FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report to Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of December, 2002

Commission File Number:

ORIGIN ENERGY LIMITED

(Translation of registrant’s name into English)

Level 39

AMP Centre

50 Bridge Street

SYDNEY NSW 2000

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form6-K in paper as permitted by Regulation S-T Rule 101(b)(1)(7):

Note: Regulation S-T Rule 101(b)(1)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨ No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Origin Energy Limited |

|

| By: | | /s/ [name] |

| Name: | | William Hundy |

| Title: | | Company Secretary |

Date: January 7, 2003

* Print the name and title of the signing officer under his Signature.

ASX Release

5 December 2002

Hovea 4 Progress Report, Onshore Perth Basin, Western Australia

Origin Energy Resources Limited* advises that at 0600 hours WST, the Hovea 4 well was drilling ahead at a measured depth of 1925 metres.

The Hovea 4 well, operated by ARC Energy NL, is being drilled as a combination appraisal and development well from the Hovea Production Facility (“HPF”) location. The well is designed to intersect the Dongara Sandstone reservoir at a position some 850 metres to the north of the HPF at a position close to the interpreted northern limit of the field. The well has been designed to give the option of either completing the deviated section for production or of drilling a horizontal section of up to 200 metres length after intersecting the reservoir in the deviated well. The decision on the final well bore configuration will be made after analysis of the results of the initial reservoir intersection in the deviated well.

The initial Dongara reservoir intersection is expected in approximately two days.

Participants in L1 and L2 (excluding the Dongara, Mondarra and Yardarino fields), and Hovea 4 are as follows:

| Origin Energy Developments Pty Limited* | | 50.00% |

| Arc Energy NL (Operator) | | 50.00% |

*a wholly owned subsidiary of Origin Energy Limited

For further information contact:

Dr Rob Willink

General Manager – Exploration

Phone: 07 3858 0676

Email: rob.willink@upstream.originenergy.com.au

APPENDIX 3B

New issue announcement,

application for quotation of additional securities

and agreement

Information or documents not available now must be given to ASX as soon as available. Information and documents given to ASX become ASX’s property and may be made public.

Name of entity

ABN

We (the entity) give ASX the following information.

Part 1 - All issues

You must complete the relevant sections (attach sheets if there is not enough space).

| | | | | |

|

|

| 1 | | | | +Class of +securities issued or to be issued | | Ordinary Fully Paid Shares |

| | | | | |

|

|

| | | | | | | |

| | | | | |

|

|

| 2 | | | | Number of +securities issued or to be issued (if known) or maximum number which may be issued | | 35,000 |

| | | | | |

|

|

| | | | | | | |

| | | | | |

|

|

| 3 | | | | Principal terms of the +securities (eg, if options, exercise price and expiry date; if partly paid +securities, the amount outstanding and due dates for payment; if+convertible securities, the conversion price and dates for conversion) | | Fully Paid Ordinary Shares |

| | | | | |

|

|

| | | |

|

|

|

|

| 4 | | Do the+securities rank equally in all respects from the date of allotment with an existing+class of quoted+securities? | | Yes | | |

|

| | | If the additional securities do not rank equally, please state: | | | | |

| | | • the date from which they do | | | | |

| | | • the extent to which they participate for the next dividend, (in the case of a trust, distribution) or interest payment | | | | |

| | | • the extent to which they do not rank equally, other than in relation to the next dividend, distribution or interest payment | | | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

|

| 5 | | Issue price or consideration | | $2.92 | | |

| | | |

|

|

|

|

|

| | | | | |

| | | |

|

| | |

|

| 6 | | Purpose of the issue (If issued as consideration for the acquisition of assets, clearly identify those assets) | | Issued as a result of the exercise of Options issued pursuant to the rules of the Origin Energy Senior Executive Option Plan (previously the Boral Limited Senior Executive Option Plan) |

| | | |

|

|

|

| | | | | |

| | | |

|

|

|

|

|

| 7 | | Dates of entering+securities into uncertificated holdings or despatch of certificates | | 3 December 2002 | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| | | | | Number | | +Class |

| | | |

|

|

|

|

| 8 | | Number and+class of all+securities quoted on ASX (including the securities in clause 2 if applicable) | | 651,741,360 | | Ordinary |

| | | |

|

|

|

|

| | | |

|

|

|

|

| | | | | Number | | +Class |

| | | |

|

|

|

|

|

| 9 | | Number and+class of all+securities not quoted on ASX (including the securities in clause 2 if applicable) | | 13,050,300 | | Options |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

| | |

| 10 | | Dividend policy (in the case of a trust, distribution policy) on the increased capital (interests) | | All Shares Participate Equally |

| | | |

|

|

Part 2 - Bonus issue or pro rata issue

| | | |

|

|

|

|

| 11 | | Is security holder approval required? | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 12 | | Is the issue renounceable or non-renounceable? | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 13 | | Ratio in which the+securities will be offered | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 14 | | +Class of+securities to which the offer relates | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 15 | | +Record date to determine entitlements | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 16 | | Will holdings on different registers (or subregisters) be aggregated for calculating entitlements? | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 17 | | Policy for deciding entitlements in relation to fractions | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

18

| | Names of countries in which the entity has+security holders who will not be sent new issue documents Note: Security holders must be told how their entitlements are to be dealt with. Cross reference: rule 7.7. | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 19 | | Closing date for receipt of acceptances or renunciations | | N/A | | |

| | | |

|

|

|

|

| | | |

|

|

| 20 | | Names of any underwriters | | N/A |

| | | |

|

|

| | | | | |

| | | |

|

|

| 21 | | Amount of any underwriting fee or commission | | N/A |

| | | |

|

|

| | | | | |

| | | |

|

|

| 22 | | Names of any brokers to the issue | | N/A |

| | | |

|

|

| | | | | |

| | | |

|

|

| 23 | | Fee or commission payable to the broker to the issue | | N/A |

| | | |

|

|

| | | | | |

| | | |

|

|

| 24 | | Amount of any handling fee payable to brokers who lodge acceptances or renunciations on behalf of+security holders | | N/A |

| | | |

|

|

| | | | | |

| | | |

|

|

| 25 | | If the issue is contingent on+security holders’ approval, the date of the meeting | | N/A |

| | | |

|

|

| | | | | |

| | | |

|

|

| 26 | | Date entitlement and acceptance form and prospectus or Product Disclosure Statement will be sent to persons entitled | | N/A |

| | | |

|

|

| | | | | |

| | | |

|

|

| 27 | | If the entity has issued options, and the terms entitle option holders to participate on exercise, the date on which notices will be sent to option holders | | N/A |

| | | |

|

|

| | | | | |

| | | |

|

|

| 28 | | Date rights trading will begin (if applicable) | | N/A |

| | | |

|

|

| | | | | |

| | | |

|

|

| 29 | | Date rights trading will end (if applicable) | | N/A |

| | | |

|

|

| | | | | |

| | | |

|

|

| 30 | | How do+security holders sell their entitlementsin full through a broker? | | N/A |

