Filed pursuant to Rule 424(b)(3)

Registration No. 333-223480

PART ONE: DISCLOSURE DOCUMENT

GRANT PARK FUTURES FUND LIMITED PARTNERSHIP

$191,606,823 Legacy 1 Class Units

$179,318,591 Legacy 2 Class Units

$119,076,039 Global Alternative Markets 1 Class Units

$158,617,364 Global Alternative Markets 2 Class Units

$199,459,166 Global Alternative Markets 3 Class Units

The Offering

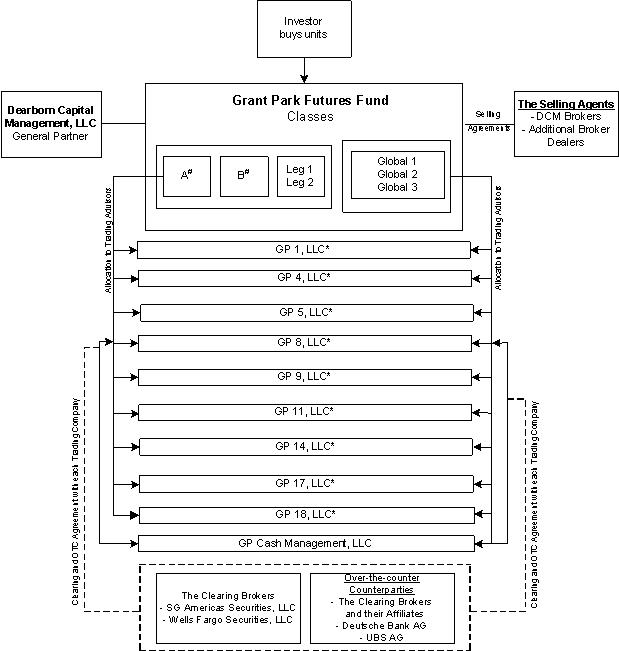

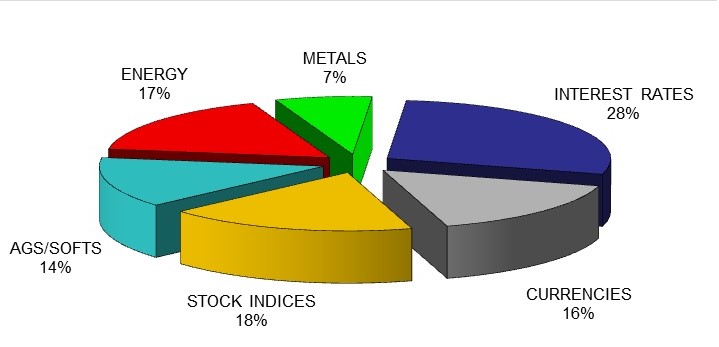

Grant Park Futures Fund Limited Partnership, which is referred to in this prospectus as Grant Park, is a multi‑advisor commodity pool organized to pool assets of investors for the purpose of trading in the U.S. and international spot and derivatives markets for currencies, interest rates, stock indices, agricultural and energy products, precious and base metals and other commodities and underliers. Grant Park, which is not registered as a mutual fund under the Investment Company Act of 1940, has been in continuous operation since January 1989. It is managed by its general partner, Dearborn Capital Management, L.L.C., and invests through independent professional commodity trading advisors.

This offering consists of five classes of limited partnership units: Legacy 1 Class units, Legacy 2 Class units, Global Alternative Markets 1 (“Global 1”) Class units, Global Alternative Markets 2 (“Global 2”) Class units and Global Alternative Markets 3 (“Global 3”) Class units, each of which are being offered to new and existing investors of Grant Park. Grant Park previously publicly offered two additional classes of units: Class A units and Class B units. Although we are no longer offering Class A Units or Class B Units, existing holders of Class A and Class B Units may continue to own such units.

The offered units have different fee arrangements and restrictions on redemptions. Additionally, investments in the offered units will be allocated to different commodity trading advisors who apply different investment strategies with respect to each class of units. The Legacy 1 Class and Legacy 2 Class units and Global 1 Class and Global 2 Class units are being offered only to investors who are represented by approved selling agents who are directly compensated by the investor for services rendered in connection with an investment in Grant Park (such arrangements commonly referred to as “wrap‑accounts”).

The selling agents offer the units at a price equal to the net asset value per unit of each of the units at the close of business on each closing date, which is the last business day of each month.

The selling agents are not required to sell any specific quantity or dollar amount of units, but have agreed to use their best efforts to sell the units offered. Subscriptions approved for investment will be effective as of each closing date and will be held in Grant Park’s subscription account until invested. The offering is not contingent on a minimum aggregate level of investment and is expected to continue until all registered units are sold. The general partner may, however, in its discretion, suspend or terminate the offering at any time, or it may elect to register and offer additional units.

Summary of Risks

Before you decide whether to invest, you should read this entire prospectus carefully and consider the risk factors beginning on page 20. Several risk factors include, but are not limited to:

| · | | An investment in Grant Park is speculative and leveraged; as a result of this leverage, small movements in the price of a commodity interest may cause you to incur significant losses. |

| · | | Performance can be volatile; rapid and substantial fluctuations in commodity interest prices could cause Grant Park’s trading positions to suddenly turn unprofitable and cause you to lose all or substantially all of your investment in Grant Park. |

| · | | Grant Park’s past performance is not necessarily indicative of future results. |

| · | | Grant Park’s use of multiple trading advisors may result in Grant Park taking offsetting trading positions, thereby incurring additional expenses with no net change in holdings. |

| · | | No secondary market exists for the units; redemptions of the units are prohibited during the first three months following an initial and each subsequent investment and, in the case of the Global 3 Class units, redemptions prior to the first anniversary date of an investment will result in early redemption fees. |

| · | | Grant Park pays substantial fees and expenses, including fees paid to its trading advisors, that must be offset by trading profits and interest income. |

| · | | A substantial portion of the trades executed for Grant Park takes place outside of the U.S., much of which exposes Grant Park to substantial credit, regulatory and foreign exchange risk. |

| · | | You will have no right to participate in the management of Grant Park. |

| · | | The structure and operation of Grant Park involve several conflicts of interest. |

| · | | The commodity interest markets are the subject of regulatory scrutiny, from both a national and international perspective, and the implementation of certain proposed laws or regulations could adversely impact Grant Park’s ability to trade speculatively and implement its trading strategies. |

Minimum Investment

There is a $10,000 minimum investment required to invest in the Legacy 1 Class and Legacy 2 Class units, except that, in the case of investors that are employee benefit plans and/or individual retirement accounts, the minimum investment is $1,000. The minimum investment in the Global 1 Class, Global 2 Class and Global 3 Class units is $5,000, respectively, except that in the case of investors that are employee benefit plans and/or individual retirement accounts, the minimum investment is $1,000. Any minimum initial investment amounts or wrap‑account requirements may be waived in the sole discretion of the general partner.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

THE COMMODITY FUTURES TRADING COMMISSION HAS NOT PASSED UPON THE MERITS OF PARTICIPATING IN THIS POOL NOR HAS THE COMMODITY FUTURES TRADING COMMISSION PASSED ON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS.

This prospectus is in two parts: a disclosure document and a statement of additional information. These parts are bound together, and both parts contain important information.

The date of this prospectus is July 13, 2018

REGULATORY NOTICES

NO DEALER, SALESMAN OR ANY OTHER PERSON HAS BEEN AUTHORIZED TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATION NOT CONTAINED IN THIS PROSPECTUS, AND, IF GIVEN OR MADE, SUCH OTHER INFORMATION OR REPRESENTATION MUST NOT BE RELIED UPON AS HAVING BEEN AUTHORIZED BY THE FUND, THE GENERAL PARTNER, THE AUTHORIZED PARTICIPANTS OR ANY OTHER PERSON.

THIS PROSPECTUS DOES NOT CONSTITUTE AN OFFER TO SELL OR A SOLICITATION OF AN OFFER TO BUY THE SECURITIES OFFERED HEREBY TO ANY PERSON OR BY ANYONE IN ANY JURISDICTION IN WHICH SUCH OFFER OR SOLICITATION MAY NOT LAWFULLY BE MADE.

THE BOOKS AND RECORDS OF THE FUND WILL BE MAINTAINED AT ITS PRINCIPAL OFFICE, 555 WEST JACKSON BOULEVARD, SUITE 600, CHICAGO, IL 60661. LIMITED PARTNERS WILL HAVE THE RIGHT, DURING NORMAL BUSINESS HOURS, TO HAVE ACCESS TO AND COPY (UPON PAYMENT OF REASONABLE REPRODUCTION COSTS) SUCH BOOKS AND RECORDS IN PERSON OR BY THEIR AUTHORIZED ATTORNEY OR AGENT. EACH MONTH, THE GENERAL PARTNER WILL DISTRIBUTE REPORTS TO ALL LIMITED PARTNERS SETTING FORTH SUCH INFORMATION AS THE COMMODITY FUTURES TRADING COMMISSION (THE “CFTC”) AND THE NATIONAL FUTURES ASSOCIATION (THE “NFA”) MAY REQUIRE BE GIVEN TO THE PARTICIPANTS IN COMMODITY POOLS WITH RESPECT TO THE FUND AND ANY SUCH OTHER INFORMATION AS THE GENERAL PARTNER MAY DEEM APPROPRIATE. THERE WILL SIMILARLY BE DISTRIBUTED TO LIMITED PARTNERS, NOT MORE THAN 90 DAYS AFTER THE CLOSE OF EACH OF THE FUND’S FISCAL YEARS, CERTIFIED AUDITED FINANCIAL STATEMENTS AND (IN NO EVENT LATER THAN MARCH 15 OF THE IMMEDIATELY FOLLOWING YEAR) THE TAX INFORMATION RELATING TO SHARES OF THE FUND NECESSARY FOR THE PREPARATION OF LIMITED PARTNERS’ ANNUAL FEDERAL INCOME TAX RETURNS.

THE DIVISION OF INVESTMENT MANAGEMENT OF THE SECURITIES AND EXCHANGE COMMISSION REQUIRES THAT THE FOLLOWING STATEMENT BE PROMINENTLY SET FORTH HEREIN: “GRANT PARK FUTURES FUND LIMITED PARTNERSHIP IS NOT A MUTUAL FUND OR ANY OTHER TYPE OF INVESTMENT COMPANY WITHIN THE MEANING OF THE INVESTMENT COMPANY ACT OF 1940, AS AMENDED, AND IS NOT SUBJECT TO REGULATION THEREUNDER.”

You should rely only on the information contained in this prospectus. Grant Park, the general partner and the selling agents have not authorized anyone to provide you with different information, and if you receive any unauthorized information, you should not rely on it. We are not making an offer of these securities in any place where the offer is not permitted. You should assume that the information in this prospectus or any prospectus supplement is accurate only as of the date of the front cover of that document, regardless of the time you receive this prospectus.

