Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-05749

THE CHINA FUND, INC.

(Exact name of registrant as specified in charter)

C/O STATE STREET BANK & TRUST COMPANY

ONE LINCOLN STREET

P.O. BOX 5049

BOSTON, MA 02206-5049

(Address of principal executive offices)(Zip code)

Copy to:

Brian F. Link Secretary The China Fund, Inc. 100 Summer Street SUM0703 Boston, MA 02110 | Leonard B. Mackey, Jr., Esq. Clifford Chance US LLP 31 West 52nd Street New York, New York 10019-6131 | |

| (Name and Address of Agent for Service) |

Registrant’s telephone number, including area code: (888) 246-2255

Date of fiscal year end: October 31

Date of reporting period: October 31, 2018

Table of Contents

| Item 1. | Report to Stockholders. |

Table of Contents

THE CHINA FUND, INC.

|

ANNUAL REPORT

October 31, 2018

| The China Fund, Inc. | ||||

| Table of Contents | ||||

| Page | ||||

| 1 | ||||

| 2 | ||||

| 3 | ||||

| 4 | ||||

| 7 | ||||

| 9 | ||||

| 10 | ||||

| 14 | ||||

| 18 | ||||

| 26 | ||||

| 27 | ||||

Dividends and Distributions: Summary of Dividend Reinvestment and Cash Purchase Plan | 29 | |||

| 33 | ||||

Table of Contents

KEY HIGHLIGHTS (unaudited)

| FUND DATA | ||

| NYSE Stock Symbol | CHN | |

| Listing Date | July 10, 1992 | |

| Shares Outstanding | 15,722,675 | |

| Total Net Assets (10/31/18) | $298,469,072 | |

| Net Asset Value Per Share (10/31/18) | $18.98 | |

| Market Price Per Share (10/31/18) | $16.98 | |

| TOTAL RETURN(1) | ||||||||

Performance as of 10/31/18: | Net Asset Value | Market Price | ||||||

1-Year Cumulative | -16.55% | -17.53% | ||||||

3-Year Cumulative | 10.26% | 12.29% | ||||||

3-Year Annualized | 3.31% | 3.94% | ||||||

5-Year Cumulative | 18.71% | 20.78% | ||||||

5-Year Annualized | 3.49% | 3.85% | ||||||

10-Year Cumulative | 176.01% | 169.92% | ||||||

10-Year Annualized | 10.69% | 10.44% | ||||||

| DIVIDEND HISTORY | ||||||||

| Record Date | Income | Capital Gains | ||||||

12/19/17 | $0.5493 | — | ||||||

12/19/16 | $0.4678 | — | ||||||

12/28/15 | $ 0.2133 | $ 1.2825 | ||||||

12/22/14 | $ 0.2982 | $ 3.4669 | ||||||

12/23/13 | $ 0.4387 | $ 2.8753 | ||||||

12/24/12 | $ 0.3473 | $ 2.9044 | ||||||

12/23/11 | $ 0.1742 | $ 2.8222 | ||||||

12/24/10 | $ 0.3746 | $ 1.8996 | ||||||

12/24/09 | $ 0.2557 | — | ||||||

12/24/08 | $ 0.4813 | $ 5.3361 | ||||||

(1) Total investment returns reflect changes in net asset value or market price, as the case may be, during each period and assumes that dividends and capital gains distributions, if any, were reinvested in accordance with the dividend reinvestment plan. The net asset value returns are not an indication of the performance of a stockholder’s investment in the Fund, which is based on market price. Total investment returns do not reflect the deduction of taxes that a stockholder would pay on Fund distributions or the sale of Fund shares. Total investment returns are historical and do not guarantee future results. Market price returns do not reflect broker commissions in connection with the purchase or sale of Fund shares.

1

Table of Contents

ASSET ALLOCATION AS OF October 31, 2018 (unaudited)

| Ten Largest Listed Equity Investments * | ||

TaiwanSemiconductor Manufacturing Co., Ltd. | 9.0% | |

ChinaConstruction Bank Corp. | 5.8% | |

TencentHoldings, Ltd. | 5.2% | |

AlibabaGroup Holding, Ltd. | 5.2% | |

PetroChinaCo., Ltd. | 4.2% | |

AIA Group, Ltd. | 4.1% | |

Ping An Insurance (Group) Company of China, Ltd. | 3.9% | |

ChinaEverbright International, Ltd. | 3.2% | |

HongKong Exchanges and Clearing, Ltd. | 3.1% | |

Sun Hung Kai Properties, Ltd. | 2.5% | |

| * | Percentages based on net assets. |

2

Table of Contents

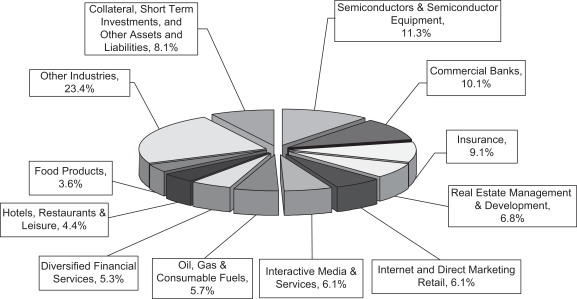

Industry Allocation (as a percentage of net assets)

Fund holdings are subject to change and percentages shown above are based on net assets at October 31, 2018. A complete list of holdings at October 31, 2018 is contained in the Schedule of Investments included in this report. The most current available data regarding portfolio holdings can be found on our website, www.chinafundinc.com. You may also obtain holdings by calling 1-888-246-2255.

3

Table of Contents

CHAIRMAN’S STATEMENT (unaudited)

Dear Stockholders,

Since reporting to you in the last semi-annual report for the period ended April 30, 2018, The China Fund, Inc. (the “Fund”) has come a long way and now stands poised to move forward in significantly new directions. In this report I will give you some highlights of what has been accomplished and some perspectives on what lies ahead.

First, with respect to investment performance over the last year, it has been a difficult time for your Fund as for many others investing in China during the period. As described more fully in the Investment Manager’s Statement section of this report, under the investment approach of Allianz Global Investors US, LLC (“Allianz”) the Fund underperformed the benchmark, MSCI Golden Dragon Index, during the fiscal year ended October 31, 2018 by 3.12%. Annualized investment performance of the Fund’s NAV compared to the benchmark lagged by 3.95% for the three-year period and by 1.92% for the five-year period ended October 31, 2018.

During much of the fiscal year ended October 31, 2018, China and the US have been embroiled in what is described by many as a tariff or trade war, but it has been a period which involved much more than that. Discussions and debates between the two nations have also included the subjects of intellectual property, knowledge sharing, cybertheft, industrial espionage and, not least of all, Chinese limitation on foreign ownership of overseas financial institutions. Notwithstanding the wide range of issues between the two countries, the imposition of tariffs by both sides has dominated media conversations and, many would argue, has had a singularly significant impact on financial markets in recent months.

Now, as for progress being made by the Fund and its Board, I will touch on several subjects, both past and future. Stockholders should obtain and read Fund press releases dated August 20 and November 9 for more complete information on certain of the following items:

| 1.) | Bilateral cessation of lawsuits — Over the past summer, the Board dropped its suit against a major stockholder which, in turn, dropped its suit against the Fund and its Board. I am particularly pleased by this development as it not only ceased the Fund’s incurrence of significant legal fees, but allowed all parties to begin to put the past behind and to focus efforts on enhancing corporate governance and improving Fund performance. |

| 2.) | Completion of search for replacement investment manager and successful shareholder vote — By an overwhelming 95% of votes cast, stockholders recently approved the appointment of Matthews International Capital Management, LLC (“Matthews Asia”) as replacement investment manager for the Fund. Transition planning is currently underway and it is anticipated that responsibility for portfolio management by Matthews Asia will begin on or about January 1, 2019. The search for a new investment manager was a thorough and rigorous effort conducted by the Board and the result recognizes the capabilities of Matthews Asia, which had approximately $29.2 billion in assets under management at October 31, 2018, of which approximately $8.6 billion consisted of Chinese securities. Matthews Asia will provide the Fund with an “All China” investment strategy, which follows a Growth at a Reasonable Price approach while adhering to the firm’s overarching investment philosophy based on the following |

4

Table of Contents

THE CHINA FUND, INC.

