Exhibit 99.1

Exhibit 99.1

EEI Financial Conference

October 2004

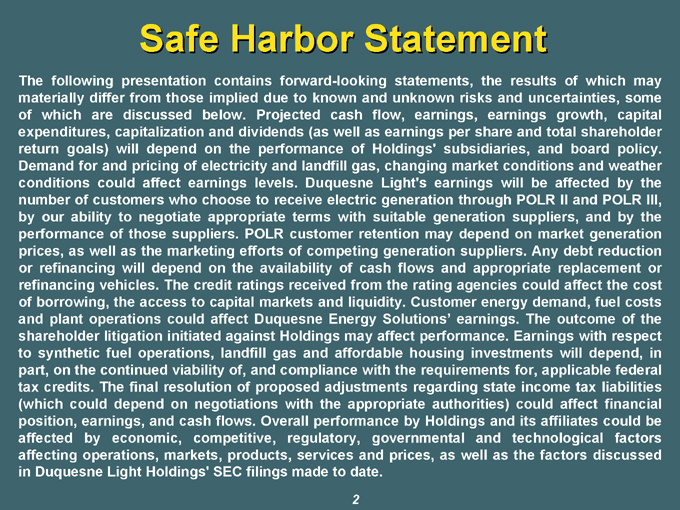

Safe Harbor Statement

The following presentation contains forward-looking statements, the results of which may materially differ from those implied due to known and unknown risks and uncertainties, some of which are discussed below. Projected cash flow, earnings, earnings growth, capital expenditures, capitalization and dividends (as well as earnings per share and total shareholder return goals) will depend on the performance of Holdings’ subsidiaries, and board policy. Demand for and pricing of electricity and landfill gas, changing market conditions and weather conditions could affect earnings levels. Duquesne Light’s earnings will be affected by the number of customers who choose to receive electric generation through POLR II and POLR III, by our ability to negotiate appropriate terms with suitable generation suppliers, and by the performance of those suppliers. POLR customer retention may depend on market generation prices, as well as the marketing efforts of competing generation suppliers. Any debt reduction or refinancing will depend on the availability of cash flows and appropriate replacement or refinancing vehicles. The credit ratings received from the rating agencies could affect the cost of borrowing, the access to capital markets and liquidity. Customer energy demand, fuel costs and plant operations could affect Duquesne Energy Solutions’ earnings. The outcome of the shareholder litigation initiated against Holdings may affect performance. Earnings with respect to synthetic fuel operations, landfill gas and affordable housing investments will depend, in part, on the continued viability of, and compliance with the requirements for, applicable federal tax credits. The final resolution of proposed adjustments regarding state income tax liabilities (which could depend on negotiations with the appropriate authorities) could affect financial position, earnings, and cash flows. Overall performance by Holdings and its affiliates could be affected by economic, competitive, regulatory, governmental and technological factors affecting operations, markets, products, services and prices, as well as the factors discussed in Duquesne Light Holdings’ SEC filings made to date.

