Provident + Lakeland Creating a Premier Super-Community Bank September 27, 2022 Exhibit 99.2

Forward-Looking Statements This communication includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, with respect to the beliefs, goals, intentions, and expectations of Provident Financial Services, Inc. (“Provident”) and Lakeland Bancorp, Inc. (“Lakeland”) regarding the proposed transaction, revenues, earnings, earnings per share, loan production, asset quality, and capital levels, among other matters; our estimates of future costs and benefits of the actions we may take; our assessments of probable losses on loans; our assessments of interest rate and other market risks; our ability to achieve our financial and other strategic goals; the expected timing of completion of the proposed transaction; the expected cost savings, synergies and other anticipated benefits from the proposed transaction; and other statements that are not historical facts. Forward‐looking statements are typically identified by such words as “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “should,” and other similar words and expressions, and are subject to numerous assumptions, risks, and uncertainties, which change over time. These forward-looking statements include, without limitation, those relating to the terms, timing and closing of the proposed transaction. Additionally, forward‐looking statements speak only as of the date they are made; Provident and Lakeland do not assume any duty, and do not undertake, to update such forward‐looking statements, whether written or oral, that may be made from time to time, whether as a result of new information, future events, or otherwise. Furthermore, because forward‐looking statements are subject to assumptions and uncertainties, actual results or future events could differ, possibly materially, from those indicated in such forward-looking statements as a result of a variety of factors, many of which are beyond the control of Provident and Lakeland. Such statements are based upon the current beliefs and expectations of the management of Provident and Lakeland and are subject to significant risks and uncertainties outside of the control of the parties. Caution should be exercised against placing undue reliance on forward-looking statements. The factors that could cause actual results to differ materially include the following: the occurrence of any event, change or other circumstances that could give rise to the right of one or both of the parties to terminate the definitive merger agreement between Provident and Lakeland; the outcome of any legal proceedings that may be instituted against Provident or Lakeland; the possibility that the proposed transaction will not close when expected or at all because required regulatory, shareholder or other approvals are not received or other conditions to the closing are not satisfied on a timely basis or at all, or are obtained subject to conditions that are not anticipated (and the risk that required regulatory approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the proposed transaction); the ability of Provident and Lakeland to meet expectations regarding the timing, completion and accounting and tax treatments of the proposed transaction; the risk that any announcements relating to the proposed transaction could have adverse effects on the market price of the common stock of either or both parties to the proposed transaction; the possibility that the anticipated benefits of the proposed transaction will not be realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy and competitive factors in the areas where Provident and Lakeland do business; certain restrictions during the pendency of the proposed transaction that may impact the parties’ ability to pursue certain business opportunities or strategic transactions; the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; diversion of management’s attention from ongoing business operations and opportunities; the possibility that the parties may be unable to achieve expected synergies and operating efficiencies in the merger within the expected timeframes or at all and to successfully integrate Lakeland’s operations and those of Provident; such integration may be more difficult, time-consuming or costly than expected; revenues following the proposed transaction may be lower than expected; Provident’s and Lakeland’s success in executing their respective business plans and strategies and managing the risks involved in the foregoing; the dilution caused by Provident’s issuance of additional shares of its capital stock in connection with the proposed transaction; effects of the announcement, pendency or completion of the proposed transaction on the ability of Provident and Lakeland to retain customers and retain and hire key personnel and maintain relationships with their suppliers, and on their operating results and businesses generally; and risks related to the potential impact of general economic, political and market factors on the companies or the proposed transaction and other factors that may affect future results of Provident and Lakeland; uncertainty as to the extent of the duration, scope, and impacts of the COVID-19 pandemic on Provident, Lakeland and the proposed transaction; and the other factors discussed in the “Risk Factors” section of each of Provident’s and Lakeland’s Annual Report on Form 10‐K for the year ended December 31, 2021, in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of each of Provident’s and Lakeland’s Quarterly Report on Form 10‐Q for the quarter ended June 30, 2022, and other reports Provident and Lakeland file with the U.S. Securities and Exchange Commission (the “SEC”).

Additional Information and Where to Find It In connection with the proposed transaction, Provident will file a registration statement on Form S-4 with the SEC. The registration statement will include a joint proxy statement of Provident and Lakeland, which also constitutes a prospectus of Provident, that will be sent to stockholders of Provident and shareholders of Lakeland seeking certain approvals related to the proposed transaction. The information contained herein does not constitute an offer to sell or a solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. INVESTORS AND SECURITY HOLDERS OF PROVIDENT AND LAKELAND AND THEIR RESPECTIVE AFFILIATES ARE URGED TO READ, WHEN AVAILABLE, THE REGISTRATION STATEMENT ON FORM S-4, THE JOINT PROXY STATEMENT/PROSPECTUS TO BE INCLUDED WITHIN THE REGISTRATION STATEMENT ON FORM S-4 AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT PROVIDENT, LAKELAND AND THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain a free copy of the registration statement, including the joint proxy statement/prospectus, as well as other relevant documents filed with the SEC containing information about Provident and Lakeland, without charge, at the SEC’s website (http://www.sec.gov). Copies of documents filed with the SEC by Provident will be made available free of charge in the “SEC Filings” section of Provident’s website, https://investorrelations.provident.bank/, under the heading “SEC Filings.” Copies of documents filed with the SEC by Lakeland will be made available free of charge in the “Investor Relations” section of Lakeland’s website, https://investorrelations.lakelandbank.com/, under the heading “Documents.”

Participants in Solicitation Provident, Lakeland, and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction under the rules of the SEC. Information regarding Provident’s directors and executive officers is available in its definitive proxy statement, which was filed with the SEC on March 18, 2022, and certain other documents filed by Provident with the SEC. Information regarding Lakeland’s directors and executive officers is available in its definitive proxy statement, which was filed with the SEC on April 7, 2022, and certain other documents filed by Lakeland with the SEC. Other information regarding the participants in the solicitation of proxies in respect of the proposed transaction and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC. Free copies of these documents, when available, may be obtained as described in the preceding paragraph.

Today’s Presenters Experienced Executive Management Team Leveraging Two Best-in-Class Organizations Anthony Labozzetta President, CEO & Director Provident Financial Services, Inc. Christopher Martin Executive Chairman Provident Financial Services, Inc. Thomas Shara Jr. President, CEO & Director Lakeland Bancorp, Inc. Thomas Lyons Senior Executive Vice President & CFO Provident Financial Services, Inc.

