The Company will disregard any votes cast on this Resolution by Gregory Steemson or any person who may participate in the proposed issue and a person who may obtain a benefit, except a benefit solely in the capacity of a security holder, if the Resolution is passed and any associates of those persons.

| 7. | | RESOLUTION 7 –ISSUE OF 2007 OPTIONS TO JEFFREY MOORE |

| | To consider and if though fit, to pass, with or without amendment, the following resolution as an ordinary resolution: |

| | “That, for the purposes of Section 208 of the Corporations Act, ASX Listing Rule 10.11 and for all other purposes, approval is given for the Directors to allot and issue 2,000,000 2007 Options to JeffreyMoore (or his nominee) on the terms and conditions set out in the Explanatory Statement.” |

Voting Exclusion: The Company will disregard any votes cast on this Resolution by Jeffrey Moore or any person who may participate in the proposed issue and a person who may obtain a benefit, except a benefit solely in the capacity of a security holder, if the Resolution is passed and any associates of those persons.

4

| 8. | | RESOLUTION 8 –ADOPTION OF INCENTIVE SCHEME |

| | To consider and, if thought fit, to pass, with or without amendment, the following resolution as anordinary resolution: |

| | “That, for the purposes of Listing Rule 7.2 (Exception 9) of the ASX Listing Rules and for all other purposes,approval is given for the Company to allot and issue options, each to acquire one fully paid ordinary share in thecapital of the Company, pursuant to an incentive option scheme known as the “Allied Gold Limited Employee IncentiveOption Scheme” (Scheme), a summary of which is set out in the Explanatory Statement accompanying this Notice ofMeeting.” |

Voting Exclusion: The Company will disregard any votes cast on this resolution by any employees or consultants of the Company (except those who are ineligible to participate in the Scheme), and any of their associates.

| 9. | | RESOLUTION 9 –RATIFICATION OF PRIOR ISSUE OF SECURITIES |

| | To consider and, if thought fit, to pass, with or without amendment, the following resolution as an ordinary resolution: |

| | “That, for the purposes of Listing Rule 7.4 of the ASX Listing Rules and for all other purposes, Shareholders ratify theallotment and issue of 2,000,000 Shares, 2,000,000 2006 Options and 2,000,000 2008 Options to Simberi Gold Corporation onthe terms set out in the Explanatory Statement accompanying this Notice.” |

Voting Exclusion:The Company will disregard any votes cast on this Resolution by any person who participated in the issue and any associates of those persons.

DATED: 27 OCTOBER 2005

BY ORDER OF THE BOARD

MR DAVID LYMBURN

COMPANY SECRETARY

ALLIED GOLD LIMITED

Voting Exclusion Note:

Where a voting exclusion applies, the Company need not disregard a vote if it is cast by a person as a proxy for a person who is entitled to vote in accordance with the directions on the proxy form or it is cast by the person chairing the meeting as proxy for a person who is entitled to vote, in accordance with a direction on the proxy form to vote as the proxy decides.

5

EXPLANATORY STATEMENT

This Explanatory Statement has been prepared for the information of the Shareholders of the Company in connection with the business to be conducted at the Annual General Meeting.

| 1. | | RESOLUTION 1–REMUNERATION REPORT |

| | The Remuneration Report is set out in the Director’s Report on page 20 of the Company’s 2005 Annual Report. It is also available on the Company’s website at www.alliedgold.com.au. |

| | The Remuneration Report sets out the Company’s remuneration arrangements for the Directors and senior management of the Company. |

| | Section 250R(2) of the Corporations Act requires that a resolution to adopt the Remuneration Report be put to the vote of the Company at the Annual General Meeting. However, Shareholders should note that the vote on Resolution 1 is advisory only and is not binding on the Company or its Directors. |

| | A reasonable opportunity will be provided for discussion of the Remuneration Report at the Annual General Meeting. |

| 2. | | RESOLUTION 2 –RE-ELECTION OF GREGORY STEEMSON |

| | Mr Gregory Steemson was appointed to fill a casual vacancy as a Director of the Company effective from 16 June 2005. |

| | In accordance with Clause 13.4 of the Constitution and ASX Listing Rule 14.4, any director appointed to fill a casual vacancy or as an additional director holds office until the next general meeting of Shareholders and is then eligible for re-election. |

| | Mr Steemson therefore retires at the forthcoming Annual General Meeting in accordance with the Constitution and being eligible, has offered himself for reelection. |

| 3. | | RESOLUTION 3 –RE-ELECTION OF MARK CARUSO |

| | Clause 13.2 of the Constitution of the Company requires that one third of the Directors retire by rotation at each annual general meeting of the Company. Mr Mark Caruso retires in accordance with that clause and being eligible for reelection, offers himself for re-election at the Meeting. |