COMMODITY FUTURES TRADING COMMISSION

RISK DISCLOSURE STATEMENT

YOU SHOULD CAREFULLY CONSIDER WHETHER YOUR FINANCIAL CONDITION PERMITS YOU TO PARTICIPATE IN A COMMODITY POOL. IN SO DOING, YOU SHOULD BE AWARE THAT COMMODITY INTEREST TRADING CAN QUICKLY LEAD TO LARGE LOSSES AS WELL AS GAINS. SUCH TRADING LOSSES CAN SHARPLY REDUCE THE NET ASSET VALUE OF THE POOL AND CONSEQUENTLY THE VALUE OF YOUR INTEREST IN THE POOL. IN ADDITION, RESTRICTIONS ON REDEMPTIONS MAY AFFECT YOUR ABILITY TO WITHDRAW YOUR PARTICIPATION IN THE POOL.

FURTHER, COMMODITY POOLS MAY BE SUBJECT TO SUBSTANTIAL CHARGES FOR MANAGEMENT AND ADVISORY AND BROKERAGE FEES. IT MAY BE NECESSARY FOR THOSE POOLS THAT ARE SUBJECT TO THESE CHARGES TO MAKE SUBSTANTIAL TRADING PROFITS TO AVOID DEPLETION OR EXHAUSTION OF THEIR ASSETS. THIS DISCLOSURE DOCUMENT CONTAINS A COMPLETE DESCRIPTION OF EACH EXPENSE TO BE CHARGED THIS POOL AT PAGE 9 AND A STATEMENT OF THE PERCENTAGE RETURN NECESSARY TO BREAK EVEN, THAT IS, TO RECOVER THE AMOUNT OF YOUR INITIAL INVESTMENT, AT PAGE 11.

THIS BRIEF STATEMENT CANNOT DISCLOSE ALL THE RISKS AND OTHER FACTORS NECESSARY TO EVALUATE YOUR PARTICIPATION IN THIS COMMODITY POOL. THEREFORE, BEFORE YOU DECIDE TO PARTICIPATE IN THIS COMMODITY POOL, YOU SHOULD CAREFULLY STUDY THIS DISCLOSURE DOCUMENT, INCLUDING A DESCRIPTION OF THE PRINCIPAL RISK FACTORS OF THIS INVESTMENT, AT PAGE 20.

YOU SHOULD ALSO BE AWARE THAT THIS COMMODITY POOL MAY TRADE FOREIGN FUTURES OR OPTIONS CONTRACTS. TRANSACTIONS ON MARKETS LOCATED OUTSIDE THE UNITED STATES, INCLUDING MARKETS FORMALLY LINKED TO A UNITED STATES MARKET, MAY BE SUBJECT TO REGULATIONS WHICH OFFER DIFFERENT OR DIMINISHED PROTECTION TO THE POOL AND ITS PARTICIPANTS. FURTHER, UNITED STATES REGULATORY AUTHORITIES MAY BE UNABLE TO COMPEL THE ENFORCEMENT OF THE RULES OF REGULATORY AUTHORITIES OR MARKETS IN NON‑UNITED STATES JURISDICTIONS WHERE TRANSACTIONS FOR THE POOL MAY BE EFFECTED.

YOU SHOULD ALSO BE AWARE THAT THIS COMMODITY POOL MAY ENGAGE IN OFF‑ EXCHANGE FOREIGN CURRENCY TRADING. SUCH TRADING IS NOT CONDUCTED IN THE INTERBANK MARKET. THE FUNDS THAT THE POOL USES FOR OFF‑EXCHANGE FOREIGN CURRENCY TRADING WILL NOT RECEIVE THE SAME PROTECTIONS AS FUNDS USED TO MARGIN OR GUARANTEE EXCHANGE‑TRADED FUTURES AND OPTION CONTRACTS. IF THE POOL DEPOSITS SUCH FUNDS WITH A COUNTERPARTY AND THAT COUNTERPARTY BECOMES INSOLVENT, THE POOL’S CLAIM FOR AMOUNTS DEPOSITED OR PROFITS EARNED ON TRANSACTIONS WITH THE COUNTERPARTY MAY NOT BE TREATED AS A COMMODITY CUSTOMER CLAIM FOR PURPOSES OF SUBCHAPTER IV OF CHAPTER 7 OF THE BANKRUPTCY CODE AND THE REGULATIONS THEREUNDER. THE POOL MAY BE A GENERAL CREDITOR AND ITS CLAIM MAY BE PAID, ALONG WITH THE CLAIMS OF OTHER GENERAL CREDITORS, FROM ANY MONIES STILL AVAILABLE AFTER PRIORITY CLAIMS ARE PAID. EVEN POOL FUNDS THAT THE COUNTERPARTY KEEPS SEPARATE FROM ITS OWN FUNDS MAY NOT BE SAFE FROM THE CLAIMS OF PRIORITY AND OTHER GENERAL CREDITORS.

SWAPS TRANSACTIONS, LIKE OTHER FINANCIAL TRANSACTIONS, INVOLVE A VARIETY OF SIGNIFICANT RISKS. THE SPECIFIC RISKS PRESENTED BY A PARTICULAR SWAP TRANSACTION NECESSARILY DEPEND UPON THE TERMS OF THE TRANSACTION AND YOUR CIRCUMSTANCES. IN GENERAL, HOWEVER, ALL SWAPS TRANSACTIONS INVOLVE SOME COMBINATION OF MARKET RISK, CREDIT RISK, COUNTERPARTY CREDIT RISK, FUNDING RISK, LIQUIDITY RISK, AND OPERATIONAL RISK.

HIGHLY CUSTOMIZED SWAPS TRANSACTIONS IN PARTICULAR MAY INCREASE LIQUIDITY RISK, WHICH MAY RESULT IN A SUSPENSION OF REDEMPTIONS. HIGHLY LEVERAGED TRANSACTIONS MAY EXPERIENCE SUBSTANTIAL GAINS OR LOSSES IN VALUE AS A RESULT OF RELATIVELY SMALL CHANGES IN THE VALUE OR LEVEL OF AN UNDERLYING OR RELATED MARKET FACTOR.

IN EVALUATING THE RISKS AND CONTRACTUAL OBLIGATIONS ASSOCIATED WITH A PARTICULAR SWAP TRANSACTION, IT IS IMPORTANT TO CONSIDER THAT A SWAP TRANSACTION MAY BE MODIFIED OR

TERMINATED ONLY BY MUTUAL CONSENT OF THE ORIGINAL PARTIES AND SUBJECT TO AGREEMENT ON INDIVIDUALLY NEGOTIATED TERMS. THEREFORE, IT MAY NOT BE POSSIBLE FOR THE COMMODITY POOL OPERATOR TO MODIFY, TERMINATE, OR OFFSET THE POOL’S OBLIGATIONS OR THE POOL’S EXPOSURE TO THE RISKS ASSOCIATED WITH A TRANSACTION PRIOR TO ITS SCHEDULED TERMINATION DATE.

NATIONAL FUTURES ASSOCIATION HAS NEITHER PASSED UPON THE MERITS OF PARTICIPATING IN THIS POOL NOR THE ADEQUACY OR ACCURACY OF THIS DISCLOSURE DOCUMENT.

A NUMBER OF JURISDICTIONS IN WHICH THE UNITS ARE OFFERED IMPOSE ON THEIR RESIDENTS HIGHER MINIMUM SUITABILITY REQUIREMENTS, WHICH ARE DESCRIBED IN APPENDIX C TO THIS PROSPECTUS. PLEASE SEE PAGES C‑3 AND C‑4 OF APPENDIX C FOR A DETAILED DESCRIPTION OF THE MINIMUM SUITABILITY REQUIREMENTS IN THE STATE IN WHICH YOU RESIDE. YOU WILL BE REQUIRED TO REPRESENT THAT YOU MEET THE REQUIREMENTS SET FORTH IN YOUR STATE OF RESIDENCE BEFORE YOUR SUBSCRIPTION TO PURCHASE UNITS WILL BE ACCEPTED. THESE SUITABILITY REQUIREMENTS ARE, IN EACH CASE, REGULATORY MINIMUMS ONLY, AND JUST BECAUSE YOU MEET SUCH REQUIREMENTS DOES NOT MEAN THAT AN INVESTMENT IN THE UNITS IS SUITABLE FOR YOU. IN NO EVENT MAY YOU INVEST MORE THAN 10% OF YOUR NET WORTH, EXCLUSIVE OF HOME, FURNISHINGS AND AUTOMOBILES, IN GRANT PARK.

Dearborn Capital Management, L.L.C.

General Partner

555 West Jackson Boulevard, Suite 600

Chicago, IL 60661

(312) 756‑4450

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus. Grant Park, the general partner and the selling agents have not authorized anyone to provide you with different information, and if you receive any unauthorized information, you should not rely on it. We are not making an offer of these securities any place where the offer is not permitted. You should assume that the information in this prospectus or any prospectus supplement is accurate only as of the date of the front cover of that document, regardless of the time you receive this prospectus.

SUMMARY

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider before investing in the units. You should read this entire prospectus carefully, including the risk factors beginning on page 20, the Statement of Additional Information and all exhibits to the prospectus, before deciding to invest. See the glossary in Appendix E for definitions of certain key terms relating to Grant Park’s trading activities that are used in this prospectus. Any March 31, 2018 and April 30, 2018 financial information disclosed herein is unaudited. This prospectus is intended to be used beginning July 13, 2018.

Grant Park

Grant Park is a multi‑advisor commodity pool organized to pool assets of investors for the purpose of trading in the U.S. and international spot and derivatives markets for currencies, interest rates, stock indices, agricultural and energy products, precious and base metals and other commodities and underliers. In trading on these markets, Grant Park may enter into: exchange‑ traded derivatives, such as futures contracts, options on futures contracts, security futures contracts and listed option contracts (collectively, “exchange‑traded derivatives”); over‑the‑counter, or OTC, derivatives, such as forwards, swaps, options and structured financial products (collectively, “OTC derivatives”); and contracts on cash, or spot, commodities (collectively, “cash commodities”) (collectively, “exchange‑traded derivatives,” “OTC derivatives” and “cash commodities” are referred to as “commodity interests”).

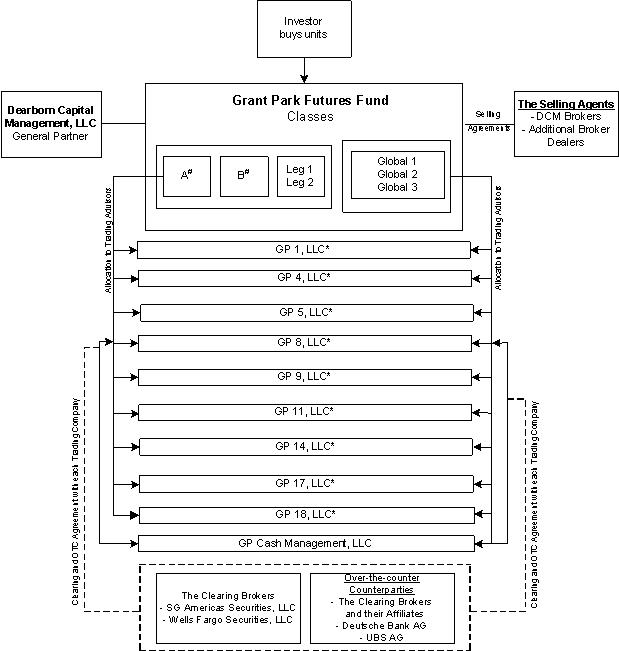

Grant Park invests the assets of each class of the fund in various trading companies which (i) enter into advisory agreements with the independent commodity trading advisors retained by the general partner; (ii) enter into swap transactions or derivative instruments tied to the performance of certain reference traders; and/or (iii) allocate assets to Grant Park’s cash management trading company. Grant Park’s general partner, commodity pool operator and sponsor is Dearborn Capital Management, L.L.C., an Illinois limited liability company. The manager of Dearborn Capital Management, L.L.C. is David M. Kavanagh, its President.

