0000844779 bf1:C000004038Member bf1:MonolithicPowerSystemsIncMember 2024-05-31 0000844779 bf1:C000228505Member us-gaap:ShortTermInvestmentsMember 2024-05-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:

Name of Fund:

BlackRock FundsSM

BlackRock Advantage International Fund

BlackRock Advantage Large Cap Growth Fund

BlackRock Advantage Small Cap Core Fund

BlackRock Commodity Strategies Fund

BlackRock Energy Opportunities Fund

BlackRock Health Sciences Opportunities Portfolio

BlackRock High Equity Income Fund

BlackRock Infrastructure Sustainable Opportunities Fund

BlackRock International Dividend Fund

BlackRock Mid-Cap Growth Equity Portfolio

BlackRock SMID-Cap Growth Equity Fund

BlackRock Technology Opportunities Fund

BlackRock U.S. Insights Long/Short Equity Fund

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock FundsSM, 50 Hudson Yards, New York, NY 10001

Registrant's telephone number, including area code:

Date of reporting period:

Item 1 — Reports to Stockholders

(a) The Reports to Shareholders are attached herewith

(b) Not Applicable

BlackRock Advantage International Fund

Institutional Shares | BROIX

Annual Shareholder Report — May 31, 2024

This annual shareholder report contains important information about BlackRock Advantage International Fund (the “Fund”) for the period of June 1, 2023 to May 31, 2024. You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class name | Costs of a $10,000

investment | Costs paid as a percentage of a

$10,000 investment |

| Institutional Shares | $55 | 0.50% |

How did the Fund perform last year?

Global equities enjoyed strong performance as resilient macro and micro data combined with excitement around the dominant themes of innovation in information technology and healthcare drove gains.

Fears of a U.S. recession waned while major overseas economies returned to positive growth.

Signs of easing inflation led to expectations that the U.S. Federal Reserve and other leading central banks were poised to reduce interest rates.

What contributed to performance?

Positive contributions to performance, relative to the benchmark (MSCI EAFE Index) were led by sentiment measures that were able to identify dominant trends by looking at informed investor positioning and through text-based analysis of broker reports (or conference calls). These insights correctly positioned the portfolio around Japanese stocks within financials and industrials that benefited as the theme of corporate reform continued to materialize in the region. Traditional fundamental measures also were additive, notably by driving positioning in U.K. consumer staples companies. An insight looking at research and development spending correctly positioned the portfolio in European healthcare stocks that benefited from enthusiasm around the use of GLP-1 drugs for weight loss. Finally, traditional quality insights looking at external financing correctly positioned the portfolio within information technology, particularly with respect to Japanese semiconductor companies likely to benefit from the emerging artificial intelligence theme.

What detracted from performance?

The largest detractors from relative performance included certain non-traditional fundamental quality insights, most notably those related to human capital such as those looking at veteran hiring, employee sentiment and hiring for environmental roles. In addition, changing market leadership proved a headwind to trend-following industry insights, with industry measures picking up on price momentum and favoring defensive positioning among the biggest laggards.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

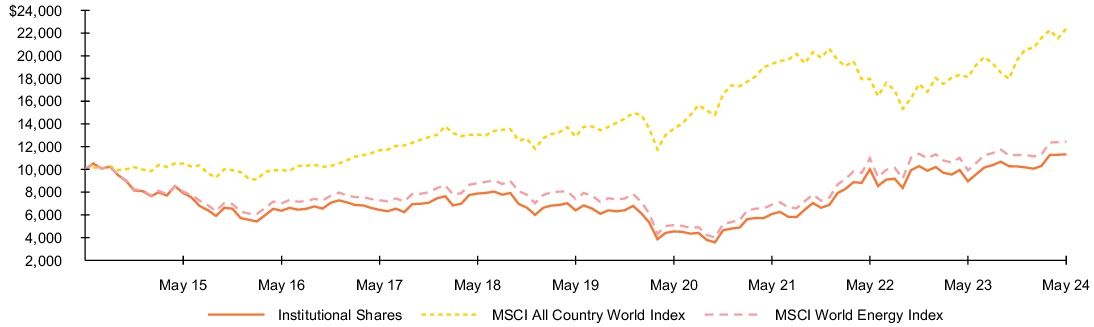

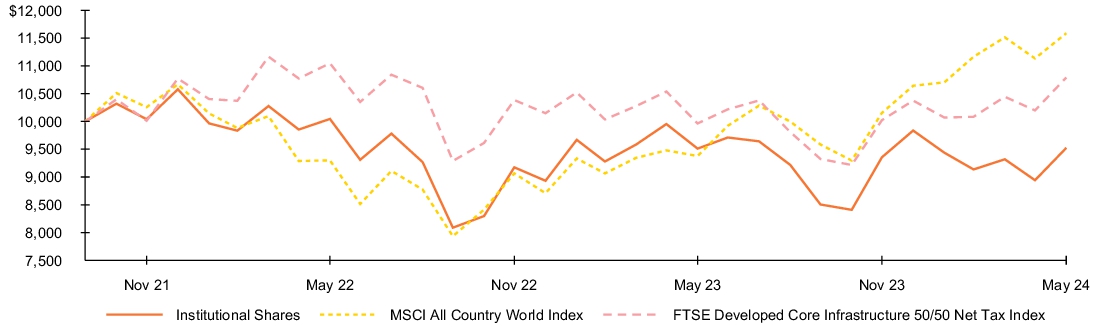

Fund performance

Cumulative performance: June 1, 2014 through May 31, 2024

Initial investment of $10,000

See “Average annual total returns” for additional information on fund performance.

Average annual total returns

| 1 Year | 5 Years | 10 Years |

| Institutional Shares | 20.40% | 8.87% | 5.79% |

| MSCI EAFE Index | 18.53% | 8.05% | 4.60% |

| Net Assets | $1,747,385,984% |

| Number of Portfolio Holdings | $324% |

| Net Investment Advisory Fees | $5,104,033% |

| Portfolio Turnover Rate | $128% |

Performance shown prior to June 12, 2017 are the returns of the Fund when it followed different investment strategies under the name BlackRock Global Opportunities Portfolio.

Past performance is not an indication of future results. Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit blackrock.com for more recent performance information.

What did the Fund invest in?

(as of May 31, 2024)

| Country | Percent of

Net Assets |

| Japan | 22.3)% |

| United Kingdom | 11.3)% |

| Germany | 10.0)% |

| France | 9.1)% |

| Switzerland | 8.2)% |

| Netherlands | 5.1)% |

| Australia | 5.1)% |

| United States | 5.0)% |

| Denmark | 4.2)% |

| Spain | 4.0)% |

| Other | 13.0)% |

| Short-Term Securities | 3.5)% |

| Liabilities in Excess of Other Assets | (0.8)% |

| Security(a) | Percent of

Net Assets |

| Novo Nordisk A/S, Class B | 3.4% |

| ASML Holding NV | 3.1% |

| Novartis AG, Registered Shares | 2.3% |

| SAP SE | 2.1% |

| Shell PLC | 1.9% |

| BHP Group Ltd. | 1.8% |

| Siemens AG, Registered Shares | 1.8% |

| Allianz SE, Registered Shares | 1.7% |

| GSK PLC | 1.6% |

| Tokyo Electron Ltd. | 1.6% |

(a) | Excludes short-term securities. |

Additional information

If you wish to view additional information about the Fund, including but not limited to financial statements, the Fund’s prospectus, and proxy voting policies and procedures, please visit blackrock.com/fundreports. For proxy voting records, visit blackrock.com/proxyrecords.

Householding

The Fund will mail only one copy of shareholder documents, including prospectuses, annual and semi-annual reports and proxy statements, to shareholders with multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses and eliminate duplicate mailings of shareholder documents. Mailings of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please call the Fund at (800) 441-7762.

The Fund is not sponsored, endorsed, issued, sold, or promoted by MSCI Inc. and its affiliates, nor does this company make any representation regarding the advisability of investing in the Fund. BlackRock is not affiliated with the company listed above.

©2024 BlackRock, Inc. or its affiliates. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

BlackRock Advantage International Fund

Institutional Shares | BROIX

Annual Shareholder Report — May 31, 2024

BROIX-05/24-AR

BlackRock Advantage International Fund

Investor A Shares | BROAX

Annual Shareholder Report — May 31, 2024

This annual shareholder report contains important information about BlackRock Advantage International Fund (the “Fund”) for the period of June 1, 2023 to May 31, 2024. You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class name | Costs of a $10,000

investment | Costs paid as a percentage of a

$10,000 investment |

| Investor A Shares | $83 | 0.75% |

How did the Fund perform last year?

Global equities enjoyed strong performance as resilient macro and micro data combined with excitement around the dominant themes of innovation in information technology and healthcare drove gains.

Fears of a U.S. recession waned while major overseas economies returned to positive growth.

Signs of easing inflation led to expectations that the U.S. Federal Reserve and other leading central banks were poised to reduce interest rates.

What contributed to performance?

Positive contributions to performance, relative to the benchmark (MSCI EAFE Index) were led by sentiment measures that were able to identify dominant trends by looking at informed investor positioning and through text-based analysis of broker reports (or conference calls). These insights correctly positioned the portfolio around Japanese stocks within financials and industrials that benefited as the theme of corporate reform continued to materialize in the region. Traditional fundamental measures also were additive, notably by driving positioning in U.K. consumer staples companies. An insight looking at research and development spending correctly positioned the portfolio in European healthcare stocks that benefited from enthusiasm around the use of GLP-1 drugs for weight loss. Finally, traditional quality insights looking at external financing correctly positioned the portfolio within information technology, particularly with respect to Japanese semiconductor companies likely to benefit from the emerging artificial intelligence theme.

What detracted from performance?

The largest detractors from relative performance included certain non-traditional fundamental quality insights, most notably those related to human capital such as those looking at veteran hiring, employee sentiment and hiring for environmental roles. In addition, changing market leadership proved a headwind to trend-following industry insights, with industry measures picking up on price momentum and favoring defensive positioning among the biggest laggards.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

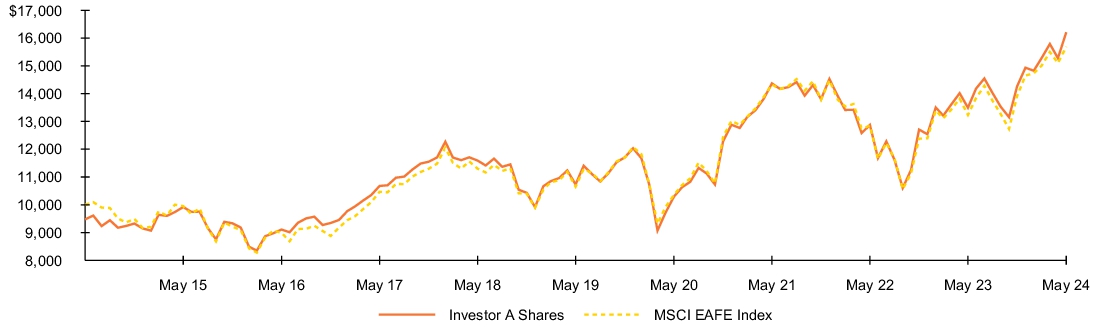

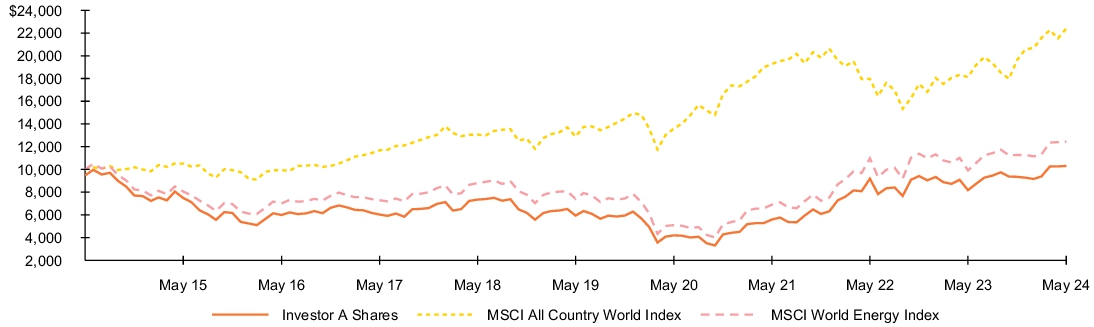

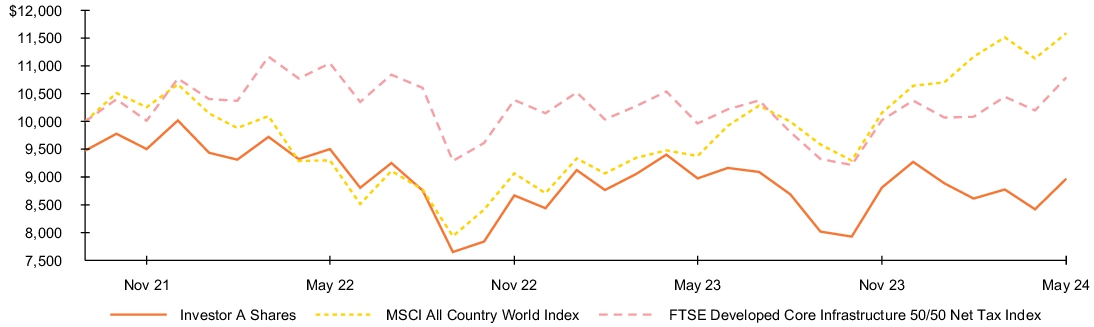

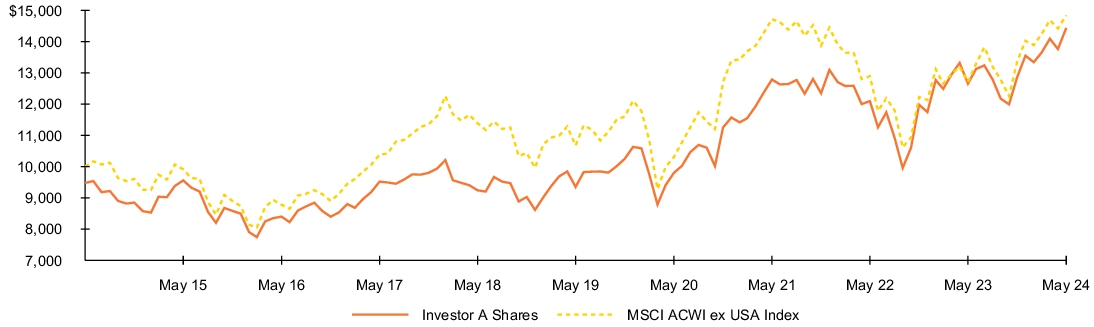

Fund performance

Cumulative performance: June 1, 2014 through May 31, 2024

Initial investment of $10,000

See “Average annual total returns” for additional information on fund performance.

