QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

DUQUESNE LIGHT HOLDINGS, INC. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

|

|

|

|

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

| Duquesne Light Holdings |

Notice of 2005 Annual Meeting and Proxy Statement

April 12, 2005

To the Stockholders of Duquesne Light Holdings, Inc.:

The Annual Meeting of Stockholders of Duquesne Light Holdings, Inc. will be held at the Manchester Craftsmen's Guild, 1815 Metropolitan Street, Pittsburgh, PA 15233 on Thursday, May 26, 2005 at 10:00 a.m., for the following purposes:

- (1)

- To elect three directors to serve until the 2008 Annual Meeting;

- (2)

- To ratify the appointment, by the Board of Directors, of Deloitte & Touche LLP as the independent registered public accounting firm for Duquesne Light Holdings for the year ending December 31, 2005; and

- (3)

- To consider and act upon other matters that may properly come before the meeting.

Stockholders of record of Duquesne Light Holdings Common Stock and Duquesne Light Holdings Preferred Stock, Series A (Convertible), at the close of business on March 10, 2005, the record date, are entitled to notice of the Annual Meeting and are entitled to vote at the meeting. THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE "FOR" PROPOSALS 1 AND 2.

If you are a stockholder of record as of March 10, 2005, and wish to attend the meeting, please fill in the form at the end of the Proxy Statement and return it with your proxy card so that we can send you an admittance ticket. If your shares are registered in the name of a brokerage firm or trustee and you plan to attend the meeting, please obtain a letter or account statement of your beneficial ownership from the brokerage firm or trustee. Only stockholders with the proper credentials will be admitted to the meeting.

For further information about Duquesne Light Holdings, please visit our web site atwww.duquesnelightholdings.com.

We hope you can join us. However, whether or not you plan to attend the meeting in person,your vote is important, so please vote.

| | | By Order of the Board of Directors, |

|

|

Douglas L. Rabuzzi

Corporate Secretary |

TABLE OF CONTENTS

| Voting and Revocation of Proxies | | 1 |

Proposal 1 |

|

|

| |

Election of Directors |

|

3 |

Proposal 2 |

|

|

| |

Ratification of Independent Registered Public Accounting Firm for 2005 |

|

4 |

Information about the Board and Management: |

|

|

| |

Statement on Corporate Governance |

|

5 |

| |

Directors' Fees and Plans |

|

5 |

| |

Meetings and Committees |

|

6 |

Beneficial Ownership Tables |

|

9 |

Audit Committee Report |

|

11 |

Compensation Committee Report |

|

11 |

Performance Graph |

|

14 |

Summary Compensation Table |

|

15 |

Option/SAR Exercises and Year-End Value Table |

|

16 |

Pension Plan Table |

|

16 |

Employment Agreements |

|

17 |

Other Information |

|

17 |

Ticket Requests |

|

19 |

Proxy Statement

For the Annual Meeting of Stockholders

to be Held May 26, 2005

We are sending this Proxy Statement to you in connection with the solicitation of proxies by the Board of Directors of Duquesne Light Holdings, Inc. for the Annual Meeting of Stockholders to be held on Thursday, May 26, 2005. These proxy materials will be first mailed to stockholders on or about April 12, 2005.

The specific proposals to be considered and voted upon at the Annual Meeting are summarized in the Notice of 2005 Annual Meeting of Stockholders. Each proposal is described in more detail in this Proxy Statement.

Voting and Revocation of Proxies

The Board of Directors has set the close of business on March 10, 2005 as the record date for determining the stockholders entitled to notice of and to vote at the Annual Meeting. There were 77,374,699 shares of Common Stock outstanding and entitled to vote on the record date. Each Common stockholder is entitled to one vote for each whole share held on all matters to be voted upon at the Annual Meeting.

There were 1,006 shares of Duquesne Light Holdings, Inc. Preferred Stock, Series A (Convertible), outstanding and entitled to vote at the close of business on the record date. The Preferred stockholders are entitled to vote on all matters submitted to a vote of the Common stockholders, voting together with them as one class. Each Preferred stockholder is entitled to three votes for each whole share held on all matters to be voted upon at the Annual Meeting, making a total of 3,018 votes for the Preferred Stock. The Common and Preferred Stock combined account for a total of 77,377,717 votes.

A majority of the voting power of the outstanding shares, present or represented by proxy, constitutes a quorum for transacting business at the Annual Meeting. Proxies marked as abstaining (including proxies containing broker non-votes) on any matter to be acted upon by stockholders will be treated as present at the Annual Meeting for purposes of a quorum.

All stockholders have cumulative voting rights with respect to the election of directors. Cumulative voting means each stockholder has the right to multiply the number of votes to which he or she may be entitled (i.e., one vote per share of Common Stock and three votes per share of Preferred Stock) by the total number of directors to be elected. Each stockholder may cast all of those votes for a single nominee or may distribute them among the nominees as the stockholder sees fit. A stockholder's votes for the election of directors by a proxy solicited on behalf of the Board of Directors will be cumulated selectively (at the discretion of the holders of the proxy) among those nominees for whom the stockholder has not withheld authority to vote.

With respect to Proposal 1, the election of directors, the three people receiving the highest number of votes will be elected as directors of Duquesne Light Holdings. Approval of Proposal 2 requires the affirmative vote of a majority of the votes cast. Proxies marked as abstaining (including proxies containing broker non-votes) will not be considered as votes cast and will not have the same legal effect as a vote "Against" Proposal 2. The shares represented by the proxy will be voted as you instruct us on the proxy. If you sign and return your proxy without voting instructions, it will be voted "FOR" approval of each nominee for election as Director named in this Proxy Statement and "FOR" ratification of the appointment of Deloitte & Touche LLP, the member firms of Deloitte Touche Tohmatsu, and their respective affiliates (together, "Deloitte") as the independent registered public accounting firm for Duquesne Light Holdings, Inc. for the year 2005. In addition, if other matters come

1

before the Annual Meeting, the persons named in the accompanying form of proxy will vote in accordance with their best judgment in respect to such matters.

You may revoke your proxy at any time before the polls close at the Annual Meeting, but the revocation shall not be effective until written notice has been given to our Corporate Secretary.

Confidentiality

We keep proxies, ballots, and voting tabulations that identify individual stockholders confidential, except in a contested proxy solicitation or as may be necessary to meet applicable legal requirements. Proxies, ballots, and other voting documents are available for examination only by the judges of election and those associated with processing proxy cards and tabulating the vote, who must agree in writing to comply with our policy of confidentiality.

2

PROPOSALS TO BE VOTED

PROPOSAL NO. 1

Election of Directors

Three directors, who will serve until the 2008 Annual Meeting and thereafter until their successors are chosen and qualified, are to be elected by the stockholders at the Annual Meeting. We intend to vote proxies solicited on behalf of the Board of Directors for the nominees named below. If, because of events not presently known or anticipated, any nominee is unable to serve or will not serve, the proxies voted for the election of that Director may be voted (in the discretion of the holders of the proxies) for other nominees not named below. Unless otherwise indicated in the biographies, the business positions have been held for the past five years.

The Board of Directors unanimously recommends that stockholders approve

the election of the nominees for Director.

Nominees for Directors

Terms Expiring in the Year 2008:

Sigo Falk, Age 70, Director since 1989. Management of personal investments. Chairman of The Maurice Falk Fund and Leon Falk Family Trust. Also Trustee of the Allegheny Land Trust, Chatham College, Historical Society of Western Pennsylvania and Pittsburgh Symphony. Board Committees: Audit, Compensation, and Finance.