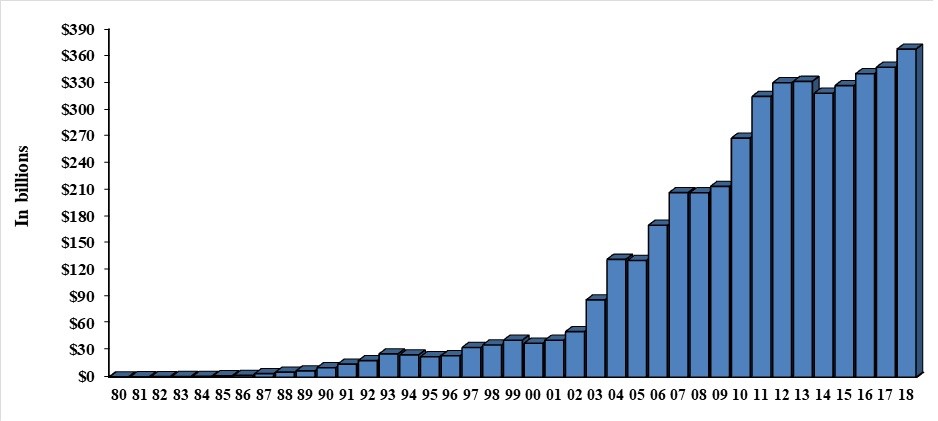

Grant Park has been trading continuously since January 1989 and, as of April 30, 2018, had a net asset value of approximately $97.8 million and 3,944 limited partners. Since its inception and through February 28, 2003, Grant Park offered its beneficial interests exclusively to qualified investors on a private placement basis. Effective June 30, 2003, Grant Park began offering units for sale to the public.

Grant Park’s main office is located at 555 West Jackson Boulevard, Suite 600, Chicago, Illinois 60661, and its telephone number is (312) 756‑4450.

The Offered Units

Grant Park’s limited partnership units are being offered in five separate and distinct classes: the Legacy 1 Class units, the Legacy 2 Class units, the Global 1 Class units, the Global 2 Class units and the Global 3 Class units. In addition to the offered units, Grant Park has two outstanding classes of limited partnership units, the Class A and Class B units, which are no longer being offered for sale and are not offered hereunder.

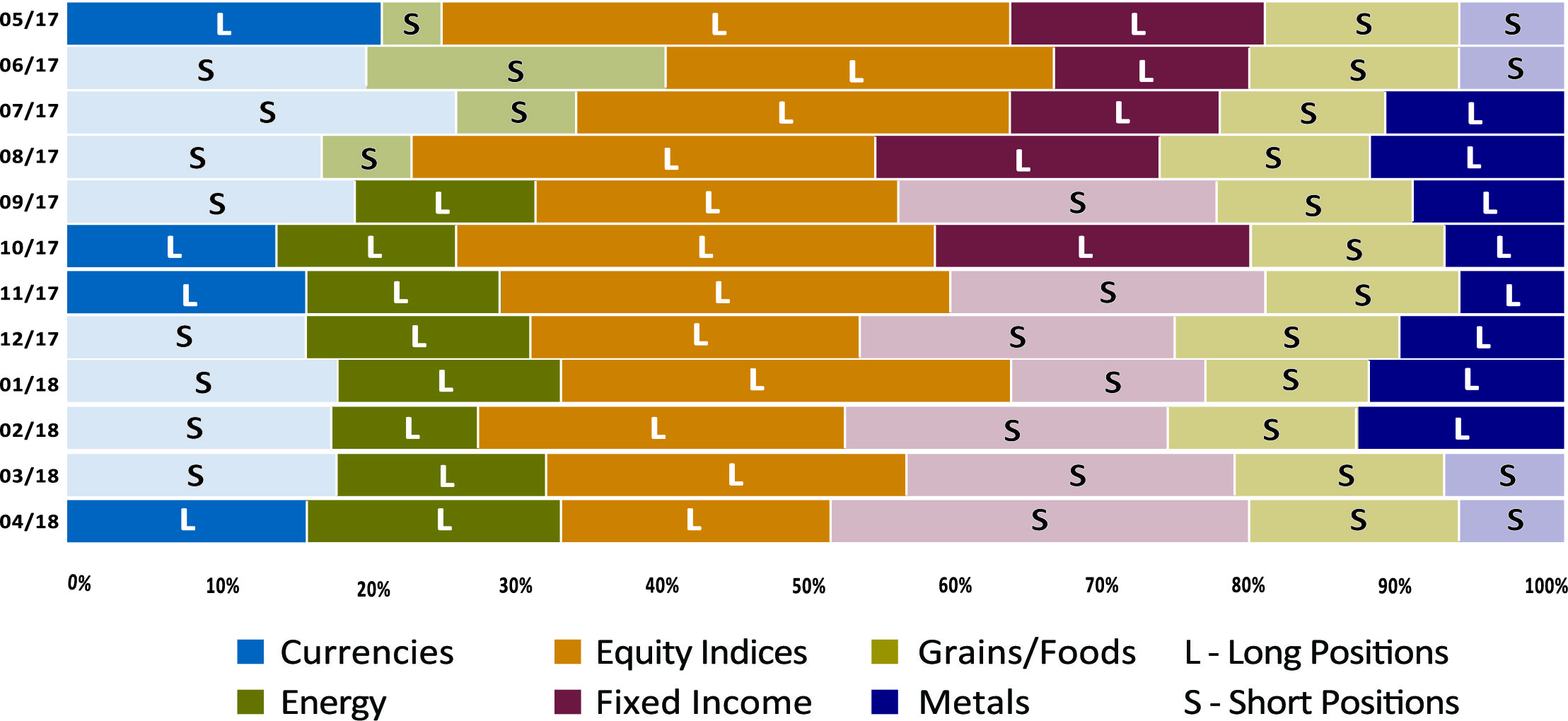

Proceeds from investments in the offered units are traded through different commodity trading advisors or through swap transactions based on reference programs of such advisors retained or selected by the general partner with respect to each class of units. Each of the trading advisors employs either technical and trend‑following trading strategies or disciplined macro thematic strategies through proprietary trading programs in an effort to achieve capital appreciation while controlling risk and volatility. The general partner may, in its sole discretion, reallocate assets among the trading advisors either directly or through swap transactions upon termination of a trading advisor or retention of any new trading advisors, or at the commencement of any month. Consequently, the current apportionments are subject to change.

The offered units are subject to a three‑month lock‑up period.

Legacy 1 Class and Legacy 2 Class units

The Legacy 1 Class and Legacy 2 Class units are allocated to the same trading advisors and are being offered only to investors who are represented by approved selling agents who are directly compensated by the investor for

services rendered in connection with an investment in Grant Park (such arrangements commonly referred to as “wrap‑accounts”). Selling agents who sell Legacy 1 Class or Legacy 2 Class units do not receive any upfront sales compensation.

Each selling agent who sells Legacy 2 Class units does, however, receive ongoing compensation for continuing administrative services at an annual rate of 25 basis points (0.25%) of the month‑end net asset value of the unit. See “FEES AND EXPENSES—Fees and Expenses Paid by the General Partner—Selling Agent Compensation.”

Through their respective trading companies, each of Rabar Market Research, Inc., or Rabar, EMC Capital Advisors LLC, or EMC, Transtrend B.V., or Transtrend, Amplitude Capital International Limited, or Amplitude, Lynx Asset Management AB, or Lynx, Quantica Capital AG, or Quantica, and Revolution Capital Management LLC, or RCM, serve as Grant Park’s commodity trading advisors with respect to the Legacy 1 Class and Legacy 2 Class units. Legacy 1 Class and Legacy 2 Class units obtain the equivalent of net profits or net losses generated by H2O AM LLP, or H2O, and Winton Capital Management Limited, or Winton, as reference traders through off-exchange swap transactions and will not allocate assets to H2O or Winton directly. The trading advisors and their respective asset allocations and the reference traders with respect to the Legacy 1 Class and Legacy 2 Class units are the same as with respect to the fund’s Class A and Class B units. With respect to the Class A and Class B units and the Legacy 1 Class and Legacy 2 Class, each of Amplitude, Transtrend, Rabar, EMC, Lynx, Quantica, and RCM manage between 5% and 25% of Grant Park’s net assets, and the swap transactions for which Winton and H2O are reference traders are similarly within this range.

Global 1 Class, Global 2 Class and Global 3 Class units

Investments in the Global 1 Class, Global 2 Class and Global 3 Class units are allocated to the same trading advisors or reference traders. However, Global 1 Class and Global 2 Class units are being offered only to investors purchasing such units through wrap‑accounts. Selling agents who sell Global 1 Class or Global 2 Class units do not receive any upfront sales compensation. Each selling agent who sells Global 2 Class units does, however, receive ongoing compensation for continuing administrative services at an annual rate of 25 basis points (0.25%) of the month‑end net asset value of the unit. See “FEES AND EXPENSES—Fees and Expenses Paid by the General Partner—Selling Agent Compensation.”

Selling agents who sell Global 3 Class units receive an upfront sales commission of up to 2.0% of the subscription amount. Beginning with the thirteenth month after the subscription proceeds of a Global 3 Class unit are invested in Grant Park, each selling agent who sells Global 3 Class units will receive ongoing compensation for continuing administrative services at an annual rate of 2.0% of the month‑end net asset value of the unit. In the event that the total underwriting compensation paid to a selling agent per a Global 3 Class unit meets certain limits, such Global 3 Class unit will be automatically exchanged for an equal net asset amount of Global 1 Class units at no additional cost. See “FEES AND EXPENSES—Fees and Expenses Paid by the General Partner—Selling Agent Compensation.”

Global 3 Class units redeemed after the three month lock‑up period, but on or before the one‑year anniversary of the subscription are subject to a fee of up to 1.50% of the net asset value of the redeemed units; the Global 1 Class and Global 2 Class units are not subject to an early redemption fee.

Through their respective trading companies, each of Rabar, EMC, Transtrend, Amplitude, Lynx, Quantica and RCM serve as Grant Park’s commodity trading advisors with respect to the Global 1 Class, Global 2 Class and Global 3 Class units. Global 1 Class, Global 2 Class, and Global 3 Class units obtain the equivalent of net profits or net losses generated by H2O AM LLP, or H2O, and Winton Capital Management Limited, or Winton, as reference traders through off-exchange swap transactions and will not allocate assets to H2O or Winton directly. With respect to the Global 1 Class, Global 2 Class and Global 3 Class units, each of Rabar, EMC, Transtrend, Amplitude, Lynx, Quantica, and RCM manage between 5% and 25% of Grant Park’s net assets, and the swap transactions for which Winton and H2O are reference traders are similarly within this range.

