QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrantý

|

| Filed by a Party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12

|

INFOCUS CORPORATION |

(Name of Registrant as Specified In Its Charter) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(l)(1) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

INFOCUS CORPORATION

27700B S.W. Parkway Avenue

Wilsonville, Oregon 97070

March 15, 2002

Dear Shareholders:

Our Annual Meeting of Shareholders will be held on Wednesday, April 18, 2002, at 1:00 p.m., Pacific Daylight Time, at InFocus' executive offices located at 27500 S.W. Parkway Avenue, Wilsonville, Oregon 97070. You are invited to attend this meeting to give us an opportunity to meet you personally, to allow us to introduce to you the key management of your Company and its directors, and to answer any questions you may have.

The formal Notice of Meeting, the Proxy Statement, the proxy card and a copy of the Annual Report to Shareholders describing the Company's operations for the year ended December 31, 2001 are enclosed.

I hope that you will be able to attend the meeting in person. Whether or not you plan to attend the meeting, please sign and return the enclosed proxy card promptly. A prepaid return envelope is provided for this purpose. Your shares will be voted at the meeting in accordance with your proxy.

If you have shares in more than one name, or if your stock is registered in more than one way, you may receive multiple copies of the proxy materials. If so, please sign and return each proxy card you receive so that all of your shares may be voted. I look forward to meeting you at the Annual Meeting.

| | | Very truly yours, |

|

|

INFOCUS CORPORATION |

|

|

JOHN V. HARKER

Chairman of the Board,

President and Chief Executive Officer

|

INFOCUS CORPORATION

27700B S.W. Parkway Avenue

Wilsonville, Oregon 97070

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held On April 18, 2002

To the Shareholders of InFocus Corporation:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders of INFOCUS CORPORATION (the "Company"), an Oregon corporation, will be held at InFocus' executive offices located at 27500 S.W. Parkway Avenue, Wilsonville, Oregon 97070, on Thursday, April 18, 2002, at 1:00 p.m., Pacific Daylight Time. The purposes of the Annual Meeting will be:

- 1.

- To elect the Board of Directors to serve until the next Annual Meeting of Shareholders (Proposal No. 1);

- 2.

- To ratify the appointment of Arthur Andersen LLP as the Company's independent accountants for the year ending December 31, 2002 (Proposal No. 2); and

- 3.

- To consider and act upon any other matter which may properly come before the meeting or any adjournment thereof.

The Board of Directors has fixed the close of business on February 28, 2002, as the record date for determining shareholders entitled to notice of and to vote at the meeting or any adjournment thereof. Only holders of record of Common Stock of the Company at the close of business on the record date will be entitled to notice of and to vote at the meeting and any adjournment thereof. Further information regarding voting rights and the matters to be voted upon is presented in the accompanying proxy statement.

All shareholders are cordially invited to attend the Annual Meeting. A review of the Company's operations for the year ended December 31, 2001 will be presented. WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE SIGN AND PROMPTLY RETURN THE ENCLOSED PROXY CARD, WHICH YOU MAY REVOKE AT ANY TIME PRIOR TO ITS USE. A prepaid, self-addressed envelope is enclosed for your convenience. Your shares will be voted at the meeting in accordance with your proxy. If you attend the meeting, you may revoke your proxy and vote in person.

| | | By Order of the Board of Directors, |

|

|

JOHN V. HARKER

Chairman of the Board,

President and Chief Executive Officer

|

Wilsonville, Oregon

March 15, 2002

INFOCUS CORPORATION

27700B S.W. Parkway Avenue

Wilsonville, Oregon 97070

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

To Be Held On April 18, 2002

Solicitation and Revocation of Proxies

This Proxy Statement and the accompanying Annual Report to Shareholders, the Notice of Annual Meeting and the proxy card are being furnished to the shareholders of InFocus Corporation, an Oregon corporation (the "Company"), in connection with the solicitation of proxies by the Company's Board of Directors for use at the Company's 2002 Annual Meeting of Shareholders (the "Annual Meeting") to be held at InFocus' executive offices located at 27500 S.W. Parkway Avenue, Wilsonville, Oregon 97070 on Thursday, April 18, 2002, at 1:00 p.m. Pacific Daylight Time and any adjournment thereof. The solicitation of proxies by mail may be followed by personal solicitation of certain shareholders, by officers or regular employees of the Company. All expenses of the Company associated with this solicitation will be borne by the Company.

The two persons named as proxies on the enclosed proxy card, John V. Harker and Michael D. Yonker, were designated by the Board of Directors. All properly executed proxies will be voted (except to the extent that authority to vote has been withheld) and where a choice has been specified by the shareholder as provided in the proxy card, it will be voted in accordance with the specification so made. Proxies submitted without specification will be voted FOR Proposal No. 1 to elect the nominees for directors proposed by the Board of Directors and FOR Proposal No. 2 to ratify the appointment of Arthur Andersen LLP as independent accountants for the Company.

A proxy may be revoked by a shareholder prior to its exercise by written notice to the Secretary of the Company, by submission of another proxy bearing a later date or by voting in person at the Annual Meeting. Such notice or later proxy will not affect a vote on any matter taken prior to the receipt thereof by the Company.

These proxy materials and the Company's 2001 Annual Report to Shareholders are being mailed on or about March 15, 2002 to shareholders of record on February 28, 2002 of the Company's Common Stock. The principal executive office of the Company is 27500 S.W. Parkway Avenue, Wilsonville, Oregon 97070 and the mailing address of the Company is 27700B S.W. Parkway Avenue, Wilsonville, Oregon 97070.

Voting at the Meeting

The shares of Common Stock constitute the only class of securities entitled to notice of and to vote at the meeting. In accordance with the Company's Bylaws, the stock transfer records were compiled on February 28, 2002, the record date set by the Board of Directors, for determining the shareholders entitled to notice of, and to vote at, this meeting and any adjournment thereof. On that date, there were 39,199,462 shares of Common Stock outstanding and entitled to vote.

Each share of Common Stock outstanding on the record date is entitled to one vote per share at the Annual Meeting. If a quorum is present at the Annual Meeting: (i) the six nominees for election as directors who receive the greatest number of votes cast for the election of directors by the shares of Common Stock present in person or represented by proxy at the meeting and entitled to vote shall be elected directors and (ii) Proposal No. 2 to ratify the appointment of Arthur Andersen LLP as independent accountants for the Company will be approved if the number of votes cast in favor of the proposal exceeds the number of votes cast against it.

With respect to the election of directors, directors are elected by a plurality of the votes cast and only votes cast in favor of a nominee will have an effect on the outcome. Therefore, abstention from voting or nonvoting by brokers will have no effect thereon. With respect to voting on Proposal No. 2, abstention from voting or nonvoting by brokers will have no effect thereon.

ELECTION OF DIRECTORS

(Proposal No. 1)

In accordance with the Company's Bylaws, the Board of Directors shall consist of no less than three and no more than seven directors, the specific number to be determined by resolution adopted by the Board of Directors. The Board of Directors has set the number of Directors at six, and six Directors are to be elected at the 2002 Annual Meeting of Shareholders.

