Exhibit 99.1

Lakeland Bancorp, inc.

Nasdaq: “LBAI”

Thomas J. Shara, President & CEO Joseph F. Hurley, EVP & CFO

First Quarter 2010

1

Lakeland Bancorp,inc.

Statement Regarding

Forward-Looking Information

The information disclosed in this document includes various forward-looking statements that are made in reliance upon the safe harbor provisions of the Private Securities Litigation Reform Act of 1994 with respect to credit quality (including delinquency trends and the allowance for loan and lease losses), corporate objectives, and other financial and business matters. The words “anticipates”, “projects”, “intends”, “estimates”, “ expects”, “believes”, “plans”, “may”, “will”, “should”, “could”, and other similar expressions are intended to identify such forward-looking statements are necessarily speculative and speak only as of the date made, and are subject to numerous assumptions, risks, and uncertainties, all of which may change over time. Actual results could differ materially from such forward-looking statements.

In addition to the risk factors disclosed elsewhere in this document, the following factors, among others, could cause the Company’s actual results to differ materially and adversely from such forward-looking statements: changes in the financial services industry and the U.S. and global capital markets, changes in economic conditions nationally, regionally and in the Company’s markets, the nature and timing of actions of the Federal Reserve Board and other regulators, the nature and timing of legislature affecting the financial services industry, government intervention in the U.S. financial system, passage by the U.S. Congress of legislation which unilaterally amends the terms of the U.S. Department of the Treasury’s preferred stock investment in the Company, changes in the levels of market interest rates, pricing pressures of the loan and deposit products, credit risks of the Company’s lending and leasing activities, customers’ acceptance of the Company’s products and services competition.

The above-listed risk factors are not necessarily exhaustive, particularly as to possible future events, and new risk factors may emerge from time to time. Certain events may occur that could cause the Company’s actual results to be materially different than those described in the Company’s periodic filings with the Securities and Exchange Commission. Any statements made by the Company that are not historical facts should be considered to be forward-looking statements. The Company is not obligated to update and does not undertake to update any of its forward-looking statements made herein.

2

2

Lakeland Bancorp,inc.

Corporate Profile

$2.8 Billion Commercial Bank

3rd largest publicly held commercial bank headquartered in New Jersey (6th largest including thrifts)

40-year history

48 branches

3

Lakeland Bancorp,inc.

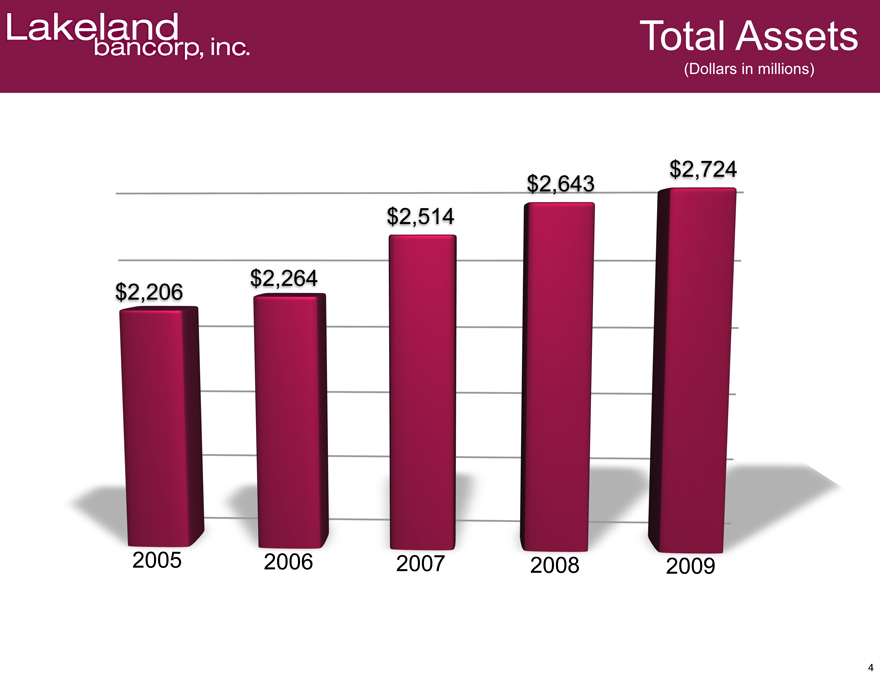

Total Assets

(Dollars in millions)

$2,206

$2,264

$2,514

$2,643

$2,724

2005

2006

2007

2008

2009

4

Lakeland Bancorp,inc.

Stockholder Information (“LBAI”)

Market Cap—$245 million

24.0 million Shares Outstanding (20.5 million float)

3,600 Registered Shareholders

55,000 Average Daily Share Volume YTD

16% Insider Ownership

27% Institutional Ownership

1.96% Dividend Yield

Price / BV—1.13 Price / TBV—1.92

Stock Price $10.23 on May 4, 2010

5

Lakeland Bancorp,inc.

Capital Position

as of March 31, 2010

Stockholders’ Equity—$273 million Equity to Assets—9.85% $59 million of Capital Purchase Program proceeds Tangible Common Equity—$128.0 million Book Value per Common Share—$9.02 Tangible Book Value per Common Share—$5.34

6

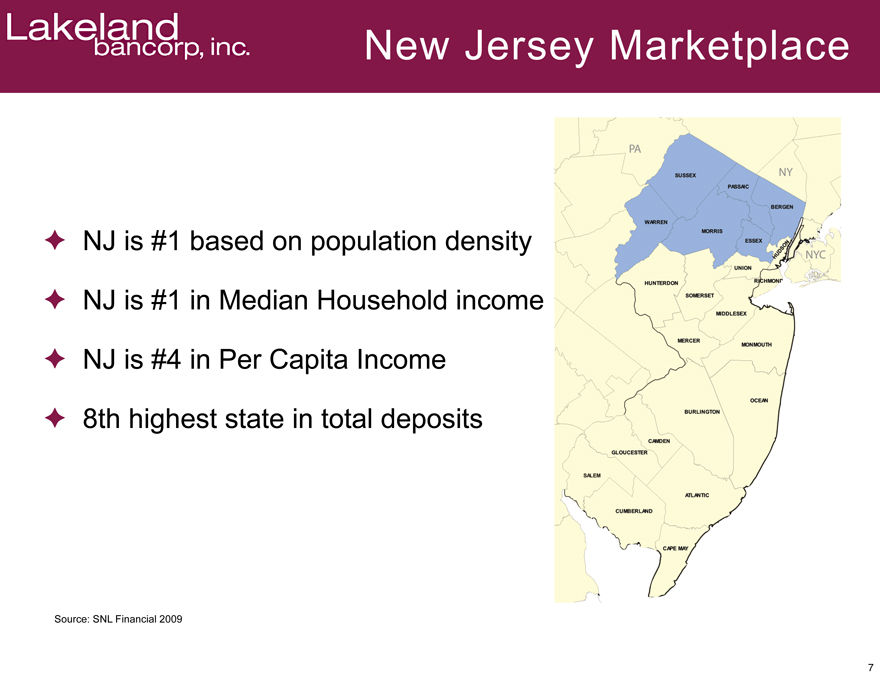

Lakeland Bancorp,inc.

