EXHIBIT 99.3

Exhibit 99.3

InFocus Update

April, 2009

www.infocus.com

Agenda

Introduction and Agenda – David InFocus Update – Bob Who is John Hui – Bob Stakeholder Benefits – Lisa

Tender Process Timeline and Transition – Lisa FAQs / What Do I Do Today ?– David Perspective – Steve Questions and Answers – All

www.infocus.com

InFocus Update

On April 10th, 2009 InFocus entered a definitive merger agreement with Image Holdings Corporation (IHC) and IC Acquisition Corp, two Oregon corporations controlled by John Hui, an accomplished entrepreneur and co-founder of eMachines

InFocus shareholders will receive $0.95 in cash per share for a total deal value of approximately $39 million

The transaction is expected to close in the second quarter of 2009

InFocus will remain a US based company with Oregon headquarters and will continue to do business as InFocus

InFocus priorities remain largely the same but our re-structuring and simplification efforts will continue at a much faster pace

www.infocus.com

Who is John Hui?

An accomplished entrepreneur with more than 20 years of experience in technology, computer and computer related businesses

Built and operated a number of tech-related operations

KDS USA – $400 million USD monitor and notebook distributor • eMachines – $1 billion USD computer company

Packard-Bell BF – a European computer distributor

History of lending personal credit, channel relationships and supply chain knowledge to his family of companies

A US citizen living in the country since 1973

Strong interest in the InFocus brand, our people, our technology, our supplier relationships and our routes to market

www.infocus.com

Stakeholder Benefits

Shareholders: The transaction delivers a 36% premium over Thursday’s closing price and a 90% premium over the 30 day trailing average – locked in and paid in cash.

Employees, Customers & Suppliers: The transaction increases stability allowing the company to execute the current strategy and prioritize longer term issues over running the quarter-to-quarter business. John Hui has a history of lending his personal credit, channel knowledge and supply chain relationships to his family of companies.

John Hui: The transaction delivers an industry leading brand, robust routes to market, strong supplier relationships and a long history of delivering innovation to the display market…plus access to an industry that is reminiscent of the PC business in the 90s.

www.infocus.com

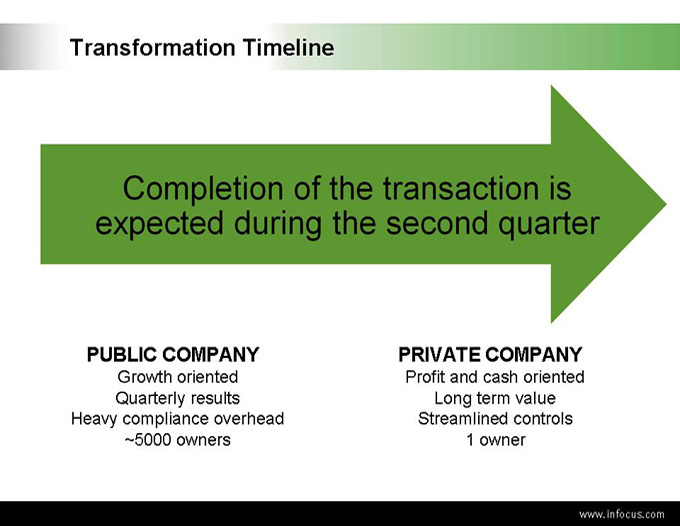

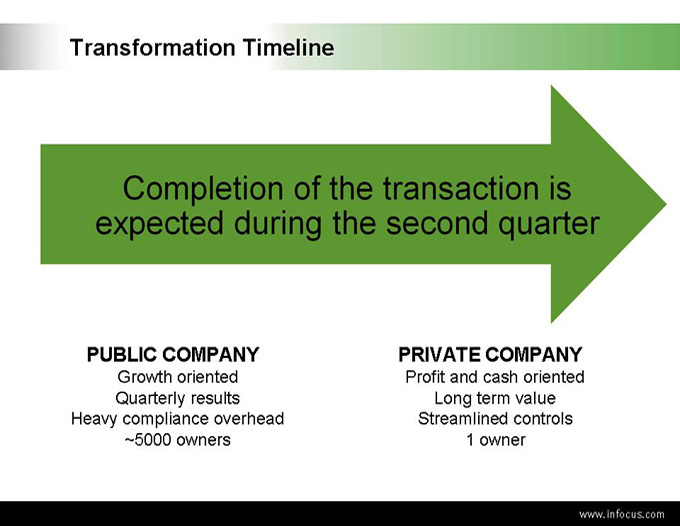

Transformation Timeline

Completion of the transaction is expected during the second quarter PUBLIC COMPANY PRIVATE COMPANY

