UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

|

¨ PreliminaryProxy Statement |

|

¨ Confidential, for Use of the Commission Only(as permitted by Rule 14a-6(e)(2)) |

|

x Definitive Proxy Statement |

|

¨ Definitive Additional Materials |

|

¨ Soliciting Material Pursuant to §240.14a-12 |

NEW HAMPSHIRE THRIFT BANCSHARES INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | 1) | | Title of each class of securities to which transaction applies: |

| | 2) | | Aggregate number of securities to which transaction applies: |

| | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials: |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | 1) | | Amount previously paid: |

| | 2) | | Form, Schedule or Registration Statement No.: |

[NEW HAMPSHIRE THRIFT BANCSHARES, INC. LOGO]

April 1, 2003

Dear Shareholder:

You are cordially invited to attend the Annual Meeting of Shareholders of New Hampshire Thrift Bancshares, Inc. (the “Company” or “NHTB”), the holding company for Lake Sunapee Bank, fsb (the “Bank” or “LSB”), to be held on May 8, 2003, at the Lake Sunapee Bank Building, 1868 Room, 9 Main Street, Newport, New Hampshire, at 10:00 a.m.

The items of business, which will be considered and voted upon this year, are explained in the accompanying Proxy Statement. Even if you are planning to attend, please complete and return the enclosed Proxy Card. This will guarantee that your preference will be expressed, and you will still be able to vote your shares in person if you attend.

If you have any questions about the Proxy Statement or the 2002 Annual Report, please let us hear from you.

Sincerely,

STEPHEN W. ENSIGN

Chairman of the Board

NEW HAMPSHIRE THRIFT BANCSHARES, INC.

9 Main Street

P.O. Box 9

Newport, NH 03773

(603) 863-0886

NOTICEOF ANNUAL MEETINGOF STOCKHOLDERS

Date: Thursday, May 8, 2003

Time: 10:00 a.m., local time

Place: Lake Sunapee Bank Building

1868 Room

9 Main Street

Newport, NH 03773

At our 2003 Annual Meeting, we will ask you to:

| | • | | Elect two directors to serve for a three-year term expiring at the 2006 annual meeting. The following two directors are the Board of Directors’ nominees to serve a three-year term: |

John A. Kelley, Jr. Jack H. Nelson

| | • | | Ratify the appointment of Shatswell, MacLeod & Co., P.C. as our independent auditors for the fiscal year ending December 31, 2003; and |

| | • | | Transact any other business as may properly come before the Annual Meeting. |

You may vote at the Annual Meeting if you were a stockholder of the Company at the close of business on March 21, 2003, the record date.

By Order of the Board of Directors,

STEPHEN R. THEROUX

Vice Chairman of the Board, Executive Vice President,

Chief Operating Officer, Chief Financial Officer &

Corporate Secretary

Newport, New Hampshire

April 1, 2003

THE BOARDOF DIRECTORSURGESYOUTOSIGN,DATEANDRETURNYOURPROXYCARDASSOONASPOSSIBLE,EVENIFYOUCURRENTLYPLANTOATTENDTHEANNUALMEETING. THISWILLNOTPREVENTYOUFROMVOTINGINPERSONATTHEMEETINGIFYOUDESIRE,ANDYOUMAYREVOKEYOURPROXYBYWRITTENINSTRUMENTATANYTIMEPRIORTOTHEVOTEATTHE ANNUAL MEETING. PLEASEINDICATEONTHEPROXYCARDIFYOUWILLBEATTENDINGTHEMEETING.

NEW HAMPSHIRE THRIFT BANCSHARES, INC.

9 MAIN STREET

P.O. Box 9

NEWPORT, NH 03773

(603) 863-0886

PROXY STATEMENT

General

We have sent you this Proxy Statement and enclosed proxy card because the Board of Directors is soliciting your proxy to vote at the Annual Meeting. This Proxy Statement summarizes the information you will need to know to cast an informed vote at the Annual Meeting. You do not need to attend the Annual meeting to vote your shares. You may simply complete, sign and return the enclosed proxy card and your votes will be cast for you at the Annual Meeting. This process is described below in the section entitled “Voting Rights.”

We began mailing this Proxy Statement, the Notice of Annual Meeting and the enclosed proxy card on or about April 1, 2003 to all stockholders entitled to vote. If you owned the Company’s common stock (“Common Stock”) at the close of business on March 21, 2003, the record date, you are entitled to vote at the Annual Meeting. On the record date, there were 1,963,356 shares of Common Stock outstanding.

Quorum

A quorum of stockholders is necessary to hold a valid meeting. If the holders of at least one-third of the total number of the outstanding shares of Common Stock of the Company entitled to vote are represented in person or by proxy at the Annual Meeting, a quorum will exist. We will include proxies marked as abstentions and broker non-votes to determine the number of shares present at the Annual Meeting.

Voting Rights

You are entitled to one vote at the Annual Meeting for each share of the Company’s Common Stock that you owned at the close of business on March 21, 2003. The number of shares you own (and may vote) is listed at the top of the back of the proxy card.

You may vote your shares at the Annual Meeting in person or by proxy. To vote in person, you must attend the Annual Meeting and obtain and submit a ballot, which we will provide to you at the Annual Meeting. To vote by proxy, you must complete, sign and return the enclosed proxy card. If you properly complete your proxy card and send it to us in time to vote, your “proxy” (one of the individuals named on your proxy card) will vote your shares as you have directed.If you sign the proxy card but do not make specific choices, your proxy will vote your sharesFOReach of the proposals identified in the Notice of the Annual Meeting.

If any other matter is presented, your proxy will vote the shares represented by all properly executed proxies on such matters as a majority of the Board of Directors determines. As of the date of this Proxy Statement, we know of no other matters that may be presented at the Annual Meeting, other than those listed in the Notice of the Annual Meeting.