2

Company Representatives

Bill Fields

VP and Treasurer

Susan Mullins

Controller

Quynh McGuire

Sr. Manager, Investor Relations

3

Agenda

Overview

PUC Update

Unregulated Businesses

Financing Review

Summary

4

OVERVIEW

Made Substantial Progress

Removed uncertainty and volatility

Resolved major legacy issues

Divested non-core businesses

Enhanced customer satisfaction at core utility

Produced solid financial & operational results

Strengthened balance sheet

No long-term debt maturities until 2008

Improved liquidity

6

Continuing To Deliver Value

Providing low risk, stable cash flow

Supports dividend, capex and debt service requirements

Focusing strategically on core traditional utility

Provides reliable earnings stream

Evaluating prudent growth initiatives

Reaffirming 2004 earnings guidance of $80M to $85M from continuing operations

$1.05 to $1.11 EPS

7

2005 Planning Process

Strategic Planning Process Oct / Nov

Complete small customer supply plan

Complete large customer supply plan

Finalize RFP process

Finalize EGS marketing & supply strategy

Evaluate growth plans for complementary businesses

Review Plan with Rating Agencies &

Financial Community Dec / Jan

8

PUC UPDATE

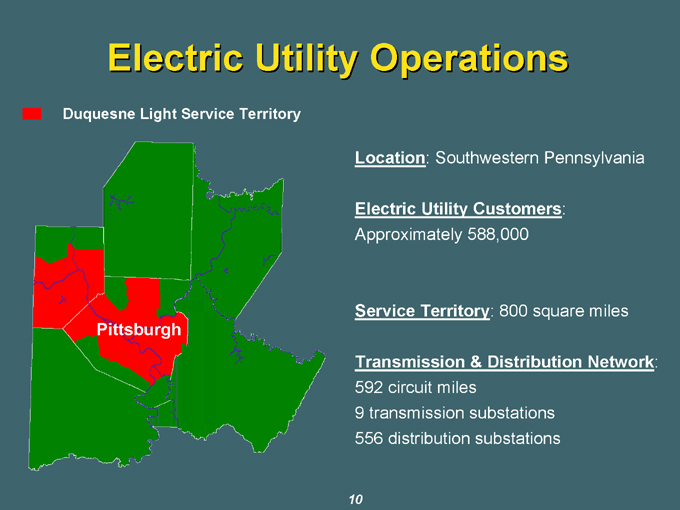

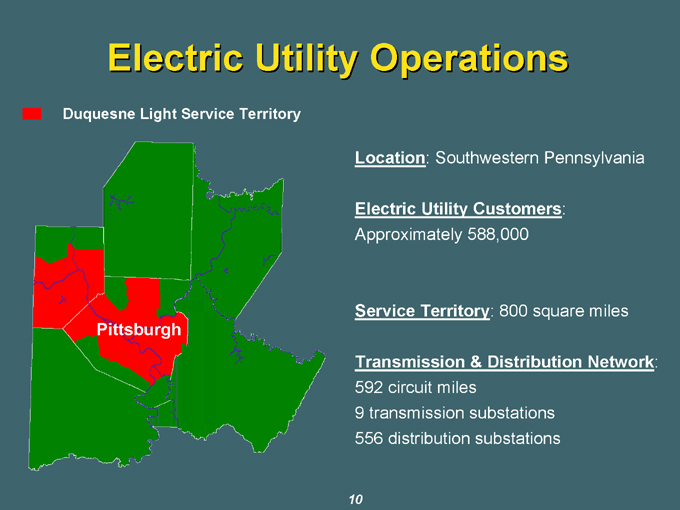

Electric Utility Operations

Duquesne Light Service Territory

Pittsburgh

Location: Southwestern Pennsylvania

Electric Utility Customers:

Approximately 588,000

Service Territory: 800 square miles

Transmission & Distribution Network:

592 circuit miles

9 transmission substations

556 distribution substations

10

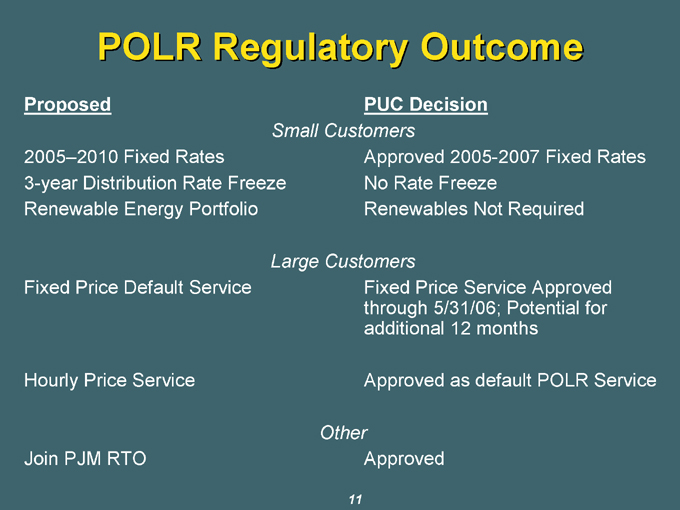

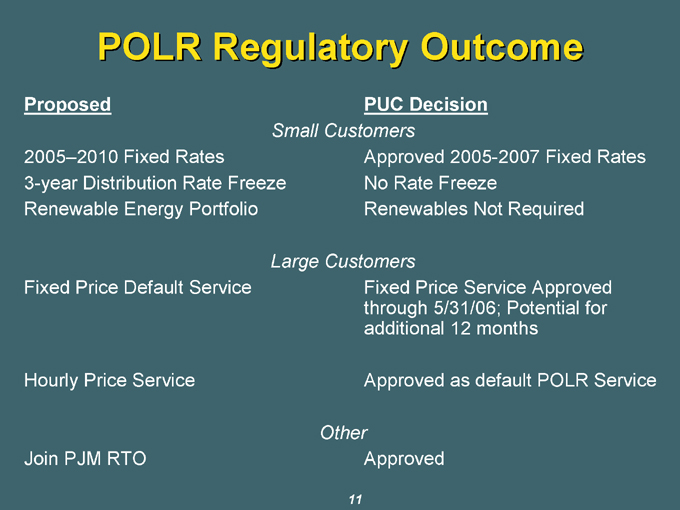

POLR Regulatory Outcome

Proposed PUC Decision

Small Customers

2005–2010 Fixed Rates Approved 2005-2007 Fixed Rates

3-year Distribution Rate Freeze No Rate Freeze

Renewable Energy Portfolio Renewables Not Required

Large Customers

Fixed Price Default Service Fixed Price Service Approved through 5/31/06; Potential for additional 12 months