Nominees for Director

The names and certain information concerning the persons to be nominated by the Board of Directors at the Annual Meeting are set forth below.THE BOARD OF DIRECTORS RECOMMENDS THAT SHAREHOLDERS VOTE FOR THE ELECTION OF EACH OF THE NOMINEES NAMED BELOW. Shares represented by proxies will be voted for the election to the Board of Directors of the persons named below unless authority to vote for a particular director or directors has been withheld in the proxy. All nominees have consented to serve as directors for the ensuing year. The Board of Directors has no reason to believe that any of the nominees will be unable to serve as a director. In the event of the death or unavailability of any nominee or nominees, the proxy holders will have discretionary authority under the proxy to vote for a suitable substitute nominee as the Board of Directors may recommend. Proxies may not be voted for more than six (6) nominees. The Board of Directors has nominated the persons named in the following table to be elected as directors:

Name

| | Age

| | Has Been a Director Since

|

|---|

| Peter D. Behrendt | | 63 | | 1995 |

| Einar J. Greve | | 41 | | 2000 |

| Michael R. Hallman | | 56 | | 1992 |

| John V. Harker | | 67 | | 1992 |

| Svein S. Jacobsen | | 50 | | 2000 |

| Nobuo Mii | | 70 | | 1997 |

Peter D. Behrendt is a director of the Company. He is a Venture Partner with New Enterprise Associates (NEA) and the Chairman of the Board of Troika Networks. He serves on the boards of Exabyte Corp., Western Digital, NanoMaterials Research, and Syvox. He is the former Chairman and Chief Executive Officer of Exabyte Corp., a publicly traded company that is the world's largest independent manufacturer focused exclusively on tape storage products, tape libraries and recording media. In addition, prior to working at Exabyte Corp., Mr. Behrendt spent 26 years in numerous executive positions at International Business Machines, Inc. ("IBM"), including worldwide responsibility for business and product planning for IBM's tape and disk drives and general management of IBM's worldwide electronic typewriter business. Mr. Behrendt is Professor of Entrepreneurship at the University of Colorado at Boulder and holds a B.S. degree in Engineering from UCLA.

Einar J. Greve was named a director of the Company upon the completion of the Company's business combination with Proxima ASA in June 2000. Mr. Greve is a lawyer and is currently a Partner in the law firm Wikborg, Rein & Co. Mr. Greve has been with Wikborg, Rein & Co. since 1992. Mr. Greve serves on several boards both as chairman and member including ANN Systems ASA, Thrane Gruppen ASA, Egroup ASA, Datum AS and other companies. Mr. Greve holds a Master of Law degree from the University of Oslo.

Michael R. Hallman is a director of the Company and is currently serving as President of The Hallman Group, a management consulting company focusing on marketing, sales, business development and strategic planning for the information systems industry. Mr. Hallman served as President and Chief Operating Officer of Microsoft Corporation from February 1990 until March 1992. From 1987 to 1990, he was Vice President of the Boeing Company and President of Boeing Computer Services. From 1967

2

to 1987, Mr. Hallman worked for IBM in various sales and marketing executive positions, with his final position being Vice President of Field Operations. Mr. Hallman holds a B.B.A. and an M.B.A. from the University of Michigan. Mr. Hallman is a member of the Board of Directors of Intuit, Inc., Network Appliance, Inc., Watch Guard Technologies and Digital Insight Corp.

John V. Harker is Chairman of the Board, and has served as President and Chief Executive Officer of the Company since April 1992. Mr. Harker served as Executive Vice President and a member of the Board of Directors of Genicom Corporation, a manufacturer of printers, from 1984 to January 1992. Mr. Harker served as Senior Vice President of Marketing and Corporate Development of Data Products, Inc. from 1982 to 1984, as Vice President and partner of Booz, Allen & Hamilton, Inc. from 1979 to 1982, and in various managerial and executive positions at IBM Corporation from 1963 to 1979. He holds a B.S. degree in Marketing from the University of Colorado.

Svein S. Jacobsen was named a director of the Company upon the completion of the Company's business combination with Proxima ASA in June 2000. Mr. Jacobsen is the former Chairman of the Board of Proxima ASA. He has an M.B.A. from the Norwegian School of Business and is also a Norwegian State Authorized Public Accountant. After having worked in an Oslo based audit firm for seven years, including three years as partner, he became Vice President Finance/CFO of Tomra Systems ASA in 1984 and President and CEO in 1988. Today, Mr. Jacobsen is a private investor and serves on several boards both as chairman and member, including Tomra Systems ASA, Orkla ASA and Sait-Stento ASA.

Nobuo Mii is a director of the Company. Mr. Mii is the Managing Partner of IGNITE Group, a venture capital firm specializing in technology investments. Previously, Mr. Mii served as a Partner with Accel Partners. From December 1995 until 1998, Mr. Mii was also the CEO and Chairman of SegaSoft Networks, Inc. Mr. Mii spent 26 years at IBM, with his final position as Corporate Vice President, General Manager of the Power Personal Systems Division. Mr. Mii holds a B.S. degree in Communication Engineering from Kyushu University in Fukuoka, Japan.

Meetings and Committees of the Board of Directors

The Board of Directors held six meetings during the year ended December 31, 2001.

The Compensation Committee and the Administrative Committee of the Company's stock plans (the "Administrative Committee") are composed of Messrs. Behrendt (Committee Chair for both committees), Hallman, Greve, Jacobsen and Mii. The Compensation Committee approves all of the policies under which compensation is paid or awarded to the Company's executive officers. The Compensation Committee is responsible for establishing compensation of executive officers who also serve on the Board of Directors. The entire Board of Directors is responsible for reviewing and providing feedback on non-director executive officer compensation with goals and dollar amounts established by the Chief Executive Officer in accordance with policies approved by the Board. During 2001, the Administrative Committee was responsible for approving grants under the Company's stock plans. The Compensation Committee held three meetings during 2001 and the Administrative Committee held five meetings during 2001.

The Audit Committee is composed of Messrs. Hallman (Committee Chair), Behrendt, Greve, Jacobsen and Mii, all of whom meet independence requirements under current National Association of Securities Dealers ("NASD") corporate governance standards. The Audit Committee reviews, with the Company's independent public accountants and representatives of management, the scope and results of audits, the appropriateness of accounting principles used in financial reporting, and the adequacy of financial and operating controls. The Audit Committee held three regular meetings in 2001. In addition to the regular meetings, the Committee Chair also reviewed the quarterly financial statements and press releases with Company management and the independent auditors prior to release.

3

The Board of Directors does not have a Nominating Committee.

Director Compensation

During 2001, non-employee directors of the Company received an $18,000 annual retainer and $2,500 for each board meeting attended. The non-employee directors were also reimbursed for their expenses in attending meetings of the Company's Board of Directors. In addition, each non-employee Director is granted an option to purchase 20,000 shares of the Company's Common Stock upon becoming a non-employee Director and, so long as he remains a non-employee Director, he is granted an option to purchase 10,000 shares of the Company's Common Stock on each date that he is re-elected to the Board at the Annual Shareholders' Meeting. Non-employee Directors also received restricted stock grants based on a ratio of one share for every two shares of the Company's Common Stock purchased during 2001. The Company pays no additional remuneration to employees of the Company who serve as directors.

The following table summarizes option and restricted stock awards during 2001 for the non-employee Directors of the Company:

Name

| | # of Shares

covered by

Options

| | Price of

Options

Granted

| | # of

Restricted

Shares

Granted

| | Value of

Restricted

Shares

Granted(A)

|

|---|

| Peter Behrendt | | 10,000 | | $19.71 | | — | | — |

| Einar J. Greve | | 10,000 | | $19.71 | | — | | — |

| Michael Hallman | | 10,000 | | $19.71 | | — | | — |

| Svein S. Jacobsen | | 10,000 | | $19.71 | | 5,000 | | $80,600 |

| Nobuo Mii | | 10,000 | | $19.71 | | — | | — |

- (A)

- Calculated based on the number of shares issued multiplied by the closing value of the Company's Common Stock on the day of issue.