| | | |

|

|

| | | | | |

| | | |

|

|

| 31 | | How do+security holders sellpartof their entitlements through a broker and accept for the balance? | | N/A |

| | | |

|

|

| | | |

|

|

| 32 | | How do+security holders dispose of their entitlements (except by sale through a broker)? | | N/A |

| | | |

|

|

| | | | | |

| | | |

|

|

| 33 | | +Despatch date | | N/A |

| | | |

|

|

Part 3 - Quotation of securities

You need only complete this section if you are applying for quotation of securities

|

| 34 | | Type of securities (tick one) |

|

| (a) | | x | | Securities described in Part 1 |

|

| (b) | | ¨ | | All other securities |

|

| | | | | Example: restricted securities at the end of the escrowed period, partly paid securities that become fully paid, employee incentive share securities when restriction ends, securities issued on expiry or conversion of convertible securities |

Entities that have ticked box 34(a)

Additional securities forming a new class of securities

(If the additional securities do not form a new class, go to 43)

Tick to indicate you are providing the information or documents

|

| 35 | | ¨ | | If the+securities are+equity securities, the names of the 20 largest holders of the additional+securities, and the number and percentage of additional+securities held by those holders |

|

| 36 | | ¨ | | If the+securities are+equity securities, a distribution schedule of the additional+securities setting out the number of holders in the categories |

| | | | | 1- 1,000 1,001 - 5,000 5,001 - 10,000 10,001 - 100,000 100,001 and over |

|

| 37 | | ¨ | | A copy of any trust deed for the additional+securities |

(now go to 43)

Entities that have ticked box 34(b)

| | | |

|

|

|

|

| 38 | | Number of securities for which+quotation is sought | | | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

|

| 39 | | Class of+securities for which quotation is sought | | | | |

| | | |

|

|

|

|

| | | |

|

|

|

|

| 40 | | Do the+securities rank equally in all respects from the date of allotment with an existing+class of quoted+securities? | | | | |

|

| | | If the additional securities do not rank equally, please state: | | | | |

| | | • the date from which they do | | | | |

| | | • the extent to which they participate for the next dividend, (in the case of a trust, distribution) or interest payment | | | | |

| | | • the extent to which they do not rank equally, other than in relation to the next dividend, distribution or interest payment | | | | |

| | | |

|

|

|

|

| | | |

|

|

|

|

| 41 | | Reason for request for quotation now | | | | |

| | | | | | | |

| | | Example: In the case of restricted securities, end of restriction period | | | | |

|

| | | (if issued upon conversion of another security, clearly identify that other security) | | | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| | | | | Number | | +Class |

| | | |

|

|

|

|

| 42 | | Number and+class of all+securities quoted on ASX (including the securities in clause 38) | | | | |

| | | |

|

|

|

|

(now go to 43)

All entities

Fees

| 43 | | Payment method (tick one) |

|

| | | ¨ | | Cheque attached |

|

| | | ¨ | | Electronic payment made |

|

| | | | | Note: Payment may be made electronically if Appendix 3B is given to ASX electronically at the same time. |

|

| | | x | | Periodic payment as agreed with the home branch has been arranged |

|

| | | | | Note: Arrangements can be made for employee incentive schemes that involve frequent issues of securities. |

Quotation agreement

| 1 | | +Quotation of our additional+securities is in ASX’s absolute discretion. ASX may quote the+securities on any conditions it decides. |

| 2 | | We warrant the following to ASX. |

| | • | | The issue of the+securities to be quoted complies with the law and is not for an illegal purpose. |

| | • | | There is no reason why those+securities should not be granted+quotation. |

| | • | | An offer of the+securities for sale within 12 months after their issue will not require disclosure under section 707(3) or section 1012C(6) of the Corporations Act. |

Note: An entity may need to obtain appropriate warranties from subscribers for the securities in order to be able to give this warranty

| | • | | Section 724 or section 1016E of the Corporations Act does not apply to any applications received by us in relation to any+securities to be quoted and that no-one has any right to return any+securities to be quoted under sections 737, 738 or 1016F of the Corporations Act at the time that we request that the+securities be quoted. |

| | • | | We warrant that if confirmation is required under section 1017F of the Corporations Act in relation to the+securities to be quoted, it has been provided at the time that we request that the+securities be quoted. |

| | • | | If we are a trust, we warrant that no person has the right to return the+securities to be quoted under section 1019B of the Corporations Act at the time that we request that the+securities be quoted. |

| | 3 | | We will indemnify ASX to the fullest extent permitted by law in respect of any claim, action or expense arising from or connected with any breach of the warranties in this agreement. |

| | 4 | | We give ASX the information and documents required by this form. If any information or document not available now, will give it to ASX before+quotation of the+securities begins. We acknowledge that ASX is relying on the information and documents. We warrant that they are (will be) true and complete. |

| | | | | |

| | |

| | | | | | |

| Sign here: | | | | | Date: | | 5 December 2002 |

| | | Company Secretary | | | | | | |

|

| Print name: | | William M Hundy | | | | | | |

APPENDIX 3B

New issue announcement,

application for quotation of additional securities

and agreement

Information or documents not available now must be given to ASX as soon as available. Information and documents given to ASX become ASX’s property and may be made public.

Name of entity

ABN

We (the entity) give ASX the following information.

Part 1 - All issues

You must complete the relevant sections (attach sheets if there is not enough space).

| | | |

|

|

| 1 | | +Class of +securities issued or to be issued | | Ordinary Fully Paid Shares |

| | | |

|

|

| | | | | |

| | | |

|

|

| 2 | | Number of +securities issued or to be issued (if known) or maximum number which may be issued | | 15,000 |

| | | |

|

|

| | | | | |

| | | |

|

|

| 3 | | Principal terms of the +securities (eg, if options, exercise price and expiry date; if partly paid +securities, the amount outstanding and due dates for payment; if +convertible securities, the conversion price and dates for conversion) | | Fully Paid Ordinary Shares |

| | | |

|

|

| | | | | | | | | |

| | | | | | | |

|

|

| 4 | | | | Do the+securities rank equally in all respects from the date of allotment with an existing+class of quoted+securities? | | Yes |

| | | | | | | | | |

| | | | | If the additional securities do not rank equally, please state: | | | | |

| | | | | • | | the date from which they do | | |

| | | | | • | | the extent to which they participate for the next dividend, (in the case of a trust, distribution) or interest payment | | | | |

| | | | | • | | the extent to which they do not rank equally, other than in relation to the next dividend, distribution or interest payment | | | | |

