FISCHER-WATT GOLD COMPANY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

October 31, 2008

(UNAUDITED)

(1) Basis of Presentation

The accompanying unaudited financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America ("GAAP") for interim financial information and in accordance with the rules and regulations of the Securities and Exchange Commission (“SEC”) pursuant to Item 210 of Regulation S-X. They do not include all of the information and footnotes required by GAAP for complete financial statements. In the opinion of management, all adjustments (consisting only of normal recurring adjustments) considered necessary for a fair presentation have been included. The results of operations for the periods presented are not necessarily indicative of the results to be expected for the full year. For further information, refer to the financial statements and notes thereto included in the Company’s Annual Report on Form 10-KSB for the year ended January 31, 2008.

The accompanying consolidated financial statements include the accounts of the Company and its subsidiary. Intercompany transactions and balances have been eliminated in consolidation.

(2) Restatement

The January 31, 2008 balance sheet and the related statements of operations and cash flows for the nine months ended October 31, 2007 have been restated to reflect the correction of an error in the amount of $360,000. This amount represents the fair market value of options granted to The Astra Ventures Inc. (see Note 3). The result of this correction was an increase in the accumulated deficit of $360,000 at January 31, 2007, and a reduction of net income in the amount of $360,000 for the nine months ended October 31, 2007. There was no effect on previously reported net income per share.

(3) Mineral Properties

Since 1996, the Company has held a 65% interest in Minera Montoro S.A. de C.V. (“Montoro”) which in turn has a 100% interest in mining concessions located in the state of Michoacan, Mexico, designated as the La Balsaproperty. Mr. Jorge E. Ordonez and his associates ("Ordonez") own the remaining 35% of Montoro. During the fiscal year ended January 31, 2006, the Company executed a binding letter of agreement to sell its 65% interest in Montoro to Nexvu Capital Corp for a total consideration of $2,235,000. An initial deposit of $50,000 was received during the year ended January 31, 2006. During the fiscal year ending January 31, 2007, the original closing date was extended because of certain accounting and legal issues that were not resolved until late 2006. The first installment of $695,000 was received January 30, 2007 and the second installment of $745,000 was received on March 29, 2007. The final payment of $745,000 was received July 9, 2007 and as a result, the Company no longer holds any interests in Mexico. All applicable taxes owing to the Government of Mexico have been paid.

6

______________________________________________________________________________

FISCHER-WATT GOLD COMPANY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

October 31, 2008

(UNAUDITED)

In order to complete the sale to Nexvu Capital Corp, the Company repurchased a 21.6% interest in La Balsa project held by The Astra Ventures Inc., a holding company controlled by a former Chairman of the Company and a Director. The Company agreed to repay capital contributions made by The Astra Ventures Inc. to Fischer-Watt Gold in the sum of $864,068, to be repaid in conjunction with the receipt of proceeds from Nexvu Capital Corp. As of October 31, 2007, the debt to The Astra Ventures Inc has been entirely repaid.

As consideration to The Astra Ventures Inc. for the lost business opportunity, the Company agreed to grant an option to them for a total of 10,000,000 shares of common stock. The option granted is for 4,000,000 shares of common stock at $0.30 per share, for 5 years, 4,000,000 shares of common stock at $0.40 per share for 7 years, and 2,000,000 shares of common stock at $0.60 per share for 10 years. These options were authorized in 2005. Stock option compensation expense of $360,000 was calculated based upon a fair value calculation using the following assumptions: expected life of five to ten years, volatility of 99.4%, risk-free interest rate of 4% and no dividend yield. This amount was charged to operations at July 31, 2007 (see Note 2).

(4) Earnings Per Share

The Company calculates net income (loss) per share as required by SFAS No. 128, "Earnings per Share." Basic earnings (loss) per share is calculated by dividing net income (loss) by the weighted average number of common shares outstanding for the period. Diluted earnings (loss) per share is calculated by dividing net income (loss) by the weighted average number of common shares and dilutive common stock equivalents outstanding.

(5) Going Concern Consideration

The Company has incurred operating losses of $17,487,525 since inception and had a stockholders’ deficit and working capital deficit of $$812,568 at October 31, 2008 and no revenue producing operations. These conditions raise substantial doubt about the Company's ability to continue as a going concern.

The ability of the Company to achieve its operating goals and thus positive cash flows from operations is dependent upon the future market price of metals, future capital raising efforts, and the ability to achieve future operating efficiencies anticipated with increased production levels. Management's plans will require additional financing, reduced exploration activity or disposition of or joint ventures with respect to mineral properties. While the Company has been successful in these capital raising endeavors in the past, there can be no assurance that its future efforts and anticipated operating improvements will be successful.

The financial statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets or the amounts and classification of liabilities that may result from the possible inability of the Company to continue as a going concern.

7

______________________________________________________________________________

FISCHER-WATT GOLD COMPANY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

October 31, 2008

(UNAUDITED)

(6) Notes Payable – Shareholder

On October 28, 2008, a shareholder advanced $50,000 to the Company for working capital purposes. The Note Payable is a demand note and there is currently no interest rate applicable and no terms of repayment have been established.

