UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05742

BlackRock FundsSM

(Exact name of registrant as specified in charter)

100 Bellevue Parkway

Wilmington, DE 19809

(Address of principal executive offices) (Zip code)

Brian Kindelan, Esq.

BlackRock Advisors, Inc.

100 Bellevue Parkway

Wilmington, Delaware 19809

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 441-7762

Date of fiscal year end: September 30, 2005

Date of reporting period: March 31, 2005

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

The Report to Shareholders is attached herewith.

ALTERNATIVES BLACKROCK SOLUTIONS EQUITIES FIXED

INCOME LIQUIDITYREAL ESTATE BlackRock Funds

Equity Portfolios

Semi-Annual Report to Shareholders

March 31, 2005 (Unaudited)

[GRAPHIC OMITTED]

[GRAPHIC OMITTED]

[GRAPHIC OMITTED]

NOT FDIC INSURED

MAY LOSE VALUE

NO BANK GUARANTEE

BLACKROCK FUNDS

EQUITY PORTFOLIOS

*Investment Trust

*Large Cap Value Equity

*Large Cap Growth Equity

*Dividend AchieversTM

*Legacy

*Mid-Cap Value Equity

*Mid-Cap Growth Equity

*Aurora

*Small/Mid-Cap Growth

*Small Cap Value Equity

*Small Cap Core Equity

*Small Cap Growth Equity

*Global Science & Technology Opportunities

*Global Resources

*All-Cap Global Resources

*Health Sciences

*U.S. Opportunities

*International

Opportunities

*Asset Allocation

*Index Equity

TABLE OF CONTENTS

Shareholder Letter..........................................................1

Portfolio Summaries

Investment Trust........................................................2-3

Large Cap Value Equity..................................................4-5

Large Cap Growth Equity.................................................6-7

Dividend AchieversTM....................................................8-9

Legacy................................................................10-11

Mid-Cap Value Equity..................................................12-13

Mid-Cap Growth Equity.................................................14-15

Aurora................................................................16-17

Small/Mid-Cap Growth..................................................18-19

Small Cap Value Equity................................................20-21

Small Cap Core Equity.................................................22-23

Small Cap Growth Equity...............................................24-25

Global Science & Technology Opportunities.............................26-27

Global Resources......................................................28-29

All-Cap Global Resources.................................................30

Health Sciences.......................................................31-32

U.S. Opportunities....................................................33-34

International Opportunities...........................................35-36

Asset Allocation......................................................37-38

Index Equity..........................................................39-40

Note on Performance Information..........................................41

Statement of Net Assets/Schedule of Investments........................42-110

Health Sciences Statement of Assets and Liabilities......................81

Portfolio Financial Statements

Statements of Operations............................................112-115

Statements of Changes in Net Assets.................................116-123

Financial Highlights................................................124-149

Notes to Financial Statements.........................................150-191

Additional Information................................................192-196

DFA Investment Trust Company Annual Report............................197-228

PRIVACY PRINCIPLES OF BLACKROCK FUNDS

BlackRock Funds is committed to maintaining the privacy of its shareholders and

to safeguarding their nonpublic personal information. The following information

is provided to help you understand what personal information BlackRock Funds

collects, how we protect that information, and why in certain cases we may

share such information with select other parties.

BlackRock Funds does not receive any nonpublic personal information relating to

its shareholders who purchase shares through their broker-dealers. In the case

of shareholders who are record owners of BlackRock Funds, BlackRock Funds

receives nonpublic personal information on account applications or other forms.

With respect to these shareholders, BlackRock Funds also has access to specific

information regarding their transactions in BlackRock Funds.

BlackRock Funds does not disclose any nonpublic personal information about its

shareholders or former shareholders to anyone, except as permitted by law or as

is necessary in order to service our shareholders' accounts (for example, to a

transfer agent).

BlackRock Funds restricts access to nonpublic personal information about its

shareholders to BlackRock employees with a legitimate business need for the

information. BlackRock Funds maintains physical, electronic and procedural

safeguards designed to protect the nonpublic personal information of our

shareholders.

BLACKROCK FUNDS

March 31, 2005

Dear Shareholder:

We are pleased to present the Semi-Annual Report to Shareholders of the

BlackRock Funds' Equity Portfolios for the period ended March 31, 2005. The

Semi-Annual Report includes important information on each Portfolio, and is

organized as follows:

o Portfolio Summary - discusses recent portfolio management activity and

highlights total returns.

o Fund Profile - displays characteristics of each Portfolio's holdings as of

March 31, 2005.

o Expense Example - discusses costs in a shareholder account and provides

information for a shareholder to estimate his or her expenses by share

class and to compare expenses of each share class to other funds.

o Statement of Net Assets (or Schedule of Investments/Statement of Assets and

Liabilities) - - lists portfolio holdings and includes each holding's

market value and par amount/number of shares as of March 31, 2005. The

Statement of Net Assets also contains the net asset value for each share

class of a Portfolio. If your Portfolio has a Schedule of Investments,

then the net asset value for each share class may be found in the

Statement of Assets and Liabilities.

o Statement of Operations - displays the components of each Portfolio's

investment income and provides a detailed look at each Portfolio's

expenses. The Statement of Operations also lists the aggregate change in

value of a Portfolio's securities due to market fluctuations and security

sales.

o Statement of Changes in Net Assets - compares Portfolio information from

the prior period to the current period. Specifically, it details

shareholder distributions by share class, aggregate realized gains and

losses, and the change in net assets from the beginning of the period to

the end of the period.

o Financial Highlights - include each Portfolio's expense ratios, net asset

values, total returns, distributions per share, and turnover ratios for

the current period and the last five years or since inception.

o Notes to Financial Statements - provides additional information on fees, a

summary of significant accounting policies, a list of affiliated

transactions, and a summary of purchases and sales of securities.

In addition to these items, a summary of shareholder privileges is listed

on the inside back cover of the report. Shareholders can find information on

this page describing how to access account balances, recent transactions, and

share prices. It also includes a summary of the Fund's various investment

plans.

There were two notable recent developments for the BlackRock Funds (the

"Fund").

First, on January 31, 2005, BlackRock, Inc., the parent of BlackRock

Advisors, Inc., the Fund's investment adviser, acquired SSRM Holdings, Inc.,

the parent of State Street Research & Management Company, the investment

adviser to the former State Street Research Funds. The transaction enhances

BlackRock's investment management platform with additional US equity,

alternative investment, and real estate equity management capabilities. In

addition, the scale and scope of BlackRock's open-end and closed-end mutual

funds and distribution capabilities has expanded significantly. We believe that

we can incorporate the best of both organizations to deliver high quality

products to both institutional and individual investors.

Second, a proxy statement was recently sent to shareholders of all

portfolios of the Fund asking them to consider and vote upon the election of

nine trustees to the board of trustees of the Fund (the "Board"). Five of the

nine nominees were already serving as trustees of the Fund and the additional

nominees had previously served as trustees of the State Street Research Funds.

Due to the increased size and complexity of the Fund resulting from the

reorganization with the State Street Research Funds, and an increase in the

responsibilities of boards of trustees of funds generally, the current Board

believed it was in the best interest of the Fund to increase the size of the

Board. On April 29, 2005, the special meeting of shareholders was held, at

which all of the nominees included in the proxy were duly elected to the Board.

We hope you find the report informative, and we thank you for making

BlackRock part of your investment strategy.

Sincerely,

[GRAPHIC OMITTED]

Anne Ackerley

Managing Director

BlackRock Advisors,Inc.

1

INVESTMENT TRUST PORTFOLIO

Total Net Assets (3/31/05): $1.4 billion

Performance Benchmark

S&P 500(Reg. TM) Index

Investment Approach

Seeks long-term capital appreciation. The Portfolio normally invests at

least 80% of its assets in equity securities. The portfolio management team

uses quantitative techniques to analyze a universe of approximately 800

companies, including those in the S&P 500(Reg. TM) Index and about 300 other

large and medium capitalization companies. Using a multi-factor model, the

management team identifies stocks with rising earnings expectations that sell

at low relative valuations when compared with their sector peers. Based on this

information, and using sophisticated risk measurement tools, the portfolio

management team selects stocks, together with their appropriate weightings,

that it believes will maximize the Portfolio's return per unit of risk. The

Portfolio seeks to maintain market capitalization, sector allocations and style

characteristics similar to the S&P 500(Reg. TM) Index.

