Exhibit 99.3

28 January 2008

Company Announcements Office

Australian Stock Exchange Ltd

"This press release is not for dissemination in the United States and

shall not be disseminated to United States news services."

QUARTERLY REPORT FOR THE PERIOD ENDED 31 DECEMBER 2008

HIGHLIGHTS

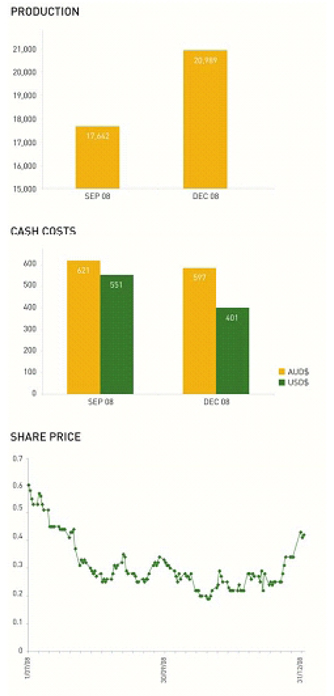

| | • Production target achieved with a 19% increase in gold production to 20,989oz. • Reduction in cash costs of 4% to A$597 (USD$401)/oz. • Increased mining production of 40% to 557,744 tonnes for the quarter. • Increase of 27% in tonnes processed to 426,276 tonnes for the quarter. Production ramp up progressing well. • Further reduction in bank debt facility of A$5.0M during the quarter. • March quarter production forecast of 20,000oz. • Sulphide pre-feasibility study commenced to underpin expanded production profile up to 200,000oz p.a. by 2011. • Resources for the Pigiput deposit increased by 204,000oz and the Sorowar deposit increased by 611,000oz taking the total Resource upgrade during Calendar 2008 to 815,000oz. • A new Reserve upgrade for Sorowar and Pigiput East is planned in the March 2009 quarter. This will underpin the extension of existing mining operations. • Oxide mineralisation intersected in the area between the Pigiput and Pigibo oxide deposits over a 400 metre strike length. • Barrick completed two diamond cored holes and commenced a third at the Tupinda copper prospect on Big Tabar Island. Encouraging results with copper molybdenum mineralisation intersected in two of the holes. |

Simberi Oxide Gold Project, (ALD 100%), offshore Papua New Guinea.

SIMBERI OXIDE GOLD PROJECT - OPERATIONS

During the December quarter management was focussed on a number of operational initiatives aimed at generating a more consistent production profile.

Mining volumes increased by 40% during the quarter. The last of the additional CAT740 trucks will arrive on site in January 2009 completing the initial phase of the mining optimisation program. The benefits of the expanded mining fleet continue to translate into higher mining volumes and flexibility to plant utilisation. These benefits have resulted in the Company rescheduling its mining to two 8 hour shifts per day which should further reduce mining costs in future periods.

The Company now has in excess of 70,000 tonnes of ROM ore stockpiled at the Pigiput processing facility to mitigate any loss of production. In addition the Company is well advanced in all pit pre- development works.

During the month of December, there were seasonally high tidal swells which had no direct impact on the gold mining operations with no lost time in the production process as a result. Management consciously allocated considerable mining and other various resources at that time to provide assistance to the local Simberi Island community.

Processing plant performance continues to improve with the plant treating a total of 154,000 dry tonnes for the month of December 2008 which is in line with management's expectations. The plant achieved nameplate production of 6,000 dry tonnes per day on 9 days and a further 11 days at a rate of 5,500 dry tonnes per day.

Grade exceeded budget during the quarter and recovery was down slightly due to a higher level of transitional sulphide ore being treated. Overall grade and recovery has remained consistent and is in line with management's existing mine plan.

| | | | Previous QTR | | | Oct - Dec | | | Financial Year | |

| | | | Sept 2008 | | | 2008 | | | 2009 | |

| | | | | | | | | | | |

| Waste Mined | tonnes | | | 36,784 | | | | 69,035 | | | | 105,819 | |

| Ore Mined | tonnes | | | 361,575 | | | | 488,709 | | | | 850,284 | |

| Total Mined | tonnes | | | 398,359 | | | | 557,744 | | | | 956,103 | |

| | | | | | | | | | | | | | |

| Ore Processed | tonnes | | | 336,420 | | | | 426,276 | | | | 762,696 | |

| Grade | g/t gold | | | 1.72 | | | | 1.94 | | | | 1.91 | |

| Recovery | % | | | 91.6 | | | | 77.1 | | | | 81.5 | |

| Gold Produced | oz | | | 17,642 | | | | 20,989 | | | | 38,631 | |

| Gold Sold | oz | | | 13,251 | | | | 17,764 | | | | 31,016 | |

| | | | | | | | | | | | | | |

| Average Realised | A$/oz | | | 900 | | | | 1,160 | | | | 1,044 | |

| Gold Price /$oz | US$/oz | | | 790 | | | | 774 | | | | 779 | |

| | | | | | | | | | | | | | |

| Operating Cash | A$/oz | | | 621 | (1) | | | 597 | | | | 608 | |

| Cost $oz | US$/oz | | | 551 | | | | 401 | | | | 474 | |

(1) The previous September 2008 quarterly release reported a cash cost of A$638 p/oz. In the current quarter this has been amended to exclude royalties to align Allied Gold's reporting format with industry practices.

OUTLOOK:

Consistent mining and processing throughput rates have continued during the beginning of the March 2009 quarter. As a result production is expected to again exceed 20,000 oz. The Company continues to focus its efforts on achieving a consistent production profile while further optimising the plant performance. Management continues to focus its efforts on reducing operating cash costs as the plant progresses to a steady state operation.

The extent of lower fuel prices were not fully experienced during the December 2008 quarter as there is a traditional time lag in price variations being passed on by regional suppliers. Reagent consumption continues to gradually reduce with further initiatives relating to the introduction of fresh water into the processing cycle. These activities remain one of management's highest priorities for the coming quarter. It is anticipated that the plant performance will continue to improve during January 2009 as fresh water replaces salt water in the plant.

In line with the current mine plans, it is expected that higher levels of sulphide transitional ore will be mined and processed during the March quarter. To ensure an improvement in the projected recovery levels, management is proactively progressing the introduction of additional in-pit crushing capability which will enhance the gold recovery.

Capital expenditure analysis is being undertaken to determine the requirements for these initiatives but it is expected that they will be commenced during the March quarter.