CHAIRMAN’S STATEMENT (continued) (unaudited)

| three pillars: active management, long-term focus and on-the-ground bottom-up research. The Fund intends to change its benchmark index from the MSCI Golden Dragon Index to the MSCI China All Shares Index upon the commencement of Matthews Asia managing the Fund. |

| 3.) | Planned commencement of tender offer — The Fund’s Board has approved in principle a one-time tender offer (the “Tender Offer”) to repurchase up to 30% of its outstanding shares at 99% of net asset value, subject to regulatory and other confirmations. The Tender Offer is currently expected to commence on or about January 10, 2019. It is currently anticipated that the Tender Offer will conclude on or about February 4, 2019. |

| 4.) | Adoption of Discount Management Program — The Fund’s Board has announced its intention to adopt a Discount Management Program, which is intended to provide enhanced value to stockholders by authorizing the Fund to repurchase, in each twelve-month period ended October 31, up to 10% of its common shares outstanding as of the close of business on October 31 of the prior fiscal year. It is expected that the Discount Management Program will be implemented shortly after the Tender Offer in February 2019. |

| 5.) | Implementation of Additional Board Governance Provisions — The Board has determined to reduce its size from seven members to five, effective no later than the date of the Fund’s Annual Meeting of Stockholders to be held in March 2019. The Fund expects to be in a position to announce the future composition of the Board in early 2019. Additionally, Board fees have been modified to, among other things, reduce the retainer fee for the Chairman of the Audit Committee and to reduce certain meeting attendance fees. |

| 6.) | Service Provider Review — The Board is also in the process of reviewing its service providers, including specifically its legal counsel, custodian, fund accounting agent and fund administrator with a view to reducing the overall level of fund expenses while maintaining a high level of service. At a Board meeting on December 7, the Board voted to engage Morgan, Lewis & Bockius (“MLB”) as counsel for the Fund. Transition to MLB will commence shortly after January 1, 2019. The objective of all these reviews is to have revised fee schedules and/or replacements identified and in place not later than March 1, 2019. |

* * *

While much has been accomplished in the past year, much work remains to be done. Please be assured that your Board is working diligently on behalf of ALL Fund stockholders, large and small. If you have any questions or concerns, I encourage you to communicate with me by e-mail at chninfo@astfundsolutions.com, by calling (888)-CHN-CALL or by sending written communications to me at the following address:

The China Fund, Inc.

c/o State Street Bank and Trust Company

P.O. Box 5049

One Lincoln Street

Boston, MA 02206-5049

5

Table of Contents

THE CHINA FUND, INC.

CHAIRMAN’S STATEMENT (continued) (unaudited)

Thank you for your continued interest in and support of your Fund.

Yours truly,

Gary L. French

Chairman

6

Table of Contents

INVESTMENT MANAGER’S STATEMENT (unaudited)

Market Review

Greater China stocks retreated significantly during the 12 month period ended October 31, 2018, especially since the beginning of 2018. Key reasons include concerns over escalation of Sino-US trade conflict, economic slowdown in China triggered by deleveraging, as well as the global emerging market equities sell off.

On macro-economic data, China’s GDP expanded at an annual rate of 6.5% in the third quarter, the slowest quarterly pace of growth since early 2009. October’s official purchasing managers’ index of manufacturing activity slowed to its lowest level in two years, reinforcing concerns over the trade conflict with the United States. Reacting to these weak data points, the Chinese government pledged to provide measures to support the economy and financial markets, and the People’s Bank of China announced a further cut to banks’ reserve requirement ratio.

In terms of capital markets, MSCI officially included China A-Shares into the flagship MSCI Emerging Market Index in June 2018. This is a milestone event that marks the rising importance of China A-Shares within global investors’ portfolios.

Performance

The portfolio underperformed the benchmark, MSCI Golden Dragon Index, over the reporting period. On a sector level, stock selection within industrials and communication services detracted the most; while top contributors came from financials and materials industries.

In particular, within industrials, the top detractor was China Everbright International (“CEI”), a leading waste water treatment company in China. In the third quarter of 2018, the company announced an unexpected rights issue with a subscription price significantly below the market price. Though the rights issue may accelerate the development of new projects, which should benefit CEI in the long term, a substantially discounted rights issue amidst the tumbling market does send a negative signal to investors. From our perspective, the company should continue to benefit from an increasing number of new projects commencing operation and the shift to higher margin business within the waste treatment and environment protection industry. The correction means valuation of this company is increasingly attractive.

On the other hand, our banking positions contributed positively. The Chinese banking sector stayed relatively resilient during a down market, buoyed by the positive news of the reserve requirement ratio cut for Chinese banks. However sector performance remains volatile amid concerns of the slowing macro economy in China. Within the sector we continue to prefer banks with strong consumer banking franchise and deposit base, such as China Merchants Bank.

Outlook

Developments in the US-China trade conflict, volatility in Renminbi, and slower growth momentum in the Chinese economy mean that earnings expectations of China / Hong Kong companies will inevitably face some pressure. That said, the valuation of Greater China equities has come off significantly since peaking in January — the price to

7

Table of Contents

THE CHINA FUND, INC.

INVESTMENT MANAGER’S STATEMENT (continued) (unaudited)

earnings ratio for the MSCI China and Hang Seng Indices are now 9.7x and 9.4x respectively as of end October. In the near term, we don’t rule out a possible short term rebound driven by positive news flow on the trade front; however, we believe more fundamental improvement in corporate earnings is needed to support a sustainable recovery.

The Chinese regulators need to find the right balance between deleveraging and addressing near term pains in the economy. In recent months, we have seen rising supportive measures to help both the economy and financial markets. We continue to like the companies that can benefit from policy stimulus measures, including infrastructure related names. The recent correction in technology names has also allowed us to buy quality names on weakness.

8

Table of Contents

ABOUT THE PORTFOLIO MANAGER (unaudited)

Allianz Global Investors (“AllianzGI”) is a leading active asset manager with over 730 investment professionals in 25 offices worldwide and managing $621 billion¹ in assets for individuals, families and institutions.

Ms. Christina Chung serves as the portfolio manager for the Fund’s portfolio of listed and direct securities. She joined the group in 1998 and has been a managing director since January 2010. She heads the Greater China Team and is the lead manager of Hong Kong, China and Greater China equity mandates. The Hong Kong and China funds that she manages have won industry recognition and awards for consistent, strong performance. She has 29 years’ experience in managing Asian regional and single country portfolios for both institutional and retail accounts.

Before joining the group, she was a senior portfolio manager with Royal Bank of Canada Investment Management. Prior to that, she was a portfolio manager with Search International and an economist with HSBC Asset Management. Christina was educated in Canada. She attained a Bachelor of Administration from Brock University, followed by an M.A. in Economics from the University of Alberta. She became a Certified Management Accountant in 1992 and qualified as a chartered financial analyst, AIMR, in 1995.

| 1 | Combined worldwide AUM as of September 30, 2018. |

9

Table of Contents

SCHEDULE OF INVESTMENTS

October 31, 2018

Name of Issuer and Title of Issue | Shares | Value (Note A) | ||||||||||

| COMMON STOCK | ||||||||||||

| CHINA — “A” SHARES | ||||||||||||

Food Products — 1.1% | ||||||||||||

Angel Yeast Co., Ltd. — A | 1,019,300 | $ | 3,156,949 | |||||||||

|

| |||||||||||

Media — 0.5% | ||||||||||||

Focus Media Information Technology Co., Ltd. — A | 1,907,366 | 1,640,957 | ||||||||||

|

| |||||||||||

TOTAL CHINA — “A” SHARES — (Cost $6,975,221) | 1.6 | % | 4,797,906 | |||||||||

|

|

|

| |||||||||

| HONG KONG | ||||||||||||

Automobiles — 0.5% | ||||||||||||

Brilliance China Automotive Holdings, Ltd. | 1,884,000 | 1,643,820 | ||||||||||

|

| |||||||||||

Commercial Services & Supplies — 3.6% | ||||||||||||

China Everbright International, Ltd.(1) | 11,811,221 | 9,416,554 | ||||||||||

Goldpac Group, Ltd.# | 4,970,000 | 1,204,556 | ||||||||||

|

| |||||||||||

| 10,621,110 | ||||||||||||

|

| |||||||||||

Construction & Engineering — 1.6% | ||||||||||||

China State Construction International Holdings, Ltd.(1) | 6,912,000 | 4,928,705 | ||||||||||

