UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended: December 31, 2007

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 000-18908

INFOCUS CORPORATION

(Exact name of registrant as specified in its charter)

| | |

| Oregon | | 93-0932102 |

(State or other jurisdiction of incorporation

or organization) | | (I.R.S. Employer

Identification No.) |

| | |

| 27500 SW Parkway Avenue, Wilsonville, Oregon | | 97070 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: 503-685-8888

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of each class | | Name of each exchange on which registered |

| Common stock, without par value | | NASDAQ Global Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act:

Yes ¨ No x

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act: ¨

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K, or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “accelerated filer,” “large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer x Non-accelerated filer ¨ Smaller reporting company ¨

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates, computed by reference to the last sales price ($2.23) as reported by the NASDAQ Global Market, as of the last business day of the Registrant’s most recently completed second fiscal quarter (June 29, 2007), was $79,437,903.

The number of shares outstanding of the Registrant’s Common Stock as of March 5, 2008 was 40,869,963 shares.

Documents Incorporated by Reference

The Registrant has incorporated into Part III of Form 10-K, by reference, portions of its Proxy Statement for its 2008 Annual Meeting of Shareholders.

INFOCUS CORPORATION

2007 FORM 10-K ANNUAL REPORT

TABLE OF CONTENTS

1

PART I

Forward Looking Statements and Factors Affecting Our Business and Prospects

Some of the statements in this annual report on Form 10-K are forward-looking statements, as defined in the Private Securities Litigation Reform Act of 1995, or the PSLRA. Forward-looking statements in this Form 10-K are being made pursuant to the PSLRA and with the intention of obtaining the benefits of the “safe harbor” provisions of the PSLRA. Forward-looking statements are those that do not relate solely to historical fact. They include, but are not limited to, any statement that may predict, forecast, indicate or imply future results, performance, achievements or events. You can identify these statements by the use of words like “intend,” “plan,” “believe,” “anticipate,” “project,” “may,” “will,” “could,” “continue,” “expect” and variations of these words or comparable words or phrases of similar meaning. They may relate to, among other things:

| | • | | our ability to operate profitably; |

| | • | | our ability to successfully introduce new products; |

| | • | | our ability to compete in the market, including our ability to compete against alternate technologies; |

| | • | | the wind-down of South Mountain Technologies (“SMT”), our 50-50 joint venture with TCL Corporation; |

| | • | | the supply of components, subassemblies, and projectors manufactured for us; |

| | • | | fluctuations in our revenues and results of operations; |

| | • | | the impact of regulatory actions by authorities in the markets we serve; |

| | • | | anticipated outcome of legal disputes; |

| | • | | uncertainties associated with the activities of our contract manufacturing partners; |

| | • | | expectations regarding results and charges associated with restructuring our business and other changes to reduce or simplify the cost structure of the business; |

| | • | | our ability to grow the business; and |

| | • | | our various expenses and expenditures, including marketing and sales expenses, research and development expenses, general and administrative expenses and expenditures for property and equipment. |

These forward-looking statements reflect our current views with respect to future events and are based on assumptions and are subject to risks and uncertainties, including, but not limited to, economic, competitive, governmental and technological factors outside of our control, which may cause actual results to differ materially from trends, plans or expectations set forth in the forward-looking statements. The forward-looking statements contained in this annual report speak only as of the date on which they are made and we do not undertake any obligation to update any forward-looking statements to reflect events or circumstances after the date of this filing. See Item 1A. Risk Factors below for further discussion of factors that could cause actual results to differ from these forward-looking statements.

Where You Can Find More Information

We file annual reports, quarterly reports, current reports, proxy statements and other information with the Securities and Exchange Commission (“SEC”) under the Securities Exchange Act of 1934, as amended (“Exchange Act”). You can inspect and copy our reports, proxy statements and other information filed with the SEC at the offices of the SEC’s Public Reference Room in Washington, D.C. Please call the SEC at 1-800-SEC-0330 for further information on the Public Reference Room. The SEC maintains an Internet site at http://www.sec.gov/ where you can obtain most of our SEC filings. We also make available, free of charge on our website atwww.infocus.com, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after they are filed electronically with the SEC. The information found on our website is not part of this Form 10-K. You can also obtain copies of these reports by contacting our investor relations department at (503) 685-8576.

2

Company Profile

InFocus Corporation is the industry pioneer and a worldwide leader in digital projection technology. We have over twenty years of innovative experience allowing us to constantly improve our product offerings and deliver a compelling immersive visual experience in business, education and home entertainment environments. Our products include projectors and related accessories for use in the conference room, board room, auditorium, classroom and living room. With one of the largest installed bases of projectors in the industry, we are also the most recognized brand in the U.S. projector market according to TFCinfo, the premiere market research organization for advanced display technologies.

Current Products

Projectors:

InFocus offers a range of projection products and services in four main categories.

| | • | | Mobile projectors are designed for small teams working in groups of three to eight people on screen sizes between 50” and 100”. Mobile projectors are often taken on business trips and moved around the office or campus and are sometimes used in the home; |

| | • | | Meeting room projectors are designed for medium sized teams working in groups of eight to twenty-five people on screen sizes between 80” and 120”. Portable projectors are usually used on a table or cart but can also be installed on the ceiling in a classroom, conference room or home; |

| | • | | Large opportunity projectors are entry level products targeted primarily for emerging markets, retail channels and government and education tenders. |

| | • | | Large venue projectors are designed for venues such as auditoriums and home cinemas where groups of people gather for events on screen sizes up to and sometimes exceeding 150”. Large venue projectors are almost always integrated into a value-added system including audio, signal distribution, touch panel controls, etc. |

InFocus is our primary brand sold worldwide in all channels. In addition, many of our products are also offered under our global reseller brand, ASK Proxima, to allow qualified value added dealers to create a unique value proposition, bundling our projectors with their other product and service offerings. We also have a limited number of private label OEM arrangements with companies that resell our projectors under their own brand.

Our current projector product offerings are as follows:

Mobile projectors (IN1X series):

| | • | | IN10 – The IN10 is a 2.4 lb XGA DLP® projector that packs 1,800 lumens into the footprint of a DVD case |

| | • | | IN12 – The IN12 is a 3.9 lb XGA projector that packs 2,000 lumens into the size and shape of a notebook PC; and |

| | • | | IN15 – The IN15 is a 3.9 lb XGA projector that packs 2,500 lumens into the size and shape of a notebook PC. |

All three of these projectors are also available under the ASK-Proxima brand name.

Meeting room projectors (IN2X series and IN3X series):

| | • | | IN2X series – The IN2X series is a 2,500 lumen mainstream portable projector using DLP® technology available in three resolutions: IN2102 (SVGA), IN2104 (XGA) and IN2106 (WXGA); and |

| | • | | IN3X series – The IN3X series is a premium portable projector using DLP® technology available in three performance levels: IN35 (2,500 lumens XGA), IN35W (2,500 lumens WXGA) and IN37 (3,000 lumens XGA). |

The IN2Xand IN3X series are also available under the ASK-Proxima brand name.

3

Large Opportunity projectors (X series):

| | • | | X series – The X series is a 2,000 lumen entry level portable projector designed primarily for emerging markets, retail channels and tender business. The X series uses DLP® technology and is available in two resolutions: X6 (SVGA) and X7 (XGA): |

Large venue projectors (LP series, IN4X series, IN8X series):

| | • | | LP860 – The LP860 is a 3,500 lumen SXGA+ LCD installation projector; |

| | • | | IN4X series – The IN4X series is a 4000 lumen LCD installation projector available in two resolutions: IN43 (XGA) and IN45 (WXGA); and |

| | • | | IN8X series – The IN8X series is a 1080p high definition DLP® home theater projector available in three different contrast levels: IN81 (3,000:1 contrast), IN82 (4,000:1 contrast) and IN83 (5,000:1 contrast). |

The LP860 and IN4X series are also available under the ASK-Proxima brand name.

