- NWG Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

FWP Filing

NatWest (NWG) FWPFree writing prospectus

Filed: 8 Jun 15, 12:00am

Filed pursuant to Rule 433

Registration Statement Nos. 333-203157 and 333-203157-01

|

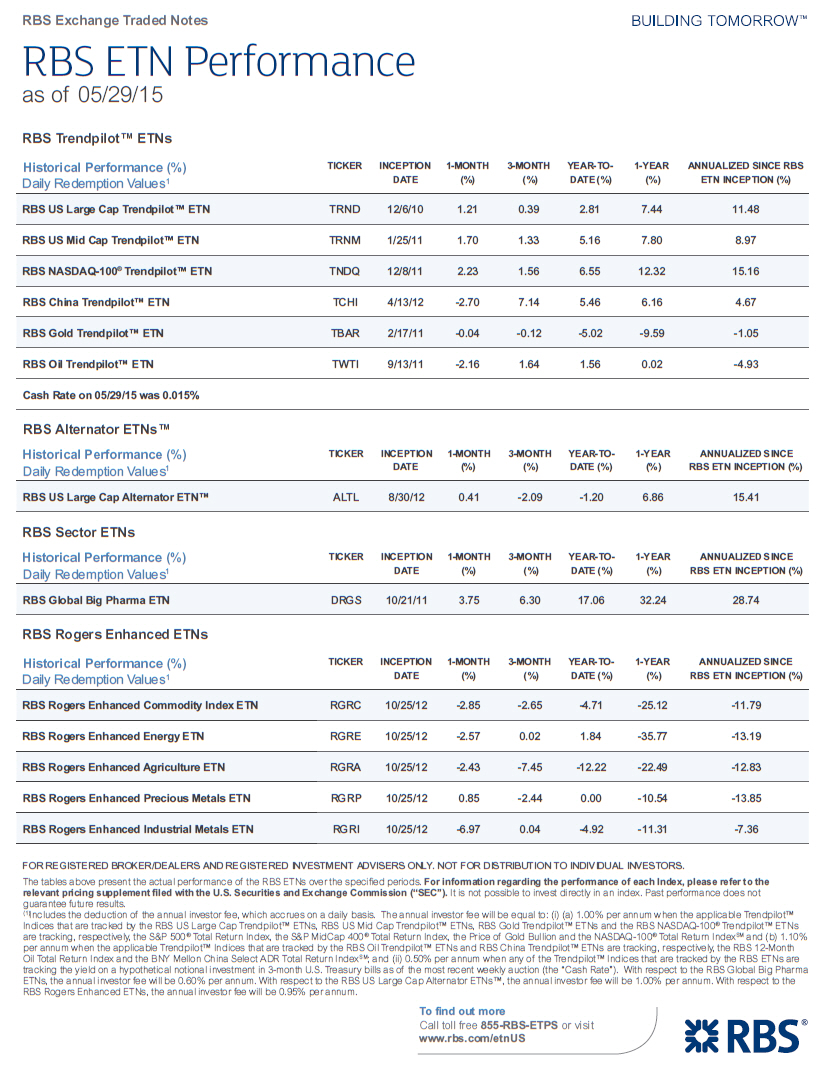

RBS Exchange Traded Notes

RBS ETN Performance

as of 05/29/15

RBS Trendpilot[] ETNs

Historical Performance (%) TICKER INCEPTION 1-MONTH 3-MONTH YEAR-TO- 1-YEAR ANNUALIZED SINCE RBS

Daily Redemption Values(1) DATE (%) (%) DATE (%) (%) ETN INCEPTION (%)

----------------------------------------- ------ --------- ------- ------- -------- ------ ---------------------

RBS US Large Cap Trendpilot[] ETN TRND 12/6/10 1.21 0.39 2.81 7.44 11.48

----------------------------------------- ------ --------- ------- ------- -------- ------ ---------------------

RBS US Mid Cap Trendpilot[] ETN TRNM 1/25/11 1.70 1.33 5.16 7.80 8.97

----------------------------------------- ------ --------- ------- ------- -------- ------ ---------------------

