File No. 0-17551

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report on Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16

Of the Securities Exchange Act of 1934

For the Period of November 29, 2002

DYNAMIC OIL & GAS, INC.

(Registrant’s name)

Airport Executive Park

#205, 10711 Cambie Road

Richmond, B.C.

Canada V6X 3G5

(Address of principal executive offices)

Indicate by check mark whether the Registrant files or will file annual reports under cover of Form 20F or Form 40-F

Indicate by check mark whether the Registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934

If “Yes” is marked, indicate below the file number assigned to the Registrant in connection with Rule 12g3-2(b): Not applicable

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | Dynamic Oil & Gas, Inc |

| | (Registrant) |

| | |

| | |

| | |

| Dated: 11-29-02 | By: /s/ Mike Bardell |

| | |

| | Mike Bardell, Chief Financial Officer & |

| | Corporate Secretary |

-2-

|

|

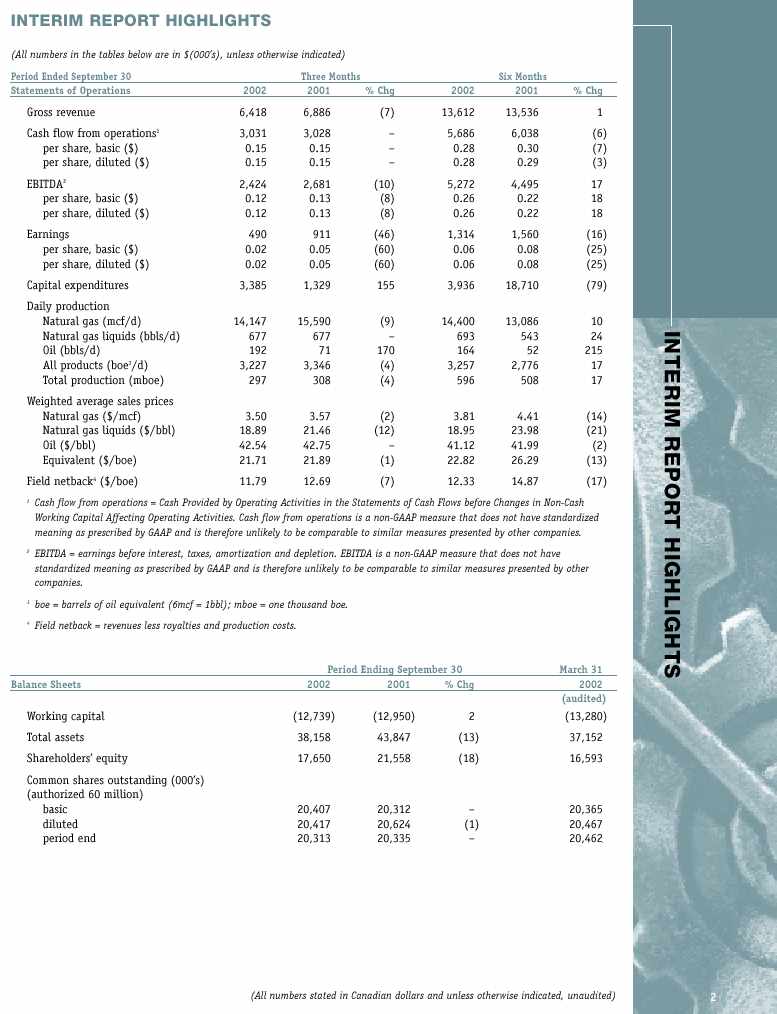

| | November 29, 2002 Fiscal 2003, Q2 Financial Highlights Dynamic Oil & Gas, Inc. reported today financial and operational highlights for the three and six months ended September 30, 2002 compared with the same periods of the previous year. | |