(7) Subsequent Event

On October 2, 2008, the Company entered into a binding letter agreement with Tournigan Energy Ltd. (“Tournigan Energy”) to acquire its wholly-owned United States subsidiary, Tournigan USA Inc. The prime asset in Tournigan USA Inc. is its portfolio of mineral claims and leases covering in excess of 55,000 acres in Wyoming, South Dakota and Arizona that cover some of the most prospective uranium-bearing geology in the United States.

Under the terms of the agreement, the Company will issue to Tournigan Energy an interest-free promissory note, due August 31, 2009, for approximately $309,500, which was the amount paid by Tournigan Energy for the current year’s federal mineral claim maintenance fees. Prior to August 31, 2009, the Company will also secure the release of, or reimburse Tournigan Energy for the existing reclamation bonds on the properties in the amount of $930,000 less any applicable reclamation costs. The Company will grant Tournigan Energy a 30% carried interest on each of the existing properties up to the completion of a feasibility study for any project encompassing any of these properties. At that point Tournigan Energy can elect to convert its interest into a 30% contributing working interest or allow its interest to dilute to a 5% net profits interest. This transaction is subject to definitive documentation, regulatory and third-party approvals, approval from the respective boards of directors and satisfaction of other customary conditions, and is expected to close by December 31, 2008.

Peter Bojtos, President, CEO and Chairman of the Board of Fischer-Watt has declared his interest in this transaction since he is also a director of Tournigan Energy. He has abstained from voting on all matters in connection with this transaction.

8

______________________________________________________________________________

Item 2. MANAGEMENT'S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION

Overview

Fischer-Watt Gold Company, Inc. (collectively with its subsidiaries, "Fischer-Watt", "FWG" or the "Company"), was formed under the laws of the State of Nevada in 1986. Fischer-Watt's primary business is mining and mineral exploration, and to that end to own, acquire, improve, sell, lease, convey lands or mineral claims or any right, title or interest therein; and to search, explore, prospect or drill for and exploit ores and minerals therein or thereupon.

MINERA MONTORO

The Company has held a 65% interest in Minera Montoro S.A. de C.V. (“Montoro”) since 1996, which in turn acquired a 100% interest in mining concessions located in the state of Michoacan, Mexico, designated as the La Balsa property. Mr. Jorge E. Ordonez and his associates owned the remaining 35% of Montoro. During the fiscal year ended January 31, 2006, the Company executed a letter of agreement to sell its 65% interest in Montoro to Nexvu Capital Corp. (“Nexvu”) for a total consideration of $2,235,000. The sale of this interest was subsequently assigned by Nexvu to Rogue River Resources, Inc. (“Rogue River”). An initial deposit of $50,000 was received during the year ended January 31, 2006. During the fiscal year ended January 31, 2007, the original closing date was extended because of certain accounting and legal issues that were not resolved until late 2006. The first of three installments of $695,000 was received January 30, 2007 and the remaining two installments of $745,000 each were received, the last having been received on July 9, 2007. All applicable taxes owing to the Government of Mexico have been paid.

As the sale of the interest in Montoro is now complete, the Company no longer holds any interest, other than a future royalty, in Mexico.

In order to effect the sale to Nexvu/Rogue River, the Company repurchased a 21.6% interest in the La Balsa project held by The Astra Ventures Inc. (“Astra”) a Company controlled by a Director of the Company. The Company had agreed to repay capital contributions made by Astra to Fischer-Watt in the sum of $864,068, to be repaid in conjunction with the receipt of proceeds from Nexvu /Rogue River. During the last fiscal year, the Company repaid $864,068 to Astra.

As consideration to Astra for the lost business opportunity, the Company agreed to grant an option to it for a total of 10,000,000 shares of common stock. The option granted is for 4,000,000 shares of common stock at $0.30 per share, for 5 years, 4,000,000 shares of common stock at $0.40 per share for 7 years, and 2,000,000 shares of common stock at $0.60 per share for 10 years. These options were authorized in 2005. Stock option compensation expense of $360,000 was calculated based upon a fair value calculation using the following assumptions: expected life of five to ten years, volatility of 99.4%, risk-free interest rate of 4% and no dividend yield. This amount was charged to operations at July 31, 2007.

9

______________________________________________________________________________

POTENTIAL ACQUISITION

On October 2, 2008, the Company entered into a Binding Letter Agreement with Tournigan Energy Ltd. (“Tournigan Energy”), a Canadian public corporation, to acquire its wholly-owned US subsidiary, Tournigan USA Inc. (“Tournigan USA”). The prime asset in Tournigan USA is its portfolio of uranium–bearing mineral claims and leases on over 55,000 acres in Wyoming, South Dakota and Arizona.

The Company proposes to issue to Tournigan Energy an interest-free promissory note, due August 31, 2009, for about $309,500, which was the amount paid by Tournigan Energy for the current year’s federal mineral claim maintenance fees. In addition to this, the Company will also secure the release of or reimburse Tournigan Energy for the existing reclamation bonds on the properties in the amount of $930,000 less any applicable reclamation costs. The Company will grant Tournigan Energy a 30% carried interest on each of the existing properties up to the completion of a feasibility study for any project encompassing any of these properties. At that point Tournigan Energy can elect to convert its interest into a 30% contributing working interest or allow its interest to dilute to a 5% net profits interest.