RBS NASDAQ-100([R]) Trendpilot[] ETN TNDQ 12/8/11 2.23 1.56 6.55 12.32 15.16

----------------------------------------- ------ --------- ------- ------- -------- ------ ---------------------

RBS China Trendpilot[] ETN TCHI 4/13/12 -2.70 7.14 5.46 6.16 4.67

----------------------------------------- ------ --------- ------- ------- -------- ------ ---------------------

RBS Gold Trendpilot[] ETN TBAR 2/17/11 -0.04 -0.12 -5.02 -9.59 -1.05

----------------------------------------- ------ --------- ------- ------- -------- ------ ---------------------

RBS Oil Trendpilot[] ETN TWTI 9/13/11 -2.16 1.64 1.56 0.02 -4.93

----------------------------------------- ------ --------- ------- ------- -------- ------ ---------------------

Cash Rate on 05/29/15 was 0.015%

----------------------------------------- ------ --------- ------- ------- -------- ------ ---------------------

RBS Alternator ETNs[]

Historical Performance (%) TICKER INCEPTION 1-MONTH 3-MONTH YEAR-TO- 1-YEAR ANNUALIZED SINCE

Daily Redemption Values(1) DATE (%) (%) DATE (%) (%) RBS ETN INCEPTION (%)

----------------------------------------- ------ --------- ------- ------- -------- ------ ---------------------

RBS US Large Cap Alternator ETN[] ALTL 8/30/12 0.41 -2.09 -1.20 6.86 15.41

----------------------------------------- ------ --------- ------- ------- -------- ------ ---------------------

RBS Sector ETNs

Historical Performance (%) TICKER INCEPTION 1-MONTH 3-MONTH YEAR-TO- 1-YEAR ANNUALIZED SINCE

Daily Redemption Values(1) DATE (%) (%) DATE (%) (%) RBS ETN INCEPTION (%)

----------------------------------------- ------ --------- ------- ------- -------- ------ ---------------------

RBS Global Big Pharma ETN DRGS 10/21/11 3.75 6.30 17.06 32.24 28.74

----------------------------------------- ------ --------- ------- ------- -------- ------ ---------------------

RBS Rogers Enhanced ETNs

Historical Performance (%) TICKER INCEPTION 1-MONTH 3-MONTH YEAR-TO- 1-YEAR ANNUALIZED SINCE

Daily Redemption Values(1) DATE (%) (%) DATE (%) (%) RBS ETN INCEPTION (%)

----------------------------------------- ------ --------- ------- ------- -------- ------ ---------------------

RBS Rogers Enhanced Commodity Index ETN RGRC 10/25/12 -2.85 -2.65 -4.71 -25.12 -11.79

----------------------------------------- ------ --------- ------- ------- -------- ------ ---------------------

RBS Rogers Enhanced Energy ETN RGRE 10/25/12 -2.57 0.02 1.84 -35.77 -13.19

----------------------------------------- ------ --------- ------- ------- -------- ------ ---------------------

RBS Rogers Enhanced Agriculture ETN RGRA 10/25/12 -2.43 -7.45 -12.22 -22.49 -12.83

----------------------------------------- ------ --------- ------- ------- -------- ------ ---------------------

RBS Rogers Enhanced Precious Metals ETN RGRP 10/25/12 0.85 -2.44 0.00 -10.54 -13.85

----------------------------------------- ------ --------- ------- ------- -------- ------ ---------------------

RBS Rogers Enhanced Industrial Metals ETN RGRI 10/25/12 -6.97 0.04 -4.92 -11.31 -7.36

FOR REGISTERED BROKER/DEALERS AND REGISTERED INVESTMENT ADVISERS ONLY. NOT FOR

DISTRIBUTION TO INDIVIDUAL INVESTORS.

The tables above present the actual performance of the RBS ETNs over the

specified periods. For information regarding the performance of each Index,

please refer to the relevant pricing supplement filed with the U.S. Securities

and Exchange Commission ("SEC"). It is not possible to invest directly in an

index. Past performance does not guarantee future results.