Average annual total returns

| 1 Year | 5 Years | 10 Years |

| Investor A Shares | 20.11% | 8.60% | 5.52% |

| Investor A Shares (with sales charge) | 13.81% | 7.43% | 4.95% |

| MSCI EAFE Index | 18.53% | 8.05% | 4.60% |

| Net Assets | $1,747,385,984% |

| Number of Portfolio Holdings | $324% |

| Net Investment Advisory Fees | $5,104,033% |

| Portfolio Turnover Rate | $128% |

Performance shown prior to June 12, 2017 are the returns of the Fund when it followed different investment strategies under the name BlackRock Global Opportunities Portfolio.

Assuming maximum sales charges. Average annual total returns with and without sales charges reflect reductions for service fees.

Past performance is not an indication of future results. Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit blackrock.com for more recent performance information.

What did the Fund invest in?

(as of May 31, 2024)

| Country | Percent of

Net Assets |

| Japan | 22.3)% |

| United Kingdom | 11.3)% |

| Germany | 10.0)% |

| France | 9.1)% |

| Switzerland | 8.2)% |

| Netherlands | 5.1)% |

| Australia | 5.1)% |

| United States | 5.0)% |

| Denmark | 4.2)% |

| Spain | 4.0)% |

| Other | 13.0)% |

| Short-Term Securities | 3.5)% |

| Liabilities in Excess of Other Assets | (0.8)% |

| Security(a) | Percent of

Net Assets |

| Novo Nordisk A/S, Class B | 3.4% |

| ASML Holding NV | 3.1% |

| Novartis AG, Registered Shares | 2.3% |

| SAP SE | 2.1% |

| Shell PLC | 1.9% |

| BHP Group Ltd. | 1.8% |

| Siemens AG, Registered Shares | 1.8% |

| Allianz SE, Registered Shares | 1.7% |

| GSK PLC | 1.6% |

| Tokyo Electron Ltd. | 1.6% |

(a) | Excludes short-term securities. |

Additional information

If you wish to view additional information about the Fund, including but not limited to financial statements, the Fund’s prospectus, and proxy voting policies and procedures, please visit blackrock.com/fundreports. For proxy voting records, visit blackrock.com/proxyrecords.

Householding

The Fund will mail only one copy of shareholder documents, including prospectuses, annual and semi-annual reports and proxy statements, to shareholders with multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses and eliminate duplicate mailings of shareholder documents. Mailings of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please call the Fund at (800) 441-7762.

The Fund is not sponsored, endorsed, issued, sold, or promoted by MSCI Inc. and its affiliates, nor does this company make any representation regarding the advisability of investing in the Fund. BlackRock is not affiliated with the company listed above.

©2024 BlackRock, Inc. or its affiliates. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

BlackRock Advantage International Fund

Investor A Shares | BROAX

Annual Shareholder Report — May 31, 2024

BROAX-05/24-AR

BlackRock Advantage International Fund

Investor C Shares | BROCX

Annual Shareholder Report — May 31, 2024

This annual shareholder report contains important information about BlackRock Advantage International Fund (the “Fund”) for the period of June 1, 2023 to May 31, 2024. You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class name | Costs of a $10,000

investment | Costs paid as a percentage of a

$10,000 investment |

| Investor C Shares | $164 | 1.50% |

How did the Fund perform last year?

Global equities enjoyed strong performance as resilient macro and micro data combined with excitement around the dominant themes of innovation in information technology and healthcare drove gains.

Fears of a U.S. recession waned while major overseas economies returned to positive growth.

Signs of easing inflation led to expectations that the U.S. Federal Reserve and other leading central banks were poised to reduce interest rates.

What contributed to performance?

Positive contributions to performance, relative to the benchmark (MSCI EAFE Index) were led by sentiment measures that were able to identify dominant trends by looking at informed investor positioning and through text-based analysis of broker reports (or conference calls). These insights correctly positioned the portfolio around Japanese stocks within financials and industrials that benefited as the theme of corporate reform continued to materialize in the region. Traditional fundamental measures also were additive, notably by driving positioning in U.K. consumer staples companies. An insight looking at research and development spending correctly positioned the portfolio in European healthcare stocks that benefited from enthusiasm around the use of GLP-1 drugs for weight loss. Finally, traditional quality insights looking at external financing correctly positioned the portfolio within information technology, particularly with respect to Japanese semiconductor companies likely to benefit from the emerging artificial intelligence theme.

What detracted from performance?

The largest detractors from relative performance included certain non-traditional fundamental quality insights, most notably those related to human capital such as those looking at veteran hiring, employee sentiment and hiring for environmental roles. In addition, changing market leadership proved a headwind to trend-following industry insights, with industry measures picking up on price momentum and favoring defensive positioning among the biggest laggards.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

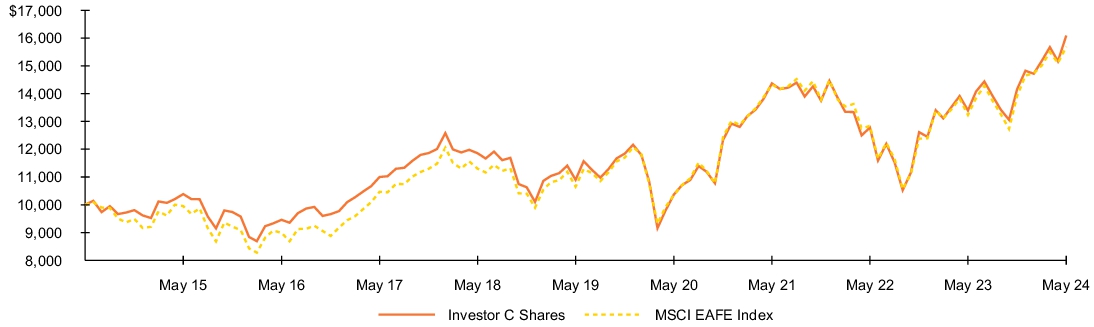

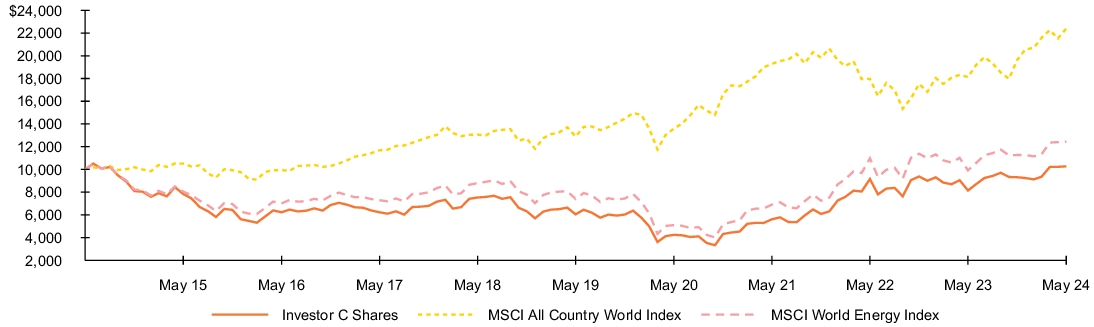

Fund performance

Cumulative performance: June 1, 2014 through May 31, 2024

Initial investment of $10,000

See “Average annual total returns” for additional information on fund performance.

Average annual total returns

| 1 Year | 5 Years | 10 Years |

| Investor C Shares | 19.21% | 7.78% | 4.87% |

| Investor C Shares (with sales charge) | 18.21% | 7.78% | 4.87% |

| MSCI EAFE Index | 18.53% | 8.05% | 4.60% |

| Net Assets | $1,747,385,984% |

| Number of Portfolio Holdings | $324% |

| Net Investment Advisory Fees | $5,104,033% |

| Portfolio Turnover Rate | $128% |

Performance shown prior to June 12, 2017 are the returns of the Fund when it followed different investment strategies under the name BlackRock Global Opportunities Portfolio.

Assuming maximum sales charges. Average annual total returns with and without sales charges reflect reductions for distribution and service fees.

Past performance is not an indication of future results. Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit blackrock.com for more recent performance information.

What did the Fund invest in?

(as of May 31, 2024)

| Country | Percent of

Net Assets |

| Japan | 22.3)% |

| United Kingdom | 11.3)% |

| Germany | 10.0)% |

| France | 9.1)% |

| Switzerland | 8.2)% |

| Netherlands | 5.1)% |

| Australia | 5.1)% |

| United States | 5.0)% |

| Denmark | 4.2)% |

| Spain | 4.0)% |

| Other | 13.0)% |

| Short-Term Securities | 3.5)% |

| Liabilities in Excess of Other Assets | (0.8)% |

| Security(a) | Percent of

Net Assets |

| Novo Nordisk A/S, Class B | 3.4% |

| ASML Holding NV | 3.1% |

| Novartis AG, Registered Shares | 2.3% |

| SAP SE | 2.1% |

| Shell PLC | 1.9% |

| BHP Group Ltd. | 1.8% |

| Siemens AG, Registered Shares | 1.8% |

| Allianz SE, Registered Shares | 1.7% |

| GSK PLC | 1.6% |

| Tokyo Electron Ltd. | 1.6% |

(a) | Excludes short-term securities. |

Additional information

If you wish to view additional information about the Fund, including but not limited to financial statements, the Fund’s prospectus, and proxy voting policies and procedures, please visit blackrock.com/fundreports. For proxy voting records, visit blackrock.com/proxyrecords.

Householding

The Fund will mail only one copy of shareholder documents, including prospectuses, annual and semi-annual reports and proxy statements, to shareholders with multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses and eliminate duplicate mailings of shareholder documents. Mailings of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please call the Fund at (800) 441-7762.

The Fund is not sponsored, endorsed, issued, sold, or promoted by MSCI Inc. and its affiliates, nor does this company make any representation regarding the advisability of investing in the Fund. BlackRock is not affiliated with the company listed above.

©2024 BlackRock, Inc. or its affiliates. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

BlackRock Advantage International Fund

Investor C Shares | BROCX

Annual Shareholder Report — May 31, 2024

BROCX-05/24-AR

BlackRock Advantage International Fund

Class K Shares | BROKX

Annual Shareholder Report — May 31, 2024

This annual shareholder report contains important information about BlackRock Advantage International Fund (the “Fund”) for the period of June 1, 2023 to May 31, 2024. You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class name | Costs of a $10,000

investment | Costs paid as a percentage of a

$10,000 investment |

| Class K Shares | $50 | 0.45% |

How did the Fund perform last year?

Global equities enjoyed strong performance as resilient macro and micro data combined with excitement around the dominant themes of innovation in information technology and healthcare drove gains.

Fears of a U.S. recession waned while major overseas economies returned to positive growth.

Signs of easing inflation led to expectations that the U.S. Federal Reserve and other leading central banks were poised to reduce interest rates.

What contributed to performance?

Positive contributions to performance, relative to the benchmark (MSCI EAFE Index) were led by sentiment measures that were able to identify dominant trends by looking at informed investor positioning and through text-based analysis of broker reports (or conference calls). These insights correctly positioned the portfolio around Japanese stocks within financials and industrials that benefited as the theme of corporate reform continued to materialize in the region. Traditional fundamental measures also were additive, notably by driving positioning in U.K. consumer staples companies. An insight looking at research and development spending correctly positioned the portfolio in European healthcare stocks that benefited from enthusiasm around the use of GLP-1 drugs for weight loss. Finally, traditional quality insights looking at external financing correctly positioned the portfolio within information technology, particularly with respect to Japanese semiconductor companies likely to benefit from the emerging artificial intelligence theme.

What detracted from performance?