Combination of Two High-Performing, Like-Minded New Jersey Institutions Creating a Preeminent Super-Community Bank

Creating Scale and Enhancing Shareholder Value Creates a top-tier New Jersey/Tri-State area super-community bank with significant scale Drives even stronger financial results and better positions the company for the future Unites like-minded institutions that have shared visions, values, and a commitment to employees, customers and the community Joins together two banks with superior credit risk management practices Combines two strong management teams and boards Unlocks compelling revenue growth opportunities in commercial lending, wealth management and insurance

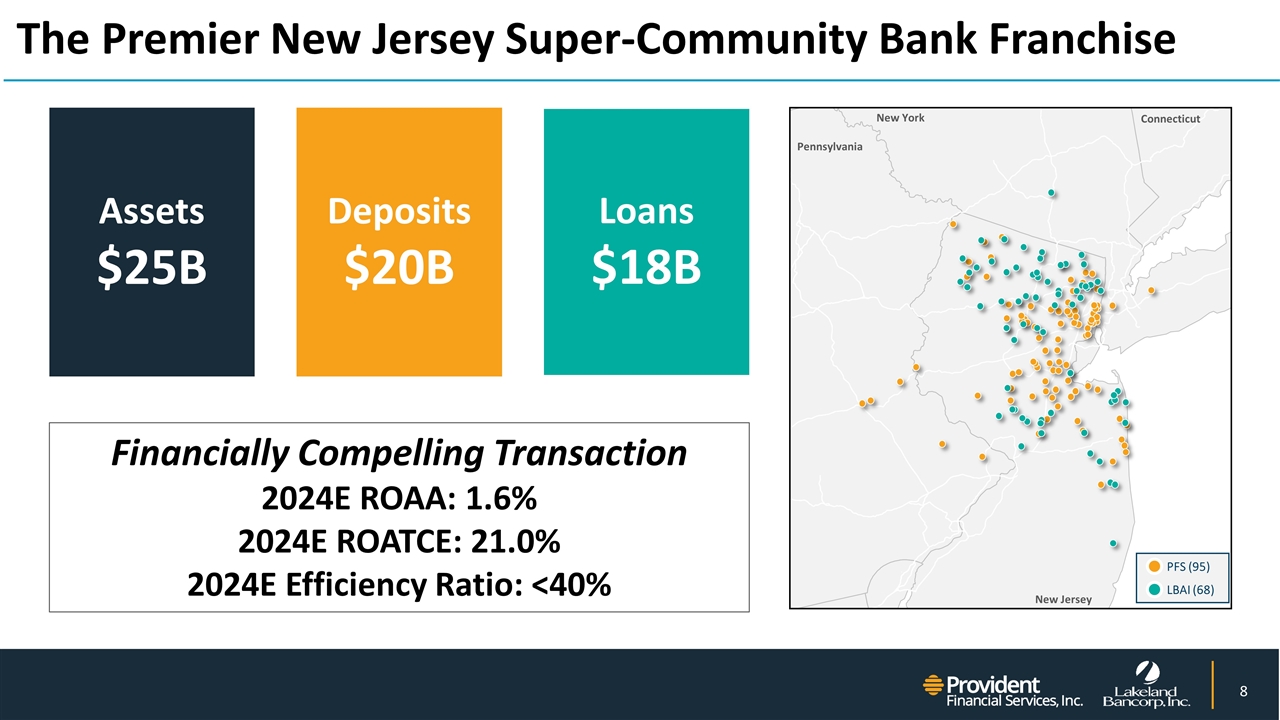

New York Pennsylvania New Jersey Connecticut The Premier New Jersey Super-Community Bank Franchise Deposits $20B Assets $25B Loans $18B PFS (95) LBAI (68) Financially Compelling Transaction 2024E ROAA: 1.6% 2024E ROATCE: 21.0% 2024E Efficiency Ratio: <40%

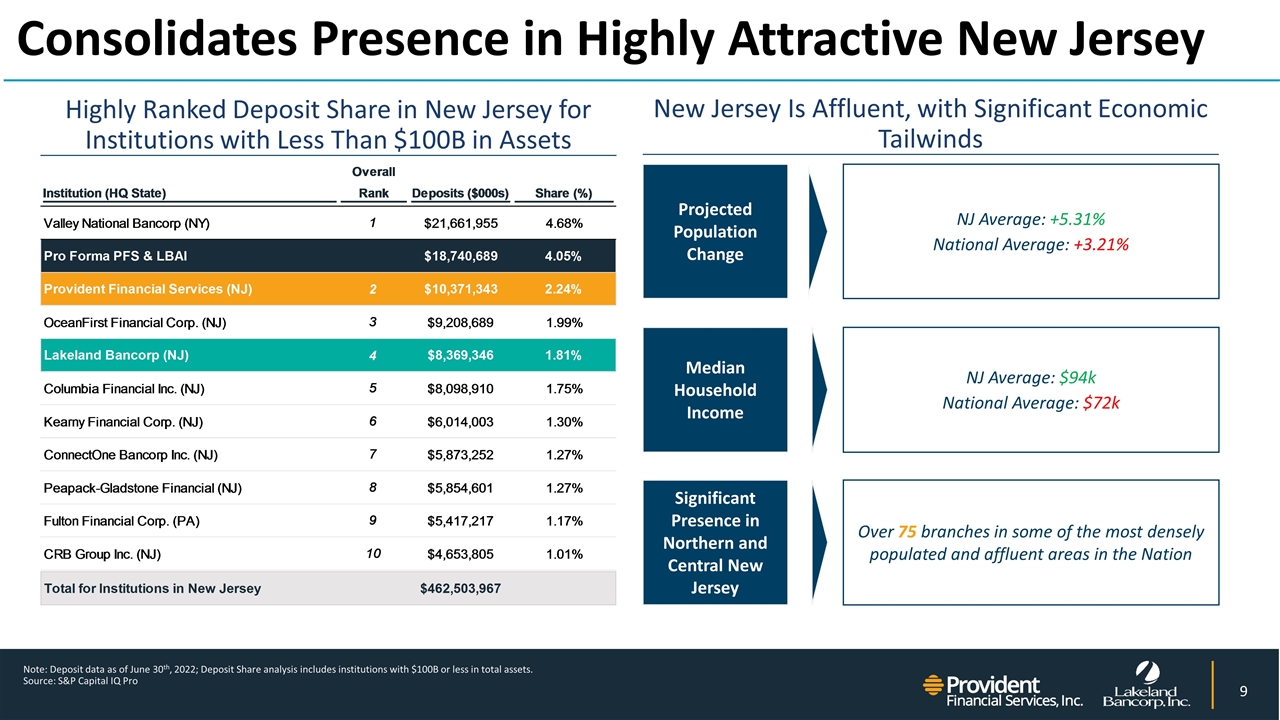

Consolidates Presence in Highly Attractive New Jersey Highly Ranked Deposit Share in New Jersey for Institutions with Less Than $100B in Assets New Jersey Is Affluent, with Significant Economic Tailwinds Note: Deposit data as of June 30th, 2022; Deposit Share analysis includes institutions with $100B or less in total assets. Source: S&P Capital IQ Pro Projected Population Change NJ Average: +5.31% National Average: +3.21% Median Household Income NJ Average: $94k National Average: $72k Significant Presence in Northern and Central New Jersey Over 75 branches in some of the most densely populated and affluent areas in the Nation