(1)Includes the deduction of the annual investor fee, which accrues on a daily

basis. The annual investor fee will be equal to: (i) (a) 1.00% per annum when

the applicable Trendpilot[] Indices that are tracked by the RBS US Large Cap

Trendpilot[] ETNs, RBS US Mid Cap Trendpilot[] ETNs, RBS Gold Trendpilot[] ETNs

and the RBS NASDAQ-100([R]) Trendpilot[] ETNs are tracking, respectively, the

SandP 500([R]) Total Return Index, the SandP MidCap 400([R]) Total Return Index,

the Price of Gold Bullion and the NASDAQ-100([R]) Total Return Index(SM) and

(b) 1.10% per annum when the applicable Trendpilot[] Indices that are tracked

by the RBS Oil Trendpilot[] ETNs and RBS China Trendpilot[] ETNs are tracking,

respectively, the RBS 12-Month Oil Total Return Index and the BNY Mellon China

Select ADR Total Return Index(SM); and (ii) 0.50% per annum when any of the

Trendpilot[] Indices that are tracked by the RBS ETNs are tracking the yield on

a hypothetical notional investment in 3-month U.S. Treasury bills as of the

most recent weekly auction (the "Cash Rate"). With respect to the RBS Global

Big Pharma ETNs, the annual investor fee will be 0.60% per annum. With respect

to the RBS US Large Cap Alternator ETNs[], the annual investor fee will be

1.00% per annum. With respect to the RBS Rogers Enhanced ETNs, the annual

investor fee will be 0.95% per annum.

To find out more

Call toll free 855-RBS-ETPS or visit www.rbs.com/etnUS

|

|

CERTAIN RISK CONSIDERATIONS: The RBS ETNs involve risks not associated with an

investment in conventional debt securities, including a possible loss of some

or all of your investment. The level of the relevant Index must increase by an

amount sufficient to offset the aggregate investor fee applicable to the RBS

ETNs in order for you to receive at least the principal amount of your

investment back at maturity or upon early repurchase or redemption. The

Benchmark Index for the RBS Global Big Pharma ETNs comprises securities of a

limited number of companies concentrated in the pharmaceuticals industry, and

may not be representative of an investment that provides exposure to the

pharmaceutical industry as a whole. The RBS Oil Trendpilot(TM) ETNs, the RBS

Rogers Enhanced ETNs and the respective indices that those ETNs track do not

provide exposure to spot prices of the relevant commodities and, consequently,

may not be representative of an investment that provides exposure to the

relevant commodities or buying and holding the relevant commodities. The prices

of commodities are volatile and are affected by numerous factors. Each

Trendpilot[] Index may underperform its respective Benchmark Index, and is

expected to perform poorly in volatile markets. The RBS China Trendpilot[] ETNs

involve risks associated with an investment in emerging markets, as well as

currency exchange risk. The RBS US Large Cap Alternator Index(TM) may

underperform the SandP 500([R]) Index or any Underlying Index. Even though the

RBS ETNs are listed on the NYSE Arca, a trading market may not develop and the

liquidity of the RBS ETNs may be limited and/or vary over time, as RBS plc is

not required to maintain any listing of the RBS ETNs. The intraday indicative

value and the daily redemption value are not the same as the trading price or

market price of the RBS ETNs in the secondary market. RBS plc has the right to

redeem the RBS ETNs, in its sole discretion. If RBS plc elects to redeem the

RBS ETNs, you may not be able to reinvest your proceeds in a comparable

investment. Pursuant to our announced plan to exit the structured retail

investor products business, the likelihood that we will redeem the RBS ETNs

prior to maturity has increased. See "Recent Developments" for more

information. The RBS ETNs are not principal protected and do not pay interest.

Any payment on the RBS ETNs is subject to the ability of RBS plc and RBS Group

to pay their respective obligations when they become due. You should carefully

consider whether the RBS ETNs are suited to your particular circumstances

before you decide to purchase them. We urge you to consult with your

investment, legal, accounting, tax and other advisors with respect to any

investment in the RBS ETNs.

