ANNUAL GENERAL MEETING

Wednesday 11 November 2009

Hyatt Regency Hotel

Perth Australia

ASX:ALD | AIM:AGLD | TSX:ALG

IMPORTANT NOTICE

Information contained in this Investor Presentation includes certain technical, financial and other information concerning the business and affairs of Allied Gold Limited (Allied Gold), including the fact and terms of the Transaction contemplated by this Investor Presentation, that is non-public, confidential or proprietary in nature (Presentation Materials).

This Investor Presentation is provided on the basis that:

•The Presentation Materials have competitive value and are confidential in nature, and Allied Gold may suffer loss and damage if the Presentation Materials are disclosed to any third party.

•The Presentation Materials are to be kept confidential, and not to be used for any purpose other than evaluating the Transaction contemplated by the Presentation Materials.

•The fact that plans, discussions or negotiations are taking place concerning the possible Transaction, and any of the terms, conditions or other facts with respect to the possible Transaction, is confidential and may be material to the price of Allied Gold securities.

•Securities laws may prohibit any person who has material, non-public information about an issuer from purchasing or selling securities of such an issuer or from communicating such information to any other person under circumstances in which it is reasonably foreseeable that such person is likely to purchase or sell such securities.

•The limitations on disclosure or use of Presentation Materials do not apply to the extent the Presentation Materials are or become generally available to the public.

ASX:ALD | AIM:AGLD | TSX:ALG

CAUTIONARY STATEMENT

Forward-Looking Statements

•This press release contains forward-looking statements concerning the projects owned by Allied Gold.

•Statements concerning mineral reserves and resources may also be deemed to be forward-looking statements in that they involve estimates, based on certain assumptions, of the mineralization that will be found if and when a deposit is developed and mined.

•Forward-looking statements are not statements of historical fact, and actual events or results may differ materially from those described in the forward-looking statements, as the result of a variety of risks, uncertainties and other factors, involved in the mining industry generally and the particular properties in which Allied Gold has an interest, such as fluctuation in gold prices; uncertainties involved in interpreting drilling results and other tests; the uncertainty of financial projections and cost estimates; the possibility of cost overruns, accidents, strikes, delays and other problems in development projects, the uncertain availability of financing and uncertainties as to terms of any financings completed; uncertainties relating to environmental risks and government approvals, and possible political instability or changes in government policy in jurisdictions in which properties are located.

•Forward-looking statements are based on management’s beliefs, opinions and estimates as of the date they are made, and no obligation is assumed to update forward-looking statements if these beliefs, opinions or estimates should change or to reflect other future developments.

Not an offer of securities or solicitation of a proxy

•This communication is not a solicitation of a proxy from any security holder of Allied Gold, nor is this communication an offer to purchase nor a solicitation to sell securities.

•Any offer will be made only through an information circular or proxy statement or similar document.

•Investors and security holders are strongly advised to read such document regarding the proposed business combination referred to in this communication, if and when such document is filed and becomes available, because it will contain important information.

•Any such document would be filed by Allied Gold with the Australian Securities and Investments Commission, the Australian Stock Exchange and with the U.S. Securities and Exchange Commission (SEC).

ASX:ALD | AIM:AGLD | TSX:ALG

COMPETENT PERSON’S STATEMENT

The information in this presentation that relates to project financial modelling, mining, exploration and metallurgical results, together with any related assessments and interpretations, has been approved for release by Mr. C.R. Hastings, MSc, BSc, who is Member of the Australian Institute of Mining and Metallurgy, and a qualified geologist and full-time employee of the Company. Mr Hastings has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined in the 2004 Edition of the “Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves”. This presentation report is a summary and based on Code-compliant Public reports to the ASX, including Company Announcements and Quarterly reports, and Company Annual reports. Mr Hastings consents to the release of the information in this ASX release in the form and context in which it appears.

The information in this presentation that relates to Ore Reserves has been compiled by Mr J Battista of Golder Associates who is a Member of the Australasian Institute of Mining and Metallurgy. Mr Battista has had sufficient experience in Ore Reserve estimation relevant to the style of mineralisation and type of deposit under consideration to qualify as a Competent Person as defined in the 2004 Edition of the “Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves”. Mr Battista consents to the inclusion of the information contained in this ASX release in the form and context in which it appears.

The information in this presentation that relates to Mineral Resource Estimates for Sorowar, Pigiput Bekouw and Pigiput has been compiled by Mr S Godfrey of Golder Associates who is a Member of the Australasian Institute of Mining and Metallurgy. Mr Godfrey has had sufficient experience in Mineral Resource estimation relevant to the style of mineralisation and type of deposit under consideration to qualify as a Competent Person as defined in the 2004 Edition of the “Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves”. Mr Godfrey consents to the inclusion of the information contained in this ASX release in the form and context in which it appears.

ASX:ALD | AIM:AGLD | TSX:ALG

BOARD & MANAGEMENT

Directors:

Mark Caruso – Executive Chairman

Monty House – Non Executive Director

Tony Lowrie – Non Executive Director

Greg Steemson – Non Executive Director

Frank Terranova – Executive Director

Key Management:

Peter Torre – Company Secretary

Ross Hastings – GM Resource Development

Peter Du Plessis – GM Simberi Gold Project

Phil Davies – Chief Geologist

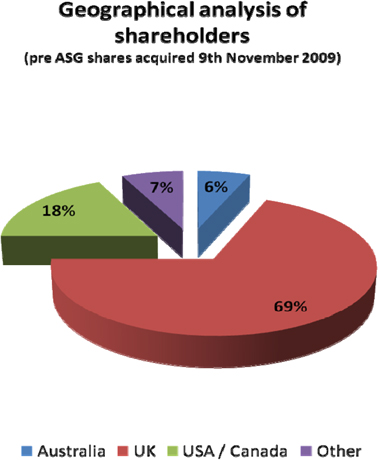

SHAREHOLDERS

Ordinary shares on issue*: | | | 472,643,276 | |

| Options (unlisted) on issue: | | | 48,832,688 | |

| Market capitalisation (approx.): | | A$ | 220,000,000 | |

| Top 20 Shareholders (beneficial): | | | 65.5 | % |

* As at 30 September 2009

| Shareholder | | % Holding | |

| | | | | |

| M&G Investment Management | | | 19.85 | % |

| Baker Steel Capital Managers | | | 8.32 | % |

| Capital Research Global Investors | | | 5.51 | % |

| Fidelity | | | 4.40 | % |

| Other global institutional investors (<10) | | | 15.50 | % |

| Barrick Gold Corporation | | | 4.07 | % |

| Mineral Commodities Limited | | | 2.45 | % |

| Mark Victor Caruso and associates | | | 1.73 | % |

ASX:ALD | AIM:AGLD | TSX:ALG

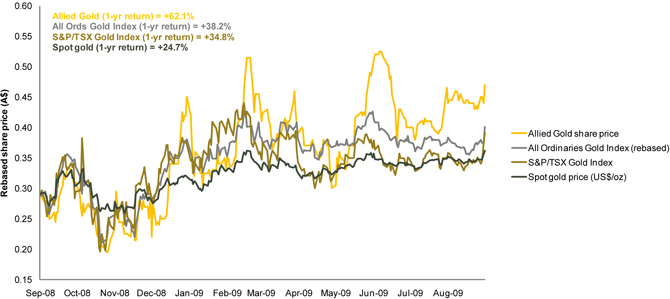

SHARE PRICE PERFORMANCE (1 year)