Break‑Even Amounts for Each Class of Units

The following summarizes the approximate dollar returns and percentage returns required for the redemption value of a hypothetical $1,000 initial investment in offered units to equal the amount invested 12 months after the

investment was made. The break‑even summary for the Global 3 Class units shows the amount required to “break‑even” both with and without an early redemption fee which, for purposes of this summary, the highest early redemption fee has been presented to approximate the effect that payment of an early redemption fee will have on a redemption of such units during the first year of investment.

| · | | Legacy 1 Class: 3.93% (or $39.28). |

| · | | Legacy 2 Class: 4.20% (or $42.02). |

| · | | Global 1 Class: 3.34% (or $33.37). |

| · | | Global 2 Class: 3.61% (or $36.14). |

| · | | Global 3 Class: 5.56% (or $55.55) without highest early redemption fee, or 7.06% (or $70.55) with highest early redemption fee. |

See “SUMMARY—Break‑Even Analysis” beginning on page 11 for detailed breakeven analysis of the offered units.

Continuous Offering Period

Grant Park offers the offered units on a continuous basis and will continue to offer such units until the maximum amount of Legacy 1 Class, Legacy 2 Class, Global 1 Class, Global 2 Class and Global 3 Class units, respectively, which are registered are sold. We refer to this period as the continuous offering period. The general partner may terminate the continuous offering period at any time.

Commodity Interests

Grant Park trades in the U.S. and international spot and derivatives markets for currencies, interest rates, stock indices, agricultural and energy products, precious and base metals and other commodities and underliers. In trading on these markets, Grant Park may enter into exchange‑traded derivatives, OTC derivatives and cash commodities. A brief description of Grant Park’s main types of investments is set forth below.

| · | | A futures contract is a standardized, exchange traded contract to buy or sell a commodity for a specified price in the future. |

| · | | A forward contract is a bilaterally negotiated contract to buy or sell something (i.e., the underlier) at a specified price in the future. |

| · | | An option on a futures contract, forward contract, swap or a commodity gives the buyer of the option the right, but not the obligation, to buy or sell a futures contract, forward contract or a commodity, as applicable, at a specified price on or before a specified date. Options on futures contracts are standardized contracts traded on an exchange, while options on forward contracts and commodities, referred to collectively in this prospectus as over‑ the‑counter, or OTC, options, generally are bilaterally negotiated, principal‑to‑principal contracts not traded on an exchange. |

| · | | A swap is a bilaterally negotiated agreement between two parties to exchange cash flows based upon an asset, rate or something else (i.e., the underlier). |

| · | | A commodity spot contract is a cash market transaction in which the buyer and seller agree to the immediate purchase and sale of a commodity, usually with a two‑day settlement. Spot contracts are not uniform and not exchange‑traded. |

| · | | A security futures contract is a futures contract on a single equity security or a narrow‑based security index. Security futures contracts are exchange‑traded. |

For more detailed descriptions of futures contracts, forward contracts, options contracts, other commodity interest contracts and other aspects of the commodity interest markets, see Part Two: Statement of Additional Information.

Plan of Distribution

What is the minimum investment?

| · | | The minimum investment required to invest in the Legacy 1 Class and Legacy 2 Class units is $10,000, except in the case of investors that are employee benefit plans and/or individual retirement accounts for which the minimum investment is $1,000; subsequent investment in the Legacy 1 Class and Legacy 2 Class units must be at least $1,000. The selling agents offer the Legacy 1 Class and Legacy 2 Class units at a price equal to the net asset value per unit of each of the units at the close of business on each closing date, which is the last business day of each month. The Legacy 1 Class and Legacy 2 Class units are being offered only to investors purchasing such units through wrap‑accounts. |

| · | | The minimum investment in the Global 1 Class, Global 2 Class and Global 3 Class units is $5,000, except in the case of investors in such units that are employee benefit plans and/or individual retirement accounts for which the minimum investment is $1,000; subsequent investment in the Global 1 Class, Global 2 Class and Global 3 Class units must be at least $1,000. The selling agents offer the Global 1 Class, Global 2 Class and Global 3 Class units at a price equal to the net asset value per unit of each of the units at the close of business on each closing date, which is the last business day of each month. The Global 1 Class and Global 2 Class units are being offered only to investors purchasing such units through wrap‑accounts. |

| · | | Any of these minimum investment requirements, including the requirement to invest in certain classes of units through wrap‑accounts, may be waived by the general partner in its sole discretion. Units are sold in fractions calculated to five decimal places. |

How do I invest in Grant Park?

| · | | You may buy units at the close of business on the last business day of each month, each a closing date, by submitting a subscription at least five business days before the applicable closing date, or at an earlier date if required by your selling agent. The number of units that you receive will be based on the net asset value per unit of the applicable class of units at the close of business on the closing date. Approved subscriptions will be accepted once payments are received and cleared, and each investor will receive written confirmation of the purchase following acceptance. |

| · | | The general partner will accept or reject your subscription, in whole or in part, in its sole discretion. The general partner will deposit your subscription funds in Grant Park’s non‑interest bearing subscription account. If the general partner accepts your subscription, your subscription funds will be invested in Grant Park on the next applicable closing date. There is no minimum aggregate subscription amount that must be received before new investors’ funds can be invested. If the general partner does not accept your subscription, your subscription funds will be returned to you without interest. |

| · | | The selling agents, which are the registered broker‑dealers who are offering the units, will use their best efforts to sell the units being offered, without any firm underwriting commitment. You will not directly pay sales commissions to the selling agents. All sales commissions and other compensation to the selling agents are paid by the general partner out of the brokerage charge paid by Grant Park to the general partner. |

| · | | Carefully read the prospectus, along with all appendices, including the limited partnership agreement and the subscription agreement and power of attorney and discuss with your financial advisor any questions you have about Grant Park. Investors will be required to make the representations and warranties set forth in Appendix C relating to their suitability to purchase the offered units in the subscription agreement and power of attorney. If you decide to invest, please complete and sign the subscription agreement and power of attorney and deliver to your selling agent a check made payable to “Grant Park Futures Fund Limited |

Partnership—Subscription Account,” or authorize a wire transfer in the amount of your subscription in accordance with the instructions set forth in the subscription agreement and power of attorney. Alternatively, if available, you may authorize your selling agent to debit your customer securities brokerage account in the amount of your subscription. |

What is the difference between the Legacy 1 Class, the Legacy 2 Class, the Global 1 Class, the Global 2 Class and the Global 3 Class units?

The Legacy 1 Class, Legacy 2 Class, Global 1 Class and Global 2 Class units are being offered only to investors who purchase such units through wrap‑ accounts, provided that they meet the suitability criteria described below and in Appendix C. The Global 3 Class units are reserved for investments by new investors generally, provided they meet the same suitability criteria.

The trading advisors or swap transactions based on reference programs of such advisors for the Legacy 1 Class and Legacy 2 Class units are Rabar, EMC, Winton, Transtrend, Amplitude, Lynx, Quantica, RCM and H2O. The trading advisors, asset allocations and trading philosophy with respect to the Legacy 1 Class and Legacy 2 Class units are the same as those utilized for Grant Park’s Class A and Class B units. The trading advisors or swap transactions based on reference programs of such advisors for the Global 1 Class, Global 2 Class and Global 3 Class units are Rabar, EMC, Winton, Transtrend, Amplitude, Lynx, Quantica, RCM and H2O. The investment process is uniquely managed for each class of units.

The Legacy 1 Class units bear organization and offering expenses at an annual rate of 30 basis points (0.30%) of the adjusted net assets of the Legacy 1 Class units, calculated and payable monthly on the basis of month‑end adjusted assets (before accruals for fees and expenses and redemptions). With respect to the monthly brokerage charge payable by Grant Park to the general partner, Legacy 1 Class units are charged 0.3750% of month‑end adjusted net assets of the Legacy 1 Class units, a rate of 4.50% annually.

The Legacy 2 Class units bear organization and offering expenses at an annual rate of 30 basis points (0.30%) of the adjusted net assets of the Legacy 2 Class units, calculated and payable monthly on the basis of month‑end adjusted assets (before accruals for fees and expenses and redemptions). With respect to the monthly brokerage charge payable by Grant Park to the general partner, Legacy 2 Class units are charged 0.3958% of month‑end adjusted net assets of the Legacy 2 Class units, a rate of 4.75% annually.

The Global 1 Class units bear organization and offering expenses at an annual rate of 30 basis points (0.30%) of the adjusted net assets of the Global 1 Class units, calculated and payable monthly on the basis of month‑end adjusted assets (before accruals for fees and expenses and redemptions). With respect to the monthly brokerage charge payable by Grant Park to the general partner, Global 1 Class units are charged 0.3292% of month‑end adjusted net assets of the Global 1 Class units, a rate of 3.95% annually.

The Global 2 Class units bear organization and offering expenses at an annual rate of 30 basis points (0.30%) of the adjusted net assets of the Global 2 Class units, calculated and payable monthly on the basis of month‑end adjusted assets (before accruals for fees and expenses and redemptions). With respect to the monthly brokerage charge payable by Grant Park to the general partner, Global 2 Class units are charged 0.3500% of month‑end adjusted net assets of the Global 2 Class units, a rate of 4.20% annually.

The Global 3 Class units bear organization and offering expenses at an annual rate of 30 basis points (0.30%) of the adjusted net assets of the Global 3 Class units, calculated and payable monthly on the basis of month‑end adjusted assets (before accruals for fees and expenses and redemptions). With respect to the monthly brokerage charge payable by Grant Park to the general partner, Global 3 Class units are charged 0.4958% of month‑end adjusted net assets of the Global 3 Class units, a rate of 5.95% annually.

Investors in the offered units are prohibited from redeeming such units for three months following the subscription date. This lock‑up period may be waived by the general partner at its sole discretion. Global 3 Class units that are redeemed before the one‑year anniversary of the subscription date will pay an early redemption fee of up to 1.5% of the net asset value at which such units are redeemed. The general partner has discretion to waive the redemption fee.

The Legacy 1 Class, Legacy 2 Class, Global 1 Class and Global 2 Class units are not subject to an early redemption fee. After termination of the lock‑up period, you may cause Grant Park to redeem your units at the net asset value per applicable unit as of the last business day of each month with at least 10 days advance written notice to the general partner, or at an earlier date if required by your selling agent.

Is Grant Park a suitable investment for you?

An investment in Grant Park is speculative and involves a high degree of risk. Grant Park is not suitable for all investors. The general partner offers Grant Park as a diversification opportunity for an investor’s entire investment portfolio, and therefore an investment in Grant Park should only represent a limited portion of an investor’s overall portfolio.

