Filed pursuant to Rule 424(b)(3)

Registration No. 333-223480

GRANT PARK FUTURES FUND

LIMITED PARTNERSHIP

________________________________________________

Supplement dated November 1, 2018

to

Prospectus and Disclosure Document

dated July 13, 2018

________________________________________________

This supplement contains information which amends, supplements or modifies certain information contained in the Prospectus and Disclosure Document of the Grant Park Futures Fund Limited Partnership dated JULY 13, 2018, and should be read together therewith.

You should carefully consider the “Risk Factors” beginning on page 20 of the Prospectus before you decide to invest.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus supplement. Any representation to the contrary is a criminal offense.

The Commodity Futures Trading Commission has not passed upon the merits of participating in this pool nor has the Commission passed on the adequacy or accuracy of this Disclosure Document supplement.

SUMMARY

This supplement revises and replaces the third paragraph on page 2 of the Prospectus under the heading “SUMMARY—Legacy 1 Class and Legacy 2 Class Units” in its entirety as follows:

Through their respective trading companies, each of Sterling Partners Quantitative Investments LLC, or Sterling, EMC Capital Advisors LLC, or EMC, Transtrend B.V., or Transtrend, Amplitude Capital International Limited, or Amplitude, Lynx Asset Management AB, or Lynx, Quantica Capital AG, or Quantica, and Revolution Capital Management LLC, or RCM, serve as Grant Park’s commodity trading advisors with respect to the Legacy 1 Class and Legacy 2 Class units. Legacy 1 Class and Legacy 2 Class units obtain the equivalent of net profits or net losses generated by H2O AM LLP, or H2O, and Winton Capital Management Limited, or Winton, as reference traders through off-exchange swap transactions and will not allocate assets to H2O or Winton directly. The trading advisors and their respective asset allocations and the reference traders with respect to the Legacy 1 Class and Legacy 2 Class units are the same as with respect to the fund’s Class A and Class B units. With respect to the Class A and Class B units and the Legacy 1 Class and Legacy 2 Class, each of Amplitude, Transtrend, Sterling, EMC, Lynx, Quantica, and RCM manage between 5% and 25% of Grant Park’s net assets, and the swap transactions for which Winton and H2O are reference traders are similarly within this range.

This supplement revises and replaces the fourth paragraph on page 2 of the Prospectus under the heading “SUMMARY—Global 1 Class, Global 2 Class and Global 3 Class” in its entirety as follows:

Through their respective trading companies, each of Sterling, EMC, Transtrend, Amplitude, Lynx, Quantica and RCM serve as Grant Park’s commodity trading advisors with respect to the Global 1 Class, Global 2 Class and Global 3 Class units. Global 1 Class, Global 2 Class, and Global 3 Class units obtain the equivalent of net profits or net losses generated by H2O AM LLP, or H2O, and Winton Capital Management Limited, or Winton, as reference traders through off-exchange swap transactions and will not allocate assets to H2O or Winton directly. With respect to the Global 1 Class, Global 2 Class and Global 3 Class units, each of Sterling, EMC, Transtrend, Amplitude, Lynx, Quantica, and RCM manage between 5% and 25% of Grant Park’s net assets, and the swap transactions for which Winton and H2O are reference traders are similarly within this range.

This supplement revises and replaces the text on page 2-3 of the Prospectus under the heading “SUMMARY—Breakeven Amounts for Each Class of Units” in its entirety as follows:

The following summarizes the approximate dollar returns and percentage returns required for the redemption value of a hypothetical $1,000 initial investment in offered units to equal the amount invested 12 months after the investment was made. The break‑even summary for the Global 3 Class units shows the amount required to “break‑even” both with and without an early redemption fee which, for purposes of this summary, the highest early redemption fee has been presented to approximate the effect that payment of an early redemption fee will have on a redemption of such units during the first year of investment.

| · | | Legacy 1 Class: 3.11% (or $31.12). |

| · | | Legacy 2 Class: 3.39% (or $33.87). |

| · | | Global 1 Class: 2.51% (or $25.06). |

| · | | Global 2 Class: 2.78% (or $27.82). |

| · | | Global 3 Class: 4.71% (or $47.11) without highest early redemption fee, or 6.21% (or $62.11) with highest early redemption fee. |

See “SUMMARY—Break‑Even Analysis” beginning on page 11 for detailed breakeven analysis of the offered units.

This supplement revises and replaces the second paragraph on page 5 of the Prospectus under the heading “SUMMARY—Plan of Distribution—What is the difference between Legacy 1 Class, the Legacy 2 Class, the Global 1 Class, the Global 2 Class and the Global 3 Class Units” in its entirety as follows:

The trading advisors or swap transactions based on reference programs of such advisors for the Legacy 1 Class and Legacy 2 Class units are Sterling, EMC, Winton, Transtrend, Amplitude, Lynx, Quantica, RCM and H2O. The trading advisors, asset allocations and trading philosophy with respect to the Legacy 1 Class and Legacy 2 Class units are the same as those utilized for Grant Park’s Class A and Class B units. The trading advisors or swap transactions based on reference programs of such advisors for the Global 1 Class, Global 2 Class and Global 3 Class units are Sterling, EMC, Winton, Transtrend, Amplitude, Lynx, Quantica, RCM and H2O. The investment process is uniquely managed for each class of units.

This supplement revises and replaces the first and second paragraphs on page 8 of the Prospectus under the heading “SUMMARY—The Trading Advisors and Reference Traders” in its entirety as follows:

Grant Park trades through its nine professional commodity trading advisors or through swap transactions based on reference programs of such advisors: Amplitude Capital International Limited, EMC Capital Advisors LLC, H2O AM LLP, Lynx Asset Management AB, Quantica Capital AG, Sterling Partners Quantitative Investments LLC, Revolution Capital Management LLC, Transtrend B.V. and Winton Capital Management Limited. Each of the trading advisors that receives a direct allocation from Grant Park is registered as a commodity trading advisor under the Commodity Exchange Act and is a member of the NFA. The general partner may terminate or replace any or all of the trading advisors or swap transactions based on reference programs of such advisors, or add additional trading advisors, at any time in its sole discretion.

Amplitude Capital International Limited is located at Highwater, Grand Pavilion Commercial Centre, 1st Floor, 802 West Bay Road, P.O. Box 31855, KY1 1203 Cayman Islands, and its telephone number is (345) 943‑2295. EMC Capital Advisors, LLC is located at 2201 Waukegan Road, Suite W240, Bannockburn, Illinois 60015, and its telephone number is (847) 267‑8700. H2O AM LLP is located at 10 Old Burlington Street, London W1S 3AG, and its telephone number is +44-207-292-1600. Lynx Asset Management AB is located at Regeringsgatan 30-32, Box 7060, Stockholm, Sweden, SE‑103 86 and its telephone number is +46‑8‑663‑3360. Quantica Capital AG is located at Freier Platz 10, Schaffhausen, CH‑8200, Switzerland, and its telephone number is +41‑52‑557-00-07. Sterling Partners Quantitative Investments LLC is located at 401 N. Michigan Ave, 33rd Floor, Chicago, Illinois 60611, and its telephone number is (312) 465‑7000. Revolution Capital Management LLC is located at 1400 16th St., Suite 510, Denver, Colorado 80202, and its telephone number is (720) 496-0940. Transtrend B.V. is located at Weena 723, Unit C5.070, 3013 AM Rotterdam, The Netherlands and its telephone number is +31‑10‑453‑6510. Winton Capital Management Limited is located at Grove House, 27 Hammersmith Grove, London, W6 ONE, England, and its telephone number is +44‑20‑8576‑5800.

