Equity Investor Presentation Third Quarter 2024

Forward-Looking Statements 2 In addition to historical information, this presentation includes forward-looking statements that reflect management’s current expectations for Farmer Mac’s future financial results, business prospects, and business developments. Forward-looking statements include, without limitation, any statement that may predict, forecast, indicate, or imply future results, performance, or achievements. Management’s expectations for Farmer Mac’s future necessarily involve assumptions, estimates, and the evaluation of risks and uncertainties. Various factors or events, both known and unknown, could cause Farmer Mac’s actual results to differ materially from the expectations as expressed or implied by the forward-looking statements. Some of these factors are identified and discussed in Farmer Mac’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2024, filed with the SEC on November 4, 2024. These reports are also available on Farmer Mac’s website (www.farmermac.com). Considering these potential risks and uncertainties, no undue reliance should be placed on any forward-looking statements expressed in this presentation. Any forward-looking statements made in this presentation are current only as of September 30, 2024, except as otherwise indicated. Farmer Mac undertakes no obligation to release publicly the results of revisions to any such forward- looking statements that may be made to reflect new information or any future events or circumstances, except as otherwise required by applicable law. The information in this presentation is not necessarily indicative of future results. NO OFFER OR SOLICITATION OF SECURITIES This presentation does not constitute an offer to sell or a solicitation of an offer to buy any Farmer Mac security. Farmer Mac securities are offered only in jurisdictions where permissible by offering documents available through qualified securities dealers. Any investor who is considering purchasing a Farmer Mac security should consult the applicable offering documents for the security and their own financial and legal advisors for information about and analysis of the security, the risks associated with the security, and the suitability of the investment for the investor’s particular circumstances. Copyright © 2024 by Farmer Mac. No part of this document may be duplicated, reproduced, distributed, or displayed in public in any manner or by any means without the written permission of Farmer Mac.

Use of Non-GAAP Financial Measures 3 This presentation is for general informational purposes only, is current only as of September 30, 2024 and should be read in conjunction with Farmer Mac’s Quarterly Report on Form 10-Q filed with the SEC on November 4, 2024. In the accompanying analysis of its financial information, Farmer Mac uses the following non-GAAP financial measures: core earnings, core earnings per share, and net effective spread. Farmer Mac uses these non-GAAP measures to measure corporate economic performance and develop financial plans because, in management's view, they are useful alternative measures in understanding Farmer Mac's economic performance, transaction economics, and business trends. The non-GAAP financial measures that Farmer Mac uses may not be comparable to similarly labeled non-GAAP financial measures disclosed by other companies. Farmer Mac's disclosure of these non-GAAP financial measures is intended to be supplemental in nature and is not meant to be considered in isolation from, as a substitute for, or as more important than, the related financial information prepared in accordance with GAAP. Core earnings and core earnings per share principally differ from net income attributable to common stockholders and earnings per common share, respectively, by excluding the effects of fair value fluctuations. These fluctuations are not expected to have a cumulative net impact on Farmer Mac's financial condition or results of operations reported in accordance with GAAP if the related financial instruments are held to maturity, as is expected. Core earnings and core earnings per share also differ from net income attributable to common stockholders and earnings per common share, respectively, by excluding specified infrequent or unusual transactions that Farmer Mac believes are not indicative of future operating results and that may not reflect the trends and economic financial performance of Farmer Mac's core business. Farmer Mac uses net effective spread to measure the net spread Farmer Mac earns between its interest-earning assets and the related net funding costs of these assets. Net effective spread differs from net interest income and net interest yield because it excludes: (1) the interest income and interest expense associated with the consolidated trusts and the average balance of the loans underlying these trusts; and (2) the fair value changes of financial derivatives and the corresponding assets or liabilities designated in fair value hedge accounting relationships. Net effective spread also principally differs from net interest income and net interest yield because it includes the accrual of income and expense related to the contractual amounts due on financial derivatives that are not designated in hedge accounting relationships ("undesignated financial derivatives") and the net effects of terminations or net settlements on financial derivatives, which consist of: (1) the net effects of cash settlements on agency forward contracts on the debt of other GSEs and U.S. Treasury security futures that we use as short-term economic hedges on the issuance of debt; and (2) the net effects of initial cash payments that Farmer Mac receives upon the inception of certain swaps.

WHY INVEST IN FARMER MAC? 4 Uniquely Positioned Focused on Growth Value Creation Consistent performance with a dedication to strategic initiatives and organizational alignment. Well-positioned to benefit from the growing agricultural mortgage market, strong demand for renewable energy projects, and agricultural mortgage-backed securities. A New York Stock Exchange Listed Government Sponsored Enterprise (GSE) that provides investors the unique opportunity to invest in American agriculture and rural infrastructure.

5 MISSION FOCUSED Strengthen Rural America Lower Financing Costs Increase Access to Credit Our Corporate Culture is Rooted in Our Values • Farmer Mac is a publicly traded company driven by our mission to increase the accessibility of credit for American agriculture and rural infrastructure. • NYSE: AGM & AGM.A • Farmer Mac increases the accessibility of financing and lowers financing costs for American agriculture and rural infrastructure. • GSE funding advantage: 10-year Treasury +0.37% as of September 30, 2024 • Farmer Mac provides a secondary market to a diverse customer set, offering a wide range of products and innovative solutions. • Successfully issued 4 large, structured FARM Series Agricultural Mortgage- Backed Securities (AMBS) • Innovation • Passion for our Mission • Integrity • Excellence • Relationships

A MISSION-DRIVEN, FOR-PROFIT COMPANY 6 TODAY1999 Listed on NYSE (Ticker: AGM) 1990 First expansion of authority: USDA guaranteed securities 1988 Farmer Mac initially chartered as an instrumentality of the United States 1996 Second expansion of authority: direct loan purchases 2008 Third expansion of authority: rural utilities loans With outstanding business volume of nearly $30 billion, Farmer Mac remains resolute in its commitment to growth, innovation, and mission fulfillment

CENTRAL TO A LARGE AGRICULTURAL MORTGAGE MARKET 7 Investments, $121,915 Inventories, $214,228 Real Estate $3,338,849 Machinery & Vehicles, $339,346 $4,014,338 Real Estate, $344,556 Nonreal Estate, $174,394 $518,951 $0 $500,000 $1,000,000 $1,500,000 $2,000,000 $2,500,000 $3,000,000 $3,500,000 $4,000,000 Farm Sector Assets 2023 Farm Sector Debt 2023 $ I N T H O U S A N D S Ag Real Estate Debt-to-Asset Ratio: 10.3% (1)

