FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report to Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of August, 2003

Commission File Number:

Origin Energy Limited

(Translation of registrant’s name into English)

Level 39

AMP Centre

50 Bridge Street

SYDNEY NSW 2000

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form6-K in paper as permitted by Regulation S-T Rule 101(b)(1)(7):

Note: Regulation S-T Rule 101(b)(1)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes ¨ No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-

INDEX TO EXHIBITS

Item

| | |

1. | | ASX announcement “Results for Year ended June 30, 2003” dated August 20, 2003 |

2. | | Media Release “Strong contributions by existing businesses and recent acquisitions drive 26% increase in net profit” dated August 20, 2003 |

3. | | Directors’ Report of Results for the year ended June 30, 2003 dated August 20, 2003 |

4. | | ASX Appendix Form 4E Final Report dated August 20, 2003 |

5. | | ASX announcement “Results Announcement year ended June 30, 2003 – Presentation” dated August 20, 2003 |

6. | | Final Results Announcement full year ended June 30, 2003 presentation dated August 20, 2003 |

7. | | ASX announcement “Exploration and Production Presentation” dated August 21, 2003 |

8. | | Exploration and Production Presentation dated August 21, 2003 |

The information contained in this report is incorporated by reference into the Registration Statement on Form F-3 (file no. 333-103886).

Item 1.

To | | Company Announcements Office | | Facsimile | | 1300 300 021 |

| | | |

Company | | Australian Stock Exchange Limited | | Date | | 20 August 2003 |

| | | |

From | | Bill Hundy | | Pages | | 44 |

| | | |

Subject | | Results for Year Ended 30 June 2003 | | | | |

This Transmittal is confidential. If you have received this document in error, please contact Origin Energy immediately.

We attach the following documents relating to Origin Energy’s Results for the year ended 30 June 2003:

1. Media Release

2. Directors’ Review

3. Final Report – ASX Appendix 4E

Regards

Bill Hundy

Company Secretary

02 9220 6467 – bill.hundy@originenergy.com.au

Item 2.

Media Release

20 August 2003

Strong contributions by existing businesses and recent acquisitions drive 26% increase in net profit

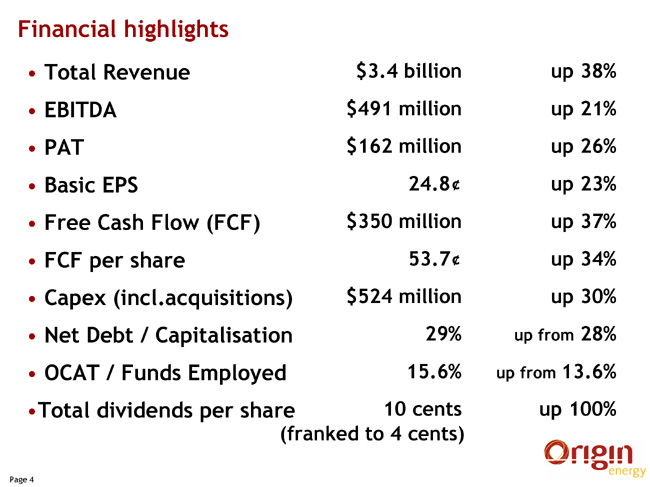

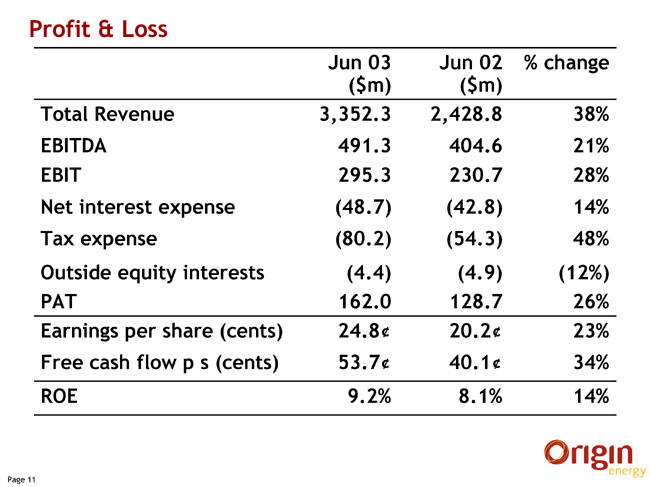

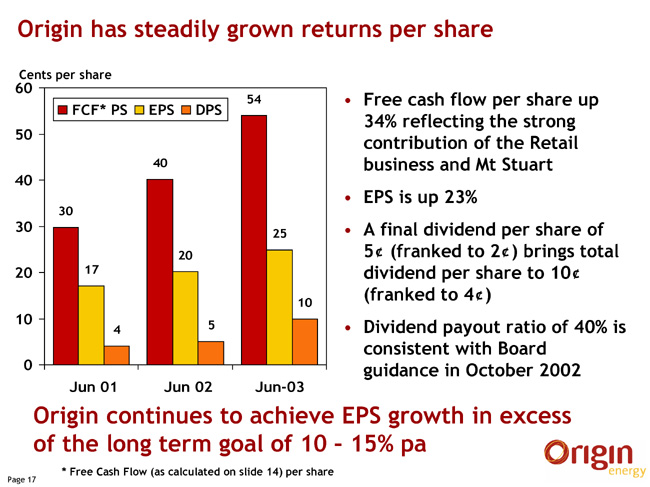

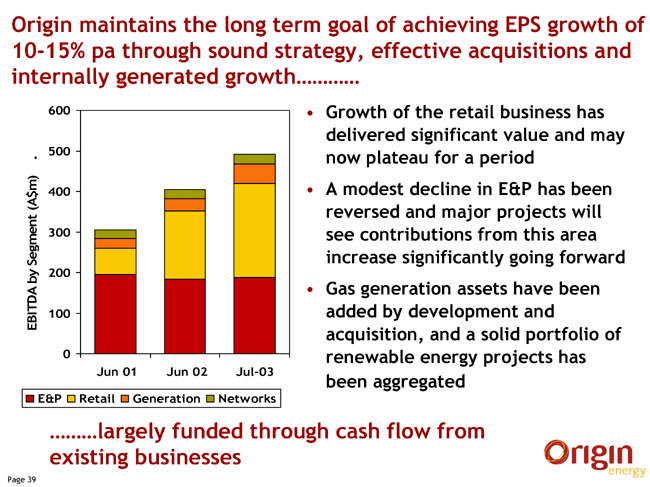

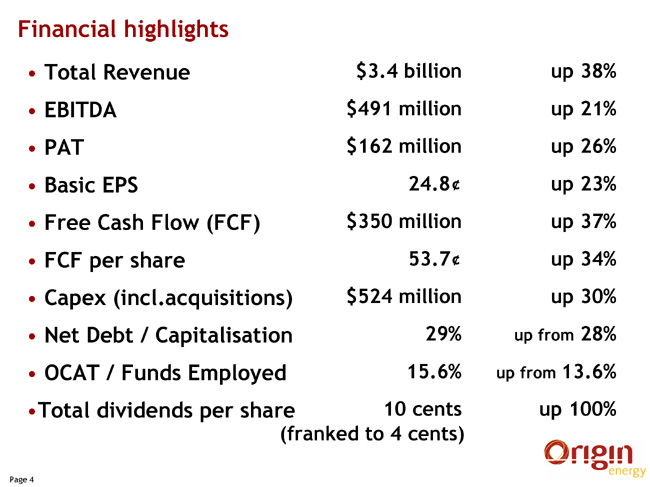

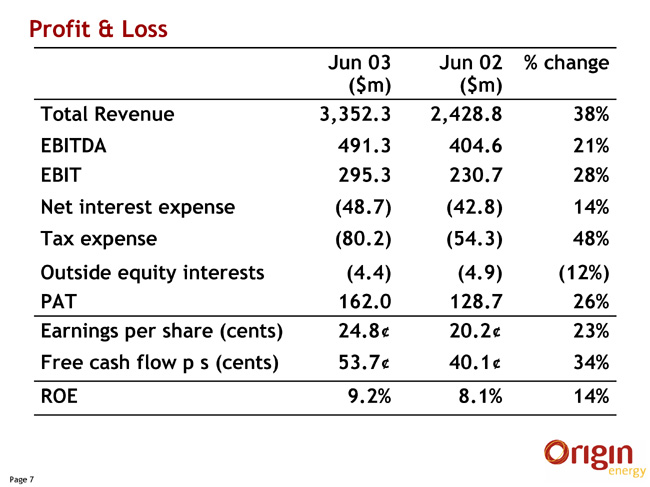

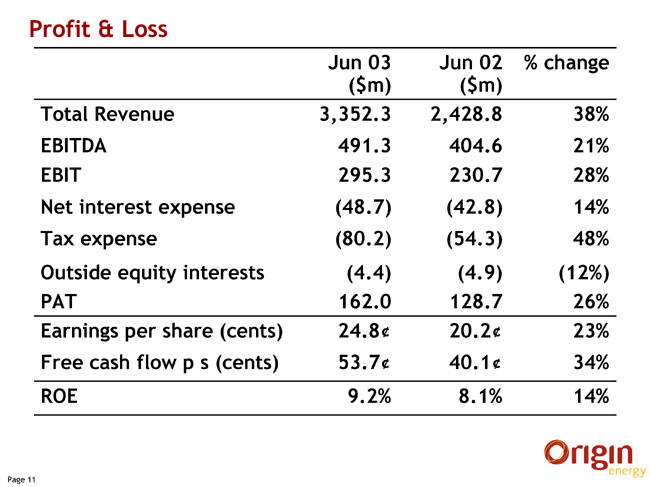

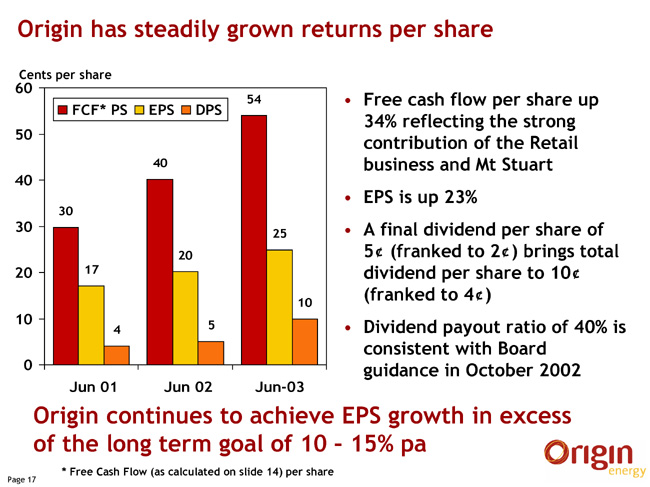

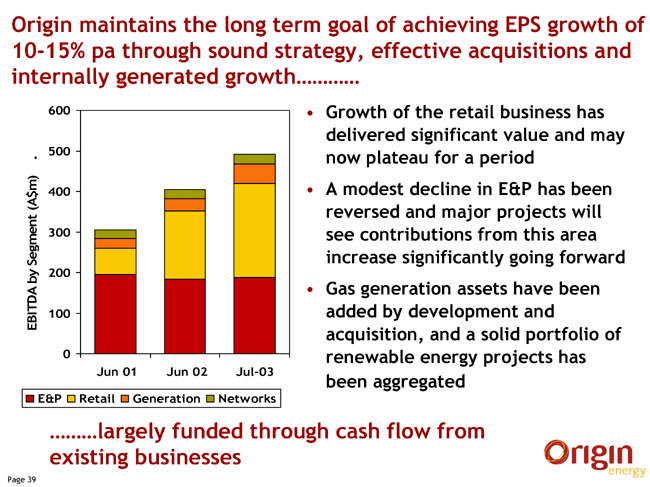

Origin Energy announced today a profit after tax and outside equity interests of $162 million for the year ended 30 June 2003, a 26% increase on the profit for the same period last year. Earnings per share increased by 23% to 24.8 cents.

Highlights

| | • | | Revenue up 38% to $3,352 million. |

| | • | | EBITDA up 21% to $491.3 million. |

| | • | | Net profit after tax up 26% to $162 million. |

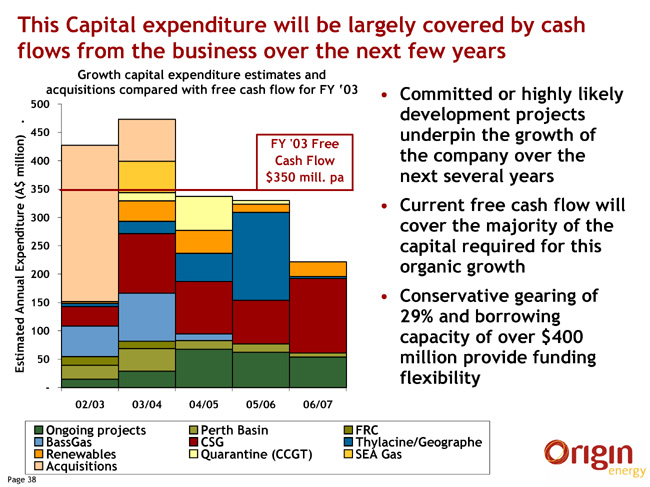

| | • | | Free cash flow up 37% to $350 million. |

| | • | | Earnings per share increased 23% to 24.8 cents per share. |

| | • | | Capital expenditure up 30% to $523 million. |

| | • | | Strong balance sheet with net debt to capitalisation of 29%. |

| | • | | Total dividends for the full year of 10 cents per share franked to 4 cents. |

| | • | | Dividend Reinvestment Plan 2.5% discount to apply. |

In announcing the final dividend the Chairman, Mr Kevin McCann said ���Based on the strength of the company’s current and expected cash flows Directors had previously advised of their intention to target dividend payments at around 40% of earnings per share.

“In line with this objective, we are pleased to announce a 5 cent final dividend franked to 2 cents will be paid on 3 October 2003 to shareholders of record on 19 September 2003 for which the dividend reinvestment plan (DRP) will apply. A 2.5% discount under the DRP will apply for this dividend.

This brings total dividends for the year to 10 cents per share (four cents franked), a doubling of the dividend paid last year.” Mr McCann said.

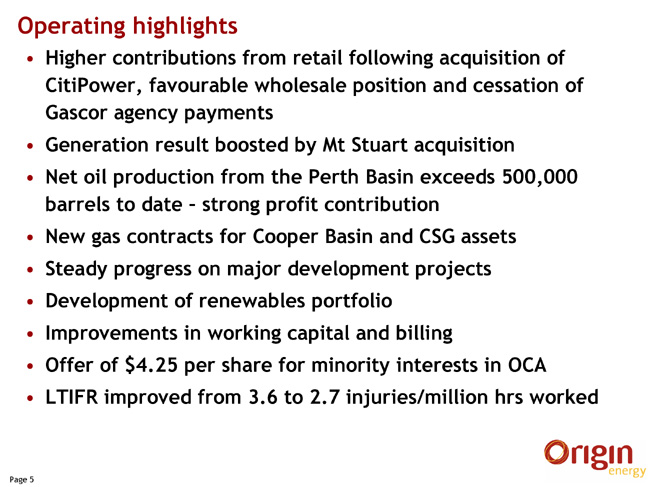

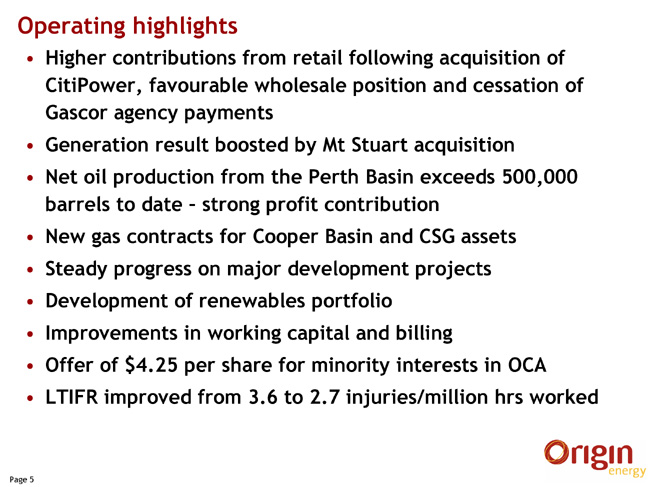

The increased profit for the year has been mainly driven by contributions from the retail business reflecting the acquisition of CitiPower and good returns from electricity purchase contracts. Initial contributions from oil production in the Perth Basin and the Mt Stuart Power Station also boosted results.

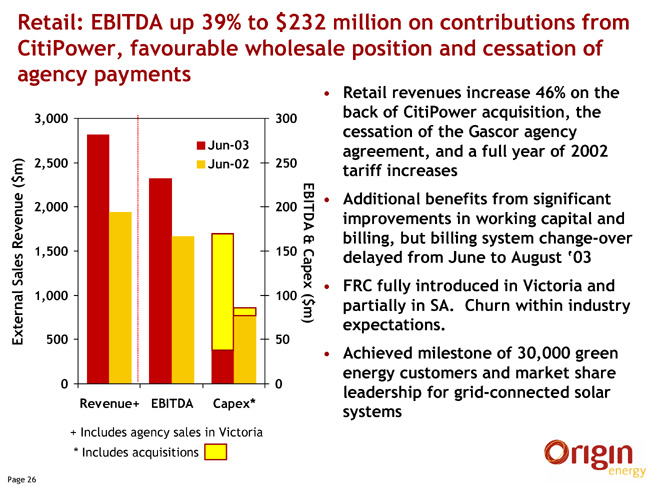

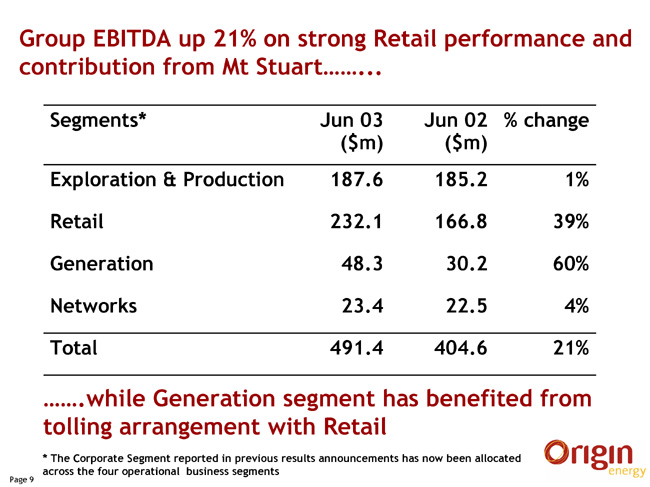

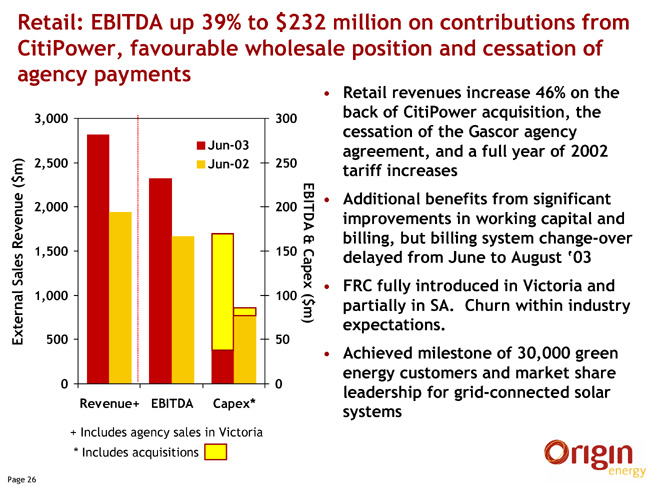

Commenting on the result, Managing Director Mr Grant King said “The Retail business increased contribution to EBITDA by 39% to $232 million. Our investments in the electricity retail business in particular have delivered results with energy retailing contributing close to half of our total EBITDA.”

