UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant o |

Filed by a Party other than the Registrant o |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12 |

Rock of Ages Corporation |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

ROCK OF AGES CORPORATION

772 GRANITEVILLE ROAD

GRANITEVILLE, VERMONT 05654

May 26, 2006

To our Stockholders:

You are cordially invited to attend the 2006 Annual Meeting of Stockholders of Rock of Ages Corporation, to be held at our Conference Center, located across the street from the Rock of Ages main office at 772 Graniteville Road, Graniteville, Vermont 05654, on Thursday, June 22, 2006 at 10:30 a.m., local time.

We encourage you to carefully read the enclosed Notice of Annual Meeting and proxy statement, as well as the enclosed 2005 Annual Report.

After the business items of the annual meeting are completed, a few of our officers will make presentations and we will answer your questions about our growth strategy and our quarrying, manufacturing and retailing operations. We will also introduce our directors and executive officers. Our annual meeting serves as a good opportunity for you to learn more about Rock of Ages and talk informally with many of our people. We will provide informal tours of our quarry and manufacturing operations to shareholders who request them.

We hope to see you at the annual meeting. It is important that your shares be represented at the annual meeting regardless of whether you are able to attend personally. Therefore, please sign, date and promptly return the enclosed proxy card(s) in the prepaid mailing envelope, or vote by proxy by telephone or through the Internet using the procedures set forth in the accompanying proxy statement and proxy card. If you attend the annual meeting, you may vote in person if you wish, even if you previously submitted a proxy.

I look forward to seeing you on June 22nd.

| Sincerely, |

|

|

Kurt M. Swenson

Chairman, President and

Chief Executive Officer |

ROCK OF AGES CORPORATION

772 Graniteville Road

Graniteville, Vermont 05654

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON

JUNE 22, 2006

To the Stockholders of

Rock of Ages Corporation:

Notice is hereby given that the 2006 Annual Meeting of the Stockholders of Rock of Ages Corporation will be held at the Rock of Ages Conference Center, 773 Graniteville Road, Graniteville, Vermont05654, on Thursday, June 22, 2006 at 10:30 a.m., local time, for the following purposes:

1. | To elect two Class III directors, each for a three-year term expiring at the annual meeting of stockholders in 2009, and until their respective successors are duly elected and qualified; |

| |

2. | To ratify the appointment of Grant Thornton LLP as the Company's independent registered public accounting firm for the 2006 fiscal year; and |

| |

3. | To transact any other business that may properly come before the annual meeting or any adjournment(s) thereof. |

The close of business on April 28, 2006 has been fixed as the record date for determining the stockholders entitled to notice of, and to vote at, the annual meeting, whether in person or by proxy.

| By Order of the Board of Directors |

|

Michael B. Tule

Secretary |

| |

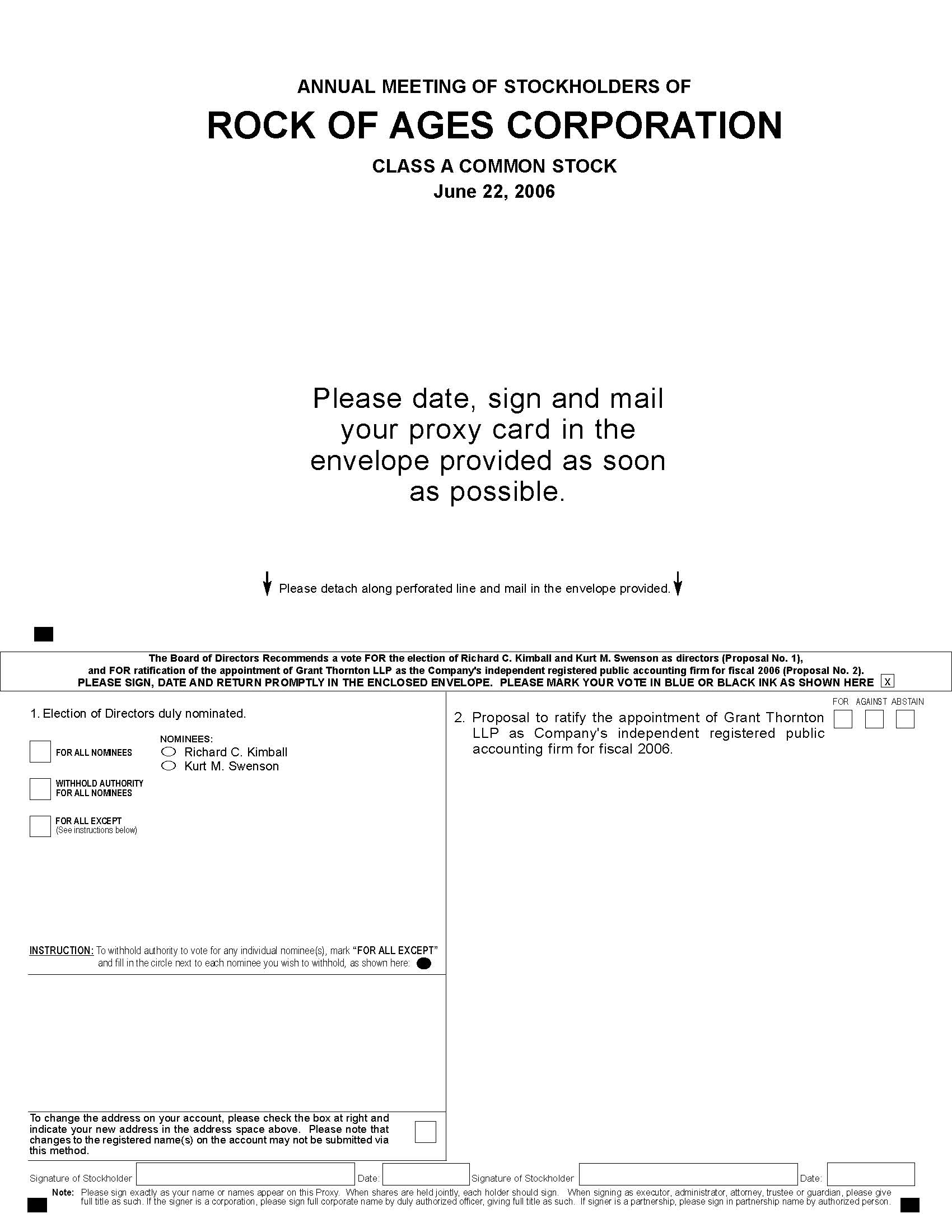

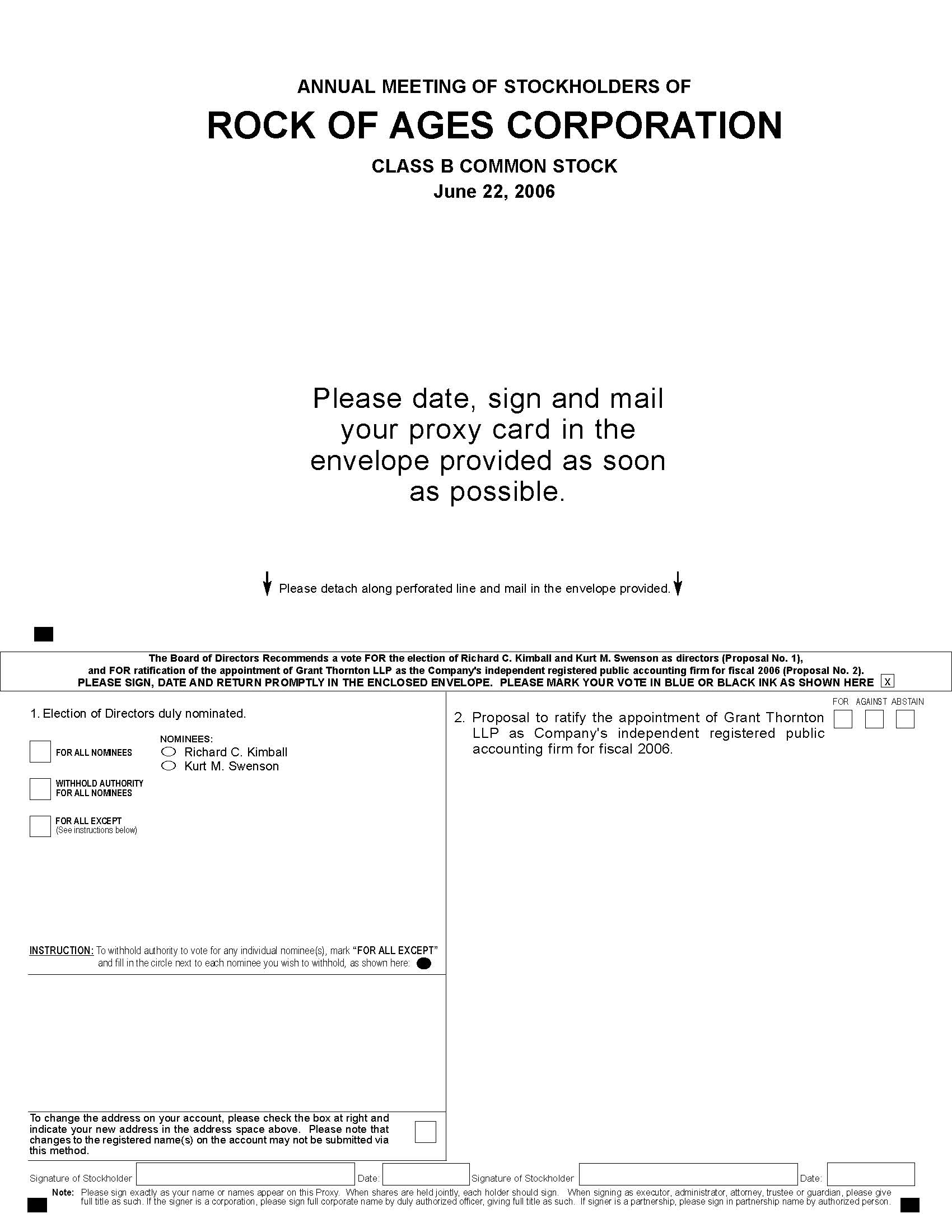

Your vote is important. Please sign, date and return the accompanying proxy card(s) in the enclosed envelope, or otherwise vote by proxy in accordance with the voting instructions set forth in the accompanying proxy statement and proxy card(s). Please note that separate proxy cards have been provided for Class A Common Stock and Class B Common Stock. If you are a holder of both classes of stock, please sign, date and return both proxy cards or otherwise vote by proxy in accordance with the voting instructions set forth in the accompanying proxy statement and proxy card(s), so that all of your shares are voted. If you attend the annual meeting, you may vote in person whether or not you have sent in your proxy card(s).