The largest detractors from relative performance included certain non-traditional fundamental quality insights, most notably those related to human capital such as those looking at veteran hiring, employee sentiment and hiring for environmental roles. In addition, changing market leadership proved a headwind to trend-following industry insights, with industry measures picking up on price momentum and favoring defensive positioning among the biggest laggards.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

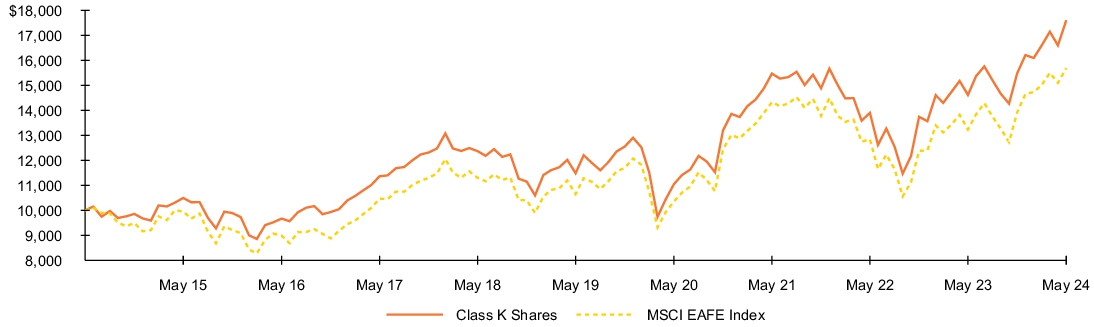

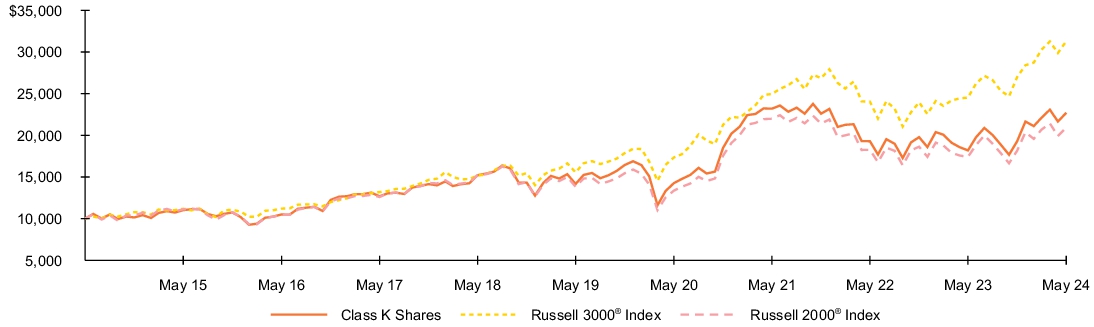

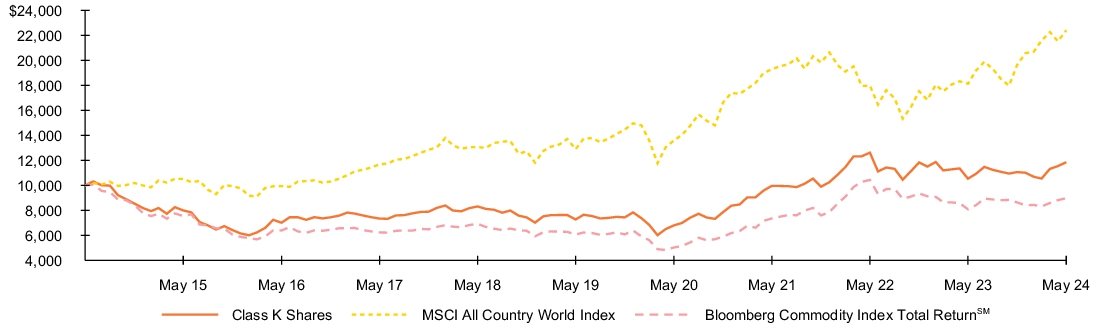

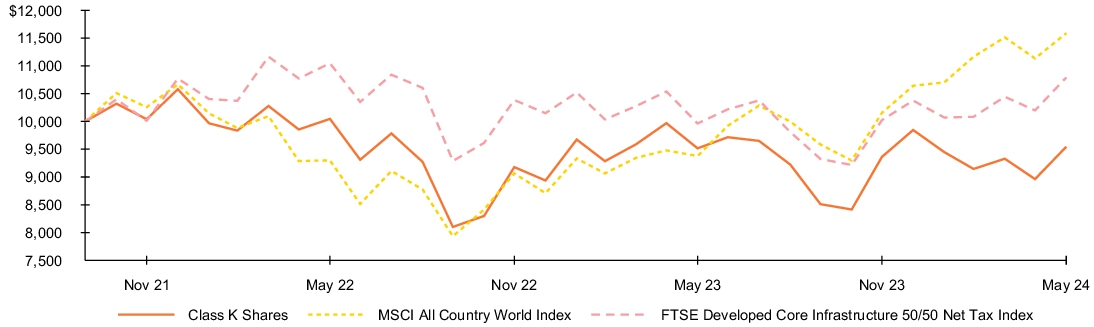

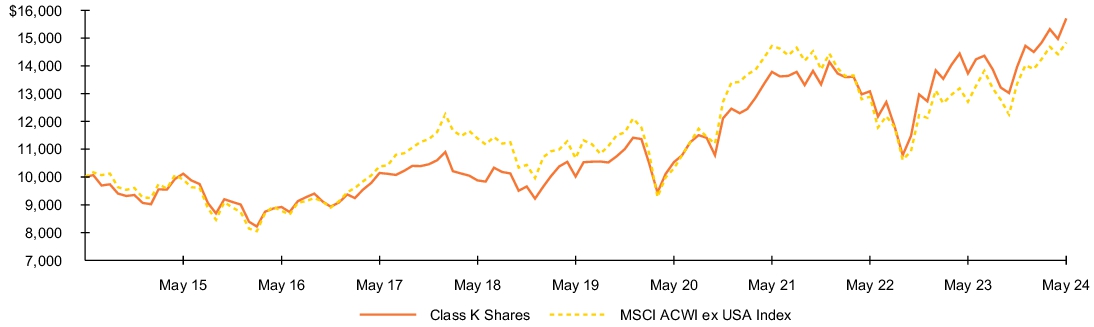

Fund performance

Cumulative performance: June 1, 2014 through May 31, 2024

Initial investment of $10,000

See “Average annual total returns” for additional information on fund performance.

Average annual total returns

| 1 Year | 5 Years | 10 Years |

| Class K Shares | 20.45% | 8.92% | 5.82% |

| MSCI EAFE Index | 18.53% | 8.05% | 4.60% |

| Net Assets | $1,747,385,984% |

| Number of Portfolio Holdings | $324% |

| Net Investment Advisory Fees | $5,104,033% |

| Portfolio Turnover Rate | $128% |

Performance shown prior to June 12, 2017 are the returns of the Fund when it followed different investment strategies under the name BlackRock Global Opportunities Portfolio.

Performance shown prior to the Class K Shares inception date of January 25, 2018 is that of Institutional Shares. The performance of the Class K Shares would be substantially similar to Institutional Shares because Class K Shares and Institutional Shares invest in the same portfolio of securities and performance would only differ to the extent that Class K Shares and Institutional Shares have different expenses. The actual returns of Class K Shares would have been higher than those of the Institutional Shares because Class K Shares have lower expenses than the Institutional Shares.

Past performance is not an indication of future results. Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit blackrock.com for more recent performance information.

What did the Fund invest in?

(as of May 31, 2024)

| Country | Percent of

Net Assets |

| Japan | 22.3)% |

| United Kingdom | 11.3)% |

| Germany | 10.0)% |

| France | 9.1)% |

| Switzerland | 8.2)% |

| Netherlands | 5.1)% |

| Australia | 5.1)% |

| United States | 5.0)% |

| Denmark | 4.2)% |

| Spain | 4.0)% |

| Other | 13.0)% |

| Short-Term Securities | 3.5)% |

| Liabilities in Excess of Other Assets | (0.8)% |

| Security(a) | Percent of

Net Assets |

| Novo Nordisk A/S, Class B | 3.4% |

| ASML Holding NV | 3.1% |

| Novartis AG, Registered Shares | 2.3% |

| SAP SE | 2.1% |

| Shell PLC | 1.9% |

| BHP Group Ltd. | 1.8% |

| Siemens AG, Registered Shares | 1.8% |

| Allianz SE, Registered Shares | 1.7% |

| GSK PLC | 1.6% |

| Tokyo Electron Ltd. | 1.6% |

(a) | Excludes short-term securities. |

Additional information

If you wish to view additional information about the Fund, including but not limited to financial statements, the Fund’s prospectus, and proxy voting policies and procedures, please visit blackrock.com/fundreports. For proxy voting records, visit blackrock.com/proxyrecords.

Householding

The Fund will mail only one copy of shareholder documents, including prospectuses, annual and semi-annual reports and proxy statements, to shareholders with multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses and eliminate duplicate mailings of shareholder documents. Mailings of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please call the Fund at (800) 441-7762.

The Fund is not sponsored, endorsed, issued, sold, or promoted by MSCI Inc. and its affiliates, nor does this company make any representation regarding the advisability of investing in the Fund. BlackRock is not affiliated with the company listed above.

©2024 BlackRock, Inc. or its affiliates. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

BlackRock Advantage International Fund

Class K Shares | BROKX

Annual Shareholder Report — May 31, 2024

BROKX-05/24-AR

BlackRock Advantage International Fund

Class R Shares | BGORX

Annual Shareholder Report — May 31, 2024

This annual shareholder report contains important information about BlackRock Advantage International Fund (the “Fund”) for the period of June 1, 2023 to May 31, 2024. You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class name | Costs of a $10,000

investment | Costs paid as a percentage of a

$10,000 investment |

| Class R Shares | $110 | 1.00% |

How did the Fund perform last year?

Global equities enjoyed strong performance as resilient macro and micro data combined with excitement around the dominant themes of innovation in information technology and healthcare drove gains.

Fears of a U.S. recession waned while major overseas economies returned to positive growth.

Signs of easing inflation led to expectations that the U.S. Federal Reserve and other leading central banks were poised to reduce interest rates.

What contributed to performance?

Positive contributions to performance, relative to the benchmark (MSCI EAFE Index) were led by sentiment measures that were able to identify dominant trends by looking at informed investor positioning and through text-based analysis of broker reports (or conference calls). These insights correctly positioned the portfolio around Japanese stocks within financials and industrials that benefited as the theme of corporate reform continued to materialize in the region. Traditional fundamental measures also were additive, notably by driving positioning in U.K. consumer staples companies. An insight looking at research and development spending correctly positioned the portfolio in European healthcare stocks that benefited from enthusiasm around the use of GLP-1 drugs for weight loss. Finally, traditional quality insights looking at external financing correctly positioned the portfolio within information technology, particularly with respect to Japanese semiconductor companies likely to benefit from the emerging artificial intelligence theme.

What detracted from performance?

The largest detractors from relative performance included certain non-traditional fundamental quality insights, most notably those related to human capital such as those looking at veteran hiring, employee sentiment and hiring for environmental roles. In addition, changing market leadership proved a headwind to trend-following industry insights, with industry measures picking up on price momentum and favoring defensive positioning among the biggest laggards.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

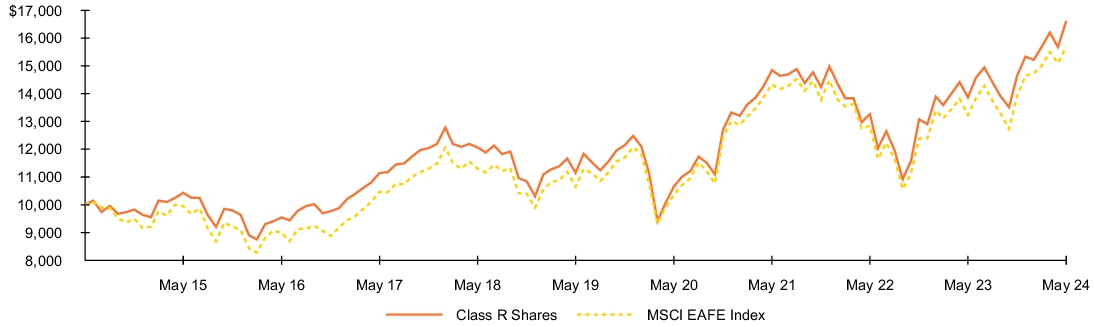

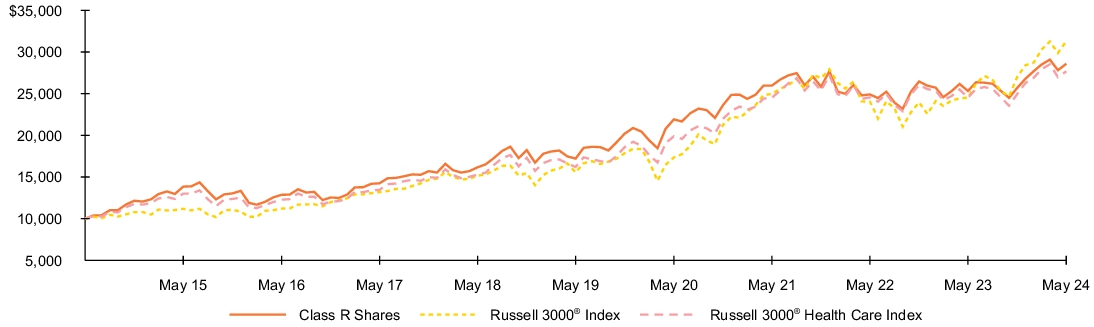

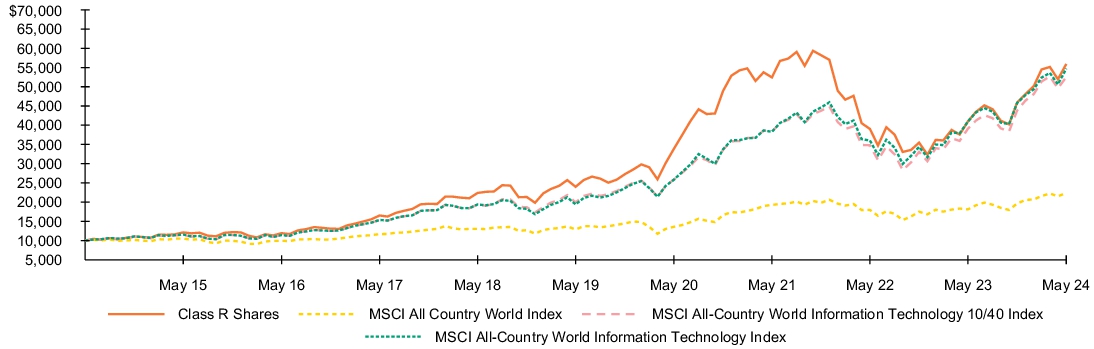

Fund performance

Cumulative performance: June 1, 2014 through May 31, 2024

Initial investment of $10,000

See “Average annual total returns” for additional information on fund performance.

Average annual total returns

| 1 Year | 5 Years | 10 Years |

| Class R Shares | 19.81% | 8.31% | 5.21% |

| MSCI EAFE Index | 18.53% | 8.05% | 4.60% |

| Net Assets | $1,747,385,984% |

| Number of Portfolio Holdings | $324% |

| Net Investment Advisory Fees | $5,104,033% |

| Portfolio Turnover Rate | $128% |

Performance shown prior to June 12, 2017 are the returns of the Fund when it followed different investment strategies under the name BlackRock Global Opportunities Portfolio.

Average annual total returns reflect reductions for distribution and service fees.

Past performance is not an indication of future results. Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit blackrock.com for more recent performance information.