* 12 month period to 3 September 2009

ASX:ALD | AIM:AGLD | TSX:ALG

KEY PERFORMANCE METRICS – SIMBERI

| Parameter | | Unit | | July 2008 to | | | July 2009 to | |

| | | | | June 2009 | | | June 2010 | |

| | | | | Actual | | | Estimate* | |

| | | | | | | | | |

| Waste mined | | tonnes | | | 199,746 | | | | 614,000 | |

| Ore mined | | tonnes | | | 1,708,765 | | | | 2,176,000 | |

| Ore processed | | tonnes p.a | | | 1,654,149 | | | | 2,080,000 | |

| Grade | | g/t gold | | | 1.64 | | | | 1.29 | |

| Recovery | | % | | | 83.2 | | | | 88 | |

| Average Life of Mine | | Years | | | 10 | + | | | 10 | + |

| Gold produced | | ounces | | | 72,609 | | | | 80,000 | |

| Average cash cost | | AUD / oz | | | 651 | | | | 646 | |

| Average cash cost | | USD / oz | | | 490 | | | | 485 | |

| Gold sold | | ounces | | | 69,880 | | | | 80,000 | |

| Average sale price | | AUD / oz | | | 1,086 | | | | 1,000 | |

| Average sale price | | USD / oz | | | 783 | | | | 750 | |

* Allied Gold management

| • | 100,000th oz of production achieved in June 2009 |

| • | Debottlenecking Optimisation initiatives commenced and will result in near term production improvements and a reduction in cash cost per ounce |

ASX:ALD | AIM:AGLD | TSX:ALG

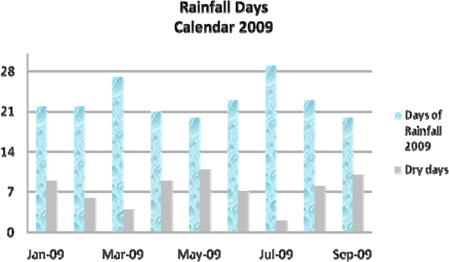

Operations hindered by unseasonal rainfall

| • | Mining operations impacted by unseasonal rainfall during FY 2009 and the start of FY 2010 |

| • | Maintaining grade consistency dependent on sequential mining and access to pits |

| • | Processing plant capacity now being achieved on consistent basis warranting expansion studies |

ASX:ALD | AIM:AGLD | TSX:ALG

FINANCIALS – FY 2009 - SUMMARY

| (30 June y/e) | | FY09 | | | FY08* | | | % ∆ | |

| | | | | | | | | | |

| Gold produced (oz) | | | 72,609 | | | | 33,068 | | | | +120 | % |

| Sales revenue (A$m) | | | 77.5 | | | | 23.4 | | | | +231 | % |

| Gold price realised (A$/oz) | | | 1,086 | | | | 815 | | | | +33 | % |

| Operating cash costs (A$/oz) | | | 651 | | | | 482 | | | | +35 | % |

| Net profit after tax (A$m) | | | (8.2 | ) | | | (9.5 | ) | | | +14 | % |

| Operating cash flow (A$m) | | | 21.6 | | | | (0.3 | ) | | | n/a | |

| Net cash (debt) (A$m) | | | 14.6 | | | | (11.1 | ) | | | n/a | |

* Note: FY08 includes only 5 months of production at Simberi Island

| • | Allied Gold is in a strong financial position, with cash on hand of A$20.5m |

| – | Importantly, the company repaid all outstanding secured bank loans during FY09 |

| • | The mark to market of the company’s hedge book is currently ~(US$10m) |

| – | Less than 50,000 oz gold remains hedged |

ASX:ALD | AIM:AGLD | TSX:ALG

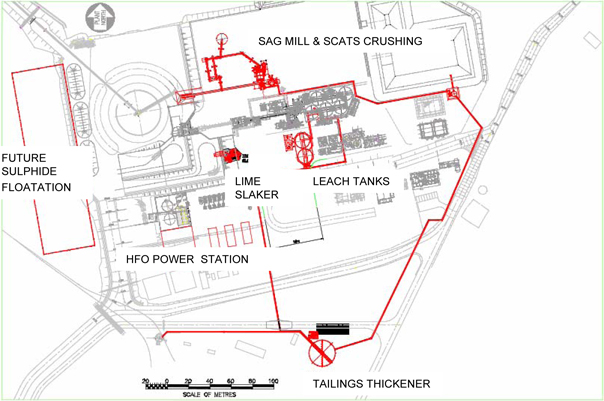

Debottlenecking and Optimisation

Study Undertaken by GRES Engineering

Objectives

| • | Incorporate Debottlenecking into Oxide Expansion Project |

| • | Increase throughput to 2.1 - 2.4 Mtpa |

| • | Increase recovery to 89% |

| • | Increase plant availability |

| • | Lower near term Processing Costs |

| • | Undertake HFO Power Study |

| • | Undertake Wharf Expansion Study for logistical and cost efficiencies |

| • | Upgrade Accommodation and Messing Infrastructure |

Actions

| • | Installation of a Scats Crusher and conveying system (completed in the September quarter) |

| • | Increase Doppelmayr Rope Conveyor capacity to 600tph, including modifications to Sorowar Dump Pocket |

| • | Installation of a Lime Slaking Plant |

| • | Installation of Larger Intertank Carbon Screens for the CIL tanks |

| • | Installation of De-gritting Spiral plant installation |

| • | Installation of replacement elution column using existing column as an acid wash vessel. |

| • | Installation of a second leach feed pipeline |

| • | Plant debottlenecking (optimisation) is estimated to be approximately A$3.7M, (excluding HFO Power Installation) scheduled to be completed by end of first quarter 2010. |

ASX:ALD | AIM:AGLD | TSX:ALG

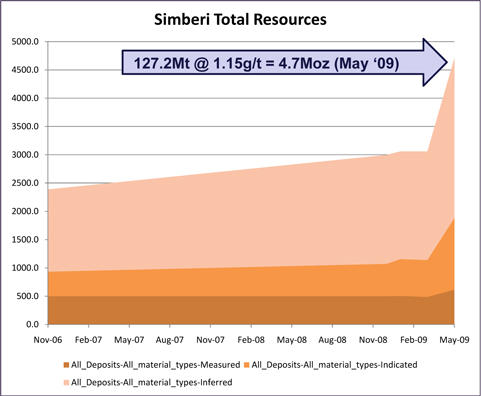

SIMBERI RESOURCES

Measured, Indicated and Inferred resources for all material types totals 4.7 Moz gold and 10.2 Moz silver

| Category | | Measured | | | Indicated | | | Inferred | | | All Categories | |

| Unit | | Mt | | | g/t | | | Koz | | | Mt | | | g/t | | | Koz | | | Mt | | | g/t | | | Koz | | | Mt | | | g/t | | | Koz | |

| Gold | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Oxide | | | 13.8 | | | | 1.24 | | | | 553 | | | | 13.6 | | | | 1.06 | | | | 465 | | | | 7.6 | | | | 1.07 | | | | 262 | | | | 35.07 | | | | 1.14 | | | | 1,280 | |