Audit Committee Report

The Audit Committee of the Board of Directors reports to the Board and is comprised of five directors, all of whom met independence requirements under current National Association of Securities Dealers corporate governance standards. The Audit Committee's activities are governed by a written charter, which was adopted by the Board in January 2000.

Management is responsible for the Company's internal controls and the financial reporting process. The independent accountants are responsible for performing an independent audit of the Company's consolidated financial statements in accordance with generally accepted auditing standards and to issue a report thereon. The Audit Committee's responsibility is to monitor and oversee these processes.

In discharging its responsibilities, the Audit Committee and its individual members have met with management and InFocus' independent auditors, Arthur Andersen LLP, to review the Company's accounting functions, the audited financial statements for the year ended December 31, 2001 and the audit process. The Audit Committee discussed and reviewed with its independent auditors all matters that the independent auditors were required to communicate and discuss with the Audit Committee under applicable auditing standards, including those described in Statement on Auditing Standards No. 61, as amended, regarding communications with audit committees. Audit Committee members also discussed and reviewed the results of the independent auditors' examination of the financial statements, the quality and adequacy of the Company's internal controls, and issues relating to auditor independence. The Audit Committee has obtained a formal written statement relating to independence consistent with Independence Standards Board Standard No. 1, "Independence Discussions with Audit

4

Committee," and discussed with the auditors any relationships that may impact their objectivity and independence.

Based on its review and discussions with management and InFocus' independent auditors, the Audit Committee recommended to the Board that the audited Financial Statements be included in InFocus' Annual Report on Form 10-K for the fiscal year ended December 31, 2001 for filing with the United States Securities and Exchange Commission.

Submitted by the Audit Committee of the Board of Directors:

| Mr. Hallman | | Mr. Jacobsen |

| Mr. Behrendt | | Mr. Mii |

| Mr. Greve | | |

SELECTION OF INDEPENDENT ACCOUNTANTS

(Proposal No. 2)

The Board of Directors has appointed Arthur Andersen LLP, independent accountants, as auditors of the Company for the year ending December 31, 2002, subject to ratification by the shareholders. In the absence of contrary specifications, the shares represented by the proxies will be voted FOR the appointment of Arthur Andersen LLP as the Company's independent accountants for the year ending December 31, 2002.

A representative of Arthur Andersen LLP is expected to be present at the Annual Meeting. The representative will be given the opportunity to make a statement on behalf of his firm if such representative so desires, and will be available to respond to appropriate shareholder questions. Arthur Andersen LLP was the Company's independent accountant for the year ended December 31, 2001.

Fees Paid to Auditors Related to Fiscal 2001

| Audit Fees | | $ | 495,000 |

| Financial Information Systems Design and Implementation Fees | | | — |

| All Other Fees | | | |

| | Audit Related | | | 215,000 |

| | Other(A) | | | 1,020,000 |

| | |

|

| | | Total All Other Fees | | | 1,235,000 |

| | |

|

| | Total | | $ | 1,730,000 |

| | |

|

- (A)

- Principally represents various forms of tax compliance assistance, both foreign and domestic.

The Audit Committee has determined that the provision of non-audit services by Arthur Andersen LLP is compatible with maintaining the independence of Arthur Andersen LLP.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE RATIFICATION OF THE APPOINTMENT OF ARTHUR ANDERSEN LLP AS INDEPENDENT ACCOUNTANTS OF THE COMPANY FOR THE YEAR ENDING DECEMBER 31, 2002.

5

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of February 28, 2002, certain information furnished to the Company with respect to ownership of the Company's Common Stock of (i) each Director, (ii) the "named executive officers" (as defined under "Executive Compensation"), (iii) all persons known by the Company to be beneficial owners of more than 5 percent of its Common Stock, and (iv) all current executive officers and Directors as a group.

| | Common Stock(A)

| |

|---|

Shareholder

| | Number of

Shares(B)

| | Percent of Shares

Outstanding

| |

|---|

Mellon Financial Corporation(C)

One Mellon Center

Pittsburgh, Pennsylvania 15258 | | 2,681,340 | | 6.8 | % |

High Rock Capital LLC(D)

28 State Street, 18th Floor Boston,

Massachusetts 02109 |

|

2,503,900 |

|

6.4 |

% |

Perkins, Wolf, McDonnell & Company(E)

310 S. Michigan Avenue, Suite 2600

Chicago, Illinois 60604 |

|

2,358,392 |

|

6.0 |

% |

John V. Harker |

|

639,390 |

|

1.6 |

% |

Ole J. Fredriksen(F) |

|

373,394 |

|

* |

|

Michael R. Hallman |

|

154,793 |

|

* |

|

Gary R. Pehrson |

|

150,439 |

|

* |

|

Peter D. Behrendt |

|

127,638 |

|

* |

|

William D. Yavorsky(G) |

|

88,471 |

|

* |

|

Nobuo Mii |

|

75,492 |

|

* |

|

Svein S. Jacobsen |

|

67,113 |

|

* |

|

Einar J. Greve(H) |

|

35,423 |

|

* |

|

Lucinda K. Rockwell |

|

26,895 |

|

* |

|

E. Scott Hildebrandt |

|

— |

|

— |

|

All current executive officers and directors as a group (13 persons)(I) |

|

1,752,573 |

|

4.4 |

% |

- *

- Less than one percent

6

- (A)

- Applicable percentage of ownership is based on 39,199,462 shares of Common Stock outstanding as of February 28, 2002 together with applicable options for such shareholders. Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission, and includes voting and investment power with respect to shares. Shares of Common Stock subject to options or warrants currently exercisable or exercisable within 60 days after February 28, 2002 are deemed outstanding for computing the percentage ownership of the person holding such options or warrants, but are not deemed outstanding for computing the percentage of any other person.

- (B)

- Includes shares of common stock subject to options exercisable within 60 days after February 28, 2002 as follows:

Name

| | Number of Options

|

|---|

| John V. Harker | | 510,658 |

| Ole J. Fredriksen | | 42,500 |

| Michael R. Hallman | | 94,793 |

| Gary R. Pehrson | | 127,520 |

| Peter D. Behrendt | | 81,881 |

| William D. Yavorsky | | 51,280 |

| Nobuo Mii | | 38,822 |

| Svein S. Jacobsen | | 30,000 |

| Einar J. Greve | | 30,000 |

| Lucinda K. Rockwell | | 21,095 |

| All current executive officers and Directors as a group | | 1,041,074 |

- (C)

- Information obtained from Schedule 13G filed by Mellon Financial Corporation ("Mellon"). Mellon is a parent holding company and has the following voting and dispositive powers with respect to the 2,681,340 shares:

| Sole voting power | | 2,280,460 |

| Shared voting power | | 235,800 |

| Sole dispositive power | | 2,635,140 |

| Shared dispositive power | | 29,000 |

- (D)

- Information obtained from Schedule 13G filed by High Rock Capital LLC ("High Rock"). High Rock is an investment advisor in accordance with Rule 13d. High Rock has sole voting and dispositive power with respect to all 2,503,900 shares.

- (E)

- Information obtained from Schedule 13G filed by Perkins, Wolf, McDonnell & Company ("Perkins Wolf"). Perkins Wolf is an investment advisor in accordance with Rule 13d and has the following voting and dispositive powers with respect to the 2,358,392 shares:

| Sole voting power | | 25,692 |

| Shared voting power | | 2,332,700 |

| Sole dispositive power | | 25,692 |

| Shared dispositive power | | 2,332,700 |

- (F)

- Includes 25,000 shares held by Mr. Fredriksen's wife.

