| BlackRock FundsSM |

| iShares Russell Mid-Cap Index Fund |

| iShares Russell Small/Mid-Cap Index Fund |

| iShares Total U.S. Stock Market Index Fund |

| Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Shares | $10 | 0.09% |

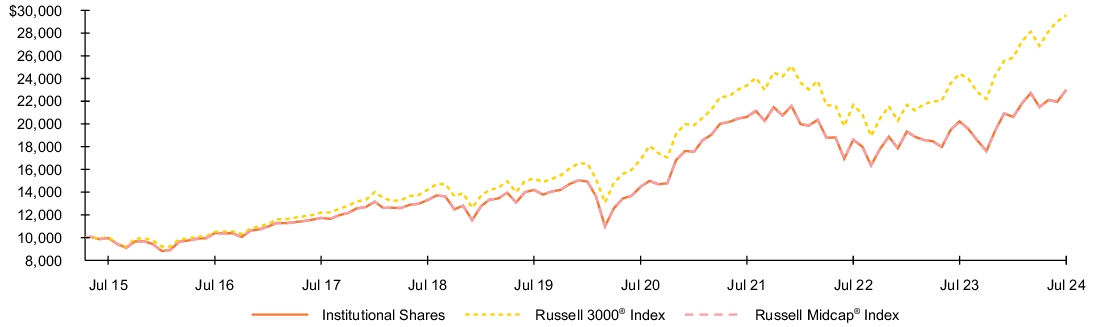

| Average annual total returns | ||||||

| 1 Year | 5 Years | Since Fund Inception | ||||

| Institutional Shares | 13.63 | % | 10.12 | % | 9.45 | % |

| Russell 3000® Index | 21.07 | 14.23 | 12.48 | |||

| Russell Midcap® Index | 13.69 | 10.16 | 9.47 |

| Key Fund statistics | |

| Net Assets | $1,996,331,954% |

| Number of Portfolio Holdings | $817% |

| Net Investment Advisory Fees | $344,702% |

| Portfolio Turnover Rate | $26% |

| Sector allocation | ||

| Sector(a) | Percent of Net Assets | |

| Industrials | 17.1 | % |

| Financials | 15.6 | % |

| Information Technology | 12.4 | % |

| Consumer Discretionary | 10.6 | % |

| Health Care | 10.3 | % |

| Real Estate | 7.7 | % |

| Materials | 6.0 | % |

| Utilities | 5.4 | % |

| Energy | 5.3 | % |

| Consumer Staples | 5.1 | % |

| Other* | 4.3 | % |

| Short-Term Securities | 3.6 | % |

| Liabilities in Excess of Other Assets | (3.4 | ) |

| Ten largest holdings | ||

| Security | Percent of Net Assets(b) | |

| iShares Russell Mid-Cap ETF | 0.9 | % |

| Arthur J Gallagher & Co. | 0.5 | % |

| Aflac, Inc. | 0.5 | % |

| Palantir Technologies, Inc., Class A | 0.5 | % |

| D.R. Horton, Inc. | 0.5 | % |

| Hilton Worldwide Holdings, Inc. | 0.5 | % |

| Williams Cos., Inc. | 0.5 | % |

| United Rentals, Inc. | 0.4 | % |

| Simon Property Group, Inc. | 0.4 | % |

| Realty Income Corp. | 0.4 | % |

| (a) | For purposes of this report, sector sub-classifications may differ from those utilized for compliance purposes. |

| (b) | Excludes short-term securities. |

| * | Ten largest sectors are presented. Additional sectors are found in Other. |

| Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Investor A Shares | $38 | 0.36% |

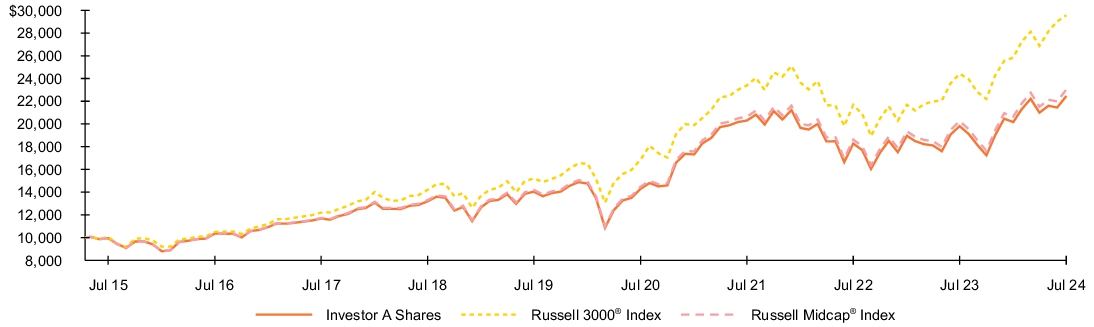

| Average annual total returns | ||||||

| 1 Year | 5 Years | Since Fund Inception | ||||

| Investor A Shares | 13.31 | % | 9.84 | % | 9.17 | % |

| Russell 3000® Index | 21.07 | 14.23 | 12.48 | |||

| Russell Midcap® Index | 13.69 | 10.16 | 9.47 |

| Key Fund statistics | |

| Net Assets | $1,996,331,954% |

| Number of Portfolio Holdings | $817% |

| Net Investment Advisory Fees | $344,702% |

| Portfolio Turnover Rate | $26% |

| Sector allocation | ||

| Sector(a) | Percent of Net Assets | |

| Industrials | 17.1 | % |

| Financials | 15.6 | % |

| Information Technology | 12.4 | % |

| Consumer Discretionary | 10.6 | % |

| Health Care | 10.3 | % |

| Real Estate | 7.7 | % |

| Materials | 6.0 | % |

| Utilities | 5.4 | % |

| Energy | 5.3 | % |

| Consumer Staples | 5.1 | % |

| Other* | 4.3 | % |

| Short-Term Securities | 3.6 | % |

| Liabilities in Excess of Other Assets | (3.4 | ) |

| Ten largest holdings | ||

| Security | Percent of Net Assets(b) | |

| iShares Russell Mid-Cap ETF | 0.9 | % |

| Arthur J Gallagher & Co. | 0.5 | % |

| Aflac, Inc. | 0.5 | % |

| Palantir Technologies, Inc., Class A | 0.5 | % |

| D.R. Horton, Inc. | 0.5 | % |

| Hilton Worldwide Holdings, Inc. | 0.5 | % |

| Williams Cos., Inc. | 0.5 | % |

| United Rentals, Inc. | 0.4 | % |

| Simon Property Group, Inc. | 0.4 | % |

| Realty Income Corp. | 0.4 | % |

| (a) | For purposes of this report, sector sub-classifications may differ from those utilized for compliance purposes. |

| (b) | Excludes short-term securities. |

| * | Ten largest sectors are presented. Additional sectors are found in Other. |

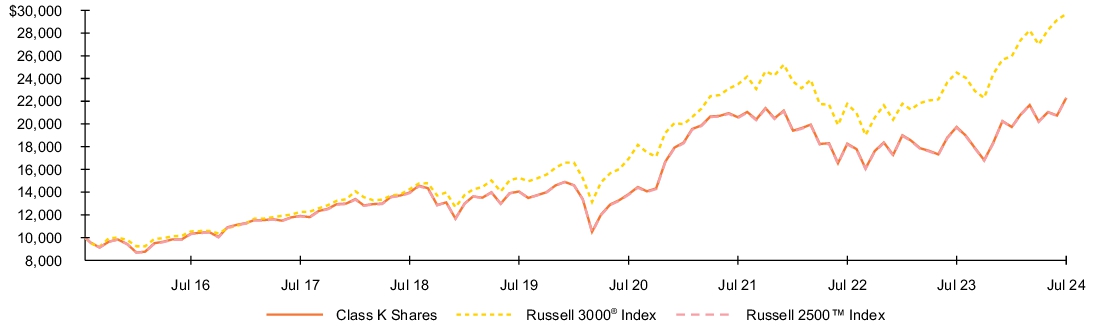

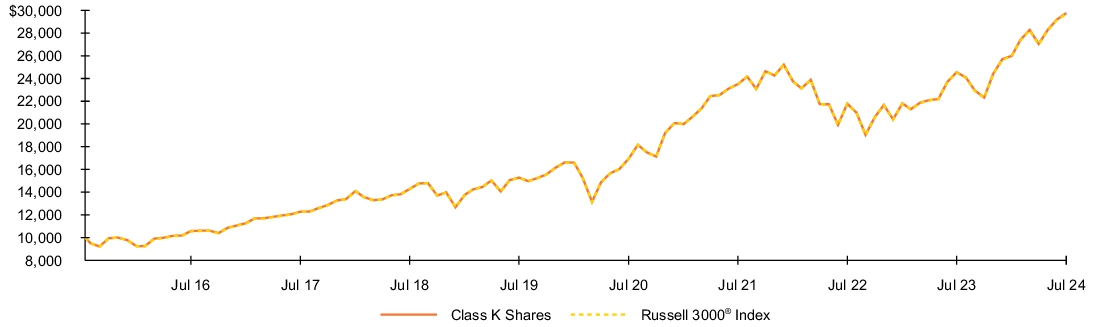

| Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class K Shares | $4 | 0.04% |

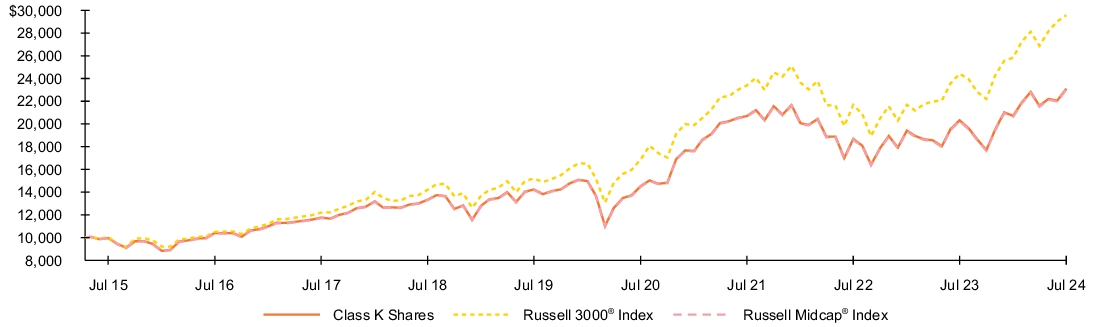

| Average annual total returns | ||||||

| 1 Year | 5 Years | Since Fund Inception | ||||

| Class K Shares | 13.66 | % | 10.16 | % | 9.51 | % |

| Russell 3000® Index | 21.07 | 14.23 | 12.48 | |||

| Russell Midcap® Index | 13.69 | 10.16 | 9.47 |

| Key Fund statistics | |

| Net Assets | $1,996,331,954% |

| Number of Portfolio Holdings | $817% |

| Net Investment Advisory Fees | $344,702% |

| Portfolio Turnover Rate | $26% |

| Sector allocation | ||

| Sector(a) | Percent of Net Assets | |

| Industrials | 17.1 | % |

| Financials | 15.6 | % |

| Information Technology | 12.4 | % |

| Consumer Discretionary | 10.6 | % |

| Health Care | 10.3 | % |

| Real Estate | 7.7 | % |

| Materials | 6.0 | % |

| Utilities | 5.4 | % |

| Energy | 5.3 | % |

| Consumer Staples | 5.1 | % |

| Other* | 4.3 | % |

| Short-Term Securities | 3.6 | % |

| Liabilities in Excess of Other Assets | (3.4 | ) |

| Ten largest holdings | ||

| Security | Percent of Net Assets(b) | |

| iShares Russell Mid-Cap ETF | 0.9 | % |

| Arthur J Gallagher & Co. | 0.5 | % |

| Aflac, Inc. | 0.5 | % |

| Palantir Technologies, Inc., Class A | 0.5 | % |

| D.R. Horton, Inc. | 0.5 | % |

| Hilton Worldwide Holdings, Inc. | 0.5 | % |

| Williams Cos., Inc. | 0.5 | % |

| United Rentals, Inc. | 0.4 | % |

| Simon Property Group, Inc. | 0.4 | % |

| Realty Income Corp. | 0.4 | % |

| (a) | For purposes of this report, sector sub-classifications may differ from those utilized for compliance purposes. |

| (b) | Excludes short-term securities. |

| * | Ten largest sectors are presented. Additional sectors are found in Other. |

| Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Shares | $14 | 0.13% |

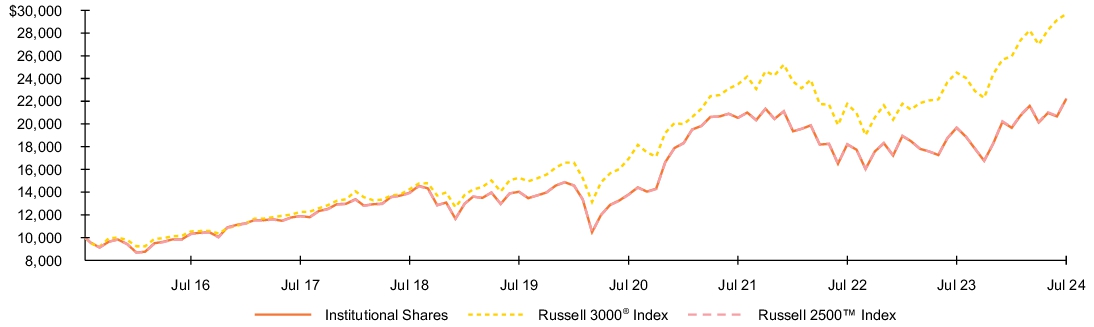

| Average annual total returns | ||||||

| 1 Year | 5 Years | Since Fund Inception | ||||

| Institutional Shares | 12.90 | % | 9.61 | % | 9.30 | % |

| Russell 3000® Index | 21.07 | 14.23 | 12.91 | |||

| Russell 2500™ Index | 13.06 | 9.65 | 9.33 |

| Key Fund statistics | |

| Net Assets | $599,823,170% |

| Number of Portfolio Holdings | $2,445% |

| Net Investment Advisory Fees | $89,117% |

| Portfolio Turnover Rate | $43% |

| Sector allocation | ||

| Sector(a) | Percent of Net Assets | |

| Industrials | 18.7 | % |

| Financials | 16.5 | % |

| Health Care | 12.6 | % |

| Consumer Discretionary | 12.3 | % |

| Information Technology | 11.6 | % |

| Real Estate | 6.8 | % |

| Materials | 5.8 | % |

| Energy | 5.4 | % |

| Consumer Staples | 3.3 | % |

| Communication Services | 3.0 | % |

| Other* | 3.7 | % |

| Short-Term Securities | 8.6 | % |

| Liabilities in Excess of Other Assets | (8.3 | ) |

| Ten largest holdings | ||

| Security | Percent of Net Assets(b) | |

| iShares Russell 2000 ETF | 0.7 | % |

| iShares Russell Mid-Cap ETF | 0.5 | % |

| EQT Corp. | 0.3 | % |

| Lennox International, Inc. | 0.3 | % |

| Textron, Inc. | 0.3 | % |

| Packaging Corp. of America | 0.3 | % |

| EMCOR Group, Inc. | 0.3 | % |

| Reliance, Inc. | 0.3 | % |

| Pure Storage, Inc., Class A | 0.3 | % |

| Avery Dennison Corp. | 0.3 | % |

| (a) | For purposes of this report, sector sub-classifications may differ from those utilized for compliance purposes. |

| (b) | Excludes short-term securities. |

| * | Ten largest sectors are presented. Additional sectors are found in Other. |

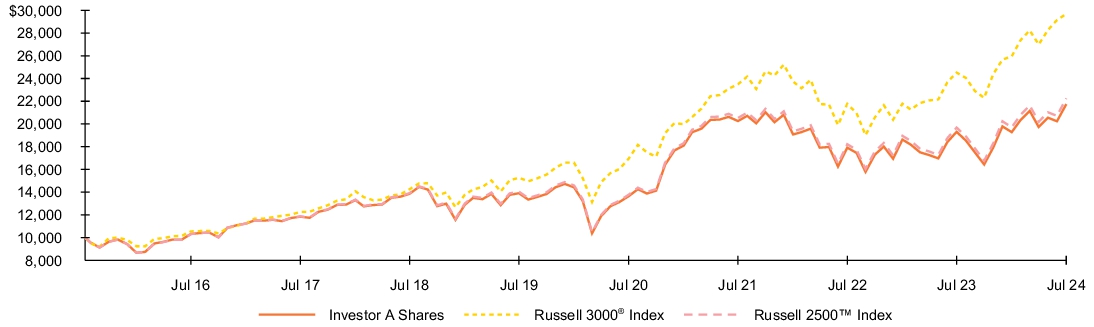

| Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Investor A Shares | $40 | 0.38% |

| Average annual total returns | ||||||

| 1 Year | 5 Years | Since Fund Inception | ||||

| Investor A Shares | 12.57 | % | 9.34 | % | 9.04 | % |

| Russell 3000® Index | 21.07 | 14.23 | 12.91 | |||

| Russell 2500™ Index | 13.06 | 9.65 | 9.33 |

| Key Fund statistics | |

| Net Assets | $599,823,170% |

| Number of Portfolio Holdings | $2,445% |

| Net Investment Advisory Fees | $89,117% |

| Portfolio Turnover Rate | $43% |

| Sector allocation | ||

| Sector(a) | Percent of Net Assets | |

| Industrials | 18.7 | % |

| Financials | 16.5 | % |

| Health Care | 12.6 | % |

| Consumer Discretionary | 12.3 | % |

| Information Technology | 11.6 | % |

| Real Estate | 6.8 | % |

| Materials | 5.8 | % |

| Energy | 5.4 | % |

| Consumer Staples | 3.3 | % |

| Communication Services | 3.0 | % |

| Other* | 3.7 | % |

| Short-Term Securities | 8.6 | % |

| Liabilities in Excess of Other Assets | (8.3 | ) |

| Ten largest holdings | ||

| Security | Percent of Net Assets(b) | |

| iShares Russell 2000 ETF | 0.7 | % |

| iShares Russell Mid-Cap ETF | 0.5 | % |

| EQT Corp. | 0.3 | % |

| Lennox International, Inc. | 0.3 | % |

| Textron, Inc. | 0.3 | % |

| Packaging Corp. of America | 0.3 | % |

| EMCOR Group, Inc. | 0.3 | % |

| Reliance, Inc. | 0.3 | % |

| Pure Storage, Inc., Class A | 0.3 | % |

| Avery Dennison Corp. | 0.3 | % |

| (a) | For purposes of this report, sector sub-classifications may differ from those utilized for compliance purposes. |

| (b) | Excludes short-term securities. |

| * | Ten largest sectors are presented. Additional sectors are found in Other. |

| Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class K Shares | $9 | 0.08% |

| Average annual total returns | ||||||

| 1 Year | 5 Years | Since Fund Inception | ||||

| Class K Shares | 12.95 | % | 9.66 | % | 9.35 | % |

| Russell 3000® Index | 21.07 | 14.23 | 12.91 | |||

| Russell 2500™ Index | 13.06 | 9.65 | 9.33 |

| Key Fund statistics | |

| Net Assets | $599,823,170% |

| Number of Portfolio Holdings | $2,445% |

| Net Investment Advisory Fees | $89,117% |

| Portfolio Turnover Rate | $43% |

| Sector allocation | ||

| Sector(a) | Percent of Net Assets | |

| Industrials | 18.7 | % |

| Financials | 16.5 | % |

| Health Care | 12.6 | % |

| Consumer Discretionary | 12.3 | % |

| Information Technology | 11.6 | % |

| Real Estate | 6.8 | % |

| Materials | 5.8 | % |

| Energy | 5.4 | % |

| Consumer Staples | 3.3 | % |

| Communication Services | 3.0 | % |

| Other* | 3.7 | % |

| Short-Term Securities | 8.6 | % |

| Liabilities in Excess of Other Assets | (8.3 | ) |

| Ten largest holdings | ||

| Security | Percent of Net Assets(b) | |

| iShares Russell 2000 ETF | 0.7 | % |

| iShares Russell Mid-Cap ETF | 0.5 | % |

| EQT Corp. | 0.3 | % |

| Lennox International, Inc. | 0.3 | % |

| Textron, Inc. | 0.3 | % |

| Packaging Corp. of America | 0.3 | % |

| EMCOR Group, Inc. | 0.3 | % |

| Reliance, Inc. | 0.3 | % |

| Pure Storage, Inc., Class A | 0.3 | % |

| Avery Dennison Corp. | 0.3 | % |

| (a) | For purposes of this report, sector sub-classifications may differ from those utilized for compliance purposes. |

| (b) | Excludes short-term securities. |

| * | Ten largest sectors are presented. Additional sectors are found in Other. |

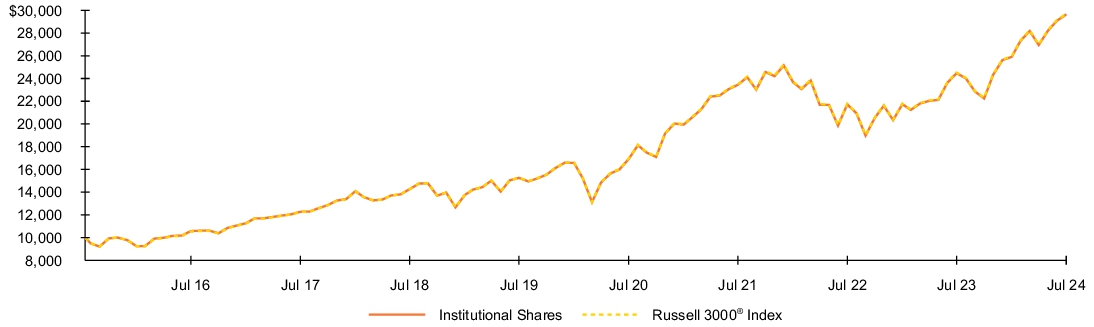

| Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Shares | $8 | 0.07% |

| Average annual total returns | ||||||

| 1 Year | 5 Years | Since Fund Inception | ||||

| Institutional Shares | 21.13 | % | 14.20 | % | 12.88 | % |

| Russell 3000® Index | 21.07 | 14.23 | 12.91 |

| Key Fund statistics | |

| Net Assets | $3,538,267,204% |

| Number of Portfolio Holdings | $2,720% |

| Net Investment Advisory Fees | $287,746% |

| Portfolio Turnover Rate | $19% |

| Sector allocation | ||

| Sector(a) | Percent of Net Assets | |

| Information Technology | 28.7 | % |

| Financials | 13.6 | % |

| Health Care | 11.8 | % |

| Consumer Discretionary | 10.1 | % |

| Industrials | 9.6 | % |

| Communication Services | 8.2 | % |

| Consumer Staples | 5.4 | % |

| Energy | 3.8 | % |

| Real Estate | 2.7 | % |

| Materials | 2.6 | % |

| Other* | 2.7 | % |

| Short-Term Securities | 2.0 | % |

| Liabilities in Excess of Other Assets | (1.2 | ) |

| Ten largest holdings | ||

| Security | Percent of Net Assets(b) | |

| Apple, Inc. | 6.0 | % |

| Microsoft Corp. | 5.8 | % |

| NVIDIA Corp. | 5.1 | % |

| Amazon.com, Inc. | 3.2 | % |

| Meta Platforms, Inc., Class A | 1.9 | % |

| Alphabet, Inc., Class A | 1.9 | % |

| Alphabet, Inc., Class C | 1.6 | % |

| Berkshire Hathaway, Inc., Class B | 1.5 | % |

| Broadcom, Inc. | 1.3 | % |

| Eli Lilly & Co. | 1.3 | % |

| (a) | For purposes of this report, sector sub-classifications may differ from those utilized for compliance purposes. |

| (b) | Excludes short-term securities. |

| * | Ten largest sectors are presented. Additional sectors are found in Other. |

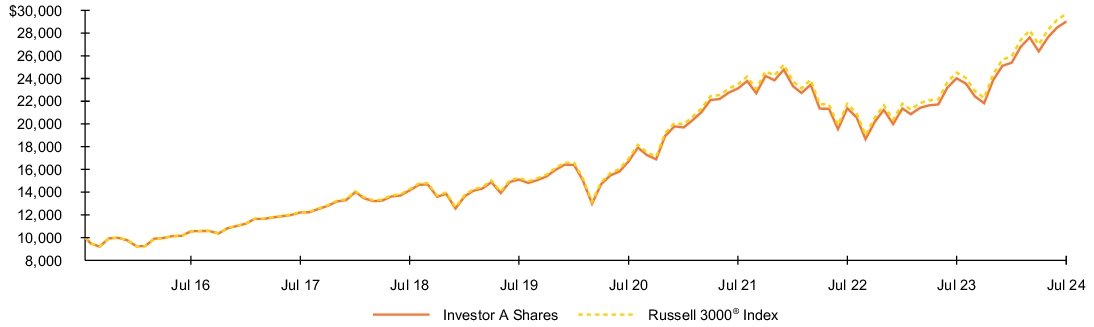

| Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Investor A Shares | $36 | 0.33% |

| Average annual total returns | ||||||

| 1 Year | 5 Years | Since Fund Inception | ||||

| Investor A Shares | 20.80 | % | 13.94 | % | 12.61 | % |

| Russell 3000® Index | 21.07 | 14.23 | 12.91 |

| Key Fund statistics | |

| Net Assets | $3,538,267,204% |

| Number of Portfolio Holdings | $2,720% |

| Net Investment Advisory Fees | $287,746% |

| Portfolio Turnover Rate | $19% |

| Sector allocation | ||

| Sector(a) | Percent of Net Assets | |

| Information Technology | 28.7 | % |

| Financials | 13.6 | % |

| Health Care | 11.8 | % |

| Consumer Discretionary | 10.1 | % |

| Industrials | 9.6 | % |

| Communication Services | 8.2 | % |

| Consumer Staples | 5.4 | % |

| Energy | 3.8 | % |

| Real Estate | 2.7 | % |

| Materials | 2.6 | % |

| Other* | 2.7 | % |

| Short-Term Securities | 2.0 | % |

| Liabilities in Excess of Other Assets | (1.2 | ) |

| Ten largest holdings | ||

| Security | Percent of Net Assets(b) | |

| Apple, Inc. | 6.0 | % |

| Microsoft Corp. | 5.8 | % |

| NVIDIA Corp. | 5.1 | % |

| Amazon.com, Inc. | 3.2 | % |

| Meta Platforms, Inc., Class A | 1.9 | % |

| Alphabet, Inc., Class A | 1.9 | % |

| Alphabet, Inc., Class C | 1.6 | % |

| Berkshire Hathaway, Inc., Class B | 1.5 | % |

| Broadcom, Inc. | 1.3 | % |

| Eli Lilly & Co. | 1.3 | % |

| (a) | For purposes of this report, sector sub-classifications may differ from those utilized for compliance purposes. |