To invest in Grant Park, you must have at a minimum:

| (1) | | a net worth of at least $250,000, exclusive of home, furnishings and automobiles; or |

| (2) | | a net worth, similarly calculated, of at least $70,000 and an annual gross income of $70,000. |

A number of jurisdictions in which the units are offered impose on their residents higher minimum suitability requirements, which are described in Appendix C to this prospectus. Please see Appendix C for a detailed description of the minimum suitability requirements in the state in which you reside. You will be required to represent that you meet the requirements set forth in your state of residence before your subscription to purchase units will be accepted. These suitability requirements are, in each case, regulatory minimums only, and just because you meet such requirements does not mean that an investment in the units is suitable for you. In no event may you invest more than 10% of your net worth, exclusive of home, furnishings and automobiles, in Grant Park. Employee benefit plans and individual retirement accounts are subject to special suitability requirements. See “INVESTMENT BY ERISA AND OTHER PLAN ACCOUNTS.” In addition, individual selling agents may impose even higher minimum suitability requirements on their clients investing in Grant Park than those described above or required by an individual state. You should consult with your financial advisor to confirm that you meet these requirements before deciding to invest in Grant Park.

Summary of Risk Factors You Should Consider Before Investing in Grant Park

An investment in Grant Park is highly speculative and involves a high degree of risk. Some of the risks you may face are summarized below. A comprehensive discussion of risks begins on page 20.

| · | | The prices of commodity interest contracts are highly volatile and subject to rapid and substantial fluctuations. You could therefore lose all or substantially all of your investment if Grant Park’s trading positions are or become unprofitable. These movements in price are often the result of factors outside of Grant Park’s and the trading advisors’ control and may not be anticipated by Grant Park’s trading advisors. |

| · | | Because Grant Park’s trading positions are typically secured by the deposit of margin funds that represent only a small percentage of a contract’s face value, Grant Park is highly leveraged. As a result of this leverage, relatively small movements in the price of a contract can cause significant losses. |

| · | | Grant Park’s use of multiple independent trading advisors may result in Grant Park taking offsetting positions on the same commodity interest contract, thereby possibly incurring additional expenses but without any net change in Grant Park’s holdings. In addition, the trading programs used by each trading advisor bear some similarities to the trading programs used by other trading advisors, which may negate the potential benefits of having multiple trading advisors. |

| · | | Past performance of Grant Park is not necessarily indicative of future results, and you should not rely on the performance record to date of Grant Park and/or the trading advisors in deciding whether to invest. The general partner has increased Grant Park’s fee and expense structure in certain respects to accommodate the public offering of units, and the fees and expenses have an impact on Grant Park’s net performance. |

| · | | The Dodd‑Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act) and related regulatory actions have, among other things, significantly changed the regulation of swaps and certain other derivative transactions, which may result in lost profit opportunities for Grant Park. |

| · | | A substantial portion of Grant Park’s trades takes place on markets and exchanges outside the United States. Some non‑U.S. markets present risks because they are not subject to the same degree of regulation as their U.S. counterparts. In some of these non‑U.S. markets, the performance on a contract is the responsibility of the counterparty and the contract is not backed by or novated to a centralized clearing house and therefore exposes Grant Park to credit risk in the form of a counterparty default or payment risk. Trading in non‑U.S. markets also leaves Grant Park susceptible to swings in the value of the local currency against the U.S. dollar. |

| · | | Grant Park pays substantial fees and expenses that are incurred regardless of whether it is profitable. In addition, Grant Park pays each of its trading advisors an incentive fee that is based only on that trading advisor’s trading profits, which means that Grant Park could pay incentive fees to one or more of the trading advisors even if Grant Park as a whole is not profitable. |

| · | | You will have no rights to participate in the management of Grant Park and will have to rely on the fiduciary duty and judgment of the general partner to manage Grant Park in the best interest of the limited partners. |

| · | | The structure and operation of Grant Park involves several conflicts of interest. For example, DCM Brokers, LLC, an affiliate of Grant Park’s general partner, serves as Grant Park’s lead selling agent. Certain principals of Grant Park’s general partner own a minority interest in EMC Capital Advisors, LLC, one of Grant Park’s trading advisors. An affiliate of one of Grant Park’s clearing brokers, Wells Fargo Securities, LLC, also serves as one of Grant Park’s selling agents. These and other conflicts may cause the parties involved to act in a manner that is other than in Grant Park’s best interests. |

| · | | The commodity interest markets are the subject of regulatory scrutiny, from both a national and international perspective, and implementation of certain proposed laws or regulations could adversely impact Grant Park’s ability to trade speculatively and implement its trading strategies. |

Investment Factors to Consider Before Investing in Grant Park

| · | | Grant Park is an alternative investment fund managed by experienced, professional trading advisors or reference traders that trade in commodity interests. |

| · | | The trading programs that the trading advisors use for Grant Park are comprised of a variety of proprietary trading strategies and systems. |

