File No. 0-17551

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report on Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16

Of the Securities Exchange Act of 1934

For the Period of May 14, 2003

DYNAMIC OIL & GAS, INC.

(Registrant’s name)

Airport Executive Park

#205, 10711 Cambie Road

Richmond, B.C.

Canada V6X 3G5

(Address of principal executive offices)

Indicate by check mark whether the Registrant files or will file annual reports under cover of Form 20F or Form 40-F

Indicate by check mark whether the Registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934

If “Yes” is marked, indicate below the file number assigned to the Registrant in connection with Rule 12g3-2(b): Not applicable.

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | Dynamic Oil & Gas, Inc |

| | (Registrant) |

| | |

| | |

| | |

| Dated: 05-14-03 | By: /s/ Mike Bardell |

| | Mike Bardell, Chief Financial Officer & |

| | Corporate Secretary |

-2-

DYNAMIC OIL & GAS, INC.

| Suite 205 - 10711 Cambie Road | Suite 230 - 10991 Shellbridge Way |

| Richmond, British Columbia V6X 3G5 | Richmond, British Columbia V6X 3C6 |

| (Before May 26, 2003) | (After May 26, 2003) |

NOTICE OF ANNUAL GENERAL MEETING

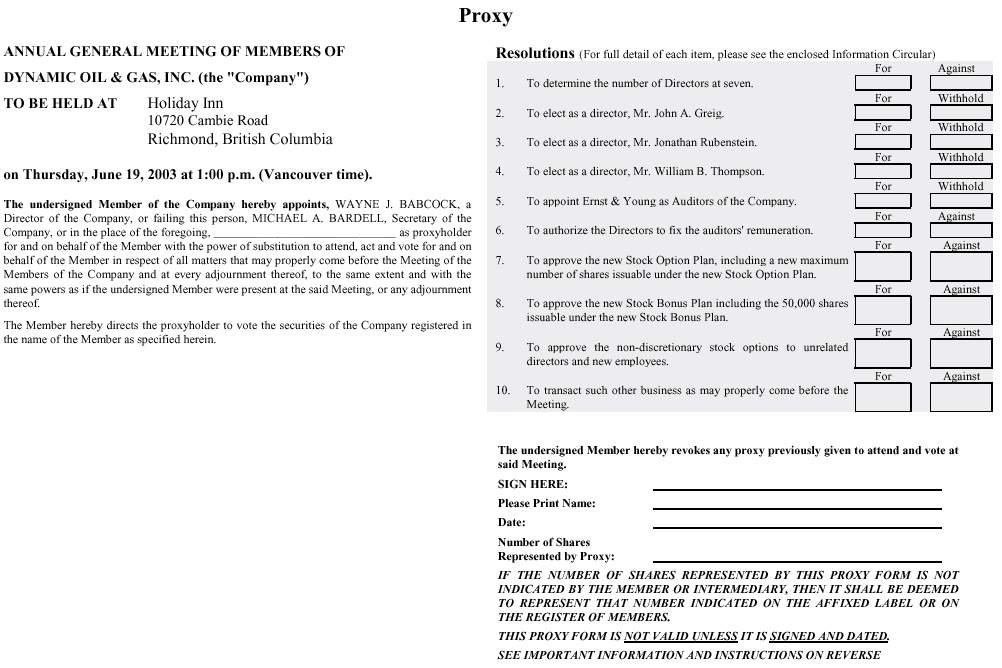

NOTICE IS HEREBY GIVEN THAT the annual general meeting of the members of DYNAMIC OIL & GAS, INC. (the “Company”) will be held at the Holiday Inn, 10720 Cambie Road, Richmond, British Columbia, on Thursday, June 19, 2003, at the hour of 1:00 p.m., Vancouver time, for the following purposes:

1.

| To receive and consider the report of the directors to the members and the financial statements of the Company together with the auditor's report thereon for the financial year ended December 31, 2002. |

| | |

2.

| To fix the number of directors at seven. |

| | |

| 3. | To elect three directors for the ensuing year. |

| | |

| 4. | To appoint the auditor for the ensuing year. |

| | |

| 5. | To authorize the directors to fix the remuneration to be paid to the auditor. |

| | |

| 6. | To adopt and approve the 2003 Stock Option Plan as further described in the accompanying information circular. |

| | |

| 7. | To adopt and approve the 2003 Stock Bonus Plan as further described in the accompanying information circular. |

| | |

| 8. | To approve certain non-discretionary stock options to unrelated directors and new employees. |

| | |

| 9. | To transact such further or other business as may properly come before the meeting and any adjournments thereof. |

The accompanying information circular provides additional information relating to the matters to be dealt with at the meeting and is deemed to form part of this notice.

If you are unable to attend the meeting in person, please complete, sign and date the enclosed form of proxy and return the same in the enclosed return envelope provided for that purpose within the time and to the location set out in the form of proxy accompanying this notice.

DATED this 5th day of May, 2003.

| BY ORDER OF THE BOARD: | /s/ Wayne J. Babcock |

| | WAYNE J. BABCOCK |

| | President, Chief Executive Officer and Director |

DYNAMIC OIL & GAS, INC.

| Suite 205 - 10711 Cambie Road | Suite 230 - 10991 Shellbridge Way |

| Richmond, British Columbia V6X 3G5 | Richmond, British Columbia V6X 3C6 |

| (Before May 26, 2003) | (After May 26, 2003) |

INFORMATION CIRCULAR

(As at May 5, 2003, except as indicated)

This management information circular is furnished in connection with the solicitation of proxies by the management of DYNAMIC OIL & GAS, INC. (the “Company”) for use at the annual general meeting of the Company to be held on Thursday, June 19, 2003 and at any adjournments thereof. The solicitation will be conducted by mail and may be supplemented by telephone or other personal contact to be made without special compensation by officers and employees of the Company. The cost of solicitation will be borne by the Company.

ADVANCE NOTICE OF ANNUAL GENERAL MEETING

Advance notice of the meeting was published in The Vancouver Province newspaper on April 15, 2003 pursuant to Section 111 of theCompany Act of British Columbia. Further disclosure was made as required by National Instrument 54-101.

NOTICE TO BENEFICIAL SHAREHOLDERS

The information set forth in this section is of significant importance to many shareholders, as a substantial number of shareholders do not hold Common shares is their own name. Please read this section carefully.

Only registered Shareholders or duly appointed proxyholders are permitted to vote at the Meeting.Shareholders who do not hold their Common shares in their own name (referred to herein as “Beneficial Shareholders”) are advised that only proxies from Shareholders of record can be recognized and voted at the Meeting.Beneficial Shareholders who complete and return an instrument of proxy must indicate thereon the person (usually a brokerage house) who holds their Common shares as registered Shareholder. Every intermediary (broker) has its own mailing procedure, and provides its own return instructions, which should be carefully followed. The instrument of proxy supplied to Beneficial Shareholders is identical to that provided to registered members. However, its purpose is limited to instructing the registered Shareholder how to vote on behalf of the Beneficial Shareholder.

If Common shares are listed in an account statement provided to a Shareholder by a broker, then in almost all cases those common shares will not be registered in such Shareholder’s name on the records of the Company. Such Common shares will more likely be registered under the name of the Shareholder’s broker or agent of that broker. In Canada, the vast majority of such shares are registered under the name of CDS & Co. (the registration name for the Canadian Depository for Securities, which company acts as nominee for many Canadian brokerage firms). Common shares held by brokers or their nominees can only be voted (for or against resolutions) upon the instructions of the Beneficial Shareholder. Without specific instructions, brokers/nominees are prohibited from voting shares for their clients. The directors and officers of the Company do not know for whose benefit the common shares registered in the name of CDS & Co. are held.

| Dynamic Oil & Gas, Inc. | Information Circular |

| | Page 2 |

|

|

Therefore, each Beneficial Shareholder should ensure that voting instructions are communicated to the appropriate person well in advance of the Meeting.

In accordance with National Instrument 54-101 of the Canadian Securities Administrators, the Company has distributed copies of the Notice of Meeting, this Circular and the Proxy to the clearing agencies and intermediaries for onward distribution to non-registered Shareholders. Existing regulatory policy requires brokers and other intermediaries to seek voting instructions from Beneficial Shareholders in advance of Members’ meetings unless the Beneficial Shareholders have waived the right to receive Meeting materials. Every broker or intermediary has its own mailing procedures and provides its own return instructions, which should be carefully followed by Beneficial Shareholders in order to ensure that their Common shares are voted at the Meeting. Often the form of proxy is supplied to a Beneficial Shareholder by its broker is identical to the form of proxy provided by the Company to the registered Shareholders. However, its purpose is limited to instructing the registered Shareholder how to vote on behalf of the Beneficial Shareholder. Should a non-registered Shareholder receive such a form wish to vote at the Meeting, the non-registered Shareholder should strike out the names of the Management Proxyholders in the form and insert the non-registered Shareholder’s name in the blank provided. The majority of brokers now delegate the responsibility for obtaining instructions from clients to Independent ADP Investor Communications (“ADP”). ADP typically applies a special sticker to the proxy forms, mails those forms to the Beneficial Shareholders and asks Beneficial Shareholders to return the proxy forms to ADP. ADP then tabulates the results of all instructions received and provides appropriate instructions respecting the voting of common shares to be represented at the Meeting.A Beneficial Shareholder receiving a proxy with an ADP sticker on it cannot use that proxy to vote common shares directly at the Meeting - the proxy must be returned to ADP well in advance of the Meeting in order to have the common shares voted. If you have any questions respecting the voting of Common shares held through a broker or other intermediary, please contact that broker or other intermediary for assistance.

All references to Shareholders in this Circular and the accompanying form of Proxy and Notice of Meeting are to Shareholders of record unless specifically stated otherwise.