Vote Required

Proposal 1: Elect Two Directors | | The two nominees for director who receive the most votes will be elected. So, if you do not vote for a nominee, or you indicate, “withhold authority” for any nominee on your proxy card, your vote will not count “for” or “against” the nominee. You may not vote your shares cumulatively for the election of directors. |

|

Proposal 2: Ratify Appointment of Independent Auditors | | The affirmative vote of a majority of the shares present in person or by proxy at the Annual Meeting and entitled to vote on this proposal is required to ratify the appointment of Shatswell, MacLeod & Co., P.C. as the Company’s independent auditors. So, if you “abstain” from voting, it has the same effect as if you voted “against” this proposal. |

Effect of Broker Non-Votes

If your broker holds shares that you own in “street name,” the broker may vote your shares on the two proposals listed above even if the broker does not receive instructions from you. If your broker does not vote on any of the proposals, this will constitute a “broker non-vote.” Here is the effect of a “broker non-vote”:

| | • | | Proposal 1: Elect Two Directors. A broker non-vote would have no effect on the outcome of this proposal because only a plurality of votes cast is required to elect a director. |

| | • | | Proposal 2: Ratify Appointment of Independent Auditors. A broker non-vote would have no effect on the outcome of this proposal. |

Revoking Your Proxy

You may revoke your proxy at any time before it is exercised by:

| | • | | Filing with the Secretary of the Company a letter revoking the proxy; |

| | • | | Submitting another signed proxy with a later date; and |

| | • | | Attending the Annual Meeting and voting in person, provided you file a written revocation with the Secretary of the Annual Meeting prior to the voting of such proxy. |

If your shares are not registered in your own name, you will need appropriate documentation from your stockholder of record tovote personally at the Annual Meeting. Examples of such documentation include a broker’s statement, letter or other document that will confirm your ownership of shares of the Company.

2

Solicitation of Proxies

The Company will pay the costs of soliciting proxies from its stockholders. Directors, officers or employees of the Company and the Bank may also solicit proxies by:

| | • | | other forms of communication. |

We will also reimburse banks, brokers, nominees and other fiduciaries for the expenses they incur in forwarding the proxy materials to you.

Obtaining an Annual Report on Form 10-K

If you would like a copy of our Annual Report on Form 10-K for the year ended December 31, 2002 which has been filed with the Securities and Exchange Commission (“SEC”), we will send you one (without exhibits) free of charge. Please write to:

Stephen R. Theroux

Vice Chairman of the Board,

Executive Vice President, Chief Operating Officer,

Chief Financial Officer & Corporate Secretary

New Hampshire Thrift Bancshares, Inc.

9 Main Street

P.O. Box 9

Newport, NH 03773

3

PROPOSAL 1—ELECTIONOF DIRECTORS

GENERAL

The Company’s Board of Directors currently consists of eight members. The Board nominated John A. Kelley, Jr. and Jack H. Nelson to serve a three-year term for election as directors at the Annual Meeting. Both nominees are currently serving on the Company’s Board of Directors.

If any nominee is unable or does not qualify to serve, your proxy may vote for another nominee proposed by the Board. If for any reason these nominees prove unable or unwilling to stand for election or cease to qualify to serve as directors, the Board will nominate alternates or reduce the size of the Board of Directors to eliminate the vacancy.

INFORMATIONABOUT NOMINEESAND CONTINUING DIRECTORS

Set forth below is certain biographical information with respect to the nominees, the continuing Directors and Executive Officers. Each of these persons has been engaged in the principal occupation or employment specified for the past five years unless otherwise noted.

Nominees for Election as Director

Class I Directors – Terms to Expire in 2003

JOHN A. KELLEY, JR., age 73, is a retired building contractor and is the owner of a commercial laundromat located in Warner, New Hampshire. He has served as a Director of LSB since 1975, and NHTB since 1989.

JACK H. NELSON, age 58, is the Chairman of the Board of Directors of North East Environmental Products Inc., a manufacturer and distributor of water treatment equipment. Mr. Nelson has been a director since 1997.

THE BOARDOF DIRECTORS RECOMMENDSA VOTE “FOR”THE ELECTIONOFTHE NOMINEESFOR DIRECTORS.

Continuing Directors

Class III Directors – Terms to Expire in 2004

PETER R. LOVELY, age 59, has been associated with LSB since 1980. In 1983, he formed the Brokerage Services Department and served as Investment Manager of the Newport, New London, and Upper Valley offices until his retirement in 1998. He has served as a director of LSB since 1996.

STEPHEN R. THEROUX, age 53, was elected Executive Vice President effective May, 1987. He has served as a Director of LSB since 1986. Mr. Theroux is Executive Vice President and Director of NHTB having served in such capacities since 1989. Mr. Theroux has served as Chief Operating Officer of LSB since 1997. Mr. Theroux has served as Vice Chairman of the Board and Chief Financial Officer since 2002.

JOSEPH B. WILLEY, age 61, is a principal owner, partner and Chief Executive Officer of Pro-Cut International, LLC., a company engaged in the manufacture, sale and export of automotive repair products. He has served as a director of LSB since 1997 and a director of NHTB since 1999.

4

Class II Directors – Terms to Expire in 2005

LEONARD R. CASHMAN, age 60, is an owner and a partner of C.O.H. Properties. He is also involved in the marketing of specialized group medical insurance products. He was formerly Vice President and General Manager of P&C Foods, Inc. Mr. Cashman has been a director since 1997.

STEPHEN W. ENSIGN, age 55, has been associated with LSB since 1971 and served as Senior Vice President, Senior Loan Officer and Executive Vice President prior to his election as President, Chief Operating Officer and Director, effective May 1987. On January 1, 1992 he was elected Chief Executive Officer of LSB. Mr. Ensign is a Director of NHTB, having served in such capacity since 1989. Formerly its Executive Vice President, he was elected President and Chief Executive Officer of the Company effective January 1, 1992. In 1997, Mr. Ensign was elected Vice Chairman of the Board of Directors of both NHTB and LSB. In 2002, Mr. Ensign was elected Chairman of the Board of Directors of NHTB.

DENNIS A. MORROW, age 66, is retired. He was formerly the Sales Manager of Cote and Reney Lumber Company in Grantham, New Hampshire. He held this position for 23 years. He has served as a Director of LSB since 1984 and NHTB since 1989.

