UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-05742

| Name of Fund: | BlackRock FundsSM |

| BlackRock Health Sciences Opportunities Portfolio |

| BlackRock Infrastructure Sustainable Opportunities Fund |

| BlackRock Mid-Cap Growth Equity Portfolio |

| BlackRock Technology Opportunities Fund |

| Fund Address: | 100 Bellevue Parkway, Wilmington, DE 19809 |

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock FundsSM, 55 East 52nd Street, New York, NY 10055

Registrant’s telephone number, including area code: (800) 441-7762

Date of fiscal year end: 05/31/2022

Date of reporting period: 05/31/2022

Item 1 – Report to Stockholders

(a) The Report to Shareholders is attached herewith.

| MAY 31, 2022 |

2022 Annual Report

| ||

BlackRock Capital Appreciation Fund, Inc.

BlackRock FundsSM

| · | BlackRock Health Sciences Opportunities Portfolio |

| · | BlackRock Infrastructure Sustainable Opportunities Fund |

| · | BlackRock Mid-Cap Growth Equity Portfolio |

| · | BlackRock Technology Opportunities Fund |

| Not FDIC Insured • May Lose Value • No Bank Guarantee |

Dear Shareholder,

The 12-month reporting period as of May 31, 2022 saw the emergence of significant challenges that disrupted the economic recovery and strong financial markets which characterized 2021. The U.S. economy shrank in the first quarter of 2022, ending the run of robust growth which followed reopening and the development of the COVID-19 vaccines. Rapid changes in consumer spending led to supply constraints and elevated inflation, which reached a 40-year high. Moreover, while the foremost effect of Russia’s invasion of Ukraine has been a severe humanitarian crisis, the invasion has presented challenges for both investors and policymakers.

Equity prices generally fell, as persistently high inflation drove investors’ expectations for higher interest rates, particularly weighing on relatively high-valuation growth stocks and economically sensitive small-capitalization stocks. Overall, small-capitalization U.S. stocks declined, while large-capitalization U.S. stocks were nearly flat. Both emerging market stocks and international equities from developed markets fell significantly, pressured by rising interest rates and a strengthening U.S. dollar.

The 10-year U.S. Treasury yield (which is inversely related to bond prices) rose notably during the reporting period as increasing inflation drove investors’ expectations for higher interest rates. The corporate bond market also faced inflationary headwinds, and increasing uncertainty led to higher corporate bond spreads (the difference in yield between U.S. Treasuries and similarly-dated corporate bonds).

The U.S. Federal Reserve (the “Fed”), acknowledging that inflation is growing faster than expected, raised interest rates twice while indicating that additional future increases were likely. Furthermore, the Fed wound down its bond-buying programs and set a timetable to begin reversing the flow and reducing its balance sheet. Continued high inflation and the Fed’s statements led many analysts to anticipate that interest rates have significant room to rise before peaking.

Furthermore, the horrific war in Ukraine has significantly clouded the outlook for the global economy, leading to major volatility in energy and metal markets. Sanctions on Russia, Europe’s top energy supplier, and general wartime disruption have magnified supply problems for key commodities. We believe sharp increases in energy prices will continue to exacerbate inflationary pressure while also constraining economic growth. Combating inflation without stifling a recovery, while buffering against ongoing supply and price shocks amid the ebb and flow of the pandemic, will be an especially challenging environment for setting effective monetary policy. Despite the likelihood of more rate increases on the horizon, we believe the Fed will err on the side of protecting employment, even at the expense of higher inflation. However, markets have been primed to expect sharp tightening, which could weigh on valuations until central banks begin to tap the brakes.

In this environment, while we favor an overweight to equities in the long-term, the market’s concerns over excessive rate hikes from central banks moderates our outlook. Furthermore, the energy shock and a deteriorating economic backdrop in China and Europe are likely to challenge corporate earnings, so we take a neutral stance on equities in the near-term. We are underweight credit long-term, but inflation-protected U.S. Treasuries should offer a measure of portfolio diversification better suited for an inflationary environment. We believe emerging market bonds denominated in local currencies also offer an opportunity, with solid income at attractive valuations.

Overall, our view is that investors need to think globally, extend their scope across a broad array of asset classes, and be nimble as market conditions change. We encourage you to talk with your financial advisor and visit blackrock.com for further insight about investing in today’s markets.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

Rob Kapito

President, BlackRock Advisors, LLC

| Total Returns as of May 31, 2022 | ||||||||

| 6-Month | 12-Month | |||||||

U.S. large cap equities | (8.85)% | (0.30)% | ||||||

U.S. small cap equities | (14.70) | (16.92) | ||||||

International equities Far East Index) | (6.80) | (10.38) | ||||||

Emerging market equities | (10.11) | (19.83) | ||||||

3-month Treasury bills Treasury Bill Index) | 0.13 | 0.15 | ||||||

U.S. Treasury securities Treasury Index) | (10.94) | (8.83) | ||||||

U.S. investment grade U.S. Aggregate Bond Index) | (9.15) | (8.22) | ||||||

Tax-exempt municipal Bond Index) | (7.32) | (6.79) | ||||||

U.S. high yield bonds | (6.26) | (5.28) | ||||||

Past performance is not an indication of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. |

| |||||||

| 2 | T H I S P A G E I S N O T P A R T O F Y O U R F U N D R E P O R T |

| Page | ||||

| 2 | ||||

Annual Report: | ||||

| 4 | ||||

| 19 | ||||

| 19 | ||||

| 20 | ||||

Financial Statements: | ||||

| 21 | ||||

| 40 | ||||

| 44 | ||||

| 46 | ||||

| 49 | ||||

| 75 | ||||

| 92 | ||||

| 93 | ||||

| 94 | ||||

| 98 | ||||

| 103 | ||||

| 105 | ||||

| 3 |

| Fund Summary as of May 31, 2022 | BlackRock Capital Appreciation Fund, Inc. |

Investment Objective

BlackRock Capital Appreciation Fund, Inc.’s (the “Fund”) investment objective is to seek long-term growth of capital.

Portfolio Management Commentary

How did the Fund perform?

For the 12-month period ended May 31, 2022, the Fund underperformed its benchmark, the Russell 1000® Growth Index. For the same period, all of the Fund’s share classes underperformed the broad-market S&P 500® Index. The following discussion of relative performance pertains to the Russell 1000® Growth Index.

What factors influenced performance?

The largest detractors from the Fund’s performance relative to the benchmark were stock selection in the information technology (“IT”), communication services and consumer discretionary sectors. Within IT, selection among IT services companies detracted the most from performance, specifically an out-of-benchmark position in Shopify, Inc. Following IT, selection in communication services weighed on performance, most notably, an out-of-benchmark position in Snap, Inc. and overweight position in Match Group, Inc. within interactive media & services. Lastly, within consumer discretionary, an out-of-benchmark position in Mercado Libre, Inc. within internet & direct marketing retail detracted from relative performance.

The largest contributors to the Fund’s relative performance were positioning in energy, its cash position and selection in materials. In energy, positioning in the oil, gas & consumable fuels sub-sector contributed to performance, most notably positions in Pioneer Natural Resources Company and EQT Corp. Within in materials, positive contributions were highlighted by an out-of-benchmark position in Linde Plc in the chemicals sub-sector.

Describe recent portfolio activity.

During the period, exposure to energy increased with investment in the oil, gas & consumable fuels sub-sector. Exposure to the healthcare sector increased as well. Conversely, exposure to communication services decreased the most due to a reduced allocation to entertainment. Exposure to the IT sector declined as well. Finally, the Fund’s cash position rose slightly over the period.

Describe portfolio positioning at period end.

As of period end, the Fund’s largest overweight position relative to the Russell 1000® Growth Index was to the energy sector, followed by health care and materials. Conversely, the IT sector was the largest underweight, followed by industrials and consumer staples.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| 4 | 2 0 2 2 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

| Fund Summary as of May 31, 2022 (continued) | BlackRock Capital Appreciation Fund, Inc. |

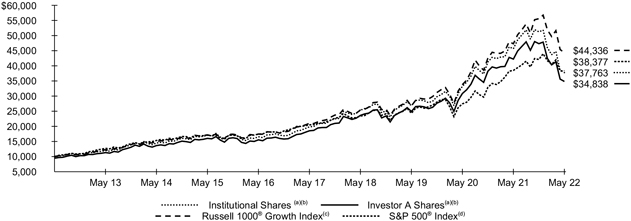

TOTAL RETURN BASED ON A $10,000 INVESTMENT

| (a) | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including investment advisory fees and administration fees, if any. Institutional Shares do not have a sales charge. |

| (b) | The Fund invests primarily in a diversified portfolio consisting primarily of common stock of U.S. companies that Fund management believes have exhibited above-average growth rates in earnings over the long term. |

| (c) | An index that measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000® companies with higher price-to-book ratios and higher forecasted growth values. |

| (d) | An unmanaged index that covers 500 leading companies and captures approximately 80% coverage of available market capitalization. |