8 COMPETITIVE LANDSCAPE Farm Credit System (FCS) (Cooperative GSE) • Four FCS Banks • 56 Retail Agricultural Credit Associations Agricultural Mortgage Market (Farmers & Ranchers) (FCS Secondary Market GSE) Agricultural Finance Line of Business (Farm & Ranch and Corporate AgFinance) $345 BILLION Non-FCS Ag Lenders • Insurance Companies • Ag Banks • Non-Bank Lenders Mortgage FinancingMortgage Financing

9 FARMER MAC’S OPERATING MODEL Operating model excludes issued agricultural mortgage-backed securities and long-term standby purchase commitment credit protection components of our business. Farmer Mac’s Regulatory/Congressional Oversight • Regulated by the Farm Credit Administration (FCA) through its Office of Secondary Market Oversight (OSMO) • Congressional oversight through Senate and House Agricultural Committees

Each operating segment is comprised of both spread-based and fee-income products • Loan purchases (spread) • Wholesale Funding (spread) • Purchase Commitments (fee) • Loans Serviced for Others (fee) Net effective spread and fees determined by a variety of factors, including: • Funding execution • Credit profile • Economic factors 10 SEGMENT PROFITABILITY Line of Business Segment Volume ($ IN BILLIONS AS OF 9/30/2024) 3Q24 Net Effective Spread (%) Risk-Adjusted Gross Return on Allocated Capital (%) Agricultural Finance Farm & Ranch $18.1 1.05% 30% Corporate AgFinance $1.8 1.56% 19% Rural Infrastructure Finance Rural Utilities $7.4 0.44% 18% Renewable Energy $1.1 1.78% 27% Treasury Funding – 0.42% – Investments – 0.05% – $28.5 1.16% –

