UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number: | | 811-05770 |

| | | |

| Exact name of registrant as specified in charter: | | Aberdeen Emerging Markets Equity Income Fund, Inc. |

| | | |

| Address of principal executive offices: | | 1900 Market Street, Suite 200 |

| | | Philadelphia, PA 19103 |

| | | |

| Name and address of agent for service: | | Andrea Melia |

| | | abrdn Inc. |

| | | 1900 Market Street Suite 200 |

| | | Philadelphia, PA 19103 |

| | | |

| Registrant’s telephone number, including area code: | | 1-800-522-5465 |

| | | |

| Date of fiscal year end: | | December 31 |

| | | |

| Date of reporting period: | | December 31, 2021 |

Item 1. Reports to Stockholders.

Aberdeen Emerging Markets Equity Income Fund, Inc. (AEF)

Annual Report

December 31, 2021

abrdn.com

Letter to Shareholders (unaudited)

Dear Shareholder,

We present this Annual Report which covers the activities of Aberdeen Emerging Markets Equity Income Fund, Inc. (the "Fund") for the fiscal year ended December 31, 2021. The Fund's investment objective is to seek to provide both current income and long-term capital appreciation.

Total Investment Return1

For the fiscal year ended December 31, 2021, the total return to shareholders of the Fund based on the net asset value ("NAV") and market price of the Fund, respectively, compared to the Fund's current primary benchmark are as follows:

| NAV2,3 | | -1.6% |

| Market Price2 | | 3.3% |

| MSCI Emerging Markets Index (Net Dividends)4 | | -2.5% |

For more information about Fund performance, please see the Report of the Investment Adviser (page x) and Total Investment Returns (page x).

NAV, Market Price and Premium/Discount

The table below represents comparison from current fiscal year end to prior fiscal year end of market price to NAV and associated premium(+)/discount(-).

| | | NAV | | Closing

Market

Price | | Premium(+)/

Discount(-) |

| 12/31/2021 | | $8.70 | | $7.92 | | -9.0% |

| 12/31/2020 | | $9.41 | | $8.16 | | -13.3% |

Throughout the fiscal year ended December 31, 2021, the Fund's NAV was within a range of $8.56 to $10.48 and the Fund's market price was within a range of $7.65 to $9.18 for the same time period. Throughout

the fiscal year ended December 31, 2021, the Fund's shares traded within a range of a premium(+)/discount(-) of -8.2% to -15.9%.

Distribution Policy

On April 20, 2021, the Fund announced it will pay quarterly distributions at an annual rate, that is a percentage of the average daily NAV for the previous three months as of the month-end prior to declaration. The Board determined that the initial annualized rate beginning with the June 2021 distribution is 6.5%. This policy is subject to regular review by the Board.

The policy is expected to provide a steady and sustainable quarterly cash distribution to Fund shareholders that may help reduce any discount to NAV at which the Fund's shares trade. There is no assurance that the Fund will achieve these results.

The distributions will be made from net investment income generated by dividends paid from the Fund's underlying securities and return of capital. As net assets of the Fund may vary from quarter to quarter, the quarterly distribution may represent more or less than one quarter of 6.5% of the Fund's net assets at the time of distribution. Shareholders should not draw any conclusions about the Fund's investment performance from the amount of the distributions or the terms of the Fund's policy.

Credit Facility

On June 22, 2021, the Fund renewed its $55 million revolving credit facility for a 1-year period with The Bank of Nova Scotia. The outstanding balance on the loan as of December 31, 2021 was $55,000,000. Under the terms of the loan facility and applicable regulations, the Fund is required to maintain certain asset coverage ratios for the amount of its outstanding borrowings. The Board regularly reviews the use of leverage by the Fund.

| 1 | Past performance is no guarantee of future results. Investment returns and principal value will fluctuate and shares, when sold, may be worth more or less than original cost. Current performance may be lower or higher than the performance quoted. Net asset value return data include investment management fees, custodial charges and administrative fees (such as Director and legal fees) and assumes the reinvestment of all distributions. |

| 2 | Assuming the reinvestment of all dividends and distributions. |

| 3 | The Fund's total return is based on the reported net asset value ("NAV") for each financial reporting period end and may differ from what is reported on the Financial Highlights due to financial statement rounding or adjustments. |

| 4 | The MSCI Emerging Markets Index (Net Dividends) captures large and mid-cap representation across 26 Emerging Markets (EM) countries. With 1,385 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country. EM countries in the Index are: Argentina, Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Pakistan, Peru, Philippines, Poland, Qatar, Russia, Saudi Arabia, South Africa, Taiwan, Thailand, Turkey and United Arab Emirates. The MSCI Emerging Markets Index (Net Dividends) is calculated net of withholding taxes to which the Fund is generally subject. The Index is unmanaged and has been provided for comparison purposes only. No fees or expenses are reflected. You cannot invest directly in an index. Index performance is not an indication of the performance of the Fund itself. For more information about Fund performance, please visit http://www.aberdeenaef.com. |

| Aberdeen Emerging Markets Equity Income Fund, Inc. | 1 |

Letter to Shareholders (unaudited) (continued)

Open Market Repurchase Program

The Fund's policy is to consider buying back Fund shares on the open market when the Fund trades at a discount to the NAV that is above an established threshold and management believes such repurchases may enhance shareholder value. During the fiscal year ended December 31, 2021, the Fund did not repurchase any shares.

Unclaimed Share Accounts

Please be advised that abandoned or unclaimed property laws for certain states require financial organizations to transfer (escheat) unclaimed property (including Fund shares) to the state. Each state has its own definition of unclaimed property, and Fund shares could be considered "unclaimed property" due to account inactivity (e.g., no owner-generated activity for a certain period), returned mail (e.g., when mail sent to a shareholder is returned to the Fund's transfer agent as undeliverable), or a combination of both. If your Fund shares are categorized as unclaimed, your financial advisor or the Fund's transfer agent will follow the applicable state's statutory requirements to contact you, but if unsuccessful, laws may require that the shares be escheated to the appropriate state. If this happens, you will have to contact the state to recover your property, which may involve time and expense. For more information on unclaimed property and how to maintain an active account, please contact your financial adviser or the Fund's transfer agent.

Portfolio Holdings Disclosure

The Fund's complete schedule of portfolio holdings for the second and fourth quarters of each fiscal year are included in the Fund's semi-annual and annual reports to shareholders. The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (the "SEC") for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. These reports are available on the SEC's website at http://www.sec.gov. The Fund makes the information available to shareholders upon request and without charge by calling Investor Relations toll-free at 1-800-522-5465.

Proxy Voting

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities, and information regarding how the Fund voted proxies relating to portfolio securities during the most recent twelve months ended June 30 is available by August 31 of the relevant year: (i) upon request and without charge by calling Investor Relations toll-free at 1-800-522-5465; and (ii) on the SEC's website at http://www.sec.gov.

COVID-19

Beginning in the first quarter of 2020, the illness caused by a novel coronavirus, COVID-19, has resulted in a global pandemic and major disruption to economies and markets around the world, including the United States. Financial markets have experienced extreme volatility and severe losses. Some sectors of the economy and individual issuers have experienced particularly large losses. These circumstances may continue for an extended period of time, and as a result may affect adversely the value and liquidity of the Fund's investments. The rapid development and fluidity of this situation precludes any prediction as to the ultimate adverse impact of COVID-19 on economic and market conditions, and, as a result, present uncertainty and risk with respect to the Fund and the performance of its investments and ability to pay distributions. The full extent of the impact and effects of COVID-19 will depend on future developments, including, among other factors, the duration and spread of the outbreak, along with related travel advisories, quarantines and restrictions, the recovery time of the disrupted supply chains and industries, the impact of labor market interruptions, the impact of government interventions, and uncertainty with respect to the duration of the global economic slowdown.

LIBOR

Under the revolving credit facility, the Fund is charged interest on amounts borrowed at a variable rate, which may be based on the London Interbank Offered Rate ("LIBOR") plus a spread. In July 2017, the head of the United Kingdom's Financial Conduct Authority ("FCA"), which regulates LIBOR, announced a desire to phase out the use of LIBOR by the end of 2021. However, subsequent announcements by the FCA, the LIBOR administrator and other regulators indicate that it is possible that the most widely used LIBOR rates may continue until mid-2023. It is anticipated that LIBOR ultimately will be discontinued or the regulator will announce that it is no longer sufficiently robust to be representative of its underlying market around that time. In connection with supervisory guidance from regulators, certain regulated entities will cease to enter into certain new LIBOR contracts after January 1, 2022. Although financial regulators and industry working groups have suggested alternative reference rates, such as European Interbank Offered Rate ("EURIBOR"), Sterling Overnight Interbank Average Rate ("SONIA") and Secured Overnight Financing Rate ("SOFR"), global consensus on alternative rates is lacking and the process for amending existing contracts or instruments to transition away from LIBOR remains unclear. The elimination of LIBOR or changes to other reference rates or any other changes or

| 2 | Aberdeen Emerging Markets Equity Income Fund, Inc. |

Letter to Shareholders (unaudited) (concluded)

reforms to the determination or supervision of reference rates could have an adverse impact on the market for, or value of, any securities or payments linked to those reference rates, which may adversely affect the Fund's performance and/or net asset value. Uncertainty and risk also remain regarding the willingness and ability of issuers and lenders to include revised provisions in new and existing contracts or instruments. Consequently, the transition away from LIBOR to other reference rates may lead to increased volatility and illiquidity in markets that are tied to LIBOR, fluctuations in values of LIBOR-related investments or investments in issuers that utilize LIBOR, increased difficulty in borrowing or refinancing and diminished effectiveness of hedging strategies, adversely affecting the Fund's performance. Furthermore, the risks associated with the expected discontinuation of LIBOR and transition may be exacerbated if the work necessary to effect an orderly transition to an alternative reference rate is not completed in a timely manner.

abrdn

abrdn plc, formerly known as Standard Life Aberdeen plc, was renamed on September 27, 2021. In connection with this re-branding, the entities within abrdn plc group, including investment advisory entities, have been or will be renamed in the near future. In addition, the Fund's name is anticipated to be re-branded over the next year.