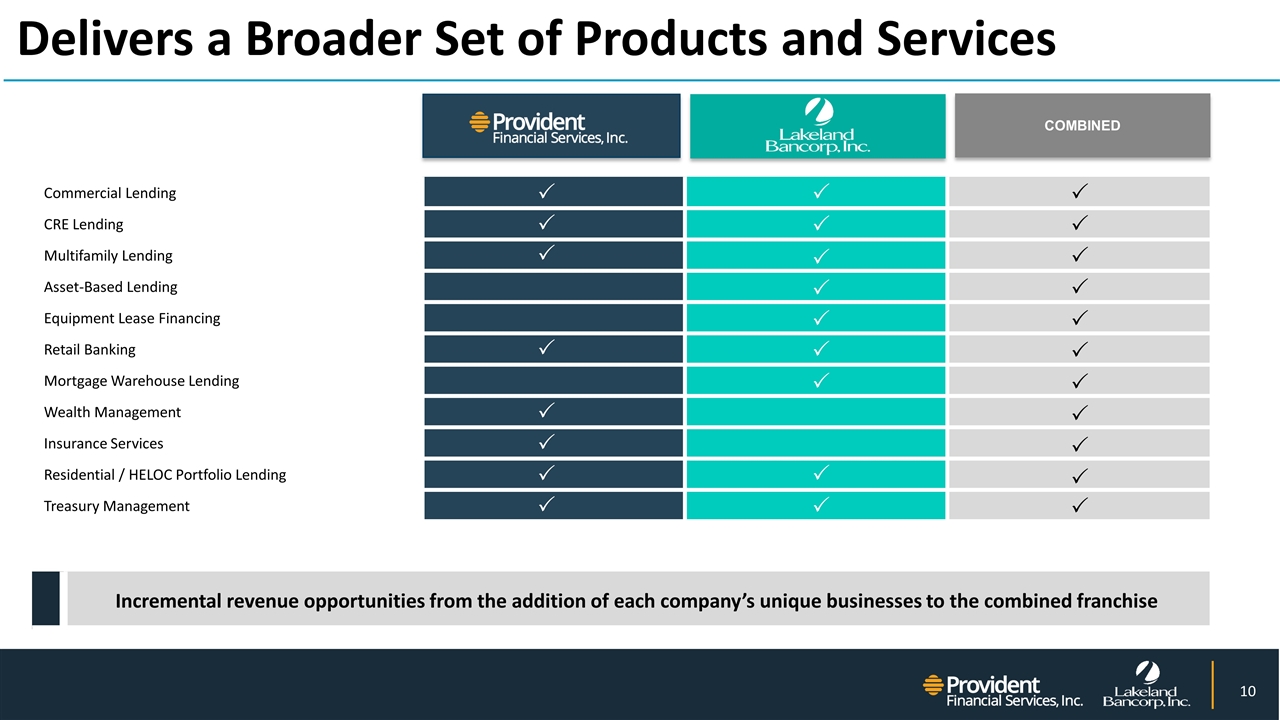

Commercial Lending CRE Lending Multifamily Lending Asset-Based Lending Equipment Lease Financing Retail Banking Mortgage Warehouse Lending Wealth Management Insurance Services Residential / HELOC Portfolio Lending Treasury Management COMBINED Delivers a Broader Set of Products and Services P P P P P P P P P P P P P P P P P P P P P P P P P P P P Incremental revenue opportunities from the addition of each company’s unique businesses to the combined franchise

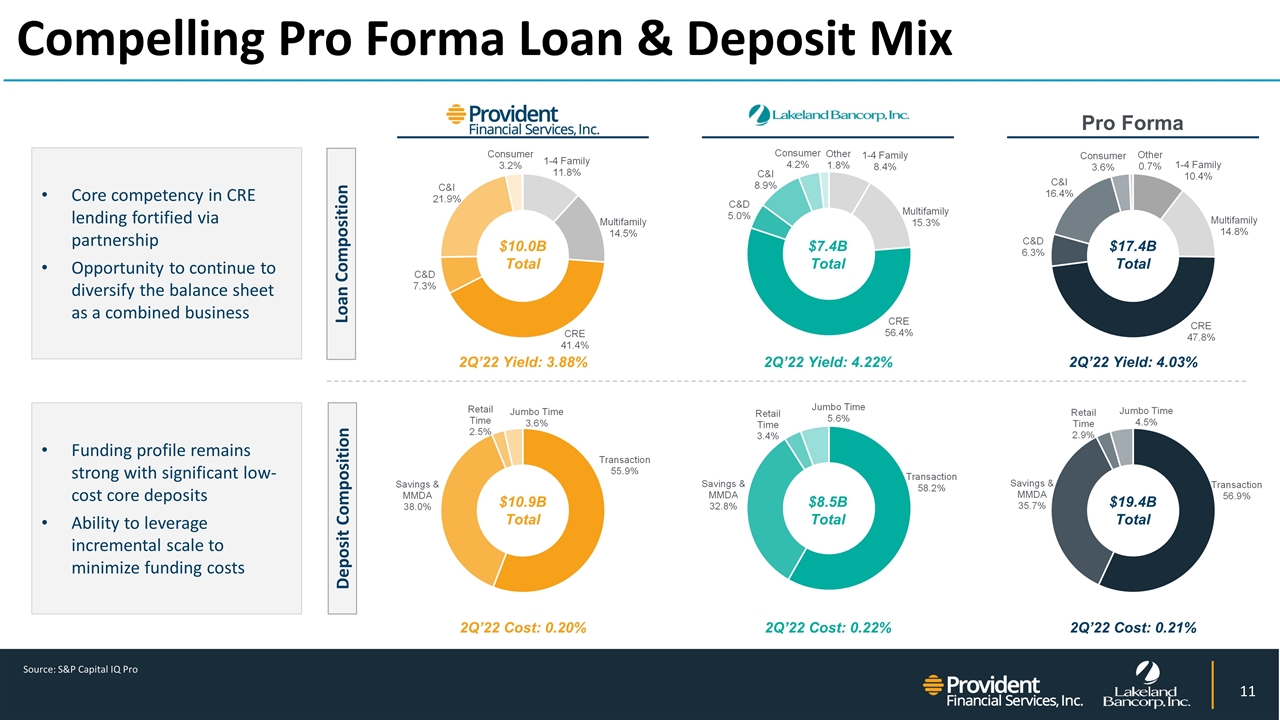

Compelling Pro Forma Loan & Deposit Mix Deposit Composition Loan Composition 2Q’22 Yield: 4.22% 2Q’22 Yield: 3.88% 2Q’22 Yield: 4.03% 2Q’22 Cost: 0.22% 2Q’22 Cost: 0.20% 2Q’22 Cost: 0.21% Pro Forma $7.4B Total $8.5B Total $10.0B Total $10.9B Total $17.4B Total $19.4B Total Core competency in CRE lending fortified via partnership Opportunity to continue to diversify the balance sheet as a combined business Funding profile remains strong with significant low-cost core deposits Ability to leverage incremental scale to minimize funding costs Source: S&P Capital IQ Pro

