SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) May 8, 2002

NORD PACIFIC LIMITED

(Exact name of registrant as specified in its charter)

New Brunswick, Canada | 000-19182 | | Not Applicable |

(State or Other

Jurisdiction of

Incorporation) | (Commission

File Number) | | (IRS Employer

Identification Number |

40 Wellington Row, Suite 2100, Scotia Plaza | |

Saint John, New Brunswick, Canada

(Address of Principal Executive Offices) | E2L 4S3

(Zip Code) |

Registrant's telephone number, including area code: (506) 633-3800

ITEM 5. Other Events

Letter to Shareholders, dated May 3, 2002

I want to take this opportunity to bring you up to date on the progress which Nord Pacific has made during the past several months. While it has been a most difficult period for the Company, I genuinely believe we now have the opportunity to rise out of the ashes like the legendary Phoenix and create a new company based around our gold and silver holdings in Papua New Guinea and Mexico. It will not be easy. We do not have much cash to work with and our window of opportunity is short.

Having said that, we are virtually free of any debt, we have a small group of dedicated, enthusiastic and very competent people who believe in what we are trying to do, and we have the projects that can truly make this company a real success. I would like to go into all of this in some detail. Please pardon the length of this letter, but a lot has happened and we have been delinquent in keeping you posted as to what has been going on, for which I apologize. I hope I answer any questions you may have.

The events of recent months were not really of our choosing, but fortuitously have provided the opportunity for a new beginning for the Company. Our Tabar Islands gold property holdings, located off the east coast of New Ireland in Papua New Guinea, contain not only significant open pit mineable deposits, but of equal or greater importance, also provide the outstanding potential for the discovery and development of world-class orebodies. In miner's language, we are in real elephant country with big elephants. The task ahead of us is to convert this potential into operating gold mines and determine where the elephants are hiding.

Although we have performed well in developing and operating the Girilambone Copper Mines in New South Wales (Australia), copper prices have continued to be weak and we believe it is an opportune time to focus our efforts on our precious metals resources. We have been an innovative company in achieving excellent results in copper mining and processing, and these same skills and expertise can now provide the foundation for developing the Simberi Oxide Gold Project in the Tabar Islands. Furthermore, our many years of experience in Australia and Papua New Guinea give us the confidence from political, economic and social perspectives that we can successfully develop projects in the Tabar Islands.

As you may be aware, during the past ten years all of the Company's revenues have been derived from our Girilambone copper operations in Australia under a joint venture with Straits Resources Limited. However, depressed copper prices in recent years and the tapering off of production due to exhaustion of the reserves reduced the income received by the Company.

Because of these low copper prices, we were unable to attract a joint venture partner to assist in funding the development of the Tritton Copper Project. In addition, accelerated cash calls initiated by Straits to meet future operating costs at Girilambone, coupled with demands for property purchase payments in arrears due to Straits on the Tritton project, placed substantial financial pressure on our Company. Accordingly, in order to maintain our gold prospects, we sold our copper holdings to Straits and on March 27, 2002 the transaction closed with the payment to the Company of US$670,000, which included relief from all debt owed to Straits and Girilambone Copper Company, and relief from all future environmental liabilities. These funds enabled the Company to pay substantially all of our creditors and provide us with a modest ability to proceed with our efforts to develop our precious metals projects.

