GRANT PARK FUTURES FUND

LIMITED PARTNERSHIP

________________________________________________

Supplement dated February 8, 2011

to

Prospectus and Disclosure Document

dated April 1, 2010

________________________________________________

THIS SUPPLEMENT CONTAINS INFORMATION WHICH AMENDS, SUPPLEMENTS OR MODIFIES CERTAIN INFORMATION CONTAINED IN THE PROSPECTUS AND DISCLOSURE DOCUMENT OF THE GRANT PARK FUTURES FUND LIMITED PARTNERSHIP DATED APRIL 1, 2010, AND SHOULD BE READ TOGETHER THEREWITH.

YOU SHOULD CAREFULLY CONSIDER THE “RISK FACTORS” BEGINNING ON PAGE 19 OF THE PROSPECTUS BEFORE YOU DECIDE TO INVEST.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS SUPPLEMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

THE COMMODITY FUTURES TRADING COMMISSION HAS NOT PASSED UPON THE MERITS OF PARTICIPATING IN THIS POOL NOR HAS THE COMMODITY FUTURES TRADING COMMISSION PASSED ON THE ADEQUACY OR ACCURACY OF THIS DISCLOSURE DOCUMENT SUPPLEMENT.

SUMMARY

This supplement revises and replaces the second paragraph on page 2 of the Prospectus under the heading “Summary – Legacy 1 Class and Legacy 2 Class units” in its entirety as follows:

Through their respective trading companies, each of Rabar Market Research, Inc., EMC Capital Management, Inc., Eckhardt Trading Company, or ETC, Winton Capital Management Limited, Welton Investment Corporation, Global Advisors Jersey Limited, Transtrend B.V., Sunrise Capital Partners, LLC, Amplitude Capital International Limited, Quantitative Investment Management, LLC, or QIM and effective February 1, 2011, Alder Capital Limited or Alder, and Denali Asset Management, LLLP or Denali, serve as Grant Park’s commodity trading advisors with respect to the Legacy 1 Class and Legacy 2 Class units. The trading advisors and their respective asset allocations with respect to the Legacy 1 Class and Legacy 2 Class units are the same as with respect to the fund’s existing Class A and Class B units. Effective February 1, 2011, with respect to the Class A and Class B units and the Legacy 1 Class and Legacy 2 Class units of the fund, each of EMC, Winton and Welton will manage between 10% to 20% of Grant Park’s net assets, and each of Rabar, ETC, Global Advisors, Transtrend, QIM, Sunrise, Amplitude, Alder and Denali will be allocated less than 10% of Grant Park’s net assets to manage.

This supplement revises and replaces the fourth paragraph on page 2 of the Prospectus under the heading “Summary – Global 1 Class, Global 2 Class and Global 3 Class units” in its entirety as follows:

Through their respective trading companies, each of EMC, ETC, Winton, Transtrend, QIM, Sunrise, Amplitude and effective February 1, 2011, Alder, Denali and Welton serve as Grant Park’s commodity trading advisors with respect to the Global 1 Class, Global 2 Class and Global 3 Class units. As of February 1, 2011, with respect to the Global 1 Class, Global 2 Class and Global 3 Class units, each of ETC, Winton, Transtrend, QIM and Welton will manage between 10% and 20% of Grant Park’s net assets, and Sunrise, EMC, Amplitude, Alder, and Denali will be allocated less than 10% of Grant Park’s assets to manage.

This supplement revises and replaces the second paragraph on page 5 of the Prospectus under the heading “Summary – What is the difference between the Legacy 1 Class, the Legacy 2 Class, the Global 1 Class, the Global 2 Class and the Global 3 Class units?” in its entirety as follows:

Trading for the Legacy 1 Class and Legacy 2 Class units, on the one hand, and the Global 1 Class, Global 2 Class and Global 3 Class units, on the other hand, will be directed by different trading advisors, and such trading advisors will pursue different trading strategies. Effective February 1, 2011, the trading advisors for the Legacy 1 Class and Legacy 2 Class units will be Rabar, EMC, ETC, Winton, Welton, Global Advisors, Transtrend, QIM, Sunrise, Amplitude, Alder and Denali and such advisors will generally pursue a technical trend trading philosophy. The trading advisors, asset allocations and trading philosophy with respect to the Legacy 1 Class and Legacy 2 Class units are the same as those utilized for Grant Park’s existing Class A and Class B units. Effective February 1, 2011, the trading advisors for the Global 1 Class, Global 2 Class and Global 3 Class units will be EMC, ETC, Winton, Transtrend, QIM, Sunrise, Amplitude, Alder, Denali and Welton and such trading advisors will generally pursue technical trend trading philosophies, as well as pattern recognition philosophies focused on relatively shorter timeframes than the Legacy 1 Class and Legacy 2 Class units.

This supplement revises and replaces the text on page 3 of the Prospectus under the heading “Summary - Breakeven Amounts for Each Class of Units” and the Breakeven Analysis tables on pages 12-17 of the Prospectus under the heading “Summary – Breakeven Analysis” in its entirety as follows:

Break-Even Amounts for Each Class of Units

The following summarizes the approximate dollar returns and percentage returns required for the redemption value of a hypothetical $1,000 initial investment in offered units to equal the amount invested 12 months after the investment was made. The breakeven summary for the Global 3 Class units shows the amount required to “break-even” both with and without an early redemption fee which, for purposes of this summary, has been averaged to approximate the effect that payment of an early redemption fee will have on a redemption of such units during the first year of investment.

| · | Legacy 1 Class: 5.27% (or $52.65). |

| · | Legacy 2 Class: 5.57% (or $55.69). |

| · | Global 1 Class: 4.67% (or $46.71). |

| · | Global 2 Class: 4.98% (or $49.76). |

| · | Global 3 Class: 7.18% (or $71.76) without average early redemption fee, or 8.18% (or $81.76) with average early redemption fee. |

See “Summary – Breakeven Analysis” beginning on page 11 for detailed breakeven analysis of the offered units.

Breakeven Analysis

The breakeven analysis below indicates the approximate dollar returns and percentage required for the redemption value of a hypothetical $1,000 initial investment in offered units to equal the amount invested 12 months after the investment was made. The breakeven analysis for Global 3 Class units shows the amount required to “break-even” both with and without an early redemption fee which, for purposes of this analysis, has been averaged to approximate the effect that payment of an early redemption fee will have on a redemption of such units during the first year of investment. The breakeven analysis is an approximation only.

Legacy 1 Class Breakeven Analysis

| | | Legacy 1 Class Units | |

Assumed initial selling price per unit(1) | | $ | 1,000.00 | |

Trading advisors’ incentive fees(2) | | $ | 4.65 | |

Brokerage charge(3) (5.00%) | | $ | 50.00 | |

Operating expenses(4) (0.25%) | | $ | 2.50 | |

Offering expenses(5) (0.30%) | | $ | 3.00 | |

Interest income(6) (0.75%) | | $ | (7.50 | ) |

| Amount of trading income required for the redemption value at the end of one year to equal the initial selling price of the unit | | $ | 52.65 | |

| Percentage of initial selling price per Legacy 1 Class unit | | | 5.27 | % |

_______________

| (1) | The minimum investment required to invest in the Legacy 1 Class units is $10,000. For ease of comparability, $1,000 will be deemed to be the assumed selling price per unit of a Legacy 1 Class |

| | unit, and, as described below, a Legacy 2 Class unit, a Global 1 Class unit, a Global 2 Class unit and a Global 3 Class unit, for purposes of the breakeven analysis. |

| (2) | Reflects incentive fees payable to Amplitude, EMC, ETC, Rabar, Winton, Welton, Global Advisors, Transtrend, QIM, Sunrise, Alder and Denali assuming they manage between 5% and 20% of invested assets and assuming each of the advisors have equivalent performance returns for the 12-month period. Actual incentive fees are calculated quarterly on the basis of each trading advisor’s individual performance, not the overall performance of Grant Park or the Legacy 1 Class units. Because incentive fees payable to certain of these trading advisors are calculated on the basis of trading profits realized on the assets they manage after deduction for the allocable portion of only certain expenses charged to Grant Park, these advisors would receive an incentive fee before Grant Park has recouped all expenses and reaches the “break-even” level. Incen tive fees payable to certain other of these trading advisors are calculated after deduction for the allocable portion of expenses charged to Grant Park. These advisors would not receive an incentive fee before Grant Park has recouped all expenses. |

| (3) | The brokerage charge is paid to the general partner on a monthly basis. Effective the initial closing date, the brokerage charge for the Legacy 1 Class units equals 0.4167 % per month, a rate of 5.00% annually, of such units’ month-end adjusted net assets. Out of this amount, the general partner pays all clearing, execution and give-up, floor brokerage, exchange and NFA fees, any other transaction costs, selling agent compensation, selling agent service fees and consulting fees to the trading advisors. The general partner retains the balance as payment for its services to Grant Park. Bid-ask spreads on Grant Park’s forward and other non-exchange traded contracts are not included in this breakeven table due to the difficulty of determining those spreads. |

| (4) | Grant Park is responsible for ongoing operating expenses, up to an amount not to exceed 0.25% of Grant Park’s average net assets per year. This amount is used for purposes of this breakeven analysis. |

| (5) | Grant Park’s organization and offering expenses are paid by the general partner and then reimbursed to the general partner by Grant Park. To pay this reimbursement, effective the initial closing date, Legacy 1 Class units are assessed at an annual rate of 30 basis points (0.30%) of adjusted net assets, calculated and payable monthly on the basis of month-end adjusted net assets of the applicable class. |

| (6) | Grant Park earns interest on free cash balances held in its futures trading accounts. Interest is estimated for these purposes at a rate of 0.75% per year. |