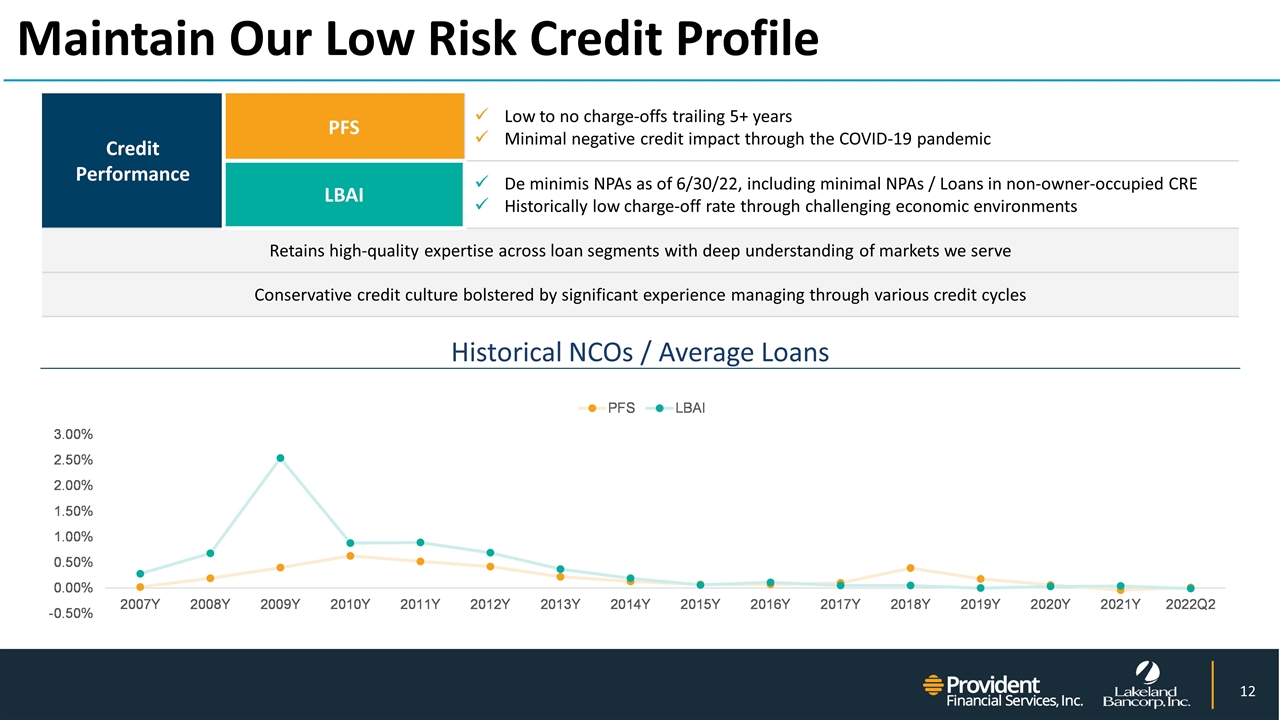

Maintain Our Low Risk Credit Profile Credit Performance PFS Low to no charge-offs trailing 5+ years Minimal negative credit impact through the COVID-19 pandemic LBAI De minimis NPAs as of 6/30/22, including minimal NPAs / Loans in non-owner-occupied CRE Historically low charge-off rate through challenging economic environments Retains high-quality expertise across loan segments with deep understanding of markets we serve Conservative credit culture bolstered by significant experience managing through various credit cycles Historical NCOs / Average Loans

Robust and Thorough Two-Way Due Diligence Scope of Diligence Efforts Comprehensive due diligence coordinated and led by key executives from Provident and Lakeland Management-led review of all functional areas Full engagement of external consultants and advisors through the diligence process Extensive review of the loan portfolio Significant detailed credit reviews 3rd party loan reviews completed by both companies Each party reviewed ~50% of the counterparty’s commercial loan portfolio Integration will be managed by long-time employees of Provident and Lakeland who have been actively involved in diligence and previous merger integrations Teams of participants across both PFS and LBAI, including consultants and advisors, dedicated to the diligence process focused on: Deposit Strategy Commercial Banking Investment Portfolio ALCO Credit & Underwriting CECL Risk Mgmt. & Internal Audit Legal & Compliance Technology & Cybersecurity Operations Balance Sheet Positioning Human Resources Capital Stress Testing Integration Planning 4 PFS Acquisitions 1 7 LBAI Acquisitions 1 Both management teams are experienced acquirors Represents whole bank acquisitions

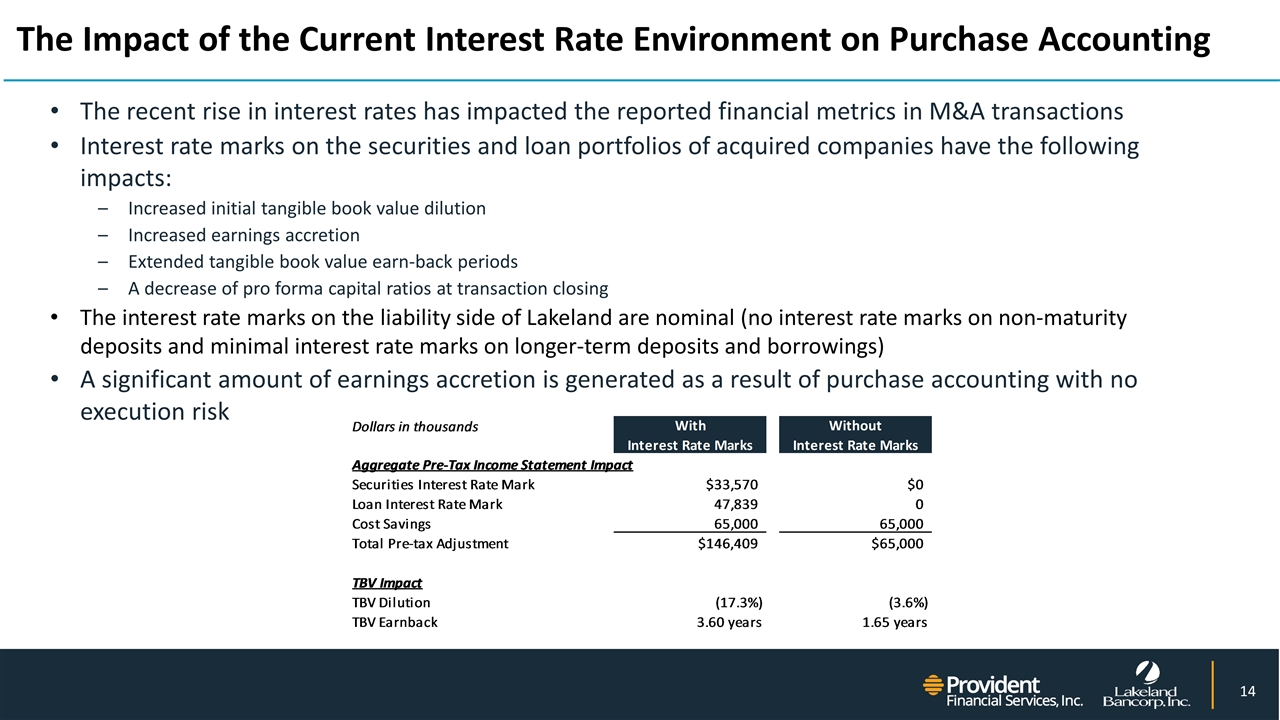

The Impact of the Current Interest Rate Environment on Purchase Accounting The recent rise in interest rates has impacted the reported financial metrics in M&A transactions Interest rate marks on the securities and loan portfolios of acquired companies have the following impacts: Increased initial tangible book value dilution Increased earnings accretion Extended tangible book value earn-back periods A decrease of pro forma capital ratios at transaction closing The interest rate marks on the liability side of Lakeland are nominal (no interest rate marks on non-maturity deposits and minimal interest rate marks on longer-term deposits and borrowings) A significant amount of earnings accretion is generated as a result of purchase accounting with no execution risk

