UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

| ¨ | Registration statement pursuant to Section 12(b) or 12(g) of the Securities Exchange Act of 1934 |

or

| ¨ | Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

or

| x | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the transition period from July 1, 2011 to December 31, 2011 |

or

| ¨ | Shell company report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

Commission file number: 033-51752

ALLIED GOLD MINING LIMITED

(Exact Name of Registrant as Specified in its Charter)

N/A

(Translation of registrant’s name into English)

England and Wales

(Jurisdiction of incorporation or organization)

Level 10, 432 St Kilda Road

Melbourne, Victoria 3004, Australia

(Address of registrant’s registered office)

Garth Campbell-Cowan

Level 10, 432 St Kilda Road

Melbourne, Victoria 3004, Australia

Tel. +61 3 8660 1905, Fax. +61 3 8660 1999, e-mail: garth.campbell-cowan@stbarbara.com.au

(Name, Telephone, E-Mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| | |

Title of Each Class | | Name of Each Exchange On Which Registered |

| None | | |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

Ordinary Shares

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

204,318,414 Ordinary Shares as of December 31, 2011

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No x

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ¨ No x

Note—checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ¨ No x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act (Check one):

Large accelerated filer ¨ Accelerated Filer x Non-accelerated filer ¨

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| | | | |

U.S. GAAP ¨ | | International Financial Reporting Standards as issued by the International Accounting Standards Board x | | Other ¨ |

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrant has elected to follow

Item 17 x Item 18 ¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No x

TABLE OF CONTENTS

EXPLANATORY NOTE

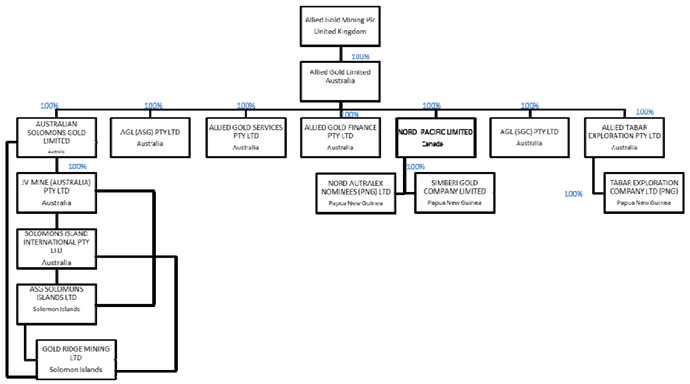

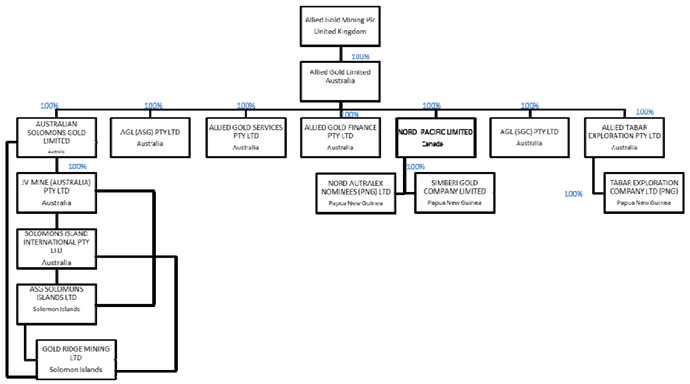

In June 2011, the Allied Gold group completed a restructuring, the Restructuring, pursuant to share and option schemes of arrangement, with Allied Gold Mining PLC, a company organized under the laws of England and Wales, becoming the parent holding company of Allied Gold Limited. As a result of the Restructuring, we changed our fiscal year end to December 31 from June 30. We are filing this transition report for the period from July 1, 2011 to December 31, 2011, the Transition Report, in connection with our anticipated deregistration in compliance with Rule 12h-6 of the Exchange Act.

On September 7, 2012, St Barbara Limited, or St Barbara, a company organized under the laws of the Commonwealth of Australia, acquired Allied Gold Mining PLC pursuant to a scheme of arrangement, the Scheme of Arrangement, resulting in Allied Gold Mining PLC becoming a wholly-owned subsidiary of St Barbara Limited. Prior to and in order to facilitate the acquisition by St. Barbara, shareholders of Allied Gold Mining PLC, acting by special resolution, approved a reduction in capital of Allied Gold Mining PLC on August 14, 2012. As a result, Allied Gold Mining PLC was re-registered on September 7, 2012 as Allied Gold Mining Limited and continues to do business under that name. References to “Allied Gold”, “the Group”, “we”, “our” and “us”, in this Transition Report, as context dictates, are to (a) Allied Gold Mining Limited and its subsidiaries subsequent to the acquisition by St Barbara, (b) Allied Gold Mining PLC and its subsidiaries prior to the acquisition by St Barbara but following the Restructuring, and (c) Allied Gold Limited and its subsidiaries prior to the Restructuring. References to “the Company” are to Allied Gold Mining Limited or Allied Gold Mining PLC, as context dictates.

CAUTIONARY STATEMENT ABOUT FORWARD-LOOKING STATEMENTS

This report contains certain forward-looking statements with respect to our financial condition, results of operations and business. These statements are forward-looking statements within the meaning of Section 27A of the Securities Act, and Section 21E of the Exchange Act. The words “intend”, “project”, “anticipate”, “estimate”, “plan”, “believes”, “expects”, “may”, “should”, “will”, or similar expressions, commonly identify such forward-looking statements.

Examples of forward-looking statements in this report include those regarding estimated ore reserves, anticipated production or construction dates, costs, outputs and productive lives of assets or similar factors. Forward-looking statements involve known and unknown risks, uncertainties, assumptions and other factors set forth in this document that are beyond our control. For example, future ore reserves will be based in part on market prices that may vary significantly from current levels. These may materially affect the timing and feasibility of particular developments. Other factors include the ability to produce and transport products profitably, demand for our products, changes to the assumptions regarding the recoverable value of our tangible and intangible assets, the effect of foreign currency exchange rates on market prices and operating costs, and activities by governmental authorities, such as changes in taxation or regulation, and political uncertainty.

In light of these risks, uncertainties and assumptions, actual results could be materially different from projected future results expressed or implied by these forward-looking statements which speak only as to the date of this report. Except as required by applicable regulations or by law, we do not undertake any obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events. We cannot guarantee that our forward-looking statements will not differ materially from actual results.