Legacy 2 Class Breakeven Analysis

| | | Legacy 2 Class Units | |

Assumed initial selling price per unit(1) | | $ | 1,000.00 | |

Trading advisors’ incentive fees(2) | | $ | 5.19 | |

Brokerage charge(3) (5.25%) | | $ | 52.50 | |

Operating expenses(4) (0.25%) | | $ | 2.50 | |

Offering expenses(5) (0.30%) | | $ | 3.00 | |

Interest income(6) (0.75%) | | $ | (7.50 | ) |

| Amount of trading income required for the redemption value at the end of one year to equal the initial selling price of the unit | | $ | 55.69 | |

| Percentage of initial selling price per Legacy 2 Class unit | | | 5.57 | % |

_______________

| (1) | The minimum investment required to invest in the Legacy 2 Class units is $10,000. For ease of comparability, $1,000 will be deemed to be the assumed selling price per unit of a Legacy 2 Class unit, and, as described above, a Legacy 1 Class unit, and, as described below, a Global 1 Class unit, a Global 2 Class unit and a Global 3 Class unit, for purposes of the breakeven analysis. |

| (2) | Reflects incentive fees payable to Amplitude, EMC, ETC, Rabar, Winton, Welton, Global Advisors, Transtrend, QIM, Sunrise, Alder and Denali assuming they manage between 5% and 20% of invested assets and assuming each of the advisors have equivalent performance returns for the 12-month period. Actual incentive fees are calculated quarterly on the basis of each trading advisor’s individual performance, not the overall performance of Grant Park or the Legacy 1 Class units. Because incentive fees payable to certain of these trading advisors are calculated on the basis of trading profits realized on the assets they manage after deduction for the allocable portion of only certain expenses charged to Grant Park, these advisors would receive an incentive fee before Grant Park has recouped all expenses and reaches the “break-even” level. Incen tive fees payable to certain other of these trading advisors are calculated after deduction for the allocable portion of expenses charged to Grant Park. These advisors would not receive an incentive fee before Grant Park has recouped all expenses. |

| (3) | The brokerage charge is paid to the general partner on a monthly basis. Effective the initial closing date, the brokerage charge for the Legacy 2 Class units equals 0.4375% per month, a rate of 5.25% annually, of such units’ month-end adjusted net assets. Out of this amount, the general partner pays all clearing, execution and give-up, floor brokerage, exchange and NFA fees, any other transaction costs, selling agent compensation, selling agent service fees and consulting fees to the trading advisors. The general partner retains the balance as payment for its services to Grant Park. Bid-ask spreads on Grant Park’s forward and other non-exchange traded contracts are not included in this breakeven table due to the difficulty of determining those spreads. |

| (4) | Grant Park is responsible for ongoing operating expenses, up to an amount not to exceed 0.25% of Grant Park’s average net assets per year. This amount is used for purposes of this breakeven analysis. |

| (5) | Grant Park’s organization and offering expenses are paid by the general partner and then reimbursed to the general partner by Grant Park. To pay this reimbursement, effective the initial closing date, Legacy 2 Class units are assessed at an annual rate of 30 basis points (0.30%) of adjusted net assets, calculated and payable monthly on the basis of month-end adjusted net assets of the applicable class. |

| (6) | Grant Park earns interest on free cash balances held in its futures trading accounts. Interest is estimated for these purposes at a rate of 0.75% per year. |

Global 1 Class Breakeven Analysis

| | | Global 1 Class Units | |

Assumed initial selling price per unit(1) | | $ | 1,000.00 | |

Trading advisors’ incentive fees(2) | | $ | 4.21 | |

Brokerage charge(3) (4.45%) | | $ | 44.50 | |

Operating expenses(4) (0.25%) | | $ | 2.50 | |

Offering expenses(5) (0.30%) | | $ | 3.00 | |

Interest income(6) (0.75%) | | $ | (7.50 | ) |

| Amount of trading income required for the redemption value at the end of one year to equal the initial selling price of the unit | | $ | 46.71 | |

| Percentage of initial selling price per Global 1 Class unit | | | 4.67 | % |

________________

| (1) | The minimum investment required to invest in the Global 1 Class units is $5,000. For ease of comparability, $1,000 will be deemed to be the assumed selling price per unit of a Global 1 Class unit, and, as described above, a Legacy 1 Class unit and a Legacy 2 Class unit, and, as described below, a Global 2 Class unit and a Global 3 Class unit, for purposes of the breakeven analysis. |

| (2) | Reflects incentive fees payable to Amplitude, EMC, ETC, Winton, Welton, Transtrend, QIM, Sunrise, Alder and Denali assuming they manage between 5% and 20% of invested assets and assuming each of the advisors have equivalent performance returns for the 12-month period. Actual incentive fees are calculated quarterly on the basis of each trading advisor’s individual performance, not the overall performance of Grant Park or the Global 1 Class units. Because incentive fees payable to certain of these trading advisors are calculated on the basis of trading profits realized on the assets they manage after deduction for the allocable portion of only certain expenses charged to Grant Park, these advisors would receive an incentive fee before Grant Park has recouped all expenses and reaches the “break-even” level. Incentive fees payable to cer tain other of these trading advisors are calculated after deduction for the allocable portion of expenses charged to Grant Park. These advisors would not receive an incentive fee before Grant Park has recouped all expenses. |

| (3) | The brokerage charge is paid to the general partner on a monthly basis. Effective the initial closing date, the brokerage charge for the Global 1 Class units equals 0.3708% per month, a rate of 4.45% annually, of such units’ month-end adjusted net assets. Out of this amount, the general partner pays all clearing, execution and give-up, floor brokerage, exchange and NFA fees, any other transaction costs, selling agent compensation, selling agent service fees and consulting fees to the trading advisors. The general partner retains the balance as payment for its services to Grant Park. Bid-ask spreads on Grant Park’s forward and other non-exchange traded contracts are not included in this breakeven table due to the difficulty of determining those spreads. |

| (4) | Grant Park is responsible for ongoing operating expenses, up to an amount not to exceed 0.25% of Grant Park’s average net assets per year. This amount is used for purposes of this breakeven analysis. |

| (5) | Grant Park’s organization and offering expenses are paid by the general partner and then reimbursed to the general partner by Grant Park. To pay this reimbursement, effective the initial closing date, Global 1 Class units are assessed at an annual rate of 30 basis points (0.30%) of adjusted net assets, calculated and payable monthly on the basis of month-end adjusted net assets of the applicable class. |

| (6) | Grant Park earns interest on free cash balances held in its futures trading accounts. Interest is estimated for these purposes at a rate of 0.75% per year. |

Global 2 Class Breakeven Analysis

| | | Global 2 Class Units | |

Assumed initial selling price per unit(1) | | $ | 1,000.00 | |

Trading advisors’ incentive fees(2) | | $ | 4.76 | |

Brokerage charge(3) (4.70%) | | $ | 47.00 | |

Operating expenses(4) (0.25%) | | $ | 2.50 | |

Offering expenses(5) (0.30%) | | $ | 3.00 | |

Interest income(6) (0.75%) | | $ | (7.50 | ) |

| Amount of trading income required for the redemption value at the end of one year to equal the initial selling price of the unit | | $ | 49.76 | |

| Percentage of initial selling price per Global 2 Class unit | | | 4.98 | % |

_______________

| (1) | The minimum investment required to invest in the Global 2 Class units is $5,000. For ease of comparability, $1,000 will be deemed to be the assumed selling price per unit of a Global 2 Class unit, and, as described above, a Legacy 1 Class unit, a Legacy 2 Class unit and a Global 1 Class unit, and, as described below, a Global 3 Class unit, for purposes of the breakeven analysis. |

| (2) | Reflects incentive fees payable to Amplitude, EMC, ETC, Winton, Welton, Transtrend, QIM, Sunrise, |