What did the Fund invest in?

(as of May 31, 2024)

| Country | Percent of

Net Assets |

| Japan | 22.3)% |

| United Kingdom | 11.3)% |

| Germany | 10.0)% |

| France | 9.1)% |

| Switzerland | 8.2)% |

| Netherlands | 5.1)% |

| Australia | 5.1)% |

| United States | 5.0)% |

| Denmark | 4.2)% |

| Spain | 4.0)% |

| Other | 13.0)% |

| Short-Term Securities | 3.5)% |

| Liabilities in Excess of Other Assets | (0.8)% |

| Security(a) | Percent of

Net Assets |

| Novo Nordisk A/S, Class B | 3.4% |

| ASML Holding NV | 3.1% |

| Novartis AG, Registered Shares | 2.3% |

| SAP SE | 2.1% |

| Shell PLC | 1.9% |

| BHP Group Ltd. | 1.8% |

| Siemens AG, Registered Shares | 1.8% |

| Allianz SE, Registered Shares | 1.7% |

| GSK PLC | 1.6% |

| Tokyo Electron Ltd. | 1.6% |

(a) | Excludes short-term securities. |

Additional information

If you wish to view additional information about the Fund, including but not limited to financial statements, the Fund’s prospectus, and proxy voting policies and procedures, please visit blackrock.com/fundreports. For proxy voting records, visit blackrock.com/proxyrecords.

Householding

The Fund will mail only one copy of shareholder documents, including prospectuses, annual and semi-annual reports and proxy statements, to shareholders with multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses and eliminate duplicate mailings of shareholder documents. Mailings of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please call the Fund at (800) 441-7762.

The Fund is not sponsored, endorsed, issued, sold, or promoted by MSCI Inc. and its affiliates, nor does this company make any representation regarding the advisability of investing in the Fund. BlackRock is not affiliated with the company listed above.

©2024 BlackRock, Inc. or its affiliates. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

BlackRock Advantage International Fund

Class R Shares | BGORX

Annual Shareholder Report — May 31, 2024

BGORX-05/24-AR

BlackRock Advantage Large Cap Growth Fund

Institutional Shares | CMVIX

Annual Shareholder Report — May 31, 2024

This annual shareholder report contains important information about BlackRock Advantage Large Cap Growth Fund (the “Fund”) for the period of June 1, 2023 to May 31, 2024. You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class name | Costs of a $10,000

investment | Costs paid as a percentage of a

$10,000 investment |

| Institutional Shares | $72 | 0.62% |

How did the Fund perform last year?

U.S. equities enjoyed strong performance as resilient macro and micro data combined with excitement around the dominant themes of innovation in information technology and healthcare drove gains.

Fears of a U.S. recession waned while major overseas economies returned to positive growth.

Signs of easing inflation led to expectations that the U.S. Federal Reserve and other leading central banks were poised to reduce interest rates, leading growth-oriented stocks to outperform value stocks.

What contributed to performance?

Positive contributions to performance, relative to the benchmark (Russell 1000® Growth Index) were led by sentiment measures that were able to identify dominant trends by looking at informed investor positioning and through text-based analysis of broker reports (or conference calls). These insights motivated a successful overweight to healthcare stocks that benefited from the GLP-1 (weight loss drug) theme. Fundamental measures also were additive, as defensive quality measures with a preference for companies with balance sheet strength and cash flow generation correctly positioned the portfolio within consumer durables. Additionally, non-traditional quality measures focusing on hiring practices and employee satisfaction contributed to performance. Finally, macro related insights successfully captured evolving dynamics at the industry level by analyzing company invoices.

What detracted from performance?

The largest detractors from relative performance were certain fundamental insights including defensive quality measures that prefer balance sheet strength and more stable companies. Certain sentiment measures looking at bond markets struggled to position the portfolio as the market narrative shifted between the “soft landing” and “higher-for-longer” themes.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

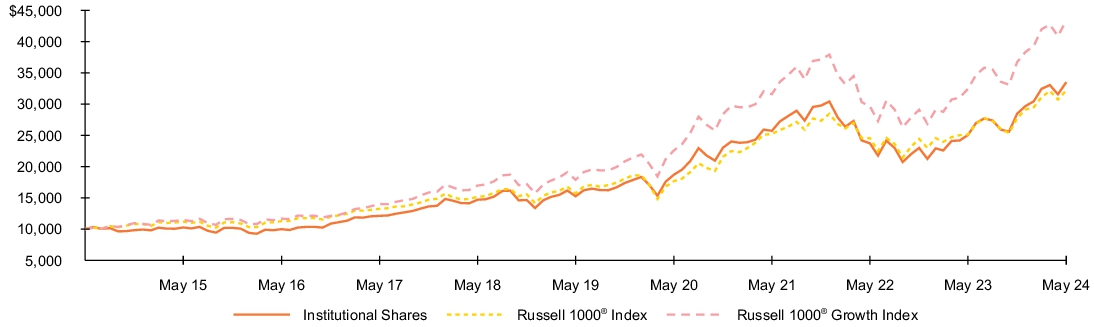

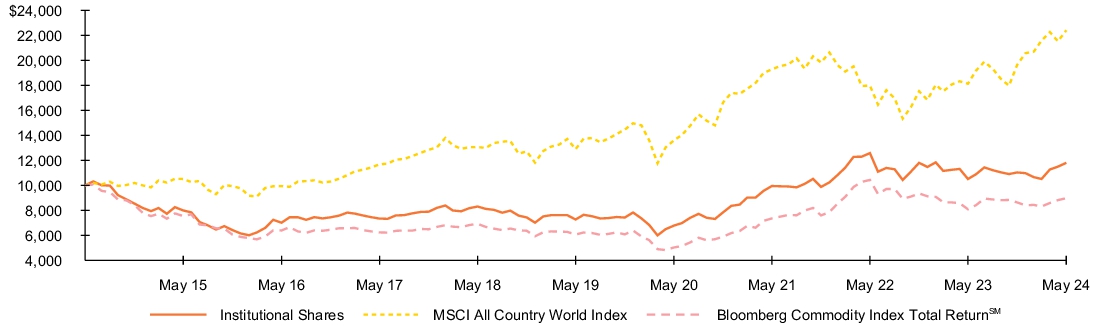

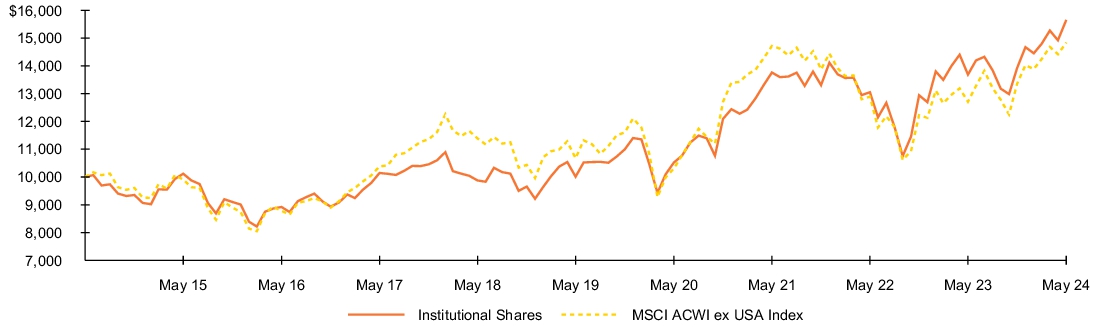

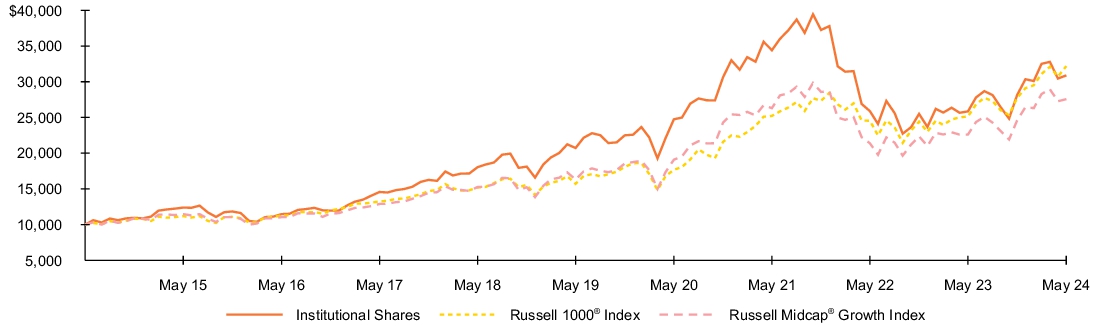

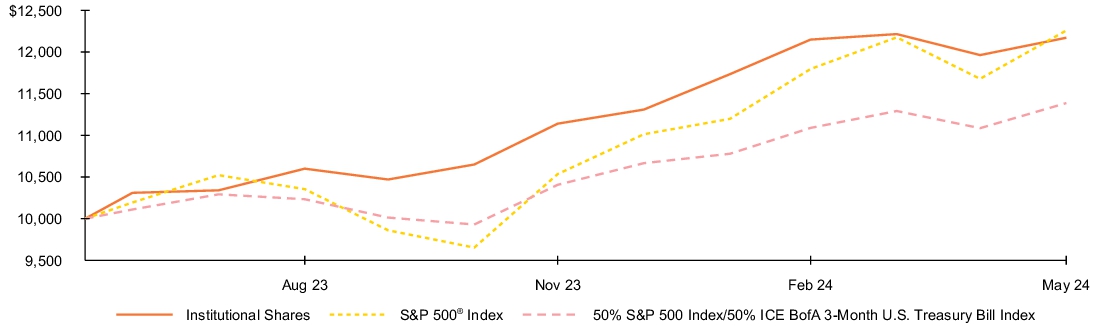

Fund performance

Cumulative performance: June 1, 2014 through May 31, 2024

Initial investment of $10,000

See “Average annual total returns” for additional information on fund performance.

Average annual total returns

| 1 Year | 5 Years | 10 Years |

| Institutional Shares | 33.74% | 17.04% | 12.85% |

| Russell 1000® Index | 28.01% | 15.42% | 12.40% |

| Russell 1000® Growth Index | 33.60% | 19.37% | 15.80% |

| Net Assets | $1,226,660,906% |

| Number of Portfolio Holdings | $128% |

| Net Investment Advisory Fees | $5,323,635% |

| Portfolio Turnover Rate | $128% |

Performance shown prior to June 12, 2017 are the returns of the Fund when it followed different investment strategies under the name BlackRock Flexible Equity Fund.

Past performance is not an indication of future results. Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit blackrock.com for more recent performance information.

What did the Fund invest in?

(as of May 31, 2024)

| Sector(a) | Percent of

Net Assets |

| Information Technology | 46.6% |

| Consumer Discretionary | 13.2% |

| Communication Services | 12.7% |

| Health Care | 11.6% |

| Financials | 6.1% |

| Industrials | 5.9% |

| Consumer Staples | 2.2% |

| Materials | 0.3% |

| Real Estate | 0.2% |

| Short-Term Securities | 1.0% |

| Other Assets Less Liabilities | 0.2% |

| Security(b) | Percent of

Net Assets |

| Microsoft Corp. | 12.8% |

| Apple Inc. | 10.1% |

| NVIDIA Corp. | 5.8% |

| Meta Platforms, Inc., Class A | 4.9% |

| Amazon.com, Inc. | 4.9% |

| Broadcom, Inc. | 3.4% |

| Eli Lilly & Co. | 3.4% |

| Alphabet, Inc., Class C, NVS | 3.2% |

| Mastercard, Inc., Class A | 2.6% |

| Home Depot, Inc. (The) | 2.4% |

(a) | For purposes of this report, sector sub-classifications may differ from those utilized for compliance purposes. |

(b) | Excludes short-term securities. |

Additional information

If you wish to view additional information about the Fund, including but not limited to financial statements, the Fund’s prospectus, and proxy voting policies and procedures, please visit blackrock.com/fundreports. For proxy voting records, visit blackrock.com/proxyrecords.

Householding

The Fund will mail only one copy of shareholder documents, including prospectuses, annual and semi-annual reports and proxy statements, to shareholders with multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses and eliminate duplicate mailings of shareholder documents. Mailings of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please call the Fund at (800) 441-7762.

The Fund is not sponsored, endorsed, issued, sold, or promoted by FTSE International Limited and its affiliates, nor does this company make any representation regarding the advisability of investing in the Fund. BlackRock is not affiliated with the company listed above.

©2024 BlackRock, Inc. or its affiliates. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

BlackRock Advantage Large Cap Growth Fund

Institutional Shares | CMVIX

Annual Shareholder Report — May 31, 2024

CMVIX-05/24-AR

BlackRock Advantage Large Cap Growth Fund

Investor A Shares | BMCAX

Annual Shareholder Report — May 31, 2024

This annual shareholder report contains important information about BlackRock Advantage Large Cap Growth Fund (the “Fund”) for the period of June 1, 2023 to May 31, 2024. You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class name | Costs of a $10,000

investment | Costs paid as a percentage of a

$10,000 investment |

| Investor A Shares | $102 | 0.87% |

How did the Fund perform last year?

U.S. equities enjoyed strong performance as resilient macro and micro data combined with excitement around the dominant themes of innovation in information technology and healthcare drove gains.

Fears of a U.S. recession waned while major overseas economies returned to positive growth.

Signs of easing inflation led to expectations that the U.S. Federal Reserve and other leading central banks were poised to reduce interest rates, leading growth-oriented stocks to outperform value stocks.

What contributed to performance?

Positive contributions to performance, relative to the benchmark (Russell 1000® Growth Index) were led by sentiment measures that were able to identify dominant trends by looking at informed investor positioning and through text-based analysis of broker reports (or conference calls). These insights motivated a successful overweight to healthcare stocks that benefited from the GLP-1 (weight loss drug) theme. Fundamental measures also were additive, as defensive quality measures with a preference for companies with balance sheet strength and cash flow generation correctly positioned the portfolio within consumer durables. Additionally, non-traditional quality measures focusing on hiring practices and employee satisfaction contributed to performance. Finally, macro related insights successfully captured evolving dynamics at the industry level by analyzing company invoices.