The proposed transaction is subject to definitive documentation, regulatory and third-party approvals, approval from the respective boards of directors and satisfaction of other customary conditions, and is expected to close by December 31, 2008.

Peter Bojtos, President, CEO and Chairman of the Board of Fischer-Watt has declared his interest in this transaction since he is also a director of Tournigan Energy. He has abstained from voting on all matters in connection with this transaction.

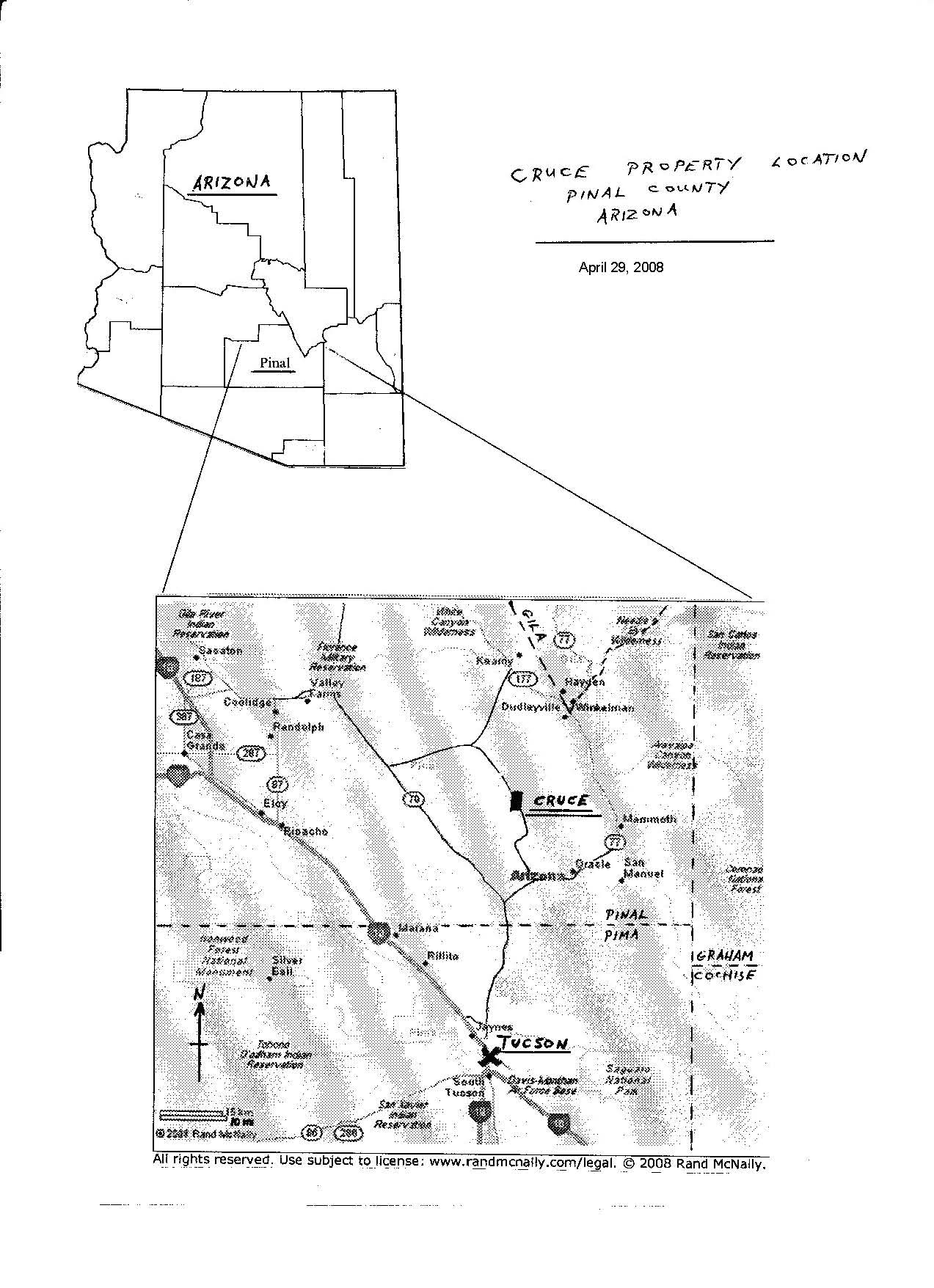

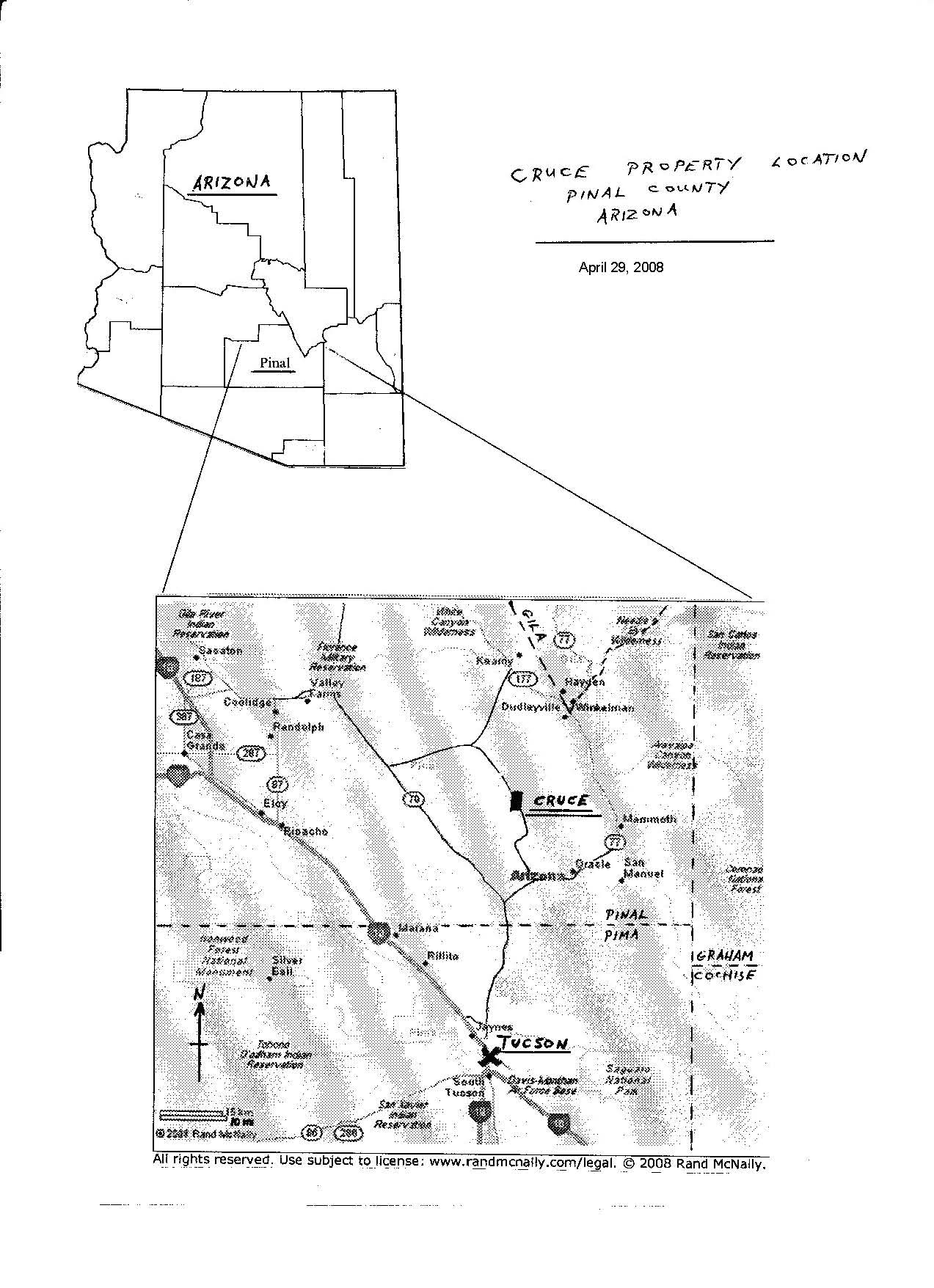

CRUCE PROJECT

The Company, on June 10, 2006, entered into an agreement with private individuals regarding the Cruce exploration project. This property is located in northwest Pinal County, Arizona in T8S, R14E, section 16 and has a history of gold and copper exploration. The Company acquired a 100% interest in the mineral lease for $15,000 and the issuance of 100,000 restricted common shares of its stock. The vendors will retain a 2% Net Smelter Return royalty and received an advance royalty of $20,000 on the first anniversary of the agreement, $25,000 on the second anniversary (which has been paid) and will receive $25,000 on subsequent anniversaries. These advance royalties will be deductible from future production royalty payments.

10

______________________________________________________________________________

Location

The property is situated on a 560 acre State lease identified as permit number 08- 113008. The Company has staked and now holds 32 additional lode claims, designated as CR 3 – 453, on surrounding BLM ground covering an area of approximately 660 acres. The property lies about 30 miles north of Tucson, AZ. The county maintained Willow Springs Road, accessible year-round from Oracle Junction, crosses the property. A high-voltage transmission line cuts across the property. There is no other infrastructure in the area.

Geology

Gold mineralization on the property is hosted within faulted blocks in well-altered sections of the pre-Cambrian age Oracle granite. Stockwork-type gold mineralization has developed within a highly altered, mylonitised, intrusive rock unit now exposed at the surface. To the east, the area is covered by Tertiary age volcanic rocks.

History

Adits, shallow shafts and pits of unknown historic age are in evidence on the property. Early work by prospectors was centered around the Hot Boy inclined shaft. This shaft was deepened to a depth of 165 feet by a Mr. Cruce who made several shipments of ore before abandoning the property.

In the early 1960's the Inspiration Copper Company carried out a 20 hole diamond drilling program in search of copper. Hydrothermally altered rocks containing copper mineralization were encountered but, due to a complicated land situation, Inspiration did not continue its exploration.