This supplement revises and updates the discussion in the Prospectus under the heading “SUMMARY—The Clearing Brokers and Swap Counterparty” by removing the third paragraph on page 9 in its entirety as follows:

ADM Investor Services, Inc. (“ADMIS”) became a Futures Commission Merchant for Grant Park effective May 30, 2018. ADM Investor Services, Inc. (“ADMIS”) is a registered futures commission merchant and is a member of the National Futures Association. Its main office is located at 141 W. Jackson Blvd., Suite 2100A, Chicago, IL 60604, and its telephone number is (312) 242-7000.

SG Americas Securities, LLC (“SG”) acts as a clearing broker for Grant Park. Newedge USA became one of Grant Park’s clearing brokers effective July 1, 2008 and in January 2015, Newedge USA, LLC (“Newedge USA”) merged with and into SG, with the latter as the surviving entity. Currently, SG serves as Grant Park’s clearing broker to execute and clear Grant Park’s futures and equities transactions and provide other brokerage-related services. SG is a futures commission merchant and broker dealer registered with the CFTC and the SEC and is a member of FINRA. SG is a clearing member of all principal futures exchanges located in the United States as well as a member of the Chicago Board Options Exchange, International Securities Exchange, New York Stock Exchange, Options Clearing Corporation, and Government Securities Clearing Corporation. SG is headquartered at 245 Park Avenue, New York, NY 10167, and its telephone number is (212) 278-6000.

The clearing brokers or their affiliates also may act as dealers through which Grant Park’s OTC derivatives will be effected. The trading advisors also may utilize other dealers in engaging in such transactions, with the general partner’s consent.

The general partner may retain additional or substitute clearing brokers for Grant Park in its sole discretion.

Deutsche Bank AG, acting through its London Branch, became the counterparty and principal for one of Grant Park’s swap transactions on July 1, 2015 and for a second swap transaction on April 5, 2016. Pursuant to agreements between Deutsche Bank and Grant Park in connection with these transactions, Grant Park is required to deposit collateral based on the notional values of the transactions in a custodial account maintained with Deutsche Bank Trust Company Americas, a subsidiary of Deutsche Bank and a New York State-chartered bank.

This supplement revises and replaces the paragraph titled, “Incentive Fees,” on page 10 of the Prospectus under the heading “SUMMARY—Fees and Expenses—Incentive Fees” in its entirety as follows:

Incentive Fees—Grant Park currently pays each trading advisor a quarterly, semi‑annual or annual incentive fee based on any new trading profits achieved on the trading advisor’s allocated net assets at the end of each calendar period. An incentive fee embedded in swap transactions or derivative instrument is taken into account in determining any net amount Grant Park receives in connection with such swap transaction or derivative instrument. A trading advisor through its respective trading company that has assets allocated to a swap transaction does not receive any incentive fees directly from Grant Park but instead receives incentive compensation from the fees embedded in the swap transaction. As of the date of this prospectus, the incentive fees embedded in the swap transactions in which Grant Park beneficially participates are 16% and 20% of trading profits earned by the relevant reference programs. Generally, new trading profits means the net increase in trading profits, realized and unrealized, experienced by the trading advisor on its allocated net assets from the most recent prior period in which an incentive fee was paid to the trading advisor, or if an incentive fee has yet to be paid to that trading advisor, the trading advisor’s initial allocation of net assets. Currently, the incentive fees payable to each of Grant Park’s trading advisors or reference traders directly or through swap transactions are as follows: 24.5% to Amplitude, 20% to EMC Classic Program, 0% to EMC Balanced Program, 20% to H2O, 23% to Lynx , 20% to Quantica, 20% to Sterling, 20% to RCM, 20% to Transtrend and 16% to Winton. The method of calculating new trading profits on the allocated net assets of each trading advisor is described in “FEES AND EXPENSES—Fees and Expenses Paid by Grant Park—Incentive Fees.”

This supplement revises and replaces the Breakeven Analysis tables on page 11-17 of the Prospectus under the heading “SUMMARY—Breakeven Analysis” in its entirety as follows:

The break‑even analysis below indicates the approximate dollar returns and percentage returns required for the redemption value of a hypothetical $1,000 initial investment in offered units to equal the amount invested 12 months after the investment was made. The break‑even analysis for Global 3 Class units shows the amount required to “break‑even” both with and without an early redemption fee. For purposes of this analysis, the highest early redemption fee has been presented to approximate the effect that payment of an early redemption fee will have on a redemption of such units during the first year of investment. The break‑even analysis is an approximation only.

Legacy 1 Class Break‑Even Analysis

| | | | |

| | Legacy 1 | |

| | Class Units | |

Assumed initial selling price per unit(1) | | $ | 1,000 | |

Trading advisors’ incentive fees(2) | | | 0.62 | |

Brokerage charge(3) (4.50%) | | | 45.00 | |

Operating expenses(4) (0.25%) | | | 2.50 | |

Offering expenses(5) (0.30%) | | | 3.00 | |

Interest income(6) (2.00%) | | | (20.00) | |

Amount of trading income required for the redemption value at the end of one year to equal the initial selling price of the unit | | $ | 31.12 | |

Percentage of initial selling price per Legacy 1 Class unit | | | 3.11 | % |

| (1) | | The minimum investment required to invest in the Legacy 1 Class units is $10,000. For ease of comparability, $1,000 will be deemed to be the assumed selling price per unit of a Legacy 1 Class unit, and, as described below, a Legacy 2 Class unit, a Global 1 Class unit, a Global 2 Class unit and a Global 3 Class unit, for purposes of the break‑even analysis. |

| (2) | | Reflects incentive fees payable directly or through swap transactions to Amplitude, EMC, Sterling, Winton, Transtrend, Lynx, Quantica, RCM and H2O assuming they manage between 5% and 25% of invested assets and assuming each of the advisors have equivalent performance returns for the 12‑month period. Any incentive fee |

embedded in a swap transaction or derivative instrument is taken into account in determining any net amount Grant Park receives in connection with such swap transaction or derivative instrument. A trading advisor through its respective trading company that has assets allocated to a swap transaction does not receive any incentive fees directly from Grant Park but instead receives incentive compensation from the fees embedded in the swap transaction. As of the date of this prospectus, the incentive fee embedded in swap transactions in which Grant Park beneficially participates are 16% and 20% of trading profits earned by the relevant reference program. Actual incentive fees are calculated quarterly, semi‑annually or annually on the basis of each trading advisor’s individual performance, not the overall performance of Grant Park or the Legacy 1 Class units. Because incentive fees payable to certain of these trading advisors are calculated on the basis of trading profits realized on the assets they manage after deduction for the allocable portion of only certain expenses charged to Grant Park, these advisors would receive an incentive fee before Grant Park has recouped all expenses and reaches the “break‑even” level. Incentive fees payable to certain other of these trading advisors are calculated after deduction for the allocable portion of expenses charged to Grant Park. These advisors would not receive an incentive fee before Grant Park has recouped all expenses. |

| (3) | | The brokerage charge is paid to the general partner on a monthly basis. As of the date of this prospectus, the brokerage charge for the Legacy 1 Class units equals 0.3750% per month, a rate of 4.50% annually, of such units’ month‑end adjusted net assets. Out of this amount, the general partner pays all clearing, execution and give‑up, floor brokerage, exchange and NFA fees, any other transaction costs, selling agent compensation, selling agent service fees and consulting fees to the trading advisors. A trading advisor through its respective trading company that has assets allocated to a swap transaction does not receive any consulting fees directly from Grant Park but instead receives a management fee from the fees embedded in the swap transaction. Transaction costs are taken into account in determining the net amount Grant Park receives or pays in connection with swap transactions or derivative instruments, but such costs or fees are not directly charged to Grant Park or any of its trading companies. The general partner will reduce (but not below zero) the brokerage charge by the amount of such costs and fees. Legacy 1 Class units may pay a fee to a counterparty in respect of any swap transaction or derivative instrument of up to 0.50% of the notional amount of such swap transaction or derivative instrument. The general partner retains the balance from the brokerage charge as payment for its services to Grant Park. Bid‑ask spreads on Grant Park’s forward and other non‑exchange traded contracts are not included in this break‑even table due to the difficulty of determining those spreads. |

| (4) | | Grant Park is responsible for ongoing operating expenses, up to an amount not to exceed 0.25% of Grant Park’s average net assets per year. This amount is used for purposes of this break‑even analysis. |

| (5) | | Grant Park’s organization and offering expenses are paid by the general partner and then reimbursed to the general partner by Grant Park. To pay this reimbursement, as of the date of this prospectus, Legacy 1 Class units are assessed at an annual rate of 30 basis points (0.30%) of adjusted net assets, calculated and payable monthly on the basis of month‑end adjusted net assets of the applicable class. |

| (6) | | Grant Park is credited with interest income received on free cash balances. The amount of interest income will vary from time to time. Interest is estimated for these purposes at a rate of 2.00% per year. |