ROCK OF AGES CORPORATION

PROXY STATEMENT

General

We are furnishing this proxy statement in connection with the solicitation, by and on behalf of the board of directors of Rock of Ages Corporation, a Delaware corporation (the "Company"), of proxies to be voted at the Company's 2006 Annual Meeting of Stockholders, and at any adjournment(s) thereof. The annual meeting will be held at the Rock of Ages Conference Center, 773 Graniteville Road, Graniteville, Vermont, on Thursday, June 22, 2006 at 10:30 a.m., local time. The principal offices of the Company are located at 772 Graniteville Road, Graniteville, Vermont 05654.

This proxy statement, the accompanying proxy card(s) and the Company's 2005 Annual Report are first being mailed to stockholders on or about May 19, 2006.

Record Date, Voting Securities, Quorum and Vote Required

Only holders of record of the Class A Common Stock, par value $.01 per share, of the Company (the "Class A Common Stock"), and Class B Common Stock, par value $.01 per share, of the Company (the "Class B Common Stock," and together with the Class A Common Stock, the "Common Stock"), at the close of business on April 28, 2006, the record date for the annual meeting, are entitled to notice of and to vote at the annual meeting. On the record date, the Company had outstanding (i) 4,660,800 shares of Class A Common Stock, each of which is entitled to one vote, or a total of 4,660,800 votes, and (ii) 2,738,596 shares of Class B Common Stock, each of which is entitled to ten votes, or a total of 27,385,960 votes. Accordingly, at the close of business on the record date, 7,399,396 shares of Common Stock were outstanding, representing a total of 32,046,760 votes.

The presence at the annual meeting, in person or by proxy, of the holders of a majority of the total voting power of the issued and outstanding shares of Common Stock is necessary to constitute a quorum to transact business. Shares held as of the record date by holders who are present or represented by proxy at the annual meeting but who have abstained from voting or have not voted with respect to some or all of such shares on any proposal to be voted on at the annual meeting will be counted as present for the purposes of establishing a quorum. If a quorum is present at the meeting, the Class III directors will be elected by a plurality of the votes cast either in person or by proxy at the annual meeting (Proposal No. 1). Under our Amended and Restated By-Laws and ratification of the appointment of Grant Thornton LLP as the Company's independent registered public accounting firm for the 2006 fiscal year (Proposal No. 2), will require the affirmative vote of the holders of Common Stock representing a majority of the voting power of the shares of Common Stock present or represented by proxy at the meeting.

Shares represented by proxies which are marked "WITHHELD" with regard to one or both nominees for election as a director (Proposal No. 1) will be excluded entirely from the vote on such nominee(s) and thus will have no effect on the outcome of the vote. Shares represented by proxies which are marked "ABSTAIN" with regard to the ratification of the appointment of Grant Thornton LLP as the Company's independent registered public accounting firm for 2006 (Proposal No. 2) will have the effect of a negative vote.

A broker "non-vote" occurs with respect to shares as to a proposal when a broker who holds shares of record in his name is not permitted to vote on that proposal without instruction from the beneficial owner of the shares and no instruction is given. Brokers holding your shares in their name will be permitted to vote those shares with respect to the election of directors (Proposal No. 1) and the ratification of the appointment of Grant Thornton LLP as the Company's independent registered public accounting firm for fiscal year 2006 (Proposal No. 2) without instruction from you, and, accordingly, broker non-votes will not occur with respect to either of those two proposals.

1

Voting

Voting Your Proxy

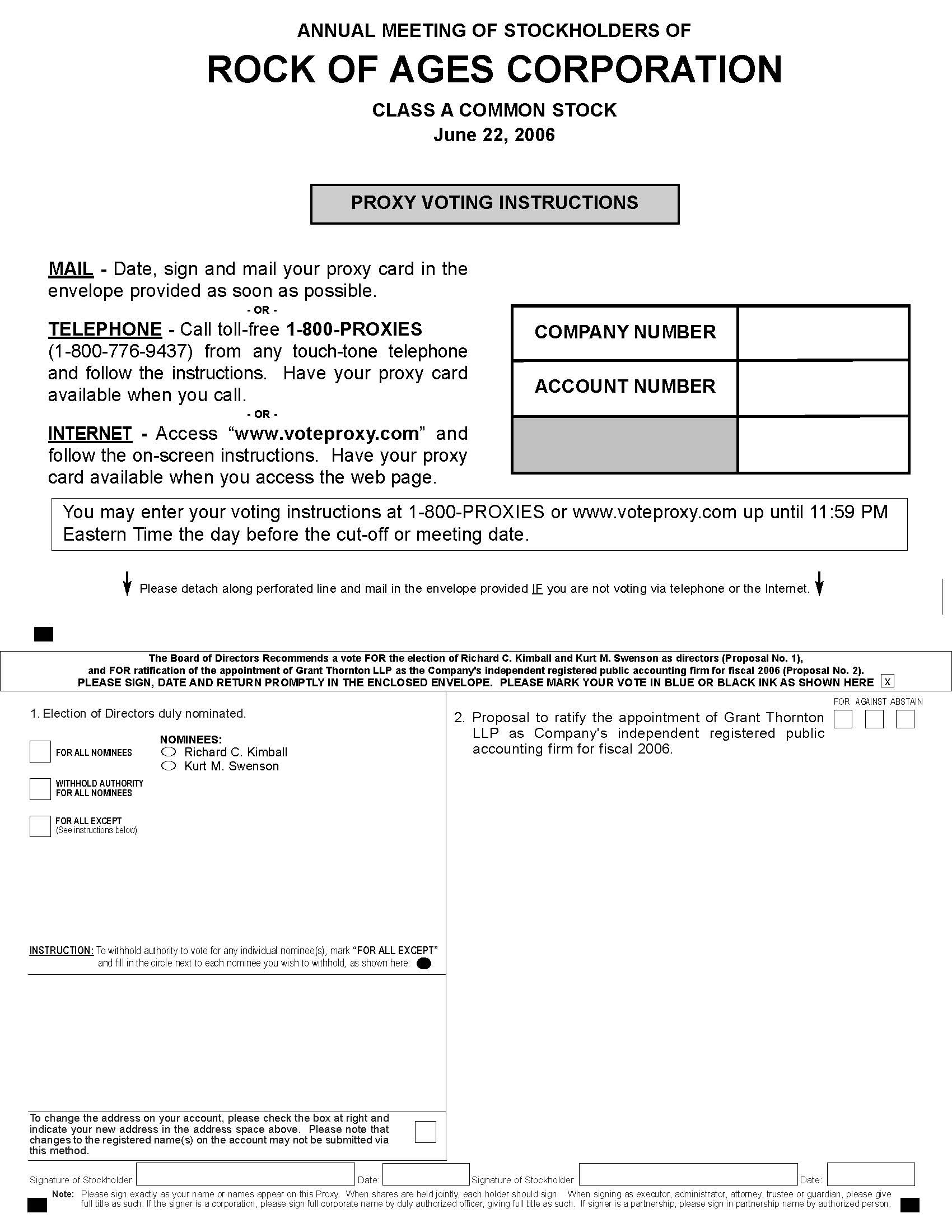

You may vote in person at the annual meeting or by proxy. We recommend you vote by proxy even if you plan to attend the meeting. You can always change your vote at the meeting.

If you sign and return your proxy cards(s) to us in time for it to be voted at the annual meeting, one of the individuals named as your proxy will vote your shares as you have directed on the proxy card(s). If you sign and timely return your proxy card(s) but no indication is given as to how to vote your shares as to one or both of the proposals to be voted on at the annual meeting, your shares will be voted FOR any proposal as to which you have given no indication as to how to vote.

The board of directors knows of no matters, other than Proposal Nos. 1 and 2 as set forth in the accompanying Notice of Annual Meeting of Stockholders, and we have not received notice of any such other matter as required by our Amended and Restated By-Laws in order to be presented at the annual meeting. If any other matter is properly presented at the annual meeting upon which a vote may properly be taken, shares represented by duly executed and timely returned proxy cards will be voted on any such matter in accordance with the judgment of the named proxies.