Recent Portfolio Management Activity

o On January 31, 2005, BlackRock, Inc., the parent of BlackRock Advisors,

Inc. (BAI), acquired SSRM Holdings, Inc., the parent of State Street Research &

Management Company (SSRM), the investment adviser to the State Street Research

mutual funds. In connection with the transaction, the BlackRock Select Equity

Portfolio reorganized with the State Street Research Large Cap Analyst and

Investment Trust Funds (the SSR Funds) and was renamed the BlackRock Investment

Trust Portfolio (the Portfolio). The SSR Funds transferred substantially all of

its assets and liabilities to the Portfolio in exchange for shares of the

Portfolio, which were then distributed to the SSR Fund shareholders.

o All share classes outperformed the benchmark for the semi-annual

period.

o During the first half of the period the U.S. equity markets experienced

a strong rebound producing positive performance in each of the three months.

The strength of the rally came in November and December as investors appeared

relieved that the long contentious political season had come to an end.

Further, oil prices fell during the fourth quarter of 2004 further fueling the

rally. However, during the second half of the period, the U.S. equity markets

faltered. Investors' concerns centered on rising oil prices, mounting

inflationary pressures and the continued "measured pace" of interest rate

increases from the Federal Open Market Committee. Given this climate of

uncertainty, investors consistently shunned the riskiest stocks as their risk

appetite apparently faded.

o During the first half of the period, all share classes of the Portfolio

outperformed the benchmark as the multi-factor model was predictive. Model

strength was driven by the valuation factors while earnings expectation factors

were only periodically predictive. Forecast earnings to price, book to price

and cash flow to price were the strongest performing individual factors. From a

relative return perspective, the consumer cyclicals, utilities and consumer

non-cyclicals sectors helped performance while the technology and finance

sectors hurt relative performance versus the benchmark. The Portfolio's

overweight positions in highly ranked Black & Decker, Nordstrom, Texas

Utilities, Exelon, Constellation Brands and Archer Daniels Midland contributed

positively to relative performance. The avoidance of lower ranked Apple

Computer, EMC, Fannie Mae and American Express hurt relative performance.

o During the second half of the period, the multi-factor model was

generally predictive as both the valuation side and the earnings expectation

side aided in stock selection. The Institutional, Service and Investor A share

classes outperformed the benchmark while the Investor B and C share classes

underperformed the benchmark. The estimate momentum, forecast earnings to price

and forecast estimate dispersion factors were particularly powerful. From a

relative return perspective, the health care, technology and transportation

sectors led the way in delivering excess returns relative to the benchmark. In

the health care sector, the avoidance of poorly ranked Biogen Idec coupled with

the overweight of Bausch & Lomb helped performance relative to the benchmark.

The avoidance of poorly ranked eBay drove solid results in the technology

sector while in the transportation sector, the avoidance of low-ranked United

Parcel Service coupled with the overweight of highly ranked Burlington Northern

Santa Fe also aided relative performance. The weakest sector was the commercial

services sector, where the Portfolio's position in highly ranked Computer

Sciences Corp detracted from performance relative to the benchmark.

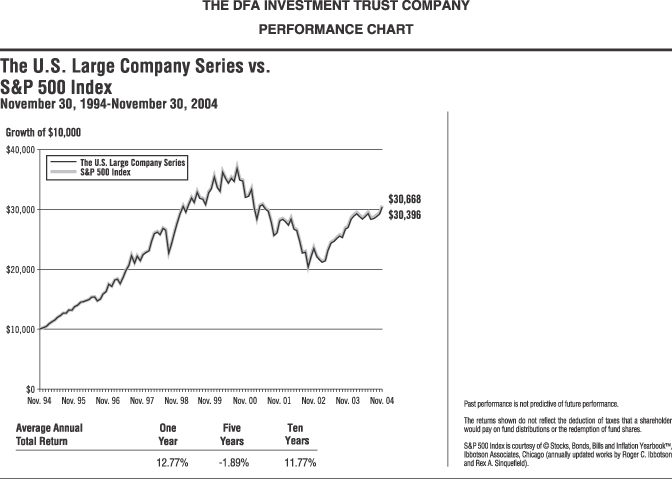

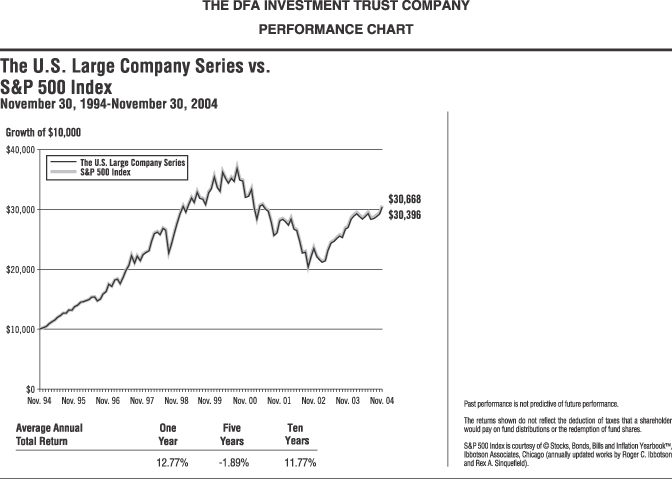

COMPARISON OF CHANGE IN VALUE OF A $10,000 INVESTMENT IN THE INVESTMENT TRUST

PORTFOLIO

AND THE S&P 500(REG. TM) INDEX FOR THE PAST TEN YEARS.

[LINE CHART]

Institutional Investor A S&P 500256 Index

------------- ---------- ----------------

03/31/1995 $ 10,000 $ 9,421 $ 10,000

06/30/1995 10,726 10,087 10,955

09/30/1995 11,510 10,823 11,825

12/31/1995 12,198 11,448 12,537

03/31/1996 12,819 12,017 13,210

06/30/1996 13,406 12,554 13,803

09/30/1996 13,795 12,904 14,230

12/31/1996 15,092 14,114 15,416

03/31/1997 15,490 14,471 15,829

06/30/1997 18,198 16,974 18,593

09/30/1997 19,657 18,317 19,985

12/31/1997 19,840 18,467 20,559

03/31/1998 22,576 20,995 23,427

06/30/1998 23,073 21,435 24,201

09/30/1998 20,457 18,980 21,793

12/31/1998 24,723 22,907 26,434

03/31/1999 25,824 23,918 27,751

06/30/1999 27,809 25,721 29,707

09/30/1999 25,973 23,998 27,853

12/31/1999 29,858 27,554 31,997

03/31/2000 30,345 27,991 32,731

06/30/2000 29,048 26,755 31,861

09/30/2000 28,088 25,831 31,553

12/31/2000 25,430 23,347 29,084

03/31/2001 21,310 19,540 25,636

06/30/2001 22,199 20,329 27,136

09/30/2001 18,176 16,638 23,153

12/31/2001 20,002 18,275 25,627

03/31/2002 19,226 17,561 25,698

06/30/2002 16,334 14,897 22,255

09/30/2002 13,733 12,516 18,410

12/31/2002 14,789 13,450 19,964

03/31/2003 14,331 13,030 19,335

06/30/2003 16,406 14,891 22,312

09/30/2003 16,864 15,281 22,902

12/31/2003 18,906 17,107 25,690

03/31/2004 19,682 17,802 26,125

06/30/2004 19,881 17,953 26,575

09/30/2004 19,749 17,817 26,078

12/31/2004 21,661 19,508 28,486

03/31/2005 21,262 19,129 27,874

FOR PERIOD ENDING MARCH 31, 2005

Average Annual Total Return

1 Year 3 Year 5 Year 10 Year

---------- ---------- ------------- ----------

Institutional Class 8.02% 3.41% (6.87)% 7.83%

Service Class 7.73% 3.08% (7.16)% 7.51%

Investor A Class (Load Adjusted) 1.26% 0.88% (8.42)% 6.70%

Investor A Class (NAV) 7.45% 2.89% (7.33)% 7.34%

Investor B Class (Load Adjusted) 2.30% 1.04% (8.30)% 6.62%

Investor B Class (NAV) 6.80% 2.17% (7.99)% 6.62%

Investor C Class (Load Adjusted) 5.80% 2.16% (7.99)% 6.62%

Investor C Class (NAV) 6.80% 2.16% (7.99)% 6.62%

THE PERFORMANCE INFORMATION ABOVE INCLUDES INFORMATION RELATING TO EACH CLASS

OF THE PORTFOLIO SINCE THE COMMENCEMENT OF OPERATIONS OF THE PORTFOLIO, RATHER

THAN THE DATE SUCH CLASS WAS INTRODUCED. THE INCEPTION DATES OF THE PORTFOLIO'S

SHARE CLASSES WERE AS FOLLOWS: INSTITUTIONAL SHARES, 9/13 /93; SERVICE SHARES,

9/15/93; INVESTOR A SHARES, 10/13/93; INVESTOR B SHARES, 3/27/96; AND INVESTOR

C SHARES, 9/27/96. SEE "NOTE ON PERFORMANCE INFORMATION" ON PAGE 41 FOR FURTHER

INFORMATION ON HOW PERFORMANCE DATA WAS CALCULATED,INCLUDING IMPORTANT

INFORMATION ON THE LINE GRAPH ABOVE.