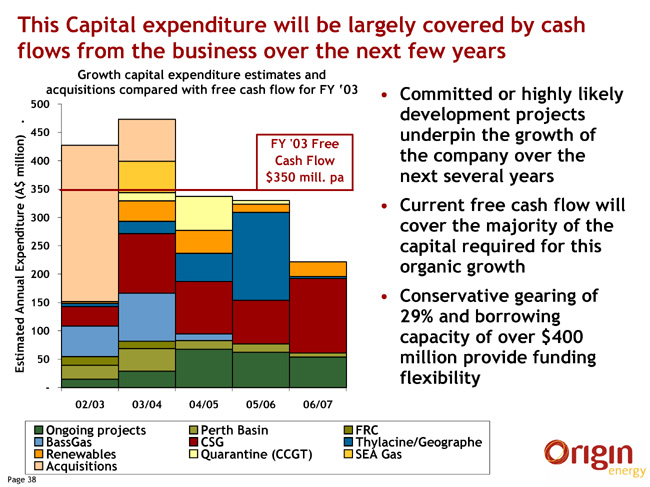

“A particularly pleasing feature of this year’s result has been the strength of the Company’s cash flow which has largely funded capital expenditure of $523 million. Borrowings increased by only $99 million with gearing at year end a modest 29%,” he said.

Commenting on the outlook for the coming year, Mr King said: “While retail earnings will benefit from reduced costs following the integration of recently acquired businesses and the cessation of agency payments to the Victorian Government, higher electricity purchasing costs will offset these gains. A significant increase in oil production from the Hovea and Jingemia fields in the Perth Basin and a full year contribution from the Mt Stuart Power Station will add to performance.”

“Looking further ahead, the prospects for the company remain strong with development of the BassGas Project, Otway Gas Project, SEA Gas Pipeline and Coal Seam Gas on schedule and within budgeted costs. These projects will all contribute to growth in the medium term.”

“The company’s modest gearing and strong cash flow sees the company well placed to fund our major capital projects and take advantage of opportunities that continue to arise in the energy sector.”

“Taking these factors into account the outlook for the coming year is for Origin to achieve its long-term target for growth in earnings per share of 10-15% per annum.”

For further information on this media release, please contact:

Mr Grant King | | Mr Angus Guthrie |

Managing Director | | Manager, Investor Relations |

Origin Energy | | Origin Energy |

Telephone: (02) 9220 6435 | | Telephone: (02) 9220 6558 |

Item 3.

20 August 2003

Directors’ Review of Results for the year ended 30 June 2003

The Directors submit their review of the results for the year ended 30 June 2003.

Financial Review

Profit and Dividend Declaration

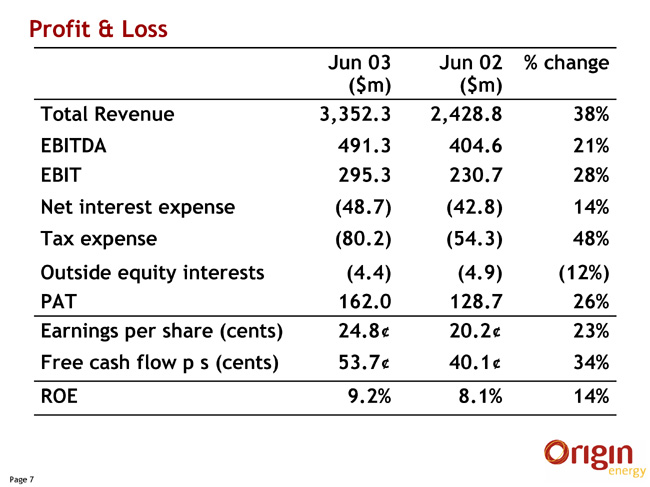

Origin Energy reported a net profit after tax and outside equity interests of $162.0 million for the year ended 30 June 2003, a 26% increase on the profit in the prior year.

Earnings per share increased by 23% to 24.8 cents per share. A final dividend of 5 cents per share, franked to 2 cents, will be paid on 3 October 2003 to shareholders of record on 19 September 2003. Origin shares will trade ex-dividend as from 15 September 2003. This final dividend will lift the total dividend paid for the year to 10 cents per share (4 cents franked) from 5 cents per share (fully franked) in the prior year.

The Board has also determined that the Dividend Reinvestment Plan will continue to apply and that for this dividend, a discount of 2.5% will apply to the shares allotted under the Plan.

Financial Highlights

| | | 2002/03 ($m)

| | | 2001/02 ($m)

| | | % Change

|

Revenue | | 3,352 | | | 2,429 | | | 38 |

Net after Tax Profit | | 162.0 | | | 128.7 | | | 26 |

EBITDA | | 491.3 | | | 404.6 | | | 21 |

Free Cash Flow | | 350 | | | 256 | | | 37 |

Capital Expenditure | | 524 | | | 403 | | | 30 |

Earnings per Share | | 24.8 cents | | | 20.2 cents | | | 23 |

Net Debt/Capitalisation | | 29 | % | | 28 | % | | |

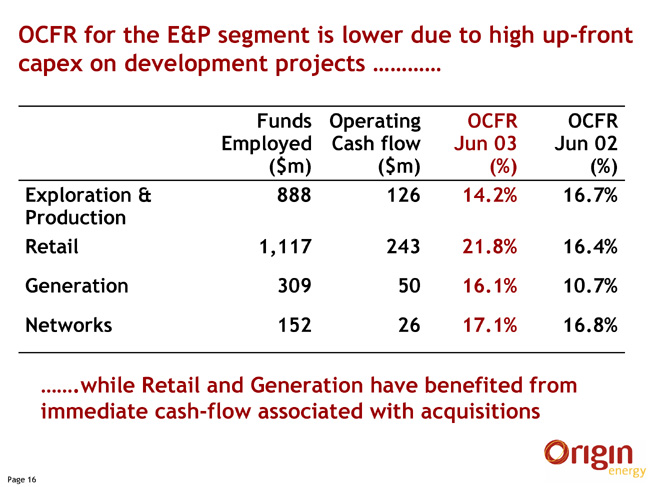

OCAT/Funds Employed | | 15.6 | % | | 13.7 | % | | |

The main factors contributing to the profit improvement include:

| • | | Higher oil prices and oil sales from new producing fields in the Perth Basin; |

| • | | Increased contribution from retailing following the acquisition of the CitiPower retail business in July 2002, reduction in electricity purchasing costs due to favourable electricity contracts and pool prices and a further reduction in retained profit payments to the Victorian Government; and |

| • | | Increased contribution from power generation with the acquisition of the Mt Stuart Power Station in December 2002. |

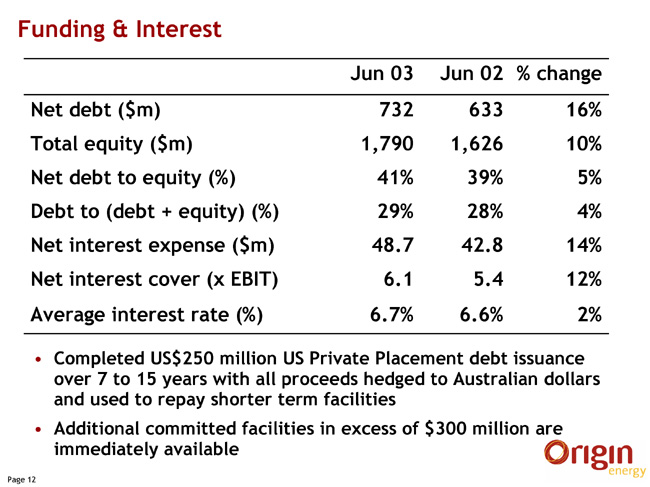

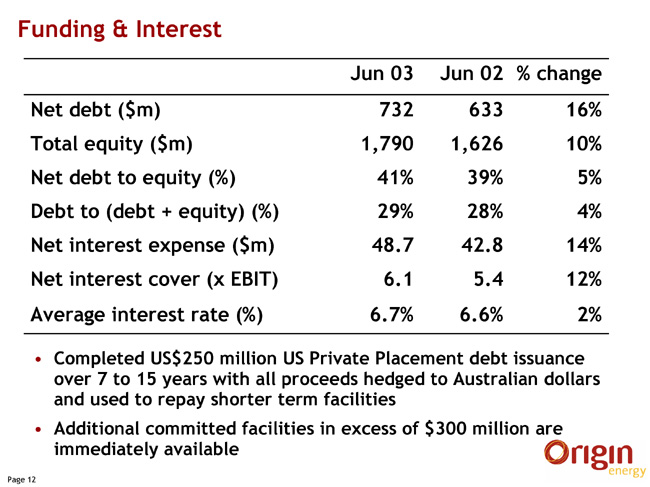

The funding requirements for growth capital and acquisitions has seen net debt increase from $633 million at 30 June 2002 to $732 million at 30 June 2003, resulting in a final net debt to capitalisation ratio of 29%.

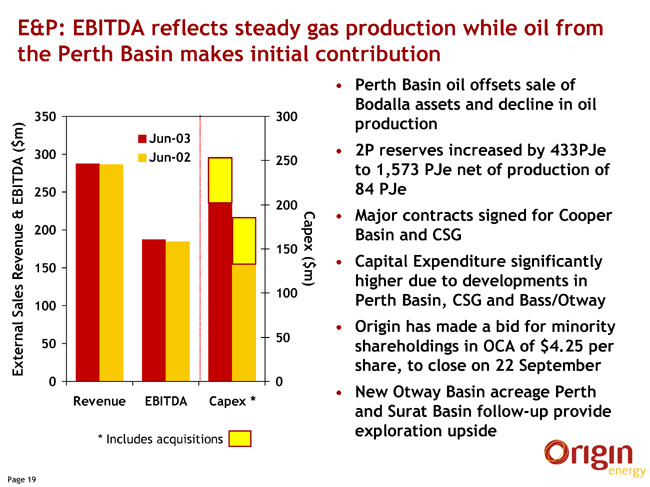

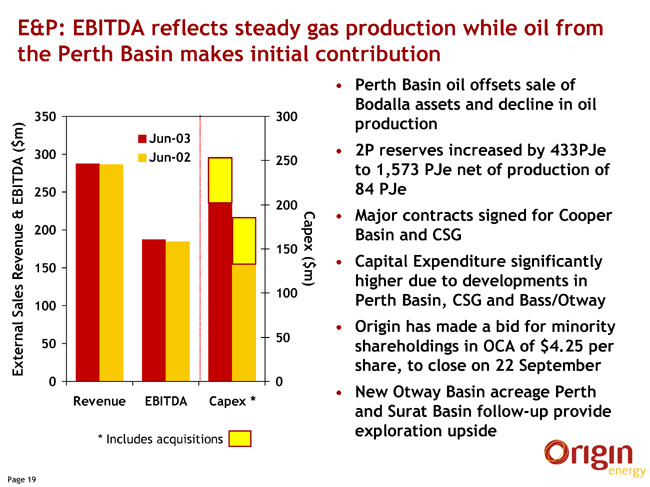

Subsequent to the end of the financial year Origin has made a takeover offer for the shares in Oil Company of Australia Limited (OCA) that it does not already own. Origin had an 85.23% interest in OCA and has offered $4.25 per share for the remaining shares. The total acquisition cost is expected to be $74 million and the offer is due to close on 22 September 2003.

Financial Performance

Total revenue increased by 38% to $3,352.3 million and includes distributions from Envestra of $12.8 million.

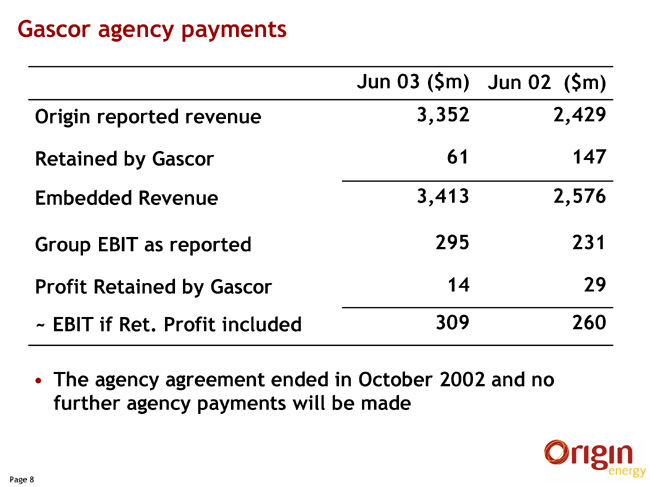

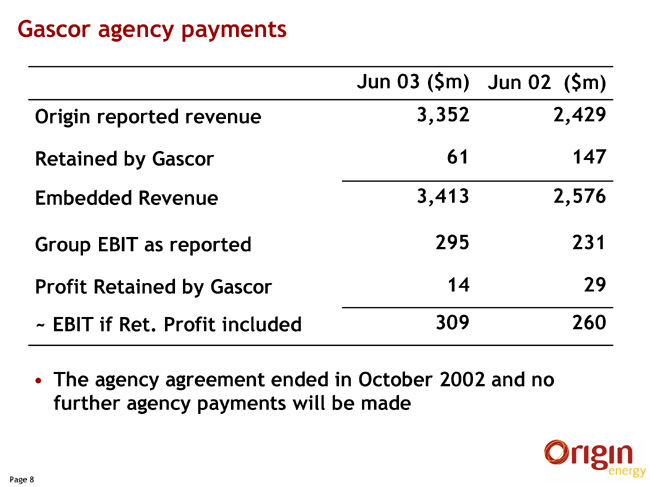

External sales revenue increased to $3,326.5 million from $2,389.2 million in the prior year. The increase was due mainly to the initial contribution from the electricity retail business acquired from CitiPower, the cessation of the Gascor agency arrangement and the full year effect of prior year tariff increases.

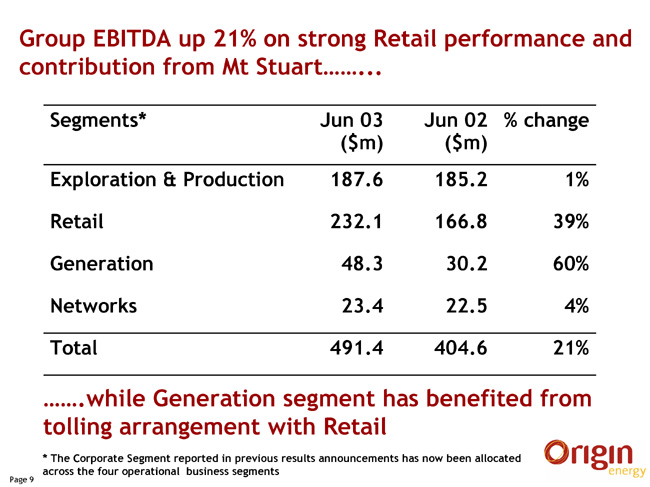

Segment contributions to EBITDA were:

| | | EBITDA $m

|

| | | 2002/03

| | 2001/02

| | % change

|

Exploration & Production | | 187.6 | | 185.2 | | 1 |

Retail | | 232.1 | | 166.8 | | 39 |

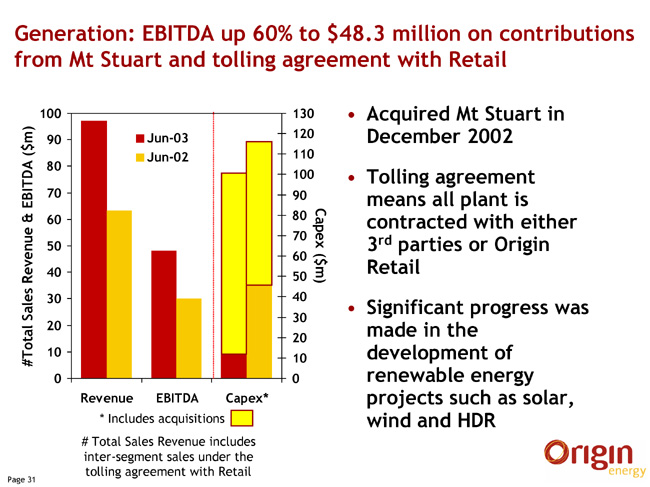

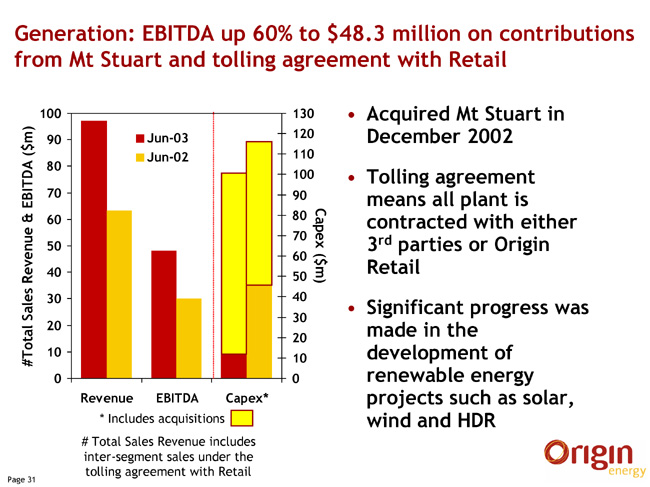

Generation | | 48.3 | | 30.2 | | 60 |

Networks | | 23.4 | | 22.5 | | 4 |

Total | | 491.3 | | 404.6 | | 21 |

Year on year comparisons are provided in the divisional highlights section below. This year’s EBITDA includes a provision for $4.5 million to fully cover deficiencies under the Group’s defined benefit superannuation plan.

