Manager’s Commentary

Market Review

In October, the MSCI Golden Dragon Index declined by 0.9% in US dollar terms, marking an end to the strong rally seen in the past six months. While economic readings from China showed some signs of improvement in areas such as manufacturing, as measured by the Purchasing Manager's Index ("PMI"), investors expressed concerns about the upcoming US presidential elections in November and the US Federal Reserve interest rate decision in December. Rising external uncertainties resulted in a correction led by high yield sectors such as telecommunication services and utilities. In addition, a sharp rally in Chinese property prices unsurprisingly triggered a new round of tightening measures by local governments. As a result, real estate stocks significantly lagged the broader market in October. Contrary to muted broader market performance, previously underperforming sectors, such as industrials and consumers, caught up over the past month.

Fund Review

In October, with large-cap Chinese stocks leading the correction, especially financials and telecommunications, mid and small-cap stocks finally started catching up after the underperformance over the first nine months of the year. The China Fund, Inc. (the "Fund") performed in line with the benchmark for October, helped by the recovery of mid and small-cap turnaround names.

The top contributor for the month was Taiwan Semiconductor Manufacturing Company Ltd., a mid-cap Chinese semiconductor foundry. The company is a major beneficiary in developments of China's domestic semiconductor supply chain, gaining market share globally. The company's share price continued to climb after it posted very strong quarterly earnings results. We have been adding to this name during its re-rating stage and expect to capture further valuation upside and earnings growth potential.

The Fund also benefited from China State Construction International Holdings Ltd., a mid-cap construction company with projects in China, Hong Kong and Macau. Good visibility on projects and an improving track record in project execution led to strong share price performance in September and October. We added to this stock during the previous weakness and will continue to hold as a proxy for rising infrastructure spending in China.

The main detractors from performance over the month were underweight positions in the materials and energy sectors. These deep cyclical sectors have bounced back significantly year to date. While we have yet to see sustainable improvement in company fundamentals, we are reluctant to chase the rally at this point.

Key Transactions

The key sale over the month was focused on the Chinese property sector, where we expect potential tightening measures will weigh on share prices. We have also been trimming positions in select turnaround companies that have performed well, including Digital China Holdings Ltd., as we are concerned about near term earnings risk.

Outlook

Chinese equities have recovered by more than 20% in US dollar terms, from the February lows, driven mainly by a re-rating from previously depressed valuations on the back of strong fund flows into emerging market equities and southbound flows from mainland China investors into Hong Kong. Without the support of broad-based improvement in corporate earnings, we remain relatively cautious on the market over the rest of the year, especially given external factors such as the November US presidential election and ongoing political uncertainty in Europe.

Within the market, we believe the strong rally in large-cap and cyclical stocks resulted in a number of structural growth opportunities being overlooked. For example, we have selectively added policy beneficiaries, such as construction contractors, railway stocks and semiconductor foundries, to the portfolio. We believe these stocks offer attractive valuations and solid earnings growth which should help provide downside support if the market continues to pull back, as well as upside participation over the long run. We have maintained our dividend exposure through telecommunications and utility names. These stocks have underperformed recently ahead of the next US Federal Reserve meeting, but we believe their dividend yields continue to offer good valuation support.

| In Brief |

| Fund Data | |

| Description | Seeks to achieve longterm capital appreciation through investments in China companies. |

| Listing Date (NYSE) | July 10, 1992 |

| Total Fund Assets (millions) | $295.3 |

| Median Market Cap (in billions) | $11.2 |

| Distribution Frequency | Annual |

| Management Firm | Allianz Global Investors U.S. LLC |

| Portfolio Management | Christina Chung, CFA, CMA Lead Portfolio Manager |

Performance (US$ Returns)

(as of 10/31/16)

| Fund | Benchmark1 |

| One Month | -1.00% | -0.94% |

| Three Month | 7.25% | 6.65% |

| One Year | 3.73% | 7.31% |

| Three Year | 3.75% | 4.21% |

| Net Asset Value / Market Price |

| Net Asset Value (NAV) / Market Price at Inception | $13.15 / $14.26 |

| NAV / Market Price (as of 10/31/16) | $18.78 / $16.18 |

| High / Low Ranges (52-Week) |

| High / Low NAV | $20.46 / $14.65 |

| High / Low Market Price | $17.86 / $12.85 |

| Premium/Discount to NAV (as of 10/31/16) | -13.84% |

| Fund Data (Common Shares) | |

| Shares Outstanding | 15,722,674 |

| Average Daily Volume | 27,968 |

| Expense Ratio | 1.53% |

Fund Manager

Christina Chung, CFA, CMA

Lead Portfolio Manager

1. MSCI Golden Dragon Index.

The China Fund, Inc.

