The information contained in this prospectus is not complete and may be changed. The registration statement relating to the securities described in this prospectus has been filed with the U.S. Securities and Exchange Commission. These securities may not be sold nor may offers to buy be accepted prior to the time the registration statement becomes effective. This prospectus shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

PRELIMINARY AND SUBJECT TO COMPLETION, DATED 2022

PROSPECTUS OF WOODSIDE PETROLEUM LTD.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

MERGER PROPOSED

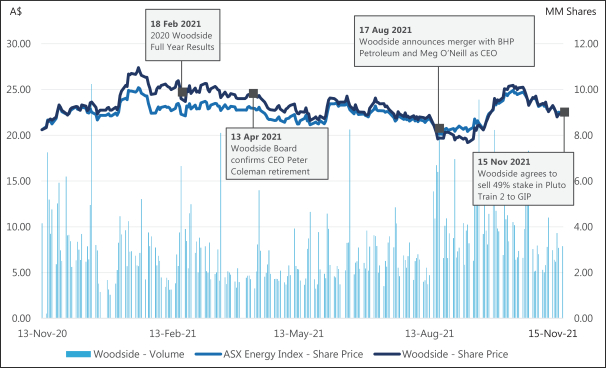

On 17 August 2021, Woodside Petroleum Ltd. (“Woodside”) publicly announced its entry into a merger commitment deed (the “Merger Commitment Deed”) with BHP Group Ltd (“BHP”) to facilitate the combination of their respective oil and gas portfolios through an all-stock merger. The Merger Commitment Deed outlined a process by which Woodside and BHP intended to progress the Merger (as defined below).

On 22 November 2021, Woodside and BHP publicly announced they had entered into a share sale agreement (the “Share Sale Agreement”) (together with an Integration and Transition Services Agreement to assist in the separation, transition and integration of BHP’s oil and gas portfolio with Woodside’s oil and gas portfolio) under which, and subject to the terms and conditions therein, Woodside (or its nominee) will acquire all of the ordinary shares in BHP Petroleum International Pty Ltd. (“BHP Petroleum”), a wholly owned subsidiary of BHP that holds the oil and gas assets of BHP in exchange for Cash Consideration (as defined below) (subject to adjustment) and the issuance of new ordinary shares of Woodside, no par value per share (the “Woodside Shares”). Immediately upon the closing of the Merger pursuant to the Share Sale Agreement (“Implementation”), the Woodside Shares issued under the Share Sale Agreement (the “New Woodside Shares”) will be issued by Woodside to BHP to be distributed by BHP to eligible holders of ordinary shares, with no par value per share, of BHP Group Ltd (the “BHP Shares”) via an in-specie dividend. Woodside refers to the combination of the oil and gas business of BHP with and into Woodside and the other transactions contemplated in the Share Sale Agreement, including the payment or distribution of Woodside Shares to BHP Shareholders upon Implementation, as the “Merger,” and refers to the New Woodside Shares to be issued in the Merger as the “Share Consideration.” The Merger effected under the Share Sale Agreement will have an Effective Time of 11:59 p.m. AEST on 30 June 2021.

Upon Implementation, BHP Shareholders as of the Distribution Record Date (as defined below) will be entitled to, in aggregate, 901,523,720 New Woodside Shares representing approximately 48% of the outstanding Woodside Shares following the Merger (based on the number of Woodside Shares outstanding on 22 November 2021, as adjusted for the Woodside Dividend (as defined below) paid on 24 September 2021, and assuming that no additional Woodside Shares are issued in connection with an equity raise permitted under the Share Sale Agreement (a “Permitted Equity Raise”) nor further declaration of Woodside Dividends will occur prior to Implementation), with each BHP Shareholder being entitled to 0.1781 New Woodside Shares in respect of each BHP Share that the BHP Shareholder owns (based on the number of BHP Shares outstanding on 22 November 2021). The actual number of New Woodside Shares that will be issued and to which each BHP Shareholder will be entitled with respect to each BHP Share will be determined as at the applicable record date for the distribution, prior to Implementation, which will be set by BHP and referred to as the “Distribution Record Date.”

The value of the Share Consideration will fluctuate with the market price of Woodside Shares. You should obtain current share price quotations for Woodside Shares on the ASX. Based on the number of Woodside Shares and BHP Shares outstanding on 22 November 2021, and based on the closing price of Woodside Shares on the Australian Securities Exchange (“ASX”) of A$22.11 on 19 November 2021, the implied value of the Share Consideration per BHP Share represented approximately A$3.95, or $2.86 (converted into dollars based on the exchange rate for such day reported by the Board of Governors of the U.S. Federal Reserve System (the “FRB”) of $0.7235 = A$1.00). Based on the number of Woodside Shares and BHP Shares outstanding on 22 November 2021, and based on the closing price of Woodside Shares on the ASX of A$21.18 on 16 August 2021, the date before the public announcement of entry into the Merger Commitment Deed, the implied value of the Woodside Share distribution per BHP Share represented approximately A$3.77, or $2.77 (converted into dollars based on the exchange rate for such day reported by the FRB of $0.7339 = A$1.00). Eligible holders of American Depositary Shares representing BHP Shares (the “BHP ADSs”) will receive a number of American Depositary Shares, each representing one New Woodside Share (the “New Woodside ADSs”), that corresponds to the New Woodside Shares received on the BHP Shares represented by BHP ADSs (subject to payment of taxes and applicable Woodside Depositary and BHP Depositary (each as defined below) fees and expenses). No fractional New Woodside Shares or New Woodside ADSs will be issued or delivered to holders of BHP Shares or BHP ADSs. Any fractional entitlements to New Woodside ADSs will be aggregated and sold by Citibank, N.A. (the “BHP Depositary”), and the net cash proceeds (after deduction of applicable fees, taxes and expenses) will be distributed to the BHP ADS holders entitled thereto.