INFORMATIONABOUT BOARDOF DIRECTORSAND MANAGEMENT

Board of Directors

The Board of Directors oversees our business and monitors the performance of our management. In accordance with our corporate governance procedures, the Board of Directors does not involve itself in the day-to-day operations of the Company. Our executive officers and management oversee our day-to-day operations. Our directors fulfill their duties and responsibilities by attending regular meetings of the Board, which are held on a monthly basis. Our directors also discuss business and other matters with the Chairman and the President, other key executives, and our principal external advisers (legal counsel, auditors, financial advisors and other consultants).

The Board of Directors of the Company held thirteen (13) meetings during the fiscal year ended December 31, 2002. Except for Mr. Willey, each incumbent director attended at least 75% of the meetings of the Board of Directors plus committee meetings on which that particular director served during this period unless such absences were otherwise excused by the Board of Directors.

5

Committees of the Board

The Board of Directors of the Company has established the following committees:

|

EXECUTIVE COMMITTEE | | The Executive Committee considers strategic planning and industry issues and is authorized to act as appropriate between meetings of the Board of Directors. Directors Cashman, Ensign, Kelley and Theroux serve as members of the committee. The Executive Committee met five (5) times in the 2002 fiscal year. |

|

CORPORATE ORGANIZATION COMMITTEE | | The Corporate Organization Committee reviews the corporate structure of the Company and the committee of the Board and makes recommendations to management for improvements to corporate structure and corporate governance practices. Directors Cashman, Ensign, Kelley, and Theroux serve as members of the committee. The Corporate Organization Committee met two (2) times in the 2002 fiscal year. |

|

COMPENSATION COMMITTEE | | The Compensation Committee assesses the structure of the management team and the overall performance of the Bank and the Company. It oversees executive compensation by approving salary increases and reviews general personnel matters such as staff performance evaluations. Directors Cashman, Kelley, and Morrow serve as members of the committee. All committee members are independent directors as defined under the Nasdaq Stock Market listing standards. The Compensation Committee met two (2) times in the 2002 fiscal year. |

|

NOMINATING COMMITTEE | | The Nominating Committee recommends nominees for election as directors and reviews if any shareholder nominations comply with the notice procedures set forth in NHTB’s Bylaws. Directors Kelley, Lovely, Morrow and Nelson currently serve on the committee. The Nominating Committee met one (1) time in the 2002 fiscal year. |

|

AUDIT COMMITTEE | | The Audit Committee oversees and monitors our financial reporting process and internal control system, reviews and evaluates the audit performed by our outside auditors and reports any substantive issues found during the audit to the Board. The Audit Committee is directly responsible for the appointment, compensation and oversight of the work of the independent auditors of LSB and NHTB. The committee also reviews and approves all transactions with affiliated parties. The board of directors of the Company have adopted a written charter for the Audit Committee. The Audit Committee is chaired by Director Morrow, with Directors Lovely and Nelson as members. The Audit committee met twelve (12) times in the 2002 fiscal year. All members of the Audit Committee are independent directors as defined under The Auit Nasdaq Stock Market listing standards |

6

Audit Committee Report

NEW HAMPSHIRE THRIFT BANCSHARES, INC. AUDIT COMMITTEE REPORT

The following Audit Committee Report is provided in accordance with the rules and regulations of the Securities and Exchange Commission (the “SEC”). Pursuant to such rules and regulations, this report shall not be deemed “soliciting materials,” filed with the SEC, subject to Regulation 14A or 14C of the SEC or subject to the liabilities of section 18 of the Securities Exchange Act of 1934, as amended.

The Audit Committee has reviewed and discussed the audited financial statements with management. The committee has also reviewed and discussed with Shatswell MacLeod & Co., P.C., the Company’s independent auditors the matters required to be discussed by SAS 61, as may be modified or supplemented.

The Audit Committee also has received the written disclosures and the letter from the independent accountants required by Independence Standards Board Standard No. 1 (Independence Standards Board Standard No.1, Independence Discussions with Audit Committee), as may be modified or supplemented, and has discussed Shatswell MacLeod & Co., P.C.’s independence with that firm.

Based on the foregoing discussions, the Audit Committee recommended to the Board of Directors of the Company that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2002.

Audit Committee of New Hampshire Thrift Bancshares, Inc. |

|

/s/ Dennis A. Morrow (Chairman) /s/ Jack H. Nelson /s/ Peter R. Lovely |

Directors’ Compensation

All of the Directors of the Company also serve as Directors of LSB. Each non-employee director of LSB receives an annual retainer of $15,000 plus an additional $125 for each committee meeting attended. Non-employee directors are also eligible for awards under the NHTB’s 1998 Stock Option Plan.

Executive Officers

The following individuals are executive officers of the Company and hold the offices set forth below opposite their names.

Name

| | Position Held with the Company

|

Stephen W. Ensign | | Chairman of the Board of Directors, President and Chief Executive Officer |

|

Stephen R. Theroux | | Vice Chairman of the Board of Directors, Executive Vice President, Chief Operating Officer, Chief Financial Officer and Corporate Secretary |

7

The Board of Directors elects the executive officers of the Company and the Bank annually. The elected officers hold office until their respective successors have been elected and qualified, or until death, resignation or removal by the Board of Directors. The Company has entered into Employment Agreements with certain of its executive officers, which set forth the terms of their employment. See “Employment Contracts and Termination of Employment Agreements.”

Biographical information of executive officers of the Company and the Bank is set forth below.

STEPHEN W. ENSIGN, age 55, has been associated with LSB since 1971 and served as Senior Vice President, Senior Loan Officer and Executive Vice President prior to his election as President, Chief Operating Officer and Director, effective May 1987. On January 1, 1992, he was elected Chief Executive Officer of LSB. Mr. Ensign is a Director of NHTB, having served in such capacity since 1989. He was elected President and Chief Executive Officer of the Company effective January 1, 1992. In 1997, Mr. Ensign was elected Vice Chairman of the Board of Directors of both NHTB and LSB. In 2002, Mr. Ensign was elected Chairman of the Board of Directors of NHTB.

