EXHIBIT 99.2

| 30 April 2010 | Company Announcements Office | Australian Securities Exchange Ltd |

QUARTERLY REPORT FOR PERIOD ENDED 31 MARCH 2010

SUMMARY

| · | Simberi production 14,739 ounces for quarter and 46,267 ounces for nine months. |

| · | Total cash costs US$754/oz (A$834/oz) for quarter and $US739/oz (A$838/oz) for nine months. |

| · | Gold sales 14,063oz at realised US$ 1,100/oz or (A$1,231/oz). |

| · | Cash and equivalents $US95m (A$104m) on hand at quarter’s end. |

| · | Gold Ridge redevelopment starts with formal Land Owner and Government ceremonies undertaken. |

| · | Gold Ridge redevelopment teams mobilised, construction activities to increase in June quarter |

| · | PNG exploration program acceleratedand Allied reacquires Tabar Island EL 609 from Barrick. |

| · | Simberi sulphidesupdated at Pigiput/Pigibo deposits with 170% increase in Measure and Indicated resources |

PRODUCTION

Simberi Operations (PNG)

| · | Mining volumes 636,515 tonnes (down 3% qoq) |

| · | Mill processing 439,318tonnes (down 9% qoq) |

| · | Gold production14,739 ounces (down 16% qoq) impacted by 12 days of lost productionthrough land owner discussions and mechanical issues. |

DEVELOPMENT

Gold Ridge (Solomon Islands)

| · | Scope of redevelopment work and plant refurbishment agreed with GR Engineering. Teams mobilised plus the appointment of new Allied Gold Site General Manager. |

Simberi Operations (PNG)

| · | Oxide expansion LOI signed and progressing. |

| · | Sulphide Study test works confirming process. |

EXPLORATION

Papua New Guinea

| · | Exceptional results released (21 April 2010) detailing the diamond core drilling at the Pigiput and Pigibo deposits. |

| · | Results continue to underpin a minimum 100,000oz p.a. PFS sulphide expansion study being finalised. |

Solomon Islands

| · | Progress with geological work programs for 2010/11 to firm up year one mining activities. |

| · | Regional exploration activity increasing with major international companies entering and continuing to explore in the region. |

CORPORATE

| · | Quarterly gold sales 14,063oz at average US$1,100/oz (A$1231/oz) with residual hedge book closed out during the quarter resulting in US$16m (A$18M) cash outflow. |

| · | Appointment of an additional Independent Non Executive Director, Mr Sean Harvey to the Board. |

| · | 100% ownership of Australian Solomons Gold achieved. |

OUTLOOK

Simberi- June quarter production forecast between 15,000-17,000 ounces as site completes debottleneck program and prepares for arrival of infrastructure for oxide expansion.

Gold Ridge - - Significant acceleration in pre-development works including purchase and shipment of mine fleet and construction equipment, various mill equipment and fabrication of landowner housing.

Mark Caruso

Executive Chairman

30April2010

| ASX:ALD | TSX:ALG | AIM:AGLD | 1 | A L D |

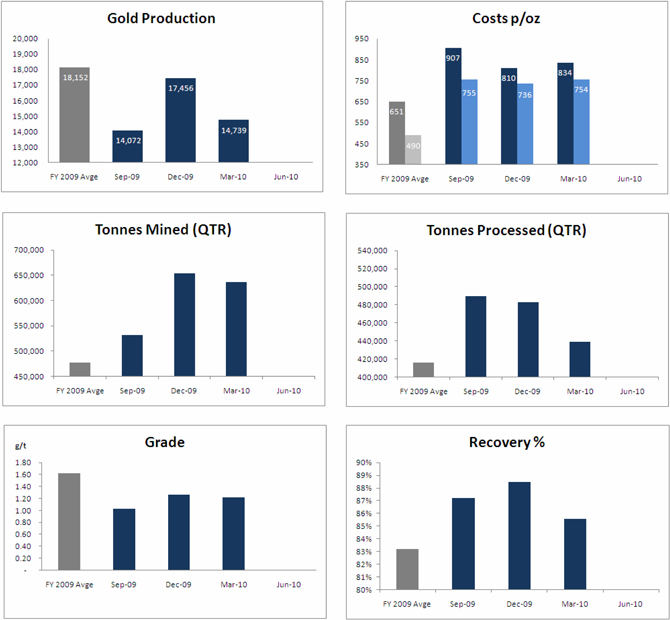

Key Metrics – PNG Simberi Island

| | | | | Previous QTR Oct – Dec 2009 | | | Current QTR Jan - Mar 2010 | | | Financial Year 2010 | |

