Exhibit 99.1

Company Announcements Office

Australian Stock Exchange Ltd

"This press release is not for dissemination in the United States and shall not be

disseminated to United States news services."

31 December 2008

Half Year Financial Report

Allied Gold Limited is an emerging Australian gold producer which today released its half year financial report for the period ended 31 December 2008.

The consolidated loss after tax of $11.031 million includes a number of non cash adjustments.

Allied Gold positively generated AUD$15.858 million cash flow from operations for the period ended 31 December 2008 which was primarily utilised to self fund a number of capital improvement initiatives as well as the significant ongoing exploration program.

The ASX has confirmed that from 17 March 2009 Allied Gold will transfer from the status of Exploration Company to that of a Gold Producer for reporting purposes. The immediate impact of this will be that the Appendix 5B quarterly cash flow statement will no longer being required for lodgement with the statement of quarterly activities.

The half year financial report is attached.

Yours Faithfully

Peter Torre

Company Secretary

Page 2

Board of Directors: Mark Caruso Executive Chairman & CEO Tony Lowrie Non Executive Director Greg Steemson Non Executive Director Frank Terranova Executive Director & CFO Peter Torre Company Secretary: ASX Code: ALD AIM Code: AGLD Principal Office 34 Douglas Street Milton, Queensland 4064 Telephone +61 7 3252 5911 Facsimile +61 7 3252 3552 Email info@alliedgold.com.au Website: www.alliedgold.com.au Postal Address PO Box 2019, Milton 4064 Registered Office Unit B9, 431 Roberts Road Subiaco, WA 6008 Share Registry Computershare Investor Services Level 2, Reserve Bank Building 45 St Georges Terrace Perth, Western Australia WA 6000 | Competent Persons The information in this Stock Exchange Announcement that relates to Mineral Resources, Project Financial modelling, Mining, Exploration and Metallurgical results, together with any related assessments and interpretations, has been approved for release by Mr C.R. Hastings, MSc, BSc, M.Aus.I.M.M., a qualified geologist and full-time employee of the Company. Mr Hastings has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined in the 2004 Edition of the "Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves". Mr Hastings consents to the inclusion of the information contained in this ASX release in the form and context in which it appears. The information in this Stock Exchange Announcement that relates to Ore Reserves has been compiled by Mr J Battista of Golder Associates who is a Member of the Australasian Institute of Mining and Metallurgy. Mr Battista has had sufficient experience in Ore Reserve estimation relevant to the style of mineralisation and type of deposit under consideration to qualify as a Competent Person as defined in the 2004 Edition of the "Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves". Mr Battista consents to the inclusion of the information contained in this ASX release in the form and context in which it appears. Forward-Looking Statements This press release contains forward-looking statements concerning the projects owned by Allied Gold. Statements concerning mineral reserves and resources may also be deemed to be forward-looking statements in that they involve estimates, based on certain assumptions, of the mineralisation that will be found if and when a deposit is developed and mined. Forward-looking statements are not statements of historical fact, and actual events or results may differ materially from those described in the forward-looking statements, as the result of a variety of risks, uncertainties and other factors, involved in the mining industry generally and the particular properties in which Allied has an interest, such as fluctuation in gold prices; uncertainties involved in interpreting drilling results and other tests; the uncertainty of financial projections and cost estimates; the possibility of cost overruns, accidents, strikes, delays and other problems in development projects, the uncertain availability of financing and uncertainties as to terms of any financings completed; uncertainties relating to environmental risks and government approvals, and possible political instability or changes in government policy in jurisdictions in which properties are located. Forward-looking statements are based on management's beliefs, opinions and estimates as of the date they are made, and no obligation is assumed to update forward-looking statements if these beliefs, opinions or estimates should change or to reflect other future developments. Not an offer of securities or solicitation of a proxy This communication is not a solicitation of a proxy from any security holder of Allied Gold, nor is this communication an offer to purchase or a solicitation to sell securities. Any offer will be made only through an information circular or proxy statement or similar document. Investors and security holders are strongly advised to read such document regarding the proposed business combination referred to in this communication, if and when such document is filed and becomes available, because it will contain important information. Any such document would be filed by Allied Gold with the Australian Securities and Investments Commission, the Australian Stock Exchange and with the U.S. Securities and Exchange Commission (SEC). |

Page 3

About Allied Gold Limited

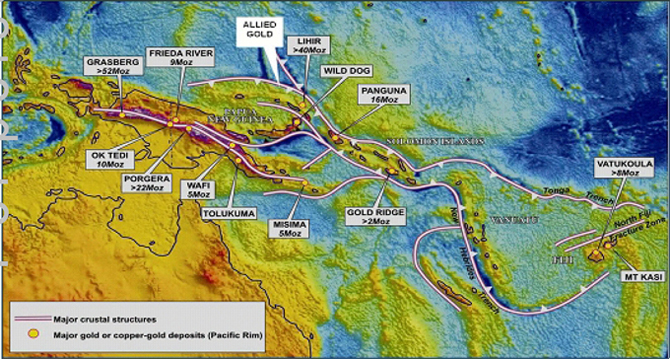

Allied Gold is a gold production company having commissioned its 100 percent owned Simberi Oxide Gold Project in February 2008. The project is situated on the northern most island of the Tabar Islands Group, located in the New Ireland Province of eastern Papua New Guinea some 60 kilometres north-west of the Lihir Gold Project, which hosts a plus 40 million ounce gold resource and is well placed in the Pacific Rim of Fire (one of the worlds proven and most prospective gold jurisdictions) see diagram.

Simberi currently hosts Measured Indicated and Inferred mineral Resources of approximately 3.3 million ounces of gold. Allied Gold currently owns 100% of Simberi and 100% of the EL on the nearby Tatau and Big Tabar islands. During 2008 Allied entered into a $20 million farm-in agreement with Barrick Gold relating to the Allied Gold's exploration licence over Big Tabar and Tatau Island. Barrick will earn in 50% once it incurs A$8.0M and 70% once a total of $20.0M is incurred. Until these specific milestones are achieved, Allied Gold retains 100% of the EL on these islands.