We continue to leverage our technological expertise and experience to deliver products that include true multimedia capabilities, can be integrated with other technologies and have user friendly features to improve ease of use for our end customers.

Our products are compatible with all major personal computers and video sources used in business, education and home entertainment. Users can connect to a variety of sources including, but not limited to, digital and analog PCs, DVD players, HDTV, S-video, VCRs, workstations, laser disc players and gaming devices.

Two key characteristics of our products are resolution and video performance. Resolution is defined by using standard industry terms SVGA, XGA, WXGA, SXGA, SXGA+ and UXGA, which are terms that define the number of pixels in a display. An SVGA display has 480,000 pixels (800X600), an XGA has 786,432 pixels (1,024X768), a WXGA has 1,024,000 pixels (1,280x800), an SXGA has 1,310,720 pixels (1,280X1,024), an SXGA+ has 1,470,000 pixels (1,400X1,050) and a UXGA has 1,920,000 pixels (1,600X1,200). Video resolution in home entertainment projectors is defined as either 480p (854X480), 576p (1,024X576), 720p (1,280X720) or 1080p (1,920X1,080). We utilize the latest in video electronics to improve the video performance over normal projection devices.

Licensing our Intellectual Property

We have royalty arrangements with third parties for various projection related technologies. Current royalties being earned under these arrangements are not material.

In addition to our projection intellectual property, we also generate licensing profits from Motif, our 50/50 joint venture with Motorola. Motif has executed numerous licenses for its active addressing technology, with additional licenses under negotiation. Motif results are not consolidated with our results, but we report our share of the net income of Motif as a component of other income. Our 50% share of Motif income for 2007 was $0.9 million.

Product and Technology Development

We continue to invest in research and development primarily for advanced development of new projection technology and complementary products and solutions. We plan to continue to invest in research and development to enable continued innovation in our product and solution offerings.

We expended $14.1 million, $18.0 million and $20.8 million on research and development activities for the years ended December 31, 2007, 2006 and 2005, respectively.

Routes to Market

As our industry has grown and matured, our marketing and sales distribution strategy has evolved so that we can reach end-user customers with our products when and where they want to buy. We sell our products through multiple distribution channels, including direct and indirect resellers that procure our

4

products from our distributor customers. Over the years, we have devoted significant resources to develop and support a well-trained reseller network with the ability to demonstrate and sell our products to a wide range of end-users worldwide. In the U.S., we offer our products through authorized professional audiovisual dealers and direct marketing resellers. We also sell our products through wholesale distributors, which in turn sell to audiovisual resellers, PC resellers, online resellers, and direct marketing resellers.

In addition, we sell our products and services directly to large multinational organizations via our Strategic Accounts Program. Strategic Accounts customers work with our teams to identify their presentation technology needs company-wide, then consolidate their purchase and support requirements across geographic boundaries. Sales of projectors and services are fulfilled either directly by us or through one of our local authorized business partners.

We also offer customers the ability to purchase many of our products and accessories directly from our online store in the U.S.

Outside the U.S., we sell our products to distributors and dealers worldwide. These distributors sell our products to audiovisual dealers, PC resellers and, in some cases, directly to end-users. Sales subsidiaries, located in Singapore, China, Norway, Germany, Sweden, France and The Netherlands, work with international distributors and local direct dealers to sell and support our products.

Geographic revenues as a percentage of total revenues, based on shipment destination, were as follows:

| | | | | | | | | |

Year Ended December 31, | | 2007 | | | 2006 | | | 2005 | |

U.S. | | 56.9 | % | | 63.9 | % | | 62.4 | % |

Europe | | 26.6 | | | 21.8 | | | 23.5 | |

Asia | | 11.3 | | | 7.4 | | | 8.1 | |

Other | | 5.2 | | | 6.9 | | | 6.0 | |

| | | | | | | | | |

| | 100.0 | % | | 100.0 | % | | 100.0 | % |

| | | | | | | | | |

Long-lived assets by geographic region were as follows (in thousands):

| | | | | | |

December 31, | | 2007 | | 2006 |

U.S. | | $ | 3,227 | | $ | 4,479 |

Europe | | | 373 | | | 168 |

Asia | | | 434 | | | 503 |

| | | | | | |

| | $ | 4,034 | | $ | 5,150 |

| | | | | | |

Seasonality

Given the buying patterns of various geographies and market segments, our revenues are subject to certain elements of seasonality during various portions of the year. The first quarter of each year is typically down from the immediately preceding fourth quarter due to corporate buying trends and typical aggressive competition from our Asian competitors with March 31 fiscal year ends. In addition, we sell our products into the education and government markets that typically see seasonal peaks in the U.S. in the second and third quarter of each year. Historically, between 20% and 30% of our revenues have come from Europe and, as such, we typically experience a seasonal downturn due to the vacation season in mid-summer, which results in decreased revenues from that region in the third quarter compared to the second quarter. Conversely, we typically experience a strong resurgence of revenue from Europe in the fourth quarter.

Sales Returns and Incentives

Some distributor and dealer agreements allow for limited partial return of products and/or price protection. Such return rights are generally limited to a contractually defined short-term stock rotation and defective or damaged product, although we have granted retailers return policies consistent with the retailers’ return policies for their customers. We also have incentive programs for dealers and distributors whereby

5

rebates are offered based upon exceeding quarterly and annual volume goals or to promote sell through of our products to end users.

Service

Our global service solutions include, but are not limited to, a mix of outsourced and in-house call center and Internet customer support, factory repair, authorized service center repair, accessories, service parts, remanufactured projectors, technology upgrade program, warranty extension contracts, service contracts, service-related training, service engineering and technical publications (including service guides, technical bulletins and user guides). Design and consulting support is available for our authorized product integration resellers.

Our in-house service organization has personnel in Wilsonville, Oregon, Almere, The Netherlands and our Singapore corporate offices. In addition, we have outsourced our U.S. call center function to a third party provider in India. Factory repair is performed in partnership with UPS Supply Chain Solutions in the U.S. and The Netherlands, as well as in partnership with PCS Peripherals Pte Ltd in Singapore and China.

In addition, personnel in approximately 90 Authorized Service Centers worldwide are trained by us to provide warranty, product repair, technical support and training to their resellers and end-user customers.

Customers have access via telephone and email in the U.S., Europe and Asia or the worldwide web to technical specialists who answer application and hardware questions. All products are covered by a warranty for parts and labor with varying terms depending on the product and geography. Extended service agreements are available for purchase.

Manufacturing and Supply

The principal components of our projectors are imaging devices, including various types of DMDs (digital micromirror devices) and LCDs, integrated circuits, light sources, optical components and lenses, plastic housing parts and electronic sub-assemblies. We qualify certain parts manufactured to our specifications and also design and deliver certain electronic components for sub-assembly. The DMD imaging engines are produced in class 10,000 clean room environments, requiring exacting design, specification and handling of precision optics. The manufacture of finished projectors includes precise alignment of optical elements and 100% image quality testing. We are currently focusing the majority of our development efforts on DMD devices based on DLP® technology from Texas Instruments.

In 2007, we outsourced the manufacturing of our projectors primarily to Funai Electric Company and Hon Hai Precision Industry Company Limited, commonly known as “Foxconn.” We are in the process of winding down our business relationship with Funai Electric Company, and, going into 2008, our two main contract manufacturers will be Foxconn and Coretronic. All three contract manufacturers are predominantly manufacturing our products in China. Each of the contract manufacturers is sourcing components directly with suppliers. Reliance on suppliers raises several risks, including the possibility of defective parts, reduced control over the availability and delivery schedule for parts and the possibility of increases in component costs. Manufacturing efficiencies and our profitability can be adversely affected by each of these risks. See Item 1A Risk Factors below for a further discussion of these risks.