Environmental, Social and Governance efforts remain a top priority Shared Values & Benefits for All Stakeholders Expand Products and Services to better serve customers Retain commitment to Community Development and Corporate Citizenship 10,000+ Volunteer Hours for Combined Organization in communities where we live and work Complementary Values Based Cultures and robust risk management Invest in Technology to enhance client and customer experience Dedicated to continuing annual corporate giving programs. $3 Million+ in annual corporate giving Commitment to advancing our progress on Diversity, Equity and Inclusion

Transaction Detail

Transaction Overview Structure & Exchange Ratio Lakeland Bancorp, Inc. to merge into Provident Financial Services, Inc.; Lakeland Bank to merge into Provident Bank 100% stock consideration 0.8319x of a Provident share for each Lakeland share Aggregate transaction value of $1.3bn ¹ Leadership Christopher Martin, Executive Chairman of Provident, will serve as Executive Chairman of the combined company Anthony Labozzetta, President, CEO & Director of Provident, will serve as CEO, President and Director of the combined company Thomas Shara Jr., President, CEO & Director of Lakeland, will serve as Executive Vice Chairman of the combined company James Nigro, Timothy Matteson and John Rath, from Lakeland, will be joining the pro forma company executive management team Board of Directors 9 Provident / 7 Lakeland Includes Christopher Martin (Executive Chairman), Thomas Shara Jr. (Executive Vice Chairman) and Anthony Labozzetta (Director) Lead Independent Director to come from Provident Ownership 58% Provident / 42% Lakeland Brand & Administrative Headquarters Provident Iselin, NJ Timing & Approvals Anticipated closing in Q2 2023 Subject to Provident and Lakeland shareholder approvals and required regulatory approvals Based on LBAI’s market price of $16.38 as of September 23, 2022 Based on Provident’s market price of $23.16 as of September 26, 2022

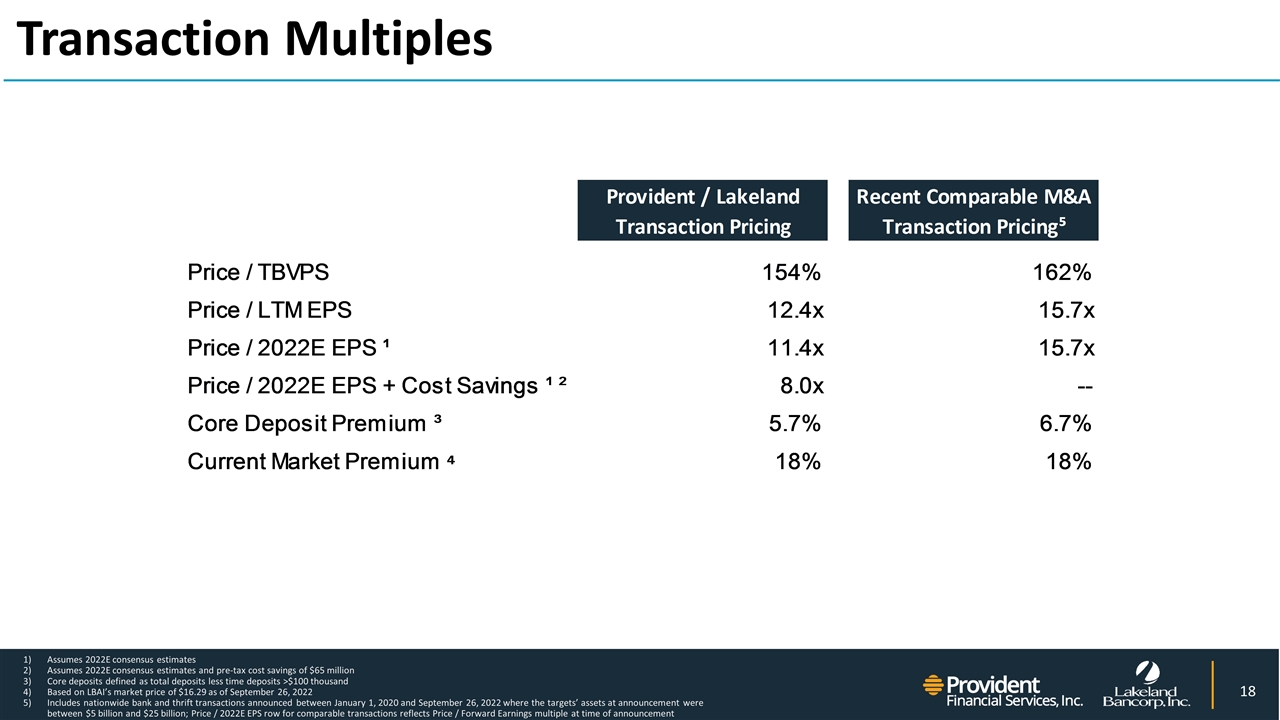

Transaction Multiples Assumes 2022E consensus estimates Assumes 2022E consensus estimates and pre-tax cost savings of $65 million Core deposits defined as total deposits less time deposits >$100 thousand Based on LBAI’s market price of $16.29 as of September 26, 2022 Includes nationwide bank and thrift transactions announced between January 1, 2020 and September 26, 2022 where the targets’ assets at announcement were between $5 billion and $25 billion; Price / 2022E EPS row for comparable transactions reflects Price / Forward Earnings multiple at time of announcement

