September 22, 2014

| Supplement dated September 22, 2014 to Prospectus dated May 08, 2014 |

| Class | August ROR | YTD ROR | Net Asset Value | Net Asset Value per Unit |

| A | 4.2% | -1.7% | $14.8M | $1,149.30 |

| B | 4.2% | -2.1% | $158.7M | $958.77 |

| Legacy 1 | 4.3% | -0.4% | $2.6M | $857.46 |

| Legacy 2 | 4.3% | -0.5% | $1.1M | $843.43 |

| Global 1 | 4.3% | -0.2% | $5.5M | $833.49 |

| Global 2 | 4.3% | -0.3% | $5.8M | $820.58 |

| Global 3 | 4.2% | -1.4% | $117.1M | $745.25 |

| ALL PERFORMANCE REPORTED IS NET OF FEES AND EXPENSES |

Sector Commentary

Currencies: The U.S. dollar strengthened sharply against counterparts, driven by strong earnings reports and better-than-expected economic indicators about the U.S. economy. Conversely, the euro fell sharply amid speculation the European Central Bank (ECB) may lower interest rates in response to weak Eurozone data. Concerns about the conflict in Ukraine also contributed to the euro’s decline. The Japanese yen also fell, driven lower by a larger-than-expected expansion of the nation’s trade deficit.

Energy: Natural gas markets rose nearly 6% as a heat wave in the U.S. drove increased demand. Crude oil markets fell under the combined pressure of elevated U.S. supplies and easing tensions in Ukraine.

Equities: Bullish economic indicators across the U.S. economy drove U.S. equity markets to all-time highs several times throughout the month. European equity markets also moved higher in anticipation the ECB may attempt to help the European economy by providing increased economic stimulus.

Fixed Income: Global fixed-income markets finished sharply higher due to increased demand for safe-haven assets and the decision by central banks across the globe to keep interest rates near historic lows.

Grains/Foods: The corn and wheat markets rallied as speculators anticipated the dry weather in the Midwest may result in lower crop yields. Soybean markets dropped 11% due to stronger-than-expected supply data from the U.S. Department of Agriculture. Sugar markets moved lower due to strong production output from Brazil and on weak global demand.

Metals: Precious metals markets rose as turmoil in Ukraine and economic concerns about the Eurozone increased demand for safe-haven assets. In the base metals markets, copper prices moved lower on weak European industrial demand and on disappointing housing and manufacturing data from China.

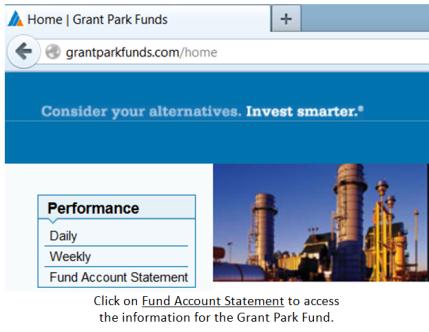

Additional Information: For the Fund’s monthly Account Statement, including the net asset value per unit, and related information, please visit our website at www.grantparkfunds.com.

Sincerely,

David Kavanagh

President

Daily fund performance and weekly commentaries are available on our website at www.grantparkfunds.com.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS

FUTURES TRADING INVOLVES A HIGH DEGREE OF RISK AND IS NOT SUITABLE FOR ALL INVESTORS

THIS DOES NOT CONSTITUTE AN OFFER OF ANY SECURITY FOR SALE NOR SHALL THERE BE ANY SALE OF SECURITIES IN ANY JURISDICTION IN WHICH AN OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL PRIOR TO REGISTRATION OR QUALIFICATION UNDER THE SECURITIES LAWS OF ANY SUCH JURISDICTION OFFERING BY PROSPECTUS ONLY.

Account Statement

(Prepared from books without audit)

For the month ended August 31, 2014

| | | | | | | | |

| STATEMENT OF INCOME | | | | | | | |

| Trading Income (Loss) | | | Monthly Performance | Year to Date Performance | |

| Realized Trading Income (Loss) | | $8,241,124 | | $15,621,736 | | |

| Change In Unrealized Income (Loss) | | 8,039,611 | | -8,235,839 | | |

| Brokerage Commission | | | -166,591 | | -1,110,651 | | |

| Exchange, Clearing Fee and NFA Charges | | 0 | | 0 | | |

| Other Trading Costs | | | -216,426 | | -2,668,104 | | |

| Change in Accrued Commission | | -17,795 | | 21,563 | | |

| Net Trading Income (Loss) | | | 15,879,923 | | 3,628,705 | | |

| | | | | | | | |

| Other Income | | | Monthly Performance | Year to Date Performance | |

| Interest, U.S. Obligations | | | $77,855 | | $596,880 | | |

| Interest, Other | | | -8,039 | | 137,904 | | |

| U.S. Government Securities Gain (Loss) | | 0 | | 0 | | |

| Dividend Income | | | 0 | | 0 | | |

| Total Income (Loss) | | | 15,949,739 | | 4,363,489 | | |

| | | | | | | | |

| Expenses | | | Monthly Performance | Year to Date Performance | |

| Management Fee | | | $0 | | $0 | | |

| Incentive Fee | | | 1,633,230 | | 2,468,668 | | |

| Operating Expenses | | | 66,802 | | 626,199 | | |

| Organization and Offering Expenses | | 77,453 | | 727,110 | | |

| Brokerage Expenses | | | 1,383,530 | | 12,859,215 | | |

| Dividend Expenses | | | 0 | | 0 | | |

| Total Expenses | | | 3,161,015 | | 16,681,192 | | |

| | | | | | | | |

| Net Income (Loss) | | | $12,788,724 | | -$12,317,703 | | |

| | | | | | | | |

| Statement of Changes in Net Asset Value | | Monthly Performance | Year to Date Performance | |

| Beginning Balance | | | $304,355,035 | | $447,372,009 | | |

| Additions | | | 127,500 | | 2,542,200 | | |

| Net Income (Loss) | | | 12,788,724 | | -12,317,703 | | |

| Redemptions | | | -11,633,185 | | -131,958,432 | | |

| Balance at August 31, 2014 | | | $305,638,074 | | $305,638,074 | | |

| PERFORMANCE SUMMARY BY CLASS | | | | | | | |

| Class | Net Asset Value per Unit | Units | Net Asset Value | Monthly ROR Year to Date ROR |

| A | $1,149.301 | | 12,858.33530 | $14,778,101 | | 4.22% | -1.74% | |

| B | $958.772 | | 165,534.70579 | $158,710,112 | | 4.20% | -2.11% | |

| Legacy 1 | $857.456 | | 3,044.63782 | $2,610,644 | | 4.33% | -0.38% | |

| Legacy 2 | $843.427 | | 1,338.00048 | $1,128,506 | | 4.34% | -0.51% | |

| Global 1 | $833.488 | | 6,615.92963 | $5,514,298 | | 4.27% | -0.21% | |

| Global 2 | $820.582 | | 7,070.92781 | $5,802,273 | | 4.28% | -0.35% | |

| Global 3 | $745.252 | | 157,120.28990 | $117,094,139 | | 4.19% | -1.43% | |

| | | | | | | | | |

To the best of my knowledge and belief the information contained herein is accurate and complete.

__________________________________________________________

David Kavanagh, President

For Dearborn Capital Management, LLC

General Partner of Grant Park Futures Fund, Limited Partnership