New Hampshire Thrift Bancshares, Inc. is the parent company of Lake Sunapee Bank,fsb,a federal stock savings bank providing financial services throughout central and western New Hampshire and central Vermont.

The Bank encourages and supports the personal and professional development of its employees, dedicates itself to consistent service of the highest level for all customers, and recognizes its responsibility to be an active participant in, and advocate for, community growth and prosperity.

Table of Contents

Selected Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

For the Years Ended December 31, | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| | | (In thousands, except per share data) | |

Net Income | | $ | 4,516 | | | $ | 5,040 | | | $ | 5,524 | | | $ | 5,098 | | | $ | 5,771 | |

Per Share Data: | | | | | | | | | | | | | | | | | | | | |

Basic Earnings(1) (2) | | | 0.93 | | | | 1.20 | | | | 1.31 | | | | 1.23 | | | | 1.46 | |

Diluted Earnings(2) | | | 0.92 | | | | 1.17 | | | | 1.29 | | | | 1.20 | | | | 1.42 | |

Dividends Paid(2) | | | 0.52 | | | | 0.52 | | | | 0.50 | | | | 0.45 | | | | 0.36 | |

Dividend Payout Ratio | | | 55.91 | | | | 43.33 | | | | 38.17 | | | | 36.59 | | | | 24.66 | |

Return on Average Assets | | | 0.61 | % | | | 0.75 | % | | | 0.89 | % | | | 0.87 | % | | | 1.15 | % |

Return on Average Equity | | | 7.98 | % | | | 11.04 | % | | | 13.10 | % | | | 12.17 | % | | | 15.83 | % |

| | | | | |

As of December 31, | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| | | (In thousands, except per share data) | |

Total Assets | | $ | 834,230 | | | $ | 672,031 | | | $ | 650,179 | | | $ | 595,514 | | | $ | 526,246 | |

Total Deposits | | | 652,972 | | | | 465,506 | | | | 464,637 | | | | 433,072 | | | | 428,477 | |

Total Securities(3) | | | 94,993 | | | | 99,063 | | | | 119,303 | | | | 123,421 | | | | 126,179 | |

Loans, Net | | | 626,274 | | | | 492,712 | | | | 463,151 | | | | 413,808 | | | | 344,573 | |

Federal Home Loan Bank Advances | | | 63,387 | | | | 120,000 | | | | 100,000 | | | | 75,000 | | | | 22,000 | |

Shareholders’ Equity | | | 72,667 | | | | 48,409 | | | | 46,727 | | | | 43,835 | | | | 39,125 | |

Book Value per Share | | $ | 12.69 | | | $ | 11.58 | | | $ | 11.07 | | | $ | 10.52 | | | $ | 9.74 | |

Average Common Equity to Average Assets | | | 6.77 | % | | | 6.77 | % | | | 6.80 | % | | | 7.15 | % | | | 7.28 | % |

Shares Outstanding | | | 5,726,772 | | | | 4,180,080 | | | | 4,219,980 | | | | 4,167,180 | | | | 4,017,380 | |

Number of Branch Locations | | | 29 | | | | 18 | | | | 17 | | | | 15 | | | | 14 | |

| (1) | See Note 1 to Consolidated Financial Statements regarding earnings per share. |

| (2) | Data presented for years prior to 2004 has been restated for the effect of a two-for-one stock split, in the form of a 100% stock dividend, in February 2005. |

| (3) | Includes available-for-sale securities shown at fair value, held-to-maturity securities at cost and Federal Home Loan Bank stock at cost. |

1

Letter to Shareholders

…the Company has positioned itself to be more broadly diversified than ever before…

Growth by expanding existing customer relationships…Growth from the strategic positioning of our newest branch offices…and…Growth through the acquisition of two Vermont-based financial institutions…all contributed to a year of significant change for New Hampshire Thrift Bancshares. The process of developing comprehensive business plans, whether short-term or long-term, embodies a collective effort that envisions both where it is that a company wants to go and what it is that a company wants to be when it gets there. As we take time to review what has happened with the Company over the last few years, we can quite clearly see that the success of our planning process results just as much from its development and design as it does from its implementation and execution.

With the recent acquisition of both the First Brandon National Bank of Brandon, Vermont and the First Community Bank of Woodstock, Vermont, the Company has positioned itself to be more broadly diversified than ever before. While this first has been geographic diversification, as we now serve several different markets in both New Hampshire and Vermont, it has more importantly diversified the balance sheet of the Company in a way that years of normal growth patterns could not have easily achieved. We have taken a major step forward and, in so doing, have acknowledged and accepted the initial short-term challenges of assimilation, transition and integration.

Consistent with our ‘How can we help you today?’ culture, the Company looks to further advance its position of financial services leadership throughout our marketplace segments as we continue to grow our banking franchise. Despite the very real forecasts of economic uncertainty that will surely compromise business expectations in almost all industry sectors in the coming year, we remain well positioned to address the variety of needs in the expanded markets that we now serve.

COMPANY EARNINGS

The Company reported consolidated net income for the year-ended December 31, 2007 of $4,515,682, or $0.92 per share of common stock (fully diluted). This compares to net income of $5,039,859, or $1.17 per share of common stock (fully diluted) that the Company reported in 2006. Margin compression continued to negatively impact most financial institutions during 2007, along with the ongoing downward slide of the housing market. Additionally, net income for the year was adversely affected by several one-time costs totaling approximately $1,000,000 that were directly associated with the two acquisitions. We also continue to recognize the ongoing expenses of the five newer branches as they move through the early years of growing their profitability levels beyond their initial operating overhead. As a result, non-interest income remains an important complement to the balancing of income over expense. And, recent actions by the Federal Reserve have and will continue to impact financial institutions, at times exacerbating the already delicate prospects of increased earnings during a time of broadening economic weakness. For more in-depth analysis, the complete financial details for the year ending December 31, 2007 can be found in the Management’s Discussion and Analysis section that immediately follows this letter.

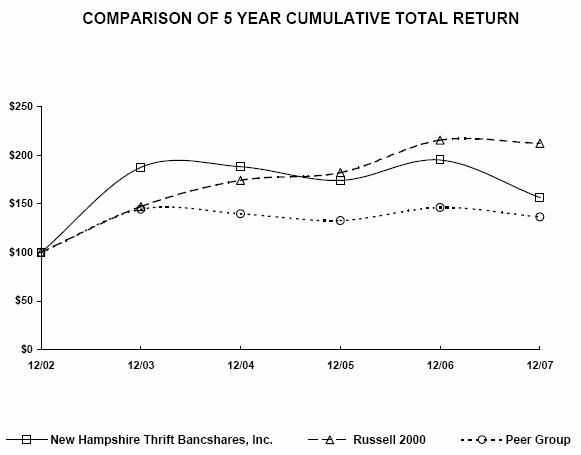

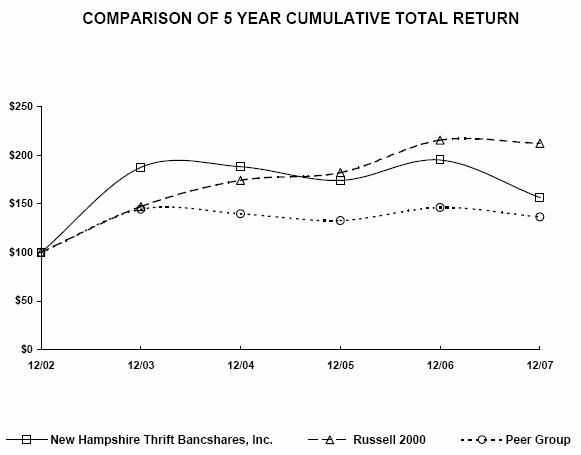

SHAREHOLDER VALUE

Despite the current lack of investor interest in the financial services sector, the Company remains focused on developing long-term shareholder value by building on our position of market leadership and expanding our efforts to penetrate new markets. The recent fluctuations in the share price of bank stocks overshadows the real growth that continues to build as a company seeks to increase the book value of our common stock. Our continuing commitment to moving the Company forward is central to our strategic planning for the future and our fundamental goals for growth over time have not been too greatly tainted by the prevailing economic climate.

The Company’s stock price closed out the year 2007 at $12.47 per share, above its low for the year, but well below its 2006 year-end price of $16.00 per share. Shareholder’s equity of $72,667,323 at year-end resulted in a book value of $12.69 per share at December 31, 2007, based upon a total of 5,719,772 shares of common stock outstanding. This represented an increase in book value of $1.11 per share, or 9.59%, from a year earlier. Additionally, the Company continued to maintain its uninterrupted history of quarterly cash dividends.