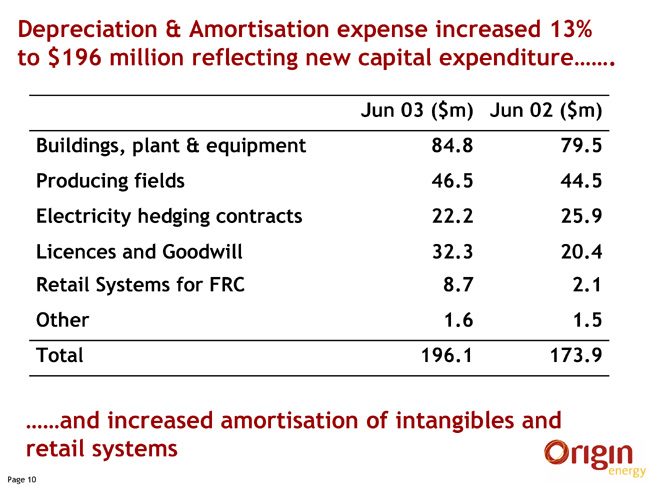

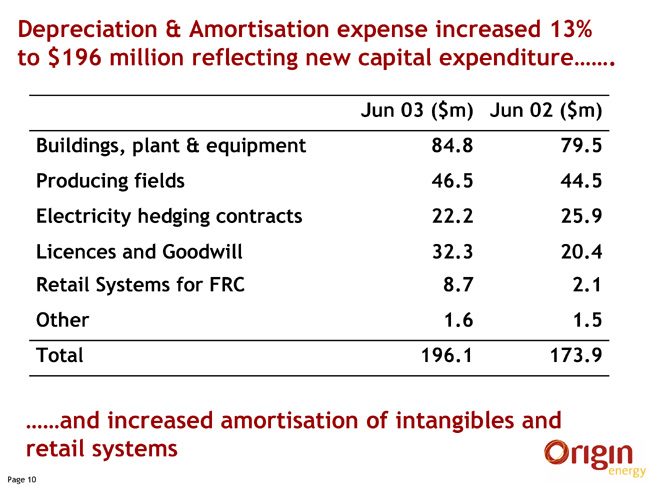

Depreciation and amortisation expense increased by 13% to $196.1 million reflecting new capital expenditure (detailed below) and increased amortisation of intangibles and retail systems.

EBIT again showed strong growth with a 28% improvement to $295.3 million.

Net interest expense for the year was $48.7 million, up 14% from the prior year. The increase is largely due to the costs associated with funding of acquisitions totalling $276 million and consequent higher average debt balances during the year.

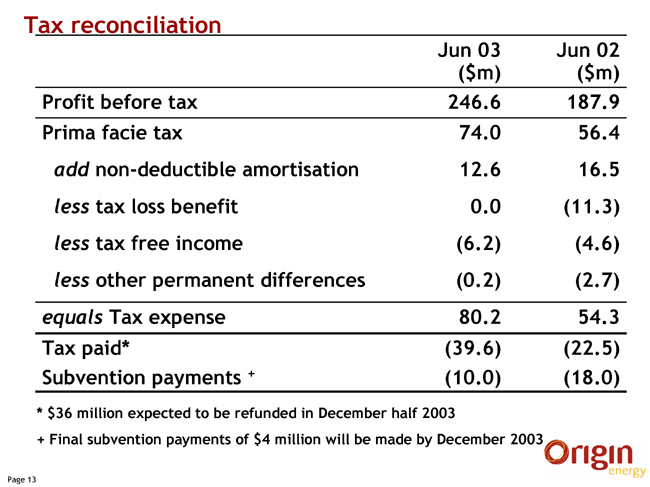

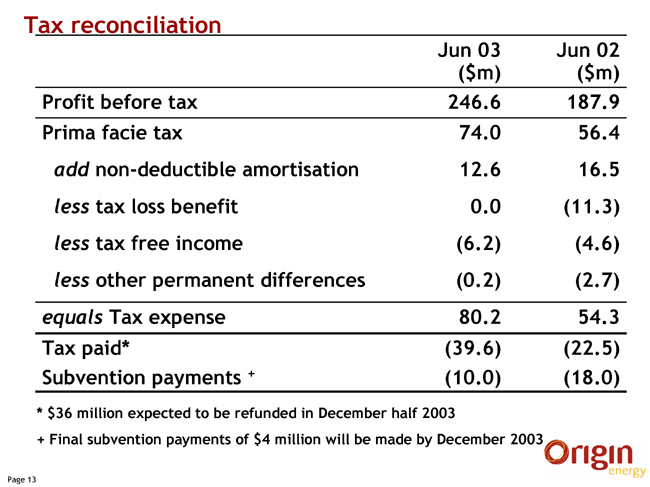

Tax expense for the year totalled $80.2 million, an increase of 48% on the prior year. The increase primarily reflects the higher pre-tax earnings and the non-recognition of tax loss benefits from Envestra. As advised in the December half results, these loss benefits have been deferred pending resolution of their availability with the Australian Tax Office. There has been no significant progress in this matter over the last six months.

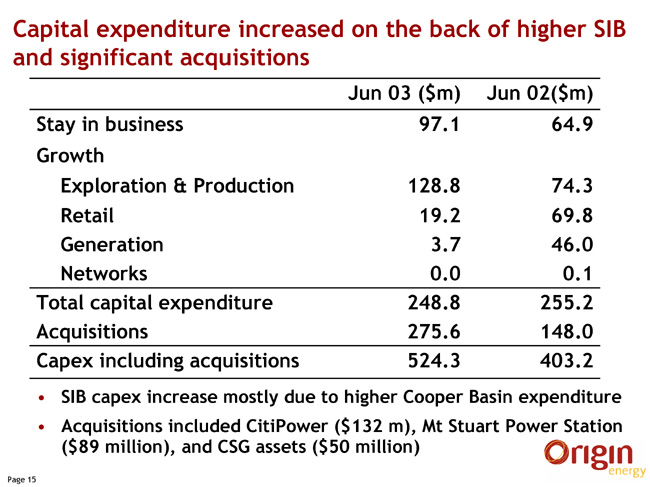

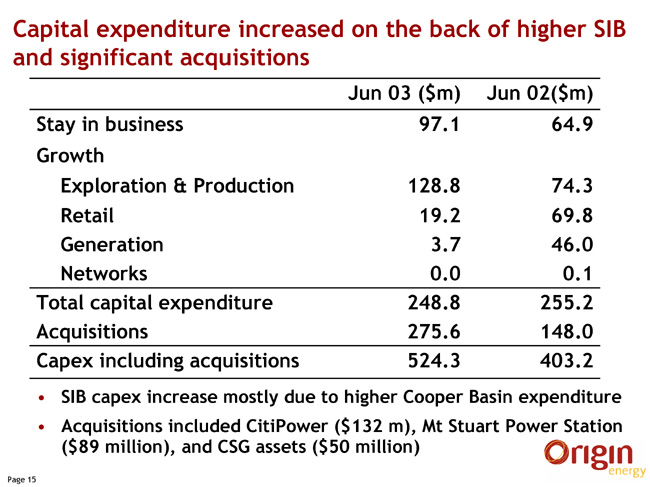

Capital Expenditure

Capital expenditure on growth and stay-in-business projects was $249 million, 3% higher than the prior year.

Stay-in-business capital expenditure associated with the maintenance of ongoing operations was $97 million. The Exploration and Production segment accounted for $74 million of this expenditure, of which two thirds was attributable to the Cooper Basin.

Growth capital expenditure associated with new business initiatives was $152 million. This included:

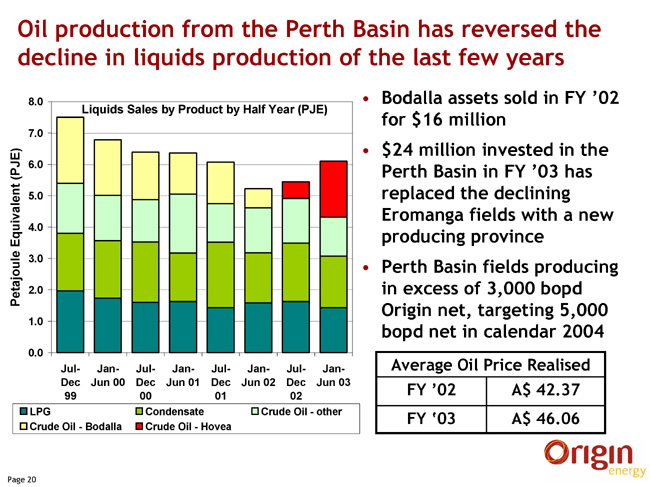

| • | | $62 million on development of the BassGas Project and the Otway gas Project in the offshore Otway Basin; |

| • | | $30 million exploring and developing coal seam gas (CSG) resources in Queensland; |

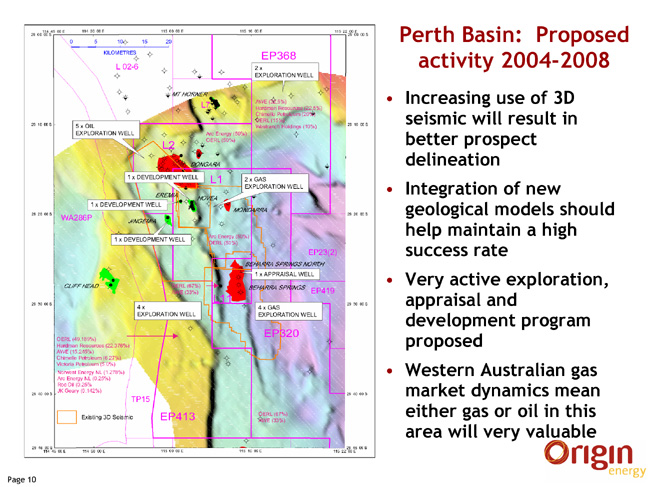

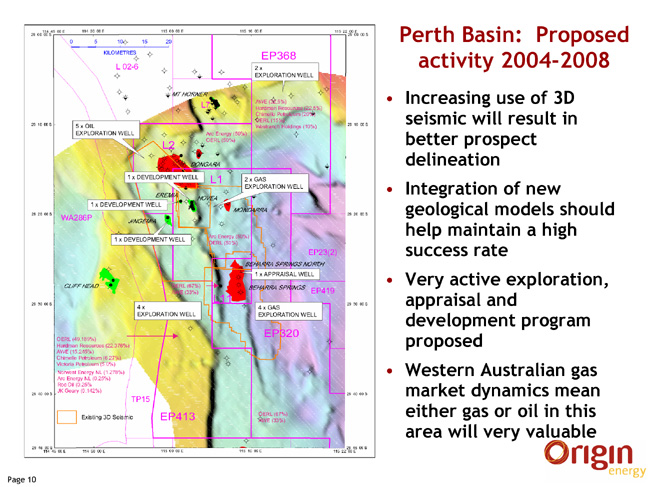

| • | | $24 million on exploration and development in the Perth Basin; |

| • | | $14 million on systems for full retail contestability (FRC) in electricity and natural gas; |

| • | | $9 million on exploration and development activities around the producing centres of the Cooper Basin, Surat Basin, Denison Trough and Otway Basin; and |

| • | | $13 million on a variety of other growth projects. |

Capital expenditure on acquisitions totalled $276 million, which included the acquisition of the CitiPower retail business for $132 million, the purchase of the Mt Stuart Power Station and contracts for $89 million and acquisition of additional CSG interests for $50 million.

Total capital expenditure including acquisitions, was $524 million, 30% higher than the prior year.

The company expects to outlay $74 million during the first quarter of the current financial year should the proposed acquisition of the minority interests in OCA be successful.

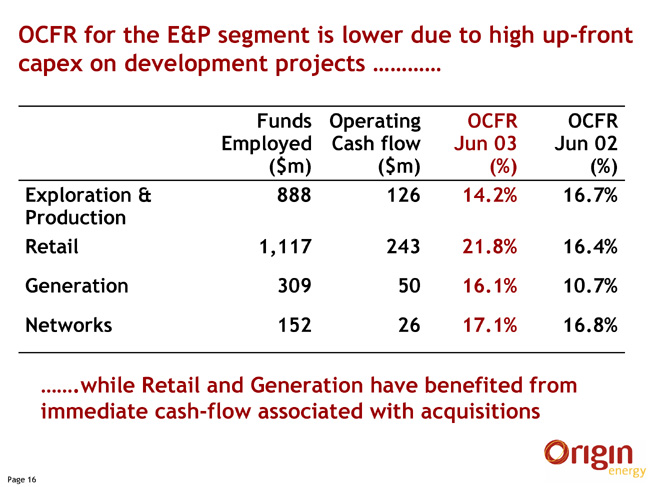

Cash Flow

The primary measure used by the company to measure its performance is operating cash flow after tax over average funds employed (referred to as the OCAT Ratio). The measure is calculated from EBITDA as the primary source of cash contribution, but adjusted for non-cash items, stay-in-business capital expenditure, changes in working capital and tax paid. Funds employed are averaged over the year. Funds employed increased significantly following the various acquisitions during the year. However, the strong performance in EBITDA, management of working capital and control of stay-in-business capital expenditure resulted in proportionately greater improvement in operating cash flow.

These factors produced an OCAT Ratio of 15.6% for the year ended 30 June 2003.

Cash flow available for funding growth and distributions to shareholders (free cash flow) was $350 million compared with $256 million in the prior year, an increase of 37%.

Funding and Capital Management

The company’s balance sheet remains strong with a net debt to capitalisation ratio of 29% as at 30 June 2003. This compares with 28% as at 30 June 2002. Additional equity of $33.6 million was raised through the operation of the Dividend Reinvestment Plan and exercise of share options under the Senior Executive Option Plan. Net borrowings have increased from $633 million at 30 June 2002 to $732 million at 30 June 2003. The increase is primarily the result of increased expenditure on acquisitions and major capital projects (totalling $524.3 million) significantly offset by strong cash flow from operations resulting in an increase in net debt of $99 million. Interest cover as measured by EBIT/interest expense remains robust at 6.1 times.

Origin completed a US$250 million US Private Placement issuance with all proceeds hedged to Australian dollars. The issuance has provided 7 to 15 year debt finance significantly extending the group’s debt maturity profile.

Risk Management

The company continued to hedge a significant portion of its exposure to both the oil price and the USD exchange rate. Currently, the company has hedged 58% of exposure to oil and related products over the 12 months to 30 June 2004 at prices averaging over $US24.50 per barrel. A US$1.00 movement in the price of oil over the next year will impact Origin’s EBITDA by approximately $1.9 million.

With regard to foreign exchange, due to a combination of external hedging and ongoing US dollar expenditure associated with major upstream projects, Origin is significantly hedged over the next 12 months and expects that variability in the USD exchange rate will have minimal impact on group profitability.

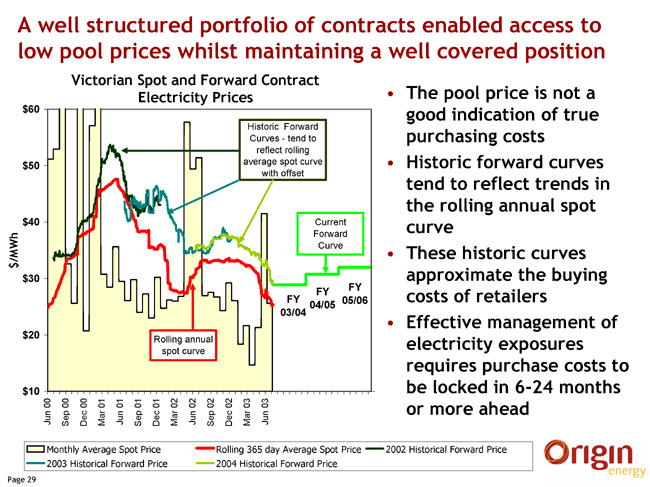

Origin only undertakes energy contracting and trading activities as part of optimising the value of its physical assets and energy retailing activities.

The Board oversees the commodity risk management policies, which incorporate short-term and long-term risk limits for the trading of electricity and natural gas, oil and renewable energy credits (RECs). The Board monitors compliance with these policies and continues to review risk management strategies on a regular basis.

Returns to Shareholders

A final dividend of 5 cents per share, franked to 2 cents per share has been declared, payable on 3 October 2003 to shareholders of record on 19 September 2003.

The Dividend Reinvestment Plan will continue to operate and for this dividend a discount of 2.5% will apply to the shares allotted under the Plan.

The final dividend will lift total dividends for the year to 10 cents per share (franked to 4 cents) from 5 cents per share (fully franked) in the prior year.

Origin will have limited capacity to frank dividends for several years. The introduction of the new tax consolidation regime may further defer the payment of tax by Origin and its wholly owned subsidiaries.

Employee Share and Option Plans

During the year the company issued 2,630,000 options under the Senior Executive Option Plan at an exercise price of $3.56 each. The options were issued subject to Origin performance hurdles and the exercise price was equal to the market price at the date of approval.

Under the Employee Share Plan, 445,626 shares were purchased on market for issuance to employees. The cost of shares purchased for the Employee Share Plan have been expensed and an amount of $1.8 million charged against profit before tax.

Details regarding a review of the operation and accounting of the Employee Share and Option Plans are provided in the Divisional Highlights under People, Health, Safety and Environment.

Issued Capital

An additional 7,547,299 shares were issued during the period under Origin’s Dividend Reinvestment Plan and 2,333,300 shares were issued as a result of the exercise of options. As at 30 June 2003, Origin had 657,709,751 shares on issue.

Corporate Governance

The Australian Stock Exchange (ASX) Corporate Governance Council issued the Principles of Good Corporate Governance and Best Practice Recommendations (“the Principles”) on 31 March 2003.

Origin has reviewed its current practices and established that it is substantially in compliance with the Principles. Origin has updated many of its practices and policies and will continue to review those to enable it to make a full statement on its compliance with the Principles in its 2004 Annual Report.

The 2003 Annual Report, which is due to be released on 16 September 2003, will provide a statement of Corporate Governance and will report by reference to the Principles. At the same time Origin will launch a Corporate Governance section of its website which will be progressively updated during the year. The Chairman will make a further report on Corporate Governance at the Annual General Meeting on 16 October 2003.

Divisional Performance Highlights

Exploration and Production

| | | 2002/03 $m

| | 2001/02 $m

| | % Change

|

EBITDA | | 187.6 | | 185.2 | | 1 |

EBIT | | 103.3 | | 103.2 | | — |

Sales Volumes

| | | 2002/03

| | 2001/02

| | % change

| |

Natural Gas (PJ) | | 74.0 | | 72.5 | | 2 | |

Crude Oil (kbbls) | | 853.8 | | 804.1 | | 6 | |

Condensate/naphtha (kbbls) | | 644.2 | | 676.4 | | (5 | ) |

LPG (ktonnes) | | 62.3 | | 61.4 | | 1 | |

Ethane (ktonnes) | | 35.5 | | 46.9 | | (24 | ) |

| | |

| |

| |

|

|

Total (PJe) | | 87.4 | | 86.3 | | 1 | |

| | |

| |

| |

|

|

External sales revenue for the Exploration and Production segment increased by 9% to $286 million as revenue from Perth Basin oil sales, higher oil prices, and increased gas sales more than offset revenues foregone following the sale of Eromanga Basin oil assets in the previous year.

EBITDA for the period was $187.6 million, up $2.4 million or 1% on the previous year. EBIT was steady at $103.3 million.

Total gas sales were 74 PJ, an increase of 2%. CSG sales continued to grow and now represent 12% of total gas sales.