Allied's strategy is to add to the gold inventory on Simberi Island by defining additional Resources and conversion of these and known resources into reserves with a view to expanding annualised gold production from current levels of around 84,000 ounces. Allied Gold recently announced in February 2009 the commencement of a feasibility study relating to a sulphide resource expansion on Simberi Island.

CONSOLIDATED INTERIM FINANCIAL REPORT

FOR THE HALF-YEAR ENDED

31 DECEMBER 2008

| |

| ALLIED GOLD LIMITED |

| CONSOLIDATED INTERIM FINANCIAL REPORT |

| FOR THE HALF-YEAR ENDED 31 DECEMBER 2008 |

| | |

DIRECTORS' REPORT

DIRECTORS' REPORT

Your directors submit the consolidated interim financial report of Allied Gold Limited and its controlled entities (together referred to as the "economic entity" or "the Group") for the half-year ended 31 December 2008.

DIRECTORS

The Directors of the Company in office during or since the end of the half-year were:

Mr Mark V Caruso

Mr Gregory H Steemson

Mr Anthony Lowrie

Mr Frank Terranova (appointed 10 December 2008)

Mr Jeffrey J Moore (resigned 7 July 2008)

Mr Richard Johnson (resigned 3 October 2008)

Directors have been in office since the start of the financial year to the date of this report unless otherwise stated.

RESULTS

The consolidated loss of the economic entity after providing for income tax was $11,031,614 (2007: loss $3,961,102).

DIVENDENDS PAID OR RECOMMENDED

No dividends were paid or declared during or in respect of the half-year ended 31 December 2008.

REVIEW OF OPERATIONS

The principal focus of the Group during the half-year to 31 December 2008 has been on operational initiatives aimed at lowering per ounce cash production costs and generating a more consistent production profile.

Key operating statistics for the mining and processing activities for the period from 1 July 2008 to 31 December 2008 are summarised in the table below:

| Key operating statistic | | Unit of measure | | Volume | |

| | | | | | |

| Waste mined | | tonnes | | | 105,819 | |

| Ore mined | | tonnes | | | 850,284 | |

| Ore processed | | tonnes | | | 762,696 | |

| Grade | | g/t gold | | | 1.91 | |

| Recovery | | % | | | 81.5 | |

| Gold produced | | ounces | | | 38,631 | |

| Gold sold | | ounces | | | 31,061 | |

| | | | | | | |

| Average realised gold price $ / oz | | A$/oz | | | 1,044 | |

| | | US$/oz | | | 779 | |

| | | | | | | |

| Operating cash cost $ / oz | | A$/oz | | | 608 | |

| | | US$/oz | | | 474 | |

DIRECTORS' REPORT (continued)

Significant events during the half-year included:

| | • | In August 2008, Allied Gold successfully raised $10.5 million through a placement of shares with sophisticated investors, including its Joint Venture partner Barrick Gold Corporation. |

| | • | Resources for the Sorowar deposit were increased by 815,000 ounces to approximately 3.2 million ounces. |

| | • | Allied Gold continued to generate significant success from its comprehensive exploration program on Simberi Island, including the discovery of additional mineralisation at Sorowar and Pigiput East. |

| | • | During the half-year Allied Gold repaid in excess of $11 million in secured bank debt, including $ 5 million in debt repaid using funds generated by the proactive management of the Group's hedge book. As a result of the accelerated debt repayments, the next scheduled debt repayment is not due until June 2009. |

| | • | In accordance with its AUD$20 million farm-in to Allied Gold's exploration licence over Big Tabar and Tatau Islands, Barrick Gold commenced exploration activities in August 2008. During the half- year Barrick commenced drilling at the Tupinda copper prospect, completed two drill holes and commenced a third. An aerial geophysical electromagnetic survey covering the entire Tabar Island Group commenced in December 2008. |

| | • | A Sulphide pre-feasibility study was commenced with a view to underpinning an expansion of the production profile by up to 200,000 ounces per annum by 2011. |

SUBSEQUENT EVENTS

On 24 February 2009, the Company executed agreements with sophisticated investors for the placement of 61,649,000 shares for a total consideration of $30,824,500.

Other than the above matter, there has not arisen in the interval between the end of the financial period and the date of this report any item, transaction or event of a material and unusual nature likely, in the opinion of the Directors of the Company, to affect significantly the operations of the Company, the results of those operations or the state of affairs of the Company in future financial periods.

FUTURE DEVELOPMENTS, PROSPECTS AND BUSINESS STRATEGIES

A number of Group wide improvement and growth opportunities are being assessed by management including:

| | • | A sulphide pre-feasibility study to assess the economic and operational feasibility of developing a sulphide processing plant on Simberi Island has commenced. |

| | • | A new Reserve upgrade for Sorowar and Pigiput East is planned for the March 2009 quarter. The results of this upgrade will influence the Group's decision whether to proceed with a proposed expansion of the Oxide plant beyond its current capacity of 2.2 million tonnes per annum. |

| | • | In accordance with the existing farm-in agreement, Barrick is continuing its drilling programme on Tabar Island with assayed results expected during the March 2009 quarter. |

| | • | Allied continues to assess a number of existing opportunities within the sector that may ultimately complement its existing strong organic growth profile. |

In the opinion of the Directors it may prejudice the interests of the Company to provide additional information in relation to likely developments in the operations of the Company and the expected results of those operations in subsequent financial periods.

DIRECTORS' REPORT (continued)

OTHER INFORMATION

The registered office and principal place of business is Unit B9, 431 Roberts Road, Subiaco WA 6008.

AUDITOR'S INDEPENDENCE DECLARATION

The auditors' independence declaration under section 307C of the Corporations Act 2001 is set out on page 17 for the half-year ended 31 December 2008 and forms part of the directors report.