| Transitional | | | 0.6 | | | | 1.18 | | | | 23 | | | | 1.7 | | | | 1.15 | | | | 63 | | | | 2.1 | | | | 0.89 | | | | 59 | | | | 4.36 | | | | 1.03 | | | | 145 | |

| Sulphide | | | 1.3 | | | | 0.93 | | | | 39 | | | | 16.9 | | | | 1.36 | | | | 742 | | | | 69.5 | | | | 1.12 | | | | 2,504 | | | | 87.76 | | | | 1.16 | | | | 3,285 | |

| Total | | | 15.7 | | | | 1.22 | | | | 615 | | | | 32.3 | | | | 1.22 | | | | 1,270 | | | | 79.2 | | | | 1.11 | | | | 2,825 | | | | 127.19 | | | | 1.15 | | | | 4,710 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Silver | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Oxide | | | 8.0 | | | | 0.85 | | | | 219 | | | | 9.4 | | | | 2.34 | | | | 707 | | | | 12.3 | | | | 0.69 | | | | 274 | | | | 29.7 | | | | 1.26 | | | | 1,200 | |

| Transitional | | | 0.6 | | | | 1.15 | | | | 22 | | | | 1.3 | | | | 2.64 | | | | 110 | | | | 2.3 | | | | 1.03 | | | | 76 | | | | 4.2 | | | | 1.55 | | | | 209 | |

| Sulphide | | | 1.3 | | | | 1.87 | | | | 73 | | | | 6.9 | | | | 1.87 | | | | 669 | | | | 72.1 | | | | 1.87 | | | | 8,024 | | | | 80.3 | | | | 2.24 | | | | 8,766 | |

| Total | | | 9.9 | | | | 0.99 | | | | 314 | | | | 17.6 | | | | 2.63 | | | | 1,486 | | | | 86.7 | | | | 3.00 | | | | 8,375 | | | | 114.2 | | | | 2.77 | | | | 10,175 | |

Notes:

i.Resources as at May 2009 at 0.5 g/t Au cut-off grade

UNDERPINNING MINE LIFE AND INCREASED PRODUCTION

ASX:ALD | AIM:AGLD | TSX:ALG

SIMBERI RESERVES

In June 2009, Allied Gold increased its ore reserves by 437,000 contained ounces of gold

This extended the total remaining mine life at Simberi by ~2 years, resulting in a total remaining mine life of 10 years

| Category | | Sorowar | | | Pigiput | | | Total | |

| Unit | | Mt | | | g/t | | | Koz | | | Mt | | | g/t | | | Koz | | | Mt | | | g/t | | | Koz | |

| Proven | | | 9.1 | | | | 1.22 | | | | 357 | | | | 2.7 | | | | 1.05 | | | | 92 | | | | 11.8 | | | | 1.18 | | | | 449 | |

| Probable | | | 7.1 | | | | 1.21 | | | | 278 | | | | 4.8 | | | | 1.88 | | | | 291 | | | | 12.0 | | | | 1.48 | | | | 569 | |

| Total | | | 16.3 | | | | 1.22 | | | | 635 | | | | 7.6 | | | | 1.58 | | | | 383 | | | | 23.8 | | | | 1.33 | | | | 1,018 | |

Notes:

i.Ore reserves as at May 2009

ii.Sorowar reserves includes minor transitional and sulphide ore types

iii.Ore reserve estimation at Pigiput resulted in the inclusion of sulphide ores, which are currently being infill drilled to expand the reserves as part of the sulphide development program

UNDERPINNING MINE LIFE AND INCREASED PRODUCTION

ASX:ALD | AIM:AGLD | TSX:ALG

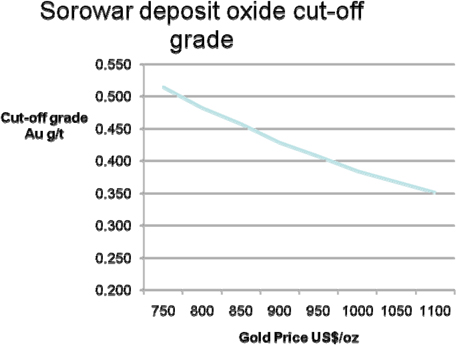

OXIDE EXPANSION

ASX:ALD | AIM:AGLD | TSX:ALG

Oxide Expansion

| ● | GRES appointed as design and construction engineers |

| ● | Plant optimization and expansion from nominal 2.0M tpa to 3.0M tpa report completed |

| ● | Initial CAPEX estimates range between A$25M – A$35M (subject to final review) |

| ● | Initial estimates of 30 – 40 weeks of project work required for completion |

| ● | Increase in an additional 15k – 20k of annual gold production |

| ● | Operating cost structure improvements result due to scale |

ASX:ALD | AIM:AGLD | TSX:ALG

Oxide Plant Expansion

ASX:ALD | AIM:AGLD | TSX:ALG

Oxide Plant Expansion

Taking advantage of high gold price

ASX:ALD | AIM:AGLD | TSX:ALG

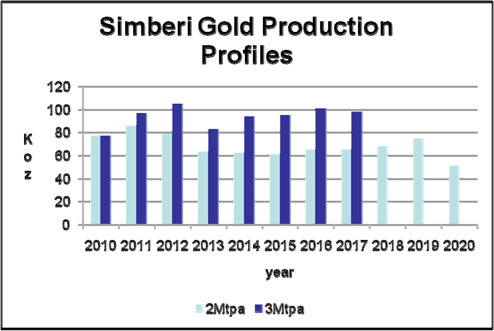

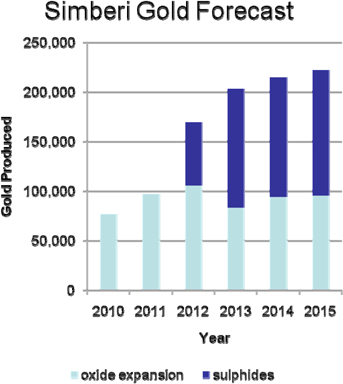

Oxide Plant Expansion

| Tonnes | | Year | | 2010 | | | 2011 | | | 2012 | | | 2013 | | | 2014 | | | 2015 | | | 2016 | | | 2017 | | | 2018 | | | 2019 | | | 2020 | |

| 2 Mt/a | | Au oz | | | 77000 | | | | 86000 | | | | 79000 | | | | 63000 | | | | 62000 | | | | 61000 | | | | 65000 | | | | 65000 | | | | 68000 | | | | 75000 | | | | 51000 | |

| 3 Mt/a | | Au oz | | | 77000 | | | | 97000 | | | | 105000 | | | | 83000 | | | | 94000 | | | | 95000 | | | | 101000 | | | | 98000 | | | | | | | | | | | | | |