Performance

| Average Annual Total Returns(a) | ||||||||||||||||||||||||||||||||||||

| 1 Year | 5 Years | 10 Years | ||||||||||||||||||||||||||||||||||

|

|

|

|

|

| |||||||||||||||||||||||||||||||

| Without Sales Charge | With Sales Charge | Without Sales Charge | With Sales Charge | Without Sales Charge | With Sales Charge | |||||||||||||||||||||||||||||||

Institutional | (17.30 | )% | N/A | 13.75 | % | N/A | 14.21 | % | N/A | |||||||||||||||||||||||||||

Investor A | (17.51 | ) | (21.84 | )% | 13.46 | 12.24 | % | 13.91 | 13.29 | % | ||||||||||||||||||||||||||

Investor C | (18.18 | ) | (18.85 | ) | 12.56 | 12.56 | 13.18 | 13.18 | ||||||||||||||||||||||||||||

Class K | (17.22 | ) | N/A | 13.87 | N/A | 14.33 | N/A | |||||||||||||||||||||||||||||

Class R | (17.82 | ) | N/A | 13.12 | N/A | 13.58 | N/A | |||||||||||||||||||||||||||||

Russell 1000® Growth Index | (6.25 | ) | N/A | 16.13 | N/A | 16.06 | N/A | |||||||||||||||||||||||||||||

S&P 500® Index | (0.30 | ) | N/A | 13.38 | N/A | 14.40 | N/A | |||||||||||||||||||||||||||||

| (a) | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” for a detailed description of share classes, including any related sales charges and fees. |

N/A - Not applicable as share class and index do not have a sales charge.

Past performance is not an indication of future results.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

Expense Example

| Actual | Hypothetical 5% Return | |||||||||||||||||||||||||||||||

|

|

|

| |||||||||||||||||||||||||||||

| | Beginning Account Value (12/01/21) | | | Ending Account Value (05/31/22) | | | Expenses Paid During the Period | (a) | | Beginning Account Value (12/01/21) | | | Ending Account Value (05/31/22) | | | Expenses Paid During the Period | (a) | | Annualized Expense Ratio | | ||||||||||||

Institutional | $ 1,000.00 | $ 736.90 | $ 3.05 | $ 1,000.00 | $ 1,021.42 | $ 3.53 | 0.70 | % | ||||||||||||||||||||||||

Investor A | 1,000.00 | 736.10 | 4.20 | 1,000.00 | 1,020.09 | 4.89 | 0.97 | |||||||||||||||||||||||||

Investor C | 1,000.00 | 733.30 | 7.52 | 1,000.00 | 1,016.26 | 8.75 | 1.74 | |||||||||||||||||||||||||

Class K | 1,000.00 | 737.30 | 2.77 | 1,000.00 | 1,021.74 | 3.23 | 0.64 | |||||||||||||||||||||||||

Class R | 1,000.00 | 734.60 | 5.76 | 1,000.00 | 1,018.29 | 6.69 | 1.33 | |||||||||||||||||||||||||

| (a) | For each class of the Fund, expenses are equal to the annualized expense ratio for the class, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). |

See “Disclosure of Expenses” for further information on how expenses were calculated.

F U N D S U M M A R Y | 5 |

| Fund Summary as of May 31, 2022 (continued) | BlackRock Capital Appreciation Fund, Inc. |

Portfolio Information

TEN LARGEST HOLDINGS

| Security(a) | Percent of Net Assets | |||

Microsoft Corp. | 11.4 | % | ||

Amazon.com, Inc. | 7.7 | |||

Alphabet, Inc., Class A | 5.9 | |||

Visa, Inc., Class A | 4.5 | |||

Intuit, Inc. | 4.3 | |||

S&P Global, Inc. | 3.4 | |||

ASML Holding NV, Registered Shares | 2.9 | |||

ServiceNow, Inc. | 2.7 | |||

LVMH Moet Hennessy Louis Vuitton SE | 2.6 | |||

Marvell Technology, Inc. | 2.5 | |||

SECTOR ALLOCATION

| Sector(b) | Percent of Net Assets | |||

Information Technology | 40.5 | % | ||

Consumer Discretionary | 18.0 | |||

Health Care | 11.9 | |||

Communication Services | 10.6 | |||

Financials | 4.5 | |||

Energy | 4.2 | |||

Materials | 3.5 | |||

Industrials | 2.2 | |||

Real Estate | 1.3 | |||

Other (each representing less than 1%) | 0.7 | |||

Short-Term Securities | 3.0 | |||

Liabilities in Excess of Other Assets | (0.4 | ) | ||

| (a) | Excludes short-term investments. |

| (b) | For Fund compliance purposes, the Fund’s sector classifications refer to one or more of the sector sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease. |

| 6 | 2 0 2 2 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

| Fund Summary as of May 31, 2022 | BlackRock Health Sciences Opportunities Portfolio |

Investment Objective

BlackRock Health Sciences Opportunities Portfolio’s (the “Fund”) investment objective is to provide long-term growth of capital.

Portfolio Management Commentary

How did the Fund perform?

For the 12-month period ended May 31, 2022, the Fund underperformed its benchmark, the Russell 3000® Health Care Index.

What factors influenced performance?

Healthcare stocks posted a gain in the annual period, even as the broader U.S. equity market lost ground. The sector was helped by its lower sensitivity to the primary drivers of market volatility, including rising interest rates, Russia’s invasion of Ukraine and the potential for slowing economic growth.

Both sector allocations and security selection detracted from performance. With respect to the former, the Fund was hurt by an underweight allocation to pharmaceuticals. However, an underweight in medical devices & supplies contributed. In terms of stock selection, the Fund’s underperformance in the healthcare providers & services and biotechnology industries offset a stronger showing in pharmaceuticals.

Among individual holdings, an underweight to AbbVie, Inc. was the largest detractor from relative performance. The biopharmaceutical company reported strong quarterly sales, primarily from Botox, and it announced positive clinical trial data for a chronic migraine treatment. An overweight position in Biogen, Inc. was another notable detractor. The company’s Alzheimer’s drug experienced weaker-than-anticipated adoption, leading to a sell-off in the stock. An overweight in the health insurance provider Humana, Inc. also detracted after the company reported flat earnings and halved its forecasts for new members it expects to add in 2022. The Fund sold the stock following this news.

A zero weighting in Veeva Systems, Inc. was the top contributor to relative performance. The medical technology company suffered from risk-off market sentiment that heavily penalized high-growth stocks in the second half of the period. Out-of-benchmark holdings in the drug distribution companies AmerisourceBergen Corp. and McKesson Corp. were also top contributors.

Describe recent portfolio activity.

The Fund’s weightings in the healthcare providers & services and pharmaceuticals sub-sectors increased. Conversely, its allocations to the biotechnology and medical devices & supplies sub-sectors decreased.

Describe portfolio positioning at period end.

The Fund is a diversified healthcare portfolio constructed using the investment adviser’s bottom-up process. Following the peak in COVID-19 cases in January 2022, the outlook for the virus improved considerably. However, the investment adviser continued to monitor developments on this front closely. In addition, given the macroeconomic and geopolitical uncertainties that could impact company fundamentals depending on the business and geographical mix, the investment adviser was focused on resilient companies with strong fundamentals, as well as those with majority of their revenue in the United States. Although the near-term outlook is challenging, the investment adviser believed the trends of aging demographics and innovation in medical technology remained key tailwinds for the sector.

At the close of the period, the Fund was overweight in healthcare providers & services, equal weight in biotechnology, and underweight in pharmaceuticals and medical devices & supplies.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

F U N D S U M M A R Y | 7 |

| Fund Summary as of May 31, 2022 (continued) | BlackRock Health Sciences Opportunities Portfolio |

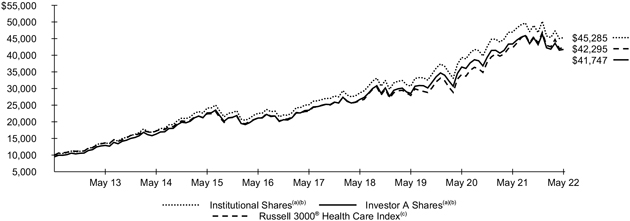

TOTAL RETURN BASED ON A $10,000 INVESTMENT

| (a) | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including investment advisory fees and administration fees, if any. Institutional Shares do not have a sales charge. |

| (b) | Under normal market conditions, the Fund invests at least 80% of its total assets in equity securities, primarily common stock, of companies in health sciences and related industries. |

| (c) | An unmanaged index that features companies involved in medical services or health care in the Russell 3000® Index, which includes the largest 3,000 U.S. companies as determined by total market capitalization. |

Performance

| Average Annual Total Returns(a) | ||||||||||||||||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| 1 Year | 5 Years | 10 Years | ||||||||||||||||||||||||||||||||||

| Without Sales Charge | With Sales Charge | Without Sales Charge | With Sales Charge | Without Sales Charge | With Sales Charge | |||||||||||||||||||||||||||||||

Institutional(b) | (3.55 | )% | N/A | 12.50 | % | N/A | 16.30 | % | N/A | |||||||||||||||||||||||||||

Service(b) | (3.83 | ) | N/A | 12.17 | N/A | 15.96 | N/A | |||||||||||||||||||||||||||||

Investor A(b) | (3.78 | ) | (8.83 | )% | 12.20 | 11.00 | % | 15.99 | 15.36 | % | ||||||||||||||||||||||||||

Investor C(b) | (4.50 | ) | (5.36 | ) | 11.38 | 11.38 | 15.32 | 15.32 | ||||||||||||||||||||||||||||

Class K(b) | (3.44 | ) | N/A | 12.61 | N/A | 16.24 | N/A | |||||||||||||||||||||||||||||

Class R(b) | (4.12 | ) | N/A | 11.83 | N/A | 15.61 | N/A | |||||||||||||||||||||||||||||

Russell 3000® Health Care Index | 0.17 | N/A | 12.78 | N/A | 15.51 | N/A | ||||||||||||||||||||||||||||||

| (a) | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” for a detailed description of share classes, including any related sales charges and fees, and how performance was calculated for certain share classes. |

| (b) | For financial reporting purposes, the market value of a certain investment was adjusted as of the report date. Accordingly, the net asset values (“NAV”) per share presented herein are different than the information previously published as of May 31, 2022. |

N/A - Not applicable as share class and index do not have a sales charge.