2

Letter to Shareholders (continued)

Over the course of the year ended December 31, 2007, the Company repurchased a total of 330,867 shares of its common stock The decision to continue to use excess capital in this manner is based on the belief that the Company’s stock remains a good investment and its true value is not currently reflected by its market price. As a result of the buy-back of shares, there were 153,088 remaining for purchase at year-end under the Company’s existing repurchase program. Going forward, the Company will continue to purchase shares from-time-to-time when the market is favorable to our general corporate purposes.

In general, the Company is looking to grow its asset base and market presence for the benefit of greater net earnings, an ever-stronger capital position and real growth in the underlying value for the shareholder. As a company, these simple operating principles of our mission have not changed.

THE ROLE OF COMMUNITY BANKS

As the ripple effect of the sub-prime mortgage crisis begins to filter its way into many more segments of the economy than originally envisioned, it is alarming to think how devastating this all may turn out to be to the universal goal of home ownership and the more general ‘American Dream’ of personal financial independence. Community banks, however, having not participated in the lending practices that brought about this untenable situation, now find themselves more deeply involved than ever as we try to find ways to help good-intentioned people out of what they seem to have gotten themselves into. This, interestingly enough, has always been part of the role we play in broadly addressing the various needs of the communities we serve. While the world of cutting-edge products and services…some good, some bad…swirls around us, we simply continue to do what we have always done. Certainly, we don’t do it the way we have always done it, but the underlying premise and focus of what we do has not changed significantly over the years.

For our Company, now operating in its 140th year, we continue to see growing opportunities for community banking. Competition from a variety of external providers remains an inherent risk to our industry, but the Company is now better positioned to meet the needs of our customers in a way that helps them to distinguish the longer-term difference in the fundamental relationship of ‘value’ over price.

While it can be argued that the longer-term relevance of community banks is ever so slowly diminishing as our more traditional customer base ages, the fact is that we are now seeing a new ‘return-to-safety’ trend emerging as the markets, products, and services to which many people have been attracted begin to erode. The traditional customer contact points of deposits and loans, while still a vital part of our business model, are now being expanded for all ages into the areas of wealth management, investment services and retirement plans, as well as a growing need in the area of health savings accounts as employers begin to share more of the burden of medical coverage to their employees.

Our continuing success as a community bank, then, rests in the development and maintenance of relationships. Changes now come quite quickly within the financial services industry and we are, as stewards of the business, obligated to acknowledge and embrace that which is good, while at the same time weeding-out that which may be not so good, for our customers….for our communities…and for our Company.

…we are, as stewards of the business, obligated to acknowledge and embrace that which is good…

BALANCE SHEET HIGHLIGHTS

Total assets of the Company stood at $834,229,842 at year-end December 31, 2007 as compared to $672,031,030 at year-end 2006. This represents an increase of nearly 25%, which is primarily attributable to the acquisition of First Brandon National Bank and First Community Bank. Total deposits increased significantly during the year, providing more than sufficient liquidity to pay down our advances from the Federal Home Loan Bank from $120,000,000 at year-end 2006 to just over $63,000,000 at December 31, 2007. Growth in assets will continue to be an important factor going forward as we identify more ways to lessen the continuing impact of margin compression.

Total loans held in portfolio increased to $626,274,462 and now represent just over 75% of our total asset base. Even though this is a slight percentage increase over last year, it does represent a true net increase in our earning assets. The mortgage market was generally flat year-over-year from 2006 to 2007, with many borrowers looking to

3

Letter to Shareholders (continued)

refinance and lock-in fixed rate loans that the Company continues to sell on a servicing-retained basis into the secondary market. At year-end December 31, 2007, the Company was servicing just over 2,700 fixed-rate mortgage loans with total outstanding balances of roughly $307,000,000. The Company continues to originate loans in a very conservative manner and has not varied from its traditional policies. In particular, the Company has not and does not originate ‘sub-prime’ mortgage loans.

…sharing in the vision of what the Company has become, and can be going forward, is an important factor in contributing to our future success as a community bank…

Despite the current turmoil in the credit markets, the Company has maintained a clear focus on the inter-dependency between asset quality and capital. Capital was deployed during the year to acquire both of the Vermont-based banks, as well as to repurchase stock of the Company in the open market. These uses were seen as further solidifying the underlying strength of the Company by broadening its market positioning and reducing the number of outstanding shares. At year-end, core capital remained strong at 7.84% and asset quality was very strong, with non-performing loans representing just 0.60% of total assets. Maintaining good asset quality is vital to the longer-term stability and growth of the Company, with the most recent Safety and Soundness Examination by the Office of Thrift Supervision confirming that our traditional high quality rating remains in place.

LOOKING AHEAD

It is difficult not to share a serious degree of concern for the financial impact of the current economic uncertainty that now weighs upon the short-term prospects for the years just ahead. The nationwide burdens of margin compression, an inevitable economic slowdown and continuing fallout from the sub-prime mortgage activity of the past are all combining to create a most challenging period ahead for those companies in the financial services sector. For us, the year 2008 will serve as a transitional period for the Company as we seek to embrace and understand the various influences both within and without our expanding markets in New Hampshire and Vermont.

This is also a time to look for opportunities. Customer needs do not go away in times like these. In fact, their needs may actually increase. And, we have been laying the groundwork over the last few years to meet a much broader variety of needs by building and maintaining a responsible pipeline for consumer, mortgage and commercial loans. It is the ‘customer-centric’ approach of our Company’s underlying business philosophy that has seen us crafting new marketing messages, adding new branches and enhancing staff training to meet the needs of our existing and future customers.

We are committed to moving the Company forward. Striving for quality over price, it is our continuing effort to bring ‘added value’ to each relationship. Sustainable growth comes one customer at a time. It is a very simple series of building blocks on which the foundational-strength of this Company continues to be built as we move into the future.

IN CLOSING

It seems appropriate that we take a moment to mention the recent changes in our corporate governance. First, we must mention the untimely death last year of Dennis A. Morrow who had served for many years as a director of both the Company and the Bank. Secondly, both John J. Kiernan and Kenneth D. Weed retired from the board of the Bank at the conclusion of last year’s annual meeting, with Mr. Kiernan’s career with Company and the Bank spanning a period of more than forty-five years. The dedication and commitment of these individuals contributed greatly to the advancement of the Company. Additionally, we would like to welcome two new members to our Board of Directors, Peter D. Terwilliger and Michael J. Putziger. Mr. Terwilliger previously served as Chairman of the Board of First Brandon National Bank and Mr. Putziger served as the Chairman of the First Community Bank of Woodstock.

On behalf of all those who work so diligently together to strengthen the presence of our banking franchise throughout the various communities we serve, I want to take this opportunity to express our appreciation to you, our shareholders, for your continuing confidence in the Company. Sharing in the vision of what the Company has become, and can be going forward, is an important factor in contributing to our future success as a community bank.

4

Management’s Discussion and Analysis

of Financial Condition and Results of Operations

General

New Hampshire Thrift Bancshares, Inc.’s (the “Company” or “NHTB”) profitability is derived from its subsidiary, Lake Sunapee Bank, fsb (the “Bank”). The Bank’s earnings are primarily generated from the difference between the yield on its loans and investments and the cost of its deposit accounts and borrowings. Loan origination fees, retail-banking service fees, and gains on security and loan transactions supplement these core earnings.

Overview

| | • | | On June 1, 2007, NHTB completed its acquisition of First Brandon National Bank, and on October 1, 2007, NHTB completed its acquisition of First Community Bank, further expanding the Company’s presence in Vermont. |

| | • | | Total assets stood at $834,229,842 at December 31, 2007, an increase of $162,198,812, or 24.14%, from $672,031,030 at December 31, 2006. |

| | • | | Net loans increased $133,562,665, or 27.11%, to $626,274,462 at December 31, 2007 from $492,711,797 at December 31, 2006. |

| | • | | In 2007, the Bank originated $200,787,883 in loans, compared to $185,458,739 in 2006. |

| | • | | The Bank’s loan servicing portfolio increased to $305,838,179 at December 31, 2007 from $300,019,470 at December 31, 2006, an increase of $5,818,709, or 1.94%. |

| | • | | The Company earned $4,515,682, or $0.92 per common share, assuming dilution, for the year ended December 31, 2007, compared to $5,039,859, or $1.17 per common share, assuming dilution, for the year ended December 31, 2006. |

| | • | | Net interest and dividend income for the year ended December 31, 2007, increased by $1,838,589 or 9.98%, to $20,262,462. |

| | • | | The Bank’s interest rate spread stabilized to 2.91% as of December 31, 2007 from 2.87% at December 31, 2006. |

| | • | | The Bank opened one new branch office during 2007, located in Hanover, New Hampshire. |

Forward-looking Statements

Statements included in this discussion and in future filings by the Company with the Securities and Exchange Commission, in the Company’s press releases, and in oral statements made with the approval of an authorized executive officer, which are not historical or current facts, are “forward-looking statements” made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, and are subject to certain risks and uncertainties that could cause actual results to differ materially from historical earnings and those presently anticipated or projected. The Company wishes to caution readers not to place undue reliance on such forward-looking statements, which speak only as of the date made. The following important factors, among others, in some cases have affected and in the future could affect the Company’s actual results, and could cause the Company’s actual financial performance to differ materially from that expressed in any forward-looking statement: (1) the Company’s loan portfolio includes loans with a higher risk of loss; (2) if the Company’s allowance for loan losses is not sufficient to cover actual loan losses, earnings could decrease; (3) changes in interest rates could adversely affect the company’s results of operations and financial condition; the local economy may affect future growth possibilities; (4) the Company depends on its executive officers and key personnel to continue the implementation of its long-term business strategy and could be harmed by the loss of their services; (5) the Company operates in a highly regulated environment, and changes in laws and regulations to which it is subject may adversely affect its results of operations; and (6) competition in the Bank’s primary market area may reduce its ability to attract and retain deposits and originate loans. The foregoing list should not be construed as exhaustive, and the Company disclaims any obligation to subsequently revise any forward-looking statements to reflect events or circumstances after the date of such statements, or to reflect the occurrence of anticipated or unanticipated events or circumstances.