David M. Kelly, Age 63, Director since 2002. Chairman, President and Chief Executive Officer of Matthews International Corporation (designer, manufacturer, and marketer principally of memorialization products and caskets for the cemetery and funeral home industries and custom-made products which are used to identify people, places, products and events). Also a director of Federated Investors, Mestek, Inc., and United Way of Allegheny County. Board Committees: Audit, Compensation, and Employment and Community Relations.

John D. Turner, Age 59, Director since 2002. Retired. Former Chairman and Chief Executive Officer of Copperweld Corporation (producer of steel tubular products and components, as well as bimetallic wire and strip products). Former President of LTV Copperweld from 1999 to 2001 and former Executive Vice President and Chief Operating Officer of LTV Corporation from February 26, 2001 to December 7, 2001. Also a director of Matthews International Corporation, Allegheny Technologies, Inc., the Greater Pittsburgh Council—Boy Scouts of America, as well as serving on the Board of Trustees of Geneva College. Board Committees: Compensation, Corporate Governance, Finance, and Executive.

Standing Directors

Terms Expiring in the Year 2006:

Robert P. Bozzone, Age 71, Director since 1990, Chair since 2002. Former Chairman and current director of Allegheny Technologies, Inc. (specialty metals production). Also a director of Teledyne Technologies, Inc., non-executive Chairman of Waterpik Technologies, a trustee of Rensselaer Polytechnic Institute, a life member of ASM International (engineering technical society), and a director of the Greater Pittsburgh Council—Boy Scouts of America, the Salvation Army Advisory Board, the Pittsburgh Foundation and a trustee of the Carnegie Museums of Pittsburgh. Also former Chairman of the Pittsburgh Branch of the Federal Reserve Bank of Cleveland and former member of the EPRI Advisory Board. Board Committees: Corporate Governance and Executive.

Joseph C. Guyaux, Age 54, Director since 2003. President of The PNC Financial Services Group, Inc. Previously held various senior management positions at PNC. Also a director of Duquesne University, Private Export Funding Corporation, Consumer Bankers Association, Highmark, and

3

Pittsburgh Civic Light Opera, and a trustee of the Carnegie Museums of Pittsburgh. Board Committees: Audit, Employment and Community Relations, and Finance.

Steven S. Rogers, Age 47, Director since 2000. Clinical Professor of Finance and Management at the J. L. Kellogg Graduate School of Management of Northwestern University. Executive Director of the Levy Institute for Entrepreneurial Practice. Also a director of AMCORE Financial Inc. (a bank holding company), S. C. Johnson & Son, Inc. (manufacturer of household cleaning, personal care and insecticide products) and Supervalu, Inc. (supermarket retailer and food distributor). Board Committees: Audit, Corporate Governance, and Finance.

Terms Expiring in the Year 2007:

Doreen E. Boyce, Age 70, Director since 1989, Vice Chair since 2002. President of the Buhl Foundation (charitable institution for educational and public purposes). Also a director of Microbac Laboratories, Inc. (analytical testing laboratory group), Orbeco Analytical Systems, Inc. (manufacturer of hand-held water testing equipment), Carnegie Science Center and Dollar Bank, Federal Savings Bank, and a Trustee Emeritus of Franklin & Marshall College. Board Committees: Employment and Community Relations, and Executive.

Charles C. Cohen, Age 64, Director since 2002. Chairman of Cohen & Grigsby, P. C. (a law firm). Also a director of Eat 'n Park Hospitality Group, Inc., Giant Eagle, Inc., Industrial Scientific Corporation, Preservation Technologies, L.P., and Robroy Industries, Inc.; Chairman and Trustee of Jewish Healthcare Foundation. Adjunct professor, Securities Regulation, at the University of Pittsburgh School of Law. Board Committees: Corporate Governance, Employment and Community Relations, and Executive.

Morgan K. O'Brien, Age 45, Director, President and Chief Executive Officer since 2001. Chief Operating Officer from August 2000 to September 2001. Executive Vice President—Corporate Development from January 2000 to August 2000. Vice President—Corporate Development from July 1999 to January 2000. Director, President and Chief Executive Officer of Duquesne Light Company. Also a director of Edison Electric Institute, Association of Edison Illuminating Companies, the United Way of Allegheny County, Catholic Charities of Pittsburgh, the Allegheny Conference on Community Development and the Greater Pittsburgh Council—Boy Scouts of America. Board Committee: Executive.

PROPOSAL NO. 2

Ratification of Appointment of Independent Registered Public Accounting Firm

Action is to be taken at the Annual Meeting of Stockholders to ratify the appointment, by the Board, of an independent registered public accounting firm to audit the books of Duquesne Light Holdings and our subsidiaries for the year ending December 31, 2005. The Board recommends the ratification of the appointment of Deloitte as our independent registered public accounting firm for the year 2005.

Deloitte provided a variety of professional services for us and our subsidiaries during 2004. Included were the audit of our annual financial statements; reviews of quarterly financial statements; services related to filings with the Securities and Exchange Commission ("SEC") and the Federal Energy Regulatory Commission; audits of certain employee benefit plans; and consultations on matters related to accounting and financial reporting. Non-audit services also were provided during 2004, including technical assistance relating to corporate tax matters, and tax consulting.

Representatives of Deloitte will be present at the meeting, will have the opportunity to make a statement if they desire, and will also be available to respond to appropriate questions from stockholders in attendance.

4

We are submitting the appointment of independent auditors for ratification by our stockholders, although ratification is not required. If ratification is not obtained, the Board may reconsider its appointment of Deloitte.

The Board of Directors unanimously recommends that stockholders

ratify the appointment of Deloitte as independent auditors.

INFORMATION ABOUT THE BOARD AND MANAGEMENT

Statement on Corporate Governance

In accordance with the New York Stock Exchange ("NYSE") listing standards, the Board has adopted a Statement of Corporate Governance Principles as our corporate governance guidelines. Our employees, officers and Directors are subject to the Guidelines for Ethical Conduct, which is our long-standing code of ethics. Both documents are accessible through our web site atwww.duquesnelightholdings.com; printed copies are available upon written request to the Corporate Secretary.

Our non-management Directors meet, without management, at regularly scheduled executive sessions led by our non-executive Chairman of the Board, Robert P. Bozzone. Stockholders who wish to communicate directly with Mr. Bozzone or the non-management Directors as a group may do so by submitting a written message to Mr. Bozzone, in care of the Corporate Secretary, 411 Seventh Avenue, Pittsburgh, PA 15219.

The Board affirmatively determines the independence of each Director in accordance with the New York Stock Exchange ("NYSE") listing standards. Three members of the Board had business relationships with the company. A subsidiary of Duquesne Light Holdings has purchased more than $100,000 of services in the last three years from Microbac, Inc., a company owned by Mrs. Boyce's son. Under the NYSE rules, Mrs. Boyce has been determined not to be independent. Mr. Cohen is a partner in a law firm that provided a small amount of legal services to Duquesne Light Holdings in 2004; this relationship has been terminated. Mr. Guyaux's employer is a minority member of Duquesne Light Holdings' bank lending group. The amount of the bank's participation is not material to the bank or Duquesne Light Holdings. After review of these relationships, the Board has determined that Messrs. Bozzone, Cohen, Falk, Guyaux, Kelly, Rogers and Turner are independent.

Directors' Fees and Plans

Directors who are employees of Duquesne Light Holdings or any of our affiliates are not compensated for their Board service.

