UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | |

| ☐ | | Preliminary Proxy Statement |

| |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ☒ | | Definitive Proxy Statement |

| |

| ☐ | | Definitive Additional Materials |

| |

| ☐ | | Soliciting Material under Rule 14a-12 |

HARVEST NATURAL RESOURCES, INC.

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| ☐ | | No fee required. |

| |

| ☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ☒ | | Fee paid previously with preliminary materials. |

| |

| ☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

| | |

| |  |

| | JAMES A. EDMISTON PRESIDENT AND CEO |

January 23, 2017

Dear Fellow Stockholders,

On behalf of the board of directors of Harvest Natural Resources, Inc., we invite you to join us at a special meeting of stockholders, which will be held on February 23, 2017, at 8:30 a.m. central time, at our headquarters located at 1177 Enclave Parkway, Suite 300, Houston, Texas 77077.

On December 22, 2016, we announced that we had entered into a sale and purchase agreement under which we would sell all of our interests in Gabon to BW Energy Gabon Pte. Ltd. Our board of directors has unanimously approved the proposed sale and has recommended that it be authorized by our stockholders. We are asking you to authorize this sale at the special meeting. In connection with the vote to authorize the sale of our Gabon interests, and as required by the Securities Exchange Act of 1934, you will also be asked to consider and vote on a non-binding, advisory proposal to approve compensation that will or may become payable by us to our named executive officers under existing agreements as a result of the sale. For information concerning the proposed sale of our Gabon interests and compensation payable as a result of the sale, please see the section of the proxy statement titledSale of Our Gabon Interests and Proposals 1 and 2 beginning on page 4.

On October 7, 2016, following the sale of our Venezuelan interests, we announced that we were evaluating a possible liquidation and dissolution of Harvest. On December 30, 2016, our board of directors unanimously determined that the liquidation and dissolution of Harvest Natural Resources, Inc. is advisable, authorized the liquidation and dissolution and recommended that the proposed complete dissolution be submitted to a vote of our stockholders. We are asking you to authorize our complete dissolution at the special meeting. For information concerning liquidation and the dissolution, please see the section of the proxy statement titledLiquidation and Dissolution and Proposal 3 beginning on page 63.

Your vote is very important. The proposed sale of our Gabon interests and the proposed dissolution cannot be effected without theaffirmative vote of the holders of a majority of the outstanding shares of our common stock entitled to vote. If you abstain from voting, if you do not provide us with your proxy, if you do not instruct your broker to vote your shares, or if you otherwise fail to vote, it will have the same effect as voting against the proposed sale and the proposed liquidation and dissolution.

OUR BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” EACH OF THE PROPOSALS TO BE CONSIDERED AT THE SPECIAL MEETING.

We encourage you to read the accompanying proxy statement, which provides information about us and each proposal to be considered at the special meeting. Whether or not you plan to attend the special meeting, please submit your enclosed proxy card or vote by telephone or internet as soon as possible so that your shares can be voted at the meeting in accordance with your instructions. You may submit your proxy over the internet, by telephone or by mail, as further described in the section of the proxy statement titled Questions and Answers Regarding the Special Meeting and Future Stockholder Proposals beginning on page 86. Voting by proxy will not prevent you from voting your shares in person if you choose to attend the special meeting.

Thank you for your continued support of Harvest Natural Resources.

Sincerely,

James A. Edmiston

President and Chief Executive Officer

PROXY STATEMENT

HARVEST NATURAL RESOURCES, INC.

1177 Enclave Parkway, Suite 300

Houston, Texas 77077

(281) 899-5700

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

| | |

| TIME AND DATE | | February 23, 2017 8:30 a.m. central time |

| |

| PLACE | | Harvest Natural Resources, Inc. 1177 Enclave Parkway Suite 300 Houston, Texas 77077 |

| |

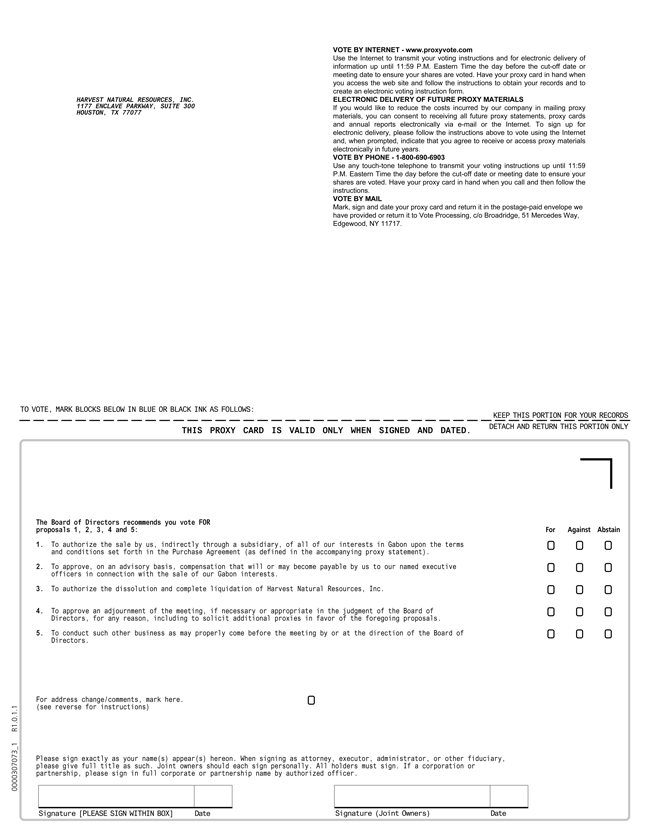

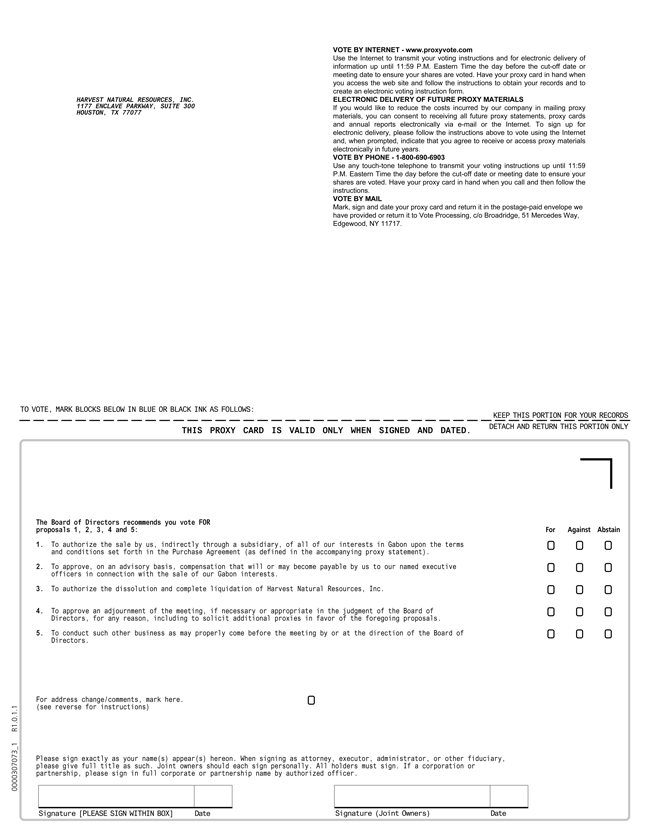

| ITEMS OF BUSINESS | | (1) The authorization of a sale by us, indirectly through a subsidiary, of all of our interests in Gabon upon the terms and conditions set forth in the Purchase Agreement (as defined in the accompanying proxy statement); |

| |

| | (2) The advisory approval of compensation that will or may become payable by us to our named executive officers in connection with the sale of our Gabon interests; |

| |

| | (3) The authorization of the complete liquidation and dissolution of Harvest Natural Resources, Inc.; |

| |

| | (4) The approval of an adjournment of the meeting, if necessary or appropriate in the judgment of the Board of Directors, for any reason, including to solicit additional proxies in favor of the foregoing proposals; and |

| |

| | (5) Such other business as may properly come before the meeting by or at the direction of the Board of Directors. |

| |

| RECORD DATE | | You are entitled to vote if you were a stockholder at the close of business on January 23, 2017. |

| |

| VOTING BY PROXY | | Please promptly complete, sign, date and return the enclosed proxy card as soon as possible so that your shares can be voted at the meeting in accordance with your instructions. You may also submit your proxy over the internet or by telephone. For specific instructions, please see the section of the proxy statement titledQuestions and Answers Regarding the Special Meeting and Future Stockholder Proposals beginning on page 86. |

| |

| STOCKHOLDER LISTING | | A list of our stockholders as of the record date will be available for inspection by our stockholders for any purpose germane to the special meeting at our headquarters located at 1177 Enclave Parkway, Suite 300, Houston, Texas 77077, during the 10 days immediately preceding the date of the special meeting. |

By Order of the Board of Directors

James A. Edmiston

President and Chief Executive Officer

On or about January 27, 2017, we will mail to our stockholders the proxy materials for the special meeting, including the proxy statement and the proxy card. These proxy materials will contain instructions on how to vote your shares.