Customers

We sell our products to a large number of customers worldwide. Ingram Micro accounted for 22.1%, 19.5% and 15.1%, respectively, of total revenues for the years ended December 31, 2007, 2006 and 2005 and accounted for 24.0% and 26.0%, respectively, of our accounts receivable balance at December 31, 2007 and 2006. In addition, Tech Data accounted for 11.7% and 12.7%, respectively, of total revenues for the years ended December 31, 2007 and 2006 and accounted for 20.0% and 16.0%, respectively, of our accounts receivable balance at December 31, 2007 and 2006. In addition, one other customer accounted for 6.5% of our accounts receivable balance at December 31, 2007.

6

Backlog

We had backlog of approximately $6.6 million at December 31, 2007, compared to approximately $9.5 million at December 31, 2006. Backlog is not necessarily indicative of sales for any future period nor is a backlog any assurance that we will realize a profit from filling the orders.

Competition

Our ability to compete depends on factors within and outside our control, including the success and timing of product introductions, product performance and price, product distribution and customer support. We believe that our twenty years of leadership in developing technologies and our focused effort on development activities give us a competitive advantage.

We face competition for our projectors from over 40 branded competitors, ten of which, including us, make up approximately 70% of the products sold in the industry. We expect continued competition as new technologies, applications and products are introduced. Our principal current competitors include Epson, NEC, Hitachi, BenQ, Optoma, Toshiba, Panasonic, Sanyo and Dell. Our products also face competition from alternate technologies such as LCD and plasma televisions and displays.

Patents, Trademarks and Licenses

We have been issued approximately 225 U.S. patents and numerous corresponding foreign patents covering various aspects of our products. In addition, numerous applications for U.S. patents are pending on inventions that enable our products to be lighter, easier to use, and produce brighter optimized images. Corresponding applications for selected inventions are pending internationally through the Patent Cooperation Treaty and at foreign Patent Offices.

We attempt to protect our proprietary information through agreements with customers and suppliers. We require our employees, consultants and advisors to execute confidentiality agreements on the commencement of employment with, or service to, us. While we have enhanced our ability to compete by aggressively protecting our intellectual property, we believe the rapid pace of technological change in the industry will mean that our ability to develop new technologies and distribute new products on a timely basis will be of greater importance in maintaining our competitive position.

We maintain and pursue an extensive worldwide trademark portfolio. We have rights and claim ownership to numerous trademarks including “InFocus,” “In Focus,” “Proxima,” “LP,” “LitePro,” “LiteShow,” “ASK,” “ScreenPlay,” “SP,” “LitePort,” “The Big Picture,” “ProjectorNet,” “ASK Proxima,” Work Big,” “Play Big,” ‘Learn Big,” “IN” and associated design marks.

Employees

As of December 31, 2007, we had 337 employees, including 29 temporary personnel primarily engaged through the services of an employment agency. We believe relations with our employees are good.

Because of the following factors, as well as other variables affecting our operating results, past financial performance may not be a reliable indicator of future performance, and historical trends should not be used to anticipate results or trends in future periods.

We may need to raise additional financing if our financial results do not improve.

We sustained an operating loss of $27.5 million and $49.8 million, respectively, during the year ended December 31, 2007 and 2006, contributing to a decrease in net working capital of $15.0 million and $42.1 million during the respective time periods. If we continue to experience significant operating losses and reductions in net working capital, we may need to obtain additional debt or equity financing to continue current business operations. There is no guarantee that we will be able to raise additional funds on favorable terms, if at all.

7

Our restructuring plans may not be successful.

Over the last three years, we have implemented a series of restructuring plans with the goal of simplifying the business and returning the company to profitability. As part of the restructuring plans, we have implemented actions to reduce our cost to serve customers, improve our supply chain efficiency, reduce our product costs and reduce our operating expenses. Our goal as a result of these actions was to improve gross margins to 16% to 18% and reduce our operating expenses to a level that will allow us to achieve breakeven or better results. We have faced a number of challenges related to our restructuring plans including uncertainties associated with the impact of our actions on revenues and gross margins.

While we have made significant progress toward achieving our goals, we continue to focus on increasing revenues, increasing gross margins, and further reducing our cost structure to continue the path towards sustainable operating profitability.

If our contract manufacturers or other outsourced service providers experience any delay, disruption or quality control problems in their operations, we could lose market share and revenues, and our reputation may be harmed.

We have outsourced the manufacturing of our products to third party manufacturers. We rely on our contract manufacturers to procure components, provide spare parts in support of our warranty and customer service obligations, and in some cases, subcontract engineering work. We generally commit the manufacturing of each product platform to a single contract manufacturer. In addition, going forward, we will be placing more reliance on our contract manufacturers for design activities related to our core projection products, as we move to outsource a larger percentage of our research and development work.

Our reliance on contract manufacturers exposes us to the following risks over which we may have limited control:

| | • | | Unexpected increases in manufacturing and repair costs; |

| | • | | Interruptions in shipments if our contract manufacturer is unable to complete production; |

| | • | | Inability to completely control the quality of finished products; |

| | • | | Inability to completely control delivery schedules; |

| | • | | Unpredictability of manufacturing yields; |

| | • | | Changes in our contract manufacturer’s business models or operations; |

| | • | | Potential loss of differentiation in our products compared to our competitors; |

| | • | | Potential lack of adequate capacity to manufacture all or a part of the products we require; and |

| | • | | Reduced control over the availability of our products. |

Our contract manufacturers are located in Asia and may be subject to disruption by natural disasters, as well as political, social or economic instability. The temporary or permanent loss of the services of any of our primary contract manufacturers could cause a significant disruption in our product supply chain and operations and delays in product shipments. In addition, we do not have long-term contracts with any of our third-party contract manufacturers and these contracts are terminable by either party on relatively short notice.

In addition, we outsourced our U.S. customer service and technical support call center to a third party provider. We rely on this third party to provide efficient and effective support to our customers and partners. To the extent our customers are not satisfied with the level of service provided by our third party provider we may lose market share and our revenues and corporate reputation could be negatively affected.

Our competitors may have greater resources and technology, and we may be unable to compete with them effectively.

The markets for our products are highly competitive and we expect aggressive price competition in our industry, especially from Asian manufacturers, to continue into the foreseeable future. Some of our current and prospective competitors have, or may have, significantly greater financial, technical, manufacturing and marketing resources than we have.

8

In order to compete effectively, we must continue to reduce the cost of our products, our manufacturing and other overhead costs, focus on the right channel sales models and reduce our operating expenses in order to offset declining selling prices for our products, while at the same time growing our presence in the markets we are in and driving our products into new markets. There is no assurance we will be able to compete successfully with respect to these factors.

Our products face competition from alternate technologies and we may be unable to compete with them effectively.

In addition to competition within the projector industry, our products also face competition from alternate technologies such as LCD and plasma televisions and displays. Our ability to compete depends on factors within and outside our control, including the success and timing of product introductions, product performance and price, product distribution and customer support and adoption of our products. Our inability to successfully manage these factors could lead to reduced revenues or a greater chance of our customers shifting their purchases to alternate technologies.

If we are unable to manage the cost of older products or successfully introduce new products with higher gross margins, our revenues may decrease or our gross margins may decline.

The market in which we compete is subject to technological advances with continual new product releases and aggressive price competition. As a result, the price at which we can sell our products typically declines over the life of the product. The price at which a product is sold is generally referred to as the average selling price (“ASP”). In order to sell products that have a declining ASP and still maintain our gross margins, we need to continually reduce our product costs. To manage product-sourcing costs, we must collaborate with our contract manufacturers to engineer the most cost-effective design for our products. In addition, we must carefully monitor the price paid by our contract manufacturers for the significant components used in our products. We must also successfully manage our freight and inventory holding costs to reduce overall product costs. We also need to continually introduce new products with improved features and increased performance at lower costs in order to maintain our overall gross margins. Our inability to successfully manage these factors could reduce revenues or result in declining gross margins. In addition, our increased reliance on our contract manufacturers for design and development work could enhance the risks described above.