| | Alder and Denali assuming they manage between 5% and 20% of invested assets and assuming each of the advisors have equivalent performance returns for the 12-month period. Actual incentive fees are calculated quarterly on the basis of each trading advisor’s individual performance, not the overall performance of Grant Park or the Global 2 Class units. Because incentive fees payable to certain of these trading advisors are calculated on the basis of trading profits realized on the assets they manage after deduction for the allocable portion of only certain expenses charged to Grant Park, these advisors would receive an incentive fee before Grant Park has recouped all expenses and reaches the “break-even” level. Incentive fees payable to certain other of these trading advisors are calculated after deduction for the allocable portion of e xpenses charged to Grant Park. These advisors would not receive an incentive fee before Grant Park has recouped all expenses. |

| (3) | The brokerage charge is paid to the general partner on a monthly basis. Effective the initial closing date, the brokerage charge for the Global 2 Class units equals 0.3917% per month, a rate of 4.70% annually, of such units’ month-end adjusted net assets. Out of this amount, the general partner pays all clearing, execution and give-up, floor brokerage, exchange and NFA fees, any other transaction costs, selling agent compensation, selling agent service fees and consulting fees to the trading advisors. The general partner retains the balance as payment for its services to Grant Park. Bid-ask spreads on Grant Park’s forward and other non-exchange traded contracts are not included in this breakeven table due to the difficulty of determining those spreads. |

| (4) | Grant Park is responsible for ongoing operating expenses, up to an amount not to exceed 0.25% of Grant Park’s average net assets per year. This amount is used for purposes of this breakeven analysis. |

| (5) | Grant Park’s organization and offering expenses are paid by the general partner and then reimbursed to the general partner by Grant Park. To pay this reimbursement, effective the initial closing date, Global 2 Class units are assessed at an annual rate of 30 basis points (0.30%) of adjusted net assets, calculated and payable monthly on the basis of month-end adjusted net assets of the applicable class. |

| (6) | Grant Park earns interest on free cash balances held in its futures trading accounts. Interest is estimated for these purposes at a rate of 0.75% per year. |

Global 3 Class Breakeven Analysis

| | | Global 3 Class Units | |

Assumed initial selling price per unit(1) | | $ | 1,000.00 | |

Trading advisors’ incentive fees(2) | | $ | 9.26 | |

Brokerage charge(3) (6.45%) | | $ | 64.50 | |

Operating expenses(4) (0.25%) | | $ | 2.50 | |

Offering expenses(5) (0.30%) | | $ | 3.00 | |

Interest income(6) (0.75%) | | $ | (7.50 | ) |

| | | | | |

| Amount of trading income required for the redemption value at the end of one year to equal the initial selling price of the unit, without early redemption fee | | $ | 71.76 | |

| | | | | |

| Percentage of initial selling price per unit, without early redemption fee | | | 7.18 | % |

Early redemption fee(7) (1.00%) | | $ | 10.00 | |

| | | | | |

| | | | | |

| Amount of trading income required for the redemption value at the end of one year to equal the initial selling price per Global 3 Class unit, with average early redemption fee | | $ | 81.76 | |

| | | | | |

| Percentage of initial selling price per Global 3 Class unit, with average early redemption fee | | | 8.18 | % |

_______________

| (1) | The minimum investment required to invest in the Global 3 Class units is $5,000. For ease of comparability, $1,000 will be deemed to be the assumed selling price per unit of a Global 3 Class unit, and, as described above, a Legacy 1 Class unit, a Legacy 2 Class unit and a Global 1 Class unit, and a Global 2 Class unit, for purposes of the breakeven analysis. |

| (2) | Reflects incentive fees payable to Amplitude, EMC, ETC, Winton, Welton, Transtrend, QIM, Sunrise, Alder and Denali assuming they manage between 5% and 20% of invested assets and assuming each of the advisors have equivalent performance returns for the 12-month period. Actual incentive fees are calculated quarterly on the basis of each trading advisor’s individual performance, not the overall performance of Grant Park or the Global 3 Class units. Because incentive fees payable to certain of these trading advisors are calculated on the basis of trading profits realized on the assets they manage after deduction for the allocable portion of only certain expenses charged to Grant Park, these advisors would receive an incentive fee before Grant Park has recouped all expenses and reaches the “break-even” level. Incentive fees pa yable to certain other of these trading advisors are calculated after deduction for the allocable portion of expenses charged to Grant Park. These advisors would not receive an incentive fee before Grant Park has recouped all expenses. |

| (3) | The brokerage charge is paid to the general partner on a monthly basis. Effective the initial closing date, the brokerage charge for the Global 3 Class units equals 0.5375% per month, a rate of 6.45% annually, of such units’ month-end adjusted net assets. Out of this amount, the general partner pays all clearing, execution and give-up, floor brokerage, exchange and NFA fees, any other transaction costs, selling agent compensation, selling agent service fees and consulting fees to the trading advisors. The general partner retains the balance as payment for its services to Grant Park. Bid-ask spreads on Grant Park’s forward and other non-exchange traded contracts are not included in this breakeven table due to the difficulty of determining those spreads. |

| (4) | Grant Park is responsible for ongoing operating expenses, up to an amount not to exceed 0.25% of Grant Park’s average net assets per year. This amount is used for purposes of this breakeven analysis. |

| (5) | Grant Park’s organization and offering expenses are paid by the general partner and then reimbursed to the general partner by Grant Park. To pay this reimbursement, effective the initial closing date, Global 3 Class units are assessed at an annual rate of 30 basis points (0.30%) of adjusted net assets, calculated and payable monthly on the basis of month-end adjusted net assets of the applicable class. |

| (6) | Grant Park earns interest on free cash balances held in its futures trading accounts. Interest is estimated for these purposes at a rate of 0.75% per year. |

| (7) | Global 3 Class limited partners are prohibited from redeeming such units for three months following the subscription for units. Thereafter, Global 3 Class limited partners causing redemption of their units on or before the one-year anniversary of their subscription for the redeemed units will pay an early redemption fee of 1.5%, 1.0% or 0.5% of the net asset value of the redeemed units, depending on when the units are redeemed during the first year. For purposes of this breakeven analysis, the early redemption fee has been presented as an average of the three different early redemption fees to approximate the effect a payment of an early redemption fee would have on a redemption of Global 3 Class units at an undetermined point during the first year of investment. Because the early redemption fee has been averaged and the other fees and expenses shown assume an investment in Grant Park for one year, the breakeven analysis does not reflect the actual amount required to “break-even” for Global 3 Class units that are redeemed prior to the one-year anniversary of the investment, which will vary depending on the date of redemption. |

This supplement revises and replaces the paragraphs on page 8 of the Prospectus under the heading “Summary – The Trading Advisors” in their entirety as follows:

Effective February 1, 2011, Grant Park trades through its twelve independent professional commodity trading advisors: Rabar Market Research, Inc., EMC Capital Management, Inc., Eckhardt Trading Company (or ETC), Winton Capital Management Limited, Welton Investment Corporation, Global Advisors Jersey Limited, Transtrend B.V., Quantitative Investment Management LLC (or QIM), Alder Capital Limited and Denali Asset Management, LLLP. Effective January 1, 2009, the portion of Grant Park’s net assets allocated to Winton Capital Management was reallocated to GP 1, LLC. Each of the trading advisors is registered as a commodity trading advisor under the Commodity Exchange Act and is a member of the NFA. The General Partner may terminate or replace any or all of the trading advisors, or add additional trading advisors, at any time in its sole discretion.

Rabar Market Research, Inc. is located at 10 Bank Street, Suite 830, White Plains, New York 10606, and its telephone number is (914) 682-8363. EMC Capital Management, Inc. is located at 2201 Waukegan Road, Suite West 240, Bannockburn, Illinois 60015, and its telephone number is (847) 267-8700. ETC is located at 1314 North Dearborn Parkway, Carriage House, Chicago, Illinois 60610, and its telephone number is (312) 787-1107. Winton Capital Management is located at 1-5 St. Mary Abbott’s Place, London, W8 6LS, United Kingdom, and its telephone number is +44-20-7610-5350. Welton Investment Corporation is located at the Eastwood Building, San Carlos between 5th and 6th, Carmel, California 93921, and its telephone number is (831) 626-5190. Global Advisors Jersey Limited’s offices are located at Spectrum, Gloucester Street, St. Helier, JE2 3DE, Channel Islands, and its telephone number is +44-153-451-3100. The business office of Transtrend B.V. is located at Weena 723, Unit C5.070, 3013 AM Rotterdam, The Netherlands and its telephone number is +31-10-453-6500. QIM is located at 401 East Market Street, Suite 104, Charlottesville, Virginia 22902, and its telephone number is (434) 817-4800. Sunrise Capital Partners, LLC is located at 990 Highland Drive, Suite 303, Solana Beach, California 92075, and its telephone number is (858)259-8911. Amplitude Capital International Limited is located at Grand Pavilion Commercial Centre, 1st Floor, 802 West Bay Road, P.O. Box 31855, KY1 1207 Cayman Islands, and its telephone number is (345)943-2295. Alder Capital Limited is located at 61 Merrion Square, Dublin 2, Ireland and its telephone number is +353-1-614-7232. Denali Asset Management, LLLP is located at 5020 Anchor Way, 2nd Floor, Christiansted, Virgin Islands 00820-4633 and its telephone number is (340)778-7744.