Legacy 2 Class Break‑Even Analysis

| | | | |

| | Legacy 2 | |

| | Class Units | |

Assumed initial selling price per unit(1) | | $ | 1,000 | |

Trading advisors’ incentive fees(2) | | | 0.87 | |

Brokerage charge(3) (4.75%) | | | 47.50 | |

Operating expenses(4) (0.25%) | | | 2.50 | |

Offering expenses(5) (0.30%) | | | 3.00 | |

Interest income(6) (2.00%) | | | (20.00) | |

Amount of trading income required for the redemption value at the end of one year to equal the initial selling price of the unit | | $ | 33.87 | |

Percentage of initial selling price per Legacy 2 Class unit | | | 3.39 | % |

| (1) | | The minimum investment required to invest in the Legacy 2 Class units is $10,000. For ease of comparability, $1,000 will be deemed to be the assumed selling price per unit of a Legacy 2 Class unit, and, as described above, a Legacy 1 Class unit, and, as described below, a Global 1 Class unit, a Global 2 Class unit and a Global 3 Class unit, for purposes of the break‑ even analysis. |

| (2) | | Reflects incentive fees payable directly or through swap transactions to Amplitude, EMC, Sterling, Winton, Transtrend, Lynx, Quantica, RCM and H2O assuming they manage between 5% and 25% of invested assets and assuming each of the advisors have equivalent performance returns for the 12‑month period. Any incentive fee embedded in a swap transaction or derivative instrument is taken into account in determining any net amount Grant Park receives in connection with such swap transaction or derivative instrument. A trading advisor through its respective trading company that has assets allocated to a swap transaction does not receive any incentive fees directly from Grant Park but instead receives incentive compensation from the fees embedded in the swap transaction. As of the date of this prospectus, the incentive fee embedded in swap transactions in which Grant Park beneficially participates are 16% and 20% of trading profits earned by the relevant reference program. Actual incentive fees are calculated quarterly, semi‑annually or annually on the basis of each trading advisor’s individual performance, not the overall performance of Grant Park or the Legacy 2 Class units. Because incentive fees payable to certain of these trading advisors are calculated on the basis of trading profits realized on the assets they manage after deduction for the allocable portion of only certain expenses charged to Grant Park, these advisors would receive an incentive fee before Grant Park has recouped all expenses and reaches the “break‑even” level. Incentive fees payable to certain other of these trading advisors are calculated after deduction for the allocable portion of expenses charged to Grant Park. These advisors would not receive an incentive fee before Grant Park has recouped all expenses. |

| (3) | | The brokerage charge is paid to the general partner on a monthly basis. As of the date of this prospectus, the brokerage charge for the Legacy 2 Class units equals 0.3958% per month, a rate of 4.75% annually, of such units’ month‑end adjusted net assets. Out of this amount, the general partner pays all clearing, execution and give‑up, floor brokerage, exchange and NFA fees, any other transaction costs, selling agent compensation, selling agent service fees and consulting fees to the trading advisors. A trading advisor through its respective trading company that has assets allocated to a swap transaction does not receive any consulting fees directly from Grant Park but instead receives a management fee from the fees embedded in the swap transaction. Transaction costs are taken into account in determining the net amount Grant Park receives or pays in connection with swap transactions or derivative instruments, but such costs or fees are not directly charged to Grant Park or any of its trading companies. The general partner will reduce (but not below zero) the brokerage charge by the amount of such costs and fees. Legacy 2 Class units may pay a fee to a counterparty in respect of any swap transaction or derivative instrument of up to 0.50% of the notional amount of such swap transaction or derivative instrument. The general partner retains the balance from the brokerage charge as payment for its services to Grant Park. Bid‑ask spreads on Grant Park’s forward and other non‑exchange traded contracts are not included in this break‑even table due to the difficulty of determining those spreads. |

| (4) | | Grant Park is responsible for ongoing operating expenses, up to an amount not to exceed 0.25% of Grant Park’s average net assets per year. This amount is used for purposes of this break‑even analysis. |

| (5) | | Grant Park’s organization and offering expenses are paid by the general partner and then reimbursed to the general partner by Grant Park. To pay this reimbursement, as of the date of this prospectus, Legacy 2 Class units are assessed at an annual rate of 30 basis points (0.30%) of adjusted net assets, calculated and payable monthly on the basis of month‑end adjusted net assets of the applicable class. |

| (6) | | Grant Park is credited with interest income received on free cash balances. The amount of interest income will vary from time to time. Interest is estimated for these purposes at a rate of 2.00% per year. |

Global 1 Class Break‑Even Analysis

| | | | |

| | Global 1 | |

| | Class Units | |

Assumed initial selling price per unit(1) | | $ | 1,000 | |

Trading advisors’ incentive fees(2) | | | 0.06 | |

Brokerage charge(3) (3.95%) | | | 39.50 | |

Operating expenses(4) (0.25%) | | | 2.50 | |

Offering expenses(5) (0.30%) | | | 3.00 | |

Interest income(6) (2.00%) | | | (20.00) | |

Amount of trading income required for the redemption value at the end of one year to equal the initial selling price of the unit | | $ | 25.06 | |

Percentage of initial selling price per Global 1 Class unit | | | 2.51 | % |

| (1) | | The minimum investment required to invest in the Global 1 Class units is $5,000. For ease of comparability, $1,000 will be deemed to be the assumed selling price per unit of a Global 1 Class unit, and, as described above, a Legacy 1 Class unit and a Legacy 2 Class unit, and, as described below, a Global 2 Class unit and a Global 3 Class unit, for purposes of the break‑ even analysis. |

| (2) | | Reflects incentive fees payable directly or through swap transactions to Amplitude, EMC, Sterling, Winton, Transtrend, Lynx, Quantica, RCM and H2O assuming they manage between 5% and 25% of invested assets and assuming each of the advisors have equivalent performance returns for the 12‑month period. Any incentive fee embedded in a swap transaction or derivative instrument is taken into account in determining any net amount Grant Park receives in connection with such swap transaction or derivative instrument. A trading advisor through its respective trading company that has assets allocated to a swap transaction does not receive any incentive fees directly from Grant Park but instead receives incentive compensation from the fees embedded in the swap transaction. As of the date of this prospectus, the incentive fee embedded in swap transactions in which Grant Park beneficially participates are 16% and 20% of trading profits earned by the relevant reference program. Actual incentive fees are calculated quarterly, semi‑annually or annually on the basis of each trading advisor’s individual performance, not the overall performance of Grant Park or the Global 1 Class units. Because incentive fees payable to certain of these trading advisors are calculated on the basis of trading profits realized on the assets they manage after deduction for the allocable portion of only certain expenses charged to Grant Park, these advisors would receive an incentive fee before Grant Park has recouped all expenses and reaches the “break‑even” level. Incentive fees payable to certain other of these trading advisors are calculated after deduction for the allocable portion of expenses charged to Grant Park. These advisors would not receive an incentive fee before Grant Park has recouped all expenses. |