|

| |||||||||||

Diversified Financial Services — 3.8% | ||||||||||||

Hong Kong Exchanges and Clearing, Ltd. | 346,200 | 9,185,601 | ||||||||||

New Oriental Education & Technology Group ADR* | 34,958 | 2,045,392 | ||||||||||

|

| |||||||||||

| 11,230,993 | ||||||||||||

|

| |||||||||||

Diversified Telecommunication Services — 1.3% | ||||||||||||

China Unicom Hong Kong, Ltd. | 3,660,000 | 3,800,342 | ||||||||||

|

| |||||||||||

Electronic Equipment & Instruments — 1.5% | ||||||||||||

Digital China Holdings, Ltd.(1)*# | 9,305,000 | 4,462,943 | ||||||||||

|

| |||||||||||

Food Products — 2.5% | ||||||||||||

China Mengniu Dairy Co., Ltd.* | 1,224,000 | 3,606,704 | ||||||||||

WH Group, Ltd. 144A | 5,726,000 | 4,009,968 | ||||||||||

|

| |||||||||||

| 7,616,672 | ||||||||||||

|

| |||||||||||

Hotels, Restaurants & Leisure — 4.4% | ||||||||||||

Galaxy Entertainment Group, Ltd. | 1,024,000 | 5,538,383 | ||||||||||

MGM China Holdings, Ltd.(1) | 2,305,200 | 3,258,109 | ||||||||||

Shangri-La Asia, Ltd. | 3,110,000 | 4,244,840 | ||||||||||

|

| |||||||||||

| 13,041,332 | ||||||||||||

|

| |||||||||||

Household Products — 1.0% | ||||||||||||

Vinda International Holdings, Ltd.(1) | 1,984,000 | 2,864,872 | ||||||||||

|

| |||||||||||

See notes to financial statements.

10

Table of Contents

THE CHINA FUND, INC.

SCHEDULE OF INVESTMENTS (continued)

October 31, 2018

Name of Issuer and Title of Issue | Shares | Value (Note A) | ||||||||||

| COMMON STOCK (continued) | ||||||||||||

| HONG KONG (continued) | ||||||||||||

Industrial Conglomerates — 2.2% | ||||||||||||

Beijing Enterprises Holdings, Ltd. | 1,229,000 | $ | 6,647,141 | |||||||||

|

| |||||||||||

Insurance — 4.1% | ||||||||||||

AIA Group, Ltd. | 1,611,400 | 12,199,478 | ||||||||||

|

| |||||||||||

Interactive Media & Services — 6.1% | ||||||||||||

Baidu, Inc. ADR* | 13,605 | 2,585,766 | ||||||||||

Tencent Holdings, Ltd. | 454,700 | 15,486,504 | ||||||||||

|

| |||||||||||

| 18,072,270 | ||||||||||||

|

| |||||||||||

Internet and Direct Marketing Retail — 6.1% | ||||||||||||

Alibaba Group Holding, Ltd. ADR(1)* | 108,358 | 15,417,176 | ||||||||||

Ctrip.com International, Ltd. ADR(1)* | 84,376 | 2,808,033 | ||||||||||

|

| |||||||||||

| 18,225,209 | ||||||||||||

|

| |||||||||||

Metals & Mining — 1.3% | ||||||||||||

Tiangong International Co., Ltd.(1) | 17,970,000 | 3,988,545 | ||||||||||

|

| |||||||||||

Pharmaceuticals — 1.7% | ||||||||||||

CSPC Pharmaceutical Group, Ltd. | 2,436,000 | 5,139,608 | ||||||||||

|

| |||||||||||

Real Estate Management & Development — 6.8% | ||||||||||||

China Overseas Land & Investment, Ltd. | 1,622,000 | 5,079,483 | ||||||||||

Country Garden Holdings Co., Ltd. | 2,208,000 | 2,363,079 | ||||||||||

Sun Hung Kai Properties, Ltd. | 576,000 | 7,487,104 | ||||||||||

Swire Pacific, Ltd. | 523,000 | 5,427,207 | ||||||||||

|

| |||||||||||

| 20,356,873 | ||||||||||||

|

| |||||||||||

Semiconductors & Semiconductor Equipment — 0.7% | ||||||||||||

ASM Pacific Technology, Ltd. | 228,600 | 1,974,159 | ||||||||||

|

| |||||||||||

Wireless Telecommunication Services — 1.6% | ||||||||||||

China Mobile, Ltd. | 510,000 | 4,768,605 | ||||||||||

|

| |||||||||||

TOTAL HONG KONG — (Cost $164,472,166) | 50.8 | % | 151,582,677 | |||||||||

|

|

|

| |||||||||

| HONG KONG — “H” SHARES | ||||||||||||

Automobiles — 1.3% | ||||||||||||

Qingling Motors Co., Ltd.# | 14,816,000 | 3,836,580 | ||||||||||

|

| |||||||||||

Commercial Banks — 10.1% | ||||||||||||

BOC Hong Kong Holdings, Ltd. | 1,471,500 | 5,499,777 | ||||||||||

China Construction Bank Corp. | 21,935,000 | 17,403,844 | ||||||||||

See notes to financial statements.

11

Table of Contents

THE CHINA FUND, INC.

SCHEDULE OF INVESTMENTS (continued)

October 31, 2018

Name of Issuer and Title of Issue | Shares | Value (Note A) | ||||||||||

| COMMON STOCK (continued) | ||||||||||||

| HONG KONG — “H” SHARES (continued) | ||||||||||||

Commercial Banks (continued) | ||||||||||||

China Merchants Bank Co., Ltd. | 1,870,500 | $ | 7,205,794 | |||||||||

|

| |||||||||||

| 30,109,415 | ||||||||||||

|

| |||||||||||

Energy Equipment & Services — 1.5% | ||||||||||||

China Oilfield Services, Ltd. | 4,770,000 | 4,472,217 | ||||||||||

|

| |||||||||||

Independent Power Producers & Energy Traders — 2.0% | ||||||||||||

China Longyuan Power Group Corp., Ltd. | 8,023,000 | 6,099,584 | ||||||||||

|

| |||||||||||

Insurance — 3.9% | ||||||||||||

Ping An Insurance (Group) Company of China, Ltd.(1) | 1,235,000 | 11,634,149 | ||||||||||

|

| |||||||||||

Oil, Gas & Consumable Fuels — 5.7% | ||||||||||||

China Petroleum & Chemical Corp. | 3,666,000 | 2,974,177 | ||||||||||

China Shenhua Energy Co., Ltd. | 656,500 | 1,487,287 | ||||||||||

PetroChina Co., Ltd. | 17,048,000 | 12,482,527 | ||||||||||

|

| |||||||||||

| 16,943,991 | ||||||||||||

|

| |||||||||||

Transportation Infrastructure — 1.2% | ||||||||||||

Qingdao Port International Co., Ltd. 144A(1)*# | 6,077,000 | 3,542,604 | ||||||||||

|

| |||||||||||

TOTAL HONG KONG — “H” SHARES — (Cost $71,911,440) | 25.7 | % | 76,638,540 | |||||||||

|

|

|

| |||||||||

TOTAL HONG KONG (INCLUDING “H” SHARES — (Cost $236,383,606) | 76.5 | % | 228,221,217 | |||||||||

|

|

|

| |||||||||

| TAIWAN | ||||||||||||

Diversified Financial Services — 1.5% | ||||||||||||

Fubon Financial Holdings Co., Ltd. | 2,805,000 | 4,392,019 | ||||||||||

|

| |||||||||||

Insurance — 1.1% | ||||||||||||

Cathay Financial Holding Co., Ltd. | 2,030,000 | 3,214,621 | ||||||||||

|

| |||||||||||

Machinery — 0.6% | ||||||||||||

King Slide Works Co., Ltd.(1) | 185,000 | 1,922,163 | ||||||||||

|

| |||||||||||

Semiconductors & Semiconductor Equipment — 10.6% | ||||||||||||

MediaTek, Inc. | 669,000 | 4,918,641 | ||||||||||

Taiwan Semiconductor Manufacturing Co., Ltd. | 3,536,000 | 26,740,264 | ||||||||||

|

| |||||||||||

| 31,658,905 | ||||||||||||

|

| |||||||||||

TOTAL TAIWAN — (Cost $29,862,555) | 13.8 | % | 41,187,708 | |||||||||

|

|

|

| |||||||||

TOTAL COMMON STOCK — (Cost $273,221,382) | 91.9 | % | 274,206,831 | |||||||||

|

|

|

| |||||||||

See notes to financial statements.