Investor Relations Information

As part of abrdn's commitment to shareholders, we invite you to visit the Fund on the web at www.aberdeenaef.com. Here, you can view monthly fact sheets, quarterly commentary, distribution and performance information, and other Fund literature.

Enroll in abrdn's email services and be among the first to receive the latest closed-end fund news, announcements, videos and other information. In addition, you can receive electronic versions of important Fund documents including annual reports, semi-annual reports, prospectuses, and proxy statements. Sign up today at https://www.abrdn.com/en-us/cefinvestorcenter/contact-us/preferences.

Contact Us:

| • | Visit: https://www.abrdn.com/en-us/cefinvestorcenter; |

| • | Email: Investor.Relations@abrdn.com; or |

| • | Call: 1-800-522-5465 (toll-free in the U.S.). |

Yours sincerely,

/s/ Christian Pittard

Christian Pittard

President

All amounts are U.S. Dollars unless otherwise stated.

| Aberdeen Emerging Markets Equity Income Fund, Inc. | 3 |

Report of the Investment Adviser (unaudited)

Market/economic review

Emerging-market (EM) equities, as measured by the Morgan Stanley Capital International (MSCI) Emerging Markets Index,1 recorded negative returns in 2021, lagging their developed-market counterparts, as represented by the MSCI World Index.2 Global stock markets got off to a strong start in 2021 following the rollout of COVID-19 vaccines worldwide and optimism over additional U.S. government stimulus spending under President Joe Biden. The markets extended their gains as economies globally reopened and commodity prices rallied. However, investors' risk aversion resurfaced in the second half of the year. The emergence of two COVID-19 variants, Delta and Omicron, prompted renewed lockdowns and fresh travel curbs globally, and stoked concerns about further supply-chain disruptions. Geopolitical tensions and the changing monetary policy environment amid rising inflation also dented investor sentiment. Following its meeting in mid-December 2021, the U.S. Federal Reserve projected three interest rate increases in 2022.3 Several EM central banks, including Brazil, Russia and Mexico, raised their benchmark interest rates to combat rising prices as well.

Across geographical regions, markets in Asia underperformed during the reporting period due to steep losses in China. Aside from persistent tensions with the U.S., Chinese stocks were also hampered by increased regulatory scrutiny across sectors and a resurgence in COVID-19 cases, particularly given the Chinese government's "zero-tolerance" approach. Other headwinds included China's power crunch and slowing economic momentum amid the property market downturn. In our view, monetary policy was a bright spot due to subdued inflation. The People's Bank of China reduced its benchmark lending rate and cut the reserve requirement ratio for banks, while policymakers signaled further action in a bid to stabilize the economy. Conversely, stocks in India rallied over the reporting period, buoyed by the country's vaccine rollout and improving macroeconomic backdrop. Taiwanese equities also performed well on the back of robust semiconductor demand.

Latin America underperformed over the reporting period, with most markets posting negative returns. Brazilian equities declined and the economy entered a technical recession in the third quarter of 2021

following two consecutive quarters of negative growth. Conversely, Mexico bucked the downtrend, lifted by hopes of more U.S. stimulus and investors welcoming interest-rate hikes by Banxico, Mexico's central bank, to counter rising inflation. Elsewhere, markets in the Emerging Europe, Middle East and Africa (EMEA) region outpaced the wider global equity asset class, buoyed largely by elevated energy prices. Russian stocks garnered positive returns over the reporting period despite escalating geopolitical tensions with Ukraine. Turkish equities recorded heavy losses over the reporting period amid political tensions in Turkey.

Fund performance review

Aberdeen Emerging Markets Equity Income Fund returned -1.6%4 on a net asset value basis for the 12-month period ended December 31, 2021, versus the -2.5% return of its benchmark, the MSCI Emerging Markets Index (net dividends).

The Fund's performance relative to the benchmark for the reporting period was bolstered by both stock selection and an underweight allocation to China. Holdings in clean-energy companies were among the main contributors to the Fund's outperformance. Nari Technology Co. Ltd. benefited from its alignment to clean energy objectives and the country's power constraints. China's 14th Five-Year Plan5 underpinned potential for power grid investment and a more aggressive grid upgrade. The Fund's solar energy holdings, Longi Green Energy Technology Co. Ltd. and Sungrow Power Supply Co. Ltd., performed well over the reporting period as investors believed that the companies had attractive long-term outlooks, supported by China's carbon-neutral target. The Fund's holding in battery separator maker Yunnan Energy New Material Co. Ltd. also contributed positively to the relative performance attributable to investors' optimism regarding demand for electric vehicles.

Another significant contributor to the Fund's relative performance for the reporting period was Russian energy giant PJSC Lukoil, which was supported by firm demand and rising oil prices. Returns from across the semiconductor ecosystem further boosted Fund performance. The Fund's positions in ASM International N.V. and ASML Holding N.V., both of which are based in the Netherlands, performed well during

| 1 | The MSCI Emerging Markets Index is an unmanaged index considered representative of stocks of developing countries. Indexes are unmanaged and have been provided for comparison purposes only. No fees or expenses are reflected. You cannot invest directly in an index. |

| 2 | The MSCI World Index is an unmanaged index considered representative of stocks of developed countries. |

| 3 | Source: Economic Projections, U.S. Federal Reserve, December 15, 2021 |

| 4 | Past performance is no guarantee of future results. Investment returns and principal value will fluctuate and shares, when sold, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted. Net asset value return data include investment management fees, custodial charges and administrative fees (such as Director and legal fees) and assumes the reinvestment of all distributions. |

| 5 | The Chinese Communist Party releases new economic plans every five years. The 14th Five-Year Plan runs from 2021 to 2025. |

| | |

| 4 | Aberdeen Emerging Markets Equity Income Fund, Inc. |

Report of the Investment Adviser (unaudited) (concluded)

the reporting period. The holding in Taiwan Semiconductor Manufacturing Co. Ltd. had a positive impact on Fund performance as the company also benefited from the attractive supply-and-demand dynamics for semiconductors. Amid the strength of the semiconductor industry, the lack of exposure to Taiwanese chip supplier MediaTek Inc. detracted from the Fund's relative performance for the reporting period.

On the flipside, positions in Chinese auto maker SAIC Motor Corp. Ltd., which we exited during the reporting period, and electrical appliance manufacturer Midea Group Co. Ltd., were among the most notable detractors from the Fund's relative performance for the reporting period. E-commerce companies were hampered in the fourth quarter of 2021 by investors' anxiety over rising interest rates, intensifying competition, increasing regulation and the rotation away from growth companies. The absence of a position in China-based agriculture-focused technology company Pinduoduo Inc. enhanced Fund performance for the reporting period, though the holdings in two e-commerce companies, Poland-based Allegro and Argentina-domiciled MercadoLibre Inc., weighed on Fund performance as their share prices declined over the reporting period due to investors' concerns about the e-commerce industry. The Fund's holding in South Korean electric vehicle battery maker LG Chem Ltd. was hampered by investors' rotation away from growth stocks.

The Fund's exposure to Hong Kong, which is not a constituent of the benchmark MSCI Emerging Markets Index, weighed on Fund performance for the reporting period, with resort and casino operator Sands China Ltd. among the key laggards. Investor sentiment towards the Macau gaming sector waned as tourist traffic remained lackluster amid ongoing COVID-19-related restrictions, while fears of further regulation added to the uncertainty. Conversely, the holding in Pacific Basin Shipping Ltd., a provider of marine transportation and logistical services, contributed to Fund performance as firm demand for commodities and the recovery in manufacturing activity boosted shipping rates for most of 2021. However, dry bulk freight rates slumped in the fourth quarter of the year, hampered by China's property tightening measures.

The quarterly distribution reflects the Fund's current policy to provide shareholders with a steady and sustainable cash distribution. This policy did not have a significant impact on the Fund's investment strategy over the reporting period. During the 12-month period ended December 31, 2021, the distributions comprised dividend income and

a return of capital. The Fund issued distributions totalling $0.53 per share for the 12-month period ended December 31, 2021.