Past performance is not an indication of future results.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

Expense Example

| Actual | Hypothetical 5% Return | |||||||||||||||||||||||||||||||

|

|

|

| |||||||||||||||||||||||||||||

| | Beginning Account Value (12/01/21) | | | Ending Account Value (05/31/22) | | | Expenses Paid During the Period | (a) | | Beginning Account Value (12/01/21) | | | Ending Account Value (05/31/22) | | | Expenses Paid During the Period | (a) | | Annualized Expense Ratio | | ||||||||||||

Institutional | $ 1,000.00 | $ 967.60 | $ 4.18 | $ 1,000.00 | $ 1,020.68 | $ 4.28 | 0.85 | % | ||||||||||||||||||||||||

Service | 1,000.00 | 966.10 | 5.62 | 1,000.00 | 1,019.21 | 5.79 | 1.15 | |||||||||||||||||||||||||

Investor A | 1,000.00 | 966.40 | 5.41 | 1,000.00 | 1,019.42 | 5.54 | 1.10 | |||||||||||||||||||||||||

Investor C | 1,000.00 | 962.70 | 8.99 | 1,000.00 | 1,015.77 | 9.25 | 1.84 | |||||||||||||||||||||||||

Class K | 1,000.00 | 968.00 | 3.66 | 1,000.00 | 1,021.21 | 3.78 | 0.75 | |||||||||||||||||||||||||

Class R | 1,000.00 | 964.60 | 7.16 | 1,000.00 | 1,017.65 | 7.34 | 1.46 | |||||||||||||||||||||||||

| (a) | For each class of the Fund, expenses are equal to the annualized expense ratio for the class, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). |

See “Disclosure of Expenses” for further information on how expenses were calculated.

| 8 | 2 0 2 2 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

| Fund Summary as of May 31, 2022 (continued) | BlackRock Health Sciences Opportunities Portfolio |

Portfolio Information

TEN LARGEST HOLDINGS

| Security(a) | Percent of Net Assets | |||

UnitedHealth Group, Inc. | 9.7 | % | ||

Johnson & Johnson | 5.2 | |||

Eli Lilly & Co. | 4.7 | |||

Pfizer, Inc. | 4.2 | |||

Abbott Laboratories | 4.1 | |||

Thermo Fisher Scientific, Inc. | 3.9 | |||

Cigna Corp. | 3.7 | |||

Merck & Co., Inc. | 3.5 | |||

AbbVie, Inc. | 3.4 | |||

Anthem, Inc. | 3.3 | |||

INDUSTRY ALLOCATION

| Industry(b) | Percent of Net Assets | |||

Pharmaceuticals | 26.1 | % | ||

Health Care Providers & Services | 25.2 | |||

Biotechnology | 18.0 | |||

Health Care Equipment & Supplies | 16.8 | |||

Life Sciences Tools & Services | 9.1 | |||

Other (each representing less than 1%) | 0.6 | |||

Short-Term Securities | 5.3 | |||

Liabilities in Excess of Other Assets | (1.1 | ) | ||

| (a) | Excludes short-term investments. |

| (b) | For Fund compliance purposes, the Fund’s industry classifications refer to one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease. |

F U N D S U M M A R Y | 9 |

| Fund Summary as of May 31, 2022 | BlackRock Infrastructure Sustainable Opportunities Fund |

Investment Objective

BlackRock Infrastructure Sustainable Opportunities Fund’s (the “Fund”) investment objective is to seek to maximize total return while seeking to invest in issuers which are helping to address certain United Nations Sustainable Development Goals (“SDGs”) through their products and services.

Portfolio Management Commentary

How did the Fund perform?

For the period beginning September 30, 2021 with commencement of operations and ended May 31, 2022, the Fund underperformed its benchmark, the FTSE Developed Core Infrastructure 50/50 Net Tax Index.

What factors influenced performance?

The Fund’s benchmark, which measures the broad infrastructure universe, does not have any environmental, social and governance (“ESG”) requirements. As a result, the index has a sizable weighting in energy companies focused on fossil fuels. This market segment performed very well during the reporting period, as energy prices surged due to an imbalance of supply and demand that was exacerbated by Russia’s invasion of Ukraine in February 2022. The Fund’s lack of a position in the energy sector was therefore a primary factor in its underperformance as compared to the benchmark over the past eight months.

Because the index is used for reference purposes only, the following discussion refers to absolute returns rather than relative performance.

The Fund’s position in the Spain-based telecommunication tower operator Cellnex Telecom was a key detractor, as central banks’ shift toward higher interest rates fueled a sell-off among faster-growing companies. GDS Holdings, Ltd.—a Chinese information technology services company—was also hurt by the downturn in growth stocks, as well as a slowdown in China’s economy. The German port operator Hamburger Hafen und Logistik AG lagged in part to its ownership of a container terminal in Odessa, Ukraine. Similarly, the French company Eutelsat Communications S.A. experienced selling pressure from its Russian exposure. The Fund sold out of the position completely at the onset of the conflict. West Japan Railway Co., which lagged to a slower-than-expected recovery in traffic, was an additional detractor of note.

The Fund’s position in Getlink SE, which operates the tunnel between the United Kingdom and France, was a top contributor to results. The economic recovery that accompanied the waning of COVID-19 contributed to outperformance across the European transportation sector. Holdings in the U.K. utility companies National Grid PLC and Severn Trent PLC also outperformed thanks to their defensive profiles and limited exposure to the Russia-Ukraine war. U.S.-based Exelon Corp., whose spin-off of its nuclear assets create a simpler corporate structure, was a further contributor of note. Additionally, the Fund benefited from its position in Eversource Energy. The company announced that it was looking to divest its offshore wind business, which helped unlock value given that the stock had been trading for less than the sum of its parts.

Describe recent portfolio activity.

A number of significant macroeconomic events affected markets following the Fund’s inception in September 2021. Bond yields rose considerably, and the conflict between Russia and Ukraine worsened the supply-chain pressures that were initially caused by COVID-19. These events created opportunities in the sustainable space, including the expedited need for energy independence and renewable energy generation.

From the Fund’s inception through early 2022, the investment adviser added to the portfolio’s weighting in the Eurozone. Airports and electric utilities, in particular, appeared attractive in this time frame. Once the Russia/Ukraine conflict began, the investment adviser slightly reduced the Fund’s weighting in the region in response to rising risks. This included exiting the position in Eutelsat and halving the Fund’s position in Hamburger Hafen.

The investment adviser reallocated to the proceeds of its sales in Europe into Australia on the view that the country offered both near-term economic resiliency and compelling valuations. Further, it believed select, high-quality stocks in the digital and transportation infrastructure industries had become discounted relative to their intrinsic values.

While the investment adviser reduced the Fund’s overall allocation to Europe, it still saw a large need for cleaner energy to be produced and transmitted throughout the region. It therefore increased the Fund’s weighting in the European electric utilities sector.

Describe portfolio positioning at period end.

The strategy is benchmark-agnostic in its construction, and it looks to manage the inherent U.S. bias that is prevalent in the index. The Fund therefore has a large underweight in the United States. While this is not an active decision to avoid the country, the investment adviser sought to construct a global portfolio. In addition, the U.S. infrastructure sector has a large weighting in energy stocks.