This supplement revises and replaces the paragraph on page 10 of the Prospectus under the heading “Fees and Expenses – Incentive Fees” in its entirety as follows:

Incentive Fees—Grant Park currently pays each trading advisor a quarterly incentive fee based on any new trading profits achieved on the trading advisor’s allocated net assets at the end of each calendar quarter. Generally, new trading profits means the net increase in trading profits, realized and unrealized, experienced by the trading advisor on its allocated net assets from the most recent prior quarter in which an incentive fee was paid to the trading advisor, or if an incentive fee has yet to be paid to that trading advisor, the trading advisor’s initial allocation of net assets. Currently, the incentive fees payable to each of Grant Park’s trading advisors that are allocated 10% or more of the fund’s assets are as follows: 22.5% to E MC, 24% to ETC, 20% to Winton and 20% to Welton. Grant Park pays incentive fees ranging between 20% and 26% to each of Rabar, Global Advisors, Transtrend, QIM, Sunrise, Amplitude, and effective February 1, 2011, Alder and Denali. The method of calculating new trading profits on the allocated net assets of each trading advisor is described in “Fees and Expenses—Incentive Fees.”

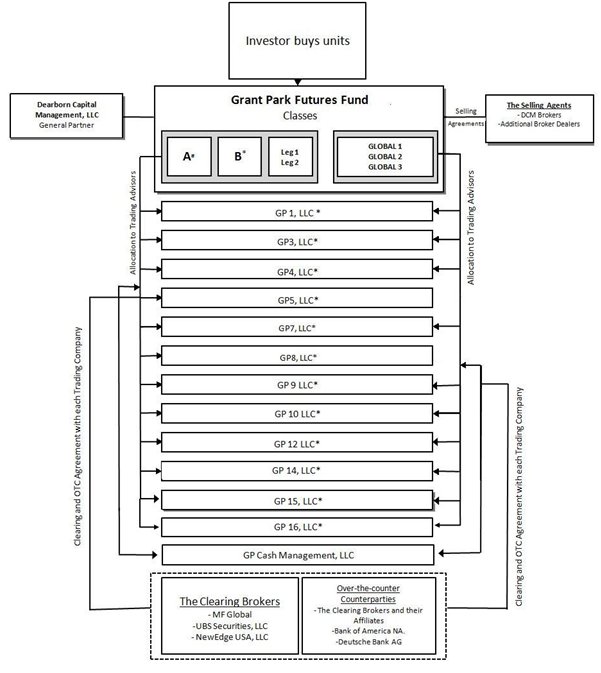

This supplement revises and replaces the chart included on page 18 & 74 of the Prospectus under the heading “Summary – Organizational Chart” in its entirety as follow:

Notes:

| # | Classes A and B are closed to new investment. These classes are no longer offered by the Selling Agents. |

| * | Grant Park invests through an individual Trading Company for each Trading Advisor. An Advisory Agreement is entered by each Advisor, its corresponding Trading Company, Grant Park and Dearborn Capital Management LLC, as General Partner and, in the case of some Advisors, Grant Park. |

RISK FACTORS

This supplement revises and replaces the paragraph on page 29 of the Prospectus under the heading “Risk Factors – The General Partner places significant reliance on the trading advisors and their key personnel” in its entirety as follows:

The General Partner relies on the trading advisors to achieve trading gains for Grant Park, entrusting each of them with the responsibility for, and discretion over, the investment of their allocated portions of Grant Park’s assets. The trading advisors, in turn, are dependent on the services of a limited number of persons to develop and refine their trading approaches and strategies and execute Grant Park’s transactions. The loss of the services of any trading advisor’s principals or key employees, or the failure of those principals or key employees to function effectively as a team, may have an adverse effect on that trading advisor’s ability to manage its trading activities successfully or may cause the trading advisor to cease operations ent irely, either of which, in turn, could negatively impact Grant Park’s performance. Each of Grant Park’s trading advisors is controlled, directly or indirectly, by single individuals, or, in the case of Transtrend, of which 100% of the voting interest is owned by Robeco Netherlands BV, by its managing directors. These individuals, Paul Rabar at Rabar, Elizabeth Cheval at EMC, William Eckhardt at ETC, David Winton Harding at Winton, Patrick Welton at Welton, Russell Newton at Global Advisors, Johannes P.A. van den Broek and Harold M. De Boer at Transtrend, Jaffrey Woodriff, Michael Geismar and Ryan Vaughn at QIM, Dr. Gary B. Davis at Sunrise, Karsten Schroeder at Amplitude, Mark Caslin at Alder and Scott T. Ramsey at Denali. The death, incapacity or other prolonged unavailability of such individuals likely would greatly hinder these trading advisors’ operations, and could result in their ceasing operations entirely, which could adversely affect the value of your inv estment in Grant Park.

THE TRADING ADVISORS

This supplement revises and replaces the first five paragraphs and chart on page 40 of the Prospectus under the heading “The Trading Advisors” in its entirety as follows:

The General Partner has retained Rabar Market Research, Inc., EMC Capital Management, Inc., Eckhardt Trading Company, or ETC, Global Advisors Jersey Limited, Transtrend B.V., Quantitative Investment Management LLC, or QIM, Winton Capital Management Limited, Welton Investment Corporation, Sunrise Capital Partners, LLC, Amplitude Capital International Limited, and effective February 1, 2011, Alder Capital Limited and Denali Asset Management, LLLP as Grant Park’s trading advisors. The table below illustrates the trading advisors for each class of Grant Park’s outstanding limited partnership units:

| | Alder | Amplitude | Denali | EMC | ETC | Global Advisors | DIM | Rabar | Sunrise | Transtrend | Welton | Winton |

| Class A | X | X | X | X | X | X | X | X | X | X | X | X |

| Class B | X | X | X | X | X | X | X | X | X | X | X | X |

| Legacy 1 | X | X | X | X | X | X | X | X | X | X | X | X |

| Legacy 2 | X | X | X | X | X | X | X | X | X | X | X | X |

| Global 1 | X | X | X | X | X | | X | | X | X | X | X |

| Global 2 | X | X | X | X | X | | X | | X | X | X | X |

| Global 3 | X | X | X | X | X | | X | | X | X | X | X |

The trading advisors and their respective asset allocations with respect to the Legacy 1 Class and the Legacy 2 Class units are the same as with respect to our existing Class A and Class B units.

Effective February 1, 2011, the General Partner will allocate Grant Park’s net assets among the trading advisors with respect to the existing Class A, Class B, Legacy 1 Class and Legacy 2 Class units as follows: EMC, Winton and Welton managed between 10% to 20% of Grant Park’s net assets and Rabar, ETC, Global Advisors, Transtrend, QIM, Sunrise, Amplitude, Alder and Denali will be allocated less than 10% of Grant Park’s net assets to manage. The trading advisors for the Legacy 1 Class and Legacy 2 Class units will pursue a technical trend trading philosophy, which is the same trading philosophy the trading advisors have historically used for the existing Class A and Class B units.

Effective February 1, 2011, for the Global 1 Class, Global 2 Class and Global 3 Class units, between 10% and 20% of Grant Park’s assets are allocated to each of ETC, Transtrend, QIM, Welton and Winton, while EMC, Sunrise, Amplitude, Alder and Denali are allocated less than 10% of Grant Park’s net assets. The trading advisors for the Global 1 Class, Global 2 Class and Global 3 Class units will pursue technical trend trading philosophies, as well as pattern recognition philosophies focused on relatively shorter timeframes than the Legacy 1 Class and Legacy 2 Class units.

The General Partner may, in its sole discretion, reallocate assets among the trading advisors upon termination of a trading advisor or retention of any new trading advisors, or at the commencement of any month. Consequently, the current apportionment for all classes of units is subject to change.

Rabar and EMC have been trading on behalf of Grant Park since January 1989 and ETC has been trading on behalf of Grant Park since April 1998. Winton began trading for Grant Park on August 1, 2004. Welton began trading for Grant Park on March 1, 2006. Transtrend and Global Advisors each began trading on July 1, 2008 and QIM began trading for Grant Park on October 1, 2008. As of January 1, 2010, Sunrise began trading for Grant Park and as of February 1, 2010, Amplitude began trading on behalf of Grant Park as well. Sunrise and Amplitude were each allocated less than 10% of Grant Park’s net assets to manage. Effective February 1, 2011, Alder and Denali will begin trading for Grant Park and will each be allocated less than 10% of Grant Park’s assets to manage. The General Partner may, in its sole discretion, reallocate assets among the trading advisors upon termination of a trading advisor or retention of any new trading advisors, or at the commencement of any month. Consequently, the current apportionment is subject to change.