12

Table of Contents

THE CHINA FUND, INC.

SCHEDULE OF INVESTMENTS (continued)

October 31, 2018

Name of Issuer and Title of Issue | Shares | Value (Note A) | ||||||||||

| COLLATERAL FOR SECURITIES ON LOAN — 2.1% | ||||||||||||

State Street Navigator Securities Lending Government Money Market Portfolio, 2.1799%¥ (Cost $6,437,278) | 6,437,278 | $ | 6,437,278 | |||||||||

|

| |||||||||||

Face | ||||||||||||

| SHORT TERM INVESTMENT — 2.5% | ||||||||||||

Repurchase Agreement with Fixed Income Clearing Corporation, dated 10/31/18, 0.42%, due 11/01/18, proceeds $7,434,087; collateralized by U.S. Treasury Bond, 3.00%, due 05/15/45, valued at $7,583,415, including interest. (Cost $7,434,000) | $ | 7,434,000 | 7,434,000 | |||||||||

|

| |||||||||||

TOTAL INVESTMENTS — (Cost $287,092,660) | 96.5 | % | 288,078,109 | |||||||||

|

|

|

| |||||||||

OTHER ASSETS AND LIABILITIES | 3.5 | % | 10,390,963 | |||||||||

|

|

|

| |||||||||

NET ASSETS | 100.0 | % | $ | 298,469,072 | ||||||||

|

|

|

| |||||||||

Notes to Schedule of Investments

| * | Denotes non-income producing security. |

| # | Illiquid security. |

| ¥ | Rate shown is the 7-day yield as of October 31, 2018. |

| (1) | Securities (or a portion of the security) is on loan. As of October 31, 2018, the market value of the securities loaned was $27,542,443. The loaned securities were secured with cash collateral of $6,437,278 and non-cash collateral with a value of $22,302,416. The non-cash collateral received consists of short term investments and long term bonds, and is held for the benefit of the Fund at the Fund’s custodian. The Fund cannot repledge or resell this collateral. Collateral is calculated based on prior day’s prices. |

144A Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At October 31, 2018, these restricted securities amounted to $7,552,572, which represented 2.5% of total net assets.

ADR American Depositary Receipt

See notes to financial statements.

13

Table of Contents

STATEMENT OF ASSETS AND LIABILITIES

October 31, 2018

ASSETS | ||||

Investments in securities, at value (cost $287,092,660) (including securities on loan, at value, $27,542,443) (Note A) | $ | 288,078,109 | ||

Cash | 198 | |||

Foreign currency, at value (cost $18,922,041) | 18,845,355 | |||

Receivable for securities lending income | 22,161 | |||

Dividends and interest receivable | 273,820 | |||

Prepaid expenses and other receivables | 19,444 | |||

|

| |||

TOTAL ASSETS | 307,239,087 | |||

|

| |||

LIABILITIES | ||||

Payable for investments purchased | 1,484,577 | |||

Payable upon return of collateral for securities on loan | 6,437,278 | |||

Investment management fee payable (Note B) | 197,413 | |||

Administration and custodian fees payable (Note B) | 87,093 | |||

Chief Compliance Officer fees payable | 10,000 | |||

Other accrued expenses and liabilities | 553,654 | |||

|

| |||

TOTAL LIABILITIES | 8,770,015 | |||

|

| |||

TOTAL NET ASSETS | $ | 298,469,072 | ||

|

| |||

COMPOSITION OF NET ASSETS: | ||||

Par value, 100,000,000 shares authorized, 15,722,675 shares outstanding (Note C) | 157,227 | |||

Paid in capital in excess of par | 292,337,833 | |||

Distributable earnings | 5,974,012 | |||

|

| |||

TOTAL NET ASSETS | $ | 298,469,072 | ||

|

| |||

NET ASSET VALUE PER SHARE | ||||

($298,469,072/15,722,675 shares of common stock outstanding) | $18.98 | |||

|

| |||

See notes to financial statements.

14

Table of Contents

THE CHINA FUND, INC.

STATEMENT OF OPERATIONS

Year Ended October 31, 2018

INVESTMENT INCOME: | ||||

Dividend income — (net of tax withheld of $744,848) | $ | 8,793,103 | ||

Securities lending income | 465,604 | |||

Interest income | 15,620 | |||

|

| |||

TOTAL INVESTMENT INCOME | 9,274,327 | |||

|

| |||

EXPENSES | ||||

Investment Management fees (Note B) | 2,461,628 | |||

Legal fees (Note B) | 1,789,564 | |||

Custodian fees (Note B) | 698,079 | |||

Directors’ fees and expenses | 667,262 | |||

Administration fees (Note B) | 499,937 | |||

Shareholder service fees | 316,022 | |||

Insurance | 97,324 | |||

Printing and postage | 96,104 | |||

Audit and tax service fees | 82,500 | |||

Chief Compliance Officer fee | 65,000 | |||

Principal Financial Officer fee | 60,000 | |||

Transfer agent fees | 27,269 | |||

Stock exchange listing fee | 12,874 | |||

Miscellaneous expenses | 130,117 | |||

|

| |||

TOTAL EXPENSES | 7,003,680 | |||

|

| |||

NET INVESTMENT INCOME | 2,270,647 | |||

|

| |||

NET REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND FOREIGN CURRENCY TRANSACTIONS | ||||

Net realized gain on investments | 34,137,690 | |||

Net realized loss on foreign currency transactions | (177,231 | ) | ||

|

| |||

| 33,960,459 | ||||

|

| |||

Net change in unrealized appreciation/depreciation on investments | (95,579,399 | ) | ||

Net change in unrealized appreciation/depreciation on foreign currency translations | (87,201 | ) | ||

|

| |||

| (95,666,600 | ) | |||

|

| |||

NET REALIZED AND UNREALIZED LOSS ON INVESTMENTS AND FOREIGN CURRENCY TRANSACTIONS | (61,706,141 | ) | ||

|

| |||

NET DECREASE IN NET ASSETS FROM OPERATIONS | $ | (59,435,494 | ) | |

|

| |||

See notes to financial statements.

15

Table of Contents

THE CHINA FUND, INC.

STATEMENTS OF CHANGES IN NET ASSETS

| Year Ended October 31, 2018 | Year Ended October 31, 2017 | |||||||

INCREASE (DECREASE) IN NET ASSETS FROM OPERATIONS | ||||||||

Net investment income | $ | 2,270,647 | $ | 2,881,848 | ||||

Net realized gain on investments and foreign currency transactions | 33,960,459 | 9,913,474 | ||||||

Net change in unrealized appreciation/depreciation on investments and foreign currency translations | (95,666,600 | ) | 65,848,652 | |||||

|

|

|

| |||||

Net increase (decrease) in net assets from operations | (59,435,494 | ) | 78,643,974 | |||||

|

|

|

| |||||

DISTRIBUTIONS TO SHAREHOLDERS FROM: | ||||||||

Distributable earnings | (8,636,465 | ) | (7,355,081 | ) | ||||

|

|

|

| |||||

Total distributions to shareholders | (8,636,465 | ) | (7,355,081 | ) | ||||

|

|

|

| |||||

NET INCREASE (DECREASE) IN NET ASSETS | (68,071,959 | ) | 71,288,893 | |||||

|

|

|

| |||||

NET ASSETS: | ||||||||

Beginning of Year | 366,541,031 | 295,252,138 | ||||||

|

|

|

| |||||

End of Year | $ | 298,469,072 | $ | 366,541,031 | ||||

|

|

|

| |||||

Distributions from net investment income and net realized capital gains are combined for the year ended October 31, 2018. Funds are no longer required to disclose the undistributed net investment income included in net assets at year end. See Note H in the Notes to Financial Statements for more information. The dividends and distributions to shareholders for the year ended October 31, 2017 have been reclassified to conform to the current year presentation.

