- TTI Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

TETRA (TTI) DEF 14ADefinitive proxy

Filed: 23 Mar 20, 2:36pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. - )

Filed by the registrant ☒ Filed by a party other than the registrant ☐.

Check the appropriate box:

☐ | Preliminary proxy statement. |

☐ | Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2)). |

☒ | Definitive proxy statement. |

☐ | Definitive additional materials. |

☐ | Soliciting material under Rule 14a-12. |

TETRA TECHNOLOGIES, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (check the appropriate box):

☒ | No Fee required. |

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of the transaction: |

| (5) | Total Fee paid: |

☐ | Fee paid previously with preliminary materials. |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and date of its filing. |

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing party: |

| (4) | Date filed: |

Notice of Annual Meeting of Stockholders and Proxy Statement 2020 TETRA

Notice of 2020 Annual Meeting of Stockholders |

To the stockholders of TETRA Technologies, Inc. (“TETRA” or the “Company”):

Our 2020 Annual Meeting of Stockholders will be held as follows: *

When: Thursday, May 7, 2020, at 11:00 a.m. local time |

| Where: TETRA Technologies, Inc. Corporate Headquarters 24955 Interstate 45 North The Woodlands, Texas 77380 |

The purpose of the meeting is to consider and take action on the following:

| 1. | Election of eight directors to serve one-year terms ending at the 2021 Annual Meeting of Stockholders, or until their successors have been duly elected or appointed; |

| 2. | Ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2020; and |

| 3. | Advisory vote to approve executive compensation. |

Additionally, if needed, the stockholders may act upon any other matters that may properly come before the Annual Meeting or any adjournments.

Only stockholders of record at the close of business on March 13, 2020 will be entitled to notice of and to vote at the Annual Meeting.

Your vote is important! Please promptly vote your shares by telephone, the internet, or, if the proxy statement was mailed to you, by marking, signing, dating, and returning the enclosed proxy card as soon as possible, regardless of whether you plan to attend the Annual Meeting. You may revoke your proxy at any time before it is voted. |

|

|

| Kimberly M. O'Brien Corporate Secretary |

March 23, 2020

The Woodlands, Texas

*

We intend to hold our annual meeting in person. However, due to the uncertainties surrounding the impact of the coronavirus (COVID-19), it may not be possible or advisable to hold our annual meeting in person and we are planning for the possibility that the annual meeting may be delayed or held by means of remote communication. If we decide to take either such step, we will announce the decision to do so in advance of the annual meeting. If we elect to hold our annual meeting by remote communication, details on how to participate will be issued by press release, posted on our website at http://ir.tetratec.com/events-and-webcasts and filed with the U.S. Securities and Exchange Commission as additional proxy material.

PROXY STATEMENT |

Table of Contents

1 |

| 36 | ||

|

|

| 36 | |

2 |

|

| ||

2 |

| 38 | ||

2 |

| 39 | ||

2 |

| 39 | ||

3 |

| 41 | ||

|

|

| 42 | |

|

| 43 | ||

9 |

| 46 | ||

9 |

| 54 | ||

9 |

| 54 | ||

9 |

| 55 | ||

10 |

| 56 | ||

10 |

| 56 | ||

|

|

| 57 | |

|

| 57 | ||

11 |

| 58 | ||

12 |

| 58 | ||

12 |

|

| ||

|

|

| 58 | |

13 |

| 59 | ||

13 |

|

|

| |

13 |

| 60 | ||

13 |

|

|

| |

Director Independence and Transactions |

|

| 61 | |

Considered in Independence Determinations | 14 |

| 61 | |

15 |

| 62 | ||

15 |

| 63 | ||

18 |

| 64 | ||

19 |

| 64 | ||

19 |

|

| ||

22 |

| 65 | ||

|

|

|

| |

23 |

| 68 | ||

24 |

|

|

| |

24 |

| 69 | ||

25 |

|

|

| |

26 |

|

| ||

26 |

| 70 | ||

26 |

|

| ||

27 |

| 72 | ||

27 |

| 72 | ||

27 |

| 72 | ||

28 |

| 72 | ||

29 |

|

|

| |

|

|

| 73 | |

30 |

| 73 | ||

32 |

| 73 | ||

|

| 75 | ||

32 |

| 76 | ||

|

|

|

|

|

33 |

|

|

| |

|

|

|

|

|

These highlights summarize certain information contained elsewhere in the proxy statement and does not contain all the information you should consider. You should refer to the remainder of the proxy statement for more information about us and the proposals you are being asked to consider.

2019 BUSINESS HIGHLIGHTS

Our 2019 results reflect a continuing increase in revenue compared to 2018, despite a challenging North America market that experienced significant decreases in customer capital budgets and drilling activity. The diversity of our business portfolio, with exposure to international, offshore, and a healthy industrial chemicals market, greatly benefitted us during this time of lower onshore US oil and gas customer spending. Our portfolio balance is one of our greatest strengths and we are focused on our long-term strategy of differentiating our core products and services through disciplined investment in technology and automation and rigorously managing our G&A spending.

Dedication to our CØRE values is integral to our culture

• Focus on Customers • “Drive to Zero” Incidents • Maximize Returns • Engage and Motivate Employees

|

| • Expanded our proprietary TETRA CS Neptune® completion fluids offerings • Introduced our BlueLinx™ water automation and control system while upgrading our pump fleet to execute on our water management strategy • Introduced our new Sandstorm™ advanced cyclone technology to improve sand recovery from flowback and produced water • Developed new applications for our GasJack® compression equipment fleet to address artificial lift in mature unconventional wells • Implemented a mandatory real-time driving monitoring system which has reduced our driving exposure and incidents • Continued to add talent from the industry to strengthen our leadership team and mid-management • Capital investments in each division remain concentrated on high-value, high-return projects

|

|

EXECUTIVE COMPENSATION HIGHLIGHTS |

| CORPORATE GOVERNANCE HIGHLIGHTS |

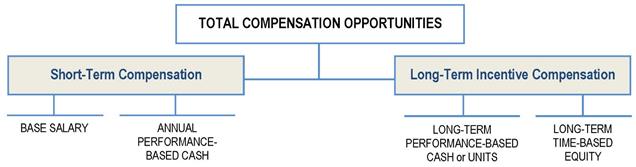

Our executive compensation program reflects a fundamental belief that rewards should be competitive, both in elements and amount, with the broad market in which we compete for executive talent and commensurate with TETRA’s and the individual executive’s performance. • Pay for Performance - Our total compensation for each individual includes incentive compensation that provides reasonable upside potential for exceptional performance; as well as risk of no payment when performance objectives are not achieved. Our variable pay programs are designed as forward-looking incentives that reflect individual and corporate performance during the year under review. • Alignment with Stockholder Value - Our long-term incentive, or LTI, awards provide a strong link to stockholder interests. Our compensation programs are designed and administered to maximize stockholder value. • Market Competitiveness - Our overall compensation strategy recognizes that attraction and retention of key talent are critical to the attainment of our stated business goals and objectives and to the creation of value for our stockholders. The mix of compensation between base salary and short- and long-term incentive awards is heavily weighted towards at-risk-pay, aligning compensation with the long-term interests of our stockholders. |

| Our practices include policies and structures that we believe are excellent corporate governance practices, including: • Majority vote policy in the election of directors; • Annual election of all directors; • Separation of Chairman of the Board and Chief Executive Officer positions; • Regular meetings of our non-employee independent directors; • A prohibition against directors, executive officers and employees holding our securities in margin accounts or pledging our securities, absent company approval; • A prohibition against directors, executive officers and employees engaging in certain hedging transactions with respect to our securities; • Rigorous stock ownership guidelines applicable to directors and executive officers; • Executive Officer change in control benefits that are subject to “double trigger”; • An independent compensation consultant hired by and reporting to the Compensation Committee; and • Compensation clawback policy that provides us with a mechanism to recover incentive compensation paid to our executive officers in certain circumstances. |

|

|

|

2020 Proxy Statement |

| TETRA Technologies, Inc. I 1 |

PROPOSAL NO. 1 – ELECTION OF DIRECTORS

Proposal No. 1 — Election of Directors

The Board recommends a vote FOR the election of each nominee |

Retirement of Current Board Member

Stuart M. Brightman, a current member of our Board of Directors and former Chief Executive Officer of our Company, will retire from the board upon the expiration of his term at the upcoming Annual Meeting, and therefore, has not been nominated for reelection. Immediately following the Annual Meeting, the Board of Directors expects to set the size of the board at eight directors. Proxies solicited hereby cannot be voted for a greater number of persons than the nominees for director set forth below.