VOTING SHARES AND PRINCIPAL HOLDERS THEREOF

The Company is authorized to issue 60,000,000 common shares without par value (the “common shares”), of which 21,051,196 common shares are issued and outstanding as at May 5, 2003. The holders of common shares (“shareholders”) are entitled to one vote for each common share held. Holders of common shares of record at the close of business on May 5, 2003 will be entitled to receive notice of and vote at the meeting. The Company has only one class of shares. On all matters to be voted upon that are set out in this Information Circular the motions to pass those matters require only a simple majority of the votes cast in person or by proxy at the meeting voting in favour of the motion.

To the knowledge of the directors and senior officers of the Company, no person beneficially owns, directly or indirectly, or exercises control or direction over shares carrying more than 10% of the voting rights attached to all shares of the Company.

| Dynamic Oil & Gas, Inc. | Information Circular |

| | Page 3 |

|

|

VOTING OF PROXIES

A SHAREHOLDER HAS THE RIGHT TO APPOINT A PERSON (WHO NEED NOT BE A SHAREHOLDER) TO ATTEND AND ACT FOR HIM AND ON HIS BEHALF AT THE MEETING OTHER THAN THE PERSONS DESIGNATED IN THE ACCOMPANYING FORM OF PROXY. TO EXERCISE THIS RIGHT, THE SHAREHOLDER MAY INSERT THE NAME OF THE DESIRED PERSON IN THE BLANK SPACE PROVIDED IN THE PROXY AND STRIKE OUT THE OTHER NAMES OR MAY SUBMIT ANOTHER PROXY. THE SHARES REPRESENTED BY PROXY IN FAVOUR OF MANAGEMENT WILL BE VOTED ON ANY BALLOT (UNLESS OTHERWISE INDICATED ON THE PROXY) IN FAVOUR OF THE MATTERS DESCRIBED IN THE PROXY.

REVOCABILITY OF PROXY

The persons named in the accompanying form of proxy are directors or officers of the Company.

Any shareholder returning the enclosed form of proxy may revoke the same at any time insofar as it has not been exercised. In addition to revocation in any other manner permitted by law, a proxy may be revoked by instrument in writing executed by the shareholder or by his attorney authorized in writing or, if the shareholder is a corporation, under its corporate seal or by an officer or attorney thereof duly authorized, and deposited at the registered office of the Company, at any time up to and including the last business day preceding the day of the meeting, or any adjournment thereof, or with the chairman of the meeting prior to the commencement of the meeting.

ELECTION OF DIRECTORS

The Company will propose at the annual general meeting two resolutions with respect to the election of directors. First, shareholders will be asked to fix the number of directors at seven. Second, shareholders will be asked to consider three nominations for the position of director (of which management’s nominees are listed below). At the annual general meeting held on August 27, 1998, shareholders approved amending the Articles of the Company to provide that approximately one-third of the members of the Board of Directors be elected annually for three year terms. As a result, three directors are to be elected at this annual general meeting for a three-year term. At the 2002 annual general meeting, John Lagadin and David J. Jennings were elected to serve until 2005. At the 2001 annual general meeting, and Donald Umbach and Wayne J. Babcock were elected to serve until 2004. At the 2000 annual general meeting, John A. Greig and Jonathan A. Rubenstein were elected to serve until 2003. In December 2002, William B. Thompson was appointed to the Board of Directors to serve until the next annual general meeting. Directors chosen to fill vacancies on the Board of Directors shall hold office until the next election of the class for which directors shall have been chosen, or until the shareholders duly elect their successors.

| Dynamic Oil & Gas, Inc. | Information Circular |

| | Page 4 |

|

|

Management of the Company proposes to nominate John A. Greig, Jonathan A. Rubenstein and William Thompson for election as directors for a three year term. Information concerning those persons and other directors whose term of office will continue after the annual general meeting, as furnished by those individuals, is as set out in the following table:

|

|

|

|

|

| | | | | Number of |

| | Principal Occupation or | | | Common |

| | employment and, if not a | | | Shares |

| | previously elected | | | beneficially |

| | director, occupation | | Year | owned or, |

| | during the past 5 years | | that | directly or |

| Name, Municipality of Residence | | Previous | Term of | indirectly, |

| and Position | | Service | Office | Controlled(8) |

| | | as a Director | Expires | |

|

|

|

|

|

| WAYNE J. BABCOCK | President and Chief | Since April 11, | 2004 | 839,893 |

| President, Chief Executive Officer | Executive Officer | 1980 | | |

| and Director | | | | |

| Vancouver, B.C. | | | | |

| | | | | |

| DONALD K. UMBACH | Vice-President | Since | 2004 | 417,016 |

| Vice-President and Chief Operating | | August 26, | | |

| Officer, | | 1988 | | |

| Delta, B.C. | | | | |

| | | | | |

| DAVID J. JENNINGS(3) | Barrister and solicitor, | Since August | 2005 | Nil |

| Director | Irwin, White & Jennings | 24, 1999 | | |

| North Vancouver, B.C. | (1999 to present), Partner, | | | |

| | DuMoulin Black (1995-99) | | | |

| JOHN A. GREIG(1) (3) | Geologist, President of | Since July 13, | 2003(5) | 140,377 |

| Director | Redfern Resources Ltd. | 1990 | | |

| Delta, B.C. | | | | |

| | | | | |

| JOHN LAGADIN(4) | Geological Engineer, | Since August | 2005 | Nil |

| Director | President of J.L Transport | 17, 2000 | | |

| Calgary, Alberta | Inc., Independent Business | | | |

| | Man. | | | |

| JONATHAN RUBENSTEIN(1)(2)(3) | Vice-President of | Since July 13, | 2003(6) | 52,363 |

| Director | Corporate Affairs for | 1990 | | |

| Vancouver, B.C. | Sutton Resources Ltd. | | | |

| | | | | |

| WILLIAM B. THOMPSON(1)(2)(4) | Geophysicist and | Since | 2003(7) | Nil |

| Director | Geoscientist Consultant | December 17, | | |

| Kelowna, B.C. | (2001 to 2002) and | 2002 | | |

| | Manager & Vice-President | | | |

| | Petro-Canada (1976 to | | | |

| | 2000) | | | |

| (1) | The Company is required to have an audit committee, of which these persons are members. |

| | |

| (2) | These members qualify as “financial experts” under US regulatory requirements. |

| | |

| (3) | The Company has a corporate governance committee and a compensation committee. These persons are members of both of these committees. |

| Dynamic Oil & Gas, Inc. | Information Circular |

| | Page 5 |

|

|

| (4) | The Company has an audit reserves committee, of which these persons are members. (5) If re-elected, Mr. Grieg would serve until the Annual General Meeting of Year 2006. |

| | |

| (6) | If re-elected, Mr. Rubenstein would serve until the Annual General Meeting of Year 2006. |

| | |

| (7) | If elected, Mr. Thompson would serve until the Annual General Meeting of Year 2006. |

| | |

| (8) | Shares beneficially owned, directly or indirectly, or over which control or direction is exercised, as at May 5, 2003, based upon information furnished to the Company by individual directors. Unless otherwise indicated, such shares are held directly. |

EXECUTIVE COMPENSATION

The Company changed its financial year end from March 31 to December 31 effective December 31, 2002. For reference purposes, the most recently-completed financial reporting period covering the nine-months ended December 31, 2002 will be termed, “Fiscal Transition 2002”.

The following table (presented in accordance with applicable Canadian securities regulations (the “Regulation”) sets forth all annual and long term compensation for services in all capacities to the Company for the three most recently completed financial reporting periods (to the extent required by the Regulation) in respect of each of the individuals comprised of the Chief Executive Officer as at December 31, 2002 and the other four most highly compensated executive officers of the Company as at December 31, 2002 whose individual total compensation for Fiscal Transition 2002 exceeded $100,000 and any individual who would have satisfied these criteria but for the fact that the individual was not serving as an officer at the end of Fiscal Transition 2002 (collectively “the Named Executive Officers”).

Summary Compensation Table

| | | Annual Compensation(1) | Long-Term Compensation | |

| Awards | Payouts |

Name and

Principal

Position | Year(2) | Salary | Bonus | Other Annual

Compensation(3) |

Securities

Under

Options/SARs

Granted(4) | Restricted

Shares or

Restricted

Share Units | LTIP

Payouts(5) | All Other

Compensation |

Wayne J.

Babcock

President,

CEO | Dec. 2002

Mar. 2002

Mar. 2001 | 85,210

112,008

112,008 | Nil

Nil

1,000 | 199,738

318,841

237,239 | 305,000

305,000

387,600 | Nil

Nil

Nil | Nil

Nil

Nil | Nil

Nil

Nil |

Donald K.

Umbach

Vice

President,

COO | Dec. 2002

Mar. 2002

Mar. 2001 | 85,210

112,008

112,008 | Nil

Nil

1,000 | 199,73

318,841

237,239 | 260,000

260,000

362,500 | Nil

Nil

Nil | Nil

Nil

Nil | Nil

Nil

Nil |

David G.

Grohs, | Dec. 2002

Mar. 2002

Mar. 2001 | 102,701

133,875

Nil | 20,250

Nil

Nil | Nil

Nil

Nil | 30,000

Nil

Nil | Nil

Nil

Nil | Nil

Nil

Nil | Nil

Nil

Nil |

| Dynamic Oil & Gas, Inc. | Information Circular |

| | Page 6 |

|

|

| | | Annual Compensation(1) | Long-Term Compensation | |

| Awards | Payouts |

Name and

Principal

Position | Year(2) | Salary | Bonus | Other Annual

Compensation(3) |

Securities

Under

Options/SARs

Granted(4) | Restricted

Shares or

Restricted

Share Units | LTIP

Payouts(5) | All Other

Compensation |

Michael A.

Bardell,

CFO &

Corp. Sect’y | Dec. 2002

Mar. 2002

Mar. 2001 | 74,275

100,000

72,000 | 30,500

33,500

14,500 | Nil

Nil

Nil | 135,000

135,000

241,000 | Nil

Nil

Nil | Nil

Nil

Nil | Nil

Nil

Nil |

James R.