5

Management’s Discussion and Analysis(continued)

Critical Accounting Policies

The Company considers the following accounting policies to be most critical in their potential effect on its financial position or results of operations:

Allowance for Loan Losses

The allowance for loan losses is established through a charge to the provision for loan losses. Provisions are made to reserve for estimated losses in outstanding loan balances. The allowance for loan losses is a significant estimate and is regularly reviewed by the Company for adequacy by assessing such factors as changes in the mix and volume of the loan portfolio; trends in portfolio credit quality, including delinquency and charge-off rates; and current economic conditions that may affect a borrower’s ability to repay. The Company’s methodology with respect to the assessment of the adequacy of the allowance for loan losses is more fully discussed on pages 15-18 of Management’s Discussion and Analysis.

Income Taxes

The Company must estimate income tax expense for each period for which a statement of operations is presented. This involves estimating the Company’s actual current tax exposure as well as assessing temporary differences resulting from differing treatment of items, such as timing of the deduction of expenses, for tax and accounting purposes. These differences result in deferred tax assets and liabilities, which are included in the Company’s consolidated balance sheets. The Company must also assess the likelihood that any deferred tax assets will be recovered from future taxable income and to the extent that recovery is not likely, a valuation allowance must be established. Significant management judgment is required in determining income tax expense, and deferred tax assets and liabilities. As of December 31, 2007, there were no valuation allowances set aside against any deferred tax assets.

Interest Income Recognition

Interest on loans is included in income as earned based upon interest rates applied to unpaid principal. Interest is not accrued on loans 90 days or more past due. Interest is not accrued on other loans when management believes collection is doubtful. All loans considered impaired are nonaccruing. Interest on nonaccruing loans is recognized as payments are received when the ultimate collectibility of interest is no longer considered doubtful. When a loan is placed on nonaccrual status, all interest previously accrued is reversed against current-period interest income.

Capital Securities

On March 30, 2004, NHTB Capital Trust II (“Trust II”), a Connecticut statutory trust formed by the Company, completed the sale of $10.0 million of 6.06%, 5 Year Fixed-Floating Capital Securities (“Capital Securities II”). Trust II also issued common securities to the Company and used the net proceeds from the offering to purchase a like amount of 6.06% Junior Subordinated Deferrable Interest Debentures (“Debentures II”) of the Company. Debentures II are the sole assets of Trust II. Total expenses associated with the offering of $160,402 are included in other assets and are being amortized on a straight-line basis over the life of Debentures II.

Capital Securities II accrue and pay distributions quarterly at an annual rate of 6.06% for the first 5 years of the stated liquidation amount of $10 per capital security. The Company has fully and unconditionally guaranteed all of the obligations of the Trust. The guaranty covers the quarterly distributions and payments on liquidation or redemption of Capital Securities II, but only to the extent that the Trust has funds necessary to make these payments.

Capital Securities II are mandatorily redeemable upon the maturing of Debentures II on March 30, 2034 or upon earlier redemption as provided in the Indenture. The Company has the right to redeem Debentures II, in whole or in part on or after March 30, 2009 at the liquidation amount plus any accrued but unpaid interest to the redemption date.

On March 30, 2004, NHTB Capital Trust III (“Trust III”), a Connecticut statutory trust formed by the Company, completed the sale of $10.0 million of Floating Capital Securities, adjustable every three months at LIBOR plus 2.79% (“Capital Securities III”). Trust III also issued common securities to the Company and used the net proceeds from the offering to purchase a like amount of Junior Subordinated Deferrable Interest Debentures (“Debentures III”) of the Company. Debentures III are the sole assets of Trust III. Total expenses associated with the offering of $160,402 are included in other assets and are being amortized on a straight-line basis over the life of Debentures III.

Capital Securities III accrue and pay distributions quarterly based on the stated liquidation amount of $10 per capital security. The Company has fully and unconditionally guaranteed all of the obligations of Trust III. The guaranty covers the quarterly distributions and payments on liquidation or redemption of Capital Securities III, but only to the extent that Trust III has funds necessary to make these payments.

Capital Securities III are mandatorily redeemable upon the maturing of Debentures III on March 30, 2034 or upon earlier redemption as provided in the Indenture. The Company has the right to redeem Debentures III, in whole or in part on or after March 30, 2009 at the liquidation amount plus any accrued but unpaid interest to the redemption date.

6

Management’s Discussion and Analysis(continued)

First Brandon Acquisition

On December 14, 2006, the Company entered into a definitive agreement to acquire First Brandon Financial Corporation, Brandon, Vermont, (“First Brandon”) for approximately $20.8 million in cash and stock (the “Merger”). Immediately following the closing of the transaction on June 1, 2007, First Brandon’s subsidiary bank, First Brandon National Bank, merged with and into the Company’s subsidiary bank, Lake Sunapee Bank, fsb, and operates under the name “First Brandon Bank, a division of Lake Sunapee Bank, fsb”. The combined company had approximately $771 million in assets and operates 24 branches in New Hampshire and Vermont at the time of the merger.

First Community Acquisition

On April 16, 2007, NHTB announced that it had entered into a definitive agreement to acquire First Community Bank (“First Community”) for approximately $14.6 million in cash and stock, which further expanded NHTB’s New Hampshire-based banking franchise into the State of Vermont. First Community merged with and into NHTB’s subsidiary bank, Lake Sunapee Bank, fsb on October 1, 2007. First Community operated 5 branches located in Woodstock, Killington and Rutland, Vermont and had over $83.4 million in assets. The acquisition of First Community created a combined company with approximately $841.0 million in assets and 29 branches in New Hampshire and Vermont.

Comparison of Years Ended December 31, 2007 and 2006

Financial Condition

Total assets increased by $162,198,812, or 24.14%, to $834,229,842 as of December 31, 2007 from $672,031,030 as of December 31, 2006. The increase in assets includes approximately $177 million from the First Brandon and First Community Bank acquisitions.

Total gross loans, excluding loans held-for-sale, increased $133,562,665, or 27.11%, including approximately $129 million from the First Brandon and First Community Bank acquisitions, to $626,274,462 as of December 31, 2007. The Bank’s conventional real estate loan portfolio increased $54,027,375, or 19.18%, to $335,782,676. Construction loans increased $4,595,025, or 26.86%, to $21,704,154. Commercial real estate loans increased $39,222,376, or 37.99%, to $142,469,203, due primarily to new loans acquired from the two acquisitions. Additionally, consumer loans increased $12,342,536, or 19.51%, to $75,619,503 and Commercial and municipal loans increased $22,993,222, or 77.89%, to $52,514,784. These increases were due to the acquired loan portfolios of the acquired two banks. The continued favorable interest rate environment also made the above loan offerings very attractive. Sold loans totaled $305,838,179 at year-end 2007, compared to $300,019,470, at year-end 2006. Sold loans are loans originated by the Bank and sold to the secondary market with the Bank retaining the majority of servicing of these loans. The Bank expects to continue to sell fixed rate loans into the secondary market, retaining the servicing, in order to manage interest rate risk and control growth. Typically, the Bank holds adjustable rate loans in portfolio. Adjustable rate mortgages comprise approximately 82% of the Bank’s real estate mortgage loan portfolio, which is consistent with prior years. Asset remained strong with non-performing assets as a percentage of total assets at 0.60% as the Bank continued to originate loans in a conservative manner. In particular, the Bank does not originate nor purchase “sub-prime” mortgage loans.

The fair value of investment securities available-for-sale decreased $4,062,300, or 4.44%, to $87,460,003, including approximately $21 million from the First Brandon and First Community Bank acquisitions, as of December 31, 2007, from $91,522,303 at December 31, 2006. The Bank used proceeds from maturing securities to pay off maturing Federal Home Loan Bank advances.