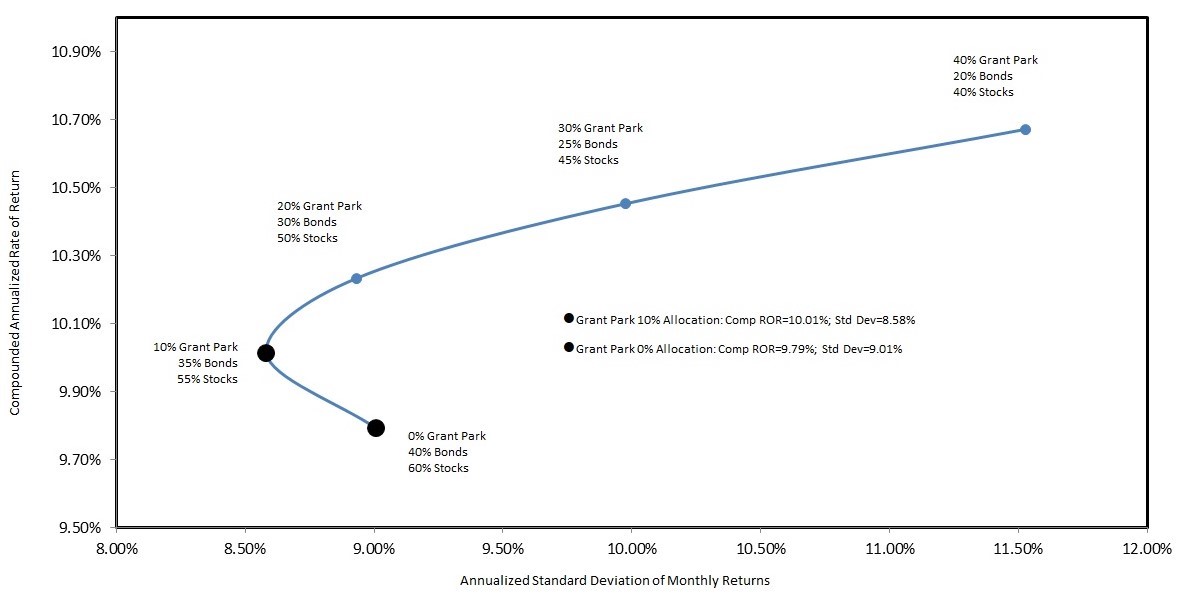

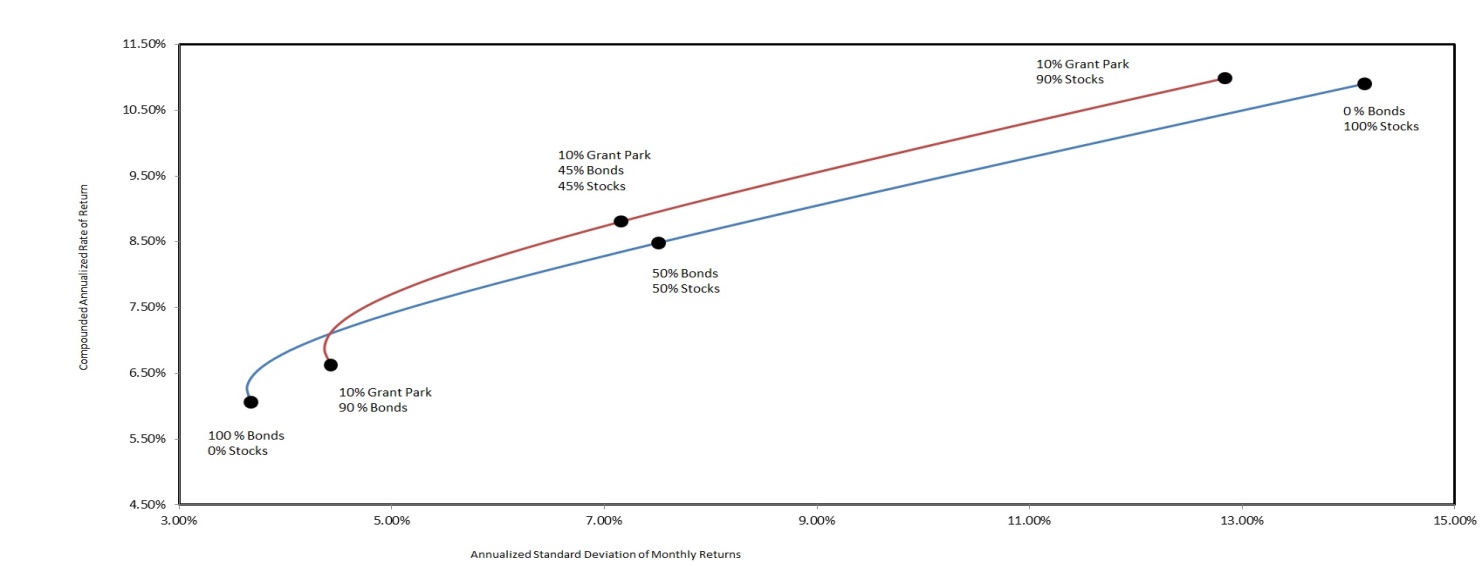

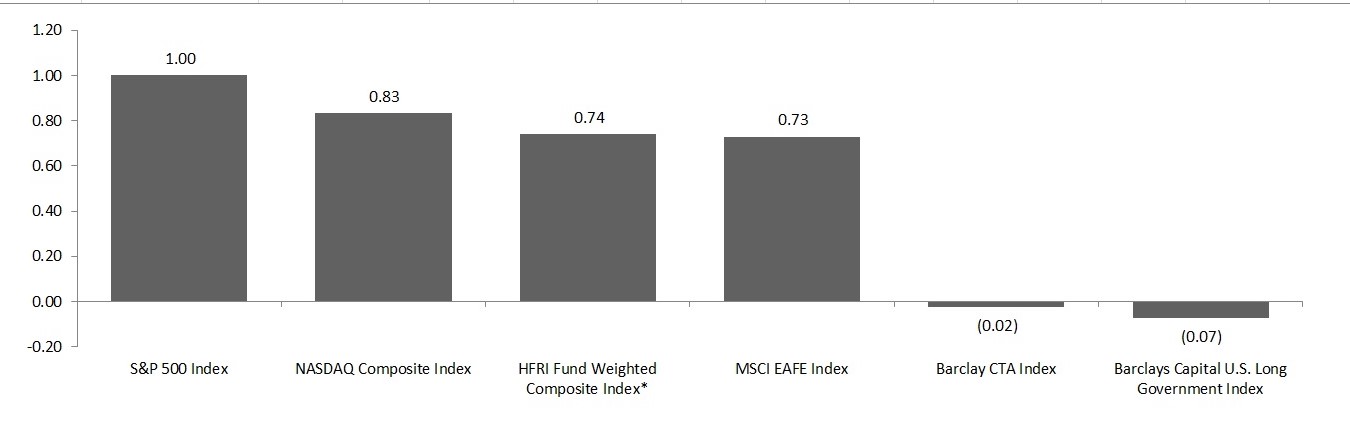

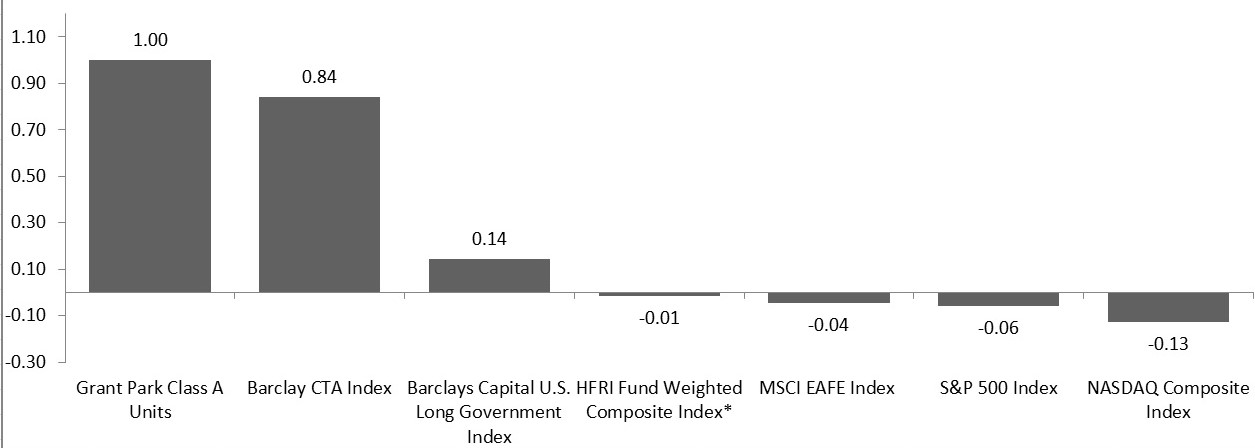

| · | | An investment in Grant Park may diversify a traditional securities portfolio. A diverse portfolio consisting of assets that perform in an unrelated manner, or non‑correlated assets, may increase overall return and reduce the volatility of a portfolio. As a risk transfer activity, trading in commodity interests has no inherent correlation with any other investment. However, non‑correlation will not provide any diversification advantages unless the non‑correlated assets are outperforming other portfolio assets, and there is no guarantee that Grant Park will outperform other sectors of an investor’s portfolio or not produce losses. Grant Park’s profitability also depends on the success of the trading advisors’ or reference traders’ trading techniques. If Grant Park is unprofitable, then it will not increase the return on an investor’s portfolio or achieve its diversification objectives. |

| · | | Investors in Grant Park obtain the advantage of limited liability in highly leveraged trading. |

The General Partner

Dearborn Capital Management, L.L.C., an Illinois limited liability company, is Grant Park’s general partner and commodity pool operator and has sole authority and responsibility for administering Grant Park. Along with its predecessor as Grant Park’s general partner and commodity pool operator, Dearborn Capital Management, Ltd., the general partner has had management responsibility for Grant Park since Grant Park’s inception. The general partner is registered as a commodity pool operator and as a commodity trading advisor under the Commodity Exchange Act, as amended (Commodity Exchange Act) and is a member of the National Futures Association, or NFA.

The office of the general partner is located at 555 West Jackson Boulevard, Suite 600, Chicago, Illinois 60661; telephone: (312) 756‑4450; facsimile: (312) 756‑4452; e‑mail: cs@dearborncapital.com. The general partner’s website address is: www.grantparkfunds.com. The information on this website is not a part of this prospectus. The books and records of the general partner and Grant Park are kept and made available for inspection at the general partner’s office.

The Trading Advisors and Reference Traders

Grant Park trades through its nine professional commodity trading advisors or through swap transactions based on reference programs of such advisors: Amplitude Capital International Limited, EMC Capital Advisors LLC, H2O AM LLP, Lynx Asset Management AB, Quantica Capital AG, Rabar Market Research, Inc., Revolution Capital Management LLC, Transtrend B.V. and Winton Capital Management Limited. Each of the trading advisors that receives a direct allocation from Grant Park is registered as a commodity trading advisor under the Commodity Exchange Act and is a member of the NFA. The general partner may terminate or replace any or all of the trading advisors or swap transactions based on reference programs of such advisors, or add additional trading advisors, at any time in its sole discretion.

Amplitude Capital International Limited is located at Highwater, Grand Pavilion Commercial Centre, 1st Floor, 802 West Bay Road, P.O. Box 31855, KY1 1203 Cayman Islands, and its telephone number is (345) 943‑2295. EMC Capital Advisors, LLC is located at 2201 Waukegan Road, Suite W240, Bannockburn, Illinois 60015, and its telephone number is (847) 267‑8700. H2O AM LLP is located at 10 Old Burlington Street, London W1S 3AG, and its telephone number is +44-207-292-1600. Lynx Asset Management AB is located at Regeringsgatan 30-32, Box 7060, Stockholm, Sweden, SE‑103 86 and its telephone number is +46‑8‑663‑3360. Quantica Capital AG is located at Freier Platz 10, Schaffhausen, CH‑8200, Switzerland, and its telephone number is +41‑52‑557-00-07. Rabar Market Research, Inc. is located at 120 S. Riverside Plaza, Suite 1600, Chicago, Illinois 60606, and its telephone number is (312) 646‑7200. Revolution Capital Management LLC is located at 1400 16th St., Suite 510, Denver, Colorado 80202, and its telephone number is (720) 496-0940. Transtrend B.V. is located at Weena 723, Unit C5.070, 3013 AM Rotterdam, The Netherlands and its telephone number is +31‑10‑453‑6510. Winton Capital Management Limited is located at Grove House, 27 Hammersmith Grove, London, W6 ONE, England, and its telephone number is +44‑20‑8576‑5800.

The Clearing Brokers and Swap Counterparty

ADM Investor Services, Inc. (“ADMIS”) became a Futures Commission Merchant for Grant Park effective May 30, 2018. ADM Investor Services, Inc. (“ADMIS”) is a registered futures commission merchant and is a member of the National Futures Association. Its main office is located at 141 W. Jackson Blvd., Suite 2100A, Chicago, IL 60604, and its telephone number is (312) 242-7000.

SG Americas Securities, LLC (“SG”) acts as a clearing broker for Grant Park. Newedge USA became one of Grant Park’s clearing brokers effective July 1, 2008 and in January 2015, Newedge USA, LLC (“Newedge USA”) merged with and into SG, with the latter as the surviving entity. Currently, SG serves as Grant Park’s clearing broker to execute and clear Grant Park’s futures and equities transactions and provide other brokerage-related services. SG is a futures commission merchant and broker dealer registered with the CFTC and the SEC and is a member of FINRA. SG is a clearing member of all principal futures exchanges located in the United States as well as a member of the Chicago Board Options Exchange, International Securities Exchange, New York Stock Exchange, Options Clearing Corporation, and Government Securities Clearing Corporation. SG is headquartered at 245 Park Avenue, New York, NY 10167, and its telephone number is (212) 278-6000.

Wells Fargo Securities, LLC became a Futures Commission Merchant for Grant Park effective May 1, 2016. Wells Fargo Securities, LLC is an indirect wholly owned subsidiary of Wells Fargo & Co. Wells Fargo Securities, LLC is registered as a futures commission merchant under the Commodity Exchange Act and is a member of the NFA. Its principal place of business is 555 South Tryon Street, 6th Floor, D1086-060, Charlotte, North Carolina 28202, and its telephone number is (704) 715-6133.

The clearing brokers or their affiliates also may act as dealers through which Grant Park’s OTC derivatives will be effected. The trading advisors also may utilize other dealers in engaging in such transactions, with the general partner’s consent.

The general partner may retain additional or substitute clearing brokers for Grant Park in its sole discretion.

Deutsche Bank AG, acting through its London Branch, became the counterparty and principal for one of Grant Park’s swap transactions on July 1, 2015 and for a second swap transaction on April 5, 2016. Pursuant to agreements between Deutsche Bank and Grant Park in connection with these transactions, Grant Park is required to deposit collateral based on the notional values of the transactions in a custodial account maintained with Deutsche Bank Trust Company Americas, a subsidiary of Deutsche Bank and a New York State-chartered bank.

Fees and Expenses

The following fees and expenses include all compensation, fees, profits and other benefits that the general partner, the trading advisors, the selling agents, the clearing brokers, any executing brokers and other dealers used by Grant Park, and the affiliates of those parties may earn or receive in connection with the offering of units in, and the operation of, Grant Park. Net asset value as of a specified time with respect to any class of units or of Grant Park as a whole equals the value of the net assets attributable to such class or of Grant Park, as applicable, as of that time. Net assets is defined as the total assets attributable to any class of units or of Grant Park, as applicable, including all cash, plus Treasury securities at accrued interest and the market value of all open commodity interest positions attributable to such class or of Grant Park, less all liabilities attributable to such class or of Grant Park, determined in accordance with generally accepted accounting principles (GAAP).

Brokerage Charge—The following units are assessed monthly brokerage charges:

Legacy 1 Class units pay the general partner a monthly brokerage charge equal to 0.3750%, a rate of 4.50% annually, of the month‑end adjusted net assets of the Legacy 1 Class units.

Legacy 2 Class units pay the general partner a monthly brokerage charge equal to 0.3958%, a rate of 4.75% annually, of the month‑end adjusted net assets of the Legacy 2 Class units.

Global 1 Class units pay the general partner a monthly brokerage charge equal to 0.3292%, a rate of 3.95% annually, of the month‑end adjusted net assets of the Global 1 Class units.

Global 2 Class units pay the general partner a monthly brokerage charge equal to 0.3500%, a rate of 4.20% annually, of the month‑end adjusted net assets of the Global 2 Class units.

Global 3 Class units pay the general partner a monthly brokerage charge equal to 0.4958%, a rate of 5.95% annually, of the month‑end adjusted net assets of the Global 3 Class units.