Benefits & costs of Expansion

| ● | 190,000 ozs brought forward |

| ● | Reduced mine life by 2.5 years |

| ● | Opportunity to lever off the high gold price |

ASX:ALD | AIM:AGLD | TSX:ALG

SIMBERI SULPHIDE DEVELOPMENT

ASX:ALD | AIM:AGLD | TSX:ALG

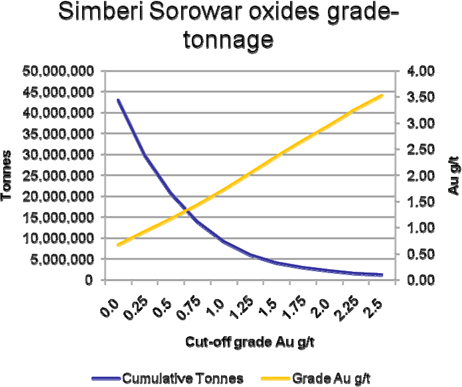

SIMBERI SULPHIDES RESOURCES

| SIMBERI SULPHIDE DEVELOPMENT | ASX:ALD | AIM:AGLD | TSX:ALG |

| Sulphide Resources | | All Categories Measured, Indicated & | |

| | | Inferred (0.5g/t Au Cut-off) | |

| Deposit | | | | | | | | | |

| | | Mt | | | g/t Au | | | Koz | |

| Sorowar | | | 38.10 | | | | 0.88 | | | | 1084 | |

| Pigicow | | | 2.00 | | | | 1.26 | | | | 81 | |

| Bekou | | | 0.94 | | | | 1.40 | | | | 42 | |

| Samat South | | | 0.06 | | | | 5.60 | | | | 11 | |

| Samat North | | | 0.06 | | | | 5.40 | | | | 10 | |

| Samat East | | | | | | | | | | | | |

| Pigiput | | | 43.70 | | | | 1.35 | | | 1902 | |

| Pigibo | | | 1.40 | | | | 1.50 | | | | 68 | |

| Botlu | | | 1.50 | | | | 1.80 | | | | 87 | |

| Total Resources | | | 87.76 | | | | 1.16 | | | | 3285 | |

Pigiput Inferred & Indicated Resources at various cut-off grades

| Cut-off g/t | | | Mt | | | g/t Au | | | Cont Au Koz | |

| | 1.0 | | | | 22.62 | | | | 2.11 | | | | 1,535 | |

| | 2.0 | | | | 7.06 | | | | 3.63 | | | | 824 | |

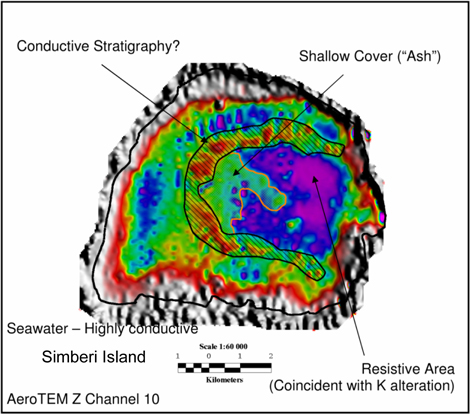

| | • | Sulphide resources already outlined below known oxide deposits: |

| | • | Hidden targets presented by interpretation of geophysical survey data |

SDH011 83.3 – 167.0m 83.7m @ 2.35g/t

ASX:ALD | AIM:AGLD | TSX:ALG

Sulphide Development

ASX:ALD | AIM:AGLD | TSX:ALG

SIMBERI SULPHIDE DEVELOPMENT

ASX:ALD | AIM:AGLD | TSX:ALG

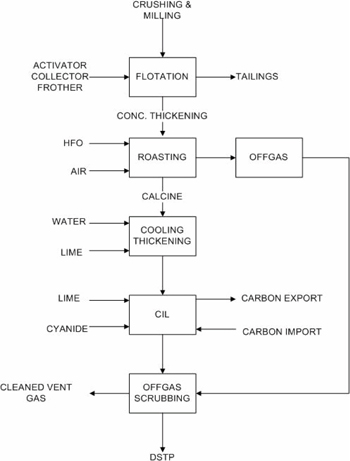

Simberi Sulphide Development

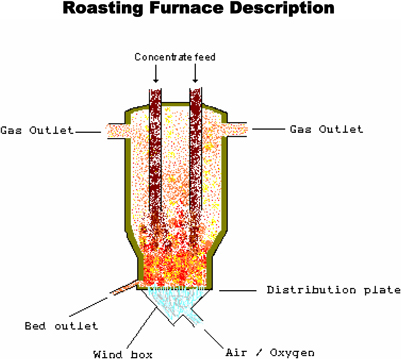

Sulphide Scoping Study (March 2009)

| • | Process plant capital cost estimate A$164 million includes: |

| | ü | 1Mtpa crushing, grinding & flotation plant |

| | ü | 300,000tpa (38tph) roaster, followed by CIL & gold recovery. |

| | ü | Process operating A$42/t ore (does not include cheaper HFO power) |

Metallurgy and Process

| • | Stage 2 metallurgy, comminution, flotation and oxidization will be completed 2009 |

| • | Process design at PFS level will be completed quarter 1/2010 |

Resources & Mining

| • | Conversion of 1.9Moz resource to +1Moz reserves/resource drilling completed Feb 2010 |

| • | Mining cost estimate A$27/t ore delivered (includes waste removal) |

Delivery

| • | Engineering & construction quarter 4/2011 |

| • | Commissioning and first gold quarter 1/2012 |

ASX:ALD | AIM:AGLD | TSX:ALG

PNG EXPLORATION

Committed to Making Safety No.1

Creating a safe workplace requires team effort

ASX:ALD | AIM:AGLD | TSX:ALG

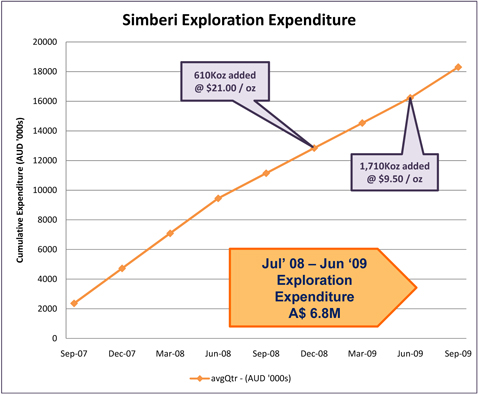

Simberi Exploration

Success since Oxide Project Approval

ASX:ALD | AIM:AGLD | TSX:ALG

Simberi Exploration

Simberi Island – ML136 - Strategy

| • | Replace ounces mined by current Oxide operation |

| • | Support Sulphide Project |

| • | Test conceptual targets that have potential to change current perception of Simberi deposits |

ASX:ALD | AIM:AGLD | TSX:ALG

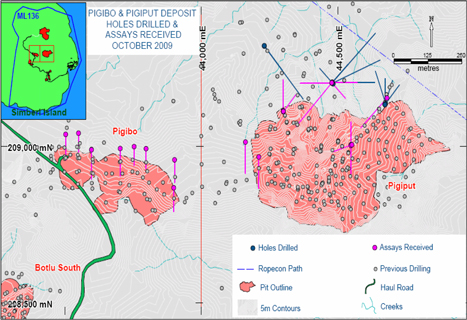

Simberi Exploration and Resource Drilling

| • | Exploration and definition drilling on Simberi ML136 in 2009 totalled 15,061m to end Sep Qtr: |

| | – | >9,892m core and 5,169m RC |

| | – | Supporting Pigiput Sulphide Project |

| | – | Exploration drilling at Pigibo Prospect |

| | – | on-line to complete 20,000m exploration and definition drilling by year end |