STEPHEN R. THEROUX, age 53, was elected Executive Vice President effective May, 1987. He has served as a Director of LSB since 1986. Mr. Theroux is Executive Vice President and Director of NHTB having served in such capacities since 1989. Mr. Theroux has served as Chief Operating Officer of LSB since 1997. Mr. Theroux has served as Chief Financial Officer since 2002. In 2002, Mr. Theroux was elected Vice Chairman of the Board of Directors of NHTB.

EXECUTIVE COMPENSATIONAND OTHER INFORMATION

Since the formation of the Company in April 1989, none of its Executive Officers and Directors has received any compensation from the Company. The Directors and Executive Officers have received all of their remuneration from LSB.

Compensation Committee Report

NEW HAMPSHIRE THRIFT BANCSHARES, INC. COMPENSATION COMMITTEE REPORT

The report of New Hampshire Thrift Bancshares, Inc.’s Compensation Committee and performance graph included in this section are provided in accordance with the rules and regulations of the SEC. Pursuant to such rules and regulations, the report and the graph are not to be deemed “soliciting materials,” filed with the SEC, subject to Regulation 14A or 14C of the SEC or subject to the liabilities of Section 18 of the 1934 Securities Exchange Act of 1934, as amended.

While the Company does not pay direct cash compensation to its officer(s), the officer(s) are also officer(s) of the Bank and are compensated directly by the Bank. Members of the Compensation Committee are non-employee members of the Board of Directors. Management offers and provides input, advice, and comparative data regarding salary administration, but compensation decisions and recommendations made concerning Mr. Ensign are made without the participation of Mr. Ensign. The Compensation Committee meets at least annually to review and make recommendations to the Board of Directors regarding the compensation of the Chief Executive Officer and certain other executives.

In general, executive compensation is intended to attract and retain qualified executives, to recognize and reward contributions and achievements, and to provide a financial package that is competitive. Components of a compensation package may include base salary, a bonus, retirement plan(s), a 401(k) plan, expense reimbursements, use of a company owned vehicle, stock options, and/or any other form of compensation deemed appropriate.

8

Compensation levels are intended to be consistent and competitive with the practices of other comparable financial institutions and the level of responsibility. In making its determinations, the Compensation Committee utilizes surveys of executive officer compensation packages for depository institutions and their holding companies with particular focus on the level of compensation paid by institutions of comparable size and characteristics primarily within the New England region. Any adjustments to compensation amounts are based on the overall contribution of the executive to the attainment of the financial goals of the Bank and the Company and such executive’s record of achievement in directing the activities for which such executive is responsible. Among the factors considered are stock price performance, earnings per share and book value per share.

During the fiscal year ended December 31, 2002, Mr. Ensign’s base salary was $198,000, which represented a $5,500 increase from the previous fiscal year based on the preceding factors discussed. Based on the operating results for the year ended December 31, 2001, a bonus of $9,625 was paid to Mr. Ensign. Following a review of available survey data, the Compensation Committee believes that Mr. Ensign’s compensation is appropriate based upon a review of Mr. Ensign’s performance in managing the Company.

The Compensation Committee of New Hampshire Thrift Bancshares, Inc. |

|

/s/ John A. Kelley, Jr. /s/ Leonard R. Cashman /s/ Dennis A. Morrow |

Compensation Committee Interlocks and Insider Participation

During the fiscal year ended December 31, 2002, our Compensation Committee consisted of Directors Cashman, Kelley, and Morrow with Mr. Kelley serving as Chairman. During fiscal 2002, there were no interlocks between members of the compensation committee or executive officers of the Company and corporations with respect to which such persons are affiliated.

9

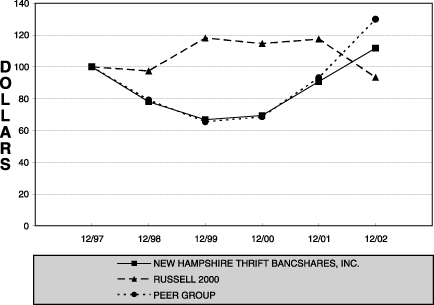

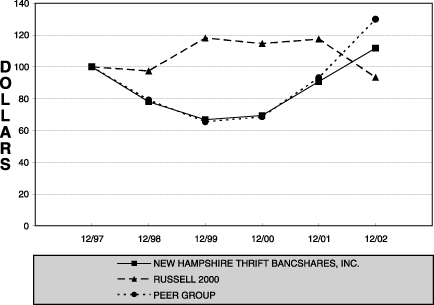

Performance Graph

The following graph compares the Company’s total cumulative shareholder return on December 31, 2002 by an investor who invested $100 on December 31, 1998 in each of the following:

| | • | | The Russell 2000 Index; |

| | • | | A hypothetical fund with investments in the stock of peer corporations (the “Peer Group”); and |

| | • | | New Hampshire Thrift Bancshares, Inc. |

The Peer Group consists of New England financial institutions with assets totaling between $200 million and $600 million. The members of the Peer Group are:

Abington Bancorp, Inc. | | Central Bancorp, Inc. | | Northeast Bancorp, Inc. |

Bar Harbor Bankshares, Inc. | | Falmouth Bancorp, Inc. | | Northway Financial, Inc. |

Bay State Bancorp, Inc. | | Mystic Financial, Inc. | | Westbank Corporation |

| | | Cumulative Total Return

|

| | | 12/97

| | 12/98

| | 12/99

| | 12/00

| | 12/01

| | 12/02

|

New Hampshire Thrift Bancshares, Inc. | | 100.00 | | 78.15 | | 66.76 | | 69.35 | | 90.75 | | 111.72 |

Russell 2000 | | 100.00 | | 97.45 | | 118.17 | | 114.60 | | 117.45 | | 93.39 |

Peer Group | | 100.00 | | 79.14 | | 65.45 | | 68.54 | | 93.18 | | 129.92 |

10

SUMMARY COMPENSATION TABLE

The following table provides certain summary information concerning compensation paid or accrued by LSB to or on behalf of the Company’s Chief Executive Officer and Chief Operating Officer (the “Named Executive Officers”) for the last three fiscal years ended December 31, 2002. No other Executive Officer received salary plus bonus in excess of $100,000 for 2002.