Signed in accordance with a resolution of the Directors.

Executive Chairman

Dated at Perth this 3rd day of March 2009

| |

| ALLIED GOLD LIMITED |

| CONSOLIDATED INTERIM FINANCIAL REPORT |

| FOR THE HALF-YEAR ENDED 31 DECEMBER 2008 |

| |

CONSOLIDATED INCOME STATEMENT

FOR THE HALF-YEAR ENDED 31 DECEMBER 2008

| | | | | | Half-year | |

| | | | | | 2008 | | | 2007 | |

| | | Note | | | $ | | | $ | |

| | | | | | | | | | | | |

| Revenue | | | | | | 32,724,924 | | | | - | |

| Cost of sales | | | | | | (24,928,578 | ) | | | - | |

| Gross profit | | | | | | 7,796,346 | | | | - | |

| | | | | | | | | | | | |

| Unrealised losses on derivatives | | 6 | | | | (3,540,748 | ) | | | - | |

| Corporate expenses | | | | | | | (4,003,202 | ) | | | (982,105 | ) |

| Share based remuneration | | 10 | | | | (4,130,120 | ) | | | (921,744 | ) |

| Other operating expenses | | | | | | | (3,416,323 | ) | | | (2,243,288 | ) |

| Operating Loss | | | | | | | (7,294,047 | ) | | | (4,147,137 | ) |

| | | | | | | | | | | | | |

| Impairment of available for sale assets | | 7 | | | | (1,158,206 | ) | | | - | |

| Other expenses | | | | | | | (1,407,970 | ) | | | (148,588 | ) |

| Other income | | | | | | | 46,778 | | | | - | |

| Financial income | | | | | | | 48,175 | | | | 334,623 | |

| Financial costs | | | | | | | (1,266,344 | ) | | | - | |

| Loss from continuing operations | | | | | | | (11,031,614 | ) | | | (3,961,102 | ) |

| | | | | | | | | | | | | |

| Income tax benefit/(expense) | | | | | | | - | | | | - | |

| Loss after tax attributable to members of | | | | | | | | | | | | |

| the parent entity | | | | | | | (11,031,614 | ) | | | (3,961,102 | ) |

| | | | | | | | | | | | | |

| Basic loss per share (cents) | | | | | | | (2.74 | ) | | | (1.16 | ) |

| Diluted loss per share (cents) | | | | | | | n/a | | | | n/a | |

The notes on pages 10 to 15 are an integral part of these consolidated interim financial statements.

| |

| ALLIED GOLD LIMITED |

| CONSOLIDATED INTERIM FINANCIAL REPORT |

| FOR THE HALF-YEAR ENDED 31 DECEMBER 2008 |

| |

CONSOLIDATED BALANCE SHEET

AS AT 31 DECEMBER 2008

| | | Note | | | 31 December | | | 30 June | |

| | | | | | 2008 | | | 2008 | |

| | | | | | $ | | | $ | |

| CURRENT ASSETS | | | | | | | | | | | |

| Cash and cash equivalents | | | | | | 1,718,906 | | | | 154,180 | |

| Trade and other receivables | | | | | | 1,527,811 | | | | 1,758,073 | |

| Inventories | | | | | | 15,421,496 | | | | 7,401,734 | |

| Derivative financial instruments | | | | | | - | | | | 314,212 | |

| Other assets | | | | | | 250,369 | | | | 531,032 | |

| Total Current Assets | | | | | | 18,918,582 | | | | 10,159,231 | |

| | | | | | | | | | | | |

| NON-CURRENT ASSETS | | | | | | | | | | | |

| Derivative financial instruments | | | | | | - | | | | 3,495,855 | |

| Available for sale financial assets | | 7 | | | | 243,300 | | | | 1,185,074 | |

| Property, plant and equipment | | 8 | | | | 138,491,912 | | | | 130,034,534 | |

| Exploration and evaluation expenditure | | | | | | | 13,664,936 | | | | 10,406,786 | |

| Total Non-Current Assets | | | | | | | 152,400,148 | | | | 145,122,249 | |

| | | | | | | | | | | | | |

| Total Assets | | | | | | | 171,318,730 | | | | 155,281,480 | |

| | | | | | | | | | | | | |

| CURRENT LIABILITIES | | | | | | | | | | | | |

| Trade and other payables | | | | | | | 22,222,637 | | | | 14,446,386 | |

| Borrowings | | 11 | | | | 7,743,025 | | | | 8,561,286 | |

| Derivative financial instruments | | | | | | | 14,526,846 | | | | 6,972,407 | |

| Provisions | | | | | | | 365,819 | | | | 365,819 | |

| Total Current Liabilities | | | | | | | 44,858,327 | | | | 30,345,898 | |

| | | | | | | | | | | | | |

| NON CURRENT LIABILITIES | | | | | | | | | | | | |

| Derivative financial instruments | | | | | | | 3,985,130 | | | | 18,911,174 | |

| Borrowings | | 11 | | | | 4,175,748 | | | | 2,739,755 | |

| Provisions | | | | | | | 2,683,648 | | | | 2,584,870 | |

| Total Non-Current Liabilities | | | | | | | 10,844,526 | | | | 24,235,799 | |

| | | | | | | | | | | | | |

| Total Liabilities | | | | | | | 55,702,853 | | | | 54,581,697 | |

| | | | | | | | | | | | | |

| NET ASSETS | | | | | | | 115,615,877 | | | | 100,699,783 | |

| | | | | | | | | | | | | |

| EQUITY | | | | | | | | | | | | |

| Issued capital | | 9 | | | | 143,602,145 | | | | 133,686,704 | |

| Reserves | | | | | | | (923,900 | ) | | | (16,956,167 | ) |

| Accumulated losses | | | | | | | (27,062,368 | ) | | | (16,030,754 | ) |

| TOTAL EQUITY | | | | | | | 115,615,877 | | | | 100,699,783 | |

The notes on pages 10 to 15 are an integral part of these consolidated interim financial statements.