1

DEFINITIONS

| | |

| “AIFRS” | | means the Australian equivalents to International Financial Reporting Standards. |

| |

| “ASX” | | means the Australian Stock Exchange. |

| |

| “ASG” | | means Australian Solomons Gold Limited. |

| |

| “AUD” or “A$” | | means Australian dollar. |

| |

| “BDO” | | means BDO Audit (WA) Pty Ltd. |

| |

| “Exchange Act” | | means the U.S. Securities Exchange Act of 1934, as amended. |

| |

| “GBP” | | means the British pound sterling. |

| |

| “Gold Ridge” or “Gold Ridge Project” | | means the 100% owned gold mining operation which is located on Guadalcanal Island in the Solomon Islands. |

| |

| “GRML” | | means Gold Ridge Mining Limited. |

| |

| “IFRS” | | means the International Financial Reporting Standards. |

| |

| “km2” | | means square kilometers. |

| |

| “LSE” | | means the London Stock Exchange PLC. |

| |

| “Main Market” | | means the LSE’s main market for listed securities. |

| |

| “Mt” | | means million tonnes. |

| |

| “Mtpa” | | means million tonnes per annum. |

| |

| “Official List” | | means the premium listing segment of the LSE. |

| |

| “Ordinary Shares” | | means the ordinary shares of Allied Gold Mining PLC (or Allied Gold Mining Limited, as applicable). |

| |

| “PNG” | | means Papua New Guinea. |

| |

| “SAG” | | means semi-autogenous grinding. |

| |

| “Securities Act” | | means the U.S. Securities Act of 1933, as amended. |

| |

| “SEC” | | means the U.S. Securities and Exchange Commission. |

| |

| “SIG” | | means Solomons Island Government. |

| |

| “Simberi” or “Simberi Project” | | means the 100% owned gold mining operations located on Simberi Island, the northernmost island of the Tabar Islands Group, in the New Ireland Province of eastern PNG. |

| |

| “TSX” | | means the Toronto Stock Exchange. |

| |

| “US$” | | means U.S. dollars. |

2

PART 1

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not applicable.

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

| A. | Selected Financial Data |

On June 30, 2011, Allied Gold Limited successfully implemented the Restructuring, whereby Allied Gold Mining PLC, a company incorporated in England and Wales, became the parent holding company of Allied Gold Limited and its subsidiaries. Pursuant to the Restructuring, Allied Gold Limited’s shares and options on issue as of June 30, 2011 were exchanged on a six for one basis for Allied Gold Mining PLC shares and options. Allied Gold Mining PLC was admitted to the premium listing segment, the Official List, of the London Stock Exchange PLC, or LSE, and commenced trading on the LSE’s main market for listed securities, the Main Market, on June 30, 2011.

While this transition report on Form 20-F for the transition period from July 1, 2011 to December 31, 2011 is filed under the name of Allied Gold Mining Limited, the financial information presented relates to its predecessor entities, Allied Gold Mining PLC (for the six-month period ended December 31, 2011) and Allied Gold Limited (for the fiscal years ended June 30, 2010 and June 30, 2011 and the six months ended December 31, 2010). The selected historical data presented below has been derived from the financial statements of Allied Gold for the periods indicated, which were audited by BDO.

The consolidated financial statements are presented in Australian dollars and have been prepared in accordance with AIFRS. The consolidated financial statements and notes for Allied Gold comply with IFRS, as adopted by the International Accounting Standards Board, or IASB.

The following table summarizes certain financial information and should be read in conjunction with “Item 5 – Operating and Financial Review and Prospects”. We did not declare a dividend during each of the six-month periods ended December 31, 2010 and 2011, or the fiscal years ended June 30, 2010 and 2011. There were significant fluctuations in revenues and net income (loss) between the years stated in the table below. For the reasons set forth herein, the information shown below may not be indicative of our future results of operations.

| | | | | | | | | | | | | | | | |

| | | Six months ended December 31, | | | Year ended June 30, | |

| | | 2011 | | | 2010 | | | 2011 | | | 2010 | |

| | | A$000s | |

Income statement data: | | | | | | | | | | | | | | | | |

Revenues | | | 98,251 | | | | 40,943 | | | | 84,392 | | | | 67,555 | |

Net profit /(loss) after tax | | | (482 | ) | | | 9,389 | | | | 6,607 | | | | 10,229 | |

Net profit / (loss) per share (basic) - cents | | | (0.24 | ) | | | 0.90 | | | | 0.61 | | | | 1.31 | |

Net profit / (loss) per share (diluted) - cents | | | (0.24 | ) | | | 0.89 | | | | 0.60 | | | | 1.31 | |

| | | | |

Balance sheet data | | | 606,174 | | | | 465,575 | | | | 598,158 | | | | 431,658 | |

Total assets | | | 494,282 | | | | 385,841 | | | | 470,942 | | | | 371,065 | |

Net assets | | | | | | | | | | | | | | | | |

| | | | |

Shares on issue (value)(1) | | | 30,248 | | | | 370,183 | | | | 459,170 | | | | 369,525 | |

Shares on issue (number) | | | 204,318,414 | (2) | | | 1,042,206,569 | | | | 1,198,537,554 | | | | 1,040,132,142 | |

| | | | |

Dividends paid or declared | | | Nil | | | | Nil | | | | Nil | | | | Nil | |

| (1) | The share capital balance reflects that Allied Gold Limited, an Australian Company, was the parent entity of the Group until June 30, 2011, and as a consequence the Group did not have a share premium account. Upon the establishment of Allied Gold Mining PLC as the parent of the Group, the balance of share capital in excess of par value of shares issued as a result of the arrangement was transferred to the capital reserve. Subsequent share issues have been recognized at par value in the share capital account with the balance shown as share premium. |

| (2) | On June 30, 2011, Allied Gold Limited successfully implemented the Restructuring whereby Allied Gold Mining PLC became the holding company of the Group. Under the Schemes of Arrangement, Allied Gold Limited’s shares and options on issue as at June 30, 2011 were exchanged on a six for one basis to Allied Gold Mining PLC shares and options. |

3

Exchange Rates

Solely for informational purposes, this Transition Report contains translations of certain Australian dollar amounts into or from U.S. dollars at a specified rate. These translations should not be construed as a representation that the Australian dollar amounts, represented in the U.S. dollar amounts indicated, could be converted into or from U.S. dollars at the rate indicated. The following table sets forth, for the financial periods indicated, certain information concerning the Noon Buying Rate for Australian dollars expressed in U.S. dollars per A$1.00 as follows:

Exchange Rates for Australian Dollar to U.S. Dollar for the Current Period

| | | | | | | | | | | | | | | | |

Period | | High | | | Low | | | Period End | | | Average | |

Six months ended December 31, 2011 | | | 1.103 | | | | 0.845 | | | | 1.025 | | | | 1.032 | |

Exchange Rates for Australian Dollar to U.S. Dollar for the Previous Six Months

| | | | | | | | | | | | | | | | |

Period | | High | | | Low | | | Period End | | | Average | |

July 1, 2011 to July 30, 2011 | | | 1.103 | | | | 1.057 | | | | 1.100 | | | | 1.078 | |

August 1, 2011 to August 31, 2011 | | | 1.093 | | | | 1.019 | | | | 1.070 | | | | 1.050 | |

September 1, 2011 to September 30, 2011 | | | 1.075 | | | | 0.974 | | | | 0.974 | | | | 1.022 | |

October 1, 2011 to October 31, 2011 | | | 1.071 | | | | 0.945 | | | | 1.061 | | | | 1.017 | |

November 1, 2011 to November 30, 2011 | | | 1.037 | | | | 0.969 | | | | 1.024 | | | | 1.011 | |

December 1, 2011 to December 31, 2011 | | | 1.030 | | | | 0.990 | | | | 1.025 | | | | 1.012 | |

Latest Practicable Date

As of December 31, 2011, the Australian dollar expressed in U.S. dollars per A$1.00 was US$1.025.

| B. | Capitalization and Indebtedness |

Not applicable.

| C. | Reasons for the Offer and Proceeds |

Not applicable.