Our Board of Directors believes that each director nominee for election at the Annual Meeting is highly qualified. The director nominees’ biographies (below) describe the specific experience, qualifications, attributes, and skills that have been considered by the Nominating, Governance and Sustainability Committee and contributed to such individuals’ being nominated for our Board of Directors. As their biographies indicate, all the director nominees possess significant leadership and professional experience, knowledge, including energy industry knowledge, and skills that qualify them for service on our board. Each director, other than Mr. Murphy, our President and Chief Executive Officer, satisfies the independence requirements under the listing standards of the New York Stock Exchange (“NYSE”). All directors satisfy the criteria stated in our Corporate Governance Guidelines and possess the personal characteristics essential for the proper and effective functioning of our board.

The terms of office of each of the nine current directors will expire at the time of the Annual Meeting. The Nominating, Governance and Sustainability Committee of the Board of Directors has recommended, and the Board of Directors has nominated and urges you to vote “FOR”, the election of the eight persons listed below who have been nominated to serve one-year terms as directors. Each of the nominees has consented to be named in this proxy statement and to serve as a director, if elected.

A plurality vote is required for the election of directors in Proposal No. 1, subject to our majority voting policy discussed below. This means that, if a quorum is present at the Annual Meeting, the eight nominees receiving the greatest numbers of “FOR” votes will be elected to serve as directors. Please see the "General Information About the Meeting and Voting" section in this proxy statement for additional information.

It is intended that the proxies solicited hereby will be voted “FOR” the election of such nominees, unless the authority to do so has been withheld by you. If, at the time of the Annual Meeting, any of the nominees should be unable or decline to serve, the discretionary authority provided in the proxy will enable the proxy holder to vote for a substitute nominee of the Board of Directors. The Board of Directors has no reason to believe that any substitute nominee will be required.

Majority Vote Policy: Our Corporate Governance Guidelines provide that in an uncontested election (that is, an election where the number of nominees is not greater than the number of directors to be elected), any nominee who receives a greater number of votes WITHHELD for his or her election than votes FOR such election shall, following certification of the stockholder vote, unless such nominee has previously submitted an irrevocable resignation in accordance with the majority vote policy, promptly tender his or her resignation to the Chairman of the Board of Directors. The Nominating, Governance and Sustainability Committee is required to recommend to the Board of Directors whether such tendered resignation should be accepted or rejected. The Board of Directors will then determine whether to accept or reject the tendered resignation. Following the Board of Director’s decision on the

|

|

|

2 I TETRA Technologies, Inc. |

| 2018 Proxy Statement |

PROPOSAL NO. 1 – ELECTION OF DIRECTORS

Governance Committee’s recommendation, we will promptly disclose the Board of Director’s decision and decision- making process regarding a tendered resignation in a document filed with the Securities and Exchange Commission (the “SEC”). Each of the director nominees has previously submitted an irrevocable resignation letter. Please read our Corporate Governance Guidelines posted in the Corporate Governance section of the Investor Relations area of our website at www.tetratec.com for more information regarding our majority vote policy.

The nominees for election as directors are as follows:

Name |

| Age |

| Position with Us |

| Tenure (years) |

| Public Directorships (including TETRA and CCLP) |

| |

Mark E. Baldwin |

| 66 |

| Independent Director |

| 6 |

|

| 3 |

|

Thomas R. Bates, Jr. |

| 70 |

| Independent Director |

| 8 |

|

| 5 |

|

Paul D. Coombs |

| 64 |

| Independent Director |

| 25 |

|

| 3 |

|

John F. Glick |

| 67 |

| Independent Director |

| 6 |

|

| 3 |

|

Gina A. Luna |

| 46 |

| Independent Director |

| 1 |

|

| 1 |

|

Brady M. Murphy |

| 60 |

| Director, President and CEO |

| 1 |

|

| 2 |

|

William D. Sullivan |

| 63 |

| Independent Director, Chairman |

| 12 |

|

| 3 |

|

Joseph C. Winkler III |

| 68 |

| Independent Director |

| 4 |

|

| 3 |

|

See “Beneficial Stock Ownership of Certain Stockholders and Management” on page 71 for information regarding the number of shares of our common stock owned by each nominee.

Mark E. Baldwin | ||

|

| • Age 66 • Independent Director since 2014 Board Committees • Audit Committee (Chairman) |

Key Attributes/Skills/Expertise. Mr. Baldwin, through his experience in executive financial positions with public companies, brings significant knowledge of accounting, capital structures, finance and financial reporting, risk management, strategic planning, and forecasting and provides the board and audit committee important perspective on our financial reporting and governance obligations. Mr. Baldwin has extensive knowledge of the energy industry and his financial management and operations experience provides a significant contribution to our Board of Director’s mix of backgrounds and skills. | ||

Mr. Baldwin has served as a member of our Board of Directors since January 2014 and as Chairman of our Audit Committee since May 2014. Mr. Baldwin served as the executive vice president and chief financial officer of Dresser-Rand Group, Inc., a public company subject to the reporting requirements of the Securities Exchange Act of 1934 (a "Public Company "), from August 2007 until his retirement in May 2013. Prior to joining Dresser-Rand, he served as the executive vice president, chief financial officer, and treasurer of Veritas DGC Inc., a Public Company, from August 2004 through February 2007, and operating partner at First Reserve Corporation from April 2003 through July 2004. Mr. Baldwin served as executive vice president and chief financial officer for NextiraOne from October 2001 through August 2002, and as chairman of the board and chief executive officer for Pentacon Inc. from 1997 through 2001. From 1980 through 1997, Mr. Baldwin served in a variety of finance and operations positions with Keystone International Inc., including treasurer, chief financial officer, and president of the Industrial Valves and Controls Group. Mr. Baldwin currently serves as a director and as a member of the audit committee of KBR, Inc. and as a director and as a member of the audit committee of Nine Energy Service, Inc., both of which are Public Companies. He previously served as a director of Seahawk Drilling Inc. from August 2009 until February 2011. Mr. Baldwin has a B.S. in Mechanical Engineering from Duke University and an MBA from Tulane University.

|

|

|

2020 Proxy Statement |

| TETRA Technologies, Inc. I 3 |

PROPOSAL NO. 1 – ELECTION OF DIRECTORS

Thomas R. Bates, Jr., Ph.D. | ||

|

| • Age 70 • Independent Director since 2011 Board Committees • Compensation Committee (Chairman) |

Key Attributes/Skills/Expertise. Dr. Bates has over 40 years of experience in the international oil and gas services industry, both in management positions with operational responsibilities and as a director. Through his leadership roles, Dr. Bates has gained significant management development, executive compensation, and succession planning experience. Dr. Bates’ experience serving as a director of other public companies provides cross-board experience and perspective, and his past management of a private equity firm provides valuable entrepreneurial and capital markets insight. | ||

