- WDS Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

425 Filing

Woodside Energy (WDS) 425Business combination disclosure

Filed: 12 Apr 22, 9:29pm

Filed by Woodside Petroleum Ltd.

Pursuant to Rule 425 of the Securities Act of 1933

Subject Company: BHP Group Ltd (Commission File No.: 001-09526)

This Prospectus comprises a prospectus relating to Woodside Petroleum Ltd prepared in accordance with the Prospectus Regulation Rules of the FCA made under section 73A of FSMA. This Prospectus has been approved by the FCA as competent authority under the UK Prospectus Regulation in accordance with section 87A of FSMA and made available to the public in accordance with Rule 3.2 of the Prospectus Regulation Rules. The FCA only approves this Prospectus as meeting the standards of completeness, comprehensibility and consistency imposed by the UK Prospectus Regulation. Such approval should not be considered as an endorsement of the company that is the subject of this Prospectus nor should such approval be considered as an endorsement of the quality of the securities that are the subject of this Prospectus. Prospective investors should make their own assessment as to the suitability of investing in the securities.

Applications will be made to the FCA and the London Stock Exchange for all of the Woodside Shares, including the New Woodside Shares, to be admitted to the standard listing segment of the Official List and to trading on the London Stock Exchange’s Main Market for listed securities, respectively. Admission to trading on the Main Market constitutes admission to trading on a UK regulated market. It is expected that, subject to completion of the Merger, Admission will become effective and that dealings in the Woodside Shares will commence at 8.00 am (London time) on or around 6 June 2022. The Merger is subject to satisfaction (or waiver, if permitted) of various Conditions. If the Merger does not proceed, then Admission will not take place.

Woodside has established arrangements to enable investors to settle interests in the Woodside Shares through the CREST system. Securities issued by non-UK companies, such as Woodside, cannot be held or transferred electronically in the CREST system. However, the Depositary Interests allow such securities to be dematerialised and settled electronically through CREST. The Depositary Interests will be independent securities constituted under English law, which may be held and transferred through the CREST system. Investors should note that it is the Depositary Interests which will be settled through CREST and not the Woodside Shares.

Woodside Shares are currently listed on the ASX, where they will continue to be listed following Admission. Woodside will make an application to the ASX for quotation of the New Woodside Shares on the ASX. Woodside is seeking a secondary listing for all Woodside Shares, including the New Woodside Shares, on the standard listing segment of the Official List and to trading on the London Stock Exchange’s Main Market for listed securities. In addition, Woodside has applied for the Woodside ADSs to be admitted to listing and trading on the NYSE.

This Prospectus is issued solely in connection with Admission. This Prospectus does not constitute or form part of an offer or invitation to sell or issue, or any solicitation of an offer to purchase or subscribe for, any securities by any person. No offer of Woodside Shares is being made in any jurisdiction.

Prospective investors should read this Prospectus in its entirety. In particular, your attention is drawn to Part 2 (Risk Factors) of this Prospectus for a discussion of the risks that might affect the value of your shareholding in Woodside. Prospective investors should be aware that an investment in Woodside involves a degree of risk and that, if certain risks described in this Prospectus occur, investors may find their investment materially adversely affected. Accordingly, an investment in the Woodside Shares is only suitable for investors who are particularly knowledgeable in investment matters and who are able to bear the loss of the whole or part of their investment.

Woodside Petroleum Ltd

(incorporated and registered in Australia with company number 004 898 962)

Admission to the Official List (by way of a Standard Listing under Chapter 14

of the LSE Listing Rules) and to trading on the London Stock Exchange’s Main Market

for listed securities of the entire issued share capital of Woodside Petroleum Ltd

Financial Adviser

English and Australian legal adviser

Notice to Australian Investors

This Prospectus does not constitute a prospectus or disclosure document under Chapter 6D of the Corporations Act 2001 and does not purport to include the information required of a prospectus or other disclosure document under Chapter 6D of the Corporations Act 2001.

This Prospectus, and any other document issued by Woodside in connection with the Merger and/or Admission, contains general information only and does not take account of the investment objectives, financial situation or particular needs of any particular person, and does not contain any securities recommendations or financial product advice. Before making an investment decision, investors need to consider whether the information in this Prospectus, and any other document issued by Woodside in connection with the Merger and/or Admission, is appropriate to their needs, objectives and circumstances, and, if necessary, seek expert advice on those matters.

Notice to South African Investors

Since the Merger and the Admission do not constitute an offer to the public as contemplated in the South African Companies Act, No. 71 of 2008 (“South African Companies Act”) no prospectus is required to be filed with the South African Companies and Intellectual Property Commission in respect thereof. As a result, this Prospectus does not comply with the substance and form requirements for a prospectus or advertisements set out in the South African Companies Act and the South African Companies Regulations of 2011, and has not been approved by and/or registered with the South African Companies and Intellectual Property Commission.

In addition, the information contained in this Prospectus constitutes factual information as contemplated in section 1(3)(a) of the South African Financial Advisory and Intermediary Services Act, No. 37 of 2002, as amended (“Fais Act”) and should not be construed as an express or implied advice, recommendation, guide or proposal that any particular transaction in respect of the Merger and/or Admission, is appropriate to the particular investment objectives, financial situations or needs of an South African investor, and nothing in this Prospectus should be construed as constituting the canvassing for, or marketing or advertising of, financial services in South Africa.

Notice to US Investors

Disclosure of reserve information and cautionary note to US investors

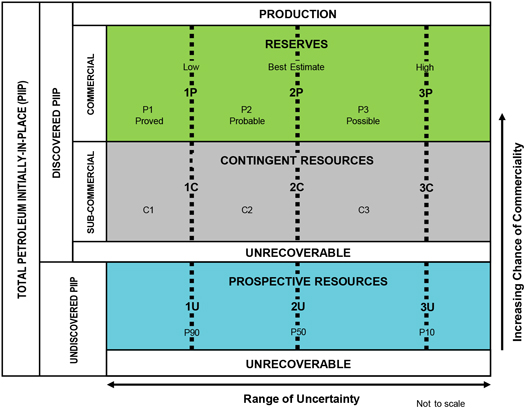

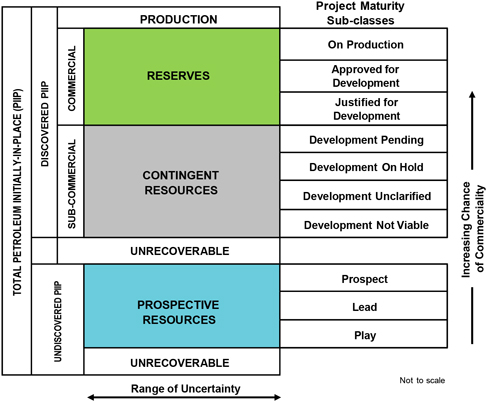

Unless expressly stated otherwise, all estimates of oil and gas reserves and contingent resources disclosed in this Prospectus have been prepared using definitions and guidelines consistent with the 2018 Society of Petroleum Engineers (SPE)/World Petroleum Council (WPC) / American Association of Petroleum Geologists (AAPG) / Society of Petroleum Evaluation Engineers (SPEE) / Society of Exploration Geophysicists (SEG) / Society of Petrophysicists and Well Log Analysts (SPWLA) / European Association of Geoscientists and Engineers (EAGE) / Petroleum Resources Management System (PRMS). Estimates of reserves and contingent resources in this Prospectus will differ from corresponding estimates prepared in accordance with the rules of the SEC and disclosure requirements of the U.S. Financial Accounting Standards Board (“FASB”), and those differences may be material. This Prospectus also includes estimates of contingent resources. Estimates of contingent resources are by their nature more speculative than estimates of proved reserves and would require substantial capital spending over a significant number of years to implement recovery. Actual locations drilled and quantities that may be ultimately recovered from Woodside’s properties may differ substantially. In addition, Woodside has made no commitment to drill, and likely will not drill, all of the drilling locations that have been attributable to these quantities.

The U.S. Registration Statement includes, among other things, disclosure of reserves and other oil and gas information in accordance with U.S. federal securities law and applicable SEC rules and regulations (collectively, “SEC requirements”). The SEC permits oil and gas companies that are subject to domestic issuer reporting requirements under U.S. federal securities law, in their filings with the SEC, to disclose only estimated proved, probable and possible reserves that meet the SEC’s definitions of such terms. In addition, the U.S. Registration Statement includes notes to the financial statements included therein that include supplementary disclosure in respect of oil and gas activities, including estimates of proved oil and gas reserves and a standardised measure of discounted future net cash flows relating to proved oil and gas reserve quantities. This supplementary financial statement disclosure is presented in accordance with FASB requirements, which align with corresponding SEC requirements concerning reserves estimation and reporting.

No offer or solicitation

This Prospectus relates to, and is issued solely in connection with, Admission. This Prospectus is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy any securities, or a solicitation of any vote or approval with respect to the Merger or otherwise, nor shall there be any offer, solicitation or sale of securities, in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under securities laws of any such jurisdiction.

