QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 20-F

(Mark One)

| o | | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR |

ý |

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2002 |

OR |

o |

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 0-17434 |

DRAXIS HEALTH INC.

(Exact name of Registrant as specified in its charter)

PROVINCE OF ONTARIO, CANADA

(Jurisdiction of incorporation or organization)

6870 GOREWAY DRIVE, 2nd FLOOR, MISSISSAUGA, ONTARIO, CANADA L4V 1P1

(Address of principal executive offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

Title of each class

NONE |

|

Name of each exchange on which registered

NONE |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

COMMON SHARES

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

NONE

(Title of Class)

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report.

Shares—37,098,690 (as of 12/31/02)

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ý No o

Indicate by check mark which financial statement item the Registrant has elected to follow.

Item 17 o Item 18 ý

| Item 1. | | Identity of Directors, Senior Management and Advisers | | 1 |

| Item 2. | | Offer Statistics and Expected Timetable | | 1 |

| Item 3. | | Key Information | | 1 |

| Item 4. | | Information on the Company | | 10 |

| Item 5. | | Operating and Financial Review and Prospects | | 42 |

| Item 6. | | Directors, Senior Management and Employees | | 57 |

| Item 7. | | Major Shareholders and Related Party Transactions | | 74 |

| Item 8. | | Financial Information | | 75 |

| Item 9. | | The Offer and Listing | | 75 |

| Item 10. | | Additional Information | | 78 |

| Item 11. | | Quantitative and Qualitative Disclosures About Market Risk | | 86 |

| Item 12. | | Description of Securities Other Than Equity Securities | | 87 |

| Item 13. | | Defaults, Dividends Arrearages and Delinquencies | | 87 |

| Item 14. | | Material Modifications to the Rights of Security Holders and Use of Proceeds | | 87 |

| Item 15. | | Controls and Procedures | | 87 |

| Item 17. | | Financial Statements | | 87 |

| Item 18. | | Financial Statements | | 87 |

| Item 19. | | Exhibits | | 87 |

Item 1. Identity of Directors, Senior Management and Advisers

Not Applicable

Item 2. Offer Statistics and Expected Timetable

Not Applicable

Item 3. Key Information

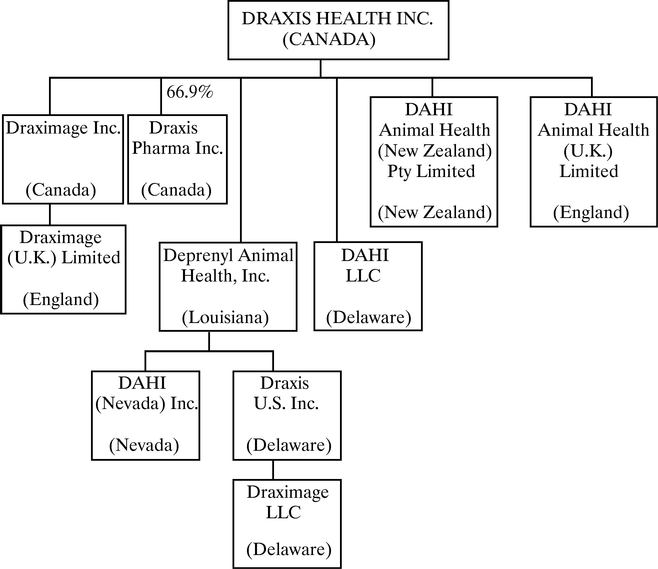

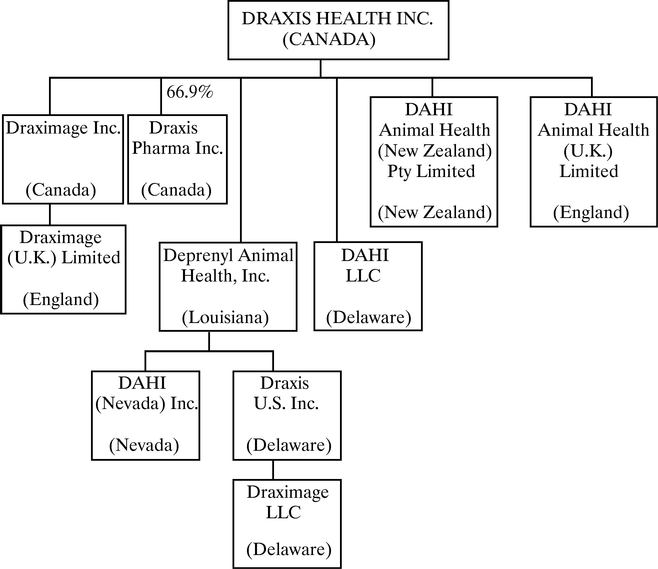

DRAXIS Health Inc. ("DRAXIS" or the "Company") is an integrated specialty pharmaceutical company with core competencies in two segments: the development, production, marketing and distribution of radiopharmaceuticals through DRAXIMAGE Inc. ("DRAXIMAGE") and the provision of contract pharmaceutical manufacturing services, specializing in liquid and freeze-dried injectables and other sterile products through DRAXIS Pharma Inc. ("DPI"). The Company believes that both DRAXIMAGE and DPI have significant long-term growth potential and has invested considerable financial and management resources in developing these businesses.

We also engage in Canadian pharmaceutical sales and marketing through DRAXIS Pharmaceutica ("DRAXIS Pharmaceutica"), which operates as a division of DRAXIS. DRAXIS has the strategic intent to divest DRAXIS Pharmaceutica. Accordingly, commencing with the quarter ended December 31, 2001, the results of operations of DRAXIS Pharmaceutica have been reported as discontinued operations. Commencing in the second quarter of 2002, discontinued operations no longer include revenues and expenses directly attributable to Alertec.

Our subsidiary Deprenyl Animal Health, Inc. ("DAHI") receives licensing and royalty revenue related to Anipryl, a companion animal health product.

Our registered and principal office is located at 6870 Goreway Drive, 2nd Floor, Mississauga, Ontario, L4V 1P1.

The selected data set forth in the following table are expressed in U.S. dollars and in accordance with U.S. generally accepted accounting principles ("U.S. GAAP"). All data presented below should be read in conjunction

1

with, and is qualified in its entirety by, reference to the audited Consolidated Financial Statements and Notes thereto for the year ended December 31, 2002.

| | U.S. GAAP

(in thousands of U.S. dollars except share related data)

|

|---|

| | 2002

| | 2001

| | 2000

| | 1999

| | 1998

|

|---|

| Operations | | | | | | | | | | | | | | | |

| | Revenues | | $ | 38,640 | | $ | 33,903 | | $ | 29,721 | | $ | 24,591 | | $ | 30,643 |

| | Operating income (loss) | | | 2,894 | | | 1,773 | | | 36 | | | (1,638 | ) | | 5,027 |

| | Income (loss) from continuing operations before cumulative effect of accounting change | | | 3,020 | | | (1,015 | ) | | 363 | | | (860 | ) | | 3,378 |

| | (Loss) income from discontinued operations, net of taxes | | | (834 | ) | | (569 | ) | | (801 | ) | | (4,610 | ) | | 339 |

| | Cumulative effect of accounting change, net of tax | | | — | | | — | | | (19,900 | ) | | — | | | — |

| | |

| |

| |

| |

| |

|

| | Net income (loss) | | $ | 2,186 | | $ | (1,584 | ) | $ | (20,338 | ) | $ | (5,470 | ) | $ | 3,717 |

| | |

| |

| |

| |

| |

|

Basic income (loss) per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | From continuing operations before cumulative effect of accounting change | | $ | 0.08 | | $ | (0.03 | ) | $ | 0.01 | | | (0.02 | ) | | 0.11 |

| | From discontinued operations | | | (0.02 | ) | | (0.02 | ) | | (0.02 | ) | | (0.14 | ) | | 0.01 |

| | From cumulative effect of accounting change | | | — | | | — | | | (0.55 | ) | | — | | | — |

| | |

| |

| |

| |

| |

|

| Basic income (loss) per share | | | 0.06 | | | (0.05 | ) | | (0.56 | ) | | (0.16 | ) | | 0.12 |

| | |

| |

| |

| |

| |

|

Financial Position at December 31 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | Cash and cash equivalents | | | 4,899 | | | 5,602 | | | 4,420 | | | 2,016 | | | 2,393 |

| | Total assets | | | 67,951 | | | 64,360 | | | 67,307 | | | 60,647 | | | 56,649 |

| | Long-term debt | | | 12,726 | | | 8,060 | | | 9,890 | | | 14,476 | | | 11,861 |

| | Common shareholders' equity | | | 20,227 | | | 16,878 | | | 20,808 | | | 38,116 | | | 34,677 |

| | Book value per common share | | | 0.55 | | | 0.46 | | | 0.57 | | | 1.07 | | | 1.07 |