| (b) | Excludes short-term securities. |

| * | Ten largest sectors are presented. Additional sectors are found in Other. |

| Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class K Shares | $3 | 0.03% |

| Average annual total returns | ||||||

| 1 Year | 5 Years | Since Fund Inception | ||||

| Class K Shares | 21.18 | % | 14.26 | % | 12.93 | % |

| Russell 3000® Index | 21.07 | 14.23 | 12.91 |

| Key Fund statistics | |

| Net Assets | $3,538,267,204% |

| Number of Portfolio Holdings | $2,720% |

| Net Investment Advisory Fees | $287,746% |

| Portfolio Turnover Rate | $19% |

| Sector allocation | ||

| Sector(a) | Percent of Net Assets | |

| Information Technology | 28.7 | % |

| Financials | 13.6 | % |

| Health Care | 11.8 | % |

| Consumer Discretionary | 10.1 | % |

| Industrials | 9.6 | % |

| Communication Services | 8.2 | % |

| Consumer Staples | 5.4 | % |

| Energy | 3.8 | % |

| Real Estate | 2.7 | % |

| Materials | 2.6 | % |

| Other* | 2.7 | % |

| Short-Term Securities | 2.0 | % |

| Liabilities in Excess of Other Assets | (1.2 | ) |

| Ten largest holdings | ||

| Security | Percent of Net Assets(b) | |

| Apple, Inc. | 6.0 | % |

| Microsoft Corp. | 5.8 | % |

| NVIDIA Corp. | 5.1 | % |

| Amazon.com, Inc. | 3.2 | % |

| Meta Platforms, Inc., Class A | 1.9 | % |

| Alphabet, Inc., Class A | 1.9 | % |

| Alphabet, Inc., Class C | 1.6 | % |

| Berkshire Hathaway, Inc., Class B | 1.5 | % |

| Broadcom, Inc. | 1.3 | % |

| Eli Lilly & Co. | 1.3 | % |

| (a) | For purposes of this report, sector sub-classifications may differ from those utilized for compliance purposes. |

| (b) | Excludes short-term securities. |

| * | Ten largest sectors are presented. Additional sectors are found in Other. |

(b) Not Applicable |

| Item 2 – | Code of Ethics – The registrant (or the “Fund”) has adopted a code of ethics, as of the end of the period covered by this report, applicable to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. During the period covered by this report, the code of ethics was amended to update certain information and to make other non-material changes. During the period covered by this report, there have been no waivers granted under the code of ethics. The registrant undertakes to provide a copy of the code of ethics to any person upon request, without charge, who calls 1-800-441-7762. |

| Item 3 – | Audit Committee Financial Expert – The registrant’s board of directors (the “board of directors”), has determined that (i) the registrant has the following audit committee financial experts serving on its audit committee and (ii) each audit committee financial expert is independent: |

Neil A. Cotty |

Henry R. Keizer |

Kenneth L. Urish |

Under applicable securities laws, a person determined to be an audit committee financial expert will not be deemed an “expert” for any purpose, including without limitation for the purposes of Section 11 of the Securities Act of 1933, as a result of being designated or identified as an audit committee financial expert. The designation or identification of a person as an audit committee financial expert does not impose on such person any duties, obligations, or liabilities greater than the duties, obligations, and liabilities imposed on such person as a member of the audit committee and board of directors in the absence of such designation or identification. The designation or identification of a person as an audit committee financial expert does not affect the duties, obligations, or liability of any other member of the audit committee or board of directors. |

| Item 4 – | Principal Accountant Fees and Services |

The following table presents fees billed by PricewaterhouseCoopers LLP (“PwC”) in each of the last two fiscal years for the services rendered to the Fund: |

| (a) Audit Fees | (b) Audit-Related Fees1 | (c) Tax Fees2 | (d) All Other Fees | |||||||||||||||||||||||||||||||||||||

| Entity Name |

Current Fiscal Year End | Previous Fiscal Year End | Current Fiscal Year End | Previous Fiscal Year End | Current Fiscal Year End | Previous Fiscal Year End | Current Fiscal Year End | Previous Fiscal Year End | ||||||||||||||||||||||||||||||||

| iShares Russell Mid-Cap Index Fund | $23,129 | $23,129 | $0 | $0 | $15,288 | $15,288 | $0 | $0 | ||||||||||||||||||||||||||||||||

| iShares Russell Small/Mid-Cap Index Fund | $23,129 | $23,129 | $0 | $0 | $15,288 | $15,288 | $0 | $0 | ||||||||||||||||||||||||||||||||

| iShares Total U.S. Stock Market Index Fund | $23,129 | $23,129 | $0 | $0 | $15,288 | $15,288 | $0 | $0 | ||||||||||||||||||||||||||||||||

The following table presents fees billed by PwC that were required to be approved by the registrant’s audit committee (the “Committee”) for services that relate directly to the operations |

| or financial reporting of the Fund and that are rendered on behalf of BlackRock Advisors, LLC ( the “Investment Adviser” or “BlackRock”) and entities controlling, controlled by, or under common control with BlackRock (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser) that provide ongoing services to the Fund (“Affiliated Service Providers”): |

| Current Fiscal Year End | Previous Fiscal Year End | |||

(b) Audit-Related Fees1 | $0 | $0 | ||

(c) Tax Fees2 | $0 | $0 | ||

(d) All Other Fees3 | $0 | $0 |

1 The nature of the services includes assurance and related services reasonably related to the performance of the audit or review of financial statements not included in Audit Fees, including accounting consultations, agreed-upon procedure reports, attestation reports, comfort letters, out-of-pocket expenses and internal control reviews not required by regulators. |

2 The nature of the services includes tax compliance and/or tax preparation, including services relating to the filing or amendment of federal, state or local income tax returns, regulated investment company qualification reviews, taxable income and tax distribution calculations. |

3 Aggregate fees borne by BlackRock in connection with the review of compliance procedures and attestation thereto performed by PwC with respect to all of the registered closed-end funds and some of the registered open-end funds advised by BlackRock. |

(e)(1) Audit Committee Pre-Approval Policies and Procedures: |

The Committee has adopted policies and procedures with regard to the pre-approval of services. Audit, audit-related and tax compliance services provided to the registrant on an annual basis require specific pre-approval by the Committee. The Committee also must approve other non-audit services provided to the registrant and those non-audit services provided to the Investment Adviser and Affiliated Service Providers that relate directly to the operations and the financial reporting of the registrant. Certain of these non-audit services that the Committee believes are (a) consistent with the SEC’s auditor independence rules and (b) routine and recurring services that will not impair the independence of the independent accountants may be approved by the Committee without consideration on a specific case-by-case basis (“general pre-approval”). The term of any general pre-approval is 12 months from the date of the pre-approval, unless the Committee provides for a different period. Tax or other non-audit services provided to the registrant which have a direct impact on the operations or financial reporting of the registrant will only be deemed pre-approved provided that any individual project does not exceed $10,000 attributable to the registrant or $50,000 per project. For this purpose, multiple projects will be aggregated to determine if they exceed the previously mentioned cost levels. |

Any proposed services exceeding the pre-approved cost levels will require specific pre-approval by the Committee, as will any other services not subject to general pre-approval (e.g., unanticipated but permissible services). The Committee is informed of each service approved subject to general pre-approval at the next regularly scheduled in-person board meeting. At this meeting, an analysis of such services is presented to the Committee for ratification. The Committee may delegate to the Committee Chairman the authority to approve the provision of and fees for any specific engagement of permitted non-audit services, including services exceeding pre-approved cost levels. |

(e)(2) None of the services described in each of Items 4(b) through (d) were approved by the Committee pursuant to the de minimis exception in paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X. |

(f) Not Applicable |

(g) The aggregate non-audit fees, defined as the sum of the fees shown under “Audit-Related Fees,” “Tax Fees” and “All Other Fees,” paid to the accountant for services rendered by the accountant to the registrant, the Investment Adviser and the Affiliated Service Providers were:

Current Fiscal Year | Previous Fiscal | |||||||||||

Entity Name | End | Year End | ||||||||||

iShares Russell Mid-Cap Index Fund | $15,288 | $15,288 | ||||||||||

iShares Russell Small/Mid-Cap Index Fund | $15,288 | $15,288 | ||||||||||

iShares Total U.S. Stock Market Index Fund | $15,288 | $15,288 |

(h) The Committee has considered and determined that the provision of non-audit services that were rendered to the Investment Adviser and the Affiliated Service Providers that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X is compatible with maintaining the principal accountant’s independence.

(i) Not Applicable

(j) Not Applicable

| Item 5 – | Audit Committee of Listed Registrant – Not Applicable |

| Item 6 – | Investments |

(a) The registrant’s Schedule of Investments is included as part of the Financial Statement and Financial Highlights for Open-End Management Investment Companies filed under Item 7 of this Form.

(b) Not Applicable due to no such divestments during the semi-annual period covered since the previous Form N-CSR filing.

| Item 7 – | Financial Statements and Financial Highlights for Open-End Management Investment Companies |

(a) The registrant’s Financial Statements are attached herewith.

(b) The registrant’s Financial Highlights are attached herewith.