The securities referred to in this Prospectus may not be offered, sold or transferred, directly or indirectly, in, into or from the United States absent registration under the U.S. Securities Act of 1933 (the “Securities Act”) or

pursuant to an applicable exemption therefrom, or in a transaction not subject to, the registration requirements of the Securities Act and in compliance with the securities laws of any applicable state or other jurisdiction of the United States. This Prospectus shall not constitute an offer to sell or the solicitation of an offer to buy any securities in the United States and may not be distributed, directly or indirectly within the United States. Neither the SEC nor any state securities commission has approved or disapproved of the securities referred to in this Prospectus or passed upon the adequacy or accuracy of this Prospectus. Any representation to the contrary is a criminal offence in the United States.

Important additional information and where to find it

In connection with the Merger, Woodside filed the U.S. Registration Statement with the SEC to register the distribution of the Woodside securities to be issued in connection with the Merger (including the prospectus therein). Woodside and BHP have also filed other documents with the SEC regarding the proposed Merger. This Prospectus is not a substitute for the U.S. Registration Statement or the prospectus or for any other document that Woodside or BHP may file with the SEC in connection with the proposed Merger. U.S. INVESTORS AND U.S. HOLDERS OF WOODSIDE AND BHP SECURITIES ARE URGED TO READ THE U.S. REGISTRATION STATEMENT, PROSPECTUS AND OTHER DOCUMENTS RELATING TO THE MERGER (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS TO THOSE DOCUMENTS) THAT MAY BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT WOODSIDE, BHP AND THE PROPOSED MERGER. Shareholders may obtain free copies of the U.S. Registration Statement, prospectus and other documents containing important information about Woodside and BHP once such documents are filed with the SEC. For more information on how to obtain a copy, please refer to paragraph 28 of Part 21 (Additional Information).

Exchange Act

Following Implementation, holders of Woodside Shares and Woodside ADSs will be subject to certain reporting requirements under the Exchange Act. Shareholders owning more than 5% of any voting class of equity securities registered pursuant to Section 12 of the Exchange Act, including ADSs representing beneficial ownership of 5% of the ordinary shares, must comply with disclosure obligations under Section 13 of the Exchange Act. Sections 13(d) and 13(g) of the Exchange Act require any person or group of persons who directly or indirectly acquires or has beneficial ownership of more than 5% of a voting class of an issuer’s equity securities to file beneficial ownership reports electronically with the SEC on either Schedule 13D or on short form Schedule 13G, as appropriate, with the SEC.

Both Schedule 13D and Schedule 13G require background information about the reporting persons, including the name, address, and citizenship or place of organisation of each reporting person, the amount of the securities beneficially owned and aggregate beneficial ownership percentage, and whether voting and investment power is held solely by the reporting persons or shared with others.

This Prospectus has been prepared solely in respect of Admission and is being made publicly available for information purposes only and does not require any action to be taken by holders of Woodside Shares. Woodside is not offering any Woodside Shares nor any other securities in connection with Admission. This Prospectus does not constitute an offer to sell, or the solicitation of an offer to subscribe for or buy, any Woodside Shares nor any other securities in any jurisdiction. The Woodside Shares will not be generally made available or marketed to the public in the UK or any other jurisdiction in connection with Admission.

Morgan Stanley is authorised and regulated in the UK by the FCA. Morgan Stanley is acting for Woodside as financial adviser (and not as sponsor). Morgan Stanley is not acting for any other person in connection with Admission and Morgan Stanley will not regard any other person as its client in relation to Admission nor will it be responsible to anyone other than Woodside for providing the protections afforded to its clients or for providing advice in relation to Admission or any other transaction or arrangement referred to in this Prospectus. Morgan Stanley has not been engaged by Woodside as sponsor in connection with Admission and it will not be responsible to anyone (including Woodside) for providing the protections afforded to its clients for providing advice as sponsor in relation to Admission.

Morgan Stanley and/or any of their respective affiliates may have engaged in transactions with, and provided various investment banking, financial advisory and other services for Woodside, for which they would have received customary fees. Morgan Stanley and/or any of their respective affiliates may provide such services to Woodside and any of its affiliates in the future.

Apart from responsibilities and liabilities which may be imposed by the FSMA or the regulatory regime established thereunder, or under the regulatory regime of any other jurisdiction where exclusion of liability under the relevant regulatory regime would be illegal, void or unenforceable, Morgan Stanley does not accept any responsibility, nor makes any representation or warranty (express or implied), for the contents of this Prospectus, including its accuracy or completeness, or for any other statement made or purported to be made by it, or on behalf of it, Woodside or any other person in connection with Woodside or the Woodside Shares. Accordingly, nothing contained in this Prospectus may be relied upon as any form of promise or representation in this respect. Morgan Stanley disclaims any responsibility or liability (save as referred to above) which it may otherwise have in respect of this Prospectus or any such statement.

Morgan Stanley has given and not withdrawn its consent to the issue of this Prospectus with the inclusion of the references to its name.

The application for Admission will be made in compliance with Rule 3 of the LSE Listing Rules.

Information to distributors

The distribution of this Prospectus in certain jurisdictions may be restricted by law. No action has been or will be taken by Woodside, BHP, the Directors or Morgan Stanley to permit possession or distribution of this Prospectus in any jurisdiction where it is believed that this may be unlawful or in contravention of local regulation. Persons into whose possession this Prospectus comes are required by Woodside, the Directors and Morgan Stanley to inform themselves about and to observe any such restrictions.

Application will be made for the Woodside Shares to be admitted to the standard listing segment of the Official List. A Standard Listing affords investors in Woodside a lower level of regulatory protection than that afforded to investors in companies whose securities are admitted to the premium segment of the Official List, which are subject to additional obligations under the LSE Listing Rules.

It should be noted that the FCA does not monitor Woodside’s compliance with any of the LSE Listing Rules or those aspects of the DTR which Woodside has indicated herein that it intends to comply with on a voluntary basis, and is not authorised to impose sanctions in respect of any failure by Woodside to so comply.

Without prejudice to any obligation of Woodside to publish a supplementary prospectus pursuant to section 87G of FSMA or Rule 3.4 of the Prospectus Regulation Rules, the publication of this Prospectus may not be taken to imply that the affairs of the Group at any time subsequent to the date of this Prospectus are not subject to change or that the information in it is correct as of any time after the date of this Prospectus.

Neither Woodside nor any of its representatives, is making any representation to any investor in Woodside Shares regarding the legality or otherwise of an investment in Woodside Shares by such investor under applicable laws. The contents of this Prospectus are not to be construed as legal, business or tax advice. Each investor should consult their own legal adviser, business adviser, financial adviser or tax adviser.

Industry and Market Data

This prospectus contains industry, market and competitive position data that are based on industry publications and studies conducted by third parties as well as Woodside’s internal estimates and research. These industry publications and third-party studies generally state that the information they contain has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. While Woodside believes that each of these publications and third-party studies is reliable, Woodside has not independently verified the market and industry data obtained from these third-party sources. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward-looking statements contained in this prospectus and may differ among third-party sources. These forecasts and forward-looking information are subject to uncertainty and risk due to a variety of factors, including those described in the sections entitled “Risk Factors” and in “Cautionary Statement Regarding Forward-Looking Statements.” These and other factors could cause results to differ materially from those expressed in each of Woodside’s and BHP Petroleum’s forecasts or estimates or those of independent third parties. While Woodside believes its internal research is reliable and its selection of industry publications and third-party studies and the description of its market and industry are appropriate, neither such research nor these descriptions have been verified by any independent source. In addition, references to “independent energy company” in this Prospectus exclude NOCs, companies with free float less than 60% (e.g., Lukoil, Wintershall Dea and Rosneft), major integrated oil and gas companies (e.g., ExxonMobil, Shell, Chevron, BP, ENI, Repsol and Total), and Canadian oil sands operators (e.g., Canadian Natural Resources, Cenovus and Suncor).

Woodside’s website

Information contained on Woodside’s website or the contents of any website accessible from hyperlinks on Woodside’s website are not incorporated into and do not form any part of this Prospectus.

Interpretation

A list of defined terms used in this Prospectus is set out in Part 22 (Definitions and Glossary) of this Prospectus. A list of defined technical terms and conversions used in this Prospectus is set out in Part 23 (Glossary of Technical Terms) of this Prospectus.

References to the singular in this Prospectus shall include the plural and vice versa, where the context so requires. References to sections or Parts are to sections or Parts of this Prospectus. All references to time in this Prospectus are to London time unless otherwise stated.

Preferred currency

Unless specifically expressed otherwise, references to “GBP” or “£” are to the lawful currency of the UK, references to “AUD” or “A$” are to the lawful currency of Australia, and references to “U.S. dollars” or “USD” or “US$” or “$” are to the lawful currency of the United States.

Responsibility statement

Woodside and each of the Directors, whose names appear in Part 12 (Directors, Senior Executives and Corporate Governance) of this Prospectus, accept responsibility for the information contained in this Prospectus. To the best of the knowledge of Woodside and the Directors, the information contained in this Prospectus is in accordance with the facts and this Prospectus makes no omission likely to affect its import.

BHP accepts responsibility for the BHP Information. To the best of the knowledge of BHP, the BHP Information is in accordance with the facts and the BHP Information makes no omission likely to affect its import.