| | | Annual Compensation

| | Long Term Compensation

| |

Name and Principal Position

| | Year

| | Salary ($)

| | Bonus ($)

| | Securities Underlying Options (#)

| | | All Other Compensation ($)

| |

Stephen W. Ensign, | | 2002 | | $ | 198,000 | | $ | 9,625 | | 8,500 | (1) | | $ | 20,727 | (2)(3) |

Chairman of the Board, President | | 2001 | | $ | 192,500 | | $ | — | | — | | | $ | 19,702 | |

and Chief Executive Officer | | 2000 | | $ | 185,000 | | $ | 16,500 | | — | | | $ | 18,945 | |

Stephen R. Theroux, Vice Chairman of the Board, Executive Vice President, | | 2002 | | $ | 150,000 | | $ | 7,325 | | 7,500 | (1) | | $ | 15,927 | (2)(3) |

Chief Operating Officer and | | 2001 | | $ | 146,500 | | $ | — | | — | | | $ | 15,102 | |

Corporate Secretary | | 2000 | | $ | 135,000 | | $ | 11,900 | | — | | | $ | 13,945 | |

| (1) | | Represents shares of common stock as to which the named individual has the right to acquire beneficial ownership pursuant to the exercise of stock options. Such options were granted on June 28, 2002 pursuant to the New Hampshire Thrift Bancshares, Inc. 1998 Stock Option Plan, and vest immediately upon grant. |

| (2) | | The Company provides Mr. Ensign and Mr. Theroux with certain non-cash benefits and perquisites such as the use of a company car. The Company believes that the aggregate value of these benefits for 2002 did not exceed $50,000 or 10% of the aggregate salary and annual bonus reported for him in the Summary Compensation Table. |

| (3) | | Includes contributions made by LSB to LSB’s Profit Sharing-Stock Ownership Plan, a plan qualified under Sections 401(a) and (k) of the Internal Revenue Code, amounting to $927 and $927, respectively, and amounts credited on behalf of the Named Executive Officers to LSB’s Supplemental Executive Retirement Plan, a nonqualified, unfunded deferred compensation plan for Messrs. Ensign and Theroux for the year ended December 31, 2002 amounting to $19,800 and $15,000, respectively. |

EMPLOYMENT CONTRACTSAND TERMINATIONOF EMPLOYMENT AGREEMENTS

The Company and LSB have entered into parallel employment agreements with Stephen W. Ensign as Chief Executive Officer. The employment agreements are for a period of five years and the agreement with the Company extends automatically each day unless either the Company or Mr. Ensign gives contrary written notice in advance. For 2003, the Board has set Mr. Ensign’s salary at $215,000. The employment agreements provide for participation in discretionary bonuses, retirement and employment benefit plans and other fringe benefits available to executive employees of the Company and LSB.

The Board of Directors may terminate the employment agreements of Mr. Ensign at any time with or without cause. However, termination without cause or following a change in control of NHTB or LSB would subject NHTB to liability for severance benefits in an amount equal to the value of the cash compensation and fringe benefits that the executive would have received if he had continued working for an additional five years. These same severance benefits would be payable to the executive if the executive resigns during the term of his employment agreement due to a material reduction in the

11

executive’s position, authority duties or responsibilities; involuntary relocation of the executive’s place of employment to a location more than 30 miles from his current place of employment; a liquidation or dissolution of NHTB or LSB; or any material breach of the employment agreement by NHTB or LSB. Change in control for purposes of the agreement occurs when any person becomes the beneficial owner of 20% or more of the voting shares of NHTB’s outstanding securities undergoes a change of control within the meaning of certain applicable laws or, if as a result of or in connection with any cash tender or exchange offer, merger or other business combination, sale of assets or contested election, a majority of the Board of Directors is not constituted by individuals who were directors before such transaction. If the executive’s employment terminates due to disability as defined in the agreements, the executive shall be entitled to a maximum of three-fourths of the value of the cash compensation and fringe benefits that the executive would have received if he had continued working for an additional five years.

The Company and LSB have also entered into parallel employment agreements with Stephen R. Theroux, Executive Vice President, Chief Operating Officer, Chief Financial Officer and Corporate Secretary of the Company and LSB. The benefits provided for in Mr. Theroux’s agreements are identical to those provided to Mr. Ensign except for the level of base salary. Change in control has the same meaning in Mr. Theroux’s employment agreements as it does in Mr. Ensign’s employment agreements. Mr. Theroux’s annual base salary for fiscal 2003 has been set at $160,000.

If NHTB or LSB experiences a change in ownership or control as contemplated under Section 280G of the Internal Revenue Code, a portion of the severance benefits provided under the employment agreements might constitute an “excess parachute payment” under current federal tax laws. Federal tax laws impose a 20 percent excise tax, payable by the executive, on excess parachute payments. Under the employment agreements, NHTB would reimburse the executive for the amount of the excise tax and all income and excise taxes imposed on the reimbursement so that he will retain approximately the same net-after tax amounts under the employment agreement that he would have retained if there was no 20 percent excise tax. The effect of this provision is that NHTB, rather than the executive, bears the financial cost of the excise tax. Neither NHTB, nor LSB could claim a federal income tax deduction for an excess parachute payment, excise tax reimbursement payment or gross-up payment.

STOCK OPTION PLAN

Long-term incentives are provided to the Named Executive Officers through awards made under the Stock Option Plans established by NHTB from time to time. Currently, 113,855 shares remain available for the issuance of option awards under NHTB’s 1998 Stock Option Plan. All salaried employees and directors are eligible to be granted options under the 1998 Plan. The 1998 Plan provides for the issuance of “incentive stock options” qualified under Section 422 of the Internal Revenue Code and “non-qualified stock options.” The 1998 Plan is administered by a committee of the Board of LSB, which has the authority to select the employees and directors who will be awarded options and determine the amount and other conditions of such awards subject to the terms of the Plans.