Britton,

Vice

President,

Exploratiom

| Dec. 2002

Mar. 2002

Mar. 2001 | 54,774

72,000

72,000 | Nil

Nil

1,000 | 199,738

318,841

237,239 | 135,000

135,000

166,500 | Nil

Nil

Nil | Nil

Nil

Nil | Nil

Nil

Nil |

(1)(2)

| The Company changed its financial year end from March 31 to December 31 effective December 31, 2002. As a result, the transition year from the old financial year to the new financial year is the nine-month period ended December 31, 2002. “Annual Compensation” amounts for December 2002 cover the nine months of Fiscal Transition 2002 rather than a twelve-month period. |

| | |

(3)

| The Other Annual Compensation paid in each of the past three reporting periods is in respect to payments made to each of the Named Executive Officers pursuant to royalty agreements previously approved by shareholders. The Company pays an overriding royalty interest of 1% of the Company’s share of gross monthly production of all petroleum substances produced or deemed to be produced and marketed from or allocated to each well on all lands acquired by the Company since June 1, 1986 (for two Named Executive Officers) and June 1, 1987 (for the third Named Executive Officer). These amounts include payments made for compensation earned in the current and prior three reporting periods. |

| | |

(4)

| Total number of stock options exercisable by the Named Executive Officers at the end of each reporting period noted. No stock appreciation rights (“SARs”) have been granted by the Company. |

| | |

(5)

| Long-Term Incentive Plan (“LTIP”)- any plan providing compensation intended to serve as incentive for performance to occur over a period longer than one financial year. |

During Fiscal Transition 2002, the Company paid cash compensation to its officers in the aggregate sum of $929,183.

Long Term Incentive Plan (LTIP) Awards

The Company does not have a LTIP pursuant to which cash or non-cash compensation may be paid or distributed by the Company as an incentive for performance.

| Dynamic Oil & Gas, Inc. | Information Circular |

| | Page 7 |

|

|

Option/Stock Appreciation Rights (“SAR”)

Grants during Fiscal Transition 2002

No grants of stock options during Fiscal Transition 2002 were made to any of the Named Executive Officers.

Options/SAR Exercises in Fiscal Transition 2002and Fiscal Transition 2002

Year-End Option/SAR Values

The following table (presented in accordance with the Regulation) sets forth details of all exercises of stock options during Fiscal Transition 2002 by each of the Named Executive Officers, the number of stock options held as at the end of Fiscal Transition 2002 by each of the Named Executive Officers and the value of unexercised in-the-money options/SAR’s on an aggregated basis as at the end of Fiscal Transition 2002.

| Name | Securities

Acquired

on Exercise (#) | Aggregate

Value

Realized ($) | Unexercised

Options/SAR's

at Fiscal Transition

2002

Year-End

(#)(1) Exercisable/

Unexercisable | Value of Unexercised

In-the-Money

Options/SAR's

at Fiscal Transition 2002 Year-End ($)(1)(2) Exercisable/

Unexercisable |

| Wayne J. Babcock | Nil | Nil | 305,000/60,000 | 602,500/124,200 |

| Donald K. Umbach | Nil | Nil | 260,000/60,000 | 508,000/124,200 |

| David G. Grohs | Nil | Nil | 30,000/ 80,000 | 63,600/168,600 |

| Michael A. Bardell | Nil | Nil | 135,000/40,000 | 264,500/82,800 |

| James R. Britton | Nil | Nil | 135,000/30,000 | 264,500/62,100 |

| (1) | As freestanding SARs have not been granted, the numbers relate solely to stock options. |

| | |

| (2) | Value of unexercised in-the-money options calculated using the closing price of common shares of the Company on The Toronto Stock Exchange on December 31, 2002, less the exercise price of in-the-money stock options. |

Option and SAR Repricings

The Company did not reprice any stock options under the Stock Option Plan or otherwise during Fiscal Transition 2002 to each of the Named Executive Officers.

Retirement and Pension Plans

The Company does not provide any retirement or pension plan benefits to its directors or executive officers.

Termination of Employment, Changes in Responsibility and Employment Contracts

As at the end of the Company's Fiscal Transition 2002, the Company had employment contracts with all of the Named Executive Officers. Each of the contracts provides for standard employment provisions including salary, benefits, vacation time, non-competition and confidentiality provisions. In addition, each of the contracts requires the Named Executive

| Dynamic Oil & Gas, Inc. | Information Circular |

| | Page 8 |

|

|

Officer not to voluntarily leave the employ of the Company during actions taken by third parties to acquire control of the Company. If a Named Executive Officer resigns within 6 months of a change of control of the Company for the sole reason that a change of control of the Company has occurred, the Named Executive Officer may receive a severance package including an amount equal to 12 months’ salary and the economic benefit of any stock options then outstanding. If the Named Executive Officer is terminated by the Company without cause, a severance package including an amount equal to 24 months’ salary, the economic benefit of any stock options then outstanding, and certain health and insurance benefits for a period not to exceed 12 months.

Other than the employment contracts described above, the Company had as at the end of Fiscal Transition 2002 no compensatory plan or arrangement in respect of compensation received or that may be received by the Named Executive Officers in the Company's Fiscal Transition 2002 to compensate such executive officers in the event of the termination of employment (resignation, retirement, change of control) or in the event of a change in responsibilities following a change in control, where in respect of the Named Executive Officer the value of such compensation exceeds $100,000.

Compensation Committee

In 1991 the Company established its Compensation Committee (the “Compensation Committee”) for the purpose of considering and making recommendations to the Board of Directors for appropriate compensation packages for the Company’s executive officers and directors. The guiding philosophy of the Compensation Committee in determining compensation for executives has been to provide a compensation package that is flexible, entrepreneurial and geared towards attracting, retaining and motivating executive officers. The policies of the Compensation Committee will encourage performance by executives to enhance the growth and profitability of the Company. Achievement of these objectives will contribute to an increase in shareholder value. The Compensation Committee expects to accomplish this through defining the key components for executive officer compensation, being a base salary comparable to executive salaries in established junior companies, and long-term incentives in the form of stock options. Short-term incentives in the form of a cash bonus could be paid for significant contributions to the Company. In combination, these elements are designed to recognize those activities of management that advance the short and long-term business objectives of the Company. The Compensation Committee meets as required, but not less than annually.

The Compensation Committee consists of three independent outside directors of the Company, namely, Mr. Rubenstein (Chair), Mr. Greig and Mr. Jennings. None of the members of the Compensation Committee have any indebtedness to the Company nor have they any material interest, or have any associates or affiliates which have any material interest, direct or indirect, in any actual or proposed transaction in Fiscal Transition 2002 which has materially affected or would materially affect the Company.

| Dynamic Oil & Gas, Inc. | Information Circular |

| | Page 9 |

|

|

Report of the Compensation Committee

The Compensation Committee met three times during Fiscal Transition 2002. The Company has never provided compensation in the form of any plan providing compensation intended to serve as incentive for performance to occur over a period longer than one financial year or pensions. However, the shareholders previously approved royalty agreements with Named Executive Officers whereby the Company pays annually an overriding royalty interest of 1% of the Company’s share of gross monthly production of all petroleum substances produced or deemed to be produced and marketed from or allocated to each well on all lands acquired by the Company since June 1, 1986 (two Named Executive Officers) and since June 1, 1987 (the third Named Executive Officer). During Fiscal Transition 2002, members of the Compensation Committee recommended, and the Board of Directors approved, the granting of 15,000 options to employees of the Company. There were no option repricings during Fiscal Transition 2002. Also, during Fiscal Transition 2002, the Compensation Committee made no recommendations to the Board to change the level of compensation or the form of compensation for directors, officers or employees.

In 1999 the Compensation Committee retained the services of William M. Mercer Inc. (“Mercer”) of Calgary, Alberta to conduct a thorough executive compensation review. As a result of the Mercer report, the Compensation Committee found that the salary levels of the Company’s executives were “outside and below the ranges of salaries for executives in comparable positions in the peer group of oil and gas producing companies”. On June 30, 1999, the Committee resolved to increase by $40,000, the base salary levels of each of the President and Chief Executive Officer, and the Vice President and Chief Operating Officer. After giving effect to these adjustments, the salary of these three executives would be in the lowest quartile of the peer group of companies. Also on June 30, 1999, the Compensation Committee resolved to increase, the salary levels of three other executive positions by percentages ranging from 43% to 47% over base salary. No subsequent increases, other than cost of living increases, have been made to the salary levels.

The Compensation Committee further resolved that, consistent with the peer group of companies, all the above executive positions would be eligible for discretionary stock option participation.

Jonathan Rubenstein, Chairman

John Greig

David Jennings

| Dynamic Oil & Gas, Inc. | Information Circular |

| | Page 10 |

|

|

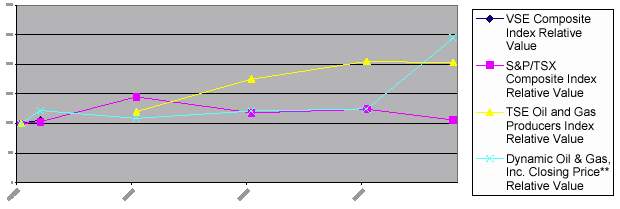

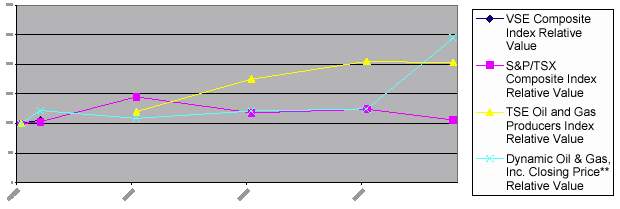

Comparative Shareholder Return Performance Graph

The graph below compares the yearly percentage change in the cumulative total shareholder return on the Company's shares against the cumulative total shareholder return on the VSE Stock Index, the S&P/TSX Composite Index and the TSE Oil and Gas Producers Index from the commencement of the five fiscal reporting periods ended March 31, 1999, 2000, 2001 and 2002 and December 31, 2002 immediately prior to the beginning of Fiscal Transition 2002, assuming a $100 initial investment with all dividends reinvested.