TABLE OF CONTENTS

- i -

APPENDICES

| | | | |

APPENDIX A – Sale and Purchase Agreement dated December 21, 2016, among HNR Energia B.V., Harvest Natural Resources, Inc. and BW Energy Gabon Pte. Ltd. | | | A-1 | |

APPENDIX B – Opinion of Tudor, Pickering, Holt & Co. Advisors, LLC | | | B-1 | |

APPENDIX C – Audited Consolidated Financial Statements of Harvest Natural Resources, Inc. and Subsidiaries and Related Management’s Discussion and Analysis of Financial Condition and Results of Operations | | | C-1 | |

Report of Independent Registered Public Accounting Firm | | | C-2 | |

Consolidated Balance Sheets at December 31, 2015 and 2014 | | | C-3 | |

Consolidated Statements of Operations and Comprehensive Loss for the Years Ended December 31, 2015 and 2014 | | | C-4 | |

Consolidated Statements of Stockholders’ Equity for the Years Ended December 31, 2015 and 2014 | | | C-5 | |

Consolidated Statements of Cash Flows for the Years Ended December 31, 2015 and 2014 | | | C-6 | |

Notes to Consolidated Financial Statements | | | C-8 | |

Management’s Discussion and Analysis of Financial Condition and Results of Operations | | | C-69 | |

APPENDIX D – Unaudited Consolidated Financial Statements of Harvest Natural Resources, Inc. and Subsidiaries and Related Management’s Discussion and Analysis of Financial Condition and Results of Operations | | | D-1 | |

Consolidated Balance Sheets at September 30, 2016 and December 31, 2015 | | | D-2 | |

Consolidated Statements of Operations and Comprehensive Loss for the Three and Nine Months Ended September 30, 2016 and 2015 | | | D-3 | |

Consolidated Statements of Cash Flows for the Nine Months Ended September 30, 2016 and 2015 | | | D-4 | |

Notes to Consolidated Financial Statements | | | D-6 | |

Management’s Discussion and Analysis of Financial Condition and Results of Operations | | | D-31 | |

APPENDIX E – Unaudited Financial Statements of Harvest Dussafu B.V. | | | E-1 | |

Balance Sheets at September 30, 2016, and December 31, 2015 and 2014 | | | E-2 | |

Statements of Operations for the Nine Months ended September 30, 2016, and for the Years Ended December 31, 2015 and 2014 | | | E-3 | |

Statements of Shareholders’ Equity for the Nine Months ended September 30, 2016, and for the Years Ended December 31, 2015 and 2014 | | | E-4 | |

Statements of Cash Flows for the Nine Months ended September 30, 2016, and for the Years Ended December 31, 2015 and 2014 | | | E-5 | |

Notes to Financial Statements | | | E-6 | |

APPENDIX F – Plan of Complete Liquidation, Dissolution, Winding Up and Distribution | | | F-1 | |

APPENDIX G – Sections 278 – 283 of the Delaware General Corporation Law | | | G-1 | |

- ii -

INTRODUCTION TO THIS PROXY STATEMENT

This proxy statement provides the stockholders of Harvest Natural Resources, Inc. (“Harvest”, “we” or “us”) with important information about us and the proposals to be considered at the special meeting of our stockholders to be held on February 23, 2017. We are asking our stockholders of record on January 23, 2017 (the “Record Date”) to vote on three sets of proposals, all of which are described in detail in this proxy statement.

THE PROPOSALS

First, we are asking you to vote on proposals relating to our recently announced transaction with BW Energy Gabon Pte. Ltd. (“BW Energy”), by which we will sell our interests in Gabon to BW Energy. These proposals include:

| | • | | A proposal to authorize the sale by us, indirectly through a subsidiary, of all of our interests in Gabon, consisting of our 100% equity interest in Harvest Dussafu B.V. (“Harvest Dussafu”), to BW Energy in exchange for $32 million in cash, subject to adjustments, pursuant to the terms and conditions set forth in the Purchase Agreement (as defined in this proxy statement); and |

| | • | | A non-binding, advisory proposal to approve compensation that will or may become payable by us to our named executive officers under existing agreements in connection with the sale of our Gabon interests, which we are required to submit to you under the Securities Exchange Act of 1934 (the “Exchange Act”). |

You can find more information about the proposed sale of our Gabon interests and associated management compensation in the section of this proxy statement titledSale of Our Gabon Interests and Proposals 1 and 2 beginning on page 4.

Second, we are asking you to vote on a proposal to authorize our complete liquidation and dissolution. You can find more information about this proposal under the headingLiquidation and Dissolution and Proposal 3 beginning on page 63.

Third, we are asking you to approve two administrative proposals relating to the conduct of the special meeting:

| | • | | A proposal to adjourn the special meeting, if necessary or appropriate in the judgment of the Board of Directors, to solicit additional proxies in favor of the foregoing proposals or for other reasons; and |

| | • | | A proposal to conduct such other business as may properly come before the special meeting by or at the direction of the Board of Directors. |

You can find more information about these two administrative proposals under the headingAdministrative Matters and Proposals 4 and 5 beginning on page 84.

In total, we are asking you to vote on five proposals, all of which have been authorized and approved unanimously by our board of directors (our “Board”).We request that each stockholder of record on the Record Date vote on these matters as soon as possible by submitting a proxy in accordance with the procedures described in the section of this proxy statement titledQuestions and Answers Regarding the Special Meeting and Future Stockholder Proposalsbeginning on page 86. This section also includes other information about the special meeting and related procedures.

INFORMATION IN THIS PROXY STATEMENT

Terms

We have used numerous defined terms in this proxy statement. For your convenience, we have included a list of those defined terms in the section of this proxy statement titledIndex to Defined Terms Used in this Proxy Statement beginning on page 91.

- 1 -

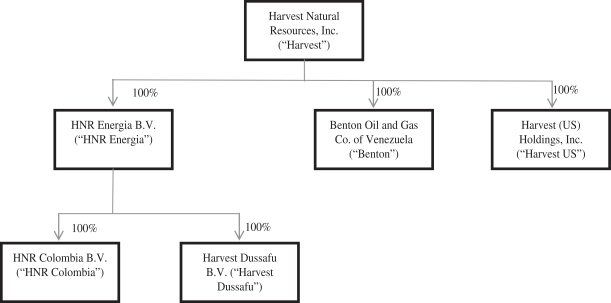

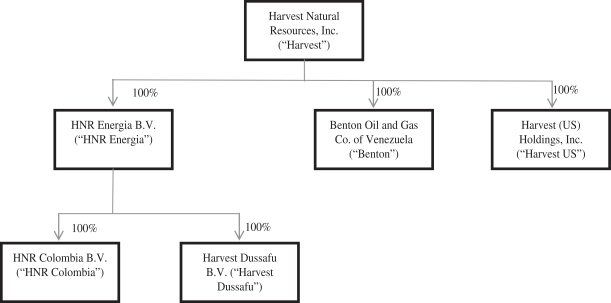

Organizational Chart

To help you better understand some of the information in this proxy statement, including the proposal to sell our Gabon interests and our proposed liquidation and dissolution, and the various relationships between us and our subsidiaries, please refer to the following organizational chart, which shows all of our subsidiaries that have not been dissolved. For information about the status of these subsidiaries and certain dissolved subsidiaries in the context of our liquidation and dissolution, seeLiquidation and Dissolution and Proposal 3 beginning on page 63.