New Jersey Marketplace

NJ is #1 based on population density NJ is #1 in Median Household income NJ is #4 in Per Capita Income 8th highest state in total deposits

Source: SNL Financial 2009

7

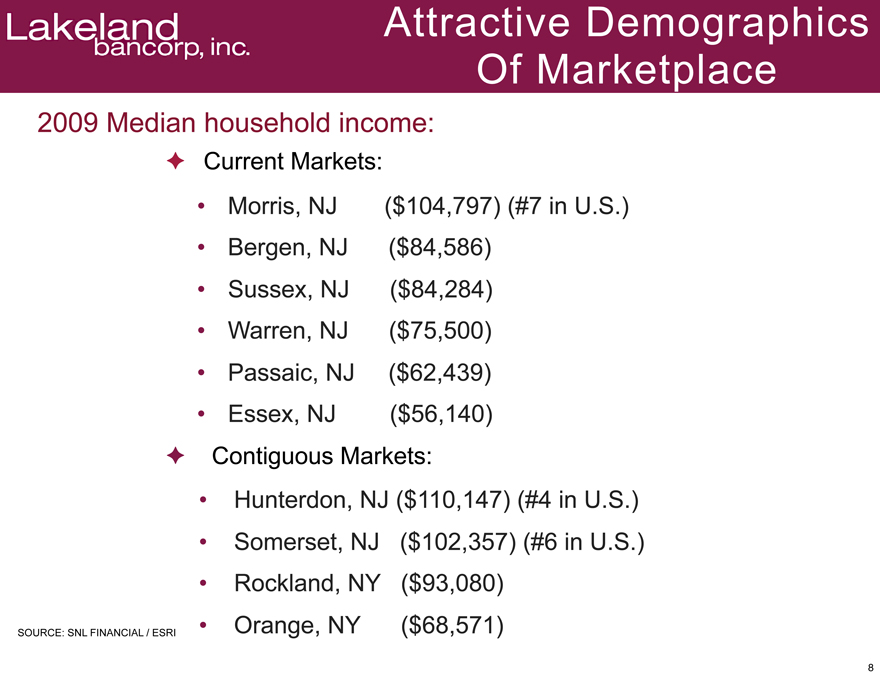

Lakeland Bancorp,inc.

Attractive Demographics Of Marketplace

2009 Median household income:

Current Markets:

Morris, NJ ($104,797) (#7 in U.S.) Bergen, NJ ($84,586) Sussex, NJ ($84,284) Warren, NJ ($75,500) Passaic, NJ ($62,439) Essex, NJ ($56,140)

Contiguous Markets:

Hunterdon, NJ ($110,147) (#4 in U.S.) Somerset, NJ ($102,357) (#6 in U.S.) Rockland, NY ($93,080) Orange, NY ($68,571)

SOURCE: SNL FINANCIAL / ESRI

8

Lakeland Bancorp,inc.

Expansion Strategy

County State Total Deposits # of Small in Markets ($M) (1) Businesses (2)

Current counties of operation

Bergen NJ $ 37,055 32,828 Essex NJ $ 19,900 19,858 Morris NJ $ 15,872 17,370 Passaic NJ $ 9,594 12,046 Sussex NJ $ 2,330 3,641 Warren NJ $ 2,244 2,803

Total $ 86,995 88,546

Contiguous counties

Hudson NJ $ 22,184 13,059 Middlesex NJ $ 21,130 21,218 Union NJ $ 15,917 14,449 Rockland NY $ 7,877 9,093 Somerset NJ $ 8,062 9,783 Orange NY $ 5,468 8,975 Hunterdon NJ $ 3,254 4,128

Total $ 83,892 80,705 Grand Total $ 170,887 169,251

SOURCE: SNL FINANCIAL / ESRI (1) Data As Of June 30, 2009

(2) Data As Of 2008; Small Businesses Defined As Those With Less Than 100 Employees

9

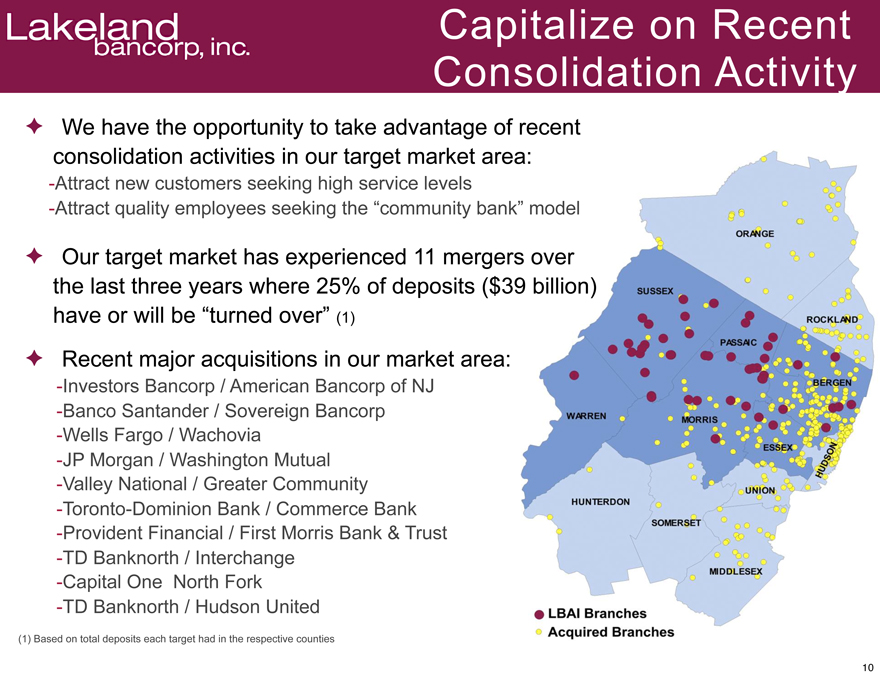

Lakeland Bancorp,inc.

Capitalize on Recent Consolidation Activity

-Attract new customers seeking high service levels

-Attract quality employees seeking the “community bank” model

We have the opportunity to take advantage of recent consolidation activities in our target market area:

Our target market has experienced 11 mergers over the last three years where 25% of deposits ($39 billion) have or will be “turned over” (1)

Recent major acquisitions in our market area:

Investors Bancorp / American Bancorp of NJ

Banco Santander / Sovereign Bancorp -Wells Fargo / Wachovia -JP Morgan / Washington Mutual -Valley National / Greater Community -Toronto-Dominion Bank / Commerce Bank -Provident Financial / First Morris Bank & Trust -TD Banknorth / Interchange -Capital One North Fork -TD Banknorth / Hudson United

(1) Based on total deposits each target had in the respective counties

10

Lakeland Bancorp,inc.

Experienced Management Team

President & CEO

25 Years Experience Hudson United, TD Banknorth

Chief Operating Officer 25+ Years Experience

Midlantic

Chief Financial Officer 25+ Years Experience Hudson United, HSBC

Chief Lending Officer

35 Years Experience Hudson United, TD Banknorth

Chief Retail Officer

30 Years Experience Sovereign

Chief Government/ Business Services Officer 25+ Years Experience Bank of New York

Chief Credit Officer 25+ Years Experience

Fleet Bank

Chief Operations Officer

30 Years Experience

Horizon

General Counsel 15+ Years Experience Hudson United, TD Banknorth

11

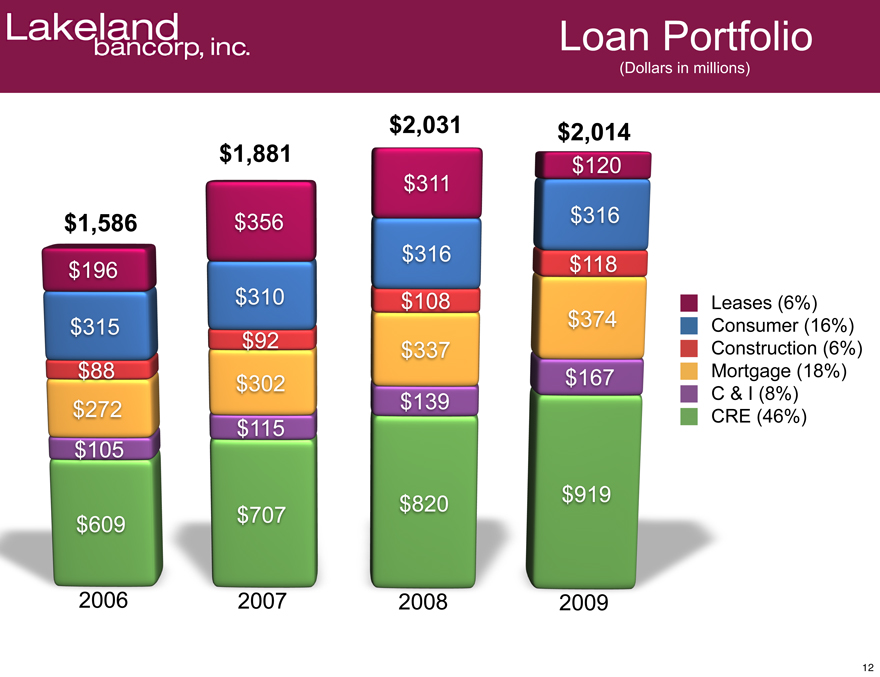

Lakeland Bancorp,inc.