| | | | | | | | | |

| | | | | | | |

|

|

| | | | | | | | | |

| | | | | | | |

|

|

| 5 | | | | Issue price or consideration | | $2.92 |

| | | | | |

|

|

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | |

|

|

| 6 | | | | Purpose of the issue (If issued as consideration for the acquisition of assets, clearly identify those assets) | | Issued as a result of the exercise of Options issued pursuant to the rules of the Origin Energy Senior Executive Option Plan (previously the Boral Limited Senior Executive Option Plan) |

| | | | | |

|

|

| | | | | | | | | |

| | | | | | | |

|

|

| 7 | | | | Dates of entering +securities into uncertificated holdings or despatch of certificates | | 6 December 2002 |

| | | | | | | |

|

| | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | |

|

|

| | | | | | | Number | | +Class |

| | | | | | | |

|

| | |

| | | | | | | | | |

| 8 | | | | Number and+class of all+securities quoted on ASX(including the securities in clause 2 if applicable) | | 651,756,360 | | Ordinary |

| | | | | |

|

|

|

|

| | | |

|

|

|

|

| | | | | Number | | +Class |

| | | |

|

|

|

|

| 9 | | Number and+class of all+securities not quoted on ASX (including the securities in clause 2 if applicable) | | 13,035,300 | | Options |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 10 | | Dividend policy (in the case of a trust, distribution policy) on the increased capital (interests) | | All Shares Participate Equally | | |

| | | |

|

|

|

|

| | | | | | | |

|

Part 2 - Bonus issue or pro rata issue |

| | | |

|

|

|

|

|

| 11 | | Is security holder approval required? | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 12 | | Is the issue renounceable or non-renounceable? | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 13 | | Ratio in which the+securities will be offered | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 14 | | +Class of+securities to which the offer relates | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 15 | | +Record date to determine entitlements | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 16 | | Will holdings on different registers (or subregisters) be aggregated for calculating entitlements? | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 17 | | Policy for deciding entitlements in relation to fractions | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 18 | | Names of countries in which the entity has+security holders who will not be sent new issue documents | | N/A | | |

| | | | | | | |

| | | Note: Security holders must be told how their entitlements are to be dealt with. | | | | |

| | | | | | | |

| | | Cross reference: rule 7.7. | | | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 19 | | Closing date for receipt of acceptances or renunciations | | N/A | | |

| | | |

|

|

|

|

| | | |

|

|

|

|

| 20 | | Names of any underwriters | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 21 | | Amount of any underwriting fee or commission | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 22 | | Names of any brokers to the issue | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 23 | | Fee or commission payable to the broker to the issue | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 24 | | Amount of any handling fee payable to brokers who lodge acceptances or renunciations on behalf of+security holders | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 25 | | If the issue is contingent on+security holders’ approval, the date of the meeting | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 26 | | Date entitlement and acceptance form and prospectus or Product Disclosure Statement will be sent to persons entitled | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 27 | | If the entity has issued options, and the terms entitle option holders to participate on exercise, the date on which notices will be sent to option holders | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 28 | | Date rights trading will begin (if | | N/A | | |

| | | applicable) | | | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 29 | | Date rights trading will end (if applicable) | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 30 | | How do+security holders sell their entitlementsin full through a broker? | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 31 | | How do+security holders sellpart of their entitlements through a broker and accept for the balance? | | N/A | | |

| | | |

|

|

|

|

| | | |

|

|

| 32 | | How do+security holders dispose of their entitlements (except by sale through a broker)? | | N/A |

| | | |

|

|

| | | | | |

| | | |

|

|

| 33 | | +Despatch date | | N/A |

| | | |

|

|

Part 3 - Quotation of securities

You need only complete this section if you are applying for quotation of securities

(a) x | | Securities described in Part 1 |

(b) ¨ | | All other securities |

Example: restricted securities at the end of the escrowed period, partly paid securities that become fully paid, employee incentive share securities when restriction ends, securities issued on expiry or conversion of convertible securities

Entities that have ticked box 34(a)

Additional securities forming a new class of securities

(If the additional securities do not form a new class, go to 43)

Tick to indicate you are providing the

information or documents

35 ¨ | | If the+securities are+equity securities, the names of the 20 largest holders of the additional+securities, and the number and percentage of additional+securities held by those holders |

36 ¨ | | If the+securities are+equity securities, a distribution schedule of the additional+securities setting out the number of holders in the categories |

1 - 1,000

1,001 - 5,000

5,001 - 10,000

10,001 - 100,000

100,001 and over

37 ¨ | | A copy of any trust deed for the additional+securities |

(now go to 43)

Entities that have ticked box 34(b)

| | | |

|

|

|

|

| 38 | | Number of securities for which+quotation is sought | | | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 39 | | Class of+securities for which quotation is sought | | | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 40 | | Do the+securities rank equally in all respects from the date of allotment with an existing+class of quoted+securities? | | | | |

| | | | | | | |

| | | If the additional securities do not rank equally, please state: | | | | |

| | | • the date from which they do | | | | |

| | | • the extent to which they participate for the next dividend, (in the case of a trust, distribution) or interest payment | | | | |

| | | • the extent to which they do not rank equally, other than in relation to the next dividend, distribution or interest payment | | | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

41

| | Reason for request for quotation now Example: In the case of restricted securities, end of restricted period (if issued upon conversion of another security, clearly identify that other security) | | | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| | | | | Number | | +Class |

| | | |

|

|

|

|

42

| | Number and+class of all+securities quoted on ASX (including the securities in clause 38) | | | | |

| | | |

|

|

|

|

(now go to 43)

All entities

Fees

| 43 | | Payment method (tick one) |

|

| | | ¨ | | Cheque attached |

|

| | | ¨ | | Electronic payment made |

|

| | | | | Note: Payment may be made electronically if Appendix 3B is given to ASX electronically at the same time. |

|

| | | x | | Periodic payment as agreed with the home branch has been arranged |

|

| | | | | Note: Arrangements can be made for employee incentive schemes that involve frequent issues of securities. |

Quotation agreement

| 1 | | +Quotation of our additional+securities is in ASX’s absolute discretion. ASX may quote the+securities on any conditions it decides. |

| 2 | | We warrant the following to ASX. |

| | • | | The issue of the+securities to be quoted complies with the law and is not for an illegal purpose. |

| | • | | There is no reason why those+securities should not be granted+quotation. |

| | • | | An offer of the+securities for sale within 12 months after their issue will not require disclosure under section 707(3) or section 1012C(6) of the Corporations Act. |