The Bank realized no gains on the sales and calls of securities during 2007, as compared $71,069 during 2006. As of December 31, 2007, the Bank’s investment portfolio had a net unrealized holding loss of $1,663,149, as compared to a net unrealized holding loss of $1,762,587 at December 31, 2006.Since the average life of the investment portfolio is less than five years and the liquidity of the Bank remains strong, the Bank does not anticipate the need to prematurely sell any investments and realize a loss. In addition, all securities are rated as investment grade by the leading rating agencies. The investments in the Bank’s investment portfolio that are temporarily impaired as of December 31, 2007 consist of debt securities issued by U.S. Government corporations or agencies, corporate debt with strong credit ratings and preferred stock issued by corporations and government sponsored agencies.

7

Management’s Discussion and Analysis(continued)

Real estate owned and property acquired in settlement of loans was at $240,802 at December 31, 2007 as compared to $0 at December 31, 2006.

Goodwill increased by $15,153,454 to $27,293,470 as of December 31, 2007, from $12,140,016 as of December 31, 2006. Goodwill recognized due to the acquisition of First Brandon amounted to $7,503,046, after acquisition costs of $20,832,293. Goodwill recognized due to the acquisition of First Community amounted to $7,650,408, after acquisition costs of $14,649,648. Goodwill also includes $2,471,560 relating to the acquisition of Landmark Bank in 1998 and $9,668,456 relating to the acquisition of New London Trust in 2001.

Core deposit intangible amounted to $3,160,303 as of December 31, 2007 due to the two acquisitions in 2007. The Bank amortized $307,697 during 2007, utilizing the sum-of-the-digit method over ten years to amortize the core deposit intangible.

Total deposits increased by $187,466,197, (including approximately $152 million from the two acquisitions closed during 2007), or 40.27%, to $652,972,017 as of December 31, 2007 from $465,505,820 as of December 31, 2006. The increase in deposits occurred due to an increase in the Bank’s certificates of deposit as customers were attracted to safety and guarantee of FDIC insurance resulting from uncertain credit markets.

Advances from the Federal Home Loan Bank (FHLB) decreased by $56,613,126, or 47.18%, to $63,386,874, including approximately $3.6 million from the two acquisitions, from $120,000,000 at December 31, 2006. The Bank used proceeds from maturing investment securities, liquidity generated from the two acquisitions, and funds from deposit in-flows to pay-off maturing FHLB advances as part of a de-leveraging strategy used to reduce funding costs. The weighted average interest rate for the outstanding FHLB advances was 4.52% as of December 31, 2007, as compared to 5.06% as of December 31, 2006.

Liquidity and Capital Resources

The Bank is required to maintain sufficient liquidity for safe and sound operations. At year-end 2007, the Bank’s liquidity was sufficient to cover the Bank’s anticipated needs for funding new loan commitments of approximately $23 million. The Bank’s source of funds comes primarily from net deposit inflows, loan amortizations, principal pay downs from loans, sold loan proceeds, and advances from the FHLB. At December 31, 2007, the Bank had approximately $179 million in additional borrowing capacity from the FHLB.

At December 31, 2007, the Company’s shareholders’ equity totaled $72,667,323, as compared to $48,409,406, at year-end 2006. The increase of $24,257,917 reflects net income of $4,515,682, the payment of $2,475,019 in common stock dividends, the exercise of stock options in the amount of $782,044, a tax benefit on the exercise of stock options in the amount of $47,911, a total increase in total common stock in the amount of $18,885 due to the exercise of stock options, paid-in capital due to the acquisition of First Brandon in the amount of $15,582,350, paid-in capital due to the acquisition of First Community in the amount of $11,138,053, an increase in accumulated other comprehensive loss in the amount of $60,520, and the repurchase of 341,779 shares at a cost of $5,291,469. The change in other comprehensive loss included an after tax loss in the amount of $120,570 due to the Bank’s curtailment of its defined benefit pension plan.

On June 12, 2007, the Company announced that it approved the repurchase of up to an additional 253,776 shares of common stock. As of December 31, 2007, 153,088 shares remained to be repurchased under the July 12, 2007 plan. The Board of Directors of the Company has determined that a share buyback is appropriate to enhance shareholder value because such repurchases generally increase earnings per share, return on average assets and on average equity; three performing benchmarks against which bank and thrift holding companies are measured. The Company buys stock in the open market whenever the price of the stock is deemed reasonable and the Company has funds available for the purchase.

As of December 31, 2007, the Company had funds in the amount of $320,355. Total cash needs for the Company during 2008 will amount to approximately $4.4 million with $3.0 million being used to pay dividends on the Company’s common stock and $1.4 million to pay interest on the Company’s capital securities. The Bank pays dividends to the Company as its sole stockholder, within guidelines set forth by the Office of Thrift Supervision (OTS). Since the Bank is well capitalized and has capital in excess of regulatory requirements, it is anticipated that funds will be available to cover the Company’s cash needs for 2008.

Net cash provided by operating activities decreased by $5,083,179 to $4,428,635 in 2007 from $9,331,814 in 2006. The decrease is primarily attributable to an increase in the amount of $1,230,180 in loans held for sale and an increase in the amount of $4,522,627 in accrued expenses and other liabilities.

8

Management’s Discussion and Analysis(continued)

Net cash flows provided from investing activities totaled 21,681,532 in 2007, as compared to net cash flows used in investing activities of $15,561,289 in 2006, a change of $37,242,821. During 2007, loan originations and principal collections, net, decreased in the amount of $21,244,142, and cash and cash equivalents acquired from First Brandon and First Community, net of expenses paid, amounted to $7,678,405 which accounted for the majority of the change in investing activities.

In 2007, net cash flows used by financing activities totaled $26,822,406, as compared to net cash flows provided from financing activities in the amount of $14,830,821, a change of $41,653,227. Net repayment of FHLB advances in the amount of $60,848,727, coupled with net deposit inflows of $35,366,059 accounted for the change in financing activities.

The Bank expects to be able to fund loan demand and other investing activities during 2008 by continuing to use funds provided by customer deposits, as well as the FHLB’s advance program. On December 31, 2007, approximately $26,000,000 in commitments to fund loans had been made. Management is not aware of any trends, events, or uncertainties that will have or that are reasonably likely to have a material effect on the Bank’s liquidity, capital resources or results of operations.

The following table represents the Company’s contractual obligations at December 31, 2007:

Payments Due by Period (in thousands)

| | | | | | | | | | | | | | | |

| | | Total | | Less than 1 year | | 1-3 years | | 3-5 years | | More than 5 years |

Long-term Debt Obligation | | $ | 63,480 | | $ | 52,098 | | $ | 10,382 | | $ | — | | $ | 1,000 |

Operating Lease Obligation | | | 1,361 | | | 373 | | | 501 | | | 302 | | | 185 |

| | | | | | | | | | | | | | | |

Total | | $ | 64,841 | | $ | 52,471 | | $ | 10,883 | | $ | 302 | | $ | 1,185 |

| | | | | | | | | | | | | | | |

The OTS requires that the Bank maintain tangible, core, and total risk-based capital ratios of 1.50%, 4.00%, and 8.00%, respectively. As of December 31, 2007, the Bank’s ratios were 7.84%, 7.84%, and 11.08%, respectively, well in excess of the OTS requirements.

Book value per share was $12.69 at December 31, 2007, as compared to $11.58 per share at December 31, 2006.

Impact of Inflation

The financial statements and related data presented elsewhere herein are prepared in accordance with generally accepted accounting principles (GAAP) ,which require the measurement of the Company’s financial position and operating results generally in terms of historical dollars and current market value, for certain loans and investments, without considering changes in the relative purchasing power of money over time due to inflation. The impact of inflation is reflected in the increased cost of operations.

Unlike other companies, nearly all of the assets and liabilities of a bank are monetary in nature. As a result, interest rates have a far greater impact on a bank’s performance than the effects of the general level of inflation. Interest rates do not necessarily move in the same direction or to the same extent as the price of goods and services, since such prices are affected by inflation. In the current interest rate environment, liquidity and the maturity structure of the Bank’s assets and liabilities are important to the maintenance of acceptable performance levels.

Interest Rate Sensitivity

The principal objective of the Bank’s interest rate management function is to evaluate the interest rate risk inherent in certain balance sheet accounts and determine the appropriate level of risk given the Bank’s business strategies, operating environment, capital and liquidity requirements and performance objectives and

9

Management’s Discussion and Analysis(continued)

to manage the risk consistent with the Board of Director’s approved guidelines. The Bank’s Board of Directors has established an Asset/Liability Committee (ALCO) to review its asset/liability policies and interest rate position monthly. Trends and interest rate positions are reported to the Board of Directors monthly.