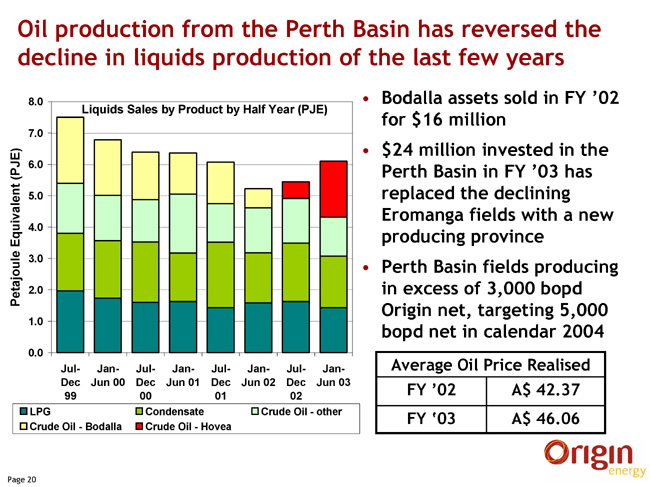

Oil production was boosted by three Perth Basin oil fields coming on stream in the second half of the year. As a result, oil sales increased by 6% to 853,800 bbls, despite the sale of the Bodalla oil field and associated assets in the Eromanga Basin midway through the prior year.

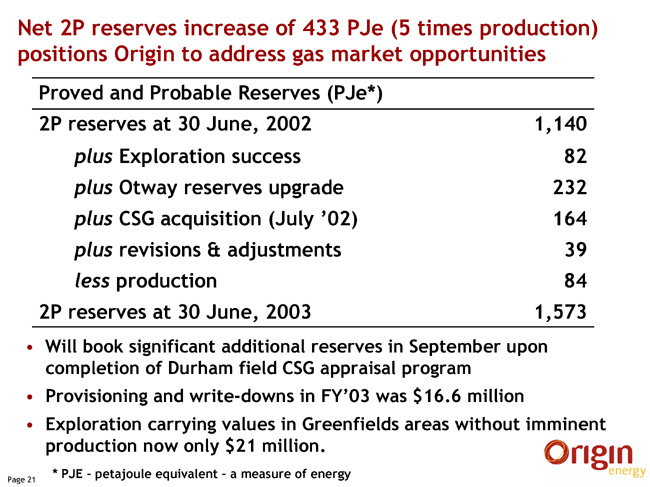

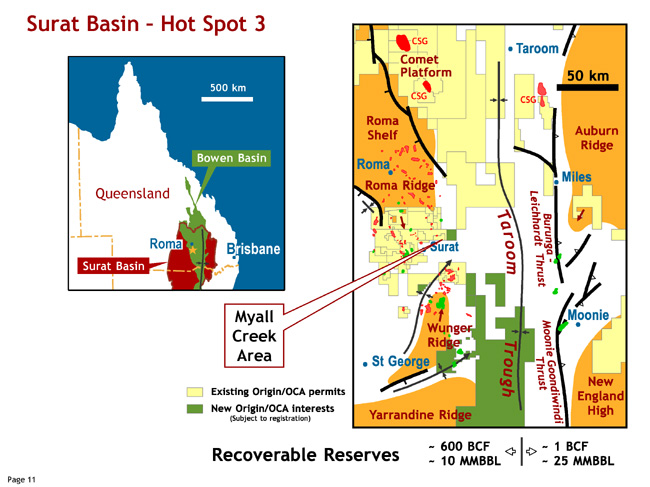

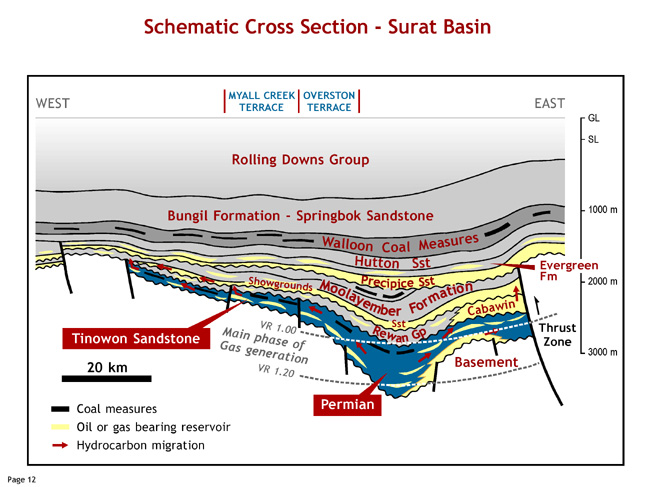

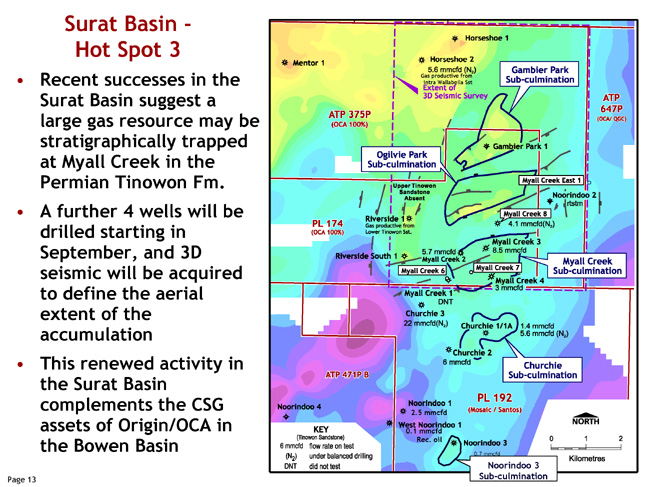

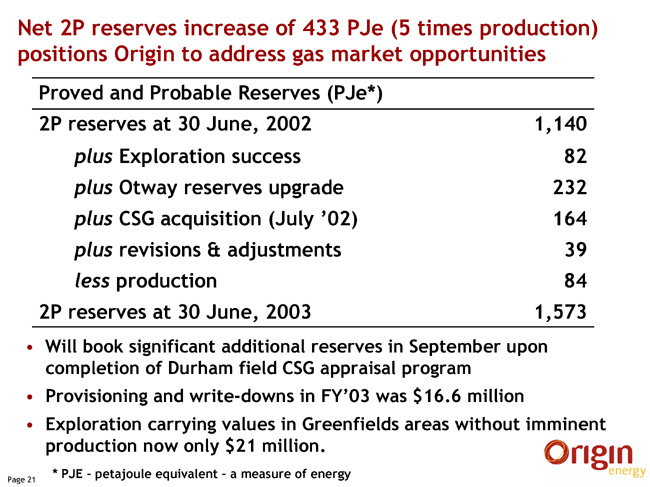

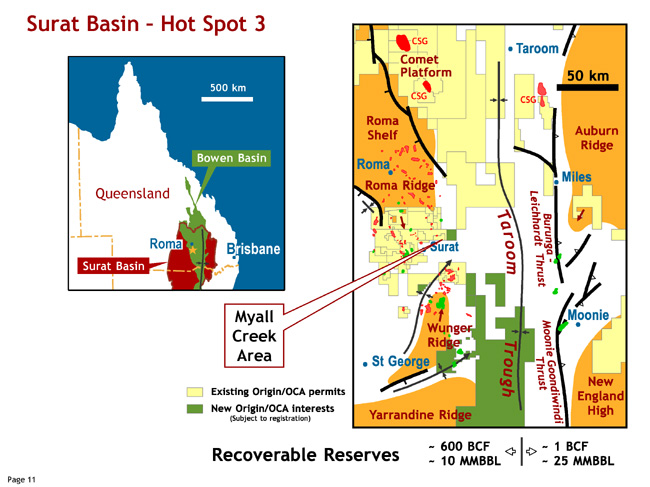

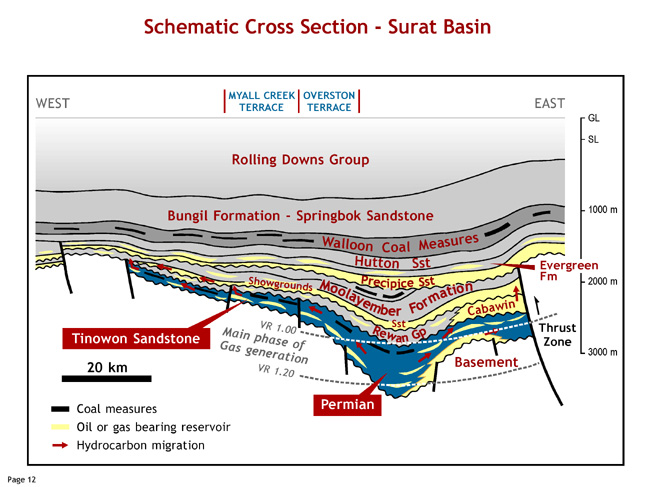

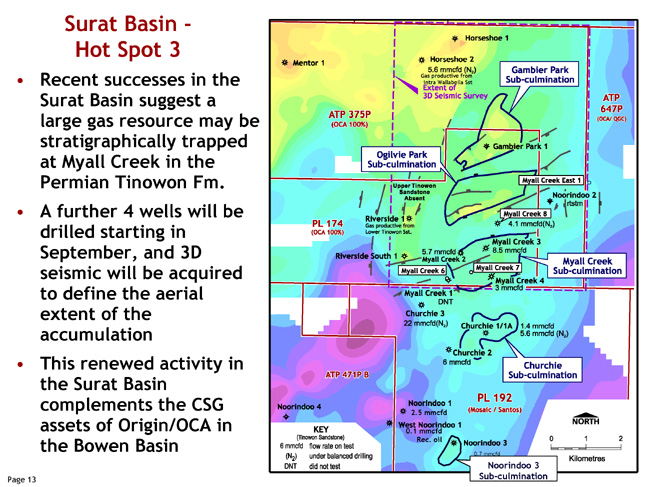

Origin’s 2P reserves increased by 38% to 1,573 PJe largely as a result of the inclusion of reserves from the Thylacine and Geographe fields, additions through CSG acquisitions and the reappraisal of the Myall Creek gas field in the Surat Basin. A total of 83 development and appraisal wells and 36 exploration wells were drilled during the year with 95 wells cased for future production providing an overall success rate of 80%.

Cooper Basin (Queensland/South Australia)

The Cooper Basin is Australia’s largest onshore gas production province and is a significant supplier of gas to southern and eastern Australia. Under a long-term gas supply arrangement signed with AGL in December, Origin and the other Cooper Basin producers will supply up to 505 PJ of gas over 14 years from 2003. Origin’s share of the contract is 71 PJ.

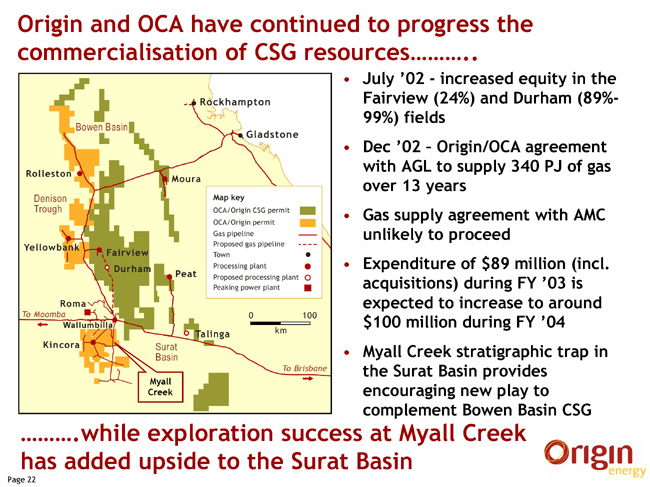

Coal Seam Gas (CSG)

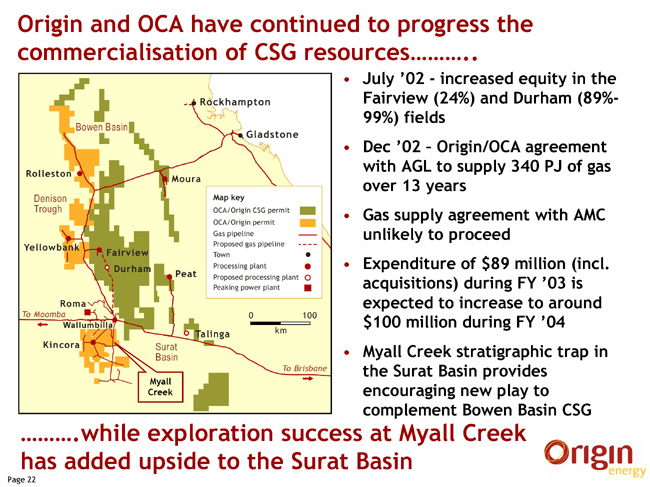

In December 2002 Origin, and 85% owned Oil Company of Australia Limited (OCA), signed an agreement with AGL to supply 340 PJ of gas for 15 years from May 2005. About 52% will be supplied from OCA’s CSG interests in central Queensland.

This contract enhanced OCA’s position as the largest CSG producer in Australia. CSG supplies about 25% of Queensland’s total gas demand. OCA’s CSG production is 30 TJ/day from three fields, which have a current production capacity of 55 TJ/day.

Through acquisition and appraisal drilling, CSG reserves increased from 296 PJ to 472 PJ, and recent drilling on the Durham field is expected to substantially increase these reserves. Significant progress has been made in the development planning of the Durham field with the granting of production and pipeline licences and the approval of an Indigenous Land Usage Agreement with native titleholders.

Other producing CSG fields have maintained strong performances with the Dawson Valley (Moura) fields reaching record production levels.

To date $225 million has been invested by Origin and OCA in the acquisition and development of CSG interests including $50 million in additional interests in the Fairview and Durham fields acquired in the prior year. Total development cost for CSG is expected to be several hundred million dollars over future years and in the coming year a further $100 million will be spent building a gas processing plant at the Durham field; developing the Mungi field at Moura; and appraising the Talinga field, which is based on the Walloon Coals near the Wallumbilla to Brisbane gas pipeline.

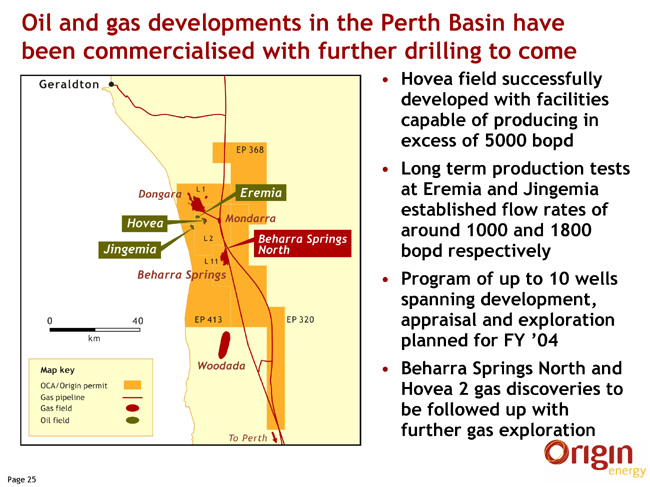

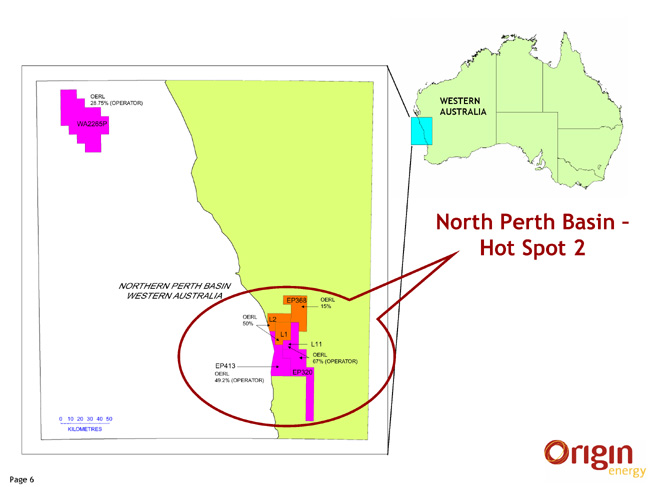

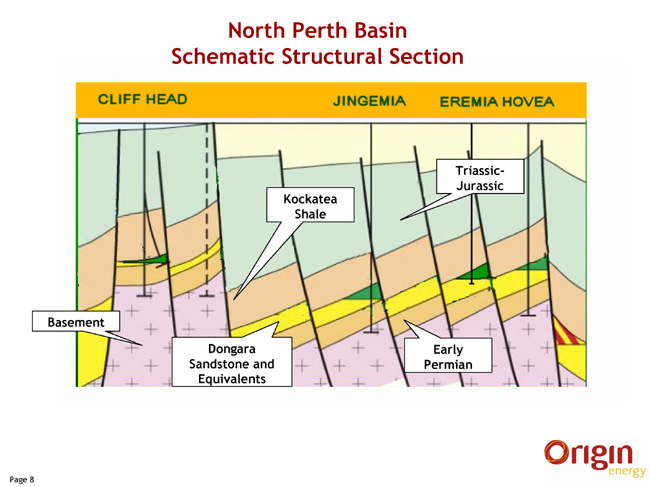

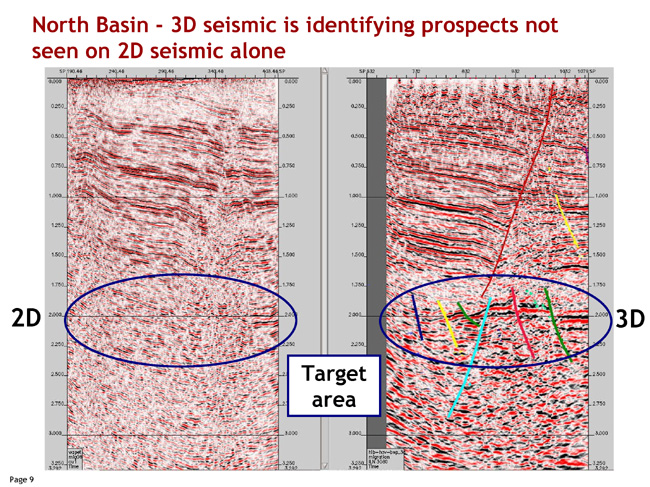

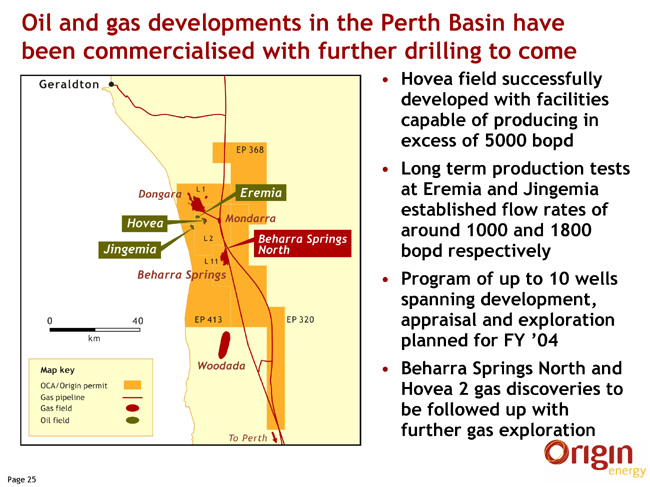

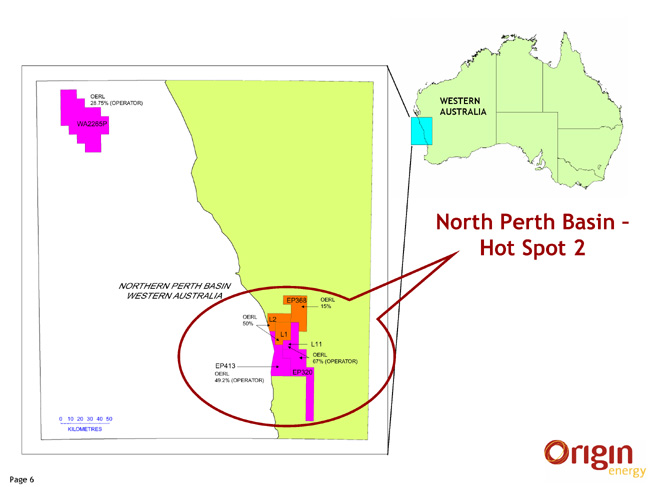

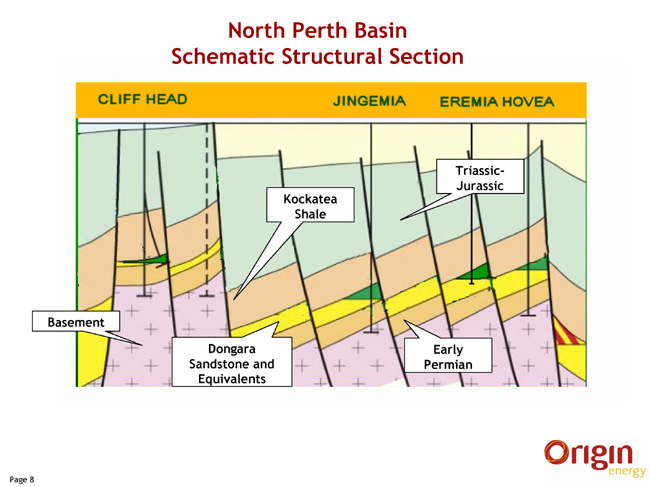

Perth Basin

Origin continued a highly successful gas and oil exploration program in the Perth Basin.