Loan Portfolio

(Dollars in millions)

$1,586

$1,881

$2,031

$2,014

$196

$315

$88

$272

$105

$609

2006

$356

$310

$92

$302

$115

$707

2007

$311

$316

$108

$337

$139

$820

2008

$120

$316

$118

$374

$167

$919

2009

Leases (6%) Consumer (16%) Construction (6%) Mortgage (18%) C & I (8%) CRE (46%)

12

Lakeland Bancorp,inc.

Loan Growth

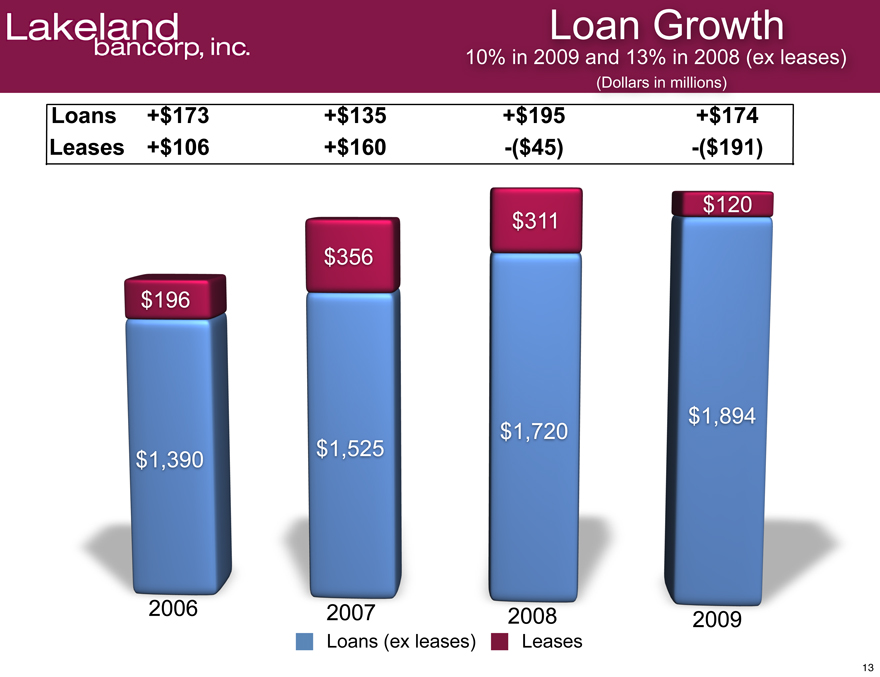

10% in 2009 and 13%in 2008(ex leases)(Dollars in millions)

Loans +$173 +$135 +$195 +$174

Leases +$106 +$160 –($45) –($191)

$196 $1,390 2006

$356 $1525 2007

$311 $1,720 2008

$120 $1,894 2009

Loans(ex leases) Leases

13

Lakeland Bancorp,inc.

Commercial Lending

Commercial Lending

Six NJ Lending offices

Legal lending limit—$40m, House limit—$27m

Only seventeen borrowers with over $10 million exposure Average Commercial loan size approximately $500k Centralized lending approval No Shared National Credits

C & I Lending

New Chief Lending Officer

Established specialized C&I Lending Teams Integrated C&I Lenders into other lending teams Relationship Banking

14

Lakeland Bancorp,inc.

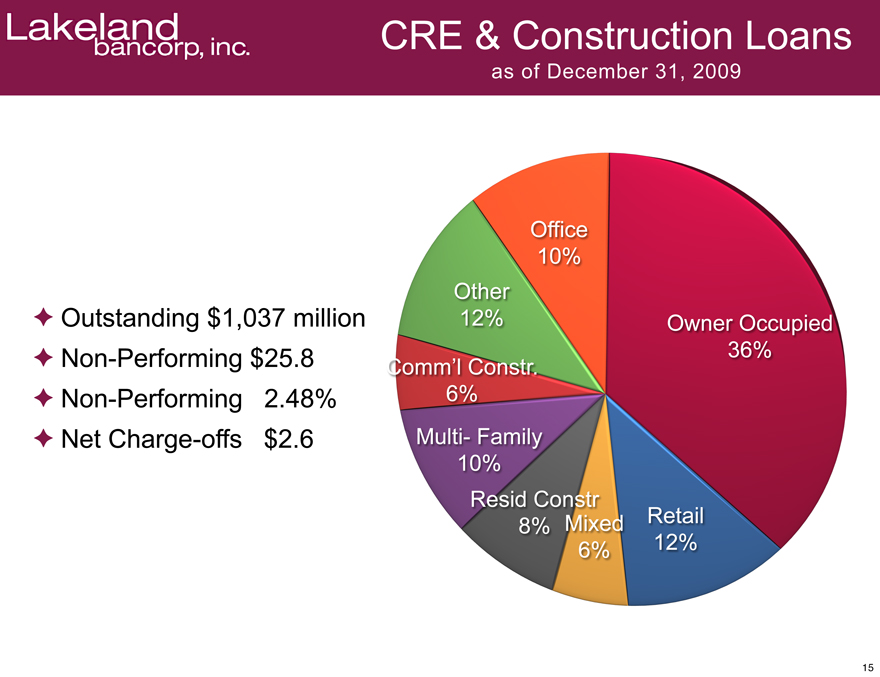

CRE & Construction Loans

as of December 31, 2009

Outstanding $1,037 million Non-Performing $25.8 Non-Performing 2.48% Net Charge-offs $2.6

Office 10%

Owner Occupied 36%

Other 12%

Comm’l Constr. 6%

Multi- Family 10%

Retail 12%

Mixed 6%

Resid Constr 8%

15

Lakeland Bancorp,inc.

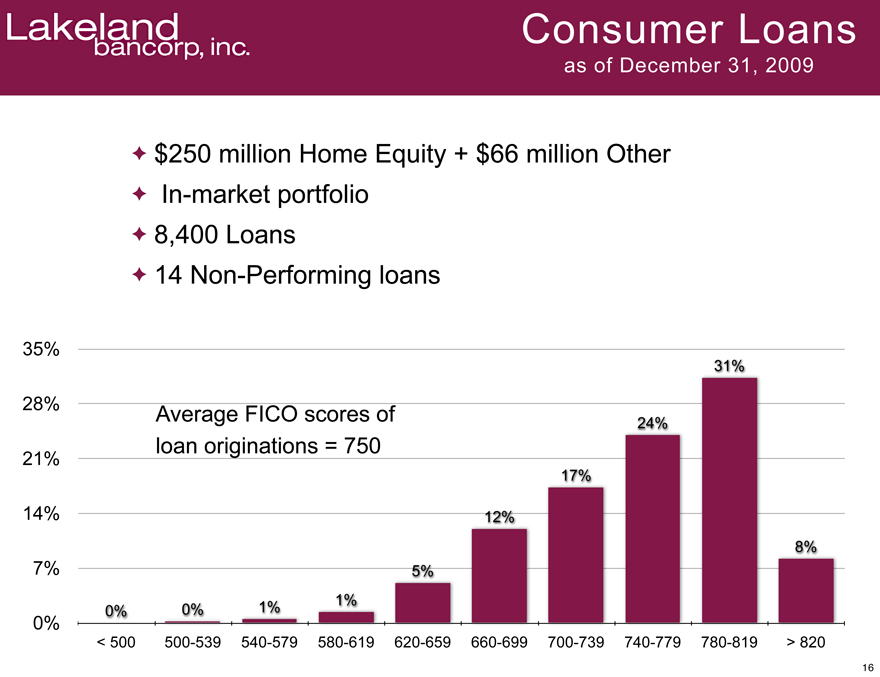

Consumer loans as of December 31,2009

$250 millins Home Equity + $66 million other

In-market portfolio

8,400 Loans

14 Non-Performing Loans

Average FICO scores of loan originations=750

35% 28% 21% 14% 7% 0%

0% 0% 1% 1% 5% 12% 17% 24% 31% 8%

<500 500-539 540-579 580-619 620-659 660-699 700-739 740-779 780-819 >200

16

Lakeland Bancorp,inc.