The Fund finished the period with a significant overweight in the European, Middle Eastern, and African regions in relation to the index. The investment adviser believed these regions featured opportunities thanks to longer-term, structural trends such as digitization and decarbonization. European electric utilities were a notable overweight given the renewable power investments occurring across the region. In addition, the investment adviser believed the sector offered a favorable value versus U.S. utilities. The Fund was also overweight in Europe communications.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| 10 | 2 0 2 2 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

| Fund Summary as of May 31, 2022 (continued) | BlackRock Infrastructure Sustainable Opportunities Fund |

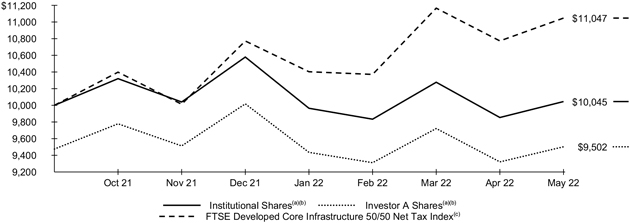

TOTAL RETURN BASED ON A $10,000 INVESTMENT

The Fund commenced operations on September 30, 2021.

| (a) | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including investment advisory fees and administration fees, if any. Institutional Shares do not have a sales charge. |

| (b) | Under normal circumstances, the Fund will invest at least 80% of its net assets, plus any borrowings for investment purposes, in the equity securities of infrastructure-related companies or derivatives with similar economic characteristics. |

| (c) | Gives participants an industry-defined interpretation of infrastructure and adjusts the exposure to certain infrastructure sub-sectors. The constituent weights are adjusted as part of the semi-annual review according to three broad industry sectors: 50% utilities; 30% transportation, including capping of 7.5% for railroads/railways; and a 20% mix of other sectors, including pipelines, satellites and telecommunication towers. |

Performance

| Total Returns(a) | ||||||||||||

|

| |||||||||||

| Since Inception(b) | ||||||||||||

|

| |||||||||||

| Without Sales Charge | With Sales Charge | |||||||||||

Institutional | 0.45 | % | N/A | |||||||||

Investor A | 0.29 | (4.98 | )% | |||||||||

Class K | 0.46 | N/A | ||||||||||

FTSE Developed Core Infrastructure 50/50 Net Tax Index | 10.47 | N/A | ||||||||||

| (a) | Assuming maximum sales charges, if any. Annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” for a detailed description of share classes, including any related sales charges and fees. |

| (b) | The Fund commenced operations on September 30, 2021. |

N/A - Not applicable as share class and index do not have a sales charge.

Past performance is not an indication of future results.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

Expense Example

| Actual | Hypothetical 5% Return | |||||||||||||||||||||||||||||||

| | Beginning Account Value | | | Ending Account Value (05/31/22) | | | Expenses Paid During the Period | (a) | | Beginning Account Value (12/01/21) | | | Ending Account Value (05/31/22) | | | Expenses Paid During the Period | | | Annualized Expense Ratio | | ||||||||||||

Institutional | $ 1,000.00 | $ 1,000.50 | $ 5.00 | $ 1,000.00 | $ 1,019.94 | $ 5.04 | 1.00 | % | ||||||||||||||||||||||||

Investor A | 1,000.00 | 998.90 | 6.24 | 1,000.00 | 1,018.69 | 6.29 | 1.25 | |||||||||||||||||||||||||

Class K | 1,000.00 | 1,000.60 | 4.75 | 1,000.00 | 1,020.18 | 4.78 | 0.95 | |||||||||||||||||||||||||

| (a) | For each class of the Fund, expenses are equal to the annualized expense ratio for the class, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). |

See “Disclosure of Expenses” for further information on how expenses were calculated.

F U N D S U M M A R Y | 11 |

| Fund Summary as of May 31, 2022 (continued) | BlackRock Infrastructure Sustainable Opportunities Fund |

Portfolio Information

TEN LARGEST HOLDINGS

| Security(a) | Percent of Net Assets | |||

Cellnex Telecom SA | 6.0 | % | ||

Fraport AG Frankfurt Airport Services Worldwide | 5.0 | |||

SBA Communications Corp. | 4.9 | |||

Enel SpA | 4.8 | |||

Public Service Enterprise Group, Inc. | 4.7 | |||

NextEra Energy, Inc. | 4.5 | |||

Transurban Group | 4.4 | |||

Eversource Energy | 4.4 | |||

Constellation Energy Corp. | 4.0 | |||

NEXTDC Ltd. | 3.7 | |||

SECTOR ALLOCATION

| Sector(b) | Percent of Net Assets | |||

Utilities | 42.6 | % | ||

Industrials | 21.0 | |||

Real Estate | 19.3 | |||

Communication Services | 8.0 | |||

Information Technology | 5.1 | |||

Short-Term Securities | 0.9 | |||

Other Assets Less Liabilities | 3.1 | |||

| (a) | Excludes short-term securities. |

| (b) | For Fund compliance purposes, the Fund’s sector classifications refer to one or more of the sector sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease. |

| 12 | 2 0 2 2 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

| Fund Summary as of May 31, 2022 | BlackRock Mid-Cap Growth Equity Portfolio |

Investment Objective

BlackRock Mid-Cap Growth Equity Portfolio’s (the “Fund”) investment objective is long-term capital appreciation.

Portfolio Management Commentary

How did the Fund perform?

For the 12-month period ended May 31, 2022, the Fund underperformed its benchmark, the Russell Midcap® Growth Index.

What factors influenced performance?

The largest detractors from the Fund’s performance relative to the benchmark were stock selection in the consumer discretionary, information technology (“IT”) and healthcare sectors. In consumer discretionary, out-of-benchmark positions in Evolution Gaming Group and Penn National Gaming within the hotels, restaurants & leisure sub-sector weighed on performance. Following consumer discretionary, IT detracted from performance, driven by an overweight position in Okta, Inc. within IT services. Lastly, selection in healthcare was a slight drag on performance, notably in the life sciences tools & services sub-sector where overweight positions in 10X Genomics, Inc. and Charles River Laboratories International, Inc. detracted.

The largest contributors to the Fund’s relative performance were selection in communication services and industrials as well as the Fund’s cash position. In communication services, avoiding most companies within entertainment and an out-of-benchmark position in Liberty Media Corp. contributed to performance. Within industrials, an overweight position in Rollins, Inc. and an out-of-benchmark position in Waste Connections, Inc. proved beneficial.

Describe recent portfolio activity.

During the period, exposure to communication services increased with investment in the entertainment sub-sector. Exposure to the industrials sector increased as well. Conversely, exposure to healthcare decreased the most due to a reduced allocation to healthcare equipment & supplies. Exposure to the IT sector decreased as well.

Describe portfolio positioning at period end.

Relative to the Russell Midcap® Growth Index, at the end of the reporting period the Fund’s largest overweight was to the communication services sector, followed by financials and industrials. Conversely, the energy sector was the largest underweight, followed by consumer staples and IT.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

F U N D S U M M A R Y | 13 |

| Fund Summary as of May 31, 2022 (continued) | BlackRock Mid-Cap Growth Equity Portfolio |

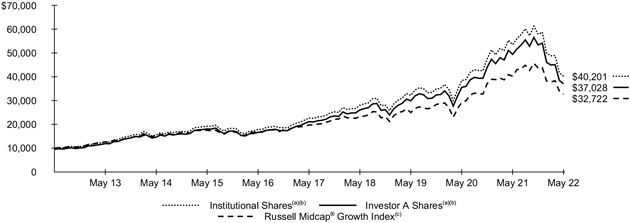

TOTAL RETURN BASED ON A $10,000 INVESTMENT

| (a) | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including investment advisory fees and administration fees, if any. Institutional Shares do not have a sales charge. |

| (b) | The Fund normally invests at least 80% of its net assets in equity securities issued by U.S. mid-capitalization companies which Fund management believes have above-average earnings growth potential. |

| (c) | An index that measures the performance of the mid-cap growth segment of the U.S. equity universe. It includes those Russell Midcap® Index companies with higher price-to-book ratios and higher forecasted growth values. |

Performance

| Average Annual Total Returns(a) | ||||||||||||||||||||||||||||||||||||

| 1 Year | 5 Years | 10 Years | ||||||||||||||||||||||||||||||||||

| Without Sales Charge | With Sales Charge | Without Sales Charge | With Sales Charge | Without Sales Charge | With Sales Charge | |||||||||||||||||||||||||||||||

Institutional | (24.87 | )% | N/A | 12.18 | % | N/A | 14.93 | % | N/A | |||||||||||||||||||||||||||

Service | (25.06 | ) | N/A | 11.90 | N/A | 14.57 | N/A | |||||||||||||||||||||||||||||

Investor A | (25.05 | ) | (28.98 | )% | 11.88 | 10.68 | % | 14.60 | 13.99 | % | ||||||||||||||||||||||||||

Investor C | (25.61 | ) | (26.30 | ) | 11.07 | 11.07 | 13.91 | 13.91 | ||||||||||||||||||||||||||||

Class K | (24.79 | ) | N/A | 12.26 | N/A | 14.99 | N/A | |||||||||||||||||||||||||||||

Class R | (25.24 | ) | N/A | 11.61 | N/A | 14.31 | N/A | |||||||||||||||||||||||||||||

Russell Midcap® Growth Index | (18.71 | ) | N/A | 10.65 | N/A | 12.59 | N/A | |||||||||||||||||||||||||||||

| (a) | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” for a detailed description of share classes, including any related sales charges and fees, and how performance was calculated for certain share classes. |

N/A - Not applicable as share class and index do not have a sales charge.