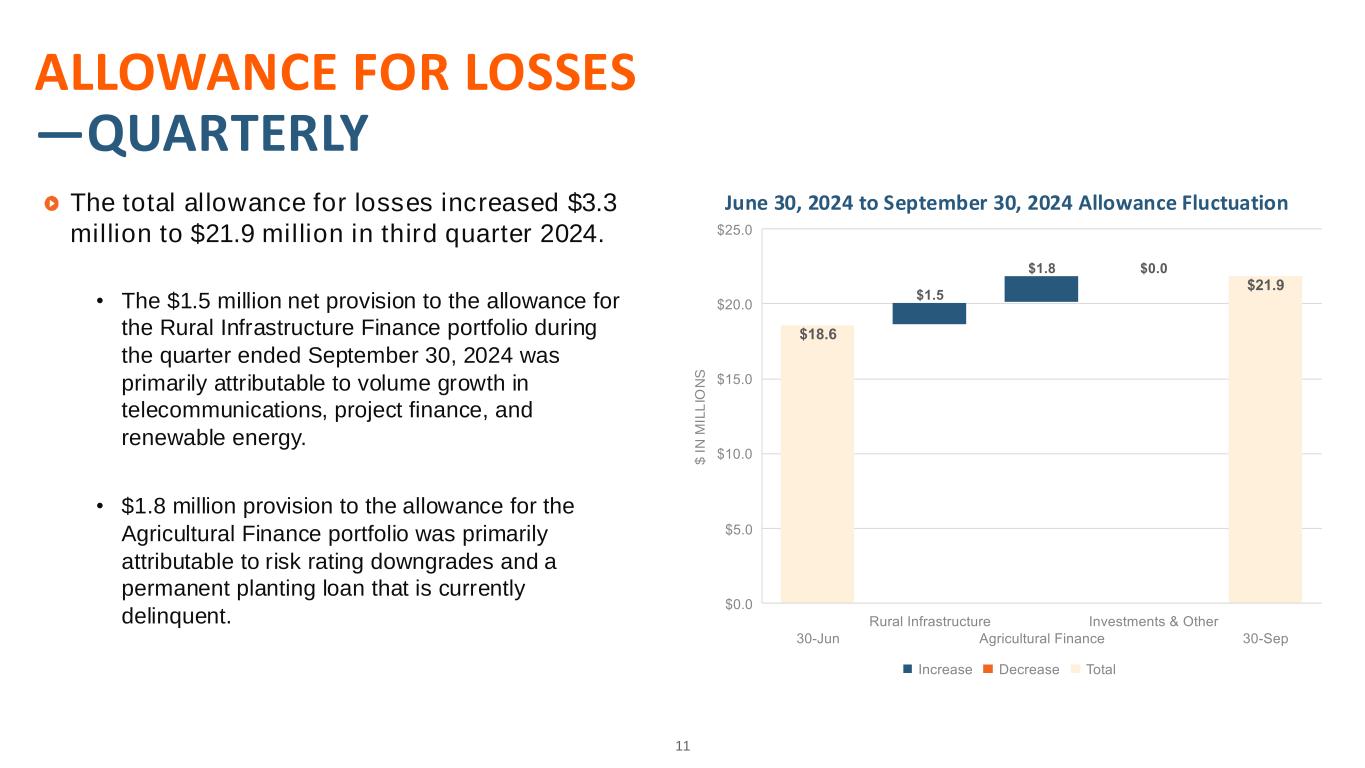

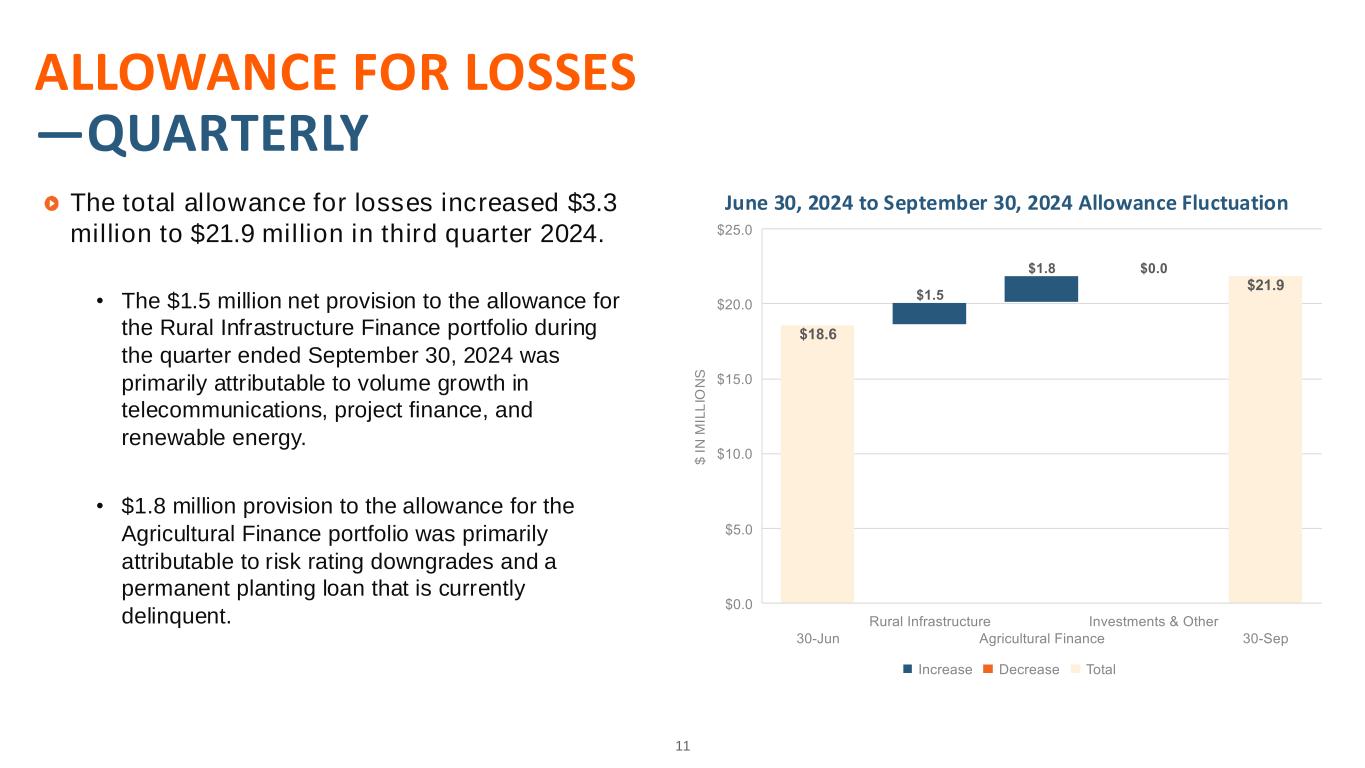

11 ALLOWANCE FOR LOSSES —QUARTERLY The total allowance for losses increased $3.3 million to $21.9 million in third quarter 2024. • The $1.5 million net provision to the allowance for the Rural Infrastructure Finance portfolio during the quarter ended September 30, 2024 was primarily attributable to volume growth in telecommunications, project finance, and renewable energy. • $1.8 million provision to the allowance for the Agricultural Finance portfolio was primarily attributable to risk rating downgrades and a permanent planting loan that is currently delinquent. n ra n rastr ct re gric t ra inance nvestments t er e $ I N M IL L IO N S June 30, 2024 to September 30, 2024 Allowance Fluctuation ncrease ecrease ota

12 AGRICULTURAL FINANCE LOAN PORTFOLIO DIVERSIFICATION Northwest 12% Southwest 30% Mid-North 27% Mid-South 17% Northeast 4% Southeast 10% By Geographic Region Crops 49% Permanent Plantings 22% Livestock 19% Part-time Farm 4% Ag. Storage and Processing 6% By Commodity Type Agricultural Update(2) • U ’s Economic esearc ervice re orted 66 bi ion in net cas incomes in , com ared to bi ion in 2022 and $155.2 billion in 2021. • Net cash income in 2024 is forecast to fall by 7% due to elevated input costs and moderating commodity prices. As of September 30, 2024

13 TREASURY/INVESTMENTS SEGMENT As of September 30, 2024 Includes the financial results of the company’s funding, liquidity, and capital allocation strategies and operations Liquidity & Investment Portfolio • Maintain investment portfolio to provide back-up source of liquidity in excess of regulatory requirements • $6.7 billion as of September 30, 2024 • Investments net effective spread of 0.05% in third quarter 2024 Benefits from Asset-Liability Management Strategies • Leverage a funds transfer pricing process to allocate interest expense to each segment, and allocate the costs and benefits of hedging strategies to the Treasury segment Cash & Equiv. 12.5% Guaranteed By GSEs and U.S. Gov't Agencies 87.2% Asset-Backed Securities 0.3% Liquidity Portfolio

$197 $221 $256 $327 $252$101 $114 $124 $171 $128 $0.0 $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 $140.0 $160.0 $180.0 $200.0 $0.0 $50.0 $100.0 $150.0 $200.0 $250.0 $300.0 $350.0 2020 2021 2022 2023 YTD 2024 C O R E E A R N IN G S $ IN M IL L IO N S N E T E F F E C T IV E S P R E A D $ I N M IL L IO N S Net Effective Spread & Core Earnings Net Effective Spread Core Earnings Consistent historical financial performance highlights the diversification and resiliency of Farmer Mac’s business model Disciplined asset liability management and uninterrupted access to the capital markets have provided buffer against market volatility and changing credit market conditions 14 GROWING, RECURRING, HIGH-QUALITY EARNINGS CAGR is defined as Compound Annual Growth Rate. Core earnings and net effective spread are non-GAAP measures. For a reconciliation of core earnings to GAAP net income attributable to common stockholders and a reconciliation of net effective spread to GAAP net interest income, please refer to pages 27-28 of the Appendix. 18% NES CAGR (2019-2023) 16% Core CAGR (2019-2023)

GROWTH OPPORTUNITIES TO INCREASE ASSETS UNDER MANAGEMENT 15Farm & Ranch Corporate AgFinance Core Farm & Ranch business provides consistent growth opportunities throughout market cycles. Rural Utilities Well positioned to benefit from the growing demand for renewable power and generation Agricultural Finance Rural Infrastructure Finance Renewable Energy Relative Size of Volume Opportunity Securitization Pool Purchases Syndications Wholesale Funding Loan Servicing Collateral Value Efficiencies Renewable Energy & Project Finance Rural Broadband Growing Electricity Demand

FARM securitization program exemplifies Farmer Mac’s core mission to lower costs for the end borrower and improve credit availability in rural America, while transforming the agricultural mortgage market industry with new efficiencies Building upon the existing FARM Securitization Program by creating a securitization product for our customers • Utilize the current capability to originate new types of eligible loans into a conduit that de-risks the sector • Creates new financing for borrowers and expands sources of revenue for Farmer Mac 16 AGRICULTURAL MORTGAGE-BACKED SECURITIES OPPORTUNITY Farmers & Ranchers Originators Farmer Mac (Mortgage Loan Seller & Guarantor) FARM Program Mortgage Trust (Securitization Issuing Entity) Senior Guaranteed (A) Tranche Subordinated Unguaranteed (B) Tranche