None of the subsidiaries shown in the chart above has been dissolved. In the last three years, we have dissolved seven subsidiaries that are not shown on the chart; the existence of those subsidiaries continues for various purposes, as required under applicable law. SeeLiquidation and Dissolution and Proposal 3 beginning on page 63.

Cautionary Notice Regarding Forward-Looking Statements

We caution that any forward-looking statements, as that term is defined in Section 27A of the Securities Act of 1933 (the “Securities Act”), and Section 21E of the Exchange Act, contained in this proxy statement involve risks and uncertainties and are subject to change based on various important factors. When used in this proxy statement, the words “budget,” “forecast,” “expect,” “believes,” “goals,” “projects,” “plans,” “expects,” “anticipates,” “estimates,” “should,” “could,” “assume” and similar expressions are intended to identify forward-looking statements. In accordance with the provisions of the Securities Act and the Exchange Act, we caution you that important factors could cause actual results to differ materially from those in any forward-looking statements. These factors include, among other factors, the failure to obtain the requisite stockholder authorizations of the proposed transaction and the proposed liquidation and dissolution; the possibility that the closing conditions to the proposed transaction may not be satisfied or waived, including that a governmental entity may prohibit, delay or refuse to grant a necessary regulatory approval; delay in closing the proposed transaction or the possibility of non-consummation of the proposed transaction or the proposed liquidation and dissolution; the occurrence of any event that could give rise to termination of the sale and purchase agreement; risks related to the disruption of the proposed transaction or the proposed liquidation and dissolution of Harvest and its operations and management; the effect of announcement of the proposed transaction or the proposed liquidation and dissolution on Harvest’s ability to retain and hire key personnel and maintain relationships with its suppliers and other third parties; difficult global economic and commodity and capital markets conditions; changes in the legal and regulatory environment; our concentration of operations in Gabon; political and economic risks associated with international

- 2 -

operations; anticipated future development costs for undeveloped reserves; drilling risks; risk that actual results may vary considerably from reserve estimates; the dependence on the abilities and continued participation of our key employees; risks normally incident to the exploration, operation and development of oil and natural gas properties; permitting and drilling of oil and natural gas wells; availability of materials and supplies necessary to projects and operations; prices for oil and natural gas and related financial derivatives; changes in interest rates; availability and cost of drilling rigs and seismic crews; political stability; civil unrest; acts of terrorism; risks associated with third-party claims and litigation and the difficulty of controlling related outcomes or assessing ultimate liabilities; currency and exchange risks; currency controls; changes in existing or potential tariffs, duties or quotas; changes in taxes; changes in governmental policy; lack of liquidity; availability of sufficient financing; changes in weather conditions; our ability to continue as a going concern; and other risks, including those discussed in our public filings.

References to Other Documents

Statements contained in this proxy statement regarding the contents of any contract or other document are not necessarily complete and are qualified by reference to the contract or other document.

Effectiveness of Information

You should rely only on the information contained in this proxy statement and any supplements or amendments to this proxy statement that we may file with the US Securities and Exchange Commission (the “SEC”) in the future. We have not authorized anyone to provide you with information that is different from what is contained in this proxy statement. This proxy statement is dated January 23, 2017. You should not assume that the information contained in this proxy statement is accurate as of any date other than that date. The mailing of the proxy statement to stockholders does not create any implication to the contrary.

Smaller Reporting Company Status

We are currently a “smaller reporting company” for purposes of determining what information we must provide in this proxy statement and other documents filed with the SEC. Our status as a smaller reporting company is based on, among other things, the fact that the market value of the shares of our common stock held by non-affiliates on June 30, 2016, was less than $50 million. Therefore, as permitted by SEC regulations, we may have eliminated or shortened certain kinds of information in this proxy statement, compared to analogous information in some of our prior proxy statements.

Consulting Your Own Advisors

You may wish to consult your own legal, tax and financial advisors with respect to any aspect of the proposed sale of our Gabon interests, our proposed dissolution, or other matters described in this proxy statement.

- 3 -

SALE OF OUR GABON INTERESTS AND PROPOSALS 1 AND 2

THE PROPOSED SALE

Summary Term Sheet

This summary of the proposed sale of our Gabon interests highlights important information discussed in more detail elsewhere in this proxy statement. The summary does not contain all of the information you should consider before voting on the proposed sale. To understand the proposed sale more fully, you are urged to read carefully this entire proxy statement and all of its appendices, including the sale and purchase agreement dated December 21, 2016, between us, HNR Energia B.V. (“HNR Energia”) and BW Energy (as amended from time to time, the “Purchase Agreement”), a copy of which is attached asAppendix A to this proxy statement, before voting on whether to authorize the proposed sale. The parenthetical page references beside each heading in this summary indicate where in this proxy statement you can find more detailed information about each subject. This summary only relates to the proposed sale of our Gabon interests. Information regarding other matters to be considered at the special meeting are included in other sections of this proxy statement; please refer to the table of contents to help you locate this other information.

Parties to the Purchase Agreement (Page 9)

The parties to the Purchase Agreement are Harvest Natural Resources, Inc., its wholly owned subsidiary HNR Energia B.V., and BW Energy. HNR Energia owns all of the equity interests in Harvest Dussafu B.V., which owns all of our Gabon interests. You are being asked to authorize HNR Energia’s sale of its 100% interest in Harvest Dussafu to BW Energy.

Key Terms of the Proposed Sale (Page 4)

The proposed sale is governed by the Purchase Agreement. On December 21, 2016, we and HNR Energia entered into the Purchase Agreement with BW Energy to sell all of our Gabon interests through the sale of HNR Energia’s equity interest in Harvest Dussafu in exchange for a cash purchase price of $32 million, subject to adjustments. The effective date of the transaction for economic and financial purposes is October 1, 2016.

The closing of the sale is conditioned on, among other things, (1) approvals by the Government of the Republic of Gabon (“Gabon”) (consisting of approvals by two separate ministers) and (2) authorization by the holders of a majority of our outstanding common stock. The Purchase Agreement requires that the closing of the sale will occur five business days after the satisfaction or waiver of the last condition to closing (unless otherwise agreed by the parties). If we do not receive the authorization of our stockholders, then either HNR Energia or BW Energy may terminate the Purchase Agreement.

We have the right to terminate the Purchase Agreement if we decide to enter into an alternative acquisition agreement with respect to a “superior proposal” (as defined in the Purchase Agreement, and as further discussed inDocuments Governing the Proposed Sale – Purchase Agreement – Exclusivity, Superior Proposals, Fiduciary Out and Change of Board Recommendation beginning on page 34). If we exercise this right, then we must pay BW Energy a termination fee of $1.12 million. We must also pay this termination fee if our Board effects a “change of parent board recommendation” (as that term is defined in the Purchase Agreement) with respect to the proposed sale to BW Energy.

The Purchase Agreement is attached asAppendix A to this proxy statement.

- 4 -

Opinion of Financial Advisor (Page 17)

Our Board engaged Tudor, Pickering, Holt & Co. Advisors, LLC (“TPH”) as our financial advisor for purposes of the proposed transaction. On November 15, 2016, TPH delivered an opinion to our Board as to the fairness, from a financial point of view, to us of the consideration to be received by HNR Energia under the Purchase Agreement.

The full text of TPH’s written opinion, dated November 15, 2016, is attached asAppendix B to this proxy statement and is incorporated by reference into this proxy statement. We encourage you to read the opinion carefully in its entirety for a description of, among other things, the assumptions made, procedures followed, factors considered and qualifications and limitations on the review undertaken. TPH’s opinion was provided to our Board in connection with our Board’s consideration of the Purchase Agreement, does not address any other aspect of the proposed sale and does not constitute a recommendation as to how any of our stockholders should vote with respect to the sale, or any other matter. SeeThe Proposed Sale – Opinion of Our Financial Advisorbeginning on page 17.

Interests of Our Executive Officers in the Proposed Sale (Page 56)

In considering the recommendation of our Board, stockholders should be aware that some of our executive officers may have interests in the proposed sale that are different from, or in addition to, the interests of our stockholders. SeeInterests of Our Executive Officers in the Proposed Sale beginning on page 56.