Gap analysis is used to examine the extent to which assets and liabilities are “rate sensitive”. An asset or liability is said to be interest rate sensitive within a specific time-period if it will mature or reprice within that time. The interest rate sensitivity gap is defined as the difference between the amount of interest-earning assets maturing or repricing within a specified period of time and the amount of interest-bearing liabilities maturing or repricing within the same specified period of time. The strategy of matching rate sensitive assets with similar liabilities stabilizes profitability during periods of interest rate fluctuations.

The Bank’s one-year gap at December 31, 2007, was negative 20.99%, as compared to the December 31, 2006 gap of negative 20.83%. If short-term interest rates were to rise, the Bank’s net interest income would be reduced because the cost to re-finance the FHLB advances and re-pricing deposits would increase prior to any asset re-pricing.

The Bank continues to offer adjustable rate mortgages, which reprice at one, three, and five-year intervals. In addition, the Bank sells fixed-rate mortgages to the secondary market in order to minimize interest rate risk.

As another part of its interest rate risk analysis, the Bank uses an interest rate sensitivity model, which generates estimates of the change in the Bank’s net portfolio value (NPV) over a range of interest rate scenarios. The OTS produces the data quarterly using its own model and data submitted by the Bank.

NPV is the present value of expected cash flows from assets, liabilities and off-balance sheet contracts. The NPV ratio, under any rate scenario, is defined as the NPV in that scenario divided by the market value of assets in the same scenario. Modeling changes require making certain assumptions, which may or may not reflect the manner in which actual yields and costs respond to the changes in market interest rates. In this regard, the NPV model assumes that the composition of the Bank’s interest sensitive assets and liabilities existing at the beginning of a period remain constant over the period being measured and that a particular change in interest rates is reflected uniformly across the yield curve. Accordingly, although the NPV measurements and net interest income models provide an indication of the Bank’s interest rate risk exposure at a particular point in time, such measurements are not intended to and do not provide a precise forecast of the effect of changes in market rates on the Bank’s net interest income and will likely differ from actual results.

10

Management’s Discussion and Analysis(continued)

The following table shows the Bank’s interest rate sensitivity (gap) table at December 31, 2007:

| | | | | | | | | | | | | | | | | | | | | | | |

| | | 0-3

Months | | | 3-6

Months | | | 6 Months-

1 Year | | | 1-3 Years | | | Beyond

3 Years | | | Total | |

| | | ($ in thousands) | |

Interest-earning assets: | | | | | | | | | | | | | | | | | | | | | | | |

Loans | | $ | 138,751 | | | $ | 63,257 | | | $ | 105,055 | | | $ | 224,465 | | | $ | 100,525 | | | 632,053 | |

Investments and FHLB overnight deposit | | | 35,713 | | | | 7,499 | | | | 10,055 | | | | 30,794 | | | | 24,710 | | | 108,771 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Total | | | 174,464 | | | | 70,756 | | | | 115,110 | | | | 255,259 | | | | 125,235 | | | 740,824 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Interest-bearing liabilities: | | | | | | | | | | | | | | | | | | | | | | | |

Deposits | | | 172,768 | | | | 72,703 | | | | 113,556 | | | | 23,571 | | | | 242,349 | | | 624,947 | |

Repurchase agreements | | | 15,441 | | | | — | | | | — | | | | — | | | | — | | | 15,441 | |

Borrowings | | | 50,122 | | | | 10,123 | | | | 1,249 | | | | 20,370 | | | | 1,000 | | | 82,864 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Total | | | 238,331 | | | | 82,826 | | | | 114,805 | | | | 43,941 | | | | 243,349 | | | 723,252 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Period sensitivity gap | | | (63,867 | ) | | | (12,070 | ) | | | 305 | | | | 211,318 | | | | (118,114 | ) | | 17,572 | |

Cumulative sensitivity gap | | $ | (63,867 | ) | | $ | (75,937 | ) | | $ | (75,632 | ) | | $ | 135,686 | | | $ | 17,572 | | | | |

Cumulative sensitivity gap as a percentage of interest-earning assets | | | -36.61 | % | | | -30.97 | % | | | -20.99 | % | | | 22.04 | % | | | 2.37 | % | | 2.37 | % |

The following table sets forth the Bank’s NPV as of December 31, 2007, as calculated by the OTS for the December 31, 2007 reporting cycle:

| | | | | | | | | | | | |

| Change | | Net Portfolio Value | | | NPV as % of PV Assets |

| in Rates | | $ Amount | | $ Change | | % Change | | | NPV Ratio | | | Change |

| +200 bp | | 82,478 | | -11,519 | | -12 | % | | 10.01 | % | | -121bp |

| +100 bp | | 89,668 | | -4,329 | | -5 | % | | 10.77 | % | | -45bp |

| 0 bp | | 93,997 | | 0 | | 0 | | | 0 | | | 0 |

| -100 bp | | 96,286 | | 2,289 | | +2 | % | | 11.44 | % | | +22bp |

| -200 bp | | 97,570 | | 3,573 | | +4 | % | | 11.56 | % | | +34bp |

11

Management’s Discussion and Analysis(continued)

Results of Operations 2007 versus 2006

Net Interest and Dividend Income

Net interest and dividend income for the year ended December 31, 2007 increased by $1,838,589, or 9.98%, to $20,262,462. The increase was due to stabilizing interest rate margins, results from the two bank acquisitions, and increases in the Bank’s loan portfolio.

Total interest and dividend income increased by $5,969,310, or 17.73%.Interest and fees on loans increased by $5,857,064, or 20.62%, to $34,257,504 in 2007, due to the increase in loans outstanding and results from the two bank acquisitions.

Interest on taxable investments increased by $26,660, or 0.63%.Dividends decreased by $78,210, or 14.50%, to $539,418, as the Bank elected to use funds from maturing securities to pay off FHLB advances in lieu of re-investing them.Interest on other investments increased by $163,796, or 39.94%, to $573,881. The yield on the Bank’s investment portfolio improved from 4.41% as of December 31, 2006 to 4.93% as of December 31, 2007 due to several higher yielding investments acquired from the two bank acquisitions.

Total interest expense increased $4,130,721, or 27.09%, for the year ended December 31, 2007.Interest on deposits increased by $5,194,471, or 67.06%, because many of the Bank’s certificates of deposit (CD) matured and re-priced into higher yielding term deposits. In addition, the Bank was unable to lag deposit re-pricing due to competitive pressures.Interest on FHLB advances and other borrowed money decreased by $1,018,404, or 18.43%, to $4,506,663 for the year ended December 31, 2007 from $5,525,067 for the year ended December 31, 2006. FHLB advances outstanding decreased to $63,386,874 at December 31, 2007 from $120,000,000 at December 31, 2006 as the Bank used the proceeds from the maturing investment securities to pay off maturing advances as part of a de-leveraging strategy deployed to reduce the Bank’s cost of funds.

The Bank’s combined cost of funds increased to 3.08% as of December 31, 2007 from 2.66% as of December 31, 2006. The cost of deposits, including repurchase agreements, increased 82 basis points to 2.59% as of December 31, 2007, from 1.77% as of December 31, 2006. The Bank’s higher costing time deposits, in particular, increased during 2007 as customers sought the safety of longer-term bank deposits.

The Bank’s interest rate spread, which represents the difference between the weighted average yield on interest-earning assets and the weighted average cost of interest-bearing liabilities, increased slightly to 2.91% at December 31, 2007 from 2.87% at December 31, 2006. The Bank’s net interest margin, representing net interest income as a percentage of average interest-earning assets, increased slightly to 3.06% as of December 31, 2007, from 3.02% as of December 31, 2006. Both increases are indicative of the Federal Reserve Bank’s easing of the Fed Funds rates and the subsequent steepenning of the yield curve. Since the Bank is liability sensitive, as interest rates decrease, the Bank’s interest rate spread and margin will increase. Although the Bank experienced a slight stabilizing of its spread and margin, the Bank’s interest expense increased by 27.09% as compared to the increase in interest income of 17.73%.