Date

Dated 11 April 2022

| 1 | ||||||

| 1 | ||||||

| 1 | ||||||

| 6 | ||||||

Section D – Key information on the admission to trading on a regulated market | 7 | |||||

| 8 | ||||||

1 | Risks Relating to the Merged Group | 9 | ||||

2 | Risks Relating to Implementation of the Merger | 27 | ||||

3 | Risks relating to Woodside Shares | 32 | ||||

| 36 | ||||||

| 42 | ||||||

| 43 | ||||||

| 44 | ||||||

| 45 | ||||||

1 | Overview | 45 | ||||

2 | Important events | 45 | ||||

3 | Business overview | 45 | ||||

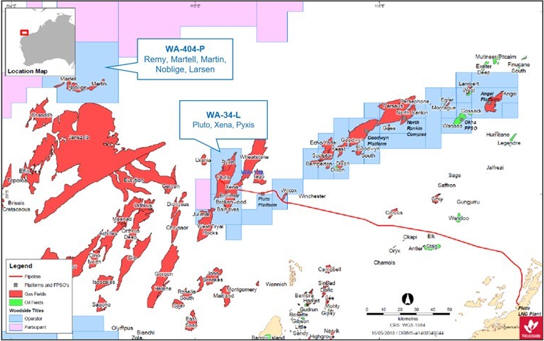

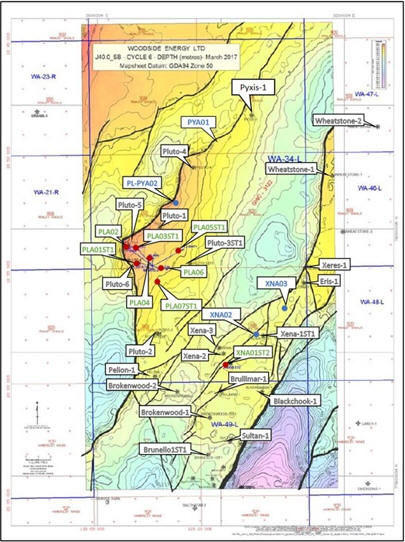

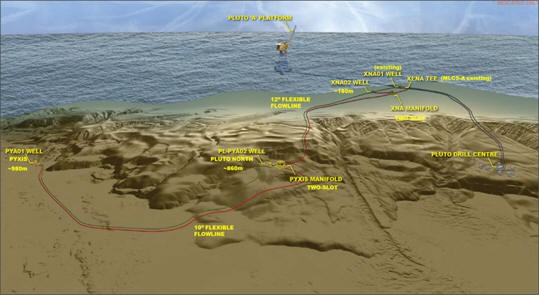

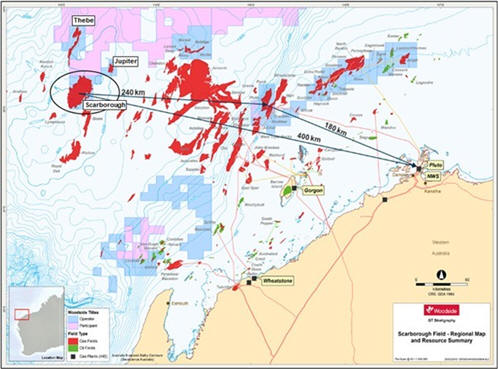

4 | Assets | 46 | ||||

5 | Description of Property | 55 | ||||

6 | Recent Performance | 56 | ||||

7 | Projects and Growth Options | 56 | ||||

8 | Other Development Options | 60 | ||||

9 | Summary of reserves and resources determined by the Competent Person | 62 | ||||

10 | Competition | 63 | ||||

11 | Key Strengths | 63 | ||||

12 | Woodside Directors and Executive Committee | 64 | ||||

13 | Group structure | 65 | ||||

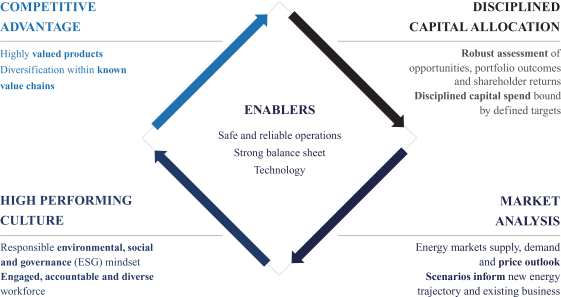

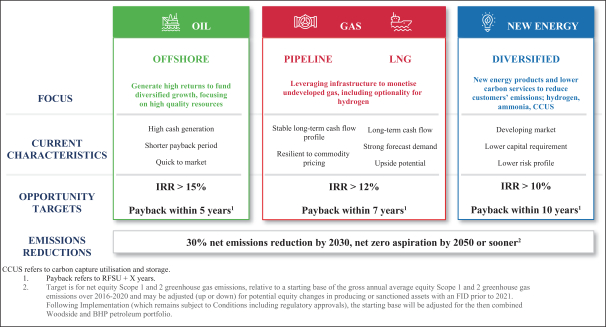

14 | Values and Strategy | 67 | ||||

15 | Strategy | 68 | ||||

16 | ESG | 68 | ||||

17 | Environmental | 68 | ||||

18 | Climate Change | 69 | ||||

19 | Social and community | 70 | ||||

20 | Governance | 71 | ||||

21 | Health and Safety | 71 | ||||

22 | Seasonality | 71 | ||||

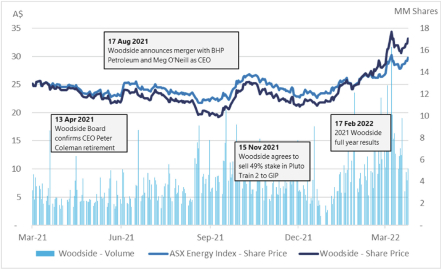

23 | Recent Share Price Performance | 72 | ||||

24 | Substantial holdings | 72 | ||||

25 | Financial information | 73 | ||||

16 | Insurance | 259 | ||||

17 | Material Contracts | 259 | ||||

18 | Licences and Leases | 262 | ||||

19 | Statutory Auditors | 263 | ||||

20 | Working Capital | 264 | ||||

21 | No Significant change | 264 | ||||

22 | The Competent Person’s Report | 264 | ||||

23 | Related Party Transactions | 264 | ||||

24 | Legal Proceedings | 264 | ||||

25 | Consents | 265 | ||||

26 | Rights of Holders Through CREST | 266 | ||||

27 | Miscellaneous | 266 | ||||

28 | Documents available for inspection | 266 | ||||

| 267 | ||||||

| 279 | ||||||

Annexure 1 | A-1 | |||||

Annexure 2 | B-1 | |||||

Annexure 3 | C-1 | |||||

Part 25 – Directors, Secretary, Registered Office and Advisers | 283 | |||||

Section A – Introduction and warnings

| A.1 | Introduction |

This summary must be read as an introduction to this Prospectus. Any decision to invest in Woodside Shares should be based on consideration of this Prospectus as a whole by the investor. By deciding to invest in Woodside Shares, an investor could lose all or part of his or her invested capital.

Civil liability attaches only to those persons who have tabled the summary, including any translation thereof, but only if the summary is misleading, inaccurate, or inconsistent, when read together with other parts of this Prospectus, or it does not provide, when read together with the other parts of this Prospectus, key information in order to aid investors when considering whether to invest in such securities.

| A.2 | The name and ISIN of the securities |

The securities being admitted to trading are the fully paid ordinary shares in the capital of Woodside (the “Woodside Shares”). At Admission, there will be an estimated 1,898,749,771 Woodside Shares in issue.1 The ISIN of the Woodside Shares is currently AU000000WPL2 and is expected to change prior to Admission following Woodside’s proposed change of name.

| A.3 | The identity and contact details of the issuer |

The issuer is Woodside Petroleum Ltd (to be renamed Woodside Energy Group Ltd prior to Admission2). Woodside’s registered office is 11 Mount Street, Perth WA 6000 Australia. Woodside’s telephone number is +61 8 9348 4000 and email address is companyinfo@woodside.com.au. The LEI number for Woodside is 2549005ZC5RXAOO7FH41.

| A.4 | The identity and contact details of the competent authority approving the Prospectus |

The head office of the Financial Conduct Authority (“FCA”) is at 12 Endeavour Square, London E20 1JN, United Kingdom. The telephone number of the FCA is +44 (0)20 7066 1000.

This Prospectus was approved by the FCA on 11 April 2022.

Section B – Key information on the issuer

| B.1 | Who is the issuer of the securities? |

Woodside Petroleum Ltd is a public company (to be renamed Woodside Energy Group Ltd prior to Admission3) incorporated and domiciled in Australia with company number 004 898 962. The principal legislation under which Woodside operates is the Corporations Act and legislation made thereunder. The LEI number for Woodside is 2549005ZC5RXAOO7FH41.

Woodside has been listed on the ASX since 18 November 1971 and is currently listed under the ticker ASX:WPL. Woodside will remain listed on the ASX following Admission.