Outlook

The 2021 calendar year saw stark underperformance and lackluster absolute returns for EM stocks despite a very strong earnings recovery over the year. This has left the EM equity asset class at an extreme relative discount to global developed markets and U.S. equities, which we believe is an indication of a potentially attractive entry point.

Looking ahead, we feel that investors will be pondering how stubborn inflation is likely to be, as they were surprised by its persistence in 2021. With supply-chain pressure easing and stimulus effects fading, we believe that inflation may normalize in 2022, though this should be balanced against rising wages, which may indicate stickier inflation. Bond markets globally are pricing in a significant tightening cycle in the U.S., perhaps overlooking the transitory nature of some inflation-drivers.

In China, we think that further support to the economy is likely during the first quarter of 2022. With muted consumer inflation and a flagging property market, government policymakers have made clear their intentions to support growth. However, the current "zero-tolerance" approach to COVID-19 may be tested by the highly transmissible Omicron variant.

Globally, the investment cycle is turning after years of decline. In our view, green infrastructure should feature heavily in renewed investment, and this is an area in which EM companies are especially prominent. The Fund has several positions that we believe should benefit from these trends, including renewable energy and technology hardware companies.

Aberdeen Asset Managers Limited

Risk Considerations

Past performance is not an indication of future results.

Foreign securities are more volatile, harder to price and less liquid than U.S. securities. They are subject to different accounting and regulatory standards, and political and economic risks. These risks are enhanced in emerging markets countries. Equity stocks of small and mid-cap companies carry greater risk and more volatility than equity stocks of larger, more established companies. Dividends are not guaranteed and a company's future ability to pay dividends may be limited. The use of leverage will also increase market exposure and magnify risk.

| | Aberdeen Emerging Markets Equity Income Fund, Inc. | 5 |

Total Investment Return (unaudited)

The following table summarizes the average annual Fund total investment return compared to the Fund's primary benchmark and Custom Index (as defined below) for the 1-year, 3-year, 5-year and 10-year periods as of December 31, 2021.

| | 1 Year | | 3 Years | | 5 Years | | 10 Years | |

| Net Asset Value (NAV) | | -1.6% | | | 10.2% | | | 9.3% | | | 3.2% | |

| Market Price | | 3.3% | | | 12.2% | | | 10.0% | | | 3.1% | |

| MSCI Emerging Markets Index (Net Dividends) | | -2.5% | | | 10.9% | | | 9.9% | | | 5.5% | |

| Custom AEF Emerging Markets Index1 | | -2.5% | | | 10.9% | | | 9.1% | | | 1.4% | |

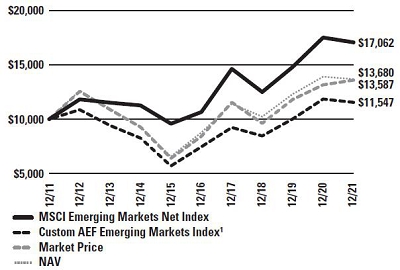

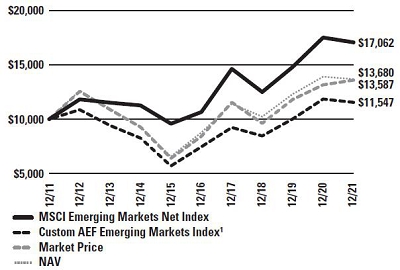

Performance of a $10,000 Investment (as of December 31, 2021)

This graph shows the change in value of a hypothetical investment of $10,000 in the Fund for the period indicated. For comparison, the same investment is shown in the indicated index.

Effective April 30, 2018, Aberdeen Asset Managers Limited ("AAML" or the "Adviser"), the Fund's adviser, entered into an expense limitation agreement with the Fund that is effective through June 30, 2022. Without such waivers and limitation agreements, performance would be lower. AAML had previously entered into a written contract with the Fund to waive certain fees which was terminated on April 30, 2018. Returns represent past performance. Total investment return at NAV is based on changes in the NAV of Fund shares and assumes reinvestment of dividends and distributions, if any, at market prices pursuant to the dividend reinvestment program sponsored by the Fund's transfer agent. All return data at NAV includes fees charged to the Fund, which are listed in the Fund's Statement of Operations under "Expenses." Total investment return at market value is based on changes in the market price at which the Fund's shares traded on the NYSE American during the period and assumes reinvestment of dividends and distributions, if any, at market prices pursuant to the dividend reinvestment program sponsored by the Fund's transfer agent. The Fund's total investment return is based on the reported NAV on the financial reporting period ended December 31, 2021. Because the Fund's shares trade in the stock market based on investor demand, the Fund may trade at a price higher or lower than its NAV. Therefore, returns are calculated based on both market price and NAV. Performance information for periods prior to April 30, 2018 does not reflect the Fund's current strategy. Past performance is no guarantee of future results. The performance information provided does not reflect the deduction of taxes that a shareholder would pay on distributions received from the Fund. The current performance of the Fund may be lower or higher than the figures shown. The Fund's yield, return, market price and NAV will fluctuate. Performance information current to the most recent month-end is available at www.aberdeenaef.com or by calling 800-522-5465.

The total operating expense ratio, excluding fee waivers/recoupment, based on the fiscal year ended December 31, 2021, was 1.27%. The total operating expense ratio, net of fee waivers/recoupment, based on the fiscal year ended December 31, 2021, was 1.31%. The total operating expenses, excluding taxes and interest and revolving credit facility expenses, net of fee waivers/recoupment based on the fiscal year ended December 31, 2021, was 1.21%.

| 1 | The Custom Index reflects the returns of the MSCI Emerging Markets Latin America Index (Net Dividends) for periods prior to April 27, 2018 and the returns of the MSCI Emerging Markets Index (Net Dividends) for periods subsequent to April 30, 2018. The indices and time periods for the Custom Index align with the strategies utilized and benchmark for the Fund during the same time periods. |

| 6 | Aberdeen Emerging Markets Equity Income Fund, Inc. | |

Portfolio Summary (unaudited)

The following table summarizes the sector composition of the Fund's portfolio, in S&P Global Inc.'s Global Industry Classification Standard ("GICS") Sectors, expressed as a percentage of net assets as of December 31, 2021.

| Sectors | As a Percentage of Net Assets | |

| Information Technology | | 36.1% | * |

| Financials | | 19.4% | |

| Consumer Discretionary | | 16.7% | |

| Materials | | 11.6% | |

| Industrials | | 8.5% | |

| Communication Services | | 8.2% | |

| Energy | | 3.6% | |

| Consumer Staples | | 3.3% | |

| Utilities | | 2.5% | |

| Real Estate | | 2.1% | |

| Health Care | | 1.9% | |

| Private Equity | | 0.1% | |

| Short-Term Investment | | 0.7% | |

| Liabilities in Excess of Other Assets | | (14.7)% | |

| | | 100.0% | |

| * | The sectors, as classified by GICS, are comprised of several industries. As of December 31, 2021, the Fund did not have more than 25% of its assets invested in any industry. As of December 31, 2021, the Fund's holdings in the Information Technology sector were allocated to six industries: Semiconductors & Semiconductor Equipment (15.6%), Technology Hardware, Storage Peripherals (9.3%), Information Technology Services (5.6%), Electronic Equipment Instruments & Components (3.9%), Software (1.1%) and Communications Equipment (0.6%). |

The following chart summarizes the composition of the Fund's portfolio by geographic classification expressed as a percentage of net assets as of December 31, 2021.

| Countries | As a Percentage of Net Assets | |

| China | | 35.6% | |

| Taiwan | | 15.5% | |

| India | | 14.7% | |

| South Korea | | 12.8% | |

| Brazil | | 5.8% | |

| Russia | | 5.5% | |

| Mexico | | 4.9% | |

| Hong Kong | | 4.5% | |

| Netherlands | | 2.5% | |

| Indonesia | | 1.8% | |

| Other | | (3.6)% | |

| | | 100.0% | |

| Aberdeen Emerging Markets Equity Income Fund, Inc. | 7 |

Portfolio Summary (unaudited) (concluded)

| Currency Composition | As a Percentage of Net Assets | |

| Hong Kong | | 27.7% | * |

| India | | 14.7% | |

| Taiwan | | 14.5% | |

| South Korea | | 12.8% | |

| China | | 11.7% | |

| United States | | 9.3% | |

| South Africa | | 4.5% | |

| Euro | | 4.0% | |

| Mexico | | 3.6% | |

| Brazil | | 3.3% | |

| Russia | | 2.8% | |

| Indonesia | | 1.8% | |

| Vietnam | | 1.8% | |

| Poland | | 1.5% | |

| Short-Term Investments | | 0.7% | |

| Other Liabilities | | (14.7)% | |

| | | 100.0% | |

* Includes 3.3% H Shares which are Chinese issued securities that trade in Hong Kong dollar

Top Ten Equity Holdings (unaudited)