| 4. | | RESOLUTIONS 4, 5 AND 6 – ISSUE OF DIRECTOR OPTIONS TO MARK CARUSO, DAVID LYMBURN AND GREGORY STEEMSON |

| | Resolutions 4, 5 and 6 seek Shareholder approval for the issue of up to 4,000,000 Director Options to Mr Mark Caruso, Mr David Lymburn and Mr Gregory Steemson (or their respective nominees). |

| | The ASX Listing Rules and the Corporations Act set out a number of regulatory requirements which must be satisfied. These are summarised below. |

| 4.1 | | Terms and Conditions of the Director Options |

| | The material terms and conditions of the 30c Director Options are as follows: |

| | (a) | | Each 30c Director Option entitles the holder to subscribe for one (1) Share. |

6

| | (b) | | The 30c Director Options are exercisable at any time on or prior to 5.00 pm (WST) on 30 June 2007 (Expiry Date) by completing a 30c Director Option exercise form and delivering it together with the payment for the number of Shares in respect of which the 30c Director Options are exercised to the registered office of the Company on or before the Expiry Date. |

| | (c) | | The 30c Director Option exercise price is $0.30 per 30c Director Option. |

| | (d) | | A 30c Director Option does not confer the right to a change in exercise price or a change in the number of underlying securities over which the 30c Director Option can be exercised. |

| | (e) | | The 30c Director Options are not transferable. |

| | (f) | | All Shares issued upon exercise of the 30c Director Options will rank pari passu in all respects with the Company’s then issued Shares. |

| | (g) | | The Company will apply for quotation of all Shares issued upon exercise of the 30c Director Options on ASX. The 30c Director Options will not be quoted on ASX. |

| | (h) | | There are no participating rights or entitlements inherent in the options and holders will not be entitled to participate in new issues of capital offered to Shareholders during the currency of the 30c Director Options. However, the Company will ensure that for the purposes of determining entitlements to any such issue, the record date will be at least 7 Business Days after the issue is announced. This will give 30c Director Option holders the opportunity to exercise their 30c Director Options prior to the date for determining entitlements to participate in any such issue. |

| | (i) | | If at any time the issued capital of the Company is reconstructed, all rights of a 30c Director Option holder are to be changed in a manner consistent with the Corporations Act and the Listing Rules. |

The material terms and conditions of the 40c Director Options are as follows:

| | (a) | | Each 40c Director Option entitles the holder to subscribe for one (1) Share. |

| | (b) | | The 40c Director Options are exercisable at any time on or prior to 5.00 pm (WST) on 30 June 2007 (Expiry Date) by completing a 40c Director Option exercise form and delivering it together with the payment for the number of Shares in respect of which the 40c Director Options are exercised to the registered office of the Company on or before the Expiry Date. |

| | (c) | | The 40c Director Option exercise price is $0.40 per 40c Director Option. |

| | (d) | | A 40c Director Option does not confer the right to a change in exercise price or a change in the number of underlying securities over which the 40c Director Option can be exercised. |

| | (e) | | The 40c Director Options are not transferable. |

| | (f) | | All Shares issued upon exercise of the 40c Director Options will rank pari passu in all respects with the Company’s then issued Shares. |

7

| | (g) | | The Company will apply for quotation of all Shares issued upon exercise of the 40c Director Options on ASX. The 40c Director Options will not be quoted on ASX. |

| | (h) | | There are no participating rights or entitlements inherent in the options and holders will not be entitled to participate in new issues of capital offered to Shareholders during the currency of the 40c Director Options. However, the Company will ensure that for the purposes of determining entitlements to any such issue, the record date will be at least 7 Business Days after the issue is announced. This will give 40c Director Option holders the opportunity to exercise their 40c Director Options prior to the date for determining entitlements to participate in any such issue. |

| | (i) | | If at any time the issued capital of the Company is reconstructed, all rights of a 40c Director Option holder are to be changed in a manner consistent with the Corporations Act and the Listing Rules. |

| 4.2 | | Value of the Director Options |

| | The Director Options have been valued by BDO Chartered Accountants using the Black &Scholes pricing model and based upon the following assumptions: |

| | (a) | | the Director Options have a 1.7 year life from their date of issue and are exerciseable at $0.30 each and $0.40 each; |

| | (b) | | a price per Share of $0.285 (being the price per Share on ASX on 5 October 2005); |

| | (c) | | an annual volatility factor of 70% (being the anticipated standard deviation over the life of the options based on an average of comparable companies’ historical data); |

| | (d) | | a risk free interest rate of 5.34% (being the risk free interest rate on government bonds with a similar maturity as the Director Options); |

| | (e) | | the valuations ascribed to the Director Options may not necessarily represent the market price of the Director Options at the date of the valuation; and |