| | – | Total exploration expenditure for 2009 A$6.8M |

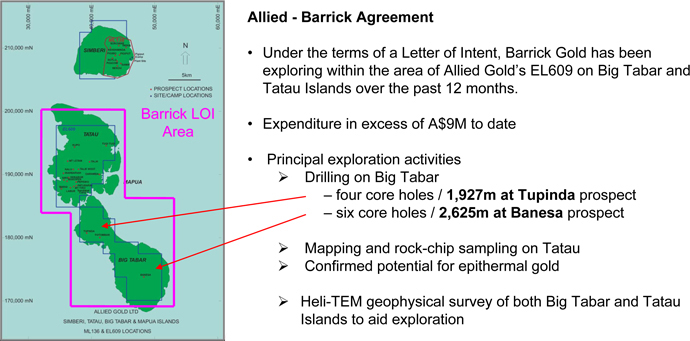

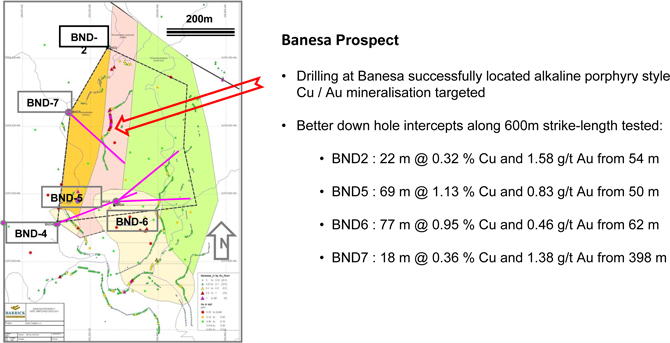

| • | On EL609, Barrick under Agreement: |

| – | completed10 holes / 4,551m core drilling |

| – | located alkaline porphyry style Cu-Au mineralisation at Banesa Prospect (Tabar Island) |

| | – | Barrick Expenditure in excess of A$9M |

ASX:ALD | AIM:AGLD | TSX:ALG

SIMBERI EXPLORATION

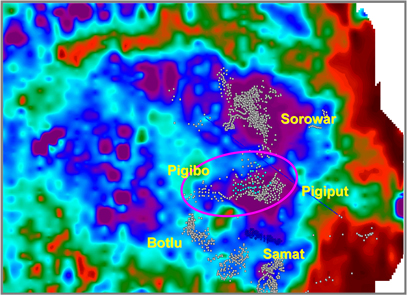

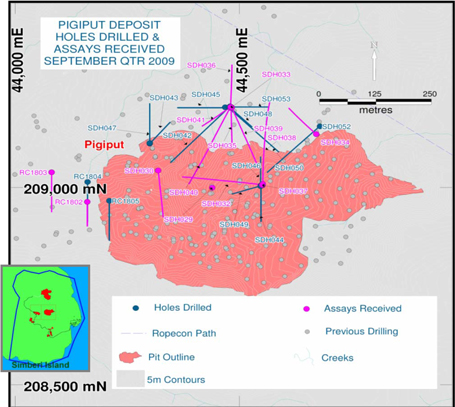

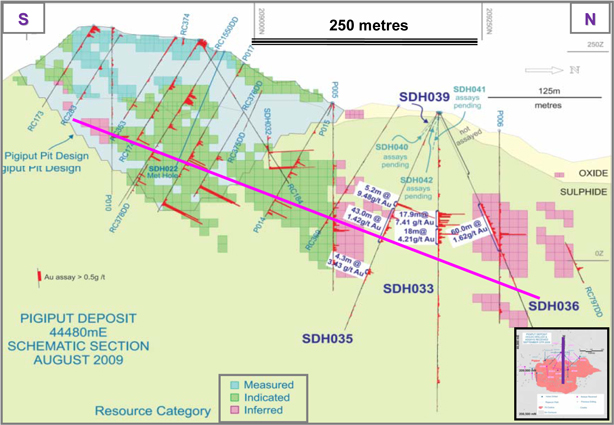

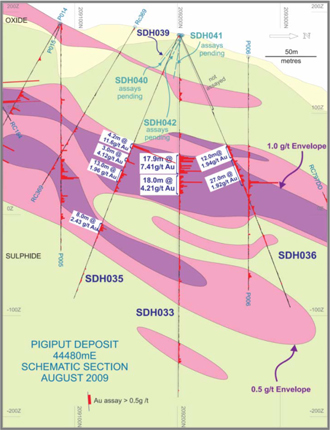

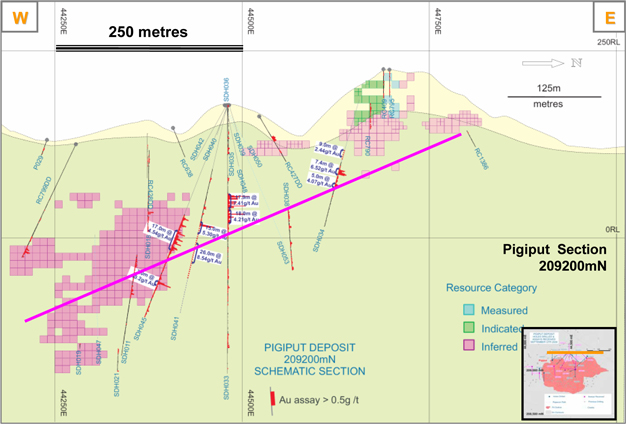

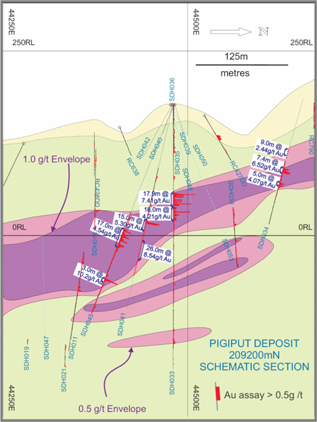

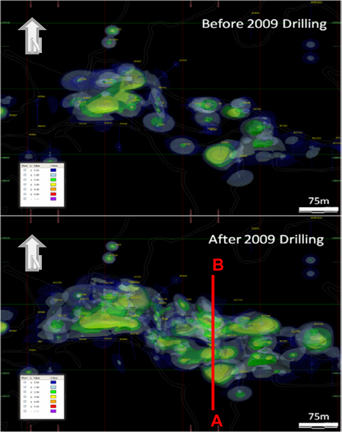

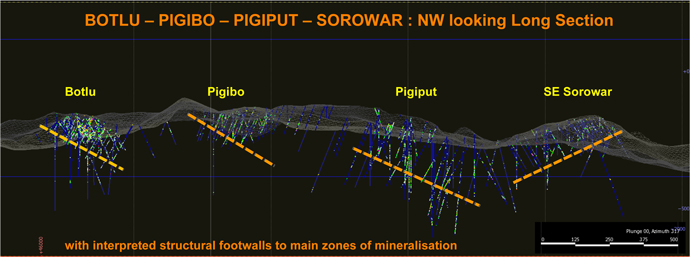

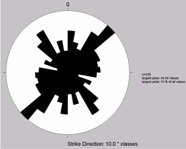

Pigiput Sulphide Project Drilling

Pigiput Sulphide Project Drilling

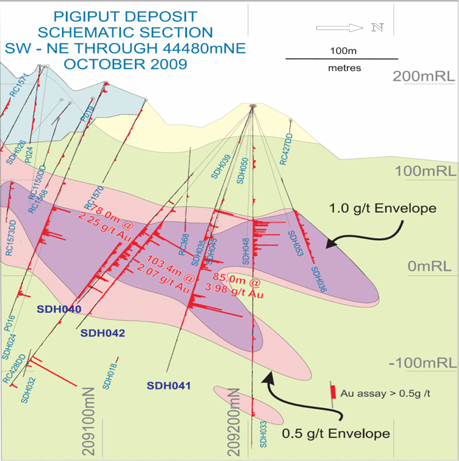

| • | Major diamond core drilling programme in progress to consolidate and expand Pigiput Sulphide resources |

| • | Targeting a moderately north-west dipping mineralised structural surface recognised throughout the prospect |

| • | To facilitate work in steep terrain, core drilling is done as sets of radiating holes, from four (4) principal drill sites |