| (3) | | The brokerage charge is paid to the general partner on a monthly basis. As of the date of this prospectus, the brokerage charge for the Global 1 Class units equals 0.3292% per month, a rate of 3.95% annually, of such units’ month‑end adjusted net assets. Out of this amount, the general partner pays all clearing, execution and give‑up, floor brokerage, exchange and NFA fees, any other transaction costs, selling agent compensation, selling agent service fees and consulting fees to the trading advisors. A trading advisor through its respective trading company that has assets allocated to a swap transaction does not receive any consulting fees directly from Grant Park but instead receives a management fee from the fees embedded in the swap transaction. Transaction costs are taken into account in determining the net amount Grant Park receives or pays in connection with swap transactions or derivative instruments, but such costs or fees are not directly charged to Grant Park or any of its trading companies. The general partner will reduce (but not below zero) the brokerage charge by the amount of such costs and fees. Global 1 Class units may pay a fee to a counterparty in respect of any swap transaction or derivative instrument of up to 0.50% of the notional amount of such swap transaction or derivative instrument. The general partner retains the balance from the brokerage charge as payment for its services to Grant Park. Bid‑ask spreads on |

Grant Park’s forward and other non‑exchange traded contracts are not included in this break‑even table due to the difficulty of determining those spreads. |

| (4) | | Grant Park is responsible for ongoing operating expenses, up to an amount not to exceed 0.25% of Grant Park’s average net assets per year. This amount is used for purposes of this break‑even analysis. |

| (5) | | Grant Park’s organization and offering expenses are paid by the general partner and then reimbursed to the general partner by Grant Park. To pay this reimbursement, as of the date of this prospectus, Global 1 Class units are assessed at an annual rate of 30 basis points (0.30%) of adjusted net assets, calculated and payable monthly on the basis of month‑end adjusted net assets of the applicable class. |

| (6) | | Grant Park is credited with interest income received on free cash balances. The amount of interest income will vary from time to time. Interest is estimated for these purposes at a rate of 2.00% per year. |

Global 2 Class Break‑Even Analysis

| | | | |

| | Global 2 | |

| | Class Units | |

Assumed initial selling price per unit(1) | | $ | 1,000 | |

Trading advisors’ incentive fees(2) | | | 0.32 | |

Brokerage charge(3) (4.20%) | | | 42.00 | |

Operating expenses(4) (0.25%) | | | 2.50 | |

Offering expenses(5) (0.30%) | | | 3.00 | |

Interest income(6) (2.00%) | | | (20.00) | |

Amount of trading income required for the redemption value at the end of one year to equal the initial selling price of the unit | | $ | 27.82 | |

Percentage of initial selling price per Global 2 Class unit | | | 2.78 | % |

| (1) | | The minimum investment required to invest in the Global 2 Class units is $5,000. For ease of comparability, $1,000 will be deemed to be the assumed selling price per unit of a Global 2 Class unit, and, as described above, a Legacy 1 Class unit, a Legacy 2 Class unit and a Global 1 Class unit, and, as described below, a Global 3 Class unit, for purposes of the break‑even analysis. |

| (2) | | Reflects incentive fees payable directly or through swap transactions to Amplitude, EMC, Sterling, Winton, Transtrend, Lynx, Quantica, RCM and H2O assuming they manage between 5% and 25% of invested assets and assuming each of the advisors have equivalent performance returns for the 12‑month period. Any incentive fee embedded in a swap transaction or derivative instrument is taken into account in determining any net amount Grant Park receives in connection with such swap transaction or derivative instrument. A trading advisor through its respective trading company that has assets allocated to a swap transaction does not receive any incentive fees directly from Grant Park but instead receives incentive compensation from the fees embedded in the swap transaction. As of the date of this prospectus, the incentive fee embedded in swap transactions in which Grant Park beneficially participates are 16% and 20% of trading profits earned by the relevant reference program. Actual incentive fees are calculated quarterly, semi‑annually or annually on the basis of each trading advisor’s individual performance, not the overall performance of Grant Park or the Global 2 Class units. Because incentive fees payable to certain of these trading advisors are calculated on the basis of trading profits realized on the assets they manage after deduction for the allocable portion of only certain expenses charged to Grant Park, these advisors would receive an incentive fee before Grant Park has recouped all expenses and reaches the “break‑even” level. Incentive fees payable to certain other of these trading advisors are calculated after deduction for the allocable portion of expenses charged to Grant Park. These advisors would not receive an incentive fee before Grant Park has recouped all expenses. |

| (3) | | The brokerage charge is paid to the general partner on a monthly basis. As of the date of this prospectus, the brokerage charge for the Global 2 Class units equals 0.3500% per month, a rate of 4.20% annually, of such units’ month‑end adjusted net assets. Out of this amount, the general partner pays all clearing, execution and give‑up, floor brokerage, exchange and NFA fees, any other transaction costs, selling agent compensation, selling agent service fees and consulting fees to the trading advisors. A trading advisor through its respective trading company that has assets allocated to a swap transaction does not receive any consulting fees directly from Grant Park but instead receives a management fee from the fees embedded in the swap transaction. Transaction costs are taken |

into account in determining the net amount Grant Park receives or pays in connection with swap transactions or derivative instruments, but such costs or fees are not directly charged to Grant Park or any of its trading companies. The general partner will reduce (but not below zero) the brokerage charge by the amount of such costs and fees. Global 2 Class units may pay a fee to a counterparty in respect of any swap transaction or derivative instrument of up to 0.50% of the notional amount of such swap transaction or derivative instrument. The general partner retains the balance from the brokerage charge as payment for its services to Grant Park. Bid‑ask spreads on Grant Park’s forward and other non‑exchange traded contracts are not included in this break‑even table due to the difficulty of determining those spreads. |

| (4) | | Grant Park is responsible for ongoing operating expenses, up to an amount not to exceed 0.25% of Grant Park’s average net assets per year. This amount is used for purposes of this break‑even analysis. |

| (5) | | Grant Park’s organization and offering expenses are paid by the general partner and then reimbursed to the general partner by Grant Park. To pay this reimbursement, as of the date of this prospectus, Global 2 Class units are assessed at an annual rate of 30 basis points (0.30%) of adjusted net assets, calculated and payable monthly on the basis of month‑end adjusted net assets of the applicable class. |

| (6) | | Grant Park is credited with interest income on free cash balances. The amount of interest income will vary from time to time. Interest is estimated for these purposes at a rate of 2.00% per year. |

Global 3 Class Break‑Even Analysis

| | | | |

| | Global 3 | |

| | Class Units | |

Assumed initial selling price per unit(1) | | $ | 1,000 | |

Trading advisors’ incentive fees(2) | | | 2.11 | |

Brokerage charge(3) (5.95%) | | | 59.50 | |

Operating expenses(4) (0.25%) | | | 2.50 | |

Offering expenses(5) (0.30%) | | | 3.00 | |

Interest income(6) (2.00%) | | | (20.00) | |

Amount of trading income required for the redemption value at the end of one year to equal the initial selling price of the unit, without early redemption fee | | $ | 47.11 | |

Percentage of initial selling price per unit, without early redemption fee | | | 4.71 | % |

Early redemption fee(7) (1.50%) | | $ | 15.00 | |

Amount of trading income required for the redemption value at the end of one year to equal the initial selling price per Global 3 Class unit, with the highest early redemption fee | | $ | 62.11 | |