Our revenues and profitability can fluctuate from period to period and are often difficult to predict for particular periods due to factors beyond our control.

Our results of operations for any individual quarter or for the year are not necessarily indicative of results to be expected in future periods. Our operating results have historically been, and are expected to continue to be, subject to quarterly and yearly fluctuations as a result of a number of factors, including:

| | • | | The introduction and market acceptance of new technologies, products and services; |

| | • | | Variations in product selling prices and costs and the mix of products sold; |

| | • | | The size and timing of customer orders, which, in turn, often depend upon the success of our customers’ business or specific products or services; |

| | • | | Changes in the conditions in the markets for projectors and alternative technologies; |

| | • | | The size and timing of capital expenditures by our customers; |

| | • | | Conditions in the broader markets for information technology and communications equipment; |

| | • | | The timing and availability of products coming from our offshore contract manufacturing partners; |

| | • | | Changes in the supply of components; and |

| | • | | Seasonality of markets such as education, government and consumer retail, which vary quarter to quarter and are influenced by outside factors such as overall consumer confidence, budgets and political party changes. |

These trends and factors could harm our business, operating results and financial condition in any particular period.

9

Our operating expenses and portions of our costs of revenues are relatively fixed and we may have limited ability to reduce expenses quickly in response to any revenue shortfalls.

Our operating expenses, warranty costs, inbound freight and inventory handling costs are relatively fixed. Because we typically recognize a significant portion of our revenues in the last month of each quarter, we may not be able to adjust our operating expenses or other costs sufficiently to adequately respond to any revenue shortfalls. If we are unable to reduce operating expenses or other costs quickly in response to any revenue shortfall, it could negatively impact our financial results.

If we are unable to accurately predict the future needs of our customer base as it relates to sales channel inventory levels we may incur unexpected declines in revenues and gross margins.

If factors in the marketplace change that negatively impact the purchase of our products or we are not able to accurately predict the sales channel inventory needs of our larger customers, we may experience declines in our revenue and gross margins. If demand for our products declines or is not sufficient to deplete existing inventory in our sales channels this will generally have an adverse effect on future revenues.

If we do not effectively manage our sales channel inventory and product mix, we may incur costs associated with excess inventory or experience declining gross margins.

If we are unable to properly monitor, control and manage our sales channel inventory and maintain an appropriate level and mix of products with our customers within our sales channels, we may incur increased and unexpected costs associated with this inventory. We generally allow distributors, dealers and retailers to return a limited amount of our products in exchange for placing an order for other new products. In addition, under our price protection policy, subject to certain conditions which vary around the globe, if we reduce the list price of a product, we may issue a credit in an amount equal to the price reduction for each of the products held in inventory by our distributors, dealers and retailers. If these events occur, we could incur increased expenses associated with rotating and reselling product, or inventory reserves associated with writing down returned inventory, or suffer declining gross margins.

If we cannot continually develop new and innovative products and integrate them into our business, we may be unable to compete effectively in the marketplace.

Our industry is characterized by continuing improvements in technology and rapidly evolving industry standards. Consequently, short product life cycles and significant price fluctuations are common. Product transitions present challenges and risks for all companies involved in the data/video digital projector and display markets. Demand for our products and the profitability of our operations may be adversely affected if we fail to effectively manage product transitions.

Advances in product technology require continued investment in research and development and product engineering to maintain our market position. There are no guarantees that such investment will result in the right products being introduced to the market at the right time. In addition, our increased reliance on our contract manufacturers for design and development work could enhance the risks described above.

If we are unable to provide our contract manufacturers with an accurate forecast of our product requirements, we may experience delays in the manufacturing of our products and the costs of our products may increase.

We provide our contract manufacturers with a rolling forecast of demand which they use to determine their material and component requirements. Lead times for ordering materials and components vary significantly and depend on various factors, such as the specific supplier, contract terms and supply and demand for a component at a given time. Some of our components have long lead times measuring as much as 4 to 6 months from the point of order.

If our forecasts are less than our actual requirements, our contract manufacturers may be unable to manufacture sufficient products to meet actual demand in a timely manner. If our forecasts are too high, our contract manufacturers may be unable to use the components they have purchased. The cost of the components used in our products tends to decline as the product platform and technologies mature. Therefore, if our contract manufacturers are unable to promptly use components purchased on our

10

behalf, our cost of producing products may be higher than our competitors due to an over-supply of higher-priced components. Moreover, if they are unable to use certain components, we may be required to reimburse them for any potential inventory exposure they incur within lead time.

Our failure to anticipate changes in the supply of product components or customer demand may result in excess or obsolete inventory that could adversely affect our gross margins.

Substantially all of our products are made for immediate delivery on the basis of purchase orders rather than long-term agreements. As a result, contract manufacturing activities are scheduled according to a monthly sales and production forecast rather than on the receipt of product orders or purchase commitments. From time to time in the past, we have experienced significant variations between actual orders and our forecasts.

If there were to be a sudden and significant decrease in demand for our products, or if there were a higher incidence of inventory obsolescence because of rapidly changing prices of product components, rapidly changing technology and customer requirements or an increase in the supply of products in the marketplace, we could be required to write-down our inventory and our gross margins could be adversely affected.

Our contract manufacturers may be unable to obtain critical components from suppliers, which could disrupt or delay our ability to procure our products.

We rely on a limited number of third party manufacturers for the product components used by our contract manufacturers. Reliance on suppliers raises several risks, including the possibility of defective parts, reduced control over the availability and delivery schedule for parts and the possibility of increases in component costs. Manufacturing efficiencies and our profitability can be adversely affected by each of these risks.

Certain components used in our products are now available only from single sources. Most importantly, DLP® devices are only available from Texas Instruments. The majority of our current products are based on DLP® technology making the continued availability of DLP® devices increasingly important.

Our contract manufacturers also purchase other single or limited-source components for which we have no guaranteed alternative source of supply, and an extended interruption in the supply of any of these components could adversely affect our results of operations. We have worked to improve the availability of lamps and other key components to meet our future needs, but there is no guarantee that we will secure all the supply we need to meet demand for our products.

Furthermore, many of the components used in our products are purchased from suppliers located outside the U.S. Trading policies adopted in the future by the U.S. or foreign governments could restrict the availability of components or increase the cost of obtaining components. Any significant increase in component prices or decrease in component availability could have an adverse effect on our results of operations.

Product defects resulting in a large-scale product recall or successful product liability claims against us could result in significant costs or negatively impact our reputation and could adversely affect our business results and financial condition.

As with any high tech manufacturing company, we are sometimes exposed to warranty and potential product liability claims in the normal course of business. There can be no assurance that we will not experience material product liability losses arising from such potential claims in the future and that these will not have a negative impact on our reputation and, consequently, our revenues. We generally maintain insurance against most product liability risks and record warranty provisions based on historical defect rates, but there can be no assurance that this insurance coverage and these warranty provisions will be adequate for any potential liability ultimately incurred. In addition, there is no assurance that insurance will continue to be available on terms acceptable to us. A successful claim that exceeds our available insurance coverage or a significant product recall could have a material adverse impact on our financial condition and results of operations.

11

SMT, our joint venture with TCL Corporation, has not been successful in implementing its business plan and is in the process of winding down its business.

SMT, our 50-50 joint venture with TCL Corporation, has not been successful in executing its business plan, primarily a result of failing to secure third party OEM customers for its products. As a result, the parent companies sought alternatives for funding ongoing operations at SMT without success. During the third quarter of 2006, SMT began the process of winding down its operations in an orderly fashion, including the sale of its assets and the negotiation of the settlement of its outstanding liabilities. At December 31, 2007, the majority of SMT employees had been laid off and only those employees working on the wind-down of the company remained. During 2006, we completely wrote off our initial investment in SMT and also recorded a charge for our share of estimated additional wind-down costs. We are uncertain how long it may take to complete the liquidation of SMT. There can be no assurance that we will not incur additional costs as SMT completes the wind-down process.