In the early 1980's, core drilling north-east of the Hot Boy shaft by a private partnership reportedly intercepted 106 feet of gold mineralization grading 0.044 ounces of gold per ton (oz.Au/t). This included an intercept of 0.153 oz.Au/t from surface to a depth of 24 feet. Strong gold mineralization in this area was further substantiated in 1987 by a reverse circulation drill hole that intersected 0.054 oz.Au/t from a depth of 30 feet to 60 feet. This included a 5 foot interval of 0.198 oz.Au/t.

A work program in 1986 and 87 included surface rock chip and soil sampling on a 200 x 100 foot grid over a 7,000 foot strike length. Approximately 330 rock samples defined several north-south elongate geochemical anomalies exceeding 1 part per million (ppm) gold. Of particular interest, southeast of the Hot Boy shaft, was a 2.6 ppm rock chip zone measuring about 500 feet across in an east-west direction and 1,200 feet north-south. The work program included an 11 hole reverse-circulation drill campaign totaling 705 feet. Highlights of this drilling included 30 feet of 0.054 oz.Au/t, 15 feet of 0.015 oz.Au/t and 30 feet of 0.023 oz.Au/t.

11

______________________________________________________________________________

Between 1988 and 1990, Freeport McMoRan Gold Company carried out geological mapping, a four line Induced Polarization and Resistivity geophysical survey and a wide-spaced 14 hole reverse-circulation drilling program totaling 5,805 feet. Hole CR-4 from surface to a depth of 60 feet returned an average grade of 0.032 oz.Au/t.

Current Exploration

In July 2007, Fischer-Watt completed its first, limited, soil and rock-chip geochemical survey on the property. This first pass survey, along with geological mapping, covered an area of about 1,000 x 1,500 meters. Over two hundred samples were taken at approximately 20 meter intervals on a sampling grid with 40 meter line spacing.

This survey located two parallel zones of anomalous gold mineralization trending north-northwest and dipping gently to the east, referred to as the East and West Zones. Both these zones appeared to extend beyond the limits of the initial survey grid.

On the east side of the sampling grid theEast Zone anomaly, lying immediately adjacent to the Hot Boy shaft, was identified as extending for over 100 meters. Two historical holes drilled some distance to the east intersected gold mineralization near surface, indicating that the surface anomaly dips gently to the east. Further surface geochemical sampling has now extended the East Zonefor up to 450 meters along a south-southeast trend from the Hot Boy shaft. The zone ranges in widths from 30 to 70 meters. This is the strongest anomaly defined on the property to date.

In addition, evidence was also found of the possible existence of veins that could represent the feeder system to the stockworks seen in surface outcrops. Follow-up work will be carried out to identify vein systems that may have acted as feeders into the diffuse lower grade mineralization.

Sampling on the west side of the grid identified theWest Zone anomaly over a 75 meter width and 250 meter length as a greater than 0.5 parts per million (ppm)gold-in-soil anomaly. A hole in the center of this area, designated as CR-4 and drilled by Freeport Gold Inc. in the early 1990’s, reportedly encountered mineralization grading 0.032 oz.Au/t from surface to a depth of 60 feet. The zone remains open at both its north and south ends and recent sampling indicates that there may be an extension of the zone lying approximately 100 meters to the north.

Further geochemical surveys and geological mapping has resulted in the identification of two additional anomalous zones; the South zone to the southeast of the West zone and the Copper Oxide zone to the southeast of the East zone anomalies.

At the south end of the project area theSouth Zonehas been identified based on the silicification and gossanous textures along contact boundaries of a 2 meter wide aplite dike for a 200 meter length. Continuing north for a further 300 meters is a 75 to 100 meter wide exposure of sheared and brecciated rocks with a lot of old surface workings and prospect pits.

12

______________________________________________________________________________

The fourth area, referred to as theCopper Oxide Zone,is a recently identified area where a series of east and southeast dipping faults have been recognized as potential conduits for mineralizing fluids giving rise to a surface geochemical copper anomaly. All the geochemical samples were analysed for multi-elements by International Plasma Labs Ltd. in Richmond, B.C. Canada.

During the first quarter of 2008, Fischer-Watt carried out its first drill program on the property. The Company used an Air-track drill rig to drill a close-spaced grid of 63 shallow holes to test three of the four anomalous zones; the East, West and Copper Oxide zones. Holes were drilled along a series of east-west oriented lines spaced 30 or 60 meters apart with holes along each line being 10 or 20 meters apart. The holes were about 80 feet in depth with 5,000 feet of drilling being completed. Readers are cautioned that an Air-track drill is used solely as a reconnaissance tool since the hole is unlined which may result in some contamination of samples. However, it provides an excellent, low-cost method of collecting indicative samples.

East Zone

A total of 33 vertical holes were drilled along 8 lines for a total footage of 2,574 feet. Gold mineralization is found within a mylonitised series of shear-faults cutting through the pre-Cambrian age granite. The mineralization has been traced by this drilling for a distance of 700 feet along strike, and down-dip for about 250 feet. To the east, the zone becomes covered by a layer of Tertiary age volcanic rocks where drilling to test the continuation of the zone has not yet been carried out. Continuity of mineralization was good throughout the zone.