Share Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | Number of shares outstanding at year end | | | 37,098,690 | | | 36,613,434 | | | 36,565,102 | | | 35,557,366 | | | 32,280,524 |

| | Weighted average number of shares outstanding—basic | | | 36,981,985 | | | 36,587,794 | | | 36,324,199 | | | 33,825,654 | | | 31,950,704 |

Overview

This Annual Report (Form 20-F) contains forward-looking statements (within the meaning of the Securities Exchange Act of 1934, as amended) and information that are based on management's beliefs, as well as assumptions made by and information currently available to management. When used in this Annual Report (Form 20-F), the words "anticipate," "estimate," "believe," "expect," "potential," "intend," "designed" and "should" and similar expressions are intended to identify forward-looking statements. These forward-looking statements necessarily make numerous assumptions with respect to industry performance, general business, economic and regulatory conditions, access to markets and materials and other matters, all of which are inherently subject to significant uncertainties and contingencies and many of which are beyond the Company's control. Should one or more of these risks or uncertainties materialise, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, estimated or projected. The Company believes that any of the following risk factors could cause the Company's actual results to differ from those that may have been or may be projected in forward-looking statements made by or on behalf of the Company from time to time. The forward-looking statements in this Annual Report (Form 20-F) are contained principally under Items 4 and 5.

RISK FACTORS

The following list of factors may not be exhaustive, as we operate in a rapidly changing business, and new risk factors emerge from time to time. We cannot predict such risk factors, nor can we assess the impact, if any, of such risk factors on our business or the extent to which any factor, or combination of factors, may cause actual

2

results to differ materially from those projected in any forward-looking statements. Accordingly, do not rely on forward-looking statements as a prediction of actual results.

The following summarizes the major risks and uncertainties facing us:

WE MAY NOT BE ABLE TO GET TIMELY REGULATORY APPROVAL FOR OUR PRODUCTS.

Preclinical studies and clinical trials, as well as the manufacturing and marketing of our existing and potential products, are subject to extensive regulation by the Health Products and Food Branch of Health Canada ("HPFB") and other authorities in Canada and by numerous federal, state and local government authorities in the United States, including the Food and Drug Administration ("FDA"). Similar regulatory requirements exist in Europe and other countries. To the extent we choose to explore foreign markets, we may rely on foreign licensees to obtain regulatory approvals in such countries. The commercialization of certain of our products will be subject to rigorous preclinical and clinical testing and other premarket approval requirements by the FDA, HPFB and similar authorities in other foreign countries. Any failure or delay by us, our collaborators or licensees to comply with applicable requirements or obtain regulatory approvals for our products could adversely affect the marketing of products developed or licensed by us and our ability to receive product or royalty revenue.

The regulatory process, which includes preclinical studies and clinical trials of each compound to establish its safety and efficacy, takes many years and requires the expenditure of substantial resources. Moreover, if regulatory approval of a drug or diagnostic product is granted, such approval may entail limitations on the indicated uses for which it may be marketed. Failure to comply with applicable regulatory requirements can, among other things, result in suspension of regulatory approvals, product recalls, seizure of products, operating restrictions and criminal prosecution. Further, government policy may change, and additional government regulations may be established that could prevent or delay regulatory approvals for our products. In addition, a marketed drug and its manufacturer are subject to continual review. Later discovery of previously unknown problems with the product or manufacturer may result in restrictions on such product or manufacturer, including withdrawal of the product from the market.

We manufacture, or expect to manufacture, many active pharmaceutical ingredients and advanced pharmaceutical intermediates that are used in our own and our customers' drug products. The final drug products in which the pharmaceutical ingredients and advanced pharmaceutical intermediates are used, however, are subject to regulation for safety and efficacy by the FDA, HPFB and other jurisdictions, as the case may be. Such products must be approved by such agencies before they can be commercially marketed. The process of obtaining regulatory clearance for marketing is uncertain, costly and time consuming. We cannot predict how long the necessary regulatory approvals will take or whether our customers will ever obtain such approval for their products. To the extent that we and/or our customers do not obtain the necessary regulatory approvals for marketing new products, our product sales could be adversely affected.

WE MAY NOT BE ABLE TO OBTAIN AND ENFORCE EFFECTIVE PATENTS TO PROTECT OUR PROPRIETARY RIGHTS FROM USE BY COMPETITORS, AND THE PATENTS OF OTHER PARTIES COULD REQUIRE US TO STOP USING OR TO ACQUIRE A LICENSE FOR CONDUCTING CERTAIN BUSINESS ACTIVITIES, AND OUR COMPETITIVE POSITION AND PROFITABILITY COULD SUFFER AS A RESULT.

Our success will depend, in part, on our ability to obtain, enforce and maintain patent protection for our technology in Canada, the United States and other countries. We cannot assure you that patents will issue from any pending applications or that claims now or in the future, if any, allowed under issued patents will be sufficiently broad to protect our technology. In addition, no assurance can be given that any patents issued to or licensed by us will not be challenged, invalidated, infringed or circumvented, or that the rights granted thereunder will provide continuing competitive advantages to us. The patent positions of pharmaceutical and biotechnology firms, including us, are generally uncertain and involve complex legal and factual questions. In addition, we do not know whether any of our current research endeavours will result in the issuance of patents in Canada, the United States, or elsewhere, or if any patents already issued will provide significant proprietary protection or will be circumvented or invalidated. Since patent applications in the United States and Canada are maintained in secrecy for at least 18 months from the date of filing, and since publication of discoveries in the scientific or patent literature tends to lag behind actual discoveries by several months, we cannot be certain that we were the first to create inventions claimed by pending patent applications or that we were the first to file patent applications for such inventions. Certain patents related to our products have expired. Loss of patent protection could lead to

3

generic competition for these products, and others in the future, which would materially and adversely affect the financial prospects for these products and, to a lesser extent, the Company.

Our commercial success will also depend in part on our not infringing patents or proprietary rights of others and not breaching the licenses granted to us. The degree of patent protection afforded to pharmaceutical or biotechnological inventions around the world is uncertain and varies significantly between different countries. There can be no assurance that we will be able to obtain a license to any third-party technology or patents that we may require to conduct our business or that such technology or patents can be licensed at a reasonable cost. Failure by us or our collaborators to obtain a license to any technology or patents that we may need to commercialize our technologies or products may result in delays in marketing our proposed products or the inability to proceed with the development, manufacture or sale of products requiring such licenses and may have a material adverse effect on us.

We have been required to, and may continue to be required to, engage in litigation and other patent proceedings to enforce patents issued to us, to defend our right, title and interest to patents related to our products and to determine the scope and validity of other parties' proprietary rights. These proceedings can be costly, and if the outcome of any such proceedings is adverse to us, we could lose the right to sell some of our products or could be required to pay damages.

We also rely on unpatented trade secrets, improvements and know-how to develop and maintain our competitive position, which we seek to protect, in part, by confidentiality agreements with our corporate partners, collaborators, employees and consultants. These agreements could be breached, and we may not have adequate remedies for any breach. Further, our trade secrets could otherwise become known or be independently discovered by competitors.

IF OUR COLLABORATIVE AND COMMERCIAL RELATIONSHIPS WITH THIRD PARTIES ON WHOM WE RELY ARE UNSUCCESSFUL, OUR BUSINESS MAY SUFFER.

To be successful, we must continually establish and maintain strategic relationships with leaders in a number of biotechnology and pharmaceutical industry segments. This is critical to success because such relationships enable us to extend the reach of our products and sales in various jurisdictions, generate additional revenue and develop and deploy new products in various marketplaces. Entering into strategic relationships is complicated as some of our current and future strategic partners may decide to compete with us in some or all of the markets or refuse to fulfil or honor their contractual obligations to us.