ASX:ALD | AIM:AGLD | TSX:ALG

Simberi Exploration

Pigiput Sulphide Project Drilling – 44480mE

ASX:ALD | AIM:AGLD | TSX:ALG

Simberi Exploration

Pigiput Sulphide Project Drilling – 209200mN

ASX:ALD | AIM:AGLD | TSX:ALG

SIMBERI EXPLORATION

Pigibo Prospect – 2009 Drilling

Pigibo Prospect

| centred 800 metres W of Pigiput; effectively along strike |

| | – | 33 x RC holes / 4,001 metres |

| | – | 4 x diamond core holes / 760 metres |

| – | 11 x NS sections 50m apart |

| – | tested approx 600m of strike length |

Selected intercepts from 2009 drilling:

| | – | RC1785 22m @ 3.40g/t from 98m |

| | – | RC1787 20m @ 2.01g/t from 82m |

| | – | RC1790 47m @ 2.84g/t from 63m |

| | – | RC1792 27m @ 4.64g/t from 93m |

| | – | RC1794 28m @ 8.54g/t from 30m |

| | – | RC1796 21m @ 3.43g/t from 71m |

| | – | SDH031 31m @ 4.55g/t Au from 100m |

| | – | (successfully twinned and extended RC1792) |

| 2009 drill results appear likely to improve on previously published Inferred Resource of 2.1Mt @ 1.1g/t Au, 74Koz Au |

ASX:ALD | AIM:AGLD | TSX:ALG

SIMBERI EXPLORATION

ML136 - Conceptual

ASX:ALD | AIM:AGLD | TSX:ALG

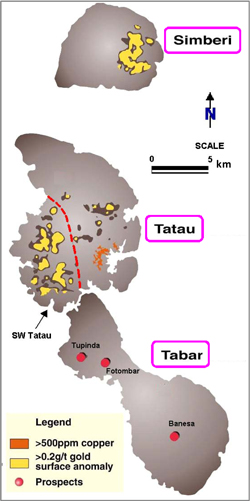

Other Exploration – EL609

ASX:ALD | AIM:AGLD | TSX:ALG

Other Exploration – EL609

ASX:ALD | AIM:AGLD | TSX:ALG

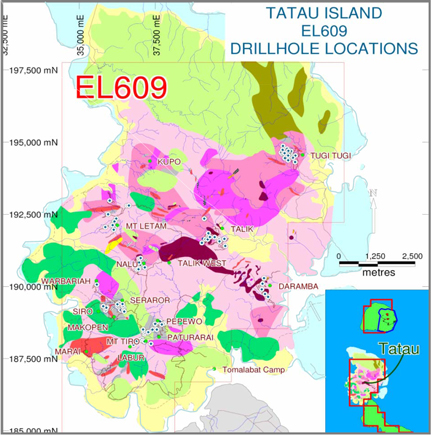

Other Exploration – EL609

Tatau Island Interpretive Geology and Drill Collar Locations

| central intermediate intrusive complex, including minor porphyritic units |

| flanking mafic volcanic and volcanoclastic rock aprons |

| gold generally associated with hbl-bio bearing monzodiorites |

| exclusively steep dipping planar features |

| both Tatau and Tabar Islands interpreted as sea-mounts |

ASX:ALD | AIM:AGLD | TSX:ALG

Simberi Exploration

2009 – 2010 Projection

| • | SIMBERI $2M per Qtr from Jul ’09 |

| | – | Core (20,000m) and RC drilling (40,000m) at: |

| | | Pigiput Sulphides extensions to NW |

| | | Pigibo Sulphides (+ test of possible link with Botlu to south) |

| | | Sorowar SE (near surface sulphides) |

| | | Samat North (+ link to Samat East) |

| • | TABAR – TATAU $1M per Qtr from Jan ’10 |

| | – | Initially IP+ Hand Auger Sampling to define specific drill targets at: |

| | | SW Tatau (notably Mt Tiro, Siro, Pepewo, Seraro, Talik) |

ASX:ALD | AIM:AGLD | TSX:ALG

ACQUISITION

OF

ASX:ALD | AIM:AGLD | TSX:ALG

Country overview

| Located east of PNG, consists of nearly 1,000 separate islands. Capital is Honiara on the island of Guadalcanal |

| A former British Colony, remains a member of the Commonwealth |

| Self-government achieved in 1976 and independence two years later |

| Common law legal system and modern Mining Act 1990 |

Political Status

| Australian-led Regional Assistance Mission to the Solomon Islands (RAMSI) established in June 2003 at the request of the Solomon Islands Government |

| In December 2007 the Parliament elected Dr. Derek Sikua (former Minister for Education) as Prime Minister, replacing Manesseh Sogavare who lost a vote of no confidence in Parliament |

| Dr Sikua has emphasised his commitment to rural development, reconciliation and re-engaging with donors |

ASX:ALD | AIM:AGLD | TSX:ALG

GOLD RIDGE PROJECT

| The Gold Ridge mine is located on Guadalcanal in the Solomon Islands |

| Formerly producing mine – operated from August 1998 to June 2000, producing ~210 koz gold |

| ASG acquired the project in May 2005 and completed a Feasibility Study in April 2007 |

| Re-development has been delayed by obtaining the necessary debt and equity financing |

Source: ASG website; Company announcements

ASX:ALD | AIM:AGLD | TSX:ALG

OVERVIEW OF ASG

| Focus | Key attributes |

| | |

| Corporate | | ASG is company incorporated in Queensland, Australia under the Corporations Act 2001 (Commonwealth) and listed on the Toronto Stock Exchange (ticker SGA) |

| | | |

| | | Principal asset is the Gold Ridge mine (100%) located in the Solomon Islands |

| | | Gold Ridge produced ~210 koz gold from August 1998 to June 2000, but was closed in 2000 due to civil unrest |

| Development | | ASG acquired the Gold Ridge project in May 2005 from AHAC and has since obtained all necessary approvals for its re-development |

| | | Capital costs associated with the mine’s re-development are ~US$125m (including US$15.3m estimate for mining fleet costs) |

| | | |

| Exploration | | 1,000 metre drill programme proposed to test for updip extensions of the mineralisation discovered beneath the Charivunga Gorge |