Principal activities:

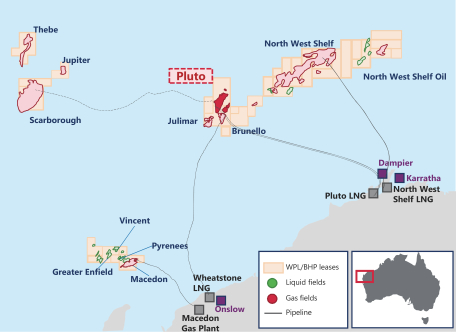

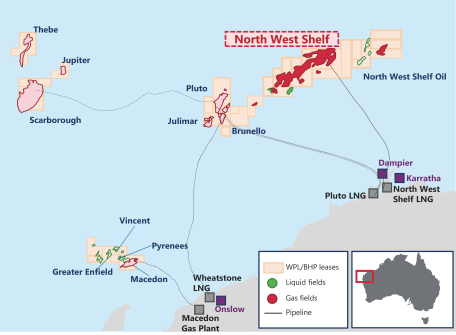

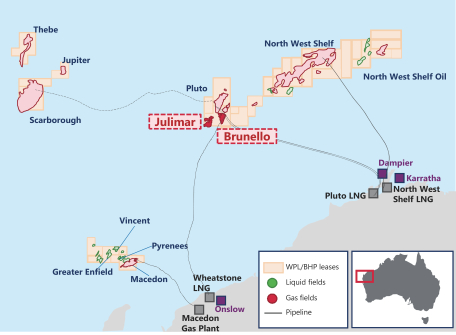

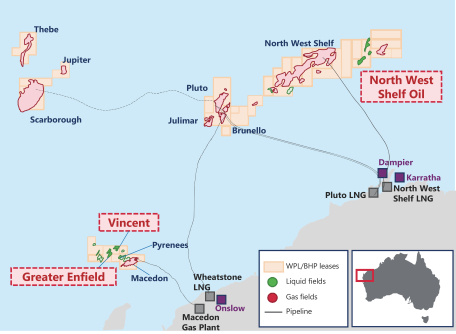

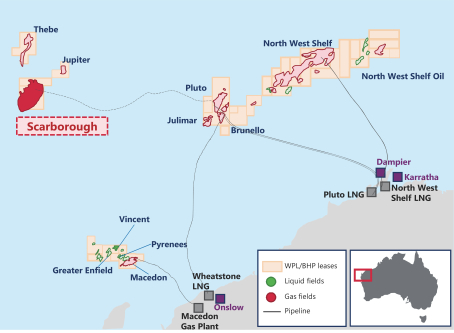

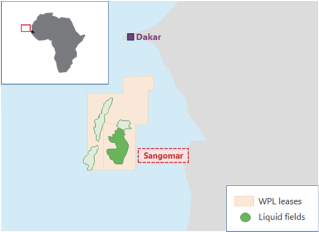

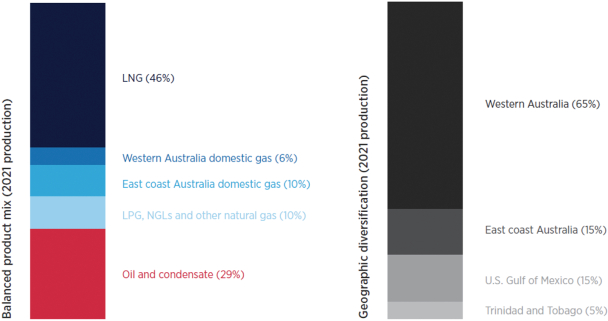

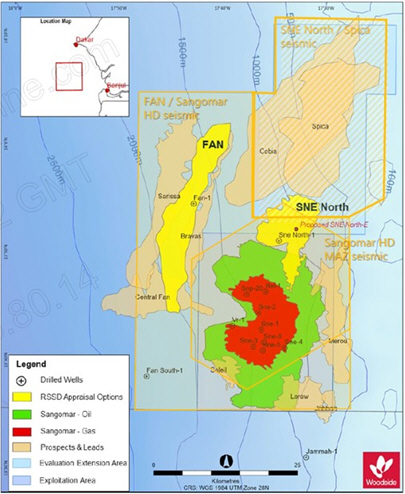

Woodside is an ASX listed oil and gas company based in Perth and is Australia’s leading natural gas producer. Woodside operates the majority of its assets and has over 65 years’ experience in the oil and gas industry. Woodside’s producing portfolio is primarily centred around the production of LNG from conventional offshore projects in Western Australia but also includes oil, condensate, LPG and domestic gas for Western Australian customers. In addition to its producing assets, Woodside is constructing the Scarborough and Pluto Train 2 development in Western Australia and the Sangomar Field Development Phase 1 in Senegal.

The Merger:

On 17 August 2021, Woodside and BHP announced that they had entered into a Merger Commitment Deed, with an effective date of 1 July 2021, to combine their respective oil and gas portfolios through an all-stock merger.

| 1 | Based on number of Woodside Shares in issue at the Last Practicable Date and the estimated number of Woodside Shares to be issued on Implementation and assumes no additional Woodside Shares are issued between the Last Practicable Date and Implementation. |

| 2 | Subject to approval by the Woodside Shareholders at the Woodside Shareholders’ Meeting. |

| 3 | Subject to approval by the Woodside Shareholders at the Woodside Shareholders’ Meeting. |

1

On 22 November 2021, Woodside and BHP entered into a binding Share Sale Agreement which sets out the parties’ obligations in relation to Implementation of the Merger.

With the combination of two high quality asset portfolios, the Merger is expected to create a top 10 global independent energy company by production and the largest energy company listed on the ASX4. The Merger will be on a cash-free and debt-free basis, where BHP Petroleum will settle all intercompany loan balances prior to Implementation.

If the Merger is implemented, Woodside will acquire all of the issued share capital in BHP Petroleum International Pty Ltd, which holds BHP’s oil and gas business, and Woodside will issue New Woodside Shares to BHP as part of the Merger Consideration which will be distributed by BHP to BHP Shareholders (or the Sale Agent in the case of all Ineligible Foreign BHP Shareholders and Relevant Small Parcel BHP Shareholders).

The Merged Group will be owned approximately 52% by Existing Woodside Shareholders and 48% by BHP Shareholders (subject to adjustment in certain circumstances and subject to any BHP Shareholders being Ineligible Foreign BHP Shareholders or Relevant Small Parcel BHP Shareholders). The Merger is subject to satisfaction (or waiver, if permitted) of various Conditions including Woodside Shareholder Approval and regulatory and other approvals.

Major Shareholders:

As at the Last Practicable Date, Woodside is aware of the following persons who (together with their associates), directly or indirectly, hold interests in 5% or more of the Woodside Shares or voting rights as notified to Woodside under the Corporations Act. The table below also shows what these interests are expected to be on Admission, which will be following the issuance of the New Woodside Shares as part of Implementation.

Name | Number of Woodside Shares (pre-Implementation) | Percentage of issued share capital (pre-Implementation)1 | Anticipated number of Woodside Shares (post-Implementation) | Anticipated percentage of issued share capital on Admission (post-Implementation)2 | ||||||||||||

Blackrock Group (Blackrock Inc. and subsidiaries) | 57,411,550 | 3 | 5.83 | 120,866,917 | 4 | 6.37 | ||||||||||

State Street Corporation and subsidiaries | 50,409,641 | 5 | 5.12 | 91,004,737 | 6 | 4.79 | 2 3 | |||||||||

| 1 | Based on number of Woodside Shares on issue as at the Last Practicable Date. |

| 2 | Based on the estimated number of Woodside Shares on issue at Implementation being 1,898,749,771. |

| 3 | This information is derived from the Notice of Change of Interests of Substantial Holder filed by the Blackrock Group with the ASX on 30 May 2019, indicating ownership of Woodside’s shares as of such date. |

| 4 | This information is derived from the Notice of Change of Interests of Substantial Holder filed by the Blackrock Group with the ASX on 30 May 2019, indicating ownership of Woodside’s shares as of such date and a Notice of Change of Interests of Substantial Holder filed by the Blackrock Group with the ASX on 31 January 2022, indicating ownership of BHP shares as of such date. |

| 5 | This information is derived from the Notice of Initial Substantial Holder filed by State Street Corporation with the ASX on 8 November 2021, indicating ownership of Woodside’s shares as of such date. |

| 6 | This information is derived from the Notice of Initial Substantial Holder filed by State Street Corporation with the ASX on 8 November 2021, indicating ownership of Woodside’s shares as of such date and information provided by BHP to Woodside dated 14 February 2022 relating to the number of shares held by State Street Corporation. |

Key managing directors:

Meg O’Neill is the Chief Executive Officer and Managing Director of Woodside.

The Woodside Board intend to appoint a current BHP director as a Woodside director following Implementation, although as at the date of this Prospectus no decisions have been made regarding such appointment.

Auditors:

Woodside’s statutory auditor is Ernst & Young with its registered office at 11 Mounts Bay Road, Perth, WA 6000, Australia. Ernst & Young is registered to carry out audit work by the Australian Securities and Investments Commission and has no material interest in the Company.