2024 Annual Financial Statements |

BlackRock FundsSM |

• iShares Russell Mid-Cap Index Fund |

• iShares Russell Small/Mid-Cap Index Fund |

• iShares Total U.S. Stock Market Index Fund |

Not FDIC Insured • May Lose Value • No Bank Guarantee |

Security | Shares | Value | |

Common Stocks | |||

Aerospace & Defense — 1.7% | |||

Axon Enterprise, Inc.(a) | 12,548 | $ 3,764,525 | |

BWX Technologies, Inc. | 16,115 | 1,603,281 | |

Curtiss-Wright Corp. | 6,665 | 1,964,175 | |

HEICO Corp. | 7,702 | 1,858,801 | |

HEICO Corp., Class A | 14,193 | 2,698,231 | |

Hexcel Corp. | 14,584 | 965,607 | |

Howmet Aerospace, Inc. | 70,819 | 6,777,378 | |

Huntington Ingalls Industries, Inc. | 6,901 | 1,932,142 | |

L3Harris Technologies, Inc. | 33,099 | 7,509,832 | |

Loar Holdings, Inc.(a) | 1,461 | 91,313 | |

Spirit AeroSystems Holdings, Inc., Class A(a) | 20,167 | 731,054 | |

Textron, Inc. | 33,240 | 3,087,996 | |

Woodward, Inc. | 10,397 | 1,621,828 | |

34,606,163 | |||

Air Freight & Logistics — 0.3% | |||

CH Robinson Worldwide, Inc. | 20,209 | 1,799,611 | |

Expeditors International of Washington, Inc. | 24,669 | 3,079,185 | |

GXO Logistics, Inc.(a) | 20,316 | 1,137,290 | |

6,016,086 | |||

Automobile Components — 0.4% | |||

Aptiv PLC(a) | 47,587 | 3,302,062 | |

BorgWarner, Inc. | 40,187 | 1,419,003 | |

Gentex Corp. | 40,417 | 1,255,352 | |

Lear Corp. | 9,899 | 1,208,074 | |

QuantumScape Corp., Class A(a)(b) | 61,208 | 395,404 | |

7,579,895 | |||

Automobiles — 0.2% | |||

Harley-Davidson, Inc. | 21,258 | 797,175 | |

Lucid Group, Inc.(a)(b) | 153,864 | 541,601 | |

Rivian Automotive, Inc., Class A(a)(b) | 143,629 | 2,356,952 | |

Thor Industries, Inc. | 8,979 | 953,031 | |

4,648,759 | |||

Banks — 2.8% | |||

Bank OZK | 19,142 | 897,568 | |

BOK Financial Corp. | 3,964 | 407,658 | |

Citizens Financial Group, Inc. | 79,855 | 3,407,413 | |

Columbia Banking System, Inc. | 36,157 | 945,867 | |

Comerica, Inc. | 23,004 | 1,260,849 | |

Commerce Bancshares, Inc. | 20,817 | 1,347,068 | |

Cullen/Frost Bankers, Inc. | 10,411 | 1,218,712 | |

East West Bancorp, Inc. | 24,467 | 2,150,405 | |

Fifth Third Bancorp | 119,342 | 5,052,940 | |

First Citizens BancShares, Inc., Class A | 2,094 | 4,371,623 | |

First Hawaiian, Inc. | 23,038 | 576,871 | |

First Horizon Corp. | 95,380 | 1,595,707 | |

FNB Corp. | 62,149 | 953,366 | |

Huntington Bancshares, Inc. | 252,314 | 3,772,094 | |

KeyCorp. | 161,728 | 2,608,673 | |

M&T Bank Corp. | 29,043 | 5,000,333 | |

NU Holdings Ltd./Cayman Islands, Class A(a) | 556,152 | 6,746,124 | |

Pinnacle Financial Partners, Inc. | 13,357 | 1,286,546 | |

Popular, Inc. | 12,462 | 1,278,975 | |

Prosperity Bancshares, Inc. | 15,917 | 1,154,301 | |

Regions Financial Corp. | 160,557 | 3,591,660 | |

Synovus Financial Corp. | 25,500 | 1,192,125 | |

TFS Financial Corp. | 9,007 | 122,135 | |

Webster Financial Corp. | 30,324 | 1,504,677 | |

Security | Shares | Value | |

Banks (continued) | |||

Western Alliance Bancorp | 18,760 | $ 1,509,430 | |

Wintrust Financial Corp. | 10,970 | 1,186,954 | |

Zions Bancorp NA | 25,814 | 1,333,809 | |

56,473,883 | |||

Beverages — 0.3% | |||

Boston Beer Co., Inc., Class A(a) | 1,595 | 446,935 | |

Brown-Forman Corp., Class A | 8,588 | 391,527 | |

Brown-Forman Corp., Class B | 30,422 | 1,373,858 | |

Celsius Holdings, Inc.(a)(b) | 31,077 | 1,455,336 | |

Coca-Cola Consolidated, Inc. | 1,032 | 1,182,558 | |

Molson Coors Beverage Co., Class B | 30,928 | 1,634,545 | |

6,484,759 | |||

Biotechnology(a) — 1.6% | |||

Alnylam Pharmaceuticals, Inc. | 22,071 | 5,240,980 | |

Apellis Pharmaceuticals, Inc. | 18,109 | 717,116 | |

Biogen, Inc. | 25,460 | 5,428,072 | |

BioMarin Pharmaceutical, Inc. | 32,996 | 2,782,553 | |

Cerevel Therapeutics Holdings, Inc. | 12,320 | 553,907 | |

Exact Sciences Corp.(b) | 31,877 | 1,456,141 | |

Exelixis, Inc. | 50,017 | 1,172,899 | |

GRAIL, Inc. | 4,573 | 70,333 | |

Incyte Corp. | 32,397 | 2,108,073 | |

Ionis Pharmaceuticals, Inc. | 25,342 | 1,253,415 | |

Natera, Inc. | 19,777 | 2,024,967 | |

Neurocrine Biosciences, Inc. | 17,427 | 2,467,140 | |

Roivant Sciences Ltd. | 61,241 | 664,465 | |

Sarepta Therapeutics, Inc. | 15,825 | 2,250,948 | |

Ultragenyx Pharmaceutical, Inc. | 15,425 | 694,433 | |

United Therapeutics Corp. | 7,631 | 2,390,716 | |

Viking Therapeutics, Inc.(b) | 18,377 | 1,047,489 | |

32,323,647 | |||

Broadline Retail — 0.7% | |||

Coupang, Inc., Class A(a) | 202,413 | 4,200,070 | |

Dillard’s, Inc., Class A | 539 | 214,840 | |

eBay, Inc. | 88,455 | 4,918,983 | |

Etsy, Inc.(a) | 20,324 | 1,323,905 | |

Kohl’s Corp. | 19,264 | 417,258 | |

Macy’s, Inc. | 47,851 | 826,865 | |

Nordstrom, Inc. | 17,246 | 393,726 | |

Ollie’s Bargain Outlet Holdings, Inc.(a) | 10,679 | 1,042,698 | |

13,338,345 | |||

Building Products — 1.5% | |||

A O Smith Corp. | 21,046 | 1,789,752 | |

AAON, Inc. | 11,979 | 1,060,501 | |

Advanced Drainage Systems, Inc. | 11,611 | 2,055,611 | |

Allegion PLC | 15,271 | 2,089,226 | |

Armstrong World Industries, Inc. | 7,619 | 1,001,137 | |

AZEK Co., Inc., Class A(a) | 25,084 | 1,126,021 | |

Builders FirstSource, Inc.(a) | 20,971 | 3,509,916 | |

Carlisle Cos., Inc. | 8,316 | 3,480,911 | |

Fortune Brands Innovations, Inc. | 21,979 | 1,776,123 | |

Hayward Holdings, Inc.(a) | 24,686 | 365,106 | |

Lennox International, Inc. | 5,601 | 3,268,183 | |

Masco Corp. | 38,456 | 2,993,800 | |

Owens Corning | 15,075 | 2,809,678 | |

Simpson Manufacturing Co., Inc. | 7,399 | 1,421,274 | |

Trex Co., Inc.(a) | 19,082 | 1,595,828 | |

30,343,067 | |||

Security | Shares | Value | |

Capital Markets — 4.7% | |||

Affiliated Managers Group, Inc. | 5,681 | $ 1,054,507 | |

Ameriprise Financial, Inc. | 17,512 | 7,531,386 | |

Ares Management Corp., Class A | 31,163 | 4,774,172 | |

Bank of New York Mellon Corp. | 130,893 | 8,517,208 | |

Blue Owl Capital, Inc., Class A | 87,669 | 1,671,848 | |

Carlyle Group, Inc. | 38,934 | 1,936,577 | |

Cboe Global Markets, Inc. | 18,435 | 3,383,007 | |

Coinbase Global, Inc., Class A(a) | 34,496 | 7,739,523 | |

Evercore, Inc., Class A | 6,268 | 1,569,445 | |

FactSet Research Systems, Inc. | 6,646 | 2,745,396 | |

Franklin Resources, Inc. | 49,792 | 1,138,743 | |

Houlihan Lokey, Inc., Class A | 9,050 | 1,359,762 | |

Interactive Brokers Group, Inc., Class A | 18,150 | 2,164,750 | |

Invesco Ltd. | 65,129 | 1,124,127 | |

Janus Henderson Group PLC | 22,583 | 840,765 | |

Jefferies Financial Group, Inc. | 31,473 | 1,840,226 | |

Lazard, Inc. | 19,125 | 940,376 | |

LPL Financial Holdings, Inc. | 13,009 | 2,881,754 | |

MarketAxess Holdings, Inc. | 6,448 | 1,441,321 | |

Morningstar, Inc. | 4,749 | 1,508,520 | |

MSCI, Inc., Class A | 13,429 | 7,261,866 | |

Nasdaq, Inc. | 71,987 | 4,872,080 | |

Northern Trust Corp. | 35,345 | 3,133,334 | |

Raymond James Financial, Inc. | 33,044 | 3,833,104 | |

Robinhood Markets, Inc., Class A(a) | 116,056 | 2,387,272 | |

SEI Investments Co. | 17,897 | 1,214,132 | |

State Street Corp. | 52,675 | 4,475,795 | |

Stifel Financial Corp. | 17,346 | 1,538,070 | |

T Rowe Price Group, Inc. | 38,333 | 4,378,012 | |

TPG, Inc., Class A | 15,031 | 766,431 | |

Tradeweb Markets, Inc., Class A | 20,284 | 2,265,317 | |

Virtu Financial, Inc., Class A | 15,018 | 410,292 | |

XP, Inc., Class A | 72,593 | 1,242,066 | |

93,941,184 | |||

Chemicals — 2.8% | |||

Albemarle Corp. | 20,499 | 1,920,141 | |

Ashland, Inc. | 8,726 | 843,368 | |

Axalta Coating Systems Ltd.(a) | 38,620 | 1,376,803 | |

Celanese Corp., Class A | 19,464 | 2,747,344 | |

CF Industries Holdings, Inc. | 32,714 | 2,499,022 | |

Chemours Co. | 26,566 | 642,100 | |

Corteva, Inc. | 122,257 | 6,858,618 | |

Dow, Inc. | 123,008 | 6,700,246 | |

DuPont de Nemours, Inc. | 73,091 | 6,117,717 | |

Eastman Chemical Co. | 20,435 | 2,111,549 | |

Element Solutions, Inc. | 39,101 | 1,053,772 | |

FMC Corp. | 21,884 | 1,277,150 | |

Huntsman Corp. | 28,551 | 683,225 | |

International Flavors & Fragrances, Inc. | 44,688 | 4,445,562 | |

LyondellBasell Industries NV, Class A | 45,494 | 4,524,833 | |

Mosaic Co. | 55,903 | 1,664,232 | |

NewMarket Corp. | 1,189 | 666,874 | |

Olin Corp. | 21,062 | 960,638 | |

PPG Industries, Inc. | 40,843 | 5,186,244 | |

RPM International, Inc. | 22,212 | 2,697,870 | |

Scotts Miracle-Gro Co. | 7,606 | 597,832 | |

Westlake Corp. | 5,859 | 866,312 | |

56,441,452 | |||

Commercial Services & Supplies — 1.1% | |||

Clean Harbors, Inc.(a) | 9,007 | 2,150,241 | |

MSA Safety, Inc. | 6,466 | 1,219,811 | |

Security | Shares | Value | |

Commercial Services & Supplies (continued) | |||

RB Global, Inc. | 31,996 | $ 2,547,841 | |

Rollins, Inc. | 48,831 | 2,339,493 | |

Stericycle, Inc.(a) | 16,087 | 941,894 | |

Tetra Tech, Inc. | 9,394 | 2,003,177 | |

Veralto Corp. | 43,162 | 4,599,343 | |

Verisk Analytics, Inc. | 24,894 | 6,516,005 | |

Vestis Corp. | 23,086 | 299,425 | |

22,617,230 | |||

Communications Equipment — 0.3% | |||

Ciena Corp.(a) | 25,150 | 1,326,411 | |

F5, Inc.(a) | 10,207 | 2,078,554 | |

Juniper Networks, Inc. | 56,172 | 2,117,123 | |

Lumentum Holdings, Inc.(a) | 11,576 | 599,405 | |

Ubiquiti, Inc. | 660 | 122,476 | |

6,243,969 | |||

Construction & Engineering — 1.0% | |||

AECOM | 23,717 | 2,148,997 | |

API Group Corp.(a) | 40,120 | 1,520,147 | |

Comfort Systems USA, Inc. | 6,141 | 2,041,391 | |

EMCOR Group, Inc. | 8,124 | 3,050,074 | |

MasTec, Inc.(a) | 11,002 | 1,210,550 | |

MDU Resources Group, Inc. | 35,488 | 956,047 | |

Quanta Services, Inc.(b) | 25,386 | 6,736,937 | |