Year

Ended(1) | VSE Composite

Index | S&P/TSX Composite

Index | TSE Oil and Gas

Producers Index | Dynamic Oil &

Gas Closing

Price** |

Index

Value | Relative

Value | Index

Value | Relative

Value | Index

Value | Relative

Value | CAD

$ | Relative

Value |

| Mar. 31, 1999 | 424.72 | 100 | 13,937.91 | 100 | 4,104.43 | 100 | 1.56 | 100 |

| May 26, 1999 | 450.58 | | 14,353.87 | | | | 1.90 | |

| Mar. 31, 2000 | n/a | | 20,277.29 | | 4,938.65 | | 1.70 | |

| Mar. 31, 2001 | n/a | | 16,503.59 | | 7,186.91 | | 1.88 | |

| Mar. 31, 2002 | n/a | | 17,308.41 | | 8,404.05 | | 1.95 | |

| Dec. 31, 2002 | n/a | | 14,782.01 | | 8,341.44 | | 3.82 | |

(1)

| The Company changed its financial year end from March 31 to December 31 effective December 31, 2002. As a result, the transition year from the old financial year to the new financial year is the nine-month period ended December 31, 2002. April 1, 2002 has been used as the year ended date instead of March 31, 2002, as the Toronto Stock Exchange was not open for trading on March 31, 2002. |

| | |

| ** | The price is taken from the Vancouver Stock Exchange until May 26, 1999 and the Toronto Stock Exchange thereafter. On May 26, 1999 the Company commenced trading on the Toronto Stock Exchange and closed trading that day at $1.90. While the Company has traded on the Toronto Stock Exchange only in Canada since May 26, 1999, five year historical data for the S&P/TSX Composite Index and the TSE Oil and Gas Producers Index has been provided for comparison purposes. |

Comparison of Cumulative Total Shareholder Return (“CSR”) on Common Shares of the

Company and the (i) VSE Composite Index, (ii) S&P/TSX Composite Index, and

(iii) TSE Oil and Gas Producers Index

| Dynamic Oil & Gas, Inc. | Information Circular |

| | Page 11 |

|

|

Compensation of Directors

The Company has no arrangements, standard or otherwise, pursuant to which directors are compensated by the Company for their services in their capacity as directors, or for committee participation, involvement in special assignments or for services as consultant or expert during Fiscal Transition 2002 or subsequently, up to and including the date of this Information Circular.

The Company does have a formalized stock option plan for the granting of incentive stock options to the officers, employees and directors. At the 2000 annual general meeting, shareholders approved an amendment to the stock option plan that replaced discretionary grants of options to directors with a predetermined number of options granted twice a year. The Company granted 117,500 stock options to the directors pursuant to the shareholder approved mandatory provisions of the plan during Fiscal Transition 2002.

CORPORATE GOVERNANCE

The Toronto Stock Exchange Committee on Corporate Governance in Canada has issued a series of proposed guidelines for effective corporate governance (the “TSE Report”), and the Toronto Stock Exchange now requires listed companies to disclose their corporate governance system in their annual reports or information circulars.

The Company’s Board of Directors has reviewed the TSE Report and the Company's own corporate governance practices. The Company's policy and practices are compared to the TSE Report in Schedule “A” to this Circular, which indicates and explains differences between the Company's corporate governance system and that set out in the TSE Report.

The present board of directors is composed of 7 directors, 5 of whom would be considered unrelated directors by the TSE Report.

The TSE Report defines a significant shareholder as a shareholder with the ability to exercise a majority of votes for the election of the board of directors. The Company does not have a significant shareholder.

INDEBTEDNESS TO COMPANY OF DIRECTORS, EXECUTIVE OFFICERS AND SENIOR OFFICERS

There is no indebtedness of any director, executive officer, senior officer, proposed nominee for election as a director or associate of them, to or guaranteed or supported by the Company either pursuant to an employee stock purchase program of the Company or otherwise, during the most recently completed financial year other than routine indebtedness.

INTEREST OF INSIDERS IN MATERIAL TRANSACTIONS

No insider or proposed nominee for election as a director of the Company and no associate or affiliate of the foregoing persons has or has had any material interest, direct or indirect, in any transaction since the commencement of the Company's last completed financial year or in any proposed transaction which in either such case has materially affected or will materially affect the Company.

| Dynamic Oil & Gas, Inc. | Information Circular |

| | Page 12 |

|

|

APPOINTMENT OF AUDITOR

Unless otherwise instructed, the proxies given pursuant to this solicitation will be voted for the appointment of Ernst & Young LLP, Chartered Accountants, of Vancouver, British Columbia, as the auditor of the Company to hold office for the ensuing year at a remuneration to be fixed by the directors.

MANAGEMENT CONTRACTS

No management functions of the Company are performed to any substantial degree by a person other than the directors or senior officers of the Company.

INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

Except as set out herein with respect to the grant and amendment of stock options, no director or senior officer of the Company or any proposed nominee of management of the Company for election as a director of the Company, nor any associate or affiliate of the foregoing persons, has any substantial interest, direct or indirect, by way of beneficial ownership or otherwise, in matters to be acted upon at the meeting.

PARTICULARS OF OTHER MATTERS TO BE ACTED UPON

ADOPTION OF A NEW INCENTIVE STOCK OPTION PLAN

At the Company’s 2002 annual general meeting, shareholders adopted an incentive stock option plan to incorporate certain changes as a result of Canadian court decisions on employment issues and stock options plans (the “Current Plan”). Recently, directors proposed changes to the Current Plan that would incorporate the Company’s enhanced corporate governance principles into a new incentive stock option plan (the “New Plan”). These proposed changes are, in the opinion of the independent directors and management, positive for shareholders of the Company. Virtually all of the provisions of the Current Plan are identical to the New Plan, except as summarized below. For full particulars, please refer to the text of the proposed New Plan, a copy of which is available from the Company’s Secretary, Michael A. Bardell, who can be reached by telephone at (604) 214-0550, by telecopier at (604) 214-0551, or by electronic mail at mbar@dynamicoil.com.

Continuing Provisions between Current Plan and New Plan

The Current Plan and the New Plan both are designed to assist the Company in attracting, retaining and motivating directors, officers and employees of the Company and will be administered by the Board of Directors in accordance with the rules and policies of The Toronto Stock Exchange and NASDAQ.

The Current Plan initially authorized and reserved for distribution 2,046,223 common shares, representing that number of shares equal to 10% of the issued and outstanding share capital of the Company in July 2002. If the New Plan is adopted, all of the shares at present under the Current Plan will be incorporated into the New Plan so that no “double-counting” will occur. As of April 30, 2003, there were 1,403,250 options outstanding. The New Plan will initially

| Dynamic Oil & Gas, Inc. | Information Circular |

| | Page 13 |

|

|

authorize and reserve for distribution as stock options 2,055,119 common shares, representing less than 10% of the issued and outstanding share capital of the Company as at the date of the date of this Information Circular. There are 1,403,250 stock options outstanding under the Current Plan, and as a result, shareholders are being asked to approve the listing of an additional 651,869 common shares under the New Plan. Combined with a stock bonus plan (see next section for details) that provides for up to 50,000 common shares to be issued, the maximum number of Bonus Shares issuable under the Bonus Plan and the maximum number of shares issuable under the 2003 Stock Option Plan will in aggregate be 2,105,119 common shares, which is equal to 10% of the issued and outstanding share capital of the Company.

The exercise price for each optioned share will continue to be based on the closing price of the shares of the Company for the trading day immediately preceding the date of the grant of the stock option.

Each option under the Current Plan expires on the earlier of (i) 30 days after the optionee ceases to be a person qualified to receive an option, if as a result of early retirement, voluntary resignation or termination other than for cause; (ii) immediately upon the optionee ceasing to be a person qualified to receive an option, if as a result of termination for cause; (iii) ten years from the date the option is granted (although such term is at present reduced to five years pursuant to the existing policy of the Board of Directors with respect to options granted to inside directors, officers and employees); and (iv) 365 days after the optionee dies, retires in accordance with the Company's retirement policy or is permanently disabled.

Under the New Plan, management proposes that the expiration date for stock options granted after the adoption of the New Plan be reduced from ten (10) years to the earlier of five (5) years and three (3) years after the director, officer or employee ceases to be a director, officer or employee of the Company, for whatever reason. Under the New Plan, any option issued will not expire until the end of the original term of the option, notwithstanding that the holder of the option has ceased to be a person qualified to receive an option by virtue of early retirement, voluntary resignation, termination other than for cause, termination for cause or the death of the optionee.

The options granted under the Current Plan and the New Plan may vest over time as determined by the Board of Directors. If a change of control of the Company occurs, the vesting provisions may, in certain circumstances, be deemed to have been satisfied and the options deemed to have been vested. The number of options granted may adjust if any share reorganization, special distribution or corporate reorganization occurs, subject to the approval of The Toronto Stock Exchange.

Under the Current Plan and the New Plan, the Board of Directors is entitled to suspend, terminate or discontinue the incentive plan or amend or revise the terms of the incentive plan, subject to the approval, in certain circumstances, of The Toronto Stock Exchange and the shareholders of the Company. Under the New Plan, the Board of Directors may delegate their responsibilities to administer the New Plan to a Committee of independent directors.

The maximum number of shares available to any one optionee under the Current Plan and the New Plan is 5% of the outstanding shares of the Company.