This supplement revises and updates the discussion in the Prospectus under the heading “The Trading Advisors” by removing the 35 paragraphs on pages 47 through 53 under the heading “Graham Capital Management, L.P.” and the 12 paragraphs on pages 63 through 64 under the heading “Revolution Capital Management LLC (RCM)” in their entirety and by adding the following paragraphs on page 69 immediately following the last paragraph under the heading “Amplitude Capital Management International Limited - Management”:

Alder Capital Limited (Alder)

Alder Capital Limited is a limited liability company which was incorporated in Ireland on December 7, 1999. Alder is regulated by the Central Bank of Ireland and received its Financial Regulator authorization in May 2000. In May of 2001, Alder became a member of the NFA and was registered as a commodity trading advisor with the CFTC. Since March 2002, Alder has been registered with the Financial Services Authority in the UK and since October 2003, Alder has been registered with the L'Autorité des Marchés Financiers in France. Alder’s offices are located at 61 Merrion Square, Dublin 2, Ireland and its phone number is +353-1-614-7232.

The listed principals of Alder Limited are Mark Caslin, Brian McCarthy, John Caslin, Richard Spring and Ceall O’Dunlaing.

Mark Caslin is the managing director of Alder. He has been registered as an Associated Person and approved as a Principal of Alder by the NFA since May 2001. In May 2000, Mr. Caslin founded Alder with Brian McCarthy. Mr. Caslin is both an Entrance Exhibitor and a Scholar of Trinity College Dublin from which he holds a B.A. Mod in Mathematical Sciences.

Brian McCarthy is an executive director of Alder. Mr. McCarthy founded Alder with Mark Caslin in May 2000. Brian McCarthy was registered as an Associated Person and was approved as a Principal of Alder by the NFA in May 2001. Mr. McCarthy graduated from the University College Dublin with a Masters Degree in Economic Science in 1991.

John Caslin is an executive director of Alder having joined the firm in September 2003 from Eagle Star Life Assurance Company of Ireland (ultimate parent Zurich Financial Services) where he held the position of General Manager Investment & Financial Solutions, was a member of the senior management team and a member of the Investment Committee of the board of Eagle Star Life Assurance Company of Ireland. John joined Eagle Star Life Assurance Company of Ireland in January 1991. John Caslin was registered as an Associated Person of Alder in March 2005 by the NFA. He was approved as a Principal of Alder by the NFA in May 2005. From March 2004 to June 2008, Mr. Caslin served as a non-executive director of iShares plc a Dublin-domiciled exchange traded fund which, as of February 2008, had approximately $20 billion in assets under management. Mr. Caslin was awarded a degree in mathematics and a first class honors degree and gold medal in engineering from Trinity College Dublin in 1991.

Richard Spring is a non-executive director of Alder. He was appointed to this position in May 2000. Mr. Spring does not take part in any trading or operational activities of Alder nor does he actively market Alder’s services. Mr. Spring was approved as a Principal of Alder by the NFA in May 2001. Mr. Spring is a graduate of Trinity College Dublin and King’s Inns.

Ceall O’Dunlaing, F.I.A. F.S.A.I., does not take part in any trading or operational activities of Alder nor does he actively market Alder’s services. Mr. O’Dunlaing was approved as a Principal of Alder by the NFA in June 2008. He is currently the director of Financial Risk Solutions Limited, for which he was the founding director in November 1999. Financial Risk Solutions Limited is one of the leading providers of investment administration software to the life and pensions industry in Europe. Mr. O’Dunlaing is a Fellow of the Institute of Actuaries, London and a Fellow of the Society of Actuaries in Ireland.

Trading Method

Alder uses a program known as Alder Global 20 in trading for Grant Park. Alder’s trading system is grounded in the following philosophies:

| - | Trends in the value of some currency pairs or combinations of currency pairs tend to persist for periods of three weeks and upwards. |

| - | Movements in the value of some other currency pairs or combinations of currency pairs tend to self correct. |

| - | Currencies with higher interest rates tend to attract capital relative to currencies with lower interest rates. |

| - | All customers have a limited tolerance for risk. |

Remaining consistent with these philosophies, Alder believes that in order to take advantage of trends, self-correcting movements and interest rate differentials currency risk must be taken. Since currency risk is constantly changing Alder makes a reasonable effort to measure these changes and to limit a client's maximum portfolio ‘Forecast Risk’ at each time of trading to an agreed level in light of whatever market risk can be forecasted using its ‘CALM’ risk management system.

Alder trades over-the-counter spot and forward contracts in the following currencies: euro, US dollar, Japanese yen, British pound, Swiss franc, Swedish krona, Australian dollar, and Canadian dollar. Their trading system is 100% systematic and at no point does it rely on discretionary trading. At least once in each trading day Alder calculates the expected trend, the interest rate differential and the ‘Forecast Risk’, as applicable, for each currency pair or combination of currency pairs. The expected trend for a currency pair or portfolio of currencies is calculated using historical prices; the interest rate differentials are sourced from the market; and the ‘Forecast Risk’ is calculated using Alder’s risk forecasting system, CALM. These parameters are the inputs to Alder’s proprietary optimization process which determines the ‘quality of the opportunity set’, the currency trades and their size with the objective of maximizing the long-term Sharpe ratio of the portfolio subject to certain constraints including those that apply at the time of trading.

Denali Asset Management, LLLP (Denali)

Denali Asset Management, LLLP, is a U.S. Virgin Islands Limited Liability Limited Partnership organized in 1994. It has been registered as a commodity trading advisor since February 1994 and as a commodity pool operator since April 2000. Denali was approved as a member of the NFA in February 1994. Denali was also approved as a forex firm by the NFA in October 2010. Denali’s offices are located at 5020 Anchor Way, 2nd Floor, Christiansted, Virgin Islands, 00820-4633 and its telephone number is (340)778-7744.

Management

The principals of Denali Asset Management are Scott T. Ramsey, Brad Lenhart and Ascent Capital LLC.

Scott T. Ramsey is Chief Executive Officer of Denali and is the chief trader. Mr. Ramsey launched Denali in 1994 to manage money for institutional investors. He was registered as an associated person and approved as a principal of Denali by the NFA in February 1994. Mr. Ramsey studied mechanical engineering at the University of Missouri.

Brad E. Lenhart is Chief Operating Officer of Denali and is responsible for all of Denali’s operations including accounting, compliance, risk, and personnel. Mr. Lenhart initially joined Denali in this capacity in January 1997 and left the firm for several years beginning in September 1998. From September 1998 through November 2002, Mr. Lenhart was a Director for H2O Plus, a privately held manufacturer and retailer for skincare products based in Chicago. Mr. Lenhart rejoined Denali in December 2002 and assumed his current responsibilities in December 2002. He became a principal of Denali in April 2003, an associated person in June 2005 and a forex associated person in October 2010. Mr. Lenhart holds a BA from the University of Kansas and has studied at Imperial C ollege, London.

Ascent Capital, LLC, a U.S. Virgin Islands limited liability company, became the general partner to Denali Asset Management, LLLP in June 2000 and is owned and controlled by Scott T. Ramsey. It was registered as a principal of Denali in April 2003.

Denali’s Trading Program

Denali’s trading strategy is a discretionary global macro strategy that trades financial futures, foreign currencies, individual equities and commodities using a flexible, opportunistic trading approach. The strategy seeks to capitalize on market volatility that results in significant price movements consistent with its overall macro-economic outlook, while actively adjusting position size on a short-term basis depending on market developments. The strategy utilizes macroeconomic fundamental research,

technical analysis and disciplined money management to identify trading opportunities. The vast majority of the trades are directional, with a limited amount of options used to capture directional moves.

This supplement revises and replaces the four paragraphs under the heading “The Trading Advisors - Welton Investment Corporation – Welton’s Trading Program” on pages 56 through 57 of the Prospectus, in their entirety as follows:

Welton’s Trading Program

Since its inception, Welton has offered managed futures advisory services to trading manager, institutional and high net worth clients. Welton will use its Alternative Equity Strategies Program (AES), Global Non-Correlated Portfolio (GNP) and Global Directional Portfolio program (GDP), described below, in managing assets for Grant Park.

Welton’s three investment programs combine various elements of the firm’s proprietary research and trading. All programs are intended to generate investment performance with a low correlation to traditional investments such as equities and hedge funds. Each program also exhibits a low performance correlation to each other. By so doing, Welton strives to make each of its offered programs distinctive in their approach, but uniformly consistent in their ability to diversify and complement the vast majority of investors’ portfolios.

AES Program

The Welton Alternative Equity Strategies portfolio (AES) is a multi-strategy investment program implemented across equity securities, listed options and broad based ETFs. AES trades a complementary and diverse group of strategies each with a different underlying basis of return. AES utilizes mean reversionary, relative value and variance-driven strategies. The strategies are typically best applied within a diverse yet like-kind instrument universe. These strategies were developed within the broader Welton research pipeline, with the specific purpose of diversifying the market breadth and strategic core momentum strategies within Welton’s flagship portfolio, the Global Directional Portfolio (GDP). The program’s overarching goal is to provide investors with a reliable source of returns non-correlated to global equity markets and equity-based hedge funds.