Valmont Industries, Inc. | 3,491 | 1,041,575 | |

WillScot Mobile Mini Holdings Corp.(a) | 32,332 | 1,325,612 | |

20,031,330 | |||

Construction Materials — 0.7% | |||

Eagle Materials, Inc. | 6,027 | 1,641,152 | |

Martin Marietta Materials, Inc. | 10,714 | 6,357,152 | |

Vulcan Materials Co. | 23,127 | 6,348,593 | |

14,346,897 | |||

Consumer Finance — 0.8% | |||

Ally Financial, Inc. | 47,960 | 2,158,680 | |

Credit Acceptance Corp.(a) | 1,107 | 636,414 | |

Discover Financial Services | 43,703 | 6,292,795 | |

OneMain Holdings, Inc. | 20,258 | 1,058,683 | |

SLM Corp. | 38,883 | 882,255 | |

SoFi Technologies, Inc.(a) | 182,734 | 1,377,815 | |

Synchrony Financial | 70,076 | 3,559,160 | |

15,965,802 | |||

Consumer Staples Distribution & Retail — 1.7% | |||

Albertsons Cos., Inc., Class A | 73,021 | 1,448,006 | |

BJ’s Wholesale Club Holdings, Inc.(a) | 23,049 | 2,027,390 | |

Casey’s General Stores, Inc. | 6,467 | 2,508,161 | |

Dollar General Corp. | 38,395 | 4,622,374 | |

Dollar Tree, Inc.(a) | 35,839 | 3,739,441 | |

Grocery Outlet Holding Corp.(a) | 16,905 | 330,662 | |

Kroger Co. | 115,957 | 6,319,657 | |

Maplebear, Inc.(a) | 29,952 | 1,033,044 | |

Performance Food Group Co.(a) | 27,024 | 1,864,656 | |

Sysco Corp. | 87,056 | 6,672,842 | |

U.S. Foods Holding Corp.(a) | 40,027 | 2,177,069 | |

Walgreens Boots Alliance, Inc. | 125,111 | 1,485,068 | |

34,228,370 | |||

Containers & Packaging — 1.3% | |||

Amcor PLC | 251,340 | 2,646,610 | |

AptarGroup, Inc. | 11,611 | 1,706,585 | |

Ardagh Group SA, Class A(a) | 2,789 | 19,774 | |

Avery Dennison Corp. | 14,000 | 3,035,620 | |

Ball Corp. | 54,413 | 3,473,182 | |

Security | Shares | Value | |

Containers & Packaging (continued) | |||

Berry Global Group, Inc. | 20,238 | $ 1,330,041 | |

Crown Holdings, Inc. | 20,430 | 1,812,141 | |

Graphic Packaging Holding Co. | 53,135 | 1,599,363 | |

International Paper Co. | 60,538 | 2,813,806 | |

Packaging Corp. of America | 15,492 | 3,096,386 | |

Sealed Air Corp. | 24,130 | 918,147 | |

Silgan Holdings, Inc. | 14,457 | 743,524 | |

Smurfit WestRock PLC | 44,696 | 2,004,169 | |

Sonoco Products Co. | 17,097 | 921,870 | |

26,121,218 | |||

Distributors — 0.4% | |||

Genuine Parts Co. | 24,304 | 3,575,361 | |

LKQ Corp. | 46,499 | 1,929,708 | |

Pool Corp. | 6,514 | 2,436,497 | |

7,941,566 | |||

Diversified Consumer Services — 0.4% | |||

ADT, Inc. | 49,598 | 385,872 | |

Bright Horizons Family Solutions, Inc.(a)(b) | 10,067 | 1,210,557 | |

Duolingo, Inc., Class A(a) | 6,508 | 1,118,986 | |

Grand Canyon Education, Inc.(a) | 5,166 | 805,638 | |

H&R Block, Inc. | 24,248 | 1,404,929 | |

Service Corp. International | 25,063 | 2,002,784 | |

6,928,766 | |||

Diversified REITs — 0.1% | |||

WP Carey, Inc. | 38,190 | 2,207,764 | |

Diversified Telecommunication Services — 0.2% | |||

ESC GCI Liberty, Inc. (c) | 15,053 | — | |

Frontier Communications Parent, Inc.(a)(b) | 42,896 | 1,256,853 | |

Iridium Communications, Inc. | 20,878 | 599,199 | |

Liberty Global Ltd., Class A(a) | 28,602 | 557,453 | |

Liberty Global Ltd., Class C(a) | 30,493 | 613,214 | |

3,026,719 | |||

Electric Utilities — 2.6% | |||

Alliant Energy Corp. | 44,829 | 2,495,182 | |

Avangrid, Inc. | 12,502 | 445,946 | |

Edison International | 66,485 | 5,319,465 | |

Entergy Corp. | 37,256 | 4,320,578 | |

Evergy, Inc. | 38,915 | 2,257,070 | |

Eversource Energy | 61,379 | 3,984,111 | |

Exelon Corp. | 174,877 | 6,505,425 | |

FirstEnergy Corp. | 100,618 | 4,216,900 | |

IDACORP, Inc. | 8,815 | 861,666 | |

NRG Energy, Inc. | 37,369 | 2,809,028 | |

OGE Energy Corp. | 35,252 | 1,366,720 | |

PG&E Corp. | 373,622 | 6,818,602 | |

Pinnacle West Capital Corp. | 20,080 | 1,718,647 | |

PPL Corp. | 129,068 | 3,835,901 | |

Xcel Energy, Inc. | 97,208 | 5,665,282 | |

52,620,523 | |||

Electrical Equipment — 1.5% | |||

Acuity Brands, Inc. | 5,380 | 1,352,263 | |

AMETEK, Inc. | 40,349 | 6,999,744 | |

Generac Holdings, Inc.(a) | 10,407 | 1,620,162 | |

Hubbell, Inc. | 9,357 | 3,702,097 | |

nVent Electric PLC | 28,864 | 2,096,392 | |

Regal Rexnord Corp. | 11,707 | 1,881,081 | |

Rockwell Automation, Inc. | 20,030 | 5,581,359 | |

Security | Shares | Value | |

Electrical Equipment (continued) | |||

Sensata Technologies Holding PLC | 26,331 | $ 1,026,646 | |

Vertiv Holdings Co., Class A | 62,568 | 4,924,102 | |

29,183,846 | |||

Electronic Equipment, Instruments & Components — 1.8% | |||

Arrow Electronics, Inc.(a) | 9,486 | 1,173,323 | |

Avnet, Inc. | 15,687 | 843,333 | |

CDW Corp. | 23,479 | 5,121,005 | |

Cognex Corp. | 30,034 | 1,490,287 | |

Coherent Corp.(a) | 23,263 | 1,620,966 | |

Corning, Inc. | 133,957 | 5,359,620 | |

Crane NXT Co. | 8,473 | 532,782 | |

IPG Photonics Corp.(a) | 4,813 | 386,965 | |

Jabil, Inc. | 20,525 | 2,312,552 | |

Keysight Technologies, Inc.(a) | 30,453 | 4,250,325 | |

Littelfuse, Inc. | 4,273 | 1,141,361 | |

TD SYNNEX Corp. | 13,303 | 1,585,318 | |

Teledyne Technologies, Inc.(a) | 8,200 | 3,459,252 | |

Trimble, Inc.(a) | 42,557 | 2,321,059 | |

Vontier Corp. | 27,151 | 1,065,134 | |

Zebra Technologies Corp., Class A(a)(b) | 8,938 | 3,138,936 | |

35,802,218 | |||

Energy Equipment & Services — 0.9% | |||

Baker Hughes Co., Class A | 174,448 | 6,754,627 | |

Halliburton Co. | 154,074 | 5,343,286 | |

NOV, Inc. | 68,802 | 1,432,458 | |

TechnipFMC PLC | 74,943 | 2,210,818 | |

Weatherford International PLC(a) | 12,739 | 1,501,419 | |

17,242,608 | |||

Entertainment — 1.3% | |||

Electronic Arts, Inc. | 46,738 | 7,054,634 | |

Live Nation Entertainment, Inc.(a) | 27,595 | 2,654,363 | |

Madison Square Garden Sports Corp., Class A(a) | 3,213 | 643,917 | |

Playtika Holding Corp. | 10,206 | 77,872 | |

ROBLOX Corp., Class A(a) | 89,295 | 3,707,528 | |

Roku, Inc., Class A(a) | 22,175 | 1,290,807 | |

Take-Two Interactive Software, Inc.(a) | 29,325 | 4,414,292 | |

TKO Group Holdings, Inc., Class A | 13,859 | 1,515,482 | |

Warner Bros Discovery, Inc., Class A(a)(b) | 424,208 | 3,669,399 | |

25,028,294 | |||

Financial Services — 1.8% | |||

Affirm Holdings, Inc., Class A(a)(b) | 40,636 | 1,149,592 | |

Block, Inc., Class A(a) | 97,086 | 6,007,682 | |

Corpay, Inc.(a) | 12,092 | 3,528,687 | |

Equitable Holdings, Inc. | 56,961 | 2,484,069 | |

Euronet Worldwide, Inc.(a) | 7,661 | 781,345 | |

Fidelity National Information Services, Inc. | 98,243 | 7,548,010 | |

Global Payments, Inc. | 44,485 | 4,521,455 | |

Jack Henry & Associates, Inc. | 12,835 | 2,200,946 | |

MGIC Investment Corp. | 46,612 | 1,157,842 | |

Rocket Cos., Inc., Class A(a) | 24,609 | 398,420 | |

Shift4 Payments, Inc., Class A(a)(b) | 10,712 | 736,879 | |

Toast, Inc., Class A(a) | 78,342 | 2,049,427 | |

UWM Holdings Corp., Class A | 16,771 | 140,876 | |

Voya Financial, Inc. | 17,862 | 1,299,103 | |

Western Union Co. | 44,858 | 533,362 | |

WEX, Inc.(a) | 7,359 | 1,350,009 | |

35,887,704 | |||

Food Products — 2.2% | |||

Archer-Daniels-Midland Co. | 86,178 | 5,343,898 | |

Bunge Global SA | 24,612 | 2,589,921 | |

Security | Shares | Value | |

Food Products (continued) | |||

Campbell Soup Co. | 33,749 | $ 1,581,478 | |

Conagra Brands, Inc. | 83,877 | 2,543,151 | |

Darling Ingredients, Inc.(a) | 27,703 | 1,100,640 | |

Flowers Foods, Inc. | 32,738 | 737,260 | |

Freshpet, Inc.(a) | 8,133 | 989,786 | |

General Mills, Inc. | 98,711 | 6,627,457 | |

Hershey Co. | 25,785 | 5,092,022 | |

Hormel Foods Corp. | 50,666 | 1,626,885 | |

Ingredion, Inc. | 11,512 | 1,431,747 | |

J.M. Smucker Co. | 18,160 | 2,141,972 | |

Kellanova | 45,816 | 2,664,200 | |

Lamb Weston Holdings, Inc. | 25,363 | 1,522,287 | |

McCormick & Co., Inc. | 44,022 | 3,390,134 | |

Pilgrim’s Pride Corp.(a) | 7,217 | 297,557 | |

Post Holdings, Inc.(a) | 8,702 | 951,651 | |

Seaboard Corp. | 45 | 146,156 | |

Tyson Foods, Inc., Class A | 49,155 | 2,993,539 | |

43,771,741 | |||

Gas Utilities — 0.3% | |||

Atmos Energy Corp. | 26,288 | 3,361,709 | |

National Fuel Gas Co. | 15,991 | 936,913 | |

UGI Corp. | 37,215 | 922,188 | |

5,220,810 | |||

Ground Transportation — 1.0% | |||

Avis Budget Group, Inc. | 2,942 | 297,171 | |

JB Hunt Transport Services, Inc. | 14,511 | 2,512,580 | |

Knight-Swift Transportation Holdings, Inc. | 27,217 | 1,481,421 | |

Landstar System, Inc. | 6,235 | 1,186,209 | |

Lyft, Inc., Class A(a) | 63,074 | 760,042 | |

Old Dominion Freight Line, Inc. | 34,331 | 7,215,690 | |

Ryder System, Inc. | 7,525 | 1,054,704 | |

Saia, Inc.(a) | 4,627 | 1,933,392 | |

Schneider National, Inc., Class B | 8,616 | 231,856 | |

U-Haul Holding Co.(a) | 1,346 | 89,899 | |

U-Haul Holding Co., Series N | 17,400 | 1,108,902 | |

XPO, Inc.(a) | 19,975 | 2,294,928 | |

20,166,794 | |||

Health Care Equipment & Supplies — 2.8% | |||

Align Technology, Inc.(a) | 13,096 | 3,036,700 | |

Baxter International, Inc. | 88,992 | 3,187,693 | |

Cooper Cos., Inc. | 34,108 | 3,183,300 | |

DENTSPLY SIRONA, Inc. | 35,918 | 974,815 | |

Dexcom, Inc.(a)(b) | 69,138 | 4,688,939 | |

Enovis Corp.(a)(b) | 9,265 | 441,385 | |

Envista Holdings Corp.(a) | 29,692 | 506,842 | |

GE HealthCare Technologies, Inc.(a)(b) | 74,516 | 6,306,289 | |

Globus Medical, Inc., Class A(a) | 19,805 | 1,425,168 | |

Hologic, Inc.(a) | 40,629 | 3,315,733 | |

IDEXX Laboratories, Inc.(a) | 14,408 | 6,859,937 | |

Inspire Medical Systems, Inc.(a) | 5,167 | 728,805 | |

Insulet Corp.(a) | 12,205 | 2,372,042 | |

Masimo Corp.(a) | 7,560 | 808,769 | |

Penumbra, Inc.(a) | 6,438 | 1,075,725 | |

QuidelOrtho Corp.(a) | 9,389 | 368,894 | |

ResMed, Inc. | 25,411 | 5,418,896 | |