17 FARMER MAC USES PROVEN, RIGOROUS UNDERWRITING Industry-leading credit requirements • Total debt coverage ratio of at least 1.25x • LTVs average 40% to 45% on mortgages purchased • Minimum borrower net equity of 50% Credits are less likely to default • Focus on repayment capacity through stressed inputs • Not a “ ender o ast resort” • Farm Credit Administration is our safety and soundness regulator Losses less likely even in default • Average portfolio LTV of 45% as of September 30, 2024 • Land values need to decline >55% to generate material losses across Agricultural Finance mortgage loans portfolio • “ tress scenario” osses of 17% to 48% • 1980s crisis saw land value declines of ~23%(3)

-0.10% 0.00% 0.10% 0.20% 0.30% 0.40% 0.50% 0.60% 0.70% 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 C H A R G E -O F F S A S % O F A S S E T S Agricultural Lender Charge-off Rates Banks Farm Credit System Farmer Mac 18 CREDIT CONSISTENTLY OUTPERFORMS 0.58% 1.26% 0.51% 0.00% 1.00% 2.00% 3.00% FY01 FY02 FY03 FY04 FY05 FY06 FY07 FY08 FY09 FY10 FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20 FY21 FY22 FY23 3Q24 90-Day Delinquencies Industry 90-Day Delinquencies Farmer Mac 90-Day Delinquencies (Agricultural Finance Mortgage Loans Portfolio Only) Farmer Mac 90-Day Delinquences (Total Portfolio) All Commercial Banks Loans and Leases Average 0.87%(8) Banks Average: 0.16% Farm Credit System Average: 0.09% Farmer Mac Average: 0.02% (4) (5) (6)(7) (8) (9)