No option issued under the Option Plans is exercisable after the tenth anniversary from the date it was granted. During the optionee’s lifetime, only the optionee can exercise the option. The optionee cannot transfer or assign any option other than by will or in accordance with the laws of descent and distribution. Pursuant to Section 422 of the Code as to incentive stock options, the aggregate fair market value of the stock for which any employee may be granted options, which first become exercisable in any calendar year generally may not exceed $100,000. In addition, no grant may be made to any employee owning more than 10% of the shares of NHTB unless the exercise price is at least 110% of the share’s fair market value and such option is not exercisable more than five years following the option grant.

12

NHTB will receive no monetary consideration for the granting of options under the Option Plans. Upon the exercise of options, NHTB receives payment from optionees in exchange for shares issued. During the last fiscal year, NHTB did not adjust or amend the exercise price of stock options previously awarded.

The following table summarizes the grants of options that were made to the named executive officers pursuant to the 1998 Plan during fiscal 2002. The 1998 Plan does not provide for the grant of stock appreciation rights.

| | | Option/SAR Grants in Fiscal Year 2002(1) Individual Grants

|

Name

| | Securities Underlying Options/SARs Granted (#)

| | Percent of Options/SARs Granted to Employees in Fiscal Year (%)

| | Exercise or Base Price ($ Per Share)

| | Expiration Date

| | Potential Realizable Value At Assumed Annual Rates of Stock Price Appreciation for Option Term

|

| | | | | | 5% ($)

| | 10% ($)

|

Stephen W. Ensign | | 8,500 | | 12.1 | | 18.25 | | 6/28/12 | | 97,557 | | 247,229 |

Stephen R. Theroux | | 7,500 | | 10.7 | | 18.25 | | 6/28/12 | | 86,080 | | 218,143 |

| (1) | | All options were granted on June 28, 2002 and are fully vested. |

The following table provides information with respect to the Named Executive Officers, concerning the exercise of options during the last fiscal year and unexercised options held as of the end of the last fiscal year.

AGGREGATE OPTION EXERCISESIN LAST FISCAL YEAR,AND FISCAL YEAR-END OPTION VALUES

Name

| | Shares Acquired on Exercise (#)

| | Value Realized ($)

| | Number of Unexercised Options at FY-End (#) Exercisable/ Unexercisable

| | Value of Unexercised In-the-Money Options at FY-End ($) Exercisable/ Unexercisable(2)

|

Stephen W. Ensign(1) | | – | | – | | 22,000 | | 68,563 |

Stephen R. Theroux(1) | | – | | – | | 11,000 | | 2,625 |

| (1) | | All unexercised options are exercisable. |

| (2) | | Based upon a market price of $18.60 per share at December 31, 2002, minus the exercise price. |

13

RETIREMENT PLAN

LSB provides eligible employees with a qualified defined benefit plan (the “Retirement Plan”) designed to meet the requirements of Section 401(a) of the Internal Revenue Code and the Employee Retirement Income Security Act (“ERISA”). Eligible employees must be at least 21 years of age and must have been employed by LSB for at least one year. Eligible employees are 100% vested after six years participation. Directors of LSB are not eligible to participate in the Retirement Plan. During 2002, all eligible employees of LSB and its subsidiaries participated in the Retirement Plan. After attainment of normal retirement age (i.e., age 65), a vested participant is entitled to receive normal retirement benefits based upon years of service and level of compensation. At December 31, 2002, Mr. Ensign had 31 years of service and Mr. Theroux had 15 years of service under the Retirement Plan. The Retirement Plan is funded entirely by contributions from LSB. The amounts of annual contributions are determined based on an actuarial analysis of an annual census of LSB’s eligible employees and their salaries at December 31 of each year.

The following table illustrates annual pension benefits for retirement at age 65 under the most advantageous Plan provisions available for various levels of compensation and years of service. Benefits are computed based on an average of an employee’s highest three consecutive years of salary during employment. There is no Social Security or other offset amount. The figures in this table are based upon the assumption that the Plan continues in its present form and certain other assumptions regarding employee participation.

Estimated Annual Benefits Payable for Life

Years of Service at Retirement (Age 65)

|

Average Annual Pay(1)

| | 10 Years

| | 15 Years

| | 20 Years

| | 25 Years

| | 30 Years

|

$ 50,000 | | $ | 6,900 | | $ | 10,300 | | $ | 13,800 | | $ | 15,200 | | $ | 15,200 |

70,000 | | | 10,800 | | | 16,200 | | | 21,600 | | | 23,700 | | | 23,700 |

90,000 | | | 14,700 | | | 22,000 | | | 29,400 | | | 32,300 | | | 32,300 |

110,000 | | | 18,600 | | | 27,900 | | | 37,200 | | | 40,900 | | | 40,900 |

130,000 | | | 22,500 | | | 33,700 | | | 45,000 | | | 49,500 | | | 49,500 |

150,000 | | | 26,400 | | | 39,600 | | | 52,800 | | | 58,100 | | | 58,100 |

160,000 | | | 28,300 | | | 42,500 | | | 56,700 | | | 62,400 | | | 62,400 |

175,000 | | | 31,300 | | | 46,900 | | | 62,500 | | | 68,800 | | | 68,800 |

200,000 | | | 36,100 | | | 54,200 | | | 72,300 | | | 79,500 | | | 79,500 |

| (1) | | The definition of pay taken into account for determining benefit payments under the Plan includes substantially the same items of compensation reflected in the Annual Compensation column of the Summary Compensation Table set forth above, but limited to the annual amount that may be taken into account under Section 401(a)(17) of the Code ($200,000 for 2002). Post 1991 benefit accrual is based on a maximum of 22 years of service. |