Dr. Bates has served as a member of our Board of Directors since November 2011, as Chairman of our Compensation Committee since May 2014, and as a member of that committee since May 2012. Dr. Bates is a private investor and currently an adjunct professor in the Finance Department at Texas Christian University where he teaches in the MBA program at the Neeley School of Business. Dr. Bates joined Lime Rock Management LP, an energy-focused private equity firm, as a managing director in 2001 and became a senior advisor of the firm in 2010 before retiring in 2013. Dr. Bates had 25 years of experience in oil service management and operations before joining Lime Rock. He served from 1998 through 2000 as president of the Discovery Group of Baker Hughes and was responsible for the integration of Western Atlas into Baker Hughes. Earlier, he served as president and chief executive officer of Weatherford Enterra. Previously, Dr. Bates spent 15 years with Schlumberger in both domestic and international locations and was responsible for the Anadrill business unit when early MWD and LWD tools were commercialized. Dr. Bates began his career with Shell Oil Company, where he conducted drilling research. Dr. Bates has been a personal investor and/or a corporate investor in more than a dozen oil service technology startups. Dr. Bates serves as chairman of the board of directors and a member of the compensation and audit committees of Independence Contract Drilling, Inc. and as chairman of the board of directors and a member of the audit and corporate governance committees of Weatherford International plc, both of which are Public Companies. Dr. Bates also serves on the board of directors and as chairman of the compensation committee of Alacer Gold Corporation, a Canadian publicly traded company, and as chairman of the board of directors and a member of the audit committee of Vantage Drilling International, a Public Company that trades on the OTC. Dr. Bates previously served on the boards of Tidewater Inc. from July 2017 to October 2019, Hercules Offshore, Inc. from 2004 through November 2015, Natco Group, Inc. from 2003 through 2009, and T-3 Energy Services from 2007 until it was acquired in 2011. Dr. Bates is a graduate of the University of Michigan with a Ph.D. in Mechanical Engineering.

|

|

|

4 I TETRA Technologies, Inc. |

| 2018 Proxy Statement |

PROPOSAL NO. 1 – ELECTION OF DIRECTORS

Mr. Coombs has served as a member of our Board of Directors since June 1994. He has served as a member of our Nominating, Governance and Sustainability Committee since July 2012 and as a member of our Audit Committee since May 2015. Mr. Coombs currently serves as a director of our CSI Compressco GP Inc. subsidiary, the general partner of CSI Compressco, also one of our consolidated subsidiaries and a publicly traded limited partnership subject to the reporting requirements of the Exchange Act. From April 2005 until his retirement in June 2007, Mr. Coombs served as our Executive Vice President of Strategic Initiatives, and from May 2001 to April 2005, as our Executive Vice President and Chief Operating Officer. From January 1994 to May 2001, Mr. Coombs served as our Executive Vice President - Oil & Gas, from 1987 to 1994 he served as Senior Vice President - Oil & Gas, and from 1985 to 1987, as General Manager - Oil & Gas. He has served in numerous other positions with us since 1982. Mr. Coombs is presently a director and serves on the audit and corporate governance committees of the board of directors of Balchem Corporation, a Public Company.

John F. Glick | ||

|

| • Age 67 • Independent Director since 2014 Board Committees • Nominating, Governance and Sustainability Committee (Chairman) • Compensation Committee |

Key Attributes/Skills/Expertise. Mr. Glick brings extensive energy industry, management, and oversight experience, having served in executive management positions with various public energy services and manufacturing companies. Mr. Glick’s broad experience in manufacturing and servicing a variety of oilfield drilling and completion products, both domestically and internationally, provides valuable insight to our Board of Directors from an operational and strategic planning perspective. | ||

Mr. Glick has served as a member of our Board of Directors since January 2014, as Chairman of our Nominating, Governance and Sustainability Committee since May 2015 and has been a member of that committee and our Compensation Committee since May 2014. Mr. Glick served as the chief executive officer and a director of Lufkin Industries, Inc., a Public Company, from March 2008 until his retirement in July 2013 and served as Lufkin’s president and a director since August 2007. During his tenure, Mr. Glick oversaw the growth of Lufkin and, ultimately, the sale of the company to General Electric in July 2013. From September 1994 through August 2007, Mr. Glick served as the vice president and general manager of Lufkin’s Power Transmission Division. He served as vice president and general manager of Lufkin’s Oilfield Division from August 2007 through August 2008. Prior to joining Lufkin, from 1974 through 1994, Mr. Glick held several senior management level positions with Cameron

|

|

|

2020 Proxy Statement |

| TETRA Technologies, Inc. I 5 |

PROPOSAL NO. 1 – ELECTION OF DIRECTORS

Iron Works, Inc. Mr. Glick currently serves as the non-executive chairman of the board of directors, chairman of the nominating and governance committee, and an ex-officio member of the audit and remuneration committees of Hunting PLC, an FTSE 350 public company traded on the London Stock Exchange, and as a director, chairman of the corporate governance and nominating committee and a member of the compensation committee of Weatherford International plc, a Public Company. Mr. Glick also serves as the vice chairman of the board of directors of CHI St. Luke's Health and sits on its executive committee and is a director of CHI St. Luke's Memorial Health. Mr. Glick received a B.S. in Journalism from the University of Kansas and graduated from the Harvard Graduate School of Business Program for Management Development.

Ms. Luna has served as a member of our Board of Directors and as a member of our Audit Committee and Nominating, Governance and Sustainability Committee since July 2018. Ms. Luna has served as the Chief Executive Officer of Luna Strategies, LLC, an independent consulting firm, since November 2016. Prior to that, Ms. Luna served at JPMorgan Chase & Co. for 21 years, holding several senior management level positions, most recently as Managing Director, Chase Commercial Banking, from 2009 to November 2016, as Chief Marketing Officer, Chase Commercial Banking, from 2005 to 2009, and as Chief Operating Officer, Commercial & Investment Banking, South Region, from 2000 to 2005. Ms. Luna received a Bachelor of Science in Business Administration, with majors in finance and management, from Texas A&M University.

Brady M. Murphy | ||

|

| • Age 60 • President and Chief Executive Officer • Director Since 2018 (not Independent) Board Committees • No Committee Memberships |

Key Attributes/Skills/Expertise. Mr. Murphy has more than 35 years of global operations, engineering, manufacturing and business development experience in a variety of areas within the energy industry, including deepwater, mature fields and unconventional assets. Mr. Murphy’s service as our President and Chief Executive Officer and his prior service as our Chief Operating Officer provides our Board of Directors with an in-depth source of knowledge regarding our operations, customers, competitors, markets in which we operate, business strategy, executive management team, and the effectiveness of our compensation programs. | ||

|

|

|

6 I TETRA Technologies, Inc. |

| 2018 Proxy Statement |

PROPOSAL NO. 1 – ELECTION OF DIRECTORS

Mr. Murphy has served as our President and Chief Executive Officer since May 2019, as our President and Chief Operating Officer from February 2018 until his promotion to Chief Executive Officer in May 2019, and as a director since December 2018. Since May 2019, Mr. Murphy has also served as President and chairman of the board of directors of our CSI Compressco GP Inc. subsidiary, the general partner of CSI Compressco LP, one of our consolidated subsidiaries and a publicly traded limited partnership. Mr. Murphy has served as a director of CSI Compressco GP Inc. since February 2018. Prior to joining TETRA, Mr. Murphy served as chief executive officer of Paradigm Group B.V., a private company focused on strategic technologies for the upstream energy industry, from January 2016 until February 2018. Mr. Murphy previously served at Halliburton Company and its affiliated companies for 26 years and held numerous international and North America positions, most recently as senior vice president - global business development and marketing from 2012 to December 2015, as senior vice president - business development Eastern Hemisphere from 2011 to 2012, and as senior vice president - Europe/Sub–Saharan Africa region from 2008 to 2011. Earlier in his career, from 1981 until 1989, Mr. Murphy held several positions with increasing responsibility at Gerhart Industries. Mr. Murphy received his B.S. degree in Chemical Engineering from Pennsylvania State University and is an alumnus of Harvard Business School’s Advanced Management Program.