Percentage of initial selling price per Global 3 Class unit, with the highest early redemption fee | | | 6.21 | % |

| (1) | | The minimum investment required to invest in the Global 3 Class units is $5,000. For ease of comparability, $1,000 will be deemed to be the assumed selling price per unit of a Global 3 Class unit, and, as described above, a Legacy 1 Class unit, a Legacy 2 Class unit and a Global 1 Class unit, and a Global 2 Class unit, for purposes of the break‑even analysis. |

| (2) | | Reflects incentive fees payable directly or through swap transactions to Amplitude, EMC, Sterling, Winton, Transtrend, Lynx, Quantica, RCM and H2O assuming they manage between 5% and 25% of invested assets and assuming each of the advisors have equivalent performance returns for the 12‑month period. Any incentive fee embedded in a swap transaction or derivative instrument is taken into account in determining any net amount Grant Park receives in connection with such swap transaction or derivative instrument. A trading advisor through its respective trading company that has assets allocated to a swap transaction does not receive any incentive fees directly from Grant Park but instead receives incentive compensation from the fees embedded in the swap transaction. As of the date of this prospectus, the incentive fee embedded in swap transactions in which Grant Park beneficially participates are 16% and 20% of trading profits earned by the relevant reference program. Actual incentive fees are calculated quarterly, semi‑annually or annually on the basis of each trading advisor’s individual performance, not the overall performance of Grant Park or the Global 3 Class units. Because incentive fees payable to certain of these trading advisors are calculated on the basis of trading profits realized on the assets they manage after deduction for the allocable portion of only certain expenses charged to Grant Park, these advisors would receive an incentive fee before Grant Park has recouped all expenses and reaches the “break‑even” level. |

Incentive fees payable to certain other of these trading advisors are calculated after deduction for the allocable portion of expenses charged to Grant Park. These advisors would not receive an incentive fee before Grant Park has recouped all expenses. |

| (3) | | The brokerage charge is paid to the general partner on a monthly basis. As of the date of this prospectus, the brokerage charge for the Global 3 Class units equals 0.4958% per month, a rate of 5.95% annually, of such units’ month‑end adjusted net assets. Out of this amount, the general partner pays all clearing, execution and give‑up, floor brokerage, exchange and NFA fees, any other transaction costs, selling agent compensation, selling agent service fees and consulting fees to the trading advisors. A trading advisor through its respective trading company that has assets allocated to a swap transaction does not receive any consulting fees directly from Grant Park but instead receives a management fee from the fees embedded in the swap transaction. Transaction costs are taken into account in determining the net amount Grant Park receives or pays in connection with swap transactions or derivative instruments, but such costs or fees are not directly charged to Grant Park or any of its trading companies. The general partner will reduce (but not below zero) the brokerage charge by the amount of such costs and fees. Global 3 Class units may pay a fee to a counterparty in respect of any swap transaction or derivative instrument of up to 0.50% of the notional amount of such swap transaction or derivative instrument. The general partner retains the balance from the brokerage charge as payment for its services to Grant Park. Bid‑ask spreads on Grant Park’s forward and other non‑exchange traded contracts are not included in this break‑even table due to the difficulty of determining those spreads. |

| (4) | | Grant Park is responsible for ongoing operating expenses, up to an amount not to exceed 0.25% of Grant Park’s average net assets per year. This amount is used for purposes of this break‑even analysis. |

| (5) | | Grant Park’s organization and offering expenses are paid by the general partner and then reimbursed to the general partner by Grant Park. To pay this reimbursement, as of the date of this prospectus, Global 3 Class units are assessed at an annual rate of 30 basis points (0.30%) of adjusted net assets, calculated and payable monthly on the basis of month‑end adjusted net assets of the applicable class. |

| (6) | | Grant Park is credited with interest income received on free cash balances. The amount of interest income will vary from time to time. Interest is estimated for these purposes at a rate of 2.00% per year. |

Global 3 Class limited partners are prohibited from redeeming such units for three months following the subscription for units. Thereafter, Global 3 Class limited partners causing redemption of their units on or before the one‑year anniversary of their subscription for the redeemed units will pay an early redemption fee of 1.5%, 1.0% or 0.5% of the net asset value of the redeemed units, depending on when the units are redeemed during the first year. For purposes of this breakeven analysis, the highest early redemption fee has been presented to approximate the effect a payment of an early redemption fee would have on a redemption of Global 3 Class units at an undetermined point during the first year of investment. Because the highest early redemption fee has been used and the other fees and expenses shown assume an investment in Grant Park for one year, the breakeven analysis does not reflect the actual amount required to “break‑even” for Global 3 Class units that are redeemed prior to the one‑year anniversary of the investment, which will vary depending on the date of redemption.