Customs or other issues involving product delivery from our contract manufacturers could prevent us from timely delivering our products to our customers.

Our business depends on the free flow of products. Due to continuing threats of terrorist attacks, U.S. Customs has increased security measures for products being imported into the U.S. In addition, increased freight volumes and work stoppages at west coast ports have, in the past, and may, in the future, cause delays in freight traffic. Each of these situations could result in delay of receipt of products from our contract manufacturers and delay fulfillment of orders to our customers. Any significant disruption in the free flow of our products may result in a reduction of revenues, an increase of in-transit inventory, or an increase in administrative and shipping costs.

A deterioration in general global economic condition could adversely affect demand for our products.

Our business is subject to the overall health of the global economy. Purchase decisions for our products are made by corporations, governments, educational institutions, and consumers based on their overall available budget for information technology products. Any number of factors impacting the global economy including geopolitical issues, balance of trade concerns, inflation, interest rates, currency fluctuations and consumer confidence can impact the overall spending climate, both positively and negatively, in one or more geographies for our products. Deterioration in any one or combination of these factors could change overall industry dynamics and demand for discretionary products like ours and negatively impact our results of operations.

We are subject to risks associated with exporting products outside the U.S.

To the extent we export products outside the U.S., we are subject to U.S. laws and regulations governing international trade and exports, including, but not limited to, the International Traffic in Arms Regulations, the Export Administration Regulations and trade sanctions against embargoed countries, which are administered by the Office of Foreign Assets Control within the Department of the Treasury. A determination that we have failed to comply with one or more of these export controls could result in civil and/or criminal sanctions, including the imposition of fines upon us, the denial of export privileges, and debarment from participation in U.S. government contracts. Any one or more of such sanctions could have a material adverse effect on our business, financial condition and results of operations.

We are exposed to risks associated with our international operations.

Revenues outside the U.S. accounted for approximately 43% of our revenues in 2007, 36% of our revenues in 2006 and 38% of our revenues in 2005. The success and profitability of our international operations are subject to numerous risks and uncertainties, including:

| | • | | local economic and labor conditions; |

| | • | | unexpected changes in the regulatory environment; |

| | • | | trade protection measures; |

| | • | | foreign currency exchange rates. |

12

Currency exchange rate fluctuations may lead to decreases in our financial results.

To the extent that we incur costs in one currency and make our sales in another, our gross margins may be affected by changes in the exchange rates between the two currencies. Although our general policy is to hedge against these currency transaction risks on a monthly basis, given the volatility of currency exchange rates, we cannot provide assurance that we will be able to effectively manage these risks. Volatility in currency exchange rates may generate foreign exchange losses, which could have an adverse effect on our financial condition or results of operations.

Our reliance on third-party logistics and customer service providers may result in customer dissatisfaction or increased costs.

We have outsourced all of our logistics and service repair functions worldwide. We are reliant on our third-party providers to effectively and accurately manage our inventory, service repair, and logistics functions. This reliance includes timely and accurate shipment of our products to our customers and quality service repair work. Reliance on third parties requires proper training of employees, creating and maintaining proper controls and procedures surrounding both forward and reverse logistics functions, and timely and accurate inventory reporting. In addition, reliance on third parties requires adherence to product specifications in order to ensure quality and reliability of our products. Failure of our third parties to deliver in any one of these areas could have an adverse effect on our results of operations.

In addition, we outsourced our U.S. customer service and technical support call center to a third-party provider. We rely on this third party to provide efficient and effective support to our customers and partners. To the extent our customers are not satisfied with the level of service provided by our third-party provider we may lose market share and our revenues and corporate reputation could be negatively impacted.

We may be unsuccessful in protecting our intellectual property rights.

Our ability to compete effectively against other companies in our industry depends, in part, on our ability to protect our current and future proprietary technology under patent, copyright, trademark, trade secret and other intellectual property laws. We utilize contract manufacturers in China and Taiwan, and anticipate doing increased business in these markets and elsewhere around the world including other emerging markets. These emerging markets may not have the same protections for intellectual property that are available in the U.S. We cannot make assurances that our means of protecting our intellectual property rights in the U.S. or abroad will be adequate, or that others will not develop technologies similar or superior to our trade secrets or design around our patents. In addition, management may be distracted by, and we may incur substantial costs in, attempting to protect our intellectual property.

Also, despite the steps taken by us to protect our intellectual property rights, it may be possible for unauthorized third parties to copy or reverse-engineer trade secret aspects of our products, develop similar technology independently or otherwise obtain and use information that we regard as our trade secrets, and we may be unable to successfully identify or prosecute unauthorized uses of our intellectual property rights. Further, with respect to our issued patents and patent applications, we cannot provide assurance that pending patent applications (or any future patent applications) will be issued, that the scope of any patent protection will exclude competitors or provide competitive advantages to us, that any of our patents will be held valid if subsequently challenged, or that others will not claim rights in or ownership of the patents (and patent applications) and other intellectual property rights held by us.

If we become subject to intellectual property infringement claims, we could incur significant expenses and could be prevented from selling specific products.

We are periodically subject to claims that we infringe the intellectual property rights of others. We cannot provide assurance that, if and when made, these claims will not be successful. Intellectual property litigation is, by its nature, expensive and unpredictable. Any claim of infringement could cause us to incur substantial costs defending against the claim even if the claim is invalid, and could distract management from other business. Any potential judgment against us could require substantial payment in damages and also could include an injunction or other court order that could prevent us from offering certain products.

13

We rely on large distributors, national retailers and other large customers for a significant portion of our revenues, and changes in price or purchasing patterns could lower our revenues or gross margins.

We sell our products through large distributors such as Ingram Micro, Tech Data and CDW and through a number of other customers and channels. We rely on our larger distributors and other large customers for a significant portion of our total revenues in any particular period. We have no minimum purchase commitments or long-term contracts with any of these customers. Our customers, including our largest customers, could decide at any time to discontinue, decrease or delay their purchases of our products. In addition, the prices that our distributors pay for our products are subject to competitive pressures and change frequently.

If any of our major customers change their purchasing patterns or refuse to pay the prices that we set for our products, our net revenues and operating results could be negatively impacted. If our large distributors and retailers increase the size of their product orders without sufficient lead-time for us to process the order, our ability to fulfill product demand could be compromised. In addition, because our accounts receivable are concentrated within our largest customers, the failure of any of them to pay on a timely basis, or at all, could reduce our cash flow or result in a significant bad debt expense.

In order to compete, we must attract, retain and motivate key employees, and our failure to do so could have an adverse effect on our results of operations.

In order to compete, we must attract, retain and motivate key employees, including those in managerial, operations, engineering, service, sales, marketing, and support positions. Hiring and retaining qualified employees in all areas of the company is critical to our business. Each of our employees is an “at will employee” and may terminate his/her employment without notice and without cause or good reason.

We depend on our officers, and, if we are not able to retain them, our business may suffer.

Due to the specialized knowledge each of our officers possess with respect to our business and our operations, the loss of service of any of our officers could adversely affect our business. We do not carry key person life insurance on our officers. Each of our officers is an “at will employee” and may terminate his/her employment without notice and without cause or good reason.

During 2007 we experienced several changes in our executive officers, including our Chief Executive Officer and our Chief Financial Officer. Changes at the executive officer level may cause delays in achieving our operational goals and plans as new individuals learn the business.

Our results of operations could vary as a result of the methods, estimates and judgments we use in applying our accounting policies.

The methods, estimates and judgments we use in applying our accounting policies have a significant impact on our results of operations (see “Critical Accounting Policies and Estimates” in Item 7 below). Such methods, estimates and judgments are, by their nature, subject to substantial risks, uncertainties and assumptions, and factors may arise that lead us to change our methods, estimates and judgments. Changes in those methods, estimates and judgments could significantly affect our results of operations. For example, we are required to make judgments or take certain tax positions in relation to income taxes in both U.S. and foreign tax jurisdictions. To the extent a taxing authority takes a position different from ours and we are unsuccessful in defending our position, the outcome of that decision could impact the amount of income tax expense recorded in the period these new positions are known.

| Item 1B. | Unresolved Staff Comments |

None.