PAST PERFORMANCE IS NOT PREDICTIVE OF FUTURE RESULTS. The graph and table do

not reflect the deduction of taxes that a shareholder would pay on fund

distributions or the redemption of shares. Although the holdings and sectors

listed above were current as of the periods indicated, the Portfolio is

actively managed and its composition will vary.

2

INVESTMENT TRUST PORTFOLIO

FUND PROFILE

Top Ten Holdings (% of long-term investments)

General Electric Co. 3.9 %

Exxon Mobil Corp. 3.5

Microsoft Corp. 3.1

Citigroup, Inc. 2.5

Pfizer, Inc. 2.4

Intel Corp. 2.4

Bank of America Corp. 2.3

International Business Machines Corp. 2.2

PepsiCo 1.7

The Procter & Gamble Co. 1.7

---

Total 25.7 %

=======

Top Ten Industries (% of long-term

investments)

Manufacturing 10.2 %

Oil & Gas 8.6

Finance 7.3

Banks 6.7

Retail Merchandising 6.0

Pharmaceuticals 5.6

Computer & Office Equipment 5.2

Computer Software & Services 5.1

Insurance 4.8

Telecommunications 4.0

---

Total 63.5 %

========

- --------------------------------------------------------------------------------

EXPENSE EXAMPLE

As a shareholder of the Portfolio, you incur two types of costs: (1)

transaction costs, including front and back end sales charges (loads) or

redemption/exchange fees, where applicable; and (2) ongoing costs, including

advisory fees, distribution (12b-1) and service fees, where applicable; and

other Portfolio expenses. This Example is intended to help you understand your

ongoing costs (in dollars) of investing in the Portfolio and to compare these

costs with the ongoing costs of investing in other mutual funds.

The Example below is based on an investment of $1,000 invested at the beginning

of the period and held for the entire period October 1, 2004 to March 31, 2005.

The information under "Actual Expenses," together with the amount you invested,

allows you to estimate actual expenses incurred over the reporting period.

Simply divide your account value by $1,000 (for example, an $8,600 account

value divided by $1,000 = 8.60) and multiply the result by the cost shown for

your share class, in the row entitled "Expenses Incurred During Period", to

estimate the expenses incurred on your account during this period.

The information under "Hypothetical Expenses" provides information about

hypothetical account values and hypothetical expenses based on the Portfolio's

actual expense ratio and an assumed rate of return of 5% per year before

expenses, which is not the Portfolio's actual return. The hypothetical account

values and expenses may not be used to estimate the actual ending account

balance or expense you incurred for the period. You may use this information to

compare the ongoing costs of investing in the Portfolio and other funds. To do

so, compare this 5% hypothetical example with the 5% hypothetical examples that

appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your

ongoing costs only and do not reflect any transactional costs, such as front

and back end sales charges (loads) or redemption/exchange fees, where

applicable. Therefore, the hypothetical information is useful in comparing

ongoing costs only, and will not help you determine the relative total costs of

owning different funds. In addition, if these transactional costs were

included, your costs would have been higher.

Actual Expenses

-------------------------------------------------------------------------------

Institutional Service Investor Investor Investor

Class Class A Class B Class C Class

--------------- --------------- --------------- --------------- ---------------

Beginning Account

Value (10/01/04) $ 1,000.00 $ 1,000.00 $ 1,000.00 $ 1,000.00 $ 1,000.00

Ending Account Value

(3/31/05) 1,076.60 1,074.60 1,073.60 1,069.90 1,069.90

Expenses Incurred

During Period

(10/01/04 -

3/31/05) 4.18 5.73 5.98 9.88 9.88

Hypothetical Expenses

(5% return before expenses)

-------------------------------------------------------------------------------

Institutional Service Investor Investor Investor

Class Class A Class B Class C Class

--------------- --------------- --------------- --------------- ---------------

Beginning Account

Value (10/01/04) $ 1,000.00 $ 1,000.00 $ 1,000.00 $ 1,000.00 $ 1,000.00

Ending Account Value

(3/31/05) 1,020.92 1,019.41 1,019.16 1,015.33 1,015.33

Expenses Incurred

During Period

(10/01/04 -

3/31/05) 4.08 5.59 5.84 9.67 9.67

For each class of the Portfolio, expenses are equal to the annualized expense

ratio of 0.81%, 1.11%, 1.16%, 1.92%, and 1.92% for the Institutional, Service,

Investor A, B, and C share classes, respectively, multiplied by the average

account value over the period, multiplied by 182/365 (to reflect the one-half

year period).

3

LARGE CAP VALUE EQUITY PORTFOLIO

Total Net Assets (3/31/05): $368.2 million

Performance Benchmark

Russell 1000 Value Index

Investment Approach

Seeks long-term capital appreciation with a secondary objective of current

income by investing at least 80% of its net assets in equity securities issued

by U.S. large capitalization value companies (defined as those with market

capitalizations equal to those within the universe of Russell 1000 Value Index

stocks). The portfolio management team uses quantitative techniques to analyze

a universe of approximately 800 value companies. The management team uses a

multi-factor model, which identifies the key factors that drive the performance

of value stocks. Using this multi-factor model, the management team identifies

stocks with low relative valuations and improving earnings expectations when

compared with their sector peers. Based on this information, and using

sophisticated risk measurement tools, the management team selects stocks,

together with their appropriate weightings, that it believes will maximize the

Portfolio's return per unit of risk. The Portfolio seeks to maintain market

capitalization, sector allocations and style characteristics similar to those

of the Russell 1000 Value Index.

Recent Portfolio Management Activity

o On January 31, 2005, BlackRock, Inc., the parent of BlackRock Advisors,

Inc. (BAI), acquired SSRM Holdings, Inc., the parent of State Street Research &

Management Company (SSRM), the investment adviser to the State Street Research

mutual funds. In connection with the transaction, the BlackRock Large Cap Value

Equity Portfolio (the Portfolio) reorganized with the State Street Research

Large Cap Value Fund (the SSR Fund). The SSR Fund transferred substantially all

of its assets and liabilities to the Portfolio in exchange for shares of the

Portfolio, which were then distributed to the SSR Fund shareholders.

o All share classes underperformed the benchmark for the semi-annual

period.

o During the first half of the period the U.S. equity markets experienced

a strong rebound producing positive performance in each of the three months.

The strength of the rally came in November and December as investors appeared

relieved that the long contentious political season had come to an end.

Further, oil prices fell during the fourth quarter of 2004 further fueling the

rally. However, during the second half of the period, the U.S. equity markets

faltered. Investors' concerns centered on rising oil prices, mounting

inflationary pressures and the continued "measured pace" of interest rate

increases from the Federal Open Market Committee. Given this climate of

uncertainty, investors consistently shunned the riskiest stocks as their risk

appetite apparently faded.

o During the first half of the period, all share classes of the Portfolio

under-performed the benchmark. The multi-factor model was essentially flat or

not predictive, producing mixed results. Valuation factors produced modest

predictive power while earnings expectation factors were slightly negative. The

forecast earnings to price, book to price, estimate momentum and earnings

revisions up were individual factors that showed some predictive power while

the earnings revisions down and forecast estimate dispersion factors were

negative. From a relative return perspective, the utilities and consumer

services sectors helped performance while the healthcare, consumer cyclicals

and basic materials sectors each hurt relative performance. The Portfolio's

overweight positions in highly ranked Texas Utilities, Disney and McGraw Hill,

contributed positively to relative performance. Generally, poor stock selection

in the healthcare sector hurt relative performance.

o During the second half of the period, the model was generally

predictive as both the valuation side and the earnings expectation side helped

in stock selection. All share classes of the Portfolio outperformed the

benchmark. The factors that were particularly powerful included price momentum,

estimate momentum, forecast earnings to price and forecast estimate dispersion.

From a relative return perspective, the utility, health care and technology

sectors led the way in delivering excess returns. In the utility sector, the

Portfolio's position in highly ranked Constellation Energy Group helped overall

performance. In the health care sector, the Portfolio's position in Coventry

Health Care drove solid results. The avoidance of poorly ranked Lucent

Technologies led to strength in the technology sector. The weakest sector was

the industrial sector which was off modestly due to the Portfolio's position in

Tyco.

COMPARISON OF CHANGE IN VALUE OF A $10,000 INVESTMENT IN THE LARGE CAP VALUE

EQUITY PORTFOLIO

AND THE RUSSELL 1000 VALUE INDEX FOR THE PAST TEN YEARS.