| |

|

|

|

|

|

|

|

|

| |

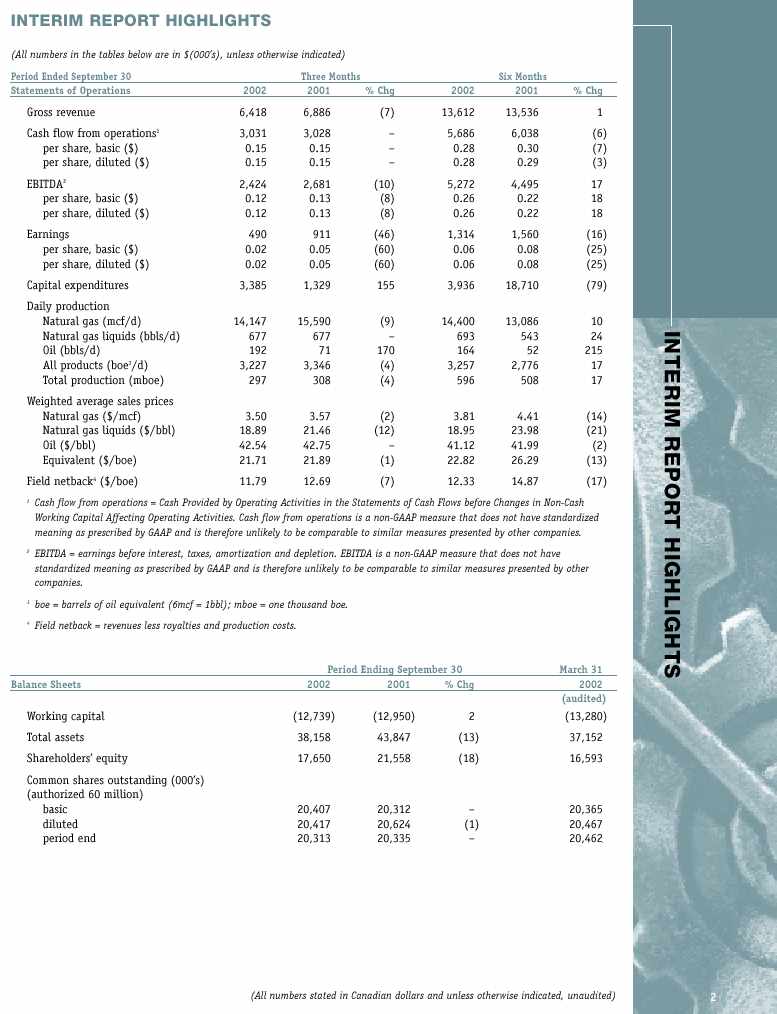

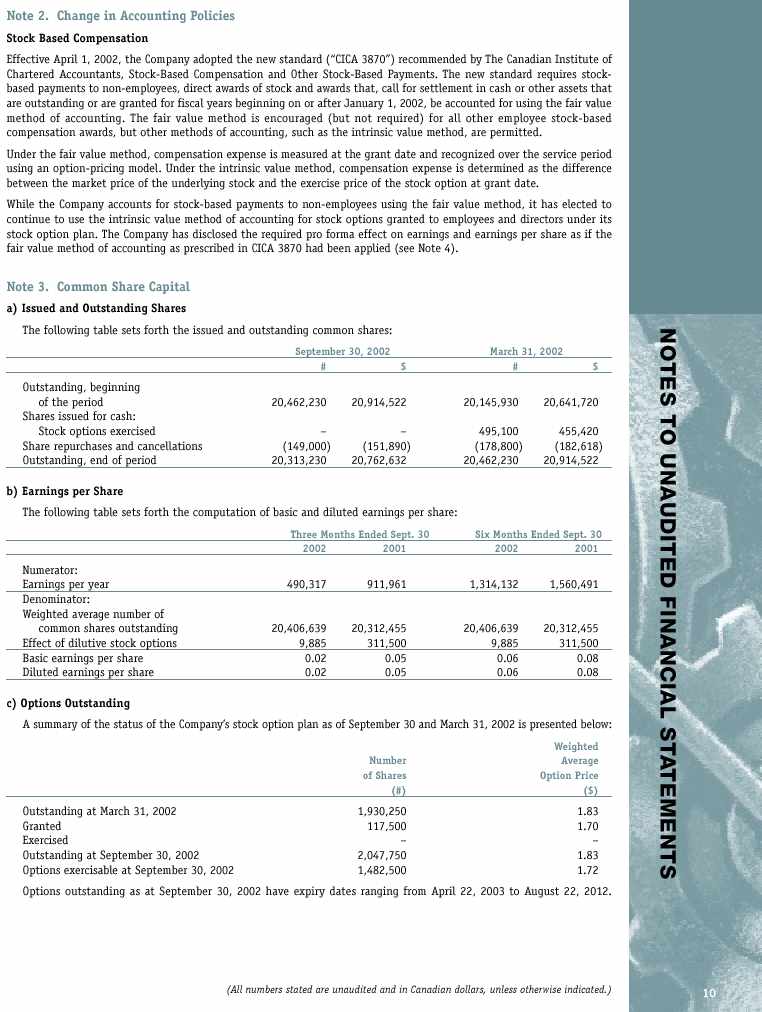

| | (Unless otherwise indicated, $(000’s) | | For the Three Months Ended | | For the Six Months Ended | |

| |

|

|

|

|

|

|

|

|

| |

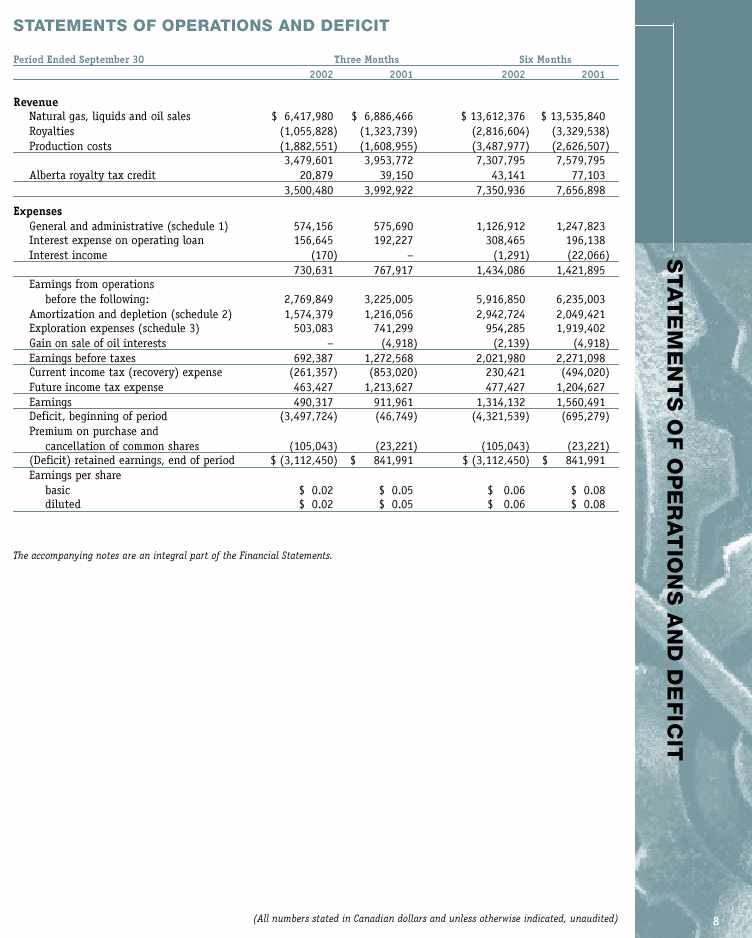

| | Statements of Operations | | Sep 30, 2002 | | Sep 30, 2001 | | Sep 30, 2002 | | Sep 30, 2001 | |