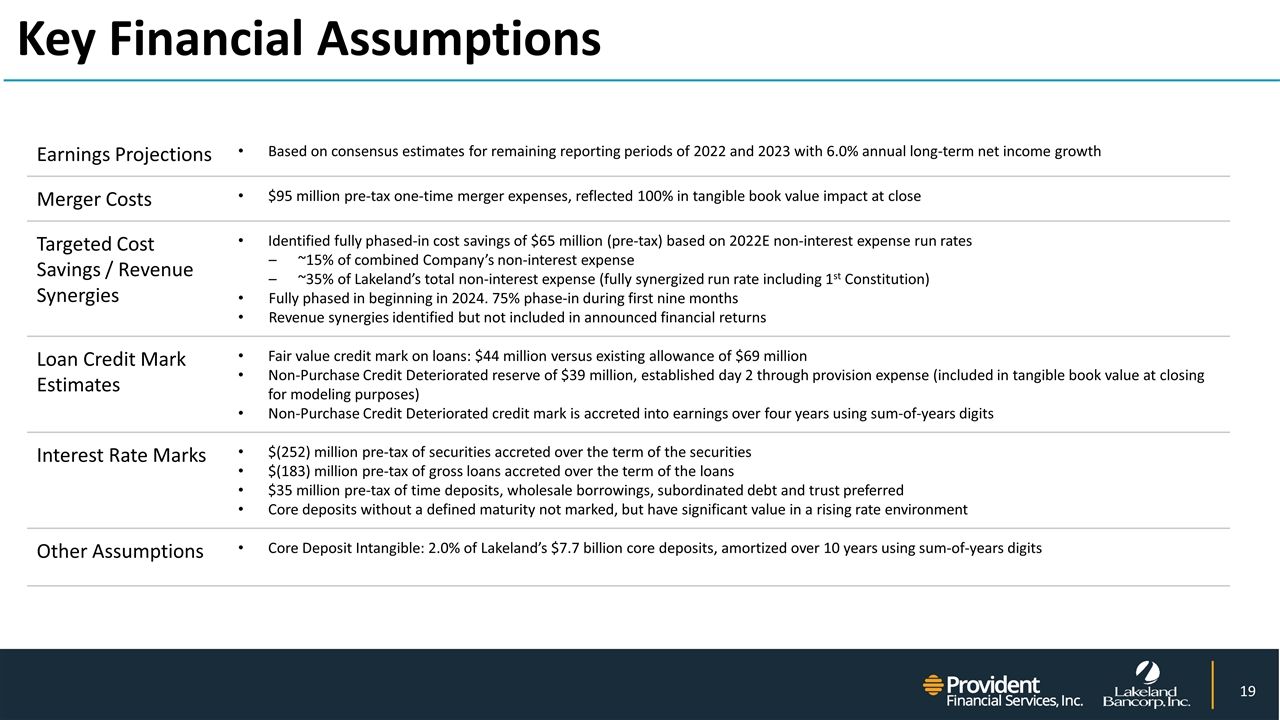

Key Financial Assumptions Earnings Projections Based on consensus estimates for remaining reporting periods of 2022 and 2023 with 6.0% annual long-term net income growth Merger Costs $95 million pre-tax one-time merger expenses, reflected 100% in tangible book value impact at close Targeted Cost Savings / Revenue Synergies Identified fully phased-in cost savings of $65 million (pre-tax) based on 2022E non-interest expense run rates ~15% of combined Company’s non-interest expense ~35% of Lakeland’s total non-interest expense (fully synergized run rate including 1st Constitution) Fully phased in beginning in 2024. 75% phase-in during first nine months Revenue synergies identified but not included in announced financial returns Loan Credit Mark Estimates Fair value credit mark on loans: $44 million versus existing allowance of $69 million Non-Purchase Credit Deteriorated reserve of $39 million, established day 2 through provision expense (included in tangible book value at closing for modeling purposes) Non-Purchase Credit Deteriorated credit mark is accreted into earnings over four years using sum-of-years digits Interest Rate Marks $(252) million pre-tax of securities accreted over the term of the securities $(183) million pre-tax of gross loans accreted over the term of the loans $35 million pre-tax of time deposits, wholesale borrowings, subordinated debt and trust preferred Core deposits without a defined maturity not marked, but have significant value in a rising rate environment Other Assumptions Core Deposit Intangible: 2.0% of Lakeland’s $7.7 billion core deposits, amortized over 10 years using sum-of-years digits

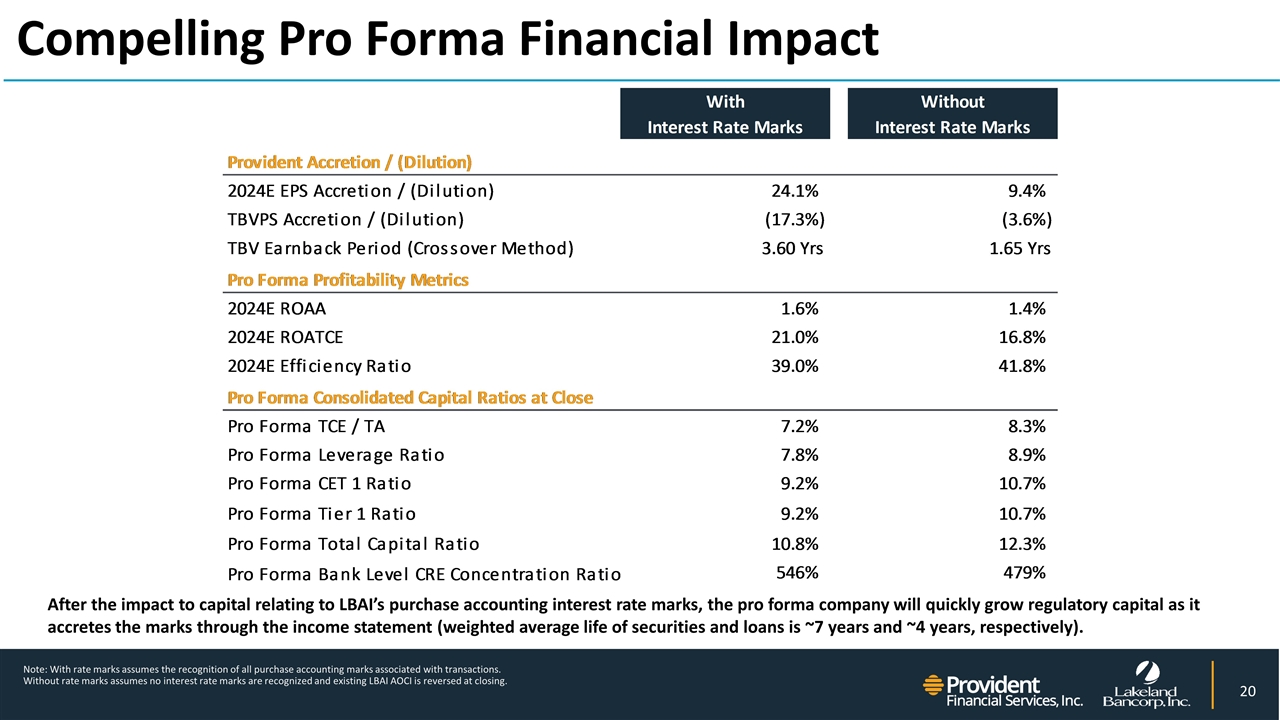

Compelling Pro Forma Financial Impact Note: With rate marks assumes the recognition of all purchase accounting marks associated with transactions. Without rate marks assumes no interest rate marks are recognized and existing LBAI AOCI is reversed at closing. After the impact to capital relating to LBAI’s purchase accounting interest rate marks, the pro forma company will quickly grow regulatory capital as it accretes the marks through the income statement (weighted average life of securities and loans is ~7 years and ~4 years, respectively).