14

We lease a 140,000 square foot corporate headquarters facility in Wilsonville, Oregon. This lease is non-cancelable and expires in October 2011. We also lease space in Fredrikstad, Norway, Almere, The Netherlands, Singapore, Shenzhen, China and Hilversum, The Netherlands, under leases expiring on February 1, 2011, July 1, 2010, March 31, 2009, August 2009 and September 30, 2008, respectively.

We closed our Hilversum, The Netherlands facility in October 2002. We have sublet this entire facility for a portion of the lease obligation value. We also closed our Fredrikstad, Norway office during 2005 as part of our December 2004 restructuring. We are currently subletting a portion of this facility to various tenants and are actively working on subletting the remaining spaces. Due to reduced space needs, in January 2007, we consolidated floors in our corporate headquarters building in Wilsonville, Oregon from four floors to three floors and in December 2007 we consolidated to two and one half floors. We are actively looking for a tenant to sub-lease the vacant space.

In addition, we have several operating leases for smaller sites internationally to support our local sales and support activities.

From time to time, we become involved in ordinary, routine or regulatory legal proceedings incidental to the business. When a loss is deemed probable and reasonably estimable an amount is recorded in our financial statements. While the ultimate results of these matters cannot presently be determined, management does not expect that they will have a material adverse effect on our results of operations or financial position. Therefore, no adjustments have been made to the accompanying financial statements relative to these routine matters.

| Item 4. | Submission of Matters to a Vote of Security Holders |

No matters were submitted to a vote of our shareholders during the quarter ended December 31, 2007.

PART II

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Stock Prices and Dividends

Our common stock trades on the NASDAQ Global Market under the symbol INFS. The high and low sales prices on the NASDAQ Global Market for the two years in the period ended December 31, 2007 were as follows:

| | | | | | |

2006 | | High | | Low |

Quarter 1 | | $ | 4.75 | | $ | 3.65 |

Quarter 2 | | | 5.10 | | | 2.76 |

Quarter 3 | | | 2.92 | | | 2.47 |

Quarter 4 | | | 3.00 | | | 2.39 |

| | |

2007 | | High | | Low |

Quarter 1 | | $ | 2.93 | | $ | 2.52 |

Quarter 2 | | | 2.82 | | | 2.23 |

Quarter 3 | | | 2.49 | | | 1.54 |

Quarter 4 | | | 1.82 | | | 1.43 |

15

The approximate number of beneficial shareholders and the number of shareholders of record at March 1, 2008 was 4,500 and 800, respectively.

There were no cash dividends declared or paid in 2007 or 2006 and we do not anticipate declaring cash dividends in the foreseeable future.

Equity Compensation Plan Information

Information regarding securities authorized for issuance under equity compensation plans is included in Part III, Item 12.

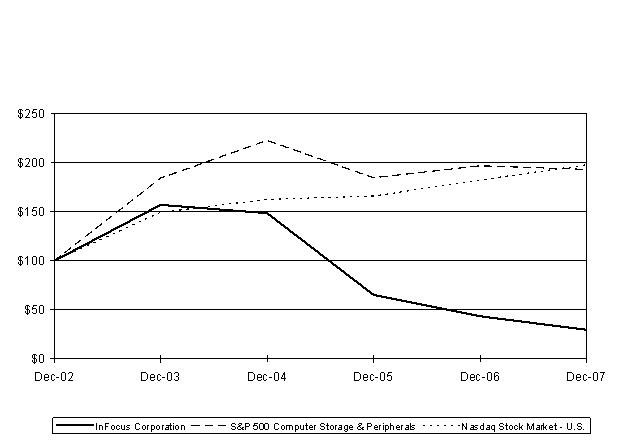

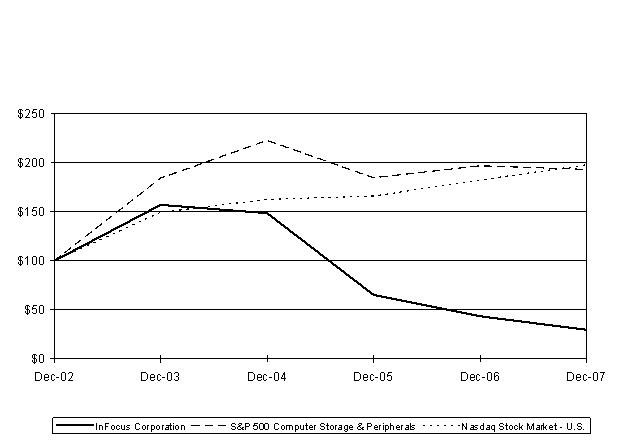

Stock Performance Graph

The SEC requires that registrants include in their annual report a line-graph presentation comparing cumulative five-year shareholder returns on an indexed basis, assuming a $100 initial investment and reinvestment of dividends, of (a) the registrant, (b) a broad-based equity market index and (c) an industry-specific index. The broad-based market index used is the NASDAQ Stock Market Total Return Index – U.S. and the industry-specific index used is the S&P 500 Computer Storage and Peripherals Index.

| | | | | | | | | | | | | | | | | | |

| | | Base

Period | | Indexed Returns

Year Ended |

Company/Index | | 12/31/02 | | 12/31/03 | | 12/31/04 | | 12/31/05 | | 12/31/06 | | 12/31/07 |

InFocus Corporation | | $ | 100.00 | | $ | 157.14 | | $ | 148.70 | | $ | 65.10 | | $ | 43.34 | | $ | 29.55 |

S&P 500 Computer Storage and Peripherals | | | 100.00 | | | 184.44 | | | 222.99 | | | 184.80 | | | 197.17 | | | 193.24 |

NASDAQ U.S. Index | | | 100.00 | | | 149.52 | | | 162.72 | | | 166.18 | | | 182.57 | | | 197.98 |

16

| Item 6. | Selected Financial Data |

| | | | | | | | | | | | | | | | | | | | |

| IN THOUSANDS | | Year Ended December 31, | |

(except per share amounts) | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

Statement of Operations Data | | | | | | | | | | | | | | | | | | | | |

Revenues | | $ | 308,181 | | | $ | 374,752 | | | $ | 532,099 | | | $ | 648,941 | | | $ | 604,490 | |

Cost of revenues | | | 257,426 | | | | 320,866 | | | | 499,327 | | | | 535,031 | | | | 545,049 | |

| | | | | | | | | | | | | | | | | | | | |

Gross margin | | | 50,755 | | | | 53,886 | | | | 32,772 | | | | 113,910 | | | | 59,441 | |

Operating expenses: | | | | | | | | | | | | | | | | | | | | |

Marketing and sales | | | 35,777 | | | | 49,107 | | | | 64,292 | | | | 70,421 | | | | 73,123 | |

Research and development | | | 14,135 | | | | 17,997 | | | | 20,847 | | | | 28,864 | | | | 33,214 | |

General and administrative | | | 19,938 | | | | 21,730 | | | | 23,360 | | | | 24,423 | | | | 27,673 | |

Restructuring costs | | | 8,375 | | | | 5,425 | | | | 11,050 | | | | 1,950 | | | | 6,650 | |

Impairment of long-lived assets | | | — | | | | — | | | | 9,813 | | | | — | | | | 26,400 | |

Regulatory assessments | | | — | | | | 9,392 | | | | 1,600 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Loss from operations | | | (27,470 | ) | | | (49,765 | ) | | | (98,190 | ) | | | (11,748 | ) | | | (107,619 | ) |

Other income (expense): | | | | | | | | | | | | | | | | | | | | |

Interest expense | | | (507 | ) | | | (401 | ) | | | (612 | ) | | | (191 | ) | | | (242 | ) |