- (G)

- Includes 700 shares held by Mr. Yavorsky's wife in her 401(k) Plan.

- (H)

- Includes 5,423 shares held by Sorrento AS, a company that is 100% owned by Mr. Greve's wife.

- (I)

- Includes 25,000 shares held by Mr. Fredriksen's wife, 700 shares held by Mr. Yavorsky's wife in her 401(k) Plan and 5,423 shares held by Sorrento AS, a company that is 100% owned by Mr. Greve's wife.

7

EXECUTIVE OFFICERS

The following table identifies the executive officers of the Company as of February 28, 2002, the positions they hold and the year in which they began serving in their respective capacities. Officers of the Company are elected by the Board of Directors to hold office until their successors are elected and qualified.

Name

| | Age

| | Current Position(s) with Company

| | Officer

Since

|

|---|

| John V. Harker | | 67 | | Chairman of the Board, President and Chief Executive Officer | | 1992 |

Peter Krogh |

|

44 |

|

Senior Vice President and General Manager of Europe, Middle East, Africa and Asia Pacific |

|

2002 |

Gary R. Pehrson |

|

56 |

|

Executive Vice President, Worldwide Research, Development and Operations |

|

1998 |

Candace Petersen, Ph.D. |

|

49 |

|

Vice President, Product Management and Services |

|

2002 |

Lucinda K. Rockwell |

|

43 |

|

Vice President, Human Resources |

|

2001 |

William D. Yavorsky |

|

45 |

|

Senior Vice President and General Manager of the Americas Business Unit |

|

1997 |

Michael D. Yonker |

|

44 |

|

Senior Vice President and Chief Financial Officer |

|

2002 |

For information on the business background of Messrs. Harker and Fredriksen see "Nominees For Director" above.

Peter Krogh joined the Company in August 2000 as Senior Vice President for Europe, Middle East and Africa Business Units and was promoted in January 2002 to Senior Vice President and General Manager of Europe, Middle East, Africa and Asia Pacific. At this time, he also became an executive officer of the Company. From 1998 until joining the Company, Mr. Krogh was the Managing Director for Publicis Group, Europe's largest advertising and communication firm. From 1995 until joining Publicis, Mr. Krogh was the President of FilmNet International and the Chief Executive Officer of NetHold Nordic. Mr. Krogh holds an M.B.A. degree from the University of Lund in Sweden.

Gary R. Pehrson joined the Company in January 1998 as Senior Vice President, Operations. In April 2001, Mr. Pehrson was named Executive Vice President Worldwide Research, Development and Operations. Prior to joining InFocus, Mr. Pehrson was with St. Jude Corporation, a medical device company for 3 years where he was Executive Vice President and General Manager. Prior to that, he was with Verbatim Corporation for over 5 years as Senior Vice President. Prior to that, Mr. Pehrson worked for Control Data Corporation for over 18 years in various Senior Management roles. Mr. Pehrson holds a B.S. degree in Business from the University of Nebraska.

Candace Petersen, Ph.D. joined InFocus in November 2000 as Vice President of Product Management and Services. In January 2002, Dr. Petersen was named as an executive officer of the Company. From August 1997 until joining the Company, Dr. Petersen served as associate professor at Portland State University's M.B.A. program and was Principal and Founder of Petersen and Prusia, an advanced display industry consulting firm. From August 1993 until June 1997, Dr. Petersen was employed at InFocus with her final position as the Director of Marketing. Dr. Petersen holds a B.A.

8

degree in Mathematics and Economics from Virginia Tech, and M.B.A. and Ph.D. degrees from Portland State University.

Lucinda K. Rockwell was promoted to Vice President, Human Resources in April 2001. Ms. Rockwell joined InFocus in 1995 and has served in various Human Resource positions since that time. Prior to joining InFocus, Ms. Rockwell served in human resource management positions at various companies for a total of 14 years. Ms. Rockwell holds a B.A. degree in Industrial Psychology from Purdue University and an M.A. degree in Industrial Relations from the University of Minnesota.

William D. Yavorsky was promoted to Vice President, Worldwide Sales in April 1997 and in June 2000 was promoted to Senior Vice President and General Manager of the Americas Business Unit. Mr. Yavorsky joined the Company in August 1993 as Manager, Strategic Relationships. In January 1995, Mr. Yavorsky was promoted to Director, Strategic Relationships, International Sales and in July 1996 he was promoted to Director, Worldwide Sales. In October 1996, Mr. Yavorsky was promoted to Vice President, Sales. From February 1992 until joining the Company, Mr. Yavorsky was a Channel Sales Manager for Tektronix Corporation. Mr. Yavorsky holds a B.S. degree in Business Administration from Bowling Green State University.

Michael D. Yonker, C.P.A. joined InFocus in January 2002 as Senior Vice President and Chief Financial Officer. From July 1998 until joining the Company, Mr. Yonker was the Chief Financial Officer of Weiden and Kennedy, a leading advertising agency. From July 1993 until July 1998, Mr. Yonker served as Vice President, Information Services, Chief Financial Officer, Treasurer and Secretary of InFocus. Prior to that time, Mr. Yonker was the Partner in Charge of Northwest Manufacturing Industry at Arthur Andersen LLP specializing in process improvement, total quality and performance measurement systems for the manufacturing industry. Mr. Yonker graduated from Linfield College in 1980 with a B.S. degree in Accounting and Finance.

9

EXECUTIVE COMPENSATION

Summary of Cash and Certain Other Compensation

The following table provides certain summary information concerning compensation awarded to, earned by or paid to the Company's Chief Executive Officer, each of the three other executive officers of the Company who earned more than $100,000 during 2001 and two additional individuals who would have been included except for the fact that they were no longer executive officers of the Company as of December 31, 2001 (herein referred to as the "named executive officers") for the fiscal years ended December 31, 2001, 2000 and 1999.

SUMMARY COMPENSATION TABLE

| |

| | Annual Compensation

| | Long-Term

Compensation

Awards

| |

|

|---|

Name and Principal

Position

| | Year

| | Salary

($)(A)

| | Bonus

($)(A)

| | Other Annual

Compensation

($)

| | Restricted

Stock

Awards($)

(B)

| | Securities

Underlying

Options(#)

| | All Other

Compensation

($)(C)

|

|---|

| John V. Harker | | 2001 | | $ | 544,243 | | $ | 41,799 | | — | | $ | 105,700 | | 110,000 | | $ | 36,938 |

| Chairman of the | | 2000 | | | 451,863 | | | 567,779 | | — | | | 210,000 | | 90,000 | | | 28,426 |

| Board, President and | | 1999 | | | 418,470 | | | 1,064,058 | | — | | | 97,815 | | — | | | 9,954 |

| Chief Executive Officer | | | | | | | | | | | | | | | | | | |

Gary R. Pehrson |

|

2001 |

|

|

311,939 |

|

|

26,157 |

|

— |

|

|

— |

|

30,000 |

|

|

14,724 |

| Executive Vice | | 2000 | | | 264,965 | | | 170,958 | | — | | | 96,938 | | 20,000 | | | 26,653 |

| President, Worldwide | | 1999 | | | 251,077 | | | 205,069 | | — | | | 71,971 | | — | | | 11,921 |