We have entered into a number of product in-licensing and out-licensing arrangements in which our business and financial success is dependent on third parties. In many of our product in-licensing arrangements, the product licensor is responsible for developing a body of data upon which we can base a submission to the HPFB, FDA or other regulatory authority. The interests of the other party to each of these agreements may not be or remain consistent with our interests, and our collaborators may not succeed in developing a body of data that can form the basis of regulatory approval. Should our collaborators fail to develop such body of data to enable us to obtain the requisite regulatory approvals or otherwise fail to honor their commitments to us or meet our expectations, our business, financial condition and results of operations may be materially and adversely affected. In addition, we cannot control the amount and timing of resources our collaborators devote to the products to which they have rights or to the subject matters of our agreements with them generally. The agreements may be terminated by our collaborators in certain circumstances.

To the extent we enter into product out-licensing arrangements for the marketing or distribution of our own products with collaborative partners, any revenues we receive will depend upon the efforts of third parties. There can be no assurance that any third party will market our products successfully or that any third-party collaboration will be on terms favorable to us. If any marketing partner does not market a product successfully, our business might be materially and adversely affected. Because revenues from our collaboration agreements with Pfizer Inc. ("Pfizer") relating to Anipryl have been a primary source of income for the Company, our business could be materially and adversely affected if Pfizer does not continue to market Anipryl successfully.

A SIGNIFICANT PORTION OF OUR BUSINESS IS DEPENDENT ON A SMALL NUMBER OF KEY CUSTOMERS.

As at December 31, 2002, the Company's two largest customers represented 19% and 17% respectively of our total revenues. The termination by either of these customers of its relationship with us would have a material adverse effect on our business, financial condition and results of operations.

4

IF OUR COLLABORATORS, EMPLOYEES, OR CONSULTANTS DISCLOSE OUR CONFIDENTIAL INFORMATION TO OTHERS DESPITE CONFIDENTIALITY AGREEMENTS IN PLACE, OUR BUSINESS MAY SUFFER.

Our practice is to require our employees, collaborators, consultants and outside scientific advisors to execute confidentiality agreements upon the commencement of employment or consulting relationships. These agreements provide that all confidential information developed or made known to the individual during the course of the individual's relationship with us is to be kept confidential and not disclosed to third parties, subject to certain specific limited exceptions. In the case of employees, the agreements provide that all inventions conceived by the individual shall be our exclusive property. These agreements, however, may not provide meaningful protection for our trade secrets or adequate remedies in the event of unauthorized use or disclosure of such information.

WE ARE SUBJECT TO REGULATION BY GOVERNMENTS IN MANY JURISDICTIONS AND, IF WE DO NOT COMPLY WITH HEALTHCARE, MANUFACTURING, NUCLEAR SAFETY AND ENVIRONMENTAL REGULATIONS, OUR EXISTING AND FUTURE OPERATIONS MAY BE CURTAILED, AND WE COULD BE SUBJECT TO LIABILITY.

The HPFB, FDA and other governmental regulators have increased requirements for drug purity and have increased environmental burdens upon the pharmaceutical industry. Because pharmaceutical drug manufacturing is a highly regulated industry, requiring significant documentation and validation of manufacturing processes and quality control assurance prior to approval of the facility to manufacture a specific drug, there can be considerable transition time between the initiation of a contract to manufacture a product and the actual initiation of manufacture of that product. Any lag time in the initiation of a contract to manufacture product and the actual initiation of manufacture at our facilities could cause us to lose profits or incur liabilities.

Products manufactured by us will have to comply with the FDA's current Good Manufacturing Practices ("cGMP") and other FDA, HPFB or European guidelines and regulations. Products containing radioactive isotopes will have to comply with the guidelines and regulations of the Canadian Nuclear Safety Commission in Canada and the Nuclear Regulatory Commission in the U.S. and with other similar regulations in other countries. Additionally, certain of our customers may require us to adhere to additional manufacturing standards, even if not required by the FDA or other regulatory authorities. Compliance with cGMP regulations requires manufacturers to expend time, money and effort in production, and to maintain precise records and quality control to ensure that the product meets applicable specifications and other requirements. The FDA and other regulators periodically inspect drug-manufacturing facilities to ensure compliance with applicable cGMP requirements. If we fail to comply with the cGMP requirements, we may become subject to possible regulatory action and manufacturing at the facility could consequently be suspended causing possible loss of profit, regulatory fines and third-party liability. Any one of these events could have a material adverse effect on our business, financial condition and results of operations.

The FDA may also require the submission of any lot of a particular product for inspection. If the lot product fails to meet the FDA requirements, then the FDA could take any of the following actions: (i) restrict the release of the product; (ii) suspend manufacturing of the specific lot of the product; (iii) order a recall of the lot of the product; or (iv) order a seizure of the lot of the product.

Canadian and United States federal, state, local and provincial regulations govern extensively the use, manufacture, storage, handling, transport and disposal of hazardous material and associated waste products. Although we believe that the operations at our facilities comply in all material respects with the applicable environmental laws in Canada and the United States, we cannot completely eliminate the risk of substantial environmental liabilities. Any failure by us or any of our subsidiaries to comply with the present or future environmental laws in Canada, the United States or elsewhere, could result in any of the following: (i) cessation of portions or all of our or our subsidiaries' operations; (ii) imposition of fines; (iii) restrictions on our or our subsidiaries' ability to carry on or expand our operations; (iv) significant expenditures by us in order to comply with environmental laws and regulations; or (v) liabilities in excess of our resources. Any of these sanctions could have a material adverse effect on our business, financial condition and results of operations.

We have in place facilities and procedures designed to reduce and, to the extent possible, eliminate the risk of environmental contamination resulting from the processing of raw materials and, more specifically, from the radiopharmaceutical business of our subsidiary DRAXIMAGE and the manufacturing business of our subsidiary DPI. We also have in place a regular maintenance program to ensure continued compliance with all applicable environmental regulations.

5

COMPETITION FROM MANUFACTURERS AND MARKETERS OF GENERIC DRUGS MAY REDUCE OUR REVENUE AND PROFITS.

Our brand name drugs face competition from generic drugs, which can have adverse effects upon sales. We have attempted to mitigate the impact of generic competition by diversifying our product lines and entering into agreements to share in the profits from the sales of generic versions of our products. However, competition from generics could result in lower revenues and margins.

OUR BUSINESS COULD BE HARMED IF THERE WERE A DISPUTE OR DISRUPTION WITH OUR UNIONISED EMPLOYEES.

Although our subsidiary DPI currently has a good relationship with the United Food & Commercial Workers International Union, Local 291 (AFL-CIO), there can be no assurance that future labor difficulties will not arise. Should such difficulties arise which lead to significant grievance issues and/or a labor strike, such events might have a material adverse effect on our business.

FACTORS BEYOND OUR CONTROL COULD CAUSE INTERRUPTION IN OUR OPERATIONS, WHICH WOULD ADVERSELY AFFECT OUR REPUTATION IN THE MARKETPLACE AND OUR RESULTS OF OPERATIONS.

��To succeed, we must be able to operate our manufacturing facilities without interruption and deliver radiopharmaceutical products in a timely manner. We could suffer an interruption caused by damage from a variety of sources, many of which are not within our control, including, fire, flood and other natural disasters, power loss and telecommunication failure, disruption to transportation systems, software and hardware errors, failures or crashes and similar disruptions, or undue delays or restrictions with cross border shipments. Any significant interruptions in our operations or our ability to deliver time-sensitive products would damage our reputation in the marketplace and have a negative impact on our results of operations.

ALTHOUGH WE CARRY INSURANCE, A SUCCESSFUL LIABILITY CLAIM COULD NEGATIVELY IMPACT OUR BUSINESS.

The use of any of our unapproved products under development and the sale of any approved products may expose us to liability claims resulting from the use of these products. Such claims might be made directly by consumers, healthcare providers or by pharmaceutical companies or others selling such products. We currently have liability insurance, but we cannot provide assurance that we will be able to maintain insurance coverage at a reasonable cost or in sufficient amounts to protect us against losses due to this potential liability. We might not be able to maintain or obtain additional commercially reasonable product liability insurance for any products approved for marketing. A successful product liability claim or a series of claims brought against us could have a material adverse effect on our business, financial condition or results of operations. Even unsuccessful product liability claims could result in the expenditure of funds in litigation and the diversion of management time and resources and could damage our reputation and impair the marketability of our products.