| Waste Mined | | tonnes | | | 158,084 | | | | 186,611 | | | | 409,706 | |

| Ore Mined | | tonnes | | | 495,121 | | | | 449,904 | | | | 1,412,393 | |

| Total Mined | | tonnes | | | 653,205 | | | | 636,515 | | | | 1,822,099 | |

| Ore Processed | | tonnes | | | 482,865 | | | | 439,318 | | | | 1,411,438 | |

| Grade | | g/t gold | | | 1.26 | | | | 1.22 | | | | 1.17 | |

| Recovery | | % | | | 88.5 | | | | 85.6 | | | | 87.3 | |

| Gold Produced | | oz | | | 17,456 | | | | 14,739 | | | | 46,267 | |

| Gold Sold | | oz | | | 17,971 | | | | 14,063 | | | | 47,454 | |

| | | | | | | | | | | | | | | |

| Average Realised | | A$/oz | | | 953 | | | | 1,231 | | | | 1,062 | |

Gold Price(1) | | US$/oz | | | 866 | | | | 1,100 | | | | 934 | |

| | | | | | | | | | | | | | | |

| Mining Costs | | A$/oz | | | 171 | | | | 212 | | | | 195 | |

| Processing Costs | | A$/oz | | | 402 | | | | 333 | | | | 396 | |

| Site Services / Admin | | A$/oz | | | 173 | | | | 245 | | | | 221 | |

| | | | | | | | | | | | | | | |

| Operating Cash Cost | | A$/oz | | | 746 | | | | 790 | | | | 812 | |

| | | US$/oz | | | 680 | | | | 680 | | | | 716 | |

| | | | | | | | | | | | | | | |

| Royalty | | A$/oz | | | 22 | | | | 27 | | | | 25 | |

| Ore and Inventory Adjustments | | A$/oz | | | 42 | | | | 17 | | | | 1 | |

| | | | | | | | | | | | | | | |

| Total Operating Cash Costs | | | | | | | | | | | | | | |

| | | A$/oz | | | 810 | | | | 834 | | | | 838 | |

| | | US$/oz | | | 736 | | | | 754 | | | | 739 | |

| (1) | Denotes cash realised value received before accounting adjustments related to prior hedging contracts |

| ASX:ALD | TSX:ALG | AIM:AGLD | 2 | A L D |

| ASX:ALD | TSX:ALG | AIM:AGLD | 3 | A L D |

OPERATIONS

Simberi Gold PNG

(Allied Gold 100%)

Oxide Operations

| · | During the March 2010 quarter, mining volumes decreased by 3% and processing throughput was 9% lower than the prior period. Gold recoveries at 85.6% effected by planned refurbishment of CIL tanks. |

| · | Production has been affected by four days direct lost time and a further period of sub-capacity production as the plant was brought back on line after the previously reported landowner stoppage in December 2009. |

| · | The company suffered a structural mechanical failure of itsScrubberTrommel processing equipment which resulted in additional lost time of eight days and lower gold recovery as CIL tank linings were recoated as part of a scheduled programme. |

Oxide Expansion

| · | A LOI has been signed with GRES to undertake an estimated A$34 million expansion of the Simberi oxide process plant. The expansion will increase current plant nameplate throughput from 2 Mtpa to 3Mtpa with a 20% installed additional capacity which will result in ability to process up to 3.6Mtpa with ore type amenable to higher throughput. |

| · | The expansion will increase annual gold production by 15,000 to 20,000 ounces per year and will be commissioned in early 2011. |

| · | The expansion will require a 2.5MW SAG mill in series with the existing ball mill, and two additional 2,500m3 agitated leach tanks and a tailings thickener. GRES have identified a second hand SAG mill (never installed or used) and the company had now purchased this piece of equipment. |

| · | Leach tank design has been finalised and preparation for earthwork and foundations has commenced. |

| · | The option to include a small 5tpd oxygen plant has also been allowed for in the scope. Geotechnical drilling for foundation design for the new components is currently underway. |

| · | An application for variation of the project has been lodged with the PNG Department of Environment & Conservation (DEC) requesting approval to the Environmental permits to accommodate a higher annual throughput. |

| · | The environmental impacts will include a minor mine pit footprint increase at Pigiput and Pigibo as an indirect result of successful sulphide exploration, generation of additional mine waste, increase of 50% in annual tailings discharge, and less fresh and sea water consumption and reagent loss due to tailings thickening. |