[LINE CHART]

Institutional Investor A Russell 1000 Value Index

------------- ---------- ------------------------

03/31/1995 $ 10,000 $ 9,425 $ 10,000

06/30/1995 10,790 10,159 10,896

09/30/1995 11,601 10,912 11,848

12/31/1995 12,419 11,667 12,634

03/31/1996 13,123 12,315 13,350

06/30/1996 13,574 12,730 13,579

09/30/1996 14,039 13,152 13,974

12/31/1996 15,423 14,444 15,368

03/31/1997 15,681 14,661 15,762

06/30/1997 17,832 16,645 18,086

09/30/1997 19,326 18,019 19,887

12/31/1997 19,842 18,492 20,775

03/31/1998 22,334 20,780 23,197

06/30/1998 21,998 20,447 23,301

09/30/1998 18,887 17,546 20,601

12/31/1998 21,922 20,335 24,022

03/31/1999 22,171 20,546 24,367

06/30/1999 24,702 22,857 27,114

09/30/1999 21,792 20,151 24,459

12/31/1999 22,720 21,002 25,789

03/31/2000 22,386 20,656 25,912

06/30/2000 21,354 19,681 24,698

09/30/2000 23,151 21,302 26,641

12/31/2000 24,986 22,979 27,599

03/31/2001 23,520 21,585 25,983

06/30/2001 24,206 22,206 27,252

09/30/2001 21,247 19,462 24,267

12/31/2001 22,544 20,623 26,056

03/31/2002 22,445 20,512 27,122

06/30/2002 18,797 17,154 24,812

09/30/2002 15,423 14,072 20,154

12/31/2002 17,144 15,605 22,012

03/31/2003 16,218 14,745 20,941

06/30/2003 18,844 17,130 24,559

09/30/2003 19,114 17,354 25,066

12/31/2003 21,562 19,536 28,623

03/31/2004 22,500 20,365 29,490

06/30/2004 22,571 20,404 29,749

09/30/2004 22,873 20,684 30,209

12/31/2004 25,148 22,704 33,344

03/31/2005 25,263 22,789 33,373

FOR PERIOD ENDING MARCH 31, 2005

Average Annual Total Return

1 Year 3 Year 5 Year 10 Year

----------- ---------- ---------- ----------

Institutional Class 12.28% 4.02% 2.45% 9.71%

Service Class 11.98% 3.70% 2.15% 9.39%

Investor A Class (Load Adjusted) 5.45% 1.54% 0.78% 8.59%

Investor A Class (NAV) 11.90% 3.57% 1.99% 9.23%

Investor B Class (Load Adjusted) 6.41% 1.63% 0.84% 8.46%

Investor B Class (NAV) 10.91% 2.75% 1.20% 8.46%

Investor C Class (Load Adjusted) 9.95% 2.76% 1.22% 8.47%

Investor C Class (NAV) 10.95% 2.76% 1.22% 8.47%

THE PERFORMANCE INFORMATION ABOVE INCLUDES INFORMATION RELATING TO EACH CLASS

OF THE PORTFOLIO SINCE THE COMMENCEMENT OF OPERATIONS OF THE PORTFOLIO, RATHER

THAN THE DATE SUCH CLASS WAS INTRODUCED. THE INCEPTION DATES OF THE PORTFOLIO'S

SHARE CLASSES WERE AS FOLLOWS: INSTITUTIONAL SHARES, 4 /20/92; INVESTOR A

SHARES, 5/2/92; SERVICE SHARES, 7/29/93; INVESTOR B SHARES, 1/18/96; AND

INVESTOR C SHARES, 8/16/96. SEE "NOTE ON PERFORMANCE INFORMATION" ON PAGE 41

FOR FURTHER INFORMATION ON HOW PERFORMANCE DATA WAS CALCULATED, INCLUDING

IMPORTANT INFORMATION ON THE LINE GRAPH ABOVE.

PAST PERFORMANCE IS NOT PREDICTIVE OF FUTURE RESULTS. The graph and table do

not reflect the deduction of taxes that a shareholder would pay on fund

distributions or the redemption of shares. Although the holdings and sectors

listed above were current as of the periods indicated, the Portfolio is

actively managed and its composition will vary.

4

LARGE CAP VALUE EQUITY PORTFOLIO

FUND PROFILE

Top Ten Holdings (% of long-term

investments)

Exxon Mobil Corp. 6.6 %

General Electric Co. 5.4

Citigroup, Inc. 4.4

Bank of America Corp. 4.2

Altria Group, Inc. 2.6

ConocoPhillips 2.2

Wachovia Corp. 2.1

ChevronTexaco Corp. 2.0

Verizon Communications, Inc. 1.9

U.S. Bancorp 1.8

---

Total 33.2 %

=======

Top Ten Industries (% of long-term

investments)

Oil & Gas 14.4 %

Banks 12.6

Manufacturing 10.2

Finance 8.9

Energy & Utilities 6.0

Telecommunications 5.6

Insurance 5.3

Retail Merchandising 5.0

Entertainment & Leisure 3.3

Real Estate 2.9

----

Total 74.2 %

========

- --------------------------------------------------------------------------------

EXPENSE EXAMPLE

As a shareholder of the Portfolio, you incur two types of costs: (1)

transaction costs, including front and back end sales charges (loads) or

redemption/exchange fees, where applicable; and (2) ongoing costs, including

advisory fees, distribution (12b-1) and service fees, where applicable; and

other Portfolio expenses. This Example is intended to help you understand your

ongoing costs (in dollars) of investing in the Portfolio and to compare these

costs with the ongoing costs of investing in other mutual funds.

The Example below is based on an investment of $1,000 invested at the beginning

of the period and held for the entire period October 1, 2004 to March 31, 2005.

The information under "Actual Expenses," together with the amount you invested,

allows you to estimate actual expenses incurred over the reporting period.

Simply divide your account value by $1,000 (for example, an $8,600 account

value divided by $1,000 = 8.60) and multiply the result by the cost shown for

your share class, in the row entitled "Expenses Incurred During Period", to

estimate the expenses incurred on your account during this period.

The information under "Hypothetical Expenses" provides information about

hypothetical account values and hypothetical expenses based on the Portfolio's

actual expense ratio and an assumed rate of return of 5% per year before

expenses, which is not the Portfolio's actual return. The hypothetical account

values and expenses may not be used to estimate the actual ending account

balance or expense you incurred for the period. You may use this information to

compare the ongoing costs of investing in the Portfolio and other funds. To do

so, compare this 5% hypothetical example with the 5% hypothetical examples that

appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your

ongoing costs only and do not reflect any transactional costs, such as front

and back end sales charges (loads) or redemption/exchange fees, where

applicable. Therefore, the hypothetical information is useful in comparing

ongoing costs only, and will not help you determine the relative total costs of

owning different funds. In addition, if these transactional costs were

included, your costs would have been higher.

Actual Expenses

-------------------------------------------------------------------------------

Institutional Service Investor Investor Investor

Class Class A Class B Class C Class

--------------- --------------- --------------- --------------- ---------------

Beginning Account

Value (10/01/04) $ 1,000.00 $ 1,000.00 $ 1,000.00 $ 1,000.00 $ 1,000.00

Ending Account Value

(3/31/05) 1,104.50 1,103.20 1,101.80 1,097.30 1,097.30

Expenses Incurred

During Period

(10/01/04 -

3/31/05) 4.13 5.70 6.17 10.27 10.06

Hypothetical Expenses

(5% return before expenses)

-------------------------------------------------------------------------------

Institutional Service Investor Investor Investor

Class Class A Class B Class C Class

--------------- --------------- --------------- --------------- ---------------

Beginning Account

Value (10/01/04) $ 1,000.00 $ 1,000.00 $ 1,000.00 $ 1,000.00 $ 1,000.00

Ending Account Value

(3/31/05) 1,021.02 1,019.51 1,019.06 1,015.08 1,015.28

Expenses Incurred

During Period

(10/01/04 -

3/31/05) 3.98 5.49 5.94 9.92 9.72

For each class of the Portfolio, expenses are equal to the annualized expense

ratio of 0.79%, 1.09%, 1.18%, 1.97%, and 1.93% for the Institutional, Service,

Investor A, B, and C share classes, respectively, multiplied by the average

account value over the period, multiplied by 182/365 (to reflect the one-half

year period).

5

LARGE CAP GROWTH EQUITY PORTFOLIO

Total Net Assets (3/31/05): $66.5 million

Performance Benchmark

Russell 1000 Growth Index

Investment Approach

Seeks long-term capital appreciation by investing at least 80% of its net

assets in equity securities issued by U.S. large capitalization growth

companies (defined as those with market capitalizations equal to those within

the universe of Russell 1000 Growth Index stocks). The portfolio management

team uses quantitative techniques to analyze a universe of approximately 700

growth companies. The management team uses a multi-factor model, which

identifies the key factors that drive the performance of growth stocks. Using

this multi-factor model, the management team identifies stocks with rising

earnings expectations that sell at attractive relative valuations when compared

with their sector peers. Based on this information, and using sophisticated

risk measurement tools, the management team selects stocks, together with their

appropriate weightings, that it believes will maximize the Portfolio's return

per unit of risk. The Portfolio seeks to maintain market capitalization, sector

allocations and style characteristics similar to those of the Russell 1000

Growth Index.