14

SECURITY OWNERSHIPOF CERTAIN BENEFICIAL OWNERSAND MANAGEMENT

Principal Shareholders of the Company

The following table sets forth, as of March 21, 2003, certain information as to the Company’s Common Stock beneficially owned by persons owning in excess of 5% of the outstanding shares of the Company’s Common Stock. We know of no person, except as listed below, who beneficially owned more than 5% of the outstanding shares of the Company’s Common Stock as of March 21, 2003. Except as otherwise indicated, the information provided in the following table was obtained from filings with the Securities and Exchange Commission and with the Company pursuant to the Securities Exchange Act of 1934, as amended and on information presented to management. Addresses provided are those listed in the filings as the address of the person authorized to receive notices and communications. For purposes of the table below, in accordance with Rule 13d-3 under the Securities Exchange Act of 1934, as amended, a person is deemed to be the beneficial owner, for purposes of any shares of Common Stock: (1) over which he or she has or shares, directly or indirectly, voting or investment power; or (2) of which he or she has the right to acquire beneficial ownership at any time within 60 days after March 21, 2003. As used in this proxy statement, “voting power” is the power to vote or direct the voting of shares and “investment power” includes the power to dispose or direct the disposition of shares.

Title

| | Name and Address of Beneficial Owner

| | Amount and Nature of Beneficial Ownership

| | Percent

|

Common Stock, $.01 par value | | Jeffrey L. Gendell Tontine Financial Partners, L.P. Tontine Management, L.L.C. 200 Park Avenue, Suite 3900 New York, NY 10166 | | 163,300(1) | | 8.3% |

| (1) | | As reported by Jeffrey L. Gendell, Tontine Financial Partners, L.P. and Tontine Management, L.L.C. in a Schedule 13D/A dated November 27, 2002, which reported shared voting power and shared investment power with respect to 163,300 shares of Common Stock as of November 27, 2002. Tontine Financial Partners, L.P. is a private investment limited partnership. Tontine Mangement L.L.C. is the general partner of Tontine Financial Partners, L.P. Mr. Gendell serves as Managing Member of Tontine Management, L.L.C. |

15

Security Ownership of Management

The following table shows the number of shares of the Company’s Common Stock, beneficially owned by each director and executive officer, and all directors and executive officers of the Company as a group, as of March 21, 2003.

Directors, Nominees, and Executive Officers

| | Number of Shares and Nature of Beneficial Ownership

| | Percentage of Total Shares

|

Leonard R. Cashman | | 16,081(1) | | * |

Stephen W. Ensign | | 63,423(2) | | 3.19% |

John A. Kelley, Jr. | | 18,552(3) | | * |

Peter R. Lovely | | 38,014(4) | | 1.93% |

Dennis A. Morrow | | 22,700(5) | | 1.15% |

Jack H. Nelson | | 11,658(6) | | * |

Stephen R. Theroux | | 31,493(7) | | 1.60% |

Joseph B. Willey | | 67,829(8) | | 3.44% |

Total owned by Directors, Nominees and Executive Officers as a group (8 persons) | | 269,750 | | 13.19% |

* Less than 1%.

| (1) | | Includes 4,372 shares held jointly by Mr. Cashman and his wife with shared voting and investment power, 3,709 shares for which he has sole voting and investment power and 8,000 shares subject to outstanding options. |

| (2) | | Includes 27,123 shares held jointly by Mr. Ensign and his wife with shared voting and investment power, 200 shares held by Mr. Ensign as custodian for a minor child, 9,294 shares held in a Supplemental Executive Retirement Plan, 4,806 shares held in the Company’s 401(k) Plan and 22,000 shares subject to outstanding options. |

| (3) | | Includes 10,552 shares held jointly by Mr. Kelley and his wife with shared voting and investment power and 8,000 shares subject to outstanding options. |

| (4) | | Includes 18,107 shares held jointly by Mr. Lovely and his wife with shared voting and investment power, 1,298 shares held in a spousal IRA for which his wife has sole voting and investment power to which Mr. Lovely disclaims beneficial ownership and 13,109 shares held in an IRA for which he has sole voting and investment power and 5,500 shares subject to outstanding options. |

| (5) | | Includes 10,700 for which he has sole voting and investment power and 12,000 shares subject to outstanding options. |

| (6) | | Includes 3,658 for which he has sole voting and investment power and 8,000 shares subject to outstanding options. |

| (7) | | Includes 9,808 shares held jointly by Mr. Theroux and his wife with shared voting and investment power, 6,819 shares held in a Supplemental Executive Retirement Plan, 3,866 shares held in the Company’s 401(k) plan and 11,000 shares subject to outstanding options. |

| (8) | | Includes 15,323 shares held jointly by Mr. Willey and his wife with shared voting and investment power, 24,582 shares held by Mr. Willey as custodian for his minor children, 689 shares and 19,235 shares held in IRAs for which he has sole voting and investment power and 8,000 shares subject to outstanding options. |

16

CERTAIN TRANSACTIONSWITH MANAGEMENTAND OTHERS

LSB maintains a policy that loans to Directors, Executive Officers and principal shareholders must be made on substantially the same terms as those prevailing for loans to unrelated parties, and must not involve more than the normal risk of repayment or present other unfavorable features. Board of Directors approval (with the interested person abstaining) is required on aggregate loans to such persons in excess of 5% of LSB’s unimpaired capital and surplus, or more than $500,000. In addition, a limit has been imposed on aggregate loans to an Executive Officer of the higher of 2.5% of LSB’s capital and unimpaired surplus but no more than $100,000 excluding certain home and education loans.

COMPLIANCEWITH SECTION 16OFTHE EXCHANGE ACT

Section 16(a) of the Exchange Act requires that the Company’s directors, executive officers, and any person holding more than ten percent of the Company’s Common Stock file with the SEC reports of ownership changes, and that such individuals furnish the Company with copies of the reports.

Based solely on its review of the copies of such forms received by it, or written representations from certain reporting persons, the Company believes that all of our executive officers and directors complied with all Section 16(a) filing requirements applicable to them.

PROPOSAL 2 – RATIFICATIONOF APPOINTMENTOF AUDITORS

The Audit Committee has appointed Shatswell, MacLeod & Co., P.C. as our independent auditors for the Company for the fiscal year ending December 31, 2003, and we are asking stockholders to ratify the appointment.