Plant Debottlenecking & Refurbishment

| · | The conveying system from Sorowar to Pigiput plant, including the rope conveyor, has been upgraded to 600tph and rain covers have been procured. The CIL intertank screens have been replaced with new larger capacity screens and a degritting spiral has been installed also. |

| · | A second elution column has been procured and will be installed next month andwill allow for more consistent and efficient stripping of gold in circuit. The design for a lime slaker has been finalised and all equipment procured to be installed by the 3rd quarter. |

| · | Plant refurbishment work was ongoing throughout the reporting period. One leach tank (tank 5) has had internal refurbishment of baffles, agitator blades and shaft and lining of protective coating of tank wall. |

| · | The Companyremains confident that on the completion of the plant debottlenecking, the plant will be capable of sustained throughput of 2.2M to 2.4M tpa |

| ASX:ALD | TSX:ALG | AIM:AGLD | 4 | A L D |

Sulphide Development

Pigiput Sulphide Study

| · | PFS metallurgical testwork on Simberi Sulphide Study completed with overall sulphide recoveries of 82% achieved via flotation, roasting and leach route. Optimum grind size for flotation is P80 of 106 microns and gold recoveries of about 93% were achieved. |

| · | Laboratory roasting trails Muffle and Midrex furnaces) achieved roast-leach gold recoveries of approximately 89%. Concentrate characteristics and laboratory results have been provided to roaster vendors to provide initial design and capital cost for appropriately sized roaster for a 1.5Mtpa flotation plant and this information has now been passed onto process engineers for integration into the plant design. |

| · | A second option is investigating selling a gold sulphur concentrate to an independent smelter is also being pursued. |

| · | The final testwork to be completed is the roaster off gas management which is focussing on using limestone and the existing deep sea tailings system to manage this. |

| · | The PFS delivery date has now been rescheduled for June 2010 as a result of incomplete resource drilling that is still ongoing to infill and delineate mineralised areas to the NE of Pigiput and other sulphide targets. |

| · | The drill database was closed off at the end of January and this data was incorporated into a new resource model that included the adjacent Pigibo deposit. |

| · | A new resource estimate completed in late February resulted in defining and additional 2.08 million contained gold ounces in Measured and Indicated Resource categories using a 0.5g/t gold cutoff grade. |

| · | These additional Resources have increased total Measured, Indicated (78.4Mt @ 1.27 g/t Au for 3.20 Moz of gold) and Inferred Resources (78.2Mt @ 0.99 g/t Au for 2.49 Moz) of gold to 156. at 1.13 g/t for 5.69Moz gold. |

| · | The feasibility study has been premised on sulphide reserves of about 1Moz. Preliminary pit optimisation work has indicated this target is close to being achieved at current gold prices. |

| · | This preliminary work has also indicated removal of oxide and transitional to access sulphide ore in a reasonable time frame will likely require stockpiling of lower grade ores due to the limited through put capacity of the process plant which is current 2Mtpa increasing to 3Mtpa by early 2011 as part of planned expansion. The company is also considering alternatives to the current mine plan including rescheduling existing mining of oxide resources to facilitate access to the oxide or bodies at Pigiput and Pigibo. |

| · | Work has commenced on investigating and reporting other areas of the study including the consultants (in brackets) that have been engaged to make those contributions. The study is being managed and compiled by Battery Limits, with the following contributors, namely; |

| | o | Geology & Resources (Allied & Golder Associates) |

| | o | Reserves and Mining, & mine costs (Golder Associates) |

| | o | Metallurgy (Battery Limits) |

| | o | Process Plant and Process, and capital and operating cost (GRES) |

| | o | Infrastructure (battery Limits and GRES) |

| | o | Environmental (Coffey Natural Systems) |

| | o | Project Implementation (battery Limits) |

| | o | Financial Modelling (Modus Capital) |

Gold Ridge Project in

Solomon Islands (Allied Gold 100%)