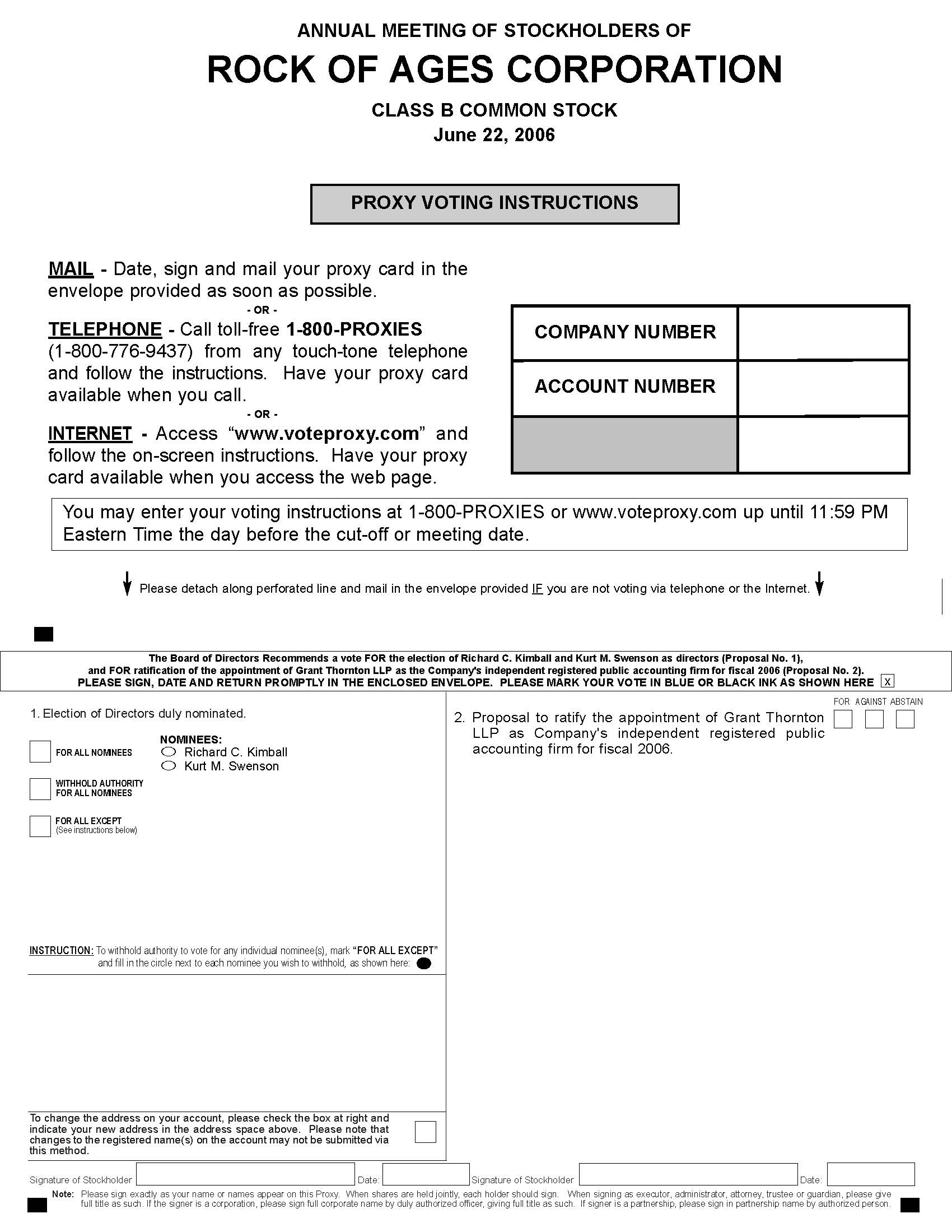

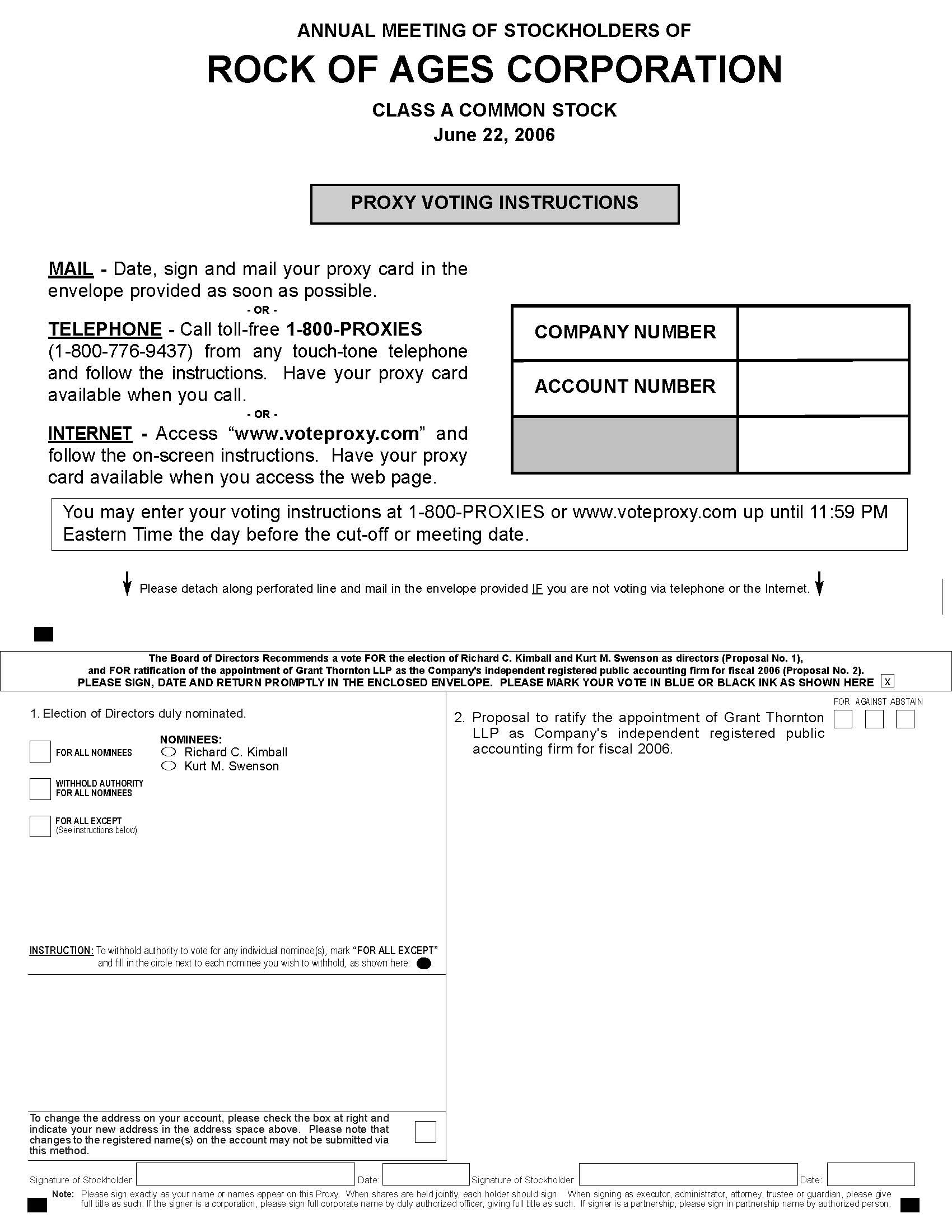

How to Vote by Proxy

You may vote by proxy by completing, signing, dating and returning your proxy card(s) in the enclosed envelope. If your shares are held in "street name" through a broker, you should provide written instructions to your broker on how to vote your shares. As noted above, if you do not provide your broker with instructions on how to vote your shares it is possible that, with respect to Proposal Nos. 1 and 3, your shares will not be voted on those proposals in the same manner that you would have voted if you had provided instructions. To ensure that your broker receives your instructions, you should promptly complete, sign and send to your broker in the envelope enclosed with this proxy statement the voting instruction form which is also enclosed.

You may also vote by proxy through the Internet at www.voteproxy.com (by following the on-screen instructions) or by telephone by calling toll-free 1-800-PROXIES from any touch-tone telephone and following the instructions. You should have your proxy card(s) available when you access the web page or call. You may also wish to check the voting form used by the firm that holds your shares to see if it offers telephone or Internet voting.

Changing Your Vote or Revoking Your Proxy

You may change your vote or revoke your proxy at any time before the proxy is exercised. If you submitted your proxy card(s) by mail, you must (i) file with the Secretary of the Company or other designee of the Company, at or before the taking of the vote at the annual meeting, a written notice of revocation bearing a later date than the proxy you previously submitted or (ii) duly execute a later dated proxy relating to the same shares and deliver it to the Secretary of the Company or other designee before the taking of the vote at the annual meeting. If you voted by proxy electronically through the Internet or by telephone as described above, you may simply vote again at a later date using the same procedures, in which case the later submitted proxy will be recorded and the earlier vote revoked. Attendance at the annual meeting will not have the effect of revoking a proxy unless you give written notice of revocation to the Secretary of the Company before the proxy is exercised or you vote by written ballot at the annual meeting. If you hold your shares through a broker, bank or other nominee in "street name," you will need to contact them or follow the instructions in the voting instruction form used by the firm that holds your shares to revoke your proxy.

2

Voting in Person

If you plan to attend the annual meeting and wish to vote in person, we will give you a ballot at the meeting. However, if your shares are held in the name of your broker, bank or other nominee, you must obtain from your nominee and bring to the annual meeting a "legal proxy" authorizing you to vote your "street name" shares held as of the record date.

Proxy Solicitation and Expenses

All expenses of this solicitation will be borne by the Company, including the cost of preparing and mailing this proxy statement and the reimbursement of brokerage firms, banks and other nominees for their reasonable expenses in forwarding proxy material to beneficial owners of the Company's stock. The Company has retained American Stock Transfer and Trust Company to assist in the solicitation of proxies. They will be paid an aggregate fee of $1,250 and will be reimbursed for their out-of-pocket expenses. In addition to solicitation by mail, certain directors, officers and regular employees of the Company, who will not receive additional compensation for solicitation, and representatives of American Stock Transfer & Trust Company, may solicit Proxies by telephone, overnight delivery service, facsimile or otherwise.

Delivery Of Proxy Materials and Annual Report To Households

The Securities and Exchange Commission has implemented a rule permitting companies and brokers, banks or other intermediaries to deliver a single copy of an annual report and proxy statement to households at which two or more beneficial owners reside. This method of delivery, which eliminates duplicate mailings, is known as "householding." Beneficial owners sharing an address who have been previously notified by their broker, bank or other intermediary and have consented to householding, either affirmatively or implicitly by not objecting to householding, will receive only a single copy of the Company's 2005 Annual Report and this proxy statement. If you hold your shares in your own name as a holder of record, householding will not apply to your shares.

Beneficial owners who reside at a shared address at which a single copy of the Company's 2005 Annual Report and this proxy statement is delivered may obtain a separate copy of the Company's 2005 Annual Report and/or this proxy statement without charge by sending a written request to Rock of Ages Corporation, 369 North State Street, Concord, New Hampshire 03301, Attention: Investor Relations, or by calling the Company at (800) 884-7936. The Company will promptly deliver a copy of its 2005 Annual Report and/or this proxy statement upon request.

Not all brokers, banks or other intermediaries offer beneficial owners the opportunity to participate in householding. If you want to participate in householding and eliminate duplicate mailings in the future, you must contact your broker, banker or other intermediary directly. Alternatively, if you want to revoke your consent to householding and receive separate annual reports and proxy statements for each beneficial owner sharing your address, you must contact your broker, bank or other intermediary to revoke your consent.

3

PROPOSAL NO. 1

ELECTION OF DIRECTORS

General

In accordance with our amended and restated certificate of incorporation, the members of the board of directors are divided into three classes, designated Class I, Class II and Class III, respectively, and are elected for a term of office expiring at the third succeeding annual stockholders' meeting following their election and until their successors are duly elected and qualified. Our amended and restated certificate of incorporation also provides that the number of directors shall be fixed from time to time by a majority of the board of directors and that each class of directors shall consist, as nearly as may be possible, of one-third of the total number of directors constituting the entire board. Currently, the total number of directorships has been fixed at seven members, allocated among the three classes as follows: three directors in Class I; two directors in Class II and two directors in Class III. There are currently serving two directors in Class I with one vacancy; two directors in Class II; and two directors in Class III. The term of office of the Class III directors expires at the annual meeting. The Class I and Class II directors are serving terms that expire at the annual meeting of stockholders in 2007 and 2008, respectively.