The RBS ETNs are complex and not suitable for all investors. You should

carefully read the relevant pricing supplement and prospectus, including the

more detailed explanation of the risks involved in any investment in the RBS

ETNs as described in the "Risk Factors" section of the applicable pricing

supplement, before investing.

RECENT DEVELOPMENTS: On June 13, 2013, we announced that we would be exiting

the structured retail investor products business that is responsible for

issuing and maintaining the RBS ETNs, and that we expect to move such business

into a runoff organization which will go through a process of restructuring and

/ or business sales (the "RBS Retail Investor Products Exit Plan"). The

implementation of the RBS Retail Investor Products Exit Plan increases the

likelihood that the RBS ETNs will be redeemed by us prior to maturity. We plan

to continue to maintain and issue the RBS ETNs, but our plans could change. We

cannot give you any assurances as to any minimum period of time that you may

hold the RBS ETNs before we redeem them at our option.

The intraday indicative value and the daily redemption value are not the same

as the trading price or market price of the RBS ETNs in the secondary market.

IMPORTANT INFORMATION: The Royal Bank of Scotland plc (RBS plc) and The Royal

Bank of Scotland Group plc (RBS Group) have filed a registration statement

(including a prospectus) with the U.S. Securities and Exchange Commission (SEC)

for the offering of RBS ETNs to which this communication relates. Before you

invest in any RBS ETNs, you should read the prospectus in that registration

statement and other documents that have been filed by RBS plc and RBS Group

with the SEC for more complete information about RBS plc and RBS Group, and the

offering. You may get these documents for free by visiting EDGAR on the SEC's

web site at www.sec.gov. Alternatively, RBS plc, RBS Securities Inc. (RBSSI) or

any dealer participating in the offering will arrange to send you the

prospectus and the pricing supplement at no charge if you request it by calling

1-855-RBS-ETPS (toll-free).

RBS China Trendpilot(TM) Index, RBS US Large Cap Trendpilot(TM) Index (USD),

RBS US Mid Cap Trendpilot(TM) Index (USD), RBS Gold Trendpilot(TM) Index (USD)

and RBS US Large Cap Alternator(TM) Index (USD) are the property of RBS plc,

which has contracted with SandP Opco, LLC (a subsidiary of SandP Dow Jones Indices

LLC) ("SandP Dow Jones Indices") to maintain and calculate these indices. The SandP

500([R]) Index, the SandP MidCap 400([R]), SandP 500 Low Volatility Index and SandP

500([R]) Equal Weight Index (including the total return versions) are the

exclusive property of SandP Dow Jones Indices and have been licensed for use by

RBS plc in connection with certain of these indices. SandP Dow Jones Indices

shall have no liability for any errors or omissions in calculating these

indices. SandP([R]) is a registered trademark of Standard and Poor's Financial

Services LLC ("SPFS") and Dow Jones([R]) is a registered trademark of Dow Jones

Trademark Holdings LLC ("Dow Jones"). These trademarks have been licensed to

SandP Dow Jones Indices. Standard and Poor's([R]), SandP([R]), SandP([R]) 500, SandP

MidCap 400([R]), SandP 500 Low Volatility Index([R]), SandP 500([R]) Equal Weight

Index(TM) and SandP 500([R]) EWI(TM) are trademarks of SPFS and together with the

"Calculated by SandP Dow Jones Indices Custom" and its related stylized mark(s)

have been licensed for use by RBS plc. The RBS China Trendpilot(TM) ETNs, RBS

US Large Cap Trendpilot(TM) ETNs, RBS US Mid Cap Trendpilot(TM) ETNs, RBS Gold

Trendpilot(TM) ETNs and RBS US Large Cap Alternator ETNs are not sponsored,

endorsed, sold or promoted by SandP Dow Jones Indices, SPFS, Dow Jones, their

affiliates or their third party licensors, and neither SandP Dow Jones Indices,

SPFS, Dow Jones, their affiliates or their third party licensors make any

representation regarding the advisability of investing in such RBS ETNs.