| |

|

|

|

|

|

|

|

|

| |

| | | | (unaudited) | | (unaudited) | | (unaudited) | | (unaudited) | |

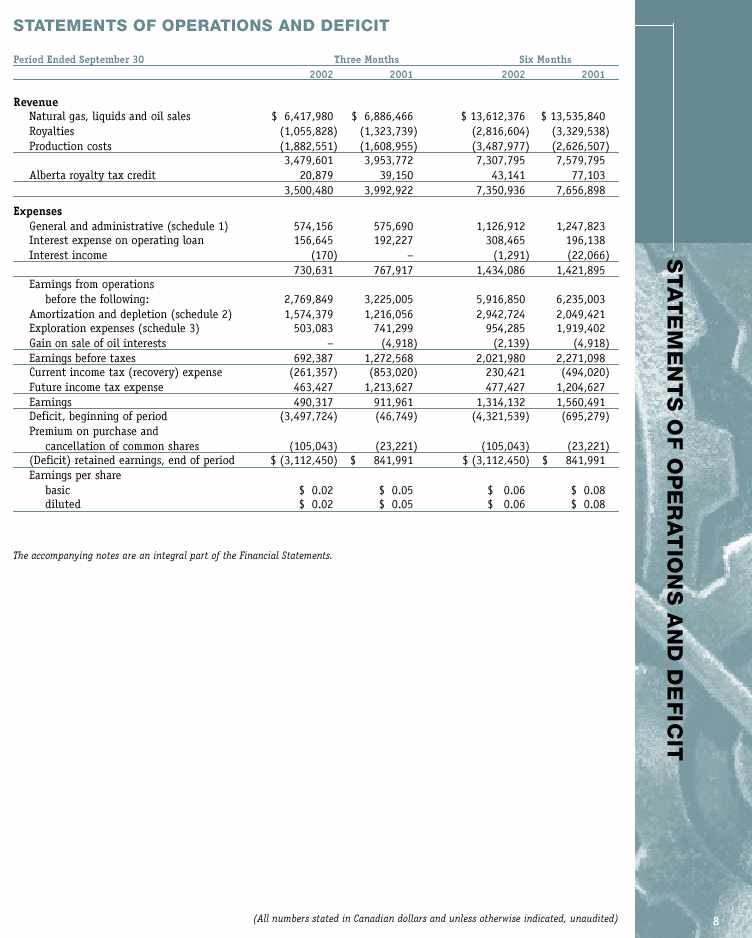

| | Gross revenue | | 6,418 | | 6,886 | | 13,612 | | 13.536 | |

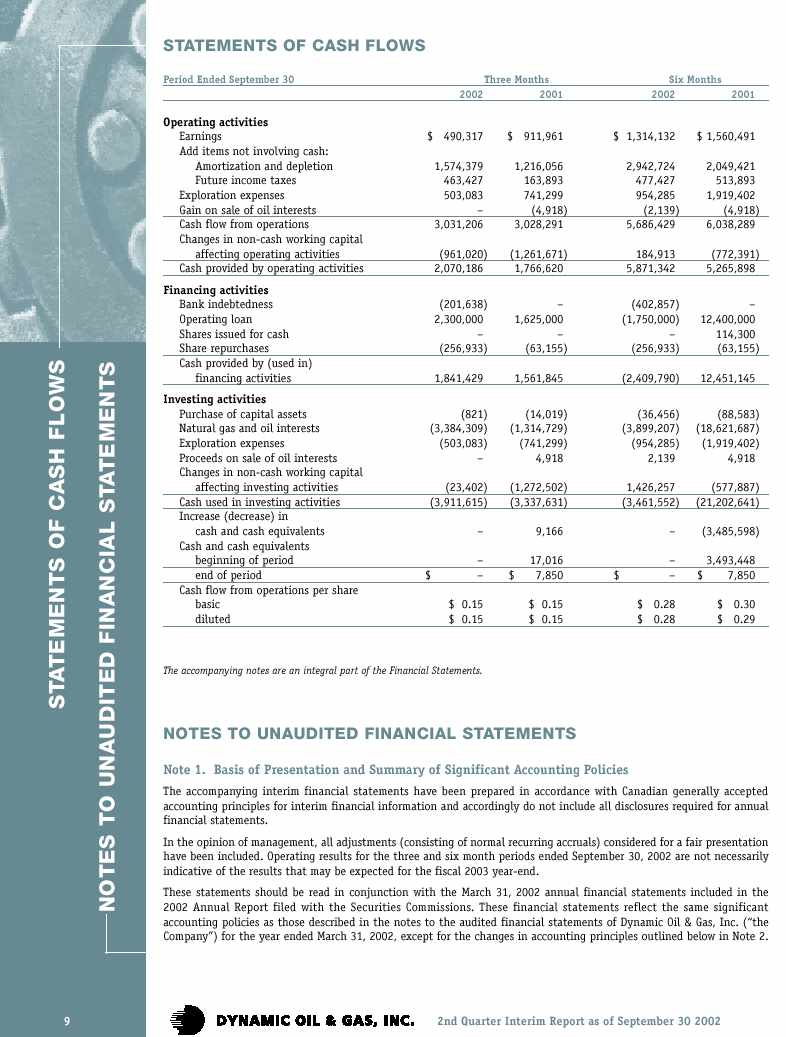

| | Cash flow from operations1 | | 3,031 | | 3,028 | | 5,686 | | 6,038 | |

| | - per share, basic($) | | 0.15 | | 0.15 | | 0.28 | | 0.30 | |

| | - per share, diluted($) | | 0.15 | | 0.15 | | 0.28 | | 0.29 | |

| | Earnings | | 490 | | 911 | | 1,314 | | 1,560 | |

| | - per share, basic($) | | 0.02 | | 0.05 | | 0.06 | | 0.08 | |

| | - per share, diluted($) | | 0.02 | | 0.05 | | 0.06 | | 0.08 | |

| | Capital expenditures | | 3,385 | | 1,329 | | 3,936 | | 18,710 | |

| | | | | | | | | | | |

| | Daily production | | | | | | | | | |

| | Natural gas(mcf/d) | | 14,147 | | 15,590 | | 14,400 | | 13,086 | |

| | Natural gas liquids(bbls/d) | | 677 | | 677 | | 693 | | 543 | |

| | Oil(bbls/d) | | 192 | | 71 | | 164 | | 52 | |

| | All products(boe2/d) | | 3,227 | | 3,346 | | 3,257 | | 2,776 | |

| | Total Q1 production (mboe) | | 297 | | 308 | | 596 | | 508 | |

| | | | | | | | | | | |

| | Weighted average sales prices | | | | | | | | | |

| | Natural gas($/mcf) | | 3.50 | | 3.57 | | 3.81 | | 4.41 | |

| | Natural gas liquids($/bbl) | | 18.89 | | 21.46 | | 18.95 | | 23.98 | |

| | Oil($/bbl) | | 42.54 | | 42.75 | | 41.12 | | 41.99 | |

| | Equivalent ($/boe) | | 21.71 | | 21.89 | | 22.82 | | 26.29 | |

| | Field netback3($/boe) | | 11.79 | | 12.69 | | 12.33 | | 14.87 | |

| | 1 | Cash flow from operations = is a non-GAAP measure that is therefore may not be comparable to similar measures presented by other companies. It is defined as Cash Provided by Operating Activities in the Company’s Statements of Cash Flows before Changes in Non-Cash Working Capital Affecting Operating Activities. | |

| | 2 | boe = barrels of oil equivalent (6 mcf = 1 bbl); mboe = one thousand boe. | |