Benefits of the New Plan

| Dynamic Oil & Gas, Inc. | Information Circular |

| | Page 14 |

|

|

Change of Expiration Date of Options

Under the New Plan, the maximum expiration date for stock options will be reduced from the current ten (10) years to the earlier of five (5) years and three (3) years after the director, officer or employee ceases to be a director, officer or employee of the Company. The Company’s independent directors and management believe that reducing the number of years an option may remain outstanding will provide even greater incentive to optionholders to maximize shareholder value within the 5 year term of the options. As well, it is important that optionholders be rewarded for their efforts and not those of optionholders several years later.

In addition, the Company’s independent directors and management believe that having accelerated expiration dates that are within 30 days after a director, officer or employee ceases to be a director, officer or employee is unfairly prejudicial to the optionholder, the Company and the shareholders. Many employees may elect not to leave their employment with the Company until a later date when they are not subject to blackout periods. Likewise, the Company may not be able to terminate non-productive employees during a blackout period without incurring substantial legal damages for such termination. A blackout period is an interval of time in which employees may not trade in securities of the Company because they may be in possession of insider information. If an optionholder were to retire, resign or be terminated during a blackout period, or a blackout period occurred during the 30-day period, that individual would be unable to exercise their options without breaching securities laws. Such changes would only apply to stock options granted after the adoption of the New Plan.

Delegation to a Committee

Under the New Plan, the Board of Directors may delegate their responsibilities for the administration of the New Plan to a Committee of independent directors. While the Board will retain independent and concurrent power to administer the New Plan, the Committee of independent directors will administer the New Plan within the framework of corporate governance principles established by the Company. The independent directors and management believe this is of benefit because it will enable the Committee to make grants of stock options and the issuance of bonus shares independent of management and non-independent directors.

| Dynamic Oil & Gas, Inc. | Information Circular |

| | Page 15 |

|

|

Recommendation

Shareholders of the Company will be asked to pass an ordinary resolution in the following terms:

“RESOLVED, that the (i) “2003 Incentive Stock Option Plan”, the form of which has been made available to the Company’s Shareholders, including the number of shares, subject to the 2003 Incentive Stock Option Plan of 2,055,119 be adopted and approved by the Company, and that all grants of stock options by the Company occurring on or after June 19, 2003, be pursuant to the “2003 Incentive Stock Option Plan” and that no further grants of stock options by the Company be pursuant to the 2002 Stock Option Plan adopted by the Company in 2002, and (ii) an additional 651,869 common shares be approved for listing on the Toronto Stock Exchange.”

ADOPTION OF AN INCENTIVE STOCK BONUS PLAN

Directors have also proposed that the Company adopt an incentive stock bonus plan separate from the 2003 Incentive Stock Option Plan which would also incorporate enhanced corporate governance principles (the “Bonus Plan”). The Bonus Plan is, in the opinion of the independent directors and management, positive for shareholders of the Company. As part of a complete compensation package, the Company believes that the issuance of bonus shares to those directors, officers and employees who provide extraordinary contributions reflects a share compensation arrangement that further ties the interests of shareholders and directors, officers and employees. Many companies have chosen to adopt this compensation method as a complement to an effective incentive stock option plan.

Under the Bonus Plan, directors, officers and employees who are deemed to have provided extraordinary contributions to the Company will be eligible to receive grants of common shares of the Company (the “Bonus Shares”) as determined by the independent directors. Bonus Shares will be awarded based upon the review of the performance of the director, officer or employee, and the Bonus Shares will be granted as compensation for that performance by the eligible director, officer or employee. The material aspects of the Bonus Plan are as follows:

The Bonus Plan will provide for a total of 50,000 Bonus Shares in the aggregate to be issued to eligible directors, officers or employees.

The issue price for each Bonus Share will also be based on the closing price of the shares of the Company for the trading day immediately preceding the date of the issue of the Bonus Shares.

The maximum number of Bonus Shares and options under the 2003 Incentive Stock Option Plan available to any one eligible director, officer or employee under the Bonus Plan and the 2003 Incentive Stock Option Plan is 5% of the outstanding shares of the Company.

The maximum number of Bonus Shares issuable under the Bonus Plan and the maximum number of shares issuable under the 2003 Stock Option Plan will in aggregate be 2,046,223 common shares, which is equal to the number of common shares issuable under the 2002 Stock Option Plan.

| Dynamic Oil & Gas, Inc. | Information Circular |

| | Page 16 |

|

|

Recommendation

The independent directors believe that the adoption of a limited share bonus plan would result in less dilution for shareholders than otherwise would occur if only stock options were provided as incentives. A number of shareholder groups have encouraged the use of stock bonus plans to reward past behaviour, particularly as generally fewer number of shares are issued as part of a stock bonus plan than stock options under a stock option plan. The independent directors would award these bonus shares based on past activities that have added extraordinary value to the Company.

The Company’s independent directors and management also believe that allowing for Bonus Shares will provide a greater incentive to directors, officers and employees to maximize shareholder value, since directors, officers and employees who receive Bonus Shares will earn Bonus Shares on the basis of an assessment of their direct contribution to the Company.

Policies of the Toronto Stock Exchange require that the 2003 Incentive Stock Bonus Plan be approved by a majority of the votes cast at the shareholders’ meeting other than votes attaching to shares beneficially owned by insiders of the Company and their associates.

Shareholders of the Company will be asked to pass an ordinary resolution in the following terms:

“RESOLVED, that the “2003 Incentive Stock Bonus Plan”, the form of which has been made available to the Company’s Shareholders, including the number of shares, subject to the 2003 Stock Bonus Plan of 50,000 be adopted and approved by the Company, and that all grants of bonus shares by the Company occurring on or after June 19, 2003, be pursuant to the “2003 Stock Bonus Plan”.”

APPROVAL OF NON-DISCRETIONARY AND OTHER OPTIONS

Under the Current Plan, independent directors of the Company receive non-discretionary grants of options upon first election and thereafter annually upon their anniversary of election. In addition, independent directors receive options annually on April 30 for serving as chairpersons or members of standing committees. These non-discretionary grant provisions were approved and adopted by shareholders at the 2000 Annual General Meeting. At that meeting, shareholders considered the following in approving the adoption of non-discretionary grant provisions:

Fairvest Securities Corporation, a company that reviews compensation plans for institutional investor clients, had indicated that it generally favours non-discretionary grants as avoiding issues of “self-dealing”

A number of major Canadian companies have plans in place with similar provisions

Management of the Company believes that non-discretionary grants of options for independent directors are of benefit to the Company to enhance their independence from management, since the grants of options need not be recommended by management. As of April 30, 2003, the Company was obligated under the Current Plan to issue 107,500 non-discretionary options. However, the Current Plan does not have enough shares reserved for issuance available for

| Dynamic Oil & Gas, Inc. | Information Circular |

| | Page 17 |

|

|

grants to permit these non-discretionary grants to occur. Under the Current Plan, where there are insufficient options available for grant, these non-discretionary options are required to be delayed until such time as options are available. However, the Company is seeking the approval of shareholders for these non-discretionary grants at this time in order to support the independence of the independent directors (referred to as “unrelated directors” under the policies of the Toronto Stock Exchange).

In addition, the Company is also seeking the approval of shareholders for the grant by the Company of options to purchase an additional 58,193 common shares issued to a new director and new employees of the Company. Since 2002, the Company has added five new employees, mostly in the areas of production and administration. New hires by the Company require that the Company issue new stock options however, as discussed above, under the Current Plan, the number of shares reserved for issuance is insufficient to permit these grants to occur without shareholder approval, and as a result, these grants were made subject to the approval of shareholders. The Company believes that the addition of these new employees if of benefit to the Company and as a result, is seeking the approval of shareholders for the grants of options to new employees.

The non-discretionary options and the additional employee options would be included in the common shares issuable under the new 2003 Incentive Stock Option Plan and would not increase the number of shares issuable under that plan. The Company is seeking the approval of a resolution on the following terms:

Policies of the Toronto Stock Exchange require that the non-discretionary options and the additional employee options be approved by a majority of the votes cast at the shareholders’ meeting other than votes attaching to shares beneficially owned by insiders of the Company and their associates to whom options will be issued as part of the non-discretionary options and the additional employee options.

Shareholders of the Company will be asked to pass an ordinary resolution in the following terms.

“RESOLVED that the 165,693 non-discretionary stock option grants to unrelated directors and committee members and new employees are hereby approved and authorized.”

OTHER MATTERS

Management of the Company is not aware of any matter to come before the meeting other than as set forth in the notice of meeting. If any other matter properly comes before the meeting, it is the intention of the persons named in the enclosed form of proxy to vote the shares represented thereby in accordance with their best judgment on such matter.