What detracted from performance?

The largest detractors from relative performance were certain fundamental insights including defensive quality measures that prefer balance sheet strength and more stable companies. Certain sentiment measures looking at bond markets struggled to position the portfolio as the market narrative shifted between the “soft landing” and “higher-for-longer” themes.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

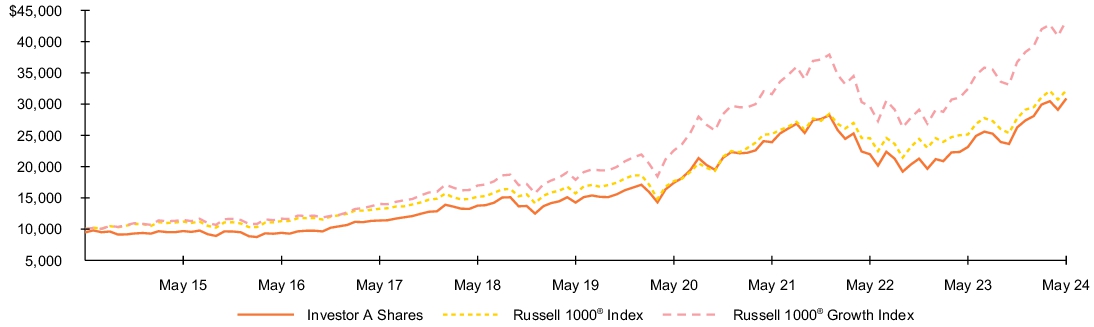

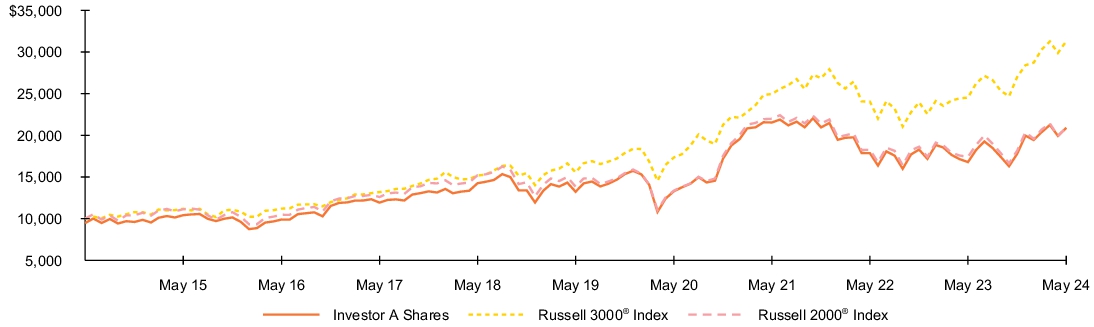

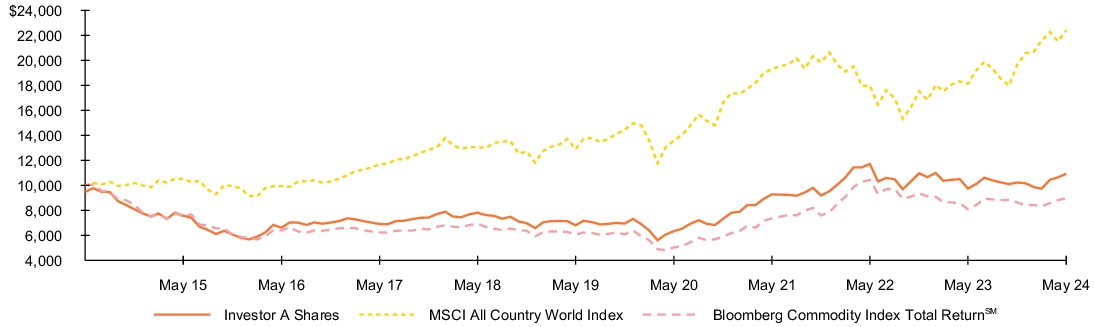

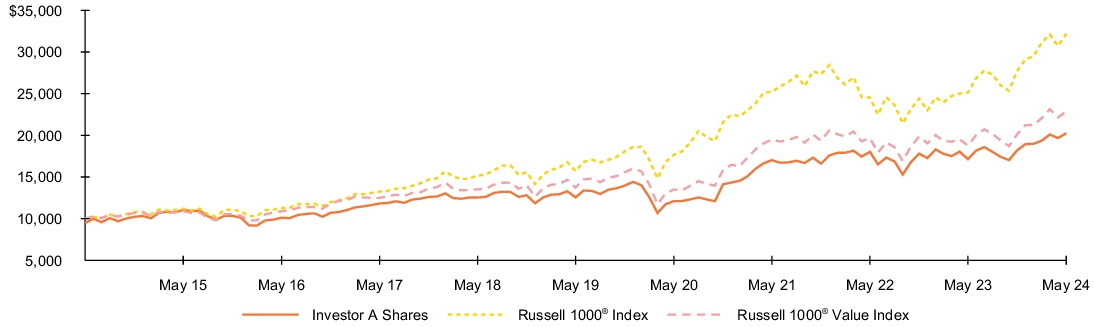

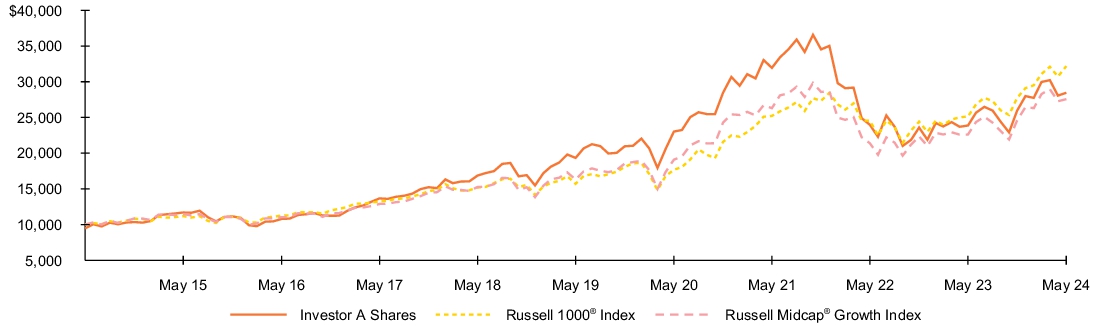

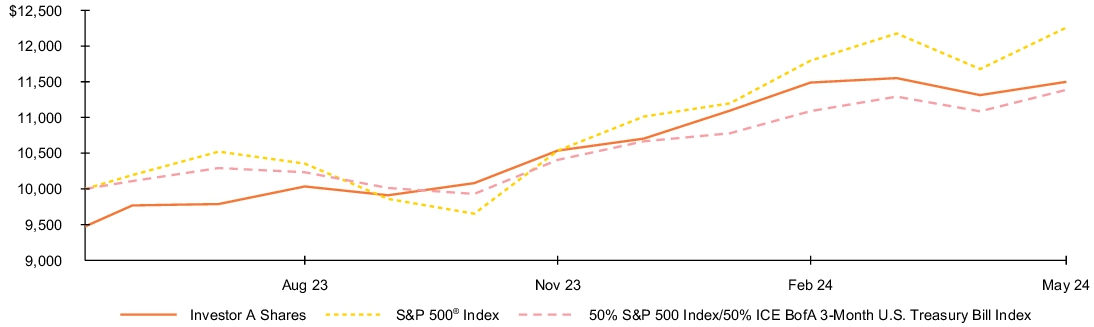

Fund performance

Cumulative performance: June 1, 2014 through May 31, 2024

Initial investment of $10,000

See “Average annual total returns” for additional information on fund performance.

Average annual total returns

| 1 Year | 5 Years | 10 Years |

| Investor A Shares | 33.45% | 16.74% | 12.54% |

| Investor A Shares (with sales charge) | 26.44% | 15.48% | 11.93% |

| Russell 1000® Index | 28.01% | 15.42% | 12.40% |

| Russell 1000® Growth Index | 33.60% | 19.37% | 15.80% |

| Net Assets | $1,226,660,906% |

| Number of Portfolio Holdings | $128% |

| Net Investment Advisory Fees | $5,323,635% |

| Portfolio Turnover Rate | $128% |

Performance shown prior to June 12, 2017 are the returns of the Fund when it followed different investment strategies under the name BlackRock Flexible Equity Fund.

Assuming maximum sales charges. Average annual total returns with and without sales charges reflect reductions for service fees.

Past performance is not an indication of future results. Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit blackrock.com for more recent performance information.

What did the Fund invest in?

(as of May 31, 2024)

| Sector(a) | Percent of

Net Assets |

| Information Technology | 46.6% |

| Consumer Discretionary | 13.2% |

| Communication Services | 12.7% |

| Health Care | 11.6% |

| Financials | 6.1% |

| Industrials | 5.9% |

| Consumer Staples | 2.2% |

| Materials | 0.3% |

| Real Estate | 0.2% |

| Short-Term Securities | 1.0% |

| Other Assets Less Liabilities | 0.2% |

| Security(b) | Percent of

Net Assets |

| Microsoft Corp. | 12.8% |

| Apple Inc. | 10.1% |

| NVIDIA Corp. | 5.8% |

| Meta Platforms, Inc., Class A | 4.9% |

| Amazon.com, Inc. | 4.9% |

| Broadcom, Inc. | 3.4% |

| Eli Lilly & Co. | 3.4% |

| Alphabet, Inc., Class C, NVS | 3.2% |

| Mastercard, Inc., Class A | 2.6% |

| Home Depot, Inc. (The) | 2.4% |

(a) | For purposes of this report, sector sub-classifications may differ from those utilized for compliance purposes. |

(b) | Excludes short-term securities. |

Additional information

If you wish to view additional information about the Fund, including but not limited to financial statements, the Fund’s prospectus, and proxy voting policies and procedures, please visit blackrock.com/fundreports. For proxy voting records, visit blackrock.com/proxyrecords.

Householding

The Fund will mail only one copy of shareholder documents, including prospectuses, annual and semi-annual reports and proxy statements, to shareholders with multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses and eliminate duplicate mailings of shareholder documents. Mailings of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please call the Fund at (800) 441-7762.

The Fund is not sponsored, endorsed, issued, sold, or promoted by FTSE International Limited and its affiliates, nor does this company make any representation regarding the advisability of investing in the Fund. BlackRock is not affiliated with the company listed above.

©2024 BlackRock, Inc. or its affiliates. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

BlackRock Advantage Large Cap Growth Fund

Investor A Shares | BMCAX

Annual Shareholder Report — May 31, 2024

BMCAX-05/24-AR

BlackRock Advantage Large Cap Growth Fund

Investor C Shares | BMCCX

Annual Shareholder Report — May 31, 2024

This annual shareholder report contains important information about BlackRock Advantage Large Cap Growth Fund (the “Fund”) for the period of June 1, 2023 to May 31, 2024. You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class name | Costs of a $10,000

investment | Costs paid as a percentage of a

$10,000 investment |

| Investor C Shares | $188 | 1.62% |

How did the Fund perform last year?

U.S. equities enjoyed strong performance as resilient macro and micro data combined with excitement around the dominant themes of innovation in information technology and healthcare drove gains.

Fears of a U.S. recession waned while major overseas economies returned to positive growth.

Signs of easing inflation led to expectations that the U.S. Federal Reserve and other leading central banks were poised to reduce interest rates, leading growth-oriented stocks to outperform value stocks.

What contributed to performance?

Positive contributions to performance, relative to the benchmark (Russell 1000® Growth Index) were led by sentiment measures that were able to identify dominant trends by looking at informed investor positioning and through text-based analysis of broker reports (or conference calls). These insights motivated a successful overweight to healthcare stocks that benefited from the GLP-1 (weight loss drug) theme. Fundamental measures also were additive, as defensive quality measures with a preference for companies with balance sheet strength and cash flow generation correctly positioned the portfolio within consumer durables. Additionally, non-traditional quality measures focusing on hiring practices and employee satisfaction contributed to performance. Finally, macro related insights successfully captured evolving dynamics at the industry level by analyzing company invoices.

What detracted from performance?