Richard C. Kimball and Kurt M. Swenson, the two Class III directors whose terms are expiring at the annual meeting, were recommended by our Corporate Governance and Nominating Committee, and nominated by the board of directors for election at the annual meeting for a three-year term of office expiring at the annual meeting of stockholders in 2009 and until their successors are duly elected and qualified. Mr. Kimball and Mr. Swenson abstained from each of these votes.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE "FOR" THE ELECTION OF EACH OF THE NOMINEES FOR CLASS III DIRECTORS. UNLESS OTHERWISE DIRECTED IN THE ACCOMPANYING PROXY, THE PERSONS NAMED THEREIN WILL VOTE "FOR" THE ELECTION OF EACH OF THE NOMINEES AS CLASS III DIRECTORS.

Stockholders may not cumulate their votes in the election of directors. Stockholders entitled to vote for the election of directors may withhold authority to vote for either or both of the nominees for directors. If either nominee becomes unavailable for any reason, then the shares represented by a duly executed and timely returned proxy will be voted FOR the other listed nominee and for such other nominee as may be designated by the board of directors as replacement for the nominee who became unavailable. Discretionary authority to do so is included in the proxies. Each person nominated for election has agreed to serve if elected, and the board of directors has no reason to believe that either nominee will be unavailable to serve.

4

The following table sets forth the names, ages and, if applicable, position with the Company, of the persons who have been nominated for election as Class III directors at the annual meeting and the other current directors of the Company. Both of the nominees for election as Class III directors are incumbent directors.

NAME | | AGE | | TITLE |

| | | | |

Nominees for Class III Directors

(For Term Expiring at 2009 Annual Meeting) | | | | |

| | | | |

Richard C. Kimball | | 65 | | Vice Chairman and Director |

| | | | |

Kurt M. Swenson | | 61 | | Chairman of the Board, President and Chief Executive Officer |

| | | | |

Continuing Class I Directors

(Term Expires at 2007 Annual

Meeting) | | | | |

| | | | |

James L. Fox (2) | | 54 | | Director |

| | | | |

Charles M. Waite (2) | | 73 | | Director |

| | | | |

Continuing Class II Directors

(Term Expires at 2008 Annual Meeting) | | | | |

| | | | |

Pamela G. Sheiffer (1) | | 59 | | Director |

| | | | |

Frederick E. Webster Jr. (2) | | 68 | | Director |

| | | | |

(1) | Member of the Corporate Governance and Nominating Committee and the Compensation Committee. |

| |

(2) | Member of the Audit Committee, the Corporate Governance and Nominating Committee, and the Compensation Committee. |

| |

Certain additional information concerning the directors and nominees for director is set forth below. Other than Swenson Granite Company LLC ("Swenson LLC"), which could be considered an affiliate of the Company, none of the corporations or organizations referred to below with which a director or nominee for director has been employed or otherwise associated is a parent, subsidiary or other affiliate of the Company.

5

Directors

James L. Fox has been a director of the Company since October 1997. He has been Executive Vice President and Chief Operating Officer of FundQuest, Inc., a global provider of turnkey, open architecture wealth management programs and services for financial institutions and advisors, since November 2005. From September 2003 to November 2005, he was Executive Vice President and Chief Financial Officer of The BISYS Group, Inc. He was President of the Fund Services Division of The BISYS Group, Inc. from April 2003 to September 2003. From August 2001 to April 2003, he was President and Chief Executive Officer of govOne Solutions, L.P., an electronic government payment service. From June 2000 to August 2001, he was Vice President-Corporate Development and Chief Financial Officer of Gomez, Inc., a research and consulting firm specializing in Internet quality measurement. Prior to joining Gomez, Mr. Fox had been Vice Chairman of PFPC Inc., a division of the PNC Financial Services Group, Inc. from December 1999 to June 2000. Before joining PFPC, Inc., Mr. Fox had an eleven year career with the Investor Services Group of First Data Corporation, a provider of processing and mutual fund and retirement services for mutual fund complexes, banks, insurance companies and advisory firms, including serving as President and Chief Executive Officer (1999) and Chief Operating Officer (1997-1999). Mr. Fox's current term as a director of the Company will expire at the Company's 2007 Annual Meeting.

Richard C. Kimball has been a director of the Company since 1986, and Vice Chairman since 1993. From 1993 to January 2001, he was Vice Chairman and Chief Operating Officer/Memorials Division of the Company and from January 2001 to December 2004, he was Chief Strategic and Marketing Officer. Prior to joining the Company, Mr. Kimball served as a director, principal and President of The Bigelow Company, Inc., a strategic planning and investment banking firm from 1972 until 1993. Mr. Kimball retired as an employee of the Company on December 31, 2004 and currently serves as a consultant to the Company. His current term as a director will expire at the Company's 2006 Annual Meeting.

Pamela G. Sheiffer has been a director of the Company since June 2004. Since 1997, she has been President of P. Joyce Associates, Inc., a consulting firm specializing in retail, manufacturing, licensing and providing services to investment firms. From 1995 to 1997, she was CEO of The Design and Source Company, a manufacturer and marketer of ladies apparel. From 1988 to 1995, she was Vice President of Merchandising and Marketing for the Retail Apparel Group, Inc. d/b/a Dots, a retailer of women's clothing with over 250 stores nationwide. Prior to that, Ms. Sheiffer held various senior management positions in retail and manufacturing, including Senior Vice President of May Department Stores. She is currently Vice Chairman and Chair of the Development Committee of Learning Lenders, New York City's largest educational nonprofit with over 14,000 volunteers in New York City schools. She has been a member of the board of directors of Dan River Mills, Inc., a manufacturer and marketer of textile products for home fashions and apparel fabrics, since February 2005. Ms. Sheiffer's current term as a director will expire at the Company's 2008 Annual Meeting.

Kurt M. Swenson has been President, Chief Executive Officer and Chairman of the Board of Directors of the Company since 1984. Prior to the Company's initial public offering in 1997, Mr. Swenson had been the Chief Executive Officer and a director of Swenson Granite Company, Inc. since 1974. Mr. Swenson currently serves as non-officer Chairman of the Board of Swenson Granite Company, LLC, a Delaware limited liability company engaged in the granite curb and landscaping business. Swenson Granite Company, LLC may be deemed an affiliate of the Company. He is also a director of the American Monument Association, the National Building Granite Quarries Association and Group Polycor International and Polycor, Inc. Mr. Swenson's current term as a director will expire at the Company's 2006 Annual Meeting.

Charles M. Waite has been a director of the Company since 1985. Since 1989, Mr. Waite has been managing partner of Chowning Partners, a financial consulting firm that provides consulting services to New England companies. Mr. Waite's current term as a director will expire at the Company's 2007 Annual Meeting.

Frederick E. Webster Jr., Ph.D. has been a director of the Company since October 1997. He was a Professor of Management at the Amos Tuck School of Business Administration of Dartmouth College from 1965 until 2002, and is now the Charles Henry Jones Professor of Management Emeritus. He is also a management consultant and lecturer, and is the Jon Underwood Distinguished Research Fellow in Marketing at the Eller College of Management, University of Arizona. Mr. Webster's current term as a director will expire at the Company's 2008 Annual Meeting.

6

Director Independence

The board of directors has determined that each of the following directors is an "independent director" within the meaning of Rule 4200(a)(15) of the Marketplace Rules of the NASDAQ Stock Market, Inc. ("NASDAQ"): James L. Fox; Pamela G. Sheiffer; Charles M. Waite and Frederick E. Webster Jr.

EXECUTIVE OFFICERS WHO ARE NOT DIRECTORS

Set forth below is certain information concerning non-director employees who are executive officers of the Company. Each executive officer serves for a term of one year (and until his or her successor is chosen and qualified) at the discretion of the board. There are no family relationships between any of the Company's directors and executive officers. Except for Rock of Ages Canada, Inc., none of the corporations or organizations referred to below with which an executive officer has been employed or otherwise associated is a parent, subsidiary or other affiliate of the Company.

Nancy Rowden Brock, age 50, has been Senior Vice President/Chief Financial Officer and Treasurer since October 27, 2005. From May 2005 to October 27, 2005 she was Senior Vice President/Finance. From February 2005 to May 2005, she was Director of Finance and Administration of the Vermont Agency of Transportation. She has been an independent business consultant since 2002. From 1998 to 2002, Ms. Brock served as Chief Financial Officer of Green Mountain Power Corporation (NYSE;GMP), an integrated electric utility serving 87,000 customers throughout Vermont. She served as Chief Financial Officer of Suss Advanced Lithography, a start up company conducting research and development on emerging technologies for semiconductor manufacturing during 1997. From 1987 to 1996, she served as Chief Financial Officer at Chittenden Corporation (NYSE; CHZ), a multi-bank holding company based in Burlington, Vermont.

Douglas S. Goldsmith, age 36, has been President and Chief Operating Officer of the Quarry Division since January 1, 2006. From October 27, 2005 to December 31, 2005, he was Senior Vice President and General Manager/Quarry Division. From September 2001 to October 27, 2005, Mr. Goldsmith was Chief Financial Officer and Senior Vice President of Finance and Administration and Treasurer. Mr. Goldsmith served as the Chief Information Officer of the Company from 1997 to September 2001. From 1991 to 1997, he held various positions in the engineering department, and was responsible for the integration of the Company's information systems for the manufacturing operations in the U.S. and Canada.

Donald Labonte, age 44, has been President and Chief Operating Officer/Manufacturing Division since August 2002 and has been President of Rock of Ages Canada, Inc., a wholly owned subsidiary of the Company, since 1999. From January 2002 to July 2002, he was Vice President/Manufacturing. From 1998 to 1999, he was Vice President/General Manager of Rock of Ages Canada, Inc. From 1993 to 1998, Mr. Labonte was Director of Operations of Rock of Ages Canada, Inc. From 1980 to 1993, Mr. Labonte held various positions in the manufacturing plant at Rock of Ages Canada, Inc.

