UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 [NO FEE REQUIRED] |

For the fiscal year ended: December 31, 2007

OR

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 [NO FEE REQUIRED] |

For the transition period from_________________to_______________

Commission File No. 000-33059

Fuel Tech, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 20-5657551 |

| (State or other jurisdiction of incorporation of organization) | (I.R.S. Employer Identification Number) |

Fuel Tech, Inc.

512 Kingsland Drive

Batavia, IL 60510-2299

630-845-4500

(Address and telephone number of principal executive offices)

Securities registered pursuant to Section 12(b) of the Act:

Common Stock $0.01 par value per share | | The NASDAQ Stock Market, Inc |

(Title of Class) | | (Name of Exchange on Which Registered) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No x

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x Noo

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, non-accelerated filer or a smaller reporting company (as defined in rule 12b-2 under the Securities Exchange Act of 1934)

Large Accelerated Filer o Accelerated Filer x Non-accelerated Filer (Do not check if a smaller reporting company) o Smaller reporting company o

The aggregate market value of the voting stock held by non-affiliates of the registrant based on the average bid and asked prices of June 29, 2007 was $606,931,000. The aggregate market value of the voting stock held by non-affiliates of the registrant based on the average bid and asked prices of February 4, 2008 was $343,585,000.

Indicate number of shares outstanding of each of the registered classes of Common Stock at February 4, 2008: 22,415,064 shares of Common Stock, $0.01 par value.

Documents incorporated by reference:

Certain portions of the Proxy Statement for the annual meeting of stockholders to be held in 2007 are incorporated by reference in Parts II, III, and IV hereof.

| | | | | Page |

| | | | | |

| | | | | |

| | | | 1 |

| | | | 6 |

| | | | 7 |

| | | | 7 |

| | | | 7 |

| | | | 7 |

| | | | | |

| | | | | |

| | | | | |

| | | | 8 |

| | | | 10 |

| | | | 11 |

| | | | 18 |

| | | | 19 |

| | | | 45 |

| | | | 45 |

| | | | 45 |

| | | | | |

| | | | | |

| | | | | |

| | | | 46 |

| | | | 47 |

| | | | 47 |

| | | | 47 |

| | | | 47 |

| | | | | |

| | | | | |

| | | | | |

| | | | 48 |

| | | | | |

| | 51 |

TABLE OF DEFINED TERMS

Term | | Definition |

| | | |

| ABC | | American Bailey Corporation |

| | | |

| CAAA | | Clean Air Act Amendments of 1990 |

| | | |

| CAIR | | Clean Air Interstate Rule |

| | | |

| CAVR | | Clean Air Visibility Rule |

| | | |

| CDT | | Clean Diesel Technologies, Inc. |

| | | |

| CFD | | Computational Fluid Dynamics |

| | | |

| Common Shares | | Shares of the Common Stock of Fuel Tech |

| | | |

| Common Stock | | Common Stock of Fuel Tech |

| | | |

| EPA | | Environmental Protection Agency |

| | | |

| EPRI | | Electric Power Research Institute |

| | | |

FUEL CHEM® | | A trademark used to describe Fuel Tech’s fuel and flue gas treatment processes, including its TIFI™ Targeted In-Furnace Injection™ technology to control slagging, fouling, corrosion and a variety of sulfur trioxide-related issues |

| | | |

| Fuel Tech | | Fuel Tech, Inc. and its subsidiaries |

| | | |

| Investors | | The purchasers of Fuel Tech securities pursuant to a Securities Purchase Agreement as of March 23, 1998 |

| | | |

| Loan Notes | | Nil Coupon Non-redeemable Convertible Unsecured Loan Notes of Fuel Tech |

| | | |

| NOx | | Oxides of nitrogen |

| | | |

NOxOUT CASCADE® | | A trademark used to describe Fuel Tech’s combination of NOxOUT and SCR |

| | | |

NOxOUT® Process | | A trademark used to describe Fuel Tech’s SNCR process for the reduction of NOx |

| | | |

NOxOUT-SCR® | | A trademark used to describe Fuel Tech’s direct injection of urea as a catalyst reagent |

| | | |

| | | |

NOxOUT ULTRA® | | A trademark used to describe Fuel Tech’s process for generating ammonia for use as SCR reagent |

| | | |

| Rich Reagent Injection Technology (RRI) | | An SNCR-type process that broadens the NOx reduction capability of the NOxOUT Process at a cost similar to NOxOUT. RRI can also be applied on a stand-alone basis. |

| | | |

| SCR | | Selective Catalytic Reduction |

| | | |

| SIP Call | | State Implementation Plan Regulation |

| | | |

| SNCR | | Selective Non-Catalytic Reduction |

| | | |

| TCI™ Targeted Corrosion Inhibition™ | | A FUEL CHEM program designed for high-temperature slag and corrosion control, principally in waste-to-energy boilers |

| | | |

| TIFI™ Targeted In-Furnace Injection™ | | A proprietary technology that enables the precise injection of a chemical reagent into a boiler or furnace as part of a FUEL CHEM program |

Forward Looking Statements

Statements in this Form 10-K that are not historical facts, so-called "forward-looking statements," are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Investors are cautioned that all forward-looking statements involve risks and uncertainties, including those detailed in Fuel Tech's filings with the Securities and Exchange Commission. See "Risk Factors" in Item 1A.

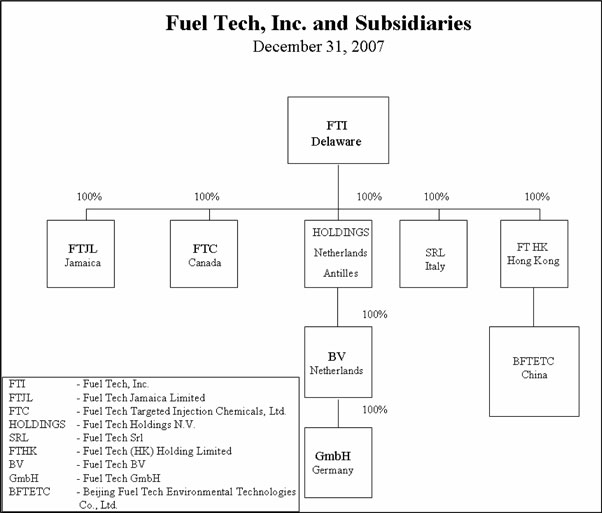

Fuel Tech

Fuel Tech, Inc. (“Fuel Tech”) is a fully integrated company that uses a suite of advanced technologies to provide boiler optimization, efficiency improvement and air pollution reduction and control solutions to utility and industrial customers worldwide. Originally incorporated in 1987 under the laws of the Netherlands Antilles as Fuel-Tech N.V., Fuel Tech became domesticated in the United States on September 30, 2006, and continues as a Delaware corporation with its corporate headquarters at 512 Kingsland Drive, Batavia, Illinois, 60510-2299. Fuel Tech maintains an Internet web site at www.ftek.com.

Fuel Tech's special focus is the worldwide marketing of its nitrogen oxide (“NOx”) reduction and FUEL CHEM® processes. The NOx reduction technology segment, which includes the NOxOUT®, NOxOUT CASCADE®, NOxOUT ULTRA® and NOxOUT-SCR® processes, reduces NOx emissions in flue gas from boilers, incinerators, furnaces and other stationary combustion sources. The FUEL CHEM technology segment improves the efficiency, reliability and environmental status of combustion units by controlling slagging, fouling, corrosion, opacity, acid plume and loss on ignition, as well as the formation of sulfur trioxide, ammonium bisulfate, particulate matter (PM2.5), carbon dioxide and NOx through the addition of chemicals into the fuel or via TIFI™ Targeted In-Furnace Injection™ programs. Fuel Tech has other technologies, both commercially available and in the development stage, all of which are related to the NOxOUT and FUEL CHEM processes or are similar in their technological base. Fuel Tech's business is materially dependent on the continued existence and enforcement of worldwide air quality regulations.

American Bailey Corporation

Ralph E. Bailey, Executive Chairman and Director of Fuel Tech, and Douglas G. Bailey, Deputy Chairman and Director of Fuel Tech, are shareholders of American Bailey Corporation (“ABC”), which is a related party. Please refer to Note 9 to the consolidated financial statements in this document for information about transactions between Fuel Tech and ABC. Additionally, see the more detailed information relating to this subject under the caption “Certain Relationships and Related Transactions” in Fuel Tech’s Proxy Statement, to be distributed in connection with Fuel Tech’s 2008 Annual Meeting of Shareholders, which information is incorporated by reference.