The largest detractors from relative performance were certain fundamental insights including defensive quality measures that prefer balance sheet strength and more stable companies. Certain sentiment measures looking at bond markets struggled to position the portfolio as the market narrative shifted between the “soft landing” and “higher-for-longer” themes.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

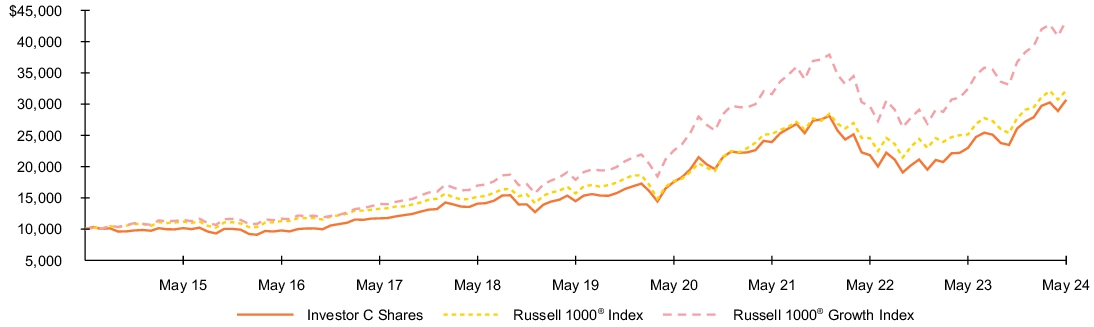

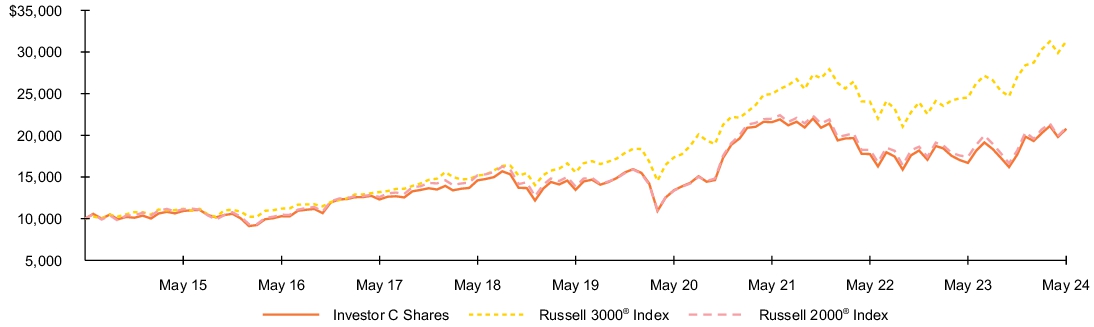

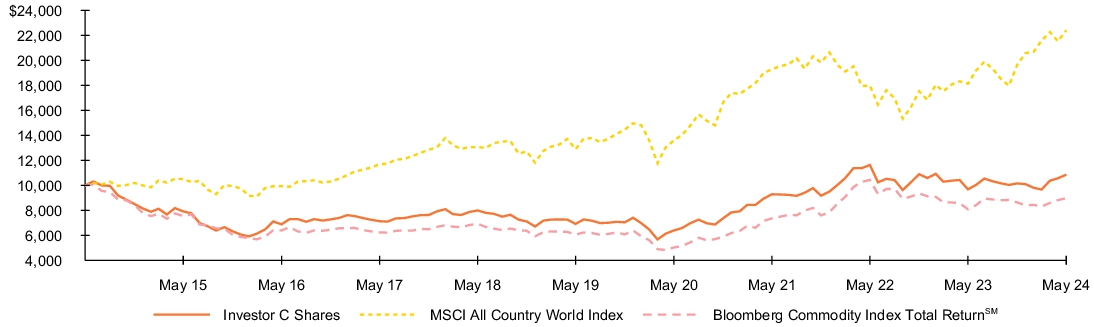

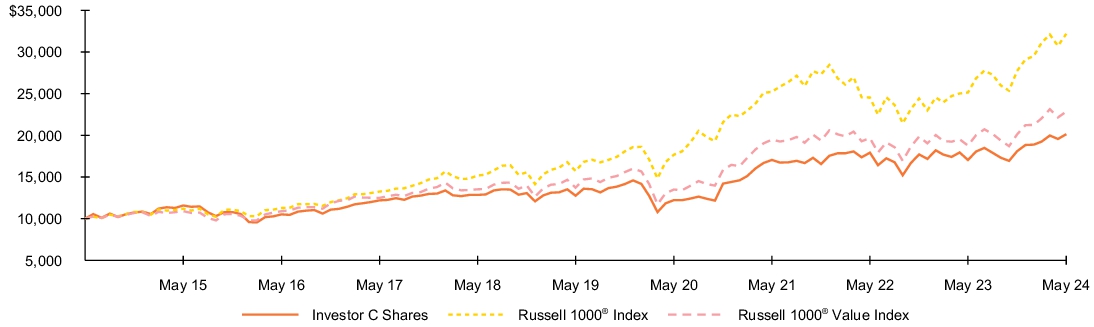

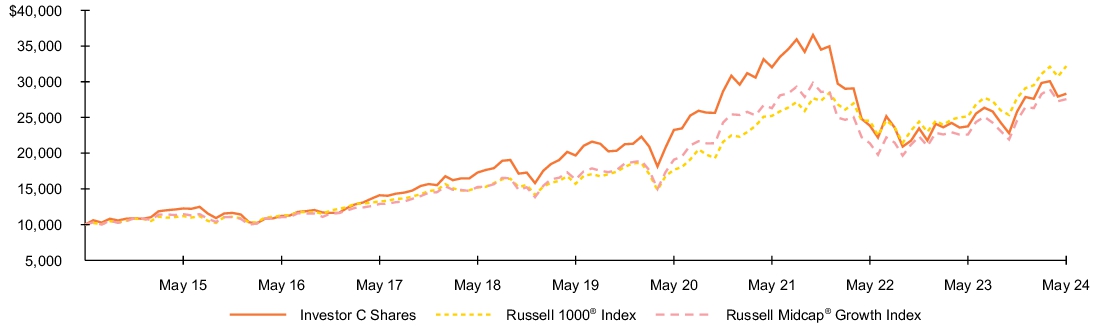

Fund performance

Cumulative performance: June 1, 2014 through May 31, 2024

Initial investment of $10,000

See “Average annual total returns” for additional information on fund performance.

Average annual total returns

| 1 Year | 5 Years | 10 Years |

| Investor C Shares | 32.46% | 15.87% | 11.86% |

| Investor C Shares (with sales charge) | 31.46% | 15.87% | 11.86% |

| Russell 1000® Index | 28.01% | 15.42% | 12.40% |

| Russell 1000® Growth Index | 33.60% | 19.37% | 15.80% |

| Net Assets | $1,226,660,906% |

| Number of Portfolio Holdings | $128% |

| Net Investment Advisory Fees | $5,323,635% |

| Portfolio Turnover Rate | $128% |

Performance shown prior to June 12, 2017 are the returns of the Fund when it followed different investment strategies under the name BlackRock Flexible Equity Fund.

Assuming maximum sales charges. Average annual total returns with and without sales charges reflect reductions for distribution and service fees.

Past performance is not an indication of future results. Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit blackrock.com for more recent performance information.

What did the Fund invest in?

(as of May 31, 2024)

| Sector(a) | Percent of

Net Assets |

| Information Technology | 46.6% |

| Consumer Discretionary | 13.2% |

| Communication Services | 12.7% |

| Health Care | 11.6% |

| Financials | 6.1% |

| Industrials | 5.9% |

| Consumer Staples | 2.2% |

| Materials | 0.3% |

| Real Estate | 0.2% |

| Short-Term Securities | 1.0% |

| Other Assets Less Liabilities | 0.2% |

| Security(b) | Percent of

Net Assets |

| Microsoft Corp. | 12.8% |

| Apple Inc. | 10.1% |

| NVIDIA Corp. | 5.8% |

| Meta Platforms, Inc., Class A | 4.9% |

| Amazon.com, Inc. | 4.9% |

| Broadcom, Inc. | 3.4% |

| Eli Lilly & Co. | 3.4% |

| Alphabet, Inc., Class C, NVS | 3.2% |

| Mastercard, Inc., Class A | 2.6% |

| Home Depot, Inc. (The) | 2.4% |

(a) | For purposes of this report, sector sub-classifications may differ from those utilized for compliance purposes. |

(b) | Excludes short-term securities. |

Additional information

If you wish to view additional information about the Fund, including but not limited to financial statements, the Fund’s prospectus, and proxy voting policies and procedures, please visit blackrock.com/fundreports. For proxy voting records, visit blackrock.com/proxyrecords.

Householding

The Fund will mail only one copy of shareholder documents, including prospectuses, annual and semi-annual reports and proxy statements, to shareholders with multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses and eliminate duplicate mailings of shareholder documents. Mailings of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please call the Fund at (800) 441-7762.

The Fund is not sponsored, endorsed, issued, sold, or promoted by FTSE International Limited and its affiliates, nor does this company make any representation regarding the advisability of investing in the Fund. BlackRock is not affiliated with the company listed above.

©2024 BlackRock, Inc. or its affiliates. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

BlackRock Advantage Large Cap Growth Fund

Investor C Shares | BMCCX

Annual Shareholder Report — May 31, 2024

BMCCX-05/24-AR

BlackRock Advantage Large Cap Growth Fund

Class K Shares | BMCKX

Annual Shareholder Report — May 31, 2024

This annual shareholder report contains important information about BlackRock Advantage Large Cap Growth Fund (the “Fund”) for the period of June 1, 2023 to May 31, 2024. You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class name | Costs of a $10,000

investment | Costs paid as a percentage of a

$10,000 investment |

| Class K Shares | $67 | 0.57% |

How did the Fund perform last year?

U.S. equities enjoyed strong performance as resilient macro and micro data combined with excitement around the dominant themes of innovation in information technology and healthcare drove gains.

Fears of a U.S. recession waned while major overseas economies returned to positive growth.

Signs of easing inflation led to expectations that the U.S. Federal Reserve and other leading central banks were poised to reduce interest rates, leading growth-oriented stocks to outperform value stocks.

What contributed to performance?

Positive contributions to performance, relative to the benchmark (Russell 1000® Growth Index) were led by sentiment measures that were able to identify dominant trends by looking at informed investor positioning and through text-based analysis of broker reports (or conference calls). These insights motivated a successful overweight to healthcare stocks that benefited from the GLP-1 (weight loss drug) theme. Fundamental measures also were additive, as defensive quality measures with a preference for companies with balance sheet strength and cash flow generation correctly positioned the portfolio within consumer durables. Additionally, non-traditional quality measures focusing on hiring practices and employee satisfaction contributed to performance. Finally, macro related insights successfully captured evolving dynamics at the industry level by analyzing company invoices.

What detracted from performance?

The largest detractors from relative performance were certain fundamental insights including defensive quality measures that prefer balance sheet strength and more stable companies. Certain sentiment measures looking at bond markets struggled to position the portfolio as the market narrative shifted between the “soft landing” and “higher-for-longer” themes.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

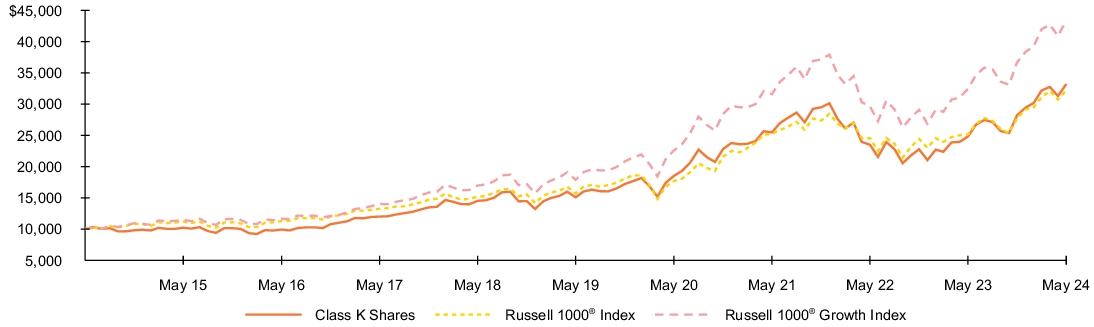

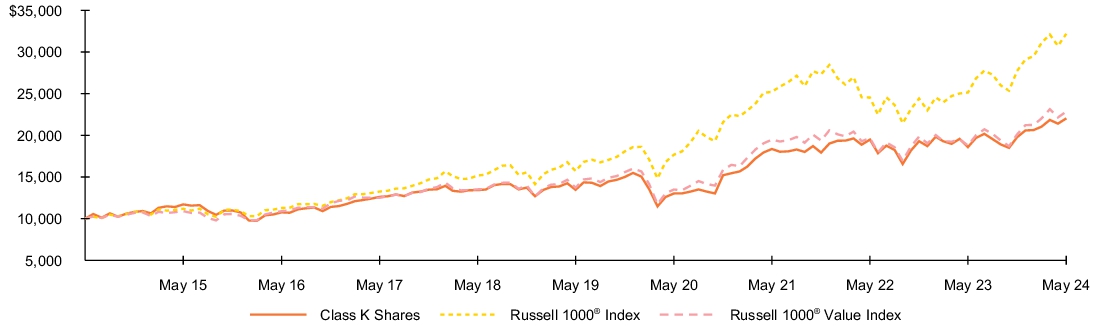

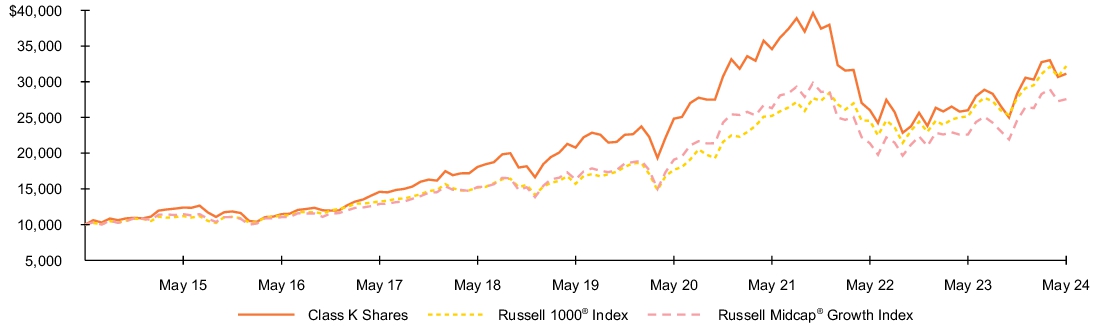

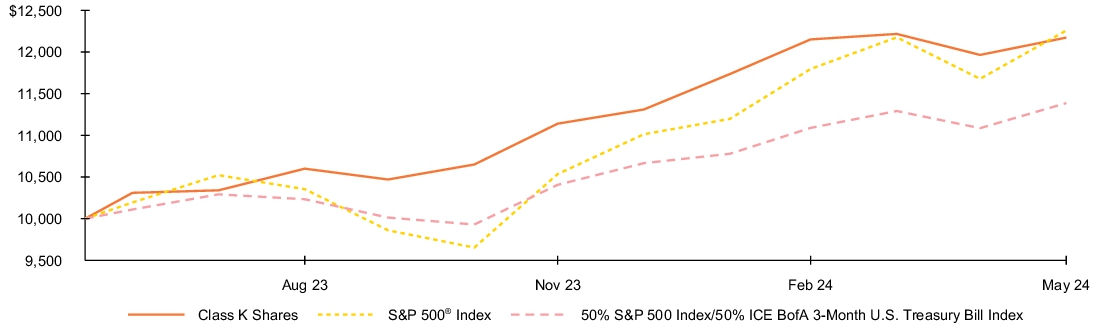

Fund performance

Cumulative performance: June 1, 2014 through May 31, 2024

Initial investment of $10,000

See “Average annual total returns” for additional information on fund performance.