Note: An entity may need to obtain appropriate warranties from subscribers for the securities in order to be able to give this warranty

| | • | | Section 724 or section 1016E of the Corporations Act does not apply to any applications received by us in relation to any+securities to be quoted and that no-one has any right to return any+securities to be quoted under sections 737, 738 or 1016F of the Corporations Act at the time that we request that the+securities be quoted. |

| | • | | We warrant that if confirmation is required under section 1017F of the Corporations Act in relation to the+securities to be quoted, it has been provided at the time that we request that the+securities be quoted. |

| | • | | If we are a trust, we warrant that no person has the right to return the+securities to be quoted under section 1019B of the Corporations Act at the time that we request that the+securities be quoted. |

| 3 | | We will indemnify ASX to the fullest extent permitted by law in respect of any claim, action or expense arising from or connected with any breach of the warranties in this agreement. |

| 4 | | We give ASX the information and documents required by this form. If any information or document not available now, will give it to ASX before+quotation of the+securities begins. We acknowledge that ASX is relying on the information and documents. We warrant that they are (will be) true and complete. |

| | | | | |

| | |

| | | | | | |

| Sign here: | | | | | Date: | | 9 December 2002 |

| | | Company Secretary | | | | | | |

|

| Print name: | | William M Hundy | | | | | | |

ASX Release

9 December 2002

Hovea 4 Progress Report, Onshore Perth Basin, Western Australia

Origin Energy Resources Limited* advises that the Hovea 4 appraisal well located in the onshore Perth Basin Production Licence L1 was at 0600 hours WST working stuck drill pipe at a measured depth of 2347 metres.

The primary objective of the Hovea 4 well which is being drilled as a deviated well from the Hovea Production Facility (HPF) location by ARC Energy NL as operator, is to appraise the oil pool in the Dongara Sandstone reservoir discovered by Hovea 1 and appraised by Hovea 3 and Hovea 3 sidetrack. Hovea 4 has successfully completed its primary objective, intersecting an estimated 47 metre oil column (true vertical thickness) in the Dongara Sandstone and Wagina Formation some 800 metres to the north of the Hovea 1 surface location. Prior to becoming stuck the well had reached a total measured depth of 2530 metres and was pulling out of the hole to commence wireline logging.

Confirmation of the thickness of the oil column and reservoir quality will require the acquisition of wireline logs, which cannot be recorded until the stuck drill pipe is recovered.

Participants in L1 and L2 (excluding the Dongara, Mondarra and Yardarino fields), and Hovea 4 are as follows:

| Origin Energy Developments Pty Limited* | | 50.00% |

| Arc Energy NL | | 50.00% |

* a wholly owned subsidiary of Origin Energy Limited.

For further information contact:

Dr Rob Willink

General Manager – Exploration

Phone: 07 3858 0676

Email: rob.willink@upstream.originenergy.com.au

ASX Release

13 December 2002

Mt Stuart purchase boosts Origin generation capacity 50%

Origin Energy announced today that it has executed an agreement to acquire the Mt Stuart power station from AES Corporation.

Mt Stuart is a 288 MW gas turbine peaking plant situated in Townsville in North Queensland. Mt Stuart supplies power to the Queensland Government owned entity, Enertrade, under a power purchase agreement (PPA) and also has the right to sell power in excess of Enertrade’s requirements. The plant achieved commercial operation in December 1998.

The purchase price is $93 million for the Enertrade contract, gas turbines, power plant infrastructure and cash deposits ($7 million). The plant is expected to contribute net earnings of around $8.5 million per annum. If the Enertrade contract is not extended, Origin will have the option of relocating the gas turbines to maximise their ongoing value.

The plant currently runs on kerosene but can be readily converted to natural gas. In addition, the plant has been designed to allow for future expansion to combined cycle, which could increase capacity by a further 150 MW.

Commenting on the purchase Origin’s Managing Director Grant King said, “This project will increase Origin Energy’s portfolio of power generation and cogeneration projects by almost 50% to 880 MW. Returns on the acquisition are underwritten by the Enertrade PPA for the next 6 years. We will also investigate the feasibility of converting the plant to run on natural gas supplied from Origin’s extensive Coal Seam Gas resources in Queensland.”

For more information on this release, please contact:

| Grant King | | Tony Wood |

| Managing Director | | General Manager Public & |

| Origin Energy | | Government Affairs |

| Ph (02) 9220 6435 | | Origin Energy |

| or Mobile 0419 266 049 | | Ph (03) 9652 5506 |

| | | or Mobile 0419 642 098 |

APPENDIX 3B

New issue announcement,

application for quotation of additional securities

and agreement

Information or documents not available now must be given to ASX as soon as available. Information and documents given to ASX become ASX’s property and may be made public.

Name of entity

ABN

We (the entity) give ASX the following information.

Part 1 - All issues

You must complete the relevant sections (attach sheets if there is not enough space).

| | | | | |

|

|

| 1 | | | | +Class of+securities issued or to be issued | | Ordinary Fully Paid Shares |

| | | | | |

|

|

| | | | | | | |

| | | | | |

|

|

| 2 | | | | Number of+securities issued or to be issued (if known) or maximum number which may be issued | | 480,000 |

| | | | | |

|

|

| | | | | | | |

| | | | | |

|

|

| 3 | | | | Principal terms of the+securities (eg, if options, exercise price and expiry date; if partly paid+securities, the amount outstanding and due dates for payment; if+convertible securities, the conversion price and dates for conversion) | | Fully Paid Ordinary Shares |

| | | | | |

|

|

| | | | | | | | | |

| | | | | | | |

|

|

| 4 | | | | Do the+securities rank equally in all respects from the date of allotment with an existing+class of quoted+securities? | | Yes |

| | | | | | | | | |

| | | | | If the additional securities do not rank equally, please state: | | | | |

| | | | | • | | the date from which they do | | |

| | | | | • | | the extent to which they participate for the next dividend, (in the case of a trust, distribution) or interest payment | | | | |

| | | | | • | | the extent to which they do not rank equally, other than in relation to the next dividend, distribution or interest payment | | | | |

| | | | | | | | | |

| | | | | | | |

|

|

| | | | | | | | | |

| | | | | | | |

|

|

| 5 | | | | Issue price or consideration | | $2.92 |

| | | | | |

|

|

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | |

|

|

| 6 | | | | Purpose of the issue (If issued as consideration for the acquisition of assets, clearly identify those assets) | | Issued as a result of the exercise of Options issued pursuant to the rules of the Origin Energy Senior Executive Option Plan (previously the Boral Limited Senior Executive Option Plan) |

| | | | | |

|

|

| | | | | | | | | |

| | | | | | | |

|

|

| 7 | | | | Dates of entering +securities into uncertificated holdings or despatch of certificates | | 11 December 2002 |

| | | | | | | |

|

| | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | |

|

|

| | | | | | | Number | | +Class |

| | | | | | | |

|

| | |

| | | | | | | | | |

| 8 | | | | Number and+class of all+securities quoted on ASX(including the securities in clause 2 if applicable) | | 652,236,360 | | Ordinary |