Investment Objective

The investment objective of the Fund is to achieve long-term capital appreciation. The Fund seeks to achieve its objective through investment in the equity securities of companies and other entities with significant assets, investments, production activities, trading or other business interests in China or which derive a significant part of their revenue from China.

The Fund has an operating policy that the Fund will invest at least 80% of its assets in China companies. For this purpose, 'China companies' are (i) companies for which the principal securities trading market is in China; (ii) companies for which the principal securities trading market is outside of China or in companies organized outside of China, that in both cases derive at least 50% of their revenues from goods or services sold or produced, or have a least 50% of their assets in China; or (iii) companies organized in China. Under the policy, China means the People's Republic of China, including Hong Kong, and Taiwan. The Fund will provide its stockholders with at least 60 days' prior notice of any change to this policy.

| Returns For Periods Ending October 31, 2016* |

| | 1 Month | 3 Month | YTD | 1 Year | 3 Year | 5 Year | 10 Year | Inception |

| NAV | -1.00% | 7.25% | 5.74% | 3.73% | 3.75% | 5.65% | 10.55% | 10.08% |

| Market Price | -1.58% | 6.31% | 4.25% | 1.73% | 3.05% | 4.91% | 9.27% | 9.04% |

| MSCI Golden Dragon Index | -0.94% | 6.65% | 11.79% | 7.31% | 4.21% | 6.72% | 6.45% | — |

| |

| Calendar Year Returns |

| | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 |

| NAV | -46.95% | 72.83% | 27.26% | -24.37% | 12.12% | 18.31% | 7.82% | -5.51% |

| Market Price | -40.65% | 72.19% | 23.60% | -27.51% | 20.52% | 12.70% | 5.29% | -6.38% |

| MSCI Golden Dragon Index | -49.37% | 67.12% | 13.60% | -18.35% | 22.65% | 7.25% | 8.06% | -7.12% |

Past performance is not a guide to future returns.

*Annualized for periods greater than one year.

Source: State Street Bank and Trust Company. Source for index data: MSCI as at October 31, 2016. Investment returns are historical and do not guarantee future results. Investment returns reflect changes in net asset value and market price per share during each period and assumes that dividends and capital gains distributions, if any, were reinvested. The net asset value (NAV) percentages are not an indication of the performance of a shareholder's investment in the Fund, which is based on market price. NAV performance includes the deduction of management fees and other expenses. Market price performance does not include the deduction of brokerage commissions and other expenses of trading shares and would be lower had such commissions and expenses been deducted. It is not possible to invest directly in an index.

Premium/Discount

| Sector Allocation | | |

| | Fund | Benchmark1 |

| Information Technology | 36.73% | 33.22% |

| Financials | 19.07% | 24.85% |

| Industrials | 11.85% | 6.41% |

| Telecom Services | 9.87% | 5.75% |

| Real Estate | 8.21% | 8.00% |

| Consumer Discretionary | 6.02% | 7.55% |

| Energy | 2.15% | 3.66% |

| Consumer Staples | 1.39% | 2.19% |

| Utilities | 1.02% | 4.17% |

| Health Care | 1.02% | 1.25% |

| Materials | 0.31% | 2.93% |

| Other assets & liabilities | 2.36% | 0.00% |

Source: IDS GmbH - Analysis and Reporting Services, a subsidiary of Allianz SE.