Each of the drill holes was approximately 80 feet deep and samples were taken in each hole over 10 foot intervals along the entire length of each hole. Of the 33 holes drilled in this area, 24 of them contained mineralization of at least 0.007 oz.Au/t over 10 feet. Of these, the following 14 vertical holes returned stronger and longer sections of mineralization:

| | |

| | |

Hole # | oz.Au/t | interval ft. |

A-5 | 0.033 | 70 |

A-6 | 0.017 | 30 |

A-8 | 0.015 | 60 |

A-9 | 0.014 | 70 |

A-10 | 0.022 | 40 |

B-5 | 0.011 | 50 |

C-4 | 0.010 | 80 |

C-5 | 0.020 | 40 |

D-3 | 0.023 | 40 |

E-4 | 0.019 | 60 |

E-6 | 0.026 | 70 |

E-8 | 0.020 | 50 |

F-1 | 0.015 | 40 |

F-2 | 0.017 | 40 |

West Zone

A total of 23 holes were drilled along 10 lines for a total footage of 1,802 feet. The geological setting, and the strike and dip of the mineralization, is the same as in the East Zone. This drilling has traced the mineralization along strike for about 800 feet and down-dip for about 250 feet. The zone remains open to the northwest where gossanous outcrops can be seen on the surface. Beyond this area there are numerous surface pits that were dug by earlier prospectors giving an indication that the mineralization continues in this direction.

13

______________________________________________________________________________

Of the 23 holes drilled in this zone, 21 of them returned assays with at least 0.007 oz.Au/t over 10 feet. The following 12 holes returned stronger and longer sections of mineralization:

| | | |

| | | |

| | | All holes are vertical |

Hole # | oz.Au/t | interval ft. | unless otherwise noted |

| | | |

M-2 | 0.014 | 40 | |

N-1 | 0.019 | 50 | |

O-2 | 0.023 | 80 | |

O-3 | 0.036 | 30 | |

O-4 | 0.016 | 60 | |

P-3 | 0.017 | 80 | |

R-1 | 0.015 | 70 | -60 west |

S-1 | 0.027 | 50 | -50 west |

T-1 | 0.018 | 80 | |

T-2 | 0.025 | 80 | -60 west |

T-3 | 0.014 | 40 | -60 west |

U-1 | 0.013 | 70 | -65 west |

Copper Oxide Zone

A total of 7 holes were drilled along 4 lines for a total of 570 feet in this zone. The continuity of the copper and gold mineralization is good throughout the zone but at sub-economic grades. Hole I-1, which was the hole collared furthest to the east, encountered 0.72 % Cu over 10 feet at a depth of 60–70 feet. A prospective target therefore remains untested here where mineralization is inferred to continue down-dip along the detachment fault.

All the drill samples were analyzed by fire-assay at Jacobs Assay Office in Tucson, AZ.

The results of this drill program indicate that Fischer-Watt has located two zones of pervasive low-grade gold mineralization. Each of these two zones strikes in a northwest direction, has a true thickness of about 50 foot, lies just below the surface, and dips gently to the east at about 30 degrees. Gold mineralization on the Cruce property is therefore in a favorable structural setting that could be amenable to open-pit mining.

The Company’s geophysical consultant, JRA Geophysics, Inc., recently reviewed the 4- line induced polarization (“IP”) geophysical survey that had been carried out in 1989 by Freeport McMoRan on the West Zone. In his report the consultant determined that anomalous electrical responses on each of the 4 survey lines indicate that the anomalous area is open to the north, the south, the west and to depth of the West Zone. The consultant also noted that because of the style of mineralization on the property a more detailed IP survey would be required to define discrete localized higher sulfide and siliceous zones. Such a detailed IP survey is currently being planned out. If this survey meets with success then a further follow-up drill program is envisaged.

The Cruce project currently has no reserves and there is no assurance that the project will advance from its present exploration stage. All of Fischer-Watt’s exploration on the property to date has been carried out under the supervision of the Company’s geological consultant, Mr. N. Barr, a qualified and experienced geologist with extensive local geological knowledge. The property has also been physically examined in the field on several occasions by the Company’s President, Mr. P. Bojtos P.Eng., who is a qualified geologist.

14

______________________________________________________________________________

The work programs to date have cost approximately $80,000, which was funded from the Company’s treasury.

15

______________________________________________________________________________

In addition, the Company continues to evaluate other projects for possible acquisition although not as vigorously as previously partly because of the proposed acquisition of Tournigan USA and partly because of the downturn in world economics. The Company continues to concentrate its interest on projects in the western part of the United States – primarily in the search for gold, copper, zinc or uranium.

The Company has cash on hand at October 31, 2008 of $13,105, and its working capital deficit position of $812,568 raises the question of the ability of the Company to continue operations without further financing. Total current liabilities at October 31, 2008 amounted to $830,173, however, only $3,250 is due to trade creditors. The balance of the current liabilities, of $826,923, is due to shareholders where there are no specific terms of repayment for either of the demand notes, accrued expenses or interest owing.

The following outlines results to date in the current fiscal year for the quarter ended October 31, 2008 and outlines our plan of operation for the foreseeable future. It also analyzes our financial condition at October 31, 2008 and compares that condition to our financial condition at year-end January 31, 2008. This information should be read in conjunction with the other financial information and reports filed with the Securities and Exchange Commission ("SEC"), especially our Annual Report on Form 10-KSB for the year ended January 31, 2008.