Recent Portfolio Management Activity

o All share classes outperformed the benchmark for the semi-annual

period.

o During the first half of the period the U.S. equity markets experienced

a strong rebound producing positive performance in each of the three months.

The strength of the rally came in November and December as investors appeared

relieved that the long contentious political season had come to an end.

Further, oil prices fell during the fourth quarter of 2004 further fueling the

rally. However, during the second half of the period, the U.S. equity markets

faltered. Investors' concerns centered on rising oil prices, mounting

inflationary pressures and the continued "measured pace" of interest rate

increases from the Federal Open Market Committee. Given this climate of

uncertainty, investors consistently shunned the riskiest stocks as their risk

appetite apparently faded.

o During the first half of the period, the multi-factor model was

predictive as all share classes of the Portfolio outperformed the benchmark.

Model strength was driven by the valuation factors while earnings expectation

factors were only periodically predictive. Forecast earnings to price, book to

price, cash flow to price, estimate momentum and earnings revisions up factors

were the strongest performing factors. From a relative return perspective, the

technology, basic materials and industrials sectors helped performance while

the consumer cyclicals sector hurt performance relative to the benchmark. The

Portfolio's overweight positions in highly ranked Advanced Micro Devices,

Verisign Inc., CheckFree, Nucor, Ball Corp., Parker Hannifin and Tyco

International contributed positively to relative performance. However, the

Portfolio's overweight position in highly ranked Claire's Stores hurt relative

performance to the benchmark.

o During the second half of the period, the model was consistently

predictive as both the valuation side and the earnings expectation side helped

in stock selection. All share classes of the Portfolio outperformed the

benchmark. The factors that were particularly powerful included price momentum,

estimate momentum, forecast earnings to price and book to price. From a

relative return perspective, the health care, technology and commercial

services sectors led the way in delivering excess returns versus the benchmark.

In the health care sector, the Portfolio's positions in highly ranked names

like Johnson & Johnson and Bausch & Lomb helped overall performance. The

avoidance of poorly ranked eBay drove solid results in the technology sector.

In the consumer services sector, the Portfolio's position in Darden Restaurants

helped performance relative to the benchmark. The weakest sector was the

commercial services sector where the Portfolio's position in highly ranked

Computer Sciences Corp detracted from performance.

COMPARISON OF CHANGE IN VALUE OF A $10,000 INVESTMENT IN THE LARGE CAP GROWTH

EQUITY

PORTFOLIO AND THE RUSSELL 1000 GROWTH INDEX FOR THE PAST TEN YEARS.

[LINE CHART]

Institutional Investor A Russell 1000 Growth Index

------------- ---------- -------------------------

03/31/1995 $ 10,000 $ 9,429 $ 10,000

06/30/1995 10,896 10,265 10,982

09/30/1995 12,021 11,305 11,979

12/31/1995 12,324 11,581 12,525

03/31/1996 13,104 12,306 13,197

06/30/1996 13,875 13,012 14,037

09/30/1996 14,266 13,361 14,543

12/31/1996 14,833 13,872 15,421

03/31/1997 14,739 13,779 15,504

06/30/1997 17,533 16,374 18,436

09/30/1997 19,073 17,795 19,821

12/31/1997 19,048 17,743 20,122

03/31/1998 22,256 20,700 23,171

06/30/1998 23,666 21,993 24,223

09/30/1998 21,316 19,780 22,023

12/31/1998 26,917 24,956 27,911

03/31/1999 29,040 26,888 29,685

06/30/1999 29,578 27,365 30,828

09/30/1999 28,874 26,685 29,699

12/31/1999 36,742 33,937 37,166

03/31/2000 38,896 35,865 39,815

06/30/2000 37,640 34,692 38,740

09/30/2000 35,485 32,638 36,656

12/31/2000 27,420 25,186 28,832

03/31/2001 19,903 18,261 22,806

06/30/2001 20,769 19,023 24,726

09/30/2001 15,763 14,434 19,927

12/31/2001 17,928 16,396 22,943

03/31/2002 17,443 15,926 22,350

06/30/2002 13,979 12,763 18,177

09/30/2002 11,623 10,590 15,442

12/31/2002 12,402 11,288 16,546

03/31/2003 12,229 11,109 16,369

06/30/2003 13,701 12,439 18,711

09/30/2003 14,169 12,845 19,443

12/31/2003 15,572 14,109 21,468

03/31/2004 15,953 14,434 21,637

06/30/2004 16,161 14,596 22,056

09/30/2004 15,451 13,947 20,904

12/31/2004 16,958 15,293 22,821

03/31/2005 16,421 14,791 21,888

FOR PERIOD ENDING MARCH 31, 2005

Average Annual Total Return

1 Year 3 Year 5 Year 10 Year

------------ ------------- -------------- ----------

Institutional Class 2.93% (1.99)% (15.84)% 5.08%

Service Class 2.55% (2.30)% (16.10)% 4.77%

Investor A Class (Load Adjusted) (3.39)% (4.34)% (17.22)% 3.99%

Investor A Class (NAV) 2.47% (2.43)% (16.23)% 4.60%

Investor B Class (Load Adjusted) (2.80)% (4.32)% (17.15)% 3.88%

Investor B Class (NAV) 1.70% (3.17)% (16.86)% 3.88%

Investor C Class (Load Adjusted) 0.70% (3.18)% (16.87)% 3.87%

Investor C Class (NAV) 1.70% (3.18)% (16.87)% 3.87%

THE PERFORMANCE INFORMATION ABOVE INCLUDES INFORMATION RELATING TO EACH CLASS

OF THE PORTFOLIO SINCE THE COMMENCEMENT OF OPERATIONS OF THE PORTFOLIO, RATHER

THAN THE DATE SUCH CLASS WAS INTRODUCED. THE INCEPTION DATES OF THE PORTFOLIO'S

SHARE CLASSES WERE AS FOLLOWS: INSTITUTIONAL SHARES, 11/1/89; INVESTOR A

SHARES, 3/14/92; SERVICE SHARES, 7/29/93; INVESTOR B SHARES, 1/24/96; AND

INVESTOR C SHARES, 1/24/97. SEE "NOTE ON PERFORMANCE INFORMATION" ON PAGE 41

FOR FURTHER INFORMATION ON HOW PERFORMANCE DATA WAS CALCULATED, INCLUDING

IMPORTANT INFORMATION ON THE LINE GRAPH ABOVE.

PAST PERFORMANCE IS NOT PREDICTIVE OF FUTURE RESULTS. The graph and table do

not reflect the deduction of taxes that a shareholder would pay on fund

distributions or the redemption of shares. Although the holdings and sectors

listed above were current as of the periods indicated, the Portfolio is

actively managed and its composition will vary.

6

LARGE CAP GROWTH EQUITY PORTFOLIO

FUND PROFILE

Top Ten Holdings (% of long-term investments)

Pfizer, Inc. 4.5 %

Johnson & Johnson 4.1

Microsoft Corp. 3.9

Intel Corp. 3.9

International Business Machines Corp. 3.0

Procter & Gamble Co. 2.7

The Home Depot, Inc. 2.1

UnitedHealth Group, Inc. 1.9

Pepsico, Inc. 1.9

Wal-Mart Stores, Inc. 1.8

---

Total 29.8 %

=======

Top Ten Industries (% of long-term

investments)

Computer Software & Services 10.1 %

Pharmaceuticals 9.6

Retail Merchandising 9.0

Medical Instruments & Supplies 8.1

Manufacturing 8.0

Computer & Office Equipment 6.8

Electronics 6.3

Finance 4.4

Insurance 4.2

Medical & Medical Services 4.1

---

Total 70.6 %

========

- --------------------------------------------------------------------------------

EXPENSE EXAMPLE

As a shareholder of the Portfolio, you incur two types of costs: (1)

transaction costs, including front and back end sales charges (loads) or

redemption/exchange fees, where applicable; and (2) ongoing costs, including

advisory fees, distribution (12b-1) and service fees, where applicable; and

other Portfolio expenses. This Example is intended to help you understand your

ongoing costs (in dollars) of investing in the Portfolio and to compare these

costs with the ongoing costs of investing in other mutual funds.

The Example below is based on an investment of $1,000 invested at the beginning

of the period and held for the entire period October 1, 2004 to March 31, 2005.

The information under "Actual Expenses," together with the amount you invested,

allows you to estimate actual expenses incurred over the reporting period.

Simply divide your account value by $1,000 (for example, an $8,600 account

value divided by $1,000 = 8.60) and multiply the result by the cost shown for

your share class, in the row entitled "Expenses Incurred During Period", to

estimate the expenses incurred on your account during this period.