| | 3 | Field netback = revenues less royalties and production costs. | |

| | | As at Sep 30 | March 31 | |

| |

|

|

|

|

|

| |

| | Balance Sheets | 2002 | | 2001 | | 2002 | |

| |

|

|

|

|

|

| |

| | | (unaudited | ) | (unaudited | ) | (audited | ) |

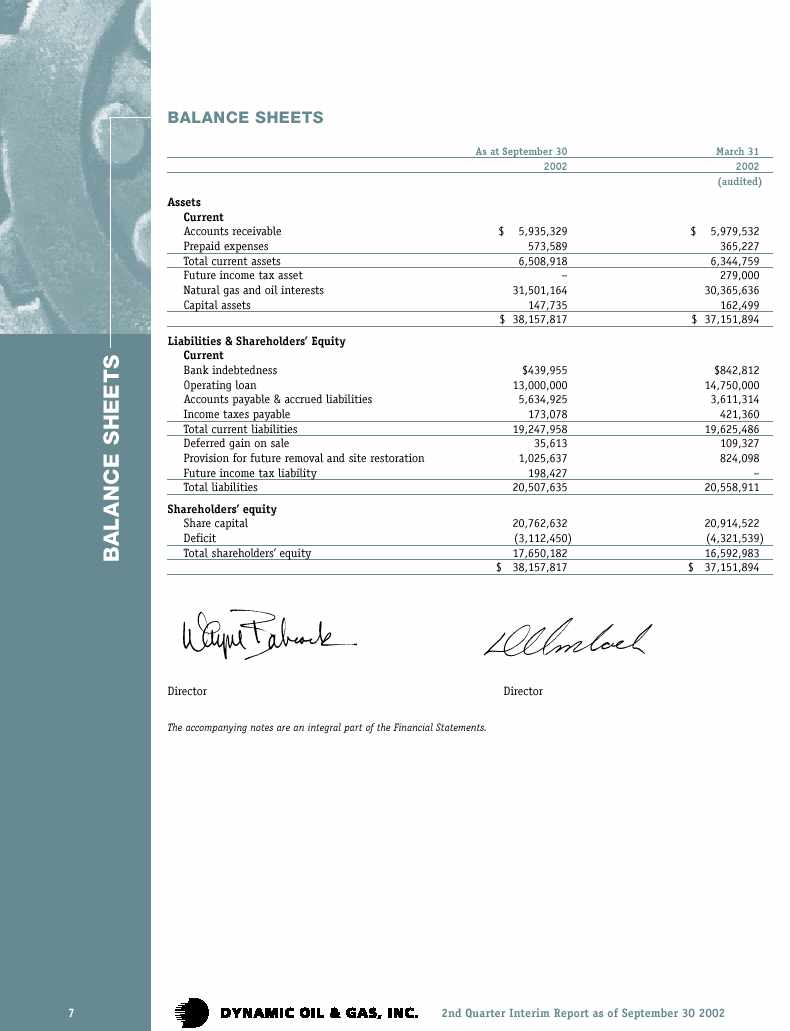

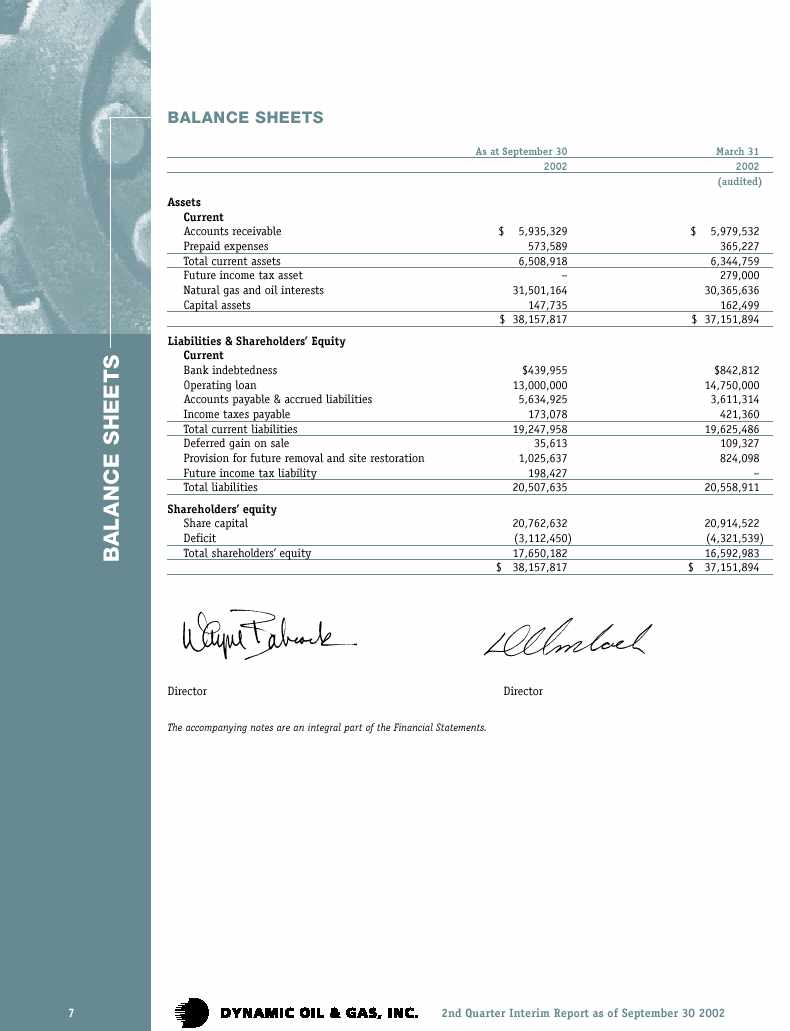

| | Working capital | (12,739 | ) | (12,950 | ) | (13,280 | ) |

| | Total assets | 38,158 | | 43,847 | | 37,152 | |

| | Shareholders’ equity | 17,650 | | 21,558 | | 16,593 | |

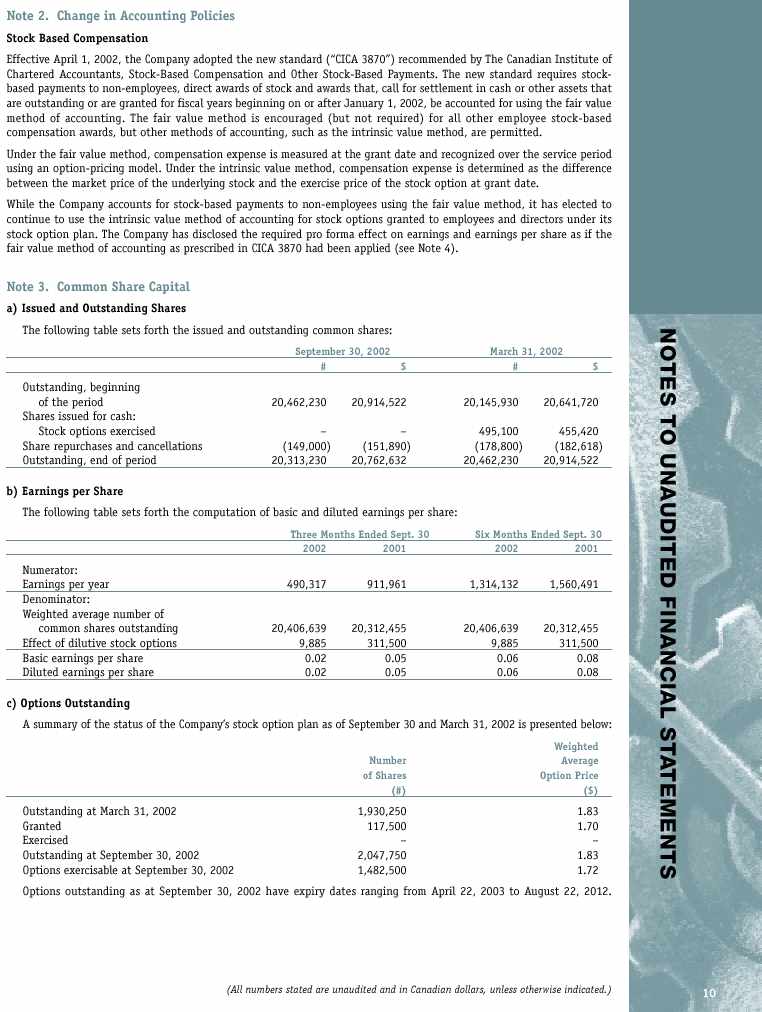

| | Common shares, (000’s) | | | | | | |

| | authorized 60 million | | | | | | |

| | - basic | 20,407 | | 20,312 | | 20,365 | |

| | - diluted | 20,417 | | 20,624 | | 20,467 | |

| | - period end | 20,313 | | 20,335 | | 20,462 | |

| |

|

|

|

|

|

| |

Dynamic Oil & Gas, Inc. Airport Executive Park Suite 205 – 10711 Cambie Road Richmond, British Columbia Canada V6X 3G5

Tel: 604/214-0550 Toll free: 1-800/663-8072 Fax: 604/214-0551 E-mail: infodynamic@dynamicoil.com Website: www.dynamicoil.com