The following table sets forth the average yield on loans and investments, the average interest rate paid on deposits and borrowings, the interest rate spread, and the net interest rate margin:

| | | | | | | | | | | | | | | |

| | | For the Years Ended December 31, | |

| | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

Yield on loans | | 6.20 | % | | 5.80 | % | | 5.37 | % | | 5.13 | % | | 5.33 | % |

Yield on investment securities | | 4.93 | % | | 4.41 | % | | 3.95 | % | | 3.76 | % | | 3.20 | % |

Combined yield on loans and investments | | 5.99 | % | | 5.53 | % | | 5.06 | % | | 4.77 | % | | 4.78 | % |

Cost of deposits, including repurchase agreements | | 2.59 | % | | 1.77 | % | | 1.09 | % | | 0.82 | % | | 1.02 | % |

Cost of other borrowed funds | | 5.37 | % | | 5.22 | % | | 3.94 | % | | 3.37 | % | | 7.64 | % |

Combined cost of deposits and borrowings | | 3.08 | % | | 2.66 | % | | 1.66 | % | | 1.29 | % | | 1.35 | % |

Interest rate spread | | 2.91 | % | | 2.87 | % | | 3.40 | % | | 3.48 | % | | 3.43 | % |

Net interest margin | | 3.06 | % | | 3.02 | % | | 3.49 | % | | 3.54 | % | | 3.50 | % |

12

Management’s Discussion and Analysis(continued)

The following table presents, for the years indicated, the total dollar amount of interest income from interest-earning assets and the resultant yields as well as the interest paid on interest-bearing liabilities, and the resultant costs:

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Years ended December 31, | | 2007 | | | 2006 | | | 2005 | |

| | | Average(1)

Balance | | Interest | | Yield/

Cost | | | Average(1)

Balance | | Interest | | Yield/

Cost | | | Average(1)

Balance | | Interest | | Yield/

Cost | |

| | | ($ in thousands) | |

Assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest-earning assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Loans(2), | | $ | 552,203 | | $ | 34,258 | | 6.20 | % | | $ | 489,930 | | $ | 28,400 | | 5.80 | % | | $ | 442,335 | | $ | 23,772 | | 5.37 | % |

Investment securities and other | | | 109,158 | | | 5,385 | | 4.93 | % | | | 119,472 | | | 5,274 | | 4.41 | % | | | 123,143 | | | 4,859 | | 3.95 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total interest-earning assets | | | 661,361 | | | 39,643 | | 5.99 | % | | | 609,402 | | | 33,674 | | 5.53 | % | | | 565,478 | | | 28,631 | | 5.06 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Noninterest-earning assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Cash | | | 16,940 | | | | | | | | | 15,738 | | | | | | | | | 18,978 | | | | | | |

Other noninterest-earning assets(3) | | | 43,922 | | | | | | | | | 33,096 | | | | | | | | | 35,583 | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total noninterest-earning assets | | | 60,862 | | | | | | | | | 48,834 | | | | | | | | | 54,561 | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | $ | 722,223 | | | | | | | | $ | 658,236 | | | | | | | | $ | 620,039 | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Liabilities and Shareholders’ Equity: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest-bearing liabilities: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Savings, NOW and MMAs | | $ | 280,578 | | $ | 2,666 | | 0.95 | % | | $ | 266,043 | | $ | 1,736 | | 0.65 | % | | $ | 294,073 | | $ | 1,511 | | 0.51 | % |

Time deposits | | | 226,618 | | | 10,275 | | 4.53 | % | | | 163,227 | | | 6,011 | | 3.68 | % | | | 123,224 | | | 2,820 | | 2.29 | % |

Repurchase agreements | | | 10,420 | | | 454 | | 4.35 | % | | | 11,247 | | | 525 | | 4.67 | % | | | 11,325 | | | 344 | | 3.04 | % |

Capital securities and other borrowed funds | | | 111,499 | | | 5,986 | | 5.37 | % | | | 133,899 | | | 6,989 | | 5.22 | % | | | 107,505 | | | 4,241 | | 3.94 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total interest-bearing liabilities | | | 629,115 | | | 19,381 | | 3.08 | % | | | 574,416 | | | 15,261 | | 2.66 | % | | | 536,127 | | | 8,916 | | 1.66 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Noninterest-bearing liabilities: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Demand deposits | | | 30,573 | | | | | | | | | 29,452 | | | | | | | | | 32,403 | | | | | | |

Other | | | 5,940 | | | | | | | | | 8,880 | | | | | | | | | 9,331 | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total noninterest-bearing liabilities | | | 36,513 | | | | | | | | | 38,332 | | | | | | | | | 41,734 | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Shareholders’ equity | | | 56,595 | | | | | | | | | 45,488 | | | | | | | | | 42,178 | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | $ | 722,223 | | | | | | | | $ | 658,236 | | | | | | | | $ | 620,039 | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net interest income/Net interest rate spread | | | | | $ | 20,262 | | 2.91 | % | | | | | $ | 18,413 | | 2.87 | % | | | | | $ | 19,715 | | 3.40 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net interest margin | | | | | | | | 3.06 | % | | | | | | | | 3.02 | % | | | | | | | | 3.49 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Percentage of interest-earning assets to interest-bearing liabilities | | | | | | | | 105.13 | % | | | | | | | | 106.09 | % | | | | | | | | 105.47 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

(1) | Monthly average balances have been used for all periods. |

(2) | Loans include 90-day delinquent loans, which have been placed on a non-accruing status. Management does not believe that including the 90-day delinquent loans in loans caused any material difference in the information presented. |

(3) | Other noninterest-earning assets include non-earning assets and other real estate owned. |

13

Management’s Discussion and Analysis(continued)

The following table sets forth, for the years indicated, a summary of the changes in interest earned and interest paid resulting from changes in volume and rates. The net change attributable to changes in both volume and rate, which cannot be segregated, has been allocated proportionately to the change due to volume and the change due to rate.

| | | | | | | | | | | | |

| | | Year ended December 31, 2007 vs. 2006 | |

| | | Increase (Decrease) due to | |

| | | Volume | | | Rate | | | Total | |

| | | ($ in thousands) | |

Interest income on loans | | $ | 3,863 | | | $ | 1,995 | | | $ | 5,858 | |

Interest income on investments | | | (366 | ) | | | 477 | | | | 111 | |

| | | | | | | | | | | | |

Total interest income | | | 3,497 | | | | 2,472 | | | | 5,969 | |

| | | | | | | | | | | | |

Interest expense on savings, NOW and MMAs | | | 138 | | | | 792 | | | | 930 | |

Interest expense on time deposits | | | 2,874 | | | | 1,390 | | | | 4,264 | |

Interest expense on repurchase agreements | | | (36 | ) | | | (35 | ) | | | (71 | ) |

Interest expense on capital securities and other borrowings | | | (1,244 | ) | | | 241 | | | | (1,003 | ) |

| | | | | | | | | | | | |

Total interest expense | | | 1,732 | | | | 2,388 | | | | 4,120 | |

| | | | | | | | | | | | |

Net interest income | | $ | 1,765 | | | $ | 84 | | | $ | 1,849 | |

| | | | | | | | | | | | |

| |

| | | Year ended December 31, 2006 vs. 2005 | |

| | | Increase (Decrease) due to | |

| | | Volume | | | Rate | | | Total | |

| | | ($ in thousands) | |

Interest income on loans | | $ | 2,654 | | | $ | 1,974 | | | $ | 4,628 | |

Interest income on investments | | | (107 | ) | | | 522 | | | | 415 | |

Total interest income | | | 2,547 | | | | 2,496 | | | | 5,043 | |

Interest expense on savings, NOW and MMAs | | | (2 | ) | | | 227 | | | | 225 | |

Interest expense on time deposits | | | 1,117 | | | | 2,073 | | | | 3,190 | |

Interest expense on repurchase agreements | | | (1 | ) | | | 182 | | | | 181 | |

Interest expense on capital securities and other borrowings | | | 1,615 | | | | 1,133 | | | | 2,748 | |

| | | | | | | | | | | | |

Total interest expense | | | 2,729 | | | | 3,615 | | | | 6,344 | |

| | | | | | | | | | | | |

Net interest income | | $ | (182 | ) | | $ | (1,119 | ) | | $ | (1,301 | ) |

| | | | | | | | | | | | |

14

Management’s Discussion and Analysis(continued)

Allowance and Provision for Loan Losses

Lake Sunapee Bank maintains an allowance for loan losses to absorb losses inherent in the loan portfolio. Adjustments to the allowance for loan losses are charged to income through the provision for loan losses. The Bank tests the adequacy at least quarterly by preparing a worksheet applying loss factors to outstanding loans by type. The worksheet stratifies the loan portfolio by loan type and assigns a loss factor to each type based on an assessment of the risk associated with each type. In determining the loss factors, the Bank considers historical losses and market conditions. Loss factors may be adjusted for qualitative factors that, in management’s judgment, affect the collectibility of the portfolio.

The allowance for loan losses incorporates the results of measuring impairment for specifically identified non-homogenous problem loans in accordance with Statement of Financial Accounting Standards (SFAS) No. 114 “Accounting by creditors for impairment of a loan,” and SFAS No. 118, “Accounting by creditors for impairment of a loan – income recognition and disclosures.” In accordance with SFAS No.’s 114 and 118 the specific allowance reduces the carrying amount of the impaired loans to their estimated fair value. A loan is recognized as impaired when it is probable that principal and/or interest are not collectible in accordance with the contractual terms of the loan. Measurement of impairment can be based on the present value of expected cash flows discounted at the loans effective interest rate, the market price of the loan, or the fair value of the collateral if the loan is collateral dependent.