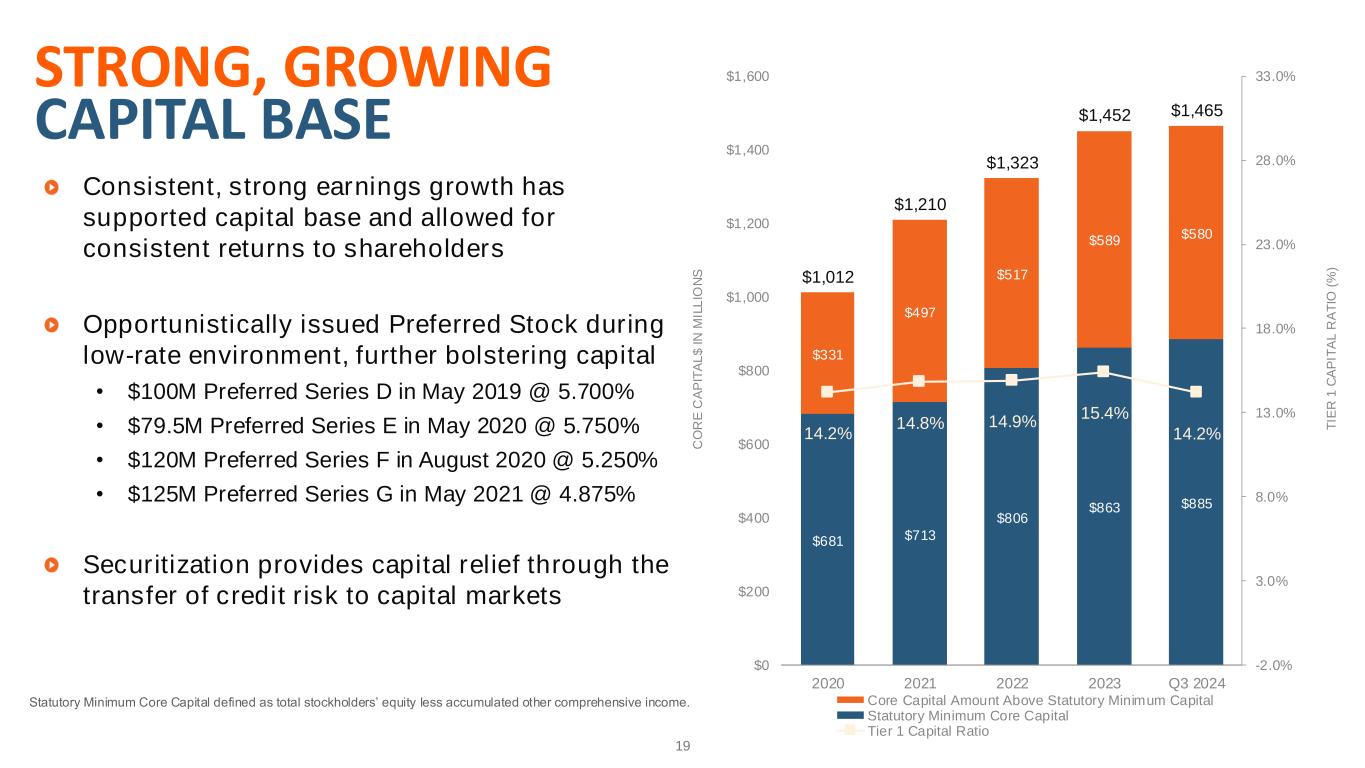

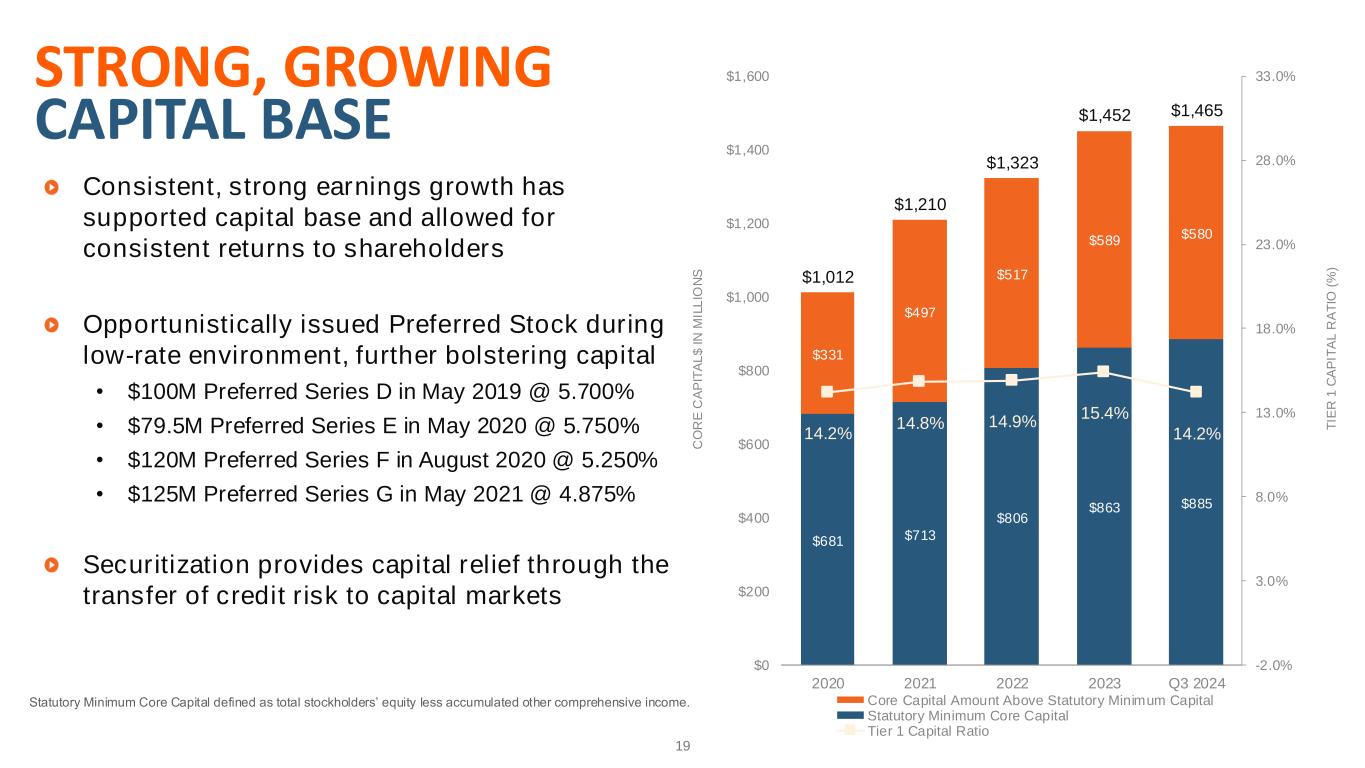

Consistent, strong earnings growth has supported capital base and allowed for consistent returns to shareholders Opportunistically issued Preferred Stock during low-rate environment, further bolstering capital • $100M Preferred Series D in May 2019 @ 5.700% • $79.5M Preferred Series E in May 2020 @ 5.750% • $120M Preferred Series F in August 2020 @ 5.250% • $125M Preferred Series G in May 2021 @ 4.875% Securitization provides capital relief through the transfer of credit risk to capital markets 19 STRONG, GROWING CAPITAL BASE tat tory Minim m Core Ca ita de ined as tota stock o ders’ eq ity ess acc m ated ot er com re ensive income $681 $713 $806 $863 $885 $331 $497 $517 $589 $580 $1,012 $1,210 $1,323 $1,452 $1,465 14.2% 14.8% 14.9% 15.4% 14.2% -2.0% 3.0% 8.0% 13.0% 18.0% 23.0% 28.0% 33.0% $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 2020 2021 2022 2023 Q3 2024 T IE R 1 C A P IT A L R A T IO ( % ) C O R E C A P IT A L $ I N M IL L IO N S Core Capital Amount Above Statutory Minimum Capital Statutory Minimum Core Capital Tier 1 Capital Ratio

KEY METRICS 20 26% 27% 29% 29% 27% 23% 24% 25% 26% 27% 28% 29% 30% 31% 2019 2020 2021 2022 2023 Operating Efficiency Maintain Efficiency Ratio Below 30% 17% 16% 16% 16% 19% 0% 5% 10% 15% 20% 25% 2019 2020 2021 2022 2023 Return on Common Equity Return on Common Equity greater than 14% • 185 employees managing nearly $30 billion in assets, as of 2023 year-end • Earnings greater than $900,000 per employee, as of 2023 year-end • Greater than 90% of total revenues are recurring net effective spread and fees • Strong returns enable consistent dividend growth

21 QUALITY EARNINGS DRIVE STRONG DIVIDENDS Strong earnings and consistent capital position support continued dividend growth for Farmer Mac. • armer Mac’s dividend growt rate over t e ast years is substantially greater than those seen from the two major market indices. • 2024 marks the 13th consecutive year of higher annual dividends for Farmer Mac. • Farmer Mac is committed to strong returns and responsible growth. Dividend Yield1 13 Yr. Dividend CAGR Farmer Mac 2.83% 29.21% S&P 500 1.28% 8.98% Russell 2000 1.41% 10.13% $0.05 $0.10 $0.12 $0.14 $0.16 $0.26 $0.36 $0.58 $0.70 $0.80 $0.88 $0.95 $1.10 $1.40 $0.00 $0.20 $0.40 $0.60 $0.80 $1.00 $1.20 $1.40 $1.60 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 $ P E R S H A R E Quarterly Dividend per Common Share 27% year-over-year increase in 2024 Increased quarterly dividend payments for 13 consecutive years 1. Dividend yield data as of 9/30/2024

WHY INVEST IN FARMER MAC? 22 Uniquely Positioned Focused on Growth Value Creation Consistent performance with a dedication to strategic initiatives and organizational alignment. Well-positioned to benefit from the growing agricultural mortgage market, strong demand for renewable energy projects, and agricultural mortgage-backed securities. A New York Stock Exchange Listed Government Sponsored Enterprise (GSE) that provides investors the unique opportunity to invest in American agriculture and rural infrastructure.