William D. Sullivan | ||

|

| • Age 63 • Independent Director since 2007 • Chairman of the Board Board Committees • As Chairman of the Board, Mr. Sullivan is an Ex-Officio member of all board committees |

Key Attributes/Skills/Expertise. Mr. Sullivan has significant management experience in mid-stream oil and gas operations and in the exploration and production of oil and gas on an international level. Mr. Sullivan also has substantial experience in corporate governance and executive compensation matters and in serving on the boards of publicly held corporations and publicly traded limited partnerships operating in the oil and gas industry. As Chairman of our Board of Directors, Mr. Sullivan serves as a critical mentor and advisor to our Chief Executive Officer and is pivotal in creating the conditions for overall board and individual director effectiveness, both inside and outside the boardroom. | ||

Mr. Sullivan has served as a member of our Board of Directors since August 2007 and as Chairman since May 2015. He previously served as Chairman of our Nominating, Governance and Sustainability Committee and as a member of our Compensation Committee. From 1981 through August 2003, Mr. Sullivan was employed in various capacities by Anadarko Petroleum Corporation, most recently as executive vice president, exploration and production. Mr. Sullivan has been retired since August 2005. Mr. Sullivan serves as a director and a member of the audit committee of our CSI Compressco GP Inc. subsidiary, the general partner of CSI Compressco, also one of our consolidated subsidiaries and a publicly traded limited partnership subject to the reporting requirements of the Exchange Act. Mr. Sullivan is the non-executive chairman of the board of directors of SM Energy Company, a Public Company. From February 2007 to May 2015, Mr. Sullivan served as a director and as a member of the conflicts and audit committees of Targa Resources Partners GP, LLC, the general partner of Targa Resources Partners LP, and from March 2006 to September 2018, Mr. Sullivan served as a director and as a member of the audit, nominating and corporate governance and conflicts, and compensation committees of Legacy Reserves GP, LLC, the general partner of Legacy Reserves, LP, both of which were publicly traded entities at the time of his service. Mr. Sullivan received his B.S. degree in Mechanical Engineering from Texas A&M University.

|

|

|

2020 Proxy Statement |

| TETRA Technologies, Inc. I 7 |

PROPOSAL NO. 1 – ELECTION OF DIRECTORS

Joseph C. Winkler III | ||

|

| • Age 68 • Independent Director since 2015 Board Committees • Audit Committee • Compensation Committee |

Key Attributes/Skills/Expertise. Mr. Winkler’s extensive energy industry-related operational, financial, international, and capital markets experience provides a significant contribution to our Board of Director’s mix of backgrounds and skills. Mr. Winkler’s substantial experience in serving on the boards of publicly held corporations and publicly traded limited partnerships operating in the oil and gas industry provides our board with valuable corporate leadership, governance, and strategy development knowledge. | ||

Mr. Winkler has served as a member of our Board of Directors since August 2015, as a member of our Audit Committee since October 2015 and as a member of our Compensation Committee since May 2018. Mr. Winkler served as chairman of the board and chief executive officer of Complete Production Services Inc. from March 2007 until February 2012, at which time he retired in connection with the acquisition of Complete by Superior Energy Services, Inc. From June 2005 to March 2007, Mr. Winkler served as Complete Production Services Inc.'s president and chief executive officer. Prior to that, from March 2005 to June 2005, Mr. Winkler served as the executive vice president and chief operating officer of National Oilwell Varco, Inc. and from May 2003 until March 2005, as the president and chief operating officer of such company’s predecessor, Varco International, Inc. From April 1996 to May 2003, Mr. Winkler served in various other senior management capacities with Varco and its predecessor, Tuboscope International. From 1993 to April 1996, Mr. Winkler served as the chief financial officer of D.O.S., Ltd., a privately held company that was acquired by Varco International in April 1996. Prior to joining D.O.S., Ltd., Mr. Winkler served as chief financial officer of Baker Hughes INTEQ, and served in a similar role for various companies owned by Baker Hughes Incorporated. Mr. Winkler is a member, lead director, chairman of the audit committee and a member of the compensation committee of the board of directors of Hi-Crush Inc., a Public Company, and served as a director of the general partner of Hi-Crush Partners LP since 2012 until its recent conversion to a C-Corp. Mr. Winkler also serves as a director of Commercial Metals Company, a Public Company, since 2012 and as the lead director and a member of its compensation and finance committees. Mr. Winkler served on the board of Eclipse Resources Corporation, a Public Company, from 2014 until its merger with Montage Resources in March 2019, and on the board of Dresser-Rand Group, Inc. from 2007 until its merger with Siemens AG in July 2015. Mr. Winkler received a B.S. degree in Accounting from Louisiana State University.

|

|

|

8 I TETRA Technologies, Inc. |

| 2018 Proxy Statement |

PROPOSAL NO. 2 – RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Proposal No. 2 — Ratification of Selection of Independent Registered Public Accounting Firm

The Board recommends a vote FOR this Proposal |

Proposal No. 2 requests stockholder approval of the Board of Directors’ selection of the firm of Ernst & Young LLP (“EY”) as our independent registered public accounting firm, or “independent auditors”, for the year ending December 31, 2020.

Independence of our Independent Auditor

The Audit Committee evaluates the selection of the independent auditors each year and has selected EY for the current year. EY has served as our independent auditors since 1981. The Audit Committee concluded that many factors contribute to the continued support of EY’s independence, such as the oversight of the Public Company Accounting Oversight Board (“PCAOB”) through the establishment of audit, quality, ethics, and independence standards, in addition to conducting audit inspections, the mandating of reports on internal control over financial reporting, PCAOB requirements for audit partner rotation, and limitations imposed by regulation and by our Audit Committee on non-audit services provided by EY. The Audit Committee reviews and pre-approves all audit and non-audit services to be performed by EY as well as reviews and approves the fees charged by EY for such services. In its review and pre-approval of non-audit service fees, the Audit Committee considers, among other factors, the possible impact of the performance of such services on the auditors’ independence. In addition, under the auditor independence rules, EY reviews its independence each year and delivers to the Audit Committee a letter addressing matters prescribed in those rules. Please see the Audit Committee Report on page 30 for additional information regarding the Audit Committee’s evaluation of EY.

In accordance with applicable rules on partner rotation, EY’s coordinating partner for our audit was changed in 2018, commencing with the 2018 audit, and will rotate off our account no later than following the completion of the 2022 audit. The Audit Committee was involved in the selection of the new coordinating partner. EY’s engagement quality review partner for our audit was also changed in 2018 and will rotate off our account no later than following the completion of the 2022 audit.

Considerations Regarding Appointment

The Audit Committee considers, among other factors, the fact that we require global, standardized, and well-coordinated services, not only for audit purposes, but for other non-audit service items, including statutory audits and various regulatory certification items. Some of these services are provided to us by multinational audit and accounting firms other than EY. A change in our independent auditor may require us to replace one or more of these other multinational service providers and could significantly disrupt our business due to a loss of cumulative knowledge in such service providers’ areas of expertise.

|

|

|

2020 Proxy Statement |

| TETRA Technologies, Inc. I 9 |

The Board of Directors recommends that you vote “FOR” ratification and approval of the appointment of EY as our independent registered public accounting firm for the 2020 fiscal year, and proxies returned will be so voted unless contrary instructions are indicated thereon.