|

|

| | Highlights – Second Quarter (“Q2”) Fiscal 2003

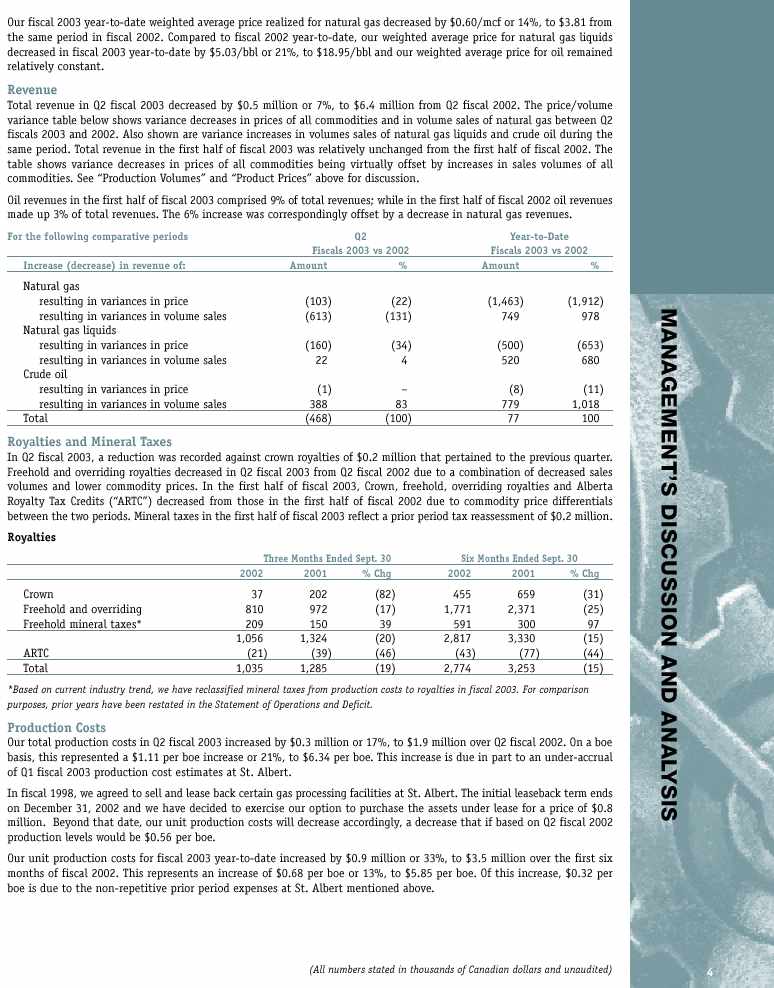

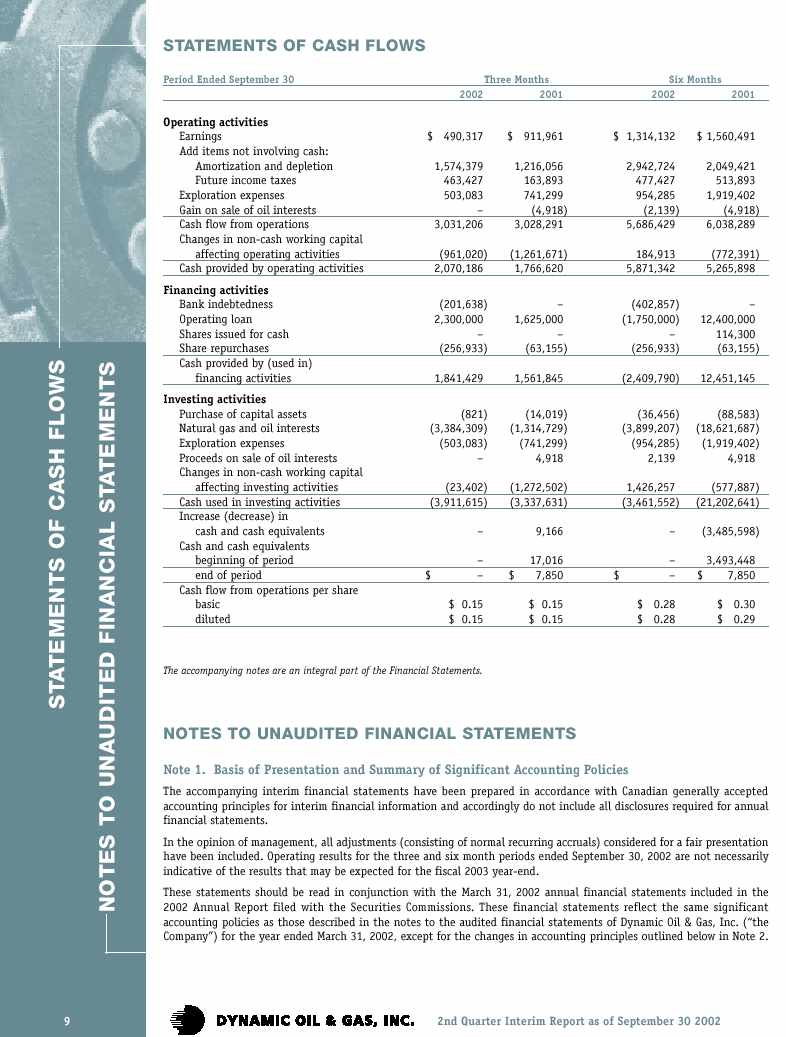

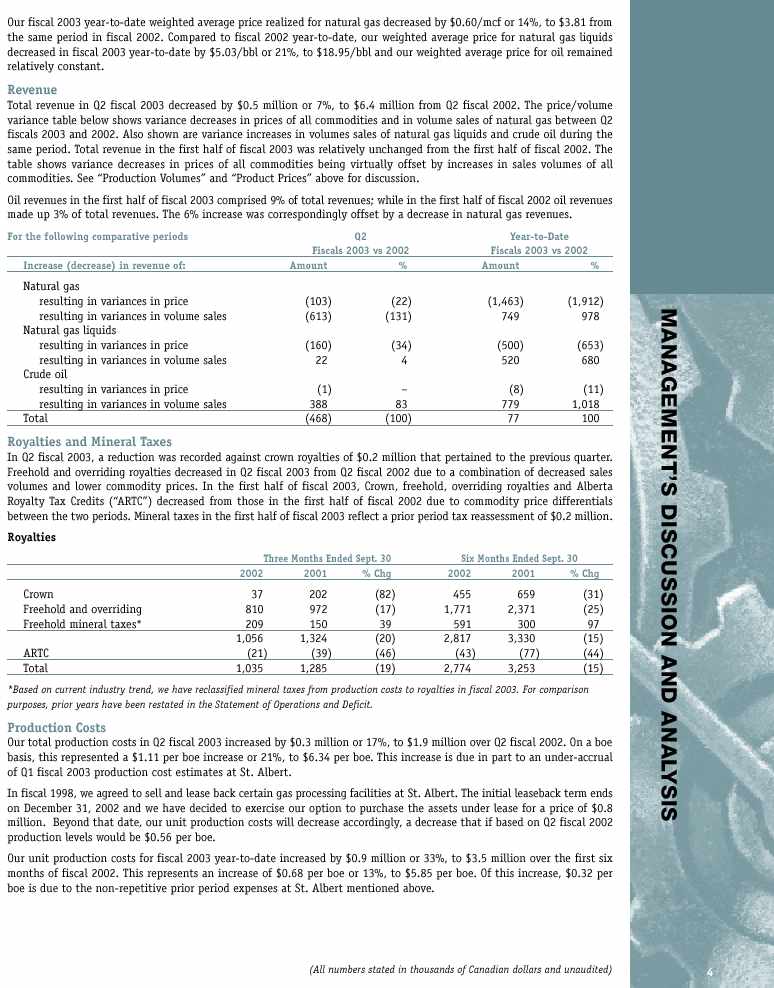

In Q2 fiscal 2003, our cash flow generated from operations was $3.0 million while earnings were $0.5 million. During all of July, natural gas prices were dramatically weaker than in August and September. Combined with the fact that our total production was over 70% natural gas, our cash flows for Q2 fiscal 2003 were lower by approximately $0.3 million. During the quarter, we significantly increased our oil production during a period of strong oil prices. At the close of Q2 fiscal 2003, we utilized $13.0 million of our revolving, demand credit facility, leaving an undrawn balance of $8.0 million available. During the first six months of fiscal 2003, our cash generated from operating activities was sufficient to fund our total capital expenditures and exploration expenses. Our average daily production of natural gas and natural gas liquids, combined, decreased by 240 boe per day (“boe/d”) or 7%, to 3,035 boe/d in Q2 fiscal 2003 compared to Q2 fiscal 2002. This decrease is the net result of production declines of 534 boe/d from Peavey/Morinville and St. Albert, offset by new production of 294 boe/d from Halkirk and Alexander, two fields that were not yet developed a year ago. In Q2 fiscal 2003, a dual-use wellbore used to produce gas at St. Albert from the BQ-A and BQ-B zones was changed to a single-use wellbore that continues to produce only from the BQ-A. The change has not affected total BQ-B reserves, as they continue to be produced from other nearby wellbores. It has, however, decreased BQ-B production by approximately 300 boe/d. Toward the end of Q2 fiscal 2003, a new gas well at Halkirk began producing at an initial average