Growth oriented Profit and cash oriented Quarterly results Long term value Heavy compliance overhead Streamlined controls ~5000 owners 1 owner

www.infocus.com

Public to Private Transition

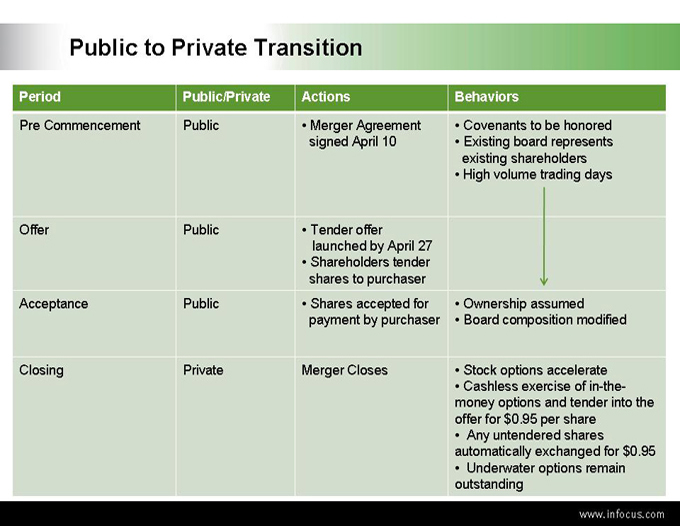

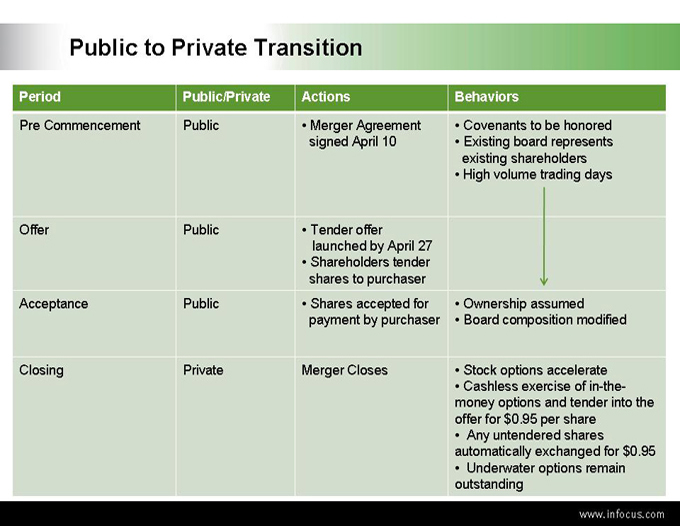

Period Public/Private Actions Behaviors

Pre Commencement Public • Merger Agreement • Covenants to be honored

signed April 10 • Existing board represents

existing shareholders

• High volume trading days

Offer Public • Tender offer

launched by April 27

• Shareholders tender

shares to purchaser

Acceptance Public • Shares accepted for • Ownership assumed

payment by purchaser • Board composition modified

Closing Private Merger Closes • Stock options accelerate

• Cashless exercise of in-the-

money options and tender into the

offer for $0.95 per share

• Any untendered shares

automatically exchanged for $0.95

• Underwater options remain

outstanding

www.infocus.com

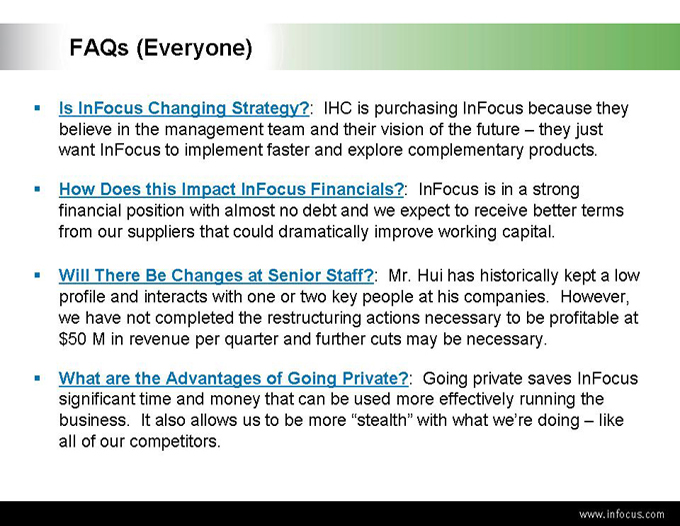

FAQs (Everyone)

Is InFocus Changing Strategy?: IHC is purchasing InFocus because they believe in the management team and their vision of the future – they just want InFocus to implement faster and explore complementary products.

How Does this Impact InFocus Financials?: InFocus is in a strong financial position with almost no debt and we expect to receive better terms from our suppliers that could dramatically improve working capital.

Will There Be Changes at Senior Staff?: Mr. Hui has historically kept a low profile and interacts with one or two key people at his companies. However, we have not completed the restructuring actions necessary to be profitable at

$50 M in revenue per quarter and further cuts may be necessary.