As a matter of good corporate governance, the Board of Directors submits the selection of the independent registered public accounting firm to our stockholders for ratification. If our stockholders do not ratify the appointment, the Audit Committee may reconsider its selection of the firm as our independent registered public accounting firm for the year ending December 31, 2020, but the Audit Committee may also elect to retain the firm. Even if the selection is ratified, the Audit Committee in its discretion may appoint a different independent registered public accounting firm at any time during the year if the committee determines that such change would be appropriate. Representatives of EY are expected to be present at the Annual Meeting and will have the opportunity to make a statement if they desire to do so and to respond to appropriate questions from stockholders.

Approval of Proposal No. 2 requires the affirmative vote of a majority of the common shares represented in person or by proxy and entitled to vote on the proposal at the annual meeting of stockholders. Please see the "General Information About the Meeting and Voting" section in this proxy statement for additional information.

|

|

|

10 I TETRA Technologies, Inc. |

| 2020 Proxy Statement |

PROPOSAL NO. 3 – ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION

Proposal No. 3 — Advisory Vote to Approve Executive Compensation

The Board recommends a vote FOR this Proposal |

In Proposal No. 3, we are asking our stockholders to approve, on an advisory basis, the compensation of our named executive officers (“NEOs”) pursuant to Section 14A of the Exchange Act, as disclosed in this proxy statement in accordance with SEC rules. While this vote is not binding on our Company, the results of the votes on this proposal will be carefully considered by the Board of Directors and the Compensation Committee of our Board of Directors when making future executive compensation decisions. The next such vote will occur at the 2021 Annual Meeting of Stockholders

As discussed in the Compensation Discussion and Analysis (“CD&A”) section of this proxy statement, our compensation philosophy is designed to enable us to recruit and retain the highly qualified and competent executives that are crucial to our long-term success while ensuring that a significant portion of the compensation opportunities available to them are tied to performance; thus aligning their interests with the interests of our stockholders. |

The following are some of the key topics discussed in greater detail in the CD&A and in other sections of this proxy statement, and stockholders are encouraged to read these other sections.

| • | Every member of our Compensation Committee is independent, as independence is defined in the listing standards of the NYSE (page 14). |

| • | Our Executive Incentive Compensation Recoupment Policy provides a mechanism for us to recover all forms of incentive compensation paid to our executive officers in some circumstances (page 56). |

| • | Our Compensation Committee has established a thorough process for the review and approval of our compensation programs and practices and it has retained and directed an independent compensation consultant to assist in the discharge of its duties (page 43). |

| • | Our Board of Directors has adopted stock ownership guidelines that apply to our directors and executive officers (pages 19 and 58). |

| • | We employ our executive officers “at will” under employment agreements similar to those executed by all our employees (page 57). |

| • | Our insider trading policy prohibits transactions involving short sales, the buying and selling of puts, calls, or other derivative instruments, and certain forms of hedging or monetization transactions involving our securities (page 27). |

| • | On an annual basis, our Compensation Committee awards performance-based, long-term cash incentives to certain of our executive officers to supplement the long-term performance-based incentive and retention value provided by time-vesting equity awards. |

| • | A significant portion of our executive officers’ compensation is in the form of long-term incentive awards that are tied to the long-term performance of our stock and certain key measures that drive stockholder returns. The process by which the Compensation Committee determines the structure of these long-term incentive awards takes into account TETRA’s performance relative to our peers and internal budgeted expectations, market compensation and the need to retain executive talent over the long-term, and alignment with the experience of our long-term stockholders. |

| • | We believe that providing both short- and long-term incentive compensation awards also helps reduce risks to us or our stockholders that could arise from excessive focus on short-term performance (page 68). |

|

|

|

2020 Proxy Statement |

| TETRA Technologies, Inc. I 11 |

Our Board of Directors believes that our compensation program is effective in implementing our compensation philosophy and furthering our strategic goals and objectives. Pursuant to SEC rules, we are asking our stockholders to approve the compensation of our NEOs as disclosed in the CD&A (beginning on page 36), the compensation tables (beginning on page 61) and the narrative discussion following the compensation tables. This advisory stockholder vote, commonly known as “say-on-pay,” gives you as a stockholder the opportunity to approve or not approve our executive compensation program and policies through the following resolution:

“RESOLVED, that the stockholders of TETRA Technologies, Inc. approve, on an advisory basis, the compensation of its named executive officers as disclosed in the Company’s 2020 Proxy Statement pursuant to the executive compensation disclosure rules of the Securities and Exchange Commission, which disclosure includes the Compensation Discussion and Analysis, the compensation tables and related narrative disclosure contained in this Proxy Statement.”

The Board of Directors recommends that you vote “FOR” approval of the named executive officer compensation as disclosed pursuant to the executive compensation disclosure rules of the SEC, including in the Compensation Discussion and Analysis, the compensation tables and related narrative discussion as contained in this proxy statement. Proxies returned will be so voted unless contrary instructions are indicated thereon.

Approval of Proposal No. 3, on an advisory basis, requires the affirmative vote of a majority of the common shares represented in person or by proxy and entitled to vote on the proposal at the annual meeting of stockholders. Please see the "General Information About the Meeting and Voting" section in this proxy statement for additional information.

|

|

|

12 I TETRA Technologies, Inc. |

| 2020 Proxy Statement |

CORPORATE GOVERNANCE

INFORMATION ABOUT US |

Corporate Governance Guidelines

The Board of Directors has adopted Corporate Governance Guidelines that address applicable NYSE corporate governance listing requirements and various other corporate governance matters. The Board of Directors believes the Corporate Governance Guidelines assist in ensuring that:

| • | the Board of Directors is independent from management; |

| • | the Board of Directors adequately performs its function as the overseer of management, and |

| • | the interests of management and the Board of Directors align with the interests of our stockholders. |

Our Corporate Governance Guidelines provide for a majority vote principle in connection with the election of our directors. This means that in an uncontested election (that is, an election where the number of nominees is not greater than the number of directors to be elected), any nominee who receives a greater number of votes “withheld” from his or her election than votes “for” his or her election must promptly tender his or her resignation to the Chairman of the Board unless such nominee has previously submitted an irrevocable letter of resignation in accordance with our Corporate Governance Guidelines. The Corporate Governance Guidelines also provide that the Board of Directors may require, in order for any incumbent director to become a nominee for further service on the Board of Directors, that such incumbent director submit to the Board of Directors an irrevocable letter of resignation. The irrevocable letter of resignation is conditioned upon, and will not become effective until there has been (i) a failure by that nominee to receive more votes “for” his or her election than votes “withheld” from his or her election in any uncontested election of directors and (ii) acceptance of the resignation by the Board of Directors. In the event a director receives a greater number of votes “withheld” from his or her election than “for” his or her election, the Nominating, Governance and Sustainability Committee will make a recommendation to the Board of Directors regarding the action to be taken with respect to the tendered resignation. A director whose resignation is being considered will not participate in any committee or Board of Directors meetings where his or her resignation is being considered. The Board of Directors will consider the Nominating, Governance and Sustainability Committee’s recommendation and decide whether to accept the tendered resignation within 90 days following the certification of the stockholder vote, and the Board of Directors will promptly and publicly disclose its decision. Each of the nominees for election to the Board of Directors has submitted an irrevocable letter of resignation in accordance with our Corporate Governance Guidelines.