NASDAQ([R]), OMX([R]), NASDAQ OMX([R]), NASDAQ-100([R]), NASDAQ-100 Index([R])

and NASDAQ-100([R]) Total Return Index(SM) are registered trademarks and

service marks of The NASDAQ OMX Group, Inc. and are licensed for use by RBS

plc. The RBS NASDAQ-100([R]) Trendpilot(TM) Index is the property of RBS plc.

RBS plc has contracted with The NASDAQ OMX Group, Inc. (which with its

affiliates and subsidiaries is referred to as the "Corporations") to calculate

and maintain the RBS NASDAQ-100([R]) Trendpilot(TM) Index, either directly or

through a third party. Currently, the RBS NASDAQ-100([R]) Trendpilot(TM) Index

is calculated and maintained by SandP Opco, LLC, a subsidiary of SandP Dow Jones

Indices LLC ("SandP Dow Jones Indices") on behalf of the Corporations. SandP([R])

is a registered trademark of Standard and Poor's Financial Services LLC ("SPFS")

and Dow Jones([R]) is a registered trademark of Dow Jones Trademark Holdings

LLC ("Dow Jones"). These trademarks have been licensed to SandP Dow Jones

Indices. SandP Dow Jones Indices, its affiliates and the Corporations shall have

no liability for any errors or omissions in calculating the RBS NASDAQ-100([R])

Trendpilot(TM) Index. The RBS NASDAQ-100([R]) Trendpilot(TM) ETNs, which are

based on the RBS NASDAQ-100([R]) Trendpilot(TM) Index, have not been passed on

by the Corporations or SandP Dow Jones Indices as to their legality or

suitability and are not sponsored, endorsed, sold or promoted by the

Corporations or SandP Dow Jones Indices and its affiliates. THE CORPORATIONS, SandP

DOW JONES INDICES AND ITS AFFILIATES MAKE NO WARRANTIES AND BEAR NO LIABILITY

WITH RESPECT TO THE RBS NASDAQ-100([R]) TRENDPILOT(TM) ETNs.

RBS Oil Trendpilot(TM) Index (USD) and RBS 12-Month Oil Total Return Index

(USD) are the property of RBS plc and are calculated by NYSE Arca, a

wholly-owned subsidiary of NYSE Euronext. The RBS Oil Trendpilot[] ETNs, which

track the RBS Oil Trendpilot(TM) Index (USD) and RBS 12-Month Oil Total Return

Index (USD), are not issued, sponsored, endorsed, sold or promoted by NYSE

Arca, and NYSE Arca makes no representation regarding the advisability of

investing in such ETNs. NYSE ARCA MAKES NO EXPRESS OR IMPLIED WARRANTIES, AND

HEREBY EXPRESSLY DISCLAIMS ALL WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A

PARTICULAR PURPOSE WITH RESPECT TO THE RBS OIL TRENDPILOT[] INDEX (USD) OR RBS

12-MONTH OIL TOTAL RETURN INDEX (USD) OR ANY DATA INCLUDED THEREIN. IN NO EVENT

SHALL NYSE ARCA HAVE ANY LIABILITY FOR ANY SPECIAL, PUNITIVE, INDIRECT, OR

CONSEQUENTIAL DAMAGES (INCLUDING LOST PROFITS), EVEN IF NOTIFIED OF THE

POSSIBILITY OF SUCH DAMAGES.