APPENDIX

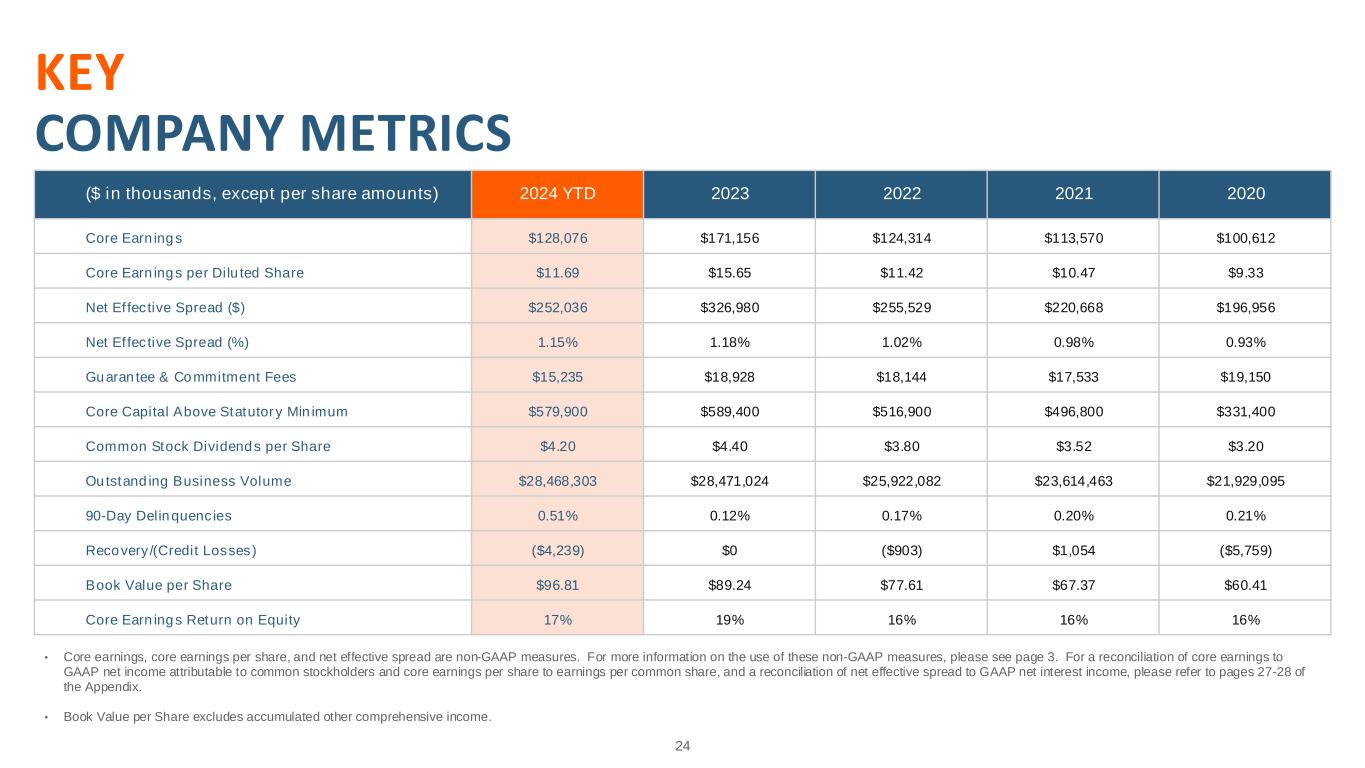

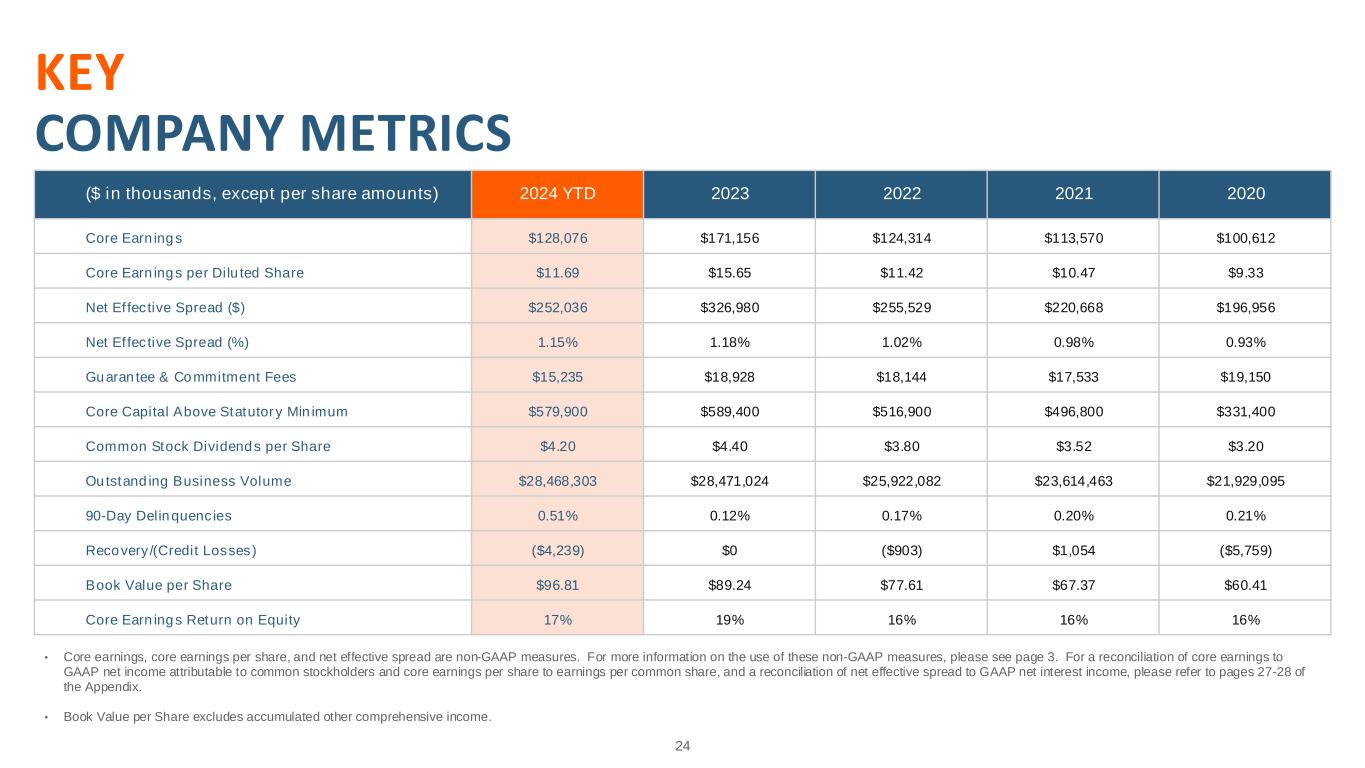

24 KEY COMPANY METRICS ($ in thousands, except per share amounts) 2024 YTD 2023 2022 2021 2020 Core Earnings $128,076 $171,156 $124,314 $113,570 $100,612 Core Earnings per Diluted Share $11.69 $15.65 $11.42 $10.47 $9.33 Net Effective Spread ($) $252,036 $326,980 $255,529 $220,668 $196,956 Net Effective Spread (%) 1.15% 1.18% 1.02% 0.98% 0.93% Guarantee & Commitment Fees $15,235 $18,928 $18,144 $17,533 $19,150 Core Capital Above Statutory Minimum $579,900 $589,400 $516,900 $496,800 $331,400 Common Stock Dividends per Share $4.20 $4.40 $3.80 $3.52 $3.20 Outstanding Business Volume $28,468,303 $28,471,024 $25,922,082 $23,614,463 $21,929,095 90-Day Delinquencies 0.51% 0.12% 0.17% 0.20% 0.21% Recovery/(Credit Losses) ($4,239) $0 ($903) $1,054 ($5,759) Book Value per Share $96.81 $89.24 $77.61 $67.37 $60.41 Core Earnings Return on Equity 17% 19% 16% 16% 16% • Core earnings, core earnings per share, and net effective spread are non-GAAP measures. For more information on the use of these non-GAAP measures, please see page 3. For a reconciliation of core earnings to GAAP net income attributable to common stockholders and core earnings per share to earnings per common share, and a reconciliation of net effective spread to GAAP net interest income, please refer to pages 27-28 of the Appendix. • Book Value per Share excludes accumulated other comprehensive income.