Company Projects

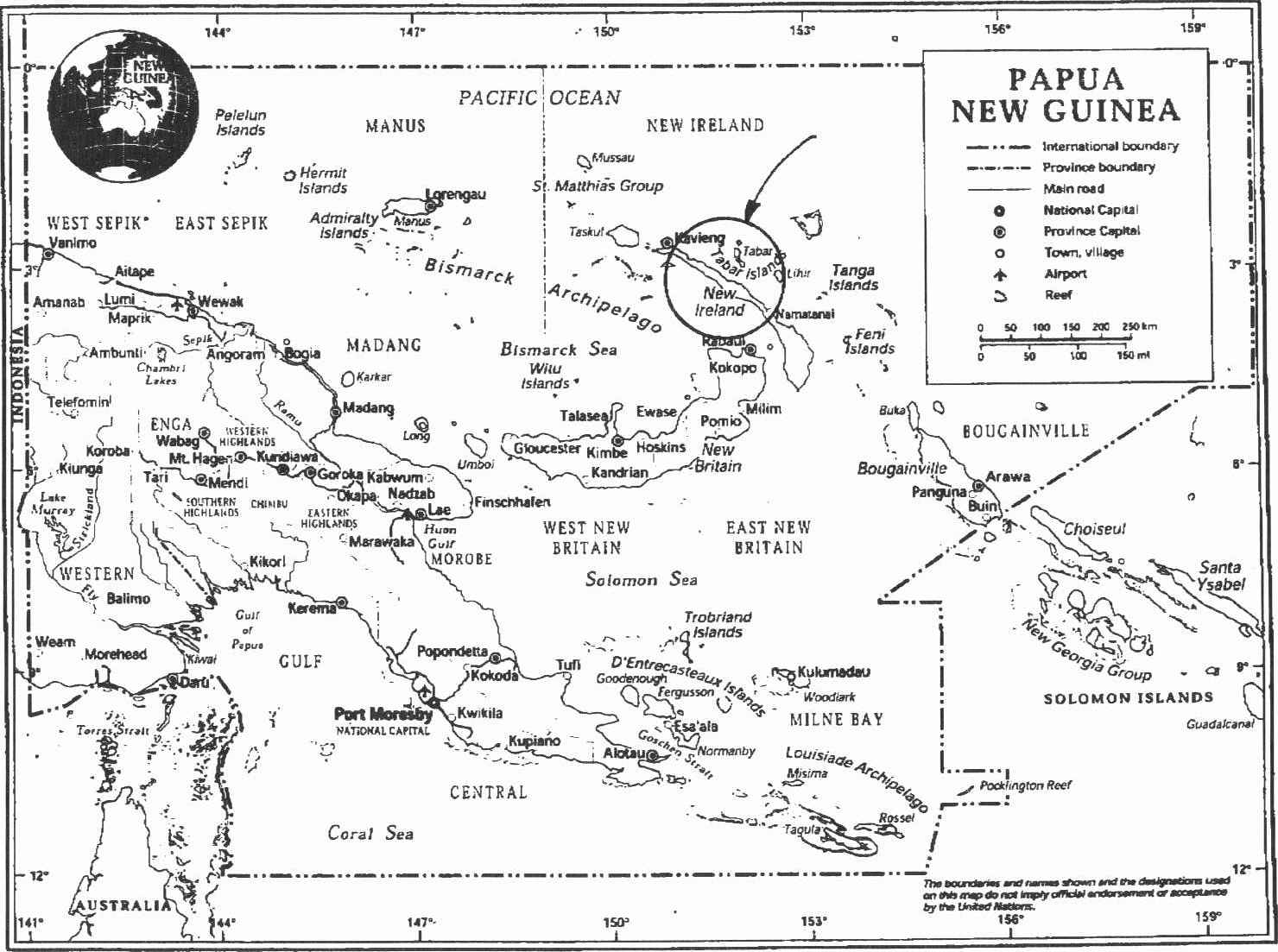

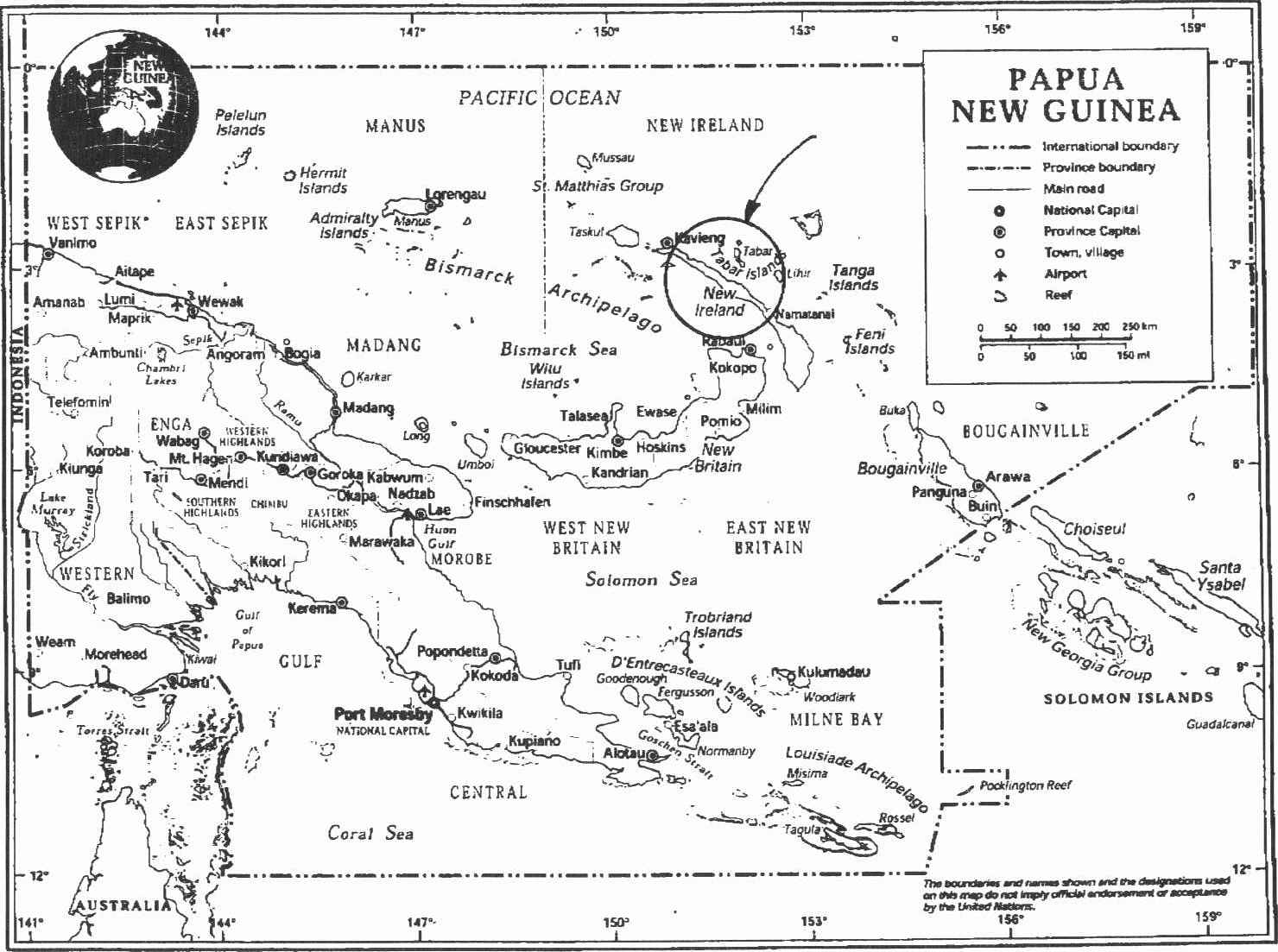

As described in our recent news releases, we now have a two-pronged effort. Our primary focus is to develop the Simberi oxide gold deposits. Secondly, we are also seeking a joint venture partner to conduct exploration for additional deposits in the Tabar Islands. Nord Pacific controls the mineral rights to all of the islands of the Tabar Islands group, which cover an area of about 250 square kilometers (90 square miles). Most of the work performed to date has been on the northernmost island of Simberi. The map on the last page of this letter will give you a better idea of the location of the Tabar Islands and the Simberi Project, and the location of our interests in relation to the substantial Lihir Gold Project.

The Company also controls a highly prospective exploration area adjacent to the Mapimi District in the State of Durango, Mexico, which has historically produced high-grade ores containing gold, silver, lead and zinc. Mapimi is considered to be an excellent exploration prospect and the Company plans to establish a joint venture relationship with a major mining company to more fully evaluate and add value to the property. Several exploration targets have already been identified through geophysical work previously completed by the Company.

We also hold a minority working interest in the Mandilla Well Joint Venture in Western Australia, which is managed by a subsidiary of Newmont Mining Corp. The Company has been advised that Newmont intends to conduct additional drilling for gold mineralization on this prospect in the immediate future. Due to our limited financial resources, we do not plan to contribute additional funds to this program at the present time and our interest will be diluted to about 25%. The Newmont program should determine the potential of this prospect for development.