DATED this 5th day of May, 2003.

| BY ORDER OF THE BOARD: | |

| |

|

| | WAYNE J. BABCOCK |

| | President, Chief Executive Officer and Director |

SCHEDULE “A”

| | | | Does the | |

| | | TSE Corporate Governance | Company | |

| | | Committee Guidelines | Align? | Comments |

|

|

|

|

|

| | | | | |

| 1 | | Board of Directors should | | |

| | | explicitly assume responsibility | | |

| | | for the stewardship of the | | |

| | | corporation and specifically | | |

| | | for: | | |

| | a. | Adoption of a strategic | Yes | The Company actively manages a portfolio of oil and gas |

| | | planning process. | | properties in Western Canada. The Company reviews on an |

| | | | | ongoing basis new and existing properties for the purpose of |

| | | | | efficiently allocating Company resources and maximizing returns |

| | | | | from production. The Company’s strategy has been to focus on a |

| | | | | number of specific projects in Western Canada. The Company’s |

| | | | | strategy is under constant review by the Board of Directors and |

| | | | | senior management. |

| | | | | |

| | b. | Identification of specific risks | Yes | The Audit Committee and the Board of Directors in conjunction |

| | | and implementing risk | | with the Company’s auditors will regularly review the |

| | | management systems. | | Company’s principal operational and strategic risks and will |

| | | | | develop any additional appropriate risk management systems |

| | | | | deemed necessary. The Company has contracts and insurance to |

| | | | | limit its operational liabilities and has used long-term sales |

| | | | | contracts to address fluctuations in commodity prices. |

| | | | | |

| | c. | Succession planning and | Yes | The Board of Directors has active directors. It appoints or |

| | | monitoring senior management. | | proposes to the shareholders that they elect appropriately skilled |

| | | | | members to the Board of Directors. The reporting structure |

| | | | | contemplates senior management reporting to the CEO and the |

| | | | | CEO reporting to the Board. All of senior management regularly |

| | | | | attend and report to the Board of Directors. To date, no formal |

| | | | | training or monitoring processes for directors have been |

| | | | | considered necessary but will be considered as the Company |

| | | | | grows. |

| | | | | |

| | d. | Communications policy. | Yes | The Board of Directors has ensured that the Company has |

| | | | | effective communication with its shareholders and the public. |

| | | | | The Company provides appropriate disclosure of all material |

| | | | | information as required by law. All material press releases are |

| | | | | reviewed by legal counsel. The Company has had and has |

| | | | | specific people responsible for investor relations. |

| | | | | |

| | e. | Integrity of internal control and | Yes | The Board of Directors and the Audit Committee regularly |

| | | management of information | | review the adequacy of the Company’s internal controls. Internal |

| | | systems. | | controls and management of information are regularly upgraded |

| | | | | as is required for the Company’s continuing and growing |

| | | | | operations. |

| Dynamic Oil & Gas, Inc. | Information Circular |

| | Page 19 |

|

|

| | | | Does the | |

| | | TSE Corporate Governance | Company | |

| | | Committee Guidelines | Align? | Comments |

|

|

|

|

|

| 2 | . | Majority of directors should be | Yes | The majority of the Board of Directors are independent from |

| | | “unrelated” (independent of | | management and free from any interest, business or other |

| | | management). | | relationship that could, or could reasonably be perceived to, |

| | | | | materially interfere with the director’s ability to act in the best |

| | | | | interests of the Company. |

| | | | | |

| 3 | . | Disclose for each director | Yes | Wayne Babcock and Don Umbach are members of senior |

| | | whether he or she is related, | | management and are the only Board Members who are related. |

| | | and how that conclusion was | | David Jennings is a member of a law firm that provides legal |

| | | reached. | | services to the Company, but that position does not interfere with |

| | | | | his ability to act with a view to the best interests of the Company |

| | | | | and as such is independent of the Company. John Greig, John |

| | | | | Lagadin, Jonathan Rubenstein and William Thompson are also |

| | | | | unrelated. |

| | | | | |

| 4 | .a. | Appoint a committee | Yes | The Corporate Governance Committee has the mandate to: |

| | | responsible for | | (a) annually recommend candidates for the Board of Directors; |

| | | appointment/assessment of | | (b) review credentials of nominees for election; |

| | | directors. | | (c) recommend candidates for filing vacancies on the Board of |

| | | | | Directors; and |

| | | | | (d) ensure qualifications are maintained. |

| | | | | |

| | b. | Composed exclusively of | Yes | The Corporate Governance Committee is comprised of Mr. |

| | | outside, non-management | | Greig, Mr. Jennings and Mr. Rubenstein. |

| | | directors, the majority of whom | | |

| | | are unrelated. | | |

| | | | | |

| 5 | . | Implement a process for | Yes | The Corporate Governance Committee is mandated to monitor |

| | | assessing the effectiveness of | | the quality of the relationship between management and the |

| | | the board of directors, its | | Board of Directors and to assess the effectiveness of the Board of |

| | | committees and individual | | Directors, its committees and individual directors, and |

| | | directors. | | recommend improvements. The assessment process is ad-hoc. |

| | | | | Given the small size of the Board of Directors, performance of |

| | | | | the directors as members of the Board of Directors and its |

| | | | | Committees is readily apparent. |

| | | | | |

| 6 | . | Provide orientation and | Yes | While there is no formal program, the Company’s operations are |

| | | education programs for new | | regularly reviewed at meeting of the Board of Directors. |

| | | directors. | | |

| | | | | |

| 7 | . | The board of directors should | Yes | The present number of directors is seven, which allows both the |

| | | examine its size and where | | COO and CEO as directors while at the same time having a |

| | | appropriate reduce the number | | majority of the directors independent of the Company. |

| | | of directors, with a view to | | |

| | | improving effectiveness. | | |

| | | | | |

| 8 | . | Review compensation of | Yes | The current policy is not to compensate any directors. The |

| | | directors to reflect risk and | | Compensation Committee intends to develop a policy regarding |

| | | responsibility. | | compensation levels for independent directors. Management |

| | | | | members of the Board of Directors will not be compensated as |

| | | | | directors. |

| Dynamic Oil & Gas, Inc. | Information Circular |

| | Page 20 |

|

|

| | | | Does the | |

| | | TSE Corporate Governance | Company | |

| | | Committee Guidelines | Align? | Comments |

|

|

|

|

|

| 9 | | Committees should generally | Yes | All committees are composed exclusively of unrelated directors. |

| | | be composed of non- | | |

| | | management directors. | | |

| 10 | | Assign a committee responsible | Yes | The Corporate Governance Committee is generally mandated to |

| | | for approach to Corporate | | be responsible for developing policies and implementing |

| | | Governance. | | procedures as approved by the Board of Directors. |

| 11 | | Define limits to management's | | |

| | | responsibilities by developing | | |

| | | mandates for: | | |

| | | | | |

| | a. | the board of directors. | Yes | The Board of Directors principal responsibilities are: to plan and |

| | | | | approve corporate strategies and goals; to ensure effective |

| | | | | communications systems are in place among the Company, its |

| | | | | shareholders and the public; to supervise and evaluate |

| | | | | management, including the establishment of executive |

| | | | | limitations; to provide oversight of the conduct of the business; |

| | | | | and to monitor organizational performance against those goals |

| | | | | and executive limitations to derive balanced judgments about |

| | | | | issues confronting the Company from time to time. |

| | | | | |

| | b. | the Chief Executive Officer. | Yes | The CEO’s objectives include the general mandate to maximize |

| | | | | shareholder value and to fulfill strategic plans of the Company. |

| | | | | The CEO is also required to formulate and propose to the |

| | | | | directors the various strategies regarding exploration, |

| | | | | development and future acquisitions. As a key force in the |

| | | | | Company’s business, the CEO has no limits to his mandate but |

| | | | | does regularly report to, and when appropriate seek approval |

| | | | | from, the Board of Directors. The Board of Directors is in the |

| | | | | process of prescribing financial authorization for the CEO and |

| | | | | other senior management which will serve as a financial control |

| | | | | of the Company. |

| | | | | |

| | c. | board of directors should | Yes | The Board of Directors is active in the regular reviews of the |

| | | approve Chief Executive | | Company’s strategic plan including corporate objectives. |

| | | Officer's corporate objectives. | | |

| | | | | |

| 12 | | Establish structures and | No | The Board of Directors is aware of the need for it to function |

| | | procedures to ensure the board | | independently of management. All the committees of the Board |

| | | of directors can function | | are, at present, comprised only of directors independent of |

| | | independently of management. | | management and the Board will establish further independent |

| | | | | committees when independent functions are required. At present |

| | | | | the Chairman’s function is only to call for and chair meetings of |

| | | | | the Board and shareholders. If the Chairman is to be mandated |

| | | | | with executive functions, then the Board will consider appointing |

| | | | | an independent chairman at that time. |

| Dynamic Oil & Gas, Inc. | Information Circular |

| | Page 21 |

|

|

| | | | Does the | |

| | | TSE Corporate Governance | Company | |

| | | Committee Guidelines | Align? | Comments |

|

|

|

|

|

| 13 | .a. | Establish an Audit Committee | Yes | The Audit Committee is mandated to (i) assist the board of |

| | | with a specifically defined | | directors in fulfilling its fiduciary responsibilities relating to |

| | | mandate. | | accounting and reporting practices and internal controls, (ii) |

| | | | | review audited financial statements and management’s |

| | | | | discussion and analysis of operations with the auditors, (iii) |

| | | | | review the annual report and all interim reports of the auditors, |

| | | | | (iv) ensure that no restrictions are placed by management on the |

| | | | | scope of the auditor's review and examination of the Company's |

| | | | | accounts and (v) recommend to the board of directors the firm of |

| | | | | auditors to be nominated by the board for appointment by the |

| | | | | shareholders at the annual general meeting. |

| | | | | |

| | b. | All members should be non- | Yes | As stated above, all members of the audit committee are |

| | | management directors. | | unrelated directors. |

| | | | | |

| 14 | . | Implement a system to enable | Yes | The Board of Directors has formalized a process to enable |

| | | individual directors to engage | | individual directors to engage outside advisors, at the Company’s |

| | | outside advisors at the | | expense, with the authorization of the Corporate Governance |

| | | Company’s expense. | | Committee. As is noted above, the Audit Committee is |

| | | | | encouraged to speak directly with the Company’s external |

| | | | | auditors on matters pertaining to its mandate. |

ANNUAL RETURN CARD FORM

(REQUEST FOR INTERIM FINANCIAL STATEMENTS)

| TO: | REGISTERED AND NON-REGISTERED SHAREHOLDERS |

| | OFDYNAMIC OIL & GAS, INC. (the “Company”) |

| | CUSIP NO. 267906 10 5 |

Shareholders may elect annually to have their name added to an issuer’s SUPPLEMENTAL MAILING LIST in order to receive interim financial statements of the Company. If you are interested in receiving such statements or other selective shareholder communications, please complete, sign and mail this form the CIBC Mellon Trust Company, Suite 1600 - 1066 West Hastings Street, Vancouver, British Columbia, V6E 3X1

| Name of Registered/ | | Address: |

| Non-Registered Shareholder: | | |

| | | |

| | | |

| ______________________________________ | | ______________________________________ |

| (Please print) | | |

| | | ______________________________________ |

| | | |

| Signature: ______________________________ | | Postal/Zip Code: _________________________ |

| | | |

| Date: _______________, 2003 | | |

I CERTIFY THAT I AM A REGISTERED / NON-REGISTERED

(please circle which one)

SHAREHOLDER OF DYNAMIC OIL & GAS, INC.