IF THE MARKET DOES NOT ACCEPT OUR PRODUCTS, OUR BUSINESS COULD BE HARMED.

There can be no assurance that any of our products in development or products recently launched will achieve market acceptance. The degree of market acceptance will depend upon a number of factors, including the receipt of regulatory approvals, the establishment and demonstration in the medical community of the clinical efficacy and safety of the products, the establishment and demonstration of the potential advantages over existing and new diagnostic and treatment methods and the reimbursement policies of government and third-party payors. There can be no assurance that physicians, patients, payors or the medical community in general will accept and utilize any existing or new products that may be developed or manufactured by us.

We anticipate that we will face increased competition in the future as new products enter the market and advanced technologies become available. There can be no assurance that existing products or new products developed by our competitors will not be more effective, or be more effectively marketed and sold, than any that may be developed or sold by us. Competitive products may render our products obsolete and uncompetitive prior to recovering research, development or commercialization expenses incurred with respect to any such products.

Many of our existing or potential competitors, particularly large pharmaceutical companies, have substantially greater financial, technical and human resources than do we. In addition, many of these competitors have significantly greater experience in undertaking research, preclinical studies and human clinical trials of new pharmaceutical products, obtaining regulatory approvals and manufacturing and marketing such products.

6

Accordingly, our competitors may succeed in commercializing products more rapidly or effectively, which could have a material adverse effect on our business, financial condition or results of operations.

FAILURE OF ONE OF OUR CURRENT OR FUTURE CLINICAL TRIALS COULD HAVE A MATERIALLY NEGATIVE IMPACT ON OUR FUTURE PROSPECTS.

The development of new products is subject to a number of significant risks. Potential products that appear to be promising in various stages of development may not reach the market for a number of reasons. Such reasons include the possibilities that the potential product will be found ineffective or unduly toxic during preclinical or clinical trials, fail to receive necessary regulatory approvals, be difficult to manufacture on a large scale, be uneconomical to market or not achieve market acceptance, or be precluded from commercialization by proprietary rights of third parties. Certain products we are attempting to develop have never been manufactured on a commercial scale, and there can be no assurance that such products can be manufactured at a cost or in a quantity to render such products commercially viable. Production of such products may require the development of new manufacturing technologies and expertise. The impact on our business in the event that new manufacturing technologies and expertise would have to be developed is uncertain. Many of our potential products will require significant additional research and development efforts and significant additional preclinical and clinical testing, prior to any commercial use. There can be no assurance that we will successfully meet any of these technological challenges, or others that may arise in the course of development.

Before obtaining regulatory approval for the commercial sale of any product under development, we must demonstrate through preclinical studies and clinical trials that the product is safe and efficacious. The results from preclinical studies and clinical trials may not be totally predictive of results obtained in larger clinical trials, and there can be no assurance that our or any collaborators' clinical trials will demonstrate safety and efficacy, achieve regulatory approvals or result in marketable products. A number of companies in the biotechnology and pharmaceutical industry have suffered significant setbacks in advanced clinical trials, even after achieving promising results in earlier trials. Failure to successfully complete clinical trials on a timely basis could have an adverse effect on our future business, financial condition and results of operations.

OUR PROFIT DEPENDS IN PART ON REIMBURSEMENT POLICIES AND REGULATIONS OF GOVERNMENT HEALTH ADMINISTRATION AUTHORITIES, PRIVATE HEALTH INSURERS AND OTHER ORGANIZATIONS.

The business and financial condition of pharmaceutical companies will continue to be affected by the efforts of governments and third-party payors to contain or reduce the costs of healthcare through various means. For example, in certain markets, including Canada, pricing or profitability of prescription pharmaceuticals, medical devices and diagnostic products is subject to government control. In the United States there have been, and we expect that there will continue to be, a number of federal and state proposals to implement similar government controls. In addition, an increasing emphasis on managed healthcare in the United States has increased and will continue to increase the pressure on pharmaceutical pricing. While we cannot predict whether such legislative or regulatory proposals will be adopted or the effects such proposals or managed care efforts may have on our business, the announcement and/or adoption of such proposals or efforts could have a material adverse effect on our business and financial condition and that of our current and prospective corporate partners. Accordingly, our ability to establish strategic alliances may be adversely affected. In addition, in Canada, the United States and elsewhere, sales of prescription pharmaceutical products and radiopharmaceutical products are dependent, in part, on the availability of reimbursement to the consumer from third-party payors, such as government and private insurance plans. Third-party payors are increasingly challenging the prices charged for medical products and services. To the extent we succeed in bringing new products to market, there can be no assurance that these products will be considered cost-effective and reimbursement to consumers will be available or will be sufficient to allow the sale of these products on a competitive basis. The Patented Medicine Prices Review Board, which monitors and controls prices of patented drug products marketed in Canada, may assert jurisdiction over our products under development which may limit the prices that can be charged for such products. We may not be able to obtain prices for our products under development that will make them commercially viable.

OUR FUTURE SUCCESS DEPENDS ON OUR ABILITY TO GROW, AND IF WE ARE UNABLE TO MANAGE OUR GROWTH EFFECTIVELY, WE MAY INCUR UNEXPECTED EXPENSES AND BE UNABLE TO MEET OUR CUSTOMERS' REQUIREMENTS.

We will need to maintain, expand and upgrade our manufacturing facilities and operations to execute current commercial obligations to customers, widen our customer base and increase manufacturing efficiencies over the

7

next few years. We cannot be certain that DPI will be able to enter into enough lucrative third-party contracts to increase its profitability. If we do secure advantageous agreements, we cannot be certain that our employees, systems, procedures, controls and existing space will be adequate to support expansion of its operations. Our future operating results will depend on the ability of our officers and key employees to manage changing business conditions and to implement and improve our technical, administrative, financial control and reporting systems and operational excellence in order to achieve established business objectives. An unexpectedly large increase in the volume of manufacturing business or the number of orders placed by customers may require us to expand and further upgrade our facilities and the technology related to our manufacturing. We may not be able to project the rate of timing of such increases or customer demands accurately or to expand and upgrade our facilities and supporting systems and infrastructure to accommodate such increases. Difficulties in managing future growth and meeting customers' expanded requirements could have a significant negative impact on our business and its profitability.

OUR FINANCIAL RESULTS MAY FLUCTUATE, AND OUR FUTURE REVENUE AND PROFITABILITY ARE UNCERTAIN.

Our ability to achieve and maintain profitability in the foreseeable future depends on the commercial success of our products and services. Because we will be launching or are in the process of launching new products in new markets, revenues are difficult to predict and may fluctuate substantially from period to period. In addition, product development programs will require substantial additional investment, including the cost of clinical trials, obtaining additional regulatory approvals, if necessary, and marketing and sales expenses associated with potential new product introductions. Our manufacturing facility will continue to require capital investment in order to maintain, upgrade and expand its operations. The success of our subsidiaries DRAXIMAGE and DPI will rely significantly on the ability of both companies to maintain and to increase substantially their manufacturing capabilities to satisfy customer demand. There can be no assurance that, or if so when, we will successfully develop, receive regulatory approvals for, or manufacture or market, any new products for our own marketing purposes, or for third parties. DPI may fail to secure sufficiently lucrative third-party manufacturing contracts to increase its profitability. The research, development, production and marketing of new products will require the application of considerable technical and financial resources by us and our collaborators, while revenues that are generated by such products, if successfully developed and marketed, may not be realized for several years. We may not be able to sustain profitability. We may require external financing to complete certain aspects of our strategic plan, and external sources of capital may not be available at an acceptable cost. Should Société générale de financement du Québec ("SGF") divest its interest in DPI, or the shareholder relationship between us and SGF become strained, there may be a negative effect on us and our manufacturing facility operations.

IF WE CANNOT ADAPT TO CHANGING TECHNOLOGIES, OUR PRODUCTS AND SERVICES MAY BECOME OBSOLETE AND OUR BUSINESS COULD SUFFER.

Because the biotechnology and pharmaceutical industry is characterized by rapid technology change and obsolescence, we may be unable to anticipate changes in our current and potential customer requirements that could make our existing technology obsolete. Our success will depend, in part, on our ability to continue to enhance our existing products and services, develop new technology that addresses the increasing sophistication and varied needs of our respective customers, license leading technologies and respond to technological advances and emerging industry standards and practices on a timely and cost-effective basis. The development of our proprietary technology and investing in certain niche markets entails significant technical and business risks. We may not be successful in using our new technologies or exploiting our niche markets effectively or adapting our businesses to evolving customer requirements or emerging industry standards.