In addition, the Company also holds an interest of approximately 6% in the Monakoff Joint Venture, a copper/gold exploration play in Queensland managed by a subsidiary of MIM Limited. Placer Dome Asia Pacific Ltd is the other joint venture partner. This property is in close proximity to a number of significant copper/gold discoveries, including Ernest Henry, which produces about 210,000,000 pounds of copper and 125,000 ounces of gold per year.

The Company has established an excellent foundation to move forward as a potential producer of precious metals, particularly in view of the recent increase in the price of gold. In the case of Simberi, we believe the current gold price is sufficient to allow profitable operations. We believe that the activities of our partner Newmont and other major mining companies support the current market view that the price of gold is likely to increase in the foreseeable future.

PNG Gold and Copper Projects

I would now like to discuss our gold project holdings in Papua New Guinea in more detail.

We have been exploring in the Tabar Islands, and especially on Simberi Island, since the mid- 1980's, and for good reason. The potential exists to discover world-class gold deposits similar to the nearby Lihir Island gold deposits located some 80 kilometers (about 48 miles) to the east in the same island chain ("the Lihir Corridor"). Most of the islands in the Corridor contain gold and copper deposits, which commence with Feni Island to the southeast, then trend to the northwest, ending with the Tabar Islands. Lihir, which is adjacent to the Tabar Islands, and is part of the chain, hosts resources in excess of 40 million ounces of gold, which are exceptionally large by any standard. The geology of the Tabar Islands is essentially the same as that found on Lihir and our exploration work has shown that gold mineralization is widespread throughout all of the main Tabar Islands. We have also discovered significant anomalous copper mineralization occurrences on Tatau and Tabar Islands, whi ch clearly deserve additional investigation.

More than US$34 million has been spent by Nord Pacific and its former co-venturers on the Tabar Islands gold programs in exploration and development drilling, metallurgical testing and evaluation. This work has established resources of about 1,500,000 ounces of gold in surface oxides and in deeper sulphide deposits.

Simberi Oxide Gold Resources

The oxide deposits are found in weathered rocks that are located literally from the grass roots at the surface down through the zone of weathering. We refer to this zone as the "oxide" zone. It is typically soft and clayey and easily mined, although it becomes harder and more rock-like at greater depth.

We have about 740,000 ounces of contained gold in oxide resources. These resources are further classified into measured, indicated and inferred. When final mining pits have been designed (preliminary economically optimum pits have already been defined), the contained resources can be reclassified as proven or probable reserves. Reserves represent mineralization which can be mined and processed at a profit at a certain price of gold, whereas resources represent mineralization that is known to exist at certain levels of confidence at some assumed gold price or grade cutoff.

Our measured and indicated resources, which we are confident can be converted to mineable reserves, amount to about 250,000 ounces of contained gold, and we believe it is likely that another 40,000 ounces of inferred resources can be converted to reserves with some additional drilling and testwork. These resources will be sufficient to develop an operation producing an average of around 40,000 ounces of gold per year for seven years at an average gold price of US$300 per ounce and at current foreign exchange rates. However, it is probable that additional resources will be delineated as operations proceed. And, of course, if the price of gold increases (or our operating costs can be reduced), some of the balance of the 740,000 ounces of identified gold resources may become mining reserves.

Since the gold is relatively uniformly distributed throughout these low grade weathered zones, we are able to define mining pits that encompass all of the profitable ore without including barren rock, or waste, into the mining plan. This results in considerable cost savings. Most open pit mines have to mine significant tonnages of waste, which is barren of profitable mineralization, in order to access the ore. The tonnes of waste that are mined will usually be several times that of the tonnes of ore that are mined. This factor is referred to as the "waste-to-ore ratio". A 5:1 ratio would mean that 5 tonnes of waste must be mined per one tonne of ore to be mined. If it costs the same amount to mine a tonne of waste as it does a tonne of ore, then a mine with a low ratio will benefit. Our ratio for the currently planned pits is 0:1, which means that we have virtually no waste to mine.

Another major economic advantage of the oxide mineralization is that it responds extremely well to processing with excellent gold recovery. Many mines consider it satisfactory if they can recover 80% of the gold sent to the mill. We expect recoveries in excess of 90%.