The information under "Hypothetical Expenses" provides information about

hypothetical account values and hypothetical expenses based on the Portfolio's

actual expense ratio and an assumed rate of return of 5% per year before

expenses, which is not the Portfolio's actual return. The hypothetical account

values and expenses may not be used to estimate the actual ending account

balance or expense you incurred for the period. You may use this information to

compare the ongoing costs of investing in the Portfolio and other funds. To do

so, compare this 5% hypothetical example with the 5% hypothetical examples that

appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your

ongoing costs only and do not reflect any transactional costs, such as front

and back end sales charges (loads) or redemption/exchange fees, where

applicable. Therefore, the hypothetical information is useful in comparing

ongoing costs only, and will not help you determine the relative total costs of

owning different funds. In addition, if these transactional costs were

included, your costs would have been higher.

Actual Expenses

-------------------------------------------------------------------------------

Institutional Service Investor Investor Investor

Class Class A Class B Class C Class

--------------- --------------- --------------- --------------- ---------------

Beginning Account

Value (10/01/04) $ 1,000.00 $ 1,000.00 $ 1,000.00 $ 1,000.00 $ 1,000.00

Ending Account Value

(3/31/05) 1,062.80 1,061.90 1,060.50 1,056.80 1,056.90

Expenses Incurred

During Period

(10/01/04 -

3/31/05) 4.21 5.74 6.25 10.07 10.07

Hypothetical Expenses

(5% return before expenses)

--------------------------------------------------------------------------------

Institutional Service Investor Investor Investor

Class Class A Class B Class C Class

--------------- --------------- --------------- --------------- ---------------

Beginning Account

Value (10/01/04) $ 1,000.00 $ 1,000.00 $ 1,000.00 $ 1,000.00 $ 1,000.00

Ending Account Value

(3/31/05) 1,020.87 1,019.36 1,018.86 1,015.08 1,015.08

Expenses Incurred

During Period

(10/01/04 -

3/31/05) 4.13 5.64 6.14 9.92 9.92

For each class of the Portfolio, expenses are equal to the annualized expense

ratio of 0.82%, 1.12%, 1.22%, 1.97%, and 1.97% for the Institutional, Service,

Investor A, B, and C share classes, respectively, multiplied by the average

account value over the period, multiplied by 182/365 (to reflect the one-half

year period).

7

DIVIDEND ACHIEVERSTM PORTFOLIO

Total Net Assets (3/31/05): $26.4 million

Performance Benchmark

Russell 1000 Value Index

Investment Approach

Seeks to provide total return through a combination of current income and

capital appreciation by investing at least 80% of its assets in common stocks

included in the universe of common stocks which Mergent(Reg. TM), a recognized

provider of financial information, has identified as Dividend Achievers(TM). To

qualify for the Dividend Achievers(TM) universe, an issuer must have raised its

annual regular cash dividend on a pre-tax basis for at least each of the last

ten consecutive years. These issuers are also subject to additional screening

criteria applied by Mergent(Reg. TM) such as liquidity. The Portfolio will be

constructed from a broad universe of stocks that the Fund management team

believes to be value stocks and all stocks in the Dividend Achievers(TM)

universe. The portfolio management team screens these issuers utilizing

BlackRock's proprietary Quantitative Equity Model, which uses earnings momentum

and valuation factors to rank stocks within a sector and industry based upon

their expected return, to continuously evaluate fund holdings. The Portfolio

will be constructed with consideration of the characteristics of the Russell

1000 Value Index, such as style, sector, industry, capitalization and

volatility. The Portfolio may invest up to 20% of its assets in common stocks

of issuers that are not included in the Dividend Achievers(TM) universe, and in

fixed income securities when, in the opinion of the portfolio management team,

it is advantageous for the Portfolio to do so.

Recent Portfolio Management Activity

o All share classes underperformed the benchmark for the semi-annual

period.

o During the first half of the period the U.S. equity markets experienced

a strong rebound producing positive performance in each of the three months.

The strength of the rally came in November and December as investors appeared

relieved that the long contentious political season had come to an end.

Further, oil prices fell during the fourth quarter of 2004 further fueling the

rally. However, during the second half of the period, the U.S. equity markets

faltered. Investors' concerns centered on rising oil prices, mounting

inflationary pressures and the continued "measured pace" of interest rate

increases from the

Federal Open Market Committee. Given this climate of uncertainty, investors

consistently shunned the riskiest stocks as their risk appetite apparently

faded.

o During the first half of the period, none of the three primary stock

selection criteria for the Portfolio helped performance as all share classes

underperformed the benchmark. The Mergent's Dividend Achievers(TM) Index

underperformed the broader market, dividend-paying stocks underperformed

non-dividend paying stocks and the multi-factor model was essentially flat or

not predictive during the period. Valuation factors produced modest predictive

power while earnings expectation factors were slightly negative. The forecast

earnings to price, book to price, estimate momentum and earnings revisions up

were individual factors that showed some predictive power while earnings

revisions down and forecast estimate dispersion were negative. From a relative

return perspective, the consumer non-cyclicals and finance sectors helped

performance while the consumer cyclicals and technology sectors each hurt

performance relative to the benchmark. The Portfolio's overweight positions in

highly ranked Altria and John Nuveen contributed positively to relative

performance. The avoidance of Sears, Apple Computer and Hewlett Packard, none

of which are Dividend Achievers(TM), hurt relative performance.

o During the second half of the period, the Portfolio's objective to

invest at least 80% of the portfolio in Dividend Achievers(TM) created

headwinds for the Portfolio as the Mergent's Dividend Achievers(TM) Index

underperformed the Russell 1000 Value Index. All share classes of the Portfolio

underperformed the benchmark. The drive for yield also led to a slight

overweight in financials and a slight underweight in energy stocks which

created additional pressure on the Portfolio's performance. The multi-factor

model was generally predictive as both the valuation side and the earnings

expectation side helped in stock selection throughout the period. The factors

that were particularly powerful included estimate momentum, forecast earnings

to price and forecast estimate dispersion. From a relative return perspective,

the weakest sectors included the financial, energy and utility sectors.

Positions in the financials sector that hurt performance included Doral Corp

and United Dominion Realty, both of which are Dividend Achievers(TM). The

Portfolio's position in the energy sector detracted from performance relative

to the benchmark due to the performance of some stocks not held by the

Portfolio - namely Valero and Occidental Petroleum. The same was true in the

utility sector where un-owned Texas Utilities surged. On a positive note, the

technology sector, led by the avoidance of Lucent Technologies, helped offset

some of the weakness.

COMPARISON OF CHANGE IN VALUE OF A $10,000 INVESTMENT IN THE DIVIDEND

ACHIEVERSTM

PORTFOLIO AND THE RUSSELL 1000 VALUE INDEX FROM INCEPTION.

[LINE CHART]

Institutional Investor A Russell 1000 Value Index

------------- ---------- ------------------------

09/08/2004 $ 10,000 $ 9,425 $ 10,000

09/30/2004 9,960 9,387 10,026

12/31/2004 10,743 10,132 11,067

03/31/2005 10,549 9,932 11,077

FOR PERIOD ENDING MARCH 31, 2005

Average Annual Total Return

From Inception

---------------

Institutional Class 5.49%

Service Class 5.14%

Investor A Class (Load Adjusted) (0.68)%

Investor A Class (NAV) 5.38%

Investor B Class (Load Adjusted) 0.69%

Investor B Class (NAV) 5.19%

Investor C Class (Load Adjusted) 4.06%

Investor C Class (NAV) 5.06%

THE PERFORMANCE INFORMATION ABOVE INCLUDES INFORMATION RELATING TO EACH CLASS

OF THE PORTFOLIO SINCE THE COMMENCEMENT OF OPERATIONS OF THE PORTFOLIO ON

9/8/04. SEE "NOTE ON PERFORMANCE INFORMATION" ON PAGE 41 FOR FURTHER

INFORMATION ON HOW PERFORMANCE DATA WAS CALCULATED, INCLUDING IMPORTANT

INFORMATION ON THE LINE GRAPH ABOVE.

PAST PERFORMANCE IS NOT PREDICTIVE OF FUTURE RESULTS. The graph and table do

not reflect the deduction of taxes that a shareholder would pay on fund

distributions or the redemption of shares. Although the holdings and sectors

listed above were current as of the periods indicated, the Portfolio is

actively managed and its composition will vary.