OUR COMMON SHARE PRICE HAS BEEN, AND IS LIKELY TO CONTINUE TO BE, VOLATILE.

The market prices for the securities of pharmaceutical and biotechnology companies, including ours, have historically been highly volatile, and the market has, from time to time, experienced significant price and volume fluctuations that are unrelated to the operating performance of particular companies. Factors such as fluctuations in our operating results, announcements of competing technological innovations or new therapeutic products by our competitors, clinical trial results, governmental regulation, developments in patent or other proprietary rights, public concern as to the safety of drugs developed by us or others and general market conditions can have an adverse effect on the market price of our shares. In particular, the realization of any of the risks described herein could have a material adverse impact on such market price. Sales of substantial amounts of our shares in the public market, or the perception that such sales will occur, could also adversely affect the market price of our shares and make it more difficult in the future for us to raise funds through equity offerings.

8

WE ARE EXPOSED TO EXCHANGE RATE FLUCTUATIONS WHICH COULD NEGATIVELY AFFECT OUR BUSINESS.

A substantial portion of our revenues are now, and are expected to continue to be, realized in US dollars. Our operating expenses are primarily paid in Canadian dollars. Fluctuations in the exchange rate between the US dollar and the Canadian dollar may have a material effect on our results of operations. In particular, we may be adversely affected by a significant strengthening of the Canadian dollar against the US dollar. We do not currently use derivative instruments to hedge our foreign exchange risk and currently have no plans to do so in the near future.

IF WE LOSE THE SERVICES OF KEY PERSONNEL, WE MAY BE UNABLE TO REPLACE THEM, AND OUR BUSINESS COULD BE NEGATIVELY AFFECTED.

Our success depends on the retention of principal members of our management and scientific staff and on our ability to continue to attract, motivate and retain additional key personnel. The market for retaining and obtaining such key personnel is intensely competitive and the loss of the services of key personnel or the failure to recruit necessary additional personnel could materially and adversely affect operations and our research and development efforts.

ALTHOUGH WE CONSIDER THE COMPANY TO HAVE GOOD DEFENCES TO SUCH ACTIONS, SHOULD CURRENT LAWSUITS AGAINST US SUCCEED, WE COULD INCUR A SUBSTANTIAL LOSS.

While we believe the Company has good defences to the Knoll, Innovations Foundation and University of Toronto proceedings (see "Legal/Arbitration Proceedings" under Item 8), these disputes may not be resolved in our favour. It is possible that a court or arbitration tribunal may find us to be in breach of certain agreements, or of infringing validly issued patents of third parties or practicing the intellectual property of others. In that event, in addition to the cost of defending the underlying proceedings, we may have to pay license fees, additional royalties and/or damages and may be ordered to assign certain Anipryl-related patents and be prohibited from conducting certain activities. Under such circumstances, we could incur substantial loss and our business could be negatively affected.

9

Item 4. Information on the Company

DRAXIS is an integrated specialty pharmaceutical company with core competencies in two segments: the development, production, marketing and distribution of radiopharmaceuticals through DRAXIMAGE and the provision of contract pharmaceutical manufacturing services, specializing in liquid and freeze-dried injectables and other sterile products through DPI. The Company believes that both DRAXIMAGE and DPI have significant long-term growth potential and has invested considerable financial and management resources in developing these businesses.

DRAXIS also has a Canadian pharmaceutical sales and marketing division which operates under the name DRAXIS Pharmaceutica. DRAXIS has made the strategic decision to divest DRAXIS Pharmaceutica in order to focus on its two core businesses.

In addition, DRAXIS has continuing financial interests associated with its collaboration agreements with Pfizer Inc. with respect to Anipryl and GlaxoSmithKline ("GSK") with respect to the SpectroPharm line of dermatology products.

The Company's consolidated operations are integrated across research, product development, manufacturing, sales and marketing, as well as the in-licensing and commercial development of pharmaceutical products.

DRAXIS is currently emerging from a transitional phase of its development. To date, the Company has been reliant on income earned from Anipryl. For the year ended December 31, 2002, the Company's collaboration agreement with respect to Anipryl was the Company's primary source of income. In the near term, however, the Company expects to lessen this reliance as it develops a diversified profit base from its other business units. In particular, the Company expects radiopharmaceuticals and contract manufacturing to become major sources of longer-term revenue and earnings.

The common shares of DRAXIS are listed on the Toronto Stock Exchange (ticker symbol DAX) and on NASDAQ (ticker symbol DRAX).

The Company's registered and head office is located at 6870 Goreway Drive, 2nd Floor, Mississauga, Ontario, Canada L4V 1P1. Telephone: (905) 677-5500. Fax: (905) 677-5494.

The Company's manufacturing, research and development facilities are located at 16751 Trans-Canada Road, Kirkland, Quebec, Canada H9H 4J4.

The Company's website is: www.draxis.com.

History and Development of the Company

The Company was incorporated under the name Deprenyl Research Limited on October 13, 1987 under the Canada Business Corporations Act. The Company was founded principally to engage in the marketing in Canada of prescription pharmaceuticals discovered, developed or acquired by Chinoin Pharmaceutical and Chemical Works Co., Ltd., the first of which was Eldepryl (selegiline; 1-deprenyl), for the treatment of Parkinson's disease. The Company changed its name to DRAXIS Health Inc. in May 1994.

The Company completed an initial public offering of its common shares in February 1988.

Beginning in 1990, the Company expanded on its knowledge and experience with selegiline by initiating directly on its own behalf, as well as through contract research arrangements, studies designed to investigate the potential of selegiline for companion animal use. This initiative ultimately resulted in the formation of its subsidiary DAHI, through which the Company developed and commercialized a companion animal health product, Anipryl.

In 1991 the Company began to invest in the applications of aminolevulinic acid photodynamic therapy which resulted in the formation of a subsidiary, DUSA Pharmaceuticals, Inc. ("DUSA"). Through a series of transactions from 1991 to 1996, the Company divested all of its interest in DUSA.

By late 1992, the Company faced considerable uncertainty due to the impending threat of generic competition for Eldepryl which, at that time, still accounted for almost 100% of the Company's revenues. Faced with this as well as other business challenges, in 1992 the Company began the process of recruiting new senior management to develop and implement a new strategic business plan for the Company to (i) address the generic threat to its lead drug by expanding and diversifying its established Canadian pharmaceuticals franchise; (ii) strengthen the

10

Company's financial position; and (iii) diversify from its historical Canadian base through the acquisition of niche pharmaceutical products and/or manufacturing-oriented businesses with international growth potential.

Between 1993 and 1999 the Company implemented the following corporate development initiatives:

Canadian Pharmaceuticals

- •

- December 1993—extension of the Company's Eldepryl franchise through an agreement with Novopharm Limited with respect to Novo-Selegiline, a generic version of Eldepryl. In September 1998, this agreement was renewed for a further five-year period to September 2003.

- •

- 1993 to 1999—acquisition and licensing of several prescription and non-prescription products for the Canadian market, predominantly products for neurological disorders.

Financial Position

- •

- March 1996—disposition of the Company's remaining interest in DUSA for net proceeds of $6.8 million.

- •

- April 1996—public offering of 3,000,000 common shares generating net proceeds of $8.5 million.

Diversification

- •

- November 1996—acquisition of the shares of DAHI that the Company did not previously own through a mandatory share exchange transaction valued at $17.4 million.

- •

- July 1997—$8.6 million acquisition of the Company's radiopharmaceutical business which began operations through DRAXIMAGE.

- •

- December 1997—licensing of Anipryl to Pfizer in return for milestone payments, royalties, a manufacturing supply agreement and a research collaboration. To December 31, 2002 $40.6 million has been received in milestone payments, royalties and royalty-related payments from Pfizer.

- •

- May 1998—$11.1 million acquisition of the Company's pharmaceutical manufacturing facility in Kirkland, Quebec, which operates as DRAXIS Pharma Inc.

Beginning in 1998 the Company embarked on a capital expansion plan directed primarily toward construction of the Company's new lyophilization line, the construction of radiopharmaceutical manufacturing facilities and the subsequent expansion of the radiopharmaceutical operation.