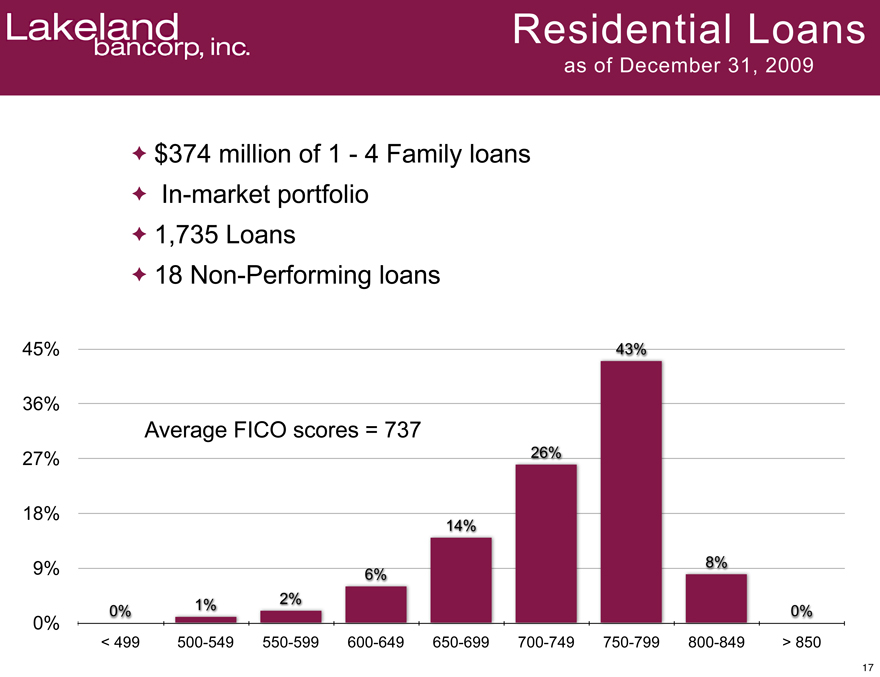

Residential Loans as of December 31, 2009

$374 million of 1-4 Family Loans

In-market portfolio

1,735 Loans

18 Non-Performing loans

45% 36% 27% 18% 9% 0%

Average FICO scores=737

0% 1% 2% 6% 14% 26% 43% 8% 0%

<499 500-549 550-599 600-649 650-699 700-749 750-799 800-849 >850

17

Lakeland bancorp, inc.

Leasing Business

Acquired Company in 2000

Small Ticket (<$100k), 32 month average remaining life

Full Payout Leases

Industries—Transportation (37%), Services (11%), Manufacturing (7%), Construction (8%), Healthcare (7%)

Equipment—Vehicles (45%), Machinery (7%), Medical (6%), Office Equipment (6%) Construction (4%), Furniture (4%),

Geographic Dispersion—nationwide; one-third in Tri-State Region

Credit Quality Challenges Developed in 2Q 2008

18

Lakeland

bancorp, inc.

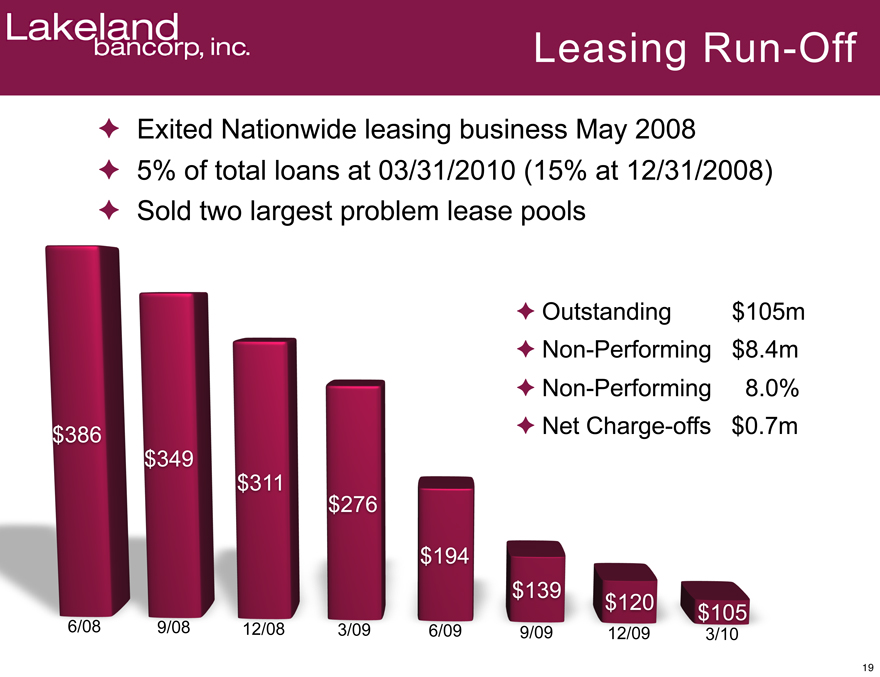

Leasing Run-Off

Exited Nationwide leasing business May 2008 5% of total loans at 03/31/2010 (15% at 12/31/2008) Sold two largest problem lease pools

Outstanding $105m Non-Performing $8.4m Non-Performing 8.0% Net Charge-offs $0.7m

$386

$349

$311

$276

$194

$139

$120

$105

6/08

9/08

12/08

3/09

6/09

9/09

12/09

3/10

19

Lakeland

bancorp, inc.

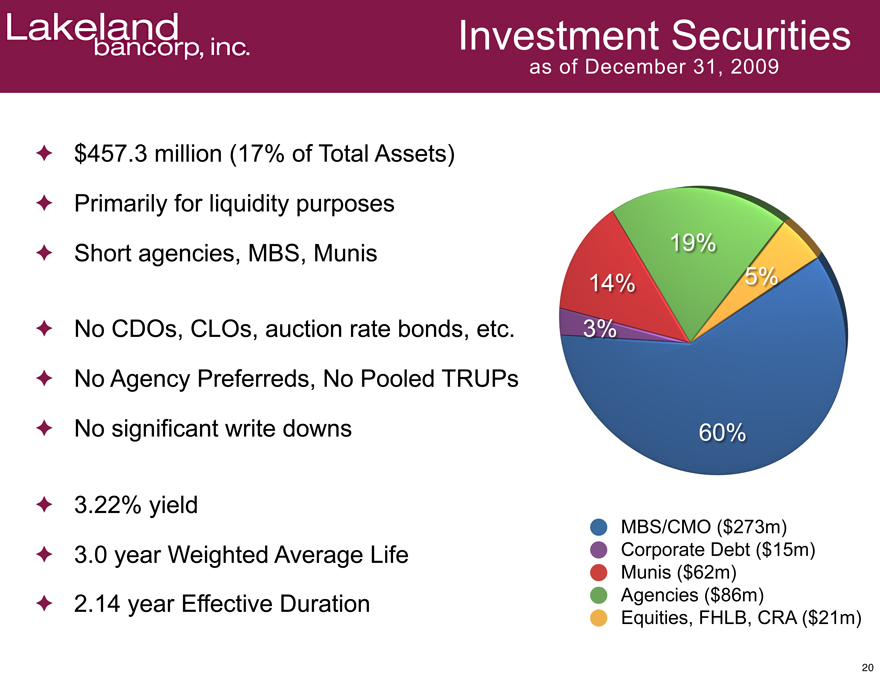

Investment Securities

as of December 31, 2009

$457.3 million (17% of Total Assets) Primarily for liquidity purposes Short agencies, MBS, Munis