Source: ASG website; Company announcements

ASX:ALD | AIM:AGLD | TSX:ALG

RESERVES & RESOURCES

| | | | | | | | | Contained | |

| Category | | Tonnes | | | Gold grade | | | metal | |

| Unit | | Mt | | | g/t | | | Moz | |

| Reserves | | | | | | | | | | |

| Proven | | | - | | | | - | | | | - | |

| Probable | | | 19.6 | | | | 1.82 | | | | 1.14 | |

| Total | | | 19.6 | | | | 1.82 | | | | 1.14 | |

| Resources | | | | | | | | | | | | |

| Measured | | | 5.4 | | | | 1.92 | | | | 0.34 | |

| Indicated | | | 22.6 | | | | 1.67 | | | | 1.21 | |

| Inferred | | | 8.0 | | | | 1.78 | | | | 0.45 | |

| Total | | | 35.9 | | | | 1.73 | | | | 2.00 | |

Notes:

i. All figures relate to Gold Ridge

ii. Reserves as of April 2007, Resources as of November 2006

iii. Resources are inclusive of Reserves at a cut-off grade of 0.8 g/t

| • | The resources at Gold Ridge were largely proved through test work conducted by Ross Mining between 1994 and 1998 |

Source: Company announcements

ASX:ALD | AIM:AGLD | TSX:ALG

FEASIBILITY STUDY (CONDUCTED BY ASG)

| Status | • | Feasibility study completed in April 2007 |

| | | |

| | • | Capital and operating costs updated in June 2007, undertaken by GR Engineering |

| | | Services Pty Ltd (GRES) |

| | | |

| Mining method | • | Production schedule 2.5 Mtpa at 1.9 g/t average over a 7 year mine life |

| | | |

| | • | Four open pits, LOM strip ratio 1.55 : 1 |

| | | |

| Permits | • | Fully permitted |

| | | |

| Capital costs | • | Total pre-production capital cost estimate US$125m (including mining fleet but |

| | | excluding overheads and financing costs) |

| | | |

| | • | Minimal expenditure to date due to lack of financing approvals |

| | | |

| Operating costs | • | Operating cash costs of US$468/oz over LOM |

| | | |

| | • | Lower cash costs of US$419/oz in years 1 – 3 |

| | | |

| Production | • | Average production of 124,000 oz gold p.a. over LOM |

| | | |

| | • | 136,000 oz gold p.a. years 1 – 3 |

| | | |

| | • | First production expected in 1Q 2011 (delayed due to lack of financing) |

Source: ASG website; Company announcements

ASX:ALD | AIM:AGLD | TSX:ALG

TRANSACTION

DETAILS

ASX:ALD | AIM:AGLD | TSX:ALG

OFFER VALUE AND PREMIUM

| ASG shareholders will receive [0.85] Allied Gold shares for every ASG share they own |

| | | ASG shareholders will own 19% of shares in the merged entity1 |

| | | Will share proportionately in the transaction benefits and synergies |

| This implies a value of $0.370 per ASG share based on the closing price of Allied Gold shares and an AUD/CAD exchange rate of 0.926 on September 3, 2009 |

| Capitalisation Post Acquisition | | | | |

| | | | | | | | | | |

| Share price | | A$ | 0.47 | | | C$ | 0.28 | | | A$ | 0.47 | |

| | | | | | | | | | | | | |

| Shares (ordinary) | | | 472.6 | | | | 129.8 | | | | 583.0 | |

| | | | | | | | | | | | | |

| Market cap (A$m) | | | 222.1 | | | | 39.2 | | | | 274.0 | |

| | | | | | | | | | | | | |

| Cash (A$m) | | | 20.5 | | | | 8.1 | | | | 28.6 | |

| | | | | | | | | | | | | |

| Debt (A$m) | | | 5.9 | | | | - | | | | 5.9 | |

1 Assumes 100% acquisition

• Based on closing prices as at 3 Sep 2009, the day prior to Allied Gold signing the pre-bid agreement with RCF

• Cash and debt as at 30 Jun 09 for Allied Gold and 31 Mar 09 for ASG, adjusted for July share placement

ASX:ALD | AIM:AGLD | TSX:ALG

OFFER STATUS

| · | As at 9th November 2009, ALD declared the bid unconditional with around 49% ownership confirmed. At that date, all ASG Directors have yet to tender their shares into the offer |

| · | Provisional TSX approvals granted 6th November 2009 |

| · | ALD expected to be trading on TSX around the 13th November 2009 |

| · | Current offer date closes 16th November |

| · | The long term objective is to secure 100% of ASG in due course. However, current offer is expected to close in near term |

| · | Approximately the 24th November 2009, the Board of ASG will be restructured to include ALD representation and will retain an independent director (non ALD) for the time being |

ASX:ALD | AIM:AGLD | TSX:ALG

RATIONALE FOR THE TRANSACTION

The acquisition will deliver significant benefits to Allied Gold including:

ü | Emerging producer in prospective Pacific Rim region |

| Diversified portfolio of operating, development and exploration assets |

| Enhanced production profile |

| Larger reserve and resource base |

| Development experience in the Pacific Rim |

| Material operating synergies |

| Increased investor relevance |

ASX:ALD | AIM:AGLD | TSX:ALG

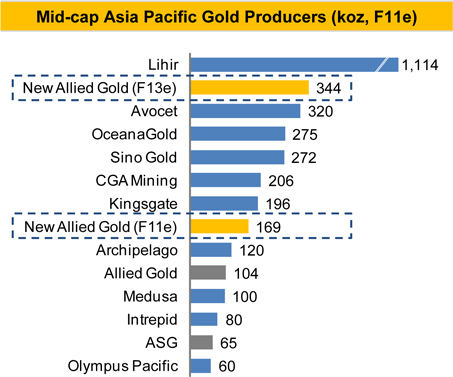

EMERGING LEADER IN PACIFIC RIM

| • | The combined company will control two material gold mines in the highly prospective Pacific Rim region, along the “Ring of Fire” |

| • | Production forecast to be: |

> 200,000 oz FY 2012

> 300,000 oz FY 2013

ASX:ALD | AIM:AGLD | TSX:ALG

MORE DIVERSIFIED ASSET PORTFOLIO

The merger of Allied Gold Limited and Australian Solomons Gold Limited will create a larger, more diversified gold production and exploration company with material mining interests in the Pacific Rim. The combined group will have the following near term production and development assets:

| Project | | Location | | Status | | Resources (Moz) | | Capital cost est. | | Est. Production (koz p.a.) | | Cash cost target (US$/oz) |

| | | | | | | | | | | | | |

| Simberi Oxide | | PNG | | Production | | 1.4 | | n/a | | 80 | | 375 |

| | | | | | | | | | | | | |

| Oxide Expansion | | PNG | | Expansion | | As above | | US$32m | | 20 | | As above |

| | | | | | | | | | | | | |

| Simberi Sulphide | | PNG | | Development | | 3.3 | | US$152m | | 100 | | 475 |

| | | | | (Pre-Feasibility) | | | | | | | | |

| | | | | | | | | | | | | |

| Gold Ridge | | Solomons | | Feasibility | | 2.0 | | US$125m | | 124 | | 468 |

* Assumes USD/AUD exchange rate of 0.93

ASX:ALD | AIM:AGLD | TSX:ALG

CAPABILITY TO DEVELOP GOLD RIDGE

To date, re-development of the Gold Ridge project has been constrained by ASG’s inability to obtain necessary financing

•As announced by ASG on 10 August 2009, further delays have been experienced in relation to approvals from each of International Finance Corporation (IFC) and European Investment Bank (ECB) for a proposed project financing package totalling US$50m