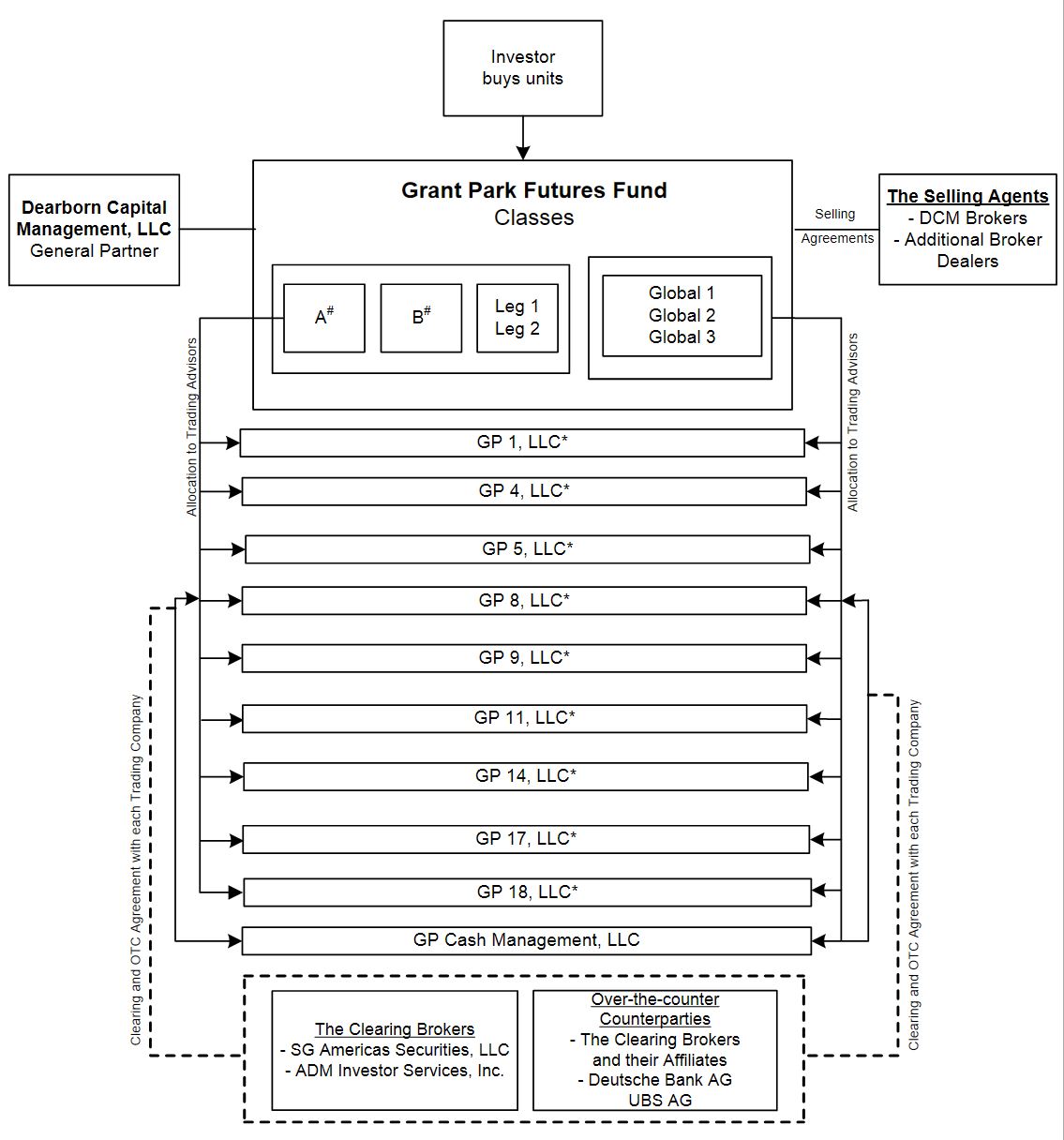

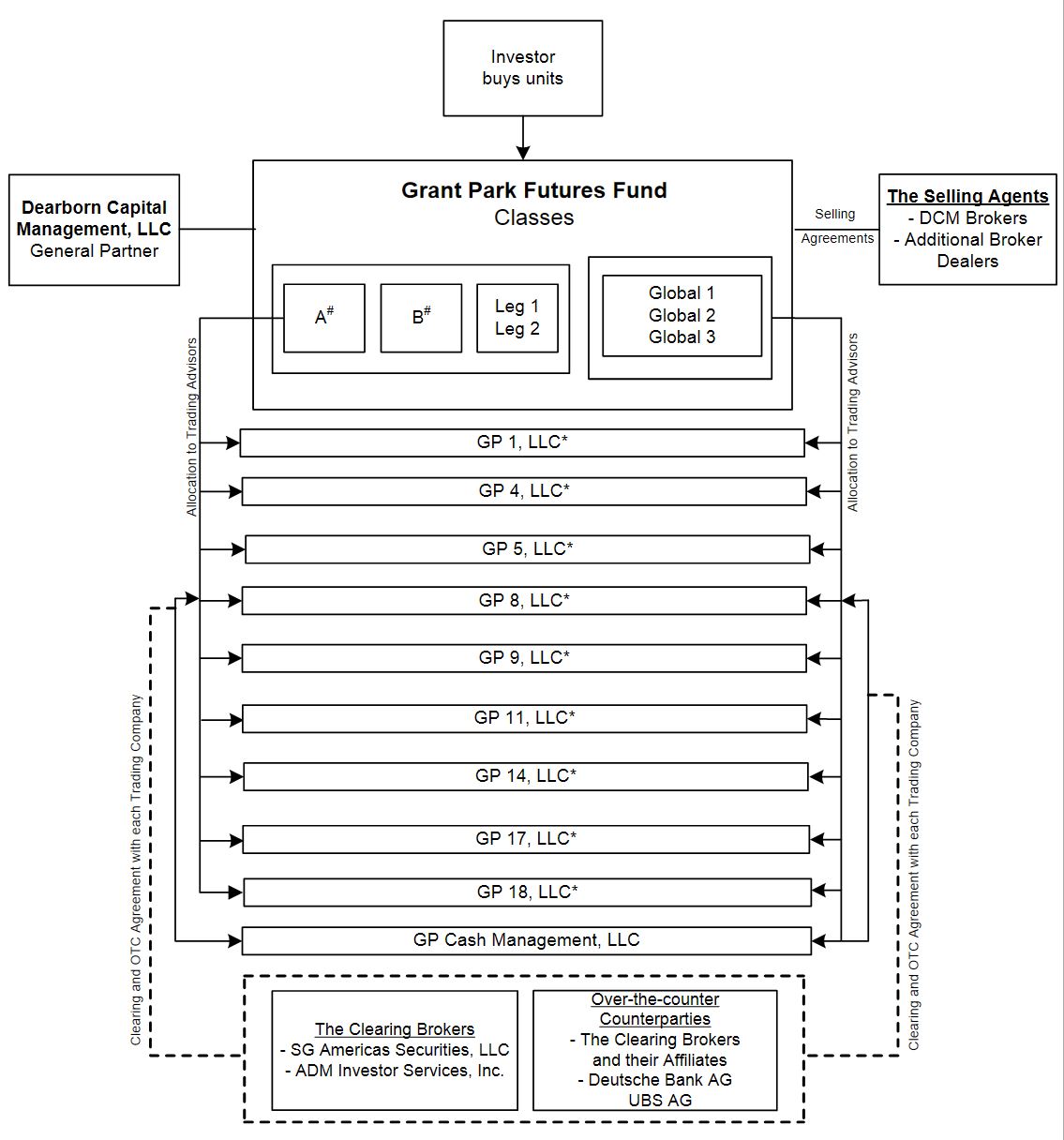

This supplement revises and replaces the chart included on page 19 of the Prospectus under the heading “SUMMARY—Organizational Chart” in its entirety as follows:

The organizational chart below illustrates the relationship among the various service providers for Grant Park.

# Classes A and B are closed to new investment. These classes are no longer offered by the Selling Agents.

* Grant Park invests through an individual trading company for each trading advisor. An Advisory Agreement is entered into by each trading advisor, its corresponding trading company, Dearborn Capital Management, L.L.C., as general partner, and Grant Park or a swap transaction or derivative instrument tied to the performance of such trading advisor is entered into by a trading company with the swap counterparty.

THE GENERAL PARTNER

This supplement adds the following paragraph after the fourth paragraph on page 44 of the Prospectus under the heading “THE GENERAL PARTNER— Principals of the General Partner” as follows:

Lauren Perkaus, chief compliance officer of the general partner, 31, is responsible for compliance issues. Ms. Perkaus became a listed principal of the general partner effective July 2018. Ms. Perkaus has worked in compliance and risk management since joining the firm in August 2010. Additionally since October 2014, Ms. Perkaus has served as the chief compliance officer of DCM Brokers, LLC, which serves as Grant Park’s lead selling agent. Ms. Perkaus received a B.A. in international studies from Miami University in 2010 and currently holds Series 22, 31, 39 and 63 licenses.

THE TRADING ADVISORS AND REFERENCE TRADERS

This supplement revises and replaces the first five paragraphs and the chart on pages 45 of the Prospectus under the heading “THE TRADING ADVISORS AND REFERENCE TRADERS” in its entirety as follows:

The general partner has retained Amplitude Capital International Limited, EMC Capital Advisors, LLC, Lynx Asset Management AB, Quantica Capital AG, Sterling Partners Quantitative Investments LLC, Revolution Capital Management LLC and Transtrend B.V. as Grant Park’s trading advisors. Grant Park will obtain the equivalent of net profits or net losses generated by H2O AM LLP and Winton Capital Management Limited as reference traders through off-exchange swap transactions and will not allocate assets to H2O or Winton directly. The table below illustrates the trading advisors or reference traders for each class of Grant Park’s outstanding limited partnership units:

| | | | | | | | | | | | | | | | | | | |

| | Amplitude | | EMC | | H2O* | | Lynx | | Quantica | | Sterling | | RCM | | Transtrend | | Winton* | |

Class A | | X | | X | | X | | X | | X | | X | | X | | X | | X | |

Class B | | X | | X | | X | | X | | X | | X | | X | | X | | X | |

Legacy 1 | | X | | X | | X | | X | | X | | X | | X | | X | | X | |

Legacy 2 | | X | | X | | X | | X | | X | | X | | X | | X | | X | |

Global 1 | | X | | X | | X | | X | | X | | X | | X | | X | | X | |

Global 2 | | X | | X | | X | | X | | X | | X | | X | | X | | X | |

Global 3 | | X | | X | | X | | X | | X | | X | | X | | X | | X | |

*Reference trader.

The trading advisors and their respective asset allocations and the reference traders under the swap transactions with respect to the Legacy 1 Class and the Legacy 2 Class units are the same as with respect to the Class A and Class B units. With respect to the Class A and Class B units and the Legacy 1 Class and Legacy 2 Class, each of Amplitude, EMC, Lynx, Quantica, Sterling, RCM and Transtrend manage between 5% and 25% of Grant Park’s net assets, and the swap transactions for which Winton and H2O are reference traders are similarly within this range.