| · | On 22nd March,the Reconciliation Ceremony between all GRML stakeholders was performed. This traditional ceremony allowed all parties to reflect and forgive the past tensions, and move forward in cooperation and friendship in the redevelopment of the mine. |

| · | There was a great display of landowner and political goodwill to not only move forward with the project but to fully support it and ensure a successful re-development and mine start. |

| · | The following day, an official start to redevelopment ceremony was held at the mine site and attended by the Prime Minister and his Cabinet, Landowner Associations Members, Chiefs, Australian Government Officials and Senior Allied Staff. All representatives again confirmed project support. |

| ASX:ALD | TSX:ALG | AIM:AGLD | 5 | A L D |

| · | A LOI for redevelopment of the Gold Ridge mine on the island of Guadalcanal in the Solomon Island has been signed between Gold Ridge Mining Limited (GRML) and GRES. The LOI is to award an EPC contract for the redevelopment and expansion of the existing process plant. GRES (formerlyJRES) built the original 2mtpa CIL process plant in 1998 and it operated for 20 months and produced approximately 210,000 ounces of gold before being shutdown due to in-country racial tensions. |

| · | The redevelopment and expansion of the plant including tailings disposal and process water supply is estimated to cost about A$63M. The expansion of the plant will involve the addition of 3 extra leach tanks and 29m diameter thickener. A tailings detoxification tank and mixing system will be installed as well as some modifications to the existing coarse gold recovery section with installation of an intense leach reactor (ILR). |

| · | GRES have placed orders for long lead items including thickener, SAG mill items, transformers and other equipment including pumps and motors. GRES will commence mobilisation of construction crews in mid April. The current schedule has first gold pour in the first half of 2011. |

| · | In addition, other works required to get the mine into production are the re-establishment of roads, mine access, pit clearing and run of mine stockpile earthworks. The accommodation village and some operations buildings need replacing and upgrading. The mining and construction fleet has been sourced and procured and will arrive in the Solomon Islands early May. Construction earthworks and pre-mine developments works can commence. |

| · | On site GRML personnel have been preparing for construction in dealing with Landowners and Government and undertaking site works such as rebuilding some operations offices, re-cladding existing workshop, power station and laboratory buildings. |

| · | Progress continues with the dewatering of the tailings Storage Facility (TSF) of 10 years of rainfall water. |

| · | Substantial progress has occurred with local recruitment for construction and also assembling an operations team. |

| · | Landowners and their guests (artisanal miners) currently residing on the Mining Lease will be relocated as part of the Agreements between Landowners, Solomon Island Government (SIG) and GRML. |

| · | The relocation of people from the mine site will require the company to construct approximately 300 resettlement houses. Previous project owners, Australian Solomons Gold Limited (ASG), had completed resettlement plans and agreements with Landowners. As such, land has been identified and purchased for relocation settlements. A LOI has been signed with an Australian Company to provide and erect the houses in accordance with agreements and the same company will undertake refurbishment and upgrade of the accommodation village. |

EXPLORATION

Simberi (PNG)ML 136

(Allied Gold 100%)

Increased resource confidence at Pigiput and Pigibo sulphide deposits with 2.08 million ounces now in Measured and Indicated categories. (See ALD media Release 9/3/2010 for more detail).

Updated Resouce statement for Pigipput and Pigibo shows;

48.1Mt @ 1.35g/t Au in Measured and Indicated categories for 2.08 million ounces of gold

| | · | 38.5Mt @ 1.00 g/t Au for 1.24 Moz of gold classified as Inferred Mineral Resources |

| | · | 86.6Mt @ 3.70g/t Ag for 10.3 Moz of silver classified as Inferred Mineral Resources |

Drilling at Pigibo (down dip) and Pigiput (the open north eastern side) is focused on resource infill and extention work, with a further sixteen diamond core holes (3,393 metres), were completed in the quarter

| ASX:ALD | TSX:ALG | AIM:AGLD | 6 | A L D |

Better down hole intercepts ineleven diamond core holes assayed subsequent to the new resource estimate (ALD Media Release, 21st Apr 2010), all in the Sulphide zone at Pigiput, include:

| | · | SDH076 98m @ 1.64g/t from 147m |

| | · | SDH079 33m @ 3.40g/t from 182m |

| | · | SDH080 71m @ 2.11g/t from 117m |

| | · | SDH082 32m @ 2.81g/t from 235m |

| | · | SDH083 40m @ 2.10g/t from 231m |

| | · | SDH084 49m @ 3.96g/t from 92m |

Gold mineralisation remains open at Pigiput, both to the north east and south west and down dip to the north.Assay results for three diamond core holes drilled at the adjacent Pigibo Prospect, included a best downhole intercept of 13m @ 2.97g/t from 125m in SDH075.