NOx Reduction

Regulations and Markets

The U.S. air pollution control market is the primary driver in Fuel Tech’s NOx reduction technology segment. This market is dependent on air pollution regulations and their continued enforcement. These regulations are based on the Clean Air Act Amendments of 1990 (the “CAAA”), which require reductions in NOx emissions on varying timetables with respect to various sources of emissions. Under the SIP (State Implementation Plan) Call, a regulation promulgated under the Amendments (discussed further below), over 1,000 utility and large industrial boilers in 19 states were required to achieve NOx reduction targets by May 31, 2004.

In 1994, governors of 11 Northeastern states, known collectively as the Ozone Transport Region, signed a Memorandum of Understanding requiring utilities to reduce their NOx emissions by 55% to 65% from 1990 levels by May 1999. In 1998, the Environmental Protection Agency (“EPA”) announced more stringent regulations. The Ozone Transport SIP Call regulation, designed to mitigate the effects of wind-aided ozone transported from the Midwestern and Southeastern U.S. into the Northeastern non-attainment areas, required, following the litigation described below, 19 states to make even deeper aggregate reductions of 85% from 1990 levels by May 31, 2004. Over 1,000 utility and large industrial boilers are affected by these mandates. Additionally, most other states with non-attainment areas were also required to meet ambient air quality standards for ozone by 2007.

Although the SIP Call was the subject of litigation, an appellate court of the D.C. Circuit upheld the validity of this regulation. This court’s ruling was later affirmed by the U.S. Supreme Court.

In February 2001, the U.S. Supreme Court, in a unanimous decision, upheld EPA’s authority to revise the National Ambient Air Quality Standard for ozone to 0.080 parts per million averaged through an eight-hour period from the current 0.120 parts per million for a one-hour period. This more stringent standard provided clarity and impetus for air pollution control efforts well beyond the then current ozone attainment requirement of 2007. In keeping with this trend, the Supreme Court, only days later, denied industry’s attempt to stay the SIP Call, effectively exhausting all means of appeal.

On December 23, 2003, the EPA proposed a new regulation affecting the SIP Call states by specifying more expansive NOx reduction. This rule, under the name “Clean Air Interstate Rule (CAIR),” was issued by the EPA on March 10, 2005. Commencing in 2009, CAIR specifies that additional annual NOx reduction requirements be extended to most SIP-affected units in 28 eastern states, while permitting a cap and trade format similar to the SIP Call. The Company expects an additional 1,300 electric generating units using coal and other fuels to be affected by this rule. In an action related to CAIR, on June 15, 2005, the EPA issued the “Clean Air Visibility Rule (CAVR),” which is a nationwide initiative to improve federally preserved areas through reduction of NOx and other pollutants. CAVR expands the NOx reduction market to Western states unaffected by CAIR or the SIP Call. Compliance begins in 2013 and CAVR will potentially affect and additional 230 western coal fired units. In addition, CAVR, along with the EPA rule for revised eight-hour ozone attainment, which was proposed on June 20, 2007, have the potential to impact thousands of boilers and industrial units in multiple industries nationwide for units burning coal and other fuels starting in 2013.

Fuel Tech also sells NOx control systems outside the United States, specifically in Europe and in the People's Republic of China (PRC). NOxOUT systems have long been sold in the traditional markets of Western Europe, but interest is growing in the newer markets of Eastern Europe as those nations join the European Union (EU) and become subject to tighter NOx emission standards. Under EU Directives, certain waste incinerators and cement plants must come into compliance with specified NOx reduction targets by 2008, while certain power plants must be in compliance by 2010. Fuel Tech was awarded its first air pollution control project in Romania during 2007.

The PRC also represents attractive opportunities for Fuel Tech as the Government's 11th Five-Year Economic Plan has set pollution control and energy efficiency and savings as the top two priorities. Fuel Tech has viable technologies to help achieve both objectives. The PRC has taken initial steps to reduce NOx emissions on new electric utility units (principally low NOx burners), and on-going research and demonstration projects are generating cost performance data for use in tightening standards in the near future, both for new and retrofit units. The PRC's dominant reliance on coal as an energy resource is not expected to diminish in the foreseeable future. Clean air has been and will continue to be a pressing issue, especially with the PRC’s booming economy (8%-12% annual GDP increase), expected growth in power production (4%-5% average annual increase through 2020), and an increasingly expanded role in international events and organizations. The PRC is the host of the upcoming 2008 Beijing Summer Olympics and the 2010 Shanghai World Expo. Fuel Tech is looking to establish a market position in NOx control resulting from the national demonstration projects utilizing NOxOUT CASCADE technology at Jiangsu Kanshan (two new 600 megawatt units), NOxOUT Selective Non-Catalytic Reduction (SNCR) technology at Jiangyin Ligang (four new 600 megawatt units), and NOxOUT ULTRA technology on two retrofit projects in Beijing. These projects are expected to showcase a wide spectrum of Fuel Tech capabilities for NOx emission control with the intent of gaining immediate penetration within the market for new power units, and establishing Fuel Tech as the leader for the larger market for retrofit units later.

Products

Fuel Tech’s NOx reduction technologies are installed worldwide on over 450 combustion units, including utility, industrial and municipal solid waste applications. Products include customized NOx control systems and patented urea-to-ammonia conversion technology, which can provide safe reagent for use in Selective Catalytic Reduction (SCR) systems.

Fuel Tech's NOxOUT process is a Selective Non-Catalytic Reduction process that uses non-hazardous urea as the reagent rather than ammonia. The NOxOUT process on its own is capable of reducing NOx by up to 35% for utilities and by potentially significantly greater amounts for industrial units in many types of plants with capital costs ranging from $5 - $20/kw for utility boilers and with total annualized operating costs ranging from $1,000 - $2,000/ton of NOx removed.

Fuel Tech’s NOxOUT CASCADE process uses a catalyst in addition to the NOxOUT process to achieve performance similar to SCR. Capital costs for NOxOUT CASCADE systems can range from $30 - $75/kw which is significantly less than that of SCRs, which can range as high as $400/kw, while operating costs are competitive with those experienced by SCR systems.

Fuel Tech’s NOxOUT-SCR process utilizes urea as a catalyst reagent to achieve NOx reductions of up to 85% from smaller stationary combustion sources with capital and operating costs competitive with equivalently sized, standard SCR systems.

Fuel Tech’s NOxOUT ULTRA system is designed to convert urea to ammonia safely and economically for use as a reagent in the SCR process for NOx reduction. In this fashion, Fuel Tech intends to participate in the SCR segment of the United States SIP Call and CAIR driven markets. Recent local hurdles in the ammonia permitting process have raised concerns regarding the safety of ammonia storage in quantities sufficient to supply SCR. In addition, the Department of Homeland Security recently characterized anhydrous ammonia as a Toxic Inhalation Hazard (TIH) commodity. This is contributing to new restrictions by rail carriers on the movement of anhydrous ammonia and to an escalation in associated rail transport and insurance rates. Overseas, new coal-fired power plants incorporating SCR systems are expected to be constructed at a rapid rate in the PRC, and Fuel Tech’s NOxOUT ULTRA process is believed to be a market leader for the safe delivery of ammonia, particularly near densely populated cities, major waterways, harbors or islands, or where the transport of anhydrous or aqueous ammonia is a safety concern.

Fuel Tech has licensed the Rich Reagent Injection Technology from Reaction Engineering International and Electric Power Research Institute. The technology has been proven in full-scale field studies on cyclone-fired units to reduce NOx by 25%-40%. The technology is a generic SNCR process, whose applicability is outside the temperature range of the NOxOUT process. The technology is seen as an add-on to Fuel Tech’s NOxOUT systems, thus potentially broadening the NOx reduction of the combined system to almost 55% with minimal additional capital requirement.

Sales of the NOx reduction technologies were $47.8 million, $46.4 million and $32.6 million for the years ended December 31, 2007, 2006 and 2005, respectively.

NOx Reduction Competition

Competition with Fuel Tech's NOx reduction products can be expected from combustion modifications, SCR and ammonia SNCR, as well as from other licensed market participants. In addition, Fuel Tech experiences competition in the urea-to-ammonia conversion market.