| Country Allocation | | |

| | Fund | Benchmark1 |

| China | 73.81% | 74.97% |

| Hong Kong Red Chips | 28.39% | 9.88% |

| Hong Kong 'H' shares | 16.36% | 20.59% |

| Equity linked securities ('A' shares) | 1.01% | 0.00% |

| China 'A' & 'B' shares | 0.00% | 0.14% |

| Other Hong Kong securities | 28.05% | 31.15% |

| Others | 0.00% | 13.21% |

| Taiwan | 23.83% | 25.03% |

| Other assets & liabilities | 2.36% | 0.00% |

| Top 10 Holdings |

| TAIWAN SEMIC CO LTD (Taiwan) | 9.02% |

| TENCENT HOLDINGS LTD (China) | 6.84% |

| SUN HUNG KAI PROPERTIES LTD (H.K.) | 6.52% |

| CHINA MERCHANTS BANK CO LTD (China) | 4.50% |

| ALIBABA GROUP HOLDING LTD (China) | 4.20% |

| HK EXCHANGES & CLEARING LTD (H.K.) | 4.03% |

| PING AN INSURANCE (China) | 3.42% |

| QINGLING MOTORS CO LTD (China) | 3.02% |

| CHINA MOBILE LTD (China) | 3.01% |

| CHINA UNICOM HONG KONG LTD (China) | 2.96% |

Portfolio Characteristics | Fund | Benchmark1 |

| P/E Ratio | 14.87 | 13.84 |

| P/B Ratio | 1.54 | 1.44 |

| Issues in Portfolio | 43 | 282 |

| Foreign Holdings (%) | 97.64 | 100.00 |

| Other assets & liabilities (%) | 2.36 | 0.00 |

| Yield (%) | 2.84 | 2.79 |

Source: IDS GmbH - Analysis and Reporting Services, a subsidiary of Allianz SE.

1. MSCI Golden Dragon Index.

The China Fund, Inc.

| Distribution History (10 Year) |

| |

Declaration Date | Ex-dividend Date | Record Date | Payable Date | Distribution/ Share | Income | Long-term Capital Gain | Short-term Capital Gain |

| 12/8/06 | 12/19/06 | 12/21/06 | 12/29/06 | $4.01170 | $0.29960 | $2.73090 | $0.98120 |

| 12/7/07 | 12/19/07 | 12/21/07 | 1/25/08 | $12.12000 | $0.28000 | $9.00000 | $2.84000 |

| 12/8/08 | 12/22/08 | 12/24/08 | 1/23/09 | $5.81740 | $0.48130 | $5.33610 | — |

| 12/9/09 | 12/22/09 | 12/24/09 | 12/29/09 | $0.25570 | $0.25570 | — | — |

| 12/8/10 | 12/21/10 | 12/24/10 | 12/29/10 | $2.27420 | $0.37460 | $1.89960 | — |

| 12/8/11 | 12/21/11 | 12/23/11 | 12/29/11 | $2.99640 | $0.17420 | $2.82220 | — |

| 12/10/12 | 12/20/12 | 12/24/12 | 12/28/12 | $3.25170 | $0.34730 | $2.90440 | — |

| 12/13/13 | 12/19/13 | 12/23/13 | 12/27/13 | $3.31400 | $0.43870 | $2.87530 | — |

| 12/8/14 | 12/18/14 | 12/22/14 | 1/5/15 | $3.76510 | $0.29820 | $3.46690 | — |

| 12/16/15 | 12/23/15 | 12/28/15 | 1/6/16 | $1.49580 | $0.21330 | $0.84620 | $0.43630 |

Distribution/Share includes Income, Long-term Capital gains and Short-term Capital gains.