The on-going drilling campaign is part of a phased in-fill and step-out programme, commenced in May 2009, designed to support the A$10 million Sulphide and Oxide Expansion Studies based around the Pigiput and Pigibo Deposits.

(Refer to press release dated 21 April 2010 for full details.)

Big Tabar Island, PNG,EL 609

(Allied Gold 100%)

Tatau Island, PNG,EL 609

(Allied Gold 100%)

Allied and Barrick reached agreement on change to a joint venture agreement over Tatau and Big Tabar Islands. Allied will now assumemanagement of exploration in the entire area of permit EL609. Allied made an immediate A$2.5M payment to Barrick with a further A$3M to paid in July as either cash or Allied shares. Such shares would be escrowed until 2012.

A new drilling programme on Tatau island has been developed for six prospects, including Mt Letham where in the 1907sKennecott’s historical drilling intersected RC1100DD :30m @ 0.68g/t from 182m(1), incl 2m @ 5.29g/t from 208m(2), and 10m @ 4.73g/t Au from 359m(1), incl. 4m @ 11.2g/t from 364m(2)(using 0.25g/t(1) and 1.0g/t(2) sample assay cut-offs respectively).

On Tabar Island, Allied is planning an geophysical IP survey as the initial follow-up of drilling done by Barrick at the Banesa Prospect that located alkaline porphyry copper-gold mineralisation including a best down hole intercept of BND5 : 69 m @ 1.13 % Cu and 0.83 g/t Au from 50 m(ALD Quarterly Report to 30th June 2009, 29th July 2009)

Gold Ridge, Solomon Islands

(Allied Gold 100%)

Exploration for 2010 have been finalised and include:

| · | Reaffirming Year 1 gold production with detailed RC drilling of Namachamata deposit. |

| · | Drill testing likely extensions to known mineralisation (Kupers and Dawsons deposits) with core holes |

| · | Geophysical review of known deposits and surrounds to compare gold-in-soil anomalism along strike and parallel to known mineralised zone with IP survey |

| · | Exploring area within Gold Ridge mining lease using first pass stream sediment andfollow-up soil sampling techniques |

CORPORATE

| · | During the quarter, Allied Gold completed the compulsory acquisition of Australian Solomons Gold (ASG). ASG has beendelisted from the TSX and has ceased being an external reporting entity. |

| · | On 11 March 2010, Mr Sean Harvey joined Allied Gold as an independent non-executive Director. |

| · | Allied Gold continues to progress migration of its London AIM listing to the London Stock Exchange (LSE). |

| ASX:ALD | TSX:ALG | AIM:AGLD | 7 | A L D |

CASH AND DEBT

| · | Gold sales during the March quarter of 14,063 (down 22% qoq) reflected lower production., |

| · | The average price of US$1,100/os (A$1,231/oz) reflected a combination of higher gold prices and hedge book being extinguished. |

| · | The outflow of funds US$16m (A$18m) due to the hedge book close shouldbe recouped in future periods at current gold prices. |

| · | For the Financial Year ending 30 June 2010, approximately 50% of the close out cost will be recognised in the earnings calculations with the remainder to flow through in FY 2011. |

| · | During the course of the June quarter, management will continue to finalise all existing study and development projections to enable updated status reports to be done for 30 June period. A comprehensive assessment of all project facets including contingency analysis will be undertaken. |

| · | The company is currently assessing a number of proposals relating to various standby and similar natured credit facilities with certain institutions with a view of establishing such facilities in calendar 2010. |