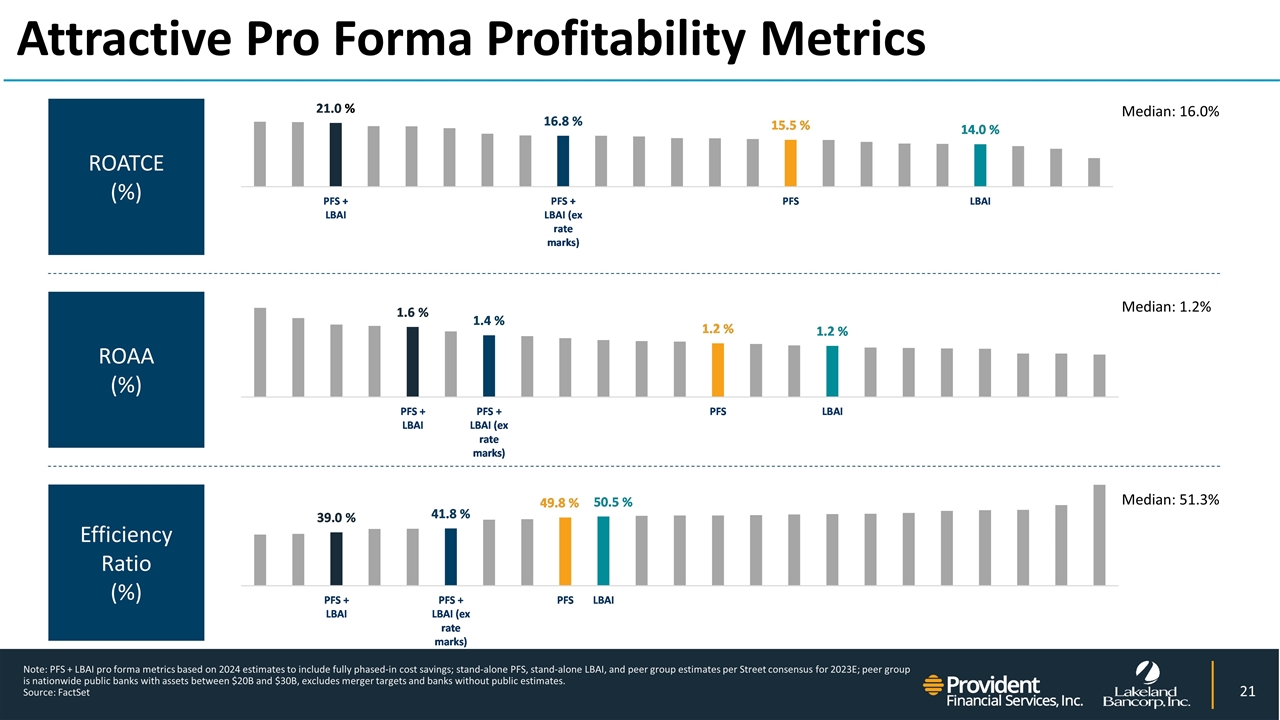

Attractive Pro Forma Profitability Metrics ROATCE (%) ROAA (%) Efficiency Ratio (%) Note: PFS + LBAI pro forma metrics based on 2024 estimates to include fully phased-in cost savings; stand-alone PFS, stand-alone LBAI, and peer group estimates per Street consensus for 2023E; peer group is nationwide public banks with assets between $20B and $30B, excludes merger targets and banks without public estimates. Source: FactSet Median: 16.0% Median: 1.2% Median: 51.3%

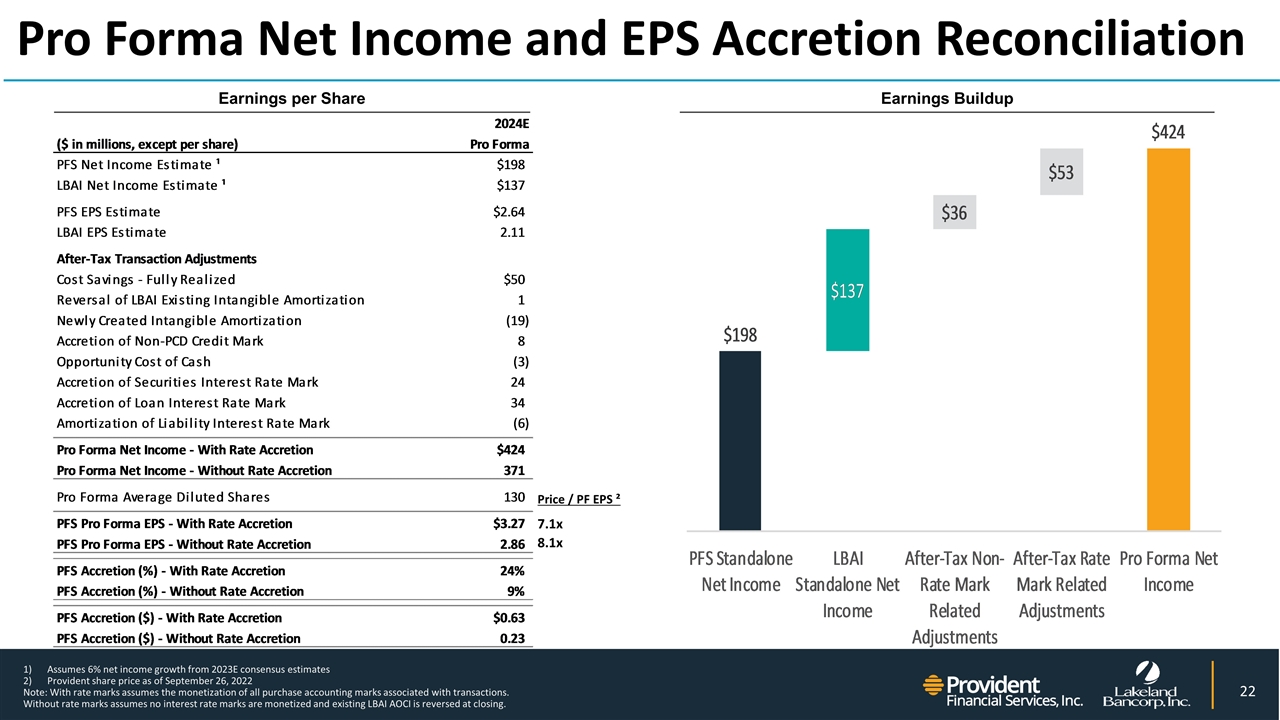

Pro Forma Net Income and EPS Accretion Reconciliation Earnings per Share Earnings Buildup Price / PF EPS ² 7.1x 8.1x Assumes 6% net income growth from 2023E consensus estimates Provident share price as of September 26, 2022 Note: With rate marks assumes the monetization of all purchase accounting marks associated with transactions. Without rate marks assumes no interest rate marks are monetized and existing LBAI AOCI is reversed at closing.