Corporate Governance Documents

The following governance documents are available in the Corporate Governance section of the Investor Relations area of our website at www.tetratec.com and are also available upon written request addressed to Corporate Secretary, TETRA Technologies, Inc., 24955 Interstate 45 North, The Woodlands, Texas 77380:

| • | Corporate Governance Guidelines which govern the qualifications and conduct of the Board of Directors. |

| • | Audit Committee Charter. |

| • | Compensation Committee Charter. |

| • | Nominating, Governance and Sustainability Committee Charter. |

|

|

|

2020 Proxy Statement |

| TETRA Technologies, Inc. I 13 |

CORPORATE GOVERNANCE

| • | Code of Business Conduct for directors, officers, and employees. The key principles of this code are honesty, loyalty, fairness, and accountability. |

| • | Code of Ethics for Senior Financial Officers. The key principles of this code include acting legally and ethically, promoting honest business conduct, and providing timely and meaningful public disclosures to our stockholders. |

| • | Supplier Code of Business Conduct which provides guidance on our expectations from our suppliers, vendors, contractors, and others with whom we do business. |

| • | Anti-Corruption Policy which provides targeted guidance in the very important areas of anti-corruption and anti-bribery compliance. |

| • | Stock Ownership Guidelines for Directors and Executive Officers, which are designed to align the interests of our executive officers and directors with the interests of our stockholders. |

| • | Policy and Procedures for Receipt and Treatment of Complaints Related to Accounting and Compliance Matters (Whistleblower Policy), which provides for the receipt, retention, and treatment of complaints received by us regarding accounting, internal accounting controls, auditing matters, or possible violations of laws, rules, or regulations applicable to us and the confidential, anonymous submission of concerns regarding those matters. |

| • | Human Rights Standards which set forth our commitment to supporting international principles aimed at protecting and promoting universal human rights. |

If any substantive amendments are made to the Code of Ethics for Senior Financial Officers, the nature of such amendment will be disclosed on our website. In addition, if a waiver from either the Code of Business Conduct or the Code of Ethics for Senior Financial Officers is granted to an executive officer, director, or principal accounting officer, the nature of such waiver will be disclosed on our website.

Director Independence and Transactions Considered in Independence Determinations

Director Independence. The NYSE listing standards and our Corporate Governance Guidelines require our Board of Directors to be comprised of at least a majority of independent directors. Our Board of Directors determines independence in accordance with the listing requirements of the NYSE, taking into consideration such facts and circumstances as it considers relevant. In order to assist the Board of Directors in making its determination of whether directors are independent, each director completed and delivered to us a questionnaire designed to solicit accurate and complete information that may be relevant in making such independence determinations. The Board of Directors, with the assistance of the Nominating, Governance and Sustainability Committee, reviewed summaries of responses to such questionnaires and such other information considered relevant with respect to the existence of any relationships between a director and us. All of the directors who serve as members of the Audit Committee, Compensation Committee and the Nominating, Governance and Sustainability Committee are independent as required by the NYSE corporate governance rules. Under these rules, Audit Committee members also satisfy the separate SEC independence requirements, and the Compensation Committee members satisfy the additional NYSE independence requirements.

|

|

|

14 I TETRA Technologies, Inc. |

| 2020 Proxy Statement |

CORPORATE GOVERNANCE

The Board of Directors has affirmatively determined that the following directors are independent:

|

Transactions Considered in Independence Determinations. In making its independence determinations, our Board of Directors considered transactions that occurred between us and entities associated with the independent directors and their immediate family members. Mr. Sullivan is a director of SM Energy Company. SM Energy or its affiliates is a customer of TETRA and CSI Compressco, although Mr. Sullivan’s interest in these transactions was not considered to be material and therefore did not impact his independence. In addition, Messrs. Sullivan and Coombs are directors of CSI Compressco GP Inc., the general partner of CSI Compressco, which are subsidiaries of ours. We have an ongoing business relationship with CSI Compressco. We have considered the foregoing and have concluded that these transactions and relationships did not disqualify Messrs. Sullivan and Coombs from being considered independent under the rules of the NYSE. Our Board of Directors has also determined that neither Mr. Sullivan nor Mr. Coombs has a material interest in these transactions, and that each of them is independent.

Based upon their ongoing employment with us, the Board of Directors has determined that Messrs. Murphy and Brightman are not independent.

Board Leadership Structure; Separation of Positions of Chairman and Chief Executive Officer

As set forth in our Corporate Governance Guidelines, we require the separation of the positions of Chairman of the Board and Chief Executive Officer. Our Board of Directors believes that the separation of these positions strengthens the independence of our Board of Directors and its ability to carry out its roles and responsibilities on behalf of our stockholders. Our Chief Executive Officer is responsible for setting the strategic direction for TETRA and provides the day-to-day leadership of its operations and performance, while Mr. Sullivan, as Chairman, provides overall leadership to our Board of Directors in its oversight function. As Chairman, Mr. Sullivan serves as the presiding director of executive sessions of the non-management and independent directors.

Our board is responsible for, and committed to, the oversight of the business of TETRA. In carrying out this responsibility, our board advises senior management, which is, in turn, responsible for the operations of our Company and driving long term value creation for our stockholders. Our board discusses and receives regular updates on a wide variety of matters affecting TETRA and the primary focus areas are business strategy, risk management, financial reporting and compliance, corporate governance and sustainability, and CEO performance and executive succession planning. In many of these areas, significant responsibilities are delegated to the board’s committees, which are responsible for reporting to the board on their activities and actions. Please refer to “Board Role in Risk Oversight” for additional information on our committees.

|

|

|

2020 Proxy Statement |

| TETRA Technologies, Inc. I 15 |

CORPORATE GOVERNANCE

Business Strategy

| • | Our board takes an active role in overseeing senior management’s formulation and implementation of our strategic plans. |

| • | In addition to our annual, multi-day strategic planning board meeting, our board receives presentations covering company-wide, divisional, and regional strategy and discusses these matters throughout the year both during and outside of board meetings. |

| • | Our board’s oversight of risk management enhances our directors’ abilities to provide insight and feedback to senior management and, if necessary, challenge senior management on our risks associated with our strategic direction. |

| • | Our Chairman of the board helps facilitate our board’s oversight of strategy by ensuring that the directors receive adequate information about strategy and by discussing strategy with independent directors at executive sessions. |

Board Role in Risk Oversight

It is our management’s responsibility to manage risks and to bring to the Board of Directors’ attention any aspects of our business or operations that may give rise to a material level of risk. Our Chief Executive Officer has ultimate responsibility for management of our business, including enterprise level risks and the risk management program and processes, and brings members of management from various business or administrative areas into meetings of the Board of Directors from time to time to make presentations and to provide insight to the board, including insight into areas of potential risk. Such risks include competition risks, industry risks, economic risks, credit and liquidity risks, risks from operations, risks posed by significant litigation and regulatory matters, cyber security risks, risks related to our compensation program, and risks related to acquisitions and dispositions. The Board of Directors, either directly or through its committees, reviews with our management policies, strategic initiatives, and other actions designed to mitigate various types of risk.

|

|

|

16 I TETRA Technologies, Inc. |

| 2020 Proxy Statement |

CORPORATE GOVERNANCE

Enterprise Risk Management Program. The board’s oversight of risk management is enhanced by the detailed information it receives as a result of our Enterprise Risk Management (“ERM”) program. Our ERM process is designed to identify potential key risks that may affect TETRA and manage risk within an established level of acceptable risk. The ERM assessment is performed quarterly and involves evaluation of key risk indicators. During the quarterly ERM assessment, management will review and, to the extent necessary, update or supplement a list of key risks affecting each respective business area along with the corresponding risk mitigation strategies. As part of the risk monitoring process, management evaluates each risk according to its likelihood of occurrence and, assuming that the development or event at risk was to occur, its most likely impact on our financial condition, operations, industry or reputation. The most significant risk items identified in each quarterly assessment are discussed with the Audit Committee. In addition, a complete copy of the ERM report is distributed to and discussed by the full board on an annual basis.