Use of Proceeds and Nature of Our Business Following the Proposed Sale (Page 24)

If the proposed sale of our Gabon interests is completed, almost all of our assets will consist of cash. We will use the proceeds from the sale of our Gabon interests to pay expenses and taxes, if any, associated with the sale and for other operating expenses. Subject to determinations to be made by our Board, and subject to authorization of the liquidation and dissolution proposal by our stockholders, the remaining proceeds will be used to provide reserves of funds for future or contingent liabilities as may be determined necessary by our Board pursuant to Delaware law, to pay or settle existing obligations, to pay costs (including taxes) associated with the liquidation and winding up of our business, and to distribute remaining assets to our stockholders. If we do not dissolve Harvest (either because our stockholders do not approve the dissolution or because our directors decide to abandon the dissolution), then the proceeds may also be used for the continued operation of our business, including the possible acquisitions of assets.

Stockholder Vote Required to Approve the Proposed Sale (Page 61)

You are being asked to consider and vote on a proposal to authorize the sale of our Gabon interests described in this proxy statement and in the Purchase Agreement. We are obtaining this vote to comply with Section 271 of the Delaware General Corporation Law (“DGCL”), which requires a stockholder vote for a corporation to sell substantially all of its assets. We need the affirmative authorization of the holders of a majority of all outstanding shares of our common stock. Abstentions, broker non-votes and failures to vote will have the effect of voting against the proposed sale of our Gabon interests. On the Record Date there were approximately 11,042,933 shares of our common stock outstanding and entitled to be voted at the meeting. The exact number of outstanding shares on the Record Date cannot currently be provided due to ongoing issuances of whole shares in lieu of fractional shares in connection with our reverse stock split.

Recommendation of Our Board and Reasons for the Proposed Sale (Page 61)

Our Board unanimously (1) determined that the proposed transaction with BW Energy and the terms of the Purchase Agreement and related documents are expedient, advisable, fair to, and in the best interest of our stockholders, (2) authorized the transaction (3) approved the Purchase Agreement and the related documents and (4) recommended that our stockholders authorize the transaction in accordance with the terms of the Purchase Agreement.Our Board recommends that you vote “FOR” the authorization of the proposed sale of our Gabon interests.

- 5 -

Voting Procedures (Page 61)

Each share of our outstanding common stock is entitled to one vote at the meeting. You may vote by completing, signing and mailing your proxy card in the postage-paid envelope, by submitting your proxy by the internet, by submitting your proxy by telephone, or by attending the meeting and voting in person.Whether or not you intend to attend the meeting, please provide your proxy to ensure that your shares are represented at the meeting and your vote is counted.

Risk Factors Related to the Proposed Sale of Our Gabon Interests

You should carefully review the risk factors described below as well as the other information provided to you or referenced in this proxy statement in deciding how to vote on the proposed sale of our Gabon interests. For a discussion of additional considerations, we refer you to the documents we file from time to time with the SEC, particularly our most recent Annual Report on Form 10-K, including under the heading “Item 1A. Risk Factors,” and our Quarterly Reports on Form 10-Q and Current Reports on Form 8-K filed since December 31, 2015. Additional risk factors and other considerations not known to us or that we currently believe are immaterial may also adversely affect our business and operations. If any of the following considerations actually occurs, our business, financial condition or results of operations could be materially and adversely affected, the value of our common stock could decline, and you may lose all or part of your investment. The risk factors discussed below also include forward-looking statements and our actual results may differ substantially from those discussed in those forward-looking statements. SeeIntroduction to This Proxy Statement – Information in This Proxy Statement – Cautionary Notice Regarding Forward-Looking Informationbeginning on page 1.

While the proposed sale of our Gabon interests is pending, it creates uncertainty about our future that could have a material adverse effect on our business, financial condition and results of operations.

As a result of this uncertainty, our current or potential business partners may decide to delay, defer or cancel entering into new business arrangements with us pending completion or termination of the proposed sale. In addition, while the proposed sale is pending, we are subject to a number of risks, including:

| | • | | the diversion of management and employee attention from our day-to-day business; |

| | • | | the potential disruption to contracting parties and service providers; and |

| | • | | the possible inability to respond effectively to competitive pressures, industry developments and future opportunities. |

The occurrence of any of these events individually or in combination could have a material adverse effect on our business, financial condition and results of operations.

There is no assurance that the proposed sale of our Gabon interests will be completed.

If our stockholders fail to authorize the proposed sale of our Gabon interests, or if the proposed sale is not completed for any other reason, the market price of our common stock may decline. Failure to complete the proposed sale will result in a reduction in the amount of cash otherwise available to us and, given that we do not currently have any operating cash inflows, may substantially limit our ability to implement any business strategy.

We cannot assure you that the proposed sale of our Gabon interests will be consummated. The consummation of the proposed sale is subject to the satisfaction or waiver of a number of conditions, including, among others, (1) the requirement that we obtain stockholder authorization of the proposed sale; (2) the requirement that we obtain approvals of the proposed sale from the Government of Gabon; (3) requirements with respect to the accuracy of the representations and warranties of the parties to the Purchase Agreement; and (4) requirements with respect to the satisfaction or waiver of the covenants and obligations of the parties to the

- 6 -

Purchase Agreement. SeeDocuments Governing the Proposed Sale – Purchase Agreement – Conditions to the Proposed Sale beginning on page 29 for detailed information about all conditions to the closing. In addition, the Purchase Agreement may be terminated in certain circumstances under its terms.

We are required to obtain approvals of the sale of our Gabon interests from the Gabonese Minister in Charge of Economy and the Gabonese Minister in Charge of Petroleum. There can be no assurances that we will be able to obtain these approvals, or that we will be able to obtain these approvals on terms reasonably satisfactory to us and BW Energy. If these approvals are not obtained, then the Purchase Agreement may be terminated. SeeDocuments Governing the Proposed Sale – Purchase Agreement – Termination beginning on page 35.

We cannot guarantee that all of the conditions to closing will be met. We or BW Energy may not be able to meet all of the closing conditions, and other closing conditions within the control of other parties (such as the required governmental approvals) may not be met. BW Energy would not be obligated to close the sale of our Gabon interests and could terminate the Purchase Agreement if we are not able to satisfy the closing conditions within our control or within the control of others. We also cannot be sure that circumstances will not rise that would also allow BW Energy to terminate the Purchase Agreement before the closing.

If the proposed sale does not close for any reason, our Board will be forced to evaluate other options. Our Board could decide to:

| | • | | Negotiate a new purchase agreement for the sale of our Gabon interests. The terms of any such new purchase agreement may be less favorable to us than the terms of the Purchase Agreement with BW Energy. It may not be possible to negotiate a new purchase agreement for the sale of our Gabon interests because there may not be any other offers to buy our Gabon interests on satisfactory terms. Negotiation of a new purchase agreement would entail a delay in our ability to sell our Gabon interests, during which we will have to continue to use our funds to pay general and administrative and other costs associated with managing the Dussafu PSC. |

| | • | | Proceed with our proposed liquidation and dissolution and sell our Gabon interests as part of our winding up procedures. Our Plan of Dissolution provides that we will sell all of our assets in existence when we dissolve. If these assets still include our Gabon interests, we will sell those interests on the best terms available, but without stockholder approval. Any such sale could be on terms less favorable than the terms of the Purchase Agreement. |

| | • | | Decide to forego any sale of our Gabon interests in the near future and continue to manage the Dussafu PSC as we have done in the past, without dissolving Harvest. If we do this, we will have to satisfy our funding obligations for our Gabon operations out of our available cash, which will reduce our cash reserves that could otherwise be distributed to our stockholders. We will also likely continue to incur the overhead costs attendant to being a publicly held company, including legal and accounting fees. |

If the proposed sale does not close, our Board will make decisions regarding our future course based on their determination of what is in the best interests of our stockholders. However, the choices will be limited and will likely be less favorable to our stockholders than the proposed sale of our Gabon interests to BW Energy under the Purchase Agreement and our proposed ensuing liquidation and dissolution, as described in this proxy statement.

We will be required to pay a break-up fee of $1.12 million if the Purchase Agreement is terminated under certain circumstances.