| |

| ALLIED GOLD LIMITED |

| CONSOLIDATED INTERIM FINANCIAL REPORT |

| FOR THE HALF-YEAR ENDED 31 DECEMBER 2008 |

| |

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE HALF-YEAR ENDED 31 DECEMBER 2007

| | | Issued Capital | | | Accumulated | | | Share-based | | | Foreign exchange | | | Available for sale | | | Cash Flow | | | Total | |

| | | | | | Losses | | | payments | | | translation | | | investments | | | Hedging Reserve | | | | |

| | | | | | | | | reserve | | | reserve | | | revaluation | | | | | | | |

| | | | | | | | | | | | | | | reserve | | | | | | | |

| | | $ | | | $ | | | $ | | | $ | | | $ | | | $ | | | $ | |

| | | | | | | | | | | | | | | | | | | | | | |

| At 1 July 2007 | | | 105,794,580 | | | | (6,491,791 | ) | | | 1,912,347 | | | | 22,575 | | | | 758,090 | | | | - | | | | 101,995,801 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Changes in fair value of investments available for sale | | | - | | | | - | | | | - | | | | - | | | | (376,955 | ) | | | - | | | | (376,955 | ) |

| Translation of foreign controlled entities | | | - | | | | - | | | | - | | | | (151,406 | ) | | | - | | | | - | | | | (151,406 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Changes in the fair value of cash flow hedges | | | - | | | | - | | | | - | | | | - | | | | - | | | | (19,794,909 | ) | | | (19,794,909 | ) |

| Total income and expenses recognised directly in equity during the year | | | - | | | | - | | | | - | | | | (151,406 | ) | | | (376,955 | ) | | | (19,794,909 | ) | | | (20,323,270 | ) |

| Loss for the period | | | - | | | | (3,961,102 | ) | | | - | | | | - | | | | - | | | | - | | | | (3,961,102 | ) |

| Total recognised income and expense during the year | | | - | | | | (3,961,102 | ) | | | - | | | | (151,406 | ) | | | (376,955 | ) | | | (19,794,909 | ) | | | (24,284,372 | ) |

| Share based payments | | | - | | | | - | | | | 921,744 | | | | - | | | | - | | | | - | | | | 921,744 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Conversion of options | | | 1,265,477 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 1,265,477 | |

| At 31 December 2007 | | | 107,060,057 | | | | (10,452,893 | ) | | | 2,834,091 | | | | (128,831 | ) | | | 381,135 | | | | (19,794,909 | ) | | | 79,898,650 | |

The notes on pages 10 to 15 are an integral part of these consolidated interim financial statements.

| |

| ALLIED GOLD LIMITED |

| CONSOLIDATED INTERIM FINANCIAL REPORT |

| FOR THE HALF-YEAR ENDED 31 DECEMBER 2008 |

| |

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE HALF-YEAR ENDED 31 DECEMBER 2008

| | | Issued Capital | | | Accumulated | | | Share-based | | | Foreign exchange | | | Available for | | | Cash Flow | | | Total | |

| | | | | | Losses | | | payments | | | translation | | | sale | | | Hedging Reserve | | | | |

| | | | | | | | | reserve | | | reserve | | | investments | | | | | | | |

| | | | | | | | | | | | | | | revaluation | | | | | | | |

| | | | | | | | | | | | | | | reserve | | | | | | | |

| | | $ | | | $ | | | $ | | | $ | | | $ | | | $ | | | $ | |

| | | | | | | | | | | | | | | | | | | | | | |

| At 1 July 2008 | | | 133,686,704 | | | | (16,030,754 | ) | | | 5,502,877 | | | | (392,076 | ) | | | 6,546 | | | | (22,073,514 | ) | | | 100,699,783 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Changes in fair value of investments available for sale | | | - | | | | - | | | | - | | | | - | | | | (24,768 | ) | | | - | | | | (24,768 | ) |

| Translation of foreign controlled entities | | | - | | | | - | | | | - | | | | (463,502 | ) | | | - | | | | - | | | | (463,502 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Changes in the fair value of cash flow hedges | | | - | | | | - | | | | - | | | | - | | | | - | | | | 12,817,527 | | | | 12,817,527 | |

| Deferred hedging loss | | | - | | | | - | | | | - | | | | - | | | | - | | | | (570,530 | ) | | | (570,530 | ) |

| Total income and expenses recognised directly in equity during the year | | | - | | | | - | | | | - | | | | (463,502 | ) | | | (24,768 | ) | | | 12,246,997 | | | | 11,578,727 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Loss for the period | | | - | | | | (11,031,614 | ) | | | - | | | | - | | | | - | | | | - | | | | (11,031,614 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total recognised income and expense during the year | | | - | | | | (11,031,614 | ) | | | - | | | | (463,502 | ) | | | (24,768 | ) | | | 12,246,997 | | | | 727,113 | |

| Cost of equity raising | | | (621,010 | ) | | | - | | | | - | | | | - | | | | - | | | | - | | | | (621,010 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Share-based payments | | | - | | | | - | | | | 4,273,540 | | | | - | | | | - | | | | - | | | | 4,273,540 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Share placements | | | 10,536,451 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 10,536,451 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| At 31 December 2008 | | | 143,602,145 | | | | (27,062,368 | ) | | | 9,776,417 | | | | (855,578 | ) | | | (18,222 | ) | | | (9,826,517 | ) | | | 115,615,877 | |

The notes on pages 10 to 15 are an integral part of these consolidated interim financial statements.