Michael B. Tule, age 44, has been Senior Vice President, General Counsel and Secretary of the Company since April 2000. From March 1996 to April 2000, he was Vice President, General Counsel and Secretary of WPI Group, Inc., a provider of diagnostic tools for commercial vehicles. Prior to 1996, Mr. Tule was a partner at the Manchester, New Hampshire law firm of McLane, Graf, Raulerson & Middleton, P.A.

Richard M. Urbach, age 37, has been President and Chief Operating Officer/Memorials Division since May 2006. From September 2004 to May 2006, Mr. Urbach was Regional Vice President/Western Region, with responsibility for managing retail sales and operations. The Western Region comprises the Iowa, Watertown, Wisconsin, Northeast Ohio and Maumee Valley retail hubs. From December 2002 to September 2004, he was Retail Operations Manager of the Ohio region, which included the Company's Northeast Ohio, Southeast Ohio, Maumee Valley, and Pittsburgh operations. From November 2001 to December 2002, he managed sales and operations for the Company's Pittsburgh and Southeast Ohio retail operations. He managed sales and operations at the Company's retail stores in Pittsburgh from November 1999 to November 2001.

7

BOARD ACTIONS; COMMITTEES OF THE BOARD OF DIRECTORS

The board of directors met 5 times and acted by unanimous written consent 8 times in 2005. Directors are encouraged but not required to attend the annual meeting of the Company's shareholders. All of our directors attended the 2005 Annual Meeting of Stockholders.

The board of directors currently has three standing committees: the Compensation Committee, the Corporate Governance and Nominating Committee and the Audit Committee. The functions of these committees and the number of meetings held during 2005 are described below.

Compensation Committee

The Compensation Committee consists of James L. Fox, Charles M. Waite (Chairman), Frederick E. Webster Jr., and Pamela G. Sheiffer, each of whom is an "independent director" within the meaning of Rule 4200(a)(15) of the NASDAQ Marketplace Rules, a "Non-Employee Director" within the meaning of Rule 16(b)(3) under the Securities Exchange Act of 1934, as amended, and an "outside director" within the meaning of Section 162(m) of the Internal Revenue Code of 1986, as amended. The Compensation Committee has a charter, a copy of which is available on our website at www.rockofages.com.

The principal function of the Compensation Committee is to oversee the remuneration arrangements (including benefits) for the executive officers of the Company. The Compensation Committee has also administered and made grants of stock-based awards under, the Company's 2005 Stock Plan (the "2005 Plan"). The Compensation Committee met 4 times as a committee during 2005. The report of the Compensation Committee is included in this proxy statement beginning on page 18.

Corporate Governance and Nominating Committee

The Corporate Governance and Nominating Committee consists of James L. Fox, Pamela G. Sheiffer, Charles M. Waite and Frederick E. Webster Jr. (Chairman), each of whom is an "independent director" within the meaning of Rule 4200(a)(15) of the NASDAQ Marketplace Rules. The Corporate Governance and Nominating Committee has a charter, a copy of which is available on our website at www.rockofages.com.

The key functions of the Corporate Governance and Nominating Committee are: identifying and recommending to the board of directors individuals qualified to serve as directors of the Company and on committees of the board; advising the board with respect to board composition, procedures and committees; developing and recommending to the board a set of corporate governance guidelines applicable to the Company and corporate governance matters generally; and overseeing the evaluation of the board and its committees.

Among the qualifications that the Corporate Governance and Nominating Committee will consider in selecting director candidates are experience, skills, expertise, relevant industry background and knowledge, personal and professional integrity, character, business judgment, time availability in light of other commitments, dedication, conflicts of interest, material relationships with the Company and independence from management of the Company. While the Corporate Governance and Nominating Committee has not formally adopted any specific, minimum qualifications that it believes must be met by a Committee-recommended nominee, or any specific qualities or skills that it believes are necessary for one or more of the Company's directors to possess, the Committee will require that the nominee demonstrate, by significant accomplishment in his or her field, an ability to make a meaningful contribution to the board's oversight of the business and affairs of the Company, and that the nominee have a record and reputation for honest and ethical conduct in both his or her professional and personal activities.

8

The Corporate Governance and Nominating Committee will consider director candidates recommended by stockholders. In considering candidates submitted by stockholders, the Committee will take into consideration the needs of the board of directors and the qualifications of the proposed candidate. To have a candidate considered by the Corporate Governance and Nominating Committee, a stockholder must submit the recommendation in writing and must include the following information:

- The name and address of the stockholder and evidence of the person's ownership of Company stock, including the number of shares owned and the length of time of ownership; and

- The name, age, business and residence address of the proposed candidate, the proposed candidate's resume or a listing of his or her qualifications to be a director of the Company and the person's consent to be named as a director if selected by the Corporate Governance and Nominating Committee and nominated by the board of directors.

In order for a proposed candidate recommended by a stockholder as described above to be considered by the Corporate Governance and Nominating Committee and nominated by the board for election at an annual meeting of stockholders, the stockholder recommendation and information described above must be sent by certified or registered mail, return receipt requested, to the attention of the Secretary at Rock of Ages Corporation, 369 North State Street, Concord, New Hampshire 03301 and must be received by the Secretary not less than 120 days prior to the anniversary date of the Company's preceding annual meeting of stockholders.

While the Corporate Governance and Nominating Committee has not adopted any formal process for identifying and evaluating potential nominees for director, it expects that the identification process will include asking current directors and executive officers to notify the Committee if they become aware of persons meeting the criteria described above, who have had a change in circumstances that might make them available to serve on the board; for example, retirement as a senior executive of a company or other organization or exiting government or military service. The Corporate Governance and Nominating Committee also anticipates that it may, from time to time, engage firms that specialize in identifying director candidates. As described above, the Committee will also consider candidates recommended by stockholders.

Once a person has been identified by the Corporate Governance and Nominating Committee as a potential candidate, the Committee may collect and review publicly available information regarding the person to assess whether the person should be considered further. The Committee expects that if it determines that the candidate warrants further consideration, the Chairman or another member of the Committee will contact the person. If the person expresses a willingness to be considered and to serve on the board, the Committee will request information from the candidate, review the person's accomplishments and qualifications, including in light of any other candidates that the Committee might be considering, and will conduct one or more interviews with the candidate. In certain instances, Committee members may contact one or more references provided by the candidate or may contact other members of the business community or other persons that may have greater first-hand knowledge of the candidate's accomplishments. It is not currently anticipated that the Committee's evaluation process would vary based on whether or not a candidate is recommended by a stockholder, although, as stated above, the board of directors may take into consideration the number of shares held by the recommending stockholder and the length of time that such shares have been held.

Audit Committee

The Audit Committee, which consists of Messrs. Fox, Waite and Webster, is a separately designated committee established by the board of directors in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended. Mr. Webster was appointed to the Audit Committee in February 2005 to fill the vacancy created by the death of Douglas M. Schair. The board of directors has determined that James L. Fox, Chairman of the Audit Committee, is an "audit committee financial expert" as defined by Item 401(h)(2) of Regulation S-K of the Securities Act 94 1933, as amended, and that each of the members of the Audit Committee is independent under Rule 10A-3(b)(1) under the Securities Exchange Act of 1934, as amended, and the applicable rules of the National Association of Securities Dealers, Inc. within the meaning of Item 7(d)(3)(iv) of Schedule 14A under the Securities Exchange Act of 1934, as amended.

9

The Audit Committee operates under, and has the responsibilities set forth in, the amended and restated written charter adopted by the board of directors which was annexed to the Company's proxy statement relating to its 2004 Annual Meeting of Stockholders. The principal function of the Audit Committee is to endeavor to assure the integrity and adequacy of financial statements issued by the Company. The report of the Audit Committee in respect of fiscal year 2005 is included in this proxy statement at page 26.

STOCKHOLDER COMMUNICATION WITH THE BOARD OF DIRECTORS

The board of directors has established a process to receive communications from stockholders by mail. Stockholders who wish to communicate with the board of directors or a particular director or group of directors may send a letter to the Secretary of the Company at 369 North State Street, Concord, New Hampshire 03301. The mailing envelope must contain a clear notation indicating that the enclosed letter is a "Stockholder-Board Communication" or "Stockholder-Director Communication." All such letters must identify the author as a stockholder and clearly state whether the intended recipients are all members of the board or just certain specified individual directors or members of a board committee by either name or title.

All communications received as set forth in the preceding paragraph will be forwarded to and opened by the Legal Department for the sole purpose of determining whether the contents contain a message or other communication to one or more of our directors. Any contents that are not in the nature of advertising, promotions of a product or service, or patently offensive material will be forwarded promptly to the addressee. In the case of communications to the board or any individual director or group or committee of directors, the Legal Department will make sufficient copies of the contents to send to such director or each director who is a member of the group or committee to which the envelope is addressed.

10

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of April 28, 2006 certain information with respect to the beneficial ownership of the Common Stock by (i) each director, (ii) each Named Executive Officer (as defined below), (iii) each beneficial owner of more than 5% of either class of the outstanding Common Stock known to the Company, and (iv) all directors and executive officers of the Company as a group. This information is based upon information received from or on behalf of the individuals or entities named below, except as otherwise noted. The Class B Common Stock is convertible on a share‑for‑share basis into Class A Common Stock. The Class B Common Stock is entitled to ten votes per share and the Class A Common Stock is entitled to one vote per share. Beneficial ownership has been determined in accordance with the rules of the Securities and Exchange Commission. Except as indicated in the footnotes below, the Company believes, based on the information furnished or otherwise available to it, that the person and entities named in the table below have sole voting and investment power with respect to all shares of Common Stock shown as beneficially owned by them, subject to applicable community property laws. The calculation of beneficial ownership is based upon 4,660,800 shares of Class A Common Stock and 2,738,596 shares of Class B Common Stock outstanding as of April 28, 2006.