On 14 October 2021, the Woodside Board selected PricewaterhouseCoopers to be the Company’s auditor from the 2022 fiscal year. Such selection and change in auditor was adopted at the proposal of the Audit and Risk

| 4 | Top 10 global independent energy company by hydrocarbon production. Woodside analysis based on the Wood Mackenzie Corporate Benchmarking Tool Q4 2021, 1 December 2021. See the section titled ‘Disclaimer and Important Notices’ for clarification of independent energy company. |

2

Committee following a competitive tender process. This selection must be approved by Woodside Shareholders at the Woodside Shareholders’ Meeting to be held on 19 May 2022. Accordingly, Ernst & Young, will retire as Company’s auditor subject to regulatory approval from the Australian Securities and Investments Commission (“ASIC”).

| B.2 | What is the key financial information regarding the issuer? |

Historical Financial Information – Woodside:

The tables below set out summary historical financial information of the Woodside Group as derived without material adjustment from the annual consolidated financial statements of the Woodside Group for the financial years ended 31 December 2021, 31 December 2020 and 31 December 2019 (in each case, prepared in accordance with Australian Accounting Standards and complying with International Financial Reporting Standards as issued by the International Accounting Standards Board) (together, the “Woodside Historical Financial Information”). This information relates to periods prior to Implementation and, as such, does not include BHP Petroleum.

Summary consolidated income statement (US$m)

| Year ended 31 December | ||||||||||||

| 2021 | 2020 | 2019 | ||||||||||

Operating revenue | 6,962 | 3,600 | 4,873 | |||||||||

Cost of sales | (3,845 | ) | (2,985 | ) | (2,727 | ) | ||||||

|

|

|

|

|

| |||||||

Gross profit | 3,117 | 615 | 2,146 | |||||||||

|

|

|

|

|

| |||||||

Other income | 139 | (36 | ) | 100 | ||||||||

Other expenses | (811 | ) | (481 | ) | (418 | ) | ||||||

Impairment reversals/(losses) | 1,048 | (5,269 | ) | (737 | ) | |||||||

Net finance costs | (203 | ) | (269 | ) | (229 | ) | ||||||

|

|

|

|

|

| |||||||

Profit/(loss) before tax | 3,290 | (5,440 | ) | 862 | ||||||||

|

|

|

|

|

| |||||||

Tax (expense)/benefit | (1,254 | ) | 1,465 | (480 | ) | |||||||

|

|

|

|

|

| |||||||

Profit/(loss) after tax | 2,036 | (3,975 | ) | 382 | ||||||||

|

|

|

|

|

| |||||||

Profit/(loss) attributable to: | ||||||||||||

Equity holders of the parent | 1,983 | (4,028 | ) | 343 | ||||||||

Non-controlling interest | 53 | 53 | 39 | |||||||||

|

|

|

|

|

| |||||||

Profit/(loss) for the period | 2,036 | (3,975 | ) | 382 | ||||||||

|

|

|

|

|

| |||||||

Basic earnings/(losses) per share attributable to equity holders of the parent (US cents) | 206.0 | (423.5 | ) | 36.7 | ||||||||

|

|

|

|

|

| |||||||

Summary consolidated statement of financial position (US$m)

| Year ended 31 December | ||||||||||||

| 2021 | 2020 | 2019 | ||||||||||

Assets | ||||||||||||

Current assets | 4,278 | 4,252 | 4,647 | |||||||||

Non-current assets | 22,196 | 20,371 | 24,706 | |||||||||

|

|

|

|

|

| |||||||

Total assets | 26,474 | 24,623 | 29,353 | |||||||||

|

|

|

|

|

| |||||||

Liabilities | ||||||||||||

Current liabilities | 2,622 | 2,094 | 1,131 | |||||||||

Non-current liabilities | 9,623 | 9,654 | 10,813 | |||||||||

|

|

|

|

|

| |||||||

Total liabilities | 12,245 | 11,748 | 11,944 | |||||||||

|

|

|

|

|

| |||||||

Net assets | 14,229 | 12,875 | 17,409 | |||||||||

|

|

|

|

|

| |||||||

Equity | ||||||||||||

Issued and fully paid shares | 9,409 | 9,297 | 9,010 | |||||||||

Reserves | 653 | 1,380 | 953 | |||||||||

Retained earnings | 3,381 | 1,398 | 6,654 | |||||||||

|

|

|

|

|

| |||||||

Equity attributable to equity holders of the parent | 13,443 | 12,075 | 16,617 | |||||||||

|

|

|

|

|

| |||||||

Non-controlling interest | 786 | 800 | 792 | |||||||||

|

|

|

|

|

| |||||||

Total equity | 14,229 | 12,875 | 17,409 | |||||||||

|

|

|

|

|

| |||||||

3

Summary consolidated cash flow statement (US$m)

| Year ended 31 December | ||||||||||||

| 2021 | 2020 | 2019 | ||||||||||

Net cash from operating activities | 3,792 | 1,849 | 3,305 | |||||||||

Net cash used in investing activities | (2,941 | ) | (2,112 | ) | (1,238 | ) | ||||||

Net cash used in financing activities | (1,424 | ) | (203 | ) | 317 | |||||||

|

|

|

|

|

| |||||||

Net (decrease)/increase in cash held | (573 | ) | (466 | ) | 2,384 | |||||||

Cash and cash equivalents at the beginning of the period | 3,604 | 4,058 | 1,674 | |||||||||

Effects of exchange rate changes | (6 | ) | 12 | — | ||||||||

|

|

|

|

|

| |||||||

Cash and cash equivalents at the end of the period | 3,025 | 3,604 | 4,058 | |||||||||

|

|

|

|

|

| |||||||

BHP Petroleum Historical Financial Information:

The tables below set out summary combined historical financial information of BHP Petroleum as derived without material adjustment from BHP’s financial statements in respect of BHP Petroleum for (i) the half year ended 31 December 2021 (together with the half year ended 31 December 2020 for comparatives purposes) (unaudited), (ii) the financial years ended 30 June 2021 and 30 June 2020 (audited) and (iii) the financial year ended 30 June 2019 (unaudited) (together, the “BHP Petroleum Historical Financial Information”). The BHP Petroleum Historical Financial Information has been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board.

Summary combined income statement (US$m)

| Half Year ended 31 December | Year ended 30 June | |||||||||||||||||||

| unaudited | unaudited | unaudited | ||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | 2019 | ||||||||||||||||

Revenue | 3,198 | 1,602 | 3,909 | 3,997 | 5,867 | |||||||||||||||

Profit from operations | 1,608 | (199 | ) | 234 | 660 | 2,387 | ||||||||||||||

Profit/(loss) before tax | 1,490 | (437 | ) | (174 | ) | 304 | 1,750 | |||||||||||||

Tax (expense)/income | (907 | ) | 50 | (187 | ) | (482 | ) | (1,089 | ) | |||||||||||

Profit/(loss) after tax from continuing operations | 583 | (387 | ) | (361 | ) | (178 | ) | 661 | ||||||||||||

Loss after tax from discontinued operations | — | — | — | — | (335 | ) | ||||||||||||||

Profit/(loss) after tax from continuing and discontinued operations | 583 | (387 | ) | (361 | ) | (178 | ) | 326 | ||||||||||||

Profit/(loss) attributable to: | ||||||||||||||||||||

BHP shareholders | 583 | (387 | ) | (361 | ) | (178 | ) | 319 | ||||||||||||

Non-controlling interests | — | — | — | — | 7 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Summary combined statement of financial position (US$m)

| Half Year ended 31 December | Year ended 30 June | |||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | 2019 | ||||||||||||||||

Assets | ||||||||||||||||||||

Current assets | 13,435 | 7,656 | 7,656 | 13,923 | 18,387 | |||||||||||||||

Non-current assets | 13,723 | 14,579 | 14,579 | 14,386 | 13,117 | |||||||||||||||

Total assets | 27,158 | 22,235 | 22,235 | 28,309 | 31,504 | |||||||||||||||

Liabilities | ||||||||||||||||||||

Current liabilities | 14,290 | 3,714 | 3,714 | 8,124 | 8,435 | |||||||||||||||

Non-current liabilities | 4,894 | 15,409 | 15,409 | 15,461 | 18,132 | |||||||||||||||

Total liabilities | 19,184 | 19,123 | 19,123 | 23,585 | 26,567 | |||||||||||||||

Net assets | 7,974 | 3,112 | 3,112 | 4,724 | 4,937 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Equity | 7,974 | 3,112 | 3,112 | 4,724 | 4,937 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

4

Summary combined cash flow statement (US$m)

| Half Year ended 31 December | �� | Year ended 30 June | ||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | 2019 | ||||||||||||||||

Net operating cash flows | 1,388 | 106 | 1,060 | 585 | 2,821 | |||||||||||||||

Net investing cash flows | (543 | ) | (980 | ) | (1,520 | ) | (1,033 | ) | (1,387 | ) | ||||||||||

Net financing cash flows | (628 | ) | 766 | 910 | (607 | ) | (10,557 | ) | ||||||||||||

Net (decrease)/increase in cash held | 217 | (108 | ) | 450 | (1,055 | ) | 1,304 | |||||||||||||

Foreign currency exchange rate changes on cash and cash equivalents | (1 | ) | — | 1 | (1 | ) | — | |||||||||||||

Cash and cash equivalents at the beginning of the period | 776 | 325 | 325 | 1,381 | 77 | |||||||||||||||

Cash and cash equivalents at the end of the period | 992 | 217 | 776 | 325 | 1,381 | |||||||||||||||

The above summary tables should be read together with the whole of this Prospectus.