| |

| ALLIED GOLD LIMITED |

| CONSOLIDATED INTERIM FINANCIAL REPORT |

| FOR THE HALF-YEAR ENDED 31 DECEMBER 2008 |

| |

CONSOLIDATED CASHFLOW STATEMENT

FOR THE HALF-YEAR ENDED 31 DECEMBER 2008

| | | Half-year | |

| | | 2008 | | | 2007 | |

| | | $ | | | $ | |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | | | | |

| Receipts from customers | | | 33,012,629 | | | | - | |

| Payments to suppliers & employees | | | (21,958,773 | ) | | | (477,430 | ) |

| Proceeds from settlement of derivatives | | | 5,144,710 | | | | - | |

| Interest received | | | 48,175 | | | | 334,623 | |

| Interest paid | | | (388,731 | ) | | | (1,849,849 | ) |

| Net cash generated from / (used in) | | | | | | | | |

| operating activities | | | 15,858,010 | | | | (1,992,656 | ) |

| | | | | | | | | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | | | | | | | |

| Purchase of equity investments | | | (241,200 | ) | | | - | |

| Purchase of plant & equipment | | | (9,857,413 | ) | | | (1,630,595 | ) |

| Exploration and evaluation expenditure | | | (3,721,696 | ) | | | (6,053,116 | ) |

| Assets under construction | | | - | | | | (26,083,895 | ) |

| Net cash used in investing activities | | | (13,820,309 | ) | | | (33,767,606 | ) |

| | | | | | | | | |

| CASH FLOWS FROM FINANCING ACTIVTIES | | | | | | | | |

| Proceeds from the issue of securities | | | 10,806,452 | | | | 1,265,477 | |

| Costs of issuing securities | | | (239,633 | ) | | | - | |

| Finance lease payments | | | (1,080,703 | ) | | | - | |

| Proceeds from borrowings | | | 2,900,000 | | | | 23,393,561 | |

| Repayments of borrowings | | | (12,859,098 | ) | | | - | |

| Net cash generated from / (used in ) | | | | | | | | |

| financing activities | | | (472,982 | ) | | | 24,659,038 | |

| | | | | | | | | |

| Net increase / (decrease) in cash held | | | 1,564,719 | | | | (11,101,224 | ) |

| Cash at beginning of the half-year | | | 154,180 | | | | 12,657,949 | |

| Effects of exchange rate changes on the | | | | | | | | |

| balance of cash and cash equivalents | | | 7 | | | | (151,403 | ) |

| Cash and cash equivalents at end of | | | | | | | | |

| the half-year | | | 1,718,906 | | | | 1,405,322 | |

The notes on pages 10 to 15 are an integral part of these consolidated interim financial statements.

| |

| ALLIED GOLD LIMITED |

| CONSOLIDATED INTERIM FINANCIAL REPORT |

| FOR THE HALF-YEAR ENDED 31 DECEMBER 2008 |

| |

NOTES TO THE CONSOLIDATED INTERIM FINANCIAL REPORT

Allied Gold Limited ("the Company") is a company incorporated in Australia and limited by shares, which are publicly traded on the Australian Stock Exchange. The consolidated interim financial report for the half-year ended 31 December 2008 comprises the Company and its controlled entities (together referred to as "the Group").

The consolidated annual report of the Group as at and for the year ended 30 June 2008 is available upon request from the Company's registered office at Unit B9, 431 Roberts Road, Subiaco WA 6008.

| 2. | Statement of compliance |

The consolidated interim financial report is a general-purpose financial report, which has been prepared in accordance with the requirements of the Corporations Act 2001 and AASB 134 Interim Financial Reporting.

The consolidated interim financial report does not include all of the information required for a full annual financial report and should be read in conjunction with the annual financial report of the Group as at and for the year ended 30 June 2008.

The financial report of Allied Gold Limited and its controlled entities for the half-year ended 31 December 2008 was approved by the directors on 3rd March 2009.

| 3. | Significant accounting policies |

The significant accounting policies applied by the Group in this consolidated interim financial report are the same as those applied by the Group in its consolidated financial report as at and for the year ended 30 June 2008.

The preparation of the half-year financial statements in accordance with Australian Accounting Standards requires management to make judgements, estimates and assumptions that affect the application of policies and reported amounts of assets, liabilities, income and expenses.

These estimates and associated assumptions are based on historical experience and various other factors that are believed to be reasonable under the circumstances, the results of which form the basis of making the judgements about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates.

In preparing this consolidated interim financial report, the significant judgements made by management in applying the Group's accounting policies and the key sources of estimation uncertainty were the same as those that applied to the consolidated annual financial report as at and for the year ended 30 June 2008.

| |

| ALLIED GOLD LIMITED |

| CONSOLIDATED INTERIM FINANCIAL REPORT |

| FOR THE HALF-YEAR ENDED 31 DECEMBER 2008 |

| |

NOTES TO THE CONSOLIDATED INTERIM FINANCIAL REPORT (continued)

The consolidated entity comprises the following main business segments, based on the consolidated entity's management and internal reporting structure:

| | | Mining and processing | | | Mineral exploration | | | Total | |

| | | 2008 | | | 2007 | | | 2008 | | | 2007 | | | 2008 | | | 2007 | |

| | | $ | | | $ | | | $ | | | $ | | | $ | | | $ | |

| Revenue | | | | | | | | | | | | | | | | | | |

| Sales to external | | | | | | | | | | | | | | | | | | |

| customers | | | 32,724,924 | | | | - | | | | - | | | | - | | | | 32,724,924 | | | | - | |

| Intersegment sales | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Total sales revenue | | | 32,724,924 | | | | - | | | | - | | | | - | | | | 32,724,924 | | | | - | |

| Other revenue | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Total segment | | | | | | | | | | | | | | | | | | | | | | | | |

| revenue | | | 32,724,924 | | | | - | | | | - | | | | - | | | | 32,724,924 | | | | - | |

| Intersegment | | | | | | | | | | | | | | | | | | | | | | | | |

| eliminations | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Unallocated revenue | | | 94,953 | | | | 334,623 | | | | - | | | | - | | | | 94,953 | | | | 334,623 | |