One or more representatives of Shatswell, MacLeod & Co., P.C. are expected to be present at the Annual Meeting of Shareholders and will have the opportunity to make a statement if they desire to do so, and such representatives are expected to be available to respond to appropriate questions.

THE BOARDOF DIRECTORS RECOMMENDS THATTHE SHAREHOLDERS VOTE “FOR” RATIFICATIONOFTHE APPOINTMENTOF SHATSWELL, MACLEOD & CO., P.C.AS INDEPENDENT AUDITORS.

A majority of the votes cast is required for ratification. If the shareholders fail to ratify the appointment, such action will be considered as a direction to the Board of Directors to select another independent auditing firm.

Independent Auditors

General. Shatswell, MacLeod & Co., P.C. served as independent public accountants for the purpose of auditing the Company’s consolidated financial statements for the year ended December 31, 2002 and will continue to serve as the Company’s independent accountants for the year ended December 31, 2003. A representative of Shatswell, MacLeod & Co., P.C. is expected to be present at the annual meeting to answer questions concerning the financial statements presented and will be permitted to make a statement at the meeting.

Audit Fees. The aggregate fees of Shatswell, MacLeod & Co., P.C. for the audit of the Company’s financial statements at and for the year ended December 31, 2002 and reviews of the Company’s Quarterly Reports on Form 10-Q were $93,775, of which an aggregate amount of $56,775 has been billed through December 31, 2002.

17

Financial Information Systems Design and Implementation Fees. Shatswell, MacLeod & Co., P.C. did not provide professional services for financial information systems design and implementation for the year ended December 31, 2002.

All Other Fees. Shatswell, MacLeod & Co., P.C. did not provide services other than those discussed above for the year ended December 31, 2002.

OTHER BUSINESS

We know of no other business, which will be presented for consideration at the Annual Meeting other than as stated in the Notice of Meeting. If, however, other matters are properly brought before the meeting, it is the intention of the persons named as proxies in the enclosed proxy card to vote the shares represented thereby in accordance with their best judgment and in their discretion, and authority to do so is included in the proxy.

ADDITIONAL INFORMATION

Information About Stockholder Proposals

If you wish to submit proposals to be included in our 2004 proxy statement for the 2004 Annual Meeting of Stockholders, we must receive them by December 3, 2003, pursuant to the proxy soliciting regulations of the SEC. SEC rules contain standards as to what stockholder proposals are required to be in the proxy statement. Any such proposal will be subject to 17 C.F.R. §240.14a-8 of the rules and regulations promulgated by the SEC.

In addition, under the Company’s Bylaws, if you wish to nominate a director or bring other business before an annual meeting:

| | • | | You must be a stockholder of record and have given timely notice in writing to the Secretary of the Company. |

| | • | | Your notice must contain specific information required in our Bylaws. |

By Order of the Board of Directors, |

|

STEPHEN R. THEROUX |

Vice Chairman of the Board, Executive Vice President, Chief Operating Officer, Chief Financial Officer & Corporate Secretary |

Newport, New Hampshire

April 1, 2003

TO ASSURE THAT YOUR SHARESARE REPRESENTEDATTHE ANNUAL MEETING, PLEASE COMPLETE, SIGN, DATEAND PROMPTLY RETURNTHE ACCOMPANYING PROXY CARDINTHE POSTAGE-PAID ENVELOPE PROVIDED.

18

New Hampshire Thrift Bancshares, Inc. | | REVOCABLE PROXY |

This Proxy is solicited on behalf of the Board of Directors of New Hampshire Thrift Bancshares, Inc.

for the Annual Meeting of Stockholders to be held on May 8, 2003.

The undersigned stockholder of New Hampshire Thrift Bancshares, Inc. hereby appoints Stephen W. Ensign and Steven R. Theroux, and each of them, with full powers of substitution, to represent and to vote as proxy, as designated, all shares of common stock of New Hampshire Thrift Bancshares, Inc. held of record by the undersigned on March 21, 2003, at the 2003 Annual Meeting of Stockholders (the “Annual Meeting”) to be held at 10:00 a.m., Eastern Time, on May 8, 2003, or at any adjournment or postponement thereof, upon the matters described in the accompanying Notice of the 2003 Annual Meeting of Stockholders and Proxy Statement, dated April 1, 2003, and upon such other matters as may properly come before the Annual Meeting. The undersigned hereby revokes all prior proxies.

This Proxy, when properly executed, will be voted in the manner directed herein by the undersigned stockholder.If no direction is given, this Proxy will be voted FOR the election of all nominees listed in Item 1 and FOR the proposal listed in Item 2.

PLEASE MARK, SIGN AND DATE THIS PROXY ON THE REVERSE SIDE

AND RETURN IT PROMPTLY IN THE ENCLOSED ENVELOPE.

| | | | | | |

|

The Board of Directors unanimously recommends a vote “FOR” all of the nominees named in Item 1 and a vote “FOR” the proposal in Item 2.

| | | | Please mark your vote as indicated in this example. | | x |

|

| | | | | | | I will attend the Annual Meeting. | | | | ¨ | | |

|

1. Election of two Directors: Nominees: John A. Kelley, Jr. and Jack H. Nelson for terms of three years each. | | FOR All nominees (except as otherwise indicated) ¨ | | WITHHOLD for all nominees ¨ | | 2. Ratification of the appointment of Shatswell, MacLeod & Co., P.C. as independent auditors for the fiscal year ending December 31, 2003. | | FOR ¨ | | AGAINST ¨ | | ABSTAIN ¨ |

Instruction: TO WITHHOLD AUTHORITY to vote for any individual nominee, write that nominee’s name in the space provided: | | | | | | The undersigned hereby acknowledges receipt of the Notice of the 2003 Annual Meeting of Stockholders and the Proxy Statement, dated April 1, 2003 for the 2003 Annual Meeting. Signature(s) Dated: , 2003 Please sign exactly as your name appears on this proxy. Joint owners should each sign personally. If signing as attorney, executor, administrator, trustee or guardian, please include your full title. Corporate or partnership proxies should be signed by an authorized officer. |