Research, Development

and Operations | | | | | | | | | | | | | | | | | | |

William D. Yavorsky |

|

2001 |

|

|

271,508 |

|

|

24,156 |

|

— |

|

|

— |

|

40,000 |

|

|

2,005 |

| Senior Vice President | | 2000 | | | 229,000 | | | 138,818 | | — | | | 142,657 | | 15,000 | | | 9,690 |

| and General Manager, | | 1999 | | | 209,231 | | | 188,729 | | — | | | 102,815 | | — | | | 2,167 |

| Americas Business Unit | | | | | | | | | | | | | | | | | | |

Lucinda K. Rockwell(D) |

|

2001 |

|

|

179,393 |

|

|

17,471 |

|

— |

|

|

34,493 |

|

10,000 |

|

|

1,072 |

Vice President, Human

Resource | | | | | | | | | | | | | | | | | | |

E. Scott Hildebrandt(E) |

|

2001 |

|

|

286,958 |

|

|

24,797 |

|

— |

|

|

— |

|

30,000 |

|

|

8,798 |

| Former Senior Vice | | 2000 | | | 242,118 | | | 191,542 | | — | | | 163,948 | | 15,000 | | | 10,381 |

| President, Finance, | | 1999 | | | 121,192 | | | 134,358 | | — | | | 10,282 | | 100,000 | | | 1,573 |

Chief Financial Officer

and Secretary | | | | | | | | | | | | | | | | | | |

Ole J. Fredriksen(F) |

|

2001 |

|

|

189,219 |

|

|

10,779 |

|

— |

|

|

— |

|

— |

|

|

9,531 |

| Vice Chairman of the | | 2000 | | | 83,333 | | | 74,111 | | — | | | — | | 170,000 | | | 4,583 |

| Board | | | | | | | | | | | | | | | | | | |

- (A)

- Amounts shown include cash compensation earned in each respective year. Amounts under the Bonus column include an annual bonus in 2000 and 1999 and 401(k) matching payments and quarterly profit sharing in all years.

10

- (B)

- Restricted stock held by each of the named executive officers and the value thereof, calculated by multiplying the number of shares by the closing price of the Company's stock on December 31, 2001, $22.02, is as follows:

Name

| | Restricted

Shares held

| | Value

|

|---|

| John V. Harker | | 20,000 | | $ | 440,400 |

| Gary R. Pehrson | | 7,500 | | | 165,150 |

| William D. Yavorsky | | 10,047 | | | 221,235 |

| Ole J. Fredriksen | | — | | | — |

| Lucinda K. Rockwell | | 1,750 | | | 38,535 |

| E. Scott Hildebrandt | | — | | | — |

- (C)

- All other compensation in 2001 includes the following:

Name

| | Financial

Planning

| | Tax

Preparation

| | Insurance

Premiums

| | Imputed

Interest

| | Auto

Allowance

|

|---|

| John V. Harker | | $ | 16,180 | | $ | 805 | | $ | 19,953 | | $ | — | | $ | — |

| Gary R. Pehrson | | | 7,071 | | | — | | | 4,306 | | | 3,347 | | | — |

| William D. Yavorsky | | | — | | | — | | | 2,005 | | | — | | | — |

| Ole J. Fredriksen | | | — | | | — | | | 256 | | | — | | | 9,275 |

| Lucinda K. Rockwell | | | — | | | — | | | 1,072 | | | — | | | — |

| E. Scott Hildebrandt | | | 7,071 | | | — | | | 1,727 | | | — | | | — |

- (D)

- Ms. Rockwell became an officer of the Company in April 2001, therefore her 2000 and 1999 compensation information is not included.

- (E)

- Mr. Hildebrandt's 2001 salary includes amounts earned in 2001 through his termination date in November 2001. The 1999 salary amount for Mr. Hildebrandt includes salary earned from the time he joined the Company in July 1999 through December 1999.

- (F)

- Mr. Fredriksen's 2000 salary includes amounts earned since joining the Company upon the completion of the Company's business combination with Proxima Corp. in June 2000. While Mr. Fredriksen remains an employee of InFocus and a member of its Board of Directors, as of April 2001, he no longer served as an executive officer. Subsequent to April 2002, Mr. Fredriksen will no longer serve on the Company's Board of Directors.

Stock Options

The following table contains information concerning the grant of stock options under the Company's 1998 Stock Incentive Plan (the "Plan") to the named executive officers in 2001.

11

OPTION GRANTS IN LAST FISCAL YEAR

| | Individual Grants(A)(B)

| |

| |

| | Potential

Realizable Value

At Assumed Annual

Rates of Stock Price

Appreciation for

Option Term (C)

|

|---|

Name

| | Number of

Securities

Underlying

Options

Granted

| | % of Total

Options

Granted to

Employees in

Fiscal Year

| | Exercise

Price($/Sh.)

| | Expiration

Date

| | 5%($)

| | 10%($)

|

|---|

| John V. Harker | | 110,000 | | 8.0 | % | $ | 21.81 | | 01/24/11 | | $ | 1,508,989 | | $ | 3,824,073 |

Gary R. Pehrson |

|

30,000 |

|

2.2 |

|

|

21.81 |

|

01/24/11 |

|

|

411,542 |

|

|

1,042,929 |

William D. Yavorsky |

|

40,000 |

|

2.9 |

|

|

21.81 |

|

01/24/11 |

|

|

548,723 |

|

|

1,390,572 |

Lucinda K. Rockwell |

|

10,000 |

|

0.7 |

|

|

21.81 |

|

01/24/11 |

|

|

137,181 |

|

|

347,643 |

E. Scott Hildebrandt |

|

30,000 |

(D) |

2.2 |

|

|

21.81 |

|

01/24/11 |

|

|

411,542 |

|

|

1,042,929 |

Ole J. Fredriksen |

|

— |

|

— |

|

|

— |

|

— |

|

|

— |

|

|

— |

- (A)

- Options granted in 2001 vest as to 25 percent of the options granted on each of the first through fourth anniversaries of the grant date, with full vesting occurring on the fourth anniversary date. Under the terms of the Plan, the Administrative Committee of the Board of Directors retains discretion, subject to Plan limits, to modify the terms of outstanding options.

- (B)

- Options held by all executive officers of the Company become immediately exercisable, without regard to any contingent vesting provision to which such option may otherwise be subject, in the event of the occurrence of a Change in Control.

- (C)

- These calculations are based on certain assumed annual rates of appreciation as required by rules adopted by the Securities and Exchange Commission requiring additional disclosure regarding executive compensation. Under these rules, an assumption is made that the shares underlying the stock options shown in this table could appreciate at rates of 5% and 10% per annum on a compounded basis over the ten-year term of the stock options. Actual gains, if any, on stock option exercises are dependent on the future performance of the Company's Common Stock and overall stock market conditions. There can be no assurance that amounts reflected in this table will be achieved.

- (D)

- Mr. Hildebrandt's options were canceled upon his termination in November 2001.

Option Exercises and Holdings

The following table provides information concerning the exercise of options during 2001 and unexercised options held as of the end of the fiscal year, with respect to the named executive officers.