Interest income | | | 2,715 | | | | 2,446 | | | | 1,772 | | | | 1,407 | | | | 1,734 | |

Other, net(1) | | | (349 | ) | | | (13,451 | ) | | | 17,130 | | | | 16,704 | | | | 113 | |

| | | | | | | | | | | | | | | | | | | | |

Income (loss) before income taxes | | | (25,611 | ) | | | (61,171 | ) | | | (79,900 | ) | | | 6,172 | | | | (106,014 | ) |

Provision (benefit) for income taxes | | | (29 | ) | | | 749 | | | | (106 | ) | | | (1,401 | ) | | | 3,499 | |

| | | | | | | | | | | | | | | | | | | | |

Net income (loss) | | $ | (25,582 | ) | | $ | (61,920 | ) | | $ | (79,794 | ) | | $ | 7,573 | | | $ | (109,513 | ) |

| | | | | | | | | | | | | | | | | | | | |

Basic net income (loss) per share | | $ | (0.64 | ) | | $ | (1.56 | ) | | $ | (2.02 | ) | | $ | 0.19 | | | $ | (2.78 | ) |

| | | | | | | | | | | | | | | | | | | | |

Diluted net income (loss) per share | | $ | (0.64 | ) | | $ | (1.56 | ) | | $ | (2.02 | ) | | $ | 0.19 | | | $ | (2.78 | ) |

| | | | | | | | | | | | | | | | | | | | |

| |

| | | December 31, | |

| | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

Balance Sheet Data | | | | | | | | | | | | | | | | | | | | |

Cash, restricted cash and marketable securities | | $ | 84,110 | | | $ | 76,233 | | | $ | 80,117 | | | $ | 69,468 | | | $ | 144,235 | |

Working capital | | | 83,287 | | | | 98,260 | | | | 140,358 | | | | 240,206 | | | | 214,853 | |

Property and equipment, net | | | 2,973 | | | | 3,961 | | | | 2,747 | | | | 16,747 | | | | 15,890 | |

Total assets | | | 172,991 | | | | 182,256 | | | | 263,888 | | | | 383,873 | | | | 366,098 | |

Short-term borrowings | | | — | | | | — | | | | — | | | | 16,198 | | | | — | |

Shareholders’ equity | | | 83,698 | | | | 100,263 | | | | 155,191 | | | | 266,633 | | | | 237,879 | |

| (1) | Other, net included the following for the years ended December 31, 2007, 2006, 2005, and 2004: |

| | | | | | | | | | | | | | | |

| | | Year Ended December 31, |

| | | 2007 | | | 2006 | | | 2005 | | | 2004 |

Net realized gain on the sale of equity securities | | $ | — | | | $ | 809 | | | $ | 19,396 | | | $ | 13,245 |

Impairment charge on valuation of equity securities | | | (124 | ) | | | (261 | ) | | | — | | | | — |

Income related to the profits of Motif, 50-50 joint venture | | | 857 | | | | 1,555 | | | | 3,722 | | | | 2,361 |

Expense related to losses of SMT, 50-50 joint venture | | | — | | | | (2,709 | ) | | | (5,185 | ) | | | — |

Write-down of equity method investment in SMT, 50-50 joint venture | | | — | | | | (2,106 | ) | | | — | | | | — |

Charge for estimated costs to wind-down SMT | | | — | | | | (1,126 | ) | | | — | | | | — |

Impairment charge related to TUN | | | — | | | | (1,117 | ) | | | — | | | | — |

Gains (losses) related to foreign currency transactions | | | (1,133 | ) | | | (1,519 | ) | | | (853 | ) | | | 826 |

Recovery (write-down) of certain cost-based investments in technology companies | | | 202 | | | | (7,474 | ) | | | — | | | | — |

Gain on sale of land | | | — | | | | 636 | | | | — | | | | — |

Other | | | (151 | ) | | | (139 | ) | | | 50 | | | | 272 |

| | | | | | | | | | | | | | | |

| | $ | (349 | ) | | $ | (13,451 | ) | | $ | 17,130 | | | $ | 16,704 |

| | | | | | | | | | | | | | | |

There were no significant unusual items in other, net in 2003.

17

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

Overview

During 2007, we focused our attention on stabilizing our operating performance. Specifically, we addressed the key drivers influencing gross margins, operating expenses and cash. We directed our sales and marketing activities at improving gross margins through product mix improvements and we also continued to focus on improving our operations and supply chain efficiencies. The improved performance in these areas resulted in gross margin improvement of 2.1 percentage points to 16.5% in 2007 compared to 14.4% achieved in 2006.

We experienced gross margin improvements throughout the year, beginning the year with gross margins in the first quarter of 2007 of 10.9% and finishing in the fourth quarter of 2007 with gross margins of 20.4%. The improvements were generated by the continued introduction of new products with higher realizable margins, efficiencies in the area of supply chain management and improved product quality.

Complementing the gross margin improvements were reductions in our operating expenses, which were reduced by $25.4 million in 2007 compared to 2006. Operating expenses, excluding charges for restructuring and regulatory assessments, were $69.9 million in 2007 compared to $88.8 million in 2006. The $18.9 million reduction in these expenses in 2007 compared to 2006 was attributed to continued efforts to better align our cost structure with our anticipated revenues and profits. Operating expenses, excluding restructuring charges, decreased $1.7 million to $15.4 million in the fourth quarter of 2007 compared to $17.1 million in the third quarter of 2007.

Revenue reported for 2007 was $308.2 million, a reduction of 17.8% from 2006 reported revenues of $374.8 million. Unit volumes increased by 3%, from 331,000 units sold in 2006 to 342,000 units sold in 2007, offset by a decline in average selling prices (ASPs) of 18% compared to 2006. The ASP reduction was driven by falling prices in the market-place, compounded by a product mix shift and InFocus selling a higher percentage of entry level products in 2007 compared to 2006.

At December 31, 2007 we had approximately 5 weeks of inventory in the channel, which compared to 4 weeks of inventory in the channel at both December 31, 2006 and September 30, 2007. To the extent that the demand for our products weakens, the increase in channel inventory levels may have a negative impact on our subsequent period revenues and gross margins. As economic conditions in the U.S. market place continue to soften the risk of such revenue and gross margin declines will increase for both our customers and us.

In 2007 we realized an operating loss of $27.5 million compared to an operating loss of $49.8 million reported in 2006. Included in the operating loss in 2007 and 2006, respectively, is $8.4 million and $14.8 million of charges for restructuring and regulatory assessments. In addition, our efforts to sustain and grow cash were directed at working capital initiatives and resulted in positive cash flows generated from operations of $5.4 million in 2007.

In 2007, we focused on providing the market with new products in all our projector categories. In total we introduced 17 new projectors to the market, 12 of which were targeted at the meeting/class room segment where we retain strong brand recognition and believe additional growth potential exists. With the introduction of these products, we have the most robust product offering in our recent history, which allows us to offer our customers a broad portfolio of market leading products.

In 2007, we incurred restructuring charges totaling $8.4 million, which included the following:

| | • | | a $2.4 million charge in the first quarter of 2007 primarily related to estimated lease losses on vacated or partially vacated facilities at our corporate headquarters and various European office locations; |

18

| | • | | a $2.1 million charge in the second quarter of 2007 primarily related to severance costs for personnel reductions; |

| | • | | a $0.2 million charge in the third quarter of 2007 for estimated employee severance costs; and |

| | • | | a $3.7 million charge in the fourth quarter of 2007 for estimated lease losses on vacated or partially vacated facilities. Included in the $3.7 million charge was a $2.7 million charge for changes in estimates of prior period sub-lease assumptions and the remaining $1.0 million charge was for remaining obligations for facilities space that was vacated in the fourth quarter of 2007. |

A portion of the $2.1 million charge recorded in the second quarter of 2007 for severance costs was related to a shift in our research and development model to outsource more of the design functions to our contract manufacturers, which allows us to reduce necessary in-house research and development resources.