Changes since end of last financial period:

Woodside – The financial performance of the Woodside Group has benefited from increases in commodity prices since 31 December 2021. There has been no other significant change in the financial performance or financial position of the Woodside Group since 31 December 2021, being the end of the last financial period of the Woodside Group for which financial information has been published, to the date of this Prospectus.

BHP Petroleum – The financial performance of BHP Petroleum has benefited from increases in commodity prices since 31 December 2021. There has been no other significant change in the financial performance or financial position of BHP Petroleum since 31 December 2021, being the end of the last financial period of BHP Petroleum for which financial information has been published, to the date of this Prospectus.

Unaudited Pro Forma Financial Information:

The table below sets out a summary of the unaudited pro forma financial information of the Merged Group (“Unaudited Pro Forma Financial Information”) as derived from the financial statements in respect of the Woodside Group for the year ended 31 December 2021 (audited) and BHP Petroleum for the financial year ended 30 June 2021 (audited) and half year ended 31 December 2021 (unaudited), after making certain pro forma adjustments.

The Unaudited Pro Forma Financial Information has been prepared on the basis set out in the notes to the Unaudited Pro Forma Financial Information, in a manner consistent with the accounting policies applied by the Woodside Group in preparing its financial statements for the financial year ended 31 December 2021, and in accordance with the requirements of sections 1 and 2 of Annex 20 of the UK Prospectus Delegated Regulation. The Unaudited Pro Forma Financial Information has been prepared for illustrative purposes only. The hypothetical financial position or results included in the Unaudited Pro Forma Financial Information may differ from the Merged Group’s actual financial position or results.

| Unaudited Pro Forma Information | Unaudited Pro Forma 31 December 2021 | |||

Revenue | 10,871 | |||

Net income (loss) attributable to common stockholders | 1,504 | |||

Total assets | 60,553 | |||

Total liabilities | 24,038 | |||

Net assets | 36,515 | |||

The above table should be read together with the whole of this Prospectus.

| B.3 | Profit forecast |

Not applicable; this Prospectus does not contain profit forecasts or estimates.

5

| B.4 | What are the key risks that are specific to the issuer? |

The global response to climate change is changing the way the world produces and consumes energy, creating risks for the Merged Group.

The Merged Group will be exposed to risks resulting from fluctuations in LNG market conditions or the price of crude oil, which can be volatile.

The Merged Group will operate in a high-risk industry and there are risks inherent in the Merged Group’s exploration, development, production, and restoration activities.

Material limitations to the Merged Group’s access to capital or a failure in financial risk management could adversely affect the Merged Group’s business, results of operations and financial condition.

Woodside invests and, following Implementation, the Merged Group is expected to invest, significant amounts of funds in a variety of activities across the world which involve uncertainties and risks.

There are numerous uncertainties inherent in estimating quantities of reserves, including many factors beyond the Merged Group’s control.

The Merged Group operations will be subject to the risk of litigation or arbitration.

Woodside’s and BHP Petroleum’s operations are subject to extensive governmental oversight and regulation.

The Merged Group’s operations will be subject to governmental and sovereign risks in the countries in which Woodside and BHP Petroleum do business.

Oversight and review by the ACCC in Australia, and other competition regulatory bodies in jurisdictions the Merged Group will operate in, may impact the Merged Group’s businesses.

An inability to attract, retain and motivate skilled workers could adversely affect the Merged Group’s business, operations and financial performance.

Section C – Key information on the securities

| C.1 | What are the main features of the securities? |

Overview of shares:

The securities being admitted to trading are the Woodside Shares. At Admission, there will be an estimated 1,898,749,771 Woodside Shares in issue.5 The ISIN of the Woodside Shares is currently AU000000WPL2 and is expected to change prior to Admission following Woodside’s proposed change of name. Woodside’s ticker symbol on Admission will be WDS, subject to shareholder approval of the proposed name change.

Securities of issuers domiciled outside the United Kingdom, such as Woodside Shares, cannot be held or settled directly in CREST. Woodside has therefore entered into depositary interest arrangements to enable investors from Admission to transact and settle trades of Woodside Shares, conducted on the LSE, within CREST. The Woodside Shares will not themselves be admitted to CREST; rather, the Depositary will issue the Depositary Interests in respect of underlying Woodside Shares which shall be capable of being held within CREST. Each Depositary Interest represents one underlying Woodside Share. The Depositary Interests are constituted under English law and held and transferred directly through the CREST system. Depositary Interests have the same ISIN as the underlying Woodside Shares and do not require a separate admission to trading on the LSE. The Depositary Interests will be created and issued pursuant to a Deed Poll issued and executed by the UK Depositary.

Following Admission, the price of the Woodside Shares will be quoted on the LSE in GBX.

Share rights:

The Woodside Shares are fully paid ordinary shares in the capital of Woodside.

The Woodside Shares rank equally for voting purposes. On a show of hands, each Shareholder present has one vote, and on a poll, each Shareholder has one vote per Woodside Share held.

The Woodside Shares rank equally for dividends declared and for any distributions on a winding-up.

| 5 | Based on number of Woodside Shares in issue at the Last Practicable Date and the estimated number of Woodside Shares to be issued on Implementation of the Merger and assumes no additional Woodside Shares are issued between the Last Practicable Date and Implementation. |

6

The Woodside Shares are freely transferable and there are no restrictions on transfer imposed by the Woodside Constitution.

Seniority:

The Woodside Shares rank equally in the right to receive a relative proportion of Woodside’s assets upon dissolution and are the most senior security in Woodside’s capital structure.

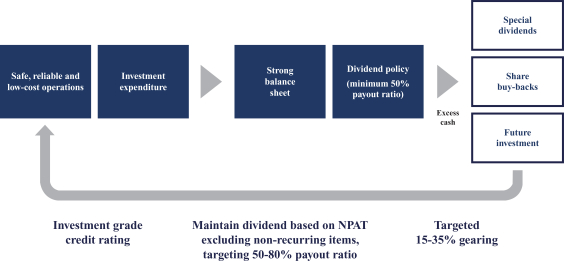

Dividend policy:

Woodside’s dividend policy specifies that it will pay a minimum of 50% of net profit after tax excluding non-recurring items in dividends. The Woodside Board targets a dividend pay-out ratio between 50% and 80% of net profit after tax excluding non-recurring items subject to market conditions and investment requirements. Generally, Woodside pays dividends to Shareholders semi-annually, once in March or April and again in September or October of each year. Woodside maintains a dividend reinvestment plan that, if utilised by the Woodside Board, provides Shareholders with the option of reinvesting all or part of their dividends in additional Woodside Shares rather than taking cash dividends.

| C.2 | Where will the securities be traded? |

Woodside Shares are currently traded on the ASX. Woodside will make an application to the ASX for quotation of the New Woodside Shares on the ASX.

In addition, Woodside will make applications to the FCA and the LSE for all of the Woodside Shares, including the New Woodside Shares, to be admitted to the standard listing segment of the Official List and to trading on the LSE’s Main Market for listed securities. It is expected that Admission will become effective and that dealings will commence at 8.00 am on or around 6 June 2022. However, Admission is conditional on Implementation. The Merger is subject to satisfaction (or waiver, if permitted) of various Conditions. If the Merger does not proceed, then Admission will not take place.

Woodside has applied for the Woodside ADSs to listing and trading on the NYSE.

| C.3 | What are the key risks that are specific to the securities? |

The market price of Woodside Shares may be volatile, and an active trading market may not develop or be sustained in the future in the United Kingdom.

There is no guarantee that dividends will be paid on Woodside Shares.

Substantial future sales of the Woodside Shares, or the perception that such sales might occur, or additional offerings of Woodside Shares could depress the market price of Woodside Shares.

Section D – Key information on the admission to trading on a regulated market

| D.1 | Under which conditions and timetable can I invest in this security? |

Woodside will make applications to the FCA and the LSE for all of the Woodside Shares to be admitted to the standard listing segment of the Official List and to trading on the LSE’s Main Market for listed securities. Admission is conditional on Implementation. If the Merger does not proceed, then Admission will not take place. It is expected that Admission will become effective and that dealings in the Woodside Shares will commence at 8.00 am on or around 6 June 2022.

Estimated transaction costs in connection with the Merger are US$410 million (excluding integration costs). No such expenses or any commissions or fees will be charged by Woodside to any investors in Woodside Shares in connection with the Merger or Admission.

| D.2 | Why is this Prospectus being produced? |

The Prospectus is being produced in connection with Admission of the Woodside Shares following Implementation. The Woodside Directors believe a listing on the LSE, in addition to Woodside’s ASX and NYSE listings, will benefit its new and more geographically diverse shareholder base and will assist in building Woodside’s profile and provide a greater market for trading in Woodside Shares.

There are no material conflicts of interest pertaining to Admission.