The following were the Fund's top ten equity holdings as of December 31, 2021:

| Name of Security | As a Percentage of Net Assets | |

| Taiwan Semiconductor Manufacturing Co. Ltd. | | 9.9% | |

| Samsung Electronics Co. Ltd., Pref | | 9.3% | |

| Tencent Holdings Ltd. | | 6.1% | |

| Alibaba Group Holding Ltd. | | 3.6% | |

| Housing Development Finance Corp. Ltd. | | 2.7% | |

| China Merchants Bank Co. Ltd., H Shares | | 2.4% | |

| NARI Technology Co. Ltd., A Shares (Stock Connect) | | 2.0% | |

| Sungrow Power Supply Co. Ltd., A Shares (Stock Connect) | | 1.9% | |

| Grupo Financiero Banorte SAB de CV, Class O | | 1.9% | |

| Hong Kong Exchanges & Clearing Ltd. | | 1.9% | |

| 8 | Aberdeen Emerging Markets Equity Income Fund, Inc. | |

Portfolio of Investments

December 31, 2021

| Shares | Description | | Industry and Percentage

of Net Assets | | Value

(US$) | |

| LONG-TERM INVESTMENTS—114.0% | |

| COMMON STOCKS—102.8% | |

| ARGENTINA—0.7% | |

| 10,250 | Globant SA(a) | | Information Technology Services—0.7% | | $ | 3,219,423 | |

| AUSTRALIA—1.1% | |

| 167,316 | BHP Group PLC | | Metals & Mining—1.1% | | | 4,986,853 | |

| AUSTRIA—1.7% | |

| 298,130 | Mondi PLC | | Paper & Forest Products—1.7% | | | 7,418,958 | |

| BRAZIL—5.8% | |

| 1,188,111 | B3 SA—Brasil Bolsa Balcao | | Capital Markets—0.5% | | | 2,365,985 | |

| 1,592,362 | Banco Bradesco SA | | Banks—1.1% | | | 4,615,801 | |

| 3,562 | MercadoLibre, Inc.(a) | | Internet & Direct Marketing Retail—1.1% | | | 4,803,001 | |

| 1,006,201 | Rumo SA(a) | | Road & Rail—0.7% | | | 3,202,677 | |

| 445,100 | TOTVS SA | | Software—0.5% | | | 2,262,035 | |

| 447,192 | Vale SA, ADR | | Metals & Mining—1.4% | | | 6,269,632 | |

| 367,500 | WEG SA | | Electrical Equipment—0.5% | | | 2,164,632 | |

| | | | 25,683,763 | |

| CHINA—35.6% | |

| 1,091,300 | Alibaba Group Holding Ltd.(a) | | Internet & Direct Marketing Retail—3.6% | | | 16,037,286 | |

| 545,000 | Centre Testing International Group Co. Ltd., A Shares

(Stock Connect)(b) | | Professional Services—0.5% | | | 2,296,923 | |

| 499,300 | China Conch Venture Holdings Ltd. | | Construction & Engineering—0.5% | | | 2,442,194 | |

| 1,337,000 | China Merchants Bank Co. Ltd., H Shares | | Banks—2.4% | | | 10,401,297 | |

| 858,000 | China Resources Gas Group Ltd. | | Gas Utilities—1.1% | | | 4,847,022 | |

| 1,015,500 | China Resources Land Ltd. | | Real Estate Management & Development—1.0% | | | 4,278,907 | |

| 174,700 | China Tourism Group Duty Free Corp. Ltd., A Shares

(Stock Connect)(b) | | Specialty Retail—1.4% | | | 6,022,521 | |

| 682,200 | China Vanke Co. Ltd., H Shares | | Real Estate Management & Development—0.4% | | | 1,588,538 | |

| 381,900 | Estun Automation Co. Ltd., A Shares(b) | | Machinery—0.3% | | | 1,555,431 | |

| 576,800 | GDS Holdings Ltd., Class A(a) | | Information Technology Services—0.8% | | | 3,341,523 | |

| 195,200 | Hangzhou Tigermed Consulting Co. Ltd., H Shares(c) | | Life Sciences Tools & Services—0.6% | | | 2,476,773 | |

| 11,000 | Kweichow Moutai Co. Ltd., A Shares (Stock Connect)(b) | | Beverages—0.8% | | | 3,534,937 | |

| 306,500 | Li Ning Co. Ltd. | | Textiles, Apparel & Luxury Goods—0.8% | | | 3,362,315 | |

| 603,834 | LONGi Green Energy Technology Co. Ltd., A Shares(b) | | Semiconductors & Semiconductor

Equipment—1.8% | | | 8,169,927 | |

| 179,200 | Meituan, B Shares(a)(c) | | Internet & Direct Marketing Retail—1.2% | | | 5,182,011 | |

| 599,886 | Midea Group Co. Ltd., A Shares (Stock Connect)(b) | | Household Durables—1.6% | | | 6,947,017 | |

| 1,373,136 | NARI Technology Co. Ltd., A Shares (Stock Connect)(b) | | Electrical Equipment—2.0% | | | 8,634,255 | |

| 82,042 | Prosus NV(a) | | Internet & Direct Marketing Retail—1.5% | | | 6,795,129 | |

| 345,000 | Shenzhou International Group Holdings Ltd. | | Textiles, Apparel & Luxury Goods—1.5% | | | 6,680,466 | |

| 371,300 | Sungrow Power Supply Co. Ltd., A Shares

(Stock Connect)(b) | | Electrical Equipment—1.9% | | | 8,497,242 | |

| 463,300 | Tencent Holdings Ltd. | | Interactive Media & Services—6.1% | | | 27,034,066 | |

| 489,500 | Wuxi Biologics Cayman, Inc.(a)(c) | | Life Sciences Tools & Services—1.3% | | | 5,795,139 | |

| 456,898 | Yonyou Network Technology Co. Ltd., A Shares(b) | | Software—0.6% | | | 2,572,401 | |

| 95,368 | Yunnan Energy New Material Co. Ltd., A Shares

(Stock Connect)(b) | | Containers & Packaging—0.8% | | | 3,742,592 | |

| 643,500 | Zhongsheng Group Holdings Ltd. | | Specialty Retail—1.1% | | | 5,021,419 | |

| | | | 157,257,331 | |

| Aberdeen Emerging Markets Equity Income Fund, Inc. | 9 |

Portfolio of Investments (continued)

December 31, 2021

| Shares | Description | Industry and Percentage

of Net Assets | Value

(US$) | |

| LONG-TERM INVESTMENTS (continued) | |

| COMMON STOCKS (continued) | |

| HONG KONG—4.5% | |

| 513,800 | AIA Group Ltd. | Insurance—1.2% | $ | 5,185,702 | |

| 142,032 | Hong Kong Exchanges & Clearing Ltd. | Capital Markets—1.9% | | 8,306,594 | |

| 17,156,000 | Pacific Basin Shipping Ltd. | Marine—1.4% | | 6,306,743 | |

| | | 19,799,039 | |

| INDIA—14.7% | |

| 117,600 | Godrej Properties Ltd.(a) | Real Estate Management & Development—0.7% | | 2,955,038 | |

| 162,683 | Hindustan Unilever Ltd. | Personal Products—1.2% | | 5,151,669 | |

| 336,800 | Housing Development Finance Corp. Ltd. | Thrifts & Mortgage Finance—2.6% | | 11,655,448 | |

| 43,000 | Info Edge India Ltd. | Interactive Media & Services—0.7% | | 3,210,267 | |

| 276,000 | Infosys Ltd. | Information Technology Services—1.6% | | 7,009,339 | |

| 232,206 | Kotak Mahindra Bank Ltd. | Banks—1.3% | | 5,594,678 | |

| 42,467 | Maruti Suzuki India Ltd. | Automobiles—1.0% | | 4,224,254 | |

| 2,258,666 | Power Grid Corp. of India Ltd. | Electric Utilities—1.4% | | 6,201,218 | |

| 412,000 | SBI Life Insurance Co. Ltd.(c) | Insurance—1.5% | | 6,600,921 | |

| 117,551 | Tata Consultancy Services Ltd. | Information Technology Services—1.3% | | 5,898,433 | |

| 61,000 | UltraTech Cement Ltd. | Construction Materials—1.4% | | 6,223,204 | |

| | | 64,724,469 | |

| INDONESIA—1.8% | |

| 23,671,586 | Bank Rakyat Indonesia Persero Tbk PT | Banks—1.5% | | 6,815,667 | |

| 37,693,900 | Sepatu Bata Tbk PT(a) | Textiles, Apparel & Luxury Goods—0.3% | | 1,301,203 | |

| | | 8,116,870 | |

| KAZAKHSTAN—1.0% | |

| 37,297 | Kaspi.KZ JSC., GDR(c) | Consumer Finance—1.0% | | 4,326,452 | |

| MACAO—0.8% | |

| 1,538,800 | Sands China Ltd.(a) | Hotels, Restaurants & Leisure—0.8% | | 3,571,242 | |

| MEXICO—4.9% | |

| 32,887 | Fomento Economico Mexicano SAB de CV, ADR | Beverages—0.6% | | 2,555,649 | |

| 55,318 | Grupo Aeroportuario del Centro Norte SAB de CV, ADR | Transportation Infrastructure—0.7% | | 2,970,023 | |

| 1,302,445 | Grupo Financiero Banorte SAB de CV, Class O | Banks—1.9% | | 8,470,934 | |

| 1,709,701 | Grupo Mexico SAB de CV, Class B | Metals & Mining—1.7% | | 7,453,196 | |

| | | 21,449,802 | |

| NETHERLANDS—2.5% | |

| 8,821 | ASM International NV | Semiconductors & Semiconductor

Equipment—0.9% | | 3,893,743 | |

| 8,717 | ASML Holding NV | Semiconductors & Semiconductor

Equipment—1.6% | | 6,982,490 | |

| | | 10,876,233 | |

| POLAND—1.5% | |

| 358,589 | Allegro.eu SA(a)(c) | Internet & Direct Marketing Retail—0.8% | | 3,452,000 | |

| 32,200 | Dino Polska SA(a)(c) | Food & Staples Retailing—0.7% | | 2,935,374 | |

| | | 6,387,374 | |

| 10 | Aberdeen Emerging Markets Equity Income Fund, Inc. | |

Portfolio of Investments (continued)