We finished 2007 with $84.1 million of cash and cash equivalents and restricted cash and had no outstanding borrowings. The increase in cash and cash equivalents, restricted cash and marketable securities of $7.9 million in 2007 was primarily attributed to positive changes in working capital cash flows from inventory, accounts receivable and accounts payable to more closely match the timing of payments to suppliers with receipts from customers for sales activities, partially offset by our operating loss.

The Company announced in October 2006 that it had engaged Banc America Securities to assist with the evaluation of strategic alternatives. The process yielded several outside parties expressing interest, but no offer was considered to be in the best interests of shareholders. In October of 2007, the Board of Directors terminated the strategic alternatives process and redirected our focus to managing the business and to maximizing shareholder value.

Results of Operations

| | | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31,(1) | |

| | | 2007 | | | 2006 | | | 2005 | |

(Dollars in thousands) | | Dollars | | | % of

revenues | | | Dollars | | | % of

revenues | | | Dollars | | | % of

revenues | |

Revenues | | $ | 308,181 | | | 100.0 | % | | $ | 374,752 | | | 100.0 | % | | $ | 532,099 | | | 100.0 | % |

Cost of revenues | | | 257,426 | | | 83.5 | | | | 320,866 | | | 85.6 | | | | 499,327 | | | 93.8 | |

| | | | | | | | | | | | | | | | | | | | | |

Gross margin | | | 50,755 | | | 16.5 | | | | 53,886 | | | 14.4 | | | | 32,772 | | | 6.2 | |

Operating expenses: | | | | | | | | | | | | | | | | | | | | | |

Marketing and sales | | | 35,777 | | | 11.6 | | | | 49,107 | | | 13.1 | | | | 64,292 | | | 12.1 | |

Research and development | | | 14,135 | | | 4.6 | | | | 17,997 | | | 4.8 | | | | 20,847 | | | 3.9 | |

General and administrative | | | 19,938 | | | 6.5 | | | | 21,730 | | | 5.8 | | | | 23,360 | | | 4.4 | |

Restructuring costs | | | 8,375 | | | 2.7 | | | | 5,425 | | | 1.4 | | | | 11,050 | | | 2.1 | |

Impairment of long-lived assets | | | — | | | — | | | | — | | | — | | | | 9,813 | | | 1.8 | |

Regulatory assessments | | | — | | | — | | | | 9,392 | | | 2.5 | | | | 1,600 | | | 0.3 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | 78,225 | | | 25.4 | | | | 103,651 | | | 27.7 | | | | 130,962 | | | 24.6 | |

| | | | | | | | | | | | | | | | | | | | | |

Loss from operations | | | (27,470 | ) | | (8.9 | ) | | | (49,765 | ) | | (13.3 | ) | | | (98,190 | ) | | (18.5 | ) |

Other income (expense): | | | | | | | | | | | | | | | | | | | | | |

Interest expense | | | (507 | ) | | (0.2 | ) | | | (401 | ) | | (0.1 | ) | | | (612 | ) | | (0.1 | ) |

Interest income | | | 2,715 | | | 0.9 | | | | 2,446 | | | 0.7 | | | | 1,772 | | | 0.3 | |

Other, net | | | (349 | ) | | (0.1 | ) | | | (13,451 | ) | | (3.6 | ) | | | 17,130 | | | 3.2 | |

| | | | | | | | | | | | | | | | | | | | | |

Loss before income taxes | | | (25,611 | ) | | (8.3 | ) | | | (61,171 | ) | | (16.3 | ) | | | (79,900 | ) | | (15.0 | ) |

Provision (benefit) for income taxes | | | (29 | ) | | — | | | | 749 | | | 0.2 | | | | (106 | ) | | — | |

| | | | | | | | | | | | | | | | | | | | | |

Net loss | | $ | (25,582 | ) | | (8.3 | )% | | $ | (61,920 | ) | | (16.5 | )% | | $ | (79,794 | ) | | (15.0 | )% |

| | | | | | | | | | | | | | | | | | | | | |

(1) | Percentages may not add due to rounding. |

19

Revenues

Revenues decreased $66.6 million, or 17.8%, in 2007 compared to 2006 and decreased $157.3 million, or 29.6%, in 2006 compared to 2005.

The decrease in revenue in 2007 compared to 2006 was due primarily to an 18% decrease in ASPs, due to both lower overall pricing across various products and a shift toward a greater weighting of overall sales being derived from our lower-priced entry-level meeting room, classroom and home products. In the first quarter of 2007, compounding the pressure on ASPs already experienced due to the above, we recognized a higher volume of sales of our IN24 and IN26 products at lower margins, as we worked to deplete existing inventory in order to transition the market to the higher-margin and better featured IN24+ and IN26+. Also contributing to the ASP declines in 2007 was increased unit sales of the IN72 entry level home entertainment product. In the first half of 2007, we aggressively sold a large quantity of the IN72 product to deplete existing inventory as the product moved to end of life.

The decrease in revenue attributable to the lower ASPs was partially offset by an increase in total projector units sold to 342,000 units in 2007 compared to 331,000 units in 2006. This increase was primarily due to the increase in sales of entry-level meeting room and classroom products discussed above.

The decrease in revenue in 2006 compared to 2005 was due to the following:

| | • | | a $16.6 million decrease in engine and display revenues as we completely exited those markets in late 2005; |

| | • | | a 71% decrease in OEM unit sales as we continued to deemphasize our OEM business in 2006; |

| | • | | a 66,000 unit decrease in total projector units sold to 331,000 units in 2006 compared to 397,000 units in 2005; and |

| | • | | a 15.5% decrease in ASPs, due to both lower overall pricing and a shift in product mix. |

Geographic Revenues

Revenue by geographic area and as a percentage of total revenue, based on shipment destination, was as follows (dollars in thousands):

| | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | |

| | | 2007 | | | 2006 | | | 2005 | |

U.S. | | $ | 175,219 | | 56.9 | % | | $ | 239,258 | | 63.9 | % | | $ | 331,988 | | 62.4 | % |

Europe | | | 81,999 | | 26.6 | % | | | 81,825 | | 21.8 | % | | | 124,939 | | 23.5 | % |

Asia | | | 34,926 | | 11.3 | % | | | 27,701 | | 7.4 | % | | | 43,350 | | 8.1 | % |

Other | | | 16,037 | | 5.2 | % | | | 25,968 | | 6.9 | % | | | 31,822 | | 6.0 | % |

| | | | | | | | | | | | | | | | | | |

| | $ | 308,181 | | | | | $ | 374,752 | | | | | $ | 532,099 | | | |

| | | | | | | | | | | | | | | | | | |

U.S. revenues in 2007 decreased 26.8% compared to 2006, primarily due to a 7.6% decline in unit sales and a 21.6% decline in ASPs. The ASP decline was affected by the greater weighting towards sales of lower-margin entry-level meeting room, classroom and home entertainment products in 2007 compared to 2006. The overall declines in units and ASPs in 2007 compared to 2006 reflect the continued industry dynamics including intense competition from our Asian competitors and a decline in revenue in the value added reseller channel.

European revenues were relatively flat in 2007 compared to 2006, primarily due to a 23.1% increase in unit sales, mostly offset by a 15.4% decline in ASPs.

Asian revenues increased 26.1% in 2007 compared to 2006 as we focused more of our sales efforts in this region, which contributed to increases in unit sales and market share. The increase in unit sales of 55% was partially offset by a decrease in ASPs of 18.6%.

20

Other revenues primarily consist of sales in Canada and Latin America. Other revenues decreased 38.2% in 2007 compared to 2006. Unit sales decreased 23.0% in 2007 compared to 2006, primarily due to the sale of 8,500 units, which resulted in $6.2 million of revenue, in the first quarter of 2006 related to an education tender order in Mexico that did not reoccur in 2007. Revenue in 2007 was also impacted by a 19.8% decrease in ASPs compared to 2006.