8

DIVIDEND ACHIEVERSTM PORTFOLIO

FUND PROFILE

Top Ten Holdings (% of long-term

investments)

Exxon Mobil Corp. 6.4 %

General Electric Co. 5.4

ChevronTexaco Corp. 4.4

Citigroup, Inc. 4.3

Bank of America Corp. 4.0

Altria Group, Inc. 3.1

SBC Communications, Inc. 2.0

McDonald's Corp. 1.9

Wells Fargo & Co. 1.9

Verizon Communications, Inc. 1.6

---

Total 35.0 %

=======

Top Ten Industries (% of long-term

investments)

Oil & Gas 13.5 %

Banks 13.1

Manufacturing 10.4

Finance 9.4

Real Estate 6.0

Insurance 5.9

Energy & Utilities 5.6

Telecommunications 5.4

Retail Merchandising 3.9

Tobacco 3.5

----

Total 76.7 %

========

- --------------------------------------------------------------------------------

EXPENSE EXAMPLE

As a shareholder of the Portfolio, you incur two types of costs: (1)

transaction costs, including front and back end sales charges (loads) or

redemption/exchange fees, where applicable; and (2) ongoing costs, including

advisory fees, distribution (12b-1) and service fees, where applicable; and

other Portfolio expenses. This Example is intended to help you understand your

ongoing costs (in dollars) of investing in the Portfolio and to compare these

costs with the ongoing costs of investing in other mutual funds.

The Example below is based on an investment of $1,000 invested at the beginning

of the period and held for the entire period October 1, 2004 to March 31, 2005.

The information under "Actual Expenses," together with the amount you invested,

allows you to estimate actual expenses incurred over the reporting period.

Simply divide your account value by $1,000 (for example, an $8,600 account

value divided by $1,000 = 8.60) and multiply the result by the cost shown for

your share class, in the row entitled "Expenses Incurred During Period", to

estimate the expenses incurred on your account during this period.

The information under "Hypothetical Expenses" provides information about

hypothetical account values and hypothetical expenses based on the Portfolio's

actual expense ratio and an assumed rate of return of 5% per year before

expenses, which is not the Portfolio's actual return. The hypothetical account

values and expenses may not be used to estimate the actual ending account

balance or expense you incurred for the period. You may use this information to

compare the ongoing costs of investing in the Portfolio and other funds. To do

so, compare this 5% hypothetical example with the 5% hypothetical examples that

appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your

ongoing costs only and do not reflect any transactional costs, such as front

and back end sales charges (loads) or redemption/exchange fees, where

applicable. Therefore, the hypothetical information is useful in comparing

ongoing costs only, and will not help you determine the relative total costs of

owning different funds. In addition, if these transactional costs were

included, your costs would have been higher.

Actual Expenses

-------------------------------------------------------------------------------

Institutional Service Investor Investor Investor

Class Class A Class B Class C Class

--------------- --------------- --------------- --------------- ---------------

Beginning Account

Value (10/01/04) $ 1,000.00 $ 1,000.00 $ 1,000.00 $ 1,000.00 $ 1,000.00

Ending Account Value

(3/31/05) 1,059.20 1,055.70 1,058.00 1,056.10 1,054.80

Expenses Incurred

During Period

(10/01/04 -

3/31/05) 4.61 6.03 6.55 10.28 10.17

Hypothetical Expenses

(5% return before expenses)

-------------------------------------------------------------------------------

Institutional Service Investor Investor Investor

Class Class A Class B Class C Class

--------------- --------------- --------------- --------------- ---------------

Beginning Account

Value (10/01/04) $ 1,000.00 $ 1,000.00 $ 1,000.00 $ 1,000.00 $ 1,000.00

Ending Account Value

(3/31/05) 1,020.47 1,019.06 1,018.56 1,014.88 1,014.98

Expenses Incurred

During Period

(10/01/04 -

3/31/05) 4.53 5.94 6.44 10.12 10.02

For each class of the Portfolio, expenses are equal to the annualized expense

ratio of 0.90%, 1.18%, 1.28%, 2.01%, and 1.99% for the Institutional, Service,

Investor A, B, and C share classes, respectively, multiplied by the average

account value over the period, multiplied by 182/365 (to reflect the one-half

year period).

9

LEGACY PORTFOLIO

Total Net Assets (3/31/05): $287.7 million

Performance Benchmark

Russell 1000 Growth Index

Investment Approach

Seeks to provide long-term growth of capital by normally investing at

least 65% of its net assets in common and preferred stock and securities

convertible into common and preferred stocks of mid- and large-capitalization

companies. The Portfolio seeks to invest in fundamentally sound companies with

strong management, superior earnings growth prospects and attractive

valuations. The disciplined investment process uses a bottom-up stock selection

approach as the primary driver of returns. The Portfolio emphasizes large

companies that exhibit stable growth and accelerated earnings.

Recent Portfolio Management Activity

o On January 31, 2005, BlackRock, Inc., the parent of BlackRock Advisors,

Inc. (BAI), acquired SSRM Holdings, Inc., the parent of State Street Research &

Management Company (SSRM), the investment adviser to the State Street Research

mutual funds. In connection with the transaction, the BlackRock Legacy

Portfolio (the Portfolio) reorganized with the State Street Research Legacy

Fund (the SSR Fund). The SSR Fund transferred substantially all of its assets

and liabilities to the Portfolio in exchange for shares of the Portfolio, which

were then distributed to the SSR Fund shareholders. For periods prior to

January 31, 2005, the performance information shown reflects the performance of

the SSR Fund, which had substantially similar investment goals and strategies

as the Portfolio.

o Both Institutional and Investor A share classes of the Portfolio

outperformed the benchmark for the semi-annual period, while all the other

share classes underperformed the benchmark.

o US equity markets lost ground during the first quarter of 2005, as the

S&P 500 Index sustained its largest quarterly loss in two years, declining

2.2%. Investors became increasingly concerned about the impact that higher

commodity prices might have on the economy and fear that inflationary pressures

are on the rise. Market weakness during the first quarter was not enough to

offset gains from the fourth quarter of 2004 as the S&P 500 Index gained 6.9%

during the six-month period. In this environment (for the 6-month period),

mid-cap stocks outperformed their large- and small-cap counterparts, while

value continued to outperform growth.

o In this environment, stock selection in energy, materials and

financials drove Portfolio returns, while stock selection decisions in

information technology and health care created a modest drag on performance

relative to the benchmark.

o A diverse mix of names contributed positively to absolute and relative

returns, as the Portfolio's gains were broad-based. The largest single

contributor to relative returns during the period was agricultural

biotechnology firm Monsanto within the materials sector.

o Energy related commodity prices remained elevated throughout the

period, with crude oil prices nearing all time highs. The Portfolio benefited

from its positions in oil and gas producers EOG Resources and Newfield

Exploration, as well as energy related holdings in the materials sector such as

coal producer Consol Energy.

o Results within health care were mixed. While stock selection had a

negative impact on the Portfolio during the period, our modest underweight

position added value. The majority of the underperformance within the sector

can be attributed to positions in Biogen and Elan Corp. PLC, which both fell

due to the unexpected withdrawal of a major drug.

o Weak relative performance within technology was largely a result of

stock selection. Our software holdings trailed those in the benchmark, as both

Symantec and Red Hat declined during the period. Additionally, our position in

information storage and management firm EMC detracted from returns.

o The Portfolio currently favors more stable growth companies, and we

increased our exposure to the household and personal product industry. However,

we also identified new accelerating earnings opportunities within the

technology sector based on company-specific fundamentals in both software

services and hardware equipment suppliers. At the end of the period, relative

to the Russell 1000 Growth Index, the Portfolio was overweight in consumer

discretionary and energy, and underweight in consumer staples and health care.

COMPARISON OF CHANGE IN VALUE OF A $10,000 INVESTMENT IN THE LEGACY

PORTFOLIO AND THE RUSSELL 1000 GROWTH INDEX FROM INCEPTION.