| | | | | |

|

|

|

|

| | | |

|

|

|

|

| | | | | Number | | +Class |

| | | |

|

|

|

|

| 9 | | Number and+class of all+securities not quoted on ASX (including the securities in clause 2 if applicable) | | 12,555,300 | | Options |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 10 | | Dividend policy (in the case of a trust, distribution policy) on the increased capital (interests) | | All Shares Participate Equally | | |

| | | |

|

|

|

|

| | | | | | | |

|

Part 2 - Bonus issue or pro rata issue |

| | | |

|

|

|

|

|

| 11 | | Is security holder approval required? | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 12 | | Is the issue renounceable or non-renounceable? | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 13 | | Ratio in which the+securities will be offered | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 14 | | +Class of+securities to which the offer relates | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 15 | | +Record date to determine entitlements | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 16 | | Will holdings on different registers (or subregisters) be aggregated for calculating entitlements? | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 17 | | Policy for deciding entitlements in relation to fractions | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 18 | | Names of countries in which the entity has+security holders who will not be sent new issue documents | | N/A | | |

| | | | | | | |

| | | Note: Security holders must be told how their entitlements are to be dealt with. | | | | |

| | | | | | | |

| | | Cross reference: rule 7.7. | | | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 19 | | Closing date for receipt of acceptances or renunciations | | N/A | | |

| | | |

|

|

|

|

| | | |

|

|

|

|

| 20 | | Names of any underwriters | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 21 | | Amount of any underwriting fee or commission | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 22 | | Names of any brokers to the issue | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 23 | | Fee or commission payable to the broker to the issue | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 24 | | Amount of any handling fee payable to brokers who lodge acceptances or renunciations on behalf of+security holders | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 25 | | If the issue is contingent on+security holders’ approval, the date of the meeting | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 26 | | Date entitlement and acceptance form and prospectus or Product Disclosure Statement will be sent to persons entitled | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 27 | | If the entity has issued options, and the terms entitle option holders to participate on exercise, the date on which notices will be sent to option holders | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 28 | | Date rights trading will begin (if | | N/A | | |

| | | applicable) | | | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 29 | | Date rights trading will end (if applicable) | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 30 | | How do+security holders sell their entitlementsin full through a broker? | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 31 | | How do+security holders sellpart of their entitlements through a broker and accept for the balance? | | N/A | | |

| | | |

|

|

|

|

| | | |

|

|

| 32 | | How do+security holders dispose of their entitlements (except by sale through a broker)? | | N/A |

| | | |

|

|

| | | | | |

| | | |

|

|

| 33 | | +Despatch date | | N/A |

| | | |

|

|

Part 3 - Quotation of securities

You need only complete this section if you are applying for quotation of securities

(a) x | | Securities described in Part 1 |

(b) ¨ | | All other securities |

Example: restricted securities at the end of the escrowed period, partly paid securities that become fully paid, employee incentive share securities when restriction ends, securities issued on expiry or conversion of convertible securities

Entities that have ticked box 34(a)

Additional securities forming a new class of securities

(If the additional securities do not form a new class, go to 43)

Tick to indicate you are providing the

information or documents

35 ¨ | | If the+securities are+equity securities, the names of the 20 largest holders of the additional+securities, and the number and percentage of additional+securities held by those holders |

36 ¨ | | If the+securities are+equity securities, a distribution schedule of the additional+securities setting out the number of holders in the categories |

1 - 1,000

1,001 - 5,000

5,001 - 10,000

10,001 - 100,000

100,001 and over

37 ¨ | | A copy of any trust deed for the additional+securities |

(now go to 43)

Entities that have ticked box 34(b)

| | | |

|

|

|

|

| 38 | | Number of securities for which+quotation is sought | | | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 39 | | Class of+securities for which quotation is sought | | | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 40 | | Do the+securities rank equally in all respects from the date of allotment with an existing+class of quoted+securities? | | | | |

| | | | | | | |

| | | If the additional securities do not rank equally, please state: | | | | |

| | | • the date from which they do | | | | |

| | | • the extent to which they participate for the next dividend, (in the case of a trust, distribution) or interest payment | | | | |

| | | • the extent to which they do not rank equally, other than in relation to the next dividend, distribution or interest payment | | | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

41

| | Reason for request for quotation now Example: In the case of restricted securities, end of restricted period (if issued upon conversion of another security, clearly identify that other security) | | | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| | | | | Number | | +Class |

| | | |

|

|

|

|

42

| | Number and+class of all+securities quoted on ASX (including the securities in clause 38) | | | | |

| | | |

|

|

|

|

(now go to 43)

All entities

Fees

| 43 | | Payment method (tick one) |

|

| | | ¨ | | Cheque attached |

|

| | | ¨ | | Electronic payment made |

|

| | | | | Note: Payment may be made electronically if Appendix 3B is given to ASX electronically at the same time. |

|

| | | x | | Periodic payment as agreed with the home branch has been arranged |

|

| | | | | Note: Arrangements can be made for employee incentive schemes that involve frequent issues of securities. |

Quotation agreement

| 1 | | +Quotation of our additional+securities is in ASX’s absolute discretion. ASX may quote the+securities on any conditions it decides. |

| 2 | | We warrant the following to ASX. |

| | • | | The issue of the+securities to be quoted complies with the law and is not for an illegal purpose. |

| | • | | There is no reason why those+securities should not be granted+quotation. |

| | • | | An offer of the+securities for sale within 12 months after their issue will not require disclosure under section 707(3) or section 1012C(6) of the Corporations Act. |

Note: An entity may need to obtain appropriate warranties from subscribers for the securities in order to be able to give this warranty

| | • | | Section 724 or section 1016E of the Corporations Act does not apply to any applications received by us in relation to any+securities to be quoted and that no-one has any right to return any+securities to be quoted under sections 737, 738 or 1016F of the Corporations Act at the time that we request that the+securities be quoted. |

| | • | | We warrant that if confirmation is required under section 1017F of the Corporations Act in relation to the+securities to be quoted, it has been provided at the time that we request that the+securities be quoted. |

| | • | | If we are a trust, we warrant that no person has the right to return the+securities to be quoted under section 1019B of the Corporations Act at the time that we request that the+securities be quoted. |

| | 3 | | We will indemnify ASX to the fullest extent permitted by law in respect of any claim, action or expense arising from or connected with any breach of the warranties in this agreement. |

| | 4 | | We give ASX the information and documents required by this form. If any information or document not available now, will give it to ASX before+quotation of the+securities begins. We acknowledge that ASX is relying on the information and documents. We warrant that they are (will be) true and complete. |

| | |

| | | | | | |

| Sign here: | | | | | Date: | | 13 December 2002 |

| | | Company Secretary | | | | | | |

|

| Print name: | | William M Hundy | | | | | | |

Media Release

13 December 2002

BassGas Project receives Federal Government approval

The T/RL1 Joint Venture today welcomed Federal Government approval to proceed with the BassGas project in line with the joint Environmental Effects Statement/ Environmental Impact Statement (EES/EIS), subject to conditions.