| | (f) | | the valuation date for the Director Options is 5 October 2005. |

| | Based on the above, the Director Options are valued in total at $394,000. |

| 4.3 | | ASX Listing Rule 10.11 |

| | ASX Listing Rule 10.11 requires a listed company to obtain shareholder approval by ordinary resolution prior to the issue of securities (including an option) to a related party of the company. |

| | If Resolutions 4, 5 and 6 are passed, Director Options will be issued to Mr Caruso, Mr Lymburn and Mr Steemson, who are related parties of the Company. Accordingly, approval for the issue of Director Options is required pursuant to ASX Listing Rule 10.11. |

| | Approval pursuant to ASX Listing Rule 7.1 is not required in order to issue the Director Options to Mr Caruso, Mr Lymburn and Mr Steemson as approval is being obtained under ASX Listing Rule 10.11. Shareholders should note that the issue of Director |

8

| | Options to Mr Caruso, Mr Lymburn and Mr Steemson will not be included in the 15% calculation for the purposes of ASX Listing Rule 7.1. |

| | ASX Listing Rule 10.13 sets out a number of matters which must be included in a notice of meeting proposing an approval under ASX Listing Rule 10.11. For the purposes of ASX Listing Rule 10.13, the following information is provided in relation to Resolutions 4, 5 and 6: |

| | (a) | | the maximum number of Director Options to be issued by the Company is 4,000,000 as follows: |

| | | (i) | | 1,000,000 30c Director Options and 1,000,000 40c Director Options to Mr Caruso; |

| | | (ii) | | 1,000,000 30c Director Options to Mr Lymburn; and |

| | | (iii) | | 1,000,000 30c Director Options to Mr Steemson; |

| | (b) | | the Director Options will be issued for no cash consideration; |

| | (c) | | the Director Options will be issued not later than one month after the date of the Annual General Meeting (or such later date as permitted by any ASX waiver or modification of the ASX Listing Rules) and it is anticipated that allotment will occur on one date; |

| | (d) | | no funds will be raised from the issue of the Director Options as the purpose of the issue is to give the Directors an incentive to provide dedicated and ongoing commitment to the Company; and |

| | (e) | | the Director Options will be issued on the terms and conditions set out in paragraph 4.1 of this Explanatory Statement. |

| 4.4 | | Section 208 of the Corporations Act |

| | Under Chapter 2E of the Corporations Act, a public company cannot give a “financial benefit” to a “related party” unless one of the exceptions to the section apply or shareholders have in general meeting approved the giving of that financial benefit to the related party. |

| | In the current circumstances, the issue of the Director Options to each of Mr Caruso, Mr Lymburn and Mr Steemson constitutes a “financial benefit” as defined in the Corporations Act. Further, each of Mr Caruso, Mr Lymburn and Mr Steemson are “related parties” of the Company as defined under the Corporations Act. Accordingly, the proposed issue of Director Options to Mr Caruso, Mr Lymburn and Mr Steemson will constitute the provision of financial benefits to related parties of the Company. |

| | It is the view of the Directors that the exceptions under the Corporations Act to the provision of a financial benefit to a related party may not apply in the current circumstances. The Directors have determined to seek Shareholder approval under Section 208 of the Corporations Act to permit the issue of the Options. |

| | Pursuant to Sections 217 to 227 of the Corporations Act, the Company provides the following information to Shareholders in respect of the proposed financial benefit to be given to Mr Caruso, Mr Lymburn and Mr Steemson: |

9

| | (a) | | the related parties to whom the financial benefit will be given is Mr Caruso, Mr Lymburn and Mr Steemson; |

| | (b) | | the maximum number of Director Options (being the nature of the financial benefit to be provided) to be issued is 4,000,000 as follows: |

| | | (i) | | 1,000,000 30c Director Options and 1,000,000 40c Director Options to Mr Caruso; |

| | | (ii) | | 1,000,000 30c Director Options to Mr Lymburn; and |

| | | (iii) | | 1,000,000 30c Director Options to Mr Steemson; |

| | (c) | | no funds will be raised from the issue of the Director Options to Mr Caruso, Mr Lymburn and Mr Steemson; |

| | (d) | | the Directors make the following recommendations in relation to Resolutions 4, 5 and 6: |