25 EQUITY CAPITAL STRUCTURE • Common stock dividend annualized divided by quarter-end closing price. • Par value of annual dividend for preferred stock. Summary Stratifications NYSE Ticker Dividend Yield Shares Outstanding COMMON STOCK CLASS A VOTING COMMON STOCK • wners i restricted to non-Farm Credit System financial institutions AGM.A 3.91% 1.0 million CLASS B VOTING COMMON STOCK • wners i restricted to arm Credit ystem instit tions – – 0.5 million CLASS C NON-VOTING COMMON STOCK • No owners i restrictions AGM 2.99% 9.4 million PREFERRED STOCK SERIES D NON-CUMULATIVE PREFERRED STOCK • tion to redeem on any ayment date on or a ter y 7, 4 • edem tion Va e: er s are AGM.PR.D 5.700% 4.0 million SERIES E NON-CUMULATIVE PREFERRED STOCK • tion to redeem on any ayment date on or a ter y 7, • edem tion Va e: er s are AGM.PR.E 5.750% 3.2 million SERIES F NON-CUMULATIVE PREFERRED STOCK • tion to redeem on any ayment date on or a ter ctober 8, • edem tion Va e: er s are AGM.PR.F 5.250% 4.8 million SERIES G NON-CUMULATIVE PREFERRED STOCK • tion to redeem on any ayment date on or a ter y 7, 6 • edem tion Va e: er s are AGM.PR.G 4.875% 5.0 million

26 FUNDING Finance asset purchases with proceeds of debt issuances: • 30 dealers • Match-funding provides for stable net effective spread and immaterial interest rate risk Farmer Mac’s debt securities carry privileges for certain holders: • 20% capital risk weighting • Eligible collateral for Fed advances • Legal investments for many federally supervised financial institutions (banks, etc.) Debt Securities Trade at Narrow Spreads to Comparable Maturity Treasuries Maturity (Years) 3 5 7 10 Spread to Treasury As of September 30, 2024 7 bps 7 bps 27 bps 37 bps

27 RECONCILIATION OF NET INCOME TO CORE EARNINGS (in thousands) 2024 YTD 2023 2022 2021 2020 Net income attributable to common stockholders 129,580$ 172,838$ 150,979$ 111,413$ 94,904$ Less reconciling items: Gains/(Losses) on undesignated financial derivatives due to fair value changes 260 5,142 13,495 (1,430) (1,701) Gains/(Losses) on hedging activities due to fair value changes 5,811 (5,394) 5,343 (1,809) (4,759) (Losses)/gains on trading assets (2) 1,979 (917) (115) 51 Net effects of amortization of premiums/discounts and deferred gains on assets consolidated at fair value 84 175 39 130 58 Net effects of terminations or net settlements on financial derivatives (2,200) 227 15,794 494 1,236 Issuance costs on retirement of preferred stock (1,619) - - - (1,667) Income tax effect related to reconciling items (830) (447) (7,089) 573 1,074 Sub-total 1,504 1,682 26,665 (2,157) (5,708) Core earnings 128,076$ 171,156$ 124,314$ 113,570$ 100,612$ Core Earnings by Period Ended