For the Global 1 Class, Global 2 Class and Global 3 Class units, between 5% and 25% of Grant Park’s assets are allocated to each of Amplitude, EMC, Lynx, Quantica, Sterling, RCM and Transtrend, and the swap transactions for which H2O and Winton are the reference traders are similarly within this range.

EMC has been trading on behalf of Grant Park since January 1989. Winton began trading for Grant Park on August 1, 2004, and Winton’s performance began being used for Grant Park through a swap arrangement on April 5, 2016. Transtrend began trading on July 1, 2008. Amplitude began trading on behalf of Grant Park on February 1, 2010. Lynx began trading on behalf of Grant Park on November 1, 2012. Quantica began trading for Grant Park on February 1, 2013,RCM began trading on behalf of Grant Park on August 1, 2014 and Sterling began trading on behalf of Grant Park effective November 1, 2018. H2O’s performance began being used through a swap arrangement for Grant Park on July 1, 2015. The general partner may, in its sole discretion, reallocate assets among the trading advisors upon termination of a trading advisor or retention of any new trading advisors, or at the commencement of any month. Consequently, the current apportionment is subject to change.

This supplement revises and updates the discussion in the Prospectus under the heading “THE TRADING ADVISORS AND REFERENCE TRADERS” by removing all of the paragraphs on pages 47-48 under the heading “Rabar Market Research, Inc” in their entirety and by adding the following paragraphs on page 47 as follows:

Sterling Partners Quantitative Investments LLC

Sterling Partners Quantitative Investments LLC (“Sterling”) is a Delaware limited liability company and was registered as commodity pool operator in January 2018 and as a commodity trading advisor in June 2018. The business address of Sterling is 401 N. Michigan Ave., Suite 3300, Chicago, Illinois 60611, and its telephone number is (312) 465-7000. Founded in 2018, Sterling is a Chicago-based investment adviser focusing on quantitative, computer-based investment strategies.

Management

The listed principals of Sterling are Dr. Francisco J. Vaca, Christ Dardanes, Desmond Werthman, Michael Schmitt, Alexander Pasman, Jeffrey Elburn, Maury Epstein, Douglas Becker, Rudolf Christopher Hoehn-Saric, and Steven Taslitz. Dr. Vaca, makes all trading and/or operational decisions for the Sterling Diversified Program.

Dr. Vaca is a listed principal and the Chief Investment Officer – Derivatives Strategies, having joined Sterling in that capacity in November 2018. Dr. Vaca became registered as an associated person of Sterling in August 2018. He has been listed as a principal of Sterling since August 2018. Prior to joining Sterling, Dr. Vaca was the co-chief investment officer of Rabar Market Research, Inc. (“Rabar”) from January 2014 until October 2018. He was registered as an associated person of Rabar from October 2013 until November 2018 and was listed as a principal of Rabar from January 2014 until November 2018. Prior to joining Rabar, he was the sole trading principal, Chairman, and Chief Executive Officer of Vaca Capital Management, LLC from November 2000 to December 2013. Dr. Vaca was registered as an associated person and listed as a principal of Vaca Capital Management, LLC from February 2005 until February 2014.

Desmond Werthman is a listed principal and the president of Sterling, having joined Sterling in that capacity in August 2018. Mr. Werthman became registered as an associate person of Sterling in January 2018. He has been listed as a principal of Sterling since January 2018. From May 2017 through February 2018, Mr. Werthman served as a consultant to Sterling Fund Management, LLC, a registered investment adviser, where he led the research of and due diligence on various investment strategies for potential seed investments. He became an employee of Sterling Fund Management, LLC in February 2018 where he continued in this capacity until becoming President of Sterling. From June 2010 through April 2017, Mr. Werthman was the Founder, Chief Investment Officer and Managing Member of Madra Asset Management, LLC (“Madra”),an asset manager focused on allocating client capital to macro-oriented trading firms.. At Madra Mr. Werthman was responsible for portfolio construction, manager due diligence, risk and also oversaw the day-to-day operations of the business. Mr. Werthman was registered as an associated person and listed as a principal of Madra from June 2010 to December 2016 and registered as a forex associated person of Madra from November 2011 to June 2014.

Sterling’s Trading Program

Strategy. Sterling currently uses a trading program known as the Diversified Program in trading for Grant Park. Sterling has been trading the Diversified Program since November 2018. Prior to this, Dr. Vaca traded such program from January 2007 to December 2013 while at Vaca Capital Management, LLC and from January 2014 to October 2018 while at Rabar Market Research, Inc. The objective of Sterling’s investment strategy is to generate capital appreciation over the long run by investing exclusively in exchange-traded futures contracts, options on futures contracts, foreign currency forward contracts and, cash commodities. Sterling may also engage in exchange for physical transactions, more commonly referred to as EFPs. An EFP transaction involves the exchange of a futures position for the underlying commodity without making an open competitive trade on an exchange, as permitted by exchange rules.

Sterling’s strategy employs a diversified, systematic, technical, trend-following approach, utilizing a blend of several separate and distinct quantitative models. Each of these elements is described more fully below.

The approach is diversified in that it can be invested in 75 markets, covering more than 22 different exchanges in 11 different countries. The portfolio includes futures contracts on currencies, financial instruments,

precious and base metals, stock indices, energies, and agricultural and soft commodities. The specific markets have been chosen for, among other reasons, their historical performance and customary liquidity.

The approach is systematic in that Sterling utilizes multiple quantitative investment models that generate signals directing Sterling to initiate or liquidate positions in each market at specific, predetermined price points. In the vast majority of circumstances, Sterling will follow the specific signals generated by the models. The approach does, however, incorporate a small discretionary element. In this regard, Sterling may, from time to time, analyze certain key fundamental factors affecting supply and demand, such as a regional or global financial crisis, extreme weather conditions, or major political events. As a result of the analysis Sterling may make adjustments to the size of positions or the timing of trades in the portfolio in an effort to control risk or to take advantage of potential profit opportunities.

The approach is technical, meaning that the signals generated by the models are based upon an analysis of objective technical factors rather than fundamental factors. Although the technical indicators analyzed are varied, they are all based primarily on daily, weekly, and monthly price movement.

The approach is trend-following. In this regard, Sterling seeks to invest in markets exhibiting directional price movement over time. Since the portfolio will maintain both long and short positions, it is not necessarily relevant whether a particular market is rising or falling. It is merely the case that Sterling’s best opportunity for profit will come from markets moving continuously in one direction while Sterling will have a difficult time profiting from, and may incur losses in, markets that are not exhibiting sustained directional movement.

The approach incorporates a blend of quantitative models. Specifically, the methodology employs several totally separate and distinct investment models in its overall approach, and several additional variations of those models, all of which are blended together in Sterling’s program.

Risk Management. Sterling employs a number of risk management techniques in the strategy with a view toward reducing and controlling risk in the portfolio. For example, Sterling’s portfolio is broadly diversified thereby spreading the risk across multiple markets. Sterling’s portfolio is also diversified across multiple quantitative models, limiting the risk exposure in the portfolio to any one such model. Sterling also employs predetermined stop loss levels or exit points for each position. These stop losses can have the effect of limiting the exposure to each position, system, market and market sector, and in the portfolio as a whole. In addition, Sterling utilizes a proprietary quantitative methodology to determine the size of each position with a view toward equalizing risk in the portfolio across all markets.

It should be noted that the risk management techniques described above may not have the desired effects of controlling or even reducing risk in the portfolio, as investing in commodity interests involves a high degree of risk.