Because of the soft nature of the oxide mineralization, it is proposed that each of the six defined deposits be mined using bulldozers pushing ore to a pile where it will be reclaimed and ground into a slurry of water and ore, or pulp, for pipeline transport down from the deposits in the hills of Simberi Island to the processing plant located on the coast nearby. There the ore will be treated in a conventional carbon-in-pulp or carbon-in-leach plant for gold recovery.

The Company has done considerable predevelopment work on the project including mining and metallurgical studies and testwork, preparation of feasibility studies, environmental permitting, logistical planning, and a host of other activities that will be necessary to place the project into production. Some of the studies will need to be updated. Almost all required permits for development of the Simberi oxide deposit are in place and we do not foresee any significant environmental hurdles in proceeding with the Simberi oxide project. Most importantly, Nord Pacific has already been granted a Mining Lease, and the Company should be able to complete development and conduct operations within 12 months of securing project finance.

Simberi High-Grade Sulphide Resources

The exploration and development drilling has also established potential for development of major, high-grade sulphide resources at depth. The sulphides take their name from the fact that the gold occurs in unweathered deeper rock below the oxidized zone, and is associated generally with iron pyrite, or iron sulphide. Weathering has not broken down the iron pyrite and the gold is encapsulated within the pyrite. Occasionally, the sulphide mineralization ("sulphides") is located near the surface. Typically, the sulphide mineralization is in harder rock than the oxidized zone. Since the gold is tied up with the pyrite, it is not as easily recovered as gold in the oxide ores, but the gold content of the sulphides is usually much higher in grade than in the oxides.

It is the economic potential of these sulphides that has generated excitement among geologists and miners who have examined our data. Some of our drill intercepts are truly bonanza in grade and thickness. For example, two drill holes in close proximity at the Pigiput deposit encountered intercepts of about 15 feet in thickness, which assayed more than 4.0 ounces of gold per tonne. These are spectacular results and the potential exists to discover significant tonnages of high-grade ore. These sulphide deposits represent extremely attractive exploration targets, with the potential for development of a major gold province containing world-class deposits.

Independent geologists have estimated that the inferred resources in the Simberi sulphide deposits amount to approximately 750,000 ounces of contained gold based upon drilling to date. None of the resources have been classified as reserves at this time, and more work needs to be done to establish their profitability.

The sulphide mineralization could be mined from either open pit surface operations or from underground access, depending on a number of factors. Although the sulphides are amenable to conventional recovery techniques, the process is considerably different from that used to recover gold from oxide ores. The sulphide ore is ground in a ball mill and then processed through flotation and gravity recovery circuits to recover pyrite containing the gold. The concentrates produced from this process could either be treated on site or shipped to Lihir or Japan for gold recovery on a contract basis.

Regarding our exploration technology, during the latter phase of the last major exploration campaign in 1997, we tested some relatively new geophysical techniques for identification of subsurface sulphide mineralization. The method is called induced polarization, or "IP." This technique takes advantage of the electrical characteristics of various rocks and minerals, and can be used to identify prospective areas that might contain ore deposits. Once a geophysicist has analyzed the IP survey data and pinpointed an area that might contain mineralization, the target zone will typically be drilled to confirm the presence and character of the deposit.

In our case, Nord Pacific tested the technique over the high-grade sulphides at the Pigiput deposit, which are known to exist based upon extensive drilling from the surface. The IP survey very clearly confirmed the existence of the sulphide deposits. This is very significant, and could be of tremendous value in searching for other sulphide deposits on all of the islands. We are excited about using this technique over other areas. It could be the key that unlocks the location of commercially rich sulphide deposits.

Furthermore, in 1998, a structural and geologic study of the Pigiput sulphide deposit was completed by an independent geological consulting group, which identified several drill targets designed to test extensions of known mineralization. One of our objectives will be to follow up on this work. It is also possible that further exploration will be conducted through an underground adit (similar to a tunnel) in order to gain a better understanding of the nature of the sulphide gold mineralization. In any event, the Tabar Islands gold occurrences are very significant and represent a tremendous opportunity for Nord Pacific and its investors and shareholders.

Country Risk

I would also like to address the issue of Papua New Guinea. Many people perceive that PNG is a "wild and woolly" place, suitable only for large mining companies with the resources necessary to explore and develop projects in this "Land of the Unexpected". To a large extent this may be correct, particularly for projects on the mainland of PNG.