7

Investors should carefully review and consider the following risk factors and the other information contained in this Prospectus. The risks discussed herein have been identified based on an evaluation of the historical risks faced by Woodside and BHP Petroleum and relate to current expectations as to future risks that may result from the Merger. Certain of the following risk factors apply to the business and operations of Woodside and BHP Petroleum and will also apply to the business and operations of the Merged Group following Implementation. The occurrence of one or more of the events or circumstances described in these risk factors, alone or in combination with other events or circumstances, may adversely affect the ability to complete or realise the anticipated benefits of the Merger, and may have a material adverse effect on the business, cash flows, financial condition and results of operations of the Merged Group following Implementation. This could cause the trading price of the Woodside Shares to decline, perhaps significantly. Investors should carefully consider the following risk factors in conjunction with the other information included in this Prospectus, including the cautionary statements regarding forward-looking statements contained in Part 3 (Presentation of financial and other information), Part 17 (Operating and Financial Review of Woodside), the financial statements of Woodside, the financial statements of BHP Petroleum and notes to the financial statements included herein. The risks discussed below are not exhaustive and are based on certain assumptions made by Woodside and BHP Petroleum which later may prove to be incorrect or incomplete. Investors are encouraged to perform their own investigation with respect to the business, financial condition and prospects of Woodside, BHP Petroleum and the Merged Group. Each of Woodside, BHP Petroleum and the Merged Group may face additional risks and uncertainties that are not presently known to it, or that are currently deemed immaterial, which may also impair their respective businesses, financial conditions or results of operations.

Any investment in, or holding of, the Woodside Shares, carries a number of risks. Investors should review this Prospectus carefully and in its entirety (together with any documents incorporated by reference into it) and consult with their professional advisers. Investors should carefully consider the risks and uncertainties described below, together with the risks normally associated with companies of a similar nature to Woodside and, in particular, all other information in this Prospectus and the information incorporated into this Prospectus by reference, before making any decision in respect of the Woodside Shares.

Investors should note that the risks relating to the Merger, the Merged Group and the Woodside Shares summarised in Part 1 (Summary) of this Prospectus are the risks that the Board believes to be most essential to an assessment by a prospective investor of whether to consider an investment in the Woodside Shares. However, the risk factors described below are not an exhaustive list or explanation of all risks relating to the Merger, the Merged Group or Woodside Shares and should be used as guidance only. Additional risks and uncertainties relating to the Merger, the Merged Group and Woodside Shares that are not currently known to Woodside, or which may currently appear to be immaterial, may individually or cumulatively also have a material adverse effect on the Merged Group’s business, results of operations, financial condition or prospects. If such risks were to materialise, the price of the Woodside Shares could decline as a consequence and investors could lose all or part of their investment.

The information given below is as of the date of this Prospectus and, except as required by the FCA, the LSE, the LSE Listing Rules, the UK Prospectus Regulation Rules or any other applicable law, will not be updated. Any forward-looking statements are made subject to the reservations specified under “Cautionary Statement Regarding Forward-Looking Statements” in Part 3 (Presentation of Financial and Other Information) of this Prospectus.

These risk factors do not consider the individual investment objectives, financial situation, position or particular needs of individual investors. If an investor does not understand any part of this Prospectus (including these risk factors) the investor should consult their legal, financial, taxation or other professional adviser.

8

| 1 | Risks Relating to the Merged Group |

| 1.1 | Climate change |

The global response to climate change is changing the way the world produces and consumes energy, creating risks for the Merged Group. The complex and pervasive nature of climate change means transition risks are interconnected with and may amplify other risks. Additionally, the inherent uncertainty of potential societal responses to climate change may create a systemic risk to the global economy. If the Merged Group fails to adequately respond and adapt to the global response, its business, results of operations and financial condition could be materially adversely affected.

A recent report of the Intergovernmental Panel on Climate Change (IPCC, Working Group 1 contribution to the Sixth Assessment Report) states that “it is unequivocal that human influence has warmed the atmosphere, ocean and land.” The Merged Group will be a major producer of energy-related products such as LNG, crude oil, condensate, pipeline gas and LPG which result in the generation of greenhouse gas emissions throughout their lifecycle. Additionally, the Merged Group’s operations and properties will generate greenhouse gas emissions, particularly in Australia and the United States.

The complex and pervasive nature of climate change means that climate change risks are interconnected with and may amplify the Merged Group’s other principal risks. Political and legal risks in relation to climate change include the possibility of executive and legislative change (such as the introduction of carbon pricing, modifications to the tax structure, tightening of restrictions on emissions, among others), delays, conditions or suspensions placed on regulatory approvals and litigation. Such political and legal risks may result in reduction or modification of certain operations, loss of lawsuits seeking to impose liability, or impairment of the Merged Group’s ability to continue to operate in an economic manner. These may lead to increased costs or decreased opportunities in operations, delay projects, and may adversely change the demand for oil and gas products in the Merged Group’s portfolio thereby reducing revenues, adversely impacting earnings and the value of its reserves and accelerating decommissioning obligations. “Green incentives” could help accelerate and de-risk investments in new energy technologies by competitors. Litigation could disrupt or delay regulatory approvals or impose financial costs.

Legislative and regulatory risks include the introduction of proposals by Australian lawmakers, the U.S. Congress and other governments intended to address climate change using different approaches, including but not limited to introducing or increasing direct limits on carbon emissions, emissions trading including in the form of baseline-and-credit or cap-and-trade schemes, a tax on carbon or greenhouse gas emissions, incentives for the development of lower-carbon technology, and renewable portfolio standards. In the U.S., many federal and state court cases have been filed in recent years asserting damage claims related to greenhouse gas emissions, and the results in those proceedings could establish adverse precedent that might apply to companies (including the Merged Group) that produce greenhouse emissions. Jurisdictions including the European Union have considered proposals to introduce “Border Adjustment Mechanisms” to apply carbon regulation to certain imported goods and services. The Merged Group could be materially and adversely affected if new legislation or regulations are adopted to address global climate change or if the Merged Group is subject to lawsuits for alleged damage to persons or property resulting from greenhouse emissions.

Technology risks include the cost of transition to lower emitting or less carbon-intensive technology in order to meet emission reduction targets and the risk of failure in novel technologies. These could increase the cost of achieving emission reduction targets and increase costs or reduce revenue from new products and services. The timing of technology development and deployment is uncertain which also results in a risk of increased cost or decreased revenue if the Merged Group’s investments in new energy technologies are not timed to meet customer demand.

Market risks include changes to the price level and volatility of products that the Merged Group sells, thereby reducing revenues and adversely impacting earnings and the value of its reserves. Market risks also include changes to the price and availability of goods and services that the Merged Group purchases. These risks could arise due to climate regulation imposed upon customers and suppliers, product substitution as new forms of energy emerge, or other forms of change in final customer demand such as reductions in petroleum product demand due to faster than expected adoption of electric vehicles and other changes in consumer preferences.

Reputation risks include the risk of increased stakeholder concern and of stigmatisation of the broader carbon-intensive energy sector, or if emissions reduction and energy transition targets are not achieved and/or do not meet community expectations. This could affect the Merged Group’s ability to attract and retain talent and

9

capital, and may include shareholder activism. The Australian legal regime, where the majority of the Merged Group’s assets and where its headquarters will be located, is generally conducive to shareholder activism. Shareholders have statutory rights to call shareholders’ meetings, to requisition resolutions and remove directors. The increased public and private focus on climate change and greenhouse gas emissions may cause some investors to take steps to involve themselves in the governance and strategic direction of the Merged Group. Any such investor activism could increase costs, divert management’s attention and resources, impact execution of business strategy and initiatives, create adverse volatility in the market price of the Merged Group securities or make it difficult to attract and retain qualified personnel and business partners.

Financial risks include the risk that investors invested in fossil fuel energy companies become increasingly concerned about the potential effects of climate change and may elect in the future to shift some or all of their investments into other sectors. Institutional lenders which provide financing to fossil fuel energy companies have also become more attentive to sustainable lending practices that favour renewable power sources such as wind and solar photovoltaic, making those sources more attractive, and some of them may elect not to provide funding for fossil fuel energy companies, or may make funding available on less competitive terms. Additionally, there is the possibility that financial institutions will be required to adopt policies that limit funding for fossil fuel energy companies. Limitation of investments in and financing for fossil fuel energy companies could result in the restriction, delay or cancellation of new or expanded development or production activities as well as a reduction in the Merged Group’s share price.

Physical risks include the potential exacerbation (frequency or severity) of existing weather conditions (for example cyclones or hurricanes), hot working conditions, rising sea levels and erosion which matters could have a material adverse effect on the Merged Group’s assets and operations as well as the business of third-party vendors who supply necessary products and services in support of such operations.

| 1.2 | Fluctuations in LNG market conditions and the price of crude oil |

| a. | Supply and demand, market conditions and price movements |

The Merged Group will be exposed to risks resulting from fluctuations in LNG market conditions or the price of crude oil, which can be volatile. Any material or sustained decline in LNG or crude oil prices, or change in buyer preferences, could have a material adverse effect on the Merged Group’s results.

Both Woodside’s and BHP Petroleum’s revenues are primarily derived from sales of LNG, crude oil, condensate, pipeline gas and LPG. Consequently, the results of operations of both businesses are strongly influenced by the prices they receive for these products, which in the case of oil and condensate are primarily determined by prevailing crude oil prices and in the case of pipeline gas, LPG and LNG are primarily determined by prevailing crude oil prices as well as some fixed pricing and other price indexes (such as Henry Hub and the JKM). For the year ended 31 December 2021, the majority (approximately 81%) of Woodside’s production was attributed to natural gas, comprising LNG, LPG and pipeline gas and the remaining portion (approximately 19%) of Woodside’s production was attributed to oil and condensate. That production mix differs from BHP Petroleum, which for the year ended 31 December 2021, was approximately 63% natural gas, comprising LNG, LPG and pipeline gas, and 37% oil and condensate (excluding Algeria and Neptune production). Overall BHP Petroleum has a lower weighting of LNG in its portfolio contrasted with Woodside. As a result, BHP Petroleum has relatively less exposure to the value of LNG relative to oil. In this context, the Merger will result in Woodside Shareholders diversifying their exposure from LNG, while Eligible BHP Shareholders who continue to hold Woodside Shares or Woodside ADSs following the Merger will increase their exposure to LNG.