If the Purchase agreement is terminated for any of the following reasons, we will be required to pay BW Energy a break-up fee of $1.12 million:

| | • | | because our stockholders do not authorize the proposed sale, and we receive an acquisition proposal after the date of the Purchase Agreement or a proposal becomes publicly known, and in either case is |

- 7 -

| | not withdrawn, before the termination of the Purchase Agreement, and within 12 months of termination of the Purchase Agreement we execute a definitive agreement with respect to, or our Board recommends, an alternative acquisition proposal and we subsequently consummate that alternative transaction; |

| | • | | because our Board has determined to enter into an alternative acquisition agreement with respect to a superior proposal; or |

| | • | | because our Board has changed its recommendation to our stockholders to vote for the proposed sale or we have intentionally committed a breach of our obligations under the Purchase Agreement regarding an alternative acquisition proposal. |

Our executive officers may have interests in the proposed sale that are different from, or in addition to, the interests they may have as stockholders.

In accordance with the terms of pre-existing agreements, our executive officers may receive change of control payments as a result of the consummation of the proposed sale of our Gabon interests, or as a result of the combination of the consummation of the proposed sale and a termination event under the applicable agreement. If we proceed with our proposed liquidation and dissolution, it is very likely that the termination of employment of our executive officers will occur at some point in time after the dissolution. Accordingly, our executive officers may have interests in the proposed sale that are different from, or in addition to, the interests of our stockholders generally. See– Golden Parachute Compensation to Named Executive Officers beginning on page 58.

The opinion of our financial advisor does not reflect changes in circumstances that may have occurred after the date of the opinion.

On November 15, 2016, TPH delivered its opinion to our Board that, as of the date of the opinion, based on and subject to the assumptions, limitations and qualifications set forth in the opinion and based on such other matters as TPH considered relevant, the consideration to be received by HNR Energia pursuant to the Purchase Agreement was fair from a financial point of view to Harvest. TPH’s opinion speaks only as of the time it was rendered and not as of the closing of the proposed sale or any other time. Changes in circumstances that have occurred or may occur after the date of TPH’s opinion could significantly alter the value, facts or elements on which the opinion was based.

There is no guarantee that you will receive any of the net cash proceeds from the proposed sale of our Gabon interests in the form of dividends.

The purchase price for the sale of our interests in Gabon will be paid to our wholly owned subsidiary, HNR Energia, which will distribute the proceeds to us in connection with its liquidation and dissolution. While we intend to dissolve after the closing of the sale of our Gabon interests, after the payment of expenses related to the proposed sale (including taxes, if any) and reservation of some of the proceeds for operating costs, contingent liabilities and taxes, any use of the remaining proceeds will be at the discretion of our Board and based on its determination of what is in the best interests of Harvest and its stockholders at the time of determination. Our Board could decide not to pursue the liquidation and dissolution and that we should use all or a significant portion of the net cash proceeds from the sale for purposes other than to pay dividends or make liquidating distributions to stockholders, including continuing our business.

We expect to delist our common stock on the NYSE after the consummation of the proposed sale of our Gabon interests. If the sale of our Gabon interests fails to close, the NYSE could delist our common stock.

If the proposed sale of our Gabon interests is consummated, our assets will consist primarily of cash. The New York Stock Exchange’s (the “NYSE”) continued listing requirements provide that a listed company’s securities can be delisted if the company’s operating assets have been substantially reduced. Based on

- 8 -

conversations with the NYSE, we expect that our stock will be delisted soon after the closing of the sale of our Gabon interests because at that time we will have no substantial operating assets. If our Board decides to declare a dividend after the closing of the sale of our Gabon interests, we expect that this delisting will be timed to occur very soon after the payment of the dividend. There can be no assurances, however, that our Board will declare a dividend shortly after the closing of the sale of our Gabon interests. For more information, see –Information About Us – General Information – Stock beginning on page 40. The delisting of our common stock from the NYSE would adversely affect liquidity and the trading price of our common stock.

If the sale of our Gabon interests fails to close and the Purchase Agreement is terminated, the NYSE may seek to delist our common stock due to our operating asset base, stock price or for another reason. Under these circumstances, we may seek to be traded on an alternative trading market, including one operated by OTC Markets Group.

Parties Related to the Proposed Sale

Harvest Natural Resources, Inc. – We are an independent energy company incorporated under Delaware law and headquartered in Houston, Texas. We own all of HNR Energia B.V. For information about how to contact us, please seeQuestions and Answers Regarding the Special Meeting and Future Stockholder Proposals – How Can I Obtain Additional Information? beginning on page 90. In the Purchase Agreement, we are referred to as the “Parent.”

HNR Energia B.V. – HNR Energia, a private company with limited liability under the laws of Curacao, is one of our wholly owned subsidiaries. It owns a 100% interest in Harvest-Dussafu B.V. which owns all of our Gabon interests. HNR Energia’s principal place of business is Prins Bemhardplein 200, 1097 JB Amsterdam, the Netherlands, and its telephone number is + 31 20 521 4777. In the Purchase Agreement, HNR Energia is referred to as the “Seller.”

BW Energy – BW Energy is a special purpose company organized under the laws of Singapore for the purpose of acquiring interests in the Dussafu Gabon production sharing contract. For more information about BW Energy, see – Information About BW Energy beginning on page 56. In the Purchase Agreement, BW Energy is referred to as the “Purchaser.”

A chart showing our organization is on page 2.

Terms of the Proposed Sale

On December 21, 2016, we and HNR Energia entered into the Purchase Agreement with BW Energy to sell all of HNR Energia’s equity interest in Harvest Dussafu for a base consideration of $32 million in cash, subject to adjustments. When we entered into the Purchase Agreement, HNR Energia, BW Energy and Citibank, N.A. (“Citibank”) also entered into an escrow agreement.

When we entered into the Purchase Agreement, BW Energy deposited $2.5 million under an escrow agreement, to be held and disbursed in accordance with the terms of the Purchase Agreement. If we terminate the Purchase Agreement because of an uncured breach of any warranty or covenant made by BW Energy, then BW Energy must pay us the $2.5 million, with interest, as liquidated damages for the breach. If the Purchase Agreement is terminated for any other reason, this $2.5 million will be returned to BW Energy.

At the closing of the transaction, we will receive $29.5 million, subject to certain adjustments, and $2.5 million will be held in an escrow account under the escrow agreement. For more information about the purchase price adjustments, seeDocuments Governing the Proposed Sale – Purchase Agreement – Generalbeginning on page 28.

The $2.5 million of the $32 million base purchase price to be held in the escrow account will be disbursed in accordance with the terms of the Purchase Agreement. If BW Energy has any claim for breach of warranties we made under the Purchase Agreement, it may follow a procedure detailed in the Purchase Agreement to collect the

- 9 -

amount of the claim from the escrow account. The amount remaining in the escrow account, subject to adjustments, will be paid to us three months after the closing of the sale (or six months after the closing if our shareholders do not approve the plan of complete liquidation and dissolution of Harvest). These adjustments include amounts payable to BW Energy in satisfaction of claims it may make before the expiration of the escrow account and which we have agreed to; reserves of amounts sufficient to pay any claims made by BW Energy that we are disputing; and costs of administering the escrow account.

The closing of the transaction is subject to the following conditions, in addition to other customary conditions:

| | • | | Authorization by the holders of a majority of all of our outstanding shares of common stock; and |

| | • | | Approvals by the Gabonese Minister in Charge of Economy and the Gabonese Minister in Charge of Petroleum. |

SeeDocuments Governing the Proposed Sale – Purchase Agreement – Conditions to the Proposed Sale beginning on page 29 for detailed information about conditions to the closing. See– Background of the Proposed Sale beginning on page 11 for information about the status of obtaining the required approvals of the Gabonese government.

We have agreed not to solicit other offers to acquire us or our interests in Gabon while the Purchase Agreement is in effect. If we receive an unsolicited offer, we may not engage in negotiations or substantive discussions with, or furnish any information and reasonable access to, any third party making the offer or its representatives unless we determine in good faith, after consultation with outside legal and financial advisors, and based on information then available, that the offer constitutes, or is reasonably likely to result in, a superior proposal and we comply with other contractual requirements, including giving written notice to BW Energy after any such determination and before taking any of the actions described above, providing information regarding the third party and its offer to BW Energy, entering into an acceptable confidentiality agreement with the third party and providing to BW Energy any material nonpublic information furnished to the third party.