| | | (i) | | the Directors (other than Mr Caruso), who do not have a material personal interest in the outcome of Resolution 4, recommend that Shareholders vote in favour of Resolution 4 as they are of the view that the issue of 2,000,000 Director Options to Mr Caruso is appropriate to provide him with an incentive to maximise returns to Shareholders. It is also the opinion of the Directors (other than Mr Caruso) that the annual emoluments paid and payable to Mr Caruso as described in paragraph 4.4(e) do not on their own amount to adequate compensation at current market rates for the services provided to the Company by Mr Caruso, and to supplement the annual emoluments with the issue of Director Options is in the Company’s best interests. The Directors (other than Mr Caruso) considered Mr Caruso’s experience, the current market price of the Shares and current market practice when determining the number and exercise price of the Director Options to be issued to Mr Caruso. Mr Caruso declined to make a recommendation in relation to Resolution 4 due to the fact that he has a material personal interest in its outcome; |

| | | (ii) | | the Directors (other than Mr Lymburn), who do not have a material personal interest in the outcome of Resolution 5, recommend that Shareholders vote in favour of Resolution 5 as they are of the view that the issue of 1,000,000 Director Options to Mr Lymburn is appropriate to provide him with an incentive to maximise returns to Shareholders. It is also the opinion of the Directors (other than Mr Lymburn) that the annual emoluments paid and payable to Mr Lymburn as described in paragraph 4.4(e) do not on their own amount to adequate compensation at current market rates for the services provided to the Company by Mr Lymburn, and to supplement the annual emoluments with the issue of Director Options is in the Company’s best interests. The Directors (other than Mr Lymburn) considered Mr Lymburn’s experience, the current market price of the Shares and current market practice when determining the number and exercise price of the Director Options to be issued to Mr Lymburn. Mr Lymburn declined to make a recommendation in relation to Resolution 5 due to the fact that he has a material personal interest in its outcome; and |

10

| | | (iii) | | the Directors (other than Mr Steemson), who do not have a material personal interest in the outcome of Resolution 6, recommend that Shareholders vote in favour of Resolution 6 as they are of the view that the issue of 1,000,000 Director Options to Mr Steemson is appropriate to provide him with an incentive to maximise returns to Shareholders. It is also the opinion of the Directors (other than Mr Steemson) that the annual emoluments paid and payable to Mr Steemson as described in paragraph 4.4(e) do not on their own amount to adequate compensation at current market rates for the services provided to the Company by Mr Steemson, and to supplement the annual emoluments with the issue of Director Options is in the Company’s best interests. The Directors (other than Mr Steemson) considered Mr Steemson’s experience, the current market price of the Shares and current market practice when determining the number and exercise price of the Directors Options to be issued to Mr Steemson. Mr Steemson declined to make a recommendation in relation to Resolution 6 due to the fact that he has a material personal interest in its outcome; |

| | (e) | | for the financial year ended 30 June 2005, Mr Caruso received directors fees of $88,500 (including superannuation), Mr Lymburn received consulting fees of $45,000 (excluding superannuation) and Mr Steemson received consulting fees of $3,200 (excluding superannuation). Prior to his appointment as a Director, Mr Steemson also received $27,200 for services rendered to the Company as a consultant. Mr Caruso, Mr Lymburn and Mr Steemson currently receive the following emoluments from the Company: |

| |

|---|

| Director | Annual Emolument

(exclusive of statutory superannuation) |

| Mr Caruso | $92,400 |

| Mr Lymburn | $48,000 |

| Mr Steemson | $38,400 |

| | (f) | | Mr Caruso, Mr Lymburn and Mr Steemson currently have an interest in the following number of Securities: |

| | |

|---|

| Director | Shares | Options |

| Mr Caruso | 694,168 | 1,000,000 |

| Mr Lymburn | 370,000 | 600,000 |

| Mr Steemson | 209,934 | 1,000,000 |

| | (g) | | if the Options issued to Mr Caruso, Mr Lymburn and Mr Steemson are all exercised, a total of 4,000,000 Shares would be allotted and issued. This will increase the number of Shares on issue from 120,579,818 to 124,579,818 Shares (assuming no other options are exercised and no other Shares are issued) with the effect that the shareholding of existing Shareholders would be diluted as follows: |

| | | |

|---|

| Director | Number of

Options to

be issued | Issued Shares

at the date of

this Notice | Dilutionary effect if all

Options issued to Director

are exercised |

| Mr Caruso | 2,000,000 | 120,579,818 | 1.63% |

| Mr Lymburn | 1,000,000 | 120,579,818 | 0.82% |

11

| | | |

|---|

| Mr Steemson | 1,000,000 | 120,579,818 | 0.82% |

| | The market price for Shares during the term of the Director Options would normally determine whether or not the Directors exercise the Director Options. If, at the time any of the Directors Options are exercised, the Shares are trading on ASX at a price that is higher than the exercise price of the Directors Options, there may be a perceived cost to the Company; |

| | (h) | | the highest, lowest and last trading price of Shares on ASX during the last 12 months are as set out below: |