CASH FLOW STATEMENT

| | | | | | 9 months | |

| | | Mar 2010 | | | ended | |

| | | Quarter(1) | | | 31 Mar 2010(1) | |

| | | A$ Million | | | A$ Million | |

| | | | | | | |

| Net cash provided by operating activities | | | (16.84 | ) | | | (25.77 | ) |

| | | | | | | | | |

| Net cash used in investing activities | | | (35.62 | ) | | | (42.22 | ) |

| | | | | | | | | |

| Net cash provided by financing activities | | | (1.76 | ) | | | (149.30 | ) |

| | | | | | | | | |

| Net increase / (decrease) in cash and cash equivalents | | | (54.22 | ) | | | 81.31 | |

| Cash and cash equivalents at the beginning of the period | | | 157.24 | | | | 20.53 | |

| | | | | | | | | |

| Effects of exchange rates on cash and cash equivalents | | | 1.4 | | | | 2.58 | |

| | | | | | | | | |

| Cash and cash equivalent at the end of the quarter | | | 104.42 | | | | 104.42 | |

| · | Cash flow from operations during the quarter was a result of a lower level of expected production due to the 12 lost days of production. |

| · | Cash flows from investing activities during the quarter included around A$17M relating to the purchase of mining fleet, A$3M for the initial payment on SAG mill, and A$2.5M of initial buyback of the Barrick JV. |

| · | With the bulk of the residual relating to Oxide plant initiatives, Gold Ridge predevelopment works and group exploration activities. |

| · | Cash flow from financing activities primarily relate to costs associated with equipment financing activities. |

SECURITIES ON ISSUE

| · | As at 31 March 2010, Allied Gold has 1,040,132,142 ordinary shares on issue. The shares are listed on the Australian Stock Exchange (ASX), Toronto Stock Exchange (TSX) and currently on the London Alternative Investment Market (AIM). The shares are interchangeable. |

Options Exercise Price | | Maturity | | Balance as at 01/01/10 | | | Options Issued | | | Options expired cancelled exercise | | | Balance as at 31/03/10 | |

| | | | | | | | | | | | | | | |

| $0.80 options | | 31/12/2010 | | | 1,000,000 | | | | | | | | | | | | 1,000,000 | |

| | | | | | | | | | | | | | | | | | | |

| $1.00 options | | 31/12/2010 | | | 1,000,000 | | | | | | | | | | | | 1,000,000 | |

| | | | | | | | | | | | | | | | | | | |

| $1.25 options | | 31/12/2010 | | | 1,000,000 | | | | | | | | | | | | 1,000,000 | |

| | | | | | | | | | | | | | | | | | | |

| $1.50 options | | 31/12/2010 | | | 1,000,000 | | | | | | | | | | | | 1,000,000 | |

| | | | | | | | | | | | | | | | | | | |

| $2.00 options | | 31/12/2010 | | | 1,000,000 | | | | | | | | | | | | 1,000,000 | |

| | | | | | | | | | | | | | | | | | | |

| $0.35 options | | 31/10/2011 | | | 30,012,500 | | | | | | | | | | | | 30,012,500 | |

| | | | | | | | | | | | | | | | | | | |

| $0.31 options | | 31/12/2010 | | | 1,699,427 | | | | | | | | | | | | 1,699,427 | |

| | | | | | | | | | | | | | | | | | | |

| $0.35 options | | 31/12/2011 | | | 1,500,000 | | | | | | | | | | | | 1,500,000 | |

| | | | | | | | | | | | | | | | | | | |

| $0.50 options | | 31/12/2013 | | | 37,500,000 | | | | | | | | | | | | 37,500,000 | |

| | | | | | | | | | | | | | | | | | | |

| $0.50 options | | 31/12/2013 | | | 1,175,000 | | | | | | | | | | | | 1,175,000 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | 76,886,927 | | | | | | | | | | | | 76,886,927 | |

a) The weighted average exercise price of all options outstanding at the end of the period was A$0.49

b) The weighted average time to expiry of all options outstanding at the end of the period was 2.37 years

Notes:

| (i) | Of the 30,102,500 options expiring 31 October 2011, 9,375,000 vest upon the share price reaching $A0.70. |

| ASX:ALD | TSX:ALG | AIM:AGLD | 8 | A L D |

| (ii) | Of the 1,500,000 options expiring 31 December 2011, 500,000 vest upon the share price reaching $A0.70. |

| (iii) | Of the 37,500,000 options expiring 31 December 2013, 15,000,000 vest on 7 December 2010; 15,000,000 vest upon the share price reaching $A0.70 and 7,500,000 vest upon Allied Gold producing 100,000 ounces of gold in the period 1 October 2009 - 31 December 2010. |

OUTLOOK

The re-development of the Gold Ridge project in the Solomon Islands remains on track with the mobilisation of Phase 1 mining and redevelopment equipment due in the June quarter. The issuing of contractual Letter of Intents (LOI) for the process plant re-development refurbishment and the construction of landowner housing relocation have allowed early and accelerated mobilisation of contractors and their personnel to site.