The BassGas Project now has approval to proceed under both State and Federal jurisdictions, following the Victorian Minister for Planning giving conditional approval in September 2002.

Origin Energy Executive General Manager Oil & Gas Production, John Piper commented “Minister Kemp’s approval endorses the commitment Origin Energy and its Joint Venture partners have invested in the environmental approval process that started in August 2001.

“The BassGas project is now positioned to deliver on our promise to improve the security of gas supply in Victoria and south eastern Australia, and to increase competition in the market. With the required approvals now granted, we can continue with our plan to start construction in January 2003 and bring new gas to Victoria by the third quarter of 2004,” Mr Piper said.

Managing Director of AWE, Bruce Phillips, said “We are pleased the BassGas Project has received this key Federal Government approval after a rigorous public consultation process. The BassGas project is now gearing up to commence construction of facilities in the first quarter of 2003. Our progress thereafter will depend on the BassGas proponents’ good relationships with all stakeholders, including the local communities and the Victorian, Tasmanian and Federal government authorities.

“The BassGas Project is important in ensuring competitively priced energy for homes and businesses in southeast Australia and we are determined to deliver the project for the mutual benefit of those communities and our shareholders,” Mr Phillips said.

General Manager of CalEnergy, Elliot Yearsley, said “CalEnergy welcomes Minister Kemp’s approval of the Yolla project and is happy to be associated with this quality project that will provide a competitive source of energy to the people of businesses of Victoria. This approval represents a major milestone for both the Yolla Joint Venture and for the maturing of CalEnergy’s gas supply business in south east Australia.”

Director of Wandoo Petroleum, Noboru JB Tsuruta, said “We are very pleased and encouraged by this excellent news. This represents a key milestone for the project

implementation and we now have greater confidence that the project will deliver a new gas supply to the Victorian market on schedule.”

The Yolla gas field is located 147 km off the Victorian coast in Bass Strait and contains up to:

| • | | 256 petajoules of sales gas – equal to Victoria’s annual gas demand, |

| • | | 1 million tonnes of Liquid Petroleum Gas (LPG), and |

| • | | 14 million barrels of condensate (light oil). |

The BassGas Project will produce enough gas to service up to 67 terajoules of gas sales a day, together with substantial volumes of condensate and LPG. It is expected to supply around 10 per cent of the Victorian natural gas market over the next 15 years.

Origin Energy has agreed to purchase 100 per cent of the 20 petajoules of gas produced per annum for its Retail business.

Project Timeline:

|

|

|

| Construction of: | | Construction Timeframe |

|

|

|

| 75MMSCFD onshore gas plant near Lang Lang | | Start 1Q 2003 |

|

|

|

| 32km, onshore pipelines | | Start 3Q 2003 |

|

|

|

| 147km, sub-sea pipeline | | Start 1Q 2004 |

|

|

|

| Offshore production platform installation | | Start 1Q 2004 |

|

|

|

| Sales gas production comes online | | 3Q 2004 |

|

|

|

The participants in the T/RL1 Joint Venture are:

| | | | |

| Origin Energy (Operator) | | 37.5 | % |

| AWE | | 30.0 | % |

| CalEnergy | | 20.0 | % |

| Wandoo Petroleum Pty | | 12.5 | % |

ENDS

For more information, contact: | | |

John Piper | | Tony Wood |

Executive General Manager Oil & Gas Production | | General Manager Public & Govt Affairs |

Origin Energy | | Origin Energy |

Tel (07) 3858 0681 | | Tel (03) 9652 5506 |

Mobile 0419 701 115 | | Mobile 0419 642 098 |

| | | |

Bruce Phillips | | |

Managing Director | | |

Australian Worldwide Exploration Limited | | |

Tel (02) 94600165 | | |

Email: bjphillips@awexp.com.au | | |

APPENDIX 3B

New issue announcement,

application for quotation of additional securities

and agreement

Information or documents not available now must be given to ASX as soon as available. Information and documents given to ASX become ASX’s property and may be made public.

Name of entity

ABN

We (the entity) give ASX the following information.

Part 1 - All issues

You must complete the relevant sections (attach sheets if there is not enough space).

| | | | | |

|

|

| 1 | | | | +Class of+securities issued or to be issued | | Ordinary Fully Paid Shares |

| | | | | |

|

|

| | | | | | | |

| | | | | |

|

|

| 2 | | | | Number of+securities issued or to be issued (if known) or maximum number which may be issued | | 43,600 |

| | | | | |

|

|

| | | | | | | |

| | | | | |

|

|

| 3 | | | | Principal terms of the+securities (eg, if options, exercise price and expiry date; if partly paid+securities, the amount outstanding and due dates for payment; if+convertible securities, the conversion price and dates for conversion) | | Fully Paid Ordinary Shares |

| | | | | |

|

|

| | | |

|

|

|

|

| 4 | | Do the+securities rank equally in all respects from the date of allotment with an existing+class of quoted+securities? | | Yes | | |

| | | | | | | |

| | | If the additional securities do not rank equally, please state: | | | | |

| | | • the date from which they do | | | | |

| | | • the extent to which they participate for the next dividend (in the case of a trust, distribution) or interest payment, | | | | |

| | | • the extent to which they do not rank equally, other than in relation to the next dividend, distribution or interest payment | | | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

| | |

| 5 | | Issue price or consideration | | $1.76 |

| | | |

|

|

| | | | | | | |

| | | |

|

| | |

| 6 | | Purpose of the issue (If issued as consideration for the acquisition of assets, clearly identify those assets)

| | Issued as a result of the exercise of Options issued pursuant to the rules of the Origin Energy Senior Executive Option Plan (previously the Boral Limited Senior Executive Option Plan) |

| | | |

|

|

| | | | | | | |

| | | |

|

| | |

| 7 | | Dates of entering+securities into uncertificated holdings or despatch of certificates | | 13 December 2002 |

| | | |

|

|

| | | | | | | |

| | | |

|

|

|

|

| | | | | Number | | +Class |

| | | |

|

|

|

|

| 8 | | Number and+class of all+securities quoted on ASX (including the securities in clause 2 if applicable) | | 652,279,960

| | Ordinary |

| | | |

|

|

|

|

| | | |

|

|

|

|

| | | | | Number | | +Class |

| | | |

|

|

|

|

| 9 | | Number and+class of all+securities not quoted on ASX (including the securities in clause 2 if applicable) | | 12,511,700 | | Options |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 10 | | Dividend policy (in the case of a trust, distribution policy) on the increased capital (interests) | | All Shares Participate Equally | | |