| | |

|---|

| | Price | Date |

| Highest | $ 0.31 | 17, 18 and 21 March 2005 |

| Lowest | $ 0.20 | 19, 20, 21 and 25 October 2004 |

| Last | $ 0.32 | 18 October 2005 |

| | (i) | | the Directors make the following disclosures in relation to Resolutions 4, 5 and 6: |

| | | (i) | | the primary purpose of the issue of the Director Options to Mr Caruso is to allow the Company to provide cost effective consideration to Mr Caruso for work done and proposed to be done by Mr Caruso for the Company. Given this purpose and bearing in mind the exercise terms of the Director Options, the Directors (other than Mr Caruso) do not consider that there are any significant opportunity costs to the Company or benefits foregone by the Company in issuing the Director Options to Mr Caruso on the terms proposed; |

| | | (ii) | | the primary purpose of the issue of the Director Options to Mr Lymburn is to allow the Company to provide cost effective consideration to Mr Lymburn for work done and proposed to be done by Mr Lymburn for the Company. Given this purpose and bearing in mind the exercise terms of the Director Options, the Directors (other than Mr Lymburn) do not consider that there are any significant opportunity costs to the Company or benefits foregone by the Company in issuing the Director Options to Mr Lymburn on the terms proposed; and |

| | | (iii) | | the primary purpose of the issue of the Director Options to Mr Steemson is to allow the Company to provide cost effective consideration to Mr Steemson for work done and proposed to be done by Mr Steemson for the Company. Given this purpose and bearing in mind the exercise terms of the Director Options, the Directors (other than Mr Steemson) do not consider that there are any significant opportunity costs to the Company or benefits foregone by the Company in issuing the Director Options to Mr Steemson on the terms proposed; |

| | (j) | | the value of the Directors Options has been calculated by BDO Chartered Accountants using the Black & Scholes pricing model and is set out in paragraph 4.2 above; and |

| | (k) | | additional information in relation to Resolutions 4, 5 and 6 is set out throughout this Explanatory Statement. Shareholders should therefore read |

12

| | the Notice of Meeting and Explanatory Statement in its entirety before making a decision as to how to vote on Resolutions 4, 5 and 6. |

| 5. | | RESOLUTION 7 –ISSUE OF OPTIONS TO JEFFREY MOORE |

| | Shareholder approval is required under Chapter 2E of the Corporations Act and ASX Listing Rule 10.11 for the issue of 2,000,000 2007 Options to Mr Moore because he is a related party of the Company. |

| 5.1 | | Terms and Conditions of the 2007 Options |

| | The material terms and conditions of the 2007 Options are as follows: |

| | (b) | | each 2007 Option entitles the holder, when exercised, to one Share; |

| | (c) | | the 2007 Options are exercisable at any time prior to 5.00 pm WST on or before 30 June 2007; |

| | (d) | | the first 1,000,000 2007 Options are exerciseable at a price of $0.30 per Option and the second 1,000,000 2007 Options are exerciseable at a price of $0.40 per 2007 Option; |

| | (e) | | the 2007 Options will not be freely transferable and application will not be made to the ASX for official quotation of the 2007 Options; |

| | (f) | | the 2007 Options must be exercised in parcels of not less than 250,000 at a time; |

| | (g) | | Shares allotted and issued pursuant to the exercise of the 2007 Options will be allotted and issued not more than 10 business days after receipt of a properly executed notice of exercise of the 2007 Option and payment of the requisite application monies. |

| | (h) | | all shares issued upon exercise of the 2007 Options will rank parri passu in all respects with the Company’s then issued shares. The Company will apply for official quotation by ASX of all shares issued upon the exercise of the 2007 Options; |

| | (i) | | there are no participating rights or entitlements inherent in the 2007 Options and holders will not be entitled to participate in new issues of capital offered to shareholders during the currency of the 2007 Options. However, the Company will ensure that for the purpose of determining entitlements to any issue, that option-holders will be notified of the proposed issue at least (10) business days before the record date. This will give option-holders the opportunity to exercise their 2007 Options prior to the date for determining entitlements to participate in any such issue; |

| | (j) | | in the event of any new or bonus issues there are no rights to a change in exercise price, or a change in the number of underlying securities over which the 2007 Options can be exercised; |

| | (k) | | in the event of any reconstruction (including consolidation, sub-division, reduction or return) of the issued capital of the Company prior to the expiry date, all rights of the option-holder will be varied in accordance with the Listing Rules; and |