Plan of Operations

The Company’s plan of operation for the fiscal year ending January 31, 2009 is to complete the acquisition of Tournigan USA, review the data and determine and prioritise the work programs that the Company would like to carry out on the extensive suite of properties in Wyoming, South Dakota and Arizona. From this information a budget will be drawn up and the Company’s financial requirements for the coming year can then be ascertained. Additionally, planning for a geophysical survey at the Cruce property in Arizona is being completed. The Company continues to evaluate other mining properties in the western United States for possible acquisition and continues to explore various financing alternatives for the Company.

Normal operating expenses for the next 12 months are estimated at $60,000, re the Cruce project and administration, and while the Company does not presently have sufficient working capital, it will continue to seek out necessary financing from existing shareholders and other potential investors. Should the Tournigan USA transaction close, it will adjust its operating requirements for the next 12 months accordingly.

16

______________________________________________________________________________

Liquidity and Capital Resources

As of October 31, 2008, the Company had cash on hand of $13,105 and current liabilities of $830,173 including $739,937 owed to related parties. Current accounts payable amounted to $3,250 and accrued expenses amounted to $86,986, which are due to related parties. The working capital deficit at October 31, 2008 was $812,568 compared to $557,572 at January 31, 2008. This represents an increase in the working capital deficit of $254,996, for the nine months ended October 31, 2008. This deterioration in working capital is the result of the loss experienced for the nine month period ended October 31, 2008.

There is no specific term of repayment for either the demand notes, accrued expenses or other debt due to related parties. Management recognizes that the Company does not have sufficient funds to retire its remaining debt and to sustain its operations. The Company continues to source out other appropriate financing in either equity or debt format, and it continues to seek out other mineral properties, but there is no assurance said financing is available or that said properties can be acquired on reasonable terms and conditions.

Results of Operations

Three Months Ended October 31, 2008 Compared to Three Months Ended October 31, 2007

For the three months ended October 31, 2008, the Company had a net loss of $62,159 compared to net loss of $121,666 for the three month period ended October 31, 2007.

During the three month period ended October 31, 2008, there was limited exploration expense in the amount of $11,099 compared to $48,604 in the three month period ended October 31, 2007. This exploration activity was directed to the Cruce property in Arizona, which is the only exploration project with an ongoing work program as the Cambridge property in Nevada was returned to its owners.

General and administrative expenses amounted to $50,787 for the three months ended October 31, 2008 compared to $78,113 for the three months ended October 31, 2007. The exploration expense and the general and administrative expenses comprise all of the expenditures by the Company in the three month period ended October 31, 2008.

While the Company currently has cash on hand of $13,105, and current trade accounts payable of $3,250, the Company realizes that it will require additional financing, reduced exploration activity, or the disposition of its remaining mineral properties. While the Company has been successful in these capital-raising endeavors in the past, there can be no assurance that its future efforts, and anticipated operating improvements will be successful.

17

______________________________________________________________________________

Nine Months Ended October 31, 2008 Compared to Nine Months Ended October 31, 2007

For the nine months ended October 31, 2008, the Company had a net loss of $254,996 compared to net income of $507,989 for the nine months ended October 31, 2007. During the nine months ended October 31, 2007, the Company received $1,565,000 related to the sale of its Montoro project.

In the nine month period ended October 31, 2008, general and administrative expenses amounted to $192,245 vs. $587,173 for the nine month period ended October 31, 2007. During the nine months ended October 31, 2007, the Company recorded $360,000 of stock option expense in connection with options granted to The Astra Ventures.

Exploration expense in the nine month period ended October 31, 2008 was $63,001 compared to $94,434 for the nine month period ended October 31, 2007 since the Nevada property had been relinquished and exploration was carried out only on the Cruce property.

During the nine month period ended October 31, 2008, other income was zero whereas in the comparative nine month period ended October 31, 2007, other income amounted to $1,565,000, representing proceeds received from the sale of Minera Montoro. Income taxes of $383,118 reduced the proceeds in 2007 to $1,181,802.

Commitments and Contingencies

Management is not aware of any legal action against the Company.

Foreign Currency Exchange

The Company accounts for foreign currency translation in accordance with the provisions of Statement of Financial Accounting Standards No. 52, "Foreign Currency Translation" ("SFAS No.52"). The assets and liabilities of foreign operations are translated at the rate of exchange in effect at the balance sheet date. Income and expenses are translated using the weighted average rates of exchange prevailing during the period. The related translation adjustments are reflected in the accumulated translation adjustment section of shareholders' equity.

18

______________________________________________________________________________

Going Concern Consideration

As the independent certified public accounting firm has indicated in their report on the financial statements for the year ended January 31, 2008, and as shown in the financial statements, the Company has experienced significant operating losses that have resulted in an accumulated deficit of $17,487,525 at October 31, 2008. These conditions raise doubt about the Company's ability to continue as a going concern.