Combustion modifications, including low NOx burners, can be fitted to most types of boilers with cost and effectiveness varying with specific boilers. Combustion modifications may effect 20% - 50% NOx reduction economically with capital costs ranging from $5 - $40/kw and levelized total costs ranging from $300 - $1,500/ton of NOx removed. The modifications are designed to reduce the formation of NOx and are typically the first NOx reduction efforts employed. Such companies as Alstom, Foster Wheeler Corporation, The Babcock & Wilcox Company, Nalco Mobotec, Inc. and Babcock Power, Inc. are active competitors in the low-NOx burner business.

Once NOx is formed, then the SCR process is an effective and proven method of control for removal of NOx up to 90%. SCR has a high capital cost ranging from $150 - $400/kw on retrofit coal applications. Such companies as Alstom, The Babcock & Wilcox Company, Cormetech, Inc., Ceram Environmental, Inc., Foster Wheeler Corporation, Peerless Manufacturing Company, and Babcock Power, Inc., are active SCR system providers, or providers of the catalyst itself.

The use of ammonia as the reagent for the SNCR process was developed by the ExxonMobil Corporation. Fuel Tech understands that the ExxonMobil patents on this process have expired. This process can reduce NOx by 30% - 70% on incinerators, but has limited applicability in the utility industry. Ammonia system capital costs range from $5 - $20/kw, with annualized operating costs ranging from $1,000 - $3,000/ton of NOx removed. These systems require the use of either anhydrous or aqueous ammonia, both of which are hazardous substances.

Other NOx reduction competitors include Combustion Components Associates, Inc., which is a licensed implementer of NOxOUT SNCR systems, and Reaction Engineering International, which licenses Rich Reagent Injection Technology to Fuel Tech.

In addition to or in lieu of using the foregoing processes, certain customers may elect to close or derate plants, purchase electricity from third-party sources, switch from higher to lower NOx emitting fuels or purchase NOx emission allowances.

Lastly, with respect to urea-to-ammonia conversion technologies, a competitive approach to Fuel Tech’s controlled urea decomposition system is available from Wahlco, Inc., which manufactures a system that hydrolyzes urea under high temperature and pressure.

FUEL CHEM

Product and Markets

The FUEL CHEM technology segment revolves around the unique application of specialty chemicals to improve the efficiency, reliability and environmental status of plants operating in the electric utility, industrial, pulp and paper, and waste-to-energy markets. FUEL CHEM programs are currently in place on over 90 combustion units, treating a wide variety of solid and liquid fuels, including coal, heavy oil, biomass and municipal waste.

Central to the FUEL CHEM approach is the introduction of chemical reagents, such as magnesium hydroxide, to combustion units via in-body fuel application (pre-combustion) or via direct injection (post-combustion) utilizing Fuel Tech’s proprietary TIFI technology. By attacking performance-hindering problems, such as slagging, fouling, corrosion, opacity, acid plume and loss on ignition (LOI), as well as the formation of sulfur trioxide (SO3), ammonium bisulfate (ABS), particulate matter (PM2.5), carbon dioxide (CO2) and NOx, the Company’s programs offer numerous operational, financial and environmental benefits to owners of boilers, furnaces and other combustion units.

The key market dynamic for this product line is the continued use of coal as the principal fuel source for global electricity production. Coal accounts for approximately 49% of all U.S. electricity generation, with U.S. government projections forecasting an increase to approximately 57% by 2030. Coal’s share of global electricity generation is forecast to be approximately 45% by 2030. Major coal consumers include the United States, the PRC and India.

The principal markets for this product line are electric power plants burning coals with slag-forming constituents. The slag-forming constituents include sodium, iron and high levels of sulfur. Sodium is typically found in the Powder River Basin coals of Wyoming and Montana. Iron is typically found in coals produced in the Illinois Basin (IB) region. High sulfur content is typical of IB coals and certain Appalachian coals. High sulfur content can give rise to unacceptable levels of SO3 formation in plants with SCR systems and flue gas desulphurization units (scrubbers).

The combination of slagging coals and SO3-related issues, such as “blue plume” formation, air pre-heater fouling and corrosion, SCR fouling and the proclivity to suppress certain mercury removal processes, represents attractive market potential for Fuel Tech.

Internationally, market opportunities exist in Europe and in the Asia-Pacific region, particularly the PRC and India, where high-slagging coals are fueling a large and growing fleet of power plants. To address the PRC market, where particular emphasis is being placed on energy efficiency, Fuel Tech entered into a one-year exclusive teaming agreement in June 2007 with ITOCHU Hong Kong Ltd., a subsidiary of ITOCHU Corporation. Working under this agreement, the first FUEL CHEM demonstration program in the PRC was announced in January 2008. In addition, Fuel Tech was awarded its first FUEL CHEM demonstration program in India in January 2008. TIFI initiatives aimed at energy efficiency improvements result in reduced CO2 emissions, which potentially can be monetized under provisions of the Kyoto Protocol.

A potentially large fuel treatment market exists in Mexico, where high-sulfur, low-grade fuel oil containing vanadium and nickel is the primary source for electricity production. The presence of these metallic constituents promotes slag build-up, and the fuel properties can result in acid gas and particulate emissions in local combustion units. Fuel Tech has successfully treated such units with its TIFI technology.

Sales of the FUEL CHEM products were $32.5 million, $28.7 million and $20.3 million for the years ended December 31, 2007, 2006 and 2005, respectively.

Competition

Competition for Fuel Tech's FUEL CHEM product line includes chemicals sold by specialty chemical and combustion engineering companies, such as GE Infrastructure, Ashland Inc. and Environmental Energy Services, Inc. No substantive competition currently exists for Fuel Tech's TIFI technology, which is designed primarily for slag control and SO3 abatement, but there can be no assurance that such lack of substantive competition will continue.

PLANT OPTIMIZATION SERVICES

While not a separate technology segment, Fuel Tech uses its advanced engineering capabilities to support the sale of its NOx reduction and FUEL CHEM systems, particularly through the use of computational fluid dynamics (“CFD”) tools. These CFD tools assist in the prediction of the behavior of gas flows, thereby enhancing the design, marketing and sale of Fuel Tech’s NOx reduction systems and FUEL CHEM product applications. To further aid the accuracy and expediency with which process solutions could be designed and delivered to a customer, Fuel Tech internally developed a virtual reality-based visualization software for exploring model results and discovering complex process behaviors. Fuel Tech intends to capitalize on its unique capabilities via offering plant optimization services to its customer base in conjunction with the NOx reduction and FUEL CHEM systems.

INTELLECTUAL PROPERTY

Fuel Tech’s products are generally protected by U.S. and non-U.S. patents. Fuel Tech owns 98 granted patents worldwide and has seven patent applications pending in the United States and 37 pending in non-U.S. jurisdictions. These patents cover some 36 inventions, 24 associated with the NOx reduction business; seven associated with the FUEL CHEM business; and five associated with non-commercialized technologies. These inventions represent significant enhancements of the application and performance of the technologies. Further, Fuel Tech believes that the protection provided by the numerous claims in the above referenced patents or patent applications is substantial, and affords Fuel Tech a significant competitive advantage in its business. Accordingly, any significant reduction in the protection afforded by these patents or any significant development in competing technologies could have a material adverse effect on Fuel Tech’s business.

EMPLOYEES

Fuel Tech has 178 employees, 154 in North America, 13 in China and 11 in Europe. Fuel Tech enjoys good relations with its employees and is not a party to any labor management agreements.

Investors in Fuel Tech should be mindful of the following risk factors relative to Fuel Tech's business.

(i) Lack of Diversification

Fuel Tech has two broad technology segments that provide advanced engineering solutions to meet the pollution control, efficiency improvement, and operational optimization needs of energy-related facilities worldwide. They are as follows:

| | - | The NOx reduction technology segment, which includes the NOxOUT, NOxOUT CASCADE, NOxOUT ULTRA and NOxOUT-SCR processes for the reduction of NOx emissions in flue gas from boilers, incinerators, furnaces and other stationary combustion sources, and |

| | - | The fuel treatment chemicals technology segment, which uses chemical processes, including TIFI Targeted In-Furnace Injection technology, to control slagging, fouling, corrosion, opacity, acid plume and loss on ignition, as well as the formation of sulfur trioxide, ammonium bisulfate, particulate matter (PM2.5), carbon dioxide and NOx in furnaces and boilers. |

An adverse development in Fuel Tech's advanced engineering solution business as a result of competition, technological change, government regulation, or any other factor could have a significantly greater impact than if Fuel Tech maintained more diverse operations.