GNP Program

The Welton Global Non-Correlated Portfolio (GNP) is a multi-strategy investment program implemented across global exchange-traded futures and foreign exchange. GNP trades a complementary and diverse group of strategies each with a different underlying basis of return. GNP utilizes mean reversion, fundamental and short-term driven strategies. These strategies were developed within the Welton Global Directional Portfolio’s broader research pipeline and are currently strategies all utilized at various allocation levels to diversify GDP’s momentum strategy suite. The program’s overarching goal is to provide investors with a reliable source of returns non-correlated to both global equity markets, hedge funds, and Managed Futures programs.

GDP Program

The Welton Global Directional Portfolio (GDP) is a multi-strategy investment program implemented across global exchange-traded futures and foreign exchange. GDP trades a complementary and diverse group of strategies each with a different underlying basis of return. GDP utilizes momentum, mean reversion, and fundamental driven strategies. GDP began trading in June 2004, and is the firm’s flagship investment program today. The program’s overarching goal is to provide investors with a reliable source of returns non-correlated to both global equity markets and hedge funds, while generally mirroring, but outperforming, the performance path of broad based Managed Futures and Global Macro indices.

This supplement revises and replaces the table on page 70 of the Prospectus captioned “Performance of Grant Park – Class A Units” in its entirety as follows:

PERFORMANCE OF GRANT PARK - CLASS A UNITS

(Unaudited)

As required by CFTC regulations, the past performance record of Grant Park’s Class A units for the last five full calendar years is presented below. While the performance record set forth in the table below has not been independently audited, the General Partner believes that the information presented is accurate. All performance information is shown net of fees and expenses.

| | |

| Name | Grant Park Futures Fund Limited Partnership (Class A units) |

| Type | Privately offered (through February 2003); Publicly offered beginning June 30, 2003; Multi-advisor |

| Inception of Trading | January 1989 |

| Aggregate Gross Subscriptions at 12/31/10 | $147,153,661 |

| Net Asset Value at 12/31/10 | $64,565,072 |

Worst Monthly Percentage Draw-Down (Since 1/05)(1) | -7.95% 01/10 |

Worst Peak-to-Valley Draw-Down (Since 1/05)(2) | -21.18% (Start of 02/04 - End of 04/05) |

| | Rate of Return(3) |

| | 2010 | | 2009 | | 2008 | | 2007 | | 2006 |

| | | | | | | | | | |

| January | -7.95% | | -0.91% | | 2.49% | | 1.25% | | 3.49% |

| February | 0.63% | | -0.80% | | 9.66% | | -4.18% | | -3.28% |

| March | 4.08% | | -3.26% | | -0.63% | | -4.55% | | 4.06% |

| April | 1.80% | | -1.73% | | -0.13% | | 5.23% | | 9.46% |

| May | -3.83% | | 1.64% | | 2.11% | | 4.60% | | -0.81% |

| June | -0.21% | | -3.41% | | 3.06% | | 4.16% | | -2.85% |

| July | -1.66% | | -1.26% | | -5.06% | | -3.72% | | -3.66% |

| August | 2.77% | | 1.15% | | -2.41% | | -3.71% | | 2.20% |

| September | 3.24% | | 1.17% | | 1.31% | | 8.78% | | -1.10% |

| October | 4.33% | | -2.59% | | 4.76% | | 5.23% | | -0.64% |

| November | -2.58% | | 4.24% | | 2.76% | | -0.66% | | 3.59% |

| December | 4.57% | | -3.57% | | 1.08% | | 0.63% | | -0.92% |

| Year | 4.45% | | -9.23% | | 19.91% | | 12.63% | | 9.11% |

| (1) | Worst Monthly Percentage Draw-Down is the largest monthly loss experienced by Grant Park in any calendar month expressed as a percentage of total equity in Grant Park and includes the month and year of that draw-down. |

| (2) | Worst Peak-to-Valley Draw-Down is the greatest cumulative percentage decline in month-end net asset value of Grant Park due to losses sustained by Grant Park during a period in which the initial month-end net asset value of Grant Park is not equaled or exceeded by a subsequent month-end net asset value of Grant Park and includes the time period in which the draw-down occurred. |

| (3) | The monthly rate of return is computed by dividing monthly performance by beginning monthly equity plus additions less redemptions. The monthly rates are then compounded to arrive at the annual rate of return. |

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS

This supplement revises and replaces the table on page 71 of the Prospectus captioned “Performance of Grant Park – Class B Units” in its entirety as follows:

PERFORMANCE OF GRANT PARK - CLASS B UNITS

(Unaudited)

As required by CFTC regulations, the past performance record of Grant Park’s Class B units for the last five full calendar years is presented below. While the performance record set forth in the table below has not been independently audited, the General Partner believes that the information presented is accurate. All performance information is shown net of fees and expenses.

| | |

| Name | Grant Park Futures Fund Limited Partnership (Class B units) |

| Type | Public; Multi-advisor |

| Inception of Trading | August 2003 |

| Aggregate Gross Subscriptions at 12/31/10 | $ 872,734,726 |

| Net Asset Value at 12/31/10 | $ 634,047,022 |

Worst Monthly Percentage Draw-Down(1) (Since 1/05) | -8.00% 01/10 |

Worst Peak-to-Valley Draw-Down(2) (Since 1/05) | -22.03% (Start of 02/04 - End of 04/05) |

| | Rate of Return(3) |

| | 2010 | | 2009 | | 2008 | | 2007 | | 2006 |

| | | | | | | | | | |

| January | -8.00% | | -0.98% | | 2.42% | | 1.18% | | 3.41% |

| February | 0.57% | | -0.88% | | 9.58% | | -4.25% | | -3.35% |

| March | 4.03% | | -3.33% | | -0.70% | | -4.62% | | 3.98% |

| April | 1.74% | | -1.78% | | -0.20% | | 5.15% | | 9.38% |

| May | -3.88% | | 1.58% | | 2.03% | | 4.52% | | -0.88% |

| June | -0.27% | | -3.46% | | 2.99% | | 4.09% | | -2.92% |

| July | -1.71% | | -1.32% | | -5.12% | | -3.79% | | -3.73% |

| August | 2.71% | | 1.09% | | -2.48% | | -3.78% | | 2.12% |

| September | 3.21% | | 1.12% | | 1.24% | | 8.70% | | -1.17% |

| October | 4.27% | | -2.64% | | 4.69% | | 5.16% | | -0.71% |

| November | -2.63% | | 4.19% | | 2.69% | | -0.73% | | 3.51% |

| December | 4.52% | | -3.63% | | 1.01% | | 0.64% | | -0.90% |

| Year | 3.80% | | -9.87% | | 18.88% | | 11.76% | | 8.28% |

_______________

| (1) | Worst Monthly Percentage Draw-Down is the largest monthly loss experienced by Grant Park in any calendar month expressed as a percentage of total equity in Grant Park and includes the month and year of that draw-down. |

| (2) | Worst Peak-to-Valley Draw-Down is the greatest cumulative percentage decline in month-end net asset value of Grant Park due to losses sustained by Grant Park during a period in which the initial month-end net asset value of Grant Park is not equaled or exceeded by a subsequent month-end net asset value of Grant Park and includes the time period in which the draw-down occurred. |

| (3) | The monthly rate of return is computed by dividing monthly performance by beginning monthly equity plus additions less redemptions. The monthly rates are then compounded to arrive at the annual rate of return. |

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS

This supplement revises and replaces the table on page 72 of the Prospectus captioned “Performance of Grant Park - Legacy 1 Units” in its entirety as follows:

PERFORMANCE OF GRANT PARK - Legacy 1 Units

(Unaudited)

As required by CFTC regulations, the past performance record of Grant Park’s Legacy 1 Class units from April 1, 2009 through December 31, 2010, is presented below. While the performance record set forth in the table below has not been independently audited, the general partner believes that the information presented is accurate. All performance information is shown net of fees and expenses.

| | |

| Name | Grant Park Futures Fund Limited Partnership (Legacy 1 Class) |

| Type | Public |

| Inception of Trading | April 2009 |

| Aggregate Gross Subscriptions at 12/31/10 | $ 7,268,103 |

| Net Asset Value at 12/31/10 | $ 7,105,762 |

Worst Monthly Percentage Draw-Down (Since April 2009)(1) | -7.77% 01/10 |

Worst Peak-to-Valley Draw-Down (Since April 2009)(2) | -10.93% (Start of 05/09 - End of 01/10) |

| | Rate of Return(3) |

| | 2010 | | 2009 |

| | | | |

| January | -7.77% | | — |

| February | 0.82% | | — |

| March | 4.15% | | — |

| April | 1.77% | | -1.59% |

| May | -3.53% | | 1.66% |

| June | -0.03% | | -3.10% |

| July | -1.50% | | -1.08% |

| August | 2.86% | | 1.27% |

| September | 3.24% | | 1.21% |

| October | 4.35% | | -2.42% |

| November | -2.32% | | 4.04% |

| December | 4.67% | | -3.19% |

| Year | 6.09% | | -3.39% |

_______________

| (1) | Worst Monthly Percentage Draw-Down is the largest monthly loss experienced by Grant Park in any calendar month expressed as a percentage of total equity in Grant Park and includes the month and year of that draw-down. |

| (2) | Worst Peak-to-Valley Draw-Down is the greatest cumulative percentage decline in month-end net asset value of Grant Park due to losses sustained by Grant Park during a period in which the initial month-end net asset value of Grant Park is not equaled or exceeded by a subsequent month-end net asset value of Grant Park and includes the time period in which the draw-down occurred. |

| (3) | The monthly rate of return is computed by dividing monthly performance by beginning monthly equity plus additions less redemptions. The monthly rates are then compounded to arrive at the annual rate of return. |