The general partner pays from the brokerage charge all clearing, execution and give‑up, floor brokerage, exchange, and NFA fees, any other transaction costs, selling agent compensation, selling agent administration fees, and consulting fees to the trading advisors. Transaction costs and consulting fees are taken into account by the swap counterparty in determining the net amount Grant Park receives or pays in connection with swap transactions or derivative instruments, but such costs or fees are not directly charged to Grant Park or any of its trading companies. A trading advisor through its respective trading company that has assets allocated to a swap transaction does not receive any consulting fees directly from Grant Park but instead receives a management fee from the fees embedded in the swap transaction. Also embedded in the swap transactions is a fee to the swap counterparty in respect of any swap transaction or derivative instrument of up to 0.50% of the notional amount of such swap transaction or derivative instrument. This

fee is not directly paid by Grant Park. The general partner will reduce (but not below zero) the brokerage charge by the amount of such costs and fees. Payments to the clearing brokers will be based upon a specified amount per round‑turn for each futures transaction executed on behalf of Grant Park. A round‑turn is both the purchase and sale of a futures contract. The all‑inclusive payments to the clearing brokers are expected to be between $5.00 and $10.00 per round‑turn transaction. The amounts paid to selling agents, trading advisors or others may be based upon a specified percentage of net asset value or round‑turn transactions of the units. The balance of the brokerage charge not paid out to other parties is retained by the general partner as payment for its services to Grant Park. The amount retained by the general partner varies based on allocations to the trading advisors and has ranged from approximately 1.20% to 3.24% in the past.

| · | | Dealer Spreads—Grant Park trades OTC derivatives. These contracts are traded among dealers, which act as principals or counterparties to each trade. The execution costs are included in the price of the contract purchased or sold and accordingly these costs to Grant Park cannot necessarily be determined. However, the general partner believes the bid‑ask spreads (i.e., compensation) paid by Grant Park are competitive with the spreads paid by other institutional customers that are comparable in size and trading activity to Grant Park. Any commissions or other transaction fees that may be incurred by Grant Park in trading OTC derivatives, other than the associated bid‑ask spreads, will be paid by the general partner out of the brokerage charge. |

| · | | Incentive Fees—Grant Park currently pays each trading advisor a quarterly, semi‑annual or annual incentive fee based on any new trading profits achieved on the trading advisor’s allocated net assets at the end of each calendar period. An incentive fee embedded in swap transactions or derivative instrument is taken into account in determining any net amount Grant Park receives in connection with such swap transaction or derivative instrument. A trading advisor through its respective trading company that has assets allocated to a swap transaction does not receive any incentive fees directly from Grant Park but instead receives incentive compensation from the fees embedded in the swap transaction. As of the date of this prospectus, the incentive fees embedded in the swap transactions in which Grant Park beneficially participates are 16% and 20% of trading profits earned by the relevant reference programs. Generally, new trading profits means the net increase in trading profits, realized and unrealized, experienced by the trading advisor on its allocated net assets from the most recent prior period in which an incentive fee was paid to the trading advisor, or if an incentive fee has yet to be paid to that trading advisor, the trading advisor’s initial allocation of net assets. Currently, the incentive fees payable to each of Grant Park’s trading advisors or reference traders directly or through swap transactions are as follows: 24.5% to Amplitude, 20% to EMC Classic Program, 0% to EMC Balanced Program, 20% to H2O, 23% to Lynx , 20% to Quantica, 20% to Rabar, 20% to RCM, 20% to Transtrend and 16% to Winton. The method of calculating new trading profits on the allocated net assets of each trading advisor is described in “FEES AND EXPENSES—Fees and Expenses Paid by Grant Park—Incentive Fees.” |

| · | | Organization and Offering Expenses—All expenses incurred in connection with the organization and ongoing offering of the units are paid by the general partner and then reimbursed to the general partner by Grant Park. This reimbursement is made monthly. Each class of offered units will bear organization and offering expenses at an annual rate of 30 basis points (0.30%) of the adjusted net assets of each such class, calculated and payable monthly on the basis of month‑end adjusted net assets. “Adjusted net assets” is defined as the month‑end net assets of the particular class before accruals for fees and expenses and redemptions. In its discretion, the general partner may require Grant Park to reimburse the general partner in any subsequent calendar year for amounts that exceed these limits in any calendar year, provided that the maximum amount reimbursed by Grant Park will not exceed the overall limit set forth above. Amounts reimbursed by Grant Park with respect to the ongoing public offering expenses are charged against partners’ capital at the time of reimbursement or accrual. Any amounts reimbursed by Grant Park with respect to organization expenses are expensed at the time the reimbursement is incurred or accrued. If Grant Park terminates prior to completion of payment of the calculated amounts to the general partner, the general partner will not be entitled to any additional payments, and Grant Park will have no further obligation to the general partner. |

| · | | Operating Expenses—Grant Park has borne, and will continue to bear, all ongoing operating expenses subject to a maximum charge for such expenses of 0.25% of the average net assets of Grant Park per year, |

including legal, auditing, administration, transfer agent, printing and postage expenses and the costs and expenses associated with preparing and filing required periodic reports with the SEC. To the extent operating expenses are less than 0.25% of Grant Park’s average net assets during the year, the difference may be reimbursed pro rata to recordholders as of December 31 of each year. The general partner estimates that the legal and audit fee portion of the operating expense chargeable to Grant Park during 2018 will be approximately $300,000. Grant Park is also responsible for any federal, state and local taxes payable by it, which amounts are not included in this estimate. The general partner, not Grant Park, is responsible for paying any operating expenses during any year that exceed 0.25% of the average net assets of Grant Park per year. |

| · | | Early Redemption Fee—Investors in the offered units are prohibited from redeeming such units for the first three months following the subscription for units. Additionally, Global 3 Class limited partners that cause Grant Park to redeem their units before the one‑year anniversary of their subscription for units will pay the general partner an early redemption fee. The early redemption fee with respect to the Global 3 Class units is based on the net asset value of the redeemed units and will differ depending on when the units are redeemed during the first year of investment as follows: |

| · | | units redeemed after the third month‑end and on or before the sixth month‑end after the subscription are subject to a fee of 1.50% of the net asset value of the redeemed units; |

| · | | units redeemed after the sixth month‑end and on or before the ninth month‑end after the subscription are subject to a fee of 1.0% of the net asset value of the redeemed units; and |

| · | | units redeemed after the ninth month‑end and before the one‑ year anniversary of the subscription are subject to a fee of 0.5% of the net asset value of the redeemed units. Legacy 1 Class, Legacy 2 Class, Global 1 and Global 2 Class limited partners, generally, and Global 3 Class limited partners causing redemption of their units on or after the one‑year anniversary of their subscription for the redeemed Global 3 Class, units do not pay any redemption fees. |

| · | | Extraordinary Expenses—Grant Park is required to pay all of its extraordinary expenses, such as litigation expenses or IRS audit expenses, if any. |

Break‑Even Analysis

The break‑even analysis below indicates the approximate dollar returns and percentage returns required for the redemption value of a hypothetical $1,000 initial investment in offered units to equal the amount invested 12 months after the investment was made. The break‑even analysis for Global 3 Class units shows the amount required to “break‑even” both with and without an early redemption fee. For purposes of this analysis, the highest early redemption fee has been presented to approximate the effect that payment of an early redemption fee will have on a redemption of such units during the first year of investment. The break‑even analysis is an approximation only.

Legacy 1 Class Break‑Even Analysis

| | | | |

| | Legacy 1 | |

| | Class Units | |

Assumed initial selling price per unit(1) | | $ | 1,000 | |

Trading advisors’ incentive fees(2) | | | 1.28 | |

Brokerage charge(3) (4.50%) | | | 45.00 | |

Operating expenses(4) (0.25%) | | | 2.50 | |

Offering expenses(5) (0.30%) | | | 3.00 | |

Interest income(6) (1.25%) | | | (12.50) | |

Amount of trading income required for the redemption value at the end of one year to equal the initial selling price of the unit | | $ | 39.28 | |

Percentage of initial selling price per Legacy 1 Class unit | | | 3.93 | % |

| (1) | | The minimum investment required to invest in the Legacy 1 Class units is $10,000. For ease of comparability, $1,000 will be deemed to be the assumed selling price per unit of a Legacy 1 Class unit, and, as described below, a Legacy 2 Class unit, a Global 1 Class unit, a Global 2 Class unit and a Global 3 Class unit, for purposes of the break‑even analysis. |

| (2) | | Reflects incentive fees payable directly or through swap transactions to Amplitude, EMC, Rabar, Winton, Transtrend, Lynx, Quantica, RCM and H2O assuming they manage between 5% and 25% of invested assets and assuming each of the advisors have equivalent performance returns for the 12‑month period. Any incentive fee embedded in a swap transaction or derivative instrument is taken into account in determining any net amount Grant Park receives in connection with such swap transaction or derivative instrument. A trading advisor through its respective trading company that has assets allocated to a swap transaction does not receive any incentive fees directly from Grant Park but instead receives incentive compensation from the fees embedded in the swap transaction. As of the date of this prospectus, the incentive fee embedded in swap transactions in which Grant Park beneficially participates are 16% and 20% of trading profits earned by the relevant reference program. Actual incentive fees are calculated quarterly or semi‑annually on the basis of each trading advisor’s individual performance, not the overall performance of Grant Park or the Legacy 1 Class units. Because incentive fees payable to certain of these trading advisors are calculated on the basis of trading profits realized on the assets they manage after deduction for the allocable portion of only certain expenses charged to Grant Park, these advisors would receive an incentive fee before Grant Park has recouped all expenses and reaches the “break‑even” level. Incentive fees payable to certain other of these trading advisors are calculated after deduction for the allocable portion of expenses charged to Grant Park. These advisors would not receive an incentive fee before Grant Park has recouped all expenses. |

| (3) | | The brokerage charge is paid to the general partner on a monthly basis. As of the date of this prospectus, the brokerage charge for the Legacy 1 Class units equals 0.3750% per month, a rate of 4.50% annually, of such units’ month‑end adjusted net assets. Out of this amount, the general partner pays all clearing, execution and give‑up, floor brokerage, exchange and NFA fees, any other transaction costs, selling agent compensation, selling agent service fees and consulting fees to the trading advisors. A trading advisor through its respective trading company that has assets allocated to a swap transaction does not receive any consulting fees directly from Grant Park but instead receives a management fee from the fees embedded in the swap transaction. Transaction costs are taken into account in determining the net amount Grant Park receives or pays in connection with swap transactions or derivative instruments, but such costs or fees are not directly charged to Grant Park or any of its trading companies. The general partner will reduce (but not below zero) the brokerage charge by the amount of such costs and fees. Legacy 1 Class units may pay a fee to a counterparty in respect of any swap transaction or derivative instrument of up to 0.50% of the notional amount of such swap transaction or derivative instrument. The general partner retains the balance from the brokerage charge as payment for its services to Grant Park. Bid‑ask spreads on Grant Park’s forward and other non‑exchange traded contracts are not included in this break‑even table due to the difficulty of determining those spreads. |

| (4) | | Grant Park is responsible for ongoing operating expenses, up to an amount not to exceed 0.25% of Grant Park’s average net assets per year. This amount is used for purposes of this break‑even analysis. |

| (5) | | Grant Park’s organization and offering expenses are paid by the general partner and then reimbursed to the general partner by Grant Park. To pay this reimbursement, as of the date of this prospectus, Legacy 1 Class units are assessed at an annual rate of 30 basis points (0.30%) of adjusted net assets, calculated and payable monthly on the basis of month‑end adjusted net assets of the applicable class. |

| (6) | | Grant Park is credited with interest income received on free cash balances. The amount of interest income will vary from time to time. Interest is estimated for these purposes at a rate of 1.25% per year. |