In late 1999 and early 2000, the Company undertook a strategic review of its operations from the perspective of enhancing shareholder value. As a result of this review, the Company resolved to focus its financial and management resources on its radiopharmaceutical and contract manufacturing businesses.

During 2000, the Company divested its dermatology product lines for aggregate proceeds of $9.0 million. The largest transaction in this regard was the sale of the SpectroPharm line of products to Block Drug Inc. (now part of GlaxoSmithKline Consumer Healthcare).

In February 2000, the Company established a strategic alliance with SGF with the sale of a 34.1% equity interest in DPI to SGF and members of DPI's management team.

During 2001 the Company received U.S. and Canadian regulatory approvals for the expanded radiopharmaceutical manufacturing facility and FDA acceptance to manufacture sterile lyophilized and sterile injectable products.

In March 2001 the Company in-licensed INFECTON, a technetium 99m-based radiopharmaceutical for imaging infection.

Also during 2001, DRAXIMAGE launched BrachySeed I-125 in the U.S. and Canada, and received regulatory approvals in the U.S. and Canada for BrachySeed Pd-103.

In 2001, the Company further implemented its strategic plan by (i) initiating the production of Bracco Diagnostic Inc.'s sodium iodide I-131 radiotherapy capsules; (ii) signing a long-term supply agreement to manufacture several GlaxoSmithKline predominantly sterile products for multiple international markets; and (iii) amending the Anipryl licensing agreement with Pfizer resulting in a $3.1 million cash payment to the Company plus return of product rights outside of North America.

11

During 2002 the Company achieved a number of significant accomplishments, including:

- •

- Record financial results from continuing operations:

- •

- Consolidated revenues of $38.6 million, an increase of 14.0% over 2001.

- •

- Consolidated net income from continuing operations before non-recurring items of $0.077 per share, an increase of 24.2% over 2001.

- •

- Consolidated earnings before interest, taxes, depreciation, amortization, research and development and non-recurring items ("EBITDARD") of $8.1 million, an increase of 46.7% over 2001.

- •

- Regulatory approvals of manufacturing facilities:

- •

- U.S. and Canadian regulatory approval to transfer production of DRAXIMAGE's line of lyophilized medical imaging products to the Company's own production facility.

- •

- U.S. regulatory approval to commence production at DPI of an established injectable product for GlaxoSmithKline for the U.S. market.

- •

- U.S. regulatory approval to manufacture solid dosage form products at DPI.

- •

- Subsequent to year end, U.K. regulatory approval to manufacture multiple sterile and non-sterile products at DPI.

- •

- Continued growth together with the realignment of the Company's U.S. sales and marketing strategy for BrachySeed, the Company's proprietary second generation radioactive brachytherapy implant:

- •

- Increased U.S. and Canadian market acceptance of the iodine version of BrachySeed which was launched in 2001.

- •

- U.S. launch of the palladium version of BrachySeed and the subsequent suspension of shipments pending the development of a revised marketing strategy for this product.

- •

- Early in 2003, commencement of direct sales of BrachySeed in the U.S.

- •

- Underwritten public sale by two corporate shareholders of 4.2 million common shares, representing approximately 11.4% of issued and outstanding shares.

- •

- In January 2003, commencement of a Phase I trial for INFECTON, a technetium-99m-based radiopharmaceutical for imaging infection.

- •

- In January 2003, U.S. regulatory approval of a new radiotherapeutic kit product for the treatment of thyroid cancer and hyperthyroidism.

Business Strategy

The Company believes that both DRAXIMAGE and DPI have significant long-term growth potential and has invested considerable financial and management resources in developing these businesses including:

- •

- $6.5 million of investments establishing the first of two sterile lyophilization (freeze-drying) units at DPI to provide in-house manufacturing of the Company's radiopharmaceutical imaging kits as well as third-party contract manufacturing services (a second unit announced in April 2002 will result in the tripling of lyophilization capacity);

- •

- $4.7 million of investments in the construction and later expansion of DRAXIMAGE's radiopharmaceutical production facilities and capabilities, including its robotic manufacturing lines;

- •

- $0.8 million of investments to enhance DPI's and DRAXIMAGE's capabilities and regulatory compliance;

- •

- $12.0 million planned investment in a three-year capital plan at DPI announced in April 2002, including expansion of the Company's existing lyophilization capacity; and

- •

- the continued development of the DRAXIMAGE product pipeline including: BrachySeed, Fibrimage, Amiscan, and INFECTON.

12

These initiatives are consistent with the Company's general business strategy to:

- •

- Focus on specialty pharmaceutical markets in which the Company can develop and sustain competitive advantage—

- •

- DRAXIS has refocused its operations on its two core businesses, radiopharmaceuticals and specialty pharmaceutical contract manufacturing. Both businesses target highly differentiated, specialized markets which feature high barriers to entry including regulatory requirements and specialized manufacturing standards.

- •

- Develop new pharmaceutical products and services consistent with the Company's strengths and capabilities

- •

- DRAXIS has established a growing franchise in the highly differentiated radiopharmaceutical segment with a portfolio of over 40 currently marketed products plus five new products in development. In addition to its radiopharmaceutical platform, the Company's expanding lyophilization capability positions it to offer new services to take advantage of growth opportunities in contract manufacturing.

- •

- Pursue growth opportunities with international market potential

- •

- The Company is leveraging its capabilities, experience and regulatory compliance in radiopharmaceuticals and manufacturing to expand its product and service offerings in the United States and other international markets.

- •

- Leverage alliances with business partners

- •

- The Company is pursuing multiple opportunities with new and existing business partners. Meeting the strict quality and service standards of such partners positions the Company to expand on these relationships in both its radiopharmaceuticals and pharmaceutical contract manufacturing businesses.

The Company's primary operational focus in 2003 will continue to be on: (i) improving near-term financial and operational performance of its radiopharmaceutical and manufacturing businesses through increasing sales of existing products and services, improving manufacturing efficiency and effectiveness, and obtaining regulatory approvals; and (ii) securing and advancing its base for long-term growth through the development of its existing product pipeline as well as identifying and capitalizing on additional new business opportunities that are consistent with the Company's capabilities and that contribute to the long-term value of the Company.

A description of the principal markets in which the Company operates and a breakdown of total revenues by category of activity and geographic market for the three most recent financial years is included in Note 23 of the Company's Consolidated Financial Statements and Notes beginning on page F-1.

The Company's two main operating businesses, radiopharmaceuticals and pharmaceutical contract manufacturing, are not characterized by significant seasonality. Plant operations, however, are generally reduced or shut down once a year for approximately two to four weeks in order to conduct regular required maintenance of facilities.

DRAXIMAGE's principal raw materials are radioactive isotopes that are used to label other compounds that act as carriers or molecular targeting agents. The isotopes are obtained from companies and agencies that are licensed by governmental regulators to produce purified radioactive chemicals. Radioactive materials, by their nature, decay over time—some rapidly and some more slowly depending on specific isotopes. Therefore, DRAXIMAGE receives shipments of chemical grade radioisotopes several times each week and converts these to finished products within days or weeks. While prices of selected isotopes can be somewhat volatile over the medium term, DRAXIMAGE endeavours to negotiate long-term supply contracts with appropriate suppliers, especially for the more important isotopes such as radioactive iodine.

DPI, as a manufacturer of pharmaceutical products, obtains its chemical raw materials from approved chemical suppliers of both active pharmaceutical ingredients ("API") and inactive or excipient ingredients such as fillers, stabilizers, preservative agents and colouring agents. In some instances the API is supplied by the customer. DPI conducts full quality control testing of all ingredients and packaging materials before they are incorporated into the finished product. Prices of principal API are not generally volatile although prices can vary between alternative suppliers.

13

Radiopharmaceuticals

DRAXIMAGE discovers, develops, manufactures, and markets diagnostic imaging and therapeutic radiopharmaceutical products for the global nuclear medicine marketplace. Nuclear medicine entails the use of radioactive agents (radiopharmaceuticals) for imaging and therapeutic purposes. The energy released as these products decay can be harnessed to: (i) elicit a visual representation of various organs and tissues (nuclear imaging), or (ii) destroy cancerous cells (radiotherapy). Products currently marketed by DRAXIMAGE include a line of lyophilized technetium-99m kits used in nuclear imaging procedures, a line of imaging and therapeutic products labelled with a variety of isotopes including radioiodine, and BrachySeed, second generation iodine-125 and palladium-103 brachytherapy implants. DRAXIMAGE also has a number of products in development including three technetium-99m-based diagnostic imaging products: Fibrimage for imaging deep vein thrombosis currently in Phase III clinical trials, Amiscan for the early diagnosis of acute myocardial infarct currently in Phase II clinical trials, and INFECTON for imaging infection currently in Phase I.