13

| | (l) | | the 2007 Options will lapse 30 days after termination of full time employment with the Company. |

| 5.2 | | Value of the 2007 Options |

| | The 2007 Options have been valued by BDO Chartered Accountants using the Black & Scholes pricing model and based upon the following assumptions: |

| | (g) | | the 2007 Options have a 1.7 year life from their date of issue and are exerciseable at $0.30 and $0.40 each; |

| | (h) | | a price per Share of $0.285 (being the price per Share on ASX on 5 October 2005); |

| | (i) | | an annual volatility factor of 70% (being the anticipated standard deviation over the life of the options based on an average of comparable companies’ historical data) |

| | (j) | | a risk free interest rate of 5.34% (being the risk free interest rate on government bonds with a similar maturity as the 2007 Options); |

| | (k) | | the valuations ascribed to the 2007 Options may not necessarily represent the market price of the 2007 Options at the date of the valuation; and |

| | (l) | | the valuation date for the 2007 Options is 5 October 2005. |

| | Based on the above, the 2007 Options are valued in total at $184,000. |

| 5.3 | | ASX Listing Rule 10.11 |

| | Shareholder approval for the issue of 2,000,000 2007 Options to Mr Moore is required pursuant to ASX Listing Rule 10.11 because Mr Moore is a related party of the Company. |

| | Approval pursuant to ASX Listing Rule 7.1 is not required in order to issue the 2007 Options to Mr Moore as approval is being obtained under ASX Listing Rule 10.11. The issue of 2,000,000 2007 Options to Mr Moore will not be included in the 15% calculation for the purposes of ASX Listing Rule 7.1. |

| | For the purposes of ASX Listing Rule 10.13, the following information is provided in relation to Resolution 7: |

| | (a) | | the maximum number of 2007 Options to be issued by the Company to Mr Moore is 2,000,000; |

| | (b) | | the 2007 Options will be issued for no cash consideration; |

| | (c) | | the 2007 Options will be issued not later than one month after the date of the Annual General Meeting (or such later date as permitted by any ASX waiver or modification of the ASX Listing Rules) and it is anticipated that allotment will occur on one date; |

| | (d) | | no funds will be raised from the issue of the 2007 Options as the purpose of the issue is to give Mr Moore an incentive to provide dedicated and ongoing commitment to the Company; and |

14

| | (e) | | the 2007 Options will be issued on the terms and conditions set out in paragraph 5.1 of this Explanatory Statement. |

| 5.4 | | Section 208 of the Corporations Act |

| | For the purposes of Chapter 2E of the Corporations Act and in particular, Sections 217 to 227 of the Corporations Act, the following information is provided to Shareholders to assess the proposed issue of the 2007 Options to Mr Moore: |

| | (a) | | the related party to whom the financial benefit will be given is Mr Moore; |

| | (b) | | the maximum number of 2007 Options to be issued to Mr Moore is 2,000,000 2007 Options; |

| | (c) | | no funds will be raised from the issue of the 2007 Options to Mr Moore; |

| | (d) | | Mr Moore currently has an interest in the following Securities in the Company: |

| | |

|---|

| | Shares | Options |

| Direct interest | 90,000 | Nil |

| Indirect interest | Nil | Nil |

| | (e) | | for the financial year ended 30 June 2005, Mr Moore received a salary of $178,698 (including superannuation). Mr Moore currently receives a base salary package of $204,200 per year (including superannuation) from the Company; |

| | (f) | | the highest, lowest and latest trading prices of Shares on ASX are set out in paragraph 4.4(h) of this Explanatory Statement; |

| | (g) | | if Shareholders approve the issue of 2007 Options to Mr Moore and all of the 2007 Options are exercised, the effect would be to increase the number of Shares on issue from 120,579,818 to 122,579,818 Shares (assuming no other options are exercised and no other Shares are issued) with the effect that the shareholding of existing Shareholders would be diluted approximately 1.63% on an undiluted basis and based on the number of Shares on issue as at the date of this Notice. The market price for Shares during the term of the 2007 Options would normally determine whether or not the Directors exercise the 2007 Options. If, at the time any of the 2007 Options are exercised, the Shares are trading on ASX at a price that is higher than the exercise price of the 2007 Options, there may be a perceived cost to the Company; |

| | (h) | | the value of the 2007 Options to be issued to Mr Moore has been calculated by BDO Chartered Accountants using the Black & Scholes model and is set out in Section 5.2 above; |

| | (i) | | the primary purpose of the issue of the 2007 Options to Mr Moore is to provide cost effective consideration to Mr Moore for work done and proposed to be done by Mr Moore for the Company . The Directors (other than Mr Moore) do not consider that there are any significant opportunity costs to the Company or benefits foregone by the Company in issuing the 2007 Options to Mr Moore on the terms proposed; and |