An investment in Allied Gold and the Ordinary Shares is subject to risks and uncertainties. The occurrence of any one or more of these risks or uncertainties could have a material adverse effect on the value of any investment in Allied Gold and the business, prospects, financial position, financial condition or operating results of the Company. Prospective investors should carefully consider the information presented in this report, including the following risk factors, which are not an exhaustive list of all risk factors associated with an investment in Allied Gold or the Ordinary Shares or in connection with the operations of the Group.

RISKS RELATING TO OUR OPERATIONS

We currently operate only two mines, which account for all of our ore reserves.

We currently have only two operating gold mines, Simberi and Gold Ridge, in Papua New Guinea, or PNG, and Solomon Islands, respectively. Any event leading to a reduction in production or closure of either mine may have a material adverse effect on our financial performance and results of operations.

Simberi and Gold Ridge account for all of our ore reserves and the potential for the future generation of revenue. Any adverse development affecting the progress of Simberi or Gold Ridge may have a material adverse effect on our financial performance and results of operations. These developments include, but are not limited to, unusual and unexpected geologic formations, seismic activity, rock bursts, cave-ins, flooding and other conditions involved in the drilling and removal of material, any of which could result in damage to, or destruction of, mines and other producing facilities, damage to life or property, environmental damage, hiring suitable personnel and engineering contractors, or securing supply agreements on commercially suitable terms.

Our mining operations have a limited operating history.

We have a limited history of mining operations on which to base assessment of our future expected performance, and there can be no assurance that we will earn significant revenues or achieve significant

4

profitability, which in turn could impact on our ability to sustain operations or obtain any additional funds we may require. The costs, timing and complexities of mine construction and development are increased by the remote location of our mining properties. In addition, delays in the commencement of mineral production often occur. Accordingly, our actual results may be subject to greater variability than would be the case for a company with a longer history of mining operations and it could be more difficult to predict our future operating costs and results of operations accurately. Other factors mentioned in this section entitled “D. Risk Factors” may also prevent us from successfully operating our mining projects.

We depend on our key personnel. If we are unable to attract and retain key personnel, our business may be materially adversely affected.

The success of our operations and activities is dependent to a significant extent upon the contributions of a number of our management and our highly skilled team of contractors. There can be no certainty that the services of such key personnel will continue to be available to us. Factors critical to retaining our present staff and attracting and recruiting additionally highly qualified personnel include, inter alia, our ability to provide competitive compensation arrangements. If we are not successful in retaining or attracting highly qualified individuals in key management positions or highly skilled contractors, our business may be materially adversely affected. Investors must be willing to rely to a significant extent on management’s discretion and judgment, as well as the expertise and competence of outside contractors. We do not have in place formal programs for succession of management and training of management, nor do we hold key person insurance on these individuals.

Furthermore, as a result of the shortage of higher education in certain of the jurisdictions in which we operate, we may find it difficult to acquire the qualified or trained and skilled labor upon which we are dependent. To the extent that we are unable to recruit and retain such skilled labor this could result in a decrease in our production or delays in the development of projects, which in turn could have a material adverse effect on our results of operations and financial condition.

We are reliant on a certain level of expatriate expertise to ensure efficient operations and management. We depend on government approval of work permits for expatriate positions and if this were to be refused, our management and operations would be adversely affected.

Currency fluctuations may affect the costs that we incur in our operations and may also impact on our revenue.

Our revenue from gold sales is received in U.S. dollars, while a significant portion of our operating expenses will be incurred in Australian dollars, PNG Kina, or PGK, Solomon Islands dollar, or SBD, and other foreign currencies. From time to time, we will borrow funds and will incur capital expenditures that may be denominated in foreign currencies other than the U.S. dollar. The appreciation of non-U.S. dollar currencies in which we transact could materially and adversely affect our profitability, results of operations and financial position. As we generate revenues and incur operating expenses, we will be exposed to currency translation risk on those revenues to the extent not mitigated by costs based on the U.S. dollar and to the extent we do not seek to hedge our currency exposure in the financial markets.

We have a history of operating losses and there can be no assurance that we will be profitable in the future.

Our operations have not consistently generated an operating profit after tax, and there can be no assurance that we can achieve or sustain profitability on a quarterly or annual basis in the future. Our operations and projects are subject to the risks and competition inherent in the establishment of a mining enterprise. There can be no assurance that future operations will be profitable. We may not achieve our business objectives and the failure to achieve such goals would have an adverse impact on us.

Insofar as certain Directors hold similar positions with other mineral resource companies, conflicts may arise between the obligations of these Directors to us and to such other mineral resource companies.

Certain Directors are, and may continue to be, involved in the mining and mineral exploration industry through their direct and indirect participation in corporations, partnerships or joint ventures, which are potential competitors of ours. Situations may arise in connection with potential acquisitions in investments where the other interests of these directors and officers may conflict with our interests. Directors with conflicts of interest will be subject to and will follow the procedures set out in applicable corporate and securities legislation, regulations, rules and policies.

For a list of the positions that each of the Directors holds with other companies and partnerships, please refer to “Item 6.A. – Directors and Senior Management”.

5

Estimates and assumptions used in preparing our consolidated financial statements and actual amounts could differ.

Preparation of the consolidated financial statements requires us to use estimates and assumptions. Accounting for estimates requires us to use our judgment to determine the amount to be recorded on our financial statements in connection with these estimates. On an ongoing basis, we re-evaluate our estimates and assumptions. However, the actual amounts could differ from those based on estimates and assumptions.

We have experienced problems with our internal controls over financial reporting. If we fail to develop and maintain an effective system of internal controls, we may be unable to accurately report our financial results or prevent fraud, which could harm our business and result in the loss of investor confidence in our financial reporting.

Effective internal controls are necessary for us to provide accurate and timely financial reports and effectively prevent fraud. We discovered in the past, and may in the future discover, areas of our internal controls involving deficiencies, significant deficiencies or material weaknesses that have required or will require improvements in our procedures on the preparation, review, approval and disclosure of financial reports. For example, we have not filed annual financial statements with the SEC since the fiscal year ended June 30, 2009.

We are subject to reporting obligations under the U.S. securities laws. The SEC, as required by Section 404 of the Sarbanes-Oxley Act of 2002, adopted rules requiring every public company to include a management report on such company’s internal control over financial reporting in its annual report, which contains management’s assessment of the effectiveness of the company’s internal control over financial reporting. In addition, an independent registered public accounting firm must attest to and report on management’s assessment of the effectiveness of a company’s internal control over financial reporting. Our management may conclude that our internal control over our financial reporting is not effective. Moreover, even if our management concludes that our internal control over financial reporting is effective, our independent registered public accounting firm may still decline to attest to our management’s assessment or may issue a report that is qualified if it is not satisfied with our controls or the level at which our controls are documented, designed, operated or reviewed, or if it interprets the relevant requirements differently than we do.

If we fail to maintain the adequacy of our internal controls, as such standards are modified, supplemented or amended from time to time, we may not be able to provide accurate financial statements, which could cause us to fail to meet our reporting obligations or provide accurate financial statements.

Actual capital costs, operating costs and economic returns for Simberi and Gold Ridge may differ significantly from those that we have anticipated, and there are no assurances that any future development activities will result in profitable mining operations.