daily rate of 472 mcf per day. In the latter half of fiscal 2003 at Halkirk, we expect to tie in a standing gas well, drill another one and add compression facilities. Our average daily production of crude oil during Q2 fiscal 2003 increased by 121 boe/d or 170%, to 192 boe/d compared to Q2 fiscal 2002. This increase was due to three new St. Albert oil well discoveries coming on stream at various times during the quarter. One of the wells, 06-25, commenced a two-week production test on September 30. Due to the fact the well began producing on the last day of Q2 fiscal 2003, it did not add significantly to the total average daily production of the quarter. However, on that day the well flowed 629 barrels of oil. The two other oil wells, St. Albert 11-25 and 10-36, produced for most of the quarter at daily average rates between 53 and 71 barrels of oil per day. In July, natural gas daily spot prices plummeted to approximately half of their late June levels and by early August, they recovered. The effect of this spot market price drop on our weighted average natural gas price of $3.50 per mcf (“/mcf”) in Q2 fiscal 2003 was softened by our sales into the aggregate market. Comparatively, our weighted average price for Q2 fiscal 2002 was $3.57/mcf. From Q2 fiscal 2002 to Q2 fiscal 2003, our weighted average price for natural gas liquids decreased $2.57 per barrel (“/bbl”) or 12%, to $18.89/bbl and our weighted average price for oil remained relatively constant. Our fiscal 2003 year-to-date weighted average price realized for natural gas decreased by $0.60/mcf or 14%, to $3.81 from the same period in fiscal 2002. From fiscals 2002 to 2003, our year-to-date average price for natural gas liquids decreased by $5.03/bbl or 21%, to $18.95/bbl and our weighted average price for oil remained relatively constant. | |