Following last year’s oil discovery at Hovea, the field was successfully appraised and developed and is now producing at about 4,000 barrels of oil per day (bopd).

Long term production tests were undertaken during the June quarter on the Jingemia and Eremia fields in the Perth Basin and established flow rates of around 1,800 and 1,000 bopd respectively.

By July 2003 these fields combined had produced more than one million barrels of oil (Origin’s share 500,000 barrels). Origin’s share of proved and probable reserves is currently estimated at 5.4 million barrels.

The Beharra Springs North 1 gas field, discovered in late 2001, commenced production in July 2002, increasing gas sales from the Beharra Springs gas plant by 32%. A further small gas pool was discovered in the exploration well Hovea 2 during 2002 and is yet to be developed.

Origin has embarked on another significant drilling program in the Perth Basin to appraise and develop the Hovea, Eremia and Jingemia oil fields and explore for gas close to the Beharra Springs gas plant and in areas further north. The program, which may include the drilling of up to 10 wells, began in July 2003 and is expected to further lift production rates.

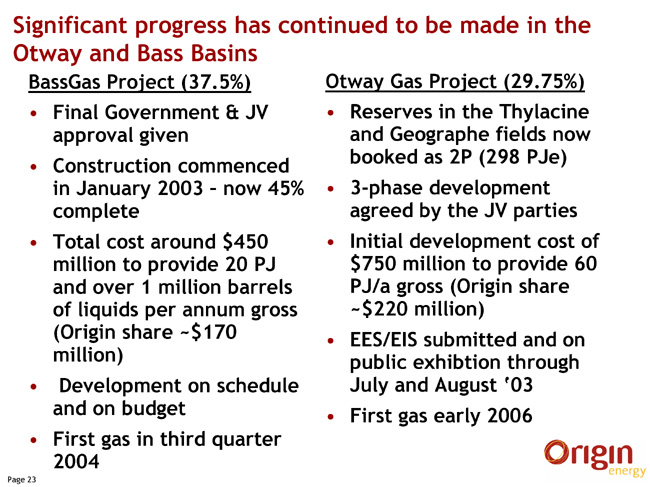

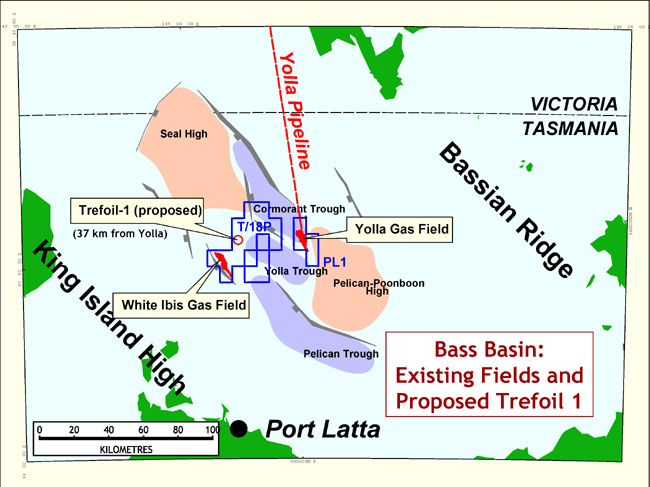

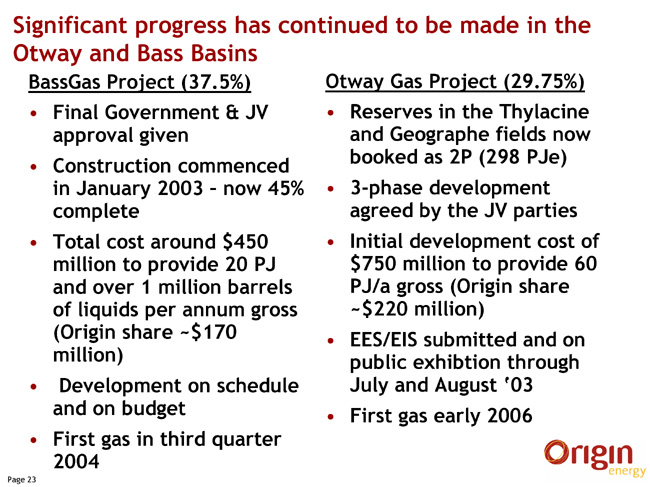

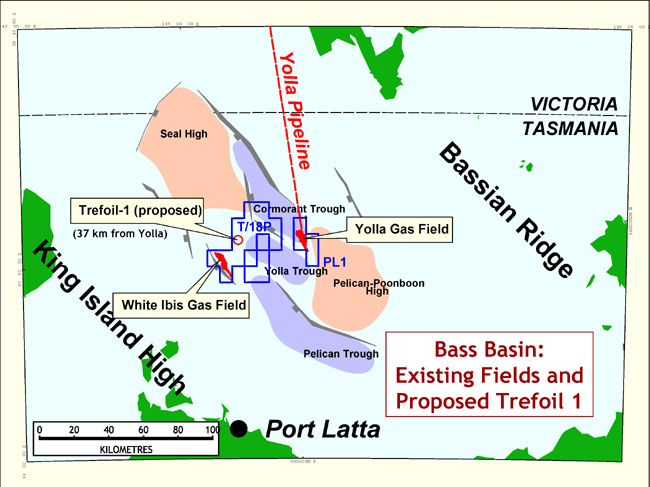

BassGas Project (Yolla field: Tasmania/Victoria)

The BassGas Project is scheduled to deliver 20 PJ of gas per annum to Victoria from July 2004, representing about 10% of that State’s natural gas demand. Origin holds a 37.5% interest and is the operator. Origin’s Retail Division will purchase the gas for sale to residential and business customers.

Following State and Federal environmental approvals, construction began in January 2003 and the project is now 45% complete.

The project will cost $450 million (Origin’s share $170 million) and will include an un-manned offshore platform over the Yolla gas field, a 147-kilometre subsea pipeline to a shore crossing near Kilcunda and a 32-kilometre onshore pipeline to a gas plant under construction at Lang Lang.

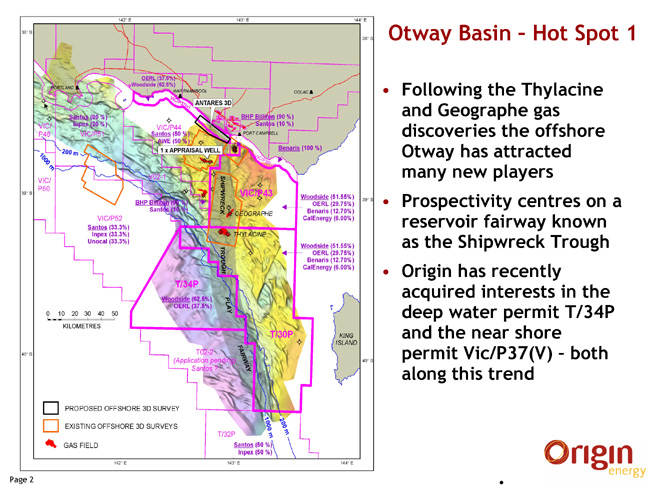

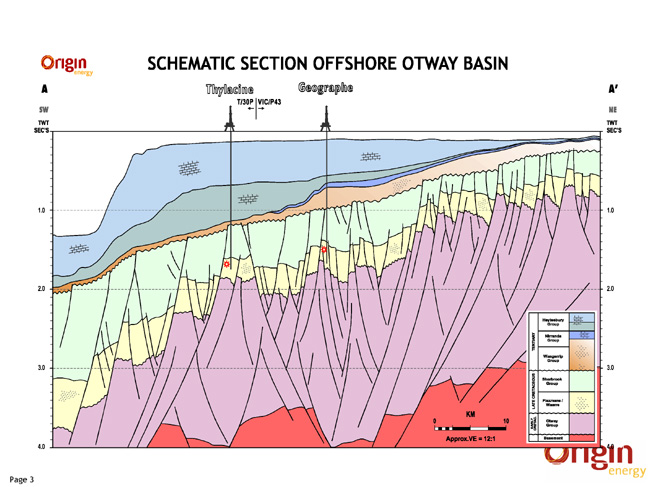

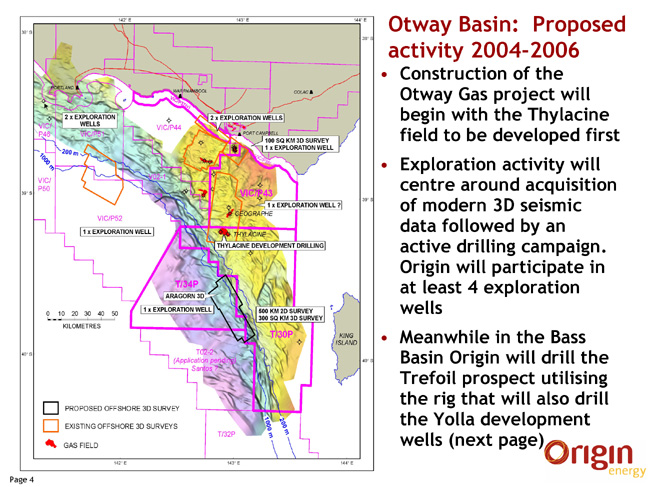

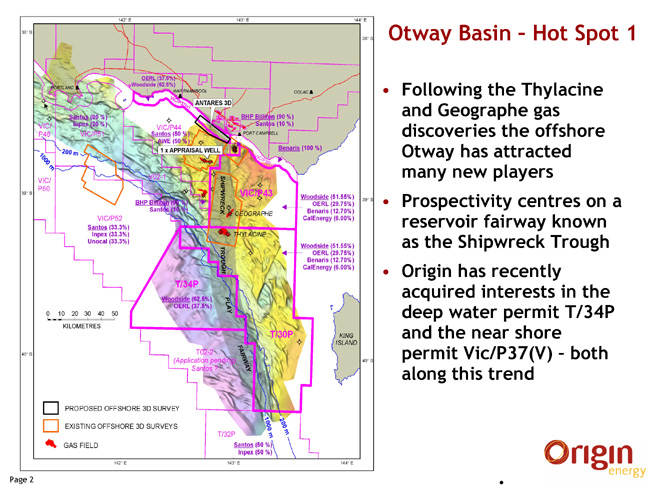

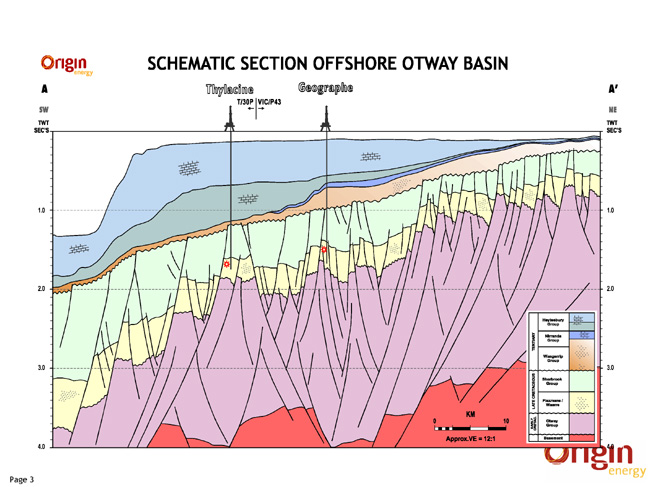

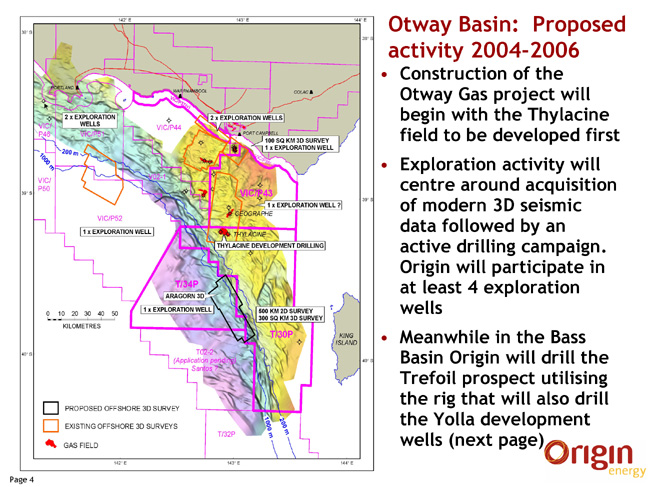

Otway Gas Project (Thylacine and Geographe fields: Tasmania/Victoria)

The Otway Gas Project will develop the Thylacine and Geographe gas fields and is designed to deliver 60PJ of sales gas each year to South Australia and Victoria by mid 2006, as well as significant volumes of condensate and LPG. During the year the interests of the joint venturers, Woodside, Benaris, CalEnergy and Origin were equalised across both fields. Origin has a 29.75% interest in the project, which is operated by Woodside Petroleum Limited.

The project received joint venture approval late in 2002 to proceed to development. Environmental impact statements were released for public exhibition in June and a preliminary development concept has been submitted to the Victorian and Federal Governments.

Phase 1 of the project will involve the development of the Thylacine field including a platform, subsea pipeline and a gas processing plant with anticipated expenditure of around $750 million (Origin’s share $220 million). Phase 2 will see the subsea development of the Geographe field and tie-in to the Thylacine facility. Phase 3 will add compression at the gas plant to maximise recovery from the fields. Total project cost is estimated at around $1 billion.

Greenfields Exploration

Origin’s exploration program focussed on gas prone areas close to developed infrastructure.

Origin participated in seven exploration and appraisal wells in greenfield areas. Of the successful wells, three were in the onshore Perth Basin, and the Morangie 1 well in the offshore Perth Basin which, although unsuccessful, recorded encouraging residual oil shows.

Origin extended its exploration efforts in the Surat Basin around existing gas fields. A reappraisal of the Myall Creek area resulted in a further five wells drilled in that area, four of which successfully tested gas at commercial rates.

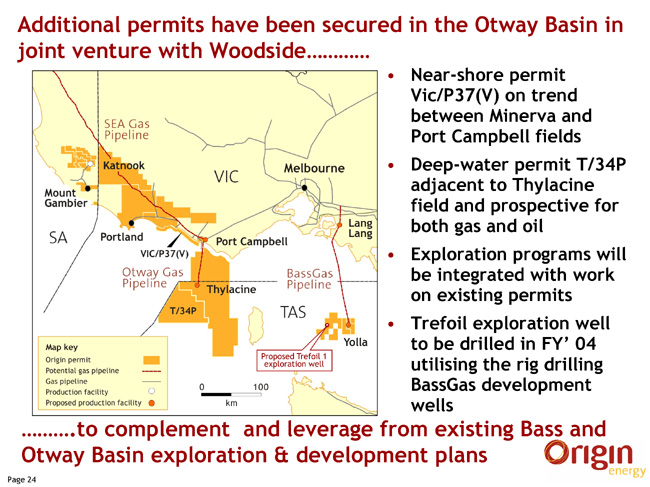

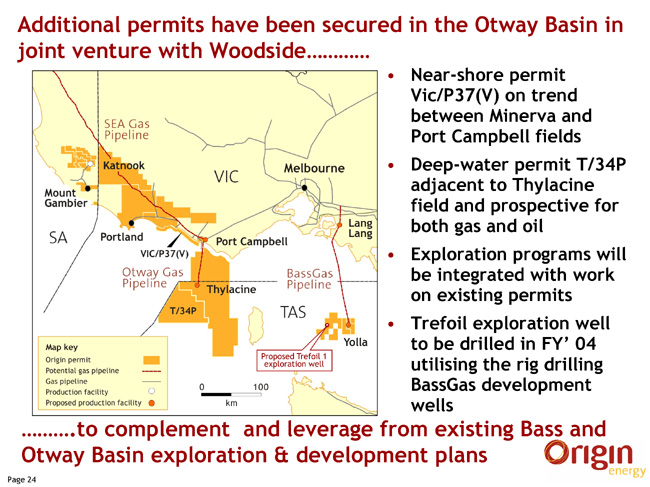

During the year, Origin and Woodside were awarded a near-shore Otway Basin permit VIC/P37(V) and in July 2003 were awarded permit T/34P in Tasmanian waters southwest and adjoining the Thylacine permit. Exploration in VIC/P37 (V), which is operated by Origin, will begin in late 2003, while the work program for T/34P (operated by Woodside) includes the acquisition of 3D seismic survey data in 2004 and the drilling of a well in 2005.