Solventum Corp.(a) | 24,457 | 1,440,028 | |

STERIS PLC | 17,224 | 4,112,402 | |

Security | Shares | Value | |

Health Care Equipment & Supplies (continued) | |||

Teleflex, Inc. | 8,249 | $ 1,822,369 | |

Zimmer Biomet Holdings, Inc. | 35,731 | 3,978,647 | |

56,053,378 | |||

Health Care Providers & Services — 2.4% | |||

Acadia Healthcare Co., Inc.(a) | 16,001 | 1,037,665 | |

Amedisys, Inc.(a) | 5,643 | 553,296 | |

Cardinal Health, Inc. | 42,567 | 4,292,031 | |

Cencora, Inc. | 29,386 | 6,990,342 | |

Centene Corp.(a) | 93,236 | 7,171,713 | |

Chemed Corp. | 2,632 | 1,500,661 | |

DaVita, Inc.(a)(b) | 8,811 | 1,203,759 | |

Encompass Health Corp. | 17,292 | 1,607,119 | |

Henry Schein, Inc.(a)(b) | 22,322 | 1,605,845 | |

Humana, Inc. | 21,071 | 7,619,484 | |

Labcorp Holdings, Inc. | 14,689 | 3,164,598 | |

Molina Healthcare, Inc.(a) | 10,149 | 3,463,549 | |

Premier, Inc., Class A | 21,038 | 441,377 | |

Quest Diagnostics, Inc. | 19,398 | 2,760,335 | |

R1 RCM, Inc.(a) | 27,772 | 357,703 | |

Tenet Healthcare Corp.(a) | 16,941 | 2,536,068 | |

Universal Health Services, Inc., Class B | 10,113 | 2,161,755 | |

48,467,300 | |||

Health Care REITs — 0.5% | |||

Healthcare Realty Trust, Inc. | 66,431 | 1,175,164 | |

Healthpeak Properties, Inc. | 123,878 | 2,703,018 | |

Medical Properties Trust, Inc. | 103,371 | 497,214 | |

Omega Healthcare Investors, Inc. | 43,112 | 1,569,277 | |

Ventas, Inc. | 70,477 | 3,836,768 | |

9,781,441 | |||

Health Care Technology(a) — 0.3% | |||

Certara, Inc. | 21,635 | 337,722 | |

Doximity, Inc., Class A | 21,251 | 595,028 | |

Veeva Systems, Inc., Class A(b) | 25,778 | 4,947,572 | |

5,880,322 | |||

Hotel & Resort REITs — 0.1% | |||

Host Hotels & Resorts, Inc. | 121,791 | 2,132,560 | |

Park Hotels & Resorts, Inc. | 36,285 | 546,452 | |

2,679,012 | |||

Hotels, Restaurants & Leisure — 3.2% | |||

Aramark | 45,755 | 1,568,024 | |

Boyd Gaming Corp. | 12,050 | 733,483 | |

Caesars Entertainment, Inc.(a)(b) | 38,045 | 1,519,898 | |

Carnival Corp.(a) | 174,397 | 2,905,454 | |

Cava Group, Inc.(a) | 13,183 | 1,110,272 | |

Choice Hotels International, Inc.(b) | 4,974 | 633,936 | |

Churchill Downs, Inc. | 12,275 | 1,762,199 | |

Darden Restaurants, Inc. | 20,802 | 3,043,125 | |

Domino’s Pizza, Inc. | 6,076 | 2,604,781 | |

DraftKings, Inc., Class A(a) | 77,662 | 2,869,611 | |

Dutch Bros, Inc., Class A(a) | 16,223 | 620,530 | |

Expedia Group, Inc.(a) | 22,098 | 2,821,252 | |

Hilton Worldwide Holdings, Inc. | 42,942 | 9,218,359 | |

Hyatt Hotels Corp., Class A | 7,718 | 1,137,093 | |

Las Vegas Sands Corp. | 62,891 | 2,494,886 | |

Light & Wonder, Inc., Class A(a) | 15,853 | 1,699,442 | |

Marriott Vacations Worldwide Corp. | 6,067 | 513,147 | |

MGM Resorts International(a) | 42,995 | 1,847,495 | |

Norwegian Cruise Line Holdings Ltd.(a) | 75,237 | 1,386,618 | |

Security | Shares | Value | |

Hotels, Restaurants & Leisure (continued) | |||

Penn Entertainment, Inc.(a) | 26,834 | $ 535,875 | |

Planet Fitness, Inc., Class A(a) | 15,167 | 1,117,808 | |

Royal Caribbean Cruises Ltd.(a)(b) | 41,434 | 6,493,536 | |

Texas Roadhouse, Inc. | 11,651 | 2,034,381 | |

Travel and Leisure Co. | 11,861 | 546,673 | |

Vail Resorts, Inc. | 6,635 | 1,207,636 | |

Wendy’s Co. | 30,531 | 516,890 | |

Wingstop, Inc. | 5,127 | 1,916,883 | |

Wyndham Hotels & Resorts, Inc. | 13,635 | 1,032,442 | |

Wynn Resorts Ltd. | 17,986 | 1,489,601 | |

Yum! Brands, Inc. | 49,245 | 6,541,213 | |

63,922,543 | |||

Household Durables — 2.1% | |||

D.R. Horton, Inc. | 51,829 | 9,325,592 | |

Garmin Ltd. | 27,063 | 4,634,539 | |

Leggett & Platt, Inc. | 22,351 | 294,363 | |

Lennar Corp., Class A | 42,227 | 7,471,223 | |

Lennar Corp., Class B | 1,984 | 327,281 | |

Mohawk Industries, Inc.(a) | 9,251 | 1,490,058 | |

Newell Brands, Inc. | 71,588 | 614,941 | |

NVR, Inc.(a) | 520 | 4,475,889 | |

PulteGroup, Inc. | 36,554 | 4,825,128 | |

SharkNinja, Inc. | 11,656 | 895,764 | |

Tempur Sealy International, Inc. | 29,635 | 1,551,392 | |

Toll Brothers, Inc. | 18,125 | 2,586,619 | |

TopBuild Corp.(a) | 5,549 | 2,655,418 | |

Whirlpool Corp. | 9,245 | 942,713 | |

42,090,920 | |||

Household Products — 0.4% | |||

Church & Dwight Co., Inc. | 42,638 | 4,178,951 | |

Clorox Co. | 21,695 | 2,862,221 | |

Reynolds Consumer Products, Inc. | 9,241 | 257,085 | |

Spectrum Brands Holdings, Inc. | 5,048 | 427,111 | |

7,725,368 | |||

Independent Power and Renewable Electricity Producers — 0.4% | |||

AES Corp. | 124,935 | 2,222,594 | |

Brookfield Renewable Corp., Class A | 23,194 | 651,751 | |

Clearway Energy, Inc., Class A | 6,473 | 159,430 | |

Clearway Energy, Inc., Class C | 13,950 | 372,186 | |

Vistra Corp. | 60,209 | 4,769,757 | |

8,175,718 | |||

Industrial REITs — 0.4% | |||

Americold Realty Trust, Inc. | 50,342 | 1,504,722 | |

EastGroup Properties, Inc. | 8,327 | 1,557,066 | |

First Industrial Realty Trust, Inc. | 23,075 | 1,262,664 | |

Rexford Industrial Realty, Inc. | 37,715 | 1,889,899 | |

STAG Industrial, Inc. | 31,618 | 1,290,330 | |

7,504,681 | |||

Insurance — 5.2% | |||

Aflac, Inc. | 99,966 | 9,534,757 | |

Allstate Corp. | 45,911 | 7,856,290 | |

American Financial Group, Inc. | 12,541 | 1,642,369 | |

Arch Capital Group Ltd.(a) | 63,047 | 6,038,642 | |

Arthur J Gallagher & Co. | 37,724 | 10,694,377 | |

Assurant, Inc. | 9,173 | 1,604,083 | |

Assured Guaranty Ltd. | 9,261 | 762,829 | |

Axis Capital Holdings Ltd. | 13,566 | 1,027,624 | |

Brighthouse Financial, Inc.(a) | 10,788 | 537,998 | |

Brown & Brown, Inc. | 41,737 | 4,149,910 | |

Security | Shares | Value | |

Insurance (continued) | |||

Cincinnati Financial Corp. | 26,755 | $ 3,494,738 | |

CNA Financial Corp. | 3,835 | 188,529 | |

Everest Group Ltd. | 7,520 | 2,954,382 | |

Fidelity National Financial, Inc., Class A | 43,466 | 2,408,451 | |

First American Financial Corp. | 17,743 | 1,074,871 | |

Globe Life, Inc. | 16,205 | 1,502,852 | |

Hanover Insurance Group, Inc. | 6,371 | 875,949 | |

Hartford Financial Services Group, Inc. | 51,883 | 5,754,862 | |

Kemper Corp. | 10,886 | 697,357 | |

Kinsale Capital Group, Inc. | 3,884 | 1,775,260 | |

Lincoln National Corp. | 27,746 | 923,942 | |

Loews Corp. | 31,658 | 2,531,057 | |

Markel Group, Inc.(a) | 2,244 | 3,677,579 | |

Old Republic International Corp. | 44,018 | 1,523,903 | |

Primerica, Inc. | 6,038 | 1,520,187 | |

Principal Financial Group, Inc. | 40,770 | 3,323,163 | |

Prudential Financial, Inc. | 62,823 | 7,872,978 | |

Reinsurance Group of America, Inc. | 11,478 | 2,587,486 | |

RenaissanceRe Holdings Ltd. | 9,060 | 2,101,105 | |

RLI Corp. | 7,411 | 1,116,022 | |

Ryan Specialty Holdings, Inc., Class A | 18,321 | 1,128,390 | |

Unum Group | 27,656 | 1,591,050 | |

W.R. Berkley Corp. | 55,416 | 3,055,084 | |

White Mountains Insurance Group Ltd. | 432 | 771,552 | |

Willis Towers Watson PLC | 17,864 | 5,042,650 | |

103,342,278 | |||

Interactive Media & Services(a) — 0.4% | |||

IAC, Inc. | 12,877 | 680,034 | |

Match Group, Inc. | 46,721 | 1,781,939 | |

Pinterest, Inc., Class A | 103,482 | 3,306,250 | |

TripAdvisor, Inc. | 18,985 | 334,706 | |

Trump Media & Technology Group Corp.(b) | 10,325 | 296,741 | |

ZoomInfo Technologies, Inc., Class A | 55,504 | 630,525 | |

7,030,195 | |||

IT Services — 2.0% | |||

Akamai Technologies, Inc.(a) | 26,308 | 2,585,550 | |

Amdocs Ltd. | 20,157 | 1,763,133 | |

Cloudflare, Inc., Class A(a) | 52,407 | 4,061,542 | |

Cognizant Technology Solutions Corp., Class A | 86,991 | 6,583,479 | |

DXC Technology Co.(a) | 32,061 | 652,121 | |

EPAM Systems, Inc.(a) | 9,793 | 2,106,768 | |

Gartner, Inc.(a) | 13,172 | 6,601,675 | |

Globant SA(a)(b) | 7,399 | 1,440,659 | |

GoDaddy, Inc., Class A(a) | 24,708 | 3,593,779 | |

Kyndryl Holdings, Inc.(a) | 39,725 | 1,067,411 | |

MongoDB, Inc., Class A(a) | 11,903 | 3,003,841 | |

Okta, Inc., Class A(a) | 27,007 | 2,537,038 | |

Twilio, Inc., Class A(a) | 30,755 | 1,818,543 | |

VeriSign, Inc.(a) | 15,157 | 2,834,510 | |

40,650,049 | |||

Leisure Products — 0.3% | |||

Brunswick Corp. | 11,752 | 957,200 | |

Hasbro, Inc. | 24,452 | 1,576,176 | |

Mattel, Inc.(a) | 59,862 | 1,154,738 | |

Polaris, Inc. | 9,064 | 754,850 | |

YETI Holdings, Inc.(a) | 15,015 | 620,870 | |

5,063,834 | |||

Life Sciences Tools & Services — 2.5% | |||

10X Genomics, Inc., Class A(a) | 18,238 | 376,979 | |

Agilent Technologies, Inc. | 51,192 | 7,238,549 | |

Security | Shares | Value | |

Life Sciences Tools & Services (continued) | |||

Avantor, Inc.(a) | 118,523 | $ 3,170,490 | |

Azenta, Inc.(a) | 9,577 | 596,551 | |

Bio-Rad Laboratories, Inc., Class A(a)(b) | 3,378 | 1,142,980 | |

Bio-Techne Corp. | 27,142 | 2,214,516 | |

Bruker Corp.(b) | 18,321 | 1,255,172 | |

Charles River Laboratories International, Inc.(a)(b) | 8,925 | 2,178,593 | |

Fortrea Holdings, Inc.(a) | 14,851 | 409,739 | |

Illumina, Inc.(a) | 27,839 | 3,413,061 | |

IQVIA Holdings, Inc.(a) | 31,501 | 7,756,491 | |

Medpace Holdings, Inc.(a) | 4,487 | 1,716,367 | |

Mettler-Toledo International, Inc.(a) | 3,688 | 5,609,559 | |

QIAGEN NV | 39,099 | 1,739,515 | |

Repligen Corp.(a)(b) | 9,776 | 1,636,014 | |

Revvity, Inc. | 21,499 | 2,700,489 | |

Sotera Health Co.(a) | 22,467 | 311,617 | |

Waters Corp.(a)(b) | 10,300 | 3,463,684 | |

West Pharmaceutical Services, Inc. | 12,687 | 3,884,379 | |

50,814,745 | |||

Machinery — 3.8% | |||

AGCO Corp. | 10,843 | 1,023,796 | |

Allison Transmission Holdings, Inc. | 15,272 | 1,352,946 | |

CNH Industrial NV | 152,544 | 1,624,594 | |

Crane Co. | 8,544 | 1,370,629 | |

Cummins, Inc. | 23,879 | 6,967,892 | |