12

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR

AND FY-END OPTION VALUES

Name

| | Number of

Shares

Acquired

On Exercise

| | Value

Realized

(A)

| | Number of

Underlying

Securities

Unexercised

Options

At FY-End

Exercisable/

Unexercisable

| | Value of Unexercised

In-The-Money Options

At FY-End (B)

Exercisable/

Unexercisable

|

|---|

| John V. Harker | | 10,000 | | $ | 202,770 | | 421,235 / 236,923 | | $1,222,065 / $208,740 |

| Gary R. Pehrson | | 12,000 | | | 206,289 | | 115,020 / 70,000 | | 135,890 / 260,925 |

| William D. Yavorsky | | — | | | — | | 24,390 / 71,890 | | 78,278 / 78,278 |

| Lucinda K. Rockwell | | — | | | — | | 17,970 / 28,440 | | 121,297 / 70,503 |

| E. Scott Hildebrandt | | 25,000 | | | 265,325 | | 3,750 / — | | — / — |

| Ole J. Fredriksen | | — | | | — | | 42,500 / 127,500 | | — / — |

- (A)

- Market value of the underlying securities at exercise date, minus exercise price of the options.

- (B)

- Market value of the underlying securities at December 31, 2001, $22.02 per share, minus exercise price of the unexercised options.

Long-Term Incentive Plan Awards

The following table provides information concerning the grant of restricted stock pursuant to the 1998 Stock Incentive Plan during 2001 with respect to the named executive officers. Restricted stock grants are one vehicle to aid officers and directors in achieving certain ownership guidelines.

Name

| | Number Of

Shares(#)(A)

| | Period Until

Maturation(B)

|

|---|

| John V. Harker | | 5,000 | | 3 years |

| Gary R. Pehrson | | — | | — |

| William D. Yavorsky | | — | | — |

| Lucinda K. Rockwell | | 1,750 | | 3 years |

| E. Scott Hildebrandt | | — | | — |

| Ole J. Fredriksen | | — | | — |

- (A)

- Shares were issued based on a ratio of one share for every two shares purchased during 2001 up to a maximum of 5,000 shares per person for qualifying purchases made during any one calendar year.

- (B)

- Each share of restricted stock vests at the end of a three-year period of continuous service as an elected or appointed officer or director of the Company, beginning with the date of the qualifying purchase. However, if the shares held or purchased that resulted in the restricted shares being issued are sold prior to the end of the three-year vesting period, a proportionate number of restricted shares as the shares sold will vest at the end of a nine-year period of continuous service as an elected or appointed officer or director of the Company. Any unvested restricted stock will become fully vested immediately prior to a consummation of a reorganization resulting in a Change in Control.

13

EMPLOYMENT CONTRACTS AND TERMINATION OF EMPLOYMENT AND

CHANGE-IN-CONTROL ARRANGEMENTS

Executive Severance Pay Plan

The Executive Severance Pay Plan (the "Executive Plan") provides for the payment of severance benefits to persons currently serving as executives of InFocus. Under the Executive Plan, covered executives are entitled to receive severance benefits in the event we terminate their employment without cause. In addition, a covered executive is entitled to severance benefits in the event the executive terminates his/her employment for "good reason." In general, an executive has "good reason" to terminate employment if, within 18 months after a "change-in-control," one of the following occurs: substantial alteration of the executive's duties or responsibilities; material reduction of the executive's pay or benefits; relocation of the executive's place of employment by more than 35 miles; or failure to pay the executive's compensation within 10 days of the date it is due.

For executives holding Vice President or Senior Vice President titles, the amount of severance or retention benefits payable under the Executive Plan is 12 months of salary continuation. For executives holding Chief Executive Officer and/or President titles, the period of salary continuation is 24 months. In addition to salary continuation, the executives receive a lump sum payment covering the cost of continuing the executive's health insurance during the period of salary continuation, as well as outplacement services for the salary continuation period. The amount of severance pay is subject to reduction in the event any portion of the payment would be subject to the excise tax imposed under the so-called "Golden Parachute" provisions of the Internal Revenue Code.

In order to receive severance or retention benefits under the Executive Plan, covered executives must sign a release of any claims against InFocus. In addition, severance payments may be immediately terminated in the event the executive discloses any of our confidential information or violates certain noncompetition provisions.

Stock Option Agreements

The stock option agreements of all executive officers of the Company provide that all options held shall become immediately exercisable, without regard to any contingent vesting provision to which such option may otherwise be subject, in the event of the occurrence of a change-in-control. In addition, any unvested restricted stock will become fully vested immediately prior to a consummation of a reorganization resulting in a change-in-control.

For officers who were with Proxima prior to the business combination, which was completed in June 2000, upon termination without cause or resignation for good reason, all options held by such officer prior to the share exchange shall become immediately exercisable, without regard to any contingent vesting provision to which such option may otherwise be subject.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The Compensation Committee of the Board of Directors is composed of Messrs. Behrendt (Committee Chair), Hallman, Greve, Jacobsen and Mii. All members of the Compensation Committee are non-employee, outside directors. Although Mr. Harker, the Company's Chief Executive Officer, served on the Company's Board of Directors in 2001 and participated in compensation discussions, he did not participate in any deliberations or decisions regarding his own compensation.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

In March 2001, the Company made an equity investment in Phoenix Electric, Co., Ltd. of Himeji-City, Japan. IGNITE Group of Japan, for which Nobuo Mii is the Managing Partner, provided certain business and legal due diligence assistance for this investment. The Company paid IGNITE

14

Group $88,372 for its services, which the Company considers to be an "arm's length rate." Nobuo Mii is on the Company's Board of Directors.

BOARD COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The Compensation Committee of the Board of Directors is composed of Messrs. Behrendt (Committee Chair), Greve, Hallman, Jacobsen and Mii. All members of the Compensation Committee are non-employee, outside directors. The Compensation Committee is responsible for establishing compensation of officers who also serve on the Board of Directors. The entire Board is responsible for reviewing and providing feedback on non-director executive officer compensation with goals and dollar amounts established by the Chief Executive Officer in accordance with policies approved by the Board. Awards to executive officers under the Company's stock option plans are made solely by the Administrative Committee, which is composed of the same non-employee, outside Directors as the Compensation Committee.

Compensation Philosophy and Policies

The Company's philosophy is to structure executive officer compensation so that it will attract, motivate and retain senior management by providing an opportunity for competitive compensation based on performance. Executive officer compensation includes competitive base salaries, annual bonus plans based on Company financial and personal performance goals, and long-term stock-based incentive opportunities in the form of options exercisable to purchase the Company's Common Stock and matching grants of restricted stock when an officer purchases and holds Common Stock of the Company. It is also the policy of both the Compensation Committee and the Administrative Committee that, to the extent possible, compensation will be structured so that it meets the "performance-based" criteria as defined by Section 162(m) of the Internal Revenue Code of 1986, as amended and therefore is not subject to federal income tax deduction limitations. Both the Compensation Committee and the Administrative Committee have the right to waive pre-established performance criteria in granting awards.

Base Salaries

In setting base salaries that were competitive with other high technology companies, the Company participated in and reviewed an executive salary survey conducted by Radford Associates. When selecting comparables, the Company attempted to select companies that were similar in many respects, including industry, annual revenue and profitability. Executives' salaries paid in 2001 were targeted within the 60th to 75th percentile compared to the range of salaries paid by companies in the salary survey mentioned above. Many of the companies included in the above mentioned survey are also included in the indices used in the Performance Graph.

Annual Bonus Awards for 2001

The 2001 Officer Bonus Plan (the "Plan") provided for annual bonuses in two components. First, the Plan provided for quarterly profit sharing bonuses equal to a percentage of each officer's quarterly salary. This percentage was determined by dividing the quarterly non-officer profit sharing bonus pool (5 percent of pre-tax income) paid quarterly to non-officer employees by total non-officer compensation for the quarter. The percentages paid were approximately 7.3%, 7.0%, 4.6% and 3.3% for the first through fourth quarters of 2001, respectively. The fourth quarter profit sharing was paid in the first quarter of 2002.