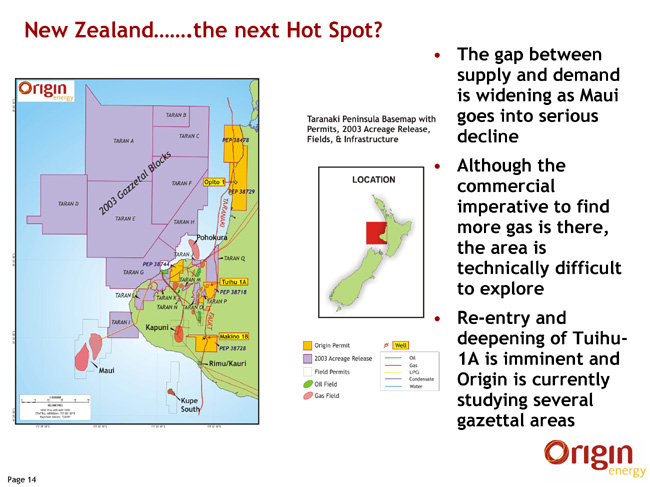

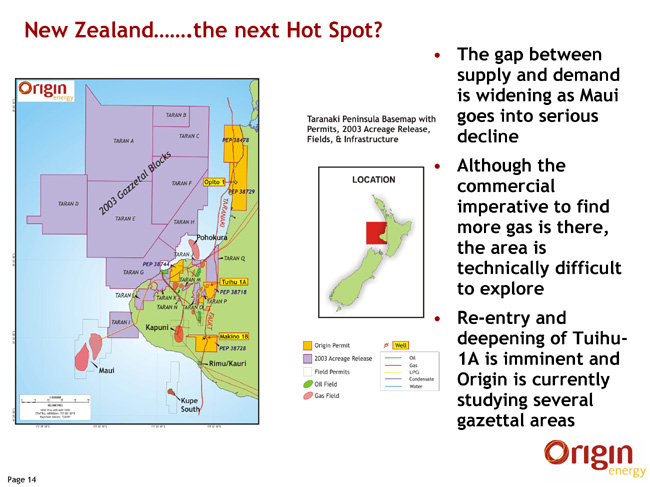

In New Zealand, Origin will participate in the deepening of the gas exploration well at Tuihi. In the Bass Basin, Origin will participate in the drilling of the Trefoil prospect near Yolla.

Retail

| | | 2002/03 $m

| | 2001/02 $m

| | % Change

|

EBITDA | | 232.1 | | 166.8 | | 39 |

EBIT | | 143.8 | | 92.0 | | 56 |

Customers (‘000) | | 2,010 | | 1,777 | | 13 |

| | | |

| | | Natural Gas*

| | Electricity

| | LPG

|

Revenue (A$m) | | 841 | | 1,547 | | 417 |

Gross Margin (A$m) | | 131 | | 285 | | 114 |

Sales – (PJ) | | 123 | | | | |

Sales – (TWh) | | | | 15 | | |

Sales – (ktonnes) | | | | | | 479 |

Total Sales (PJe) | | 123 | | 54 | | 24 |

Customer # (‘000) | | 986 | | 851 | | 200+ |

| * | | Revenue for natural gas is the gross revenue received from customers including the Retained Profit component which terminated in Sept 2002. Gross margin is after payment of Retained Profit. |

Revenue from the Retail segment increased 46% to $2.8 billion. EBITDA increased by 39% to $232 million mostly due to the contribution of the CitiPower retail business purchased in July

2002, reductions in electricity purchasing costs due to favourable electricity contracts and pool prices and the cessation of retained profits paid to the Victorian Government.

The CitiPower acquisition, which added 264,000 customers in Melbourne’s CBD and surrounding suburbs, makes Origin the largest energy retailer in Victoria and the second largest nationally.

The integration of the CitiPower business with existing gas and electricity businesses was a major focus for the year. Work will be completed on the integration of billing systems and conversion of customer data in August 2003.

Having common back office systems will help reduce costs, improve the service levels and ability to access customers in competitive markets. While there were cost increases associated with the CitiPower integration and the introduction of FRC, the expanded customer base will deliver reduced cost to serve in the next financial year.

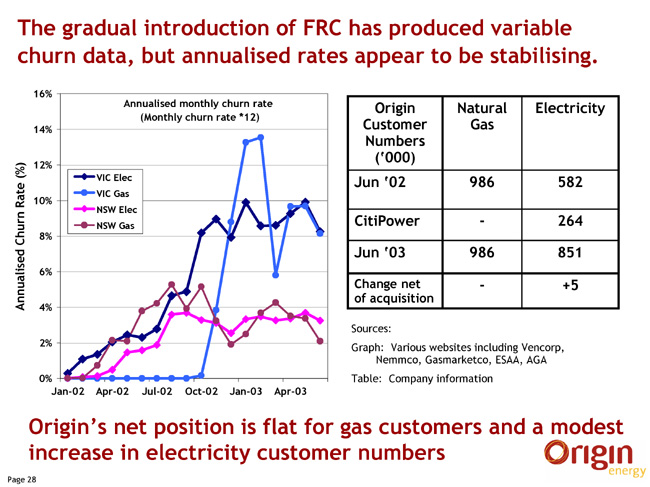

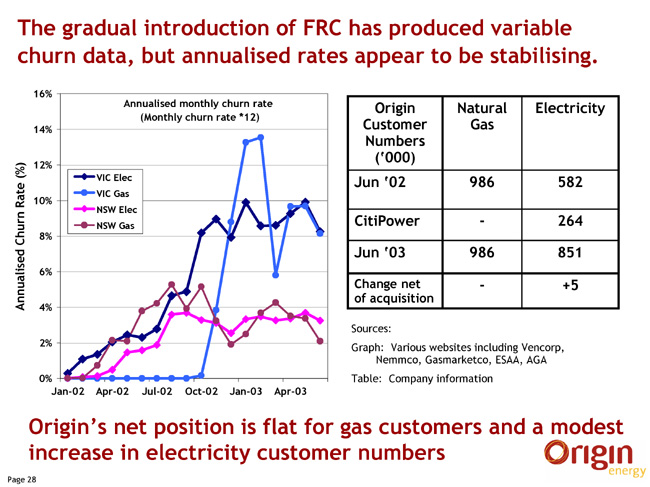

FRC was introduced in Victoria in January 2002 for electricity and October 2002 for natural gas. Churn in the electricity market grew modestly until the introduction of contestability for natural gas, after which there was a spike in activity for both fuels. Churn appears to have stabilised at rates of 5-10% per annum which is in line with industry expectation. FRC for electricity was introduced in South Australia in January 2003, but no official statistics are available for this market.

Overall during financial year ended June 2003 Origin maintained its gas customer numbers and achieved a modest growth in electricity customer numbers. Early losses of mass market customers in the Victorian electricity market due to transfers in progress at the time of the CitiPower acquisition were reversed by gains later in the year in both Victoria and South Australia.

Electricity

Origin supplies electricity predominantly to customers in Victoria, and also participates in competitive markets in New South Wales, Queensland and South Australia.

Electricity revenue increased by over $700 million and gross margins increased by over $125 million to $285 million largely due to the CitiPower retail acquisition in July 2002.

The Victorian Government continues to cap prices for mass market customers and in January 2003 rejected proposed tariff increases for electricity supplied to customers in the former Powercor area and implemented a 4% tariff reduction for customers in the former CitiPower area.

Notwithstanding these caps Origin is rebalancing individual tariff categories to cover the costs of buying electricity and costs to serve in an increasingly competitive market. This will deliver reduced tariffs to customers who have been receiving competitive market offers while un-profitable segments of the market will continue to have their tariffs adjusted on a gradual basis.

At the wholesale level the industry has undergone a degree of consolidation with the withdrawal of several retail competitors. Despite the consolidation, the National Electricity Market continues to be vigorously competitive. Even with this competitive environment Origin has managed to increase its market share renewing most existing contracts and signing new contracts with major customers in Victoria, New South Wales, South Australia and Queensland.

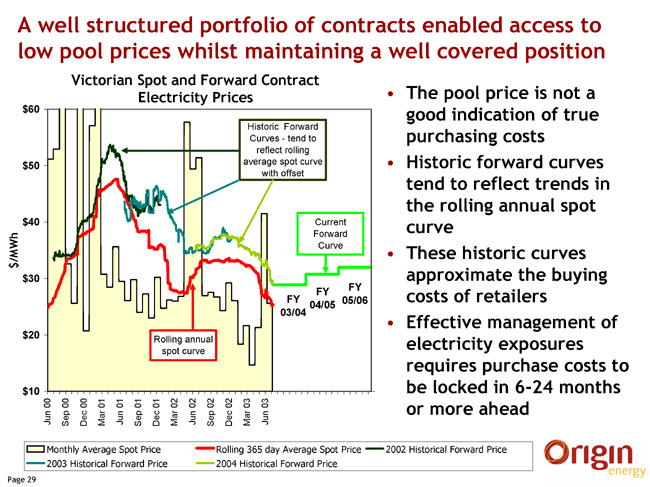

Electricity purchase costs, while increasing due to the replacement of long-term favourable contracts with current market contracts, benefited from generally low pool price volatility. Origin entered into a number of electricity purchase contracts that enabled Origin to take advantage of low pool prices while maintaining appropriate cover against periods of high pool prices. The combination of these factors meant that Retail profitability was maintained on a unit margin basis and improved overall because of the increased retail and wholesale customer sales volumes.

Natural Gas

Origin supplies natural gas mainly to customers in Victoria, South Australia, Queensland and New South Wales.

Natural gas revenues increased mainly due to the termination of the Gascor Agency Agreement and cessation of retained profit payments to the Victorian Government following the introduction of FRC in the Victorian gas market in October 2002. The profit retained by the State under the Gascor Agency Agreement reduced to $14 million from $29 million in the prior year.

In the mass market the natural gas business benefited from tariff increases of 2.5% in Victoria in January 2002; 6% in South Australia in July 2002; and 6.7% increase in Queensland in March 2002. However as a result of an unsuccessful application for a Victorian tariff increase in January 2003, prices were flat in Victoria during the later half of this year.

Sales volumes were also impacted by mild winter weather in Victoria. The measure of average degree-days, which provides an indication of heating requirements, continued to be well below long-term averages.

The deregulated natural gas market for commercial and industrial customers in South Australia and Queensland is moving into a more challenging phase with the emergence of effective competition. Nationally commercial and industrial sales decreased by 6% to 51 PJ.

LPG

Origin is a retailer and wholesaler of LPG in Australia, New Zealand and the near Pacific.

The LPG business continued the strong performance reported last year despite a reduction in sales volumes of 2% and an increase of 17% in the unit purchase cost of LPG. The Contract Price (CP) - the international benchmark price for LPG - was up by $74 per tonne to $517 per tonne average for the year.

Sales volumes were impacted by the drought, which particularly affected sales to commercial and industrial customers in many parts of rural Australia. Autogas volumes declined in the face of competition from alternative fuels. However these reductions were offset by an improvement in sales to the Pacific Islands.

Operating costs were reduced $2.9 million while a focus on credit management delivered an improved debtor performance compared to the prior year of $4.6 million and contributed to operating cash flow returns in excess of 20%.

Margins were maintained despite the increased costs of LPG, through a favourable change in the mix of sales towards the higher margin customers. As a result gross margins were steady at $114 million.

During the year Origin acquired the Treston Gas business in Shepparton, Victoria. This business, which will continue to operate under the Treston brand name, will deliver additional sales of 12,000 tonnes per annum and provide opportunities for multi fuel offerings to Origin’s electricity and natural gas customer base in the region.

Generation

| | | 2002/03 $m

| | 2001/02 $m

| | % Change

|

EBITDA | | 48.3 | | 30.2 | | 60 |

EBIT | | 26.5 | | 15.6 | | 70 |

| | | |

| | | 2002/03

| | 2001/02

| | % Change

|

Total Sales (TWh) | | 1.90 | | 1.86 | | 2 |

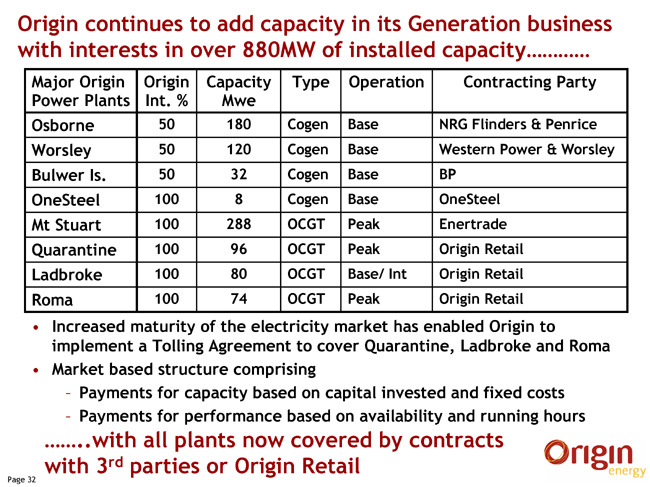

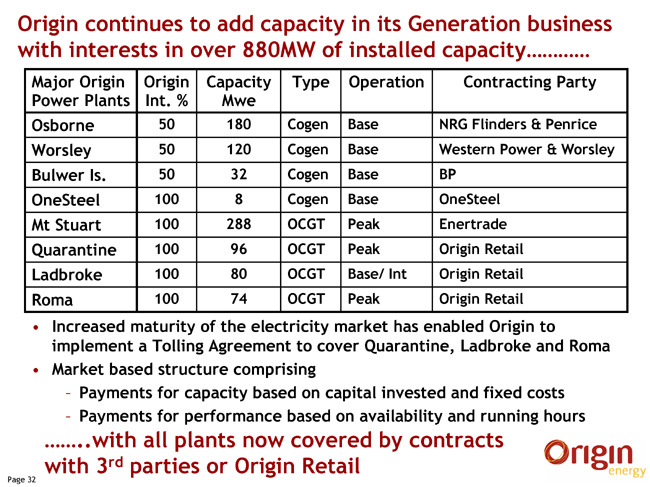

The Generation segment recorded a 54% growth in total sales revenue to $97 million. EBITDA rose 60% to $48.3 million. This was largely due to the implementation of a tolling agreement between Origin’s Retail and Generation Divisions and the acquisition of the Mt Stuart Power Station in Townsville Queensland.

Contract Plant

The acquisition of the Mt Stuart Power Station increased the capacity of contracted plant by 86% to 622 MW.

Mt Stuart supplies peaking power to the Queensland Government owned entity, Enertrade, under a long-term power purchase agreement. The plant, commissioned in December 1998, currently runs on kerosene but can be readily converted to natural gas and could be expanded by a further 150 MW through conversion to combined cycle mode.

Origin’s 50% owned cogeneration plants at the Worsley Alumina refinery in Western Australia and the Osborne Cogeneration Plant in South Australia operated at high levels of availability and efficiency.

Availability of the cogeneration plant at BP’s Bulwer Island refinery (50% interest) improved during the year following the implementation of a technical remediation plan to reduce the level of outages experienced in the prior year. During the early part of 2003/04 both gas turbines will be upgraded to full design rating.

Construction of the energy centres at the Toowoomba and Baillie Henderson Hospitals in Queensland proceeded satisfactorily, with the Toowoomba Base Hospital works completed just prior to year-end. The energy centres will deliver electricity, steam and hot and chilled water to each hospital.

Merchant Plant

Origin owns and operates three merchant plants - Roma Power Station in central Queensland, Ladbroke Grove Power Station and Quarantine Power Station in South Australia - all maintained high availability and reliability during the year.

The maturity of the national electricity market has enabled Origin to implement a market based tolling arrangement whereby capacity provided by its electricity merchant plant is charged to Origin’s Retail businesses. This has allowed the stabilisation of Generation income and quarantined the volatility of the electricity spot market to the Retail business where that volatility is managed across Origin’s entire portfolio of electricity purchases and sales.

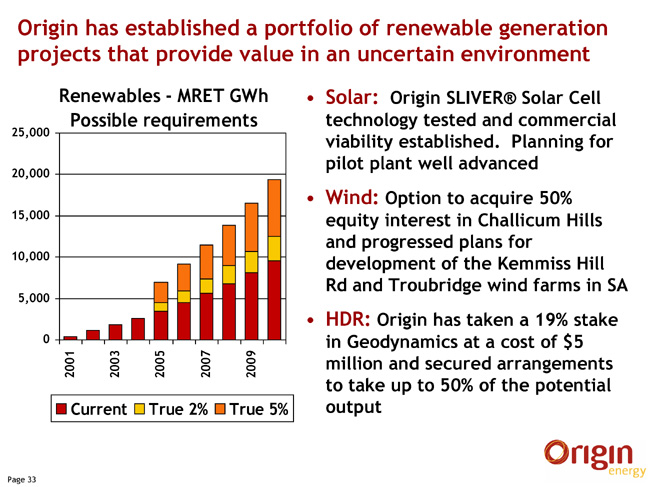

Renewable Generation

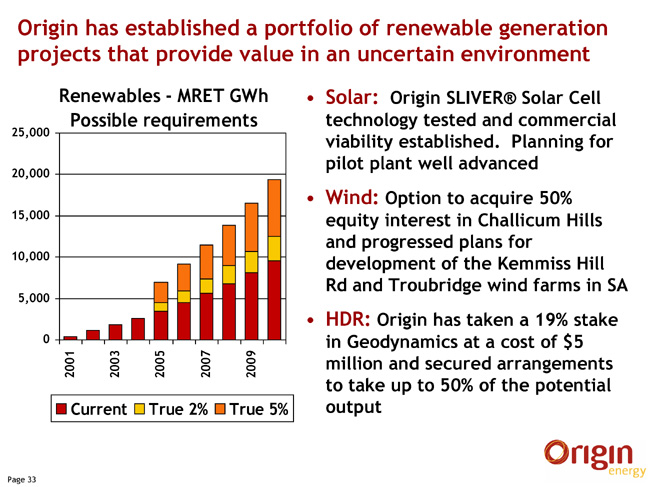

Throughout the year Origin continued to develop a portfolio of renewable energy projects.

This included the acquisition of an option to develop the Troubridge Point wind farm near Edithburgh on the Yorke Peninsula in South Australia, and an option to acquire a 50% interest in the Challicum Hills wind farm in Victoria. Development is also underway for the Kemiss Hill Road wind farm, near Yankalilla in South Australia. Wind monitoring is being conducted on a further two potential wind farm locations.

Origin has also funded research to develop lower cost solar energy. During the year Origin and the Australian National University announced the development ofSLIVER® Solar Cell technology which uses one tenth of the silicon used in conventional solar panels while matching power, performance and efficiency.

Testing confirmed that solar panels using this technology could be commercially competitive. An automated approach to module assembly was developed and planning for a pilot production facility is well advanced.

In August 2003 Origin announced the acquisition of a 19% interest in Geodynamics Limited for a consideration of $5 million. The company has been exploring and seeking to develop geothermal sources of energy including the hot dry rock geothermal resource in the Cooper Basin. Under a Power Purchase Agreement, Origin will have the right to purchase 50% of the power generated by Geodynamics’ projects including RECs and environmental credits at a discount to the prevailing market price. The acquisition is subject to approval by shareholders of Geodynamics.