Hourly Price Service Approved as default POLR Service

Other

Join PJM RTO Approved

11

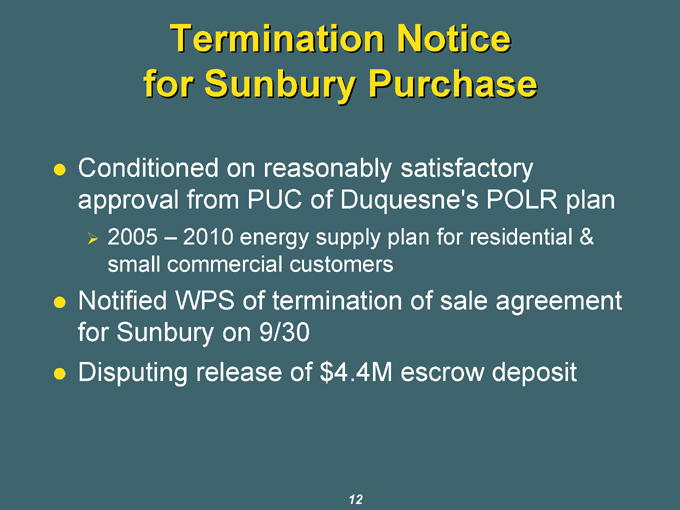

Termination Notice for Sunbury Purchase

Conditioned on reasonably satisfactory approval from PUC of Duquesne’s POLR plan

2005 – 2010 energy supply plan for residential & small commercial customers

Notified WPS of termination of sale agreement for Sunbury on 9/30

Disputing release of $4.4M escrow deposit

12

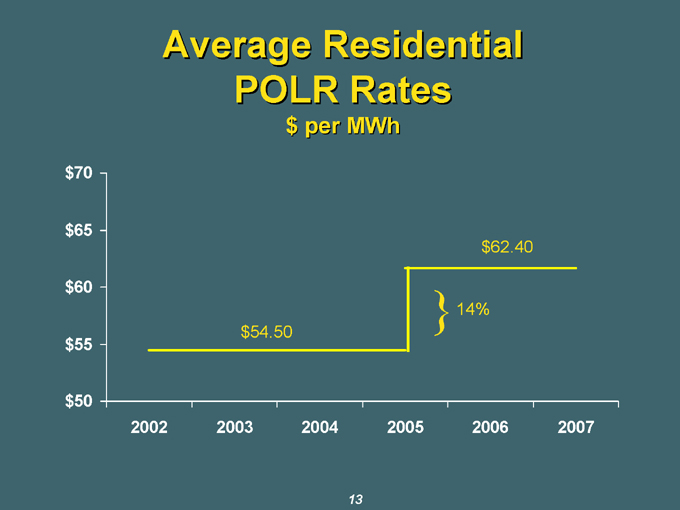

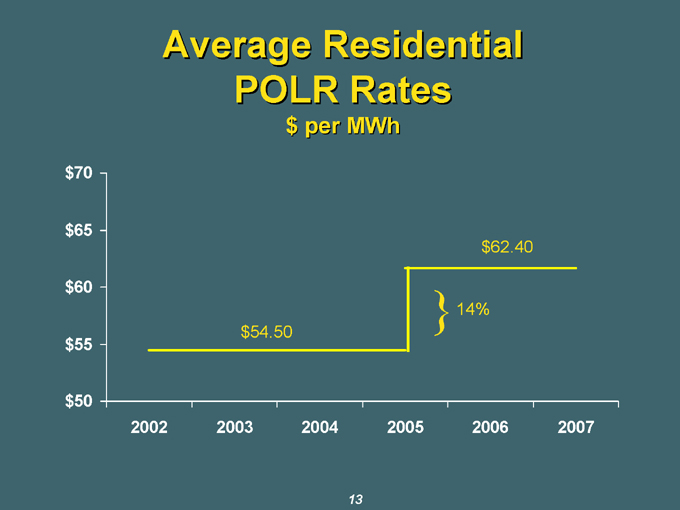

Average Residential POLR Rates $ per MWh

$54.50

$62.40

}14%

$50

$55

$60

$65

$70

2002

2003

2004

2005

2006

2007

13

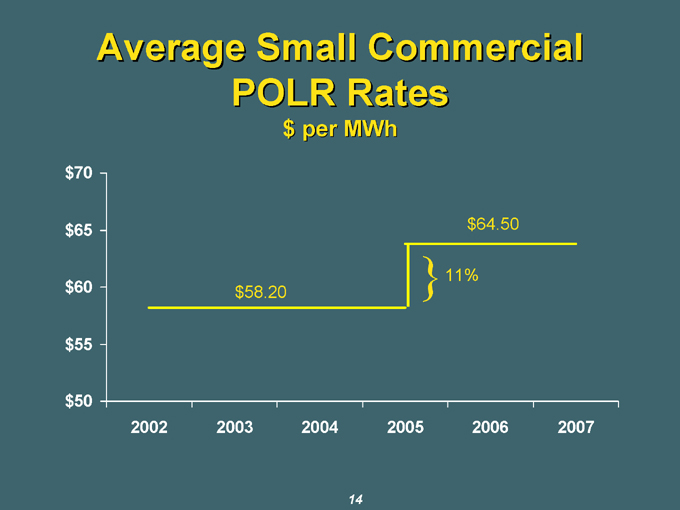

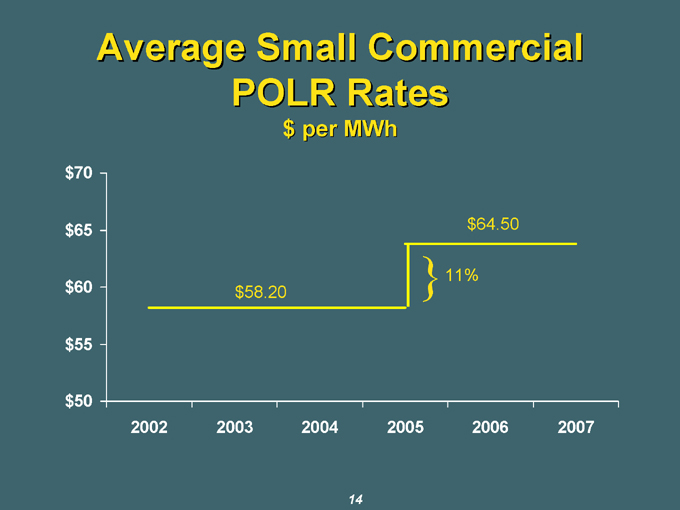

Average Small Commercial POLR Rates $ per MWh

$58.20

$64.50

}11%