The capital costs for Simberi and Gold Ridge may be significantly higher than anticipated. Gold Ridge does not have an extensive operating history upon which we can base estimates of future operating costs. Decisions about the development of this and other mineral properties will ultimately be based upon feasibility studies. Feasibility studies derive estimates of cash operating costs based upon, among other things:

| | • | | anticipated tonnage, grades and metallurgical characteristics of the ore to be mined and processed; |

| | • | | anticipated recovery rates of gold and other metals from the ore; |

| | • | | cash operating costs of comparable facilities and equipment; and |

| | • | | anticipated climatic conditions. |

Cash operating costs, production and economic returns, and other estimates contained in studies or estimates prepared by or for us may differ significantly from those anticipated by our current studies and estimates, and there can be no assurance that our actual operating costs will not be higher than currently anticipated.

Power stoppages and fluctuations and disruptions in electrical power could adversely affect our results of operations and our financial condition.

Our mining operations are heavily reliant on the availability of electricity. If we were to experience a major power failure, or any other interruption in our electricity supplies, gold production could continue for only a limited time, if at all. Such disruptions to our power supplies could have an adverse effect on our results of operations and financial condition.

6

The cost of electricity, particularly self-generated, can be unstable. An increase in power costs will make production more costly and alternative power sources may not be available.

Both Simberi and Gold Ridge rely on self-generation of electricity by diesel power generators located on site. The self-generation of electricity by diesel power generators is expensive, and the cost of such self-generation can fluctuate rapidly and significantly depending on the market price of diesel fuel. We are currently planning to convert the electricity generation system at Simberi to operate on heavy fuel oil, with the aim of reducing power generation costs. As with other mining sector inputs, we have historically been exposed to energy cost inflation. Any renewed increases in energy costs will adversely affect our results of operations or financial condition.

The profitability of operations and the cash flows generated by these operations are significantly affected by the fluctuations in the price, cost and supply of inputs.

Fuel, power and consumables, including diesel, steel, chemical reagents, explosives and tires, form a relatively large part of our operating costs. The cost of these consumables is impacted to varying degrees by fluctuations in the price of oil, exchange rates and the availability of supplies.

Such fluctuations have a significant impact on our operating costs and capital expenditure estimates and, in the absence of other economic fluctuations, could result in significant changes in the total expenditure estimates for mining projects, new and existing, and could even render certain projects non-viable.

Our success may depend on our social and environmental performance.

Our ability to operate successfully will likely depend on our ability to develop, operate and close mines in a manner that is consistent with the health, safety and well-being of our employees, the protection of the environment, and the creation of long-term economic and social opportunities in the communities in which we operate. We seek to promote improvements in health and safety, environmental performance and community relations. However, our ability to operate could be adversely impacted by accidents or events detrimental (or perceived to be detrimental) to the health, safety and well-being of our employees, the environment or the communities in which we operate.

Our business depends on good relations with our employees. A breakdown in these relations and/or restrictive labor and employment laws could have a material adverse impact on us.

Although management believes that labor relations with our employees are good, there can be no assurance that a work slowdown or a work stoppage will not occur at any of our operating units or exploration prospects. Future work slowdowns, stoppages, disputes with employee unions, or other labor-related developments or disputes could result in a decrease in our production levels and adverse publicity and/or increased costs, which could have a material adverse effect on our business, results of operations and financial condition. To assist with labor relations in the Solomon Islands, we have in place a collective labor agreement covering approximately 35% of our workforce in that jurisdiction.

We depend on a variety of information technology systems.

We depend on a variety of information technology and software systems for our operations, including management reporting and accounting systems. Failures or significant disruptions to our information technology systems could prevent us from conducting our operations efficiently. Were we to experience a significant security breakdown or other disruption to our information technology systems, sensitive information could be compromised and our operations could be disrupted, which could harm our relationship with suppliers or customers, or otherwise have a material adverse effect on our business, revenues, financial condition, results of operations or prospects.

In addition, our ability to operate our business depends on our ability to protect the information technology systems that we operate from the intrusion of third parties who may attempt to enter our systems through the internet or otherwise. Third parties may attempt to gain access to our systems, and we cannot be certain that we will be able to protect our systems from such attacks. If such attacks occur, some of the problems we may encounter include theft or destruction of our data, including commercial, financial and product information. In addition, disgruntled employees may cause similar damage to, or take similar actions with respect to, our information technology systems to which they have authorized or unauthorized access. If such an attack occurs or damage is inflicted, it could have a material adverse effect on our business, revenues, financial condition, results of operations or prospects or the trading price of the our shares.

7

Our current strategy may not develop as anticipated.

We regularly monitor potential investment opportunities in the gold mining industry. If we do not acquire and successfully integrate additional gold mining operations, we may not be able to maintain our production levels. If we do acquire additional gold mining operations, the acquisition and integration of new businesses will pose significant risks to our operations. These risks include the difficulty of integrating the operations and personnel of the acquired business, problems with minority shareholders in acquired companies and their material subsidiaries, the potential disruption of current business, the assumption of liabilities, including in relation to tax and environmental matters, relating to the acquired assets or businesses, the possibility that warranty protection from, or indemnification agreements with, the sellers of those assets may be unenforceable or insufficient to cover potential tax or other liabilities, the difficulty of implementing effective management, financial and accounting systems and controls over acquired businesses, the imposition and maintenance of common standards, controls, procedures and policies, and the impairment of relationships with employees and counterparties as a result of difficulties arising out of integration.

Furthermore, even if we successfully integrate new businesses, expected synergies and cost savings may not materialize, resulting in lower than expected profit margins. The value of any business that we acquire or invest in may be less than the amount we pay for it if, for example, there is a decline in the price of gold or ore reserves estimates. When making acquisitions, it may not be possible for us to conduct a detailed investigation of the nature or title of the assets being acquired, for example, due to time constraints in making the decision. We may also become responsible for additional liabilities or obligations not foreseen at the time of an acquisition. As a result, unforeseen expenditures may arise which may have a material adverse effect on our business, revenues, financial condition, results of operations or prospects.

RISKS RELATING TO THE GOLD MINING INDUSTRY GENERALLY

The business of mining metals involves a number of risks and hazards, many of which are outside our control.

To maintain future gold production beyond the life of the current reserves or to increase production materially through mining new deposits, we need to extend our mineral base through geological exploration, which may result in adverse environmental consequences for our operations. Our mining operations are subject to all the hazards and risks normally encountered in the exploration for and development and production of precious metals, including unusual and unexpected geologic formations, seismic activity, rock bursts, cave-ins, flooding, variations in grade, deposit size, density and other geological problems, hydrological conditions, metallurgical and other processing problems, mechanical equipment performance problems, the unavailability of materials and equipment including fuel, labor force disruptions, unanticipated transportation costs, unanticipated regulatory changes, unanticipated or significant changes in the costs of supplies including, but not limited to, petroleum, and adverse weather conditions and other conditions involved in the drilling and removal of material, any of which could result in damage to, or destruction of, mines and other producing facilities, damage to life or property, environmental damage, business interruption and delays in mining, asset write-downs, monetary losses, and possible legal liability, and may result in actual production differing, potentially materially, from estimates of production, including those contained in this report, whether expressly or by implication. Should any of these risks and hazards affect any of our proposed mining operations, it may cause the cost of production to increase to a point where it would no longer be economic to produce gold from our mineral reserves, which would have a material and adverse effect on our financial condition, results of operation, and cash flows.