Project development costs will be finalised in the June quarter along with all formal contractual arrangements with EPC contractors to allow the recommencement of gold production in the 1st half of 2011.

Despite significant downtime in the March quarter due to mechanical and landowner disruption, Simberi Oxide operations will stabilise to produce 15-17,000oz of gold for the June quarter. The delivery of consistent ROM head grade will be improvedby the delivery of additional mining equipment in the quarter to allow maintenance of the Ore/Waste strip ratio. The Oxide Expansion from 2 to 3 MTPA is well advanced and will gain impetus in the next quarter with the letting of CIL tank construction contracts and the mobilisation of EPC contract personnel to site.

Exploration will be driven by the significant increase in measured and indicated resource delivered in the March quarter. Drilling will be focused on expanding the critical mass of the Sulphide resource to reserve status in the Pigiput and Pigibo prospects, while testing for the extensional potential to South East Sorowar.

Additional work will also commence on testing the Sulphide potential of the previously mined Oxide Samat and Botlu deposits. The delivery of the Sulphide pre-feasibility study will be underpinned by the Reserve Statements which will be delivered pending the completion and testing of all Sulphide targets on the above mentioned deposits.

| ASX:ALD | TSX:ALG | AIM:AGLD | 9 | A L D |

Preparation work for the recommencement of drilling on Tatau Island has been completed and dependent upon drillrig availability, will recommence in the latter half of the June quarter.

The recommencement of drilling is also in the Solomon Islands is targeted for the latter half of the quarter or early in July 2010. The company will also take initial steps to explore other potential exploration prospects due to its presence in the Solomon Islands.

| ASX:ALD | TSX:ALG | AIM:AGLD | 10 | A L D |

The company will conduct a full assessment of its funding requirements on the completion of the final project delivery costs for the Gold Ridge Redevelopment and the Simberi Oxide Expansion and the additional exploration costs for the Sulphide Pre-Feasibility Study all of which should be completed in the June quarter with the conclusion of contractual arrangements.

Corporately, the migration to the main board of the London Stock Exchange (LSE) remains on track. A concerted effort in the coming quarter to market the company in the North American investor market in conjunction with broker research coverage has been initiated. The investment drivers for the company will be further driven by industry and regional consolidation through M/A activity and its recognition as an imminent producer of 225,000oz of gold.

| ASX:ALD | TSX:ALG | AIM:AGLD | 11 | A L D |

For enquiries in connection with this release, please contact:

Allied Gold Limited

Office of the Executive Chairman

+61 8 9353 3638 phone

Corporate Office

Frank Terranova - Chief Financial Officer

Simon Jemison - Investor & Media Relations

+61 7 3252 5911 phone

Board of Directors: Mark Caruso Executive Chairman & CEO Sean Harvey Non Executive Director Monty House Non Executive Director Tony Lowrie Non Executive Director Greg Steemson Non Executive Director Frank Terranova Executive Director & CFO Peter Torre Company Secretary ASX Code: ALD TSX Code: ALG AIM Code: AGLD Principal Office 34 Douglas Street Milton, Queensland 4064 Telephone +61 7 3252 5911 Facsimile +61 7 3252 3552 Email info@alliedgold.com.au Website: www.alliedgold.com.au Postal Address PO Box 2019, Milton 4064 Registered Office Unit B9, 431 Roberts Road Subiaco, WA 6008 Share Registry Computer Share Investor Services Level 2, Reserve Bank Building 45 St Georges Terrace Perth, Western Australia WA 6000 | | Qualified Person The information in this report that relates to Mineral Exploration results and Mineral Resources, together with any related assessments and interpretations, have been verified by and approved for release by Mr P R Davies, MSc, BSc, M.Aus.I.M.M., a qualified geologist and full-time employee of the Company. Mr Davies has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined in the 2004 Edition of the “Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves”. Mr Davies consents to the inclusion of the information contained in this Presentation in the form and context in which it appears. Forward-Looking Statements This press release contains forward-looking statements concerning the projects owned by Allied Gold. Statements concerning mineral reserves and resources may also be deemed to be forward-looking statements in that they involve estimates, based on certain assumptions, of the mineralisation that will be found if and when a deposit is developed and mined. Forward-looking statements are not statements of historical fact, and actual events or results may differ materially from those described in the forward-looking statements, as the result of a variety of risks, uncertainties and other factors, involved in the mining industry generally and the particular properties in which Allied has an interest, such as fluctuation in gold prices; uncertainties involved in interpreting drilling results and other tests; the uncertainty of financial projections and cost estimates; the possibility of cost overruns, accidents, strikes, delays and other problems in development projects, the uncertain availability of financing and uncertainties as to terms of any financings completed; uncertainties relating to environmental risks and government approvals, and possible political instability or changes in government policy in jurisdictions in which properties are located. Forward-looking statements are based on management’s beliefs, opinions and estimates as of the date they are made, and no obligation is assumed to update forward-looking statements if these beliefs, opinions or estimates should change or to reflect other future developments. Not an offer of securities or solicitation of a proxy This communication is not a solicitation of a proxy from any security holder of Allied Gold, nor is this communication an offer to purchase or a solicitation to sell securities. Any offer will be made only through an information circular or proxy statement or similar document. Investors and security holders are strongly advised to read such document regarding the proposed business combination referred to in this communication, if and when such document is filed and becomes available, because it will contain important information. Any such document would be filed by Allied Gold with the Australian Securities and Investments Commission, the Australian Stock Exchange and with the U.S. Securities and Exchange Commission (SEC). |

| ASX:ALD | TSX:ALG | AIM:AGLD | 12 | A L D |

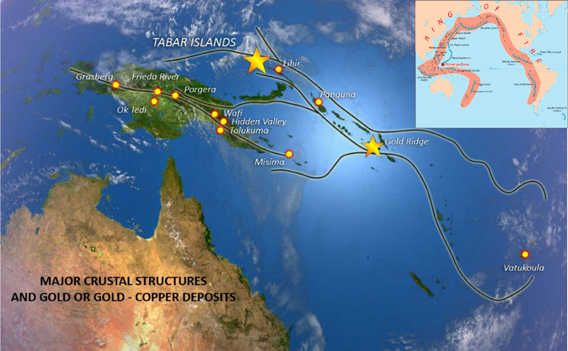

BACKGROUND

Allied Gold Limited’s gold production and exploration development portfolio is centred on the Pacific Rim of Fire, in particular the Tabar Islands of Papua New Guinea, approximately 60 kilometres from Lihir Island, which hosts a plus 40 million ounce gold resource.

In 2008-2009, Allied produced 72,609 ounces of gold. Studies on an expansion of the PNG oxide plant from 2 Mtpa to 3 Mtpa have been completed to increase production to 100,000 oz pa. A study focused on the PNG sulphide resources is looking at the optional configuration for 100,000 oz pa sulphide operation which would lift PNG group production towards 250,000 oz pa by 2012.

In December 2009, Allied Gold acquired Australian Solomons Gold Limited (ASG) whose principal asset is the Gold Ridge mine located on the island of Guadalcanal in the Solomon Islands. Between1998 – 2000 whilst in operation, the mine produced in excess of 200,000oz. Allied Gold is progressing the redevelopment of this asset which will add an approximate 125,000oz of additional production to the group.

The Pacific Rim of Fire is one of the world’s proven and most prospective gold jurisdictions.

Allied Gold has group Resources of 7.8 million ounces and in excess of 2.0 million ounces of Reserves.

At the Simberi mine, Allied Gold currently hosts Measured Indicated and Inferred mineral resources of approximately 5.6 million ounces of gold. Allied Gold currently owns 100% of Simberi and 100% of the EL on the nearby Tatau and Big Tabar islands. At the Gold Ridge mine, Allied Gold currently hosts Measured, Indicated and Inferred mineral resources of approximately 2.2 million ounces of gold.

| ASX:ALD | TSX:ALG | AIM:AGLD | 13 | A L D |