Average annual total returns

| 1 Year | 5 Years | 10 Years |

| Class K Shares | 33.81% | 17.09% | 12.75% |

| Russell 1000® Index | 28.01% | 15.42% | 12.40% |

| Russell 1000® Growth Index | 33.60% | 19.37% | 15.80% |

| Net Assets | $1,226,660,906% |

| Number of Portfolio Holdings | $128% |

| Net Investment Advisory Fees | $5,323,635% |

| Portfolio Turnover Rate | $128% |

Performance shown prior to June 12, 2017 are the returns of the Fund when it followed different investment strategies under the name BlackRock Flexible Equity Fund.

Performance shown prior to the Class K Shares inception date of January 25, 2018 is that of Investor A Shares. The performance of the Class K Shares would be substantially similar to Investor A Shares because Class K Shares and Investor A Shares invest in the same portfolio of securities and performance would only differ to the extent that Class K Shares and Investor A Shares have different expenses. The actual returns of Class K Shares would have been higher than those of the Investor A Shares because Class K Shares have lower expenses than the Investor A Shares.

Past performance is not an indication of future results. Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit blackrock.com for more recent performance information.

What did the Fund invest in?

(as of May 31, 2024)

| Sector(a) | Percent of

Net Assets |

| Information Technology | 46.6% |

| Consumer Discretionary | 13.2% |

| Communication Services | 12.7% |

| Health Care | 11.6% |

| Financials | 6.1% |

| Industrials | 5.9% |

| Consumer Staples | 2.2% |

| Materials | 0.3% |

| Real Estate | 0.2% |

| Short-Term Securities | 1.0% |

| Other Assets Less Liabilities | 0.2% |

| Security(b) | Percent of

Net Assets |

| Microsoft Corp. | 12.8% |

| Apple Inc. | 10.1% |

| NVIDIA Corp. | 5.8% |

| Meta Platforms, Inc., Class A | 4.9% |

| Amazon.com, Inc. | 4.9% |

| Broadcom, Inc. | 3.4% |

| Eli Lilly & Co. | 3.4% |

| Alphabet, Inc., Class C, NVS | 3.2% |

| Mastercard, Inc., Class A | 2.6% |

| Home Depot, Inc. (The) | 2.4% |

(a) | For purposes of this report, sector sub-classifications may differ from those utilized for compliance purposes. |

(b) | Excludes short-term securities. |

Additional information

If you wish to view additional information about the Fund, including but not limited to financial statements, the Fund’s prospectus, and proxy voting policies and procedures, please visit blackrock.com/fundreports. For proxy voting records, visit blackrock.com/proxyrecords.

Householding

The Fund will mail only one copy of shareholder documents, including prospectuses, annual and semi-annual reports and proxy statements, to shareholders with multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses and eliminate duplicate mailings of shareholder documents. Mailings of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please call the Fund at (800) 441-7762.

The Fund is not sponsored, endorsed, issued, sold, or promoted by FTSE International Limited and its affiliates, nor does this company make any representation regarding the advisability of investing in the Fund. BlackRock is not affiliated with the company listed above.

©2024 BlackRock, Inc. or its affiliates. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

BlackRock Advantage Large Cap Growth Fund

Class K Shares | BMCKX

Annual Shareholder Report — May 31, 2024

BMCKX-05/24-AR

BlackRock Advantage Large Cap Growth Fund

Class R Shares | BMCRX

Annual Shareholder Report — May 31, 2024

This annual shareholder report contains important information about BlackRock Advantage Large Cap Growth Fund (the “Fund”) for the period of June 1, 2023 to May 31, 2024. You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class name | Costs of a $10,000

investment | Costs paid as a percentage of a

$10,000 investment |

| Class R Shares | $131 | 1.12% |

How did the Fund perform last year?

U.S. equities enjoyed strong performance as resilient macro and micro data combined with excitement around the dominant themes of innovation in information technology and healthcare drove gains.

Fears of a U.S. recession waned while major overseas economies returned to positive growth.

Signs of easing inflation led to expectations that the U.S. Federal Reserve and other leading central banks were poised to reduce interest rates, leading growth-oriented stocks to outperform value stocks.

What contributed to performance?

Positive contributions to performance, relative to the benchmark (Russell 1000® Growth Index) were led by sentiment measures that were able to identify dominant trends by looking at informed investor positioning and through text-based analysis of broker reports (or conference calls). These insights motivated a successful overweight to healthcare stocks that benefited from the GLP-1 (weight loss drug) theme. Fundamental measures also were additive, as defensive quality measures with a preference for companies with balance sheet strength and cash flow generation correctly positioned the portfolio within consumer durables. Additionally, non-traditional quality measures focusing on hiring practices and employee satisfaction contributed to performance. Finally, macro related insights successfully captured evolving dynamics at the industry level by analyzing company invoices.

What detracted from performance?

The largest detractors from relative performance were certain fundamental insights including defensive quality measures that prefer balance sheet strength and more stable companies. Certain sentiment measures looking at bond markets struggled to position the portfolio as the market narrative shifted between the “soft landing” and “higher-for-longer” themes.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

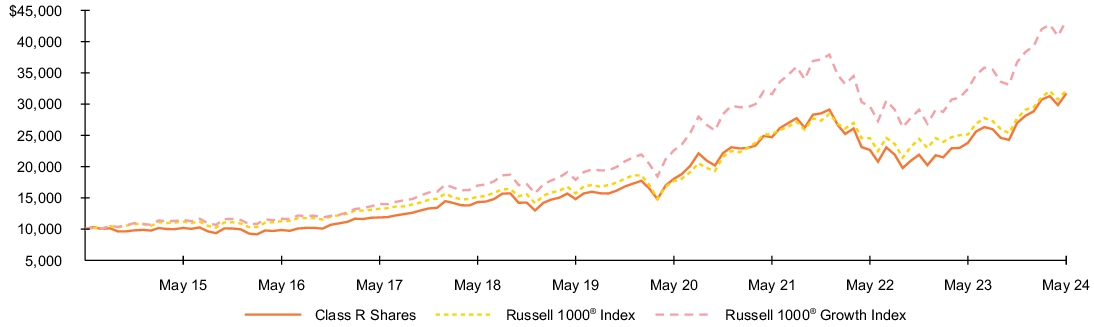

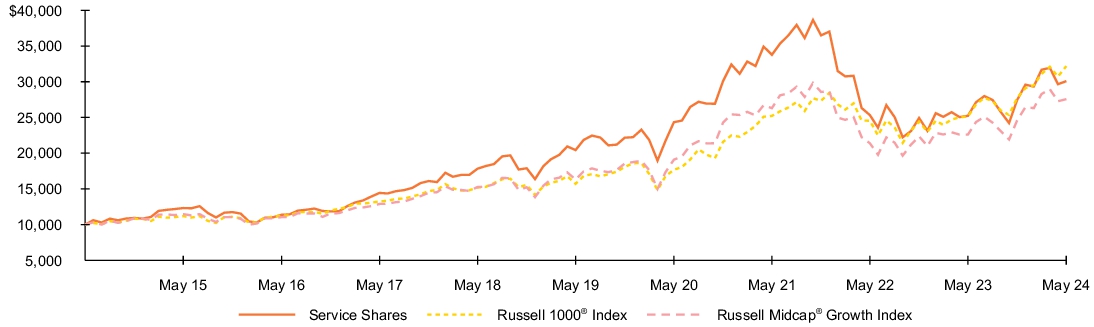

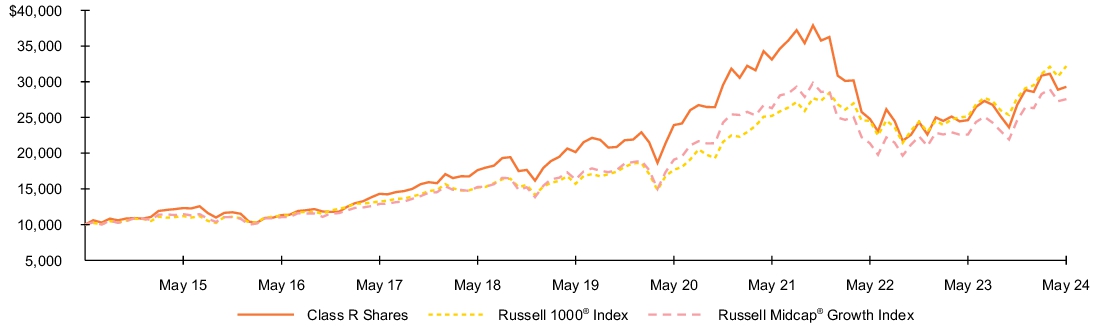

Fund performance

Cumulative performance: June 1, 2014 through May 31, 2024

Initial investment of $10,000

See “Average annual total returns” for additional information on fund performance.

Average annual total returns

| 1 Year | 5 Years | 10 Years |

| Class R Shares | 33.12% | 16.45% | 12.22% |

| Russell 1000® Index | 28.01% | 15.42% | 12.40% |

| Russell 1000® Growth Index | 33.60% | 19.37% | 15.80% |

| Net Assets | $1,226,660,906% |

| Number of Portfolio Holdings | $128% |

| Net Investment Advisory Fees | $5,323,635% |

| Portfolio Turnover Rate | $128% |

Performance shown prior to June 12, 2017 are the returns of the Fund when it followed different investment strategies under the name BlackRock Flexible Equity Fund.

Average annual total returns reflect reductions for distribution and service fees.

Past performance is not an indication of future results. Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit blackrock.com for more recent performance information.

What did the Fund invest in?

(as of May 31, 2024)

| Sector(a) | Percent of

Net Assets |

| Information Technology | 46.6% |

| Consumer Discretionary | 13.2% |

| Communication Services | 12.7% |

| Health Care | 11.6% |

| Financials | 6.1% |

| Industrials | 5.9% |

| Consumer Staples | 2.2% |

| Materials | 0.3% |

| Real Estate | 0.2% |

| Short-Term Securities | 1.0% |

| Other Assets Less Liabilities | 0.2% |

| Security(b) | Percent of

Net Assets |

| Microsoft Corp. | 12.8% |

| Apple Inc. | 10.1% |

| NVIDIA Corp. | 5.8% |

| Meta Platforms, Inc., Class A | 4.9% |

| Amazon.com, Inc. | 4.9% |

| Broadcom, Inc. | 3.4% |

| Eli Lilly & Co. | 3.4% |

| Alphabet, Inc., Class C, NVS | 3.2% |

| Mastercard, Inc., Class A | 2.6% |

| Home Depot, Inc. (The) | 2.4% |

(a) | For purposes of this report, sector sub-classifications may differ from those utilized for compliance purposes. |

(b) | Excludes short-term securities. |

Additional information

If you wish to view additional information about the Fund, including but not limited to financial statements, the Fund’s prospectus, and proxy voting policies and procedures, please visit blackrock.com/fundreports. For proxy voting records, visit blackrock.com/proxyrecords.

Householding

The Fund will mail only one copy of shareholder documents, including prospectuses, annual and semi-annual reports and proxy statements, to shareholders with multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses and eliminate duplicate mailings of shareholder documents. Mailings of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please call the Fund at (800) 441-7762.

The Fund is not sponsored, endorsed, issued, sold, or promoted by FTSE International Limited and its affiliates, nor does this company make any representation regarding the advisability of investing in the Fund. BlackRock is not affiliated with the company listed above.

©2024 BlackRock, Inc. or its affiliates. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

BlackRock Advantage Large Cap Growth Fund

Class R Shares | BMCRX

Annual Shareholder Report — May 31, 2024

BMCRX-05/24-AR

BlackRock Advantage Small Cap Core Fund

Institutional Shares | BDSIX

Annual Shareholder Report — May 31, 2024

This annual shareholder report contains important information about BlackRock Advantage Small Cap Core Fund (the “Fund”) for the period of June 1, 2023 to May 31, 2024. You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class name | Costs of a $10,000

investment | Costs paid as a percentage of a

$10,000 investment |

| Institutional Shares | $56 | 0.50% |

How did the Fund perform last year?

U.S. equities broadly moved higher as the reporting period progressed, resulting in significant positive returns across most market segments.

Fears of a U.S. recession waned while major overseas economies returned to positive growth.

Signs of easing inflation led to expectations that the U.S. Federal Reserve and other leading central banks were poised to reduce interest rates, driving outperformance by mega-cap growth stocks within information technology and communications services.

What contributed to performance?

Positive contributions to performance, relative to the benchmark (Russell 2000® Index) were led by fundamental and sentiment insights. Within fundamental measures, traditional valuation insights evaluating a company’s sales value worked well within the industrials and financials sectors. Within sentiment insights, measures of text-based trends along with retail investor and smart money flows supported stock selection across the industrials and energy sectors. Finally, while performance from macro measures was mixed overall, insights looking at inventory levels drove successful positioning within the consumer discretionary sector.

What detracted from performance?