Founded in 1950 as a division of Charles E. Frosst & Co., the predecessor business to DRAXIMAGE pioneered and became a leader in the medical application of nuclear technology after assuming the development function from Atomic Energy of Canada Ltd. Following the 1965 acquisition of Charles E. Frosst & Co. by Merck Inc. ("Merck"), the business continued operations as a division of Merck's Canadian subsidiary, Merck Frosst Canada and Co. ("Merck Frosst"), until its acquisition by DRAXIS in 1997. As part of the acquisition, the Company retained all of the business's managers, scientists and employees as well as its existing products and intellectual property.

The acquisition of this business was consistent with the Company's strategy of acquiring speciality pharmaceutical platforms with potential for expansion into global markets. DRAXIMAGE is the only company that manufactures radiopharmaceuticals in Canada.

DRAXIMAGE and its predecessor have a long history of technological and scientific progress in the field of radiopharmaceuticals. Notable achievements include: the development of lyophilized kits for the in-situ preparation of technetium-99m ("Tc-99m") radiopharmaceutical products for nuclear medical imaging ("Tc-99m Kits"); the development of chelates for the indium/yttrium and technetium/rhenium groups of metals; and development of stabilisers for use in iodinated radiopharmaceuticals which resulted in DRAXIMAGE being one of the few companies to market iodinated products that do not require refrigeration.

Key business development transactions involving DRAXIMAGE have included:

- •

- July 1997—$8.6 million acquisition of the radiopharmaceutical division of Merck Frosst which began operations through DRAXIMAGE;

- •

- June 1998—establishment of a strategic alliance with Molecular Targeting Technology, Inc. ("MTTI") to develop, manufacture and market potential novel imaging agents. The first opportunity being pursued under this alliance is Amiscan, an agent for the imaging of acute myocardial infarct;

- •

- October 1999—licensing from Isogenic Science Ltd. ("Isogen") of the rights to Isogen's proprietary technology related to radioactive brachytherapy implants ("BrachySeed") for the treatment of various localized cancers;

- •

- December 2000—entering into license, distribution and supply agreements for BrachySeed for the U.S. market with Cytogen Corporation;

- •

- March 2001—licensing from British Technology Group ("BTG") of the rights to INFECTON, an agent for imaging infection;

- •

- October 2001—long-term manufacturing supply agreement to produce Bracco Diagnostics Inc.'s sodium iodide I-131 radiotherapy capsules for the U.S. market;

- •

- March 2003—five-year non-exclusive product distribution agreement with Cardinal Health, Inc. for a new radioactive iodine I-131 kit product for the U.S.; and

- •

- April 2003—termination of license, distribution and supply agreements with Cytogen Corporation for BrachySeed for the U.S. market.

14

DRAXIMAGE's growth strategy is to leverage its history and experience in the research, development, manufacture and distribution of radiopharmaceutical products and services and to capitalize on its recently expanded manufacturing capabilities. In particular, DRAXIMAGE's business strategy includes:

- •

- Increasing sales of radioactive products, particularly in the U.S., facilitated by the recent expansion of its radiopharmaceutical manufacturing facility and the acceptance of that facility by U.S. regulatory agencies;

- •

- Increasing international sales of its existing Tc-99m Kits facilitated by the increase in manufacturing capacity following regulatory approval of DPI's lyophilization manufacturing line;

- •

- Timely, cost-effective development of its portfolio of innovative imaging and therapeutic radiopharmaceutical products; and

- •

- Identifying and capitalizing on additional new business opportunities which are consistent with DRAXIMAGE's capabilities.

Overview of Radiopharmaceuticals

The medical specialty of nuclear medicine involves the use of short-lived radioisotopes for both diagnostic imaging and therapeutic applications. Pharmaceutical products used in such applications are commonly called radiopharmaceuticals. Radiopharmaceuticals represent a well-defined, growing niche market with high barriers to entry, including regulatory approval, specialized manufacturing standards, access to supply and critical delivery logistics.

Frost and Sullivan, a pharmaceutical industry consulting firm, estimates that the U.S. radiopharmaceuticals market will continue to demonstrate double-digit growth rates. The total U.S. market reached more than $900 million in 2001 with over 80% of revenues from the diagnostics sector, strongly led by cardiology diagnostics. Total diagnostic procedures performed in the U.S. reached nearly 14 million in 2001, with an estimated 90% of dosages being distributed through radiopharmacies. Frost and Sullivan forecasts that the U.S. diagnostic radiopharmaceuticals market could reach more than $1 billion by 2004 and that the total U.S. radiopharmaceuticals market could grow to exceed $1.6 billion by the end of 2006.

The diagnostic imaging applications of nuclear medicine normally involve the intravenous administration of a radiopharmaceutical consisting of a targeting molecule, which has a particular binding affinity for a specific organ or tissue, linked to a low intensity, gamma-emitting radioisotope such as Tc-99m. Following administration, the radiopharmaceutical with its radioactive isotope concentrates at the biological target which is then imaged using a scanning device such as a gamma camera. A gamma camera consists of a scintillation crystal which, when placed over a region of the body, is capable of detecting gamma rays emitted by radionuclides in underlying tissues. This imaging modality is also referred to as gamma scintigraphy. The gamma camera and its associated computerised peripheral devices accurately measure the radiation being emitted by the radioisotope and so provide both a visual picture of the target as well as quantitative data concerning the distribution of radioactivity.

A nuclear medicine image provides both static and functional, or dynamic, information about a biological target thereby revealing functional and morphological information normally unobtainable by other imaging techniques such as X-ray, magnetic resonance imaging, computer tomography, and ultrasound, all of which provide primarily anatomical information.

Nuclear medical imaging procedures are well-established and trusted medical procedures with many years of safe and effective use. Most procedures are non-invasive, are performed with a minimum of discomfort and inconvenience to the patient and are normally less costly and involve less risk than alternative techniques.

In the U.S., it is estimated by the Nuclear Medicine Industry Association that one in three hospital stays involves at least one nuclear medicine procedure, aggregating in excess of 40,000 such procedures per day, 80—90% of which involve the use of Tc-99m as the radioactive isotope.

15

Increasingly, therapeutic radiopharmaceuticals are being used and new products are being developed for the treatment of disease, particularly for the treatment of various cancers. Examples of currently marketed therapeutic radiopharmaceuticals, include:

- •

- Various sodium iodide I-131 products for the treatment of thyroid cancer and hyperthyroidism;

- •

- Brachytherapy implants for the treatment of prostate and other forms of localized cancer;

- •

- Phosphorous-32 for the palliation of bone pain for patients with advanced bone metastases; and

- •

- I-131 meta-Iodobenzylguanidine (MIBG) for the treatment of neuroblastoma.

New generations of anti-cancer agents based on targeting molecules such as peptides, proteins, metabolites and monoclonal antibodies that have binding affinities to the surface of cancerous cells are being developed to be linked to more potent, higher intensity, beta-emitting radioisotopes such as yttrium-90, rhenium-186, holmiun-166 and lutetium-199. There is a growing body of scientific evidence that molecules, thus bound, will permit the delivery of therapeutic quantities of radiation directly to malignant cells.

Proprietary technology and know-how within DRAXIMAGE are particularly applicable to the discovery and development of the new generations of innovative radiotherapeutic products. The Company is currently in preclinical development of Somatostatin Therapy which is being developed for the treatment of neuroendocrine tumours, lymphoma, carcinoid and small cell lung cancer.

Competition

The radiopharmaceutical field is highly specialized, and there are significant barriers to entry, especially in the therapeutic area. The barriers include meeting pharmaceutical product and nuclear regulatory requirements, having the ability to handle radioactive materials and establishing facilities and procedures to manufacture in a sterile lyophilized or freeze-dried form, which involves manufacturing standards higher than those typically employed for most pharmaceutical products. In addition, manufacturing and distribution logistics systems must be well-integrated and supportive to ensure that radiopharmaceutical products can be produced rapidly and delivered to the end-user in a timely manner with the prescribed level of strength.