No CDOs, CLOs, auction rate bonds, etc. No Agency Preferreds, No Pooled TRUPs No significant write downs

3.22% yield

3.0 year Weighted Average Life

2.14 year Effective Duration

MBS/CMO ($273m) Corporate Debt ($15m) Munis ($62m) Agencies ($86m) Equities, FHLB, CRA ($21m)

20

3%

14%

19%

5%

60%

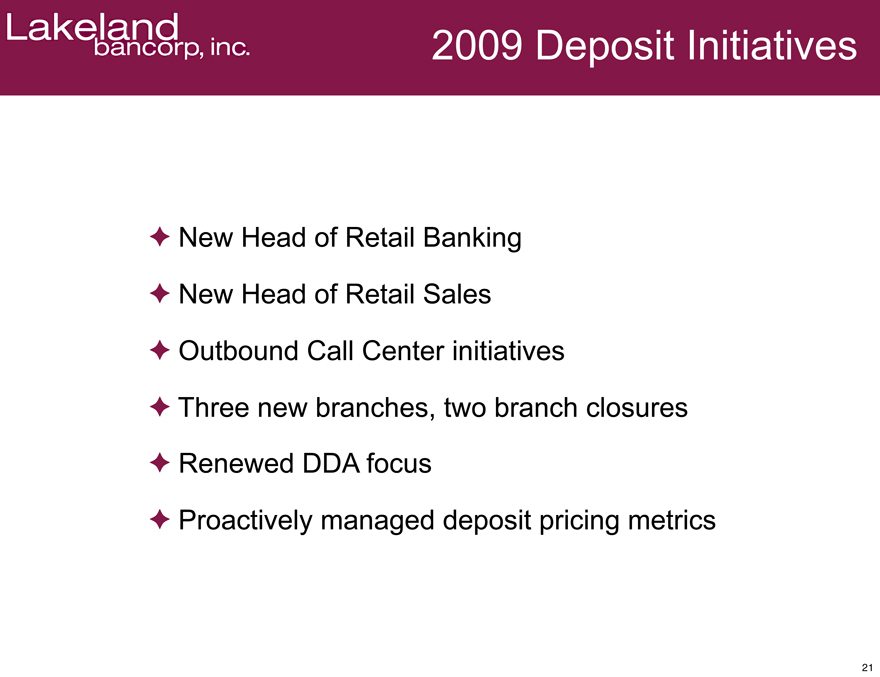

Lakeland Bancorp,inc.

2009 Deposit Initiatives

New Head of Retail Banking

New Head of Retail Sales

Outbound Call Center initiatives

Three new branches, two branch closures

Renewed DDA focus

Proactively managed deposit pricing metrics

21

Lakeland

bancorp, inc.

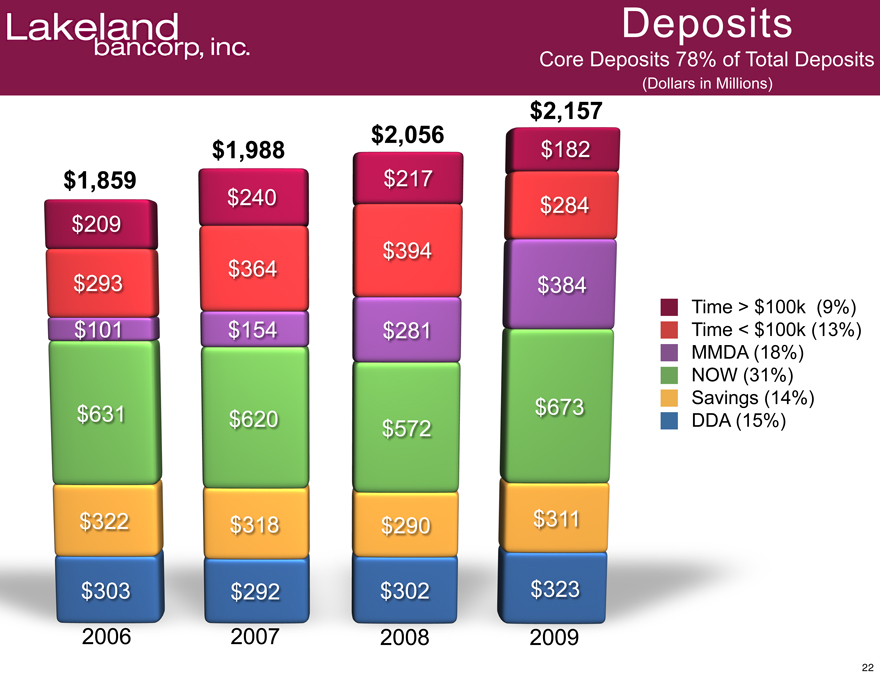

Deposits

Core Deposits 78% of Total Deposits

(Dollars in Millions)

Time > $100k (9%) Time < $100k (13%) MMDA (18%) NOW (31%) Savings (14%) DDA (15%)

$1,859

$1,988

$2,056

$2,157

$209

$240

$217

$182

$293

$364

$394

$284

$101

$154

$281

$384

$631

$620

$572

$673

$322

$318

$290

$311

$303

$292

$302

$323

2006

2007

2008

2009

22

Lakeland

bancorp, inc.

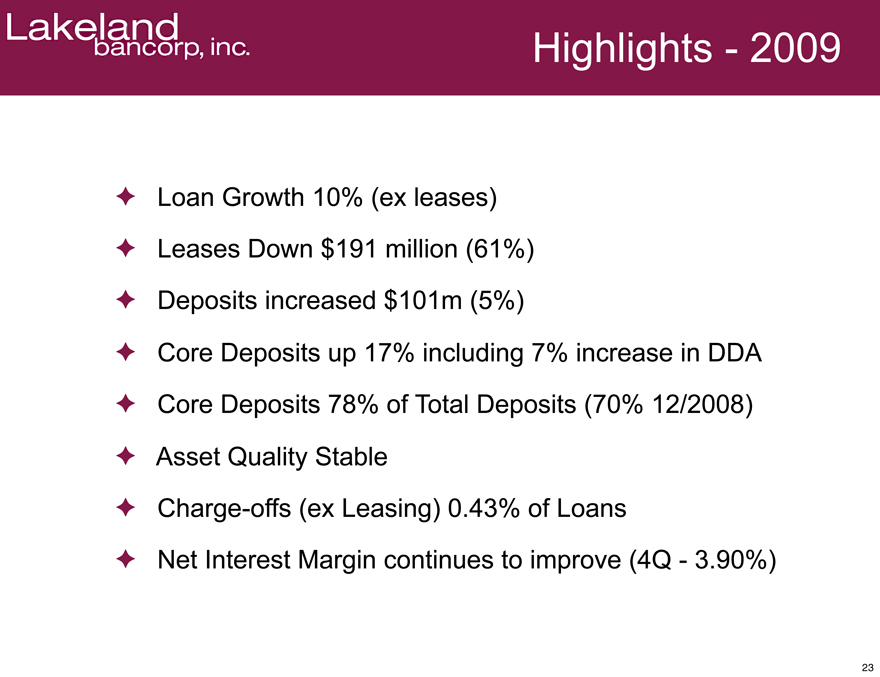

Highlights—2009

Loan Growth 10% (ex leases) Leases Down $191 million (61%) Deposits increased $101m (5%)

Core Deposits up 17% including 7% increase in DDA Core Deposits 78% of Total Deposits (70% 12/2008) Asset Quality Stable Charge-offs (ex Leasing) 0.43% of Loans Net Interest Margin continues to improve (4Q—3.90%)

23

Lakeland

bancorp, inc.