(ii) Competition

Competition in the NOx control market will come from processes utilizing low-NOx burners, over-fire air, flue gas recirculation, ammonia SNCR, SCR and, with respect to particular uses of urea not infringing Fuel Tech's patents, urea (see Item 1 "Intellectual Property"). Competition will also come from business practices such as the purchase rather than the generation of electricity, fuel switching, closure or derating of units, and sale or trade of pollution credits. Utilization by customers of such processes or business practices or combinations thereof may adversely affect Fuel Tech's pricing and participation in the NOx control market if customers elect to comply with regulations by methods other than Fuel Tech's NOxOUT or NOxOUT CASCADE Processes. See above text under the captions "Products" and “NOx Reduction Competition.”

Competition in the FUEL CHEM markets includes chemicals sold by specialty chemical and combustion engineering companies, such as GE Infrastructure, Ashland Inc. and Environmental Energy Services, Inc. As noted previously, no substantive competition currently exists for Fuel Tech's TIFI technology, which is designed primarily for slag control and SO3 abatement. However, there can be no assurance that such lack of substantive competition will continue.

(iii) Dependence on Regulations and Enforcement

Fuel Tech's business is significantly impacted by the regulatory environment surrounding the markets in which it serves. Fuel Tech’s business will be adversely impacted to the extent that regulations are repealed or amended to significantly reduce the level of required NOx reduction, or to the extent that regulatory authorities minimize enforcement. See also the text above under the caption “Regulations and Markets.”

(iv) Protection of Patents and Proprietary Rights

Fuel Tech holds licenses to or owns a number of patents and also has patents pending. There can be no assurance that pending patent applications will be granted or that outstanding patents will not be challenged or circumvented by competitors. Certain critical technology relating to Fuel Tech's products is protected by trademark and trade secret laws and by confidentiality and licensing agreements. There can be no assurance that such protection will prove adequate or that Fuel Tech will have adequate remedies for disclosure of its trade secrets or violations of its intellectual property rights. See Item 1 “Intellectual Property.”

(v) Foreign Operations

Fuel Tech has recently expanded its operations into the Peoples Republic of China (PRC) via the establishment of a wholly owned subsidiary in Beijing. The Asia-Pacific region, particularly the PRC and India, offers tremendous market opportunity for Fuel Tech as these nations look to establish regulatory policies for improving their environment and utilizing fossil fuels efficiently and effectively. The future business opportunities in these markets are dependent on the implementation of regulatory policies that will benefit Fuel Tech’s technologies.

(vi) Product Pricing and Operating Results

The onset of significant competition for either of the technology segments might have an adverse impact on product pricing and a resulting adverse impact on realized gross margins and operating profitability.

(vii) Raw Material Supply and Pricing

The fuel treatment chemicals technology segment is reliant upon a long-term global supply of magnesium hydroxide. Any adverse change in the availability of supply for this chemical will likely have an adverse impact on Fuel Tech’s cost structure.

(viii) Changes in Tax and Other Legislation

Income tax laws and legislation relating to the regulatory environment may be changed or interpreted in a manner that adversely affects Fuel Tech.

None

Fuel Tech and its subsidiaries operate from leased office facilities in Batavia, Illinois; Stamford, Connecticut; Gallarate, Italy and Beijing, China. Fuel Tech does not segregate any of its leased facilities by operating business segment. The terms of the three material agreements are as follows:

- The Batavia, Illinois building lease term, for approximately 18,000 square feet, runs from June 1, 1999 to May 31, 2009. Fuel Tech has the option to extend the lease term for two successive terms of five years each at market rates to be agreed upon between Fuel Tech and the lessor.

- The Stamford, Connecticut building lease term, for approximately 7,000 square feet, runs from February 1, 2004 to January 31, 2010. Fuel Tech has the option to extend the lease term for one successive term of five years at a market rate to be agreed upon between Fuel Tech and the lessor.

- The Beijing, China building lease term, for approximately 4,000 square feet, runs from September 1, 2007 to August 31, 2009. Fuel Tech has the option to extend the lease term at a market rate to be agreed upon between Fuel Tech and the lessor.

In addition to the above, on November 30, 2007, Fuel Tech purchased an office building in Warrenville, Illinois which will serve as the new corporate headquarters for the Company. This facility, with approximately 40,000 square feet of office space, was purchased for approximately $6,000,000 and will meet Fuel Tech’s growth requirements for the foreseeable future. Fuel Tech anticipates moving into this space in the second quarter of 2008.

We are from time to time involved in litigation incidental to our business. We are not currently involved in any litigation in which we believe an adverse outcome would have a material effect on our business, financial conditions, results of operations, or propects.

During the fourth quarter of 2007, no matters were submitted to a vote of security holders.

Market

Fuel Tech's Common Shares have been traded since September 1993 on The NASDAQ Stock Market, Inc. The trading symbol is FTEK.

Prices

The table below sets forth the high and low sales prices during each calendar quarter since January 2006.

2007 | | High | | Low | |

| Fourth Quarter | | $ | 34.48 | | $ | 16.89 | |

| Third Quarter | | | 35.85 | | | 20.65 | |

| Second Quarter | | | 38.20 | | | 21.65 | |

| First Quarter | | | 29.68 | | | 22.54 | |

2006 | | High | | Low | |

| Fourth Quarter | | $ | 27.44 | | $ | 14.40 | |

| Third Quarter | | | 16.45 | | | 10.07 | |

| Second Quarter | | | 18.80 | | | 11.15 | |

| First Quarter | | | 16.75 | | | 8.11 | |

Dividends

Fuel Tech has not paid dividends on its Common Shares to date and is not expected to do so in the foreseeable future.

Holders

Based on information from Fuel Tech’s transfer agent, as of February 20, 2008, there were 304 registered holders of Fuel Tech’s Common Shares. Management believes that, on such date, there were approximately 24,000 beneficial holders of Fuel Tech’s Common Shares.

Transfer Agent

The Transfer Agent and Registrar for the Common Shares is BNY Mellon Shareowner Services, 480 Washington Boulevard, Jersey City, New Jersey 07310.

Securities Authorized for Issuance Under Equity Compensation Plans

The following table provides information for all equity compensation plans as of the fiscal year ended December 31, 2007, under which the securities of Fuel Tech were authorized for issuance:

Plan Category | | Number of Securities to be issued upon exercise of outstanding options, warrants and rights | | Weighted-average exercise price of outstanding options, warrants and rights | | Number of securities remaining available for future issuance under equity compensation plans excluding securities listed in column (a) | |

| | | (a) | | (b) | | (c) | |

| Equity compensation plans approved by security holders (1) | | | 2,464,325 | | $ | 15.03 | | | 845,000 | |

| | (1) | Includes Common Shares of Fuel Tech authorized for awards under Fuel Tech’s Incentive Plan, as amended through June 3, 2004. |

In addition to the above, Fuel Tech has a Deferred Compensation Plan for directors under which 100,000 Common Shares of Fuel Tech stock have been reserved for issuance as a form of deferred compensation with respect to directors fees elected to be deferred. At December 31, 2007, 43,130 Common Shares have been earned as stock units to be granted on a one to one basis in Common Shares at the election of the Directors.

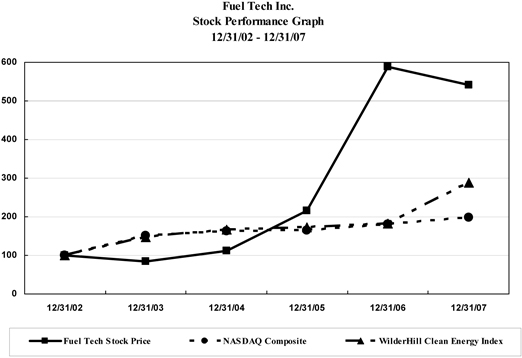

Performance Graph

The following line graph compares (i) Fuel Tech’s total return to shareholders per share of Common Stock for the five years ended December 31, 2007 to that of (ii) the NASDAQ Composite index, and (iii) the WilderHill Clean Energy Index for the period December 31, 2002 through December 31, 2007.