***************************

DYNAMIC OIL & GAS, INC. IS A RAPIDLY GROWING, TSX

AND NASDAQ SMALL CAP, NATURAL GAS AND CRUDE OIL ENERGY

COMPANY WITH A STRONG POSITION IN WESTERN CANADA.

| ABBREVIATIONS |

| bbl or bbls | barrel or barrels |

| mcf | thousand cubic feet |

| bbl/d | barrels per day |

| mcf/d | thousand cubic feet per day |

| mbbl | thousand barrels |

| mmcf | million cubic feet |

| boe | barrels of oil equivalent (6 mcf = 1 bbl) |

| mmcf/d | million cubic feet per day |

| boe/d | barrels of oil equivalent per day |

| NGL’s | natural gas liquids |

| mboe | thousand barrels of oil equivalent |

In 2003, North America will need 25.6 trillion cubic feet of natural gas to heat homes and fuel industry. Almost 7% of the total energy consumed is used by the Internet.

In 2002, U.S. natural gas production history shows an average 29% decline rate. Almost half of total current production is coming from wells less than five years old.

In 2003, North America will consume 22.3 million barrels of oil per day. The U.S. will import 10.7 million barrels per day or 53% of their total consumption.

Dynamic’s market cap increased by 103% to $81.1 million, based primarily on the December 31, 2002 market price.

5

2002 HIGHLIGHTS

Our last annual report covered the twelve-month period ended March 31, 2002. Since then, we changed our fiscal year end to December 31. This report covers the nine-month transition period ended December 31, 2002.

| | Nine Months | | Twelve Months | | | | | |

| | Ended Dec 31 | | Ended Mar 31 | | | | | |

| | 2002 | | 2002 | | Change | | % Change | |

|

|

|

|

|

|

|

|

|

| | | | | | | | | |

| Operations | | | | | | | | |

| Daily production | | | | | | | | |

| Natural gas (mcf/d) | 14,174 | | 15,107 | | (933 | ) | (6 | ) |

| Natural gas liquids(bbls/d) | 698 | | 631 | | 67 | | 11 | |

| Crude oil(bbls/d) | 271 | | 76 | | 195 | | 257 | |

| All products(boe/d) | 3,332 | | 3,225 | | 107 | | 3 | |

| Total annual production(mboe) | 916 | | 1,177 | | (261 | ) | (22 | ) |

|

|

|

|

|

|

|

|

|

| | | | | | | | | |

| Prices – weighted average | | | | | | | | |

| Natural gas($/mcf) | 4.36 | | 3.81 | | 0.55 | | 14 | |

| Natural gas liquids($/bbl) | 20.90 | | 19.30 | | 1.60 | | 8 | |

| Crude oil($/bbl) | 41.40 | | 34.33 | | 7.07 | | 21 | |

| Corporate netback($/boe) | 14.59 | | 12.08 | | 2.51 | | 21 | |

|

|

|

|

|

|

|

|

|

| | | | | | | | | |

| Reserves – proved plus probable additional | �� | | | | | | | |

| Natural gas(mmcf) | 43,285 | | 44,740 | | (1,455 | ) | (3 | ) |

| Natural gas liquids(bbls) | 1,779 | | 1,905 | | (126 | ) | (7 | ) |

| Crude oil(bbls) | 2,288 | | 553 | | 1,735 | | 314 | |

| Total(boe) | 11,281 | | 9,915 | | 1,366 | | 14 | |

|

|

|

|

|

|

|

|

|

| | | | | | | | | |

| Undeveloped land | | | | | | | | |

| Net acres | 110,745 | | 69,162 | | 41,583 | | 60 | |

|

|

|

|

|

|

|

|

|

| | | | | | | | | |

| Financial ($ thousands) | | | | | | | | |

| Gross revenues | 24,123 | | 26,402 | | (2,279 | ) | (9 | ) |

| Cash flow from operations1 | 10,723 | | 11,337 | | (614 | ) | (5 | ) |

| Per common share | 0.53 | | 0.55 | | – | | (4 | ) |

| Earnings (loss) | 1,978 | | (3,519 | ) | 5,497 | | 156 | |

| Per common share | 0.10 | | (0.17 | ) | – | | 159 | |

| Capital expenditures | 12,578 | | 22,111 | | (9,533 | ) | (43 | ) |

| Operating loan | 11,075 | | 14,750 | | (3,675 | ) | (25 | ) |

| Common shares outstanding | | | | | | | | |

| Basic | 20,357,153 | | 20,365,031 | | (7,878 | ) | – | |

| Diluted | 20,554,231 | | 20,466,543 | | 87,688 | | – | |

|

|

|

|

|

|

|

|

|

- Cash flow from operations = “Cash provided by operating activities” plus “Changes in non-cash working capital affecting operating activities” in the Statements of Cash Flows. Cash flow from operations is a non-GAAP measure that does not have standardized meaning as prescribed by GAAP and is therefore unlikely to be comparable to similar measures presented by other companies. We consider it a key measure as it demonstrates our ability to generate cash flow necessary to fund future growth through capital investment and to repay debt.

DYNAMIC OIL & GAS, INC. ANNUAL REPORT DECEMBER 31, 2002

6

PRESIDENT'S MESSAGE

In my mind, the word that best describes the nine-month period ended December 31, 2002 ischange. Some changes have been small and may even seem insignificant; others will have a lasting effect on our company and how we do business.

Some of the pressure for changes has come from outside the Company – from analysts, brokers and shareholders. Other changes have been driven internally as we strive to add value and become a larger, more efficient company.

Most of you know that we changed our corporate fiscal year end to December 31st from March 31st – an importantchangethat parallels a wide majority of our peer group companies and allows for more ready comparison. We welcome this kind of attention and believe it can add value to our Company.

Anotherchangehas been in the area of reserve evaluations. During this nine-month period, we hired Sproule Associates Limited of Calgary, Alberta to evaluate our reserves. Sproule is considered one of the top oil and natural gas evaluation firms in North America and we believe their certification of our reserves is an added benefit to our shareholders.

We have increased our staff over the past few months, from 11 employees at the start of 2002, to a total of 16 employees at the beginning of 2003. Additions have been mostly in the area of production and administration. Over the coming year, we expect to staff up in the key areas of exploration and land.

This past nine-month period has seen us receiving regular coverage and reports from analysts in the brokerage community. With the market attention we have been getting, I expect to see even more coverage in the near future.

I recently had an opportunity to participate as a speaker, in a provincial energy conference hosted by the British Columbia Government. The message I delivered was that B.C. is the best place in North America right now to be exploring for large new reserves of natural gas. I urged the Government to speed up development of the physical infrastructure such as roads and power, while at the same time improve educational and employment opportunities for the local people.

The sweetestchangethis year has been the stock price. Through calendar 2002 we saw a 125% increase in the value of our securities on both the TSX and Nasdaq exchanges. Most shareholders know our upward movement has continued into 2003, surging forward again after the end of the first quarter. What is responsible for this increase? Well, some of the changes we have been talking about certainly played a part. Our successful exploration strategy and a sharp increase in commodity prices have been a major factor, too. Natural gas has been a star performer this year because of a cold winter and storage falling to its lowest level in many years. Did I say cold winter? In fact, it was a 'normal' winter based on average temperatures over the last 25 years. Many of us have forgotten what winter can really be like with the kind of mild winters we have seen recently.

DYNAMIC OIL & GAS, INC. ANNUAL REPORT DECEMBER 31, 2002

7

Anotherchange– climate change – has been on everyone's mind. It used to be called 'global warming' and you will still hear that term occasionally. Most scientists know that the climate is constantly changing – always getting warmer or getting colder, never remaining constant. Have fossil fuels had an impact? They have almost certainly modulated the normal trend…but by how much? Here, no one can agree – we simply do not know. I believe the actual impact has been moderate to small. Only time will tell, but what I see before me is a strong natural gas market, driven and constrained by many diverse factors in an industry struggling to meet current demands. I expect continued strong pricing through the summer months as facilities across the country try to meet power and air conditioning demands, and at the same time store enough gas for next winter.

As I gaze into my crystal ball again this year, a couple of things seem to stand out. Oil prices are likely to remain unstable due to war related political issues in the Arab world. OPEC however, will almost certainly try and keep prices above the $25 U.S. benchmark. Natural gas will entrench with solid prices, strong demand and weather-based upside fluctuations. The scariest thing I know is that almost 50% of the natural gas currently produced in North America is coming from wells found in the last five years and most of those wells are in small fields with high decline rates.

I want to leave you with an idea and a prediction – at Dynamic, we're explorers and we are growing our Company through the drill bit. Solid ideas and performance is what is needed and what we're good at – and that isnotgoing tochange.

Wayne J. Babcock,

President & Chief Executive Officer

DYNAMIC OIL & GAS, INC. ANNUAL REPORT DECEMBER 31, 2002

We added new growth opportunities and continued drilling and completion activities.