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS

This supplement revises and replaces the table on page 73 of the Prospectus captioned “Performance of Grant Park - Legacy 2 Units” in its entirety as follows:

PERFORMANCE OF GRANT PARK - Legacy 2 Units

(Unaudited)

As required by CFTC regulations, the past performance record of Grant Park’s Legacy 2 Class units from April 1, 2009 through December 31, 2010, is presented below. While the performance record set forth in the table below has not been independently audited, the general partner believes that the information presented is accurate. All performance information is shown net of fees and expenses.

| Name | Grant Park Futures Fund Limited Partnership (Legacy 2 Class) |

| Type | Public |

| Inception of Trading | April 2009 |

| Aggregate Gross Subscriptions at 12/31/10 | $ 7,524,731 |

| Net Asset Value at 12/31/10 | $ 5,506,761 |

Worst Monthly Percentage Draw-Down (Since April 2009)(1) | -7.79% 01/10 |

Worst Peak-to-Valley Draw-Down (Since April 2009)(2) | -11.06% (Start of 03/09 - End of 01/10) |

| | Rate of Return(3) |

| | 2010 | | 2009 |

| | | | |

| January | -7.79% | | — |

| February | 0.80% | | — |

| March | 4.13% | | — |

| April | 1.72% | | -1.61% |

| May | -3.53% | | 1.62% |

| June | -0.05% | | -3.12% |

| July | -1.52% | | -1.09% |

| August | 2.82% | | 1.26% |

| September | 3.20% | | 1.21% |

| October | 4.31% | | -2.44% |

| November | -2.34% | | 4.04% |

| December | 4.62% | | -3.22% |

| Year | 5.73% | | -3.55% |

_______________

| (1) | Worst Monthly Percentage Draw-Down is the largest monthly loss experienced by Grant Park in any calendar month expressed as a percentage of total equity in Grant Park and includes the month and year of that draw-down. |

| (2) | Worst Peak-to-Valley Draw-Down is the greatest cumulative percentage decline in month-end net asset value of Grant Park due to losses sustained by Grant Park during a period in which the initial month-end net asset value of Grant Park is not equaled or exceeded by a subsequent month-end net asset value of Grant Park and includes the time period in which the draw-down occurred. |

| (3) | The monthly rate of return is computed by dividing monthly performance by beginning monthly equity plus additions less redemptions. The monthly rates are then compounded to arrive at the annual rate of return. |

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS

This supplement revises and replaces the table on page 74 of the Prospectus captioned “Performance of Grant Park - Global 1 Units” in its entirety as follows:

PERFORMANCE OF GRANT PARK - Global 1 Units

(Unaudited)

As required by CFTC regulations, the past performance record of Grant Park’s Global 1 Class units from April 1, 2009 through December 31, 2010 is presented below. While the performance record set forth in the table below has not been independently audited, the general partner believes that the information presented is accurate. All performance information is shown net of fees and expenses.

| Name | Grant Park Futures Fund Limited Partnership (Global 1 Class) |

| Type | Public |

| Inception of Trading | April 2009 |

| Aggregate Gross Subscriptions at 12/31/10 | $ 11,382,980 |

| Net Asset Value at 12/31/10 | $ 11,003,386 |

Worst Monthly Percentage Draw-Down (Since April 2009)(1) | -7.80% 01/10 |

Worst Peak-to-Valley Draw-Down (Since April 2009)(2) | -13.28% (Start of 05/09 - End of 01/10) |

| | Rate of Return(3) |

| | 2010 | | 2009 |

| | | | |

| January | -7.80% | | — |

| February | 0.71% | | |

| March | 3.65% | | |

| April | 1.52% | | -0.28% |

| May | -2.21% | | 2.02% |

| June | 0.29% | | -3.21% |

| July | -2.51% | | -1.26% |

| August | 2.71% | | 1.11% |

| September | 1.97% | | 1.18% |

| October | 3.70% | | -3.22% |

| November | -2.13% | | 3.75% |

| December | 3.59% | | -4.21% |

| Year | 2.88% | | -4.32% |

_______________

| (1) | Worst Monthly Percentage Draw-Down is the largest monthly loss experienced by Grant Park in any calendar month expressed as a percentage of total equity in Grant Park and includes the month and year of that draw-down. |

| (2) | Worst Peak-to-Valley Draw-Down is the greatest cumulative percentage decline in month-end net asset value of Grant Park due to losses sustained by Grant Park during a period in which the initial month-end net asset value of Grant Park is not equaled or exceeded by a subsequent month-end net asset value of Grant Park and includes the time period in which the draw-down occurred. |

| (3) | The monthly rate of return is computed by dividing monthly performance by beginning monthly equity plus additions less redemptions. The monthly rates are then compounded to arrive at the annual rate of return. |

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS

This supplement revises and replaces the table on page 75 of the Prospectus captioned “Performance of Grant Park - Global 2 Units” in its entirety as follows:

PERFORMANCE OF GRANT PARK - Global 2 Units

(Unaudited)

As required by CFTC regulations, the past performance record of Grant Park’s Global 2 Class units from April 1, 2009 through December 31, 2010, is presented below. While the performance record set forth in the table below has not been independently audited, the general partner believes that the information presented is accurate. All performance information is shown net of fees and expenses.

| | |

| Name | Grant Park Futures Fund Limited Partnership (Global 2 Class) |

| Type | Public |

| Inception of Trading | April 2009 |

| Aggregate Gross Subscriptions at 12/31/10 | $ 19,571,983 |

| Net Asset Value at 12/31/10 | $ 19,376,873 |

Worst Monthly Percentage Draw-Down (Since April 2009)(1) | -7.82% 01/10 |

Worst Peak-to-Valley Draw-Down (Since April 2009)(2) | -13.53% (Start of 05/09 - End of 01/10) |

| | Rate of Return(3) |

| | 2010 | | 2009 |

| | | | |

| January | -7.82% | | — |

| February | 0.69% | | — |

| March | 3.56% | | — |

| April | 1.50% | | -0.30% |

| May | -2.24% | | 1.97% |

| June | 0.29% | | -3.24% |

| July | -2.53% | | -1.28% |

| August | 2.70% | | 1.09% |

| September | 1.94% | | 1.10% |

| October | 3.68% | | -3.24% |

| November | -2.15% | | 3.61% |

| December | 3.56% | | -4.17% |

| Year | 2.56% | | -4.64% |

_______________

| (1) | Worst Monthly Percentage Draw-Down is the largest monthly loss experienced by Grant Park in any calendar month expressed as a percentage of total equity in Grant Park and includes the month and year of that draw-down. |

| (2) | Worst Peak-to-Valley Draw-Down is the greatest cumulative percentage decline in month-end net asset value of Grant Park due to losses sustained by Grant Park during a period in which the initial month-end net asset value of Grant Park is not equaled or exceeded by a subsequent month-end net asset value of Grant Park and includes the time period in which the draw-down occurred. |

| (3) | The monthly rate of return is computed by dividing monthly performance by beginning monthly equity plus additions less redemptions. The monthly rates are then compounded to arrive at the annual rate of return. |

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS

This supplement revises and replaces the table on page 76 of the Prospectus captioned “Performance of Grant Park - Global 3 Units” in its entirety as follows:

PERFORMANCE OF GRANT PARK - Global 3 Units

(Unaudited)

As required by CFTC regulations, the past performance record of Grant Park’s Global 3 Class units from April 1, 2009 through December 31, 2010 is presented below. While the performance record set forth in the table below has not been independently audited, the general partner believes that the information presented is accurate. All performance information is shown net of fees and expenses.