LNG market conditions, including, but not limited to, supply and demand, are unpredictable and will be beyond the Merged Group’s control. In particular, supply and demand for, and pricing of, LNG remain sensitive to energy prices, external economic and political factors, weather, climate conditions, natural disasters (including pandemics), timing of FIDs for new operations, construction and start-up and operating costs for new LNG supply, buyer preferences for LNG, coal or crude oil and evolving buyer preferences for different LNG price regimes and the energy transition. Buyers and sellers of LNG are increasingly more flexible with the way they transact, and contracts may involve hybrid pricing that is linked to other indices such Brent or JCC. Typically, only LNG supplied from the U.S. was based on a component linked to movements in the U.S. Henry Hub plus certain fixed and variable components. This type of pricing structure may become a component of the weighted average price into Asia and other markets since LNG supply and trade has globalised and increasingly the lowest cost supply is setting the floor for long-term average global natural gas prices with transportation costs accounting for regional differences. This marginal supply is predominantly from the United States, indirectly pegging global gas prices and Asian spot LNG prices to the Henry Hub marker which could adversely affect the

10

pricing of new LNG contracts and potential future price reviews of existing LNG contracts. Tenders may also be used by suppliers and buyers, typically for shorter-term contracts. In addition, long-term LNG contracts typically contain price review mechanisms which sometimes need to be resolved by expert determination or arbitration. The use of these independent resolution mechanisms are likely to be more prevalent in volatile commodity markets. Alternatives to fossil fuel-based products for the generation of electricity, for example nuclear power and renewable energy sources, are continually under development and, if these alternatives continue to gain market share, they could also have a material impact on demand for LNG, which in turn may negatively impact the Merged Group’s business, results of operations and financial condition in the longer-term.

In early March 2020, oil prices experienced a precipitous decline in response to reduced oil demand due to the economic impacts of COVID-19 lockdowns and a fallout between Russia and Saudi Arabia, two of the 23 nations in OPEC+ (which is comprised of the 13 Organization of Petroleum Exporting Countries, and 10 non-OPEC members including Russia). OPEC+ had been balancing the market through supply management. Oil prices have rallied since the 2020 lows and in March 2022 were at multi-year highs as markets priced in geopolitical risk premiums relating primarily to Russia’s invasion of Ukraine, exacerbating market uncertainty and energy market volatility. Oil prices can be very volatile, and periods of sustained low prices could result in changes to the Merged Group’s carrying value assumptions and may also reduce the reported net profit for the relevant period.

Crude oil prices are affected by numerous factors beyond the Merged Group’s control, including worldwide oil supply and demand. In addition to the recent impacts on oil prices resulting from those summarised above, the price of crude oil may be affected by other factors such as:

| • | the level of economic activity in the markets Woodside and BHP Petroleum serve; |

| • | regional political developments and military conflicts (including the ongoing Ukraine conflict); |

| • | economic sanctions; |

| • | weather conditions and natural disasters; |

| • | conservation and environmental protection efforts; |

| • | the level of crude oil inventories; |

| • | the ability of OPEC and other major oil-producing or oil-consuming nations to influence global production levels and prices; |

| • | governmental regulations and actions, including the imposition of taxes and trade restrictions; |

| • | market uncertainty; |

| • | speculative activities by those who buy and sell oil and gas on the world markets, including commodity futures trading; |

| • | availability and capacity of infrastructure, processing facilities and necessary transportation; |

| • | supply chain disruptions; |

| • | the price and availability of new technology; |

| • | the availability and cost of alternative sources of energy; and |

| • | the impact of climate change considerations and actions towards energy transition on the demand for key commodities which the Merged Group produces. |

The transition to lower-carbon sources of energy in many parts of the world (driven by ESG and climate change concerns) may affect demand for the Merged Group’s products, including crude oil, natural gas and LNG, which in turn may affect the price received (or expected to be received) for these products. Material adverse price impacts (including as a result of the energy transition) may affect the economic performance (including as to margins and cash flows) of, and longevity of production from, the Merged Group’s existing and future production assets, and ultimately the financial performance of the Merged Group.

It is impossible to predict future crude oil, LNG and natural gas price movements with certainty. A low crude oil price environment or declines in the price of crude oil, in LNG and natural gas prices, could adversely affect the Merged Group’s business, results of operations and financial condition and liquidity. They could also negatively impact its ability to access sources of capital, including equity and debt markets. Those circumstances may also adversely impact the Merged Group’s ability to finance planned capital expenditures, including development projects, and may change the economics of operating certain wells, which could result in a reduction in the volume of the Merged Group’s reserves. Declines in crude oil, LNG and natural gas prices, especially sustained

11

declines, may also reduce the amount of oil and gas that it can produce economically, reduce the economic viability of planned projects or of assets that it plans to acquire or has acquired and may reduce the expected value and the potential commerciality of exploration and appraisal assets. Those reductions may result in substantial downward adjustments to the Merged Group’s estimated proved reserves and require additional write-downs of the value of its oil and gas properties.

Sales contracts with the National Gas Company relating to production from BHP Petroleum’s operations in the T&T are linked to ammonia pricing. Similar to crude oil, LNG and natural gas, it is impossible to predict future ammonia prices with certainty.

| b. | Exposure to short-term contracts and spot pricing |

The Merged Group’s exposure to shorter-term contracts and more volatile spot pricing (which can vary from time to time) could result in lower pricing in periods of LNG market over-supply.

A portion of the Merged Group’s production will be exposed to shorter-term contracts and more volatile spot pricing, contrasted with long-term or medium-term contracts. In the past decade, there has been an increased prevalence of shorter-term contracts (i.e. spot sales and contracts with a duration of two years or less) and lower quantity contracts across the LNG market, although the share of total trade has tapered off slightly in recent years. It is anticipated that the proportion of such production of the Merged Group will vary from time to time. If the proportion of the Merged Group’s production contracted on a shorter-term basis increases at any point in time, this may result in the Merged Group having increased exposure to deterioration in LNG market conditions.

Further, there is a risk that in a lower price environment, buyers are unwilling to commit to medium-term or long-term contracts, which may also result in the Merged Group having increased exposure to spot prices and LNG market volatility. Any increase in the Merged Group’s percentage of uncommitted production could result in lower average realised prices during periods of LNG over-supply, which could have an adverse effect on the Merged Group’s business, results of operations and financial condition.

| c. | Commodity and currency hedging |

The Merged Group may be exposed to commodity and currency hedging.

There can be no assurance that the Merged Group will successfully manage its exposure to commodity prices. There is also counterparty risk associated with derivative contracts. If any counterparty to the Merged Group’s derivative instruments were to default or seek bankruptcy protection, it could subject a larger percentage of the Merged Group’s future oil and gas production to price changes and could have a negative effect on Woodside’s financial performance, including its ability to fund future projects. Whether or not the Merged Group engages in hedging and other oil and gas derivative contracts on a limited basis or otherwise, the Merged Group will remain exposed to fluctuations in crude oil prices.

| d. | Interests in LNG and oil projects in construction |

The Merged Group will have interests in LNG projects in construction which will increase the Merged Group’s LNG production and LNG sales and, therefore, its reliance on the prices at which it is able to sell its LNG production to its customers.

Woodside and BHP Petroleum have interests in LNG projects in construction, for example, in the case of Woodside, the Scarborough and Pluto Train 2 development and the North West Shelf and Julimar Brunello upstream supply projects which will, if and when completed, supplement Woodside’s LNG production and LNG sales and, therefore, its reliance on the prices at which it is able to sell its LNG production to its customers. Accordingly, negative movements in the LNG market may have a material adverse effect on Woodside’s financial performance, including in relation to uncommitted production from existing facilities or from potential future developments.

The Merged Group’s profits may be adversely affected by the introduction of new LNG facilities, or increased LNG throughput and expansion of existing LNG facilities (including those owned or operated by the Merged Group) in the LNG market, which could increase the supply of LNG and thereby lower prices. In particular, in both the Atlantic and Asia-Pacific markets, there is increasing LNG supply under construction and potential East African, North American, Qatari and Russian LNG projects, which may increase competition in the Atlantic and Asia-Pacific LNG markets. Such increases in the supply of LNG without a corresponding increase in demand for

12

LNG may lower LNG prices and the prices at which the Merged Group will be able to sell its LNG production to its customers. Decreases in LNG prices may materially affect the Merged Group’s business, results of operations and financial condition.

| e. | Interests in oil projects in construction |

The Merged Group will have a significant interest in oil projects in construction which will increase the Merged Group’s crude oil production and crude oil sales and, therefore, its reliance on crude oil prices at which it is able to sell its production to its customers.