December 31, 2021

| Shares | | Description | Industry and Percentage

of Net Assets | Value

(US$) | |

| LONG-TERM INVESTMENTS (continued) | |

| COMMON STOCKS (continued) | |

| RUSSIA—5.5% | |

| 97,468 | | LUKOIL PJSC, ADR | Oil, Gas & Consumable Fuels—2.0% | $ | 8,736,864 | |

| 314,849 | | Novatek PJSC | Oil, Gas & Consumable Fuels—1.6% | | 7,188,405 | |

| 1,346,063 | | Sberbank of Russia PJSC | Banks—1.2% | | 5,263,844 | |

| 39,148 | | TCS Group Holding PLC | Banks—0.7% | | 3,300,170 | |

| | | 24,489,283 | |

| SOUTH AFRICA—1.7% | |

| 65,908 | | Anglo American Platinum Ltd. | Metals & Mining—1.7% | | 7,517,277 | |

| SOUTH KOREA—1.7% | |

| 21,215 | | Kakao Corp. | Interactive Media & Services—0.4% | | 2,003,380 | |

| 10,291 | | Samsung SDI Co. Ltd. | Electronic Equipment Instruments &

Components—1.3% | | 5,659,761 | |

| | | 7,663,141 | |

| TAIWAN—15.5% | |

| 266,000 | | Accton Technology Corp. | Communications Equipment—0.6% | | 2,492,472 | |

| 397,000 | | Chroma ATE, Inc. | Electronic Equipment Instruments &

Components—0.7% | | 2,863,023 | |

| 281,000 | | Delta Electronics, Inc. | Electronic Equipment Instruments &

Components—0.6% | | 2,788,134 | |

| 182,000 | | Globalwafers Co. Ltd. | Semiconductors & Semiconductor

Equipment—1.3% | | 5,830,583 | |

| 1,626,000 | | Hon Hai Precision Industry Co. Ltd. | Electronic Equipment Instruments &

Components—1.4% | | 6,097,725 | |

| 19,692 | | Sea Ltd., ADR(a) | Entertainment—1.0% | | 4,405,298 | |

| 1,980,000 | | Taiwan Semiconductor Manufacturing Co. Ltd. | Semiconductors & Semiconductor

Equipment—9.9% | | 43,799,569 | |

| | | 68,276,804 | |

| VIETNAM—1.8% | |

| 1,310,000 | | FPT Corp. | Information Technology Services—1.2% | | 5,341,639 | |

| 1,225,000 | | Vietnam Technological & Commercial Joint

Stock Bank(a) | Banks—0.6% | | 2,685,991 | |

| | | 8,027,630 | |

| | | Total Common Stocks | | | 453,791,944 | |

| PREFERRED STOCKS—11.1% | |

| SOUTH KOREA—11.1% | |

| 33,356 | | LG Chem Ltd., Pref | Chemicals—1.8% | | 8,048,374 | |

| 688,771 | | Samsung Electronics Co. Ltd., Pref | Technology Hardware, Storage &

Peripherals—9.3% | | 41,178,628 | |

| | | 49,227,002 | |

| | | Total Preferred Stocks | | | 49,227,002 | |

| PRIVATE EQUITY—0.1% | |

| GLOBAL—0.0%* | |

| 11,723,413 | (d) | Emerging Markets Ventures I, L.P.(a)(e)(f)(g)(h)(i) | Private Equity— –% | | 1,759 | |

| Aberdeen Emerging Markets Equity Income Fund, Inc. | 11 |

Portfolio of Investments (concluded)

December 31, 2021

| Shares | Description | Industry and Percentage

of Net Assets | Value

(US$) | |

| LONG-TERM INVESTMENTS (continued) | |

| PRIVATE EQUITY (continued) | |

| ISRAEL—0.1% | |

| 3,349,175 | (d) | BPA Israel Ventures, LLC(a)(e)(f)(g)(h)(i)(j) | Private Equity— –% | $ | 50,405 | |

| 108,960 | | Exent Technologies Ltd. Preferred A1 Shares(a)(e)(f)(h)(i)(k) | Private Equity— –% | | – | |

| 93,456 | | Exent Technologies Ltd. Preferred C Shares(a)(e)(f)(h)(i)(k) | Private Equity— –% | | – | |

| 23,574 | | Exent Technologies Ltd. Warrants A1(a)(e)(f)(h)(i)(k) | Private Equity— –% | | – | |

| 1,522,368 | (d) | Neurone Ventures II, L.P.(a)(e)(f)(h)(i)(j) | Private Equity—0.1% | | 206,418 | |

| 2,400,000 | | Telesoft Partners II QP, L.P.(a)(e)(h)(i)(j)(l) | Private Equity— –% | | 119,328 | |

| | | 376,151 | |

| | | Total Private Equity | | 377,910 | |

| | | Total Long-Term Investments—114.0% (cost $440,512,010) | | 503,396,856 | |

| Shares | Description | Value

(US$) | |

| SHORT-TERM INVESTMENT—0.7% | |

| UNITED STATES—0.7% | |

| 3,295,215 | | State Street Institutional U.S. Government Money Market Fund, Premier Class, 0.03%(m) | | 3,295,215 | |

| | Total Short-Term Investment—0.7% (cost $3,295,215) | | 3,295,215 | |

| | Total Investments—114.7% (cost $443,807,225)(n) | | 506,692,071 | |

| | Liabilities in Excess of Other Assets—(14.7)% | | (65,115,816 | ) |

| | Net Assets—100.0% | $ | 441,576,255 | |

| (a) | Non-income producing security. |

| (b) | China A Shares. These shares are issued in local currency, traded in the local stock markets and are held through either a Qualified Foreign Institutional Investor (QFII) license or the Shanghai or Shenzhen Hong-Kong Stock Connect program. |

| (c) | Denotes a security issued under Regulation S or Rule 144A. |

| (d) | Represents contributed capital. |

| (f) | Considered in liquidation by the Fund's Adviser. |

| (g) | As of December 31, 2021, the aggregate amount of open commitments for the Fund is $2,806,782. |

| (h) | Fair Valued Security. Fair Values are determined pursuant to procedures approved by the Fund's Board of Directors. Unless otherwise noted, securities are valued by applying valuation factors to the exchange traded price. See Note 2(a) of the accompanying Notes to Financial Statements. |

| (i) | Restricted security, not readily marketable. See Note 2(b) of the accompanying Notes to Financial Statements. |

| (j) | Fund of Fund investment. |

| (l) | Considered active investments by the Fund's Adviser. |

| (m) | Registered investment company advised by State Street Global Advisors. The rate shown is the 7 day yield as of December 31, 2021. |

| (n) | See accompanying Notes to Financial Statements for tax unrealized appreciation/(depreciation) of securities. |

| * | "Global" is the percentage attributable to the Fund's holdings in a private equity fund which invests globally and is not categorized under a particular country. |

ADR—American Depositary Receipt

GDR—Global Depositary Receipt

PLC—Public Limited Company

See accompanying Notes to Financial Statements.

| 12 | Aberdeen Emerging Markets Equity Income Fund, Inc. | |

Statement of Assets and Liabilities

As of December 31, 2021

| Assets | |

| Investments, at value (cost $440,512,010) | | | $ 503,396,856 | | |

| Short-term investments, at value (cost $3,295,215) | | | 3,295,215 | | |

| Foreign currency, at value (cost $236,222) | | | 236,567 | | |

| Interest and dividends receivable | | | 778,896 | | |

| Receivable for investments sold | | | 185,350 | | |

| Tax reclaim receivable | | | 53,097 | | |

| Prepaid expenses | | | 59,668 | | |

| Prepaid expenses in connection with revolving credit facility (Note 7) | | | 13,379 | | |

| Total assets | | | 508,019,028 | | |

| Liabilities | | | | | |

| Revolving credit facility payable (Note 7) | | | 55,000,000 | | |

| Dividends payable to common shareholders | | | 7,612,767 | | |

| Deferred foreign capital gains tax(Note 2h) | | | 1,978,590 | | |

| Investment advisory fees payable (Note 3) | | | 1,223,390 | | |

| Administration fees payable (Note 3) | | | 93,533 | | |

| Director fees payable | | | 53,250 | | |

| Interest payable on revolving credit facility | | | 35,841 | | |

| Investor relations fees payable (Note 3) | | | 34,030 | | |

| Other accrued expenses | | | 411,372 | | |

| Total liabilities | | | 66,442,773 | | |

| | | | | | |

| Net Assets | | | $ 441,576,255 | | |

| Composition of Net Assets: | | | | | |

| Common stock (par value $.001 per share) (Note 5) | | | $ 50,752 | | |

| Paid-in capital in excess of par | | | 434,393,511 | | |

| Distributable earnings | | | 7,131,992 | | |

| Net Assets | | | $ 441,576,255 | | |

| Net asset value per share based on 50,751,778 shares issued and outstanding | | | $ 8.70 | | |