Networks

| | | 2002/03 $m

| | 2001/02 $m

| | % Change

|

EBITDA | | 23.4 | | 22.5 | | 4 |

EBIT | | 21.6 | | 19.9 | | 9 |

The Network segment EBITDA of $23.4 million was 4% higher than the prior year.

Origin increased its holding in Envestra by 17.4 million shares to 19.14% in April 2002. As a consequence distributions received from Envestra increased by $1.2 million.

There was a steady increase in management fees earned from Envestra, reflecting the underlying growth in its business but this was largely offset by changes to other fees.

During the year, total natural gas connections increased by 2.5% to 905,500. This increase was largely driven by the continued strength of the domestic housing market. About 300 km of new mains were laid and 105 km of existing mains replaced.

FRC was introduced for Victorian natural gas customers in October 2002, allowing consumers to change retailers. New Information systems and processes were introduced to ensure cost

efficient metering and billing of consumers serviced by Envestra’s networks in the new competitive environment. Work has commenced on introducing similar systems and processes in South Australia where the natural gas market will open to full competition in 2004.

In a joint venture with United Utilities, Origin won a contract for the management of the water network and treatment assets of Coliban Water in regional Victoria. The 10-year contract commencing 1 July 2003 is a significant win for the joint venturers and will generate more than $120 million in revenue over the contract term.

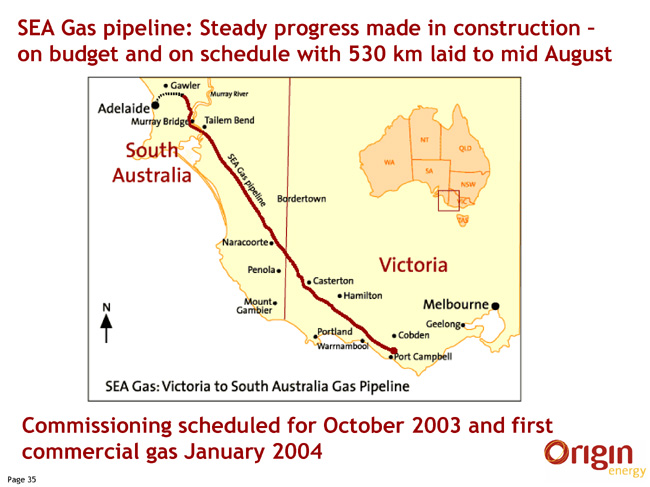

SEA Gas Pipeline

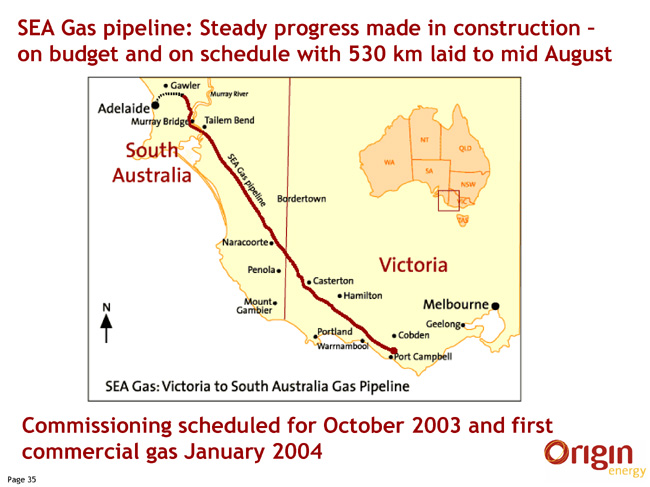

The SEA Gas Partnership (33.3% Origin, 33.3% International Power, 33.3% TXU) is constructing the SEA Gas Pipeline that will travel 680 km linking Origin’s new gas production interests in Victoria to retail gas markets and growing generation assets in South Australia.

By mid August 2003, 530 km of the pipeline had been completed, and the project remained on budget and on schedule for commercial operation in January 2004.

People, Health, Safety and Environment

Employee numbers increased 5% to 2,857 reflecting the growth in the retail business.

A continued focus on safety performance has assisted in reducing the Lost Time Injury Frequency Rate by 25% from 3.6 to 2.7. Regrettably, an incident at a drilling rig resulted in the death of an employee of a contractor engaged to drill an appraisal well for OCA. The incident will be the subject of a coronial enquiry and investigations into the cause of the incident have not yet been completed.

There were no significant environmental incidents during the year and there were no breaches of significant environmental regulations that relate to the company’s operations.

During the year Origin produced its first Sustainability Report, which provided a detailed report to stakeholders on the company’s social, environmental and economic impacts.

Over the past two years employees with at least 12 months’ service have been able to become Origin shareholders under the Employee Share Plan, in recognition of the financial performance of the company and the achievement of a significantly improved safety record. A further issue under this Plan will be made in recognition of 2002/03 performance. The cost of $2.2 million before tax has been provided for in the current year result.

In October 2002 Origin announced that it would undertake a review of its equity based compensation programs.

This review has been undertaken covering the Executive Option Plan, Employee and Executive Share Plans including an assessment of the impact of proposed changes to the accounting and tax treatment of options.

The review has concluded that the use of equity as part of the company’s remuneration program is an effective means of providing long-term incentives that motivate and reward employees for acting in the best interests of shareholders. The Board acknowledges that the plans are part of a remuneration strategy that must adhere to appropriate corporate governance principles and has concluded that they meet these objectives.

For the Employee Share Plans, the company will purchase all shares on market for distribution to employees under these plans, the cost of which will be treated as an expense.

The Board has concluded that the Executive Option Plan with its existing exercise hurdles and market exercise price meets best practice and is in the interests of shareholders. The plan has been reinstated as part of Origin’s remuneration plan.

The Australian Accounting Standards Board has released an exposure draft (ED108) on how to account for share-based payments, including employee options. The company has not adopted ED108 as there are a number of unresolved issues, and the final form of the AASB and IASB standards may well change from that currently on issue. Accordingly, the reported net profit after tax of $162.0 million does not include any amount for the expensing of options. However, if the draft standard were applied Origin would have reported an expense of $1.8 million in the past year in respect of options issued.

When the accounting standards have been determined and the tax implications are clear, Origin will again review the use of options as the long-term incentive component of executive remuneration.

Further details of the Executive Option Plan and Employee Share Plans will be included in Origin’s 2003 Annual Report.

Outlook

In the year ahead Origin will continue to build upon the performance to date and further develop opportunities for growth.

Performance of the Exploration and Production segment will be boosted by increased oil production from the Perth Basin.

Retail will continue to benefit from cessation of the Gascor retained profit payment and the drive to reduce costs from the integration of recently acquired businesses. As current favourable contracts for the purchase of electricity roll off they are being replaced at competitive prices and the wholesale margin gained in the last financial year is unlikely to be sustained.

The Generation segment will benefit from a full year contribution from the Mt Stuart Power Station and Networks segment earnings will benefit from the Coliban Water contract.

Based on these factors the outlook for the coming year is for Origin to achieve its long-term target for growth in earnings per share of 10-15% per annum.

During the coming year the company will also continue to develop opportunities that provide the basis for growth in the medium term. These include the BassGas Project, Otway Gas Project, SEAGas Pipeline and development of coal seam gas.

In the longer term Origin expects to benefit from new opportunities in its Greenfield exploration portfolio, further investment in power generation and development of opportunities in renewable generation.

Notwithstanding the recent acquisitions and capital expenditure on new projects Origin maintains a conservatively geared balance sheet. This, combined with the company’s strong cash flows, means that Origin is well placed to take advantage of opportunities that continue to arise from the rationalisation and growth that is occurring in the energy sector.

Origin Energy Key Financials

| | | 2002/2003 ($m)

| | | 2001/2002 ($m)

| | | % change

|

Total revenue | | | 3,352 | | | | 2,429 | | | 38 |

EBITDA | | | 491.3 | | | | 404.6 | | | 21 |

EBIT | | | 295.3 | | | | 230.7 | | | 28 |

Profit before tax | | | 246.6 | | | | 187.9 | | | 31 |

Profit after tax | | | 166.3 | | | | 133.6 | | | 24 |

Profit after tax and outside equity interests | | | 162.0 | | | | 128.7 | | | 26 |

| | | |

Free cash flow | | | 350 | | | | 256 | | | 37 |

OCAT ratio | | | 15.6 | % | | | 13.7 | % | | 14 |

Capital expenditure | | | 524 | | | | 403 | | | 30 |

Total assets | | | 3,409 | | | | 2,958 | | | 15 |

Net debt | | | 732 | | | | 633 | | | 16 |

Shareholders equity | | | 1,790 | | | | 1,626 | | | 10 |

| | | |

Key Ratios | | | | | | | | | | |

Earnings per share | | | 24.8 cents | | | | 20.2 cents | | | 23 |

Free cash flow(1) per share | | | 53.7 cents | | | | 40.1 cents | | | 34 |

Total dividend per share(2) | | | 10 cents | | | | 5 cents | | | 100 |

Net asset backing per share | | $ | 2.70 | | | $ | 2.50 | | | 8 |

Net debt to capitalisation | | | 29 | % | | | 28 | % | | |

Net debt to equity | | | 41 | % | | | 39 | % | | |

EBIT Interest cover | | | 6.1 times | | | | 5.4 times | | | |

Return on equity | | | 9.2 | % | | | 8.1 | % | | |

| | | |

Segment Analysis (EBITDA) (3) | | | | | | | | | | |

Exploration & Production | | | 187.6 | | | | 185.2 | | | 1 |

Retail | | | 232.1 | | | | 166.8 | | | 39 |

Generation | | | 48.3 | | | | 30.2 | | | 60 |

Networks | | | 23.4 | | | | 22.5 | | | 4 |

| (1) | | Cash flow available for funding growth and distributions to shareholders |

| (2) | | Final dividend 5 cents per share (franked to 2 cents), interim dividend 5 cents per share (franked to 2 cents) |

| (3) | | The Corporate segment reported in previous results announcements has now been allocated across the four operational business segments |

Item 4.

[GRAPHIC APPEARS HERE]

ASX APPENDIX 4E

FINAL REPORT

For the year ended 30 June 2003

Origin Energy Limited and its Controlled Entities

ABN 30 000 051 696

Results for announcement to the market:

| | | | | | | | | | A$’000

|

Revenues from ordinary activities | | up | | 38.0 | % | | to | | 3,352,303 |

Profit from ordinary activites after tax attributable to members | | up | | 25.9 | % | | to | | 161,952 |

Net profit for the period attributable to members | | up | | 25.9 | % | | to | | 161,952 |

Earnings per share - Basic | | up | | 22.8 | % | | to | | 24.8 cents |

Earnings per share - Diluted | | up | | 22.9 | % | | to | | 24.7 cents |

Dividends

| | Amount per security

| | Franked amount per security at 30% tax

|

Final dividend declared subsequent to 30 June 2003 | | 5 cents | | 2 cents |

Previous corresponding period | | 3 cents | | 3 cents |

| | |

Date for determining entitlements to the dividend | | | | 19 September 2003 |

Brief explanation of any of the figures reported above or other item(s) of importance not previously released to the market:

Nil

Discussion and Analysis of the results for the year ended 30 June 2003

Refer to the Directors’ Review for commentary.

1

STATEMENT OF FINANCIAL PERFORMANCE

Origin Energy Limited and Controlled Entities

| | | | | Consolidated

| | | Consolidated

| |

| for year ended 30 June | | Note | | 2003 A$’000

| | | 2002 A$’000

| |

Revenue from ordinary activities | | 3 | | 3,352,303 | | | 2,428,808 | |

Expenses from ordinary activities excluding borrowing costs | | 3 | | (3,068,179 | ) | | (2,204,790 | ) |

Borrowing costs | | | | (50,138 | ) | | (44,476 | ) |

Share of net profits of associates and joint venture entities accounted for using the equity method | | 12 | | 12,565 | | | 8,338 | |

| | | | |

|

| |

|

|

Profit from ordinary activities before related income tax expense | | | | 246,551 | | | 187,880 | |

Income tax expense relating to ordinary activities | | 4 | | 80,248 | | | 54,280 | |

| | | | |

|

| |

|

|

Net profit | | | | 166,303 | | | 133,600 | |

Net profit attributable to outside equity interests | | | | 4,351 | | | 4,940 | |

| | | | |

|

| |

|

|

Net profit attributable to members of the parent entity, Origin Energy Limited | | 10 | | 161,952 | | | 128,660 | |

| | | | |

|

| |

|

|

Non-owner transaction changes in equity | | | | | | | | |

Net decrease in retained profits on initial adoption of revised AASB 1028 “Employee Benefits” | | | | (283 | ) | | — | |

Net exchange difference relating to self-sustaining foreign operations | | | | (1,779 | ) | | (1,444 | ) |

| | | | |

|

| |

|

|

Total revenues, expenses and valuation adjustments attributable to members of Origin Energy Limited recognised directly in equity | | | | (2,062 | ) | | (1,444 | ) |

| | | | |

|

| |

|

|

Total changes in equity from non-owner related transactions attributable to members of the parent entity, Origin Energy Limited | | 10 | | 159,890 | | | 127,216 | |

| | | | |

|

| |

|

|

Basic earnings per share | | 9 | | 24.8 | ¢ | | 20.2 | ¢ |

Diluted earnings per share | | 9 | | 24.7 | ¢ | | 20.1 | ¢ |

The Statement of Financial Performance should be read in conjunction with the notes to the financial statements set out on pages 5 to 19.

2

STATEMENT OF FINANCIAL POSITION

Origin Energy Limited and Controlled Entities

| | | | | Consolidated

| | Consolidated

|

| as at 30 June | | Note | | 2003 A$’000

| | 2002 A$’000

|

CURRENT ASSETS | | | | | | |

Cash assets | | | | 16,431 | | 17,255 |

Receivables | | | | 621,085 | | 485,538 |

Inventories | | | | 53,913 | | 46,392 |

Other | | | | 43,063 | | 37,064 |

| | | | |

| |

|

TOTAL CURRENT ASSETS | | | | 734,492 | | 586,249 |

| | | | |

| |

|

NON-CURRENT ASSETS | | | | | | |

Receivables | | | | 31,675 | | 21,499 |

Investments accounted for using the equity method | | | | 55,272 | | 53,347 |

Other financial assets | | | | 170,713 | | 196,135 |

Property, plant and equipment | | | | 1,352,527 | | 1,155,372 |

Exploration, evaluation and development expenditure | | | | 154,300 | | 130,655 |

Intangible assets | | | | 777,948 | | 634,436 |

Deferred tax assets | | | | 123,192 | | 171,654 |

Other | | | | 8,622 | | 8,587 |

| | | | |

| |

|

TOTAL NON-CURRENT ASSETS | | | | 2,674,249 | | 2,371,685 |

| | | | |

| |

|

TOTAL ASSETS | | | | 3,408,741 | | 2,957,934 |

| | | | |

| |

|

CURRENT LIABILITIES | | | | | | |

Payables | | | | 475,026 | | 371,534 |

Interest-bearing liabilities | | | | 85,522 | | 85,238 |

Current tax liabilities | | | | 546 | | 3,290 |

Provisions | | | | 71,330 | | 67,451 |

| | | | |

| |

|

TOTAL CURRENT LIABILITIES | | | | 632,424 | | 527,513 |

| | | | |

| |

|

NON-CURRENT LIABILITIES | | | | | | |

Payables | | | | 11,840 | | 6,100 |

Interest-bearing liabilities | | | | 663,012 | | 565,139 |

Deferred tax liabilities | | | | 243,904 | | 197,055 |

Provisions | | | | 67,957 | | 36,088 |

| | | | |

| |

|

TOTAL NON-CURRENT LIABILITIES | | | | 986,713 | | 804,382 |

| | | | |

| |

|

TOTAL LIABILITIES | | | | 1,619,137 | | 1,331,895 |

| | | | |

| |

|

NET ASSETS | | | | 1,789,604 | | 1,626,039 |

| | | | |

| |

|

EQUITY | | | | | | |

Contributed equity | | 7 | | 418,612 | | 385,039 |

Reserves | | | | 110,764 | | 112,347 |

Retained profits | | 10 | | 1,223,977 | | 1,095,158 |

| | | | |

| |

|

Total parent entity interest | | | | 1,753,353 | | 1,592,544 |

Outside equity interests | | | | 36,251 | | 33,495 |

| | | | |

| |

|

TOTAL EQUITY | | 10 | | 1,789,604 | | 1,626,039 |

| | | | |

| |

|

The Statement of Financial Position should be read in conjunction with the notes to the financial statements set out on pages 5 to 19.

Net Tangible Asset Backing

| | | Consolidated 2003

| | Consolidated 2002

|

Net tangible asset backing per ordinary security | | $ | 1.48 | | $ | 1.48 |

| | |

|

| |

|

|

3

STATEMENT OF CASH FLOWS

Origin Energy Limited and Controlled Entities

| | | | | Consolidated

| | | Consolidated

| |

| for year ended 30 June | | Note | | 2003 A$’000

| | | 2002 A$’000

| |

CASH FLOWS FROM OPERATING ACTIVITIES | | | | | | | | |

Cash receipts in the course of operations | | | | 3,703,004 | | | 2,553,539 | |

Cash payments in the course of operations | | | | (3,193,463 | ) | | (2,155,062 | ) |

Dividends/distributions received from associates/joint venture entities | | | | 10,998 | | | 6,000 | |

Other dividends received | | | | 413 | | | 409 | |

Interest received | | | | 1,832 | | | 1,785 | |

Borrowing costs | | | | (50,571 | ) | | (44,919 | ) |

Income taxes paid | | | | (39,619 | ) | | (22,455 | ) |

Subvention payments | | | | (10,000 | ) | | (18,000 | ) |

| | | | |

|

| |

|

|

Net cash provided by operating activities | | | | 422,594 | | | 321,297 | |

| | | | |

|

| |

|

|

CASH FLOWS FROM INVESTING ACTIVITIES | | | | | | | | |

Payments for purchases of property, plant and equipment | | | | (146,776 | ) | | (169,464 | ) |

Payments for exploration, development and mine properties | | | | (132,454 | ) | | (135,379 | ) |

Proceeds from sale of non-current assets | | | | 3,494 | | | 18,613 | |

Payments for purchases of investments | | | | (459 | ) | | (15,904 | ) |

Payments for purchases of businesses | | 6(C) | | (131,614 | ) | | — | |

Payments for purchases of controlled entities | | 6(C) | | (93,107 | ) | | (87,452 | ) |

| | | | |

|

| |

|

|

Net cash used in investing activities | | | | (500,916 | ) | | (389,586 | ) |

| | | | |

|

| |

|

|

CASH FLOWS FROM FINANCING ACTIVITIES | | | | | | | | |

Proceeds from borrowings | | | | 1,092,626 | | | 385,591 | |

Repayment of borrowings | | | | (987,675 | ) | | (485,000 | ) |

Dividends paid | | | | (25,858 | ) | | (35,282 | ) |

Proceeds from issue of securities | | 7 | | 5,417 | | | 198,465 | |

| | | | |

|

| |

|

|

Net cash provided by financing activities | | | | 84,510 | | | 63,774 | |

| | | | |

|

| |

|

|

NET INCREASE / (DECREASE) IN CASH HELD | | | | 6,188 | | | (4,515 | ) |

Cash and cash equivalents at the beginning of the year | | | | 10,551 | | | 15,910 | |

Effect of exchange rate changes on cash | | | | (308 | ) | | (844 | ) |

| | | | |

|

| |

|

|

CASH AND CASH EQUIVALENTS AT THE END OF THE YEAR | | 6(A) | | 16,431 | | | 10,551 | |

| | | | |

|

| |

|

|

The Statement of Cash Flows should be read in conjunction with the notes to the financial statements set out on pages 5 to 19.