Past performance is not an indication of future results.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

Expense Example

| Actual | Hypothetical 5% Return | |||||||||||||||||||||||||||||||

| | Beginning Account Value (12/01/21) | | | Ending Account Value (05/31/22) | | | Expenses Paid During the Period | (a) | | Beginning Account Value (12/01/21) | | | Ending Account Value (05/31/22) | | | Expenses Paid During the Period | (a) | | Annualized Expense Ratio | | ||||||||||||

Institutional | $ 1,000.00 | $ 694.80 | $ 3.38 | $ 1,000.00 | $ 1,020.94 | $ 4.03 | 0.80 | % | ||||||||||||||||||||||||

Service | 1,000.00 | 693.90 | 4.43 | 1,000.00 | 1,019.70 | 5.29 | 1.05 | |||||||||||||||||||||||||

Investor A | 1,000.00 | 693.90 | 4.43 | 1,000.00 | 1,019.70 | 5.29 | 1.05 | |||||||||||||||||||||||||

Investor C | 1,000.00 | 691.40 | 7.53 | 1,000.00 | 1,016.03 | 9.00 | 1.79 | |||||||||||||||||||||||||

Class K | 1,000.00 | 695.00 | 2.96 | 1,000.00 | 1,021.44 | 3.53 | 0.70 | |||||||||||||||||||||||||

Class R | 1,000.00 | 693.10 | 5.49 | 1,000.00 | 1,018.45 | 6.54 | 1.30 | |||||||||||||||||||||||||

| (a) | For each class of the Fund, expenses are equal to the annualized expense ratio for the class, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). |

See “Disclosure of Expenses” for further information on how expenses were calculated.

| 14 | 2 0 2 2 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

| Fund Summary as of May 31, 2022 (continued) | BlackRock Mid-Cap Growth Equity Portfolio |

Portfolio Information

TEN LARGEST HOLDINGS

| ||||

| Security(a) | Percent of Net Assets | |||

| ||||

Cadence Design Systems, Inc. | 3.6% | |||

MSCI, Inc. | 3.5 | |||

Match Group, Inc. | 3.4 | |||

Synopsys, Inc. | 3.1 | |||

Copart, Inc. | 3.0 | |||

Monolithic Power Systems, Inc. | 3.0 | |||

Entegris, Inc. | 2.9 | |||

Paycom Software, Inc. | 2.9 | |||

ON Semiconductor Corp. | 2.8 | |||

West Pharmaceutical Services, Inc. | 2.7 | |||

| ||||

SECTOR ALLOCATION

| ||||

| Sector(b) | Percent of Net Assets | |||

| ||||

Information Technology | 30.9% | |||

Industrials | 16.4 | |||

Health Care | 15.3 | |||

Consumer Discretionary | 14.8 | |||

Financials | 10.2 | |||

Communication Services | 9.2 | |||

Real Estate | 1.7 | |||

Materials | 1.0 | |||

Short-Term Securities | 2.0 | |||

Liabilities in Excess of Other Assets | (1.5) | |||

| ||||

| (a) | Excludes short-term investments. |

| (b) | For Fund compliance purposes, the Fund’s sector classifications refer to one or more of the sector sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease. |

F U N D S U M M A R Y | 15 |

| Fund Summary as of May 31, 2022 | BlackRock Technology Opportunities Fund |

Investment Objective

BlackRock Technology Opportunities Fund’s (the “Fund”) investment objective is to provide long-term capital appreciation.

Portfolio Management Commentary

How did the Fund perform?

For the 12-month period ended May 31, 2022, the Fund underperformed its benchmark, the MSCI All-Country World Information Technology Index.

What factors influenced performance?

The largest detractor from relative performance was the Fund’s underweight position in Apple Inc., as the company reported strong earnings and all-time record revenue in the quarter containing the key holiday shopping period. Apple also benefited from the flight to quality and safety in equity markets more broadly during the market downturn. Also weighing on relative performance were out-of-benchmark positions in AppLovin Corp. and Snap, Inc. AppLovin is a mobile-app tech company, and it delivered a disappointing outlook for the remainder of 2022. Social media and Snapchat parent Snap warned that it would not meet revenue and earnings projections for the year, given the current adverse market environment for consumer-oriented tech companies.

By contrast, an underweight position in semiconductor chip maker Nvidia Corp. was a top contributor to relative returns. Investors grew concerned about the sustainability of its sales momentum, given a potential economic slowdown in consumer spending and its impact on the company’s gaming business. An out-of-benchmark position in Activision Blizzard also contributed to returns following the announced acquisition of the video game company by Microsoft for $69 billion. Lastly, an out-of-benchmark position in BYD benefited Fund performance, as the Chinese conglomerate announced that it would begin to supply batteries for electric vehicles manufactured by Tesla.

Describe recent portfolio activity.

The Fund increased its exposure to stable, quality stocks, adding more defensive characteristics to the portfolio in the midst of broader market volatility. The Fund took advantage of price dislocation during the market sell-off to rotate its exposure within the semiconductor industry, adding to positions with long, structural tailwinds and less cyclical sensitivity.

Describe portfolio positioning at period end.

The Fund finished the period overweight in the internet and semiconductors sub-sectors, and underweight in hardware and software. This positioning reflected the investment adviser’s view favoring value-oriented, higher-quality companies in light of higher interest rates and inflation expectations as well as additional uncertainties from the COVID-19 pandemic, geopolitical risk, and threats to a global economic recovery. The Fund has maintained its exposure to long-term secular themes within the portfolio, such as artificial intelligence, cloud computing, and electric vehicles, as well as more nascent themes such as the metaverse, space, and quantum computing. Although growth assets have been penalized due to rising rate concerns, the fundamentals of the companies within the portfolio remain compelling. The secular growth trends driving technology are multi-year transformations that are expected to persist regardless of the macroeconomic environment or geopolitical risk.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| 16 | 2 0 2 2 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

| Fund Summary as of May 31, 2022 (continued) | BlackRock Technology Opportunities Fund |

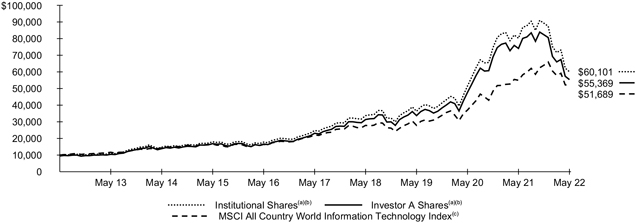

TOTAL RETURN BASED ON A $10,000 INVESTMENT

| (a) | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including investment advisory fees and administration fees, if any. Institutional Shares do not have a sales charge. |

| (b) | Under normal market conditions, the Fund invests at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in equity securities issued by U.S. and non-U.S. technology companies in all market capitalization ranges, selected for their rapid and sustainable growth potential from the development, advancement and use of technology. |

The Fund’s total returns prior to December 30, 2017 are the returns of the Fund when it followed different investment strategies under the name BlackRock Science & Technology Opportunities Portfolio. |

| (c) | An index that includes large- and mid-cap securities across certain Developed Markets countries and certain Emerging Markets countries. All securities in the index are classified in the Information Technology sector as per the Global Industry Classification Standard. |

Performance

| Average Annual Total Returns(a) | ||||||||||||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||

| 1 Year | 5 Years | 10 Years | ||||||||||||||||||||||||||||||

|

|

|

|

|

| |||||||||||||||||||||||||||

| Without Sales Charge | With Sales Charge | Without Sales Charge | With Sales Charge | Without Sales Charge | With Sales Charge | |||||||||||||||||||||||||||

Institutional(b) | (25.09 | )% | N/A | 19.40 | % | N/A | 19.64 | % | N/A | |||||||||||||||||||||||

Service(b) | (25.28 | ) | N/A | 19.12 | N/A | 19.37 | N/A | |||||||||||||||||||||||||

Investor A(b) | (25.28 | ) | (29.20 | )% | 19.11 | 17.83 | % | 19.31 | 18.67 | % | ||||||||||||||||||||||

Investor C(b) | (25.81 | ) | (26.49 | ) | 18.23 | 18.23 | 18.55 | 18.55 | ||||||||||||||||||||||||

Class K(b) | (25.05 | ) | N/A | 19.45 | N/A | 19.66 | N/A | |||||||||||||||||||||||||

Class R(b) | (25.47 | ) | N/A | 18.80 | N/A | 18.99 | N/A | |||||||||||||||||||||||||

MSCI All-Country World Information Technology Index | (5.93 | ) | N/A | 18.56 | N/A | 17.85 | N/A | |||||||||||||||||||||||||

| (a) | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” for a detailed description of share classes, including any related sales charges and fees, and how performance was calculated for certain share classes. |

| (b) | For financial reporting purposes, the market value of a certain investment was adjusted as of the report date. Accordingly, the net asset values (“NAV”) per share presented herein are different than the information previously published as of May 31, 2022. |

N/A - Not applicable as share class and index do not have a sales charge.