Second, the Plan provided for the payment of executive officer bonuses (other than the Chief Executive Officer and the Senior Vice President and General Manager of the Americas Business Unit) based 70 percent on InFocus meeting its 2001 profit before income tax objectives and 30 percent on

15

meeting individual goals and objectives. The Chief Executive Officer bonus was based 100 percent on meeting the profit before income tax objectives. The Senior Vice President and General Manager of the Americas Business Unit bonus was based 50 percent on meeting profit before income taxes and 50 percent on the Americas Business Unit results. The targeted bonus was 75 percent of annual salary for the Chief Executive Officer and between 35 percent and 55 percent of annual salary for all other executive officers. A 2.5 percent accelerator was to be applied to the bonus amount for achieving greater than 100% of the targeted profit before income tax. The profit before income tax target amount had to be met at the 50 percent level or greater and the individual goals and objectives had to be met at the 75 percent level or greater for an officer to receive any bonus under this portion of the Plan. Due to the Company not meeting the profit before income tax objective, no bonuses were paid under this portion of the Plan for 2001 performance.

Stock Option Awards for 2001

The Company's 1998 Stock Incentive Plan provides for the issuance of incentive and non-qualified stock options to officers and employees of the Company to purchase shares of the Company's Common Stock at an exercise price equal to the fair market value on the date of grant. See "Option Grants in Last Fiscal Year" table for a summary of options granted to the named executive officers during 2001.

Restricted Stock Awards for 2001

The Company's 1998 Stock Incentive Plan provides for the granting of restricted stock to officers, employees and consultants, including non-employee board members, of the Company. During 2001, the officers of the Company received restricted stock based on a ratio of one share for every two shares purchased between January 1, 2001 and December 31, 2001, up to a maximum of 5,000 shares per person. See "Long-Term Incentive Plans—Awards in Last Fiscal Year" table for a summary of restricted stock granted to the named executive officers during 2001.

Chief Executive Officer Compensation

Mr. Harker's 2001 base salary and annual bonus were determined in the same manner as the other executives as described in "Base Salaries" and "Annual Bonus Awards for 2001" above. The Compensation Committee's objective in setting Mr. Harker's 2001 compensation was to be competitive with other companies in the Company's industry and to allow for potential compensation based on long-term performance criteria as defined in "Annual Bonus Awards for 2001", "Stock Option Awards for 2001" and "Long-Term Incentive Plans—Awards in Last Fiscal Year" above.

SUBMITTED BY THE COMPENSATION COMMITTEE OF THE BOARD OF DIRECTORS:

| Peter D. Behrendt (Committee Chair) | | Svein S. Jacobsen |

| Einar J. Greve | | Nobou Mii |

| Michael R. Hallman | | |

16

STOCK PERFORMANCE GRAPH

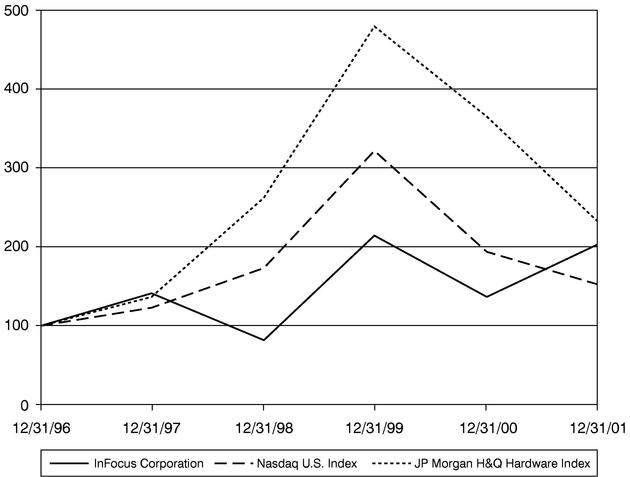

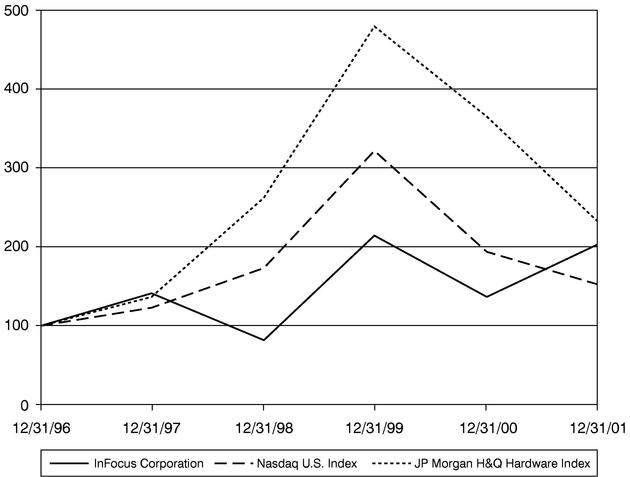

The SEC requires that registrants include in their proxy statement a line-graph presentation comparing cumulative five-year shareholder returns on an indexed basis, assuming a $100 initial investment and reinvestment of dividends, of (a) the registrant, (b) a broad-based equity market index and (c) an industry-specific index. The broad-based market index used is the Nasdaq Stock Market Total Return Index—U.S. and the industry-specific index used is the JP Morgan H&Q Hardware Index.

| |

| | Indexed Returns Year Ending

|

|---|

Company/Index

| | Base

Period

12/31/96

|

|---|

| | 12/31/97

| | 12/31/98

| | 12/31/99

| | 12/31/00

| | 12/31/01

|

|---|

| InFocus Corporation | | $ | 100.00 | | $ | 140.46 | | $ | 82.08 | | $ | 214.45 | | $ | 136.42 | | $ | 203.65 |

| Nasdaq U.S. Index | | | 100.00 | | | 122.48 | | | 172.68 | | | 320.89 | | | 193.01 | | | 153.15 |

| JP Morgan | | | | | | | | | | | | | | | | | | |

| H&Q Hardware Index | | | 100.00 | | | 136.14 | | | 261.56 | | | 478.93 | | | 364.61 | | | 233.38 |

17

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the 1934 Act requires the Company's directors and executive officers and persons who own more than ten percent of the outstanding shares of the Company's Common Stock ("ten percent shareholders"), to file with the SEC initial reports of beneficial ownership and reports of changes in beneficial ownership of shares of Common Stock and other equity securities of the Company. To the Company's knowledge, based solely on review of the copies of such reports furnished to the Company or otherwise in its files and on written representations from its directors, executive officers and ten percent shareholders that no other reports were required, during the fiscal year ended December 31, 2001, the Company's officers, directors and ten percent shareholders complied with all applicable Section 16(a) filing requirements.

SHAREHOLDER PROPOSALS

Proposals by shareholders intended to be included in the Company's Proxy Statement for its 2003 Annual Meeting must be received by the Company at its principal executive office no later than November 15, 2002. According to the Company's bylaws, proposals by shareholders intended to be presented at the Company's 2003 Annual Meeting must be received by the Company at its principal executive office no later than sixty calendar days (February 17, 2003) and no earlier than 90 calendar days (January 18, 2003) prior to the first anniversary of the preceding year's annual meeting.

TRANSACTION OF OTHER BUSINESS

As of the date of this Proxy Statement, the Board of Directors is not aware of any other matters that may come before this meeting. It is the intention of the persons named in the enclosed proxy to vote the proxy in accordance with their best judgment if any other matters do properly come before the meeting. Please return your proxy as soon as possible. Unless a quorum consisting of a majority of the outstanding shares entitled to vote is represented at the meeting, no business can be transacted. Please act promptly to insure that you will be represented at this important meeting.