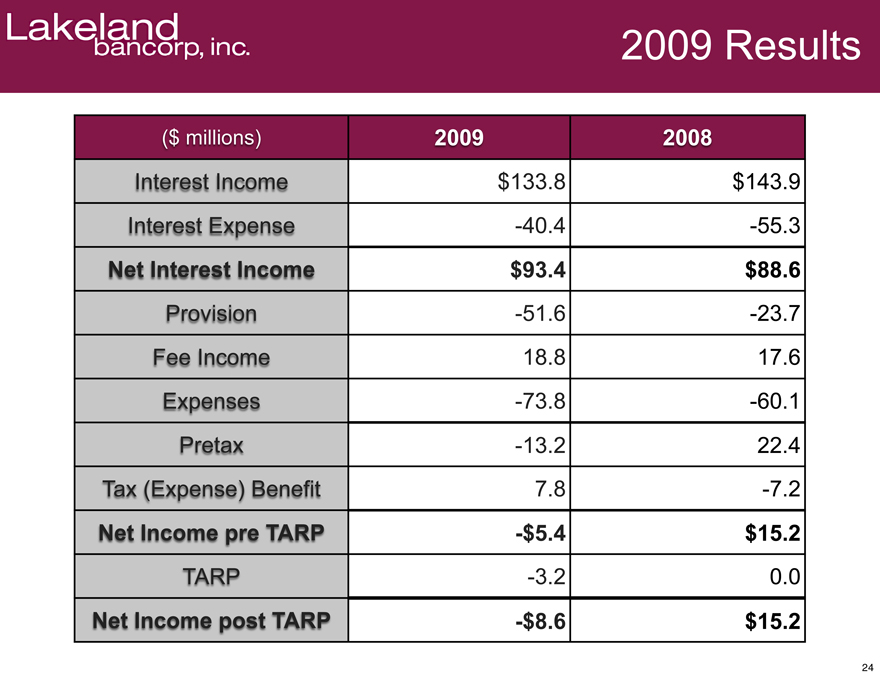

2009 Results

($ millions)

2009

2008

Interest Income

$133.8

$143.9

Interest Expense

-40.4

-55.3

Net Interest Income

$93.4

$88.6

Provision

-51.6

-23.7

Fee Income

18.8

17.6

Expenses

-73.8

-60.1

Pretax

-13.2

22.4

Tax (Expense) Benefit

7.8

-7.2

Net Income pre TARP

-$5.4

$15.2

TARP

-3.2

0.0

Net Income post TARP

-$8.6

$15.2

24

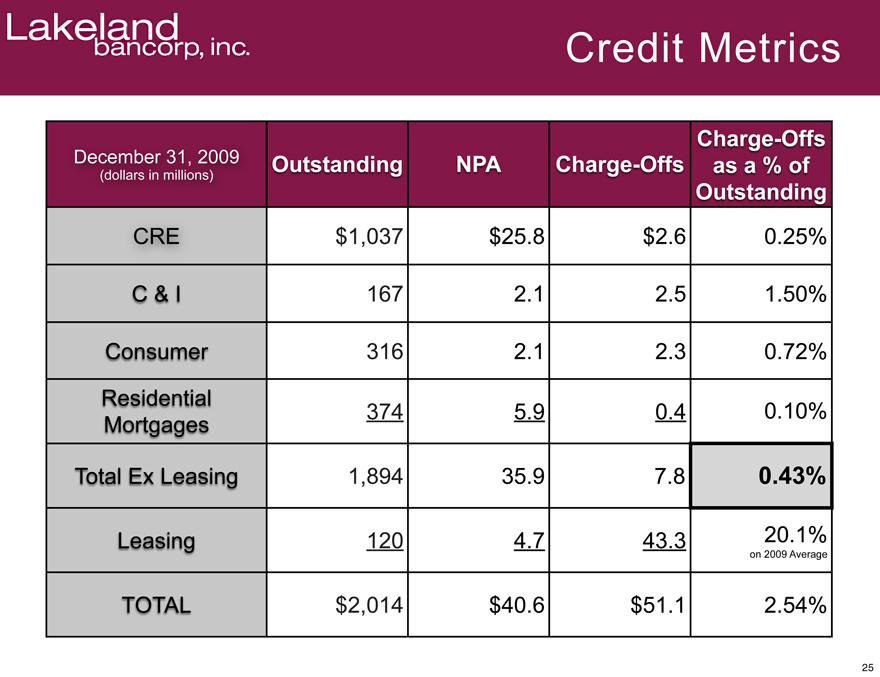

Lakeland

bancorp, inc.

Credit Metrics

December 31, 2009

(dollars in millions)

Outstanding

NPA

Charge-Offs

Charge-Offs as a % of Outstanding

CRE

$1,037

$25.8

$2.6

0.25%

C & I

167

2.1

2.5

1.50%

Consumer

316

2.1

2.3

0.72%

Residential Mortgages

374

5.9

0.4

0.10%

Total Ex Leasing

1,894

35.9

7.8

0.43%

Leasing

120

4.7

43.3

20.1%

on 2009 Average

TOTAL

$2,014

$40.6

$51.1

2.54%

25

Lakeland

bancorp, inc.

Highlights—First Quarter 2010

Net Income up 44%

Diluted EPS up 36% from 1Q 2009

Net Interest Margin (NIM) up 9bp from 4Q to 3.99% Core Deposits up $29m YTD (DDA up $23m) Expenses Flat to 1Q 2009 and down from 4Q

26

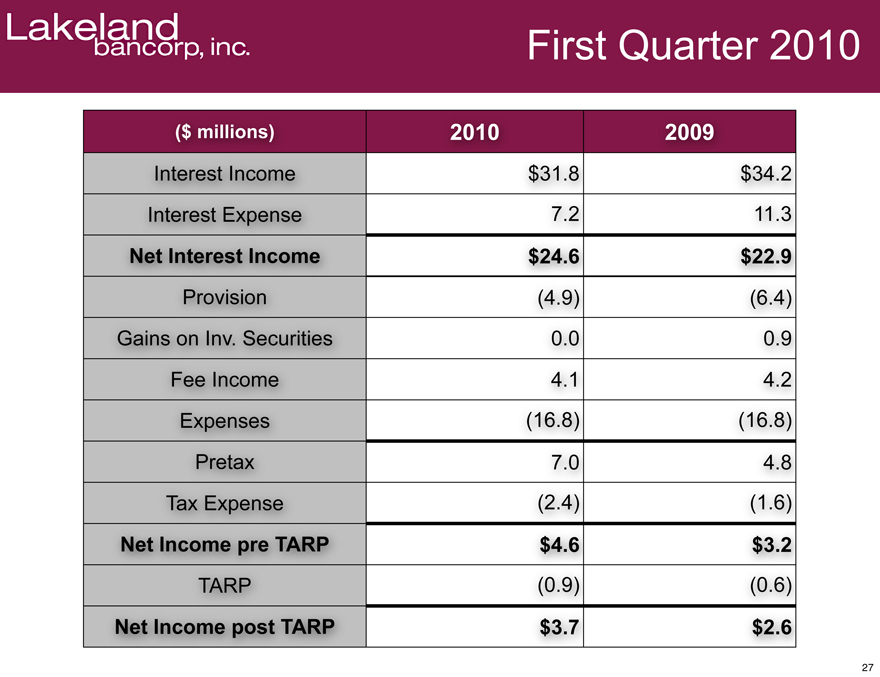

Lakeland

bancorp, inc.