•As a result of these delays, ASG now expects first production to commence in 1Q 2011

•The new company will be better positioned to deliver the development of this project, due to:

| | ü | Allied Gold’s operational experience and track record in commissioning new mines in remote locations |

| | | The new company's greater access to capital through support of shareholder base |

Allied Gold’s key achievements at Simberi:

| • | Resources more than tripled since acquisition |

| • | Fully commissioned Greenfield operation in logistically challenging environment |

| • | Capital costs controlled in rising cost environment |

| • | First production within 2 years of FID |

| • | Strong relationships forged with local community |

| • | Project finance facility fully repaid ahead of schedule |

ASX:ALD | AIM:AGLD | TSX:ALG

MATERIAL OPERATING SYNERGIES

The new company will benefit from material cost synergies, including rationalisation of corporate costs, savings in transport costs and procurement savings

| Source | Description |

| | |

| Corporate | • | Rationalisation savings from combining two listed companies into one |

| | • | Reduced head office and administration costs |

| | | |

| Transport | • | Logistics and transport savings from having two operations in close proximity in the |

| | | Pacific Rim region |

| | | |

| Procurement | • | Procurement savings from greater purchasing power and economics of scale |

| | | |

| Exploration | • | Combined exploration teams and expertise |

| | • | Focus on most attractive prospects |

Note: This assumes a 100% acquisition of ASG by Allied Gold

ASX:ALD | AIM:AGLD | TSX:ALG

INCREASED INVESTOR RELEVANCE

| · | Pro forma market capitalisation over A$250m |

| TSX listing broadening international share register |

| Potential index inclusions |

| Increased trading liquidity |

| Access to funding from wide range of sources |

| Favourable production profile relative to listed Asia Pacific peer group |

Note: Chart includes selected listed producers with major mining operations in the Asia Pacific region and F11e production >50koz (gold only). Figures have been calendarised to 30 June for comparative purposes

Source: Company reports, consensus broker estimates

ASX:ALD | AIM:AGLD | TSX:ALG

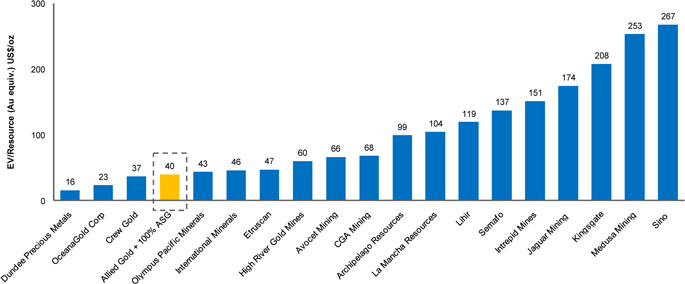

INCREASED INVESTOR RELEVANCE

EV/RESOURCES (Au equiv.)

The value of Allied Gold’s resource base is yet to be fully recognised.

The value of Allied Gold’s resource base is yet to be fully recognised.

Notes:

i.Chart includes listed gold companies (excluding majors) with material mining operations in Asia Pacific and F11e production >50koz (Au only) and other selected mid-cap emerging gold producers.

ii.Data sourced from broker consensus estimates (where available), company reports and investor presentations.

iii.Enterprise value as at 10 Nov 09 converted to US$m at A$1:US$ = 0.92618 and based on last reported net debt and minority positions.

ASX:ALD | AIM:AGLD | TSX:ALG

FUNDING INITIATIVES

| · | Allied Gold considering to undertake an International Capital raising to ensure the funding of the Simberi Oxide expansion and ASG development is assured. |

| | Demonstrate confidence to the Solomon Island Government that development will proceed. |

| | Confidence in placing orders for significant long lead CAPEX items. |

| Options include an international equity placement involving North American, UK and European institutions targeted at: |

| | | Maintaining the quality of the existing share register by focusing on investors with medium term growth focus. |

| | | Broker research being increased on Allied Gold as a result. |

| Debt and Equity funding ratio is being reviewed: |

| | | Debt facilities offered to ASG by the International Finance Corporation and European Development Bank will be reviewed to determine compatibility with Allied Gold requirements. E.g. Potential hedging and other covenants. |

ASX:ALD | AIM:AGLD | TSX:ALG

TSX LISTING

| · | Provisional TSX approval granted on 6th November 2009 for compliance listing. Expected date of full admission around 13th November 2009 |

| TSX Listing will provide enhanced access to North American and European capital markets |

| The search for an additional Independent Non Executive Director based out of Canada is well advanced |

| Allied Gold will be listed on the major mining exchanges across all time zones: |

ASX:ALD | AIM:AGLD | TSX:ALG

| OVERVIEW | ASX:ALD | AIM:AGLD | TSX:ALG |

| GOLD PRODUCTION | | • Simberi Oxides production of ~80,000 ounces per annum • Current oxide mine life of 10 years + • Target cash costs of < US$375 per ounce (short term < US$450 per ounce) |

| | | |

| DEVELOPMENT PORTFOLIO | | • Simberi oxide expansion from 2.0mtpa plant to 3.0mtpa. Study complete. Production to increase to around 100,000 ounces per annum post expansion. Approval Pending. • Simberi Sulphide PFS progressing. 70,000 - 100,000 ounces of production per annum expected from Sulphide deposits. • Review feasibility and commence redevelopment of Gold Ridge, Solomon Islands of 130,000 oz of production per annum at a cash cost of US$468/oz |

| | | |

| EXPLORATION PORTFOLIO | | • Simberi oxide and sulphide mineralisation not yet fully defined • Tatau and Big Tabar island under explored • Barrick JV on Tatau and Big Tabar Island • Total of approximately 275 km2 of tenure, PNG • Total of approximately 130 m2 in the Solomon Islands. Largely unexplored since 2000 |

| | | |

| TARGETED PRODUCTION | | • Near term target production of 250,000 oz increasing to approx. >300,000 oz per annum by 2013 through organic and acquisition growth |

| | | |

| CORPORATE | | • Complete and integrate acquisition of ASG • TSX Listing to be completed by December 2009 • Capital raising and funding initiatives completed for development initiatives by Dec 2009 |

| | | |

| INDUSTRY CONSOLIDATION | | • Assessing opportunities to acquire projects with embedded long term value • Well placed to participate in global industry consolidation |

ASX:ALD | AIM:AGLD | TSX:ALG

CONCLUSION

| • | Simberi operations continue towards a steady state, improving plant performance and significant cost saving initiatives being prepared for implementation. |

| • | The first full year of production has established a platform for GROWTH. |

| • | Allied Gold possesses a well balanced portfolio of exploration, development and producing assets, with genuine incremental increases in production realistically achievable over the next 1 – 3 years. |

| • | The PNG assets (Simberi, Tabar and Tatau) and Solomon Islands still remain significantly under explored and Allied Gold continues to demonstrate exploration success. |

| • | The ASG acquisition provides M/A credibility plus asset diversification and complements the organisational strengths of Allied Gold. |

| • | Allied Gold is a 250,000oz + producer in waiting |

| • | The gold price fundamentals remain robust and sustainable. |

| • | The gold industry is poised for continued consolidation and Allied Gold is well positioned as a regional consolidator or as a potential cornerstone asset in the region. |

| • | Increased investor relevance and a remaining operational focus should translate to increased shareholder value. |