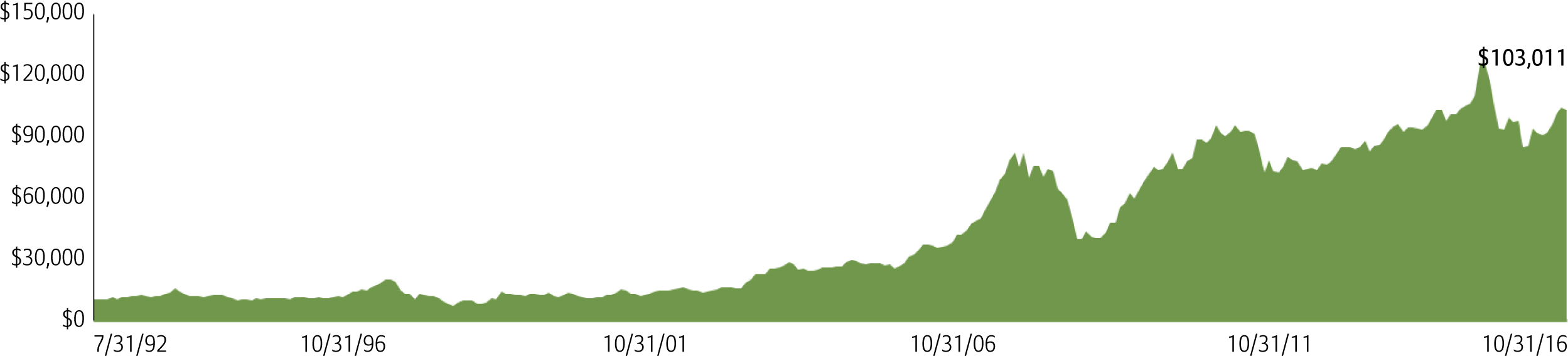

The China Fund NAV Performance of $10,000 since inception

Past performance is not a guide to future returns.

Index Description

MSCI Golden Dragon Index

The MSCI Golden Dragon Index captures the equity market performance of large and mid cap China securities (H shares, B shares, Red-Chips and P-Chips) and non-domestic China securities listed in Hong Kong and Taiwan.

It is not possible to invest directly in an index.

The China Fund, Inc.

Portfolio in Full

| Sector | Company (exchange ticker) | Market Price | Holding | Value US$ | % of net assets |