$50

$55

$60

$65

$70

2002

2003

2004

2005

2006

2007

14

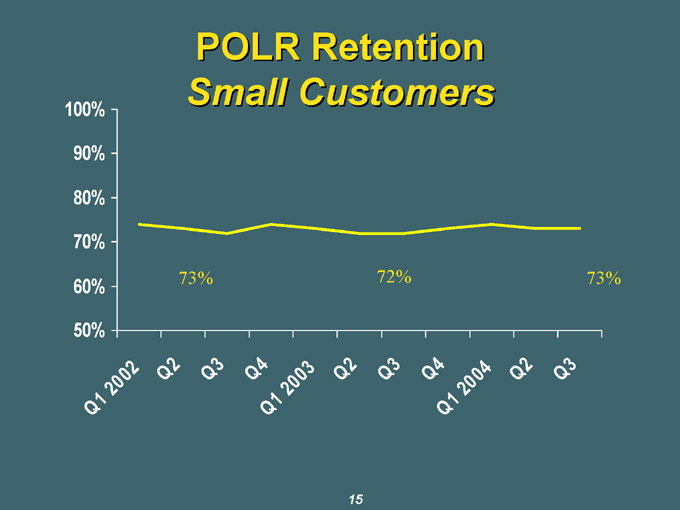

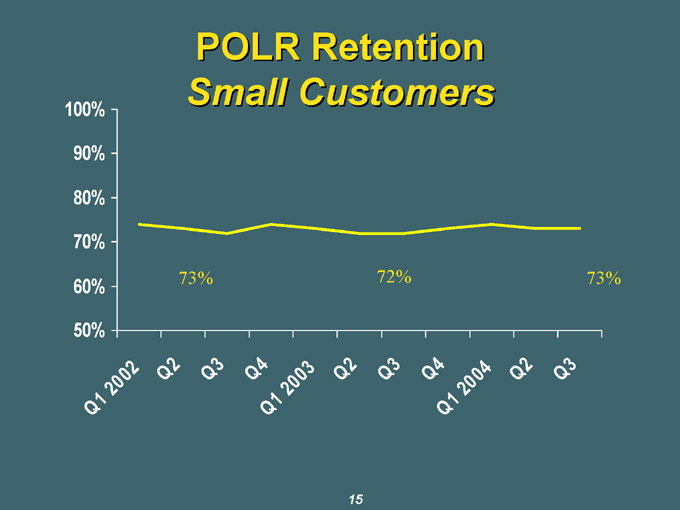

POLR Retention Small Customers

73%

72%

73%

50%

60%

70%

80%

90%

100%

Q1 2002

Q2

Q3

Q4

Q1 2003

Q2

Q3

Q4

Q1 2004

Q2

Q3

15

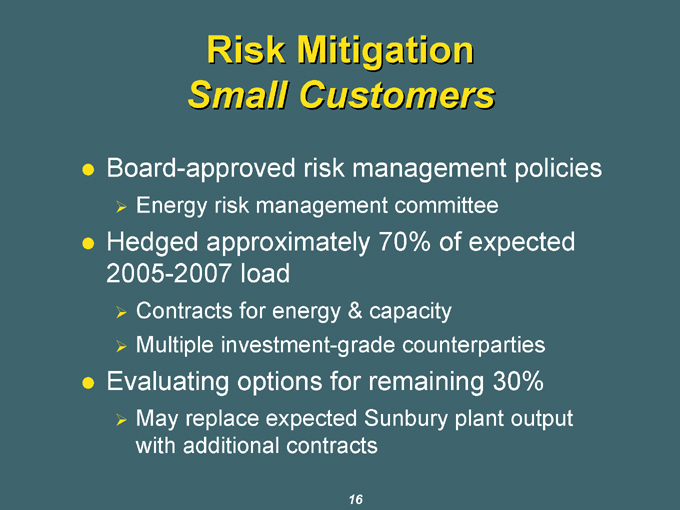

Risk Mitigation Small Customers

Board-approved risk management policies

Energy risk management committee

Hedged approximately 70% of expected 2005-2007 load

Contracts for energy & capacity

Multiple investment-grade counterparties

Evaluating options for remaining 30%

May replace expected Sunbury plant output with additional contracts

16

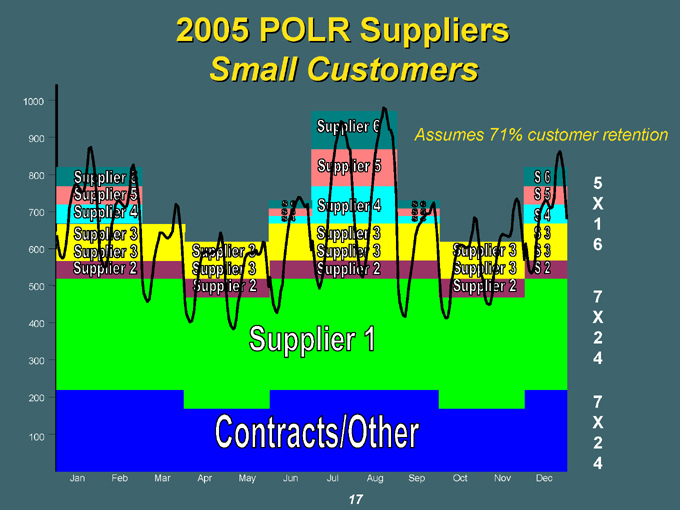

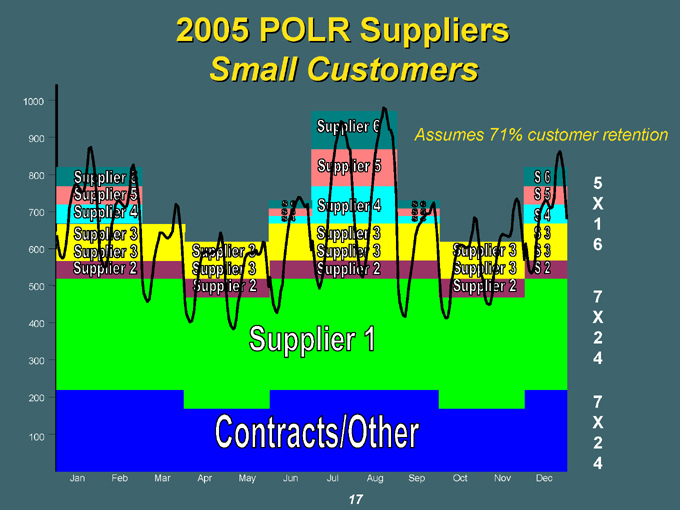

2005 POLR Suppliers Small Customers

1000

900

800