During the March quarter, Allied Gold is required to deliver only 6,778oz of production into the hedge book at USD$700/oz. The remainder of production will be realised at the greater of the spot price or USD$700/oz. Therefore Allied Gold is significantly positioned to participate in any gold price appreciation.

In accordance with the existing farm-in agreement Barrick continues to drill on the neighbouring island of Tabar with assayed results expected during the March quarter. As these results become available, management will ensure the results are communicated accordingly.

Management has begun a number of optimisation studies including a sulphide expansion scoping study. The scoping study is expected to be completed by the end of February 2009 and depending on the outcome, it is likely to evolve into a formal Pre-Feasibility study. Details on the proposed timing and associated capital requirements will be advised as management finalises the process.

Despite the current fuel prices retracting from their recent high levels, management is continuing to assess alternative fuel options with a number of parallel scoping studies having been commenced.

Gold remains a beacon for the investment community with underlying fundamentals in the global financial and investment sectors remaining turbulent. Allied Gold is one of the few producing gold companies that possess significant exploration potential as well as the expertise to develop projects in geographically challenging locations.

Allied Gold continues to assess a number of existing opportunities within the sector that may ultimately complement its existing strong organic growth profile.

As a direct result of Allied Gold's exposure to the gold sector, it is well positioned to capitalise on any further upturn in investor confidence into the sector.

EXPLORATION

SIMBERI ISLAND - ML 136

Mine site exploration continued during the quarter with a focus on Sorowar and Pigiput Ridge and Samat North (figure 1), with 37 holes completed for 4837.2 metres.

SIMBERI GOLD RESOURCES - Increases in Mineral Resources

Recent resource updates were completed for the Sorowar and Pigiput areas that have collectively resulted in an increase in Mineral Resources for Simberi to 3.2 million ounces as indicated in the table below. An additional 611,000 Inferred, Indicated and Measured Resource ounces were defined at Sorowar and an additional 204,000 Inferred and Indicated Resource ounces were defined at Pigiput East.

For further information refer to the relevant sections below.

Simberi Total Resources November 2008 - Above 0.5g/t Au cutoff grade

| | | Measured | | | Indicated | | | Inferred | | | All Categories | |

| Material All | | | | | g/t | | | | | | | | | g/t | | | | | | | | | g/t | | | | | | | | | g/t | | | | |

| Deposits | | Mt | | | Au | | | Koz | | | Mt | | | Au | | | Koz | | | Mt | | | Au | | | Koz | | | Mt | | | Au | | | Koz | |

| Oxide | | | 9.64 | | | | 1.36 | | | | 421 | | | | 17.88 | | | | 1.04 | | | | 596 | | | | 8.05 | | | | 1.09 | | | | 282 | | | | 35.56 | | | | 1.14 | | | | 1299 | |

| Transitional | | | 0.56 | | | | 1.18 | | | | 21 | | | | 1.43 | | | | 1.20 | | | | 55 | | | | 0.68 | | | | 1.07 | | | | 23 | | | | 2.67 | | | | 1.16 | | | | 100 | |

| Sulphide | | | 1.31 | | | | 0.93 | | | | 39 | | | | 5.67 | | | | 0.90 | | | | 163 | | | | 40.15 | | | | 1.24 | | | | 1602 | | | | 47.12 | | | | 1.19 | | | | 1805 | |

| Total | | | 11.50 | | | | 1.30 | | | | 482 | | | | 24.98 | | | | 1.01 | | | | 814 | | | | 48.88 | | | | 1.21 | | | 1908 | | | | 85.36 | | | | 1.17 | | | | 3204 | |

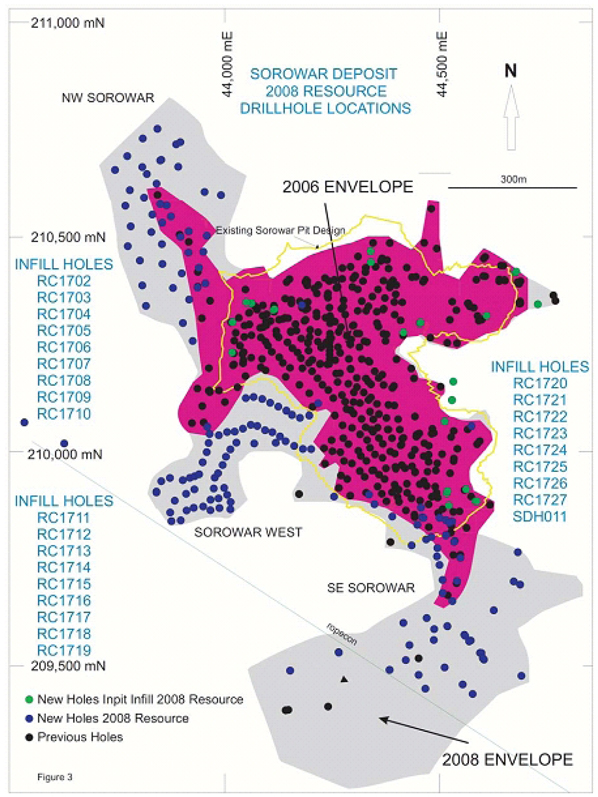

SOROWAR RESOURCE

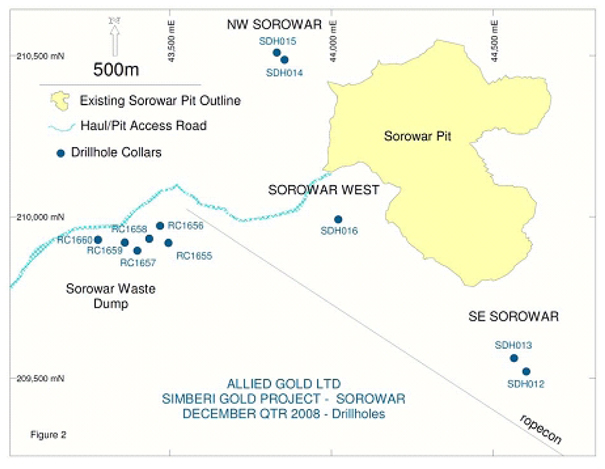

At the Sorowar deposit, 5 DD holes for 759.1 metres were completed during the quarter for metallurgical testing. A further 6 RC holes for 720 metres were drilled to the West of Sorowar at the waste dump site (figure 2).

A new resource estimate for the Sorowar deposit area was completed by Golder Associates and reported in the September 2008 Quarterly Report.