4

NOTES TO THE FINANCIAL INFORMATION

Origin Energy Limited and Controlled Entities

FOR THE YEAR ENDED 30 JUNE 2003

1. BASIS OF PREPARATION OF THE FINAL REPORT

The ASX 4E Report has been prepared in accordance with Accounting Standard AASB 1039 “Concise Financial Reports” (excluding the discussion and analysis requirements of the standard) and applicable Urgent Issues Group Consensus Views. It has been prepared on the basis of historical costs and, except where stated, does not take into account changing money values or current valuations of non-current assets. The accounting policies have been consistently applied by each entity in the consolidated entity and, except where there is a change in an accounting policy, are consistent with those of the previous year.

Changes in accounting policy

PROVISIONS & CONTINGENT LIABILITIES - The consolidated entity has applied AASB 1044 “Provisions, Contingent Liabilities and Contingent Assets” for the first time from 1 July 2002. Dividends are now recognised at the time they are declared, determined or publicly recommended. Previously, final dividends were recognised in the financial year to which they related, despite the dividends being announced after the end of that financial year. The adjustments to the consolidated financial report as at 1 July 2002 as a result of this change were an increase of $19,435,000 in opening retained profits (refer note 10) and a corresponding reduction in the provision for the dividend reported in current provisions at the beginning of the current financial year. Had the new accounting policy been applied in the previous financial year, the provision for dividend of $19,435,000 would have been nil.

EMPLOYEE BENEFITS - The consolidated entity has applied the revised AASB 1028 “Employee Benefits” for the first time from 1 July 2002. The liability for wages and salaries, annual leave and sick leave is now calculated using the remuneration rates the company expects to pay as at each reporting date, not wage and salary rates current at reporting date. The initial adjustments to the consolidated financial report as at 1 July 2002 as a result of this change were an increase of $404,000 in provision for employee benefits, a decrease of $283,000 in opening retained profits, and an increase of $121,000 in future income tax benefit.

FOREIGN CURRENCY TRANSLATION: The consolidated entity has applied the revised AASB1012 “Foreign Currency Translation” for the first time from 1 July 2002. For hedges of specific purchases or sales, the costs (or gains) of entering the hedge and the unrealised exchange differences up to the date of the specific purchase or sale are now deferred and recognised as assets or liabilities on the statement of financial position from the inception of the hedge contract, not when the specific purchase or sale occurs. As a result of this change in accounting policy, payables and receivables were increased by $15,843,000 representing deferred foreign currency hedge exchange gains and a net hedge receivable as at 30 June 2003.

5

Origin Energy Limited and Controlled Entities

2. SEGMENTS

(a) Primary Reporting - Business Segments

| | | Exploration and

Production

| | | Retail

| | Generation

| | Networks

| | Consolidated

| |

| | | 2003 A$’000

| | | 2002 A$’000

| | | 2003 A$’000

| | 2002 A$’000

| | 2003 A$’000

| | | 2002 A$’000

| | 2003 A$’000

| | 2002 A$’000

| | 2003 A$’000

| | | 2002 A$’000

| |

REVENUE | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Sales | | 330,302 | | | 304,736 | | | 2,836,474 | | 1,937,770 | | 97,308 | | | 63,174 | | 149,270 | | 125,382 | | 3,413,354 | | | 2,431,062 | |

Intersegment Sales Elimination ** | | (43,989 | ) | | (41,884 | ) | | — | | — | | (42,816 | ) | | — | | — | | — | | (86,805 | ) | | (41,884 | ) |

| | |

|

| |

|

| |

| |

| |

|

| |

| |

| |

| |

|

| |

|

|

External Sales Revenue | | 286,313 | | | 262,852 | | | 2,836,474 | | 1,937,770 | | 54,492 | | | 63,174 | | 149,270 | | 125,382 | | 3,326,549 | | | 2,389,178 | |

Other Revenue | | 1,534 | | | 24,116 | | | 4,681 | | 1,172 | | 1,667 | | | 2 | | 14,490 | | 12,037 | | 22,372 | | | 37,327 | |

| | |

|

| |

|

| |

| |

| |

|

| |

| |

| |

| |

|

| |

|

|

Total Segment Revenue | | 287,847 | | | 286,968 | | | 2,841,155 | | 1,938,942 | | 56,159 | | | 63,176 | | 163,760 | | 137,419 | | 3,348,921 | | | 2,426,505 | |

Unallocated Revenue | | | | | | | | | | | | | | | | | | | | | 3,382 | | | 2,303 | |

| | | | | | | | | | | | | | | | | | | | | |

|

| |

|

|

Revenue from Ordinary Activities | | | | | | | | | | | | | | | | | | | | | 3,352,303 | | | 2,428,808 | |

| | |

|

| |

|

| |

| |

| |

|

| |

| |

| |

| |

|

| |

|

|

RESULT | | | | | | | | | | | | | | | | | | | | | | | | | |

Segment Result | | 103,272 | | | 103,209 | | | 142,123 | | 91,341 | | 15,677 | | | 7,904 | | 21,632 | | 19,892 | | 282,704 | | | 222,346 | |

Share of Net Profits of Associates and Joint Venture Entities | | — | | | — | | | 1,694 | | 686 | | 10,871 | | | 7,652 | | — | | — | | 12,565 | | | 8,338 | |

| | |

|

| |

|

| |

| |

| |

|

| |

| |

| |

| |

|

| |

|

|

EARNINGS BEFORE INTEREST AND TAX (EBIT) | | 103,272 | | | 103,209 | | | 143,817 | | 92,027 | | 26,548 | | | 15,556 | | 21,632 | | 19,892 | | 295,269 | | | 230,684 | |

Net Interest Expense | | | | | | | | | | | | | | | | | | | | | (48,718 | ) | | (42,804 | ) |

| | | | | | | | | | | | | | | | | | | | | |

|

| |

|

|

Profit from Ordinary Activities Before Income Tax | | | | | | | | | | | | | | | | | | | | | 246,551 | | | 187,880 | |

Income Tax Expense | | | | | | | | | | | | | | | | | | | | | (80,248 | ) | | (54,280 | ) |

| | | | | | | | | | | | | | | | | | | | | |

|

| |

|

|

Net Profit | | | | | | | | | | | | | | | | | | | | | 166,303 | | | 133,600 | |

| | |

|

| |

|

| |

| |

| |

|

| |

| |

| |

| |

|

| |

|

|

EARNINGS BEFORE INTEREST, TAX, DEPRECIATION AND AMORTISATION (EBITDA) | | 187,565 | | | 185,180 | | | 232,055 | | 166,755 | | 48,258 | | | 30,202 | | 23,448 | | 22,473 | | 491,326 | | | 404,610 | |

| | |

|

| |

|

| |

| |

| |

|

| |

| |

| |

| |

|

| |

|

|

DEPRECIATION AND AMORTISATION | | 84,293 | | | 81,971 | | | 88,238 | | 74,728 | | 21,710 | | | 14,646 | | 1,816 | | 2,581 | | 196,057 | | | 173,926 | |

| | |

|

| |

|

| |

| |

| |

|

| |

| |

| |

| |

|

| |

|

|

OTHER NON-CASH EXPENSES | | 23,600 | | | 15,501 | | | 10,270 | | 18,494 | | 694 | | | 1,122 | | 963 | | 3,059 | | 35,527 | | | 38,176 | |

| | |

|

| |

|

| |

| |

| |

|

| |

| |

| |

| |

|

| |

|

|

ACQUISITIONS OF NON-CURRENT ASSETS (includes capital expenditure) | | 253,604 | | | 184,632 | | | 169,628 | | 86,308 | | 100,579 | | | 116,312 | | 538 | | 15,932 | | 524,349 | | | 403,184 | |

| | |

|

| |

|

| |

| |

| |

|

| |

| |

| |

| |

|

| |

|

|

6

Origin Energy Limited and Controlled Entities

2. SEGMENTS (continued)

| | | Exploration and Production

| | Retail

| | Generation

| | Networks

| | Consolidated

|

| | | 2003 A$’000

| | 2002 A$’000

| | 2003 A$’000

| | 2002 A$’000

| | 2003 A$’000

| | 2002 A$’000

| | 2003 A$’000

| | 2002 A$’000

| | 2003 A$’000

| | 2002 A$’000

|

ASSETS | | | | | | | | | | | | | | | | | | | | |

Segment Assets | | 1,081,787 | | 886,348 | | 1,633,050 | | 1,405,555 | | 309,183 | | 232,894 | | 189,826 | | 190,881 | | 3,213,846 | | 2,715,678 |

Equity accounted investments | | — | | — | | 5,966 | | 4,265 | | 48,956 | | 49,082 | | 350 | | — | | 55,272 | | 53,347 |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

Total Segment Assets | | 1,081,787 | | 886,348 | | 1,639,016 | | 1,409,820 | | 358,139 | | 281,976 | | 190,176 | | 190,881 | | 3,269,118 | | 2,769,025 |

Unallocated Assets * | | | | | | | | | | | | | | | | | | 139,623 | | 188,909 |

| | | | | | | | | | | | | | | | | | |

| |

|

Total Assets | | | | | | | | | | | | | | | | | | 3,408,741 | | 2,957,934 |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

LIABILITIES | | | | | | | | | | | | | | | | | | | | |

Segment Liabilities | | 110,284 | | 82,681 | | 464,108 | | 349,912 | | 12,298 | | 10,086 | | 39,463 | | 38,494 | | 626,153 | | 481,173 |

Unallocated Liabilities * | | | | | | | | | | | | | | | | | | 992,984 | | 850,722 |

| | | | | | | | | | | | | | | | | | |

| |

|

Total Liabilities | | | | | | | | | | | | | | | | | | 1,619,137 | | 1,331,895 |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| * | | Unallocated assets consists of cash and deferred tax assets. Unallocated liabilities consists of current and non-current interest bearing liabilities and current and deferred tax liabilities. |

| ** | | Intersegment pricing is determined on an arm’s length basis. Intersegment sales are eliminated on consolidation. With effect from 1 July 2002, a tolling arrangement was put in place between Retail and Generationin relation to the consolidated entity’s three merchant power stations. The tolling arrangement pricing is at commercial rates. The external revenue from the merchant power stations is now recognised in Retail’s revenuewhile Generation receives a tolling fee from Retail for the capacity provided and costs incurred by these power stations. Comparative amounts for 2002 have not been restated. |

Corporate costs are allocated across business segments on the basis of external sales revenue.

Industry Segments: | | Products and Services: |

| |

Exploration and Production | | Natural gas and oil |

Retail | | Natural gas, electricity, LPG, energy related products and services |

Generation | | Natural gas-fired cogeneration and power generation |

Networks | | Infrastructure investment and management services |

(b) Secondary Reporting - Geographical Segments

The consolidated entity operates predominantly in Australia. More than 90% of revenue, profit, assets and acquisition of non-current assets relate to operations in Australia.

7

Origin Energy Limited and Controlled Entities

3. PROFIT FROM ORDINARY ACTIVITIES

(a) Revenue from ordinary activities

| | | Consolidated

| | | Consolidated

| |

| | | 2003 $’000

| | | 2002 $’000

| |

Revenue from operating activities: | | | | | | |

Revenue from sale of goods | | 3,176,888 | | | 2,263,727 | |

Revenue from rendering of services | | 149,661 | | | 125,451 | |

| | |

|

| |

|

|

Total sales revenue | | 3,326,549 | | | 2,389,178 | |

Revenue from outside operating activities | | 25,754 | | | 39,630 | |

| | |

|

| |

|

|

Revenue from ordinary activities | | 3,352,303 | | | 2,428,808 | |

| | |

|

| |

|

|

(b) Expenses from ordinary activities excluding borrowing costs | | | | | | |

Expenses by nature: | | | | | | |

Raw materials and consumables used, and changes in finished goods and work in progress | | 2,263,030 | | | 1,535,775 | |

Advertising | | 18,448 | | | 13,190 | |

Bad and doubtful debts | | 6,760 | | | 8,850 | |

Consultancy costs | | 24,391 | | | 8,177 | |

Contracting costs | | 102,439 | | | 88,657 | |

Depreciation and amortisation | | 196,057 | | | 173,926 | |

Employee expenses | | 206,683 | | | 157,495 | |

Exploration and production costs | | 57,677 | | | 48,999 | |

Motor vehicle expenses | | 15,957 | | | 16,259 | |

Occupancy expenses | | 26,172 | | | 20,422 | |

Repairs and maintenance | | 18,963 | | | 17,140 | |

Royalties | | 26,134 | | | 26,978 | |

Administration and other expenses from ordinary activities | | 105,468 | | | 88,922 | |

| | |

|

| |

|

|

| | | 3,068,179 | | | 2,204,790 | |

| | |

|

| |

|

|

Profit before tax/revenue | | | | | | |

Profit from ordinary activities before related income tax expense as a percentage of revenue from ordinary activities | | 7.4 | % | | 7.7 | % |

Profit after tax/equity interests | | | | | | |

Net profit from ordinary activities after tax attributable to members of the parent entity as a percentage of members equity at the end of the period | | 9.2 | % | | 8.1 | % |

8

Origin Energy Limited and Controlled Entities

4. INCOME TAX EXPENSE

| | | Consolidated

| | | Consolidated

| |

| | | 2003 $’000

| | | 2002 $’000

| |

Income tax expense/(benefit) on pre-tax accounting profit: | | | | | | |

(i) at Australian tax rate of 30% | | 73,965 | | | 56,363 | |

(ii) adjustment for difference between Australian and overseas tax rates | | (7 | ) | | 63 | |

| | |

|

| |

|

|

Income tax expense on pre-tax accounting profit at standard rates | | 73,958 | | | 56,426 | |

| | |

|

| |

|

|

Add/(subtract) tax effect of major items causing permanent differences: | | | | | | |

Non-taxable distributions received | | (2,649 | ) | | (2,458 | ) |

Depreciation and amortisation | | 12,615 | | | 16,491 | |

Recoupment of capital losses not previously recognised | | (918 | ) | | (2,066 | ) |

Share of associates’ net profit | | (3,598 | ) | | (2,131 | ) |

Recoupment of tax losses not previously brought to account | | (165 | ) | | (527 | ) |

Under/(Over) provision for tax in previous years | | 733 | | | (981 | ) |

Net benefit of subvention payments | | — | | | (11,301 | ) |

Other | | 272 | | | 827 | |

| | |

|

| |

|

|

| | | 6,290 | | | (2,146 | ) |

| | |

|

| |

|

|

Income tax expense relating to ordinary activities | | 80,248 | | | 54,280 | |

| | |

|

| |

|

|

9

Origin Energy Limited and Controlled Entities

5. DIVIDENDS

Date the dividend is payable | | | | 3 October 2003 |

| | |

Date to determine entitlements to the dividend (ie on the basis of registrable transfers received by 5.00pm if securities are not CHESS approved, or security holding balances established by 5.00pm or such later time permitted by SCH Business Rules if securities are CHESS approved) and the last date for receipt of election notices for the dividend. | | | | 19 September 2003 |

| | | | | Consolidated

| | | Consolidated

|

| | | Note | | 2003 $’000

| | | 2002 $’000

|

(a) Dividend Reconciliation | | | | | | | |

Final prior year dividend under/(over) provided | | | | (1 | ) | | 1,818 |

Interim dividend of 5 cents per share, franked to 2 cents per share at 30% paid 24 March 2003 (2002: 2 cents per share, fully franked at 30%) | | | | 32,655 | | | 12,950 |

Nil (2002: Final dividend of 3 cents per share, fully franked at 30% paid 21 October 2002) | | | | — | | | 19,435 |

| | | | |

|

| |

|

| | | 10 | | 32,654 | | | 34,203 |

Restatement adjustment: | | | | | | | |

Final dividend previously recognised in the year ended 30 June 2002, now recognized in the current financial year as a result of the initial adoption of AASB 1044 “Provisions, Contingent Liabilities and Contingent Assets” (refer note 1). | | 10 | | 19,435 | | | — |

| | | | |

|

| |

|

| | | | | 52,089 | | | 34,203 |

| | | | |

|

| |

|

(b) Subsequent Event | | | | | | | |

Since the end of the financial year, the Directors have declared a final dividend of 5 cents per share, franked to 2 cents per share at 30%, payable 3 October 2003. | | | | 32,885 | | | — |

| | | | |

|

| |

|

The financial effect of this dividend has not been brought to account in the financial statements for the year ended 30

June 2003 and will be recognised in subsequent financial reports.

(c) Dividend Franking Account

Origin Energy Limited has no available franking credits.

10

Origin Energy Limited and Controlled Entities

6. NOTES TO THE STATEMENT OF CASH FLOWS

| | | Consolidated

| | Consolidated

| |

| | | 2003 $’000

| | 2002 $’000

| |

(A) Reconciliation of cash and cash equivalents | | | | | |

Cash includes cash on hand, at bank and short term deposits at call, net of outstanding bank overdrafts. | | | | | |

Cash as at the end of the financial period as shown in the Statement of Cash Flows is reconciled to the related items in the Statement of Financial Position as follows: | | | | | |

| | |

Cash | | 16,431 | | 17,255 | |

Bank overdrafts | | — | | (6,704 | ) |

| | |

| |

|

|

| | | 16,431 | | 10,551 | |

| | |

| |

|

|

(B) The following non cash financing and investing activities have not been included in the Statement of Cash Flows: | | | | | |

| | |

Issue of shares in respect of the Dividend Reinvestment Plan | | 28,156 | | 8,117 | |

| | |

| |

|

|

11

Origin Energy Limited and Controlled Entities

6. NOTES TO THE STATEMENT OF CASH FLOWS (continued)

(C) The consolidated entity acquired entities/businesses during the year ended 30 June 2003 for total consideration

of $225 million (30 June 2002: $87 million). The total assets and liabilities acquired are as follows:

| | | Consolidated

| | Consolidated

|

| as at 30 June | | 2003 $’000

| | 2002 $’000

|

CURRENT ASSETS | | | | |

Receivables | | 133,327 | | 7,168 |

Inventories | | 3,470 | | 5,663 |

Other | | 3,377 | | 14,573 |

| | |

| |

|

TOTAL CURRENT ASSETS | | 140,174 | | 27,404 |

| | |

| |

|

NON-CURRENT ASSETS | | | | |

Receivables | | 363 | | — |

Property, plant and equipment | | 93,011 | | 70,572 |