Past performance is not an indication of future results.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

F U N D S U M M A R Y | 17 |

| Fund Summary as of May 31, 2022 (continued) | BlackRock Technology Opportunities Fund |

Expense Example

| Actual | Hypothetical 5% Return | |||||||||||||||||||||||||||||||

| | Beginning Account Value (12/01/21) | | | Ending Account Value (05/31/22) | | | Expenses Paid During the Period | (a) | | Beginning Account Value (12/01/21) | | | Ending Account Value (05/31/22) | | | Expenses Paid During the Period | (a) | | Annualized Expense Ratio | | ||||||||||||

Institutional | $ 1,000.00 | $ 673.50 | $ 3.84 | $ 1,000.00 | $ 1,020.35 | $ 4.63 | 0.92 | % | ||||||||||||||||||||||||

Service | 1,000.00 | 672.70 | 4.88 | 1,000.00 | 1,019.10 | 5.89 | 1.17 | |||||||||||||||||||||||||

Investor A | 1,000.00 | 672.80 | 4.88 | 1,000.00 | 1,019.10 | 5.89 | 1.17 | |||||||||||||||||||||||||

Investor C | 1,000.00 | 670.50 | 7.98 | 1,000.00 | 1,015.38 | 9.65 | 1.92 | |||||||||||||||||||||||||

Class K | 1,000.00 | 673.60 | 3.53 | 1,000.00 | 1,020.71 | 4.28 | 0.85 | |||||||||||||||||||||||||

Class R | 1,000.00 | 671.80 | 5.92 | 1,000.00 | 1,017.85 | 7.14 | 1.42 | |||||||||||||||||||||||||

| (a) | For each class of the Fund, expenses are equal to the annualized expense ratio for the class, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). |

See “Disclosure of Expenses” for further information on how expenses were calculated.

Portfolio Information

TEN LARGEST HOLDINGS

| Security(a) | Percent of Net Assets | |||

Apple Inc. | 7.7% | |||

Microsoft Corp. | 6.7 | |||

Tesla, Inc. | 4.1 | |||

Alphabet, Inc., Class A | 3.8 | |||

Marvell Technology, Inc. | 3.5 | |||

Mastercard, Inc., Class A | 2.7 | |||

ASML Holding NV | 2.6 | |||

Advanced Micro Devices, Inc. | 2.5 | |||

Visa, Inc., Class A | 2.5 | |||

Lam Research Corp. | 2.4 | |||

INDUSTRY ALLOCATION

| Industry(b) | Percent of Net Assets | |||

Semiconductors & Semiconductor Equipment | 28.9% | |||

Software | 23.6 | |||

IT Services | 14.8 | |||

Interactive Media & Services | 7.9 | |||

Technology Hardware, Storage & Peripherals | 7.7 | |||

Automobiles | 5.3 | |||

Internet & Direct Marketing Retail | 2.8 | |||

Entertainment | 1.8 | |||

Hotels, Restaurants & Leisure | 1.8 | |||

Electronic Equipment, Instruments & Components | 1.5 | |||

Other (each representing less than 1%) | 2.8 | |||

Short-Term Securities | 3.3 | |||

Liabilities in Excess of Other Assets | (2.2) | |||

| (a) | Excludes short-term securities. |

| (b) | For Fund compliance purposes, the Fund’s industry classifications refer to one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease. |

| 18 | 2 0 2 2 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

Institutional and Class K Shares are not subject to any sales charge. These shares bear no ongoing distribution or service fees and are available only to certain eligible investors. BlackRock Capital Appreciation Fund, Inc.’s Class K Shares performance shown prior to the Class K Shares inception date of August 15, 2016 is that of BlackRock Shares. BlackRock Health Sciences Opportunities Portfolio’s Class K Shares performance shown prior to the Class K Shares inception date of June 8, 2016 is that of Investor A Shares. BlackRock Mid-Cap Growth Equity Portfolio’s Class K Shares performance shown prior to the Class K Shares inception date of March 28, 2016 is that of Institutional Shares. BlackRock Technology Opportunities Fund’s Class K Shares performance shown prior to the Class K Shares inception date of December 10, 2019 is that of Institutional Shares. The performance of each Fund’s Class K Shares would be substantially similar to Investor A Shares or Institutional Shares, as applicable, because the share classes of a Fund invest in the same portfolio of securities and performance would only differ to the extent that Class K Shares and Investor A Shares or Institutional Shares, as applicable, have different expenses. The actual returns of Class K Shares would have been higher than those of the Investor A Shares or Institutional Shares, as applicable, because Class K Shares have lower expenses than the Investor A Shares and Institutional Shares.

Service Shares (not available in BlackRock Capital Appreciation Fund, Inc. and BlackRock Infrastructure Sustainable Opportunities Fund) are not subject to any sales charge. These shares are subject to a service fee of 0.25% per year (but no distribution fee) and are only available to certain eligible investors.

Investor A Shares are subject to a maximum initial sales charge (front-end load) of 5.25% and a service fee of 0.25% per year (but no distribution fee). Certain redemptions of these shares may be subject to a contingent deferred sales charge (“CDSC”) where no initial sales charge was paid at the time of purchase. These shares are generally available through financial intermediaries.

Investor C Shares (not available in BlackRock Infrastructure Sustainable Opportunities Fund) are subject to a 1.00% CDSC if redeemed within one year of purchase. In addition, these shares are subject to a distribution fee of 0.75% per year and a service fee of 0.25% per year. These shares are generally available through financial intermediaries. These shares automatically convert to Investor A Shares after approximately eight years.

Class R Shares (not available in BlackRock Infrastructure Sustainable Opportunities Fund) are not subject to any sales charge. These shares are subject to a distribution fee of 0.25% per year and a service fee of 0.25% per year. These shares are available only to certain employer-sponsored retirement plans.

Past performance is not an indication of future results. Financial markets have experienced extreme volatility and trading in many instruments has been disrupted. These circumstances may continue for an extended period of time and may continue to affect adversely the value and liquidity of each Fund’s investments. As a result, current performance may be lower or higher than the performance data quoted. Refer to blackrock.com to obtain performance data current to the most recent month-end. Performance results do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Figures shown in the performance tables assume reinvestment of all distributions, if any, at net asset value (“NAV”) on the ex-dividend date or payable date, as applicable. Investment return and principal value of shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Distributions paid to each class of shares will vary because of the different levels of service, distribution and transfer agency fees applicable to each class, which are deducted from the income available to be paid to shareholders.

BlackRock Advisors, LLC (the “Manager”), each Fund’s investment adviser, has contractually and/or voluntarily agreed to waive and/or reimburse a portion of each Fund’s expenses. Without such waiver(s) and/or reimbursement(s), each Fund’s performance would have been lower. With respect to each Fund’s voluntary waiver(s), if any, the Manager is under no obligation to waive and/or reimburse or to continue waiving and/or reimbursing its fees and such voluntary waiver(s) may be reduced or discontinued at any time. With respect to each Fund’s contractual waiver(s), if any, the Manager is under no obligation to continue waiving and/or reimbursing its fees after the applicable termination date of such agreement. See the Notes to Financial Statements for additional information on waivers and/or reimbursements.

Shareholders of each Fund may incur the following charges: (a) transactional expenses, such as sales charges; and (b) operating expenses, including investment advisory fees, administration fees, service and distribution fees, including 12b-1 fees, acquired fund fees and expenses, and other fund expenses. The expense examples shown (which are based on a hypothetical investment of $1,000 invested at the beginning of the period and held through the end of the period) are intended to assist shareholders both in calculating expenses based on an investment in each Fund and in comparing these expenses with similar costs of investing in other mutual funds.

The expense examples provide information about actual account values and actual expenses. Annualized expense ratios reflect contractual and voluntary fee waivers, if any. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 and then multiply the result by the number corresponding to their Fund and share class under the heading entitled “Expenses Paid During the Period.”

The expense examples also provide information about hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. In order to assist shareholders in comparing the ongoing expenses of investing in these Funds and other funds, compare the 5% hypothetical examples with the 5% hypothetical examples that appear in shareholder reports of other funds.

The expenses shown in the expense examples are intended to highlight shareholders’ ongoing costs only and do not reflect transactional expenses, such as sales charges, if any. Therefore, the hypothetical examples are useful in comparing ongoing expenses only and will not help shareholders determine the relative total expenses of owning different funds. If these transactional expenses were included, shareholder expenses would have been higher.

A B O U T F U N D P E R F O R M A N C E / D I S C L O S U R E O F E X P E N S E S | 19 |

Derivative Financial Instruments

The Funds may invest in various derivative financial instruments. These instruments are used to obtain exposure to a security, commodity, index, market, and/or other assets without owning or taking physical custody of securities, commodities and/or other referenced assets or to manage market, equity, credit, interest rate, foreign currency exchange rate, commodity and/or other risks. Derivative financial instruments may give rise to a form of economic leverage and involve risks, including the imperfect correlation between the value of a derivative financial instrument and the underlying asset, possible default of the counterparty to the transaction or illiquidity of the instrument. The Funds’ successful use of a derivative financial instrument depends on the investment adviser’s ability to predict pertinent market movements accurately, which cannot be assured. The use of these instruments may result in losses greater than if they had not been used, may limit the amount of appreciation a Fund can realize on an investment and/or may result in lower distributions paid to shareholders. The Funds’ investments in these instruments, if any, are discussed in detail in the Notes to Financial Statements.