This revised resource estimate has resulted in an additional 611,000 ounces of gold. The new Inferred, Indicated and Measured Resource estimate above 0.5g/t gold is 59.3Mt at 0.98g/t for a total of 1.869 million ounces as shown in the table below.

Sorowar Resources October 2009 - Above 0.5g/t Au cutoff (Golder Associates)

| Sorowar | | Measured | | | Indicated | | | Inferred | | | All categories | |

| | | | | | g/t | | | | | | | | | g/t | | | | | | | | | g/t | | | | | | | | | g/t | | | | |

| Material | | Mt | | | Au | | | Koz | | | Mt | | | Au | | | Koz | | | Mt | | | Au | | | Koz | | | Mt | | | Au | | | Koz | |

| Oxide | | | 7.91 | | | | 1.30 | | | | 330 | | | | 8.27 | | | | 1.04 | | | | 276 | | | | 4.15 | | | | 1.10 | | | | 147 | | | | 20.32 | | | | 1.15 | | | | 754 | |

| Transitional | | | 0.56 | | | | 1.18 | | | | 21 | | | | 1.43 | | | | 1.20 | | | | 55 | | | | 0.53 | | | | 1.02 | | | | 17 | | | | 2.51 | | | | 1.16 | | | | 94 | |

| Sulphide | | | 1.31 | | | | 0.93 | | | | 39 | | | | 5.65 | | | | 0.89 | | | | 162 | | | | 29.51 | | | | 0.87 | | | | 821 | | | | 36.46 | | | | 0.87 | | | | 1021 | |

| Total | | | 9.77 | | | | 1.24 | | | | 391 | | | | 15.34 | | | | 1.00 | | | | 493 | | | | 34.19 | | | | 0.90 | | | | 985 | | | | 59.30 | | | | 0.98 | | | | 1869 | |

As initially reported in June 2006, the Sorowar Inferred Resource totalled approximately 500,000 ounces. Based on the revised estimate this Resource category is now (Oct 2009) estimated to be about 985,000 ounces of which approximately 100,000 ounces lie within the current Sorowar pit shell. Drilling was initiated during the previous quarter to potentially upgrade this mineralisation from the Inferred category to a higher JORC category.

Results for these remaining holes (figure 3) were received during the quarter are being incorporated into the revised resource estimate currently being undertaken by Golder Associates. This revised estimate will be used to generate a new reserve estimate and pit shells for the Sorowar deposit.

The results to date have been extremely encouraging. Some of the better intercepts are shown in the table below:

Sorowar Pit Significant Gold Intersections - Above 0.5g/t Au cutoff grade

| RC1717 | 7m at 4.55g/t (From 42m, OX) |

| RC1719 | 19m at 1.83g/t (From 0m, OX ) |

27m at 5.77g/t (From 53m, OX) |

| RC1720 | 16m at 0.88g/t (From 7m, OX,TR,SU) |

| RC1721 | 13m at 2.9g/t (From 15m, OX) |

| RC1722 | 12m at 1.46g/t (From 0m, OX,SU) |

19m at 0.78g/t (From 103m, OX,TR,SU) |

| RC1723 | 11m at 0.91g/t (From 33m, OX,TR,SU) |

| RC1724 | 31m at 0.86g/t (From 21m, OX) |

23m at 1.65g/t (From 57m, OX,TR,SU) |

| RC1725 | 18m at 2.72g/t (From 58m, OX,SU) |

| RC1726 | 5m at 3.96g/t (From 0m, OX ) |

| RC1727 | 19m at 2.4g/t (From 6m, OX, TR) |

Simberi mineralization types are: OX = oxide material - extremely weathered (average cyanide recovery >90%)

TR = transitional material - distinctly weathered (average cyanide leach recovery 50 - 90%)

SU = sulphide material - slightly weathered to fresh (average cyanide leach recovery <50%)

SE SOROWAR

Two diamond holes for 240 metres were drilled (figure 2) as part of a program to obtain samples for bulk density and gold recovery determinations, and to test the underlying sulphides.

Results from both of these holes have been received with best intercepts including:

SE Sorowar Significant Gold Intersections - Above 0.5g/t Au cutoff grade

| SDH012 | 9m at 3.50g/t (From 93m TR, SU) |

12m at 1.23g/t (From 164.8m TR, SU) |

82m at 1.23g/t (From 183m SU) |

| SDH013 | 4m at 14.8g/t (From 76m TR,SU) |

31m at 1.16g/t (From 135m SU) |

NW SOROWAR

Two diamond holes (SDH014 and SDH015, figure 2) for 424.6 metres were drilled as part of a program to obtain samples for bulk density and gold recovery determinations, and to test the underlying sulphides.

No results for these holes have been received to date.

SOROWAR WEST

One diamond hole (SDH016, figure 2) for 94.5 metres was drilled to obtain samples for bulk density and gold leach recovery determinations.

No results for this hole have been received to date

A further 6 RC holes for 720 metres were drilled at the Sorowar Waste Dump as part of a sterilization program. Results were patchy and of low grade for the majority of these holes, however some mineralisation was encountered at depth including - -

Sorowar Waste Dump Significant Gold Intersections - Above 0.5g/t Au cutoff grade

| RC1657 | 8m at 1.43 g/t (From 44m, TR, SU) |

| including | 2m at 3.37g/t (From 44m, SU) |

| RC1750 | 6m at 0.90/t g/t (From 29m OX) |

PIGIPUT RESOURCE

Drilling at Pigiput East commenced in late March this year and a total of 48 RC holes for 5,107m, and 8 diamond cored holes for 1,075m were completed and used in the new resource estimate. Note however, that sulphide material was excluded from the resource estimate and only gold mineralisation in oxide material has been estimated.

A new resource estimate for the Pigiput East oxides area has resulted in an additional 204,000 Inferred and, Indicated gold ounces, and this new estimate is compared with the previous results in the table below.

Pigiput Resource Estimate November 2008 - Above 0.5g/t Au cutoff

| Domain | | 2003 | | | November 2008 | |

| | | Mt | | | Au g/t | | | Koz | | | Mt | | | Au g/t | | | Koz | |

| Measured | | | 0.47 | | | | 1.21 | | | | 18 | | | | | | | | | | |

| Indicated | | | 1.00 | | | | 0.87 | | | | 28 | | | | 8.38 | | | | 1.00 | | | | 268 | |

| Inferred | | | 1.49 | | | | 0.90 | | | | 43 | | | | 0.89 | | | | 0.86 | | | | 25 | |

| Total | | | 2.96 | | | | 0.94 | | | | 89 | | | | 9.27 | | | | 0.98 | | | | 293 | |

The Pigiput East drilling program did not extend to some areas due to access restrictions associated with steep topography. Mineralisation in these areas is still untested. However, as the Pigiput pit is developed, access to these steep areas will become available and further oxide and sulphide definition drilling will be carried out.

PIGIPUT EAST

Drilling at Pigiput East continues to extend the limits of mineralisation. Some 14 holes for 1,685 metres were completed during the quarter, (figure 4).

The RC program continued to define gold mineralisation in oxide material, which based on the results to date, has been extended.

Assay results were received from 26 holes. Some of the significant intercepts are shown below:

Pigiput East Significant Intersections - Above 0.5g/t Au cutoff

| RC1645 | 8m at 2.27g/t(From 17m, OX) |

5m at 2.05g/t (From 100m, OX) |

| RC1648 | 34m at 1.43g/t (From 18m, OX) |

| RC1649 | 6m at 2.13g/t (From 0m, OX) |

| RC1650 | 11m at 0.99g/t (From 3m, OX) |

| RC1651 | 19m at 1.14g/t (From 9m, OX) |

| RC1652 | 16m at 0.8g/t (From 0m, OX) |

7m at 1.81g/t (From 72m, OX TR) |

8m at 2.05g/t (From 101m, OX) |

| RC1653 | 20m at 1.69g/t (From 0m, OX) |

16m at 2.51g/t (From 27m, OX) |

4m at 18.3g/t (From 60m, OX) |

| RC1654 | 6m at 2.04g/t (From 0m, OX ) |

| RC1740 | 15m at 2.57g/t (From 58m, OX ) |

| RC1741 | 11m at 1.39g/t (From 22m, OX, TR) |

| SDH009 | 33m at 1.96g/t (From 0m, OX ) |

13m at 0.86g/t (From 153m, OX,TR,SU) |

| SDH010 | 17m at 9.04g/t (From 8m, OX) |

1.3m at 26g/t (From 10.3m, OX) |

| RC1743 | 10m @ 3.35g/t (From 74m OX) |

| RC1756 | 15m @ 3.77g/t (From 101m OX) |

| RC1757 | 17m @ 1.29g/t (From 84m OX,SU) |

| RC1761 | 23m @ 1.67g/t (From 23m OX) |

PIGIPUT SULPHIDES

One diamond cored hole of 364.1m (SDH017, figure 4) was completed near the end of the quarter to test the mineralogy and lithology of the Pigiput sulphide.

Assays were received from 1 diamond core hole with best results including:

Pigiput Sulphide Significant Intersections - Above 0.5g/t Au cutoff

| SDH011 | 95.7m at 1.79g/t (From 83.3m, OX,TR,SU) |

18.5m at 1.31g/t (From 193.5m, TR,SU) |

PIGIPUT WEST

During the quarter reconnaissance drilling commenced at Pigiput West, which is the area between the known Pigiput Pit and the Pigibo Pit, refer to Figure 1.

A total of 11 RC drill holes for 1,308m were completed.

Assays were received from 11 holes with best results including:

Pigiput West Significant Intersections - Above 0.5g/t Au cutoff

| RC1745 | 39m at 0.90 g/t (From 56m, OX, TR, SU) |

| | 7m at 1.52g/t (From 88m, OX) |

| RC1748 | 18m at 1.12g/t (From 63m OX,TR ,SU) |

| | 11m at 1.76g/t (From 93m OX) |

| RC1749 | 11m at 0.84g/t (From 58m,OX, TR,SU) |

| RC1750 | 6m at 0.90g/t (From 29m, OX) |

| RC1752 | 7m at 1.00g/t (From 39m, OX) |

7m at 1.68g/t (From 59m, OX ) |

| RC1753 | 9m at 1.21g/t (From 21m, OX, SU) |

| RC1754 | 11m at 1.06g/t (From 52m, OX) |

6m at 1.29g/t (From 92m, OX ) |

Drilling so far has indicated relatively deep scattered gold mineralised oxides to depths exceeding 100 metres along the ridge top between the Pigiput and Pigibo deposits, a distance of 400m.

Based on the information to date and reasonable projections therefrom the Pigiput-Pigibo ridge area is shaping up as a major future potential oxide/sulphide development for the Company.

SAMAT NORTH

No holes were drilled at Samat North this quarter however results for 14 RC holes drilled in the previous quarter were received (figure 1).

Best results include:

Samat North Significant Intersections - Above 0.5g/t Au cutoff

| RC1730 | 11m at 1.07g/t (From 17m, OX,TR,SU) |

| RC1731 | 6m at 2.83g/t (From 3m, OX,TR ) |

7m at 2.03g/t (From 38m, TR,SU) |

| | 40m at 1.39g/t (From 53m, OX,TR,SU) |

| RC1733 | 14m at 0.97g/t (From 21m, TR,SU) |

6m at 1.92g/t (From 47m, TR,SU) |

| RC1734 | 60m at 0.39g/t (From 0m, OX,TR,SU) |

| including | 9m at 1.23g/t (From 48m, TR, SU) |

| RC1735 | 9m at 1.6g/t (From 7m, OX ) |

| RC1736 | 9m at 1.4g/t (From 2m, OX) |

| RC1737 | 27m at 1.2g/t (From 1m, OX ) |

| RC1739 | 5m at 15.1g/t (From 33m, OX) |

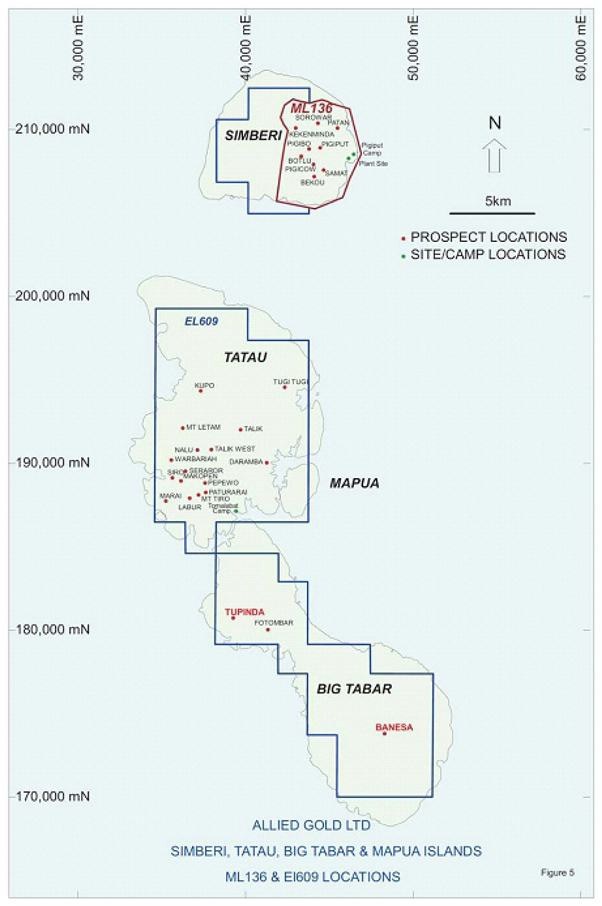

TATAU AND BIG TABAR ISLANDS - EL609

Barrick commenced drilling at the Tupinda copper prospect and completed two diamond cored holes and commenced a third for 945.0 metres.

Barrick also commenced an airborne Electromagnetic Survey over the Tabar Islands Group.

In accordance with its $20 million farm-in to Allied Gold's exploration licence over Big Tabar and st Tatau Island, Barrick Gold commenced exploration on 1 August 2008. Initial work comprised reconnaissance mapping and sampling on Big Tabar Island at the Tupinda gold, and copper- molybdenum prospect, and the Banesa gold-copper prospect (see figure 5). Barrick has also expanded the Tomalabat base camp and the Tupinda fly camp. Construction of a fly camp at Banesa has also been completed.

Barrick's drill contractor commenced mobilisation to site and the first helicopter transportable diamond drill rig has commenced drilling at the Tupinda copper-molybdenum prospect in November.

Two diamond cored drill holes were completed in the quarter for a total of 771m and a third was at 174m depth drilling towards a target depth of 500m. No assays have been received to date however core inspection has indicated the first hole intersected weak to moderate copper (chalcopyrite- molybdenite) mineralisation and that second hole has no visual sulphide content, but the rocks are highly altered (propylitic). The third hole has weak to moderate copper (chalcopyrite-bornite) mineralisation.

Barrick has organised a second diamond drill machine which will arrive in Tabar in January 2009 and will commence drilling at the Banasa copper-gold prospect located at the southern end of Big Tabar Island.

An aerial geophysical electromagnetic (EM) survey commenced in December 2008 and will be completed in January 2009 that will cover the entire Tabar Island group, including Simberi Island. As previously reported, this technique will assist in identifying electrically anomalous zones that may be associated with gold or other mineralisation.

EXPLORATION

GOLD HEDGING

Allied currently has committed gold sales contracts over 70,532oz production. Allied gold has an additional 81,582oz of hedging in the form of put options. The structure of Allied Gold hedge book is as follows:

| | | | | | | | | | | | Price Participation | |

| | | | | | | | | Production | | | Bought | | | | | | | |

| Year | | Estimated | | | FIXED | | | With | | | Put | | | Ounces | | | | |

| Ending | | Annualized | | | US$ | | | Price | | | Options | | | Deliverable | | | | |

| 30 June | | Production | | | 700 | | | Participation | | | $700 | | | At Spot Price | | | TOTAL | |

| Remaining | | | 45,586 | | | | 13,010 | | | | 32,576 | | | | 21,680 | | | | 10,896 | | | | 32,576 | |

FY 2009 1 | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| FY 2010 | | | 84,000 | | | | 23,850 | | | | 60,150 | | | | 39,748 | | | | 20,402 | | | | 60,150 | |

| FY 2011 | | | 84,000 | | | | 22,764 | | | | 61,236 | | | | 20,154 | | | | 41,082 | | | | 61,236 | |

| FY 2012 | | | 84,000 | | | | 10,908 | | | | 73,092 | | | | - | | | | 73,092 | | | | 73,092 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total | | | 297,586 | | | | 70,532 | | | | 227,054 | | | | 81,582 | | | | 145,472 | | | | 227,054 | |

Notes:

| 1. | Remaining estimated production for the 2009 financial year of 45,369 is calculated as estimated total production of 84,000 ounces less year to date production of 38,631. |

| 2. | Current Reserves indicate annualized production over 8 years. |

At 31 December 2008 the mark to market value of the hedge book was approximately (US$18.5m)

CASH AND DEBT

Allied Gold retired a further A$5.0m of debt during the December quarter, reducing the outstanding debt position to A$5.0M at the end of the period. The next formally scheduled loan repayment is not due until June 2009. As of 31 December 2008 Allied Gold Limited had cash at bank of A$1.67m.

Allied Gold will continue to assess its ongoing hedge book requirements to ensure ongoing gold price participation.

Management's primary focus remains on achieving steady-state operation at the Simberi Island gold project and continuing to monitor operating costs with a view to reducing the bottom line cash costs per ounce of gold.

Management is also currently assessing the incremental scoping studies that are taking place regarding organic expansion and optimisation initiatives. In parallel management continues to monitor the sector for value accretive growth opportunities which may complement the existing organic growth initiatives.

SECURITIES ON ISSUE

As at 31 December 2008 issued securities comprised:

410,994,276 fully paid ordinary shares listed on the Australian Stock Exchange (ASX) and on the London Alternative Investment Market (AIM).

| No. Of | | Class of option | | Exercise | | Maturity |

| Options | | | | Price A$ | | Date |

| | | | | | | |

| 713,261 | | Unlisted options | | $ | 0.72 | | 30 June 2009 |

| 370,000 | | Unlisted options | | $ | 0.50 | | 30 October 2009 |

| 3,400,000 | | Unlisted options | | $ | 0.45 | | 31 December 2010 |

| 1,000,000 | | Unlisted options | | $ | 0.80 | | 31 December 2010 |

| 1,000,000 | | Unlisted options | | $ | 1.00 | | 31 December 2010 |

| 1,000,000 | | Unlisted options | | $ | 1.25 | | 31 December 2010 |

| 1,000,000 | | Unlisted options | | $ | 1.50 | | 31 December 2010 |

| 1,000,000 | | Unlisted options | | $ | 2.00 | | 31 December 2010 |

| 1,699,427 | | Unlisted options | | $ | 0.31 | | 31 December 2010 |

| 37,650,000 | 1 | Unlisted options | | $ | 0.35 | | 31 October 2011 |

1 Note: Of the 37,650,000 options expiring 31 October 2011:

| • | 10,000,000 vest upon Allied Gold producing 100,000oz of gold between the period of 1/10/08 - 31/12/09. 50% of this amount may vest if only 75,000oz ounces are produced; and |

| • | 10,350,000 vest upon the Company's share price trading at greater than A$0.70 for five consecutive days. |

Yours faithfully

ALLIED GOLD LIMITED

Mark V. Caruso

Executive Chairman

For enquiries in connection with this release please contact:

Allied Gold Limited

+61 8 9353 3638 phone

+61 8 9353 4894 fax

info@alliedgold.com.au e-mail

Board of Directors: Mark Caruso Executive Chairman & CEO Tony Lowrie Non Executive Director Greg Steemson Non Executive Director Frank Terranova Executive Director & CFO Peter Torre Company Secretary: ASX Code: ALD AIM Code: AGLD Principal Office 34 Douglas Street Milton, Queensland 4064 Telephone +61 7 3252 5911 Facsimile +61 7 3252 3552 Email info@alliedgold.com.au Website: www.alliedgold.com.au Postal Address PO Box 2019, Milton 4064 Registered Office Unit B9, 431 Roberts Road Subiaco, WA 6008 Share Registry Computershare Investor Services Level 2, Reserve Bank Building 45 St Georges Terrace Perth, Western Australia WA 6000 | | Competent Persons The information in this Stock Exchange Announcement that relates to Mineral Resources, Project Financial modelling, Mining, Exploration and Metallurgical results, together with any related assessments and interpretations, has been approved for release by Mr C.R. Hastings, MSc, BSc, M.Aus.I.M.M., a qualified geologist and full-time employee of the Company. Mr Hastings has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined in the 2004 Edition of the "Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves". Mr Hastings consents to the inclusion of the information contained in this ASX release in the form and context in which it appears. The information in this Stock Exchange Announcement that relates to Ore Reserves has been compiled by Mr J Battista of Golder Associates who is a Member of the Australasian Institute of Mining and Metallurgy. Mr Battista has had sufficient experience in Ore Reserve estimation relevant to the style of mineralisation and type of deposit under consideration to qualify as a Competent Person as defined in the 2004 Edition of the "Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves". Mr Battista consents to the inclusion of the information contained in this ASX release in the form and context in which it appears. Forward-Looking Statements This press release contains forward-looking statements concerning the projects owned by Allied Gold. Statements concerning mineral reserves and resources may also be deemed to be forward-looking statements in that they involve estimates, based on certain assumptions, of the mineralisation that will be found if and when a deposit is developed and mined. Forward-looking statements are not statements of historical fact, and actual events or results may differ materially from those described in the forward-looking statements, as the result of a variety of risks, uncertainties and other factors, involved in the mining industry generally and the particular properties in which Allied has an interest, such as fluctuation in gold prices; uncertainties involved in interpreting drilling results and other tests; the uncertainty of financial projections and cost estimates; the possibility of cost overruns, accidents, strikes, delays and other problems in development projects, the uncertain availability of financing and uncertainties as to terms of any financings completed; uncertainties relating to environmental risks and government approvals, and possible political instability or changes in government policy in jurisdictions in which properties are located. Forward-looking statements are based on management's beliefs, opinions and estimates as of the date they are made, and no obligation is assumed to update forward-looking statements if these beliefs, opinions or estimates should change or to reflect other future developments. Not an offer of securities or solicitation of a proxy This communication is not a solicitation of a proxy from any security holder of Allied Gold, nor is this communication an offer to purchase or a solicitation to sell securities. Any offer will be made only through an information circular or proxy statement or similar document. Investors and security holders are strongly advised to read such document regarding the proposed business combination referred to in this communication, if and when such document is filed and becomes available, because it will contain important information. Any such document would be filed by Allied Gold with the Australian Securities and Investments Commission, the Australian Stock Exchange and with the U.S. Securities and Exchange Commission (SEC). |

Page 18

Background

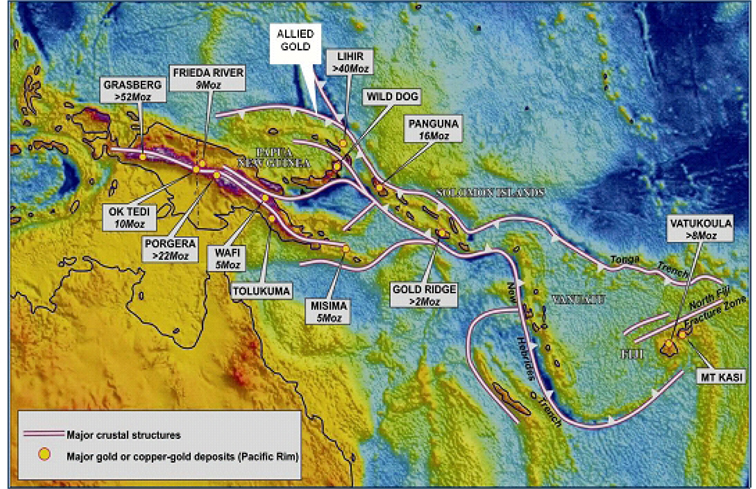

Allied Gold is a gold production company having commissioned its 100 percent owned Simberi Oxide Gold Project in February 2008. The project is situated on the northern most island of the Tabar Islands Group, located in the New Ireland Province of eastern Papua New Guinea some 60 kilometres north-west of the Lihir Gold Project, which hosts a plus 40 million ounce gold resource and is well placed in the Pacific Rim of Fire (one of the worlds proven and most prospective gold jurisdictions) see diagram.

Simberi currently hosts Measured Indicated and Inferred mineral resources of approximately 3.2 million ounces of gold. Allied Gold currently owns 100% of Simberi and 100% of the EL on the nearby Tatau and Big Tabar islands. During 2008 Allied entered into a $20 million farm-in to Allied Gold's exploration licence over Big Tabar and Tatau Island. Barrick will earn in 50% once it incurs A$8.0M and 70% once a total of $20.0M is incurred. Until these specific milestones are achieved, Allied Gold retains 100% of the EL on these islands.

Allied's strategy is to add to the gold inventory on Simberi Island by defining additional resources and conversion of these and known resources into reserves with a view to expanding annualised gold production from current levels of around 84,000 ounces.

Appendix 5B

Mining exploration entity quarterly report

Appendix 5B

Mining exploration entity quarterly report

Introduced 1/7/96. Origin: Appendix 8. Amended 1/7/97, 1/7/98, 30/9/2001.

Name of entity

| ABN | | Quarter ended ("current quarter") |

| 86 104 855 067 | | 31 December 2008 |

Consolidated statement of cash flows

| | | | Current quarter | | | Year to date | |

| Cash flows related to operating activities | | $A'000 | | | ( 6 months) | |

| | | | | | | $A'000 | |

| 1.1 | Receipts from product sales and related debtors | | | 25,099 | | | | 38,466 | |

| | | | | | | | | | |

| 1.2 | Payments for | | | | | | | | |

| | (a) exploration and evaluation | | | (1,323 | ) | | | (3,699 | ) |

| | (b) development | | | (3,333 | ) | | | (5,287 | ) |

| | (c) production | | | (9,917 | ) | | | (23,258 | ) |

| | (d) administration | | | (3,808 | ) | | | (5,236 | ) |

| 1.3 | Dividends received | | | - | | | | - | |

| 1.4 | Interest and other items of a similar nature received | | | 36 | | | | 47 | |

| 1.5 | Interest and other costs of finance paid | | | (139 | ) | | | (270 | ) |

| 1.6 | Income taxes paid | | | - | | | | - | |

| 1.7 | Other (provide details if material) | | | - | | | | - | |

| | | | | | | | | | |

| | Net Operating Cash Flows | | | 6,615 | | | | 763 | |

| | | | | | | | | | |

| | Cash flows related to investing activities | | | | | | | | |

| 1.8 | Payment for purchases of: | | | | | | | | |

| | (a)prospects | | | - | | | | - | |

| | (b)equity investments | | | - | | | | (241 | ) |

| | (c) other fixed assets | | | - | | | | - | |

| | | | | | | | | | |

| 1.9 | Proceeds from sale of: | (a)prospects | | | - | | | | - | |

| | | (b)equity investments | | | - | | | | - | |

| | | (c)other fixed assets | | | - | | | | - | |

| 1.10 | Loans to other entities | | | - | | | | - | |

| 1.11 | Loans repaid by other entities | | | - | | | | - | |

| 1.12 | Other (provide details if material) | | | - | | | | - | |

| | | | | | | | | | |

| | Net investing cash flows | | | - | | | | (241 | ) |

| 1.13 | Total operating and investing cash flows | | | | | | | | |

| | (carried forward) | | | 6,615 | | | | 522 | |

+ See chapter 19 for defined terms.

| 30/9/2001 | Appendix 5B Page 1 |

Appendix 5B

Mining exploration entity quarterly report

| 1.13 | Total operating and investing cash flows | | | | | | |

| | (brought forward) | | | 6,615 | | | | 522 | |

| | | | | | | | | | |

| | Cash flows related to financing activities | | | | | | | | |

| 1.14 | Proceeds from issues of shares, options, etc. | | | - | | | | 10,852 | |

| 1.15 | Proceeds from sale of forfeited shares | | | - | | | | - | |

| 1.16 | Proceeds from borrowings | | | - | | | | - | |

| 1.17 | Repayment of borrowings | | | (5,003 | ) | | | (9,800 | ) |

| 1.18 | Dividends paid | | | - | | | | - | |

| 1.19 | Other (provide details if material) | | | - | | | | - | |

| | | | | | | | | | |

| | Net financing cash flows | | | (5,003 | ) | | | 1,051 | |

| | | | | | | | | | |

| | Net increase (decrease) in cash held | | | 1,612 | | | | 1,574 | |

| | | | | | | | | | |

| 1.20 | Cash at beginning of quarter/year to date | | | 116 | | | | 155 | |

| 1.21 | Exchange rate adjustments to item 1.20 | | | (50 | ) | | | (51 | ) |

| | | | | | | | | | |

| 1.22 | Cash at end of quarter | | | 1,678 | | | | 1,678 | |

Payments to directors of the entity and associates of the directors

Payments to related entities of the entity and associates of the related entities

| | | | Current quarter | |

| | | | $A'000 | |

| | | | | |

| 1.23 | Aggregate amount of payments to the parties included in item 1.2 | | | 147 | |

| | | | | | |

| 1.24 | Aggregate amount of loans to the parties included in item 1.10 | | | - | |

| 1.25 | Explanation necessary for an understanding of the transactions |

| | |

| | Remuneration of executive and non executive directors. |

| | |

| Non-cash financing and investing activities |

| | |

| 2.1 | Details of financing and investing transactions which have had a material effect on consolidated |

| | assets and liabilities but did not involve cash flows |

| | |

| | Nil |

| 2.2 | Details of outlays made by other entities to establish or increase their share in projects in which the |

| | reporting entity has an interest |

| | |

| | Barrick Gold has recently commenced exploration activities in accordance with the Farm in agreement dated January 2008. Expenditure reports are in the process of being compiled and submitted to Allied Gold for validation in accordance with the agreement. |

+ See chapter 19 for defined terms.

| Appendix 5B Page 2 | 30/9/2001 |

Appendix 5B

Mining exploration entity quarterly report

Financing facilities available

Add notes as necessary for an understanding of the position.

| | | | Amount available | | | Amount used | |

| | | | $USD'000 | | | $A'000 | |

| 3.1 | Loan facilities | | USD 3,329 | | | USD3,329 | |

| | | | | | | | |

| 3.2 | Credit standby arrangements | | | - | | | | - | |

Estimated cash outflows for next quarter

| | | | $A'000 | |

| 4.1 | Exploration and evaluation | | | 750 | |

| | | | | | |

| 4.2 | Development | | | 4,200 | |

| | | | | | |

| | Total | | | 4,950 | |

Reconciliation of cash

| Reconciliation of cash at the end of the quarter (as | | Current quarter | | | Previous quarter | |

| shown in the consolidated statement of cash flows) to | | $A'000 | | | $A'000 | |

| the related items in the accounts is as follows. | | | | | | |

| 5.1 | Cash on hand and at bank | | | 1,678 | | | | 1,678 | |

| | | | | | | | | | |

| 5.2 | Deposits at call | | | - | | | | - | |

| | | | | | | | | | |

| 5.3 | Bank overdraft | | | - | | | | - | |

| | | | | | | | | | |

| 5.4 | Other (provide details) | | | - | | | | - | |

| | | | | | | | | | |

| | Total: cash at end of quarter (item 1.22) | | | 1,678 | | | | 1,678 | |

Changes in interests in mining tenements

| | | | | | | | | Interest at | | Interest at |

| | | | | Tenement | | Nature of interest | | beginning | | end of |

| | | | | reference | | (note (2)) | | of quarter | | quarter |

| 6.1 | | Interests in mining tenements relinquished, reduced or lapsed | | | | | | | | |

| | | | | | | | | | | |

| 6.2 | | Interests in mining tenements acquired or increased | | | | | | | | |

+ See chapter 19 for defined terms.