We have the right to terminate the Purchase Agreement to accept a third-party proposal if we determine in good faith (after consultation with our outside legal counsel and financial advisor) that the third party proposal constitutes a superior proposal and that the failure to approve or recommend the superior proposal would be inconsistent with our fiduciary duties to our stockholders under applicable law. Before terminating the Purchase Agreement, we must (at BW Energy’s request) engage in good faith negotiations with BW Energy regarding the terms of the Purchase Agreement, and we must consider any adjustments in the Purchase Agreement proposed by BW Energy and determine in good faith (after consultation with our outside legal counsel and financial advisor) that the superior proposal continues to be superior. In addition, we may not terminate the Purchase Agreement unless, concurrently with the termination, we pay BW Energy a break-up fee of $1.12 million. For more information regarding what constitutes a superior proposal, seeDocuments Governing the Proposed Sale – Purchase Agreement – Fiduciary Out beginning on page 34.

Before closing the sale of our Gabon interests, we will be responsible for funding interim period petroleum costs (as defined in the Purchase Agreement) up to an aggregate limit of $2.4 million. At the time of the closing, the total amount of these interim period petroleum costs funded by us will be added to the purchase price.

The Purchase Agreement contains customary warranties and covenants. These warranties and covenants were made only for the purposes of the Purchase Agreement and as of specific dates, are solely for the benefit of the parties to the Purchase Agreement, may be subject to limitations agreed on by the parties, and may be subject to standards of materiality applicable to the parties that differ from those applicable to our stockholders. You should not rely on the warranties or covenants, or any description of them, as characterizations of the actual state of facts or conditions of any party to the Purchase Agreement or any of their subsidiaries or affiliates. Information about the subject matter of the warranties and covenants may change after the date of the Purchase Agreement, which subsequent information may or may not be fully reflected in public disclosures.

- 10 -

For a more detailed description of the documents governing the proposed transaction, see – Documents Governing the Proposed Sale beginning on page 28. For a more detailed description of the Gabon interests that are the subject of the proposed transaction, see –Description of Interests to be Sold beginning on page 26.

Background of the Proposed Sale

During the last several years, we have been exploring a broad range of strategic alternatives for enhancing and realizing stockholder value. We have retained financial advisors from time to time to provide advisory services to assist us in exploring those strategic alternatives, including among others, possible sales of assets, including our Venezuelan and Gabon interests.

We received several indications of interest from third parties regarding a sale of our interests in Venezuela. Between 2012 and 2016 we entered into three purchase agreements to sell our Venezuelan interests. The first of these purchase agreements was terminated. Under the second purchase agreement, we were able to sell approximately 36% of our Venezuelan interests, but the purchase agreement was terminated as to the sale of the remaining 64% of our Venezuelan interests. On October 7, 2016, we closed the sale of all of our remaining Venezuelan interests under the third purchase agreement. For more information about our Venezuelan operations and the sale of our Venezuelan interests, seeInformation About Us – Operations by Geographical Locations beginning on page 37.

In the meantime, beginning in 2013, we began to actively seek a purchaser for all or a substantial portion of our Gabon interests, which consist solely of Harvest Dussafu’s 66.667% interest in the Dussafu, Gabon production sharing contact (the “Dussafu PSC”). We believed that this was in the our best interests because the estimated cost of developing the properties held under the Dussafu PSC would likely exceed our financial capabilities. We engaged TPH as our advisor for this purpose on April 2, 2013. In April 2013, we solicited an offer to purchase our Gabon interests from Pan-Petroleum Gabon B.V. (“Pan-Petroleum”), which then held a 33.333% interest in the Dussafu PSC. Pan-Petroleum is a subsidiary of Panoro Energy ASA, an exploration and production company based in London and listed on the Oslo Stock Exchange. We were required to make this offer to Pan-Petroleum before we could seek third-party offers. Pan-Petroleum indicated that it did not intend to make an offer.

We then proceeded with marketing our Gabon interests. From April to July 2013, we and our advisors contacted 128 companies, of which 24 companies further engaged in the marketing process and were provided with detailed information about our Gabon interests. Of these 24 companies, we received two indications of interest, one of which was rejected because we determined the proposed purchase price was too low. The other indication of interest was from Vitol SA (“Vitol”).

In September 2013 we entered into a non-binding letter of intent with Vitol for a transaction under which we would sell our Gabon interests to Vitol for Vitol’s suggested purchase price of $137 million, plus approximately $8 million for certain seismic information to be acquired by Harvest. We also agreed to negotiate exclusively with Vitol through November 15, 2013. We engaged in negotiations with Vitol in October 2013. In November 2013, we terminated discussions with Vitol because it became apparent to us that Vitol did not want to close the transaction until the Dussafu PSC project had developed sufficiently for the Gabonese government to grant its exclusive exploitation authorization permit to us and we were close to proving that there were developed reserves on the property, conditions that we believe would not be satisfied for at least another year after November 2013, if at all. The purchase price ostensibly offered by Vitol was provided at a time when global markets indicated a price for oil of over $100 per barrel, significantly higher than the current price for oil.

In December 2013, we completed the acquisition of a 3D seismic survey over approximately 1,200 square kilometers, most of which included areas of the block not previously covered by any other 3D seismic survey. In 2014, we and our advisors contacted 12 companies in an effort to market our Gabon interests, and we provided

- 11 -

information about our Gabon interests to four of these companies. We received one indication of interest which we rejected because we determined it was not in our best interests, in part because the proposed purchase price was below the Vitol offer in 2013.

In 2014 we completed our initial processing and analysis of the new 3D seismic survey on the Gabon acreage, which identified new exploration prospects that were larger than those that had been previously identified. We again solicited an offer from Pan-Petroleum in February 2015. In March 2015 Pan-Petroleum responded with an offer on terms that we deemed to be inadequate, and we rejected Pan-Petroleum’s offer. The consideration offered by Pan-Petroleum was materially below the consideration that would be paid by BW Energy under the Purchase Agreement. We then initiated a new marketing effort and provided information about our Gabon interests, including this new information, to seven companies, but no bids were received.

We continued to market our Gabon interests on an ad-hoc basis as companies that we contacted from time to time expressed interest. During the remainder of 2015, we and our advisors contacted 29 companies, and we provided information about our Gabon interests to eight of these companies. Although some of these companies expressed interest, no bids were received.

We continued to market our Gabon interests through the first three quarters of 2016. During this time, we and our advisors contacted eight companies, and we provided information about our Gabon interests to four of these companies. From these four companies, we received two indications of interest. We decided not to pursue one of these indications of interest because the prospective buyer had not secured financing.

The other indication of interest, the one that we pursued, was submitted on June 1, 2016 by San Andres Corporation (“SAC”), a Houston-based oil and gas company formed by former employees of Vaalco Energy, Inc., a Houston-based independent energy company, which has a production sharing contract in Gabon. We believed that these employees were familiar with the properties held under the Dussafu PSC. The non-binding June 1, 2016 indication of interest proposed a purchase price of $20 million to acquire Harvest Dussafu, cash and debt free. SAC indicated that financing would be a condition to closing, among other conditions, and requested the exclusive right to negotiate the transaction through August 1, 2016.

Our management responded to SAC in late June, revising the indication of interest to include a purchase price of $30 million and eliminate the exclusivity period and financing condition, among other revisions. On June 29, 2016, SAC submitted a new indication of interest, this one proposing a purchase price of $25 million and indicating that financing would remain a condition to closing. We rejected this proposal.

On July 14, 2016, we received a new non-binding proposal from SAC to purchase Harvest Dussafu. This proposal included a purchase price of $25 million and requested exclusivity through August 29, 2016, but did not include a financing condition. SAC indicated that BW Offshore Limited (“BWO”), a specialist floating production, storage and offloading unit (“FPSO”) building, leasing and operating company listed on the Oslo stock exchange, was a part of its equity team, and indicated that its discussions with BWO had initiated approximately one month earlier. We communicated again that the purchase price under the proposal was inadequate and suggested that SAC revise its proposal.

On August 9, 2016, our representatives met with representatives of SAC to continue our negotiations. Negotiations continued until August 29, when we received a new non-binding proposal from SAC. This proposal included a purchase price of $28.0 million and indicated that BWO would provide all of the financial support to SAC in its bid to purchase Harvest Dussafu. The proposal was subject to approval of SAC’s board, however, and other conditions. On the same day that we received this new proposal from SAC, we received a letter from Carl Arnet, the chief executive officer of BWO, indicating that BWO would provide funding and critical equipment and services in support of SAC’s bid to purchase Harvest Dussafu, subject to approval by BWO’s board.