Measurement of impairment does not apply to large groups of smaller balance homogenous loans such as residential mortgage, home equity, or installment loans that are collectively evaluated for impairment. Please refer to Note 4 “Loans Receivable,” in the Consolidated Financial Statements for information regarding SFAS No. 114 and 118.

The Bank’s commercial loan officers review the financial condition of commercial loan customers on a regular basis and perform visual inspections of facilities and inventories. The Bank also has loan review, internal audit, and compliance programs. Results are reported directly to the Audit Committee of the Bank’s Board of Directors.

At December 31, 2007 the allowance for loan losses was $5,181,471 compared to $3,975,122 at year- end 2006. The increase comes from the allowance for loan loss that came with the acquisitions of First Brandon National Bank and First Community Bank. Through those acquisitions in 2007, Lake Sunapee Bank received allowances of $579,304 from First Brandon and $724,057 from First Community. Most of the activity in the allowance accounts in both 2007 and 2006 was attributable to the fee for service overdraft privilege program. Overdraft charge-offs were $273,871 in 2007 compared to $391,821 in 2006. Loan charge-offs, excluding the overdrafts, were $125,567 in 2007 and $75,197 in 2006. Approximately $90,000 of the 2007 loan loss came from residential mortgage loans while the remainder came from automobile and other consumer loans. Net charge-offs were $219,512 in 2007 compared to $277,230 in 2006. The provision for loan loss was $122,500 in 2007 compared to $230,011 in 2006. The lower level of both net charge-offs and provisions in 2007 is due to the decrease in overdraft charge-offs. The allowance for loan losses represented 0.82% of total loans at December 31, 2007 compared to 0.80% at the end of 2006. It remained relatively constant as the acquired allowance kept pace with the portfolio growth from the bank acquisitions. The provision for the overdraft program is driven by a policy to maintain that portion of the allowance at a level sufficient to cover 100% of the aggregate balance of accounts remaining negative for 30 days or more. All of the provisions in 2007, and most of the provisions in 2006 were for overdrafts. Results of the adequacy tests showed the allowance remained at a sufficient level, given current conditions. On-going provisions are anticipated as overdraft charge-offs continue and the Bank adheres to the policy to maintain an overdraft allowance equal to 100% of the aggregate negative balance of accounts remaining negative for 30 days or more.

Loans classified for regulatory purposes as loss, doubtful, substandard or special mention do not result from trends or uncertainties that the Bank reasonably expects will materially impact future operating results, liquidity, or capital resources. Total classified loans, excluding special mention loans, as of December 31, 2007 and 2006, were $6,172,310 and $4,063,615 respectively. The increase comes from the acquisition of some classified loans, the downgrading of some credits, and an increase in the amount of loans over 90 days past due. Special mention loans were $2,099,598 at December 31, 2007 compared to $890,554 at year-end 2006. The increase results from changes in the risk rating of some loans. Those changes are a reflection of weaker cash flows as some borrowers operate with lower revenue and higher expenses.

Loans 30 to 89 days past due were $8,291,466 and $1,511,770 at December 31, 2007 and 2006, respectively. Total non-performing loans amounted to $4,744,729 and $753,992 at December 31, 2007 and 2006, respectively. That increase is largely due to one commercial real estate loan on nonaccrual status. At year-end 2007, $3.8 million was considered impaired. That compares to

15

Management’s Discussion and Analysis(continued)

$305,000 at the end of 2006. Loans over 90 days past due increased from $753,992 to $4,744,729 during 2007. This increase reflects an increased number of past due loans, as the acquisitions increased the total number of loans in the portfolio. As a percent of assets, non-performing loans increased from 0.11% at the year-end 2006 to 0.57% at December 31, 2007. Non-performing loans as a percent of total loans increased from 0.15% to 0.75% at the end of 2007. At December 31, 2007 the Bank held $240,802 of other real estate owned and repossessed assets. The Bank had no other real estate owned or repossessed assets at year-end 2006. If all non-accruing loans had been current in accordance with their terms during the years ended December 31, 2007 and 2006, interest income on such loans would have amounted to approximately $64,200 and $39,600 respectively.

As of December 31, 2007 there were no other loans not included in the tables below or discussed above where known information about possible credit problems of the borrowers caused management to have doubts as to the ability of the borrower to comply with present loan repayment terms and which may result in disclosure of such loans in the future.

At December 31, 2007 the Bank had $53,352 of “troubled debt restructurings” as defined in Statement of Accounting Standards No. 15, “Accounting by Debtors and Creditors for Troubled Debt Restructurings.” At December 31, 2006 the Bank’s portfolio did not include any “troubled debt restructurings.”

The following table sets forth the breakdown of non-performing assets at December 31:

| | | | | | | | | | | | | | | |

| | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 |

Nonaccrual loans(1) | | $ | 4,744,729 | | $ | 753,992 | | $ | 278,422 | | $ | 293,203 | | $ | 1,157,957 |

Real estate and chattel property owned | | | | | | — | | | — | | | — | | | — |

| | | | | | | | | | | | | | | |

Total nonperforming assets | | $ | 4,985,531 | | $ | 753,992 | | $ | 278,422 | | $ | 293,203 | | $ | 1,157,957 |

| | | | | | | | | | | | | | | |

(1) | All loans 90 days or more delinquent are placed on a nonaccruing status. |

The following table sets forth nonaccrual(1) loans by category at December 31:

| | | | | | | | | | | | | | | |

| | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 |

Real estate loans - | | | | | | | | | | | | | | | |

Conventional | | $ | 851,201 | | $ | 448,685 | | $ | 254,982 | | $ | 243,809 | | $ | 1,074,096 |

Construction | | | — | | | — | | | — | | | — | | | — |

Consumer loans | | | 97,717 | | | — | | | 7,977 | | | — | | | 1,891 |

Commercial and municipal loans | | | — | | | — | | | 15,463 | | | — | | | 31,036 |

Nonaccrual impaired loans(2) | | | 3,795,811 | | | 305,307 | | | — | | | 49,394 | | | 50,934 |

| | | | | | | | | | | | | | | |

Total | | $ | 4,744,729 | | $ | 753,992 | | $ | 278,422 | | $ | 293,203 | | $ | 1,157,957 |

| | | | | | | | | | | | | | | |

(1) | All loans 90 days or more delinquent are placed on a nonaccruing status. |

(2) | At 12/31/04 $853,064 of impaired loans, not included above, were on accrual status and performing. |

At 12/31/03 $726,698 of impaired loans, not included above, were on accrual status and performing.

16

Management’s Discussion and Analysis(continued)

The following is a summary of activity in the allowance for loan losses account for the years ended December 31:

| | | | | | | | | | | | | | | | | | | | |

| | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

Balance, beginning of year | | $ | 3,975,122 | | | $ | 4,022,341 | | | $ | 4,019,450 | | | $ | 3,898,650 | | | $ | 3,875,708 | |

Charge-offs: | | | | | | | | | | | | | | | | | | | | |

Residential real estate | | | 89,872 | | | | — | | | | — | | | | — | | | | — | |

Commercial real estate | | | — | | | | — | | | | — | | | | — | | | | — | |

Construction | | | — | | | | — | | | | — | | | | — | | | | — | |

Consumer loans | | | 33,531 | | | | 18,499 | | | | 36,766 | | | | 14,737 | | | | 28,862 | |

Overdrafts | | | 273,871 | | | | 391,821 | | | | 87,119 | | | | — | | | | — | |

Commercial loans | | | 5,164 | | | | 56,698 | | | | — | | | | — | | | | 57,780 | |

| | | | | | | | | | | | | | | | | | | | |

Total charged-off loans | | | 402,438 | | | | 467,018 | | | | 123,885 | | | | 14,737 | | | | 86,642 | |

Recoveries (2) | | | | | | | | | | | | | | | | | | | | |

Residential real estate | | | 5,317 | | | | — | | | | 2,403 | | | | — | | | | — | |

Commercial real estate | | | — | | | | — | | | | — | | | | 35,000 | | | | — | |

Construction | | | — | | | | — | | | | — | | | | — | | | | — | |

Consumer loans | | | 29,530 | | | | 5,979 | | | | 5,416 | | | | 25,540 | | | | 9,588 | |

Overdrafts | | | 148,079 | | | | 183,809 | | | | 30,457 | | | | — | | | | — | |

Commercial loans | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Total recoveries | | | 182,926 | | | | 189,788 | | | | 38,276 | | | | 60,540 | | | | 9,588 | |

Net charge-offs (recoveries) | | | 219,512 | | | | 277,230 | | | | 85,609 | | | | (45,803 | ) | | | 77,054 | |

Allowance from Acquisitions | | | 1,303,361 | | | | — | | | | — | | | | — | | | | — | |

Provision for loan loss charged to income | | | — | | | | 29,700 | | | | — | | | | 74,997 | | | | 99,996 | |