The Woodside Shares are listed on the ASX under the ticker symbol “WPL.” No trading market exists in the United States for the Woodside Shares. Woodside has established an American Depositary Receipt program (the “Woodside ADR Program”) for American Depositary Shares representing Woodside Shares (the “Woodside ADSs”), for which Citibank, N.A. is the depositary (the “Woodside Depositary”), with each Woodside ADS representing one Woodside Share. A registration statement on Form F-6 (Registration No. 333-201669) was filed with the SEC on 23 January 2015 and declared effective 9 February 2015, with respect to existing American Depositary Shares representing Woodside Shares (the “Existing Woodside ADSs”). Existing Woodside ADSs currently trade on the U.S. over-the-counter market through a sponsored ADR facility under the symbol “WOPEY.” Woodside intends to apply to list the Woodside ADSs on the NYSE under the symbol “ ” and to file a registration statement on Form F-6 with the U.S. Securities and Exchange Commission (the “SEC”) with respect to the New Woodside ADSs (the “F-6 Registration Statement”) and to amend the Woodside Deposit Agreement (as defined below) for the Woodside ADR Program to, among other things, reflect Woodside’s status as an SEC reporting company and certain regulatory changes in Australia and in the United States. Following Implementation, the Woodside Shares will continue to be listed on the ASX and are expected to be listed on the London Stock Exchange (the “LSE”).

BHP ADSs are traded on the NYSE under the symbol “BHP,” with each BHP ADS representing two BHP Shares. Each holder of BHP ADSs will receive in the Merger, in lieu of New Woodside Shares, New Woodside ADSs. Holders of BHP ADSs will not be able to trade the New Woodside Shares underlying the New Woodside ADSs received as Share Consideration for the BHP ADSs before such New Woodside Shares are deposited with the Woodside Depositary and the New Woodside ADSs are issued and delivered to the BHP ADS holders. BHP Shares and BHP ADSs will not be exchanged or cancelled in the Merger, but will continue to represent an interest in BHP without the oil and gas assets in BHP. Following Implementation, BHP Shareholders that are not Ineligible Foreign BHP Shareholders (“Participating BHP Shareholders”) will hold both New Woodside Shares and BHP Shares, and holders of BHP ADSs will hold both New Woodside ADSs and BHP ADSs.

There can be no assurances regarding the prices at which Woodside Shares or New Woodside ADSs (as applicable) will trade following Implementation of the Merger, including whether the New Woodside ADSs will trade at the equivalent prices at which the Woodside Shares traded prior to the Merger or at which the Woodside Shares may trade following Implementation of the Merger.

The Merger cannot be completed without the satisfaction (or waiver, if permitted) of the several conditions precedent under the Share Sale Agreement (the “Conditions”) by 30 June 2022 (or an agreed later date), including approval by certain regulatory and competition authorities, approval of the shareholders of Woodside (the “Woodside Shareholders”), the issuing of a report with “best interests” conclusions (the “Independent Expert’s Report”) by KPMG Financial Advisory Services (Australia) Pty Ltd (“KPMG”), the independent expert appointed by Woodside (the “Independent Expert”), and the completion of the Restructure of certain of BHP’s subsidiaries. If all Conditions of the Merger are satisfied, including approval by Woodside Shareholders, then (i) 100% of the issued share capital of BHP Petroleum International Pty Ltd. will be transferred to Woodside (or its nominee), and BHP Petroleum will become a wholly owned subsidiary of Woodside, (ii) Woodside will pay BHP the Purchase Price (as defined below), including the Share Consideration of approximately 901,523,720 New Woodside Shares in the aggregate which will be issued to BHP, (iii) BHP will immediately distribute to BHP Shareholders (or the Sale Agent (as defined below) in the case of all Ineligible Foreign BHP Shareholders (as defined below) and Relevant Small Parcel BHP Shareholders (as defined below)) as of the Distribution Record Date the Share Consideration, pro rata to their respective ownership of BHP (as more fully defined herein, the “Distribution Entitlement”), and (iv) Ineligible Foreign BHP Shareholders and Relevant Small Parcel BHP Shareholders will receive a cash payment from proceeds of the sale of the New Woodside Shares in lieu of receiving New Woodside Shares. See the section entitled “The Share Sale Agreement and Related Agreements—The Share Sale Agreement—Share Consideration.” From the date of their issuance, the New Woodside Shares received as Share Consideration will be fully paid and rank equally with the Woodside Shares outstanding prior to Implementation of the Merger (the “Existing Woodside Shares”).

Woodside expects to hold a meeting of its shareholders at , Perth, Western Australia, Australia, on 2022 at a.m. (AWST) time (the “Woodside Shareholders Meeting”) to vote on the issuance by Woodside of the New Woodside Shares. As a holder of BHP Shares or BHP ADSs, you are not permitted to vote at the Woodside Shareholders Meeting. THIS PROSPECTUS IS NOT A PROXY STATEMENT. WE ARE NOT ASKING YOU FOR A PROXY, AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

More information about Woodside, BHP Petroleum, the Share Sale Agreement, the Merger and the Woodside Shareholders Meeting can be found elsewhere in this prospectus. In reviewing this prospectus, you should carefully consider the matters described under the caption “Risk Factors” beginning on page 39.

NEITHER THE U.S. SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THE SECURITIES TO BE ISSUED IN CONNECTION WITH THE MERGER OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is 2022.