Selected financial data are presented below as of the end of and for each of the fiscal years in the five-year period ended December 31, 2007. The selected financial data should be read in conjunction with the audited consolidated financial statements as of and for the year ended December 31, 2007, and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

| | | For the years ended December 31 | |

CONSOLIDATED STATEMENT OF OPERATIONS DATA | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 | |

(in thousands of dollars, except for share and per-

share data) | | | | | | | | | | | |

| | | | | | | | | | | | |

| Revenues | | $ | 80,297 | | $ | 75,115 | | $ | 52,928 | | $ | 30,832 | | $ | 35,736 | |

| | | | | | | | | | | | | | | | | |

| Cost of sales | | | 42,471 | | | 38,429 | | | 27,118 | | | 16,566 | | | 21,789 | |

| Selling, general and administrative and other costs and expenses | | | 27,087 | | | 25,953 | | | 18,655 | | | 14,130 | | | 12,978 | |

| Operating income | | | 10,739 | | | 10,733 | | | 7,155 | | | 136 | | | 969 | �� |

| Net income | | | 7,243 | | | 6,826 | | | 7,588 | | | 1,572 | | | 1,120 | |

| | | | | | | | | | | | | | | | | |

| Basic income per Common Share | | $ | 0.33 | | $ | 0.32 | | $ | 0.38 | | $ | 0.08 | | $ | 0.06 | |

| Diluted income per Common Share | | $ | 0.29 | | $ | 0.28 | | $ | 0.33 | | $ | 0.07 | | $ | 0.05 | |

| Weighted-average basic shares outstanding | | | 22,280,000 | | | 21,491,000 | | | 20,043,000 | | | 19,517,000 | | | 19,637,000 | |

| Weighted-average diluted shares outstanding | | | 24,720,000 | | | 24,187,000 | | | 23,066,000 | | | 22,155,000 | | | 22,412,000 | |

| | | December 31 | |

CONSOLIDATED BALANCE SHEET DATA | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 | |

(in thousands of dollars, except for share and per-

share data) | | | | | | | | | | | |

| | | | | | | | | | | | |

| Working capital | | $ | 45,143 | | $ | 38,715 | | $ | 19,590 | | $ | 11,292 | | $ | 10,973 | |

| Total assets | | | 87,214 | | | 65,660 | | | 44,075 | | | 23,828 | | | 21,598 | |

| Long-term obligations | | | 1,255 | | | 500 | | | 448 | | | 505 | | | 299 | |

| Total liabilities | | | 23,975 | | | 18,005 | | | 14,939 | | | 4,873 | | | 4,287 | |

| Shareholders' equity (1) | | | 63,239 | | | 47,655 | | | 29,136 | | | 18,955 | | | 17,311 | |

| Net tangible book value per share (2) | | $ | 2.43 | | $ | 1.83 | | $ | 1.12 | | $ | 0.70 | | $ | 0.61 | |

Notes:

(1) Shareholders’ equity includes principal amount of nil coupon non-redeemable perpetual loan notes. See Note 5 to the consolidated financial statements.

(2) Net tangible book value per share is defined as shareholders’ equity less intangible assets, divided by weighted-average shares outstanding, and assumes full conversion of Fuel Tech’s nil coupon non-redeemable perpetual loan notes into shares of Fuel Tech’s Common Shares.

Background

Fuel Tech, Inc. (“Fuel Tech”) has two broad technology segments that provide advanced engineering solutions to meet the pollution control, efficiency improvement, and operational optimization needs of energy-related facilities worldwide. They are as follows:

Nitrogen Oxide (“NOx”) Reduction Technologies

The nitrogen oxide (“NOx”) reduction technology segment includes the NOxOUT, NOxOUT CASCADE, NOxOUT ULTRA and NOxOUT-SCR processes for the reduction of NOx emissions in flue gas from boilers, incinerators, furnaces and other stationary combustion sources. Fuel Tech distributes its products through its direct sales force, licensees and agents.

Fuel Treatment Chemicals

The fuel treatment chemicals technology segment uses chemical processes, including TIFI Targeted In-Furnace Injection technology, to control slagging, fouling, corrosion, opacity, acid plume and loss on ignition, as well as the formation of sulfur trioxide, ammonium bisulfate, particulate matter (PM2.5), carbon dioxide and NOx in furnaces and boilers. Fuel Tech sells its fuel treatment chemicals through its direct sales force and agents to industrial and utility power-generation facilities. FUEL CHEM programs are currently in place on over 90 combustion units, treating a wide variety of solid and liquid fuels, including coal, heavy oil, biomass and municipal waste. The FUEL CHEM program improves the efficiency, reliability and environmental status of plants operating in the electric utility, industrial, pulp and paper, and waste-to-energy markets and offers numerous operational, financial and environmental benefits to owners of boilers, furnaces and other combustion units.

The key market dynamic for both technology segments is the continued use of coal as the principal fuel source for global electricity production. Coal accounts for approximately 49% of all U.S. electricity generation, with U.S. government projections calling for an increase to approximately 57% by 2030. Coal’s share of global electricity generation is forecast to be approximately 45% by 2030. Major coal consumers include the PRC, the United States and India.

Critical Accounting Policies and Estimates

The consolidated financial statements are prepared in accordance with accounting principles generally accepted in the United States of America, which require Fuel Tech to make estimates and assumptions. Fuel Tech believes that of its accounting policies (see Note 1 to the consolidated financial statements), the following involve a higher degree of judgment and complexity and are deemed critical. Fuel Tech discusses its critical accounting policies with the Audit Committee.

Revenue Recognition

Fuel Tech uses the percentage of completion method of accounting for certain long-term equipment construction and license contracts that are sold within the nitrogen oxide reduction business segment. Under the percentage of completion method, sales and gross profit are recognized as work is performed based on the relationship between actual construction costs incurred and total estimated costs at completion. Since the financial reporting of these contracts depends on estimates that are assessed continually during the term of the contract, recognized sales and profit are subject to revisions as the contract progresses to completion. Revisions in profit estimates are reflected in the period in which the facts that give rise to the revision become known. Provisions are made for estimated losses on uncompleted contracts in the period in which such losses are determined.

Fuel Tech’s construction contracts are typically six to twelve months in length. A typical contract will have three or four critical milestones that serve as the basis for Fuel Tech to invoice the customer. At a minimum, the milestones will include the generation of engineering drawings, the shipment of equipment and the completion of a system performance test.

As part of most of its contractual project agreements, Fuel Tech will agree to customer-specific acceptance criteria that relate to the operational performance of the system that is being sold to the customer. These criteria are determined based on mathematical modeling that is performed by Fuel Tech personnel, which is based on operational inputs that are provided by the customer. The customer will warrant that these operational inputs are accurate as they are specified in the binding contractual agreement. Further, the customer is solely responsible for the accuracy of the operating condition information; all performance guarantees and equipment warranties granted by Fuel Tech are void if the operating condition information is inaccurate or is not met.

Fuel Tech has installed over 450 units with the technology and has never failed to meet a performance guarantee when the customer has provided the required operating conditions for the project. As part of the project implementation process, Fuel Tech will perform system start-up and optimization services that effectively serve as a test of actual project performance. Fuel Tech believes that this test, combined with the accuracy of the modeling that is performed, enables revenue to be recognized prior to the receipt of formal customer acceptance.

Allowance for Doubtful Accounts

Fuel Tech, in order to control and monitor the credit risk associated with its customer base, reviews the credit worthiness of customers on a recurring basis. Factors influencing the level of scrutiny include the level of business the customer has with Fuel Tech, the customer’s payment history and the customer’s financial stability. Representatives of Fuel Tech’s management team review all past due accounts on a weekly basis to assess collectibility. At the end of each reporting period, the allowance for doubtful accounts balance is reviewed relative to management’s collectibility assessment and is adjusted if deemed necessary. Fuel Tech’s historical credit loss has been insignificant.