See notes to financial statements.

16

Table of Contents

THE CHINA FUND, INC.

FINANCIAL HIGHLIGHTS

Selected data for a share of common stock outstanding for the years indicated

| Year Ended October 31, | ||||||||||||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||

Per Share Operating Performance | ||||||||||||||||||||

Net asset value, beginning of year | $ | 23.31 | $ | 18.78 | $ | 19.91 | $ | 24.21 | $ | 25.77 | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Net investment income* | 0.14 | 0.18 | (1) | 0.46 | (1) | 0.26 | 0.33 | |||||||||||||

Net realized and unrealized gain (loss) on investments and foreign currency transactions | (3.92 | ) | 4.82 | (0.10 | ) | (0.79 | ) | 1.43 | ||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total from investment operations | (3.78 | ) | 5.00 | 0.36 | (0.53 | ) | 1.76 | |||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Less dividends and distributions: | ||||||||||||||||||||

Dividends from net investment income | (0.55 | ) | (0.47 | ) | (0.21 | ) | (0.30 | ) | (0.44 | ) | ||||||||||

Distributions from net realized gains | — | — | (1.28 | ) | (3.47 | ) | (2.88 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total dividends and distributions | (0.55 | ) | (0.47 | ) | (1.49 | ) | (3.77 | ) | (3.32 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Capital Share Transactions: | ||||||||||||||||||||

Accretion (Dilution) to net asset value, resulting from share repurchase program, tender offer or issuance of shares in stock dividend | — | — | 0.00 | (2) | — | — | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Net asset value, end of year | $ | 18.98 | $ | 23.31 | $ | 18.78 | $ | 19.91 | $ | 24.21 | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Market price, end of year | $ | 16.98 | $ | 21.10 | $ | 16.18 | $ | 17.49 | $ | 21.44 | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total Investment Return (Based on Market Price) | (17.53 | )% | 33.83 | % | 1.73 | % | (1.95 | )% | 9.71 | % | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total Investment Return (Based on Net Asset Value) | (16.55 | )% | 27.38 | % | 3.73 | % | (1.16 | )% | 8.93 | % | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Ratios and Supplemental Data | ||||||||||||||||||||

Net assets, end of year (000’s) | $ | 298,469 | $ | 366,541 | $ | 295,252 | $ | 312,191 | $ | 379,692 | ||||||||||

Ratio of net expenses to average net assets | 1.91 | % | 1.49 | % | 1.51 | % | 1.34 | % | 1.31 | % | ||||||||||

Ratio of net investment income/(loss) to average net assets | 0.62 | % | 0.92 | %(1) | 2.66 | %(1) | 1.16 | % | 1.39 | % | ||||||||||

Portfolio turnover rate | 50 | % | 31 | % | 52 | % | 64 | % | 67 | % | ||||||||||

| * | Per share amounts have been calculated using the average share method. |

| (1) | Amount includes a non-recurring receipt of a refund for over-billing of prior years’ custody out of pocket expense which amounted to $0.02 per share and 0.12% of average net assets during 2016 and less than $0.01 per share and less than 0.005% of net assets during 2017. |

| (2) | Amount is less than $0.01. |

See notes to financial statements.

17

Table of Contents

NOTES TO FINANCIAL STATEMENTS

October 31, 2018

NOTE A — SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The China Fund, Inc. (the “Fund”) was incorporated under the laws of the State of Maryland on April 28, 1992, and is a non-diversified, closed-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund’s investment objective is long-term capital appreciation which it seeks to achieve by investing primarily in equity securities (i) of companies for which the principal securities trading market is the People’s Republic of China (“China”), (ii) of companies for which the principal securities trading market is outside of China, or constituting direct equity investments in companies organized outside of China, that in both cases derive at least 50% of their revenues from goods and services sold or produced, or have at least 50% of their assets, in China and (iii) constituting direct equity investments in companies organized in China (“Direct Investments”). The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. The Fund’s Investment Manager is Allianz Global Investors (“Investment Manager”)

The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board Accounting Standard Codification Topic 946 “Financial Services — Investment Companies.”

The financial statements are prepared in accordance with U.S. generally accepted accounting principles (“GAAP”), which require management to make estimates and assumptions that affect the reported amounts of assets and liabilities. Actual results could differ from those estimates. The following summarizes the significant accounting policies of the Fund:

Security Valuation: Portfolio securities listed on recognized United States or foreign security exchanges are valued at the last quoted sales price in the principal market where they are traded. Listed securities with no such sales price and unlisted securities are valued at the mean between the current bid and asked prices, if any, from brokers. Short-term investments having maturities of sixty days or less are valued at amortized cost (original purchase cost as adjusted for amortization of premium or accretion of discount) which when combined with accrued interest approximates market value. Securities for which market quotations are not readily available or are deemed unreliable are valued at fair value in good faith by or at the direction of the Board of Directors considering relevant factors, data and information including, if relevant, the market value of freely tradable securities of the same class in the principal market on which such securities are normally traded. Direct Investments, if any, are valued at fair value as determined by or at the direction of the Board of Directors based on financial and other information supplied by the Investment Manager regarding each Direct Investment. Forward currency contracts are valued at the current cost of offsetting the contract. Equity linked securities, if any, are valued at fair value primarily based on the value(s) of the underlying security (or securities), which normally follows the same methodology as the valuation of securities listed on recognized exchanges.

Factors used in determining fair value may include, but are not limited to, the type of security, the size of the holding, the initial cost of the security, the existence of any contractual restrictions on the security’s disposition, the price and extent of public trading in similar securities of the issuer or of comparable companies, the availability of quotations from broker-dealers, the availability of values of third parties other than the Investment Manager,

18

Table of Contents

NOTES TO FINANCIAL STATEMENTS (continued)

information obtained from the issuer, analysts, and/or the appropriate stock exchange (if available), an analysis of the company’s financial statements, an evaluation of the forces that influence the issuer and the market(s) in which the security is purchased and sold and with respect to debt securities, the maturity, coupon, creditworthiness, currency denomination, and the movement of the market in which they trade.

Repurchase Agreements: In connection with transactions in repurchase agreements, it is the Fund’s policy that its custodian take possession of the underlying collateral securities, the fair value of which exceeds the principal amount of the repurchase transaction, including accrued interest, at all times. If the seller defaults, realization of the collateral by the Fund may be delayed or limited.

| Remaining Contractual Maturity of the Agreements As of October 31, 2018 | ||||||||||||||||||||

| Overnight and Continuous | <30 days | Between 30 & 90 days | >90 days | Total | ||||||||||||||||

Repurchase Agreements |

| |||||||||||||||||||

U.S. Treasury and agency securities | $ | 7,434,000 | $ | — | $ | — | $ | — | $ | 7,434,000 | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total Borrowings | $ | 7,434,000 | $ | — | $ | — | $ | — | $ | 7,434,000 | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Securities Lending: The Fund may lend up to 33 1/3% of the Fund’s total assets held by State Street Bank and Trust Company (“State Street”) as custodian to certain qualified brokers, except those securities which the Fund or the Investment Manager specifically identifies as not being available. By lending its investment securities, the Fund attempts to increase its net investment income through the receipt of interest on the loan. Any gain or loss in the market price of the securities loaned that might occur and any interest or dividends declared during the term of the loan would accrue to the account of the Fund. Risks of delay in recovery of the securities or even loss of rights in the collateral may occur should the borrower of the securities fail financially. Risks may also arise to the extent that the value of the collateral decreases below the value of the securities loaned. Upon entering into a securities lending transaction, the Fund receives cash or other securities as collateral in an amount equal to or exceeding 100% of the current market value of the loaned securities with respect to securities of the U.S. government or its agencies, 102% of the current market value of the loaned securities with respect to U.S. securities and 105% of the current market value of the loaned securities with respect to foreign securities. Any cash received as collateral is generally invested by State Street, acting in its capacity as securities lending agent (the “Agent”), in the State Street Navigator Securities Lending Government Money Market Portfolio. Non-cash collateral is not disclosed in the Fund’s Statement of Assets and Liabilities as it is held by the lending agent on behalf of the Fund and the Fund does not have the ability to re-hypothecate those securities. A portion of the dividends received on the collateral may be rebated to the borrower of the securities and the remainder is split between the Agent and the Fund.

19

Table of Contents

NOTES TO FINANCIAL STATEMENTS (continued)

| Remaining Contractual Maturity of the Agreements As of October 31, 2018 | ||||||||||||||||||||

| Overnight and Continuous | <30 days | Between 30 & 90 days | >90 days | Total | ||||||||||||||||

Securities Lending Transactions |

| |||||||||||||||||||

Money Market Fund | $ | 6,437,278 | $ | — | $ | — | $ | — | $ | 6,437,278 | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total Borrowings | $ | 6,437,278 | $ | — | $ | — | $ | — | $ | 6,437,278 | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Gross amount of recognized liabilities for securities lending transactions | $ | 6,437,278 | ||||||||||||||||||

As of October 31, 2018, the Fund had loaned securities which were collateralized by cash, short term investments and long term bonds. The value of the securities on loan and the value of the related collateral were as follows:

| Value of Securities | Value of Cash Collateral | Value of Non-Cash Collateral* | Total Collateral | |||||||||||

| $27,542,443 | $ | 6,437,278 | $ | 22,302,416 | $ | 28,739,694 | ||||||||

| * | Fund cannot repledge or dispose of this collateral, nor does the Fund earn any income or receive dividends with respect to this collateral. |

| Gross Amounts Not Offset in the Statement of Assets and Liabilities | ||||||||||||||

| Gross Asset Amounts Presented in Statement of Assets and Liabilities | Financial Instrument | Collateral Received | Net Amount | |||||||||||

| $6,437,278 | — | $ | (6,437,278 | ) | $ | 0 | ||||||||

Foreign currency translations: The records of the Fund are maintained in U.S. dollars. Foreign currencies, investments and other assets and liabilities are translated into U.S. dollars at the current exchange rates. Purchases and sales of investment securities and income and expenses are translated on the respective dates of such transactions. Net realized gains and losses on foreign currency transactions represent net gains and losses from the disposition of foreign currencies, currency gains and losses realized between the trade dates and settlement dates of security transactions, and the difference between the amount of net investment income accrued and the U.S. dollar amount actually received. The effects of changes in foreign currency exchange rates on investments in securities are not segregated in the Statement of Operations from the effects of changes in market prices of those securities, but are included in realized and unrealized gain or loss on investments. Net unrealized foreign currency gains and losses arise from changes in the value of assets and liabilities, other than investments in securities, as a result of changes in exchange rates.

Forward Foreign Currency Contracts: The Fund may enter into forward foreign currency contracts to hedge against foreign currency exchange rate risks. A forward currency contract is an agreement between two parties to buy or sell currency at a set price on a future date. Upon entering into these contracts, risks may arise from the potential inability of counterparties to meet the terms of their contracts and from unanticipated movements in the value of the foreign currency relative to the U.S. dollar. The U.S. dollar value of forward currency contracts is determined using forward exchange rates provided by quotation services. Daily fluctuations in the value of such

20

Table of Contents

NOTES TO FINANCIAL STATEMENTS (continued)

contracts are recorded as unrealized gain or loss on the Statement of Assets and Liabilities. When the contract is closed, the Fund records a realized gain or loss equal to the difference between the value at the time it was opened and the value at the time it was closed. Such gain or loss is disclosed in the realized and unrealized gain or loss on foreign currency in the Fund’s accompanying Statement of Operations. At October 31, 2018, the Fund did not hold forward foreign currency contracts.

Option Contracts: The Fund may purchase and write (sell) call options and put options provided the transactions are for hedging purposes and the initial margin and premiums do not exceed 5% of total assets. Option contracts are valued daily and unrealized gains or losses are recorded on the Statement of Assets and Liabilities based upon the last sales price on the principal exchange on which the options are traded. The Fund will realize a gain or loss upon the expiration or closing of the option contract. Such gain or loss is disclosed in the realized and unrealized gain or loss on options in the Fund’s accompanying Statement of Operations. When an option is exercised, the proceeds on sales of the underlying security for a written call option, the purchase cost of the security for a written put option, or the cost of the security for a purchased put or call option is adjusted by the amount of premium received or paid.

The risk in writing a call option is that the Fund gives up the opportunity for profit if the market price of the security increases and the option is exercised. The risk in writing a put option is that the Fund may incur a loss if the market price of the security decreases and the option is exercised. The risk in buying an option is that the Fund pays a premium whether or not the option is exercised. Risks may also arise from an illiquid secondary market or from the inability of counter parties to meet the terms of the contract. At October 31, 2018, the Fund did not hold any option contracts.

Equity-Linked Securities: The Fund may invest in equity-linked securities such as linked participation notes, equity swaps and zero-strike options and securities warrants. Equity-linked securities may be used by the Fund to gain exposure to countries that place restrictions on investments by foreigners. To the extent that the Fund invests in equity-linked securities whose return corresponds to the performance of a foreign securities index or one or more foreign stocks, investing in equity-linked securities will involve risks similar to the risks of investing in foreign securities. In addition, the Fund bears the risk that the issuer of any equity-linked securities may default on its obligation under the terms of the arrangement with the counterparty. Equity-linked securities are often used for many of the same purposes as, and share many of the same risks with, derivative instruments. In addition, equity-linked securities may be considered illiquid. At October 31, 2018, the Fund did not hold equity-linked securities.

Direct Investments: The Fund may invest up to 25% of the net proceeds from its offering of its outstanding common stock in direct investments; however, the Board of Directors of the Fund has suspended additional investments in direct investments. Direct investments are generally restricted and do not have a readily available resale market. Because of the absence of any public trading market for these investments, the Fund may take longer to liquidate these positions than would be the case for publicly traded securities. Although these securities may be resold in privately negotiated transactions, the prices on these sales could be less than those originally paid by the Fund. Issuers whose securities are not publicly traded may not be subject to public disclosure and other investor protections requirements applicable to publicly traded securities. At October 31, 2018, the Fund did not hold Direct Investments.

21

Table of Contents

NOTES TO FINANCIAL STATEMENTS (continued)

Indemnification Obligations: Under the Fund’s organizational documents, its Officers and Directors are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business the Fund enters into contracts that provide general indemnifications to other parties. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred.

Security transactions and investment income: Security transactions are recorded as of the trade date. Realized gains and losses from securities sold are recorded on the identified cost basis. Dividend income is recorded on the ex-dividend date, or, in the case of dividend income on foreign securities, on the ex-dividend date or when the Fund becomes aware of its declaration. Interest income is recorded on the accrual basis. All premiums and discounts are amortized/accreted for both financial reporting and federal income tax purposes.

Effective January 1, 2018, dividend and interest income generated in Taiwan is subject to a 21% withholding tax (20% for the period November 1, 2017 through December 31, 2017). Stock dividends received (except those which have resulted from capitalization of capital surplus) are taxable at 21% of the par value of stock dividends received (20% for the period from September 1, 2017 through December 31, 2017). The Fund records the taxes paid on stock dividends as an operating expense.

Dividends and distributions: The Fund intends to distribute to its stockholders, at least annually, substantially all of its net investment income and any net realized capital gains. Distributions to stockholders are recorded on the ex-dividend date. Income and capital gains distributions are determined in accordance with federal income tax regulations, which may differ from U.S. generally accepted accounting principles. Certain capital accounts in the financial statements are periodically adjusted for permanent differences in order to reflect their tax character. These adjustments have no impact on net assets or net asset value per share. Temporary differences which arise from recognizing certain items of income, expense, gain or loss in different periods for financial statement and tax purposes will reverse at some time in the future. Unless the Board of Directors elects to make distributions in shares of the Fund’s common stock, the distributions will be paid in cash, except with respect to stockholders who have elected to participate in the Fund’s Dividend Reinvestment and Cash Purchase Plan.

Federal Taxes: It is the Fund’s policy to qualify each year as a regulated investment company under Subchapter M of the Internal Revenue Code, as amended (“Code”) and to distribute to stockholders each year substantially all of its income. Accordingly, no provision for federal income tax is necessary. As of and during the period ended October 31, 2018, the Fund did not have a liability for any uncertain tax positions. The Fund recognizes interest and penalties, if any, related to tax liabilities as income tax expense in the Statement of Operations. For the previous three years the Fund remains subject to examination by the Fund’s major tax jurisdictions, which include the United States of America and the State of Maryland. The Fund may be subject to taxes imposed by governments of countries in which it invests. Such taxes are generally based on either income or gains earned or repatriated. The Fund accrues and applies such taxes to net investment income, net realized gains and net unrealized gains as income and/or gains are earned.

The tax character of distributions the Fund made during the year ended October 31, 2018 and October 31, 2017 from ordinary income was $8,636,465 and $7,355,081, respectively.

22

Table of Contents

NOTES TO FINANCIAL STATEMENTS (continued)

Tax components of distributable earnings are determined in accordance with income tax regulations which may differ from the composition of net assets reported under GAAP. Accordingly, for the year ended October 31, 2018, the effects of certain differences were reclassified. The Fund increased undistributed net investment income by $1,735,817 and decreased accumulated net realized gain by $1,735,817. These differences were primarily due to the differing tax treatment of foreign currency and distribution redesignations. Net assets of the Fund were unaffected by the reclassifications and the calculation of net investment income per share in the Financial Highlights excludes these adjustments.

As of October 31, 2018, the components of distributable earnings on a tax basis were $2,654,648 of undistributed ordinary income and $5,834,707 of undistributed capital gains. On a tax basis, the Fund also had $2,515,343 of net unrealized depreciation on investments and currency, resulting in a total accumulated earnings of $5,974,012. During the year ended October 31, 2018 the Fund utilized $26,169,118 in capital loss carryforwards. Permanent book/tax differences relate to foreign currency gain/losses and passive foreign investment company gains and losses.

At October 31, 2018, the cost of investments for federal income tax purposes was $290,516,760. Gross unrealized appreciation of investments was $41,243,966 while gross unrealized depreciation of investments was $43,682,617, resulting in net unrealized depreciation of investments of $2,438,651.

NOTE B — ADVISORY FEE AND OTHER TRANSACTIONS

Allianz Global Investors (“AGI” or “Investment Manager”) is the investment manager for the Fund’s listed assets (“Listed Assets”) and Direct Investments. AGI receives a fee, computed weekly and payable monthly, at the following annual rates: 0.70% of the first US$315 million of the Fund’s average weekly net assets invested in Listed Assets; and 0.50% of the Fund’s average weekly net assets invested in Listed Assets in excess of US$315 million. For the year ended October 31, 2018, the Listed Assets investment management fee rate was equivalent to an annual effective rate of 0.67% of the Fund’s average weekly net assets. AGI receives a fee computed weekly and payable monthly, at an annual rate of 1.50% of the average weekly value of the Fund’s assets invested in Direct Investments, if any. For the year ended October 31, 2018, the Investment Manager was paid no fees for Direct Investments as the Fund held no such investments during the period.

No director, officer or employee of the Investment Manager or any affiliates of those entities will receive any compensation from the Fund for serving as an officer or director of the Fund.

State Street provides, or arranges for the provision of certain administrative services for the Fund, including preparing certain reports and other documents required by federal and/or state laws and regulations. The Fund pays State Street a fee that is calculated daily and paid monthly at an annual rate based on aggregate average daily assets of the Fund. The Fund also pays State Street an annual fee for certain legal administration services, including corporate secretarial services and preparing regulatory filings.

The Fund has also contracted with State Street to provide custody and fund accounting services to the Fund. For these services, the Fund pays State Street asset-based fees that vary according to the number of positions and transactions plus out-of-pocket expenses.

23

Table of Contents

NOTES TO FINANCIAL STATEMENTS (continued)

During the 2018 reporting period, legal expenses increased significantly as compared to 2017 as a result of the Fund’s involvement in litigation brought against the Fund and its Directors by one of its major stockholders and in an action brought by the Fund against that stockholder, in both cases relating to the Fund’s 2018 Annual Meeting of Stockholders and related proxy solicitation. The actions were withdrawn in July 2018 by agreement of the parties.

NOTE C — FUND SHARES

At October 31, 2018, there were 100,000,000 shares of $0.01 par value capital stock authorized, of which 15,722,675 were issued and outstanding.

NOTE D — INVESTMENT TRANSACTIONS

For the year ended October 31, 2018, the Fund’s cost of purchases and proceeds from sales of investment securities, other than short-term securities, were $177,826,324 and $201,561,487, respectively.

NOTE E — INVESTMENTS IN CHINA

The Fund’s investments in Chinese companies involve certain risks not typically associated with investments in securities of U.S. companies or the U.S. Government, including risks relating to (1) social, economic and political uncertainty; (2) price volatility, lesser liquidity and smaller market capitalization of securities markets in which securities of Chinese companies trade; (3) currency exchange fluctuations, currency blockage and higher rates of inflation; (4) controls on foreign investment and limitations on repatriation of invested capital and on the Fund’s ability to exchange local currencies for U.S. dollars; (5) governmental involvement in and control over the economy; (6) risk of nationalization or expropriation of assets; (7) the nature of the smaller, less seasoned and newly organized Chinese companies, particularly in China; and (8) the absence of uniform accounting, auditing and financial reporting standards, practices and disclosure requirements and less government supervision and regulation.

NOTE F — FAIR VALUE MEASUREMENT

The Fund has adopted fair valuation accounting standards which establish a definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion of changes in valuation techniques and related inputs during the period. These inputs are summarized in the three broad levels listed below:

| • | Level 1 — Inputs that reflect unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access at the measurement date; |

| • | Level 2 — Inputs other than quoted prices that are observable for the asset or liability either directly or indirectly, including inputs in markets that are not considered to be active; |

| • | Level 3 — Inputs that are unobservable. |

24

Table of Contents

NOTES TO FINANCIAL STATEMENTS (continued)

The following is a summary of the inputs used as of October 31, 2018 in valuing the Fund’s investments carried at value:

ASSETS VALUATION INPUT

Description* | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

Common Stock | $ | 274,206,831 | $ | — | $ | — | $ | 274,206,831 | ||||||||

Collateral for Securities on Loan | 6,437,278 | — | — | 6,437,278 | ||||||||||||

Short Term Investments | — | 7,434,000 | — | 7,434,000 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

TOTAL INVESTMENTS | $ | 280,644,109 | $ | 7,434,000 | $ | — | $ | 288,078,109 | ||||||||

|

|

|

|

|

|

|

| |||||||||

| * | Please refer to the Schedule of Investments for additional security details. |

NOTE G — DERIVATIVE INSTRUMENTS AND HEDGING ACTIVITIES

The Fund did not enter into any derivatives transactions or hedging activities for the year ended October 31, 2018.

NOTE H — RECENT ACCOUNTING PRONOUNCEMENTS

As of November 5, 2018 pursuant to the Securities and Exchange Commission (“SEC”) Release #33-10532 “Disclosure Update and Simplification,” funds are no longer required to disclose whether distributions from earnings are either from net investment income or net realized capital gains. Funds are also not required to disclose the undistributed net investment income included in net assets at year end. The presentation for the year ended October 31, 2017 has been adjusted for this change in the Statement of Changes in Net Assets. At October 31, 2017 the distributions to stockholders from net investment income were $7,355, 081 and the undistributed net investment income included in net assets — end of year was $4,544,636.

NOTE I — SUBSEQUENT EVENT

Management has evaluated the impact of all events or transactions occurring after year end through the date these financial statements were issued, and has determined that there were no subsequent events requiring recognition or disclosure other than the following:

On December 7, 2018, the Fund’s stockholders approved Matthews Asia as the Fund’s new Investment Manager. It is expected that Matthews Asia will commence managing the Fund’s portfolio on or about January 1, 2019.

25

Table of Contents

REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and Board of Directors

of The China Fund, Inc.

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of The China Fund, Inc. (the “Fund”), including the schedule of investments, as of October 31, 2018, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, financial highlights for each of the five years in the period then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of October 31, 2018, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB. We have served as the Fund’s auditor since 2012.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of October 31, 2018 by correspondence with the custodian and brokers; when replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

TAIT, WELLER & BAKER LLP

Philadelphia, Pennsylvania

December 20, 2018

26

Table of Contents

Other Information (unaudited)

TAX INFORMATION

Foreign Taxes Credit: The Fund designates $494,385 as foreign taxes paid and $9,537,950 as foreign source income earned for regular Federal income tax purposes.

Qualified Dividend Income: For the fiscal year ended October 31, 2018, the Fund will designate up to the maximum amount allowable pursuant to the Internal Revenue Code, as qualified dividend income eligible for reduced tax rates. These lower rates range from 5% to 15% depending on the individual’s tax bracket. Complete information will be reported in conjunction with the Form 1099-DIV. For the year ended October 31, 2018, the Fund had $2,544,812 in Qualified Dividend Income and 0.25% of total ordinary income dividends paid qualified for the corporate dividends received deduction.

RESULTS OF THE ANNUAL STOCKHOLDER MEETING HELD ON MAY 23, 2018

| 1. | Election of Directors — The stockholders of the Fund elected Julian Reid and Richard A. Silver as Class I directors each to serve for a term expiring on the date on which the annual meeting of stockholders is held in 2021. The stockholders of the Fund did not re-elect Joe O. Rogers and Richard Shore to serve on the Board of Directors. |

Director | For | Against/Withheld | ||||||

Joe O. Rogers | 3,712,015 | 400,251 | ||||||

Richard Shore | 3,713,567 | 398,699 | ||||||

Julian Reid | 7,709,976 | 41,201 | ||||||

Richard A. Silver | 7,710,176 | 41,001 | ||||||

PRIVACY POLICY

Privacy Notice

The China Fund, Inc. collects nonpublic personal information about its stockholders from the following sources:

☐ Information it receives from stockholders on applications or other forms; and

☐ Information about stockholder transactions with the Fund.

The Fund’s policy is to not disclose nonpublic personal information about its stockholders to nonaffiliated third parties (other than disclosures permitted by law).

The Fund restricts access to nonpublic personal information about its stockholders to those agents of the Fund who need to know that information to provide products or services to stockholders. The Fund maintains physical, electronic and procedural safeguards that comply with federal standards to guard its stockholders’ nonpublic personal information. |

27

Table of Contents

THE CHINA FUND, INC.

Other Information (continued) (unaudited)

QUARTERLY PORTFOLIO OF INVESTMENTS

A Portfolio of Investments will be filed as of the end of the first and third quarter of each fiscal year on Form N-Q and will be available on the Securities and Exchange Commission’s website at http://www.sec.gov. Form N-Q was filed as of July 31, 2018 for the third quarter of this fiscal year and is available on the Securities and Exchange Commission’s website at www.sec.gov. Additionally, the Portfolio of Investments may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330. The quarterly Portfolio of Investments will be made available with out charge, upon request, by calling 1-888-246-2255.

CERTIFICATIONS

The Fund’s chief executive officer has certified to the New York Stock Exchange that, as of June 11, 2018, he was not aware of any violation by the Fund of applicable New York Stock Exchange corporate governance listing standards. The Fund also has included the certifications of the Fund’s chief executive officer and chief financial officer required by Section 302 and Section 906 of the Sarbanes-Oxley Act of 2002 in the Fund’s Form N-CSR filed with the Securities and Exchange Commission, for the period of this report.

28

Table of Contents

SUMMARY OF DIVIDEND REINVESTMENT AND CASH PURCHASE PLAN

The Fund will distribute to stockholders, at least annually, substantially all of its net investment income from dividends and interest earnings and expects to distribute any net realized capital gains annually. Pursuant to the Dividend Reinvestment and Cash Purchase Plan (the “Plan”), adopted by the Fund, each stockholder will automatically be a participant (a “Participant”) in the Plan unless Computershare Trust Company, N.A., the Plan Agent, is otherwise instructed by the stockholder in writing, to have all distributions, net of any applicable U.S. withholding tax, paid in cash. Stockholders who do not participate in the Plan will receive all distributions in cash paid by check in U.S. dollars mailed directly to the stockholder by Computershare Trust Company, N.A., as paying agent. Stockholders who do not wish to have distributions automatically reinvested should notify the Fund by contacting Computershare Trust Company, N.A. c/o The China Fund, Inc. at P.O. Box 505000 Louisville, Kentucky 40233-5000, by telephone at 1-800-426-5523 or via the Internet at www.computershare.com/investor.

Whenever the Directors of the Fund declare a capital gains distribution or an income dividend payable only in shares of the Fund’s common stock (including such a declaration that provides an option to receive cash), Participants will take such distribution or dividend entirely in shares of common stock to be issued by the Fund, and the Plan Agent shall automatically receive such shares of common stock, including fractions, for the Participant’s account.

Whenever a dividend or distribution is declared payable in cash or shares of the Fund’s common stock, the Plan will operate as follows: (i) whenever the market price per share of common stock equals or exceeds the net asset value per share at the time shares of common stock are valued for the purpose of determining the number of shares of common stock equivalent to the dividend or distribution (the “Valuation Date”), Participants will be issued shares of common stock by the Fund valued at net asset value or, if the net asset value is less than 95% of the market price on the Valuation Date, then Participants will be issued shares valued at 95% of the market price; and (ii) whenever the net asset value per share of the common stock on the Valuation Date exceeds the market price of a share of the common stock on the Valuation Date, Participants will receive shares of common stock of the Fund purchased in the open market. The Plan Agent will, as purchasing agent for the Participants, buy shares of common stock in the open market, on the New York Stock Exchange (the “Exchange”) or elsewhere, with the cash in respect of such dividend or distribution for the Participants’ accounts on, or shortly after, the payment date.

If the Fund should declare an income dividend or capital gains distribution payable only in cash, the Plan Agent will, as purchasing agent for the Participants, buy shares of common stock in the open market, on the Exchange or elsewhere, with the cash in respect of such dividend or distribution for the Participants’ accounts on, or shortly after, the payment date.

Participants in the Plan have the option of making additional payments to the Plan Agent annually, in any amount from $100 to $3,000 for investment in the Fund’s Common Stock. The Plan Agent will use all funds received from participants (as well as any dividends and capital gains distributions received in cash) to purchase Fund shares in the open market on January 15 of each year or the next trading day if January 15th is not a trading day. Participants may make voluntary cash payments by sending a check (in U.S. dollars and drawn on a U.S. Bank) made payable to “Computershare” along with a completed transaction form which is attached to each statement a Participant receives. The Plan Agent will not accept cash, traveler’s checks, money orders or third party checks. Any voluntary

29

Table of Contents

DIVIDENDS AND DISTRIBUTIONS:

SUMMARY OF DIVIDEND REINVESTMENT AND CASH PURCHASE PLAN (continued)

cash payments received more than thirty-five days prior to such date will be returned by the Plan Agent, and interest will not be paid on any such amounts. To avoid unnecessary cash accumulations, and also to allow ample time for receipt and processing by the Plan Agent, participants should send in voluntary cash payments to be received by the Plan Agent approximately two days before January 15. A participant may withdraw a voluntary cash payment by written notice, if the notice is received by the Plan Agent not less than 48 hours before such payment is to be invested. In the event that a Participant’s check for a voluntary cash payment is returned unpaid for any reason, the Plan Agent will consider the request for investment of such funds null and void, and shall immediately remove from the Participant’s account those shares, if any, purchased upon the prior credit of such funds. The Plan Agent shall be entitled to sell shares to satisfy any uncollected amount plus any applicable fees. If the net proceeds of the sale of such shares are insufficient to satisfy the balance of such uncollected amounts, the Plan Agent shall be entitled to sell such additional shares from the Participant’s account as may be necessary to satisfy the uncollected balance.

For all purposes of the Plan: (a) the market price of shares of common stock of the Fund on a particular date shall be the last sales price on the Exchange on the close of the previous trading day or, if there is no sale on the Exchange on that date, then the mean between the closing bid and asked quotations for such stock on the Exchange on such date, (b) Valuation Date shall be the dividend or distribution payment date or, if that date is not an Exchange trading day, the next preceding trading day, and (c) net asset value per share of common stock on a particular date shall be as determined by or on behalf of the Fund.