What are the Advantages of Going Private?: Going private saves InFocus significant time and money that can be used more effectively running the business. It also allows us to be more “stealth” with what we’re doing – like all of our competitors.

www.infocus.com

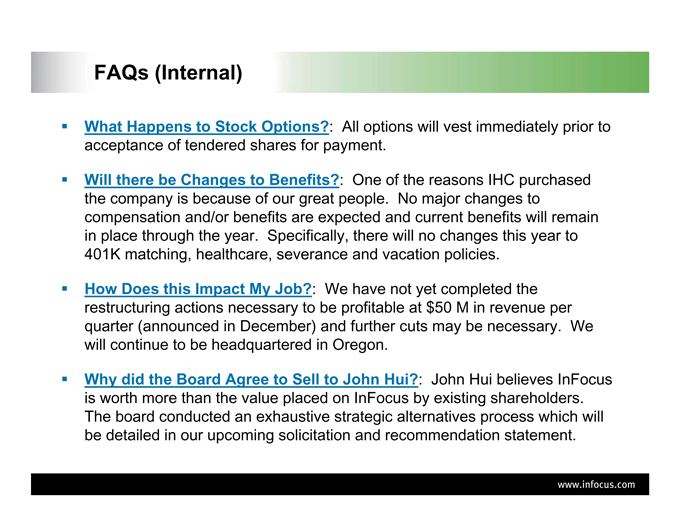

FAQs (Internal)

What Happens to Stock Options?: All options will vest immediately prior to acceptance of tendered shares for payment.

Will there be Changes to Benefits?: One of the reasons IHC purchased the company is because of our great people. No major changes to compensation and/or benefits are expected and current benefits will remain in place through the year. Specifically, there will no changes this year to 401K matching, healthcare, severance and vacation policies.

How Does this Impact My Job?: We have not yet completed the restructuring actions necessary to be profitable at $50 M in revenue per quarter (announced in December) and further cuts may be necessary. We will continue to be headquartered in Oregon.

Why did the Board Agree to Sell to John Hui?: John Hui believes InFocus is worth more than the value placed on InFocus by existing shareholders.

The board conducted an exhaustive strategic alternatives process which will be detailed in our upcoming solicitation and recommendation statement.

www.infocus.com

FAQs (Channel)

Will the Channel Proposition Change?: As a private company, InFocus will not be as driven by short term business results so channel programs could change to encourage more linear sales and other more efficient ways of doing business.

Is InFocus Getting Back into Retail?: Mr. Hui supports our current strategy of focusing on achieving leadership positions in the Pro AV and IT channels worldwide.

Will This Impact Prices?: Not in the short term but we may be able to negotiate better pricing due to Mr. Hui’s supplier relationships.

Does this Impact Warranties?: InFocus remains your supplier and there are no changes to our warranty or other commitments.

Does this Affect our Contracts and Transactional Relationship?: InFocus continues as the legal entity that you will do business with and our contracts will not change.

www.infocus.com

So What Do I Do Today?

We all expect you to continue your day-to-day activities –for example, Bob is visiting with industry leaders and customers today in Chicago.

We need to exceed our forecast in Q2.

We continue to invest in industry leading projectors and we need to get them out and ramped on time.

We must implement our next generation IT systems in July.

We are still a public company working for our existing shareholders and we still need to close Q1 and announce our results.

www.infocus.com

NOTICE TO INVESTORS: This announcement is neither an offer to purchase nor a solicitation of an offer to sell securities. The tender offer for the outstanding shares of InFocus common stock described in the press release has not commenced. At the time the offer is commenced, a tender offer statement on Schedule TO will be filed with the Securities and Exchange Commission (SEC) and InFocus will file a solicitation / recommendation statement on Schedule 14D-9 with respect to the offer.The tender offer statement (including an offer to purchase and a related letter of transmittal) and the solicitation / recommendation statement will contain important information that should be read carefully before any decision is made with respect to the tender offer. Those materials will be made available to InFocus shareholders at no expense to them. In addition, all of those materials (and all other offer documents filed with the SEC) will be available at no charge on the SEC’s website atwww.sec.gov.

STEVE’S PERSPECTIVE

Q & A

www.infocus.com

NOTICE TO INVESTORS: This announcement is neither an offer to purchase nor a solicitation of an offer to sell securities. The tender offer for the outstanding shares of InFocus common stock described in the press release has not commenced. At the time the offer is commenced, a tender offer statement on Schedule TO will be filed with the Securities and Exchange Commission (SEC) and InFocus will file a solicitation / recommendation statement on Schedule 14D-9 with respect to the offer. The tender offer statement (including an offer to purchase and a related letter of transmittal) and the solicitation / recommendation statement will contain important information that should be read carefully before any decision is made with respect to the tender offer. Those materials will be made available to InFocus shareholders at no expense to them. In addition, all of those materials (and all other offer documents filed with the SEC) will be available at no charge on the SEC’s website at www.sec.gov.