The ability of the Company to achieve its operating goals and thus positive cash flows from operations is dependent upon the future market price of gold, future capital raising efforts, and the ability to achieve future operating efficiencies anticipated with increased production levels. Management's plans will require additional financing, reduced exploration activity, or disposition of or joint ventures with respect to mineral properties. While the Company has been successful in these capital-raising endeavors in the past, there can be no assurance that its future efforts, and anticipated operating improvements will be successful. Depending on the level of exploration activity, the Company does have adequate capital to continue its contemplated business plan through January 31, 2009, but does not have sufficient capital to carry out an extensive exploration program without additional capital. The Company is presently investigating all of the alternatives identified above to meet its short-term liquidity needs. The Company believes that it can arrange a transaction or transactions to meet its short-term liquidity needs, however there can be no assurance that any such transactions will be concluded or that if concluded they will be on terms favorable to the Company.

Cautionary Note Regarding Forward-Looking Statements

This Form 10-Q contains or incorporates by reference "forward-looking statements," as that term is used in federal securities laws, about our financial condition, results of operations and business. These statements include, among others:

-

statements concerning the benefits that we expect will result from our business activities and certain transactions that we contemplate or have completed, such as increased revenues, decreased expenses and avoided expenses and expenditures; and

-

statements of our expectations, beliefs, future plans and strategies, anticipated developments and other matters that are not historical facts.

These statements may be made expressly in this document or may be incorporated by reference to other documents that we will file with the SEC. You can find many of these statements by looking for words such as "believes," "expects," "anticipates," "estimates" or similar expressions used in this report or incorporated by reference in this report.

These forward-looking statements are subject to numerous assumptions, risks and uncertainties that may cause our actual results to be materially different from any future results expressed or implied by us in those statements. Because the statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied. We caution you not to put undue reliance on these statements, which speak only as of the date of this report. Further, the information contained in this document or incorporated herein by reference is a statement of our present intention and is based on present facts and assumptions, and may change at any time and without notice, based on changes in such facts or assumptions.

19

______________________________________________________________________________

Risk Factors Impacting Forward-Looking Statements

The important factors that could prevent us from achieving our stated goals and objectives include, but are not limited to, those set forth in our other reports filed with the SEC and the following:

The worldwide economic situation;

·

Any change in interest rates or inflation;

·

Foreign government changes to laws or regulations related to Company activities;

·

The willingness and ability of third parties to honor their contractual commitments;

·

Our ability to raise additional capital, as it may be affected by current conditions in the stock market and competition in the gold mining industry for risk capital;

·

Our costs of production; Environmental and other regulations, as the same presently exist and may hereafter be amended; Our ability to identify, finance and integrate other acquisitions; and

·

Volatility of our stock price.

We undertake no responsibility or obligation to update publicly these forward-looking statements, but may do so in the future in written or oral statements. Investors should take note of any future statements made by or on our behalf.

Item 3. Qualitative Disclosures about Market Risk

None.

Item 4T. Controls and Procedures

The Company maintains disclosure controls and procedures that are designed to ensure that information required to be disclosed in the Company's Exchange Act reports is recorded, processed, summarized and reported within the time periods specified in the SEC's rules and forms, and that such information is accumulated and communicated to the Company's management, including its Chief Executive Officer and Chief Financial Officer, as appropriate, to allow timely decisions regarding required disclosure based closely on the definition of "disclosure controls and procedures" in Rule 13a-15(e) and 15d-15(e). The Company’s disclosure controls and procedures are designed to provide a reasonable level of assurance of reaching the Company’s desired disclosure control objectives. In designing and evaluating the disclosure controls and procedures, management recognized that any controls and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving the desired control objectives, and management necessarily was required to apply its judgment in evaluating the cost-benefit relationship of possible controls and procedures. The Company’s certifying officer has concluded that the Company’s disclosure controls and procedures are effective in reaching that level of assurance.

20

______________________________________________________________________________

As of the end of the period being reported upon, the Company carried out an evaluation, under the supervision and with the participation of the Company's management, including the Company's Chief Executive Officer/Chief Financial Officer, of the effectiveness of the design and operation of the Company's disclosure controls and procedures. Based on the foregoing, the Company's Chief Executive Officer/Chief Financial Officer concluded that the Company's disclosure controls and procedures were effective.

There have been no changes in the Company's internal controls or in other factors that could affect the internal controls subsequent to the date the Company completed its evaluation.

PART II

Item 1. Legal Proceedings.

None.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds.

None

Item 3. Defaults Upon Senior Securities.

None.

Item 4. Submission of Matters to a Vote of Security Holders.

None.

Item 5. Other Information.

None

Item 6. Exhibits.

| |

| |

Exhibit No. | Document |

| |

31 | Officers Certification under Section 302 of the Sarbanes-Oxley Act of 2002 for Peter Bojtos |

| |

32 | Certification of Chief Executive Officer under Section 906 of the Sarbanes-Oxley Act of 2002for Peter Bojtos |

21

______________________________________________________________________________

SIGNATURES

In accordance with Section 13 or 15(d) of the Exchange Act, the registrant caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | |

| | | FISCHER-WATT GOLD COMPANY, INC. |

| | | | |

| | | | |

| | | | |

Date: | December 15, 2008 | | By: | /s/ Peter Bojtos |

| | | | Peter Bojtos |

| | | | Chairman of the Board of Directors, President and Chief Executive Officer |

| | | | |

22

______________________________________________________________________________