15

| | (j) | | the Directors (other than Mr Moore), who do not have a material personal interest in the outcome of Resolution 7, recommend that Shareholders vote in favour of Resolution 7 as they are of the view that the issue of 2,000,000 2007 Options to Mr Moore is appropriate to provide him with an incentive to maximise returns to Shareholders. The Directors (other than Mr Moore) considered Mr Moore’s experience, the current market price of the Shares and current market practice of providing appropriate incentive remuneration to the office of Managing Director, when determining the number and exercise price of the 2007 Options to be issued to Mr Moore. Mr Moore declined to make a recommendation in relation to Resolution 7 due to the fact that he has a material personal interest in its outcome; and |

| | (k) | | additional information in relation to Resolution 7 is set out throughout this Explanatory Statement. Shareholders should therefore read the Notice of Meeting and Explanatory Statement in its entirety before making a decision as to how to vote on Resolution 7. |

| 6. | | RESOLUTION 8 – ADOPTION OF INCENTIVE SCHEME |

| | Resolution 8 seeks the approval of Shareholders for the grant of options pursuant to the “Allied Gold Ltd Employee Incentive Option Scheme” (Scheme). Resolution 8 is placed before Shareholders in accordance with Exception 9 of Listing Rule 7.2. If Resolution 8 is passed, the Company will be able to issue options under the Scheme over a period of 3 years without impacting on the Company’s ability to issue up to 15% of its total ordinary securities without shareholder approval in any 12 month period. |

| | Shareholders should note that no options have previously been issued under this Scheme and the objective of the Scheme is to attract, motivate and retain key employees. Shareholders should also note that Directors and other related parties of the Company will not be permitted to participate under the Scheme without further Shareholder approval. |

| | It is considered by the Directors that the adoption of the Scheme and the future grant of options under the Scheme will provide selected employees with the opportunity to participate in the future growth of the Company. |

| | A summary of the terms and conditions of the Scheme is set out below: |

| | The Scheme is designed to provide eligible participants with an ownership interest in the Company and to provide additional incentives for eligible participants to increase profitability and returns to Shareholders. |

| | The summary of the Scheme is set out below for the information of potential investors in the Company. The detailed terms and conditions of the Scheme may be obtained free of charge by contacting the Company. |

| | The Board may from time to time, in its absolute discretion, offer to grant options to eligible participants under the Scheme. |

16

| | Each option will be issued for no consideration and will carry the right in favour of the option holder to subscribe for one (1) Share in the capital of the Company. |

| | The Board may determine the exercise price of the options in its absolute discretion. Subject to the Listing Rules, the exercise price may be nil but to the extent the Listing Rules specify or require a minimum price, the exercise price in respect of an offer made following the day on which Shares are first quoted on the Official List must not be less than any minimum price specified in the Listing Rules. |

| 6.4 | | Eligible Participants |

| | Full time employees, part time employees, Directors and consultants of the Company or an associated body corporate (theGroup) are eligible to participate in the Scheme. |

| | Unless the Board in its absolute discretion determines otherwise, options shall lapse immediately if: |

| | (a) | | the eligible participant ceases to be an employee or director of, or to render services to, a member of the Group for any reason whatsoever and the conditions of exercise of the options (Exercise Conditions) have not been met; |

| | (b) | | the Exercise Conditions of the options are unable to be met; |

| | (c) | | the date which is 2 years after the date of the grant of the options, or such other expiry date as the Board determines in its discretion at the time of grant of the option (Lapsing Date) has passed; or |

| | (d) | | the expiry of 60 days after the eligible participant ceases to be an employee or director of, or to render services to, a member of the Group for any reason whatsoever prior to the Lapsing Date where the Exercise Conditions have been met, |

| 6.6 | | Participation in Future Issues |

| | There are no participating rights or entitlements inherent in the options and holders will not be entitled to participate in new issues of capital offered to Shareholders during the currency of the options. However, the Company will ensure that for the purposes of determining entitlements to any such issue, the record date will be at least 7 business days after the issue is announced. This will give option holders the opportunity to exercise their options prior to the date for determining entitlements to participate in any such issue. |

| | If the Company makes a pro rata issue of securities (except a bonus issue) to the holders of Shares (other than an issue in lieu or in satisfaction of dividends or by way of dividend reinvestment) the exercise price of the options shall be reduced in accordance with the formula in the Listing Rules. |

| | In the event of a bonus issue of Shares being made pro-rata to Shareholders (other than an issue in lieu of dividends), the number of Shares issued on exercise of each option will include the number of bonus Shares that would have been issued if the |