Dynamic Oil & Gas, Inc. Airport Executive Park Suite 205 – 10711 Cambie Road Richmond, British Columbia Canada V6X 3G5

Tel: 604/214-0550 Toll free: 1-800/663-8072 Fax: 604/214-0551 E-mail: infodynamic@dynamicoil.com Website: www.dynamicoil.com

|

|

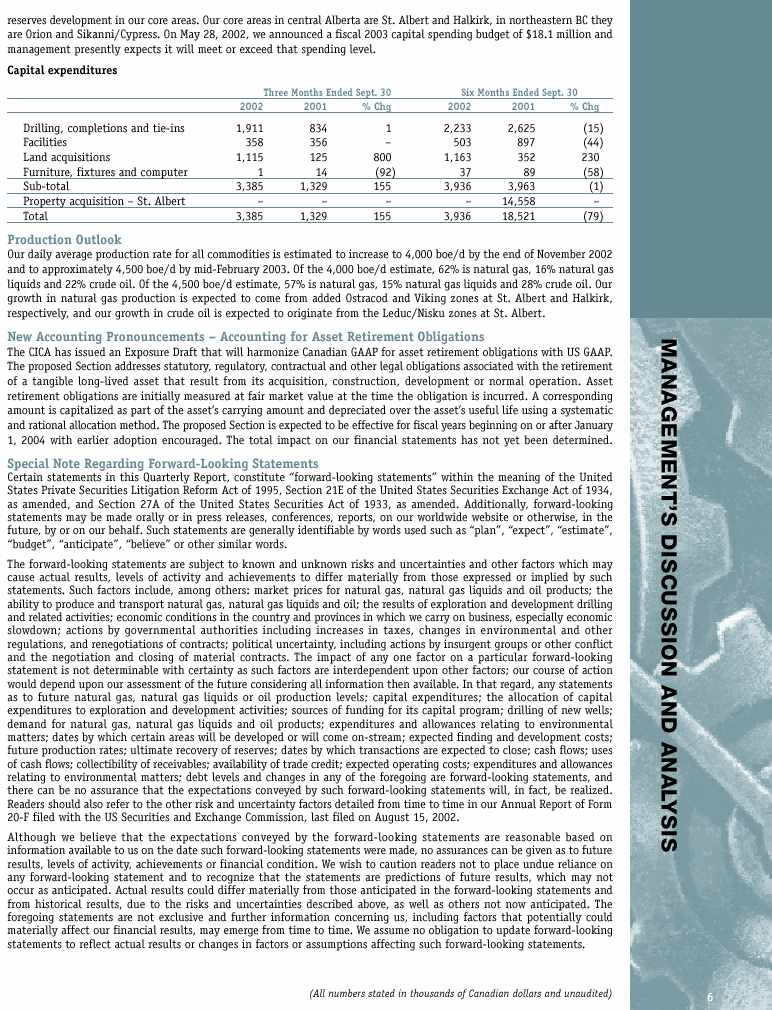

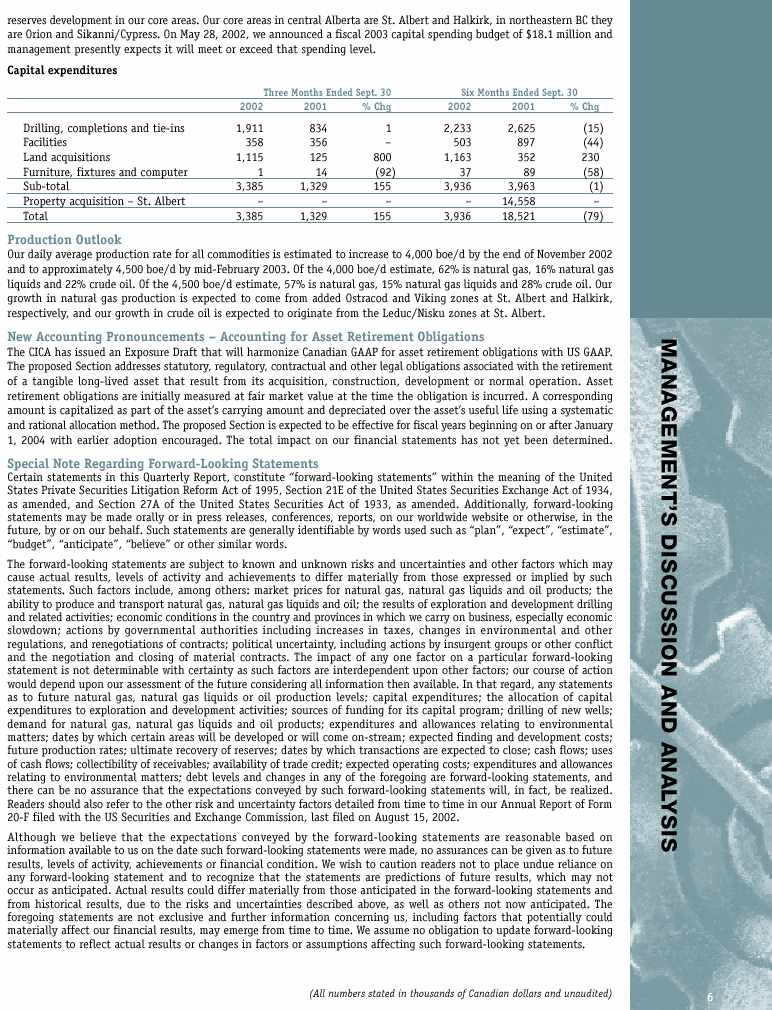

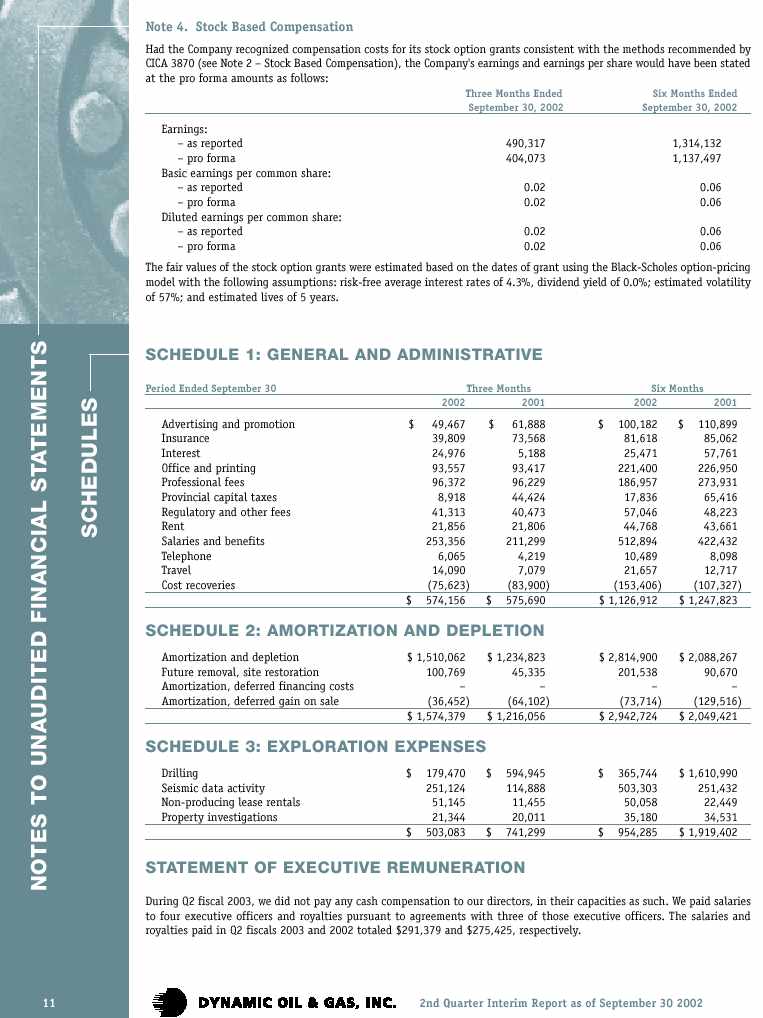

| | During Q2 fiscal 2003, our capital expenditures increased by $2.0 million or 155%, to $3.4 million over Q2 fiscal 2002. Of our total capital expenditures in Q2 fiscal 2003, we incurred 64% for drilling and facilities at St. Albert, 17% at Halkirk, and the balance at Cypress and Orion, BC. In Q2 fiscal 2002, we spent 87% of our total capital expenditures developing the Halkirk property. Apart from $14.7 million spent last year for the acquisition of additional working interests at St. Albert, our level of capital spending remained unchanged in the first six months of fiscal 2003 from the comparable period a year ago. We will continue to focus on exploration activity, production increases, and reserves development in our core areas for the remainder of fiscal 2003. Our core areas in central Alberta are St. Albert and Halkirk, and in northeastern BC they are Orion and Sikanni/Cypress. Dynamic Oil & Gas, Inc. is a Canadian based energy company engaged in the production and exploration of Western Canada’s natural gas and oil reserves. We own working interests in several central Alberta producing properties, and in early-stage exploration properties located in southwestern and northern British Columbia. On Behalf of our Board of Directors, Wayne J. Babcock