However, PNG is and has been pro-active towards mining, and required permits for projects can be obtained in a reasonable period of time without compromising environmental standards. Secondly, because of PNG's British-Australian heritage, the rule of law operates successfully with a democratic system of government. English is widely spoken and the people are educated, even in the smallest villages on the islands. And thirdly, because we are on islands, logistical access and support make the implementation of project plans achievable because we can be supplied by sea or by air from within PNG or directly from Australia. Accordingly, Nord Pacific is quite comfortable with its prospective operations on the Tabar Islands.

In our 20 years of operating in PNG, we have not experienced crime of any consequence and the local populace is very supportive of our activities. We go to great lengths to maintain these good relations with the islanders. In fact, the major problem we have is that they want us to get cracking on developing the gold mines.

This is not to underestimate the difficulties of project development. It is a difficult and costly place to do business. But we have found it to be stable with regards to our activities and a good place to do business. Most importantly, a project the size of Simberi is achievable, even by a small company such as Nord Pacific.

The Way Forward

During forthcoming months, we will be seeking the support of our shareholders and investors to raise further working capital, as a first step, to ensure that we have sufficient funds to sustain our efforts to secure project financing adequate for development of the Simberi oxide deposits.

Based upon the most recent feasibility study completed by Nord Pacific, the estimated capital cost to develop the oxide project is about US$20 million and site cash operating costs are estimated to be around US$150 per ounce of gold at current foreign exchange rates. It could be, however, that the project will grow in capital cost to a much larger scale with a commensurate economic return.

As a part of our overall strategy, we have initiated discussions with several prospective joint venture partners with the objective of conducting additional exploration to determine the extent of the mineral resources at Simberi and on the other islands controlled by the Company. We recognize the need to be careful in these endeavors to ensure that our shareholders gain the maximum potential benefit of any future decisions to undertake a world scale gold project.

It is important again to re-emphasize that the potential for development of world class gold deposits at Simberi and the other islands in the Tabar group held by the Company is excellent. Considerable additional drilling will be required to determine the ultimate value of our holdings, which in turn will determine the need for additional shareholder and investor support. While the Company has sufficient cash reserves to implement its objectives in the short term, it will require additional working capital to implement our strategy. Accordingly, we are examining alternatives to raise additional short to medium term funding.

Although the disposal of Nord Pacific's Girilambone and Tritton copper interests in Australia represents the passing of an era in the history of the Company, it also represents the opportunity to move forward with the objective of concentrating on precious metals at a time when the price of gold is strengthening. We have kept in place our key Australian/ PNG employees and consultants, who will be an important factor in developing Simberi, and have clearly established our expertise in the use of conventional and new technology for profitable development of successful mining properties.

As an incentive for employees, directors and consultants to remain with the Company, Nord Pacific has issued a total of 2.3 million restricted shares of its Common Stock to these key personnel, subject to the requirement that each individual receiving shares will remain engaged by the Company through December 31, 2002. Management considered this action as essential to maintaining its core group of key personnel intact through a critical period that will probably determine the Company's ability to maintain commercial viability and upside potential.

As separate issues, we are endeavoring to bring our web site up to date, and hope to have this done in the near future. Also, as you have undoubtedly noted, we are not current in our SEC filings nor have audited financial statements been prepared for the recent past. Because of our limited current cash position, we have decided not to spend the money to obtain audited financials at this time, and will do so when more cash is available. In the meantime, we are preparing unaudited financial reports. We have cut our overhead costs to a minimum consistent with maintaining viability and are watching our costs very closely.

As best as I can determine, there are no skeletons in the closet that give me pause for concern. We will be as candid and transparent as we can to the best of our ability, and I want to assure you that we will always try to do the right thing by you with integrity and professionalism.

We look forward to restoring Nord Pacific to its former status as an innovative mining company. Incidentally, one of our strategic considerations will also be a possible name change of the Company to more accurately reflect our current objectives. Any suggestions you might have concerning these matters will be welcomed.

On a personal note, I want to thank the many shareholders who have called and written with encouraging remarks. Your continued support is greatly appreciated and I want to assure you that all of us are trying to do the very best we can to make this company a success.

Dated: May 8, 2002 | By: /s/ Mark R. Welch |

| | Mark R. Welch |

| | President and Chief Executive Officer |

|

|