Research & Development. Sterling believes that the development of quantitative models for use in investing in commodity interests is a continual process. To this end, Sterling conducts an ongoing research and development effort led by Dr. Vaca and including a team of professionals working on research related matters. The goal of the research effort is to evaluate the continued viability of the existing models, to enhance the existing models, and to develop new models. Although these goals may not be achieved, through its research effort Sterling has modified its models over time and it is likely that modifications will be made in the future. Thus, the models that might be used by Sterling in the future may differ from those presently used or those used in the past. Clients such as Grant Park will not be informed about non-material modifications, including generally, markets or commodity interest contracts traded.

Miscellaneous. As stated above, some investment decisions involve the exercise of judgment by Sterling. For example, the decision not to trade particular commodity interests or to reduce or eliminate exposure in particular markets may result at times in missing price moves and hence profits of great magnitude, which other managers who are willing to trade these commodity interests or have not reduced exposure may be able to capture. For these and other reasons, the performance of Sterling may not result in profitable trading.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

This supplement revises and replaces the fifth paragraph on page 69 of the Prospectus under the heading “MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS—Organization of Grant Park” in its entirety as follows:

Grant Park invests through the Trading Companies with independent professional commodity trading advisors or through swap transactions based on reference programs of certain reference traders. Sterling, EMC, Transtrend, Amplitude, Lynx, Quantica, and RCM serve as Grant Park’s commodity trading advisors. Grant Park obtains the equivalent of net profits or net losses generated by H2O and Winton as reference traders through off-exchange swap transactions and does not allocate assets to H2O or Winton directly. Each of the trading advisors that receives a direct allocation of assets from Grant Park is registered as a commodity trading advisor under the Commodity Exchange Act and is a member of the NFA. The general partner allocates between 5% to 25% of Grant Park’s net assets through the respective trading companies among Sterling, EMC, Transtrend, Amplitude, Lynx, Quantica, and RCM, and the swap transactions through which Winton and H2O are reference traders are similarly within this range. No more than 25% of Grant Park’s assets are allocated to any one trading company and, in turn, any one trading advisor and/or reference trader. The general partner may terminate or replace the trading advisors and/or enter into swap transactions related to the performance of reference traders or retain additional trading advisors in its sole discretion. The trading advisors for the Legacy 1 Class, Legacy 2 Class, Global 1 Class, Global 2 Class and Global 3 Class units pursue a technical trend trading philosophy, which is the same trading philosophy the trading advisors have historically used for the Class A and Class B units.

THE CLEARING BROKERS AND SWAP COUNTERPARTY

This supplement revises and replaces the first paragraph on page 84 of the Prospectus under the heading “THE CLEARING BROKERS AND SWAP COUNTERPARTY” in its entirety as follows:

ADM Investor Services, Inc. and SG Americas Securities, LLC serve as Grant Park’s clearing brokers. Deutsche Bank AG serves as Grant Park’s swap counterparty. The following descriptions for each clearing broker and the swap counterparty provide background information and information regarding material legal proceedings involving the clearing broker or swap counterparty.

This supplement revises and updates the discussion in the Prospectus under the heading “The Clearing Brokers and Swap Counterparty” by removing all of the paragraphs on pages 86-87 under the heading “Wells Fargo Securities, LLC” in their entirety.

CONFICTS OF INTEREST

This supplement revises and replaces the first paragraph in the Prospectus under the heading “CONFLICTS OF INTEREST—General Partner and Trading Advisor Ownership Interest in Grant Park on page 90 in its entirety as follows:

As of April 30, 2018, Grant Park had net assets of approximately $97.8 million, and has issued limited partnership interests in transactions registered under the Securities Act of 1933 for net aggregate capital contributions equal to $1.52 billion. The general partner has made and is required to maintain a cash general partnership investment in Grant Park equal to 1% of such amount from time to time. The general partner may make withdrawals of any investment in excess of this amount. As of April 30, 2018, Ms. O’Rourke and Mr. Meehan, principals of the general partner, owned less than 0.30% of the interests in Grant Park as limited partners. Other principals of or persons affiliated with the general partner or the trading advisors or reference traders may, from time to time, own interests in Grant Park. However, at April 30, 2018, no other persons affiliated with any of the trading advisors or reference traders, other than as detailed above, own an interest in Grant Park.

FEES AND EXPENSES

This supplement revises and replaces the first paragraph in the Prospectus under the heading “FEES AND EXPENSES—Fees and Expenses Paid by Grant Park—Incentive Fees on page 93 in its entirety as follows:

Grant Park pays each trading advisor a quarterly, semi‑annual or annual incentive fee based on any new trading profits achieved on the trading advisor’s allocated net assets at the end of each calendar period. Generally, new trading profits means the net increase in trading profits, realized and unrealized, experienced by the trading advisor on its allocated net assets from the most recent prior period in which an incentive fee was paid to the trading advisor, or if an incentive fee has yet to be paid to that trading advisor, the trading advisor’s initial allocation of net assets. An incentive fee embedded in a swap transaction or derivative instrument is taken into account in determining any net amount Grant Park receives in connection with such swap transaction or derivative instrument. A trading advisor through its respective trading company that has assets allocated to a swap transaction does not receive any incentive fees directly from Grant Park but instead receives incentive compensation from the fees embedded in the swap transaction. As of the date of this prospectus, the incentive fees embedded in swap transactions in which Grant Park beneficially participates are 16% and 20% of trading profits earned by the relevant reference programs. Currently, the incentive fees payable to each of Grant Park’s trading advisors directly or through swap transactions are as follows: 24.5% to Amplitude, 20% to EMC Classic Program, 0% to EMC Balance Program, 20% to H2O, 23% to Lynx, 20% to Quantica, 20% to Sterling, 20% to RCM, 20% to Transtrend and 16% to Winton.

This supplement revises and replaces the first paragraph in the Prospectus under the heading “FEES AND EXPENSES—Fees and Expenses Paid by Grant Park—Trading Advisor Consulting Fees on page 98 in its entirety as follows:

Each trading advisor receives a consulting fee, payable by the general partner out of the brokerage charge Grant Park pays the general partner, ranging from 0.5% to 1.5% per year, computed and accrued monthly on the basis of the trading advisor’s allocated net assets either at the beginning of the month or at month‑end and paid, depending on the trading advisor, either monthly or quarterly. Consulting fees are taken into account by the swap counterparty in determining the net amount Grant Park receives or pays in connection with swap transactions or derivative instruments, but such costs or fees are not directly charged to Grant Park or any of its trading companies. A trading advisor through its respective trading company that has assets allocated to a swap transaction does not receive any consulting fees directly from Grant Park but instead receives a management fee from the fees embedded in the swap transaction. The general partner will reduce (but not below zero) the brokerage charge by the amount of such costs and fees. The embedded consulting fee is accrued on the relevant notional amount of the swap. The consulting fees payable to each of Grant Park’s trading advisors directly or through swap transactions are as follows: 1% to Amplitude, 1% to EMC Classic Program, 0.2% to EMC Balance Program, 1% to H2O, 0.5% to Lynx, 1% to Quantica, 1% to Sterling, 1% to RCM, 1% to Transtrend and .85% to Winton.

POTENTIAL ADVANTAGES OF INVESTMENT

This supplement revises and replaces the first paragraph on page 235 of the Prospectus under the heading “POTENTIAL ADVANTAGES OF INVESTMENT—Professional Trading” in its entirety as follows:

Grant Park trades through the following commodity trading advisors or through swap transactions based on certain programs of reference traders: Amplitude Capital International Limited, EMC Capital Advisors, LLC, H2O AM LLP, Lynx Asset Management AB, Quantica Capital AG, Sterling Partners Quantitative Investments LLC, Revolution Capital Management LLC, Transtrend B.V. and Winton Capital Management Limited. Proceeds from investments in the offered units are traded through proprietary trading programs of the trading advisors or through swap transactions based on reference programs of such advisors. Each trading advisor uses its own proprietary trading program.