First Quarter 2010

($ millions)

2010

2009

Interest Income

$31.8

$34.2

Interest Expense

7.2

11.3

Net Interest Income

$24.6

$22.9

Provision

(4.9)

(6.4)

Gains on Inv. Securities

0.0

0.9

Fee Income

4.1

4.2

Expenses

(16.8)

(16.8)

Pretax

7.0

4.8

Tax Expense

(2.4)

(1.6)

Net Income pre TARP

$4.6

$3.2

TARP

(0.9)

(0.6)

Net Income post TARP

$3.7

$2.6

27

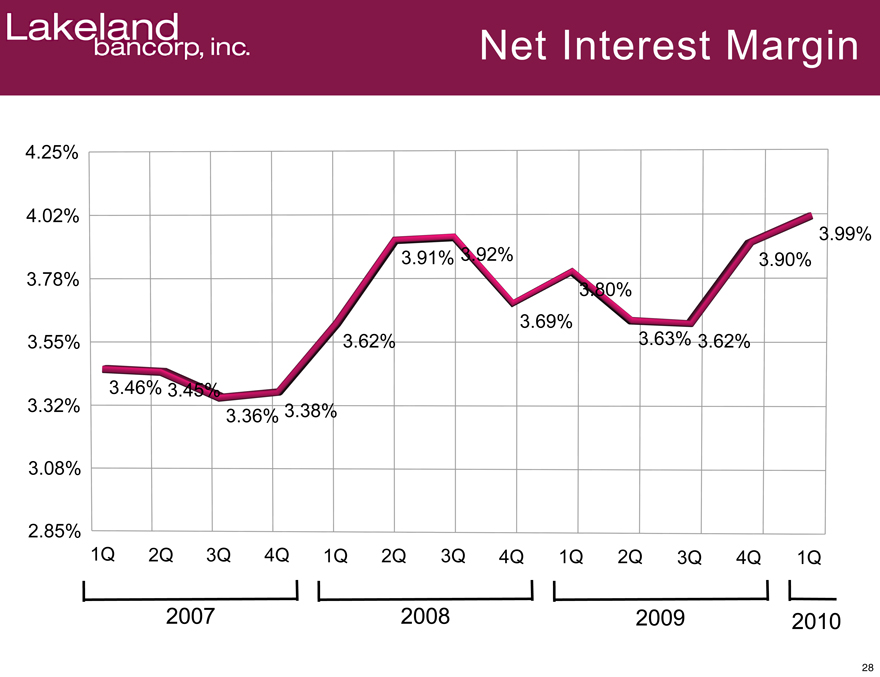

Lakeland

bancorp, inc.

Net Interest Margin

4.25%

4.02%

3.78%

3.55%

3.32%

3.08%

2.85%

1Q

2Q

3Q

4Q

1Q

2Q

3Q

4Q

1Q

2Q

3Q

4Q

1Q

2007

2008

2009

2010

3.46%

3.45%

3.36%

3.38%

3.62%

3.91%

3.92%

3.69%

3.80%

3.63%

3.62%

3.90%

3.99%

28

Lakeland

bancorp, inc.

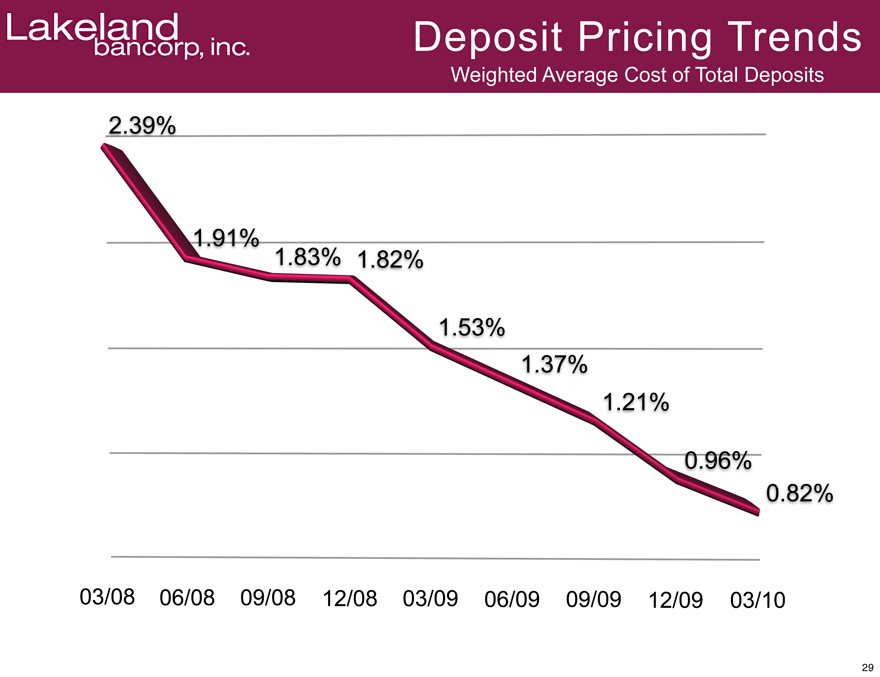

Deposit Pricing Trends

Weighted Average Cost of Total Deposits

2.39%

1.91%

1.83%

1.82%

1.53%

1.37%

1.21%

0.96%

0.82%

03/08

06/08

09/08

12/08

03/09

06/09

09/09

12/09

03/10

29

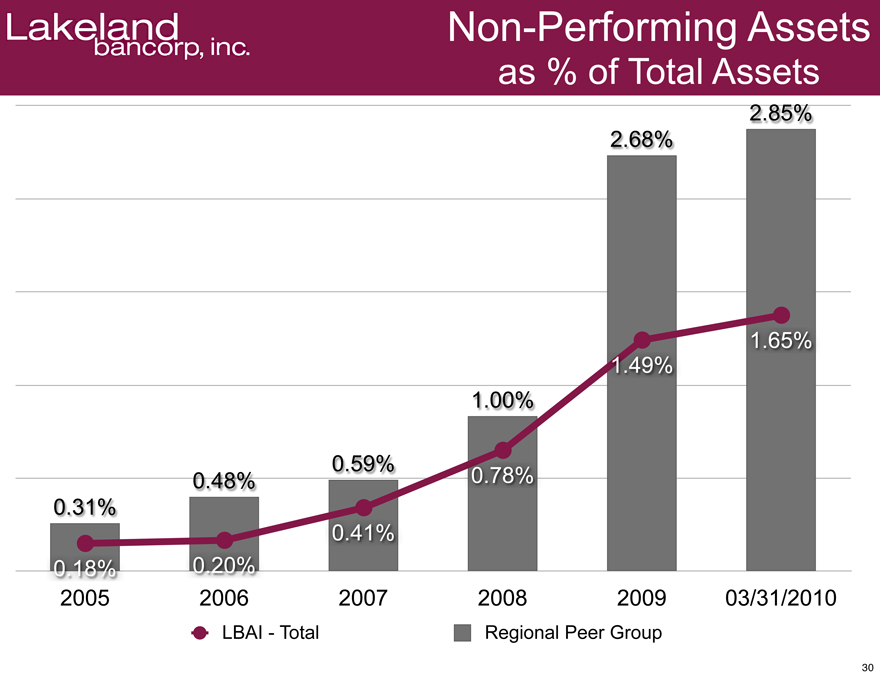

Non-Performing Assets as % of TotalAssets

0.31%

0.48%

0.59%

1.00%

2.68%

2.85%

0.18%

0.20%

0.41%

0.78%

1.49%

1.65%

2005

2006

2007

2008

2009

03/31/2010

LBAI – Total

Regional Peer Group

30

Lakeland

bancorp, inc.