| 20 | 2 0 2 2 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

May 31, 2022 | BlackRock Capital Appreciation Fund, Inc. (Percentages shown are based on Net Assets) |

| Security | Shares | Value | ||||||

Common Stocks |

| |||||||

| Aerospace & Defense — 2.2% | ||||||||

TransDigm Group, Inc.(a) | 128,807 | $ | 77,975,894 | |||||

|

| |||||||

| Automobiles — 2.2% | ||||||||

Tesla, Inc.(a) | 102,359 | 77,614,735 | ||||||

|

| |||||||

| Capital Markets — 4.5% | ||||||||

Blackstone, Inc. | 351,543 | 41,408,250 | ||||||

S&P Global, Inc. | 342,642 | 119,746,526 | ||||||

|

| |||||||

| 161,154,776 | ||||||||

| Chemicals — 3.0% | ||||||||

Linde PLC | 185,735 | 60,304,440 | ||||||

Sherwin-Williams Co. | 174,492 | 46,770,835 | ||||||

|

| |||||||

| 107,075,275 | ||||||||

| Containers & Packaging — 0.5% | ||||||||

Ball Corp. | 230,585 | 16,346,171 | ||||||

|

| |||||||

| Electronic Equipment, Instruments & Components — 0.2% | ||||||||

Zebra Technologies Corp., Class A(a) | 26,861 | 9,084,122 | ||||||

|

| |||||||

| Equity Real Estate Investment Trusts (REITs) — 1.3% | ||||||||

Prologis, Inc. | 349,968 | 44,613,921 | ||||||

|

| |||||||

| Health Care Equipment & Supplies — 0.6% | ||||||||

Intuitive Surgical, Inc.(a) | 96,373 | 21,938,350 | ||||||

|

| |||||||

| Health Care Providers & Services — 3.0% | ||||||||

Humana, Inc. | 66,534 | 30,221,739 | ||||||

UnitedHealth Group, Inc. | 150,541 | 74,785,758 | ||||||

|

| |||||||

| 105,007,497 | ||||||||

| Hotels, Restaurants & Leisure — 3.2% | ||||||||

Chipotle Mexican Grill, Inc.(a) | 28,794 | 40,385,025 | ||||||

Domino’s Pizza, Inc. | 62,937 | 22,856,830 | ||||||

Evolution AB(b) | 487,675 | 51,118,140 | ||||||

|

| |||||||

| 114,359,995 | ||||||||

| Interactive Media & Services — 9.7% | ||||||||

Alphabet, Inc., Class A(a) | 90,879 | 206,771,536 | ||||||

Match Group, Inc.(a)(c) | 1,064,327 | 83,847,681 | ||||||

Meta Platforms, Inc., Class A(a) | 161,517 | 31,276,152 | ||||||

Snap, Inc., Class A(a)(c) | 1,497,980 | 21,136,498 | ||||||

|

| |||||||

| 343,031,867 | ||||||||

| Internet & Direct Marketing Retail — 7.7% | ||||||||

Amazon.com, Inc.(a) | 112,763 | 271,103,677 | ||||||

|

| |||||||

| IT Services — 7.6% | ||||||||

Mastercard, Inc., Class A | 238,606 | 85,389,929 | ||||||

MongoDB, Inc.(a)(c) | 64,448 | 15,283,843 | ||||||

Snowflake, Inc., Class A(a) | 76,775 | 9,800,329 | ||||||

Visa, Inc., Class A | 746,108 | 158,301,734 | ||||||

|

| |||||||

| 268,775,835 | ||||||||

| Life Sciences Tools & Services — 5.4% | ||||||||

Danaher Corp. | 321,864 | 84,914,160 | ||||||

Lonza Group AG, Registered Shares | 60,954 | 36,749,520 | ||||||

Thermo Fisher Scientific, Inc. | 125,477 | 71,216,981 | ||||||

|

| |||||||

| 192,880,661 | ||||||||

| Oil, Gas & Consumable Fuels — 4.2% | ||||||||

EQT Corp. | 1,262,689 | 60,255,519 | ||||||

Pioneer Natural Resources Co. | 317,912 | 88,360,461 | ||||||

|

| |||||||

| 148,615,980 | ||||||||

| Personal Products — 0.7% | ||||||||

Olaplex Holdings, Inc.(a)(c) | 1,474,917 | 23,775,662 | ||||||

|

| |||||||

| Security | Shares | Value | ||||||

| Pharmaceuticals — 2.9% | ||||||||

Eli Lilly & Co. | 124,390 | $ | 38,988,802 | |||||

Zoetis, Inc. | 371,709 | 63,536,219 | ||||||

|

| |||||||

| 102,525,021 | ||||||||

| Semiconductors & Semiconductor Equipment — 8.7% | ||||||||

Applied Materials, Inc. | 218,046 | 25,574,615 | ||||||

ASML Holding NV, Registered Shares | 180,590 | 104,072,211 | ||||||

Marvell Technology, Inc. | 1,519,582 | 89,883,275 | ||||||

NVIDIA Corp. | 463,763 | 86,593,828 | ||||||

|

| |||||||

| 306,123,929 | ||||||||

| Software — 21.5% | ||||||||

Adobe, Inc.(a) | 140,285 | 58,425,897 | ||||||

Bill.com Holdings, Inc.(a)(c) | 167,080 | 19,755,539 | ||||||

Cadence Design Systems, Inc.(a) | 196,234 | 30,167,053 | ||||||

Intuit, Inc. | 369,914 | 153,314,556 | ||||||

Microsoft Corp. | 1,477,870 | 401,788,517 | ||||||

ServiceNow, Inc.(a) | 205,449 | 96,041,244 | ||||||

|

| |||||||

| 759,492,806 | ||||||||

| Technology Hardware, Storage & Peripherals — 2.5% | ||||||||

Apple Inc. | 588,207 | 87,548,730 | ||||||

|

| |||||||

| Textiles, Apparel & Luxury Goods — 4.9% | ||||||||

LVMH Moet Hennessy Louis Vuitton SE | 144,826 | 93,503,464 | ||||||

NIKE, Inc., Class B | 662,141 | 78,695,458 | ||||||

|

| |||||||

| 172,198,922 | ||||||||

|

| |||||||

Total Common Stocks — 96.5% | 3,411,243,826 | |||||||

|

| |||||||

Preferred Securities |

| |||||||

| Preferred Stocks — 0.9% | ||||||||

| Interactive Media & Services — 0.9% | ||||||||

Bytedance Ltd., Series E-1 (Acquired 11/11/20, cost | 183,711 | 30,407,105 | ||||||

|

| |||||||

Total Preferred Securities — 0.9% | 30,407,105 | |||||||

|

| |||||||

Total Long-Term Investments — 97.4% | 3,441,650,931 | |||||||

|

| |||||||

Short-Term Securities(f)(g) |

| |||||||

| Money Market Funds — 3.0% | ||||||||

BlackRock Liquidity Funds, T-Fund, Institutional Class, 0.71% | 95,737,315 | 95,737,315 | ||||||

SL Liquidity Series, LLC, Money Market Series, 0.96%(h) | 11,762,776 | 11,761,599 | ||||||

|

| |||||||

Total Short-Term Securities — 3.0% | 107,498,914 | |||||||

|

| |||||||

Total Investments — 100.4% | 3,549,149,845 | |||||||

Liabilities in Excess of Other Assets — (0.4)% | (15,715,804 | ) | ||||||

|

| |||||||

Net Assets — 100.0% | $ | 3,533,434,041 | ||||||

|

| |||||||

| (a) | Non-income producing security. |

| (b) | Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may be resold in transactions exempt from registration to qualified institutional investors. |

| (c) | All or a portion of this security is on loan. |

| (d) | Security is valued using significant unobservable inputs and is classified as Level 3 in the fair value hierarchy. |

S C H E D U L E S O F I N V E S T M E N T S | 21 |

Schedule of Investments (continued) May 31, 2022 | BlackRock Capital Appreciation Fund, Inc. |

| (e) | Restricted security as to resale, excluding 144A securities. The Fund held restricted securities with a current value of $30,407,105, representing 0.9% of its net assets as of period end, and an original cost of $20,129,982. |

| (f) | Affiliate of the Fund. |

| (g) | Annualized 7-day yield as of period end. |

| (h) | All or a portion of this security was purchased with the cash collateral from loaned securities. |

Affiliates

Investments in issuers considered to be affiliate(s) of the Fund during the year ended May 31, 2022 for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows:

| Affiliated Issuer | Value at 05/31/21 | Purchases at Cost | Proceeds from Sale | Net Realized | Change in | Value at 05/31/22 | Shares Held at 05/31/22 | Income | Capital Gain | |||||||||||||||||||||||||||||||||||||||

BlackRock Liquidity Funds, T-Fund, Institutional Class | $ | 21,582,078 | $ | 74,155,237 | (a) | $ — | $ | — | $ | — | $ | 95,737,315 | 95,737,315 | $ | 86,365 | $ | — | |||||||||||||||||||||||||||||||

SL Liquidity Series, LLC, Money Market Series | — | 11,770,032 | (a) | — | (10,591 | ) | 2,158 | 11,761,599 | 11,762,776 | 43,887 | (b) | — | ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||||

| $ | (10,591) | $ | 2,158 | $ | 107,498,914 | $ | 130,252 | $ | — | |||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||||

| (a) | Represents net amount purchased (sold). |

| (b) | All or a portion represents securities lending income earned from the reinvestment of cash collateral from loaned securities, net of fees and collateral investment expenses, and other payments to and from borrowers of securities. |

For Fund compliance purposes, the Fund’s industry classifications refer to one or more of the industry sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease.

