File No. 333-179641

Grant Park Fund May 2014 Update

June 23, 2014

| | | | Supplement dated June 23, 2014 to Prospectus dated May 08, 2014 |

| Class | May ROR | YTD ROR | Net Asset Value | Net Asset Value per Unit |

| A | 0.9% | -5.4% | $16.7M | $1,106.56 |

| B | 0.9% | -5.7% | $177.9M | $924.05 |

| Legacy 1 | 1.1% | -4.5% | $3.1M | $821.75 |

| Legacy 2 | 1.1% | -4.6% | $3.3M | $808.58 |

| Global 1 | 1.1% | -4.4% | $5.6M | $798.56 |

| Global 2 | 1.1% | -4.5% | $9.2M | $786.47 |

| Global 3 | 1.0% | -5.2% | $134.9M | $716.94 |

| | ALL PERFORMANCE REPORTED IS NET OF FEES AND EXPENSES |

Sector Commentary

Currencies: The New Zealand dollar declined in anticipation the Reserve Bank of New Zealand will slow the pace of interest rate hikes following reports of weaker business confidence in the New Zealand economy. The euro weakened against counterparts in reaction to poor economic data in the Eurozone; this was seen as an indicator of additional monetary easing by the European Central Bank.

Energy: Crude oil prices increased over 2% in anticipation of increased demand during the summer driving season. Natural gas prices fell by 4% after the U.S. Energy Information Administration announced larger-than-expected inventories.

Equities: Global equity markets rallied in reaction to strong economic data in the U.S. and on speculation of further monetary expansion from the European Central Bank.

Fixed Income: U.S. Treasury markets rallied after overall demand for safe-haven assets surged. Concerns surrounding the global economic outlook and the situation in Ukraine drove demand for safe-haven assets. German Bunds rallied in excess of 1.5% after the European Central Bank hinted at further economic stimulus.

Grains/Foods: Corn and wheat prices fell sharply due to strong supply data and improving weather in planting regions across the U.S. Cotton prices fell over 8% in reaction to weak Chinese demand and increased inventories in the U.S.

Metals: Precious metal markets declined and demand for safe-haven assets fell as equity markets remained bullish. Copper prices rose, driven higher by strong industrial demand forecasts.

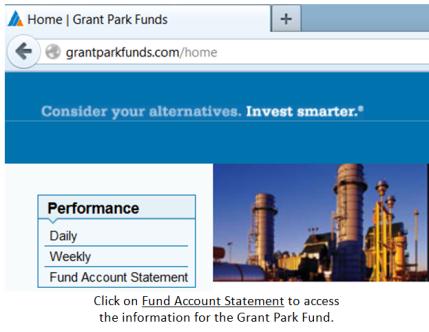

Additional Information: For the Fund’s monthly Account Statement, including the net asset value per unit, and related information, please visit our website at www.grantparkfunds.com.

Sincerely,

David Kavanagh

President

Daily fund performance and weekly commentaries are available on our website at www.grantparkfunds.com.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS

FUTURES TRADING INVOLVES A HIGH DEGREE OF RISK AND IS NOT SUITABLE FOR ALL INVESTORS

THIS DOES NOT CONSTITUTE AN OFFER OF ANY SECURITY FOR SALE NOR SHALL THERE BE ANY SALE OF SECURITIES IN ANY JURISDICTION IN WHICH AN OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL PRIOR TO REGISTRATION OR QUALIFICATION UNDER THE SECURITIES LAWS OF ANY SUCH JURISDICTION OFFERING BY PROSPECTUS ONLY.