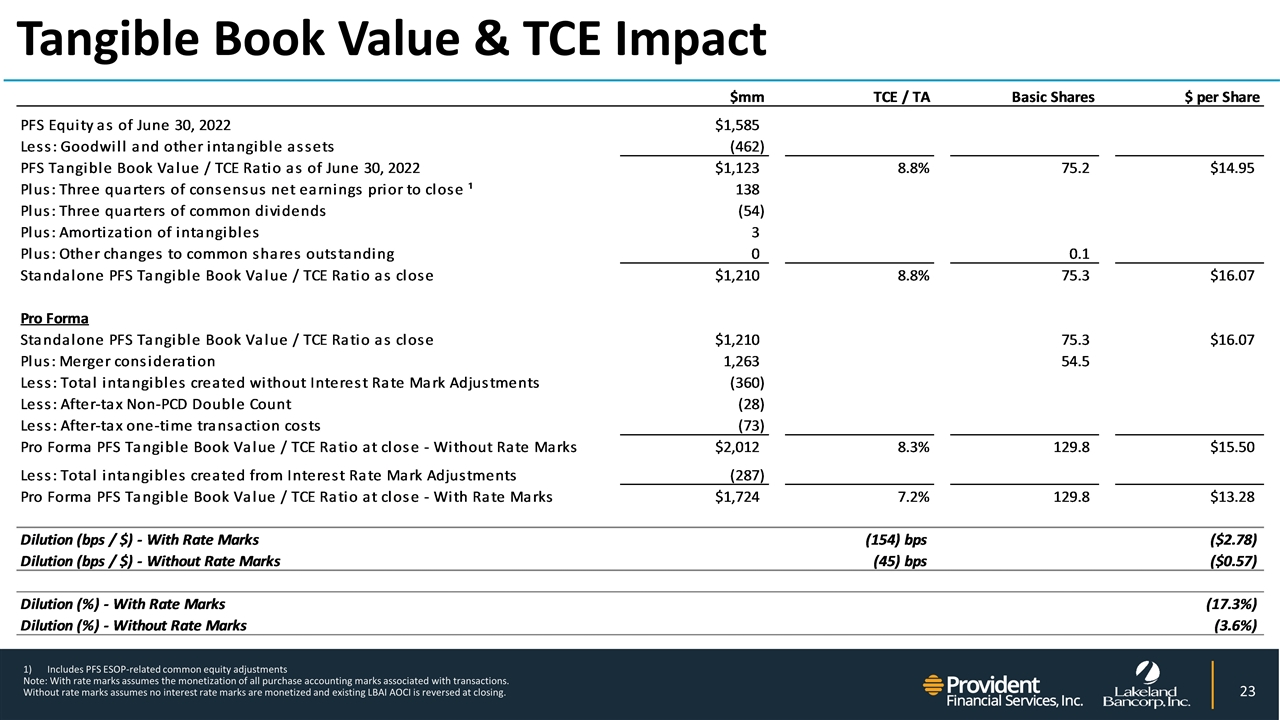

Tangible Book Value & TCE Impact Includes PFS ESOP-related common equity adjustments Note: With rate marks assumes the monetization of all purchase accounting marks associated with transactions. Without rate marks assumes no interest rate marks are monetized and existing LBAI AOCI is reversed at closing.

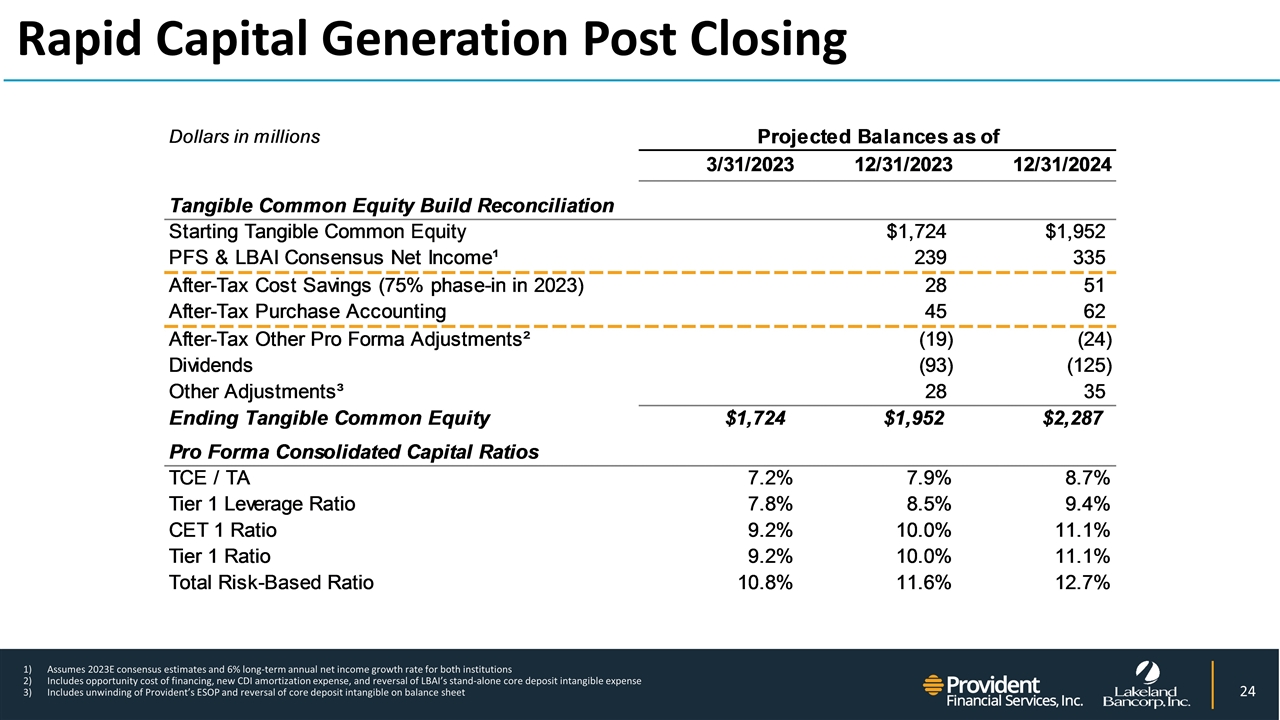

Rapid Capital Generation Post Closing Assumes 2023E consensus estimates and 6% long-term annual net income growth rate for both institutions Includes opportunity cost of financing, new CDI amortization expense, and reversal of LBAI’s stand-alone core deposit intangible expense Includes unwinding of Provident’s ESOP and reversal of core deposit intangible on balance sheet

In Summary Creates a premier super-community bank Financially compelling: size and scale creates unparalleled strategic positioning in the Tri-State area Internal rate of return of approximately 20% Low execution risk between two partners with significant M&A experience and material, low-risk purchase accounting accretion Ability to deliver greater value to all constituents: employees, customers, communities & ultimately shareholders

Thank You