On September 6, 2016, a second prospective purchaser of our Harvest Dussafu interests submitted a non-binding proposal to purchase our Gabon interests for $30.0 million on a debt-free basis. The consideration would

- 12 -

be funded through an initial public offering of the purchaser that the purchaser indicated would occur in late fall. We did not actively pursue this offer because there was some uncertainty about the financing.

On September 9, 2016, representatives of Harvest and SAC had a telephone conference to further discuss the terms of a potential transaction. On September 17, we provided SAC with a revised draft of the sale and purchase agreement that among other changes, inserted as a condition to closing that the transaction be authorized by our stockholders because the transaction would constitute the sale of our last remaining operating asset. The terms of this draft allowed us to terminate the sale and purchase agreement under certain circumstances upon the payment of a break-up fee of 3 1/2% of the purchase price if we received a better offer or if our Board determined that the transaction was no longer in our best interests.

At a meeting in Houston on September 20, 2016, our representatives met with representatives of SAC and BWO to discuss the potential transaction further. At this meeting, our representatives discussed due diligence matters and the budget under which we would continue to develop the Dussafu PSC.

In response to our September 16, 2016 draft sale and purchase agreement, on September 26, SAC and BWO provided us with a term sheet that set out the principal terms that it believed should be incorporated in the sale and purchase agreement. Among other things, the term sheet proposed that the purchaser’s obligation to close the transaction would be conditioned on (1) BWO board approval of the transaction after the sale and purchase agreement was signed, (2) approval by the government of Gabon of a contract under which an affiliate of BWO would lease an FPSO to Harvest Dussafu pursuant to Harvest Dussafu’s upcoming November invitation for bids to lease an FPSO, as described below, and (3) withholding of 15% of the purchase price for 12 months to secure any obligations that we might have under the sale and purchase agreement after the closing. The SAC term sheet proposed a purchase price of $32 million, subject to adjustment.

On September 27, 2016, we met again with representatives of SAC and BWO in Houston to discuss the required governmental approvals and other open issues. Following these meetings, we responded to the term sheet provided by SAC and BWO, rejecting the 15% hold-back, requiring our warranties to expire on the closing date, rejecting conditioning the closing on the government of Gabon’s approval of the lease of the FPSO by an affiliate of BWO to Harvest Dussafu and requiring BWO board approval before the sale and purchase agreement was signed. We also requested the right to retain the $2.5 million escrow if the government of Gabon did not approve the transaction or imposed conditions on its approval that were unacceptable to SAC.

On September 28, 2016, we engaged TPH to provide us with a fairness opinion regarding the transaction.

SAC responded to our September 27, 2016 comments to its term sheet in writing on October 3, and we and our legal advisors participated in a conference call with SAC, BWO and their advisors on October 4. During that call, the outstanding issues were discussed, but remained unresolved.

In early October, SAC and BWO proposed a transaction under which a newly formed company jointly owned by SAC and BWO would purchase our Gabon interests for a purchase price to be agreed on, with a verbal indication that the purchase price would be superior to the $28 million previously communicated. Soon afterwards, SAC and an affiliate of BWO formed a special purpose entity, Offshore San Andres Pts Ltd. (“OSA”) to enter into a sale and purchase agreement with us for the acquisition of our Gabon interests. OSA provided us with a revised draft of the sale and purchase agreement on October 7. That draft was consistent with its term sheet and did not make many of the changes that we had requested in our response to the term sheet. We responded to the OSA draft on October 10 with a revised draft that changed the terms to be consistent with our comments to the term sheet. Following receipt of our draft, OSA agreed to meet with us in person on October 13 and 14 in Houston to see whether the open issues could be resolved.

On October 13, 2016, James Edmiston, our president and chief executive officer, met with Carl Arnet, BWO’s chief executive officer, to discuss the transaction. From October 13 through October 16, and then at a

- 13 -

reconvened meeting on October 19, representatives of SAC and BWO met with our representatives in Houston to negotiate the open issues on the sale and purchase agreement. During the course of these discussions, SAC and BWO agreed to withdraw their request that the transaction be conditioned on a subsequent BWO board approval and the approval by the government of Gabon of a lease of an FPSO by an affiliate of BWO to Harvest Dussafu, and we agreed that the $2.5 million escrow would not be forfeited if the government of Gabon conditioned its approval on terms that were materially adverse to OSA. OSA and we also agreed that $2.5 million would be held back from the purchase price to cover post-closing obligations for a period equal to the shorter of six months or 90 days after the later of the closing and the date that our stockholders approved the transaction.

Under the proposed terms of the sale and purchase agreement, we were required to continue to develop the Dussafu PSC pursuant to an agreed budget until the closing, with any amounts spent after October 1, 2016, to be added to the purchase price. In the weeks following the mid-October meetings in Houston, our representatives and representatives of SAC and BWO worked to prepare the agreed budget. The parties also negotiated a resolution of what would happen if we or OSA concluded that expenditures outside of the agreed budget were necessary to comply with the terms of the development plan for the Dussafu PSC, which required that oil be produced by July 16, 2018. These negotiations were completed by November 7.

From October 19 through November 14, we and our representatives negotiated and exchanged drafts of the sale and purchase agreement with representatives of SAC and BWO. During the course of negotiations, our Board was advised of the status of the negotiations and the proposed terms. Our executive officers also had discussions with the potential purchaser that had submitted a non-binding offer to purchase our Gabon interests on September 6, but these discussions did not progress because the other potential purchaser would need to obtain funding before it could make a binding offer.

On November 4, 2016, in accordance with the Dussafu PSC, Harvest Dussafu submitted an invitation for bids to lease an FPSO for the Dussafu PSC. Harvest Dussafu received six bids, one of which was received from an affiliate of BW Energy, the proposed purchaser of our Gabon interests. Harvest Dussafu currently is evaluating the bids and expects to determine the superior bid by the end of January 2017. Harvest Dussafu’s determination of the superior bid is subject to the approval of the Gabonese government.

On November 15, 2016, our Board met to further consider the transaction, including the terms of the draft of the sale and purchase agreement that had been negotiated between OSA and us. Our legal counsel and representatives of TPH also attended the meeting. The TPH representatives reviewed its analysis with the Board and orally delivered the opinion described inThe Proposed Sale – Opinion of Our Financial Advisor beginning on page 17. The Board discussed these matters and unanimously approved the proposed transaction.

Because SAC was a new entrant into Gabon, we were not willing to sign the sale and purchase agreement without discussing the acceptability of the sale to OSA with the Gabonese Minister in Charge of Petroleum. A meeting with the Minister could not be scheduled until November 16, 2016. On November 16, Stephen Haynes, our chief financial officer, and Robert Speirs, our senior vice president, met with the Minister in Libreville, Gabon, to discuss the transaction. At that meeting, the Minister expressed reservations about the proposed transaction, citing dissatisfaction with SAC ownership, and indicated that he was not in a position to approve the transaction. To gain the Minister’s approval, the decision was made to remove SAC from the transaction and proceed with BWO directly.

On December 2, 2016, Carl Arnet, BWO’s chief executive officer, met with the then-chairman of the Gabonese Oil Company and an advisor to the Gabonese Minister in Charge of Petroleum, and subsequently met with the Minister to discuss proceeding with the transaction with BWO as the purchasing entity, and the possible purchase of an interest in the Dussafu PSC from Pan-Petroleum. The Minister indicated that a transaction with BWO as the purchasing entity would be viewed favorably. At BWO’s request the Minister provided us with letters indicating the same. On December 6, BWO received a letter from the Minister indicating it would view favorably its acquisition of our Gabon interests. Also on December 6, we received a letter from the Minister consenting to the transfer of its interest in Harvest Dussafu BV to BW Offshore.

- 14 -

On December 6, our Board met, received a status report on the transaction, and discussed the transaction.

In late November we had been advised that the Gabon Oil Company, an oil and gas company wholly owned by the Government of Gabon (the “Gabon Oil Company”), was interested in participating in the acquisition of a minority interest in the Dussafu PSC from BWO following the closing of the sale of our Gabon interests. We met with representatives of the Gabon Oil Company on November 30 and provided an executive review of the Dussafu PSC operations. On December 12, 13 and 14, we met in Libreville, Gabon with a technical team from the Gabon Oil Company for a full review of the Dussafu block. In early December, we were also advised that BWO intended to purchase an additional 25% interest in the Dussafu PSC for up to $12 million, subject to the closing of the sale of our Gabon interests.