DYNAMIC OIL & GAS, INC. ANNUAL REPORT DECEMBER 31, 2002

9

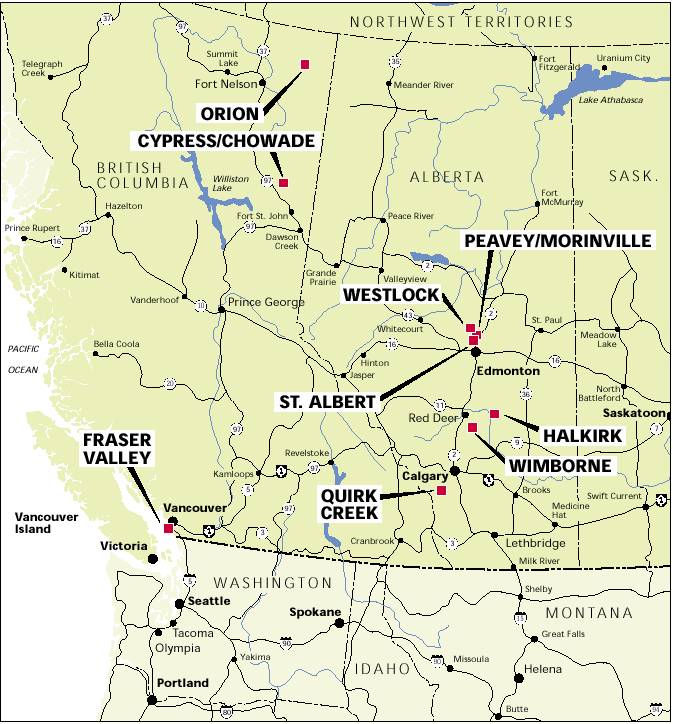

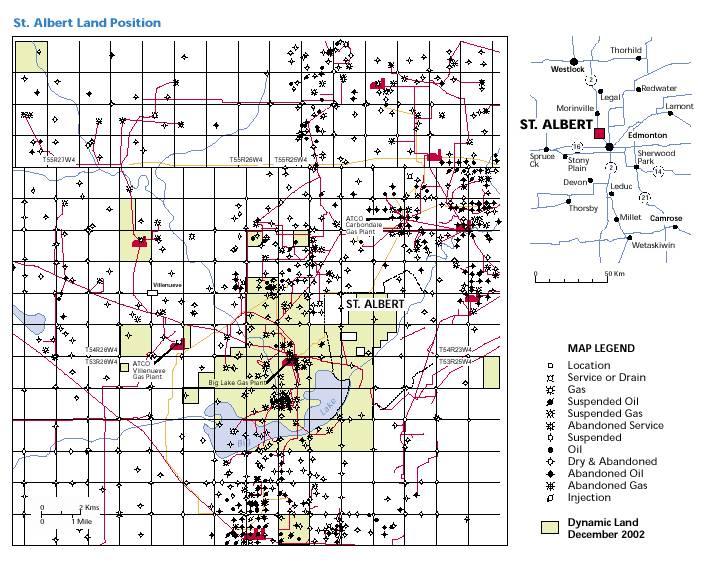

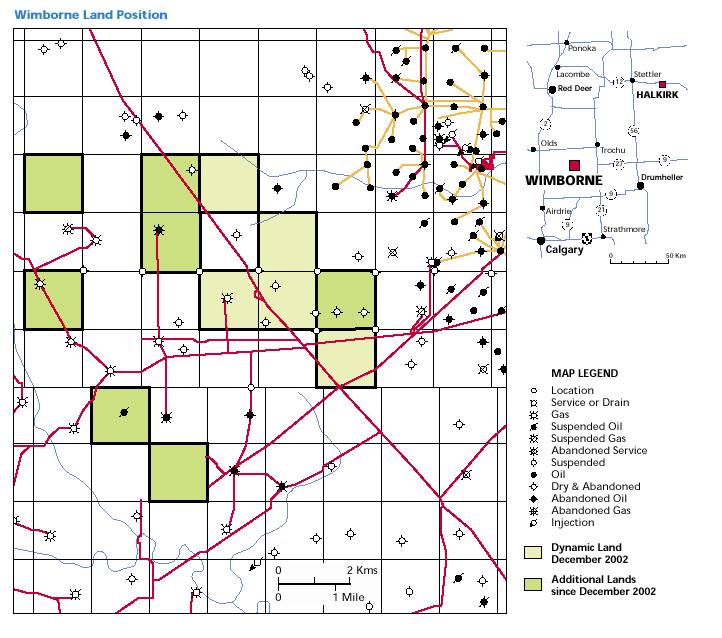

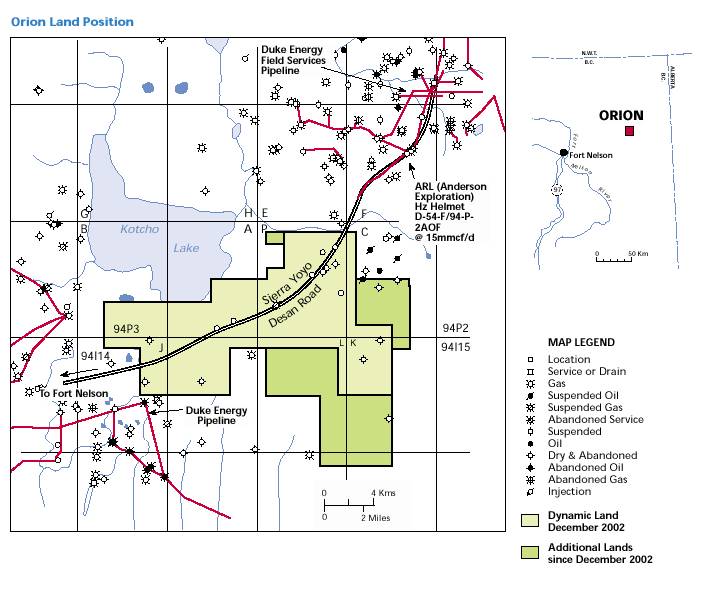

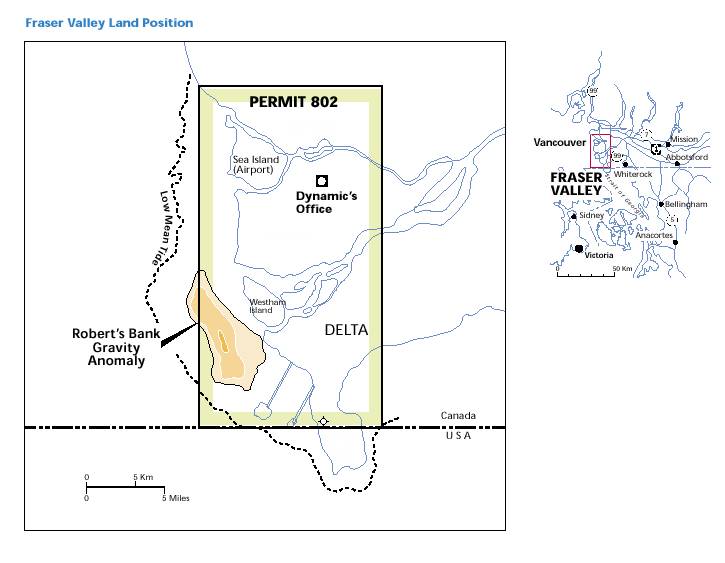

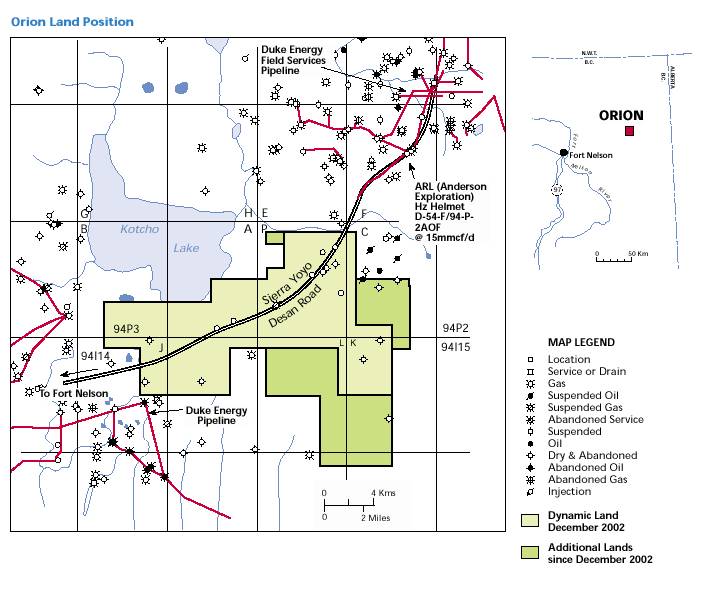

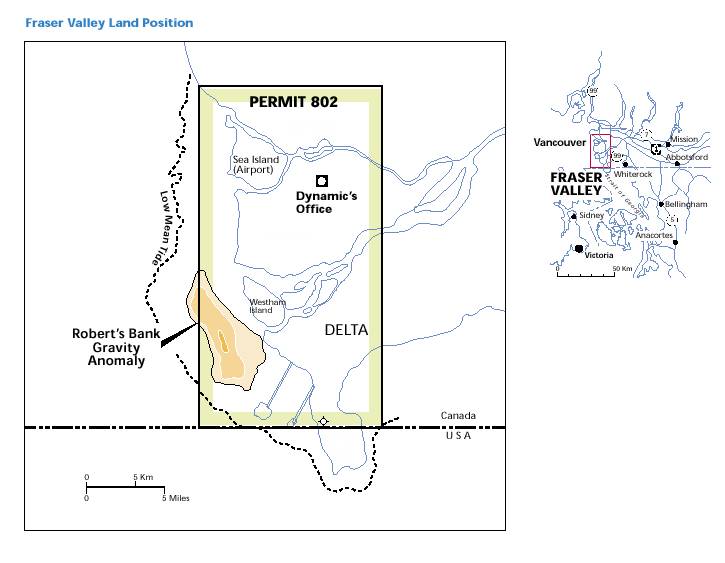

REVIEW OF OPERATIONS

For discussion purposes, we may refer to the nine-month period ended December 31, 2002 as “Fiscal Transition 2002” and the twelve-month period ended March 31, 2002 as “Fiscal 2002”.