[LINE CHART]

Institutional Investor A Russell 1000 Growth Index

------------- ---------- -------------------------

12/31/1997 $ 10,000 $ 9,425 $ 10,000

03/31/1998 11,470 10,801 11,515

06/30/1998 12,290 11,565 12,038

09/30/1998 10,730 10,085 10,944

12/31/1998 13,227 12,429 13,871

03/31/1999 13,907 13,070 14,752

06/30/1999 14,908 13,994 15,320

09/30/1999 14,027 13,164 14,759

12/31/1999 16,608 15,569 18,470

03/31/2000 16,668 15,616 19,786

06/30/2000 16,228 15,116 19,252

09/30/2000 16,849 15,672 18,217

12/31/2000 15,698 14,597 14,328

03/31/2001 13,037 12,108 11,334

06/30/2001 13,547 12,579 12,288

09/30/2001 11,376 10,561 9,903

12/31/2001 12,787 11,853 11,402

03/31/2002 12,867 11,919 11,107

06/30/2002 10,896 10,081 9,033

09/30/2002 9,285 8,591 7,674

12/31/2002 9,815 9,072 8,223

03/31/2003 9,655 8,921 8,135

06/30/2003 10,966 10,118 9,299

09/30/2003 11,336 10,458 9,663

12/31/2003 12,686 11,693 10,669

03/31/2004 12,787 11,778 10,753

06/30/2004 13,057 12,014 10,961

09/30/2004 12,586 11,580 10,388

12/31/2004 13,957 12,825 11,341

03/31/2005 13,207 12,127 10,878

FOR PERIOD ENDING MARCH 31, 2005

Average Annual Total Return

1 Year 3 Year 5 Year From Inception

------------ ------------ ------------- ---------------

Institutional Class 3.29% 0.87% (4.55)% 3.91%

Service Class 3.04% 0.60% (4.92)% 3.55%

Investor A Class (Load Adjusted) (2.94)% (1.39)% (6.05)% 2.70%

Investor A Class (NAV) 2.96% 0.58% (4.93)% 3.54%

Investor B Class (Load Adjusted) (2.24)% (1.31)% (5.99)% 2.79%

Investor B Class (NAV) 2.26% (0.14)% (5.61)% 2.79%

Investor C Class (Load Adjusted) 1.26% (0.14)% (5.61)% 2.79%

Investor C Class (NAV) 2.26% (0.14)% (5.61)% 2.79%

THE PERFORMANCE INFORMATION ABOVE INCLUDES INFORMATION RELATING TO EACH CLASS

OF THE PORTFOLIO SINCE THE COMMENCEMENT OF OPERATIONS OF THE PORTFOLIO, RATHER

THAN THE DATE SUCH CLASS WAS INTRODUCED. THE INCEPTION DATES OF THE PORTFOLIO'S

SHARE CLASSES WERE AS FOLLOWS: INSTITUTIONAL SHARES, 12/31/97; INVESTOR A

SHARES, 12/31/97; INVESTOR C SHARES, 12/31/97; INVESTOR B SHARES, 1/1/99; AND

SERVICE SHARES, 1/28/05. SEE "NOTE ON PERFORMANCE INFORMATION" ON PAGE 41 FOR

FURTHER INFORMATION ON HOW PERFORMANCE DATA WAS CALCULATED, INCLUDING IMPORTANT

INFORMATION ON THE LINE GRAPH ABOVE.

PAST PERFORMANCE IS NOT PREDICTIVE OF FUTURE RESULTS. The graph and table do

not reflect the deduction of taxes that a shareholder would pay on fund

distributions or the redemption of shares. Although the holdings and sectors

listed above were current as of the periods indicated, the Portfolio is

actively managed and its composition will vary.

10

LEGACY PORTFOLIO

FUND PROFILE

Top Ten Holdings (% of long-term

investments)

General Electric Co. 3.9 %

Johnson & Johnson 3.9

Microsoft Corp. 3.7

Yahoo!, Inc 3.3

Novartis AG - ADR 3.0

UniterHealth Group, Inc. 2.9

Intel Corp. 2.9

Tyco International Ltd. - ADR 2.8

The Procter & Gamble Co. 2.6

Target Corp. 2.6

---

Total 31.6 %

=======

Top Ten Industries (% of long-term

investments)

Computer Software & Services 15.1 %

Manufacturing 12.5

Retail Merchandising 7.2

Medical Instruments & Supplies 7.2

Pharmaceuticals 7.1

Medical & Medical Services 6.9

Finance 6.7

Broadcasting 4.6

Oil & Gas 4.2

Entartainment & Leisure 4.1

----

Total 75.6 %

========

- --------------------------------------------------------------------------------

EXPENSE EXAMPLE

As a shareholder of the Portfolio, you incur two types of costs: (1)

transaction costs, including front and back end sales charges (loads) or

redemption/exchange fees, where applicable; and (2) ongoing costs, including

advisory fees, distribution (12b-1) and service fees, where applicable; and

other Portfolio expenses. This Example is intended to help you understand your

ongoing costs (in dollars) of investing in the Portfolio and to compare these

costs with the ongoing costs of investing in other mutual funds.

The Example below is based on an investment of $1,000 invested at the beginning

of the period and held for the entire period October 1, 2004 to March 31, 2005.

The information under "Actual Expenses," together with the amount you invested,

allows you to estimate actual expenses incurred over the reporting period.

Simply divide your account value by $1,000 (for example, an $8,600 account

value divided by $1,000 = 8.60) and multiply the result by the cost shown for

your share class, in the row entitled "Expenses Incurred During Period", to

estimate the expenses incurred on your account during this period.

The information under "Hypothetical Expenses" provides information about

hypothetical account values and hypothetical expenses based on the Portfolio's

actual expense ratio and an assumed rate of return of 5% per year before

expenses, which is not the Portfolio's actual return. The hypothetical account

values and expenses may not be used to estimate the actual ending account

balance or expense you incurred for the period. You may use this information to

compare the ongoing costs of investing in the Portfolio and other funds. To do

so, compare this 5% hypothetical example with the 5% hypothetical examples that

appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your

ongoing costs only and do not reflect any transactional costs, such as front

and back end sales charges (loads) or redemption/exchange fees, where

applicable. Therefore, the hypothetical information is useful in comparing

ongoing costs only, and will not help you determine the relative total costs of

owning different funds. In addition, if these transactional costs were

included, your costs would have been higher.

Actual Expenses

-------------------------------------------------------------------------------

Institutional Service Investor Investor Investor

Class Class A Class B Class C Class

--------------- --------------- --------------- --------------- ---------------

Beginning Account

Value (10/01/04) $ 1,000.00 $ 1,000.00 $ 1,000.00 $ 1,000.00 $ 1,000.00

Ending Account Value

(3/31/05) 1,049.30 993. 00 1,042.20 1,043.60 1,043.60

Expenses Incurred

During Period

(10/01/04 -

3/31/05) 5.06 2.29 6.43 10.14 10.14

Hypothetical Expenses

(5% return before expenses)

-------------------------------------------------------------------------------

Institutional Service Investor Investor Investor

Class Class A Class B Class C Class

--------------- --------------- --------------- --------------- ---------------

Beginning Account

Value (10/01/04) $ 1,000.00 $ 1,000.00 $ 1,000.00 $ 1,000.00 $ 1,000.00

Ending Account Value

(3/31/05) 1,020.00 1,022.68 1,018.64 1,014.95 1,014.95

Expenses Incurred

During Period

(10/01/04 -

3/31/05) 5.00 2.32 6.36 10.05 10.05

For each class of the Portfolio, expenses are equal to the annualized expense

ratio of 0.99%, 1.35%, 1.26%, 1.99%, and 1.99% for the Institutional, Service,

Investor A, B, and C share classes, respectively, multiplied by the average

account value over the period, multiplied by 182/365 (to reflect the one-half

year period) and 62/365 for the Service share class (to reflect the period the

class was open during the one-half year period).

11

MID-CAP VALUE EQUITY PORTFOLIO

Total Net Assets (3/31/05): $706.1 million

Performance Benchmark

Russell Midcap Value Index

Investment Approach

Seeks long-term capital appreciation by investing primarily in

mid-capitalization stocks believed by the Portfolio management team to be worth

more than is indicated by current market price. The Portfolio normally invests

at least 80% of assets in equity securities issued by US mid-capitalization

value companies (market capitalizations between $1 billion and $10 billion).

The Portfolio management team uses fundamental analysis to examine each company

for financial strength before deciding to purchase the stock.

Recent Portfolio Management Activity

o On January 31, 2005, BlackRock, Inc., the parent of BlackRock Advisors,

Inc. (BAI), acquired SSRM Holdings, Inc., the parent of State Street Research &

Management Company (SSRM), the investment adviser to the State Street Research

mutual funds. In connection with the transaction, the Portfolio reorganized

with the State Street Research Mid Cap Value Fund (the SSR Fund). The SSR Fund

transferred substantially all of its assets and liabilities to the Portfolio in

exchange for shares of the Portfolio, which were then distributed to the SSR

Fund shareholders. For periods prior to January 31, 2005, the performance

information shown reflects the performance of the SSR Fund, which had similar

investment goals and strategies as the Portfolio.

o All share classes of the Portfolio underperformed the benchmark for the

semi-annual period.

o US equity markets lost ground during the first quarter of 2005, as the

S&P 500 Index sustained its largest quarterly loss in two years, declining

2.2%. Investors became increasingly concerned about the impact that higher

commodity prices might have on the economy and feared that inflationary

pressures may be on the rise. Market weakness during the first quarter was not

enough to offset gains from the fourth quarter of 2004, as the S&P 500 Index

gained 6.9% during the six-month period. In this environment, mid-cap stocks

outperformed their large- and small-cap counterparts, while value stocks

continued to outperform growth stocks.

o Within the Portfolio's benchmark, the Russell Midcap Value Index, all

major sectors posted positive returns for the six-month period. During the

period, the Portfolio's underweight in financial stocks aided return