President & CEO "THE NASDAQ AND TORONTO STOCK EXCHANGES HAVE NOT REVIEWED NOR ACCEPTED RESPONSIBILITY FOR THE ACCURACY OF THIS RELEASE. SOME OF THE STATEMENTS IN THIS PRESS RELEASE ARE FORWARD-LOOKING STATEMENTS WITHIN THE MEANING OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995. FORWARD LOOKING STATEMENTS INCLUDE ALL PASSAGES CONTAINING VERBS SUCH AS 'AIMS, ANTICIPATES, BELIEVES, ESTIMATES, EXPECTS, HOPES, INTENDS, PLANS, PREDICTS, PROJECTS OR TARGETS' OR NOUNS CORRESPONDING TO SUCH VERBS. FORWARD-LOOKING STATEMENTS ALSO INCLUDE ANY OTHER PASSAGES THAT ARE PRIMARILY RELEVANT TO EXPECTED FUTURE EVENTS OR THAT CAN ONLY BE FULLY EVALUATED BY EVENTS THAT WILL OCCUR IN THE FUTURE. FORWARD LOOKING STATEMENTS IN THIS RELEASE INCLUDE, WITHOUT LIMITATION, UNCERTAINTY RELATING TO THE RATE OF CAPITAL SPENDING AND CREDIT LINE USAGE FOR THE BALANCE OF FISCAL 2003. FORWARD-LOOKING STATEMENTS INVOLVE RISKS AND UNCERTAINTIES, INCLUDING A RISK THAT INITIAL PRODUCTION FROM NEW WELLS WILL CONTINUE AT RATES REPORTED FOR A PERIOD OF AT LEAST ONE YEAR, AND THE OTHER RISKS DETAILED FROM TIME TO TIME IN THE COMPANY'S ANNUAL REPORT ON FORM 20F FILED WITH THE U.S. SECURITIES AND EXCHANGE COMMISSION, LAST FILED ON AUGUST 19, 2002." | |

Dynamic Oil & Gas, Inc. Airport Executive Park Suite 205 – 10711 Cambie Road Richmond, British Columbia Canada V6X 3G5

Tel: 604/214-0550 Toll free: 1-800/663-8072 Fax: 604/214-0551 E-mail: infodynamic@dynamicoil.com Website: www.dynamicoil.com