Directors who are not employees are compensated for their Board service by a combination of cash and an annual grant of Common Stock. The cash component consists of an annual Board retainer of $24,000, payable in twelve monthly installments, and a fee of $1,000 for each Board, Committee or ad hoc meeting attended. The Board Chair is not compensated for attending Committee meetings. The stock component consists of an annual grant of 2,500 restricted shares or deferred stock units (which vest over two years) for each Director, plus annual grants of stock (which may be deferred in the form of deferred stock units at the recipient's option) in the following amounts: $30,000 to the Board Chair; $15,000 to the Vice Chair; and $5,000 to each Committee chairperson. In order to emphasize the alignment of stockholder and Director interests, each Director is required to own Holdings Common Stock equal in value to at least five times the annual cash retainer. The Directors have until 2010 to meet their ownership targets.

Each non-employee Director under the age of 72 may elect to defer receipt of a percentage of his or her Director's remuneration until after termination of service as a Director. Deferred compensation may be received in one to ten annual installments commencing the year designated by the Director.

5

Interest accrues quarterly on all deferred compensation at a rate equal to a specified bank's prime lending rate.

For Directors elected prior to June 1, 2003, we have a Charitable Giving Program funded by company-owned life insurance policies on the Directors. Upon the death of a Director, we donate up to $500,000, payable in ten equal annual installments, to a maximum of ten qualifying charitable or educational organizations recommended by the Director and reviewed and approved by the Employment and Community Relations Committee and the Board. A Director must have Board service of 60 months or more in order to qualify for the full donation amount, with service of less than 60 months qualifying for a pro-rated donation. The program does not result in any material cost to us.

We provide Business Travel Insurance to our non-employee directors as part of our Business Travel Insurance Plan for Management Employees. In the event of accidental death or dismemberment, benefits of up to $400,000 per individual are provided. The program does not result in any material cost to us.

Directors can participate in the Duquesne Light Company College Matching Gift Program, which provides a dollar-for-dollar match of a gift of cash or securities (up to a maximum of $5,000 per donor per calendar year) to an accredited, nonprofit, non-proprietary, degree-granting college, university, or junior college located within the United States or one of its possessions which is recognized by the Internal Revenue Service as eligible to receive tax-deductible contributions. The program does not result in any material cost to us.

Meetings and Committees

The Board held 7 regular meetings during 2004. Attendance by the Directors at Board and Committee meetings in 2004 averaged 94%. Each Director attended at least 75% of the meetings of the Board and Committees of which he or she was a member. It is Board policy that Directors should attend the Annual Meeting of Stockholders barring a compelling reason that makes attendance impossible; seven members attended the 2004 Annual Meeting.

The Board has standing Audit, Compensation, Corporate Governance, Employment and Community Relations, and Finance Committees that meet periodically, as well as the Executive Committee. Actions taken by all Committees are reported to the full Board. Each Committee operates under a written charter adopted by the Board. The charters for our Audit, Compensation and Corporate Governance Committees comply with the NYSE requirements. The charters for all the standing Committees are accessible on our web site; printed copies are available upon written request to the Corporate Secretary.

Audit Committee. The Audit Committee is comprised of four directors, all of whom are independent as required by Federal securities law and the NYSE listing standards. The Committee recommends the independent auditors who are appointed by the Board and ratified by the stockholders. The Committee also reviews our financial statements, the related report of the independent auditors and the results of the annual audit. The Committee monitors our system of internal accounting control and the adequacy of the internal audit function, and oversees corporate compliance and ethics. The Committee met seven times during 2004. The members are Messrs. Falk, Guyaux, Kelly (Chair) and Rogers. The full Board has determined that Mr. Kelly is an audit committee financial expert as defined under Federal securities regulations.

While evaluating its recommendation of Deloitte as the independent registered public accounting firm, the Audit Committee considered whether Deloitte's provision of non-audit services was compatible with maintaining its independence. The following paragraphs discuss the fees billed by Deloitte for both audit and non-audit services in 2004.

6

Fees Paid to Deloitte. The following table sets forth the aggregate fees billed by Deloitte for professional services rendered for the years ended December 31, 2004 and 2003.

| | 2004

($)

| | 2003

($)

|

|---|

| Audit Fees | | 851,076 | | 497,200 |

| Audit-related Fees | | 74,000 | | 68,300 |

| Tax Fees | | 28,520 | | 1,362,688 |

| All Other Fees | | — | | 23,105 |

Audit fees consist of fees for professional services rendered for the audit of our annual financial statements, the reviews of financial statements for the Quarterly Reports on Form 10-Q, and the review of our internal controls over financial reporting required under Section 404 of the Sarbanes-Oxley Act of 2002.

Audit-related fees consist of fees for audits of employee benefit plans and our insurance subsidiary.

Tax fees consist of fees for tax compliance and tax consultation.

All other fees consist of fees related to the stockholder class-action litigation initiated in 2001 against the company.

The Audit Committee considered whether the provision of these services is compatible with maintaining the auditor's independence, and has determined such services for 2004 and 2003 were compatible.

Policy on Pre-Approval of Services. The Audit Committee approves all fees to be paid to Deloitte. Audit fees are approved annually, in conjunction with the selection of Deloitte to perform the annual audit. Audit-related fees, tax fees and all other fees are pre-approved on an on-going basis. At each Audit Committee meeting, management communicates specific projects and categories of service, and requests the Committee's advance approval. The Audit Committee considers these requests and advises management if the Committee approves the engagement of Deloitte. Management regularly reports on the actual spending for such projects and services compared to approved amounts. The Committee pre-approved all fees for 2004.

All of the hours expended by Deloitte in auditing our financial statements for 2004 were attributable to work performed by full-time, permanent employees of Deloitte.

Compensation Committee. The Compensation Committee is comprised of three directors, all of whom are independent as required by the NYSE listing standards. The Committee makes recommendations to the Board regarding compensation and benefits provided to executive officers and members of the Board, and the establishment or amendment of various employee benefit plans. The Committee also administers the Long-Term Incentive Plan. The Committee met three times during 2004. The members are Messrs. Falk (Chair), Kelly, and Turner.

Corporate Governance Committee. The Corporate Governance Committee is comprised of four directors, all of whom are independent as required by the NYSE listing standards. The Committee reviews and makes recommendations concerning corporate governance policies, and recommends to the Board candidates for election and re-election to, or to fill vacancies on, the Board. The Committee met four times during 2004. The members are Messrs. Bozzone, Cohen (Chair), Rogers and Turner.

Nomination Process. To be considered by the Corporate Governance Committee, a nominee must have consistently displayed the following individual qualities: integrity and trustworthiness; diligence and sound judgment; financial literacy; collaborative competency; and high standards of stewardship. In addition to these qualities, the Committee shall require of all recommended candidates a commitment

7

to devote the time and effort necessary to be productive members of the Board, including learning the business of the company and the Board, to do all preparatory work necessary to participate in Board meetings, to attend all meetings of the Board and committees to which he or she is assigned, and to offer to resign on change of employment or professional responsibilities if requested by the Board to do so. In addition, the Committee will evaluate whether a nominee's skills are complementary to the existing Board members' skills, and the Board's needs for operational, managerial, financial, technological or other expertise. The Committee considers nominees recommended to it in writing by stockholders and sent to our Corporate Secretary. Such recommendations must be received by December 1, 2005 to be considered for inclusion in the slate of nominees for the 2006 annual meeting. Stockholder recommendations will receive the same consideration that the other candidates recommended to or by the Committee members receive.

Employment and Community Relations Committee. The Employment and Community Relations Committee considers social responsibility and employee issues. The Committee met twice during 2004. The members are Mrs. Boyce (Chair) and Messrs. Cohen, Guyaux and Kelly.

8

Finance Committee. The Finance Committee reviews major financial matters, including all major investments, tax planning and subsidiary performance. The Committee met three times during 2004. The members are Messrs. Falk, Guyaux, Rogers (Chair) and Turner.

Executive Committee. The Executive Committee was formed to address matters that arise between regular Board meetings. It has all the power and authority of the Board except as restricted by Pennsylvania law. The Committee did not meet during 2004. The members are Mrs. Boyce and Messrs. Bozzone (Chair), Cohen, O'Brien and Turner.

Beneficial Ownership of Stock

The following table shows all equity securities beneficially owned, directly or indirectly, as of March 10, 2005, by each Director and each executive officer named in the Summary Compensation Table.

| | Total Shares of

Common Stock(1)

| | Shares of Common Stock/

Nature of Ownership(2)

|

|---|

| Doreen E. Boyce | | 23,617 | | 12,377

2,500 | | VP, IP

VP |

| Robert P. Bozzone | | 137,726 | | 117,746

2,500 | | VP, IP

VP |

| Charles C. Cohen | | 18,188 | (3) | 4,771

5,405 | | VP, IP

VP |

| Sigo Falk | | 26,229 | (4) | 14,989

2,500 | | VP, IP

VP |

| Joseph C. Guyaux | | 10,500 | (3) | 1,038

5,820 | | VP, IP

VP |

| David M. Kelly | | 17,688 | (3) | 4,271

5,405 | | VP, IP

VP |

| Steven S. Rogers | | 22,730 | (3) | 4,983

4,575 | | VP, IP

VP |

| John D. Turner | | 15,120 | (3) | 1,703

5,405 | | VP, IP

VP |

| Morgan K. O'Brien | | 260,030 | (5) | 29,682

51,678 | | VP, IP

VP |

| Joseph G. Belechak | | 45,698 | (5) | 6,798

16,400 | | VP, IP

VP |

| Maureen L. Hogel | | 43,774 | (5) | 5,874

15,400 | | SVP, SIP

VP |

| Stevan R. Schott | | 27,646 | (5) | 5,971

13,400 | | VP

VP |

| James E. Wilson | | 40,410 | (5) | 4,804

11,000 | | VP, IP

VP |

| Directors, Nominees and Executive Officers as a Group (14 persons) | | 750,276 | | | | |

9

None of the individuals named in the table owned beneficially more than 1% of the outstanding shares of Common Stock. The directors and executive officers as a group beneficially owned less than 1% of the outstanding shares of Common Stock as of March 10, 2005.

- (1)

- The amounts shown include shares of Common Stock which the individuals have a right to acquire within 60 days of March 10, 2005 through the exercise of stock options granted under the Long-Term Incentive Plan in the following amounts: Mrs. Boyce: 8,740; Mr. Bozzone: 17,480; Mr. Cohen: 8,012; Mr. Falk: 8,740; Mr. Guyaux: 3,642; Mr. Kelly: 8,012; Mr. Rogers: 13,172; Mr. Turner: 8,012; Mr. O'Brien: 178,670; Mr. Belechak: 22,500; Ms. Hogel: 22,500; Mr. Schott: 8,275; Mr. Wilson: 24,606; and all directors and executive officers as a group: 385,440.

- (2)

- The term "Joint" means owned jointly with the person's spouse. The initials "VP" and "IP" mean sole voting power and sole investment power, respectively, and the initials "SVP" and "SIP" mean shared voting power and shared investment power, respectively.

- (3)

- Includes the unvested portions of restricted stock grants under our 1996 Plan for Non-Employee Directors, as amended, in the following amounts: Mr. Cohen: 2,905; Mr. Guyaux: 3,320; Mr. Kelly; 2,905; Mr. Rogers: 2,075; and Mr. Turner: 2,905. These shares vest in increments of 415 shares per year. Grants are no longer being made under this plan, which has been terminated by the Board.

- (4)

- Includes 1,500 shares held by a trust for which Mr. Falk is an income beneficiary but not a trustee, and over which he has no voting or investment power whatsoever. Also includes 150 shares held by the Leon Falk Family Trust, with respect to which Mr. Falk disclaims beneficial ownership.

- (5)

- Includes the unvested portions of restricted stock grants to management under the Incentive Plan, as described in more detail in the Summary Compensation Table.

Messrs. Belechak and Schott and Ms. Hogel also beneficially own 1,325; 837; and 1,026 shares, respectively, of Duquesne Light Company Preference Stock, Plan Series A as of March 10, 2005. The Preference shares are held by the Employee Stock Ownership Plan trustee for our 401(k) Plan on behalf of the executive officers, who have voting but not investment power. The Preference shares are redeemable for Common Stock or cash on retirement, termination of employment, death, or disability. As of March 10, 2005, there were 404,492 Preference shares outstanding. Messrs. O'Brien and Wilson do not own any Preference shares.

Our directors and executive officers do not own any Preferred Stock of Duquesne Light Holdings or our subsidiary, Duquesne Light Company.

Principal Shareholders

The following table sets forth, to our knowledge, the beneficial owners of more than 5% of the outstanding shares of Common Stock:

| |

| | Common Stock Owned Beneficially

| |

|---|

Name

| | Address

| | Number of Shares

| | Percent of Class

| |

|---|

| Barclays Global Investors, NA | | 45 Fremont Street

San Francisco, CA 94105 | | 7,815,595 | (1) | 10.17 | % |

| Gabelli Asset Management, Inc. | | One Corporate Center

Rye, NY 10580-1435 | | 5,632,568 | (2) | 7.35 | % |

- (1)

- This information was taken from Barclays Global Investors, NA's Schedule 13G, filed with the SEC on January 10, 2005 on behalf of itself and certain affiliates. The share amount includes 1,492,256 shares held by Barclays Global Investors, NA, with respect to 1,221,413 of which it claims sole voting power and all of which it claims dispositive power; 6,171,439 shares held by Barclays Global Fund Advisors, with respect to all of which it claims sole voting and dispositive power; 1,300 shares

10

held by Barclays Capital Securities Limited, with respect to all of which it claims sole voting and dispositive power; and 15,600 shares held by Palomino Limited, with respect to all of which it claims sole voting and dispositive power.

- (2)

- This information was taken from Gabelli Asset Management's Amendment No. 4 to Schedule 13D, filed with the SEC on September 29, 2004 on behalf of itself and certain affiliates. The share amount includes 1,107,000 shares held by Gabelli Funds LLC, with respect to all of which it claims sole voting and dispositive power; 4,535,468 shares held by GAMCO Investors, Inc., with respect to 4,130,968 of which it claims sole voting power and all of which it claims sole dispositive power; and 100 shares held by Gabelli Asset Management Inc., with respect to all of which it claims sole voting power.

The following table sets forth the sole beneficial owner, as of March 10, 2005, of the outstanding shares of our Preferred Stock. Mr. Beyer has sole voting and investment power.

| |

| | Preferred Stock Owned Beneficially

| |

|---|

Name

| | Address

| | Number of Shares

| | Percent of Class

| |

|---|

| David J. Beyer | | 7703 Oakwood Lakes

Houston, TX 77095 | | 1,006 | | 100 | % |

Audit Committee Report

Deloitte & Touche LLP, our independent auditor, has provided the Audit Committee with the written disclosures and the written assurance of its independence (as required by Independence Standards Board Standard No. 1). The Audit Committee also met with the independent auditor to review and discuss its independence and the matters required to be discussed by Statement on Auditing Standards No. 61.

The Audit Committee has also reviewed and discussed the audited financial statements that appear in the 2004 Annual Report with management.

Based on its review and discussions with management and the independent auditors, the Audit Committee recommended to the Board of Directors that the audited financial statements for 2004 be included in the Annual Report on Form 10-K for filing with the SEC.

Compensation Committee Report

The Compensation Committee establishes the salaries and other compensation of the Chief Executive Officer and other executive officers named in the Summary Compensation Table (together, the "Named Executive Officers"). The Committee consists entirely of independent Directors who are not officers or employees. The Committee has retained an independent compensation consultant to assist it in determining appropriate compensation. The consultant reports and is responsible directly to the Committee.

Our executive compensation program consists of salaries, annual incentive compensation and long-term incentive compensation and is designed to:

- •

- attract and retain qualified executive officers by paying them competitively, motivate them to contribute to our success and reward them for their performance;

11

- •

- link a substantial part of each executive officer's compensation to the performance of both the individual executive officer and the company (including the creation of stockholder value and achievement of long-term strategic goals); and

- •

- encourage significant ownership of our common stock by executive officers.

The Committee also intends that, to the maximum extent practicable, all incentive compensation paid to the Named Executive Officers will be deductible for Federal income tax purposes.

To establish total compensation target levels for the Named Executive Officers, the Committee considers total compensation in the competitive market. The total compensation package is then broken down into the three basic components indicated above. Target salary and bonus levels are benchmarked with the averages of comparative utility and general industry panels of companies with similar revenue and operating characteristics. These levels are determined using benchmarking information from a combination of publicly available proxy statement information and a compensation survey conducted by the Committee's compensation consultant. The Committee also considers individual experience, performance, and the role of each executive officer in the company's future when determining compensation levels.

The accomplishment of goals and objectives is at the center of the Committee's compensation decisions, and strengthens the relationship between stockholder interests and ultimate total compensation. Individual objectives are established annually for each executive officer and approved by the Committee. The Chief Executive Officer's performance is evaluated on the basis of our overall performance, the performance of the other members of his management team and his leadership in developing and implementing operating and strategic plans to further our long-term corporate objectives. In determining the annual performance-based compensation awards, the Committee considers specific individual objectives that support the following major corporate objectives: maximizing long-term stockholder value; providing quality service and superior customer satisfaction; managing assets cost effectively; maintaining excellent operational performance; and providing leadership within the company and the community.

The Committee reviews individual results and the corporate performance with the other independent members of the Board. The independent Directors, upon the Committee's recommendation, approve the base salary and annual incentive compensation for each executive officer based on the achievement of corporate and individual objectives. Long-term incentive compensation is reviewed with the independent Directors; however, pursuant to the terms of the stockholder-approved Incentive Plan, final approval authority rests solely with the Committee.

The 2004 salaries of the Named Executive Officers are shown in the "Salary" column of the Summary Compensation Table, and reflect increases for Messrs. O'Brien, Belechak, Schott and Ms. Hogel. Mr. O'Brien's salary is set pursuant to his Employment Agreement, described elsewhere in this Proxy Statement. Following review by the Committee, Mr. O'Brien's salary was increased to $480,000.

Target annual incentives are 65% of salary for the Chief Executive Officer and 40% of salary for the remaining Named Executive Officers, in each case based on the salary level in effect for that executive at the time the Committee determines whether performance objectives have been met for the preceding year. Depending on the performance objectives achieved each year, performance-based payouts can vary from 0% to 150% of the targeted amount. All performance objectives for 2004 were

12

met, and the Committee awarded the maximum annual incentive compensation payments to the Named Executive Officers, as shown in the "Bonus" column of the Summary Compensation Table. Mr. O'Brien's payment was $468,000.

The executive officers received no long-term incentive compensation awards in 2004. As reported in last year's Proxy Statement, in 2003 the executive officers received awards covering the three-year period ending December 31, 2006. These awards included restricted stock and deferred stock unit awards. The first third of the restricted stock vested at the end of 2004, and the remaining two-thirds will vest in equal portions at the end of 2005 and 2006, provided the grantee is employed by Duquesne Light Holdings at the time. Unvested shares will be forfeited. The deferred stock units, one-half of which vest based on earnings per share results over the performance period, and one-half of which vest based on our "total shareholder return" over the three-year period, will remain unvested and outstanding until the end of 2006.

The executive officers are subject to stock ownership requirements, put in place to emphasize the alignment of stockholder and management interests.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires our Directors and executive officers, and any persons who beneficially own more than 10% of our Common or Preferred Stock, to file with the SEC initial reports of ownership and reports of changes in ownership of Duquesne Light Holdings-related securities. Such persons are required by SEC regulations to furnish us with copies of all Section 16(a) forms they file. To our knowledge, based solely on review of the copies of such reports furnished to us and written representations that no other reports were required, during the year ended December 31, 2004, all such Section 16(a) filing requirements were met except for Tommy C. Bussell, a former 10% owner of our Preferred Stock, who did not make the necessary Form 4 filing to report the final conversion of his Preferred Stock into Common shares.

Compensation Committee Interlocks and Insider Participation

No member of the Compensation Committee was an officer or employee of Duquesne Light Holdings during 2004 or at any other time. No executive officer of Duquesne Light Holdings served on the Board of Directors or Compensation Committee of any entity that has one or more executive officers serving as a member of our Board or Compensation Committee.

Certain Relationships and Related Transactions

Mr. Cohen is Chairman of the law firm of Cohen & Grigsby, P.C. We obtained legal services from the firm in 2004, paying approximately $29,000 in fees. This relationship was terminated in mid-2004.

13

Involvement in Certain Legal Proceedings

Until his March 31, 2003 retirement, Mr. Turner was the Chairman and Chief Executive Officer of Copperweld Corporation. On December 29, 2000, LTV Corporation and 48 subsidiaries (including Copperweld Corporation) filed voluntary petitions under Chapter 11 of the U.S. Bankruptcy Code. On December 19, 2003, Copperweld announced its emergence from bankruptcy as a stand-alone company under a plan of reorganization confirmed by the U.S. Bankruptcy Court.

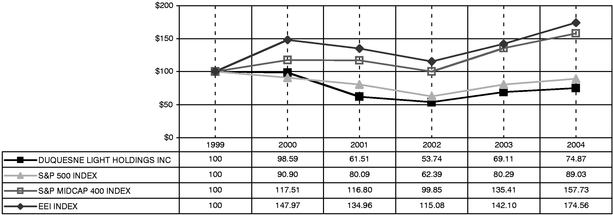

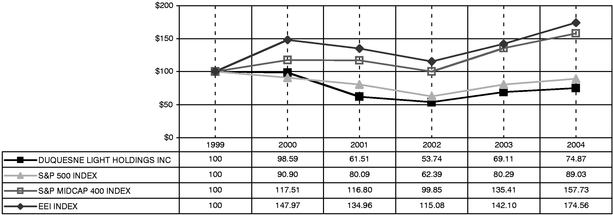

Performance Graph

The following graph represents a performance comparison of cumulative total return on Common Stock (assuming the investment of $100 on December 31, 1999 and the reinvestment of all dividends) as compared to the Edison Electric Institute Index (the "EEI Index"), the S&P Mid-Cap 400 Index and the S&P 500 Index for the five-year period ending December 31, 2004. The EEI Index is a market-capitalization based index comprised of the more than 65 U.S. investor-owned electric utilities.

COMPARISON OF FIVE-YEAR CUMULATIVE TOTAL RETURNS

DUQUESNE LIGHT HOLDINGS, S&P 500 INDEX, S&P MID-CAP 400 INDEX AND EDISON ELECTRIC INDEX

ASSUMES REINVESTMENT OF DIVIDEND

Compensation

The following Summary Compensation Table sets forth certain information as to cash and non-cash compensation earned and either paid to, or accrued for the benefit of, our Chief Executive Officer and the four other highest-paid executive officers during 2004.

14

SUMMARY COMPENSATION TABLE

| |

| |

| |

| |

| | Long Term Compensation

|

|---|

| | Annual Compensation

| | Awards

| | Payouts

|

|---|

(a)

| | (b)

| | (c)

| | (d)

| | (e)

| | (f)

| | (g)

| | (h)

| | (i)

|

|---|

Name and Principal Position

| |

Year

| |

Salary

($)

| |

Bonus

($)(1)

| |

Other

Annual

Compensation

($)(2)

| | Other

Restricted

Stock

Award(s)

($)(3)

| | Securities

Underlying

Performance

Options/SARs

(#)(4)

| |

LTIP

Payouts

($)

| |

All Other

Compensation

($)(5)

|

|---|

M. K. O'Brien

President & Chief Executive Officer | | 2004

2003

2002 | | 462,500

450,000

450,000 | | 468,000

438,750

286,875 | | —

—

— | | —

1,298,409

— | | —

—

134,000 | | —

—

— | | 10,347

10,047

10,047 |

J. G. Belechak

Sr. VP & Chief Operations Officer | | 2004

2003

2002 | | 260,908

227,500

174,250 | | 164,028

151,200

110,250 | | 2,965

3,864

5,101 | | —

412,050

— | | —

—

24,000 | | —

—

— | | 14,311

6,039

5,711 |

M. L. Hogel

Sr. VP & Chief Legal and Admin. Officer | | 2004

2003

2002 | | 254,849

222,125

173,833 | | 160,258

147,660

107,625 | | 2,989

3,895

34,660 | | —

386,925

— | | —

—

24,000 | | —

—

— | | 12,025

9,418

8,958 |

S. R. Schott

Sr. VP & Chief Financial Officer | | 2004

2003

2002 | | 219,942

184,167

151,667 | | 145,356

122,400

76,500 | | 2,965

3,703

5,627 | | —

336,675

— | | —

—

15,000 | | —

—

— | | 11,843

5,433

7,859 |

J. E. Wilson

Sr. VP & Chief Strategic Officer | | 2004

2003

2002 | | 192,000

173,333

150,833 | | 115,200

115,200

79,800 | | —

—

— | | —

276,375

— | | —

—

15,000 | | —

—

— | | 4,414

3,861

3,365 |

- (1)

- Bonus compensation is determined annually based upon the prior year's performance and either paid or deferred (via an eligible participant's prior election) in the following year. The amounts shown for each year are the awards earned in those years but established and paid or deferred in the subsequent years.

- (2)

- Includes amounts reimbursed for the payment of taxes related to the provision of investment counseling services. Also includes perquisites or personal benefits if, in the aggregate, they exceed the lesser of $50,000 or 10% of the Named Executive Officer's salary and bonus for the covered year. The information for 2002 includes $10,357 for club dues for Ms. Hogel.

- (3)

- No restricted stock awards were made in 2004. The amounts shown in the table represent the market value of restricted stock awards made November 10, 2003, based on the closing stock price of $16.75 on that date. One-third of these awards vested on December 31, 2004. The remaining restricted stock will vest in equal increments on December 31, 2005 and 2006. As of December 31, 2004, and based on the then-closing stock price of $18.85, the number and value of the officers' aggregate restricted stock holdings was: Mr. O'Brien 51,678 restricted shares valued at $974,130; Mr. Belechak 16,400 restricted shares valued at $308,648; Ms. Hogel 15,400 restricted shares valued at $290,290; Mr. Schott 13,400 restricted shares valued at $252,590; and Mr. Wilson 11,000 restricted shares valued at $207,350. Dividends accumulate on the restricted shares at the same rate as paid to all stockholders; accumulated dividends are paid upon the vesting of the shares.

- (4)

- Includes total number of stock options granted during the fiscal year, with or without tandem SARs and stock-for-stock (reload) options on option exercises, as applicable, whether vested or not. Once granted, the stock options can be exercised only if they become awarded and vested.

- (5)

- The information for 2004 includes (i) accrued, unused vacation sold to Duquesne light Holding of $8,654 for Mr. O'Brien; $4,846 for Mr. Belechak; $4,733 for Ms. Hogel; $3,923 for Mr. Schott; and $3,692 for Mr. Wilson; (ii) term life insurance premiums of $1,693 for Mr. O'Brien; $948 for Mr. Belechak; $928 for Ms. Hogel; $767 for Mr. Schott; and $722 for Mr. Wilson; and (iii) 401(k) Retirement Savings Plan for Management Employees matching contributions of $8,517 for Mr. Belechak; $6,364 for Ms. Hogel; and $7,153 Mr. Schott.

15

AGGREGATED OPTION/SAR EXERCISES IN LAST FISCAL YEAR

AND FISCAL YEAR-END OPTION/SAR VALUES

(a)

| | (b)

| | (c)

| | (d)

| | (e)

|

|---|

Name

| | Number of

Securities

Underlying

Options/SARs

Exercised (#)

| | Value

Realized

($)(1)

| | Number of Securities

Underlying Unexercised

Options/SARs at Fiscal Year-End

Exercisable/Unexercisable

(#)(2)

| | Value of Unexercised

In-the-Money

Options/SARs at Year-End

Exercisable/Unexercisable

($)

|

|---|

| M. K. O'Brien | | 13,059/0 | | $ | 38,524.37 | | 202,712/67000 | | $ | 341,074/$261,300 |

| J. G. Belechak | | — | | | — | | 22,500/12,000 | | $ | 67,957/$46,800 |

| M. L. Hogel | | — | | | — | | 22,500/12,000 | | $ | 67,957/$46,800 |

| S. R. Schott | | — | | | — | | 14,000/7,500 | | $ | 42,347/$29,250 |

| J. E. Wilson | | 7,763/0 | | $ | 22,410.67 | | 24,606/7,500 | | $ | 24,324/$29,250 |

- (1)

- Represents the difference between the option/SAR exercise price and the fair market value of the common stock on the NYSE on the date of exercise.

- (2)

- The numbers set forth include options/SARs previously granted but not yet earned. The number to be earned will be based on individual and corporate performance and may be earned over future periods from one to three years as established with each option grant.

Retirement Plan

We maintain tax-qualified and non-qualified defined benefit pension plans and arrangements that cover the Named Executive Officers, among others. The following table illustrates the estimated annual straight-life annuity benefits payable at the normal retirement age of 65 to management employees in the specified earnings classifications and years of service shown:

PENSION PLAN TABLE

| | Years of Services

|

|---|

Highest Consecutive

Five-Year Average Compensation

|

|---|

| | 5

| | 10

| | 15

| | 20

| | 25

| | 30

| | 35

|

|---|

| $100,000 | | $ | 8,000 | | $ | 15,000 | | $ | 23,000 | | $ | 30,000 | | $ | 37,000 | | $ | 43,000 | | $ | 48,000 |

| $200,000 | | $ | 17,000 | | $ | 33,000 | | $ | 50,000 | | $ | 66,000 | | $ | 82,000 | | $ | 95,000 | | $ | 105,000 |

| $300,000 | | $ | 26,000 | | $ | 51,000 | | $ | 77,000 | | $ | 102,000 | | $ | 127,000 | | $ | 146,000 | | $ | 161,000 |

| $400,000 | | $ | 35,000 | | $ | 69,000 | | $ | 104,000 | | $ | 138,000 | | $ | 172,000 | | $ | 198,000 | | $ | 218,000 |

| $500,000 | | $ | 44,000 | | $ | 87,000 | | $ | 131,000 | | $ | 174,000 | | $ | 217,000 | | $ | 250,000 | | $ | 275,000 |

| $600,000 | | $ | 53,000 | | $ | 105,000 | | $ | 158,000 | | $ | 210,000 | | $ | 262,000 | | $ | 301,000 | | $ | 331,000 |

Compensation used for pension formula purposes includes salary and bonus reported in columns (c) and (d) of the Summary Compensation Table and stock option compensation prior to March 1, 1994. An employee who has at least five years of service has a vested interest in the retirement plan. Benefits are received by an employee upon retirement, which may be as early as age 55. Benefits are reduced by reason of retirement if commenced prior to age 60 or upon election of certain options under which benefits are payable to survivors upon the death of the employee. Pension amounts set forth in the above table reflect the integration with social security of the tax-qualified retirement plans. Retirement benefits are also subject to offset by other retirement plans under certain conditions.

The current covered compensation and current years of credited service for the Named Executive Officers are as follows: Mr. O'Brien ($586,267 and 19.75); Mr. Belechak ($255,783 and 22.917); Ms. Hogel ($269,323 and 17.83); Mr. Schott ($227,267 and 12.5); and Mr. Wilson ($207,333 and 15.33).

16

Employment Agreements

Non-Competition Agreements. We have stand-alone non-competition agreements with Messrs. O'Brien, Belechak, Schott and Wilson and Ms. Hogel. These agreements provide for non-disclosure of confidential information, non-competition in a specified geographic area, non-solicitation of customers and suppliers, among other provisions, for specified periods of time following termination of employment.

Employment Agreement. Mr. O'Brien has a three-year employment agreement, subject to automatic one-year extensions as of each anniversary of the effective date unless prior written notice of termination is given by Mr. O'Brien or the company. The agreement provides, among other things, that Mr. O'Brien will serve as President and Chief Executive Officer of Duquesne Light Holdings at an annual base salary (which in 2005 was set to be at least $480,000), subject to periodic review, and provides for his participation in executive compensation and other employee benefit plans. If Mr. O'Brien is discharged other than for cause (as defined) or resigns for good reason (as defined), then, in addition to any amounts earned but not paid as of the date of termination, he will receive the balance of his base salary and bonus for the remaining term of the agreement, payable as specified in the agreement. Upon any such termination, Mr. O'Brien will also receive a lump sum payment equal to the actuarial equivalent of the additional pension he would have accrued had his service for pension purposes continued until the expiration of the agreement and be entitled to immediate vesting (or, in the Board's discretion, the redemption in cash) of all of his stock-based awards. The agreement also provides for reimbursement for any additional tax liability incurred as a result of excise taxes imposed on payments deemed to be attributable to a change of control (as defined), under certain circumstances, or for reduction of the payments to avoid excise taxes.

Severance Agreements. We have entered into severance agreements with Messrs. O'Brien, Belechak, Schott and Wilson and Ms. Hogel. These officers will receive certain payments if, in connection with a change in control (as defined) of the company, his or her employment is terminated other than for cause, death or disability (as defined). Certain other events that constitute constructive discharge may also trigger payment. Payments will only be triggered if such officer's employment is terminated, or he or she is constructively discharged, during a coverage period (as defined) beginning when a change in control occurs and ending if a transaction is abandoned or, if not, 24 months after the closing of the transactions constituting a change of control. Each officer is entitled to receive a lump sum severance payment equal to three times the sum of the officer's then-current annual base pay and the highest target bonus opportunity available during the three years preceding termination; an amount intended to compensate the officer for the loss of long-term benefits; an amount equal to the present value of benefits that would have accrued under qualified and non-qualified defined benefit retirement plans, had the officer continued to participate for 36 months following termination; and certain other payments and benefits, including continuation of employee benefits for 36 months following termination. The agreements also provide for reimbursement for any additional tax liability incurred as a result of excise taxes imposed on payments deemed to be attributable to a change of control, under certain circumstances, or for reduction of the payments to avoid excise taxes. The severance agreements also contain non-competition, non-solicitation and confidentiality provisions. The termination payments and benefits under the severance agreements are in lieu of, and not in addition to, termination payments and benefits under the company's other termination plans or agreements. Once the coverage period begins, the severance agreements supersede the non-competition agreements and Mr. O'Brien's employment agreement described above.

OTHER INFORMATION

The Board does not intend to present any matters at the meeting other than those referred to, and at this date is unaware of anything that will be presented by other parties. Other matters that properly

17

come before the meeting will be voted on by the persons named in the enclosed form of proxy in accordance with their best judgment.

Stockholder Communications

Any proposal which a stockholder intends to present at the 2006 Annual Meeting of Stockholders, currently expected to be held in May 2006, and which the stockholder requests to be included in our proxy statement and form of proxy for the 2006 Annual Meeting, as well as notice of any proposal a stockholder intends to raise at the meeting pursuant to an independent solicitation, must be received by us no later than December 14, 2005. Proposals received after that date cannot be submitted for action at the 2006 Annual Meeting. Proposals must be in writing and mailed to the Corporate Secretary at our principal executive offices: Duquesne Light Holdings, Inc., 411 Seventh Avenue, Pittsburgh, PA 15219.

Stockholders may send other communications to the Board by mailing them to Robert P. Bozzone, Chairman of the Board, c/o the Corporate Secretary at the address above. All such communications are held available for review by the Chairman.

18

Proxy Statement Delivery

Under certain circumstances, we deliver only one Proxy Statement or Annual Report to multiple stockholders who share an address. If you are receiving multiple copies of these documents and would prefer only one, you may make such a request by notifying our Shareholder Relations Department in writing at 411 Seventh Avenue, Mail Stop 7-4, Pittsburgh PA 15219, or by telephone at 412-393-6167 (in the Pittsburgh area) or 800-247-0400 (outside of Pittsburgh). If your household receives single copies of the Proxy Statement or Annual Report, and you wish to receive separate copies for each stockholder for this year or in the future, you may make such a request by notifying our Shareholder Relations Department as set forth above.

Form 10-K

If you are a beneficial holder of Common Stock on the record date for the stockholder's meeting, we will send you, free upon request, a copy of our Annual Report on Form 10-K as filed with the SEC for 2004. Requests must be made in writing to the Corporate Secretary at the address above.

Proxy Solicitation

This solicitation of proxies is made on behalf of the Board, and we will bear the related cost. In addition to the solicitation of proxies by mail, officers, directors and regular employees may solicit proxies in person or by telephone, electronic transmission or by facsimile transmission. We have engaged Georgeson Shareholder, 17 State Street, 28th Floor, New York, NY 10004, to assist through similar means in the solicitation of brokers, nominees and other institutions. The anticipated cost is approximately $3,500 plus reimbursement of related expenses. We will also request brokerage firms and other nominees or fiduciaries to forward copies of our proxy material to beneficial owners of stock held in their names. We may reimburse them for reasonable out-of-pocket expenses.

| | | By Order of the Board of Directors |

|

|

Douglas L. Rabuzzi

Corporate Secretary |

| April 12, 2005 | | |

TICKET REQUEST

An admittance ticket will be sent to a stockholder whose request is received by May 10, 2005. Stockholders without tickets will need to register at the meeting.

RETURN WITH YOUR PROXY, OR MAIL TO:

Douglas L. Rabuzzi, Corporate Secretary

Duquesne Light Holdings, Inc.

411 Seventh Avenue, 8-7

Pittsburgh, PA 15219

19

DO NOT RETURN THIS FORM UNLESS YOU PLAN TO ATTEND THE ANNUAL MEETING.

Cut here

I (We) will attend the Annual Meeting of Stockholders on May 26, 2005 at 10:00 a.m. at the Manchester Craftsmen's Guild, 1815 Metropolitan Street, Pittsburgh, PA 15233.

| NOTE: | | If you are not a stockholder of record or 401(K) participant, please send proof of ownership if requesting a ticket. |

PLEASE PRINT

| ACCOUNT NO.: | |

|

NAME: |

|

|

ADDRESS: |

|

|

PHONE: |

|

( )

|

| Duquesne Light Holdings, Inc. |

SPECIAL NOTICE

Dear Shareholder(s):

You are receiving this proxy card without our Annual Report because of previous notification that you were receiving duplicate reports. If you have not yet received the Annual Report, it is important that you request one from us by calling one of the following telephone numbers:

| Pittsburgh Area | | (412) 393-6167 |

| Outside Pittsburgh | | 1-800-247-0400 |

We will immediately forward a copy to you upon request. You shouldreview this documentbefore voting your proxy.

SHAREHOLDER RELATIONS DEPARTMENT

| Duquesne Light Holdings, Inc. |

SPECIAL NOTICE

Dear Shareholder(s):

You are receiving this proxy card without our Annual Report because of previous notification that you were receiving duplicate reports. If you have not yet received the Annual Report, it is important that you request one from us by calling one of the following telephone numbers:

| Pittsburgh Area | | (412) 393-6167 |

| Outside Pittsburgh | | 1-800-247-0400 |

We will immediately forward a copy to you upon request. You shouldreview this documentbefore voting your proxy.

SHAREHOLDER RELATIONS DEPARTMENT

| Duquesne Light Holdings, Inc. |

SPECIAL NOTICE

Dear Shareholder(s):

You are receiving this proxy card without our Annual Report because of previous notification that you were receiving duplicate reports. If you have not yet received the Annual Report, it is important that you request one from us by calling one of the following telephone numbers:

| Pittsburgh Area | | (412) 393-6167 |

| Outside Pittsburgh | | 1-800-247-0400 |

We will immediately forward a copy to you upon request. You shouldreview this documentbefore voting your proxy.

SHAREHOLDER RELATIONS DEPARTMENT

| | | | |

VOTE BY INTERNET

|

| | Duquesne Light Holdings

Box 68

Pittsburgh, PA 15230 | | Have your proxy card available when you access the websitewww.votefast.com, and follow the simple instructions presented to record your vote. |

|

|

|

|

VOTE BY TELEPHONE

|

| | | | | Have your proxy card available when you call theToll-Free number 1-800-542-1160 using a touch-tone telephone, and follow the simple instructions presented to record your vote. |

|

|

|

|

VOTE BY MAIL

|

| | | | | Please mark, sign and date your proxy card and return it in the enclosedpostage-paid envelope to Duquesne Light Holdings, Inc., Box 68, Pittsburgh, PA 15230. |

| | | | | |

| |

| |

|

VOTE BY INTERNET

Access the Website and

cast your vote:

www.votefast.com | | VOTE BY TELEPHONE

Call Toll-Free using a

touch-tone telephone:

1-800-542-1160 | | VOTE BY MAIL

Return your proxy card

in the enclosed postage-

paid envelope. |

| |

| |

|

Voting by Internet or telephone helps us save money and processes your vote immediately.

Vote 24 hours a day, 7 days a week!

Your Internet or telephone vote must be received by 11:59 p.m. Eastern Time

on May 25, 2005 to be counted in the final tabulation.

Please fold and detach card at perforation before mailing.

| | Duquesne Light Holdings | | ANNUAL MEETING OF STOCKHOLDERS—May 26, 2005 |

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" ALL ITEMS.

|

| | | FOR ALL

(Except those

crossed out) | | WITHHELD

(All Nominees) | | | | FOR | | AGAINST | | ABSTAIN |

| 1. ELECTION OF THREE DIRECTORS | | o | | o | | 2. RATIFICATION OF AUDITORS DELOITTE & TOUCHE LLP | | o | | o | | o |

| | (01) SIGO FALK

(02) DAVID M. KELLY

(03) JOHN D. TURNER | | | | | | | | | | | | |

TO WITHHOLD AUTHORITY TO VOTE FOR ANY INDIVIDUAL NOMINEE, STRIKE A LINE THROUGH THE NOMINEE'S NAME. |

|

|

|

|

|

|

|

|

NOTE: Stockholder(s) signature(s) should correspond to the name(s) appearing on this proxy. Please give full title if signing in a representative capacity.

| |

|

|---|

| | Duquesne Light Holdings |

| ANNUAL MEETING OF STOCKHOLDERS—May 26, 2005 |

Duquesne Light Holdings' Annual Meeting of Stockholders will be held on Thursday, May 26, 2005 at the Manchester Craftsmen's Guild, 1815 Metropolitan Street, Pittsburgh, PA 15233 at 10:00 a.m.

The lower portion on the reverse side of this form is your PROXY CARD.EACH PROPOSAL IS FULLY EXPLAINED IN THE "NOTICE OF 2005 ANNUAL MEETING AND PROXY STATEMENT." If you will attend the Annual Meeting, please complete and return the ticket request form found at the end of the proxy statement.A ticket will be needed for admittance to the meeting.

YOUR VOTE IS IMPORTANT!

If you do not vote by Internet or telephone, please sign and date this proxy card and return it promptly in the enclosed postage-paid envelope, or otherwise to Duquesne Light Holdings, Inc., Box 68, Pittsburgh, PA 15230, so your shares may be represented at the meeting. If you vote by Internet or telephone, please do not mail this proxy card.

Please fold and detach card at perforation before mailing.

| |

|

|---|

| | Duquesne Light Holdings |

| PROXY FOR ANNUAL MEETING OF STOCKHOLDERS—May 26, 2005 |

Morgan K. O'Brien or Douglas L. Rabuzzi or either of them, are hereby appointed Proxy or Proxies, with full power of substitution, to vote the shares of the stockholder(s) named on the reverse side hereof at the Annual Meeting of Stockholders of Duquesne Light Holdings to be held on May 26, 2005 and at any adjournments or postponements thereof as directed on the reverse side hereof and in his or their discretion to act upon any other matters that may properly come before the meeting or any adjournments or postponements thereof.

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS and, when properly executed and delivered, will be voted as you specify. If not specified, this proxy will be voted FOR Proposals 1 and 2 and in the discretion of the holder on such other matters that may properly come before the meeting. A vote FOR Proposal 1 includes discretionary authority to cumulate votes selectively among the nominees as to whom authority to vote has not been withheld and to vote for a substitute nominee if any nominee is unable to serve or for good cause will not serve.

Please mark, sign and date this proxy on the reverse side and return the completed proxy promptly in the enclosed envelope.

Your Vote Is Important

Please consider voting by Phone or Internet ~ it will enable the Company tosave money.

(See Instructions on your Proxy Card.)

To Vote by phone call:

1-800-542-1160

Or

To Vote by Internet:

www.votefast.com

Or

To Vote by mail:

Mark, Sign, Date & Return your Proxy Card

Do not return your proxy card if you vote by

Phone or Internet

Please Vote Today!

QuickLinks

TABLE OF CONTENTSPROPOSALS TO BE VOTEDThe Board of Directors unanimously recommends that stockholders approve the election of the nominees for Director.The Board of Directors unanimously recommends that stockholders ratify the appointment of Deloitte as independent auditors.DO NOT RETURN THIS FORM UNLESS YOU PLAN TO ATTEND THE ANNUAL MEETING.PLEASE PRINT