Fair Value Hierarchy as of Period End

Various inputs are used in determining the fair value of financial instruments. For a description of the input levels and information about the Fund’s policy regarding valuation of financial instruments, refer to the Notes to Financial Statements.

The following table summarizes the Fund’s financial instruments categorized in the fair value hierarchy. The breakdown of the Fund’s financial instruments into major categories is disclosed in the Schedule of Investments above.

| ||||||||||||||||

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| ||||||||||||||||

Assets | ||||||||||||||||

Investments | ||||||||||||||||

Long-Term Investments | ||||||||||||||||

Common Stocks | ||||||||||||||||

Aerospace & Defense | $ | 77,975,894 | $ | — | $ | — | $ | 77,975,894 | ||||||||

Automobiles | 77,614,735 | — | — | 77,614,735 | ||||||||||||

Capital Markets | 161,154,776 | — | — | 161,154,776 | ||||||||||||

Chemicals | 107,075,275 | — | — | 107,075,275 | ||||||||||||

Containers & Packaging | 16,346,171 | — | — | 16,346,171 | ||||||||||||

Electronic Equipment, Instruments & Components | 9,084,122 | — | — | 9,084,122 | ||||||||||||

Equity Real Estate Investment Trusts (REITs) | 44,613,921 | — | — | 44,613,921 | ||||||||||||

Health Care Equipment & Supplies | 21,938,350 | — | — | 21,938,350 | ||||||||||||

Health Care Providers & Services | 105,007,497 | — | — | 105,007,497 | ||||||||||||

Hotels, Restaurants & Leisure | 63,241,855 | 51,118,140 | — | 114,359,995 | ||||||||||||

Interactive Media & Services | 343,031,867 | — | — | 343,031,867 | ||||||||||||

Internet & Direct Marketing Retail | 271,103,677 | — | — | 271,103,677 | ||||||||||||

IT Services | 268,775,835 | — | — | 268,775,835 | ||||||||||||

Life Sciences Tools & Services | 156,131,141 | 36,749,520 | — | 192,880,661 | ||||||||||||

Oil, Gas & Consumable Fuels | 148,615,980 | — | — | 148,615,980 | ||||||||||||

Personal Products | 23,775,662 | — | — | 23,775,662 | ||||||||||||

Pharmaceuticals | 102,525,021 | — | — | 102,525,021 | ||||||||||||

Semiconductors & Semiconductor Equipment | 306,123,929 | — | — | 306,123,929 | ||||||||||||

Software | 759,492,806 | — | — | 759,492,806 | ||||||||||||

Technology Hardware, Storage & Peripherals | 87,548,730 | — | — | 87,548,730 | ||||||||||||

Textiles, Apparel & Luxury Goods | 78,695,458 | 93,503,464 | — | 172,198,922 | ||||||||||||

Preferred Securities | — | — | 30,407,105 | 30,407,105 | ||||||||||||

| 22 | 2 0 2 2 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

Schedule of Investments (continued) May 31, 2022 | BlackRock Capital Appreciation Fund, Inc. |

| ||||||||||||||||

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| ||||||||||||||||

Short-Term Securities | ||||||||||||||||

Money Market Funds | $ | 95,737,315 | $ | — | $ | — | $ | 95,737,315 | ||||||||

|

|

|

|

|

|

|

| |||||||||

| $ | 3,325,610,017 | $ | 181,371,124 | $ | 30,407,105 | 3,537,388,246 | ||||||||||

|

|

|

|

|

|

|

| |||||||||

Investments valued at NAV(a) | 11,761,599 | |||||||||||||||

|

| |||||||||||||||

| $ | 3,549,149,845 | |||||||||||||||

|

| |||||||||||||||

| (a) | Certain investments of the Fund were fair valued using NAV per share as no quoted market value is available and therefore have been excluded from the fair value hierarchy. |

See notes to financial statements.

S C H E D U L E S O F I N V E S T M E N T S | 23 |

Schedule of Investments May 31, 2022 | BlackRock Health Sciences Opportunities Portfolio (Percentages shown are based on Net Assets) |

| Security | Shares | Value | ||||||

Common Stocks |

| |||||||

| Biotechnology — 17.6% | ||||||||

AbbVie, Inc. | 2,162,165 | $ | 318,638,256 | |||||

Acumen Pharmaceuticals, Inc.(a)(b) | 772,313 | 2,733,988 | ||||||

Alkermes PLC(a) | 356,424 | 10,639,256 | ||||||

Alnylam Pharmaceuticals, Inc.(a)(b) | 268,302 | 33,752,392 | ||||||

Ambrx Biopharma, Inc., ADR(a) | 842,149 | 3,309,644 | ||||||

Amgen, Inc. | 1,087,435 | 279,188,062 | ||||||

Arcutis Biotherapeutics, Inc.(a) | 799,932 | 16,702,580 | ||||||

Argenx SE, ADR(a) | 63,432 | 19,619,518 | ||||||

Biogen, Inc.(a) | 351,243 | 70,248,600 | ||||||

BioMarin Pharmaceutical, Inc.(a) | 556,320 | 41,796,322 | ||||||

Blueprint Medicines Corp.(a) | 123,333 | 6,783,315 | ||||||

Cerevel Therapeutics Holdings, Inc.(a)(b) | 312,854 | 8,174,875 | ||||||

Decibel Therapeutics, Inc.(a) | 897,801 | 1,975,162 | ||||||

Design Therapeutics, Inc.(a) | 257,492 | 3,213,500 | ||||||

Enanta Pharmaceuticals, Inc.(a)(b) | 57,153 | 2,282,119 | ||||||

Everest Medicines Ltd.(a)(c) | 576,500 | 1,620,302 | ||||||

Exact Sciences Corp.(a)(b) | 263,958 | 13,147,748 | ||||||

Forma Therapeutics Holdings, Inc.(a) | 222,122 | 1,263,874 | ||||||

Genmab A/S(a) | 42,470 | 12,926,142 | ||||||

Genmab A/S, ADR(a)(b) | 289,405 | 8,754,501 | ||||||

Gilead Sciences, Inc. | 1,478,097 | 95,854,591 | ||||||

Horizon Therapeutics PLC(a) | 363,751 | 32,624,827 | ||||||

Imago Biosciences, Inc.(a)(b) | 907,400 | 14,663,584 | ||||||

Immuneering Corp., Class A(a) | 264,380 | 1,184,422 | ||||||

Immunocore Holdings PLC, ADR(a)(b) | 181,355 | 5,141,414 | ||||||

Incyte Corp.(a)(b) | 458,365 | 34,785,320 | ||||||

Ionis Pharmaceuticals, Inc.(a) | 257,120 | 9,390,022 | ||||||

Kronos Bio, Inc.(a) | 312,693 | 1,163,218 | ||||||

Krystal Biotech, Inc.(a) | 100,946 | 5,943,701 | ||||||

Mersana Therapeutics, Inc.(a) | 1,050,918 | 3,510,066 | ||||||

Moderna, Inc.(a) | 473,419 | 68,801,983 | ||||||

Monte Rosa Therapeutics, Inc.(a)(b) | 533,603 | 4,130,087 | ||||||

MoonLake Immunotherapeutics(a)(b) | 226,542 | 1,751,170 | ||||||

Neurocrine Biosciences, Inc.(a)(b) | 395,980 | 37,020,170 | ||||||

PMV Pharmaceuticals, Inc.(a)(b) | 306,148 | 3,600,301 | ||||||

Point Biopharma Global, Inc.(a)(b) | 499,734 | 4,107,814 | ||||||

Prothena Corp. PLC(a) | 391,632 | 10,664,139 | ||||||

Regeneron Pharmaceuticals, Inc.(a)(b) | 214,112 | 142,328,811 | ||||||

REVOLUTION Medicines, Inc.(a)(b) | 192,944 | 3,276,189 | ||||||

Sarepta Therapeutics, Inc.(a) | 368,594 | 26,841,015 | ||||||

Seagen, Inc.(a) | 747,245 | 101,386,202 | ||||||

Sierra Oncology, Inc.(a)(b) | 189,391 | 10,374,839 | ||||||

Sigilon Therapeutics, Inc.(a) | 332,626 | 252,131 | ||||||

Talaris Therapeutics, Inc.(a)(b) | 451,718 | 3,889,292 | ||||||

Tenaya Therapeutics, Inc.(a)(b) | 431,076 | 2,888,209 | ||||||

TScan Therapeutics, Inc.(a)(b) | 551,194 | 1,763,821 | ||||||

Vertex Pharmaceuticals, Inc.(a)(b) | 714,739 | 192,014,632 | ||||||

|

| |||||||

| 1,676,122,126 | ||||||||

| Diversified Financial Services — 0.3% | ||||||||

Health Assurance Acquisition Corp., Class A(a) | 1,747,926 | 17,234,550 | ||||||

Health Sciences Acquisitions Corp. 2(a)(b) | 262,308 | 2,609,965 | ||||||

MedTech Acquisition Corp., Class A(a) | 831,621 | 8,166,518 | ||||||

|

| |||||||

| 28,011,033 | ||||||||

| Health Care Equipment & Supplies — 16.6% | ||||||||