See Notes to Financial Statements.

| | Aberdeen Emerging Markets Equity Income Fund, Inc. | 13 |

Statement of Operations

For the Year Ended December 31, 2021

| Net Investment Income: | | | | |

| Income | | | | |

| Dividends and other income (net of foreign withholding taxes of $1,748,503) | | $ 14,392,711 | | |

| Total Investment Income | | 14,392,711 | | |

| Expenses: | | | | |

| Investment advisory fee (Note 3) | | 4,188,403 | | |

| Administration fee (Note 3) | | 394,075 | | |

| Custodian's fees and expenses | | 269,961 | | |

| Directors' fees and expenses | | 213,000 | | |

| Investor relations fees and expenses (Note 3) | | 114,273 | | |

| Legal fees and expenses | | 81,189 | | |

| Independent auditors' fees and expenses | | 74,273 | | |

| Reports to shareholders and proxy solicitation | | 72,506 | | |

| Insurance expense | | 63,960 | | |

| Transfer agent's fees and expenses | | 35,766 | | |

| Miscellaneous | | 216,018 | | |

| Total expenses before reimbursed/waived expenses | | 5,723,424 | | |

| Interest and revolving credit facility expenses (Note 7) | | 509,557 | | |

| Total expenses | | 6,232,981 | | |

| Recoupment of expenses previously reimbursed (Note 3) | | 225,047 | | |

| Net expenses | | 6,458,028 | | |

| | | | | |

| Net Investment Income | | 7,934,683 | | |

| Net Realized/Unrealized Gain/(Loss) from Investments and Foreign Currency Related Transactions: | | | | |

| Net realized gain/(loss) from: | | | | |

| Investment transactions | | 2,365,608 | | |

| Foreign currency transactions | | (247,851 | ) | |

| | | 2,117,757 | | |

| Net change in unrealized appreciation/(depreciation) on: | | | | |

| Investments (including $1,141,488 change in deferred capital gains tax) | | (18,896,608 | ) | |

| Foreign currency translation | | (1,759 | ) | |

| | | (18,898,367 | ) | |

| Net realized and unrealized (loss) from investments and foreign currency translations | | (16,780,610 | ) | |

| Net Decrease in Net Assets Resulting from Operations | | $ (8,845,927 | ) | |

Amounts listed as "–" are $0 or round to $0.

See Notes to Financial Statements.

| 14 | Aberdeen Emerging Markets Equity Income Fund, Inc. | |

Statements of Changes in Net Assets

| | | For the Year Ended December 31, 2021 | | | | For the

Year Ended

December 31, 2020 | | |

| Increase/(Decrease) in Net Assets: | | | | | | | | |

| Operations: | | | | | | | | |

| Net investment income | | $ 7,934,683 | | | | $ 11,570,190 | | |

| Net realized gain/(loss) from investment and foreign currency related transactions | | 2,117,757 | | | | (26,533,210 | ) | |

| Net change in unrealized appreciation on investments and foreign currency translation | | (18,898,367 | ) | | | 67,049,130 | | |

| Net increase/(decrease) in net assets resulting from operations | | (8,845,927 | ) | | | 52,086,110 | | |

| Distributions to Shareholders From: | | | | | | | | |

| Distributable earnings | | (11,561,960 | ) | | | (13,943,039 | ) | |

| Tax return of capital | | (15,488,739 | ) | | | – | | |

| Net decrease in net assets from distributions | | (27,050,699 | ) | | | (13,943,039 | ) | |

| Change in net assets resulting from operations | | (35,896,626 | ) | | | 38,143,071 | | |

| Net Assets: | | | | | | | | |

| Beginning of year | | 477,472,881 | | | | 439,329,810 | | |

| End of year | | $ 441,576,255 | | | | $ 477,472,881 | | |

See Notes to Financial Statements.

| Aberdeen Emerging Markets Equity Income Fund, Inc. | 15 |

Financial Highlights

| | | | For the Fiscal Years Ended December 31, | | |

| | | | 2021 | | | | 2020 | | | | 2019 | | | | 2018(a)(b) | | | | 2017 | | |

| PER SHARE OPERATING PERFORMANCE(c): | |

| Net asset value per common share, beginning of year | | | $ 9.41 | | | | $ 8.66 | | | | $ 7.37 | | | | $ 9.99 | | | | $ 7.80 | | |

| Net investment income | | | 0.16 | | | | 0.23 | | | | 0.23 | | | | 0.19 | | | | 0.10 | | |

| Net realized and unrealized gains/(losses) on investments and foreign currency transactions | | | (0.34 | ) | | | 0.79 | | | | 1.21 | | | | (1.36 | ) | | | 2.23 | | |

| Total from investment operations applicable to common shareholders | | | (0.18 | ) | | | 1.02 | | | | 1.44 | | | | (1.17 | ) | | | 2.33 | | |

| Dividends and distributions to common shareholders from: | |

| Net investment income | | | (0.22 | ) | | | (0.27 | ) | | | (0.17 | ) | | | (0.13 | ) | | | (0.14 | ) | |

| Net realized gains | | | – | | | | – | | | | – | | | | (1.36 | ) | | | – | | |

| Tax return of capital | | | (0.31 | ) | | | – | | | | – | | | | – | | | | – | | |

| Total distributions | | | (0.53 | ) | | | (0.27 | ) | | | (0.17 | ) | | | (1.49 | ) | | | (0.14 | ) | |

| Capital Share Transactions: | |

| Impact of open market repurchase program (Note 6) | | | – | | | | – | | | | – | | | | 0.01 | | | | – | | |

| Impact due to tender offer | | | – | | | | – | | | | 0.02 | | | | 0.03 | | | | – | | |

| Total capital share transactions | | | – | | | | – | | | | 0.02 | | | | 0.04 | | | | – | | |

| Net asset value per common share, end of year | | | $ 8.70 | | | | $ 9.41 | | | | $ 8.66 | | | | $ 7.37 | | | | $ 9.99 | | |

| Market value, end of year | | | $ 7.92 | | | | $ 8.16 | | | | $ 7.62 | | | | $ 6.35 | | | | $ 9.15 | | |

| Total Investment Return Based on(d): | |

| Market value | | | 3.27 | % | | | 11.42 | % | | | 22.80 | % | | | (16.72 | %) | | | 37.05 | % | |

| Net asset value | | | (1.63 | %) | | | 13.06 | % | | | 20.25 | % | | | (10.38 | %) | | | 30.05 | % | |

| Ratio to Average Net Assets/Supplementary Data: | | |

| Net assets, end of year (000 omitted) | | | $ 441,576 | | | | $ 477,473 | | | | $ 439,330 | | | | $ 440,819 | | | | $ 217,187 | | |

| Average net assets (000 omitted) | | | $ 492,593 | | | | $ 390,881 | | | | $ 442,354 | | | | $ 445,001 | | | | $ 203,477 | | |

| Total expenses, net of fee waivers/recoupment(d) | | | 1.31 | % | | | 1.44 | % | | | 1.54 | % | | | 1.55 | %(e)(f) | | | 1.68 | %(e)(f) | |

| Total expenses, excluding fee waivers/recoupment(d) | | | 1.27 | % | | | 1.44 | % | | | 1.57 | % | | | 1.56 | %(e)(f) | | | 1.70 | %(e)(f) | |

| Total expenses, excluding taxes net of fee waivers/recoupment | | | 1.31 | % | | | 1.44 | % | | | 1.54 | % | | | 1.45 | %(f) | | | 1.32 | % | |

| Total expenses, excluding taxes and interest and revolving credit facility expenses, net of fee waivers/recoupment | | | 1.21 | % | | | 1.27 | % | | | 1.19 | % | | | 1.25 | %(f) | | | – | (g) | |

| Net investment income(e) | | | 1.61 | % | | | 2.96 | % | | | 2.92 | % | | | 2.24 | %(e) | | | 1.03 | %(e) | |

| Portfolio turnover | | | 49.88 | % | | | 21.03 | % | | | 13.26 | % | | | 145.10 | %(h) | | | 14.53 | % | |

| Senior securities (loan facility) outstanding (000 omitted) | | | $ 55,000 | | | | $ 40,900 | | | | $ 40,900 | | | | $ 49,000 | | | | $ – | (g) | |