Our ore reserves are only estimates.

Like any mining company, our financial condition depends on our ore reserves. The ore reserves stated in this report represent the amount of gold that we estimated, as of December 31, 2011, could be economically and legally extracted or produced at the time of the ore reserve determination. Ore reserves estimates of mining companies are inherently imprecise and depend to some extent on statistical inferences drawn from limited drilling and other testing, which may ultimately prove unreliable. Such estimates should not be interpreted as an assurance of the profitability of our operations in the future. Until ore reserves are actually mined and processed, the quantity of ore mineral reserve grades must be considered as estimates only. In addition, the quantity of ore reserves may vary depending on, among other things, metal prices and currency exchange rates. Any material change in the quantity of ore reserves, grade or stripping ratio may affect the economic viability of our properties. Declines in market prices of gold could render the mining of our deposits uneconomic. In addition, there can be no assurance that gold recoveries or other metal recoveries in small scale laboratory tests will be duplicated in larger scale tests under on-site conditions or during production. Results of drilling, metallurgical testing and production and the evaluation of mine plans subsequent to the date of any estimate may require revision of such estimate. The volume and grade of ore reserves mined and processed and recovery rates may not be the same as currently anticipated. Any material reductions in estimates of ore reserves, or of our ability to extract these ore reserves, could have a material adverse effect on our results of operations and financial

8

condition. Also, a reduction in estimated ore reserves could require material write-downs in investment in the affected mining property and increased amortization, reclamation and closure charges. Alternatively, if our ore reserves exceed current forecasts, it cannot be assured that we will be able to develop the production capacity to exploit commercially those ore reserves.

We may not achieve our production estimates.

We prepare estimates of future production for particular operations. No assurance can be given that future estimates will be achieved. Our production may vary from estimates for a variety of reasons, including actual ore mined varying from estimates of grade, tonnage and other characteristics. Short-term operating factors may also be relevant such as those relating to the ore reserves, revisions to mine plans and risks associated with mining, such as inclement weather conditions, water availability and unexpected labor shortages or strikes.

If we fail to acquire or find and develop additional ore reserves, our ore reserves and production will decline from their current levels over time.

Except to the extent that we conduct successful exploration and development activities or acquire further properties/licenses containing reserves or both, our reserves will decline as gold is produced.

The life-of-mine estimates included in this report in respect of Simberi and Gold Ridge may not be achieved. Our ability to maintain or increase our annual production of gold in the future will be dependent in significant part on our ability to bring new mines into production and to expand mineral reserves at existing mines. Both Simberi and Gold Ridge have a remaining life of over nine years from December 31, 2011 based only on proven and probable ore reserves.

Feasibility studies may be used to determine the economic viability of a deposit. Many factors are involved in the determination of the economic viability of a deposit, including the achievement of satisfactory ore reserve estimates, the level of estimated metallurgical recoveries, capital and operating cost estimates and the estimate of future gold prices. Capital and operating cost estimates are based upon many factors, including anticipated tonnage and grades of ore to be mined and processed, the configuration of the ore body, ground and mining conditions, expected recovery rates of the gold from the ore, anticipated environmental and regulatory compliance costs and mining consumables and capital equipment costs. Each of these factors involves uncertainties and as a result we cannot give assurance that our development or exploration projects will become operating mines. If a mine is developed, actual operating results may differ from those anticipated, thereby impacting on the economic viability of the project.

We may experience delays in receiving permits, licenses, consents or other regulatory approval.

Our business depends on the continuing validity of some of our licenses, the renewal of our licenses, and our compliance with the terms of our licenses. The legal and regulatory basis for the licensing requirements is subject to frequent change, which increases the risk that we may be found non-compliant.

The business of mineral exploration, project development, mining and processing is subject to various national and local laws and plans relating to: permitting and maintenance of title, environmental consents, taxation, employee relations, heritage/historic matters, health and safety, royalties, land acquisition, and other matters. There is a risk that the necessary permits, consents, authorizations and agreements to implement planned exploration, project development, or mining may not be obtained under conditions or within time frames that make such plans economic, that applicable laws, regulations or the governing authorities will change or that such changes will result in additional material expenditures or time delays.

Our leases may not be renewed at all or may be renewed only on terms and/or conditions which are unacceptable or impractical to us.

Our leases are due to expire on the following dates:

| | • | | ML 136 (Simberi), December 2, 2018; |

| | • | | GRML Mining Lease (Gold Ridge), March 11, 2022; and |

| | • | | SPL 194 (Gold Ridge) is an exclusive prospecting license which has no fixed expiry date, but which will expire upon the “commencement of preliminary works” as defined in the assignment agreement dated May 12, 2005 pursuant to which the license was granted to us. |

Renewal of these licenses is outside of our control, and such renewal cannot be guaranteed. Further, renewal may only be granted on terms or subject to conditions that are commercially or operationally unacceptable or impractical to us. Should this occur, this could have a material adverse effect on our business, prospects, financial condition and results of operations.

9

In particular, EL609 held by us in relation to Simberi has an expiry of May 5, 2013, and at the date of the filing of this report is the subject of an application for renewal for an additional two-year term, which has not yet been processed, failing which our rights to EL609 may be forfeited. Although we have no reason to believe that EL609 will not be renewed for an additional two-year term, there can be no assurance that this will be the case.

Any failure to renew EL609 may have a material adverse effect on the market price of the Ordinary Shares due to the loss of any perceived exploration upside, but will have no effect on our current production or operations. Pending its renewal, EL609 is held over on a statutory basis in favor of the license holder, Nord Australex Nominees (PNG) Ltd.

Our properties are subject to environmental risks.

Mining operations have inherent risks and liabilities associated with pollution of the environment and the disposal of waste products occurring as a result of mineral exploration and production. Environmental hazards may exist on the properties on which we hold interests, which hazards are unknown to us at present and which may have been caused by previous or existing owners or operators of the properties. Reclamation costs are uncertain and planned expenditures may differ from the actual expenditures required.

We are subject to significant environmental regulations.

Our operations involve the use of environmentally hazardous materials as well as the discharge of materials and contaminants into the environment, disturbance of land, and other environmental concerns. Our activities are subject to significant environmental regulations promulgated by relevant governmental authorities and other agencies periodically. Environmental legislation generally provides for the remediation of mining sites which may require significant capital expenditure. These laws and regulations, as interpreted by relevant agencies and courts, impose increasingly stringent environmental protection standards regarding, among other things, air emissions, wastewater storage, treatment and discharges, the use and handling of hazardous or toxic materials, waste disposal practices and remediation of environmental contamination. The costs of complying with these laws and regulations, including participation in assessments and remediation of sites, could be significant. In addition, these standards can create the risk of substantial environmental liabilities, including liabilities associated with divested assets and past activities. Environmental matters cannot be predicted with certainty, and amounts required to establish and maintain adequate provision for environmental liabilities may be significant, especially in light of potential changes in environmental conditions or the discovery of previously unknown environmental conditions, the risk of governmental orders to carry out compliance on certain sites not initially included in remediation in progress, and our potential liability to remediate sites for which provisions have not been previously established. Such future developments could result in increased environmental costs and liabilities that could have a material adverse effect on our business, assets, financial position and results of operations.

Our insurance coverage does not cover all of our potential losses, liabilities and damages related to our business and certain risks are uninsured or uninsurable.