17

| | option had been exercised prior to the record date for the bonus issue. No adjustment will be made to the exercise price per Share of the option. |

| | The terms upon which options will be granted will not prevent them being reorganised as required by the Listing Rules on the reorganisation of the capital of the Company. |

| | Upon the occurrence of certain trigger events (for example the receipt by the Company of a bidder’s statement in respect of the Company), the Directors may determine: |

| | (a) | | that the options may be exercised at any time from the date of such determination, and in any number until the date determined by the Directors acting bona fide so as to permit the holder to participate in any change of control arising from a trigger event, provided that the Directors will forthwith advise in writing each holder of such determination. Thereafter, the options shall lapse to the extent they have not been exercised; or |

| | (b) | | to use their reasonable endeavours to procure that an offer is made to holders of options on like terms (having regard to the nature and value of the options) to the terms proposed under the trigger event in which case the Directors shall determine an appropriate period during which the holder may elect to accept the offer and, if the holder has not so elected at the end of that period, the options shall immediately become exercisable and if not exercised within 10 days, shall lapse. |

| 7. | | RESOLUTION 9 – RATIFICATION OF PRIOR ISSUE OF SECURITIES |

| | Pursuant to an agreement between Simberi Gold Corporation (SG Corporation), Nord Pacific Limited (Nord Pacific) and the Company dated 31 January 2005 (Sale Agreement), the Company (through Simberi Gold Company (SG Company) has purchased various joint venture interests in the Simberi Mining Joint Venture (SMJV) and Tabar Exploration Joint Venture (TEJV) owned by SG Corporation. |

| | On 13 October 2005 2005, the Company entered into an Acknowledgement Agreement with SG Corporation, Nord Pacific and SG Company where the Company agreed to pay C$200,000 and issue the following securities to SG Corporation or its nominee in consideration of the transfer of a 12.5% free carried direct equity interest in the SMJV (Free Carried Interest) by SG Corporation to SG Company: |

| | (b) | | 2,000,000 2006 Options; and |

| | (c) | | 2,000,000 2008 Options. |

| | These Securities were issued by the Company to SG Company on 20 October 2005. The issue of the Securities complied with Listing Rule 7.1 at the time of issue. |

18

| | By Resolution 9, the Company is seeking Shareholder ratification pursuant to Listing Rule 7.4 for the issue of up to 2,000,000 Shares 2,000,000 2006 Options and 2,000,000 2008 Options to SG Corporation in consideration of the transfer of the Free Carried Interest by SG Corporation to SG Company. |

| | By ratifying this issue, the Company will retain the flexibility to issue equity securities in the future up to the 15% threshold as set out in Listing Rule 7.1 without the requirement to obtain prior Shareholder approval. |

| | The material terms and conditions of the 2006 Options are as follows: |

| | (a) | | Each 2006 Option entitles the holder to subscribe for one (1) Share. |

| | (b) | | The 2006 Options are exercisable at any time on or prior to 5.00 pm (WST) on 31 December 2006 (Expiry Date) by completing a 2006 Option exercise form and delivering it together with the payment for the number of Shares in respect of which the 2006 Options are exercised to the registered office of the Company on or before the Expiry Date. |

| | (c) | | The 2006 Option exercise price is $0.25 per 2006 Option. |

| | (d) | | A 2006 Option does not confer the right to a change in exercise price or a change in the number of underlying securities over which the 2006 Option can be exercised. |

| | (e) | | The 2006 Options are not transferable. |

| | (f) | | All Shares issued upon exercise of the 2006 Options will rank pari passu in all respects with the Company’s then issued Shares. |

| | (g) | | The Company will apply for quotation of all Shares issued upon exercise of the 2006 Options on ASX. The 2006 Options will not be quoted on ASX. |

| | (h) | | There are no participating rights or entitlements inherent in the options and holders will not be entitled to participate in new issues of capital offered to Shareholders during the currency of the 2006 Options. However, the Company will ensure that for the purposes of determining entitlements to any such issue, the record date will be at least 7 Business Days after the issue is announced. This will give 2006 Option holders the opportunity to exercise their 2006 Options prior to the date for determining entitlements to participate in any such issue. |

| | (i) | | If at any time the issued capital of the Company is reconstructed, all rights of a 2006 Option holder are to be changed in a manner consistent with the Corporations Act and the Listing Rules. |

| | The material terms and conditions of the 2008 Options are as follows: |

| | (a) | | Each 2008 Option entitles the holder to subscribe for one (1) Share. |

| | (b) | | The 2008 Options are exercisable at any time on or prior to 5.00 pm (WST) on 31 December 2008 (Expiry Date) by completing a 2008 Option exercise form and delivering it together with the payment for the number of Shares in respect of which the 2008 Options are exercised to the registered office of the Company on or before the Expiry Date. |

19

| | (c) | | The 2008 Option exercise price is $0.50 per 2008 Option. |

| | (d) | | A 2008 Option does not confer the right to a change in exercise price or a change in the number of underlying securities over which the 2008 Option can be exercised. |

| | (e) | | The 2008 Options are not transferable. |

| | (f) | | All Shares issued upon exercise of the 2008 Options will rank pari passu in all respects with the Company’s then issued Shares. |