| Consolidated | | | | | | | | | | | | | | | | | | | | | | | | |

| revenue | | | 32,819,877 | | | | 334,623 | | | | - | | | | - | | | | 32,819,877 | | | | 334,623 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Result | | | | | | | | | | | | | | | | | | | | | | | | |

| Segment result | | | 4,255,598 | | | | - | | | | - | | | | - | | | | 4,255,598 | | | | - | |

| Intersegment eliminations | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Unallocated revenue less unallocated expenses | | | (15,287,212 | ) | | | (3,961,102 | ) | | | - | | | | - | | | | (15,287,212 | ) | | | (3,961,102 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Loss before income tax | | | (11,031,614 | ) | | | (3,961,102 | ) | | | - | | | | - | | | | (11,031,614 | ) | | | (3,961,102 | ) |

| Income Tax | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Loss for the year | | | (11,031,614 | ) | | | (3,961,102 | ) | | | - | | | | - | | | | (11,031,614 | ) | | | (3,961,102 | ) |

| |

| ALLIED GOLD LIMITED |

| CONSOLIDATED INTERIM FINANCIAL REPORT |

| FOR THE HALF-YEAR ENDED 31 DECEMBER 2008 |

| |

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL REPORT (continued)

| 6. | Derivative financial instruments |

During the half-year the Group closed out certain sold put options maturing in the period March 2011 to December 2011.

The effects of this are that

| | • | The cumulative loss of $570,530 existing in the Hedging Reserve at the time that the options was sold will remain in equity and be recognised when the forecast transactions that they were hedging are recognised in the income statement. |

| | • | The call options with a corresponding maturity and entered into in conjunction with the sold put options as a component of an effective hedge of gold price risk no longer meet the hedge effectiveness criteria. In accordance with the Group's accounting policies they were classified as derivatives held for trading and all subsequent changes in their fair value were taken directly to the income statement. The total of those unrealised losses for the period was $3,540,748. |

| 7. | Available for sale financial assets |

During the six months ended 31 December 2008 the Group recognised an impairment loss of $1,158,206 in relation to listed equity investments. These investments declined significantly in value during the six months and in the view of the Directors the decline in value is not considered to be temporary.

The impairment loss has been recognised in the income statement.

| 8. | Property plant and equipment |

During the six months ended 31 December 2008, the Group acquired assets with a cost of $7,215,357 (six months ended 31 December 2007: 26,421,389). This included assets capitalised under finance leases of $5,711,334 (six months ended 31 December 2007:$ nil).

| | | 2008 | | | 2007 | | | 2008 | | | 2007 | |

| | | Number of | | | Number of | | | | | | | |

| | | shares | | | shares | | | $ | | | $ | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| (a) Ordinary shares | | | 410,994,276 | | | | 342,014,710 | | | | 143,602,565 | | | | 107,060,057 | |

| | | | | | | | | | | | | | | | | |

| Balance at 1 July | | | 377,005,725 | | | | 337,649,110 | | | | 133,686,704 | | | | 105,794,580 | |

| Shares issued through capital raising | | | 33,988,551 | | | | - | | | | 10,536,451 | | | | - | |

| Shares issued on exercise of options | | | - | | | | 4,365,600 | | | | - | | | | 1,265,477 | |

| | | | | | | | | | | | 144,223,155 | | | | 107,060,057 | |

| Costs of capital raising | | | | | | | | | | | (621,010 | ) | | | - | |

| Balance at 31 December | | | 410,994,276 | | | | 342,014,710 | | | | 143,602,145 | | | | 107,060,057 | |

Ordinary shares entitle the holder to one vote per share and to participate in dividends and proceeds on winding up of the company in proportion to the number of and amounts paid on the shares held.

| |

| ALLIED GOLD LIMITED |

| CONSOLIDATED INTERIM FINANCIAL REPORT |

| FOR THE HALF-YEAR ENDED 31 DECEMBER 2008 |

| |

NOTES TO THE CONSOLIDATED INTERIM FINANCIAL REPORT (continued)

| 9. | Contributed equity (continued) |

(b) Options

Options granted and exercised during the period, and on issue at balance date are as follows.

| Date and details of grant/exercise | | No. of Options | | | Exercise Price | | Expiry Date |

| | | | | | | | |

| As at 1 July 2008 | | | 17,333,261 | | | Various | | Various |

| 1 December 2008 | | | 15,650,000 | | | $ | 0.35 | | 30 November 2011 |

| 5 December 2008 | | | 14,000,000 | | | $ | 0.35 | | 31 October 2011 |

| 29 December 2008 | | | 8,000,000 | | | $ | 0.35 | | 30 November 2011 |

| 31 December 2008 | | | 1,699,427 | | | $ | 0.31 | | 31 December 2010 |

| Options lapsed or cancelled | | | (7,850,000 | ) | | Various | | Various |

| As at 31 December 2008 | | | 48,832,688 | | | | | | |

Each option is convertible into one ordinary share in the company when exercised. Options do not participate in dividends and do not give holders voting rights.

In 2006, the group established a share option program that entitles key management personnel and senior employees to purchase shares in the entity. The terms and conditions of the share option programme are disclosed in the consolidated financial report as at and for the year ended 30 June 2008. The Group uses the binomial option pricing methodology.