Our business is subject to a number of risks and hazards generally, including adverse environmental conditions, industrial accidents, labor disputes or slowdowns, unusual or unexpected geological conditions, ground or slope failures, cave-ins, changes in the regulatory environment or laws, and natural phenomena such as inclement weather conditions, floods and earthquakes. Such occurrences could result in damage to mineral properties or production facilities, personal injury or death, environmental damage to our properties or the properties of others, delays in development or mining, monetary losses and possible legal liability.

Although we maintain insurance to protect against certain risks in such amounts as we consider to be reasonable, our insurance will not cover all the potential risks associated with our operations. We may also be unable to maintain insurance to cover these risks at economically feasible premiums. Insurance coverage may not continue to be available or may not be adequate to cover any resulting liability. Moreover, insurance against risks such as environmental pollution or other hazards as a result of exploration and production is not generally available to us or to other companies in the mining industry on acceptable terms. We might also become subject to liability for pollution or other hazards which may not be insured against or which we may elect not to insure against because of premium costs or other reasons. Losses from these events may cause us to incur significant costs that could have a material adverse effect on our financial performance and results of operations.

10

Our business requires substantial capital expenditure and lead times to operation which in the longer term may require external financing that may not be available.

The mining business is capital intensive, and the development and exploration of gold and the acquisition of the related machinery and equipment require substantial capital expenditure and lead times until such machinery and equipment is operational. Further exploration and development in the future may be dependent upon our ability to obtain financing through the raising of additional equity or debt financing or other means.

We may from time to time need to raise funds through the issuance of equity securities or the issuance of debt instruments or other securities convertible into Ordinary Shares in order to finance future operations and developments. Our ability to secure debt or equity financing in amounts sufficient to meet our financial needs could be adversely affected by many factors beyond our control, including, but not limited to, economic conditions in Melanesia and the state of the banking sector. Any additional equity financing may be dilutive to existing shareholders, and debt financing, if available, may involve restrictions on financing and operating activities. There can be no assurance that additional funding we require will be made available to us and, if such funding is available, that it will be offered on reasonable terms. If we are unable to obtain additional financing as needed, we may be required to reduce the scope of our operations or anticipated expansion, which may have a material adverse effect on our business, revenues, financial condition, results of operations or prospects.

Increased competition could adversely affect our ability to attract the necessary capital funding or acquire suitable producing properties or prospects for mineral exploration in the future.

Competition in the gold exploration, mining and production business is intense and could adversely affect our ability to develop our properties. We compete with numerous individuals and companies, including major mining companies, many of which have greater financial and operational resources than us. There is a high degree of competition for the discovery and acquisition of properties considered to have commercial potential. We compete with other mining companies for the acquisition of mineral claims, leases and other mineral interests as well as for the recruitment and retention of qualified employees and other personnel. The intensity of competition, combined with the cyclicality and unpredictability of the gold market, results in significant variations in economic performance, which may lead to a change in our strategy.

Further, the recent marked increase in activity in the global mining industry has led to excess demand for key production inputs, such as heavy vehicles, chemicals and specialist contractors, resulting in unavailability of, or long lead times for, plant, equipment and services and/or material increases in the prices at which such inputs can be obtained. As a result, we may be unable to continue to source such inputs on commercially acceptable terms, or at all, or may experience significant delays in doing so, any of which could have a material adverse effect on our ability to develop Simberi and/or Gold Ridge on schedule, within budget, or at all, and on our business, costs, results of operations and overall financial condition.

Precious metal exploration projects may not be successful and are highly speculative in nature.

The exploration for, and development of, precious metals involves significant risks which even a combination of careful evaluation, experience and knowledge cannot eliminate. While the discovery of a precious metal deposit may result in substantial rewards, few properties which are explored are ultimately profitable. Major expenses may be required to locate and establish mineral reserves, to develop metallurgical processes and to construct mining and processing facilities at a particular site. Whether a precious metal deposit will be commercially viable depends on a number of factors, some of which are: the particular attributes of the deposit, such as size, grade and proximity to infrastructure; metal prices which are highly cyclical; and government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of precious metals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in us not receiving an adequate return on invested capital. There is no certainty that the expenditures we made towards the search and evaluation of precious metal deposits will result in discoveries of commercial quantities of such metals.

Land reclamation requirements for exploration properties may be burdensome and may divert funds from our exploration programs.

Although variable, depending on location and the governing authority, land reclamation requirements are generally imposed on mineral exploration companies, as well as companies with mining operations, in order to minimize long term effects of land disturbance. Reclamation may include requirements to control dispersion of potentially deleterious effluents and to reasonably re-establish pre-disturbance land forms and vegetation. In order to carry out reclamation obligations imposed on us in connection with our mineral exploration, we must allocate financial resources that might otherwise be spent on further exploration programs.

11

Gold price volatility may affect our future production, profitability, financial position and financial condition.

We derive substantially all of our revenues from the sale of gold. We generally sell our products on the spot market at market prices. Accordingly, our financial results largely depend on the price of gold. The gold market is cyclical and sensitive to changes in general economic conditions, and may be subject to significant volatility. The development and success of Simberi and Gold Ridge will be primarily dependent on the future price of gold. Gold prices are subject to significant fluctuation and are affected by a number of factors which are beyond our control.

Such factors include, but are not limited to, interest rates, exchange rates, inflation or deflation, fluctuation in the value of the U.S. dollar and foreign currencies, global and regional supply and demand, and the political and economic conditions of major gold-producing countries throughout the world. The price of gold and other base and precious metals has fluctuated widely in recent years, and future serious price declines could cause continued development of, and commercial production from, our properties to be impracticable or uneconomic. Depending on the price of gold and other base metals, projected cash flow from planned mining operations may not be sufficient, and we could be forced to discontinue development and may lose its interest in, or may be forced to sell, some of our properties. Future production from our mining properties is dependent on gold prices that are adequate to make these properties economically viable. Furthermore, reserve calculations and life-of-mine plans using significantly lower gold prices could result in material write-downs of our investment in mining properties and increased amortization, reclamation and closure charges. In addition to adversely affecting our mineral reserve estimates and our financial condition, declining commodity prices can impact operations by requiring a reassessment of the feasibility of a particular project. Such a reassessment may be the result of a management decision or may be required under financing arrangements related to a particular project. Even if the project is ultimately determined to be economically viable, the need to conduct such a reassessment may cause substantial delays or may interrupt operations until the reassessment can be completed.

Our operations are subject to extensive governmental and environmental regulations, which could cause us to incur costs that adversely affect our results of operations.

Our mining facilities and operations are subject to a significant number of laws and government regulations, concerning taxation, the employment of expatriates, labor standards, mine safety, land use, environmental protection and historic and cultural preservation. We must comply with requirements regarding exploration operations, public safety, employee health and safety, use of explosives and other hazardous materials, air quality, water pollution, noxious odor, noise and dust controls, reclamation, solid waste, hazardous waste and wildlife as well as laws protecting the rights of other property owners and the public.

Any failure on our part to comply with these laws, regulations, and requirements with respect to our properties and/or operations could result in us being subject to substantial penalties, fees and expenses, significant delays in our operations or even the complete shutdown of our operations. Contravention of these laws and regulations could also lead to the imposition of criminal sanctions. The costs associated with compliance with government regulations may ultimately be material and adversely affect our results of operations and financial condition.