The following table summarizes the role of the board and each of its committees in overseeing risk:

Board of Directors |

|

| Audit Committee |

|

|

|

|

| |

The Board of Directors has ultimate responsibility for protecting stockholder value. Among other things, our Board of Directors is responsible for understanding the risks to which we are exposed, approving management’s strategy to manage these risks, and measuring management’s performance against the strategy. The Board of Directors’ responsibilities include, but are not limited to, appointing our Chief Executive Officer, monitoring our performance relative to our goals, strategies, and the performance of our competitors, reviewing and approving our annual budget, our compliance with rules and regulations, and reviewing and approving investments in and acquisitions and dispositions of assets and businesses. It also periodically reviews management’s business continuity plans. |

| Our Audit Committee oversees risks associated with the integrity of our financial statements, our compliance with legal and regulatory requirements, and matters reported to the Audit Committee through our internal auditors, our chief compliance officer, and our anonymous reporting procedures. The Audit Committee reviews with management, internal auditors, and our independent auditors the accounting policies, the system of internal control over financial reporting, and the quality and appropriateness of disclosure content in the financial statements or other external financial communications. It also periodically reviews, with our management and our independent auditors, management’s ERM program, cyber security program, and significant financial risk exposures and the processes we have implemented to identify, monitor, control, and report such exposures. Our Audit Committee also performs oversight of our compliance program and monitors the results of our compliance efforts.

| ||

Nominating, Governance & Sustainability Committee |

|

| Compensation Committee |

|

|

|

| ||

Our Nominating, Governance and Sustainability Committee oversees risks primarily associated with our ability to attract, motivate, and retain quality directors, board succession planning, our overall corporate governance programs and practices and our compliance therewith. In consultation with the board and each of its committees, the committee also provides oversight and guidance with respect to material environmental, social and other sustainability matters involving our Company. Additionally, the Nominating, Governance and Sustainability Committee oversees the performance evaluation of the Board of Directors and its committees. |

| Our Compensation Committee oversees risks primarily associated with TETRA and CSI Compressco's abilities to attract, motivate, retain and develop quality talent, particularly executive talent, including risks associated with the design and implementation of our compensation programs, policies and practices, and the disclosure of executive compensation philosophies, strategies, and activities. The Compensation Committee also oversees executive succession planning and the compensation of the Board of Directors and its committees. | ||

|

|

| ||

|

|

| ||

|

|

|

2020 Proxy Statement |

| TETRA Technologies, Inc. I 17 |

CORPORATE GOVERNANCE

Our Board of Directors is focused on integrating sustainability into our Company’s long-term strategy. We are committed to operating in a sustainable manner and being a responsible corporate citizen for the benefit of our customers, investors, employees, the environment and the communities in which we operate. We focus on environmental stewardship, the health and safety of our workforce, the recruitment, development and retention of our workforce, and community engagement.

Environmental Stewardship | Health, Safety, Environment and Quality (“HSEQ”) |

• We deliver innovative products to further the sustainability goals of many of our customers. • Our fully automated and integrated water management solution helps meet customers’ increasing water requirements by recycling, treating, and optimizing produced water for fracturing operations – all while yielding significant cost savings and reducing operational and HSE risks. • TETRA CS Neptune® fluids are more environmentally friendly, cost-effective alternatives to zinc brines and cesium formate. • Our leak-resistant water transfer system is the industry’s only double-jacketed, UV resistant hose and helps reduce HSE risk to personnel and landowners. • Our fleet of electric and natural gas-powered compressors are monitored via satellite communications and serviced by strategically placed field service technicians, thereby reducing engine emissions and overall driving risks as a result of our employees having shorter distances to drive to repair and maintain compression equipment. | • We are firmly committed to the health and safety of our employees, the protection of the environment, and to product and service quality. Our commitment focuses on controlling risks to employees and others with whom they interact, maintaining safe work practices, minimizing adverse impacts to the environment, meeting customer requirements, and ensuring customer satisfaction. • Our focus on HSEQ, an approach we call “Drive to ZERO”, is a concerted effort to achieve ZERO health, safety, environmental, and quality incidents every day, “stop the job” when necessary, follow HSEQ and ethics guidelines at all times, and live by our Code of Business Conduct everywhere. • We continually train and educate our employees on their responsibility to identify work that is unsafe or environmentally unsound and to help mitigate negative impacts. • Our HSEQ policy has been endorsed by our CEO and communicated throughout the Company, and to our suppliers and contractors. • Our vehicle monitoring systems, journey management, vehicle selection guidelines and driver training reduce our driving exposure and incidents. |

Our People | Communities |

• We offer our employees the opportunity to advance in their professional careers through training and development programs. Further training for certain positions includes leadership development and management skills for individuals to progress within the organization. • Our health and wellness program provides for preventive care and is designed to support our employees’ health and overall well-being. • Our Board of Directors and executive leadership team is committed to enhancing diversity at TETRA. The executive leadership team sponsors the TETRA Diversity Committee, which is focused on promoting gender diversity and inclusion in our workforce and workplace. We increased our number of female managers by over 40% in 2019. • We are committed to helping transitioning military service members and veterans lead successful lives after their military service and have a military hire initiative that is dedicated to welcoming more veterans into our Company. | • We are committed to being a responsible corporate citizen in the communities where we operate and our employees live. We engage in philanthropic activities that support TETRA’s values, fostering strong community relationships and enhancing employee satisfaction and engagement. • Primary focus areas for our community investments are health, education, and community enrichment. For example, we partner with the American Heart Association and CASA Child Advocates of Montgomery County, Texas and provide numerous opportunities for our employees to participate in activities to support these organizations. |

|

|

|

18 I TETRA Technologies, Inc. |

| 2020 Proxy Statement |

CORPORATE GOVERNANCE

Our Board of Directors has adopted guidelines with regard to stock ownership for our directors and executive officers. The stock ownership guidelines are intended to align the interests of our directors and executive officers with the interests of our stockholders. Under the guidelines, our executive officers have historically been required to hold shares of our common stock with a value equal to a multiple, based upon position, of their base salary. In addition to ownership of our stock, ownership of common units of CSI Compressco by our executive officers and directors count under the guidelines. For purposes of these guidelines: (1) each share of our common stock and each CSI Compressco common unit owned on the date of our Annual Meeting each year is deemed to have a value equal to the greater of (a) the trading price as of the date the applicable share or common unit was acquired or (b) the trading price as of the date of our Annual Meeting. The guidelines establish the following minimum ownership:

| • | Executive Officers: |

| • | Under the guidelines, newly appointed officers have five years from their date of appointment to meet the guidelines. In addition, in the event the multiple of an executive officer’s base salary is increased, the executive officer will have five years from the time of such increase to meet the new minimum. |

| • | As of the date of this proxy statement, subject to the transition periods described above, all covered officers are in compliance with the guidelines. |

| • | Non-Employee Directors - including the Chairman of the Board of Directors, are required to hold shares of our common stock and/or common units of CSI Compressco having a deemed value equal to five-times their annual cash retainer. Non-employee directors have four years from the date of their election or appointment to meet the guidelines. As of the date of this proxy statement, subject to the transition periods described above, all non-employee directors are in compliance with the guidelines. |

Board Committees. The Board of Directors assigns responsibilities and delegates authority to its committees, as appropriate, and the committees regularly report on their activities to the full board. During 2019, the standing committees of the Board of Directors consisted of an Audit Committee, a Compensation Committee, and a Nominating, Governance and Sustainability Committee. Each committee has the authority to engage outside experts, advisors, and legal counsel to assist in its work.