Legacy 2 Class Break‑Even Analysis

| | | | |

| | Legacy 2 | |

| | Class Units | |

Assumed initial selling price per unit(1) | | $ | 1,000 | |

Trading advisors’ incentive fees(2) | | | 1.52 | |

Brokerage charge(3) (4.75%) | | | 47.50 | |

Operating expenses(4) (0.25%) | | | 2.50 | |

Offering expenses(5) (0.30%) | | | 3.00 | |

Interest income(6) (1.25%) | | | (12.50) | |

Amount of trading income required for the redemption value at the end of one year to equal the initial selling price of the unit | | $ | 42.02 | |

Percentage of initial selling price per Legacy 2 Class unit | | | 4.20 | % |

| (1) | | The minimum investment required to invest in the Legacy 2 Class units is $10,000. For ease of comparability, $1,000 will be deemed to be the assumed selling price per unit of a Legacy 2 Class unit, and, as described above, a Legacy 1 Class unit, and, as described below, a Global 1 Class unit, a Global 2 Class unit and a Global 3 Class unit, for purposes of the break‑ even analysis. |

| (2) | | Reflects incentive fees payable directly or through swap transactions to Amplitude, EMC, Rabar, Winton, Transtrend, Lynx, Quantica, RCM and H2O assuming they manage between 5% and 25% of invested assets and assuming each of the advisors have equivalent performance returns for the 12‑month period. Any incentive fee embedded in a swap transaction or derivative instrument is taken into account in determining any net amount Grant Park receives in connection with such swap transaction or derivative instrument. A trading advisor through its respective trading company that has assets allocated to a swap transaction does not receive any incentive fees directly from Grant Park but instead receives incentive compensation from the fees embedded in the swap transaction. As of the date of this prospectus, the incentive fee embedded in swap transactions in which Grant Park beneficially participates are 16% and 20% of trading profits earned by the relevant reference program. Actual incentive fees are calculated quarterly or semi‑annually on the basis of each trading advisor’s individual performance, not the overall performance of Grant Park or the Legacy 2 Class units. Because incentive fees payable to certain of these trading advisors are calculated on the basis of trading profits realized on the assets they manage after deduction for the allocable portion of only certain expenses charged to Grant Park, these advisors would receive an incentive fee before Grant Park has recouped all expenses and reaches the “break‑even” level. Incentive fees payable to certain other of these trading advisors are calculated after deduction for the allocable portion of expenses charged to Grant Park. These advisors would not receive an incentive fee before Grant Park has recouped all expenses. |

| (3) | | The brokerage charge is paid to the general partner on a monthly basis. As of the date of this prospectus, the brokerage charge for the Legacy 2 Class units equals 0.3958% per month, a rate of 4.75% annually, of such units’ month‑end adjusted net assets. Out of this amount, the general partner pays all clearing, execution and give‑up, floor brokerage, exchange and NFA fees, any other transaction costs, selling agent compensation, selling agent service fees and consulting fees to the trading advisors. A trading advisor through its respective trading company that has assets allocated to a swap transaction does not receive any consulting fees directly from Grant Park but instead receives a management fee from the fees embedded in the swap transaction. Transaction costs are taken into account in determining the net amount Grant Park receives or pays in connection with swap transactions or derivative instruments, but such costs or fees are not directly charged to Grant Park or any of its trading companies. The general partner will reduce (but not below zero) the brokerage charge by the amount of such costs and fees. Legacy 2 Class units may pay a fee to a counterparty in respect of any swap transaction or derivative instrument of up to 0.50% of the notional amount of such swap transaction or derivative instrument. The general partner retains the balance from the brokerage charge as payment for its services to Grant Park. Bid‑ask spreads on Grant Park’s forward and other non‑exchange traded contracts are not included in this break‑even table due to the difficulty of determining those spreads. |

| (4) | | Grant Park is responsible for ongoing operating expenses, up to an amount not to exceed 0.25% of Grant Park’s average net assets per year. This amount is used for purposes of this break‑even analysis. |

| (5) | | Grant Park’s organization and offering expenses are paid by the general partner and then reimbursed to the general partner by Grant Park. To pay this reimbursement, as of the date of this prospectus, Legacy 2 Class units are assessed at an annual rate of 30 basis points (0.30%) of adjusted net assets, calculated and payable monthly on the basis of month‑end adjusted net assets of the applicable class. |

| (6) | | Grant Park is credited with interest income received on free cash balances. The amount of interest income will vary from time to time. Interest is estimated for these purposes at a rate of 1.25% per year. |

Global 1 Class Break‑Even Analysis

| | | | |

| | Global 1 | |

| | Class Units | |

Assumed initial selling price per unit(1) | | $ | 1,000 | |

Trading advisors’ incentive fees(2) | | | 0.87 | |

Brokerage charge(3) (3.95%) | | | 39.50 | |

Operating expenses(4) (0.25%) | | | 2.50 | |

Offering expenses(5) (0.30%) | | | 3.00 | |

Interest income(6) (1.25%) | | | (12.50) | |

Amount of trading income required for the redemption value at the end of one year to equal the initial selling price of the unit | | $ | 33.37 | |

Percentage of initial selling price per Global 1 Class unit | | | 3.34 | % |

| (1) | | The minimum investment required to invest in the Global 1 Class units is $5,000. For ease of comparability, $1,000 will be deemed to be the assumed selling price per unit of a Global 1 Class unit, and, as described above, a Legacy 1 Class unit and a Legacy 2 Class unit, and, as described below, a Global 2 Class unit and a Global 3 Class unit, for purposes of the break‑ even analysis. |

| (2) | | Reflects incentive fees payable directly or through swap transactions to Amplitude, EMC, Rabar, Winton, Transtrend, Lynx, Quantica, RCM and H2O assuming they manage between 5% and 25% of invested assets and assuming each of the advisors have equivalent performance returns for the 12‑month period. Any incentive fee embedded in a swap transaction or derivative instrument is taken into account in determining any net amount Grant Park receives in connection with such swap transaction or derivative instrument. A trading advisor through its respective trading company that has assets allocated to a swap transaction does not receive any incentive fees directly from Grant Park but instead receives incentive compensation from the fees embedded in the swap transaction. As of the date of this prospectus, the incentive fee embedded in swap transactions in which Grant Park beneficially participates are 16% and 20% of trading profits earned by the relevant reference program. Actual incentive fees are calculated quarterly or semi‑annually on the basis of each trading advisor’s individual performance, not the overall performance of Grant Park or the Global 1 Class units. Because incentive fees payable to certain of these trading advisors are calculated on the basis of trading profits realized on the assets they manage after deduction for the allocable portion of only certain expenses charged to Grant Park, these advisors would receive an incentive fee before Grant Park has recouped all expenses and reaches the “break‑even” level. Incentive fees payable to certain other of these trading advisors are calculated after deduction for the allocable portion of expenses charged to Grant Park. These advisors would not receive an incentive fee before Grant Park has recouped all expenses. |

| (3) | | The brokerage charge is paid to the general partner on a monthly basis. As of the date of this prospectus, the brokerage charge for the Global 1 Class units equals 0.3292% per month, a rate of 3.95% annually, of such units’ month‑end adjusted net assets. Out of this amount, the general partner pays all clearing, execution and give‑up, floor brokerage, exchange and NFA fees, any other transaction costs, selling agent compensation, selling agent service fees and consulting fees to the trading advisors. A trading advisor through its respective trading company that has assets allocated to a swap transaction does not receive any consulting fees directly from Grant Park but instead receives a management fee from the fees embedded in the swap transaction. Transaction costs are taken into account in determining the net amount Grant Park receives or pays in connection with swap transactions or derivative instruments, but such costs or fees are not directly charged to Grant Park or any of its trading companies. The general partner will reduce (but not below zero) the brokerage charge by the amount of such costs and fees. Global 1 Class units may pay a fee to a counterparty in respect of any swap transaction or derivative |

instrument of up to 0.50% of the notional amount of such swap transaction or derivative instrument. The general partner retains the balance from the brokerage charge as payment for its services to Grant Park. Bid‑ask spreads on Grant Park’s forward and other non‑exchange traded contracts are not included in this break‑even table due to the difficulty of determining those spreads. |

| (4) | | Grant Park is responsible for ongoing operating expenses, up to an amount not to exceed 0.25% of Grant Park’s average net assets per year. This amount is used for purposes of this break‑even analysis. |

| (5) | | Grant Park’s organization and offering expenses are paid by the general partner and then reimbursed to the general partner by Grant Park. To pay this reimbursement, as of the date of this prospectus, Global 1 Class units are assessed at an annual rate of 30 basis points (0.30%) of adjusted net assets, calculated and payable monthly on the basis of month‑end adjusted net assets of the applicable class. |

| (6) | | Grant Park is credited with interest income received on free cash balances. The amount of interest income will vary from time to time. Interest is estimated for these purposes at a rate of 1.25% per year. |

Global 2 Class Break‑Even Analysis

| | | | |

| | Global 2 | |

| | Class Units | |

Assumed initial selling price per unit(1) | | $ | 1,000 | |

Trading advisors’ incentive fees(2) | | | 1.14 | |

Brokerage charge(3) (4.20%) | | | 42.00 | |

Operating expenses(4) (0.25%) | | | 2.50 | |

Offering expenses(5) (0.30%) | | | 3.00 | |

Interest income(6) (1.25%) | | | (12.50) | |

Amount of trading income required for the redemption value at the end of one year to equal the initial selling price of the unit | | $ | 36.14 | |

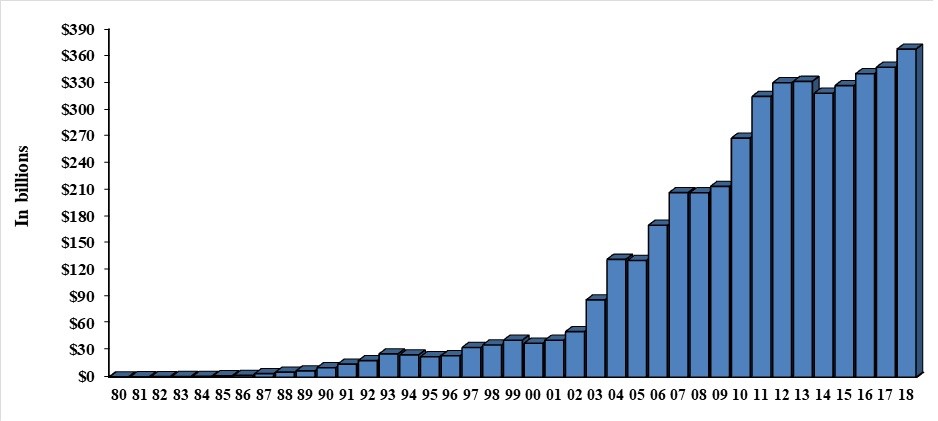

Percentage of initial selling price per Global 2 Class unit | | | 3.61 | % |