In computing the number of shares of Common Stock beneficially owned by a person and the percentage ownership of such person, shares of Class A Common Stock subject to options held by that person that are currently exercisable or exercisable within 60 days of April 28, 2006 were deemed to be outstanding, and shares of Class B Common Stock owned by such person were deemed to be converted into Class A Common Stock. Such shares were not deemed to be outstanding, however, for the purpose of computing the percentage ownership of any other person.

| | SHARES OF CLASS B

COMMON STOCK

BENEFICIALLY OWNED | | SHARES OF CLASS A

COMMON STOCK

BENEFICIALLY OWNED |

NAME AND ADDRESS OF BENEFICIAL OWNER (1) | | NUMBER | | PERCENT OF

CLASS | | NUMBER (2) | | PERCENT OF

CLASS (2) |

| | | | | | | | |

Connors Investor Services, Inc. (3)

2727 Allen Parkway, Suite 460

Houston, TX77019 | | — | | — | | 287,650 | | 6.2% |

| | | | | | | | |

Dimensional Fund Advisors (4)

1299 Ocean Avenue

Santa Monica, CA90401 | | — | | — | | 280,650 | | 6.0% |

| | | | | | | | |

Lord Abbett & Co. LLC (5)

90 Hudson Street

Jersey City, NJ07302 | | — | | — | | 247,770 | | 5.3% |

| | | | | | | | |

Estate of Douglas M. Schair (6)** | | — | | — | | 570,303 | | 12.2% |

Kurt M. Swenson (7) ** | | 1,005,000 | | 36.7% | | 1,135,000 | | 20.0% |

Kevin C. Swenson (8) | | 1,023,489 | | 37.4% | | 1,023,489 | | 18.0% |

Rick Wrabel (9)** | | — | | — | | 157,000 | | 3.4% |

Robert L. Pope | | 144,875 | | 5.3% | | 160,875 | | 3.3% |

Richard C. Kimball ** | | 29,126 | | 1.1% | | 113,426 | | 2.4% |

Jon M. Gregory (10) ** | | — | | — | | 85,326 | | 1.8% |

Charles M. Waite (11)** | | 29,126 | | 1.1% | | 51,000 | | 1.0% |

James L. Fox (12) ** | | — | | — | | 7,000 | | * |

Frederick E. Webster Jr. (13)** | | — | | — | | 7,000 | | * |

Donald Labonte (14)** | | — | | — | | 15,000 | | * |

Pamela G. Sheiffer (15)** | | — | | — | | 7,500 | | * |

Caryn Crump (16)** | | — | | — | | 25,000 | | * |

All directors and executive officers as a group (12 persons) | | 1,063,252 | | 38.8% | | 1,665,752 | | 29.1% |

** Named Executive Officer and/or Director

* Less than 1%

11

(1) | The business address of each director and executive officer of the Company is c/o Rock of Ages Corporation, 772 Graniteville Road, Graniteville, Vermont 05654. |

| |

(2) | For each beneficial owner (and directors and executive officers as a group), (i) the number of shares of Class A Common Stock listed includes (or is comprised solely of) a number of shares equal to the number of shares of Class B Common Stock, if any, listed as beneficially owned by such beneficial owner(s) and (ii) the percentage of Class A Common Stock listed assumes the conversion on March 20, 2006 of all shares of Class B Common Stock, if any, listed as beneficially owned by such beneficial owner(s) into Class A Common Stock and also that no other shares of Class B Common Stock beneficially owned by others are so converted. |

| |

(3) | According to a Schedule 13G dated February 14, 2006, Connors Investment Services, Inc., in its capacity as an investment advisor or manager, may be deemed to be the beneficial owner of the listed shares that are held of record by certain investment companies, trusts or other accounts it advises or manages. |

| |

(4) | According to a Schedule 13G dated February 1, 2006, Dimensional Fund Advisors, Inc., in its capacity as an investment advisor or manager, may be deemed to be the beneficial owner of the listed shares that are held of record by certain investment companies, trusts or other accounts it advises or manages. |

| |

(5) | According to a Schedule 13G dated February 1, 2006, Lord Abbett & Co., LLC , in its capacity as an investment advisor or manager, may be deemed to be the beneficial owner of the listed shares that are held of record by certain investment companies, trusts or other accounts it advises or manages. |

| |

(6) | Douglas M. Schair, a former director of the Company, died January 26, 2005. Includes 18,800 shares of Class A Common Stock held by a trust of which Mr. Schair was co-trustee until his death. Mr. Schair disclaimed beneficial ownership of such shares. Does not include 15, 018 shares held by trusts with an independent trustee for the benefit of Mr. Schair's adult children. |

| |

(7) | Kurt M. Swenson is the brother of Kevin C. Swenson. Includes 1,005,000 shares of Class B Common Stock and 130,000 shares of Class A Common Stock held by the Kurt M. Swenson Revocable Trust of 2000. Kurt M. Swenson, as the sole trustee of the Kurt M. Swenson Revocable Trust of 2000, beneficially owns such shares. Does not include 61,489 Class B Common Stock held by trusts with an independent trustee for the benefit of Mr. Swenson's adult children. |

| |

(8) | Kevin C. Swenson is the brother of Kurt M. Swenson. Does not include 38,000 shares of Class B Common Stock held by trusts with an independent trustee for the benefit of Mr. Swenson's adult children. |

| |

(9) | Mr. Wrabel resigned from employment on May 5, 2006. Includes 150,000 shares of Class A Common Stock subject to currently exercisable stock options. |

| |

(10) | Mr. Gregory retired from employment with the Company on March 31, 2006. Includes 6,000 shares of Class A Common Stock subject to currently exercisable stock options. |

| |

(11) | Includes 60,000 shares of Class A Common Stock subject to currently exercisable stock options. |

| |

(12) | Includes 6,000 shares of Class A Common Stock subject to currently exercisable options. |

| |

(13) | Includes 2,000 shares of Class A Common Stock subject to currently exercisable options. |

| |

(14) | All 15,000 shares of Class A Common Stock are subject to currently exercisable options. |

| |

(15) | Includes 5,000 shares of Class A Common Stock subject to currently exercisable options. |

| |

(16) | Ms. Crump was classified as an executive officer until February 16, 2006. She resigned from employment on May 5, 2006. All 25,000 shares of Class A Common Stock subject to currently exercisable options. |

12

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires directors, certain officers and beneficial owners of more than 10% of our Common Stock to file reports of initial beneficial ownership and changes in beneficial ownership of our Common Stock with the Securities and Exchange Commission. Based solely upon a review of reports filed pursuant to Section 16(a) of the Exchange Act and written representations by such reporting persons, we believe during fiscal year 2005 such persons made all required filings.

EXECUTIVE COMPENSATION AND OTHER INFORMATION

Summary Compensation Table

The following table sets forth compensation information for the years ended December 31, 2005, 2004 and 2003 with respect to our Chief Executive Officer and each of our four other most highly compensated executive (the "Named Executive Officers").

NAME AND PRINCIPAL POSITION | | YEAR | | ANNUAL COMPENSATION

SALARY BONUS | | LONG-TERM

COMPENSATION

SECURITIES

UNDERLYING OPTIONS | | ALL OTHER

COMPENSATION (1) | |

| | | | | | | | | | | |

Kurt M. Swenson | | 2005 | $ | 481,799 (2) | $ | — | | — | $ | 21,799 | (4) |

Chief Executive Office and Chairman | | 2004 | $ | 445,000 (2) | $ | — | | — | $ | 17,674 | (4) |

of the Board of Directors | | 2003 | $ | 430,008 (2) | $ | 15,000 (2) | | — | $ | 7,831 | (4) |

| | | | | | | | | | | |

Jon M. Gregory | | 2005 | $ | 420,004 (3) | $ | — | | — | $ | 6,795 | (5) |

President and COO/ | | 2004 | $ | 300,004 (3) | $ | 30,000 | | — | $ | 2,849 | (5) |

Quarry Division | | 2003 | $ | 260,004 | $ | 25,000 | | — | $ | 1,350 | |

| | | | | | | | | | | |

Donald Labonte | | 2005 | $ | 220,379 | $ | — | | — | $ | 14,770 | (6) |

President and COO/ | | 2004 | $ | 185,359 | $ | 15,000 | | — | $ | 13,756 | (6) |

Manufacturing Division | | 2003 | $ | 192,414 | $ | 15,000 | | — | $ | 12,031 | (6) |

| | | | | | | | | | | |

Rick Wrabel (7) | | 2005 | $ | 320,004 | $ | — | | — | $ | 33,600 | (8) |

President and COO/ | | 2004 | $ | 175,005 | | 20,000 | | 150,000 | $ | 16,800 | (8) |

Memorials Division | | 2003 | | — | | — | | — | | — | |

| | | | | | | | | | | |

Caryn Crump (9) | | 2005 | $ | 225,000 | $ | — | | — | $ | 151,818 | (10) |

Senior Vice President/ | | 2004 | $ | 56,250 | $ | — | | 25,000 | $ | — | |

Memorials Division | | 2003 | $ | — | $ | — | | — | $ | — | |

| | | | | | | | | | | |

(1) | Except as otherwise specified, represents a matching contribution under the Company's 401(k) Plan. | |

| | |

(2) | For 2005, includes $100,000 of salary earned but deferred at the election of Mr. Swenson pursuant to the Rock of Ages Key Employees Deferred Salary Plan ("Deferred Salary Plan."). For 2004, includes $85,000 of salary and $15,000 of bonus paid in 2004 on account of 2003 results, earned but deferred at the election of Mr. Swenson under the Deferred Salary Plan. For 2003, includes $70,000 of salary and $30,000 of bonus paid in 2003 on account of 2002 results, deferred at the election of Mr. Swenson under the Deferred Salary Plan. | |

| | |

(3) | For 2005, includes $100,000 of salary earned but deferred at the election of Mr. Gregory under the Deferred Salary Plan. For 2004, included $40,008 of salary earned but deferred by Mr. Gregory under the Deferred Salary Plan. | |

| | |

(4) | Includes $20,249 for 2005, $16,224 for 2004 and $6,481 for 2003 of interest credited on deferred compensation pursuant to the Deferred Salary Plan in excess of 120% of the applicable federal long term rate. | |

| |

(5) | Includes $5,245 for 2005 and $1,399 for 2004 of interest credited on deferred compensation pursuant to the Deferred Salary Plan in excess of 120% of the applicable federal long term rate. |

13

| |

(6) | Represents amounts paid by the Company to Mr. Labonte's self-directed retirement account under the Retirement Plan for Salaried Employees of Rock of Ages Canada, Inc. |

| |

(7) | Mr. Wrabel joined the Company as of May 17, 2004. He resigned from employment on May 5, 2006. |

| |

(8) | Represents amounts paid for temporary living allowance. |

| |

(9) | Ms. Crump joined the Company as of October 4, 2004. She resigned from employment on May 5, 2006. |

| |

(10) | Includes $146,497 paid for temporary living allowance and relocation expenses, and $5,321 401(k) matching contribution. |

Stock Option Grants in Last Fiscal Year

We did not grant any stock options or stock appreciation rights to the Named Executive Officers in 2005.