We are subject to extensive licensing and other legal and regulatory requirements, non-compliance with which may result in material adverse consequences for us.

Our current and future operations are subject to exploration, development, exploitation and mining licenses, leases, licenses, concessions and regulatory consents and approvals, collectively, Authorizations, from the government and regulatory authorities in the territories in which we operate.

While the Directors believe that we have obtained all Authorizations that are material in the context of our business as it is now conducted, there can be no assurance that we have every necessary or desirable Authorization, that the Authorizations required to carry on our operations will not change or that we will be able to successfully enforce our current Authorizations, or that we will obtain any additional Authorizations that may be required in the future. Certain Authorizations may, or may in the future, contain onerous conditions with which we may not be able to comply or on terms which include PNG or SIG participation, which may impact on our results, operations, or financial conditions or prospects. A failure to comply with an obligation in an Authorization may result in adverse consequences for us, including the termination of that Authorization.

There can also be no assurance that any existing or future Authorizations will be renewed following their expiry or that the terms of any such renewed Authorizations will be renewed following their expiry or that the terms of any such renewed Authorizations will be commercially acceptable. Obtaining new permits and rights or renewals of existing permits and rights can be a complex and time-consuming process and we cannot guarantee whether any necessary permits or rights will be obtained on acceptable terms, in a timely manner, or

12

at all. The costs and delays associated with obtaining necessary permits or rights (or renewals thereof) could stop, delay or restrict our operations and any planned development. Conditions may be imposed on such Authorizations that may affect the viability of operations at Simberi or Gold Ridge, including payment and any other obligations.

Failure to obtain, renew, enforce or comply with one or more Authorizations could have a material adverse effect on our prospects, business and results of operations.

We may face the risk of litigation in connection with our business and/or other activities.

We may from time to time face the risk of litigation in connection with our business and/or other activities. Recovery may be sought against us for large and/or indeterminate amounts and the existence and scope of liabilities may remain unknown for substantial periods of time. A substantial legal liability and/or an adverse ruling could have a material adverse effect on our business, results of operation and/or financial condition.

Global economic conditions could adversely affect the profitability of our operations.

Our operations and performance depend significantly on worldwide economic conditions. The recent turmoil affecting the banking system and financial markets has resulted in major financial institutions consolidating or going out of business, the tightening of credit markets, significantly lower liquidity in most financial markets, and extreme volatility in fixed income, credit, currency, commodities and equity markets. In addition, general economic indicators have deteriorated, including declining consumer sentiment, increased unemployment and declining or negative economic growth and uncertainty regarding corporate earnings.

These disruptions in the financial markets and the global economic downturn may have follow-on material adverse effects on our business, results of operations and financial condition. For example:

| | • | | the insolvency of key suppliers could result in a supply chain break-down; |

| | • | | the reduced creditworthiness and possible insolvency of key customers for concentrate could result in lower sales and revenue; |

| | • | | the absence of available credit may make it more difficult for us to obtain, or may increase the cost of obtaining, financing for our operations and capital expenditures; and |

| | • | | the market value of the Ordinary Shares may become volatile. |

Adverse publicity from consumer and environmental groups could have an adverse effect on our reputation and financial position.

There is an increasing level of consumer awareness relating to the effect of mining exploration and production on its surroundings, communities and the environment. Consumer and environmental groups therefore exist to encourage participants in the mining industry to employ practices which minimize any adverse impact that mining may have on communities, workers and the environment and also to lobby governments for the introduction of additional environmental and social policies, regulation and legislation. While we seek to operate in a socially responsible manner, changes to governmental policy and adverse publicity generated by such consumer groups, which either relate to the gold mining industry as a whole or to us in particular, could have an adverse effect on our reputation and financial position.

RISKS RELATING TO THE TERRITORIES IN WHICH WE OPERATE

Emerging markets such as those in which we currently operate are subject to greater risks than more developed markets and any material adverse effect on the economies of such markets could disrupt our business.

Generally, investment in companies with a significant proportion of their assets located in emerging markets is only suitable for sophisticated investors who fully appreciate the significance of the risks involved in, and are familiar with, investing in such companies. Emerging markets such as those in which we currently operate are subject to rapid change, and the information set forth in this report may become out of date relatively quickly. Moreover, financial turmoil in any emerging market country tends to adversely affect prices in equity markets of all emerging market countries as investors move their money to more stable, developed markets. In the event that there is an economic crisis in any of the jurisdictions in which we operate, we may face severe difficulties in the operation of its business and the value of our assets in such jurisdictions may decrease, resulting in a material adverse effect on our financial condition.

13

Exchange control regimes in PNG and the Solomon Islands may prevent us from converting funds into foreign currencies to meet obligations or pay dividends.

Both PNG and the Solomon Islands retain certain controls on foreign exchange transactions. Although these regulations have been substantially relaxed in both jurisdictions as the PNG and Solomon Islands central banks move to a more liberal foreign exchange regime, there remains a risk that if we were to hold PGK or SBD we may not be able to convert these funds into foreign currency when required to meet our obligations or to pay dividends to Shareholders outside PNG or the Solomon Islands without the appropriate authority’s prior approval.

We currently have in place approvals that permit us to operate foreign currency bank accounts and hold and exchange currencies in accordance with our business and liquidity requirements. Should the central bank in either PNG or the Solomon Islands alter our existing foreign exchange approvals, there is a risk that we may be forced to hold PGK or SBD and that we may not be able convert these funds into foreign currency when required to meet our obligations outside PNG or the Solomon Islands without the appropriate authority’s prior approval.

Our current and proposed exploration and mining activities are in PNG and the Solomon Islands. Investments and operations in PNG and the Solomon Islands are subject to numerous risks associated with operating in those jurisdictions.

We are conducting our exploration and development activities predominantly in PNG and the Solomon Islands, and as such our foreign mining investments are subject to the risks normally associated with the conduct of business in foreign countries. The occurrence of one or more of these risks could have a material adverse effect on our profitability or the viability of our affected foreign operations, which could have a material adverse effect on our future cash flows, earnings, results of operations and financial condition. Risks may include, among others, labor disputes, invalidation of governmental orders and permits, uncertain political and economic environments, sovereign risk, war (including in neighboring states), civil disturbances and terrorist actions, arbitrary changes in laws or policies of particular countries, the failure of foreign parties to honor contractual relations, corruption, foreign taxation, delays in obtaining or the inability to obtain necessary governmental permits, opposition to mining from environmental or other non-governmental organizations, limitations on foreign ownership, limitations on the repatriation of earnings, limitations on gold exports, instability due to economic under-development, inadequate infrastructure and increased financing costs. In addition, the enforcement by us of our legal rights to exploit our properties may not be recognized by the governments of PNG or the Solomon Islands or by the court systems in those jurisdictions. These risks may limit or disrupt our operations, restrict the movement of funds or result in the deprivation of contractual rights or the taking of property by nationalization or expropriation without fair compensation.

The possibility that the current, or future, governments of PNG or the Solomon Islands may adopt substantially different policies in respect of foreign development and ownership of mineral resources, take arbitrary action which might halt production, extend to the re-nationalization of private assets or the cancellation of contracts, the cancellation of mining and exploration rights and/or changes in taxation treatment cannot be ruled out, the happening of any of which could result in a material and adverse effect on our results of operations and financial condition.