700

600

500

400

300

200

100

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

5X16

7X24

7X24

Supplier 1

Contracts/Other

Assumes 71% customer retention

17

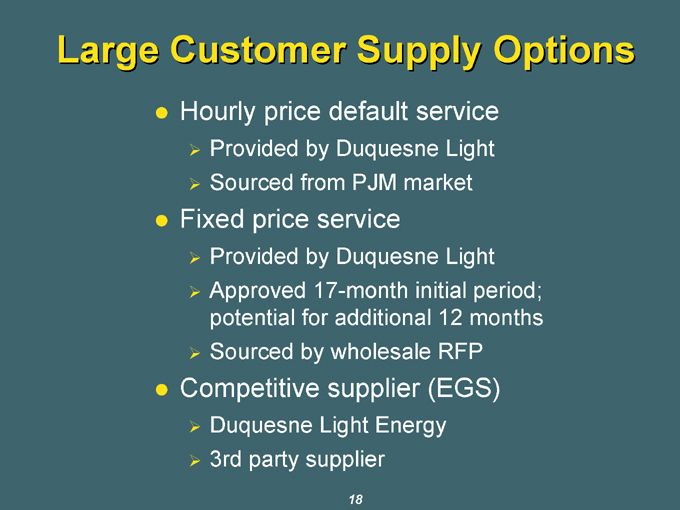

Large Customer Supply Options

Hourly price default service

Provided by Duquesne Light

Sourced from PJM market

Fixed price service

Provided by Duquesne Light

Approved 17-month initial period; potential for additional 12 months

Sourced by wholesale RFP

Competitive supplier (EGS)

Duquesne Light Energy

3rd party supplier

18

Large Customer Supply Timeline

Executed contracts with 2 suppliers on Oct. 18, subject to PUC approval

Suppliers have investment grade credit ratings

Submitted summary of RFP process & proposed retail rates to PUC on Oct. 19

Will notify customers beginning Nov. 1 of rates and options

Will implement POLR III service on Jan. 1, 2005

Fixed price option must be selected by Jan. 31, 2005

19

UNREGULATED BUSINESSES

DQE Financial

Landfill gas & alternative energy

Duquesne Energy Solutions

Operations & maintenance of synthetic fuel and other facilities

DQE Communications

High-speed, fiber optic based network

20

Unregulated Businesses

Restructured businesses into one energy operation

Significant cost reductions

Lease investments provide low risk, predictable earnings and cash flows

Landfill gas investments

3 sites selling pipeline quality gas

Benefiting from high gas prices

Synthetic fuel investment

8.3% interest in limited partnership

Book balance = $0

Completed IRS audit with acceptance of placed in service dates and tax credits through 2001