Assessment of Potential Impairments of Goodwill and Intangible Assets

Effective January 1, 2002, Fuel Tech adopted FASB (Financial Accounting Standards Board) Statement No. 142, “Goodwill and Other Intangible Assets.” Under the guidance of this statement, goodwill and indefinite-lived intangible assets are no longer amortized, but rather, are required to be reviewed annually or more frequently if indicators arise, for impairment. The evaluation of impairment involves comparing the current fair value of the business to the carrying value. Fuel Tech uses a discounted cash flow model (DCF) to determine the current fair value of its two reporting units. A number of significant assumptions and estimates are involved in the application of the DCF model to forecast operating cash flows, including markets and market share, sales volumes and prices, costs to produce and working capital changes. Management considers historical experience and all available information at the time the fair values of its reporting units are estimated. However, actual fair values that could be realized in an actual transaction may differ from those used to evaluate the impairment of goodwill.

Fuel Tech reviews other intangible assets, which include a customer list, a covenant not to compete and patent assets, for impairment on a recurring basis or when events or changes in circumstances indicate the carrying amount of an asset may not be recoverable. In the event the sum of the expected undiscounted future cash flows resulting from the use of the asset is less than the carrying amount of the asset, an impairment loss equal to the excess of the asset’s carrying value over its fair value is recorded. Management considers historical experience and all available information at the time the estimates of future cash flows are made, however, the actual cash values that could be realized may differ from those that are estimated.

Valuation Allowance for Deferred Income Taxes

Deferred tax assets represent deductible temporary differences and net operating loss and tax credit carryforwards. A valuation allowance is recognized if it is more likely than not that some portion of the deferred tax asset will not be realized.

At the end of each reporting period, Fuel Tech reviews the realizability of the deferred tax assets. As part of this review, Fuel Tech will consider if there are taxable temporary differences that could generate taxable income in the future, if there is the ability to carryback the net operating losses or credits, if there is a projection of future taxable income, and if there are any tax planning strategies which can be readily implemented.

Stock-Based Compensation

Fuel Tech recognizes compensation expense for employee equity awards ratably over the requisite service period of the award. Fuel Tech utilizes the Black-Scholes option-pricing model to estimate the fair value of awards. Determining the fair value of stock options using the Black-Scholes model requires judgment, including estimates for (1) risk-free interest rate - an estimate based on the yield of zero-coupon treasury securities with a maturity equal to the expected life of the option; (2) expected volatility - an estimate based on the historical volatility of Fuel Tech’s Common Stock for a period equal to the expected life of the option; and (3) expected life of the option - an estimate based on historical experience including the effect of employee terminations. If any of these assumptions differ significantly from actual, stock-based compensation expense could be impacted.

Recently Adopted Accounting Standards

In July 2006, the Financial Accounting Standards Board (FASB) issued FASB Interpretation No. 48, “Accounting for Uncertainty in Income Taxes - an interpretation of FASB Statement No. 109,” (FIN 48). FIN 48 prescribes a comprehensive model for how a company should recognize, measure, present, and disclose in its financial statements uncertain tax positions that it has taken or expects to take on a tax return. On January 17, 2007, the FASB affirmed its previous decision to make FIN 48 effective for fiscal years beginning after December 15, 2006. Accordingly, FIN 48 was effective for Fuel Tech on January 1, 2007.

Previously, Fuel Tech had accounted for tax contingencies in accordance with Statement of Financial Accounting Standards 5, Accounting for Contingencies. As required by FIN 48, which clarifies Statement 109, Accounting for Income Taxes, Fuel Tech recognizes the financial statement benefit of a tax position only after determining that the relevant tax authority would more likely than not sustain the position following an audit. For tax positions meeting the more-likely-than-not threshold, the amount recognized in the financial statements is the largest benefit that has a greater than 50% likelihood of being realized upon ultimate settlement with the relevant tax authority. At the adoption date, Fuel Tech applied FIN 48 to all tax positions for which the statute of limitations remained open. As a result of the implementation of FIN 48, Fuel Tech recognized an increase of approximately $86,000 in the liability for unrecognized tax benefits, of which $81,000 was accounted for as a reduction to the January 1, 2007 balance of retained earnings.

In June 2006, the FASB ratified a consensus opinion reached by the Emerging Issues Task Force (EITF) on EITF Issue 06-3, "How Taxes Collected from Customers and Remitted to Governmental Authorities Should Be Presented in the Income Statement (That Is, Gross versus Net Presentation)." The guidance in EITF Issue 06-3 requires disclosure in interim and annual financial statements of the amount of taxes on a gross basis, if significant, that are assessed by a governmental authority that are imposed on and concurrent with a specific revenue producing transaction between a seller and customer such as sales, use, value added, and some excise taxes. Additionally, the income statement presentation (gross or net) of such taxes is an accounting policy decision that must be disclosed. The consensus in EITF Issue 06-3 is effective for interim and annual reporting periods beginning after December 15, 2006. The Company adopted EITF Issue 06-3 effective January 1, 2007. The Company presents sales tax on a net basis in its consolidated financial statements. The adoption did not have a material effect on the consolidated financial statements.

In November 2006, the FASB ratified the consensus reached by the Emerging Issues Task Force (EITF) in EITF Issue No. 06-9, “Reporting a Change in (or the Elimination of) a Previously Existing Difference between the Fiscal Year-End of a Parent Company and that of a Consolidated Entity or between the Reporting Period of an Investor and that of an Equity Method Investee” (“EITF 06-9”). EITF 06-9 requires certain disclosures whenever a change is made to modify or eliminate the time lag used for recording results of consolidated entities or equity method investees that have a different fiscal year end than a parent. EITF 06-9 is effective for changes in the time lag occurring in the interim or annual reporting periods beginning after November 29, 2006. The adoption of EITF 06-9 did not have a material impact on the consolidated financial statements.

New Accounting Pronouncements

In September 2006, the FASB issued Financial Accounting Standard No. 157, “Fair Value Measurements” (FAS No. 157). FAS No. 157 defines fair value, establishes a framework for measuring fair value in generally accepted accounting principles (GAAP), and expands disclosures about fair value measurements. FAS No. 157 applies under other accounting pronouncements that require or permit fair value measurements, and accordingly, does not require any new fair value measurements. FAS No. 157 is effective for Fuel Tech beginning January 1, 2008. Fuel Tech is currently reviewing the provisions of FAS No. 157, but does not expect the provisions to have a material impact on its consolidated financial statements.

In February 2007, the FASB issued Financial Accounting Standard No. 159, “The Fair Value Option for Financial Assets and Financial Liabilities” (FAS No. 159). FAS No. 159 provides the option to report certain financial assets and liabilities at fair value, with the intent to mitigate volatility in financial reporting that can occur when related assets and liabilities are recorded on different bases. This statement is effective for Fuel Tech beginning January 1, 2008. Fuel Tech does not expect FAS No. 159 to have a material impact on its consolidated financial statements.

In May 2007, the FASB issued FASB Staff Position FIN 48-1 (FSP FIN 48-1), which amends FASB Interpretation No. 48, “Accounting for Uncertainty in Income Taxes.” FSP FIN 48-1 provides guidance on how an enterprise should determine whether a tax position is effectively settled for the purpose of recognizing previously unrecognized tax benefits. Fuel Tech does not expect the provisions of FSP FIN 48-1 to have a material impact on its consolidated financial statements.

In December 2007, the FASB issued SFAS No. 141 (revised 2007), "Business Combinations" (SFAS 141R). SFAS 141R establishes principles and requirements for how an acquirer recognizes and measures in its financial statements the identifiable assets acquired, the liabilities assumed, any noncontrolling interest in the acquiree and the goodwill acquired. SFAS 141R also establishes disclosure requirements to enable the evaluation of the nature and financial effects of the business combination. SFAS 141R is effective for financial statements issued for fiscal years beginning after December 15, 2008. The Company is currently evaluating the potential impact of adoption of SFAS 141R on its consolidated financial statements. However, the Company does not expect the adoption of SFAS 141R to have a material impact on its consolidated financial statements.

In December 2007, the Financial Accounting Standards Board (“FASB”) issued Financial Accounting Standard No. 160, (SFAS 160) “Noncontrolling Interests in Consolidation Financial Statements an amendment of ARB No. 51”. The objective of SFAS 160 is to improve the relevance, comparability, and transparency of the financial information that a reporting entity provides in its consolidated financial statements. SFAS 160 amends ARB No. 51 to establish accounting and reporting standards for the noncontrolling interest in a subsidiary and for the deconsolidation of a subsidiary. SFAS 160 also changes the way the consolidated income statement is presented, establishes a single method of accounting for changes in a parent’s ownership interest in a subsidiary that do not result in deconsolidation, requires that a parent recognize a gain or loss in net income when a subsidiary is deconsolidated and expanded disclosures in the consolidated financial statements that clearly identify and distinguish between the interests of the parent’s owners and the interest of the noncontrolling owners of a subsidiary. SFAS 160 is effective for financial statements issued for the fiscal years beginning on or after December 15, 2008. Fuel Tech does not expect the provisions to have a material impact on its consolidated financial statements.

2007 versus 2006

Revenues for the years ended December 31, 2007 and 2006 were $80,297,000 and $75,115,000, respectively. The year over year increase of $5,182,000, or 7%, predominantly reflects moderate increases in both technology segments.

Revenues for the NOx reduction technology segment were $47,750,000 in 2007, an increase of $1,296,000, or 3%, over 2006. This segment is positioned well to capitalize on the next phase of increasingly stringent U.S. air quality standards. With the compliance for the Environmental Protection Agency’s (EPA) State Implementation Plan (SIP) Call regulation beginning to wind down, utilities and industrial facilities across the country are planning for compliance with the Clean Air Interstate Rule (CAIR) and the Clean Air Visibility Rule (CAVR), which take effect in 2009 and 2013, respectively. Thousands of utility and industrial boilers will be impacted by these regulations and Fuel Tech’s technologies will serve as an important element in enabling utility and industrial boiler unit owners to attain compliance. In 2007, Fuel Tech announced new contracts valued at $60 million which exceeded the previous annual record by almost 40%.

Revenues for the Fuel Treatment Chemical business segment were $32,547,000 in 2007, an increase of $3,886,000, or 14%, over 2006. This segment’s growth is indicative of the continued market acceptance of Fuel Tech’s patented TIFI™ Targeted In-Furnace Injection™ technology, particularly on coal-fired units, which represent the largest market opportunity for the technology, both domestically and abroad. In 2007, Fuel Tech added 10 new coal-fired units to its customer base, the largest annual total in the Company’s history.

Cost of sales for the years ended December 31, 2007 and 2006 was $42,471,000 and $38,429,000, respectively. Cost of sales as a percentage of net sales for the years ended December 31, 2007 and 2006 was 53% and 51%, respectively. The cost of sales percentage for 2007 for the NOx reduction segment decreased to 54% from 57% in 2006. The decrease is attributable to the mix of project business. For the fuel treatment chemical segment, the cost of sales percentage increased to 51% in 2007 from 42% in 2006. The increase is due to startup costs related to the incremental units noted above, without the realization of related revenues as only two of the 10 new units contributed significant revenues during 2007 due to customer-related delays impacting the timing of startup.

Selling, general and administrative expenses for the years ended December 31, 2007 and 2006 were $24,950,000 and $23,901,000, respectively. The $1,049,000 increase over 2006 is principally attributable to the following:

- Fuel Tech recorded $4,791,000 in stock compensation expense in 2007 in accordance with Statement 123(R), as discussed in Note 6 to the consolidated financial statements. This amount was a $2,986,000 increase over 2006. This increase in stock compensation expense is attributable to the awarding of stock options to all Fuel Tech employees in December 2006 and to an increase in the fair value of the options granted, which was driven by an increase in the price of Fuel Tech’s Common Stock.

- Partially offsetting this unfavorable variance was a reduction in revenue-related expenses of $2,100,000 as Fuel Tech aligned the focus of all employees under a common incentive plan in 2007.

Research and development expenses were $2,137,000 and $2,052,000 for the years ended December 31, 2007 and 2006, respectively. Fuel Tech has established a more focused approach in the pursuit of commercial applications for its technologies outside of its traditional markets, and in the development and analysis of new technologies that could represent incremental market opportunities.

Interest income increased by $623,000 over 2006 driven by higher average cash and short-term investment balances. Further, Fuel Tech recorded interest expense of $24,000 in 2007 related specifically to a short-term credit facility that was used to support the start-up of Fuel Tech’s new office in Beijing, China. Finally, the moderate increase in other income is due largely to foreign exchange gains related to balances denominated in foreign currencies.

For the year ended December 31, 2007, Fuel Tech recorded tax expense of $5,187,000, which predominantly represents deferred tax expense related to taxable income recognized in 2007. For the year ended December 31, 2006, Fuel Tech recorded tax expense of $4,942,000, also representing deferred tax expense related to taxable income.

2006 versus 2005

Net sales for the years ended December 31, 2006 and 2005 were $75,115,000 and $52,928,000, respectively. The year over year increase of $22,187,000, or 42%, reflects an increase of $13,804,000 from the nitrogen oxide (NOx) reduction technology segment and an increase of $8,389,000 from the fuel treatment chemical technology segment.

Revenues for the NOx reduction technology segment were $46,454,000 in 2006, an increase of $13,804,000, or 42%, over 2005. The increase was driven by enhanced order flow for Fuel Tech’s NOx reduction technologies. Domestically, orders were driven by the SIP Call and CAIR regulations while internationally, revenues were enhanced by two large Chinese projects that were awarded late in 2005 and contributed significantly to revenues in 2006.

Revenues for the Fuel Treatment Chemical business segment were $28,661,000 in 2006, an increase of $8,389,000, or 41%, over 2005. The increase was driven by continued market acceptance of Fuel Tech’s TIFI™ technology, particularly on coal-fired units in the United States.

Cost of sales for the years ended December 31, 2006 and 2005 was $38,429,000 and $27,118,000, respectively. Cost of sales as a percentage of net sales for the years ended December 31, 2006 and 2005 was 51%. The cost of sales percentage for 2006 for the NOx reduction segment increased to 57% from 51% in 2005. The increase is attributable to the mix of project business. For the fuel treatment chemical segment, the cost of sales percentage decreased to 42% in 2006 from 50% in 2005. The decrease is due to the timing of revenue recognition on cost-share demonstrations and to leveraging fixed costs on higher revenue-generating coal-fired utility units.

Selling, general and administrative expenses for the years ended December 31, 2006 and 2005 were $23,901,000 and $17,414,000, respectively. The $6,487,000 increase over 2005 is attributable to the following:

- Fuel Tech recorded $1,805,000 in stock compensation expense in accordance with Statement 123(R), as discussed in Note 6 to the consolidated financial statements.

- Fuel Tech realized an increase in revenue-related expenses in the amount of $1,500,000 as both technology segments had significantly improved revenue growth versus the comparable prior-year period.

- Fuel Tech recorded an increase in human resource-related expenses of approximately $1,800,000 as staffing levels were increased in several areas in response to overall business growth.

- Finally, Fuel Tech realized incremental expenses related to audit, tax, consulting and recruiting fees, all in support of achieving business growth. Of specific note are the costs that were incurred to domesticate Fuel Tech.

Research and development expenses were $2,052,000 and $1,241,000 for the years ended December 31, 2006 and 2005, respectively. Fuel Tech has established a more focused approach in the pursuit of commercial applications for its technologies outside of its traditional markets, and in the development and analysis of new technologies that could represent incremental market opportunities.

Interest income increase by almost $800,000 year over year, driven by higher average cash and short-term investment balances, and market interest rates versus those experienced in the prior year. The increase in other income is due largely to foreign exchange gains related to balances denominated in foreign currencies.

On a full-year basis, Fuel Tech recorded tax expense of $4,942,000. This amount primarily represents non-cash deferred tax expense related to taxable income recognized in 2006.

Fuel Tech’s income tax benefit of $419,000 for 2005 predominantly represented the recording of the reduction in the deferred tax asset valuation allowance representing the anticipated utilization of net operating loss and research and development tax credit carryforwards. Based on a review of both historical and projected taxable income, Fuel Tech concluded in 2005 that it was more likely than not that the net operating losses and the research and development tax credits would be utiized in subsequent periods and the valuation allowance was no longer required.

Liquidity and Sources of Capital

At December 31, 2007, Fuel Tech had cash and cash equivalents and short-term investments of $32,471,000 and working capital of $45,143,000 versus $32,405,000 and $38,715,000 at the end of 2006, respectively. Operating activities provided $4,099,000 of cash during 2007, primarily due to the favorable operating results of the business segments. Investing activities used cash of $3,713,000 during 2007, as short-term investments were decreased $6,002,000 while $9,715,000 was utilized to support and enhance the operations of the business. Of this amount, approximately $6,000,000 was used to purchase the future corporate headquarters for Fuel Tech, with the remainder used principally for equipment related to the fuel treatment chemical technology segment. Fuel Tech generated cash from financing activities in the amount of $5,595,000. Of this amount, $912,000 represents proceeds derived from the exercise price of options exercised in 2007, while $1,482,000 represents the excess tax benefits realized from the exercise of stock options in 2007. Fuel Tech generated cash in an amount of $1,150,000 resulting from the issuance of directors’ deferred shares of stock. Finally, Beijing Fuel Tech borrowed $2,051,000 in funds to meet the short-term working capital needs of this new legal entity.

Fuel Tech has a $25.0 million revolving credit facility expiring July 31, 2009. The facility is unsecured and bears interest at a rate of LIBOR plus 75 basis points. Fuel Tech can use this facility for cash advances and standby letters of credit.

At December 31, 2007, the bank had provided standby letters of credit, predominantly to customers, totaling approximately $6,021,000 in connection with contracts in process. Fuel Tech is committed to reimbursing the issuing bank for any payments made by the bank under these letters of credit. At December 31, 2007, there were no cash borrowings under the revolving credit facility and approximately $18,979,000 was available.

Beijing Fuel Tech Environmental Technologies Company, Ltd. (Beijing Fuel Tech), a newly formed wholly-owned subsidiary of Fuel Tech, entered into a revolving credit facility agreement during the third quarter of 2007 for RMB 35 million (approximately $4.8 million), which expires on July 31, 2009. The facility is unsecured and bears interest at a rate of 90% of the People's Bank of China (PBOC) Base Rate. Beijing Fuel Tech can use this facility for cash advances and bank guarantees. At December 31, 2007, Beijing Fuel Tech had borrowings outstanding in the amount $2,051,000.

Interest payments in the amount of $24,000 were made during the year ended December 31, 2007, and no payments were made during the years ended December 31, 2006 or 2005.

In the opinion of management, Fuel Tech’s expected near-term revenue growth will be driven by the timing of penetration of the coal-fired utility marketplace via utilization of its TIFI technology, by utility and industrial entities’ adherence to the NOx reduction requirements of the various domestic environmental regulations, and by the expansion of both business segments in non-U.S. geographies. Fuel Tech expects its liquidity requirements to be met by the operating results generated from these activities.

Contractual Obligations and Commitments

In its normal course of business, Fuel Tech enters into agreements that obligate Fuel Tech to make future payments. The operating lease obligations noted below are primarily related to supporting the operations of the business.

Payments due by period in thousands of dollars | |

Contractual Cash

Obligations | | Total | | Less than 1

year | | 2-3 years | | 4-5 years | | Thereafter | |

| Operating Leases | | $ | 1,664 | | $ | 645 | | $ | 684 | | $ | 241 | | $ | 94 | |

Fuel Tech has a sublease agreement that obligates the lessee to make future payments to Fuel Tech. The sublease obligations noted below are related to a sublease agreement between Fuel Tech and American Bailey Corporation (ABC). ABC will reimburse Fuel Tech for its share of lease and lease-related expenses under Fuel Tech’s January 29, 2004 lease of its executive offices in Stamford, Connecticut. Please refer to Note 9 to the consolidated financial statements for a discussion of the relation between Fuel Tech and ABC.

Rental payments due to Fuel Tech by period in thousands of dollars | |

Contractual Cash

Obligations | | Total | | Less than 1

year | | 2-3 years | | 4-5 years | | Thereafter | |

| Sublease | | $ | 169 | | $ | 81 | | $ | 88 | | $ | - | | $ | - | |

Beijing Fuel Tech Environmental Technologies Company, Ltd. (Beijing Fuel Tech), a newly formed wholly-owned subsidiary of Fuel Tech, entered into a revolving credit facility agreement during the third quarter of 2007 for RMB 35 million (approximately $4.8 million), which expires on July 31, 2009. The facility is unsecured and bears interest at a rate of 90% of the People's Bank of China (PBOC) Base Rate. Beijing Fuel Tech can use this facility for cash advances and bank guarantees. At December 31, 2007, Beijing Fuel Tech had borrowings outstanding in the amount $2,051,000 as noted in the table below.

Commitment expiration by period in thousands of dollars | |

Commercial Commitments | | | Total | | | Less than 1 year | | | 2-3 years | | | 4-5 years | | | Thereafter | |

| Short-tern debt | | $ | 2,051 | | $ | 2,051 | | $ | - | | $ | - | | $ | - | |

Fuel Tech, in the normal course of business, uses bank performance guarantees and letters of credit in support of construction contracts with customers as follows:

| | - | in support of the warranty period defined in the contract, or |

| | - | in support of the system performance criteria that are defined in the contract |

In addition, Fuel Tech uses letters of credit as security for other obligations as needed in the normal course of business. As of December 31, 2007, Fuel Tech has outstanding bank performance guarantees and letters of credit as noted in the table below:

Commitment expiration by period in thousands of dollars | |

Commercial

Commitments | | Total | | Less than 1

year | | 2-3 years | | 4-5 years | | Thereafter | |

| Standby letters of credit and bank guarantees | | $ | 6,021 | | $ | 1,153 | | $ | 4,868 | | $ | - | | $ | - | |

The following table summarizes Fuel Tech’s FIN 48 obligations as of December 31, 2007. Please refer to Note 3 to the consolidated financial statements in this document for a description of our FIN 48 obligations.

Commitment expiration by period in thousands of dollars | |

Commercial Commitments | | Total | | Less than 1

year | | 2-3 years | | 4-5 years | | Thereafter | |

| FIN 48 Obligations | | $ | 678 | | $ | - | | $ | - | | $ | - | | $ | 678 | |

Off-Balance-Sheet Transactions

There were no off-balance-sheet transactions during the two-year period ended Decmeber 31, 2007.

Forward-Looking Information

From time to time, information provided by Fuel Tech, statements made by its employees or information included in its filings with the Securities and Exchange Commission (including this Annual Report) may contain statements that are not historical facts, so-called “forward-looking statements.” These forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Fuel Tech’s actual future results may differ significantly from those stated in any forward-looking statements. Forward-looking statements involve a number of risks and uncertainties, including, but not limited to, product demand, pricing, market acceptance, litigation, risk of dependence on significant customers, third-party suppliers and intellectual property rights, risks in product and technology development and other risk factors detailed in the text under the caption “Risk Factors” in Item 1 “Business” under Part I of this Annual Report and in Fuel Tech’s Securities and Exchange Commission filings.

Fuel Tech’s earnings and cash flow are subject to fluctuations due to changes in foreign currency exchange rates. Fuel Tech does not enter into foreign currency forward contracts or into foreign currency option contracts to manage this risk due to the immaterial nature of the transactions involved.

Fuel Tech is also exposed to changes in interest rates primarily due to its long-term debt arrangement (refer to Note 8 to the consolidated financial statements). A hypothetical 100 basis point adverse move in interest rates along the entire interest rate yield curve would not have a materially adverse effect on interest expense during the upcoming year ended December 31, 2007.

Fuel Tech does not believe that the current economic environment in the United States will have a material impact on the results of its operations.

Report of Independent Registered Public Accounting Firm on Internal Control Over Financial Reporting

The Board of Directors and Shareholders of Fuel Tech, Inc.

We have audited Fuel Tech, Inc. (a Delaware Corporation) and Subsidiaries’ (the “Company”) internal control over financial reporting as of December 31, 2007 based on criteria established in Internal Control—Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO). The Company’s management is responsible for maintaining effective internal control over financial reporting and for its assessment of the effectiveness of internal control over financial reporting, included the accompanying Management’s Report on Internal Control Over Financial Reporting appearing under Item 9A. Our responsibility is to express an opinion on the Company’s internal control over financial reporting based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether effective internal control over financial reporting was maintained in all material respects. Our audit included obtaining an understanding of internal control over financial reporting, assessing the risk that a material weakness exists, testing and evaluating the design and operating effectiveness of internal control based on the assessed risk, and performing such other procedures as we considered necessary in the circumstances. We believe that our audit provides a reasonable basis for our opinion.

A company’s internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company’s internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company’s assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

In our opinion, Fuel Tech, Inc. and Subsidiaries maintained, in all material respects, effective internal control over financial reporting as of December 31, 2007, based on criteria established in Internal Control - Integrated Framework issued by COSO.