| Asset coverage ratio on revolving credit facility at year end | | | 903 | % | | | 1,267 | % | | | 1,174 | % | | | 1,000 | % | | | – | (g) | |

| Asset coverage per $1,000 on revolving credit facility at year end(i) | | | $ 9,029 | | | | $ 12,674 | | | | $ 11,742 | | | | $ 9,996 | | | | $ – | (g) | |

| (a) | Seven Aberdeen Funds reorganized into Aberdeen Emerging Markets Equity Income Fund on April 27, 2018. |

| (b) | Historical net asset value and per share amounts for the accounting survivor of the reorganizations have been recasted to reflect the conversion ratio of 2.9187 in effect on the date of reorganization of April 27, 2018. Ratios to Average Net Assets were not impacted. |

| (c) | Based on average shares outstanding. |

| (d) | Total investment return based on market value is calculated assuming that shares of the Fund's common stock were purchased at the closing market price as of the beginning of the period, dividends, capital gains, and other distributions were reinvested as provided for in the Fund's dividend reinvestment plan and then sold at the closing market price per share on the last day of the period. The computation does not reflect any sales commission investors may incur in purchasing or selling shares of the Fund. The total investment return based on the net asset value is similarly computed except that the Fund's net asset value is substituted for the closing market value. |

| (e) | Ratios include the effect of Chilean taxes. |

| 16 | Aberdeen Emerging Markets Equity Income Fund, Inc. | |

Financial Highlights (concluded)

| (f) | Effective April 30, 2018, the Fund entered into an expense limitation agreement to limit total ordinary operating expenses of the Fund (excluding any interest, taxes, brokerage fees, short sale dividend and interest expenses and non-routine expenses) from exceeding 1.20% of the average daily Net Assets of the Fund on an annualized basis. (See Note 3) Prior to this, there was no expense limitation agreement in place. |

| (g) | Effective June 26, 2018, the Fund began utilizing the Revolving Credit Facility. |

| (h) | The variation in the Fund's turnover rate from 2017 to 2018 was primarily due to the reorganization of the Fund and change in investment strategy. |

| (i) | Asset coverage ratio is calculated by dividing net assets plus the amount of any borrowings, for investment purposes by the amount of the Revolving Credit Facility. |

Amounts listed as "–" are $0 or round to $0.

See Notes to Financial Statements.

| Aberdeen Emerging Markets Equity Income Fund, Inc. | 17 |

Notes to Financial Statements

December 31, 2021

1. Organization

Aberdeen Emerging Markets Equity Income Fund, Inc. (the "Fund") was incorporated in Maryland on January 30, 1989 and commenced investment operations on September 27, 1989. The Fund is registered under the Investment Company Act of 1940, as amended (the "1940 Act"), as a non-diversified closed-end, management investment company. The Fund trades on the NYSE American under the ticker symbol "AEF".

2. Summary of Significant Accounting Policies

The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board ("FASB") Accounting Standard Codification Topic 946 Financial Services-Investment Companies. The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. The policies conform to generally accepted accounting principles ("GAAP") in the United States of America. The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of income and expenses for the period. Actual results could differ from those estimates. The accounting records of the Fund are maintained in U.S. Dollars.

a. Security Valuation:

The Fund values its securities at current market value or fair value, consistent with regulatory requirements. "Fair value" is defined in the Fund's Valuation and Liquidity Procedures as the price that could be received to sell an asset or paid to transfer a liability in an orderly transaction between willing market participants without a compulsion to transact at the measurement date.

Equity securities that are traded on an exchange are valued at the last quoted sale price on the principal exchange on which the security is traded at the "Valuation Time" subject to application, when appropriate, of the valuation factors described in the paragraph below. Under normal circumstances, the Valuation Time is as of the close of regular trading on the New York Stock Exchange ("NYSE") (usually 4:00 p.m. Eastern Time). In the absence of a sale price, the security is valued at the mean of the bid/ask price quoted at the close on the principal exchange on which the security is traded. Securities traded on NASDAQ are valued at the NASDAQ official closing price.

Foreign equity securities that are traded on foreign exchanges that close prior to Valuation Time are valued by applying valuation factors to the last sale price or the mean price as noted above. Valuation factors are provided by an independent pricing service provider approved by

the Board. These valuation factors are used when pricing the Fund's portfolio holdings to estimate market movements between the time foreign markets close and the time the Fund values such foreign securities. These valuation factors are based on inputs such as depositary receipts, indices, futures, sector indices/ETFs, exchange rates, and local exchange opening and closing prices of each security. When prices with the application of valuation factors are utilized, the value assigned to the foreign securities may not be the same as quoted or published prices of the securities on their primary markets. A security that applies a valuation factor is determined to be a Level 2 investment because the exchange-traded price has been adjusted. Valuation factors are not utilized if the independent pricing service provider is unable to provide a valuation factor or if the valuation factor falls below a predetermined threshold; in such case, the security is determined to be a Level 1 investment. Closed-end funds and exchange-traded funds ("ETFs") are valued at the market price of the security at the Valuation Time. A security using any of these pricing methodologies is determined to be a Level 1 investment.

Short-term investments are comprised of cash and cash equivalents invested in short-term investment funds which are redeemable daily. The Fund sweeps available cash into the State Street Institutional U.S. Government Money Market Fund, which has elected to qualify as a "government money market fund" pursuant to Rule 2a-7 under the 1940 Act, and has an objective, which is not guaranteed, to maintain a $1.00 per share NAV. Generally, these investment types are categorized as Level 1 investments.

In the event that a security's market quotations are not readily available or are deemed unreliable (for reasons other than because the foreign exchange on which it trades closes before the Valuation Time), the security is valued at fair value as determined by the Fund's Pricing Committee, taking into account the relevant factors and surrounding circumstances using valuation policies and procedures approved by the Board. A security that has been fair valued by the Fund's Pricing Committee may be classified as Level 2 or Level 3 depending on the nature of the inputs.

In accordance with the authoritative guidance on fair value measurements and disclosures under GAAP, the Fund discloses the fair value of its investments using a three-level hierarchy that classifies the inputs to valuation techniques used to measure the fair value. The hierarchy assigns Level 1, the highest level, measurements to valuations based upon unadjusted quoted prices in active markets for identical assets, Level 2 measurements to valuations based upon other significant observable inputs, including adjusted quoted prices in active markets for similar assets, and Level 3, the lowest level, measurements to valuations based upon unobservable inputs that are significant to

| 18 | Aberdeen Emerging Markets Equity Income Fund, Inc. |

Notes to Financial Statements (continued)

December 31, 2021

the valuation. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk, for example, the risk inherent in a particular valuation technique used to measure fair value including a pricing model and/or the risk inherent in the inputs to the valuation technique. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability, which are based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity's own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances. A financial instrument's level within the fair value hierarchy is based upon the lowest level of any input that is significant to the fair value measurement. The three-level hierarchy of inputs is summarized below.

Level 1 – quoted prices in active markets for identical investments;

Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, and credit risk); or

Level 3 – significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments).

The Fund may also invest in private equity private placement securities, which represented 0.1% of the net assets of the Fund as of December 31, 2021. The private equity private placement securities in which the Fund is invested are deemed to be restricted securities. In the absence of readily ascertainable market values, these securities are valued at fair value as determined in good faith by, or under the direction of the Board, pursuant to valuation policies and procedures established by the Board. The Fund's estimate of fair value assumes a willing buyer and a willing seller neither of whom are acting under the compulsion to buy or sell. Although these securities may be resold in privately negotiated transactions, the prices realized on such sales could differ from the prices originally paid by the Fund or the current carrying values, and the difference could be material. These securities are stated at fair value as determined by the Fund's Pricing Committee by utilizing the net asset valuations provided by the underlying funds as a practical expedient. In determining the fair value of these investments, management uses the market approach which includes as the primary input the capital balance reported; however, adjustments to the reported capital balance may be made based on various factors, including, but not limited to, the attributes of the interest held, including the rights and obligations, and any restrictions or illiquidity of such interests, and the fair value of these private equity investments. No such adjustments were made to the NAVs provided by the underlying funds.