Exploring 50% sale of investment

21

FINANCING REVIEW

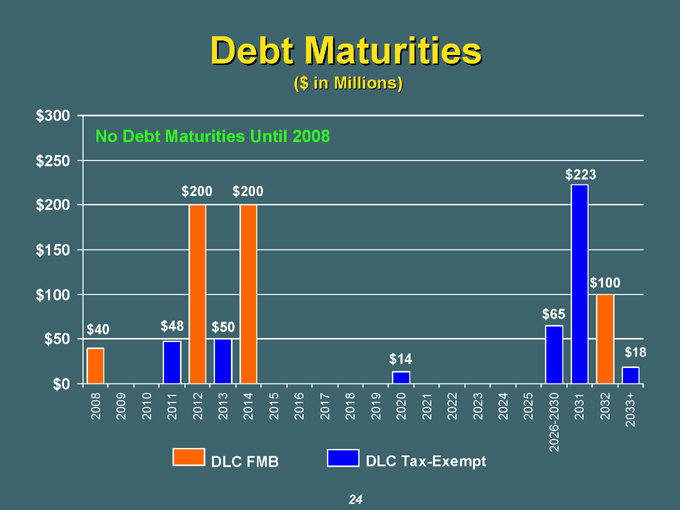

Financing Activities

Reduced $215M of debt in 2003

Retired $21M of debt from Fresh Kills settlement in February 2004

Recapitalized balance sheet in 2004

Redeemed $150M of 8 3/8% MIPS during first-half of 2004

Issued $75M of 6.5% preferreds in April; $200M of 5.7% FMB in May

Retired DQE Capital’s $100M 8 3/8% PINES

23

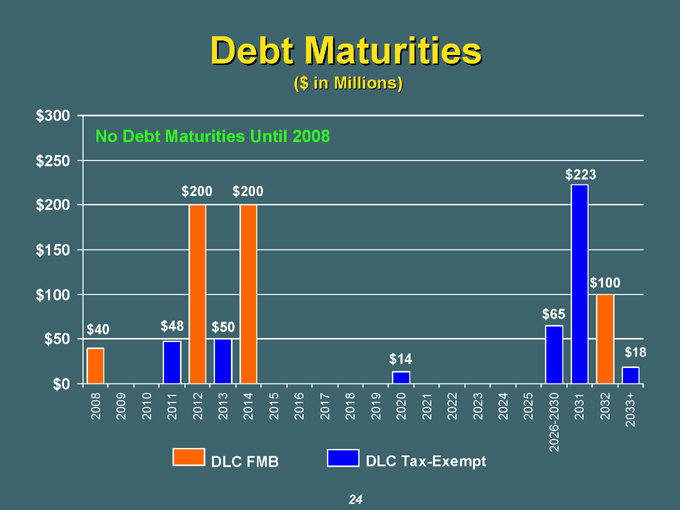

Debt Maturities ($ in Millions)

$300

$250

$200

$150

$100

$50

$0

No Debt Maturities Until 2008

$40

$48

$200

$50

$200

$14

$65

$223

$100

$18

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

2023

2024

2025

2026-2030

2031

2032

2033+

DLC FMB

DLC Tax-Exempt

24

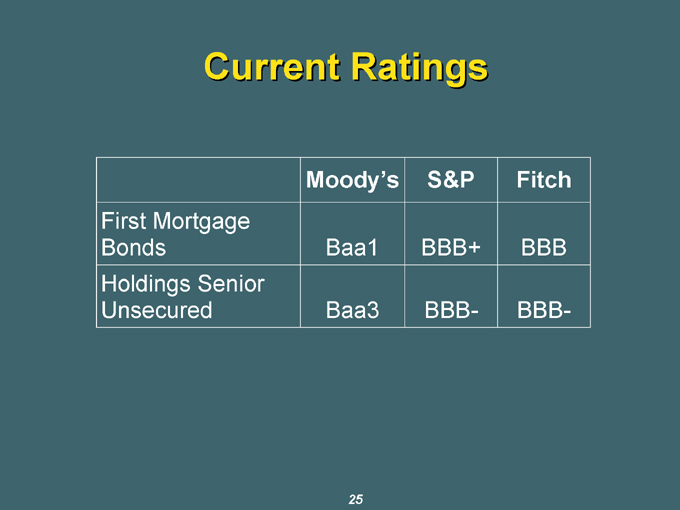

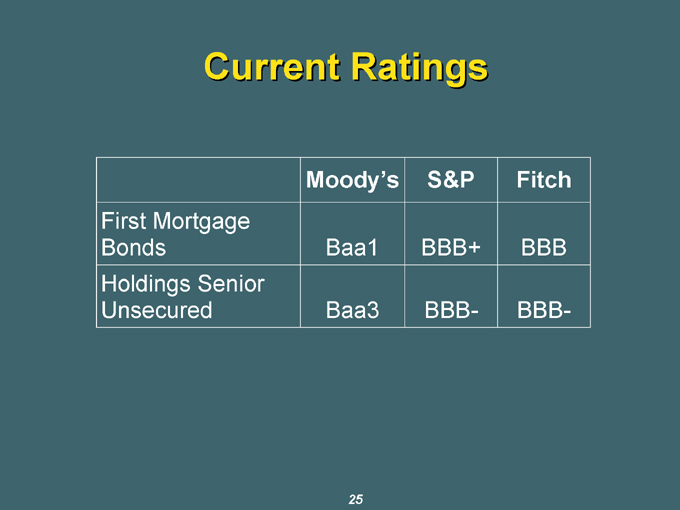

Current Ratings

Moody’s S&P Fitch

First Mortgage Bonds Baa1 BBB+ BBB

Holdings Senior Unsecured Baa3 BBB- BBB-

25

SUMMARY

Summary

Focusing on operational excellence at core traditional utility

Strengthening balance sheet

Delivering value

Goal of providing top-tier total return

Expect to review strategic plan with financial community Dec/Jan

27