The terms and conditions of the grants made during the six months ended 31 December 2008 are as follows:

Employee options issued 1 December 2008

| | | Tranche A | | | Tranche B | | | Tranche C | |

| | | options | | | options | | | options | |

| Fair value at grant date | | $ | 0.0924 | | | $ | 0.0924 | | | $ | 0.0858 | |

| Exercise price | | $ | 0.35 | | | $ | 0.35 | | | $ | 0.35 | |

| Grant date | | 1/12/2008 | | | 1/12/2008 | | | 1/12/2008 | |

| Expiry date | | 31/10/2011 | | | 31/10/2011 | | | 31/10/2011 | |

| Share price at grant date | | $ | 0.27 | | | $ | 0.27 | | | $ | 0.27 | |

| Expected price volatility of shares | | | 60 | % | | | 60 | % | | | 60 | % |

| Expected dividend yield | | | 0 | % | | | 0 | % | | | 0 | % |

| Risk free interest rate | | | 3.27 | % | | | 3.27 | % | | | 3.27 | % |

| Discount applied in relation to vesting | | | | | | | | | | | | |

| conditions | | | 0 | % | | | 30 | % | | | 0 | % |

| |

| ALLIED GOLD LIMITED |

| CONSOLIDATED INTERIM FINANCIAL REPORT |

| FOR THE HALF-YEAR ENDED 31 DECEMBER 2008 |

| |

NOTES TO THE CONSOLIDATED INTERIM FINANCIAL REPORT (continued)

10. Share based payments (continued)

Director options issued 5 December 2008

| | | Tranche A | | | Tranche B | | | Tranche C | |

| | | options | | | options | | | options | |

| Fair value at grant date | | $ | 0.097 | | | $ | 0.097 | | | $ | 0.0905 | |

| Exercise price | | $ | 0.35 | | | $ | 0.35 | | | $ | 0.35 | |

| Grant date | | 5/12/2008 | | | 5/12/2008 | | | 5/12/2008 | |

| Expiry date | | 30/11/2011 | | | 30/11/2011 | | | 30/11/2011 | |

| Share price at grant date | | $ | 0.275 | | | $ | 0.275 | | | $ | 0.275 | |

| Expected price volatility of shares | | | 60 | % | | | 60 | % | | | 60 | % |

| Expected dividend yield | | | 0 | % | | | 0 | % | | | 0 | % |

| Risk free interest rate | | | 3.24 | % | | | 3.24 | % | | | 3.24 | % |

| Discount applied in relation to vesting | | | | | | | | | | | | |

| conditions | | | 0 | % | | | 30 | % | | | 0 | % |

| Employee options issued 29 December 2008 | | | | | | | | | |

| | | | | | | | | | |

| | | Tranche A | | | Tranche B | | | Tranche C | |

| | | options | | | options | | | options | |

| Fair value at grant date | | $ | 0.2009 | | | $ | 0.2009 | | | $ | 0.195 | |

| Exercise price | | $ | 0.35 | | | $ | 0.35 | | | $ | 0.35 | |

| Grant date | | 1/12/2007 | | | 1/12/2007 | | | 1/12/2007 | |

| Expiry date | | 31/10/2011 | | | 31/10/2011 | | | 31/10/2011 | |

| Share price at grant date | | $ | 0.425 | | | $ | 0.425 | | | $ | 0.425 | |

| Expected price volatility of shares | | | 60 | % | | | 60 | % | | | 60 | % |

| Expected dividend yield | | | 0 | % | | | 0 | % | | | 0 | % |

| Risk free interest rate | | | 2.95 | % | | | 2.95 | % | | | 2.95 | % |

| Discount applied in relation to vesting | | | | | | | | | | | | |

| conditions | | | 0 | % | | | 30 | % | | | 0 | % |

The terms of each Tranche of options are summarised below:

Tranche A - - vest on grant date.

Tranche B - - vest upon the 100,000th ounce of gold production between 1 October 2008 and 31 December 2009. Upon production of 75,000 ounces within that timeframe, the Directors have the discretion to require the holder to exercise 50% of the Tranche B options in which case the holder will forego the balance of the options.

Tranche C - - vest when the weighted average price of Allied shares is greater than 70 cents for five consecutive days.

NOTES TO THE CONSOLIDATED INTERIM FINANCIAL REPORT (continued)

The following loans and borrowings were drawn down and repaid during the six months ended 31 December 2008:

| | | Half-year | |

| | | 2008 | | | 2007 | |

| | | $ | | | $ | |

| Balance at 1 July | | | 11,301,041 | | | | - | |

| | | | | | | | | |

| New Issues | | | | | | | | |

| Secured bank loan (USD) | | | - | | | | 23,393,561 | |

| Finance lease liabilities (PGK and AUD) | | | 5,671,404 | | | | - | |

| Unsecured loans (AUD) | | | 2,900,000 | | | | - | |

| Impact of exchange rates | | | 5,207,294 | | | | - | |

| | | | | | | | | |

| Repayments | | | | | | | | |

| Secured bank loan (USD) | | | (11,459,098 | ) | | | - | |

| Finance lease liabilities (PGK and AUD) | | | (301,868 | ) | | | - | |

| Unsecured loans (AUD) | | | (1,400,000 | ) | | | - | |

| | | | | | | | | |

| Balance at 31 December | | | 11,918,773 | | | | 23,393,651 | |

| 12. | Related party transactions |

Arrangements with related parties continue to be in place. With the exception of the items described below, the nature and terms of transactions with related parties are consistent with those described in the consolidated financial report for the year ended 30 June 2008.

Mine Site Construction Services provides goods and services including the hire of mining equipment to the Group. During the six months ended 31 December 2008, equipment hire contracts that were previously disclosed as operating leases were recorded as finance leases pursuant to a modification in the terms of those agreements (refer note 11).

As at 31 December 2008 the financial statements indicated a prima facie working capital deficiency of AUD$25,939,745. Notwithstanding this prima facie deficiency the Board has determined that it is appropriate to apply the Going Concern basis in the preparation of the financial statements for the following reasons:

| | • | Included in current liabilities were amounts of AUD$14,526,846 relating to derivative financial instruments that will be satisfied through the delivery of gold production into the respective hedge contracts. It is not anticipated that any of these liabilities will require cash settlement to satisfy the obligation. |

| | • | In the six months to 31 December 2008 the entity generated cash flow from operations of AUD$10,713,300 (net of proceeds from sale of derivatives). Given prevailing market conditions and the current forecast production profile it is anticipated that significant operating cash flows will continue to be generated in the coming period. |

| | • | Inventories in the balance sheet are recorded at the lower of cost or net realisable value which is significantly lower than the gold price at which the inventories are expected to be realised. |

On 24 February 2009, the Company executed agreements with sophisticated investors for the placement of 61,649,000 shares for a total consideration of $30,824,500.

| |

| ALLIED GOLD LIMITED |

| CONSOLIDATED INTERIM FINANCIAL REPORT |

| FOR THE HALF-YEAR ENDED 31 DECEMBER 2008 |

| |

DECLARATION BY DIRECTORS

The Directors of Allied Gold Limited declare that:

| 1. | The consolidated financial statements comprising the income statement, balance sheet, cash flow statement, statement of changes in equity and accompanying notes are in accordance with the Corporations Act 2001 and: |

| (a) | comply with Accounting Standard AASB 134 Interim Financial Reporting and the Corporations Regulations 2001; and |

| (b) | give a true and fair view of the economic entity's financial position as at 31 December 2008 and of its performance for the half-year ended on that date . |

| 2. | In the directors' opinion, there are reasonable grounds to believe that Allied Gold Limited will be able to pay its debts as and when they become due and payable. |

Signed in accordance with a resolution of the Directors:

Mark Caruso

Executive Chairman

Dated at Perth this 3rd day of March 2009

| BDO Kendalls Audit & Assurance (WA) Pty Ltd |

| 128 Hay Street |

| SUBIACO WA 6008 |

| PO Box 700 |

| WEST PERTH WA 6872 |

| Phone 61 8 9380 8400 |

| Fax 61 8 9380 8499 |

| aa.perth@bdo.com.au |

| www.bdo.com.au |

| |

| ABN 79 112 284 787 |

3 rd March 2009

The Directors

Allied Gold Ltd

Unit B9, 431 Roberts Road

SUBIACO WA 6008

Dear Sirs,

DECLARATION OF INDEPENDENCE BY PETER TOLL TO THE DIRECTORS OF ALLIED GOLD LTD

As lead auditor for the review of Allied Gold Ltd for the half-year ended 31 December 2008, I declare that, to the best of my knowledge and belief, there have been no contraventions of:

| • | the auditor independence requirements of the Corporations Act 2001 in relation to the review; and |

| • | any applicable code of professional conduct in relation to the review. |

This declaration is in respect of Allied Gold Ltd and the entities it controlled during the period.

Peter Toll

Director

BDO Kendalls Audit & Assurance (WA) Pty Ltd

Dated this 3rd day of March 2009

Perth, Western Australia

| | BDO Kendalls is a national association of |

| | separate partnerships and entities |

| BDO Kendalls Audit & Assurance (WA) Pty Ltd |

| 128 Hay Street |

| SUBIACO WA 6008 |

| PO Box 700 |

| WEST PERTH WA 6872 |

| Phone 61 8 9380 8400 |

| Fax 61 8 9380 8499 |

| aa.perth@bdo.com.au |

| www.bdo.com.au |

| |

| ABN 79 112 284 787 |

INDEPENDENT AUDITOR'S REVIEW REPORT

TO THE MEMBERS OF ALLIED GOLD LTD

We have reviewed the accompanying half-year financial report of Allied Gold Ltd, which comprises the balance sheet as at 31 December 2008, and the income statement, statement of changes in equity and cash flow statement for the half-year ended on that date, a statement of accounting policies, other selected explanatory notes and the directors' declaration of the consolidated entity comprising the disclosing entity and the entities it controlled at the half-year end or from time to time during the half-year.

Directors' Responsibility for the Half-Year Financial Report

The directors of the disclosing entity are responsible for the preparation and fair presentation of the half-year financial report in accordance with Australian Accounting Standards (including the Australian Accounting Interpretations) and the Corporations Act 2001. This responsibility includes establishing and maintaining internal control relevant to the preparation and fair presentation of the half-year financial report that is free from material misstatement, whether due to fraud or error; selecting and applying appropriate accounting policies; and making accounting estimates that are reasonable in the circumstances.

Auditor's Responsibility

Our responsibility is to express a conclusion on the half-year financial report based on our review. We conducted our review in accordance with Auditing Standard on Review Engagements ASRE 2410 Review of Interim and Other Financial Reports Performed by the Independent Auditor of the Entity, in order to state whether, on the basis of the procedures described, we have become aware of any matter that makes us believe that the financial report is not in accordance with the Corporations Act 2001 including: giving a true and fair view of the disclosing entity's financial position as at 31 December 2008 and its performance for the half-year ended on that date; and complying with Accounting Standard AASB 134 Interim Financial Reporting and the Corporations Regulations 2001. As the auditor of Allied Gold Ltd, ASRE 2410 requires that we comply with the ethical requirements relevant to the audit of the annual financial report.

A review of a half-year financial report consists of making enquiries, primarily of persons responsible for financial and accounting matters, and applying analytical and other review procedures. A review is substantially less in scope than an audit conducted in accordance with Australian Auditing Standards and consequently does not enable us to obtain assurance that we would become aware of all significant matters that might be identified in an audit. Accordingly, we do not express an audit opinion.

| | BDO Kendalls is a national association of |

| | separate partnerships and entities |

Independence

In conducting our review, we have complied with the independence requirements of the Corporations Act 2001.

Conclusion

Based on our review, which is not an audit, we have not become aware of any matter that makes us believe that the half-year financial report of Allied Gold Ltd is not in accordance with the Corporations Act 2001 including:

| (a) | giving a true and fair view of the consolidated entity's financial position as at 31 December 2008 and of its performance for the half-year ended on that date; and |

| (b) | complying with Accounting Standard AASB 134 Interim Financial Reporting and Corporations Regulations 2001. |

BDO Kendalls Audit & Assurance (WA) Pty Ltd

Peter Toll

Director

Dated this 3rd March 2009

Perth, Western Australia