| | | |

|

|

|

|

| | | | | �� | | |

|

Part 2 - Bonus issue or pro rata issue |

| | | |

|

|

|

|

|

| 11 | | Is security holder approval required? | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 12 | | Is the issue renounceable or non-renounceable? | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 13 | | Ratio in which the+securities will be offered | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 14 | | +Class of+securities to which the offer relates | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 15 | | +Record date to determine entitlements | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 16 | | Will holdings on different registers (or subregisters) be aggregated for calculating entitlements? | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 17 | | Policy for deciding entitlements in relation to fractions | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 18 | | Names of countries in which the entity has+security holders who will not be sent new issue documents | | N/A | | |

| | | | | | | |

| | | Note: Security holders must be told how their entitlements are to be dealt with. | | | | |

| | | | | | | |

| | | Cross reference: rule 7.7. | | | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 19 | | Closing date for receipt of acceptances or renunciations | | N/A | | |

| | | |

|

|

|

|

| | | |

|

|

|

|

| 20 | | Names of any underwriters | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 21 | | Amount of any underwriting fee or commission | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 22 | | Names of any brokers to the issue | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 23 | | Fee or commission payable to the broker to the issue | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 24 | | Amount of any handling fee payable to brokers who lodge acceptances or renunciations on behalf of+security holders | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 25 | | If the issue is contingent on+security holders’ approval, the date of the meeting | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 26 | | Date entitlement and acceptance form and prospectus or Product Disclosure Statement will be sent to persons entitled | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 27 | | If the entity has issued options, and the terms entitle option holders to participate on exercise, the date on which notices will be sent to option holders | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 28 | | Date rights trading will begin (if | | N/A | | |

| | | applicable) | | | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 29 | | Date rights trading will end (if applicable) | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 30 | | How do+security holders sell their entitlementsin full through a broker? | | N/A | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 31 | | How do+security holders sellpart of their entitlements through a broker and accept for the balance? | | N/A | | |

| | | |

|

|

|

|

| | | |

|

|

| 32 | | How do+security holders dispose of their entitlements (except by sale through a broker)? | | N/A |

| | | |

|

|

| | | | | |

| | | |

|

|

| 33 | | +Despatch date | | N/A |

| | | |

|

|

Part 3 - Quotation of securities

You need only complete this section if you are applying for quotation of securities

(a) x | | Securities described in Part 1 |

(b) ¨ | | All other securities |

Example: restricted securities at the end of the escrowed period, partly paid securities that become fully paid, employee incentive share securities when restriction ends, securities issued on expiry or conversion of convertible securities

Entities that have ticked box 34(a)

Additional securities forming a new class of securities

(If the additional securities do not form a new class, go to 43)

Tick to indicate you are providing the

information or documents

35 ¨ | | If the+securities are+equity securities, the names of the 20 largest holders of the additional+securities, and the number and percentage of additional+securities held by those holders |

36 ¨ | | If the+securities are+equity securities, a distribution schedule of the additional+securities setting out the number of holders in the categories |

1 - 1,000

1,001 - 5,000

5,001 - 10,000

10,001 - 100,000

100,001 and over

37 ¨ | | A copy of any trust deed for the additional+securities |

(now go to 43)

Entities that have ticked box 34(b)

| | | |

|

|

|

|

| 38 | | Number of securities for which+quotation is sought | | | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 39 | | Class of+securities for which quotation is sought | | | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| 40 | | Do the+securities rank equally in all respects from the date of allotment with an existing+class of quoted+securities? | | | | |

| | | | | | | |

| | | If the additional securities do not rank equally, please state: | | | | |

| | | • the date from which they do | | | | |

| | | • the extent to which they participate for the next dividend, (in the case of a trust, distribution) or interest payment | | | | |

| | | • the extent to which they do not rank equally, other than in relation to the next dividend, distribution or interest payment | | | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

41

| | Reason for request for quotation now Example: In the case of restricted securities, end of restricted period (if issued upon conversion of another security, clearly identify that other security) | | | | |

| | | |

|

|

|

|

| | | | | | | |

| | | |

|

|

|

|

| | | | | Number | | +Class |

| | | |

|

|

|

|

42

| | Number and+class of all+securities quoted on ASX (including the securities in clause 38) | | | | |

| | | |

|

|

|

|

(now go to 43)

All entities

Fees

| 43 | | Payment method (tick one) |

|

| | | ¨ | | Cheque attached |

|

| | | ¨ | | Electronic payment made |

|

| | | | | Note: Payment may be made electronically if Appendix 3B is given to ASX electronically at the same time. |

|

| | | x | | Periodic payment as agreed with the home branch has been arranged |

|

| | | | | Note: Arrangements can be made for employee incentive schemes that involve frequent issues of securities. |

Quotation agreement

| 1 | | +Quotation of our additional+securities is in ASX’s absolute discretion. ASX may quote the+securities on any conditions it decides. |

| 2 | | We warrant the following to ASX. |

| | • | | The issue of the+securities to be quoted complies with the law and is not for an illegal purpose. |

| | • | | There is no reason why those+securities should not be granted+quotation. |

| | • | | An offer of the+securities for sale within 12 months after their issue will not require disclosure under section 707(3) or section 1012C(6) of the Corporations Act. |

Note: An entity may need to obtain appropriate warranties from subscribers for the securities in order to be able to give this warranty

| | • | | Section 724 or section 1016E of the Corporations Act does not apply to any applications received by us in relation to any+securities to be quoted and that no-one has any right to return any+securities to be quoted under sections 737, 738 or 1016F of the Corporations Act at the time that we request that the+securities be quoted. |

| | • | | We warrant that if confirmation is required under section 1017F of the Corporations Act in relation to the+securities to be quoted, it has been provided at the time that we request that the+securities be quoted. |

| | • | | If we are a trust, we warrant that no person has the right to return the+securities to be quoted under section 1019B of the Corporations Act at the time that we request that the+securities be quoted. |

| 3 | | We will indemnify ASX to the fullest extent permitted by law in respect of any claim, action or expense arising from or connected with any breach of the warranties in this agreement. |

| 4 | | We give ASX the information and documents required by this form. If any information or document not available now, will give it to ASX before+quotation of the+securities begins. We acknowledge that ASX is relying on the information and documents. We warrant that they are (will be) true and complete. |

| | | | | |

| | |

| | | | | | |

| Sign here: | | | | | Date: | | 16 December 2002 |

| | | Company Secretary | | | | | | |

|

| Print name: | | William M Hundy | | | | | | |

Rule 3.19A.2

APPENDIX 3Y

Change of Director’s Interest Notice

Information or documents not available now must be given to ASX as soon as available. Information and documents given to ASX become ASX’s property and may be made public.