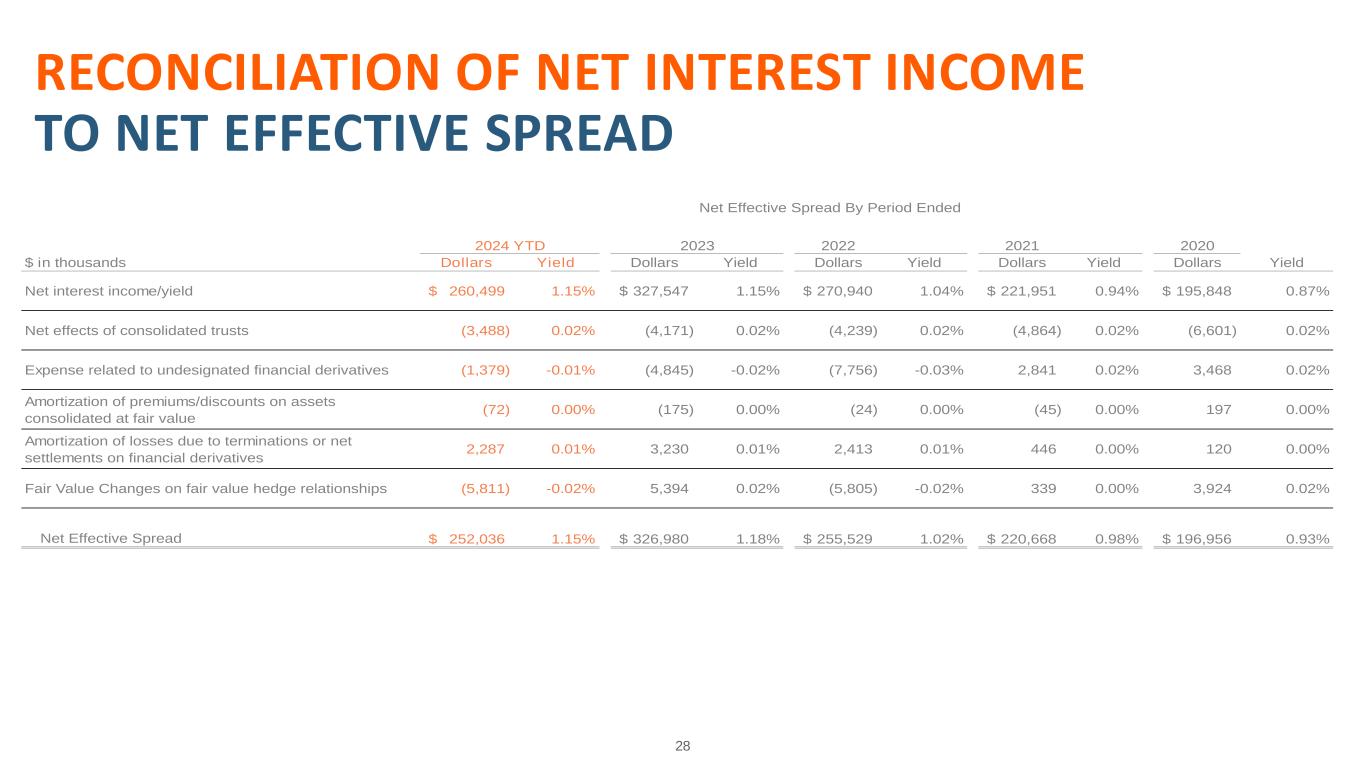

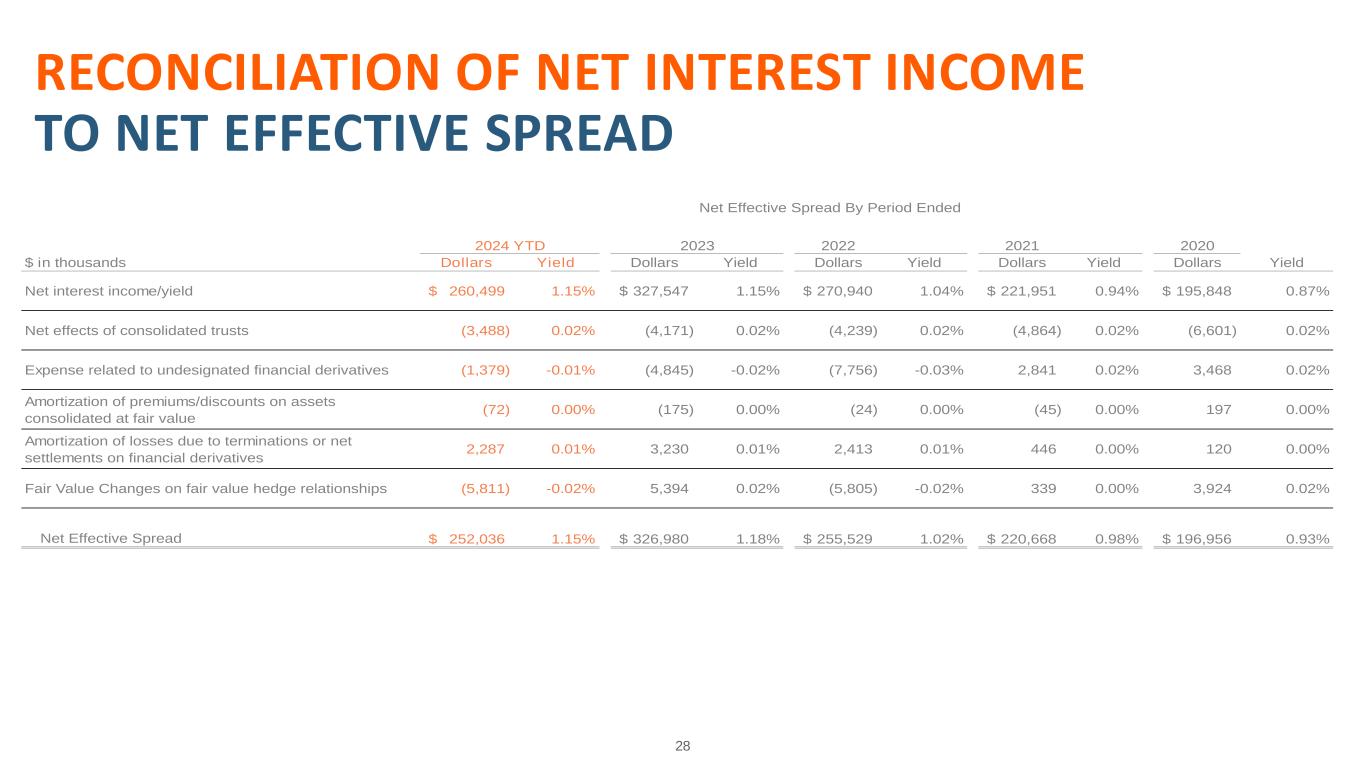

28 RECONCILIATION OF NET INTEREST INCOME TO NET EFFECTIVE SPREAD 2022 2021 2020 $ in thousands Dollars Yield Dollars Yield Dollars Yield Dollars Yield Dollars Yield Net interest income/yield 260,499$ 1.15% 327,547$ 1.15% 270,940$ 1.04% 221,951$ 0.94% 195,848$ 0.87% Net effects of consolidated trusts (3,488) 0.02% (4,171) 0.02% (4,239) 0.02% (4,864) 0.02% (6,601) 0.02% Expense related to undesignated financial derivatives (1,379) -0.01% (4,845) -0.02% (7,756) -0.03% 2,841 0.02% 3,468 0.02% Amortization of premiums/discounts on assets consolidated at fair value (72) 0.00% (175) 0.00% (24) 0.00% (45) 0.00% 197 0.00% Amortization of losses due to terminations or net settlements on financial derivatives 2,287 0.01% 3,230 0.01% 2,413 0.01% 446 0.00% 120 0.00% Fair Value Changes on fair value hedge relationships (5,811) -0.02% 5,394 0.02% (5,805) -0.02% 339 0.00% 3,924 0.02% Net Effective Spread 252,036$ 1.15% 326,980$ 1.18% 255,529$ 1.02% 220,668$ 0.98% 196,956$ 0.93% 2024 YTD Net Effective Spread By Period Ended 2023

29 RESOURCES Footnote 1: USDA Economic Research Service year end 2023 balance sheet (https://data.ers.usda.gov/reports.aspx?ID=17835). Far m Sector Assets and Farm Sector Debt values are values for 2023 from USDA Economic Research Service. Footnote 2: USDA, Economic Research Service U.S. and State-Level Farm Income and Wealth Statistic (https://www.ers.usda.gov/data-products/farm-income-and- wealth-statistics/data-files-us-and-state-level-farm-income-and-wealth-statistics/). Footnote 3: USDA, National Agricultural Statistics Service (as of August 2015). Historic values are not necessarily predictive of future results or outcomes. Footnote 4: FDIC Call Report Data & Farm Credit Funding Corp Annual Information Statements – Non-accrual real estate loans and accruing loans that are 90 days or more past due made by commercial and Farm Credit System banks (as of December 2022). ootnote : e inq encies re ect armer Mac’s gric t ra inance mortgage oan ort o io t at are 9 days or more ast d e , in foreclosure, or in bankruptcy with at least one missed payment, excluding loans performing under either their original loan terms or a court -approved bankruptcy plan. Footnote 6: Kansas City Federal Reserve Agriculture Finance Databook (https://www.kansascityfed.org/agriculture/agfinance -updates/). ootnote 7: Banks’ c arge-off rate is a percentage of agricultural loan assets. ootnote 8: arm Credit Banks nding Cor oration nn a n ormation tatements; arm Credit ystem’s c arge-off rate is the percentage of total loans and guarantees. ootnote 9: armer Mac’s c arge-off rate is the percentage of total loans and guarantees.

30