The following table identifies the current chairs and membership of the board and each standing board committee. As discussed above, the board has determined that each member of the Audit, Compensation, and Nominating, Governance and Sustainability Committees is independent in accordance with NYSE standards.

|

|

|

2020 Proxy Statement |

| TETRA Technologies, Inc. I 19 |

CORPORATE GOVERNANCE

| Board of Directors | Committee Membership |

| |||||||

Director |

| Audit |

| Compensation |

| Governance |

| |||

Mark E. Baldwin(1) | √ | C |

|

|

|

|

|

|

| |

Thomas R. Bates, Jr. | √ |

|

|

| C |

|

|

|

| |

Stuart M. Brightman ** | √ |

|

|

|

|

|

|

| ||

Paul D. Coombs | √ | √ |

|

|

|

| √ |

| ||

John F. Glick | √ |

|

|

| √ |

| C |

| ||

Gina A. Luna | √ | √ |

|

|

|

| √ |

| ||

Brady M. Murphy ** | √ |

|

|

|

|

|

|

|

|

|

William D. Sullivan(2) | √ |

|

|

|

|

|

|

| ||

Joseph C. Winkler III | √ | √ |

| √ |

|

|

|

| ||

Number of Meetings held in 2019 | 7 |

| 6 |

|

| 7 |

|

| 4 |

|

| (1) | Designated Audit Committee Financial Expert |

| (2) | As Chairman of the Board, Mr. Sullivan is an ex officio member of the Audit, Compensation, and Nominating, Governance and Sustainability Committees and has a standing invitation to attend all such committee meetings. He also serves as the presiding director of executive sessions of the non-management and independent directors. |

| C | Committee Chair |

| √ | Member |

| ** | Non-Independent Director |

Meetings and Attendance. During 2019, the Board of Directors held seven meetings, including six regular and one special meetings. Each member of the Board of Directors attended 75% or more of the meetings of the Board of Directors and the meetings of the committees on which they served. Our Corporate Governance Guidelines provide that our preference is to have our directors attend the annual meeting of stockholders. All members of our Board of Directors who were serving at the time of the Annual Meeting of Stockholders in 2019 attended that Annual Meeting.

Audit Committee |

|

|

|

| The Audit Committee’s primary purpose is to assist the Board of Directors in its oversight of: (i) the integrity of our financial statements; (ii) our compliance with legal and regulatory requirements; (iii) the independent auditor’s qualifications; and (iv) the performance of our internal audit function and independent auditors. The Audit Committee has sole authority to appoint and terminate our independent auditors. To promote the independence of the audit, the Audit Committee consults separately with the independent auditors, the internal auditors, and management. As required by NYSE and SEC rules regarding audit committees, the Board of Directors has reviewed the qualifications of its Audit Committee and has determined that none of the current members of the Audit Committee has a relationship with us that might interfere with the exercise of their independence from us or our management, as independence is defined in the listing standards of the NYSE. Accordingly, our Board of Directors has determined that all current members of our Audit Committee are independent as defined in Section 10A of the Exchange Act and as defined in the listing standards of the NYSE. Further, our board has determined that Mr. Baldwin, the current Audit Committee chairman, is an “audit committee financial expert” within the definition established by the SEC. |

|

|

|

20 I TETRA Technologies, Inc. |

| 2020 Proxy Statement |

CORPORATE GOVERNANCE

Compensation Committee |

|

|

|

|

|

2020 Proxy Statement |

| TETRA Technologies, Inc. I 21 |

CORPORATE GOVERNANCE

Board and Committee Succession Planning

The Nominating, Governance and Sustainability Committee regularly considers the long-term make up of our Board of Directors, the experience and skills needed for our board as our business and the markets in which we do business evolve, and whether the composition appropriately aligns with our business and strategic needs. The Committee also considers succession planning in light of anticipated retirements and for board and committee chair and membership roles to maintain relevant expertise and depth of experience. As a result of this ongoing process, over the last six years we have added five new independent directors, who bring fresh and diverse perspectives into our boardroom. In addition, six directors retired during the 2014-2018 time period and one will retire at the conclusion of the 2020 Annual Meeting.

|

|

|

22 I TETRA Technologies, Inc. |

| 2020 Proxy Statement |

CORPORATE GOVERNANCE

Director Nominations by the Nominating, Governance and Sustainability Committee

The Board has a robust process for the consideration of potential director candidates through which the Nominating, Governance and Sustainability Committee (the “Governance Committee”) establishes criteria, screens candidates, and evaluates the qualifications of persons who may be considered as nominees for director, including any candidates nominated or recommended by stockholders. The following graph illustrates our general selection process for new directors:

Diversity. Although we have not adopted a separate policy with regard to the consideration of diversity when evaluating candidates for election to our board, our Corporate Governance Guidelines provide that when assessing candidates, we will consider diversity, including gender diversity. The Governance Committee believes that board membership should reflect diversity in the broadest sense, taking into account our needs and the current composition of the board. We strive to maintain a diversity of backgrounds and experience among the members of the board, as we believe this improves the quality of the board’s deliberations. The Board of Directors’ final selection of board nominees is based on merit, giving consideration to the nominee’s knowledge, experience, skills in areas deemed critical to understanding our business, and personal characteristics such as integrity and judgment, diversity, including gender diversity, ethnicity, and background, and the candidates’ other time commitments.

|

|

|

2020 Proxy Statement |

| TETRA Technologies, Inc. I 23 |

CORPORATE GOVERNANCE

The following chart illustrates the tenure of the director nominees of our Board of Directors. We believe the tenure of our directors provides the appropriate balance of expertise, experience, continuity, and perspective to our board to serve the best interests of our stockholders.

Director Orientation and Continuing Education

We provide each new director with an orientation that consists of a series of in-person briefings provided by senior management and others on our business operations, strategic plans, significant accounting and risk management issues, corporate governance, compliance, and key policies and practices. The orientation sessions are tailored to the particular director depending on their orientation needs. Each director is expected to participate in continuing educational programs as necessary to maintain expertise to perform his or her responsibilities as a director. In this regard, from time to time we provide pertinent articles and information relating to our business, financial affairs, risks, competitors, corporate governance, and changes in legal and regulatory issues. We may also coordinate training and educational sessions for directors from outside experts and provide directors with tours of our facilities from time to time. We reimburse directors for reasonable costs associated with attending other relevant director education programs.

|

|

|

24 I TETRA Technologies, Inc. |

| 2020 Proxy Statement |

CORPORATE GOVERNANCE

Board and Committee Self-Evaluation Process

Our board recognizes the critical role that board and committee evaluations play in ensuring the effective functioning of our board. Accordingly, each year, our Nominating, Governance and Sustainability Committee appraises the framework for our board and committee evaluation process and oversees the evaluation process to ensure that the full board and each committee conduct an assessment of their performance and functioning and solicit feedback for enhancement and improvement.

Board Evaluations – A Multistep Process |

|

Our annual board and committee evaluations cover the following topics: • Board and committee composition, including skills, background and experience; • Review of key areas of focus for the board and effectiveness in overseeing these responsibilities; • Satisfaction with board performance, including the performance of the board and committee chairs in those positions; • Board and committee information needs and quality of materials presented; • Areas where the board and committees should increase their focus; • Satisfaction with the board schedule, agendas, time allotted for topics, and encouragement of open communication and discussion; • Satisfaction with committee structure and responsibilities; and • Access to management, experts, and internal and external resources

|

2019 Evaluation Process | ||

|

|

|

Determine Format | Conduct Evaluation | Follow-Up |

|

|

|