Introduced 30/9/2001.

|

|

|

|

|

Name of entity | | ORIGIN ENERGY LIMITED | | |

|

|

|

|

|

ABN | | 30 000 051 696 | | |

|

|

|

|

|

We (the entity) give ASX the following information under listing rule 3.19A.2 and as agent for the director for the purposes of section 205G of the Corporations Act.

|

|

|

|

|

| Name of Director | | Grant A King | | |

|

|

|

|

|

Date of last notice | | 2 January 2002 | | |

|

|

|

|

|

Part 1 - Change of director’s relevant interests in securities

In the case of a trust, this includes interests in the trust made available by the responsible entity of the trust

|

|

|

Direct or indirect interest | | Direct and indirect |

|

|

|

Nature of indirect interest (including registered holder) Note: Provide details of the circumstances giving rise to the relevant interest | | Shares held in : • Austrust G A King Private Superannuation Fund • Fabco Investments Pty Limited • Origin Energy Executive Share Plan |

|

|

|

Date of change | | 11 December 2002 |

|

|

|

No. of securities held prior to change | | 17,882 Ordinary Fully Paid Shares held directly 32,148 Ordinary Full Paid Shares held indirectly 1,636,750 Ordinary Energy Limited Options held directly |

|

|

|

Class | | Ordinary |

|

|

|

Number acquired | | 50,000 |

|

|

|

Number disposed | | Nil |

|

|

|

|

|

|

Value/Consideration | | $2.92 |

| Note: If consideration is non-cash, provide details and estimated valuation | | |

|

|

|

No. of securities held after change | | 17,882 Ordinary Fully Paid Shares held directly |

| | | 82,148 Ordinary Fully Paid Shares held indirectly |

| | | 1,586,750 Origin Energy Limited Options held directly |

|

|

|

Nature of change Example: on-market trade, off-market trade, exercise of options, issue of securities under dividend reinvestment plan, participation in buy-back | | Shares issued as a result of the exercise of options under the Senior Executive Option Plan. |

|

|

|

Part 2 - Change of director’s interests in contracts

|

|

|

Detail of contract | | N/A |

|

|

|

Nature of interest | | N/A |

|

|

|

Name of registered holder (if issued securities) | | N/A |

|

|

|

Date of change | | N/A |

|

|

|

No. and class of securities to which interest related prior to change | | N/A |

Note: Details are only required for a contract in relation to which the interest has changed | | |

|

|

|

Interest acquired | | N/A |

|

|

|

Interest disposed | | N/A |

|

|

|

Value/Consideration | | N/A |

Note: If consideration is non-cash, provide details and an estimated valuation | | |

|

|

|

Interest after change | | N/A |

|

|

|

ASX Release

18 December 2002

Major agreements herald a new era in gas supply

Origin Energy and its subsidiary, Oil Company of Australia (OCA), today announced major new long-term gas supply arrangements with AGL, including Australia’s largest coal seam gas (CSG) agreement.

Using gas from various CSG fields in central Queensland, OCA and Origin will supply 340 petajoules (PJ) of gas over 15 years from 1 May 2005. This is the largest CSG agreement ever signed in Australia. It effectively doubles CSG production in Queensland, and confirms CSG as a viable, local gas source for Queensland and southern Australian markets.

Of the volumes to be supplied, 195 PJ will be sourced via Origin Energy from the Fairview field, where Tipperary Oil and Gas (Australia) is the operator and OCA has a 23.9% interest. The balance of the agreement will be sourced from other fields operated by OCA. Overall OCA is expected to supply approximately 52% of the total gas requirements.

Under the agreement, gas will be delivered to Moomba through arrangements with owners of existing pipelines and through a new gas pipeline to be built from Ballera to Moomba.

The Cooper Basin Producers have separately announced an agreement with AGL to deliver up to 505 PJ over 14 years from 2003, incremental to existing contracted volumes, which phase out by late 2006. Origin’s net share of this agreement will be up to 71 PJ.

Origin Energy Managing Director, Grant King said, “This deal confirms that the Cooper Basin still has a long-term role to play and that CSG is a new resource which will contribute significantly to Australia’s future gas supplies.

“These, and other gas supply agreements signed in the past six months, demonstrate how Australia’s gas producers are responding to the growing demand for gas in eastern Australia. We expect that exploration and development of new gas resources in eastern Australia will continue - ensuring ongoing self-sufficiency in gas supply,” he said.

OCA’s share of capital expenditure is expected to be around $200 million, staged over the life of the project. This investment, together with expenditure by other suppliers, will provide a significant boost for the regional economy, including additional employment and support for regional infrastructure in central Queensland. The project will also contribute more than $20 million (OCA net share) to Queensland government royalties.

For further information please contact:

| Tony Wood | | Angus Guthrie |

| General Manager Public & Government Affairs | | Manager, Investor Relations |

| Ph: (03) 9652 5506 | | Ph: (02) 9220 6558 |

| Mobile: 0419 642 098 | | Mobile: 0417 864 255 |

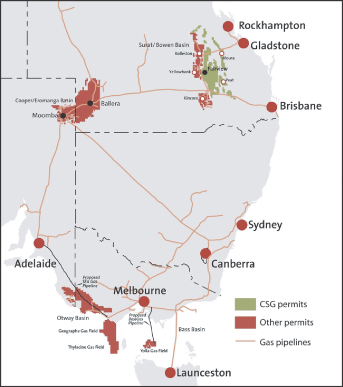

Origin Energy and OCA exploration and production tenements in eastern Australia

Coal Seam Gas agreements – 340 PJ

Company | | Fairview Field |

| Tipperary Oil and Gas (Australia) | | 69.5% |

| OCA | | 23.9% |

| Other minor parties | | 6.6% |

| Volume to be supplied from | | 195 PJ |

| Fairview | | |

A further 145 PJ will be sourced from fields operated by OCA

Cooper Basin Agreements – up to 505 PJ

The interests in the South Australian Gas Producers and the South West Queensland Gas Producers and volumes to be supplied are as follows:

Company | | South Australia | | Queensland |

| Santos | | 59.8% | | 60.1% |

| Delhi (ExxonMobil) | | 20.2% | | 23.2% |

| Origin Energy | | 13.2% | | 16.7% |

| Novus Petroleum | | 4.7% | | |

| Basin Oil (OMV) | | 1.2% | | |

| Volume to be supplied is up to | | 355 PJ | | 150 PJ |

APPENDIX 3B

New issue announcement,

application for quotation of additional securities

and agreement

Information or documents not available now must be given to ASX as soon as available. Information and documents given to ASX become ASX’s property and may be made public.

Name of entity

ABN

We (the entity) give ASX the following information.

Part 1 - All issues

You must complete the relevant sections (attach sheets if there is not enough space).

| | | | | | | |

|

|

| | | 1 | | | | +Class of+securities issued or to be issued | | Ordinary Fully Paid Shares |

| | | | | | | |

|

|

| | | | | | | | | |

| | | | | | | |

|

|

| | | 2 | | | | Number of+securities issued or to be issued (if known) or maximum number which may be issued | | 38,000 |

| | | | | | | |

|

|

| | | | | | | | | |

| | | | | | | |

|

|