Companies with significant radiopharmaceutical operations include: Bristol-Myers Squibb Company, Amersham plc, Tyco International Ltd., Schering AG, and Bracco SpA. In addition, there are a number of companies that are developing and/or marketing other radiopharmaceutical products including: MDS Nordion Inc., Immunomedics, Inc., IDEC Pharmaceuticals Corporation and NeoRx Corporation.

BrachySeed implants are sold into a competitive marketplace that includes the established market leader, Amersham plc. Other competitors in the U.S. market include Theragenics Corporation, North American Scientific, Inc., UroCor, Inc., Mentor Corporation, Implant Sciences Corporation and Cardinal Health, Inc.

Marketed Products

DRAXIMAGE's products are divided into two groups: (i) radioactive products, which are in a radioactive and ready-to-use form when shipped to customers, and (ii) non-radioactive products (predominantly Tc-99m Kits), which are sold in lyophilized (freeze-dried), non-radioactive form consisting of sterile, pyrogen-free complexes of chemical and/or biological substances. Tc-99m Kits are reconstituted and labelled with Tc-99m in the nuclear medicine laboratory of a hospital or a unit-dose service supplier prior to use.

Radioactive products, which are shipped by DRAXIMAGE with the radioactive isotope already incorporated, are distributed to the nuclear medicine departments of hospitals or diagnostic clinics in a ready-to-use form.

16

The following table summarises DRAXIMAGE's radioactive products:

Product

| | Indication

| | Principle

Markets

|

|---|

| Imaging Products | | | | |

| |

51 Cr-Chromic Chloride Injection |

|

Diagnosis of gastroenteropathy |

|

Canada |

| | 51 Cr-Sodium Chromate Injection, USP | | Measurement of blood volume | | Canada |

| | 57 Co-Cyanocobalamin Capsule USP | | Diagnosis of Vitamin-B12 malabsorption | | Canada |

| | 57 Co-Cyanocobalamin Solution USP | | Diagnosis of Vitamin-B12 malabsorption | | Canada |

| | 57 Co-Standard Cobalt Reference Solution | | Reference for57Co-Cyanocobalamin | | Canada |

| | 111 In-Diethylene Triamine Pentacetic Acid Injection (DTPA) | | Cisternography | | Canada |

| | 111 In-Indium Chloride Sterile Solution | | Labelling of peptides and antibodies | | Canada |

| | 131 I-Sodium Iodide Diagnostic Capsules and Solutions, Oral and Intravenous | | Imaging of thyroid disorders | | Canada |

| | 131 I-metaIodobenzylguanidine | | Adrenal imaging | | Canada |

| | 131 I-Iodinated Serum Albumin Injection, USP | | Measurement of blood and plasma volume | | Canada |

| | 131 I-Iodohippuric Sodium Injection, USP | | Measurement of renal plasma flow | | Canada |

| | 125 I-Iodinated Albumin Injection, USP | | Measurement of blood and plasma volume | | Canada |

| | 133 Xe-Xenon Gas | | Lung ventilation studies | | Canada |

| Therapeutic Products | | | | |

| |

125 I BrachySeed |

|

Treatment of various localized cancers |

|

U.S./Canada/

South America |

| | 103 Pd BrachySeed | | Treatment of various localized cancers | | U.S./Canada |

| | 131 I-Sodium Iodide Therapeutic Capsules and Solutions, Oral and Intravenous | | Treatment of thyroid disorders | | Canada |

| | Kit for the Preparation of Sodium Iodide I-131 Capsules and Solution USP Therapeutic—Oral | | Treatment of thyroid disorders | | U.S. |

| | 131 I-meta-Iodobenzylguanidine (MIBG) | | Treatment of neuroblastoma | | Canada/Europe |

| | 32 P-Sodium Phosphate Solution, USP | | Treatment of bone pain | | Canada |

| Other | | | | Canada |

| |

131 I-Sodium Iodine Solution—Chemical |

|

Radiochemical synthesis |

|

Canada |

| | 125 I-Sodium Iodide Solution—Chemical | | Radiochemical synthesis | | Canada |

| | 131 I-Iodinated Human Serum Albumin | | Radiochemical | | U.S./Europe |

| | 125 I-Iodinated Human Serum Albumin | | Radiochemical | | U.S./Europe |

During the second half of 2001, DRAXIMAGE entered into a third-party manufacturing contract to supply sodium iodide I-131 radiotherapy capsules for Bracco Diagnostics Inc. for the U.S. market for the treatment of thyroid cancer and hyperparathyroidism.

In January 2003, DRAXIMAGE received FDA approval to produce and market a new radiopharmaceutical kit product for the preparation of Sodium Iodide I-131 Capsules and Oral Solution for the treatment of thyroid

17

cancer and hyperthyroidism. This was the first such product on the market that allows physicians and radiopharmacists to prepare an FDA-approved I-131 gelatine capsule or oral solution. In March 2003, DRAXIMAGE launched the new kit product and initiated shipments to the Nuclear Pharmacy Services group of Cardinal Health, Inc., under a five-year, non-exclusive distribution agreement for the product for the United States and its possessions.

BrachySeed is a uniquely designed, second-generation radioactive brachytherapy implant developed by DRAXIMAGE. The unique design of BrachySeed brings a high level of accuracy, precision and safety to sealed source implant surgery. Each BrachySeed is robotically manufactured at the DRAXIMAGE facility.

One of the key segments of the radiopharmaceuticals market is brachytherapy—the implantation of radioactive "seeds" for the treatment of localized cancers of the prostate and other organs. These seeds can contain either iodine-125 or palladium-103, depending on the status of the cancer and the required duration of treatment. The seeds deliver a concentrated, defined radiation dose that destroys cancer cells while minimizing damage to surrounding tissues. This targeted strategy is particularly important for organs such as the prostate, which is nestled between the bladder and the rectum. The procedure involves placement of approximately 100-150 of these seeds into a locally anaesthetised patient.

DRAXIMAGE's Iodine-125 implant was approved by the FDA in the second half of 2000 and launched into the Canadian and U.S. markets during the second quarter of 2001. The palladium-103 product was approved by the FDA in the fourth quarter of 2001 and launched during the second quarter of 2002, but shipments were subsequently suspended pending development of a revised marketing strategy. The palladium isotope releases its energy over a shorter time-span, and tends to be used in the treatment of more aggressive cancers. DRAXIS' brachytherapy seed utilizes a patented design that delivers a more uniform distribution of radiation than its competitors' products, which can result in the use of relatively fewer BrachySeed implants per procedure.

In early 2003 DRAXIMAGE implemented a strategy to market brachytherapy products directly to U.S. customers drawing on the expertise and resources of its established customer service system, following the ending of license, distribution and supply agreements with Cytogen Corporation. The move to the end-user marketing of brachytherapy implants is part of a trend that has become evident throughout the brachytherapy industry. This trend is in part as a result of a change in the reimbursement policy of the U.S. Center for Medicare and Medicaid Services (CMS) as of January 2003, whereby the fee for a prostate cancer treatment procedure now includes the cost of implants. DRAXIMAGE established a direct brachytherapy marketing and sales group, including product management, in-house sales/telemarketing, customer service support, secure website ordering and sales representatives in the U.S.

In a report in 2000, Frost & Sullivan forecasted that the brachytherapy market in the U.S. would grow from $160 million in 1999 (base year) to $360 million by 2006, a compound annual growth rate (1999-2006) of 12.0%. With the trend towards earlier diagnosis and treatment of prostate cancer, brachytherapy is expected to gain an increasingly larger market share for the treatment of localized prostate cancer, currently believed to be approximately 50-55%.

In addition, DRAXIMAGE is developing BrachySeed product enhancements to support expanded sales of BrachySeed. Examples of such value-added enhancements include: pre-sterilization of BrachySeed implants and delivery of BrachySeed in pre-loaded needles and cartridges.

DRAXIMAGE believes that BrachySeed offers important advantages over its competitors including:

- •

- a patented design resulting in a nearly spherical dispersion of the radiation field, delivering uniform doses of radiation to the affected area;

- •

- double encapsulation of the radioisotope for additional patient safety;

- •