| | |

| Name | Grant Park Futures Fund Limited Partnership (Global 3 Class) |

| Type | Public |

| Inception of Trading | April 2009 |

| Aggregate Gross Subscriptions at 12/31/10 | $ 148,501,347 |

| Net Asset Value at 12/31/10 | $ 148,307,899 |

Worst Monthly Percentage Draw-Down (Since April 2009)(1) | -7.95% 01/10 |

Worst Peak-to-Valley Draw-Down (Since April 2009)(2) | -14.63% (Start of 05/09 - End of 01/10) |

| | Rate of Return(3) |

| | 2010 | | 2009 |

| | | | |

| January | -7.95% | | — |

| February | 0.54% | | — |

| March | 3.40% | | — |

| April | 1.33% | | -0.44% |

| May | -2.38% | | 1.77% |

| June | 0.10% | | -3.49% |

| July | -2.67% | | -1.43% |

| August | 2.54% | | 0.94% |

| September | 1.79% | | 0.96% |

| October | 3.51% | | -3.38% |

| November | -2.28% | | 3.52% |

| December | 3.40% | | -4.36% |

| Year | 0.68% | | -6.04% |

| (1) | Worst Monthly Percentage Draw-Down is the largest monthly loss experienced by Grant Park in any calendar month expressed as a percentage of total equity in Grant Park and includes the month and year of that draw-down. |

| (2) | Worst Peak-to-Valley Draw-Down is the greatest cumulative percentage decline in month-end net asset value of Grant Park due to losses sustained by Grant Park during a period in which the initial month-end net asset value of Grant Park is not equaled or exceeded by a subsequent month-end net asset value of Grant Park and includes the time period in which the draw-down occurred. |

| (3) | The monthly rate of return is computed by dividing monthly performance by beginning monthly equity plus additions less redemptions. The monthly rates are then compounded to arrive at the annual rate of return. |

This supplement revises and replaces the eighteen paragraphs on pages 92-95 of the Prospectus under the heading “The Clearing Brokers – MF Global Inc. – Legal Proceedings” in its entirety as follows:

Legal Proceedings

At any given time, MF Global is involved in numerous legal actions and administrative proceedings, which in the aggregate, MF Global has advised the general partner are not expected to have a material effect upon its condition, financial or otherwise, or to the services it will render to Grant Park. There have been no administrative, civil or criminal proceedings pending, on appeal or concluded against MF Global or its principals within the five years preceding the date of this prospectus that MF Global would deem material for purposes of Part 4 of the Regulations of the Commodity Futures Trading Commission (the “CFTC”), except as follows:

In May 2006, MF Global was sued by the Receiver for Philadelphia Alternate Asset Fund (“PAAF”) and associated entities for common law negligence common law fraud, violations of the Commodity Exchange Act and RICO violations (the “Litigation”). In December 2007, without admitting any liability of any party to the Litigation to any other party to the Litigation, the Litigation was settled with MF Global agreeing to pay $69 million, plus $6 million of legal expenses, to the receiver, in exchange for releases from all applicable parties and the dismissal of the Litigation with prejudice. In a related action, MF Global settled a CFTC administrative proceeding (In the Matter of MF Global, f/k/a Man Financial Inc., and Thomas Gilmartin) brought by the CFTC against MF Global and one of its employees for failure to supervise and recordkeeping violations. Without admitting or denying the allegations, MF Global agreed to pay a civil monetary penalty of $2 million and accept a cease and desist order.

On February 20, 2007, MF Global settled a CFTC administrative proceeding (In the Matter of Steven M. Camp and Man Financial Inc., CFTC Docket No. 07-04) in which MF Global was alleged to have failed to supervise one of its former associated persons (“AP”) who was charged with fraudulently soliciting customers to open accounts at MF Global. The CFTC alleged that the former AP misrepresented the profitability of a web-based trading system and of a purported trading system to be traded by a commodity trading advisor. Without admitting or denying the allegation, MF Global agreed to pay restitution to customers amounting to $196,900.44 and a civil monetary penalty of $120,000. MF Global also agreed to a cease and desist order and to strengthen its sup ervisory system for overseeing sales solicitations by employees in connection with accounts to be traded under letters of direction in favor of third party system providers.

On March 6, 2008, and thereafter, five virtually identical proposed class action securities suits were filed against MF Global’s parent, MF Global Ltd., certain of its officers and directors, and Man Group plc. These suits have now been consolidated into a single action. The complaints seek to hold defendants liable under Sections 11, 12 and 15 of the Securities Act of 1933 by alleging that the registration statement and prospectus issued in connection with MF Global Ltd.’s initial public offering in July 2007 were materially false and misleading to the extent that representations were made regarding MF Global Ltd.’s risk management policies, procedures and systems. The allegations are based upon MF Global Ltd.’s disclosure of $141.5 million in tradin g losses incurred in a single day by an associated person in his personal trading account (“Trading Incident”), which losses MF Global Ltd. was responsible to pay as an exchange clearing member. The consolidated cases have been dismissed on a motion to dismiss by defendants. Plaintiffs have appealed.

On December 17, 2009, MF Global settled a CFTC administrative proceeding in connection with the Trading Incident and three other matters without admitting or denying any allegations and accepting a charge of failing to supervise (In the Matter of MF Global Inc. CFTC Docket No. 10-03). The three

additional matters that were settled involved allegations that MF Global failed to implement procedures to ensure proper transmissions of price information for certain options that were sent to a customer, specifically that the price indications reflected a consensus taken on [a particular] time and date and were derived from different sources in the market place; failed to diligently supervise the proper and accurate preparation of trading cards and failed to maintain appropriate written authorization to conduct trades for a certain customer. Under the CFTC’s order, MF Global agreed to pay an aggregate civil monetary penalty of $10 million (which it had previously accrued) and agreed to a cease and desist order. In addition, MF Global agreed to specific undertakings related to its supervisory practices and procedures and MF Global agreed that it would engage an independent outside firm to review and assess the implementation of the undertakings and certain recommendations that MF Global previously accepted. At the same time, MF Global, without admitting or denying the allegations made by the CME, settled a CME disciplinary action relating to the Trading Incident by paying a fine of $495,000.

On August 28, 2009, Bank of Montreal (“BMO”) instituted suit against MF Global and its former broker, Joseph Saab (“Saab”) (as well as a firm named Optionable, Inc. and five of its principals or employees), in the United States District Court for the Southern District of New York. In its complaint, BMO asserts various claims against all defendants for their alleged misrepresentation of price quotes to BMO’s Market Risk Department (“MRD”) as independent quotes when defendants knew, or should have known, that David Lee (“Lee”), BMO’s trader, created the quotes which, in circular fashion, were passed on to BMO through MF Global’s broker, thereby enabling Lee substantially to overvalue his book at BMO. BMO further all eges that MF Global and Saab knew that Lee was fraudulently misrepresenting prices in his options natural gas book and aided and abetted his ability to do so by MF Global’s actions in sending price indications to the BMO MRD, and substantially assisted Lee’s breach of his fiduciary duties to BMO as its employee. The complaint seeks to hold all defendants jointly and severally liable and, although it does not specify an exact damage claim, it claims CAD 680.0 million (approximately $635.9 million) as a pre-tax loss for BMO in its natural gas trading, claims that it would not have paid brokerage commissions to MF Global (and Optionable), would not have continued Lee and his supervisor as employees at substantial salaries and bonuses, and would not have incurred substantial legal costs and expenses to deal with the Lee mispricing. MF Global has made a motion to dismiss, which is pending.

In or about October 2003, MF Global uncovered an apparent fraudulent scheme conducted by third parties unrelated to MF Global that may have victimized a number of its clients. CCPM, a German Introducing Broker, introduced to MF Global all the clients that may have been victimized. An agent of CCPM, Michael Woertche (and his associates), apparently engaged in a Ponzi scheme in which allegedly unauthorized transfers from and trading in accounts maintained at MF Global were utilized to siphon money out of these accounts, on some occasions shortly after they were established. MF Global was involved in two arbitration proceedings relating to these CCPM introduced accounts. The first arbitration involved claims made by two claimants before a NFA panel.& #160; The second arbitration involves claims made by four claimants before a FINRA panel. The claims in both arbitrations are based on allegations that MF Global and an employee assisted CCPM in engaging in, or recklessly or negligently failed to prevent, unauthorized transfers from, and trading in, accounts maintained by MF Global. Damages sought in the NFA arbitration proceeding were approximately $1.7 million in compensatory damages, unspecified punitive damages and attorney’s fees in addition to the rescission of certain deposit agreements. The NFA arbitration was settled for $200,000 as to one claimant and a net of $240,000 as to the second claimant during fiscal 2008. Damages sought in the FINRA proceeding were approximately $6 million in compensatory damages and $12 million in punitive damages. During the year ended March 31, 2009, the FINRA arbitration was settled for an aggregate of $800,000.

MF Global was named as a co-defendant in an action filed in Florida State Court by Eagletech Communications Inc. (“Eagletech”) and three of its alleged shareholders against 21 defendants, including banks, broker-dealers and clearing brokers, as well as “100 John Doe defendants or their nominee entities”. The complaint alleges that the defendants engaged in a criminal conspiracy designed to manipulate the publicly traded share price of Eagletech stock. Plaintiffs seek unspecified compensatory and special damages, alleging that “Man Group PLC d/b/a Man Financial Inc” participated in the