The largest detractors from relative performance included fundamental quality insights, most notably defensive quality measures focusing on cash flows and debt maturities which drove unsuccessful stock selection within healthcare amid enthusiasm around the use of GLP-1 drugs for weight loss. Nontraditional measures with a preference for founder-led company management also detracted.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

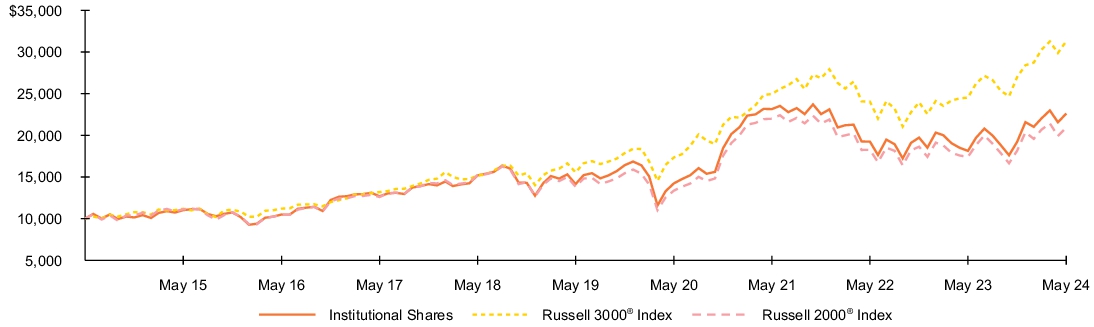

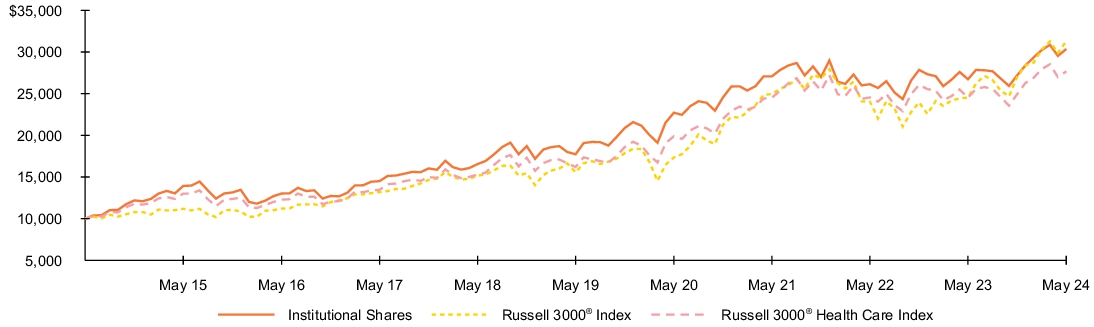

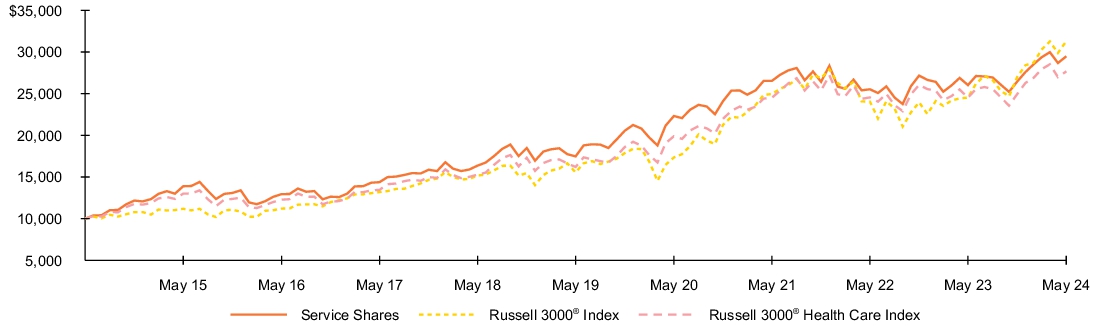

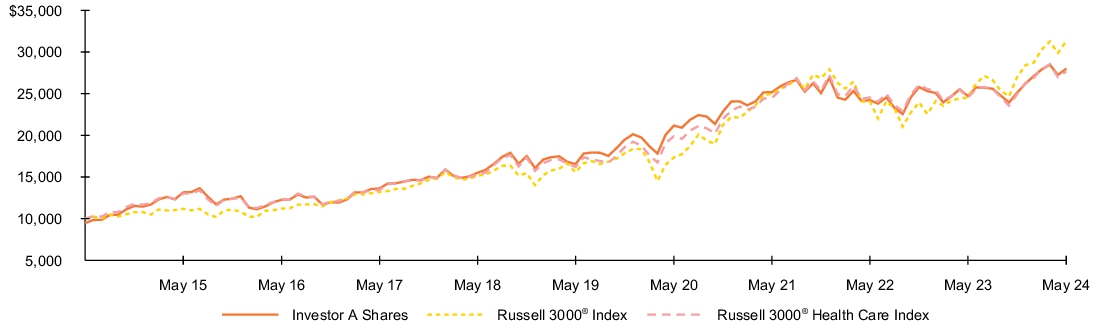

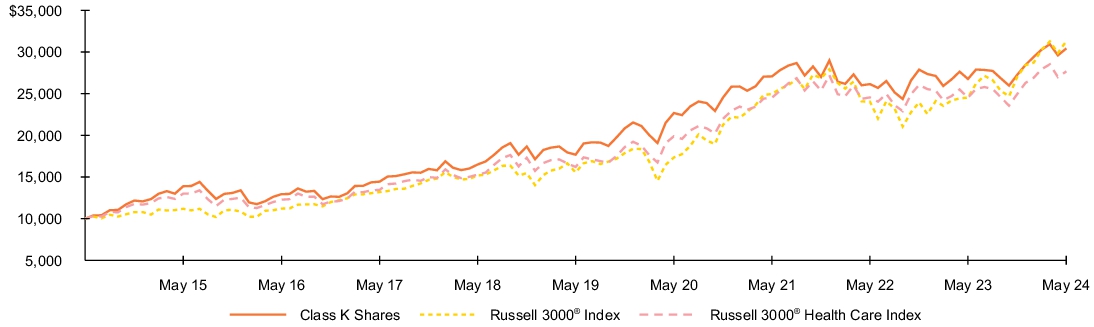

Fund performance

Cumulative performance: June 1, 2014 through May 31, 2024

Initial investment of $10,000

See “Average annual total returns” for additional information on fund performance.

Average annual total returns

| 1 Year | 5 Years | 10 Years |

| Institutional Shares | 24.68% | 9.83% | 8.50% |

| Russell 3000® Index | 27.58% | 15.00% | 12.09% |

| Russell 2000® Index | 20.12% | 8.61% | 7.66% |

| Net Assets | $3,514,797,540% |

| Number of Portfolio Holdings | $781% |

| Net Investment Advisory Fees | $13,668,396% |

| Portfolio Turnover Rate | $75% |

Past performance is not an indication of future results. Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit blackrock.com for more recent performance information.

What did the Fund invest in?

(as of May 31, 2024)

| Sector(a) | Percent of

Net Assets |

| Industrials | 18.5)% |

| Health Care | 16.0)% |

| Information Technology | 15.7)% |

| Financials | 14.2)% |

| Consumer Discretionary | 11.7)% |

| Energy | 6.5)% |

| Real Estate | 4.5)% |

| Materials | 4.0)% |

| Consumer Staples | 3.0)% |

| Communication Services | 2.9)% |

| Utilities | 2.2)% |

| Short-Term Securities | 5.3)% |

| Liabilities in Excess of Other Assets | (4.5)% |

| Security(b) | Percent of

Net Assets |

| Super Micro Computer, Inc. | 1.4% |

| Boise Cascade Co. | 1.1% |

| Flowserve Corp. | 1.0% |

| SM Energy Co. | 0.8% |

| Plains GP Holdings LP, Class A | 0.8% |

| Murphy Oil Corp. | 0.8% |

| Reinsurance Group of America, Inc. | 0.7% |

| EMCOR Group, Inc. | 0.7% |

| Sanmina Corp. | 0.7% |

| Laureate Education, Inc., Class A | 0.7% |

(a) | For purposes of this report, sector sub-classifications may differ from those utilized for compliance purposes. |

(b) | Excludes short-term securities. |

Additional information

If you wish to view additional information about the Fund, including but not limited to financial statements, the Fund’s prospectus, and proxy voting policies and procedures, please visit blackrock.com/fundreports. For proxy voting records, visit blackrock.com/proxyrecords.

Householding

The Fund will mail only one copy of shareholder documents, including prospectuses, annual and semi-annual reports and proxy statements, to shareholders with multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses and eliminate duplicate mailings of shareholder documents. Mailings of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please call the Fund at (800) 441-7762.

The Fund is not sponsored, endorsed, issued, sold, or promoted by FTSE International Limited and its affiliates, nor does this company make any representation regarding the advisability of investing in the Fund. BlackRock is not affiliated with the company listed above.

©2024 BlackRock, Inc. or its affiliates. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

BlackRock Advantage Small Cap Core Fund

Institutional Shares | BDSIX

Annual Shareholder Report — May 31, 2024

BDSIX-05/24-AR

BlackRock Advantage Small Cap Core Fund

Investor A Shares | BDSAX

Annual Shareholder Report — May 31, 2024

This annual shareholder report contains important information about BlackRock Advantage Small Cap Core Fund (the “Fund”) for the period of June 1, 2023 to May 31, 2024. You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class name | Costs of a $10,000

investment | Costs paid as a percentage of a

$10,000 investment |

| Investor A Shares | $84 | 0.75% |

How did the Fund perform last year?

U.S. equities broadly moved higher as the reporting period progressed, resulting in significant positive returns across most market segments.

Fears of a U.S. recession waned while major overseas economies returned to positive growth.

Signs of easing inflation led to expectations that the U.S. Federal Reserve and other leading central banks were poised to reduce interest rates, driving outperformance by mega-cap growth stocks within information technology and communications services.

What contributed to performance?

Positive contributions to performance, relative to the benchmark (Russell 2000® Index) were led by fundamental and sentiment insights. Within fundamental measures, traditional valuation insights evaluating a company’s sales value worked well within the industrials and financials sectors. Within sentiment insights, measures of text-based trends along with retail investor and smart money flows supported stock selection across the industrials and energy sectors. Finally, while performance from macro measures was mixed overall, insights looking at inventory levels drove successful positioning within the consumer discretionary sector.

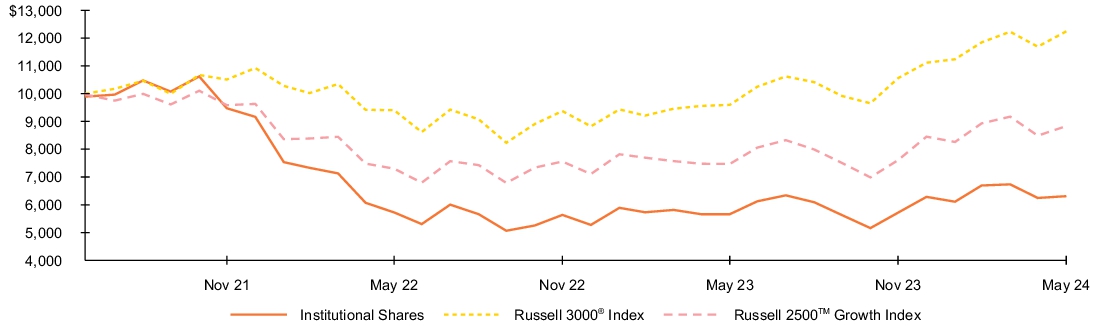

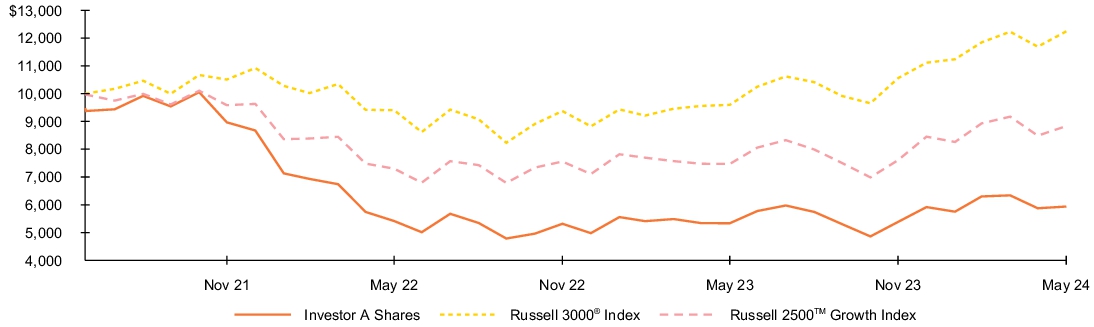

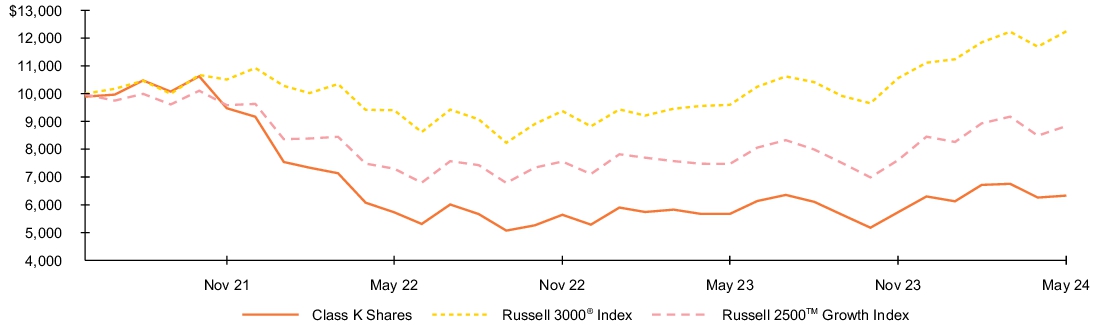

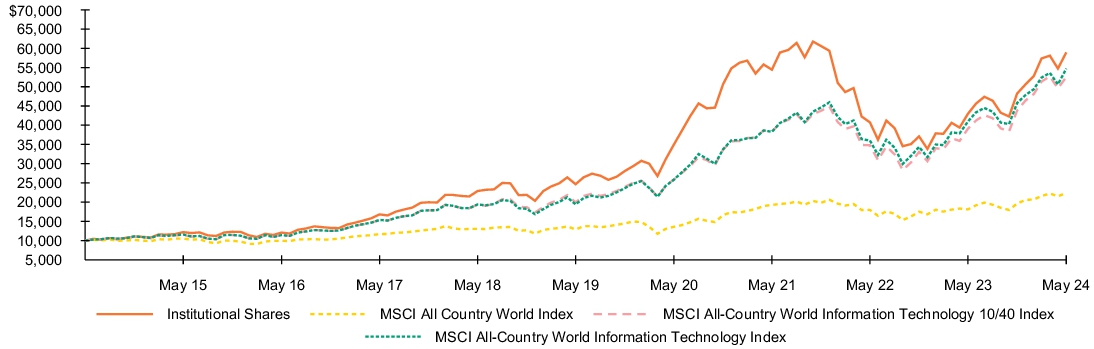

What detracted from performance?