Donaldson Co., Inc. | 20,981 | 1,569,798 | |

Dover Corp. | 23,965 | 4,415,791 | |

Esab Corp. | 9,880 | 1,003,808 | |

Flowserve Corp. | 22,944 | 1,159,819 | |

Fortive Corp. | 61,496 | 4,418,488 | |

Gates Industrial Corp. PLC(a) | 36,355 | 675,839 | |

Graco, Inc. | 29,299 | 2,491,880 | |

IDEX Corp. | 13,232 | 2,758,607 | |

Ingersoll Rand, Inc. | 70,534 | 7,081,614 | |

ITT, Inc. | 14,389 | 2,035,468 | |

Lincoln Electric Holdings, Inc. | 9,644 | 1,980,974 | |

Middleby Corp.(a) | 9,267 | 1,256,420 | |

Nordson Corp. | 9,909 | 2,480,520 | |

Oshkosh Corp. | 11,555 | 1,255,451 | |

Otis Worldwide Corp. | 70,608 | 6,672,456 | |

Pentair PLC | 28,850 | 2,535,050 | |

RBC Bearings, Inc.(a)(b) | 4,966 | 1,444,311 | |

Snap-on, Inc. | 9,027 | 2,591,020 | |

Stanley Black & Decker, Inc. | 26,836 | 2,834,418 | |

Timken Co. | 11,213 | 974,970 | |

Toro Co. | 18,246 | 1,746,690 | |

Westinghouse Air Brake Technologies Corp. | 30,572 | 4,926,678 | |

Xylem, Inc./New York | 42,232 | 5,637,972 | |

76,287,899 | |||

Marine Transportation — 0.1% | |||

Kirby Corp.(a) | 10,285 | 1,263,821 | |

Media — 1.7% | |||

Charter Communications, Inc., Class A(a) | 16,399 | 6,227,028 | |

Fox Corp., Class A | 42,068 | 1,600,267 | |

Fox Corp., Class B | 23,300 | 825,519 | |

Interpublic Group of Cos., Inc. | 65,832 | 2,117,815 | |

Liberty Broadband Corp., Class A(a) | 2,963 | 196,210 | |

Liberty Broadband Corp., Class C(a) | 19,394 | 1,306,962 | |

Liberty Media Corp.-Liberty Formula One, Class C(a) | 34,474 | 2,787,912 | |

Liberty Media Corp.-Liberty Formula One, Class A(a) | 4,208 | 311,266 | |

Liberty Media Corp.-Liberty Live, Class A(a) | 3,676 | 138,843 | |

Security | Shares | Value | |

Media (continued) | |||

Liberty Media Corp.-Liberty Live, Class C(a) | 8,081 | $ 315,321 | |

Liberty Media Corp.-Liberty SiriusXM(a) | 26,591 | 598,563 | |

Liberty Media Corp.-Liberty SiriusXM, Class A(a)(b) | 12,571 | 284,356 | |

New York Times Co., Class A | 28,240 | 1,513,382 | |

News Corp., Class A | 66,593 | 1,836,635 | |

News Corp., Class B | 19,860 | 565,811 | |

Nexstar Media Group, Inc., Class A | 5,444 | 1,005,997 | |

Omnicom Group, Inc. | 33,829 | 3,316,595 | |

Paramount Global, Class A | 1,521 | 34,831 | |

Paramount Global, Class B | 103,400 | 1,180,828 | |

Sirius XM Holdings, Inc.(b) | 109,521 | 377,847 | |

Trade Desk, Inc., Class A(a) | 77,246 | 6,942,870 | |

33,484,858 | |||

Metals & Mining — 1.1% | |||

Alcoa Corp. | 43,984 | 1,453,231 | |

ATI, Inc.(a) | 21,850 | 1,479,464 | |

Cleveland-Cliffs, Inc.(a) | 83,132 | 1,276,076 | |

MP Materials Corp., Class A(a)(b) | 22,837 | 308,756 | |

Nucor Corp. | 41,894 | 6,826,208 | |

Reliance, Inc. | 9,978 | 3,038,900 | |

Royal Gold, Inc. | 11,380 | 1,571,806 | |

Steel Dynamics, Inc. | 25,972 | 3,459,990 | |

U.S. Steel Corp. | 39,323 | 1,615,782 | |

21,030,213 | |||

Mortgage Real Estate Investment Trusts (REITs) — 0.3% | |||

AGNC Investment Corp. | 120,618 | 1,207,386 | |

Annaly Capital Management, Inc. | 88,213 | 1,756,321 | |

Rithm Capital Corp. | 86,558 | 1,004,938 | |

Starwood Property Trust, Inc. | 51,786 | 1,033,131 | |

5,001,776 | |||

Multi-Utilities — 1.7% | |||

Ameren Corp. | 46,499 | 3,685,976 | |

CenterPoint Energy, Inc. | 110,705 | 3,072,064 | |

CMS Energy Corp. | 52,012 | 3,370,378 | |

Consolidated Edison, Inc. | 60,529 | 5,902,788 | |

DTE Energy Co. | 36,130 | 4,354,749 | |

NiSource, Inc. | 78,373 | 2,449,156 | |

Public Service Enterprise Group, Inc. | 87,155 | 6,952,354 | |

WEC Energy Group, Inc. | 55,276 | 4,757,052 | |

34,544,517 | |||

Office REITs — 0.4% | |||

Alexandria Real Estate Equities, Inc. | 30,271 | 3,550,486 | |

Boston Properties, Inc. | 27,441 | 1,956,818 | |

Cousins Properties, Inc. | 26,467 | 728,107 | |

Highwoods Properties, Inc. | 18,222 | 564,335 | |

Kilroy Realty Corp. | 20,420 | 754,927 | |

Vornado Realty Trust | 30,622 | 918,354 | |

8,473,027 | |||

Oil, Gas & Consumable Fuels — 4.5% | |||

Antero Midstream Corp. | 59,158 | 849,509 | |

Antero Resources Corp.(a) | 50,687 | 1,470,937 | |

APA Corp. | 63,230 | 1,972,144 | |

Cheniere Energy, Inc. | 40,138 | 7,330,804 | |

Chesapeake Energy Corp. | 22,935 | 1,750,629 | |

Chord Energy Corp. | 10,797 | 1,853,413 | |

Civitas Resources, Inc. | 17,734 | 1,237,124 | |

Coterra Energy, Inc. | 129,649 | 3,344,944 | |

Devon Energy Corp. | 109,979 | 5,172,312 | |

Diamondback Energy, Inc. | 31,078 | 6,287,390 | |

DT Midstream, Inc.(a) | 17,217 | 1,297,473 | |

Security | Shares | Value | |

Oil, Gas & Consumable Fuels (continued) | |||

EQT Corp. | 102,981 | $ 3,553,874 | |

Hess Corp. | 48,827 | 7,491,038 | |

HF Sinclair Corp. | 28,308 | 1,457,013 | |

Kinder Morgan, Inc. | 338,828 | 7,159,436 | |

Marathon Oil Corp. | 99,820 | 2,799,951 | |

Matador Resources Co. | 20,705 | 1,272,943 | |

New Fortress Energy, Inc., Class A | 10,999 | 217,120 | |

ONEOK, Inc. | 101,987 | 8,498,577 | |

Ovintiv, Inc. | 46,868 | 2,176,550 | |

Permian Resources Corp., Class A | 109,728 | 1,683,228 | |

Range Resources Corp. | 41,813 | 1,305,820 | |

Southwestern Energy Co.(a) | 192,155 | 1,239,400 | |

Targa Resources Corp. | 38,403 | 5,195,158 | |

Texas Pacific Land Corp. | 3,282 | 2,772,962 | |

Viper Energy, Inc., Class A | 15,669 | 668,596 | |

Williams Cos., Inc. | 212,712 | 9,133,853 | |

89,192,198 | |||

Paper & Forest Products — 0.1% | |||

Louisiana-Pacific Corp. | 11,256 | 1,104,889 | |

Passenger Airlines — 0.6% | |||

Alaska Air Group, Inc.(a) | 21,783 | 817,516 | |

American Airlines Group, Inc.(a)(b) | 114,376 | 1,216,961 | |

Delta Air Lines, Inc. | 112,580 | 4,843,192 | |

Southwest Airlines Co. | 104,407 | 2,812,724 | |

United Airlines Holdings, Inc.(a) | 57,209 | 2,598,433 | |

12,288,826 | |||

Personal Care Products — 0.5% | |||

BellRing Brands, Inc.(a) | 22,920 | 1,175,338 | |

Coty, Inc., Class A(a) | 68,782 | 684,381 | |

elf Beauty, Inc.(a) | 9,320 | 1,608,446 | |

Kenvue, Inc. | 334,695 | 6,188,510 | |

9,656,675 | |||

Pharmaceuticals — 0.6% | |||

Catalent, Inc.(a) | 31,625 | 1,876,628 | |

Elanco Animal Health, Inc.(a) | 86,421 | 1,126,930 | |

Intra-Cellular Therapies, Inc.(a) | 18,136 | 1,427,666 | |

Jazz Pharmaceuticals PLC(a) | 10,657 | 1,174,934 | |

Organon & Co. | 44,953 | 982,673 | |

Perrigo Co. PLC | 23,527 | 665,108 | |

Royalty Pharma PLC, Class A | 69,102 | 1,946,603 | |

Viatris, Inc. | 207,401 | 2,501,256 | |

11,701,798 | |||

Professional Services — 2.4% | |||

Booz Allen Hamilton Holding Corp., Class A | 22,376 | 3,206,705 | |

Broadridge Financial Solutions, Inc. | 20,464 | 4,379,296 | |

CACI International, Inc., Class A(a) | 3,886 | 1,793,311 | |

Clarivate PLC(a)(b) | 71,512 | 481,991 | |

Concentrix Corp. | 8,347 | 588,463 | |

Dayforce, Inc.(a)(b) | 26,176 | 1,551,713 | |

Dun & Bradstreet Holdings, Inc. | 51,767 | 563,225 | |

Equifax, Inc. | 21,469 | 5,997,795 | |

FTI Consulting, Inc.(a) | 6,169 | 1,344,657 | |

Genpact Ltd. | 30,953 | 1,073,140 | |

Jacobs Solutions, Inc. | 21,785 | 3,188,235 | |

KBR, Inc. | 23,487 | 1,563,999 | |

Leidos Holdings, Inc. | 23,559 | 3,401,920 | |

ManpowerGroup, Inc. | 8,408 | 643,885 | |

Parsons Corp.(a) | 7,916 | 723,285 | |

Paychex, Inc. | 56,208 | 7,195,748 | |

Security | Shares | Value | |

Professional Services (continued) | |||

Paycom Software, Inc. | 8,898 | $ 1,484,097 | |

Paycor HCM, Inc.(a) | 12,765 | 158,414 | |

Paylocity Holding Corp.(a) | 7,660 | 1,149,536 | |

Robert Half, Inc. | 17,749 | 1,139,308 | |

Science Applications International Corp. | 8,928 | 1,110,643 | |

SS&C Technologies Holdings, Inc. | 37,498 | 2,735,479 | |

TransUnion | 33,910 | 3,060,717 | |

48,535,562 | |||

Real Estate Management & Development(a) — 0.8% | |||

CBRE Group, Inc., Class A | 53,460 | 6,025,476 | |

CoStar Group, Inc. | 70,935 | 5,534,349 | |

Howard Hughes Holdings, Inc.(b) | 5,458 | 404,820 | |

Jones Lang LaSalle, Inc. | 8,348 | 2,094,513 | |

Zillow Group, Inc., Class A | 8,217 | 389,486 | |

Zillow Group, Inc., Class C | 26,991 | 1,314,462 | |

15,763,106 | |||

Residential REITs — 1.5% | |||

American Homes 4 Rent, Class A | 58,996 | 2,129,165 | |

AvalonBay Communities, Inc. | 24,791 | 5,080,172 | |

Camden Property Trust | 18,225 | 2,018,419 | |

Equity LifeStyle Properties, Inc. | 32,199 | 2,211,427 | |

Equity Residential | 66,011 | 4,596,346 | |

Essex Property Trust, Inc. | 11,156 | 3,105,384 | |

Invitation Homes, Inc. | 106,944 | 3,771,915 | |

Mid-America Apartment Communities, Inc. | 20,292 | 2,836,213 | |

Sun Communities, Inc. | 21,553 | 2,731,412 | |

UDR, Inc. | 57,364 | 2,298,575 | |

30,779,028 | |||

Retail REITs — 1.4% | |||

Agree Realty Corp. | 17,160 | 1,183,525 | |

Brixmor Property Group, Inc. | 52,357 | 1,333,533 | |

Federal Realty Investment Trust | 14,401 | 1,607,872 | |

Kimco Realty Corp. | 115,112 | 2,501,384 | |

NNN REIT, Inc. | 31,670 | 1,421,666 | |

Realty Income Corp. | 150,634 | 8,650,910 | |

Regency Centers Corp. | 32,120 | 2,162,961 | |

Simon Property Group, Inc. | 56,545 | 8,676,265 | |

27,538,116 | |||

Semiconductors & Semiconductor Equipment — 2.5% | |||

Allegro MicroSystems, Inc.(a) | 12,912 | 310,404 | |

Amkor Technology, Inc. | 19,684 | 642,879 | |

Astera Labs, Inc.(a)(b) | 3,907 | 171,283 | |

Cirrus Logic, Inc.(a) | 9,415 | 1,228,469 | |

Enphase Energy, Inc.(a) | 23,026 | 2,650,523 | |

Entegris, Inc. | 26,313 | 3,112,565 | |

First Solar, Inc.(a) | 18,633 | 4,024,542 | |

GLOBALFOUNDRIES, Inc.(a)(b) | 17,204 | 877,576 | |

Lattice Semiconductor Corp.(a) | 23,984 | 1,271,152 | |