The Company will provide, without charge, on the written request of any beneficial owner of shares of the Company's Common Stock entitled to vote at the Annual Meeting of Shareholders, a copy of the Company's Annual Report on Form 10-K as filed with the U.S. Securities and Exchange Commission for the Company's fiscal year ended December 31, 2001. Written requests should be mailed to the Secretary, InFocus Corporation, 27700B SW Parkway Avenue, Wilsonville, Oregon 97070.

| | | By Order of the Board of Directors: |

|

|

JOHN V. HARKER

Chairman of the Board,

President and Chief Executive Officer

|

Dated: March 15, 2002

18

INFOCUS CORPORATION

Proxy for Annual Meeting of Shareholders to be Held on April 18, 2002

The undersigned hereby names, constitutes and appoints John V. Harker and Michael D. Yonker, or either of them acting in absence of the other, with full power of substitution, my true and lawful attorneys and Proxies for me and in my place and stead to attend the Annual Meeting of the Shareholders of InFocus Corporation (the "Company") to be held at 1:00 p.m. on Thursday, April 18, 2002, and at any adjournment thereof, and to vote all the shares of Common Stock held of record in the name of the undersigned on February 28, 2002, with all the powers that the undersigned would possess if he were personally present.

| 1. | | PROPOSAL 1—Election of Directors | | o FOR all nominees listed below |

| | | | | o WITHHOLD AUTHORITY to vote for all nominees listed below |

To withhold authority to vote for any individual nominee, strike a line through the nominee's name in the list below: |

|

|

Peter D. Behrendt |

|

Einar J. Greve |

|

Michael R. Hallman |

|

|

John V. Harker |

|

Svein S. Jacobsen |

|

Nobuo Mii |

|

|

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTEFOR EACH OF

THE NOMINEES NAMED ABOVE.

|

2. |

|

PROPOSAL 2—To ratify the appointment of Arthur Andersen LLP as the Company's independent accountants for the year ending December 31, 2002. |

|

|

FOR PROPOSAL 2 o |

|

AGAINST PROPOSAL 2 o |

|

ABSTAIN ON PROPOSAL 2 o |

|

|

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTEFOR THE

APPROVAL OF PROPOSAL 2 |

3. |

|

Upon such other matters as may properly come before, or incident to the conduct of the Annual Meeting, the Proxy holders shall vote in such manner as they determine to be in the best interests of the Company. Management is not presently aware of any such matters to be presented for action at the meeting. |

THIS PROXY IS SOLICITED BY THE MANAGEMENT OF THE COMPANY. IF NO SPECIFIC DIRECTION IS

GIVEN AS TO ANY OF THE ABOVE ITEMS, THIS PROXY WILL BE VOTED FOR EACH OF THE

NOMINEES NAMED IN PROPOSAL 1 AND FOR PROPOSAL 2.

| Signature(s) | | | | | | Dated | | | , 2002 |

| | |

| | |

| | |

| | | | | | | | | | |

| | | NOTE: | | Please sign as name appears hereon. Joint owners should each sign. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such. |

I do ( ) do not ( ) plan to attend the meeting. (Please check)

The shareholder signed above reserves the right to revoke this Proxy at any time prior to its exercise by written notice delivered to the Company's Secretary at the Company's corporate offices at 27700B S.W. Parkway Avenue, Wilsonville, Oregon 97070, prior to the Annual Meeting. The power of the Proxy holders shall also be suspended if the shareholder signed above appears at the Annual Meeting and elects in writing to vote in person.

Vote by Internet or Telephone or Mail

24 Hours a Day, 7 Days a Week

Internet and telephone voting is available through 4:00 p.m. Eastern Time

the business day prior to the annual meeting day.

Your telephone or Internet vote authorizes the named proxies to vote your shares in the same manner as if you marked, signed and returned your proxy card.

| Internet | | | | Telephone | | | | Mail |

| http://www.eproxy.com/infs | | | | 1-800-435-6710 | | | | |

| Use the Internet to vote your proxy. Have your proxy card in hand when you access the web site. You will be prompted to enter your control number, located in the box below to create and submit an electronic ballot. | | OR | | Use any tough-tone telephone to vote your proxy. Have your proxy card in hand when you call. You will be prompted to enter your control number, located in the box below, and then follow the directions given. | | OR | | Mark, sign and date your proxy card and return it in the enclosed postage-paid envelope. |

If you vote your proxy by Internet or by telephone,

you do NOT need to mail back your proxy card.

You can view the Annual Report and Proxy Statement

on the Internet at:http://www.infocus.com

You can now access your InFocus Corporation account online.

Access our InFocus Corporation shareholder account online via Investor ServiceDirectSM (ISD)

Mellon Investor Services LLC, agent for InFocus Corporation, now makes it easy and convenient to get current information on your shareholder account. After a simple and secure process of establishing a Personal Identification Number (PIN), you are ready to log in and access your account to:

| • View account status | | • View payment history for dividends |

| • View certificate history | | • Make address changes |

| • View book-entry information | | • Obtain a duplicate 1099 tax form |

| | | • Establish/change your PIN |

Visit us on the web athttp://www.melloninvestor.com

And follow the instructions shown on this page.

| Step 1: FIRST TIME USERS—Establish a PIN | | Step 2: Log in for Account Access | | Step 3: Account Status Screen |

| You must first establish a Personal Identification Number (PIN) online by following the directions provided in the upper right portion of the web screes as follows. You will also need your Social Security Number (SSN) available to establish a PIN. | | You are now ready to log in. to access your account, please enter your:

• SSN

• PIN

• Then click on the Submit button | | You are now ready to access your account information. Click on the appropriate button to view or initiate transactions.

• Certificate History

• Book-Entry Information

• Issue Certificate |

| Investor ServiceDirectSM is currently only available for domestic individual and joint accounts. | | If you have more than one account, you will now be asked to select you will now be asked to select the appropriate account. | | • Payment History

• Address Change

• Duplicate 1099 |

| • SSN | | | | |

| • PIN | | | | |

| • Then click on the Establish PIN button | | | | |

Please be sure to remember your PIN, or maintain it in a secure place for future reference. |

|

|

|

|

For Technical Assistance Call 1-877-978-7778 between

9am-7pm Monday-Friday Eastern Time

QuickLinks

INFOCUS CORPORATION 27700B S.W. Parkway Avenue Wilsonville, Oregon 97070PROXY STATEMENT ANNUAL MEETING OF SHAREHOLDERS To Be Held On April 18, 2002ELECTION OF DIRECTORS (Proposal No. 1)SELECTION OF INDEPENDENT ACCOUNTANTS (Proposal No. 2)SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENTEXECUTIVE OFFICERSEXECUTIVE COMPENSATIONSUMMARY COMPENSATION TABLEOPTION GRANTS IN LAST FISCAL YEARAGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR AND FY-END OPTION VALUESEMPLOYMENT CONTRACTS AND TERMINATION OF EMPLOYMENT AND CHANGE-IN-CONTROL ARRANGEMENTSCOMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATIONCERTAIN RELATIONSHIPS AND RELATED TRANSACTIONSBOARD COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATIONSTOCK PERFORMANCE GRAPHSECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCESHAREHOLDER PROPOSALSTRANSACTION OF OTHER BUSINESSINFOCUS CORPORATION Proxy for Annual Meeting of Shareholders to be Held on April 18, 2002