The successful development and operation of our assets depends on adequate infrastructure.

Our principal operations are located in remote areas that are difficult to access, some of which have harsh climates, resulting in technical challenges and logistical challenges for conducting both geological exploration and mining. Reliable roads, bridges, power sources and water supplies are important determinants which affect capital and operating costs and our ability to maintain expected levels of progress with our exploration activities. Unusual weather or other natural phenomena, sabotage or government or other interference in the maintenance or provision of such infrastructure could impact on the development of our projects and effective supply chain management, increase exploration costs or delay the transportation of supplies, equipment or machinery to our projects. Any such issues in respect of our supply chain and/or infrastructure supporting our projects could materially and adversely affect our business, results of operations, financial condition and prospects.

Communications infrastructure at our projects is primarily comprised of satellite links provided by a third party service provider, Pactel International Pty Ltd. Communication by means of satellite link is subject to service interruptions caused by, among other factors, climatic conditions, solar activity and equipment failure. Such communications outages can, in certain cases, be predicted but can also happen without warning. Prolonged communications black-outs may disrupt our operations at Simberi and Gold Ridge and affect our ability to continue to efficiently explore and develop those properties.

14

There is a possibility of shipping delays and storage capacity problems at Port Moresby, Lae and other wharves through which we may need to ship goods. There are presently problems with port congestion in Port Moresby, and delays could have a material effect on our operations and our financial performance. However, to date, we have not experienced any material problems.

Our Gold Ridge operations are heavily dependent on air transport for personnel, smaller freight and gold dore. We have sought to ensure reliance in air transport services by contracting an air transport provider with a substantial fleet of common aircraft of mature design. A risk remains that if this service provider does not operate for any reason, due to a limited number of alternative providers, air transport disruptions may occur.

Operational failures, the impact of climatic conditions and other unscheduled interruptions could have a material adverse impact on the financial performance of our operations.

The achievement of our operational targets will be subject to the completion of planned operational goals on time and according to budget, and will be dependent on the effective support of our personnel, systems, procedures and controls. Any failure of these may result in delays in the achievement of operational targets with a consequent material adverse impact on our business, operations and financial performance.

The location of our assets means that geological activity and climatic conditions may have an impact on operations and, in particular, severe weather could disrupt operations, including the delivery of supplies, equipment and fuel. Both PNG and the Solomon Islands experience severe volcanic activity and frequent seismological activity, such as earthquakes, tremors and tsunamis. It is, therefore, possible that exploration and extraction activity levels may fall or cease completely as a result of such meteorological and/or geological factors.

The countries in which we operate are susceptible to seasonal rains and rainfall caused by tropical cyclones. Such rains, if heavy and sustained, could limit our mining operations and further hinder the supply of resources to such assets resulting in a material adverse effect on gold exploration during such periods.

Unscheduled interruptions in our operations due to mechanical or other failures or industrial relations related issues or problems or issues with the supply of goods or services may occur and could have a material adverse impact on the financial performance of those operations.

External perceptions of PNG and the Solomon Islands may adversely affect the market price of securities of companies operating in PNG and the Solomon Islands, including the Ordinary Shares, and increase our cost of capital.

External perceptions of PNG and the Solomon Islands with respect to political and economic instability and civil unrest may have an adverse effect on the market value of securities of issuers operating in PNG and the Solomon Islands, including the Ordinary Shares. This could adversely affect the market price of the Ordinary Shares, and could also make it more difficult for us to gain access to the capital markets and finance our operations in the future on acceptable terms or at all and otherwise have a material adverse effect on our business.

The legal systems of PNG and the Solomon Islands are less developed than those of other jurisdictions and may offer less certainty as to judicial outcome or less effective forms of redress.

PNG and the Solomon Islands have less developed legal systems than those of other jurisdictions, such as Australia, the United Kingdom, and the United States, which may result in risks such as:

| | • | | potential difficulties in obtaining effective legal redress in the courts of PNG and/or the Solomon Islands, whether in respect of a breach of law or regulation, or in an ownership dispute; |

| | • | | a higher degree of discretion on the part of governmental authorities; |

| | • | | a lack of judicial or administrative guidance on interpreting applicable rules and regulations; |

| | • | | inconsistencies or conflicts between and within various laws, regulations, decrees, orders and resolutions; or |

| | • | | the relative inexperience of the judiciary and courts in such matters. |

The commitments of local business people, government officials and agencies and the judicial system to abide by legal requirements and negotiated agreements may be more uncertain, creating particular concerns with respect to licenses and agreements for business. These may be susceptible to revision or cancellation and legal redress may be uncertain or delayed.

15

Civil unrest in PNG and/or the Solomon Islands may disrupt our operations in those territories.

There have been instances of civil unrest and insurrection within PNG and the Solomon Islands in the past. Although the Directors believe that the risk of future civil insurrection on Simberi Island, the Tabar Islands in general or on Guadalcanal Island is unlikely, there can be no assurance that the people of those regions will not disrupt operations at our mine sites in the future.

Sporadic outbreaks of tribal fighting in PNG are a normal occurrence, especially near Port Moresby and in the Highlands Provinces (particularly the Southern and Western Highlands and Enga Provinces). There have also been outbreaks of violence and looting against local Asian-owned businesses in Port Moresby, Mount Hagen and several other population centers across PNG.

In late 1998, the Solomon Islands entered into a period of prolonged ethnic tension, known as the tensions. The tensions included a paramilitary coup in June 2000 and a change of government. Peace was brokered through what is known as the Townsville Peace Accord in October 2000. However, following the signing of the Peace Accord there was a breakdown in law and order accompanied by a severe economic recession. During this period many overseas investors withdrew from the Solomon Islands.

In July 2003, the Regional Assistance Mission to the Solomon Islands, or RAMSI, at the invitation of the SIG, intervened in the continuing tensions. RAMSI is led by Australia but has components from PNG and other pacific nations. Following the withdrawal of RAMSI there is a risk that the Solomon Islands could experience a renewed outbreak of ethnic violence and widespread lawlessness. If this were to happen, our operations at Gold Ridge may be disrupted.

Political instability in PNG and/or the Solomon Islands may disrupt our operations in those territories.

Our mining operations are subject to political, economic and other uncertainties, including the risk of civil rebellion, expropriation, nationalization, renegotiation or nullification of existing contracts, mining licenses and permits or other agreements, changes in laws or taxation policies, currency exchange restrictions, changing political conditions and international monetary fluctuations. Future PNG or Solomons Islands government actions concerning the economy or the operation and regulation of nationally important facilities such as mines could have a significant effect on the company. No assurances can be given that our operation will not be adversely affected by future developments in PNG or the Solomon Islands.

Fiscal and tax policy in PNG can be uncertain and subject to sudden changes. For example, the PNG government imposed and later replaced a 4% mining levy and 15% withholding tax on interest in 1998 and 1999. In addition to the PNG national government, PNG has a system of 19 provincial level governments, which are funded almost entirely by direct grants from the PNG national government. In the past, there have been disagreements between the PNG national government and the provincial level governments of PNG, primarily in relation to power sharing and revenue arrangements.

Land ownership disputes in PNG and/or the Solomon Islands may disrupt our operations in those territories.