The NYSE Arca Equal Weighted Pharmaceutical Index(SM) and the NYSE Arca Equal

Weighted Pharmaceutical Total Return Index(SM) are service marks of NYSE

Euronext or its affiliates (NYSE Euronext) and have been licensed for use by

RBS plc and RBSSI (Licensees) in connection with the RBS Global Big Pharma

ETNS. Neither the Licensees nor the RBS Global Big Pharma ETNS is sponsored,

endorsed, sold or promoted by NYSE Euronext. NYSE Euronext makes no

representations or warranties regarding the RBS Global Big Pharma ETNS or the

ability of the NYSE Arca Equal Weighted Pharmaceutical Index(SM) or the NYSE

Arca Equal Weighted Pharmaceutical Total Return Index(SM) to track general

stock market performance. NYSE EURONEXT MAKES NO EXPRESS OR IMPLIED WARRANTIES,

AND HEREBY EXPRESSLY DISCLAIMS ALL WARRANTIES OF MERCHANTABILITY OR FITNESS FOR

A PARTICULAR PURPOSE WITH RESPECT TO THE NYSE ARCA EQUAL WEIGHTED

PHARMACEUTICAL INDEX(SM) OR THE NYSE ARCA EQUAL WEIGHTED PHARMACEUTICAL TOTAL

RETURN INDEX(SM) OR ANY DATA INCLUDED THEREIN. IN NO EVENT SHALL NYSE EURONEXT

HAVE ANY LIABILITY FOR ANY SPECIAL, PUNITIVE, INDIRECT, OR CONSEQUENTIAL

DAMAGES (INCLUDING LOST PROFITS), EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH

DAMAGES.

BNY Mellon is a corporate brand of The Bank of New York Mellon Corporation and

may be used as a generic term to reference the corporation as a whole or its

various subsidiaries. BNY Mellon and BNY Mellon ADR Indices and BNY Mellon DR

Indices are service marks owned by The Bank of New York Mellon Corporation.

This information is provided for general purposes only and is not investment

advice. We provide no advice nor recommendations or endorsement with respect to

any company, security or products based on any index licensed by BNY Mellon,

and we make no representation regarding the advisability of investing in the

same. BNY Mellon's Depositary Receipt business is conducted through BNY

Mellon.

BNY Mellon does not guarantee the accuracy, timeliness and/or completeness of

BNY Mellon ADR Indices and BNY Mellon DR Indices, or any associated indices, or

any data included therein, and BNY Mellon shall have no liability for any

errors, omissions, or interruptions therein. BNY Mellon makes no express or

implied warranties, and expressly disclaims all warranties of merchantability

or fitness for a particular purpose or use with respect to BNY Mellon ADR

Indices and BNY Mellon DR Indices or any associated indices, or any data

included therein, or any materials derived from such data. Without limiting any

of the foregoing, in no event shall the company have any liability for any

special, punitive, indirect, or consequential damages (including lost profits),

even if notified of the possibility of such damages. For the full disclaimer

please see the pricing supplement relating to the notes that RBS plc and RBS

Group filed with the SEC.

The RBS ETNs are not sponsored, endorsed, sold or promoted by Beeland Interests

Inc. ("Beeland Interests"), James B. Rogers, Jr. or Diapason Commodities

Management SA ("Diapason").[] Neither Beeland Interests, James B. Rogers, Jr.

nor Diapason makes any representation or warranty, express or implied, nor

accepts any responsibility, regarding the accuracy or completeness of this

document, or the advisability of investing in securities or commodities

generally, or in the RBS ETNs or in futures particularly. "Jim Rogers", "James

Beeland Rogers, Jr.", "Rogers", "Rogers International Commodity Index", "RICI",

"RICI Enhanced", and the names of all other RICI Enhanced(SM) Indices mentioned

herein are trademarks, service marks and/ or registered marks of Beeland

Interests, Inc., which is owned and controlled by James Beeland Rogers, Jr.,

and are used subject to license.[] The personal names and likeness of Jim

Rogers/James Beeland Rogers, Jr. are owned and licensed by James Beeland

Rogers, Jr.

NEITHER BEELAND INTERESTS NOR DIAPASON, NOR ANY OF THEIR RESPECTIVE AFFILIATES

OR AGENTS, GUARANTEES THE ACCURACY AND/OR THE COMPLETENESS OF THE ROGERS

INTERNATIONAL COMMODITY INDEX ("RICI"), THE RICI ENHANCED, ANY SUB-INDEX

THEREOF, OR ANY DATA INCLUDED THEREIN.[] SUCH PERSON SHALL NOT HAVE ANY

LIABILITY FOR ANY ERRORS, OMISSIONS, OR INTERRUPTIONS THEREIN AND MAKES NO

WARRANTY, EXPRESS OR IMPLIED, AS TO RESULTS TO BE OBTAINED BY OWNERS OF THE RBS

ETNS, OR ANY OTHER PERSON OR ENTITY FROM THE USE OF THE RICI, THE RICI

ENHANCED, ANY SUB-INDEX THEREOF, ANY DATA INCLUDED THEREIN OR THE RBS ETNS.[]