On December 8, Mr. Arnet met with James Edmiston, our president and chief executive officer, and provided an update regarding the Gabonese Minister in Charge of Petroleum’s position.

On December 15, 2016, our representatives met with representatives of BWO to further discuss the transaction. We also learned that BWO and an affiliate had formed BW Energy to be the purchasing party for the sale of our Gabon interests. On December 16, we provided BW Energy with a revised draft of the sale and purchase agreement that included BW Energy as the purchasing entity. This was the only material change made to the draft of the sale and purchase agreement that was originally approved by our Board at the November 15 meeting.

Between December 16 and December 20, 2016, our representatives and representatives of BWO discussed final issues relating to the proposed transaction. They also discussed the timing of signing the Purchase Agreement, and we urged BWO to be ready to sign the agreement as soon as possible. On December 20, a representative of BWO met with the chairman of the Gabonese Oil Company and advisor to the Gabonese Minister in Charge of Petroleum to discuss the status of the transaction and future plans with respect to the Dussafu PSC.

Also on December 20, 2016, our Board met to consider developments in the transaction and the terms of the revised purchase agreement, including the change in the purchaser. It decided that it was reasonable and in our best interests to not request an update to the TPH opinion that was given at the November 15 meeting of our Board. After discussion, our Board unanimously (1) determined that the proposed transaction and the terms of the current draft sale and purchase agreement and related documents were expedient, advisable, fair to, and in the best interests of our stockholders, (2) authorized the transaction and approved the related documents, (3) recommended that our stockholders authorize the transaction in accordance with the terms of the current draft sale and purchase agreement, and (4) generally authorized our officers to take all necessary actions to effect the terms of the current draft sale and purchase agreement.

On December 21, 2016, we, HNR Energia and BW Energy signed and delivered the Purchase Agreement, which provided for a base purchase price of $32 million. After the signing, we issued a press release to announce the transaction on December 22. On December 28, we filed a Current Report on Form 8-K with the SEC describing the transaction and attaching as an exhibit the Purchase Agreement.

In early January 2017, the Petroleum Ministry requested meetings during the week of January 9 with Harvest, BW Energy and Pan-Petroleum to discuss the transactions involving the Dussafu PSC and the proposed sale of interests by us and Pan-Petroleum, including finalizing the transfer documents that will serve to satisfy the governmental approval conditions precedent under the Purchase Agreement. Harvest submitted a draft of the transfer documents to the Petroleum Ministry, but the Minister of Petroleum was replaced on January 10, and the meetings have been postponed.

On January 13, 2017, we filed a preliminary proxy statement with the SEC asking our stockholders to approve the proposed sale of our Gabon interests.

- 15 -

Recommendation of Our Board and Reasons for the Proposed Sale

At a meeting held on December 20, 2016, our Board unanimously (1) determined that the proposed transaction with BW Energy and the terms of the Purchase Agreement and related documents are expedient, advisable, fair to, and in the best interest of our stockholders, (2) authorized the transaction and approved the related documents, and (3) recommended that our stockholders authorize the transaction in accordance with the terms of the Purchase Agreement. Our Board recommends that you vote “FOR” the authorization of the proposed sale of our Gabon interests.

Our Board has recognized that we have very limited choices in Gabon. Our Board has met on several occasions to discuss the situation in Gabon to determine the best alternative available to us and has concluded that the proposed sale of our Gabon interests is the best alternative we have at this time. In recommending the approval of the proposed sale, our Board considered a number of factors, both positive and negative, and potential benefits and detriments of the proposed sale. Our Board believes that the following factors support its decision to authorize the sale of our Gabon interests and recommends that our stockholders authorize the sale:

| | • | | that if we do not sell our Gabon interests, we will be required to make additional investment in Gabon to meet our financial commitments without any assurances that those investments will yield sufficient cash in the near future; |

| | • | | the deterioration, over the last two years, of global energy prices; |

| | • | | the risks and uncertainties associated with the consummation of the proposed sale of our Gabon interests described inRisk Factors Related to the Proposed Sale of Our Gabon Interests beginning on page 6; |

| | • | | that we have held a prolonged process to monetize our interests in Gabon over the last three years, including a possible sale, and that the proposed sale is the best offer that could be found; |

| | • | | the fact that BW Energy deposited $2.5 million into an escrow account at the time of signing the Purchase Agreement and that we will receive that amount if we terminate the Purchase Agreement due to an uncured breach of a warranty or covenant on the part of BW Energy; |

| | • | | the opinion of TPH, dated November 15, 2016, as to the fairness, from a financial point of view and as of the date of the opinion, to Harvest of the consideration to be received by HNR Energia, as more fully described below in the section entitled –Opinion of Our Financial Advisor beginning on page 17; |

| | • | | presentations made by our management and advice of outside legal counsel; |

| | • | | the detailed terms and conditions of the Purchase Agreement; |

| | • | | the anticipated net proceeds after tax from the sale; |

| | • | | the ability to consider unsolicited alternative transactions and to enter into negotiations with a third party if our Board determines that an unsolicited proposal is reasonably likely to result in a superior proposal (even taking into consideration that we would be required to give BW Energy a right to match a superior proposal, and if we accept a superior proposal, we would be required to pay a break-up fee); and |

| | • | | that we sold our historical primary asset (our Venezuelan interests) on October 7, 2016, and the Board believes it is in the best interests of us and our stockholders to sell our only remaining asset (our Gabon interests) in contemplation of the proposed liquidation and dissolution. |

Our Board based its ultimate decision on its business judgment that the benefits of the proposed sale of our Gabon interests significantly outweigh the risks of alternatives to that sale. Our Board judged that the proposed sale represents the best currently available strategic alternative to preserve stockholder value, and unanimously concluded that the completion of the proposed sale pursuant to the Purchase Agreement is expedient, advisable, fair to and in the best interests of us and our stockholders.

- 16 -

The draft sale and purchase agreement approved by our Board at its meeting held on December 20, 2016, included substantially the same terms as the form of purchase agreement approved by our Board at its meeting held on November 15, 2016, except for the designation of the purchaser of our Gabon interests, which changed from being OSA (in the November 15 draft of the sale and purchase agreement) to being BW Energy, which is affiliated with BWO but not SAC. TPH’s oral opinion was presented to our Board at the November 15, 2016, meeting, and its written opinion, which is included with this proxy statement asAppendix B, is dated as of that date and speaks only as of the date it was rendered. TPH did not present our Board with an updated analysis at its December 20, 2016, meeting, nor did it update its written opinion, at our direction. We determined that it would be in the best interests of us and our stockholders not to incur the expense of an updated analysis or opinion for our Board’s December 20, 2016, meeting to preserve our limited available funds because, in our Board’s opinion, (1) there were no material changes to the terms of the transaction between the draft sale and purchase agreement considered at our Board’s November 15, 2016, meeting and the final Purchase Agreement considered at our Board’s December 20, 2016, meeting (other than the change in the designation of the purchaser), (2) there were no changes in the global economy or the oil and gas industry in general that our Board believed would materially affect the value of our interest in the Dussafu PSC, (3) no significant changes had occurred in the operations of Harvest Dussafu and (4) we had received no new indications of interest from others relating to the acquisition of our Gabon interests. Therefore, our Board relied on the November 15, 2016, analysis by TPH, as well as the other general considerations described above. For more information about the evolution of the proposed sale of our Gabon interests between November 15, 2016, and December 20, 2016, see – Background of the Proposed Sale beginning on page 11.

The preceding discussion is not, and is not intended to be, exhaustive. In light of the number and the wide variety of positive and negative factors that our Board considered in connection with its evaluation of the proposed sale of our Gabon interests and the complexity of these matters, our Board did not find it practicable, and has not tried, to quantify, rank or otherwise assign relative weights to the specific factors it considered. Individual members of our Board may have given different weight to different factors. Our Board considered all these factors together and, on the whole, considered them to be favorable to, and to support, its determination.

Our Board recommends that you vote “FOR” the authorization of the proposed sale of our Gabon interests.

Opinion of Our Financial Advisor

Introduction