MACOM Technology Solutions Holdings, Inc., Class H(a) | 9,806 | 989,622 | |

Microchip Technology, Inc. | 92,677 | 8,227,864 | |

MKS Instruments, Inc. | 11,800 | 1,485,620 | |

Monolithic Power Systems, Inc. | 8,208 | 7,084,243 | |

ON Semiconductor Corp.(a) | 75,030 | 5,871,097 | |

Onto Innovation, Inc.(a) | 8,557 | 1,636,954 | |

Qorvo, Inc.(a) | 16,984 | 2,034,683 | |

Skyworks Solutions, Inc. | 28,068 | 3,189,086 | |

Teradyne, Inc. | 26,745 | 3,507,874 | |

Security | Shares | Value | |

Semiconductors & Semiconductor Equipment (continued) | |||

Universal Display Corp. | 8,185 | $ 1,822,145 | |

Wolfspeed, Inc.(a) | 22,234 | 419,111 | |

50,557,692 | |||

Software — 4.3% | |||

ANSYS, Inc.(a) | 15,247 | 4,781,917 | |

Appfolio, Inc., Class A(a) | 3,865 | 856,020 | |

AppLovin Corp., Class A(a) | 45,837 | 3,534,033 | |

Aspen Technology, Inc.(a) | 4,740 | 890,883 | |

Bentley Systems, Inc., Class B | 24,447 | 1,191,547 | |

Bill Holdings, Inc.(a) | 17,938 | 896,183 | |

CCC Intelligent Solutions Holdings, Inc.(a) | 73,701 | 756,172 | |

Confluent, Inc., Class A(a)(b) | 42,238 | 1,056,795 | |

Datadog, Inc., Class A(a) | 52,243 | 6,083,175 | |

DocuSign, Inc.(a) | 35,503 | 1,969,706 | |

Dolby Laboratories, Inc., Class A | 10,128 | 797,681 | |

DoubleVerify Holdings, Inc.(a) | 25,748 | 543,798 | |

Dropbox, Inc., Class A(a) | 43,447 | 1,039,252 | |

Dynatrace, Inc.(a) | 45,870 | 2,014,610 | |

Elastic NV(a) | 14,353 | 1,574,094 | |

Fair Isaac Corp.(a) | 4,200 | 6,720,000 | |

Five9, Inc.(a) | 13,019 | 579,996 | |

Gen Digital, Inc. | 98,349 | 2,556,091 | |

Gitlab, Inc., Class A(a) | 20,765 | 1,063,791 | |

Guidewire Software, Inc.(a)(b) | 14,302 | 2,146,301 | |

HashiCorp, Inc., Class A(a) | 16,659 | 562,241 | |

HubSpot, Inc.(a) | 8,540 | 4,244,636 | |

Informatica, Inc., Class A(a)(b) | 11,466 | 274,496 | |

Manhattan Associates, Inc.(a) | 10,703 | 2,733,332 | |

MicroStrategy, Inc., Class A(a)(b) | 2,737 | 4,418,722 | |

nCino, Inc.(a) | 14,182 | 464,602 | |

Nutanix, Inc., Class A(a) | 42,436 | 2,143,442 | |

Palantir Technologies, Inc., Class A(a) | 351,650 | 9,455,869 | |

Pegasystems, Inc. | 7,963 | 555,180 | |

Procore Technologies, Inc.(a)(b) | 18,515 | 1,315,121 | |

PTC, Inc.(a) | 20,688 | 3,679,361 | |

RingCentral, Inc., Class A(a) | 14,542 | 509,697 | |

SentinelOne, Inc., Class A(a) | 40,389 | 924,908 | |

Smartsheet, Inc., Class A(a) | 22,205 | 1,064,952 | |

Teradata Corp.(a) | 16,966 | 550,038 | |

Tyler Technologies, Inc.(a) | 7,409 | 4,209,127 | |

UiPath, Inc., Class A(a) | 67,825 | 825,430 | |

Unity Software, Inc.(a) | 51,764 | 846,859 | |

Zoom Video Communications, Inc., Class A(a) | 43,555 | 2,630,722 | |

Zscaler, Inc.(a)(b) | 15,998 | 2,869,241 | |

85,330,021 | |||

Specialized REITs — 2.5% | |||

Crown Castle, Inc. | 75,983 | 8,364,209 | |

CubeSmart | 39,435 | 1,876,317 | |

Digital Realty Trust, Inc. | 56,444 | 8,437,813 | |

EPR Properties | 13,299 | 598,455 | |

Extra Space Storage, Inc. | 36,551 | 5,834,271 | |

Gaming & Leisure Properties, Inc. | 45,513 | 2,284,753 | |

Iron Mountain, Inc. | 50,470 | 5,176,203 | |

Lamar Advertising Co., Class A | 15,215 | 1,823,670 | |

National Storage Affiliates Trust | 12,776 | 543,874 | |

Rayonier, Inc. | 26,046 | 789,975 | |

SBA Communications Corp. | 18,753 | 4,117,034 | |

Security | Shares | Value | |

Specialized REITs (continued) | |||

VICI Properties, Inc. | 182,198 | $ 5,695,509 | |

Weyerhaeuser Co. | 127,393 | 4,046,002 | |

49,588,085 | |||

Specialty Retail — 2.3% | |||

Advance Auto Parts, Inc. | 10,324 | 653,819 | |

AutoNation, Inc.(a) | 4,502 | 858,621 | |

Bath & Body Works, Inc. | 39,775 | 1,461,731 | |

Best Buy Co., Inc. | 37,669 | 3,259,122 | |

Burlington Stores, Inc.(a) | 11,081 | 2,884,606 | |

CarMax, Inc.(a) | 27,471 | 2,319,651 | |

Carvana Co., Class A(a) | 18,426 | 2,454,896 | |

Dick’s Sporting Goods, Inc. | 9,945 | 2,151,601 | |

Five Below, Inc.(a) | 9,504 | 691,321 | |

Floor & Decor Holdings, Inc., Class A(a)(b) | 18,329 | 1,796,242 | |

GameStop Corp., Class A(a) | 47,027 | 1,066,102 | |

Gap, Inc. | 35,007 | 821,964 | |

Lithia Motors, Inc., Class A | 4,734 | 1,308,146 | |

Murphy USA, Inc. | 3,290 | 1,661,187 | |

Penske Automotive Group, Inc. | 3,216 | 559,938 | |

RH(a) | 2,608 | 756,529 | |

Ross Stores, Inc. | 57,502 | 8,236,012 | |

Tractor Supply Co. | 18,851 | 4,963,845 | |

Ulta Beauty, Inc.(a) | 8,362 | 3,051,210 | |

Valvoline, Inc.(a) | 22,453 | 1,044,065 | |

Wayfair, Inc., Class A(a) | 16,122 | 877,520 | |

Williams-Sonoma, Inc. | 22,240 | 3,440,083 | |

46,318,211 | |||

Technology Hardware, Storage & Peripherals — 1.4% | |||

Hewlett Packard Enterprise Co. | 226,765 | 4,514,891 | |

HP, Inc. | 170,934 | 6,169,008 | |

NetApp, Inc. | 36,008 | 4,572,296 | |

Pure Storage, Inc., Class A(a) | 50,675 | 3,036,953 | |

Super Micro Computer, Inc.(a)(b) | 8,659 | 6,075,587 | |

Western Digital Corp.(a) | 57,021 | 3,823,258 | |

28,191,993 | |||

Textiles, Apparel & Luxury Goods — 0.7% | |||

Amer Sports, Inc.(a) | 20,041 | 232,676 | |

Birkenstock Holding PLC(a) | 7,010 | 414,361 | |

Capri Holdings Ltd.(a) | 19,824 | 664,897 | |

Carter’s, Inc. | 6,166 | 373,351 | |

Columbia Sportswear Co. | 5,711 | 466,589 | |

Crocs, Inc.(a) | 10,391 | 1,396,239 | |

Deckers Outdoor Corp.(a) | 4,463 | 4,117,698 | |

PVH Corp. | 9,951 | 1,014,903 | |

Ralph Lauren Corp., Class A | 6,827 | 1,198,753 | |

Skechers USA, Inc., Class A(a) | 23,703 | 1,543,776 | |

Tapestry, Inc. | 40,392 | 1,619,315 | |

Under Armour, Inc., Class A(a) | 32,202 | 224,448 | |

Under Armour, Inc., Class C(a) | 34,442 | 233,861 | |

VF Corp. | 61,351 | 1,040,513 | |

14,541,380 | |||

Trading Companies & Distributors — 2.0% | |||

Air Lease Corp., Class A | 18,169 | 901,546 | |

Core & Main, Inc., Class A(a) | 28,989 | 1,550,042 | |

Fastenal Co. | 100,044 | 7,078,113 | |

Ferguson PLC | 35,357 | 7,872,236 | |

MSC Industrial Direct Co., Inc., Class A | 8,116 | 721,918 | |

SiteOne Landscape Supply, Inc.(a)(b) | 7,791 | 1,142,784 | |

United Rentals, Inc. | 11,612 | 8,791,445 | |

Security | Shares | Value | |

Trading Companies & Distributors (continued) | |||

Watsco, Inc. | 6,043 | $ 2,957,988 | |

WESCO International, Inc. | 7,738 | 1,353,763 | |

WW Grainger, Inc. | 7,606 | 7,429,617 | |

39,799,452 | |||

Water Utilities — 0.3% | |||

American Water Works Co., Inc. | 34,087 | 4,852,626 | |

Essential Utilities, Inc. | 43,882 | 1,783,803 | |

6,636,429 | |||

Total Common Stocks — 98.9% (Cost: $1,340,447,634) | 1,973,572,765 | ||

Investment Companies | |||

Equity Funds — 0.9% | |||

iShares Russell Mid-Cap ETF(d) | 208,356 | 17,697,759 | |

Total Investment Companies — 0.9% (Cost: $17,056,534) | 17,697,759 | ||

Total Long-Term Investments — 99.8% (Cost: $1,357,504,168) | 1,991,270,524 | ||

Short-Term Securities | |||

Money Market Funds — 3.6% | |||

BlackRock Cash Funds: Institutional, SL Agency Shares, 5.45%(d)(e)(f) | 65,439,936 | 65,466,112 | |

BlackRock Cash Funds: Treasury, SL Agency Shares, 5.29%(d)(e) | 6,620,555 | 6,620,555 | |

Total Short-Term Securities — 3.6% (Cost: $72,082,542) | 72,086,667 | ||

Total Investments — 103.4% (Cost: $1,429,586,710) | 2,063,357,191 | ||

Liabilities in Excess of Other Assets — (3.4)% | (67,025,237 ) | ||

Net Assets — 100.0% | $ 1,996,331,954 | ||

(a) | Non-income producing security. |

(b) | All or a portion of this security is on loan. |

(c) | Security is valued using significant unobservable inputs and is classified as Level 3 in the fair value hierarchy. |

(d) | Affiliate of the Fund. |

(e) | Annualized 7-day yield as of period end. |

(f) | All or a portion of this security was purchased with the cash collateral from loaned securities. |

Affiliated Issuer | Value at 07/31/23 | Purchases at Cost | Proceeds from Sales | Net Realized Gain (Loss) | Change in Unrealized Appreciation (Depreciation) | Value at 07/31/24 | Shares Held at 07/31/24 | Income | Capital Gain Distributions from Underlying Funds |

BlackRock Cash Funds: Institutional, SL Agency Shares | $ 43,582,836 | $ 21,873,727 (a) | $ — | $ 5,733 | $ 3,816 | $ 65,466,112 | 65,439,936 | $ 393,324 (b) | $ — |

BlackRock Cash Funds: Treasury, SL Agency Shares | 11,395,519 | — | (4,774,964 )(a) | — | — | 6,620,555 | 6,620,555 | 760,434 | — |

iShares Russell Mid-Cap ETF | 21,270,589 | 174,046,586 | (178,873,227 ) | 1,967,300 | (713,489 ) | 17,697,759 | 208,356 | 202,864 | — |

$ 1,973,033 | $ (709,673 ) | $ 89,784,426 | $ 1,356,622 | $ — |

(a) | Represents net amount purchased (sold). |

(b) | All or a portion represents securities lending income earned from the reinvestment of cash collateral from loaned securities, net of fees and collateral investment expenses, and other payments to and from borrowers of securities. |

Description | Number of Contracts | Expiration Date | Notional Amount (000) | Value/ Unrealized Appreciation (Depreciation) |

Long Contracts | ||||

S&P 500 E-Mini Index | 6 | 09/20/24 | $ 1,667 | $ (38,995 ) |

S&P Mid 400 E-Mini Index | 17 | 09/20/24 | 5,304 | 290,225 |

$ 251,230 |

Commodity Contracts | Credit Contracts | Equity Contracts | Foreign Currency Exchange Contracts | Interest Rate Contracts | Other Contracts | Total | |

Assets — Derivative Financial Instruments | |||||||

Futures contracts Unrealized appreciation on futures contracts(a) | $ — | $ — | $ 290,225 | $ — | $ — | $ — | $ 290,225 |

Liabilities — Derivative Financial Instruments | |||||||

Futures contracts Unrealized depreciation on futures contracts(a) | $ — | $ — | $ 38,995 | $ — | $ — | $ — | $ 38,995 |