| 30/9/2001 | Appendix 5B Page 3 |

Appendix 5B

Mining exploration entity quarterly report

Issued and quoted securities at end of current quarter

Description includes rate of interest and any redemption or conversion rights together with prices and dates.

| | | | | | | | | | Issue price per | | Amount paid up per |

| | | | | | | | | | security (see note | | security (see note 3) |

| | | | Total number | | | Number quoted | | | 3) (cents) | | (cents) |

| 7.1 | Preference +securities | | | | | | | | | | |

| | (description) | | | | | | | | | | |

| 7.2 | Changes during quarter | | | | | | | | | | |

| | (a) Increases through issues | | | | | | | | | | |

| | (b) Decreases through returns of capital, buy- backs, redemptions | | | | | | | | | | |

| 7.3 | +Ordinary securities | | | 410,994,276 | | | | 410,994,276 | | | | | |

| | | | | | | | | | | | | | |

| 7.4 | Changes during quarter | | | | | | | | | | | | |

| | (a) Increases through issues | | | | | | | | | | | | |

| | (b) Decreases through returns of capital, buy- backs | | | | | | | | | | | | |

| 7.5 | +Convertible debt securities | | | | | | | | | | | | |

| | (description) | | | | | | | | | | | | |

| 7.6 | Changes during quarter | | | | | | | | | | | | |

| | (a) Increases through issues | | | | | | | | | | | | |

| | (b) Decreases through securities matured, converted | | | | | | | | | | | | |

| 7.7 | Options | | | | | | | | | | Exercise price | | Expiry date |

| | (description and | | | | | | | | | | | | |

| | conversion | | | 370,000 | | | | | | | $ | 0.50 | | 30 October 2009 |

| | factor) | | | 713,261 | | | | | | | $ | 0.72 | | 30 June 2009 |

| | | | | 3,400,000 | | | | | | | $ | 0.45 | | 31 December 2009 |

| | | | | 1,000,000 | | | | | | | $ | 0.80 | | 31 December 2010 |

| | | | | 1,000,000 | | | | | | | $ | 1.00 | | 31 December 2010 |

| | | | | 1,000,000 | | | | | | | $ | 1.25 | | 31 December 2010 |

| | | | | 1,000,000 | | | | | | | $ | 1.50 | | 31 December 2010 |

| | | | | 1,000,000 | | | | | | | $ | 2.00 | | 31 December 2010 |

| | | | | 37,650,000 | | | | | | | $ | 0.35 | | 31 October 2011 |

| | | | | 1,699,427 | | | | | | | $ | 0.31 | | 31 December 2010 |

| | | | | | | | | | | | | | | |

| 7.8 | Issued during quarter | | | 37,650,000 | | | | | | | $ | 0.35 | | 31 October 2011 |

| | | | | 1,699,427 | | | | | | | $ | 0.31 | | 31 December 2010 |

+ See chapter 19 for defined terms.

| Appendix 5B Page 4 | 30/9/2001 |

Appendix 5B

Mining exploration entity quarterly report

| 7.9 | Exercised during quarter | | | | | | | | | | |

| 7.10 | Expired during quarter | | Cancelled during quarter | | | | | | | | |

| | | | | | | | | | | | |

| | | | | 400,000 | | | | | | $ | 0.80 | | 31 December 2010 |

| | | | | 400,000 | | | | | | $ | 1.00 | | 31 December 2010 |

| | | | | 400,000 | | | | | | $ | 1.25 | | 31 December 2010 |

| | | | | 400,000 | | | | | | $ | 1.50 | | 31 December 2010 |

| | | | | 400,000 | | | | | | $ | 2.00 | | 31 December 2010 |

| | | | | | | | | | | | | | |

| | | | Expired during quarter | | | | | | | | | |

| | | | | 2,720,000 | | | | | | $ | 0.50 | | 31 December 2008 |

| | | | | 500,000 | | | | | | $ | 0.80 | | 31 December 2008 |

| | | | | 1,000,000 | | | | | | $ | 0.44 | | 31 December 2008 |

| 7.11 | Debentures (totals only) | | | | | | | | | | | | |

| 7.12 | Unsecured notes (totals only) | | | | | | | | | | | | |

Compliance statement

| 1 | This statement has been prepared under accounting policies which comply with accounting standards as defined in the Corporations Act or other standards acceptable to ASX (see note 4). |

| | |

| 2 | This statement does /does not* (delete one) give a true and fair view of the matters disclosed. |

| Sign here:.. | | Date: | 28 January 2009 |

| | (Director/Company secretary) | | |

| | | | |

| Print name: | Peter Torre | | |

Notes

| 1 | The quarterly report provides a basis for informing the market how the entity's activities have been financed for the past quarter and the effect on its cash position. An entity wanting to disclose additional information is encouraged to do so, in a note or notes attached to this report. |

+ See chapter 19 for defined terms.

| 30/9/2001 | Appendix 5B Page 5 |

Appendix 5B

Mining exploration entity quarterly report

| 2 | The "Nature of interest" (items 6.1 and 6.2) includes options in respect of interests in mining tenements acquired, exercised or lapsed during the reporting period. If the entity is involved in a joint venture agreement and there are conditions precedent which will change its percentage interest in a mining tenement, it should disclose the change of percentage interest and conditions precedent in the list required for items 6.1 and 6.2. |

| | |

| 3 | Issued and quoted securities The issue price and amount paid up is not required in items 7.1 and 7.3 for fully paid securities. |

| | |

| 4 | The definitions in, and provisions of, AASB 1022: Accounting for Extractive Industries and AASB 1026: Statement of Cash Flows apply to this report. |

| | |

| 5 | Accounting Standards ASX will accept, for example, the use of International Accounting Standards for foreign entities. If the standards used do not address a topic, the Australian standard on that topic (if any) must be complied with. |

== == == == ==

+ See chapter 19 for defined terms.

| Appendix 5B Page 6 | 30/9/2001 |