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

The following table sets forth information concerning options to purchase Class A Common Stock held by the Named Executive Officers. The Company has not granted any stock appreciation rights.

| | | | | | EXERCISABLE (1) | | UNEXERCISABLE | | EXERCISABLE | | UNEXERCISABLE |

NAME | | SHARES

ACQUIRED

ON

EXERCISE | | VALUE

REALIZED | | NUMBER OF SECURITIES

UNDERLYING UNEXERCISED

OPTIONS AT DECEMBER 31, 2005 | | VALUE OF UNEXERCISED

IN-THE-MONEY OPTIONS

AT DECEMBER 31, 2005 |

| | | | | | | | | | | | |

Kurt M. Swenson | | — | $ | — | | — | | — | $ | — | $ | — |

Jon M. Gregory | | — | $ | — | | 60,000 | | — | $ | — | $ | — |

Donald Labonte | | — | $ | — | | 15,000 | | — | $ | — | $ | — |

Caryn Crump | | — | $ | — | | 25,000 | | — | $ | — | $ | — |

Rick Wrabel | | — | $ | — | | 150,000 | | — | $ | — | $ | — |

Pension Plans

The Company maintains a qualified pension plan (the "Pension Plan"), and has entered into nonqualified salary continuation agreements (the "Salary Continuation Agreements") with certain officers of the Company, including some of the Named Executive Officers listed in the table on page 14. The Company's Pension Plan is noncontributory and provides benefits based upon length of service and final average earnings. Generally, employees age 21 with one year of continuous service are eligible to participate in the Pension Plan. The annual pension benefits shown for the Pension Plan assume a participant attains age 65 during 2005 and retires immediately. The Employee Retirement Income Security Act of 1974 places limitations on the compensation used to calculate pensions and on pensions that may be paid under federal income tax qualified plans, and some of the amounts shown on the following table may exceed the applicable limitations. Such limitations are not currently applicable to the Salary Continuation Agreements.

14

Pension Plan Table

The following table shows the total estimated annual retirement benefits payable upon normal retirement under the Pension Plan for the Named Executive Officers at the specified executive remuneration and years of continuous service.

| FINAL AVERAGE

COMPENSATION | | 15 YEARS | | 20 YEARS | | 25 YEARS | | 30+ YEARS |

| | | | | | | | | |

$ | 125,000 | $ | 38,175 | $ | 50,900 | $ | 63,625 | $ | 76,350 |

$ | 150,000 | $ | 46,425 | $ | 61,900 | $ | 77,375 | $ | 92,850 |

$ | 175,000 | $ | 54,675 | $ | 72,900 | $ | 91,125 | $ | 109,350 |

$ | 200,000 | $ | 62,925 | $ | 83,900 | $ | 104,875 | $ | 125,850 |

$ | 225,000 | $ | 71,175 | $ | 94,900 | $ | 118,625 | $ | 142,350 |

$ | 250,000 | $ | 79,425 | $ | 105,900 | $ | 132,375 | $ | 158,850 |

$ | 275,000 | $ | 87,675 | $ | 116,900 | $ | 146,125 | $ | 175,350 |

$ | 300,000 | $ | 95,925 | $ | 127,900 | $ | 159,875 | $ | 191,850 |

$ | 325,000 | $ | 104,175 | $ | 138,900 | $ | 173,625 | $ | 208,350 |

$ | 350,000 | $ | 112,425 | $ | 149,900 | $ | 187,375 | $ | 224,850 |

$ | 375,000 | $ | 120,675 | $ | 160,900 | $ | 201,125 | $ | 241,350 |

$ | 400,000 | $ | 128,925 | $ | 171,900 | $ | 214,875 | $ | 257,850 |

$ | 425,000 | $ | 137,175 | $ | 182,900 | $ | 228,625 | $ | 274,350 |

$ | 450,000 | $ | 145,425 | $ | 193,900 | $ | 242,375 | $ | 290,850 |

$ | 475,000 | $ | 153,675 | $ | 204,900 | $ | 256,125 | $ | 307,350 |

$ | 500,000 | $ | 161,925 | $ | 215,900 | $ | 269,875 | $ | 323,850 |

These calculations are based on the retirement formula in effect as of December 31, 2005, which provides an annual life annuity at age 65 equal to 1.8% of a participant's highest consecutive five-year average compensation (excluding bonus) during the last ten years of employment ("Final Average Compensation"), plus .4% of a participant's Final Average Compensation in excess of social security covered compensation times years of service to a maximum of 30 years. Completed years of continuous service for each of the Named Executive Officers, as of December 31, 2005 and rounded to the full year, are: Mr. Gregory, 30 years; Mr. Swenson, 32 years; Mr. Wrabel 2 years; and Ms. Crump, 1 year.

In addition, the Company's Salary Continuation Agreements provide for supplemental pension benefits to certain officers of the Company, including the Named Executive Officers listed in the table below. The following table sets forth the supplemental pension benefits for the specified Named Executive Officers under their respective Salary Continuation Agreements.

NAME | | ANNUAL BASE

COMPENSATION | | TOTAL YEARS

OF SERVICE

AT AGE 65 | | ANNUAL

RETIREMENT

BENEFIT

AT AGE 65 |

| | | | | | |

K. Swenson | | $445,000 | | 26 | | 127,270 |

J. Gregory | | $300,000 | | 39 | | 70,200 |

These calculations are based on individual Salary Continuation Agreements, which provide a 100% joint and survivor annuity at age 65 equal to a percentage, ranging from .6% to 1.1%, of a participant's highest annual base compensation times full years of service. The board of directors has determined the percentage range. There are no compensation increases assumed in these calculations.

15

We have a deferred salary plan ("Plan") for certain management and highly compensated employees within the meaning of Section 2520.104-23(d) of the U.S. Department of Labor Regulations. Participation in the Plan is limited to those employees designated by the Board of Directors in its sole discretion, and who satisfy the following criteria: (1) the employee has attained the age of 55; the employee is an executive officer; the employee has completed a minimum of ten years of continuous service with the Company; and the employee's annual base salary, fringe benefits and other non-cash compensation exceeds $200,000 (subject to adjustment each year to reflect the average percentage change in the base salaries of all officers of the Company). Currently, Mr. Swenson, Mr. Kimball and Mr. Gregory are the only participants in the Plan and Mr. Gregory's participation in the Plan ceased upon his retirement on March 31, 2006. Mr. Kimball retired as an employee of the Company on December 31, 2004 and is currently collecting benefits under the Plan. Mr. Gregory retired as an employee of the Company on March 31, 2006 and is currently collecting benefits under the Plan. Participants may make an irrevocable election to defer up to $100,000 annually under the Plan. Any amounts deferred are held in deferred salary accounts created by the Company. Interest at the rate of 12% per annum is credited on a monthly basis to each Participant's deferred salary account. The aggregate account balances remain part of the general unrestricted assets of the Company and are available for investment and use by the Company. Participants do not have any right or claim to any specific assets of the Company, but only a claim against the Company as a general, unsecured creditor to the extent of the undistributed portion of their deferred salary account. Benefits under the Plan are paid upon the retirement, death or disability of the participant or other termination of participation, subject to certain procedures relating to distribution.

The Company has a retirement plan for its Canadian employees, the Retirement Plan for Salaried Employees of Rock of Ages Canada, Inc. (the "Canadian Retirement Plan"), which is registered with the Province of Quebec and the Government of Canada. All salaried, non-union employees of Rock of Ages Canada, Inc. are participants in the Canadian Retirement Plan, including Mr. Labonte. Pursuant to the Plan, Rock of Ages Canada contributes 8% of a participant's monthly compensation each month to each participant's account. The investments in the account are self-directed by each participant with a range of investment options. Rock of Ages Canada may, at its discretion, make an additional contribution to a participant's account, up to a maximum aggregate amount of $15,500 CDN per year (including amounts previously contributed during the year).

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

Mr. Fox, Ms. Sheiffer, Mr. Waite and Mr. Webster served as members of the Compensation Committee for all of 2005. None of the members of the Compensation Committee is currently or has ever been an officer or employee of the Company or any of its subsidiaries. None of the Company's executive officers serves as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving as a member of the board of directors or the Compensation Committee.

COMPENSATION COMMITTEE REPORT

Overall Policy

The Company's compensation policy is designed to link compensation of the Company's executives to the Company's performance and to each executive's contribution and performance. The objectives of this policy are to attract and retain the best possible executives, to motivate them to achieve the Company's business goals and to provide a compensation package that recognizes individual contributions as well as overall business results, both short term and long term.

The Compensation Committee determines the compensation of the Company's executive officers, including the Named Executive Officers whose compensation is detailed in this proxy statement.

The Company's executive compensation consists of these principal components: base salary, annual bonus awards and stock incentives. In addition, the Compensation Committee takes into account the full compensation package afforded by the Company to the individual, including pension benefits, insurance and other benefits, as well as the specific elements described below.

Base Salaries

The Compensation Committee determined the base salaries of the Company's executive officers including Mr. Swenson, the Company's chief executive officer, for 2005. In determining such base salaries, the Compensation Committee considered historical salaries paid by the Company to officers having similar duties and responsibilities, salaries paid to similar executives by publicly held companies in the death care industry, the performance of each executive officer and the contribution of that officer to the performance of the Company.

16

In evaluating Mr. Swenson's performance and setting his salary, the Compensation Committee primarily considered Mr. Swenson's success in implementing the strategic goals of the Company, including implementation of the Company's retail distribution strategy, and managing the Company's personnel. The Committee also considered the impact on corporate performance of his efforts to develop and implement new business strategies and enhance the Company's brand and corporate reputation. On December 7, 2005, the Committee, at the request of Mr. Swenson, approved a voluntary 10% reduction in the rate of pay on the non-deferred portion of Mr. Swenson's salary. That reduction continues in effect during 2006. The Committee also took into account Mr. Swenson's level of stock ownership and concluded that, as the Company's largest stockholder, Mr. Swenson did not need any further incentive stock options and that available options should be used as incentives for other officers. The Compensation Committee has instead continued to utilize the Company's deferred salary plan to provide Mr. Swenson with incentives to defer salary and to continue to provide services to the Company for the opportunity to supplement his ultimate retirement income.