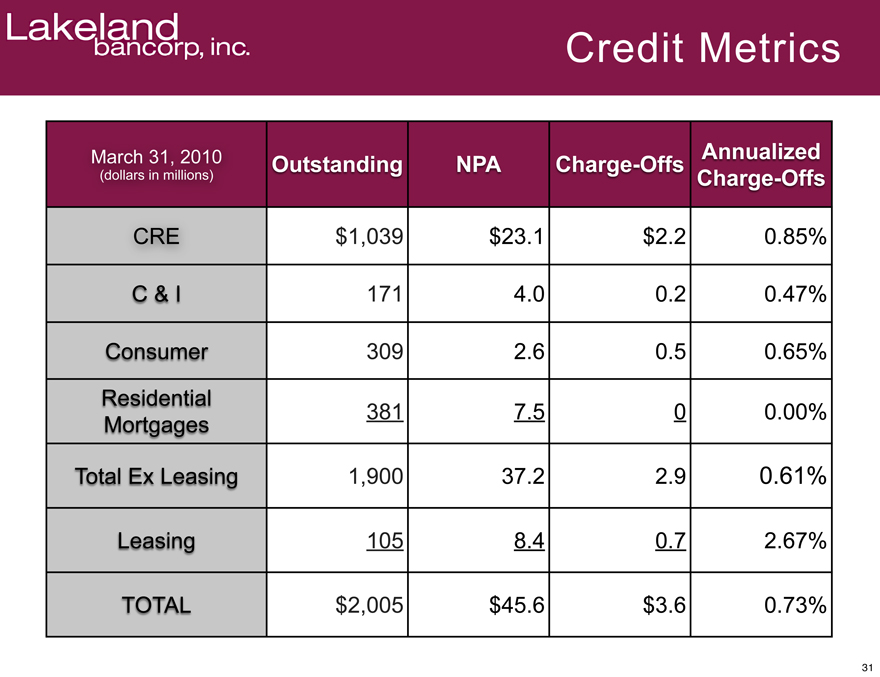

Credit Metrics

March 31, 2010

(dollars in millions)

Outstanding

NPA

Charge-Offs

Annualized Charge-Offs

CRE

$1,039

$23.1

$2.2

0.85%

C & I

171

4.0

0.2

0.47%

Consumer

309

2.6

0.5

0.65%

Residential Mortgages

381

7.5

0

0.00%

Total Ex Leasing

1,900

37.2

2.9

0.61%

Leasing

105

8.4

0.7

2.67%

TOTAL

$2,005

$45.6

$3.6

0.73%

31

Lakeland

bancorp, inc.

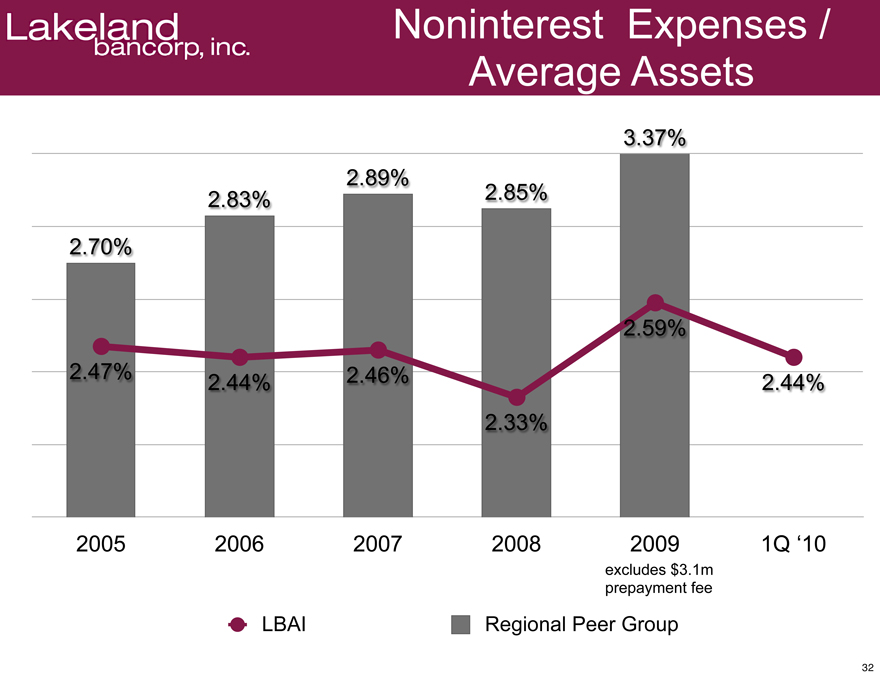

Noninterest Expenses / Average Assets

2.70%

2.83%

2.89%

2.85%

3.37%

2.47%

2.44%

2.46%

2.33%

2.59%

2.44%

2005

2006

2007

2008

2009

1Q ‘10

Excludes $3.1m

Prepayment fee

LBAI

Regional Peer Group

32

Lakeland

bancorp, inc.

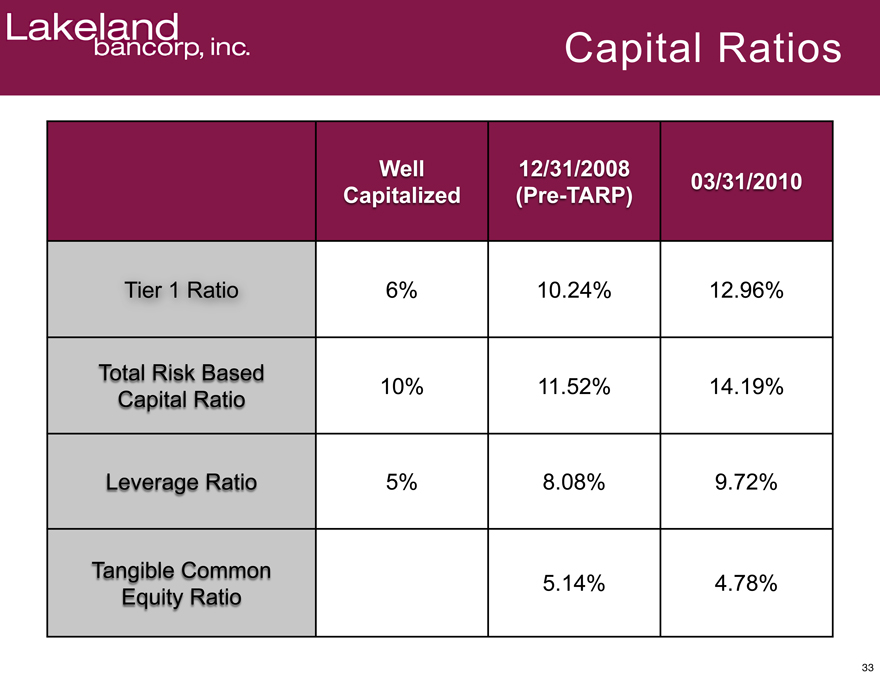

Capital Ratios

Well Capitalized

12/31/2008 (Pre-TARP)

03/31/2010

Tier 1 Ratio

6%

10.24%

12.96%

Total Risk Based Capital Ratio

10%

11.52%

14.19%

Leverage Ratio

5%

8.08%

9.72%

Tangible Common Equity Ratio

5.14%

4.78%

33

Lakeland

bancorp, inc.

LBAI Investment Considerations

Attractive market demographics

Growing loan and deposit market share

One of the largest commercial banks in Northern NJ Leasing issues addressed Relatively low NPA’s and Past Dues Solid Core Bank performance

34

Lakeland

bancorp, inc.

Regional Peer Group

Financial Institutions (FISI)

Harleysville National (HNBC) (through 12/31/2009) Hudson Valley Holding Corp. (HUVL) S & T Bancorp (STBA) Sandy Spring Bancorp (SASR) Smithtown Bancorp (SMTB) Sterling Bancorp (STL) Sun Bancorp (SNBC) Tompkins Financial (TMP)

35