| Information Technology | | | | | 36.72 |

| TAIWAN SEMICONDUCTOR MANUFACTURING CO LTD | 2330 | 188.50 | 4,461,000 | 26,646,550 | 9.02 |

| TENCENT HOLDINGS LTD | 700 | 205.80 | 760,900 | 20,192,940 | 6.84 |

| ALIBABA GROUP HOLDING LTD | BABA | 101.69 | 121,966 | 12,402,723 | 4.20 |

| DELTA ELECTRONICS INC | 2308 | 166.50 | 1,548,359 | 8,169,271 | 2.77 |

| SEMICONDUCTOR MANUFACTURING INTERNATIONAL CORP | 981 | 0.94 | 64,229,000 | 7,785,484 | 2.64 |

| HON HAI PRECISION INDUSTRY CO LTD | 2317 | 85.30 | 2,537,100 | 6,857,788 | 2.32 |

| ADVANTECH CO LTD | 2395 | 257.00 | 798,841 | 6,505,653 | 2.20 |

| LARGAN PRECISION CO LTD | 3008 | 3,735.00 | 54,000 | 6,391,191 | 2.16 |

| DIGITAL CHINA HOLDINGS LTD | 861 | 6.50 | 7,444,000 | 6,239,450 | 2.11 |

| BAIDU INC | BIDU | 176.86 | 32,722 | 5,787,213 | 1.96 |

| GOLDPAC GROUP LTD | 3315 | 2.30 | 5,021,000 | 1,489,171 | 0.50 |

| Financials | | | | | 19.07 |

| CHINA MERCHANTS BANK CO LTD | 3968 | 18.92 | 5,450,500 | 13,297,931 | 4.50 |

| HONG KONG EXCHANGES & CLEARING LTD | 388 | 205.40 | 449,400 | 11,903,101 | 4.03 |

| PING AN INSURANCE GROUP CO OF CHINA LTD | 2318 | 40.95 | 1,911,000 | 10,091,162 | 3.42 |

| CHINA CONSTRUCTION BANK CORP | 939 | 5.68 | 10,814,000 | 7,920,659 | 2.68 |

| FUBON FINANCIAL HOLDING CO LTD | 2881 | 44.80 | 3,758,000 | 5,334,973 | 1.81 |

| CITIC SECURITIES CO LTD | 6030 | 17.20 | 1,810,000 | 4,014,520 | 1.36 |

| CATHAY FINANCIAL HOLDING CO LTD | 2882 | 40.95 | 2,880,000 | 3,737,178 | 1.27 |

| Industrials | | | | | 11.84 |

| CHINA EVERBRIGHT INTERNATIONAL LTD | 257 | 9.30 | 6,312,000 | 7,569,663 | 2.56 |

| BEIJING ENTERPRISES HOLDINGS LTD | 392 | 38.80 | 1,182,500 | 5,916,426 | 2.00 |

| CN STATE CONSTRUCTION INTERNATIONAL HOLDINGS LTD | 3311 | 11.34 | 3,046,000 | 4,454,198 | 1.51 |

| QINGDAO PORT INTERNATIONAL CO LTD | 6198 | 4.75 | 6,596,000 | 4,040,181 | 1.37 |

| CK HUTCHISON HOLDINGS LTD | 1 | 95.95 | 310,000 | 3,835,600 | 1.30 |

| ZHUZHOU CRRC TIMES ELECTRIC CO LTD | 3898 | 37.60 | 647,500 | 3,139,455 | 1.06 |

| JARDINE MATHESON HOLDINGS LTD | J36 | 60.91 | 51,100 | 3,112,501 | 1.05 |

| KING SLIDE WORKS CO LTD | 2059 | 387.00 | 239,000 | 2,930,936 | 0.99 |

| Telecom Services | | | | | 9.87 |

| CHINA MOBILE LTD | 941 | 88.85 | 776,500 | 8,896,629 | 3.01 |

| CHINA UNICOM HONG KONG LTD | 762 | 9.09 | 7,466,000 | 8,751,419 | 2.96 |

| PCCW LTD | 8 | 4.62 | 8,623,000 | 5,137,206 | 1.74 |

| CHUNGHWA TELECOM CO LTD | 2412 | 108.00 | 1,110,000 | 3,798,780 | 1.29 |

| HUTCHISON TELECOMMUNICATIONS HK HOLDINGS LTD | 215 | 2.50 | 7,974,000 | 2,570,649 | 0.87 |

| Real Estate | | | | | 8.21 |

| SUN HUNG KAI PROPERTIES LTD | 16 | 115.80 | 1,289,000 | 19,248,109 | 6.52 |

| CHINA OVERSEAS LAND & INVESTMENT LTD | 688 | 23.95 | 1,616,000 | 4,990,838 | 1.69 |

| Consumer Discretionary | | | | | 6.01 |

| QINGLING MOTORS CO LTD | 1122 | 2.39 | 28,960,000 | 8,925,305 | 3.02 |

| SANDS CHINA LTD | 1928 | 33.75 | 810,800 | 3,528,695 | 1.20 |

| CITIGROUP GLOBAL MARKETS HOLD (exch. for CHINA CYTS TOURS HOLDIN) | N/A | 3.36 | 888,827 | 2,986,459 | 1.01 |

| LI & FUNG LTD | 494 | 3.82 | 4,690,000 | 2,310,270 | 0.78 |

| Energy | | | | | 2.15 |

| CNOOC LTD | 883 | 9.87 | 4,982,000 | 6,340,850 | 2.15 |

| Consumer Staples | | | | | 1.39 |

| WANT WANT CHINA HOLDINGS LTD | 151 | 4.73 | 3,538,000 | 2,157,971 | 0.73 |

| VINDA INTERNATIONAL HOLDINGS LTD | 3331 | 15.36 | 984,000 | 1,949,005 | 0.66 |

| Health Care | | | | | 1.02 |

| CSPC PHARMACEUTICAL GROUP LTD | 1093 | 8.04 | 2,892,000 | 2,998,340 | 1.02 |

| Utilities | | | | | 1.02 |

| CHINA RESOURCES POWER HOLDINGS CO LTD | 836 | 13.18 | 1,778,000 | 3,021,856 | 1.02 |

The China Fund, Inc.

Portfolio in Full

| Sector | Company (exchange ticker) | Market Price | Holding | Value US$ | % of net assets |

| Materials | | | | | 0.31 |

| TIANGONG INTERNATIONAL CO LTD | 826 | 0.98 | 7,246,000 | 915,695 | 0.31 |