NEITHER BEELAND INTERESTS NOR DIAPASON, NOR ANY OF THEIR RESPECTIVE AFFILIATES

OR AGENTS, MAKES ANY EXPRESS OR IMPLIED WARRANTIES, AND EACH EXPRESSLY

DISCLAIMS ALL WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE

OR USE WITH RESPECT TO THE RICI, THE RICI ENHANCED, ANY SUB INDEX THEREOF, OR

ANY DATA INCLUDED THEREIN.[] WITHOUT LIMITING ANY OF THE FOREGOING, IN NO EVENT

SHALL BEELAND INTERESTS, DIAPASON OR ANY OF THEIR RESPECTIVE AFFILIATES OR

AGENTS HAVE ANY LIABILITY FOR ANY LOST PROFITS OR INDIRECT, PUNITIVE, SPECIAL,

OR CONSEQUENTIAL DAMAGES OR LOSSES, EVEN IF NOTIFIED OF THE POSSIBILITY

THEREOF.

NEITHER THE INDICATION THAT SECURITIES OR OTHER FINANCIAL PRODUCTS OFFERED

HEREIN ARE BASED ON DATA PROVIDED BY ICE DATA LLP, NOR THE USE OF THE

TRADEMARKS OF ICE DATA LLP IN CONNECTION WITH SECURITIES OR OTHER FINANCIAL

PRODUCTS DERIVED FROM SUCH DATA IN ANY WAY SUGGESTS OR IMPLIES A REPRESENTATION

OR OPINION BY ICE DATA OR ANY OF ITS AFFILIATES AS TO THE ATTRACTIVENESS OF

INVESTMENT IN ANY SECURITIES OR OTHER FINANCIAL PRODUCTS BASED UPON OR DERIVED

FROM SUCH DATA. ICE DATA IS NOT THE ISSUER OF ANY SUCH SECURITIES OR OTHER

FINANCIAL PRODUCTS AND MAKES NO EXPRESS OR IMPLIED WARRANTIES WHATSOEVER,

INCLUDING BUT NOT LIMITED TO, WARRANTIES OF MERCHANTABILITY OR FITNESS FOR ANY

PARTICULAR PURPOSE WITH RESPECT TO SUCH DATA INCLUDED OR REFLECTED THEREIN, NOR

AS TO RESULTS TO BE OBTAINED BY ANY PERSON OR ANY ENTITY FROM THE USE OF THE

DATA INCLUDED OR REFLECTED THEREIN. The indices that the RBS Rogers Enhanced

ETNs track are calculated by NYSE Arca, Inc. ("NYSE Arca"), a wholly-owned

subsidiary of NYSE Euronext. The RBS ETNs, which are based on such indices, are

not issued, sponsored, endorsed, sold or promoted by NYSE Arca, and NYSE Arca

makes no representation regarding the advisability of investing in such

products. NYSE ARCA MAKES NO EXPRESS OR IMPLIED WARRANTIES, AND HEREBY

EXPRESSLY DISCLAIMS ALL WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A

PARTICULAR PURPOSE WITH RESPECT TO SUCH INDICES OR ANY DATA INCLUDED THEREIN.

IN NO EVENT SHALL NYSE ARCA HAVE ANY LIABILITY FOR ANY SPECIAL, PUNITIVE,

INDIRECT, OR CONSEQUENTIAL DAMAGES (INCLUDING LOST PROFITS), EVEN IF NOTIFIED

OF THE POSSIBILITY OF SUCH DAMAGES.

Copyright [C] 2015 RBS Securities Inc. All rights reserved. RBS Securities

Inc., a U.S. registered broker-dealer, member of FINRA and SIPC, is an indirect

wholly-owned subsidiary of The Royal Bank of Scotland plc.

|