Provision for overdraft losses charged to income | | | 122,500 | | | | 200,311 | | | | 88,500 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Balance, end of year(1) | | $ | 5,181,471 | | | $ | 3.975,122 | | | $ | 4,022,341 | | | $ | 4,019,450 | | | $ | 3,898,650 | |

| | | | | | | | | | | | | | | | | | | | |

Ratio of net charge-offs (recoveries) to average loans | | | 0.04 | % | | | 0.06 | % | | | 0.02 | % | | | (0.01 | )% | | | 0.02 | % |

| | | | | | | | | | | | | | | | | | | | |

(1) | Balance at end of year includes allowance for overdraft privilege losses of $20,843 in 2007, $24,136 in 2006 and $31,838 in 2005. |

The following table sets forth the allocation of the loan loss allowance, the percentage of allowance to the total allowance and the percentage of loans in each category to total loans as of December 31 ($ in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2007 | | | 2006 | | | 2005 | |

Real estate loans - | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Conventional | | $ | 3,023 | | | 58 | % | | 77 | % | | $ | 2,592 | | | 65 | % | | 78 | % | | $ | 2,544 | | | 63 | % | | 77 | % |

Construction | | | 501 | | | 10 | % | | 3 | % | | | 357 | | | 9 | % | | 3 | % | | | 291 | | | 7 | % | | 3 | % |

Collateral and consumer loans & | | | 199 | | | 4 | % | | 12 | % | | | 130 | | | 3 | % | | 13 | % | | | 224 | | | 6 | % | | 14 | % |

Commercial and municipal loans | | | 1,413 | | | 27 | % | | 8 | % | | | 850 | | | 22 | % | | 6 | % | | | 963 | | | 24 | % | | 6 | % |

Impaired loans | | | 45 | | | 1 | % | | | | | | 46 | | | 1 | % | | | | | | — | | | — | | | | |

Unallocated | | | — | | | | | | | | | | — | | | | | | | | | | — | | | — | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Allowance | | $ | 5,181 | | | 100 | % | | 100 | % | | $ | 3,975 | | | 100 | % | | 100 | % | | $ | 4,022 | | | 100 | % | | 100 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Allowance as a percentage of total loans | | | 0.82 | % | | | | | | | | | 0.80 | % | | | | | | | | | 0.86 | % | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

17

Management’s Discussion and Analysis(continued)

| | | | | | | | | | | | | | | | | | | | |

| | | 2004 | | | 2003 | |

Real estate loans: | | | | | | | | | | | | | | | | | | | | |

Conventional | | $ | 2,445 | | | 61 | % | | 77 | % | | $ | 2,405 | | | 62 | % | | 78 | % |

Construction | | | 265 | | | 7 | % | | 5 | % | | | 251 | | | 6 | % | | 4 | % |

Collateral and consumer loans | | | 109 | | | 3 | % | | 14 | % | | | 114 | | | 3 | % | | 13 | % |

Commercial and municipal loans | | | 1,058 | | | 26 | % | | 4 | % | | | 1,012 | | | 26 | % | | 5 | % |

Impaired loans | | | 142 | | | 3 | % | | | | | | 117 | | | 3 | % | | | |

Unallocated | | | — | | | — | | | | | | | — | | | — | | | | |

| | | | | | | | | | | | | | | | | | | | |

Allowance | | $ | 4,019 | | | 100 | % | | 100 | % | | $ | 3,899 | | | 100 | % | | 100 | % |

| | | | | | | | | | | | | | | | | | | | |

Allowance as a percentage of total loans | | | 0.97 | % | | | | | | | | | 1.12 | % | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

The Bank believes the current allowance for loan losses is at a level sufficient to cover losses in the loan portfolio, given present conditions. At the same time, the Bank recognizes the determination of future loss potential is inherently uncertain. Future adjustments to the allowance may be necessary if economic, real estate, and other conditions differ substantially from the current operating environment resulting in increased levels of non-performing loans and substantial differences between estimated and actual losses.

Noninterest Income and Expense

Total noninterest income increased $1,039,817, or 17.70%, to $6,914,377 as of December 31, 2007.Customer service fees increased $758,697, or 18.85%, due to an increased volume of transations on the Bank’s overdraft protection program, as well as new fees in the amount of approximately $375,000 contributed from the Bank’s two acquired banks.Net gain on sales and calls of securities decreased in the amount of $71,069, but was more than offset byIncome on other investments in the amount of $144,174, which was earned when the Bank exercised stock warrants on one of its subordinated debt investments.Net gain on sale of loans increased by $81,240, or 10.63%, as the Bank’s total of sold loans increased to $49.7 million during 2007 from $38.2 million of sold loans during 2006.Rental income increased in the amount of $96,614, or 17.38%, as the Bank’s investment property purchased in 2005 and located in Hillsborough, NH realized a full year of rental income. In addition, therealized gain in Charter Holding Corp. increased by $34,998, or 18.48%, to $224,376 as of December 31, 2007, from $189,378 as of December 31, 2006.Brokerage service income increased slightly in the amount of $4,673, or 2.63%, to $182,089 for the year ended December 31, 2007.

Total noninterest expenses increased $4,098,975, or 24.80%, to $20,627,617 as of December 31, 2007, from $16,528,642 as of December 31, 2006. One-time costs in the amount of approximately $1 million associated with the two acquisitions are included in the increase of noninterest expense.

| | • | | Salaries and employee benefits increased by $1,727,358, or 19.76%, to $10,469,900 as of December 31, 2007 from $8,742,542 as of December 31, 2006. Gross salaries and benefits paid increased by $1,546,446, or 15.80%, to $11,336,252 as of December 31, 2007, from $9,789,806 as of December 31, 2006. In addition to normal salary and benefit increases, fifty new staff positions were added to the Bank as a result of the opening of a new branch office in Hanover, NH, and the acquisitions of the First Brandon and First Community. Total full time equivalents increased to 238 as of December 31, 2007, as compared to 188 as of December 31, 2006. The deferral of expenses in conjunction with the origination of loans decreased by $180,912, or 17.27%, to $866,852 as of December 31, 2007, from $1,047,264 as of December 31, 2006. This decrease was due to lower costs associated with the origination of residential real estate mortgage loans in 2007 as compared to 2006, which results in a lower amount of deferred expenses associated with origination costs associated with salary and employee benefits. |

| | • | | Occupancy and equipment expenses increased by $717,716, or 27.18%, to $3,358,720 as of December 31, 2007 from$ 2,641,004 as of December 31, 2006 as the Bank absorbed expenses from operating eleven new branch offices as a result of the two acquisitions and the opening of the Hanover, New Hampshire, branch. |

| | • | | Advertising and promotion increased in the amount of $82,339, or 25.64%, to $403,436 as of December 31, 2007 from $321,097 as of December 31, 2006, due to the promotion of the Bank’s eleven new offices and increased media outlets associated with the Bank’s enlarged geographical footprint. |

18

Management’s Discussion and Analysis(continued)

| | • | | Professional fees increased by $60,958, or 11.13% to $608,528 as of December 31, 2007 from $547,570 as of December 31, 2006, due to expanded requirements associated with the Bank’s audit and compliance programs. |

| | • | | Data processing and outside services fees increased by $155,189, or 24.24%, to $795,538 as of December 31, 2007 from $640,349 as of December 31, 2006, due to the increase of transactions associated with the Bank’s two acquisitions. |

| | • | | ATM processing fees increased by $117,818, or 29.52%, to $516,926 as of December 31, 2007 from $399,108 as of December 31, 2006, due to the increase in ATM transactions, which were offset by fees generated from ATM transactions. |

| | • | | Amortization of mortgage servicing rights (MSR) in excess of mortgage servicing income decreased in the amount of $103,131, or 54.47%, to $86,189 as of December 31, 2007 from $189,320 as of December 31, 2006, due to a lower volume of prepayments of sold loans. |

| | • | | Other expenses increased in the amount of $1,254,456, or 46.54%, to $3,949,689 as of December 31, 2007 from $2,684,540 as of December 31, 2006, due in part to increases in postage and telephone usage, as well as new expenses of approximately $460,000 associated with the Vermont franchise tax and the amortization of the core deposit intangible. In addition, one-time expenses in the amount of $222,000 associated with the Bank’s conversion of databases associated with the two acquisitions contributed to the increase in other expenses. |

Impact of New Accounting Standards

In February 2006, the Financial Accounting Standards Board (FASB) issued SFAS No. 155, “Accounting for Certain Hybrid Instruments” (SFAS 155), which permits, but does not require, fair value accounting for any hybrid financial instrument that contains an embedded derivative that would otherwise require bifurcation in accordance with SFAS 133. The statement also subjects beneficial interests issued by securitization vehicles to the requirements of SFAS No. 133. The statement is effective as of January 1, 2007. The adoption of SFAS 155 is not expected to have a material impact on the Company’s financial condition and results of operations.