The amount of base salary paid to each Named Executive Officer in 2005 is set forth in the summary compensation table on page 13.

Annual Performance Bonus

The Company's executive officers are eligible for an annual cash performance bonus. In 2005, the Compensation Committee recommended the establishment of a bonus pool for the Company's officers in respect of 2005 results. The payment of annual bonuses to officers for 2005 depended on whether certain specified results or strategic objectives were achieved. No bonuses were paid to officers for performance in respect of 2005 results.

Stock Options

Under the Company's 2005 Stock Plan, the Compensation Committee may grant stock options to the Company's executive officers. In general, the guidelines for the grant and size of stock option awards are based on factors similar to those used to determine base salaries. Stock options are typically granted with an exercise price equal to the market price of the Common Stock on the date of grant and vest over time. This approach is designed to encourage the creation of stockholder value over the long term since the full benefit of such options cannot be realized unless stock price appreciation occurs over time.

Conclusion

Through the programs described above, a significant portion of the Company's executive compensation is linked directly to corporate performance. The Compensation Committee intends to continue the policy of linking executive compensation to corporate performance.

| COMPENSATION COMMITTEE |

| |

| Charles M. Waite (Chairman) |

| James L. Fox |

| Pamela G. Sheiffer |

17

COMPENSATION OF DIRECTORS

Directors who are not also officers of the Company are paid annual directors' retainers of $20,000. Audit Committee members are paid an additional annual retainer fee of $1,500 and members of other committees are paid additional annual retainers of $1,000 for each committee. Directors were also eligible for stock options grants under our Amended and Restated 1994 Stock Plan and will be eligible for grants under the 2005 Stock Plan.

EMPLOYMENT AGREEMENTS

We have an employment agreement with Kurt M. Swenson (the "Swenson Employment Agreement") for retention of his services as President and Chief Executive Officer of the Company. The term of the Swenson Employment Agreement commenced on October 24, 1997, the date of consummation of the initial public offering (the "Commencement Date"), and continues until the fifth anniversary thereof, provided on the third and each subsequent anniversary of the Commencement Date such term will automatically be extended for one additional year, unless, not later than ninety days prior to the expiration of the term, the Company or Mr. Swenson gives notice the term will not be extended. The Swenson Employment Agreement has been automatically extended each year since 2002 and will, subject to further automatic extension, expire in October 2008. The Swenson Employment Agreement provides for continued payment of salary and benefits over the remainder of the term if Mr. Swenson's employment is terminated by the Company without Cause (as defined in the Swenson Employment Agreement) or as a result of death or disability or by Mr. Swenson for Good Reason (as defined in the Swenson Employment Agreement). The Swenson Employment Agreement also provides for a lump sum payment to Mr. Swenson equal to the sum of (i) accrued but unpaid salary, and a prorated bonus amount equal to the greater of the largest annual bonus paid to Mr. Swenson during the prior three years and the annual bonus payable in respect of the most recently completed fiscal year (the "Highest Annual Bonus"), through the date of termination and (ii) three times the sum of (A) his then annual salary and (B) Highest Annual Bonus, and for continuation of benefits for three years, if Mr. Swenson's employment is terminated by the Company (other than for Cause, death or disability) during the twelve-month period following, or prior to but in connection with, or by Mr. Swenson during the twelve-month period following, a Change in Control (as defined in the Swenson Employment Agreement). In the event of a termination related to a Change in Control, Mr. Swenson may elect in lieu of the lump sum payment described above, to receive in a lump sum or over the then remaining term of the Swenson Employment Agreement, an amount equal to the total amount he would have been entitled to receive if his employment had been terminated by the Company without Cause or by Mr. Swenson for Good Reason. If any payment or distribution by the Company to or for the benefit of Mr. Swenson under the Swenson Employment Agreement would be subject to the excise tax imposed by Section 4999 of the Code or any interest or penalties are incurred by Mr. Swenson with respect to such excise tax, then Mr. Swenson will generally be entitled to receive an additional payment such that after payment by Mr. Swenson of all taxes, Mr. Swenson retains an amount of the additional payment equal to the excise tax imposed.

We had an employment agreement with Rick Wrabel (the "Wrabel Employment Agreement") for retention of his services as President of the Memorials Division of the Company. The term of the Wrabel Employment Agreement commenced on May 17, 2004. The Wrabel Employment Agreement provided for continued payment of salary and benefits over a period of 12 months if Mr. Wrabel's employment is terminated by the Company without Cause (as defined in the Wrabel Employment Agreement) or if he terminates the Agreement for Good Reason (as defined in the Wrabel Employment Agreement). In such event, the Wrabel Employment Agreement also provided for payment of (i) earned, but unpaid bonus, prorated to the date of termination; (ii) continuation of health care coverage for a period of 12 months; and (iii) reimbursement for outplacement services in an aggregate amount not to exceed $10,000. The Wrabel Employment Agreement provided for a lump sum payment to Mr. Wrabel equal to two times his then current annual base salary if his employment is terminated by the Company within 12 months of a Change In Control (as defined by the Wrabel Employment Agreement) or if he terminated his employment for Good Reason within 12 months after the occurrence of a Change In Control. In addition, Mr. Wrabel would have received the payments and/or benefits set forth in (i), (ii) and (iii) above in the event of a termination in connection with a Change In Control. We also agreed to reimburse Mr. Wrabel for housing expenses incurred while he was searching for a suitable residence in Vermont. Mr. Wrabel resigned from employment with the Company on May 5, 2006. In connection therewith, the Company entered into a severance agreement and general release with Mr. Wrabel pursuant to which the Company agreed, in accordance with the terms of the Wrabel Employment Agreement, to continue his salary and health insurance benefits for a period of 12 months. Accordingly, the Wrabel Employment Agreement was terminated upon the execution of the severance agreement and general release.

18

We had an employment agreement with Caryn Crump (the "Crump Employment Agreement") for retention of her services as Vice President/Marketing of the Memorials Division of the Company. The term of the Crump Employment Agreement commenced on October 4, 2004. The Crump Employment Agreement provided for continued payment of salary and benefits over a period of 12 months if her employment is terminated by the Company without Cause (as defined in the Crump Employment Agreement) or if she terminates the Agreement for Good Reason (as defined in the Crump Employment Agreement). In such event, the Crump Employment Agreement provided for payment of (i) earned, but unpaid bonus, prorated to the date of termination; (ii) continuation of health care coverage for a period of 24 months; (iii) reimbursement for outplacement services in an aggregate amount not to exceed $5,000. The Crump Employment Agreement provided for a lump sum payment to Ms. Crump equal to one times her then current base salary if her employment is terminated by the Company within 12 months of a Change in Control (as defined by the Crump Employment Agreement) or if she terminated her employment for Good Reason within 12 months after the occurrence of a Change in Control. In addition, Ms. Crump would have received the payments and/or benefits set forth in (i), (ii) and (iii) above in the event of a termination in connection with a Change in Control. Ms. Crump resigned from employment with the Company on May 5, 2006. In connection therewith, the Company entered into a severance agreement and general release with Ms. Crump pursuant to which the Company agreed, in accordance with the terms of the Crump Employment Agreement, to continue her salary for a period of 12 months, and to continue her health coverage for a period of 24 months, or until she is covered by another plan. Accordingly, the Crump Employment Agreement was terminated upon the execution of the severance agreement and general release.

19

COMPARATIVE STOCKHOLDER RETURN

The following graph compares on a cumulative basis the percentage change during the period from December 31, 1999 to December 31, 2005, in the total stockholder return on (i) the Class A Common Stock of the Company, (ii) the Russell 2000 Stock Price Index and (iii) an industry peer group index of the following six publicly traded companies: Carriage Services Inc., Hillenbrand Industries, Matthews International Corp., Service Corp. International, and Stewart Enterprises, Inc. (the "Industry Peer Group"). The graph assumes that the value of the investment in the Company's Class A Common Stock and in each index was $100 on December 31, 1998 and that all dividends were reinvested. The returns for each company in the Industry Peer Group are weighted according to such company's stock market capitalization at the beginning of each period for which a return is indicated. The stock price performance on the following graph and in the following table is not necessarily indicative of future stock price performance.

COMPARISON OF STOCKHOLDER TOTAL RETURN AMONG

ROCK OF AGES CORPORATION, THE RUSSELL 2000 STOCK PRICE INDEX AND

AN INDUSTRY PEER GROUP

| | 12/31/99 | | 12/31/00 | | 12/31/01 | | 12/31/02 | | 12/31/03 | | 12/31/04 | | 12/31/05 |

| | | | | | | | | | | | | | |

| Rock of Ages Corporation | | 100 | | 98.63 | | 109.81 | | 123.84 | | 127.37 | | 162.91 | | 99.33 |

Russell 2000 Index | | 100 | | 96.98 | | 99.39 | | 79.03 | | 116.38 | | 137.71 | | 148.46 |

Industry Peer Group | | 100 | | 92.19 | | 132.65 | | 111.90 | | 176.81 | | 122.67 | | 172.75 |

20

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

In connection with and prior to its initial public offering in 1997, the Company effected a reorganization whereby, among other things, the Company's then parent corporation, Swenson Granite Company, Inc. ("Swenson Granite"), was merged with and into the Company, with the Company as the surviving corporation, and, immediately prior to such merger, Swenson Granite distributed its curb and landscaping business to its stockholders through a pro rata distribution of all of the member interests in a newly formed limited liability company named Swenson Granite Company LLC ("Swenson LLC"). Kurt M. Swenson, the Company's Chairman, President and Chief Executive Officer, and his brother Kevin C. Swenson, each own approximately 31% of Swenson Granite LLC. Certain other executive officers and directors of the Company collectively own approximately 9% of Swenson LLC. Kurt M. Swenson serves as a non-officer Chairman of the Board of Swenson LLC, but has no involvement with its day-to-day operations. Robert Pope, a holder of more than 5% of the Class B Common Stock, is the President and Chief Executive Officer, and including shares owned by his wife and children, owns 12% of Swenson LLC. Neither Kurt M. Swenson nor any other officer or director of the Company, receives salary, bonus, expenses or other compensation from Swenson LLC, except for any pro rata share of earnings attributable to their ownership interest in Swenson LLC.