A summary of standard inputs is listed below:

| Security Type | Standard Inputs |

Foreign equities utilizing a fair value factor | Depositary receipts, indices, futures, sector indices/ETFs, exchange rates, and local exchange opening and closing prices of each security. |

The following is a summary of the inputs used as of December 31, 2021 in valuing the Fund's investments and other financial instruments at fair value. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. Please refer to the Portfolio of Investments for a detailed breakout of the security types:

| Investments, at Value | Level 1 – Quoted

Prices ($) | Level 2 – Other Significant

Observable Inputs ($) | Level 3 – Significant

Unobservable Inputs ($) | Total ($) |

| Investments in Securities |

| Common Stocks | $55,201,804 | $398,590,140 | $– | $453,791,944 |

| Preferred Stocks | – | 49,227,002 | – | 49,227,002 |

| Money Market Funds | 3,295,215 | – | – | 3,295,215 |

| Total | $58,497,019 | $447,817,142 | $– | $506,314,161 |

Private Equity(a) | | | | 377,910 |

| Total Investments | | | | $506,692,071 |

Amounts listed as "–" are $0 or round to $0.

| (a) | Private Equity investments are measured at the net asset valuations provided by the underlying funds as a practical expedient and have not been classified in the fair value levels. The fair value amounts presented are intended to permit reconciliation to the total investment amount presented in the Portfolio of Investments. |

| Aberdeen Emerging Markets Equity Income Fund, Inc. | 19 |

Notes to Financial Statements (continued)

December 31, 2021

b. Restricted Securities:

Restricted securities are privately-placed securities whose resale is restricted under U.S. securities laws. The Fund may invest in restricted securities, including unregistered securities eligible for resale without registration pursuant to Rule 144A and privately-placed securities of U.S. and non-U.S. issuers offered outside the U.S. without registration pursuant to Regulation S under the Securities Act of 1933, as amended. Rule 144A securities may be freely traded among certain qualified institutional investors, such as the Fund, but resale of such securities in the U.S. is permitted only in limited circumstances.

c. Foreign Currency Translation:

Foreign securities, currencies, and other assets and liabilities denominated in foreign currencies are translated into U.S. Dollars at the exchange rate of said currencies against the U.S. Dollar, as of the Valuation Time, as provided by an independent pricing service approved by the Board.

Foreign currency amounts are translated into U.S. Dollars on the following basis:

| (i) | market value of investment securities, other assets and liabilities – at the current daily rates of exchange at the Valuation Time; and |

| (ii) | purchases and sales of investment securities, income and expenses – at the relevant rate of exchange prevailing on the respective dates of such transactions. |

The Fund does not isolate that portion of gains and losses on investments in equity securities due to changes in the foreign exchange rates from the portion due to changes in market prices of equity securities. Accordingly, realized and unrealized foreign currency gains and losses with respect to such securities are included in the reported net realized and unrealized gains and losses on investment transactions balances.

The Fund reports certain foreign currency related transactions and foreign taxes withheld on security transactions as components of realized gains for financial reporting purposes, whereas such foreign currency related transactions are treated as ordinary income for U.S. federal income tax purposes.

Net unrealized currency gains or losses from valuing foreign currency denominated assets and liabilities at period end exchange rates are reflected as a component of net unrealized appreciation/depreciation in value of investments, and translation of other assets and liabilities denominated in foreign currencies.

Net realized foreign exchange gains or losses represent foreign exchange gains and losses from transactions in foreign currencies and forward foreign currency contracts, exchange gains or losses realized

between the trade date and settlement date on security transactions, and the difference between the amounts of interest and dividends recorded on the Fund's books and the U.S. Dollar equivalent of the amounts actually received.

Foreign security and currency transactions may involve certain considerations and risks not typically associated with those of domestic origin, including unanticipated movements in the value of the foreign currency relative to the U.S. Dollar. Generally, when the U.S. Dollar rises in value against foreign currency, the Fund's investments denominated in that foreign currency will lose value because the foreign currency is worth fewer U.S. Dollars; the opposite effect occurs if the U.S. Dollar falls in relative value.

d. Rights Issues and Warrants:

Rights issues give the right, normally to existing shareholders, to buy a proportional number of additional securities at a given price (generally at a discount) within a fixed period (generally a short-term period) and are offered at the company's discretion. Warrants are securities that give the holder the right to buy common stock at a specified price for a specified period of time. Rights issues and warrants are speculative and have no value if they are not exercised before the expiration date. Rights issues and warrants are valued at the last sale price on the exchange on which they are traded.

e. Security Transactions, Investment Income and Expenses:

Security transactions are recorded on the trade date. Realized and unrealized gains/(losses) from security and currency transactions are calculated on the identified cost basis. Dividend income is recorded on the ex-dividend date except for certain dividends on foreign securities, which are recorded as soon as the Fund is informed after the ex-dividend date. Interest income and expenses are recorded on an accrual basis.

Certain distributions received by the Fund could represent a return of capital or capital gain. The Fund determines the components of these distributions subsequent to the ex-dividend date, based upon receipt of tax filings or other correspondence relating to the underlying investment. These distributions are recorded as a reduction of cost of investments and/or as a realized gain.

f. Distributions:

The Fund records dividends and distributions payable to its shareholders on the ex-dividend date. The amount of dividends and distributions from net investment income and net realized capital gains are determined in accordance with federal income tax regulations, which may differ from GAAP. These book basis/tax basis differences are either considered temporary or permanent in nature. To the extent

| 20 | Aberdeen Emerging Markets Equity Income Fund, Inc. |

Notes to Financial Statements (continued)

December 31, 2021

these differences are permanent in nature, such amounts are reclassified within the capital accounts based on their federal tax basis treatment; temporary differences do not require reclassification. Dividends and distributions which exceed net investment income and net realized capital gains for tax purposes are reported as return of capital.

g. Federal Income Taxes:

The Fund intends to continue to qualify as a "regulated investment company" by complying with the provisions available to certain investment companies, as defined in Subchapter M of the Internal Revenue Code of 1986, as amended, and to make distributions of net investment income and net realized capital gains sufficient to relieve the Fund from all federal income taxes. Therefore, no federal income tax provision is required.

The Fund recognizes the tax benefits of uncertain tax positions only where the position is "more likely than not" to be sustained assuming examination by tax authorities. Management of the Fund has concluded that there are no significant uncertain tax positions that would require recognition in the financial statements. Since tax authorities can examine previously filed tax returns, the Fund's U.S. federal and state tax returns for each of the most recent four fiscal years up to the most recent fiscal year ended December 31, 2021 are subject to such review.

h. Foreign Withholding Tax:

Dividend and interest income from non-U.S. sources received by the Fund are generally subject to non-U.S. withholding taxes and are recorded on the Statement of Operations. The Fund files for tax reclaims for the refund of such withholdings taxes according to tax treaties. Tax reclaims that are deemed collectible are booked as tax reclaim receivable on the Statement of Assets and Liabilities. In addition, the Fund may be subject to capital gains tax in certain countries in which it invests. The above taxes may be reduced or eliminated under the terms of applicable U.S. income tax treaties with some of these countries. The Fund accrues such taxes when the related income is earned.

In addition, when the Fund sells securities within certain countries in which it invests, the capital gains realized may be subject to tax. Based on these market requirements and as required under GAAP, the Fund accrues deferred capital gains tax on securities currently held that have unrealized appreciation within these countries. The amount of deferred capital gains tax accrued is reported on the Statement of Assets and Liabilities.

i. Partnership Accounting Policy:

The Fund records its pro-rata share of the income/(loss) and capital gains/(losses) allocated from the private equity investments, which are classified as partnerships, and adjusts the cost of the underlying partnerships accordingly. These amounts are included in the Fund's Statement of Operations.

3. Agreements and Transactions with Affiliates

a. Investment Adviser:

Aberdeen Asset Managers Limited ("AAML", the "Investment Adviser" or the "Adviser") serves as the Fund's investment adviser with respect to all investments. AAML is an indirect wholly-owned subsidiary of abrdn plc. AAML receives, an annual fee, calculated weekly and paid quarterly, equal to 0.90% of the first $250 million, 0.80% of amounts $250-$500 million and 0.75% of amounts over $500 million. For the fiscal year ended December 31, 2021, AAML earned $4,188,403 for advisory services.

AAML entered into a written contract (the "Expense Limitation Agreement") with the Fund that is effective through June 30, 2022. The Expense Limitation Agreement limits the total ordinary operating expenses of the Fund (excluding any interest, taxes, brokerage fees, short sale dividend and interest expenses and non-routine expenses) from exceeding 1.20% of the average daily Net Assets of the Fund on an annualized basis. AAML did not waive any advisory fees pursuant to the Expense Limitation Agreement during the fiscal year ended December 31, 2021. AAML may request and receive reimbursement of the advisory fees waived and other expenses reimbursed pursuant to the Expense Limitation Agreement as of a date not more than three years after the date when AAML limited the fees or reimbursed the expenses; provided that the following requirements are met: the reimbursements do not cause the Fund to exceed the lesser of the applicable expense limitation in the contract at the time the fees were limited or expenses are paid or the applicable expense limitation in effect at the time the expenses are being recouped by AAML (the "Reimbursement Requirements").

In accordance with the Fund's Expense Limitation Agreement and criteria, as described above, AAML recaptured $225,047 from the Fund for which it previously reimbursed the Fund. At December 31, 2021, the Fund had $225,047 in investment advisory fees payable for recapture on the Statement of Assets and Liabilities.

b. Fund Administration:

abrdn Inc. (formerly, Aberdeen Standard Investments Inc.), an affiliate of the Adviser, is the Fund's Administrator, pursuant to an agreement under which abrdn Inc. receives a fee paid by the Fund, at an annual

| Aberdeen Emerging Markets Equity Income Fund, Inc. | 21 |

Notes to Financial Statements (continued)

December 31, 2021

fee rate of 0.08% of the Fund's average monthly net assets. For the fiscal year ended December 31, 2021, abrdn Inc. earned $394,075 from the Fund for administration services.

c. Investor Relations: